Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - RigNet, Inc. | d925361d8k.htm |

Jefferies TMT Conference

May 13, 2015

“ENABLING THE DIGITAL OIL FIELD”

Exhibit 99.1 |

Forward-looking Statements

2

Certain

statements

made

in

this

presentation

may

constitute

"forward-

looking

statements"

within

the

meaning

of

the

safe

harbor

provisions

of

the

United

States

Private

Securities

Litigation

Reform

Act

of

1995

—

that

is,

statements

related

to

the

future,

not

past,

events.

Forward-looking

statements

are

based

on

current

expectations

and

include

any

statement

that

does

not

directly

relate

to

a

current

or

historical

fact.

In

this

context,

forward-looking

statements

often

address

our

expected

future

business

and

financial

performance,

and

often

contain

words

such

as

"anticipate,"

"believe,"

"intend,"

"expect,"

"plan"

or

other

similar

words.

Forward-looking

statements

included

in

this

presentation

include,

without

limitation,

statements

regarding

future

average

bandwidth

for

offshore

rigs,

future

ultra-deep

water

rig

supply,

projected

revenue,

EBITDA,

UFCF,

Cash

Earnings

and

Cash

EPS

numbers

for

RigNet.

These

forward-looking

statements

involve

certain

risks

and

uncertainties

that

ultimately

may

not

prove

to

be

accurate.

Actual

results

and

future

events

could

differ

materially

from

those

anticipated

in

such

statements.

Factors

that

could

cause

actual

results

to

differ

materially

from

those

contemplated

in

our

forward-looking

statements

include,

among

others:

adverse

changes

in

economic

conditions

in

the

markets

we

operate;

the

extent,

timing

and

overall

effects

of

competition

in

our

industry;

the

impact

of

new,

emerging

or

competing

technologies;

material

changes

in

the

communications

industry

that

could

adversely

affect

vendor

relationships

with

equipment

and

network

suppliers

and

customer

relationships

with

wholesale

customers;

unfavorable

results

of

litigation

or

intellectual

property

infringement

claims

asserted

against

us;

unanticipated

increases

or

other

changes

in

our

future

cash

requirements;

the

effects

of

federal

and

state

legislation,

and

rules

and

regulations

governing

the

communications

industry;

the

impact

of

equipment

failure,

natural

disasters

or

terrorist

acts;

and

those

additional

factors

set

forth

under

the

caption

“Risk

Factors”

and

other

factors

described

in

our

filings

with

the

SEC,

including

under

the

section

“Management’s

Discussion

and

Analysis

of

Financial

Condition

and

Results

of

Operations”

in

our

Form

10-K

for

the

fiscal

year

December

31,

2014,

and

in

our

Form

10-Q

for

the

quarter

ending

March

31,

2015,

which

is

incorporated

by

reference

herein.

RigNet

undertakes

no

obligation

and

does

not

intend

to

update

these

forward-looking

statements

to

reflect

events

or

circumstances

occurring

after

this

press

release.

You

are

cautioned

not

to

place

undue

reliance

on

these

forward-looking

statements,

which

speak

only

as

of

the

date

of

this

press

release.

All

forward-looking

statements

are

qualified

in

their

entirety

by

this

cautionary

statement.

In

addition

to

U.S.

GAAP

financials,

this

presentation

includes

certain

non-GAAP

financial

measures.

These

non-GAAP

measures

are

in

addition

to,

not

a

substitute

for

or

superior

to,

measures

of

financial

performance

prepared

in

accordance

with

GAAP.

Definitions

of

these

non-GAAP

measures

and

reconciliations

between

certain

GAAP

and

non-GAAP

measures

are

included

in

the

appendix

to

this

presentation. |

RigNet

Investment Highlights 3

Strong Historic Organic Growth within the Oil and Gas Industry

Growing and Attractive Long-Term Market Runway in the Digital

Oilfield

High Operating Leverage / Free Cash Flow

RigNet (NASDAQ: RNET) provides digital technology solutions for offshore and

onshore drilling rigs, production facilities, energy maritime vessels and

other remote locations, effectively spanning the global oil and gas

industry Strong Balance Sheet with Significant Debt Capacity to Support

Growth

Leverages Best in Class Remote Communications Technologies

Low Customer Churn, Stable End-User Pricing and High Barriers

to Entry |

RigNet

Provides Mission Critical Technology Solutions for the Digital

Oilfield… RigNet

has the experience to provide

“Life of the Field”

solutions beyond just

telecommunications.

•

•

•

RigNet

provides solutions ranging from:

•

•

•

Leverage our digital communications technology

to enhance customers’

productivity

Expertise applies equally to remote

job sites and back-office IT infrastructure

More than 1,200 remote sites in over

50 countries on six continents

Fully-managed voice and data networks

Video

conferencing

and real-time

data

services

Bandwidth intensive “big data”

applications |

…That Allow Oil and Gas Companies to Operate in a

Productive, Efficient and Safe Manner

5

HARDWARE

Remotely managed appliances

Managed Solution with 24x7 Support

SOLUTIONS

A rich portfolio of innovative

products and collaborative

solutions that allow for improved

performance, minimized risk and

increased efficiency

CONNECTIVITY

Fully managed communication

solution with multiple connectivity

technologies for best performance

capabilities

Complete managed services

solution for Global Connectivity |

What

Does Fully Managed Digital Technology Mean for RigNet and its Customers?

6

RigNet

provides a fully managed

communications package, bundling network

services and value-added offerings such as

crew welfare enhancements.

This end-to-end connectivity solution

maximizes uptime, reliability and security.

In turn, RigNet benefits from multiple

revenue growth streams:

•

•

•

A majority of this revenue comes from

recurring, multi-tenant business models

under long-term contracts.

Additional sites

ARPU growth from advanced solutions

Multi-tenancy |

Two Way Radio

and Telephony systems

improve crew

connectivity

and

operational safety

while

reducing NPT

Security systems protect capital

investments

on site and online

Entertainment Systems enