Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ASHFORD HOSPITALITY TRUST INC | aht2015annualmeetingpresen.htm |

1 Annual Shareholder Meeting - May 2015

Safe Harbor 2 In keeping with the SEC's "Safe Harbor" guidelines, certain statements made during this presentation could be considered forward-looking and subject to certain risks and uncertainties that could cause results to differ materially from those projected. When we use the words "will likely result," "may," "anticipate," "estimate," "should," "expect," "believe," "intend," or similar expressions, we intend to identify forward-looking statements. Such forward-looking statements include, but are not limited to, our business and investment strategy, our understanding of our competition, current market trends and opportunities, projected operating results, and projected capital expenditures. These forward-looking statements are subject to known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated including, without limitation: general volatility of the capital markets and the market price of our common stock; changes in our business or investment strategy; availability, terms and deployment of capital; availability of qualified personnel; changes in our industry and the market in which we operate, interest rates or the general economy, and the degree and nature of our competition. These and other risk factors are more fully discussed in the Company's filings with the Securities and Exchange Commission. EBITDA is defined as net income before interest, taxes, depreciation and amortization. EBITDA yield is defined as trailing twelve month EBITDA divided by the purchase price. EBITDA, FFO, AFFO, CAD and other terms are non-GAAP measures, reconciliations of which have been provided in prior earnings releases and filings with the SEC. This overview is for informational purposes only and is not an offer to sell, or a solicitation of an offer to buy or sell, any securities of Ashford Hospitality Trust, Inc. and may not be relied upon in connection with the purchase or sale of any such security.

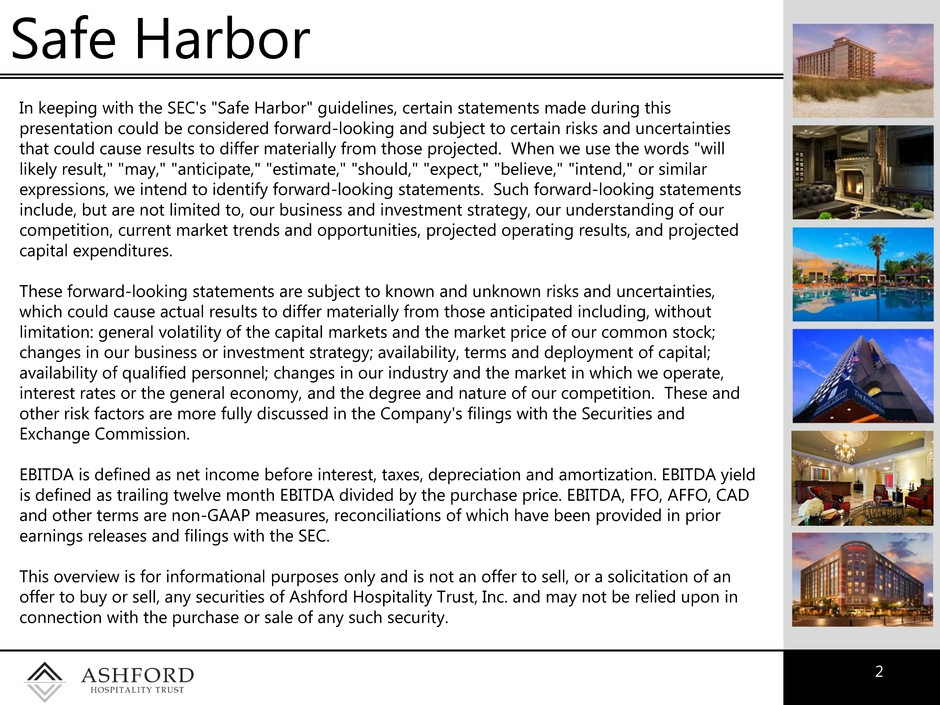

3 Peer average includes: BEE, CHSP, CLDT, DRH, FCH, HST, HT, INN, LHO, PEB, RLJ, SHO Trailing Total Shareholder Returns as of 5/6/15 Source: Bloomberg • Disciplined growth, operational expertise, and capital allocation to maximize shareholder returns • AHT expects to benefit from strong management capabilities Total Shareholder Return Demonstrated Long-Term Track Record 99% 223% 129% 79% 28% 32% 0% 100% 200% 300% 5-Yr 7-Yr 10-yr AHT Peer Avg

4 Highest Insider Ownership Public Lodging REITs include: BEE, CHSP, CLDT, DRH, FCH, HST, HT, INN, LHO, PEB, RLJ, SHO Source: Company filings. * Insider ownership for Ashford entities includes direct & indirect interests & interests of related parties 15%* 14%* 5% 4% 3% 3% 2% 2% 2% 2% 1% 1% 1% 1% 0.5% 0% 2% 4% 6% 8% 10% 12% 14% 16% Publicly-Traded Hotel REIT Insider Ownership

5 Source: PKF Attractive Supply/Demand Imbalance • Demand expected to exceed supply through at least 2015 -8.0 -6.0 -4.0 -2.0 0.0 2.0 4.0 6.0 8.0 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015F Supply Growth Demand Growth Yea r- o v e r- Year % Gro w th PKF Forecast

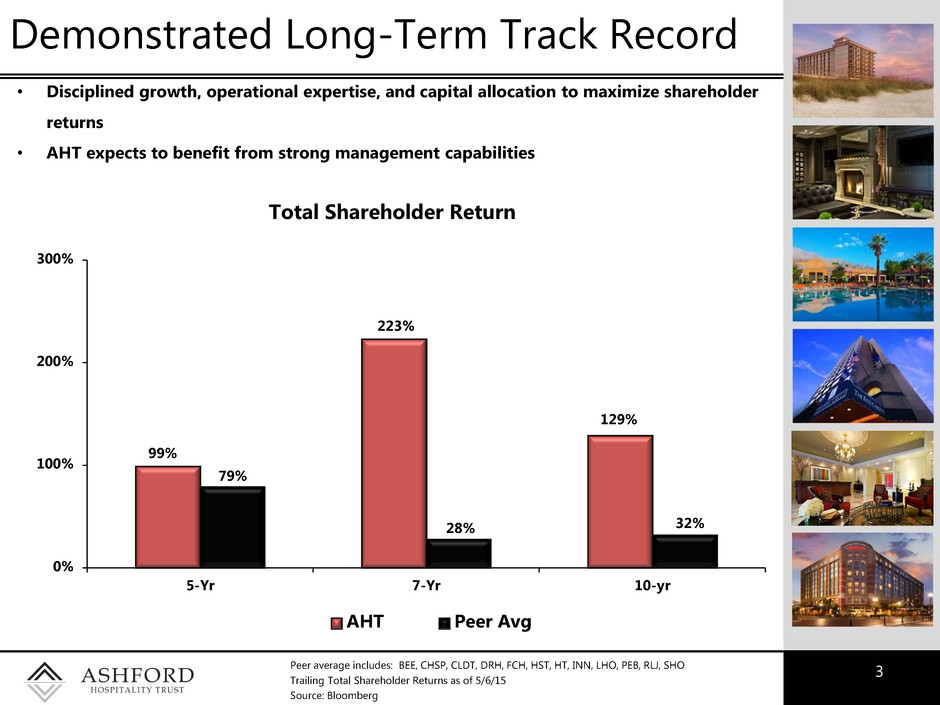

6 Historical Industry Stock Returns • Historically, attractive returns remain for investors from this point in the lodging cycle Index includes AHT, BEE, DRH, FCH, HST, HT, LHO, and SHO. Companies are included in the data from the time of their IPO % 50% 100% 150% 200% 250% 300% 350% 0 12 24 36 48 60 72 84 96 108 T S R Months from Peak to Peak 1989-1997 1997-2007 2007-Current Current data as of April 30, 2015.

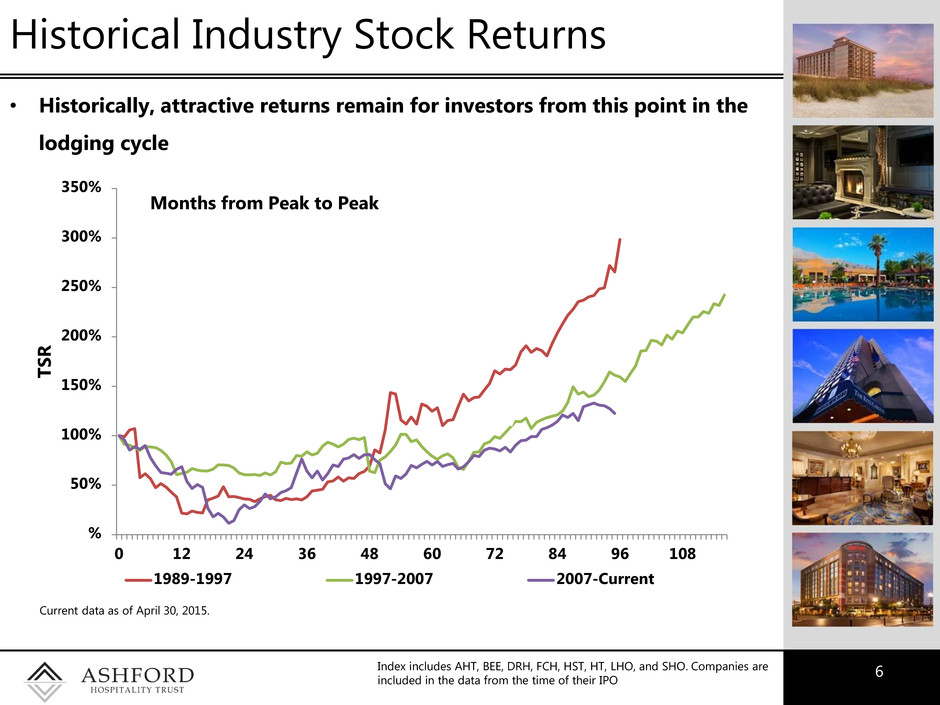

7 • Historically, Ashford consistently outperforms peers in hotel EBITDA flow throughs Historical Flow-Through vs. Peers 2007 – 2013 Ashford Portfolio includes Ashford Trust & Ashford Prime 2007 – 2013 Peers include: BEE, CHSP, DRH, FCH, HST, HT, LHO, PEB, SHO 2014 Ashford Portfolio represents Ashford Trust 2014 Peers include: BEE, CHSP, CLDT, DRH, FCH, HST, HT, INN, LHO, PEB, RLJ, SHO Source: Company Filings 51% 37% 53% 104% 63% 65% 49% 49% 39% 8% 49% 41% 50% 53% 38% 52% 0% 20% 40% 60% 80% 100% 120% 2007 2008 2009 2010 2011 2012 2013 2014 Ashford Portfolio Peer Average

8 Asset Performance – Ashford Trust Revenue and EBITDA figures displayed in $000's 2013 2014 Q1 2014 Q1 2015 Var RevPAR $95.94 $105.39 $102.04 $110.69 8.5% Hotel Revenue $1,031,840 $1,117,739 $305,113 $326,443 7.0% Hotel EBITDA $312,766 $354,513 $92,757 $104,545 12.7% EBITDA Flow 48.6% 55.3% The above table assumes the 116 properties owned and included in continuing operations March 31, 2015 were owned as of the beginning of each of the periods shown 50.1% 42.8% 60.0% 69.4% 55.3% 48.6% 0.0% 20.0% 40.0% 60.0% 80.0% 2009 2010 2011 2012 2013 2014 Annual Hotel EBITDA Flow-Through

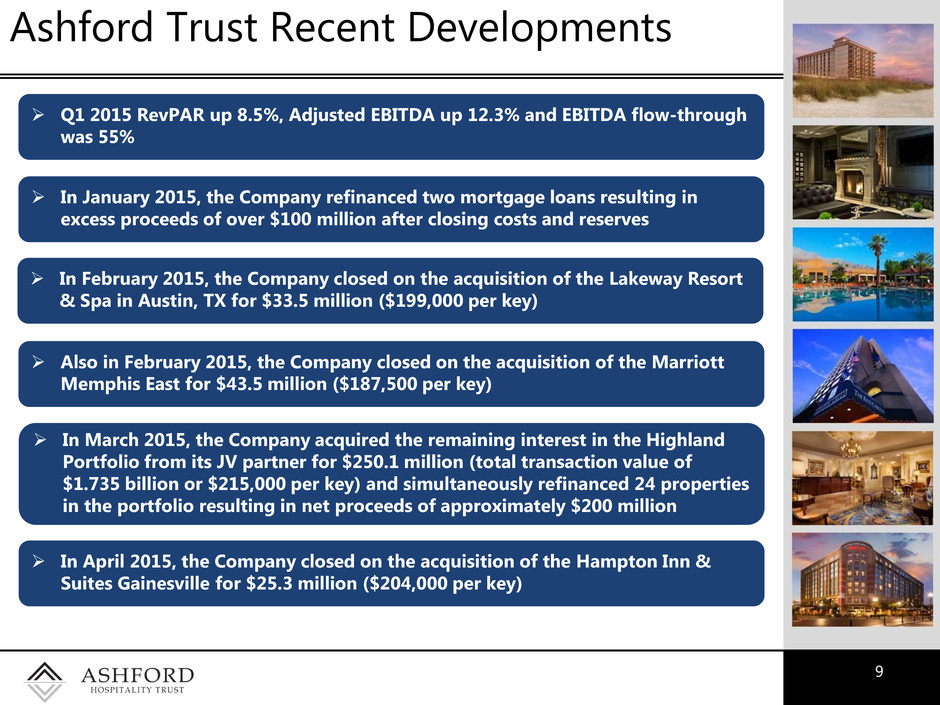

9 Ashford Trust Recent Developments Q1 2015 RevPAR up 8.5%, Adjusted EBITDA up 12.3% and EBITDA flow-through was 55% In January 2015, the Company refinanced two mortgage loans resulting in excess proceeds of over $100 million after closing costs and reserves Also in February 2015, the Company closed on the acquisition of the Marriott Memphis East for $43.5 million ($187,500 per key) In February 2015, the Company closed on the acquisition of the Lakeway Resort & Spa in Austin, TX for $33.5 million ($199,000 per key) In March 2015, the Company acquired the remaining interest in the Highland Portfolio from its JV partner for $250.1 million (total transaction value of $1.735 billion or $215,000 per key) and simultaneously refinanced 24 properties in the portfolio resulting in net proceeds of approximately $200 million In April 2015, the Company closed on the acquisition of the Hampton Inn & Suites Gainesville for $25.3 million ($204,000 per key)

10 Marriott Memphis Transaction Strengths/Opportunities: • Excellent physical condition with minimal capex needs –recent renovation prior to conversion to Marriott • No new material competitive supply projected for the submarket and stable corporate demand generators • Opportunity to install Remington as manager to drive better operational performance • In first full month of operation increased RevPAR index by 19.1% Acquisition Overview: • Purchase Price: $43.5 million • Purchase Price/Key: $187,500 • RevPAR of $105.40* • Purchased at approx. 37% discount to replacement cost • Estimated forward 12-month NOI cap rate of 8.6% • Estimated forward 12-month EBITDA multiple of 10.3x • Location: Memphis, TN • Rooms: 232 • Year Built: 1986 • 8,960 sf of meeting space • Fee simple • Segmentation: 84% transient; 16% group Property Information: *TTM through 3/31/15

11 Lakeway Resort & Spa Transaction *TTM through 3/31/15 Strengths/Opportunities: • Unique lakefront location in Austin, one of the fastest growing MSAs in the country • Excellent physical condition with minimal capex needs – recent renovation of guestrooms • Opportunity to install Remington as manager to drive better operational performance Acquisition Overview: • Purchase Price: $33.5 million • Purchase Price/Key: $199,000 • RevPAR of $109.31* • Purchased at approx. 32% discount to replacement cost • Estimated forward 12-month NOI cap rate of 8.7% • Estimated forward 12-month EBITDA multiple of 9.5x • Location: Austin, TX • Rooms: 168 • Year Built: 1966 • 24,175 sf of meeting space • Fee simple • Segmentation: 70% transient; 30% group Property Information:

12 Annual Shareholder Meeting - May 2015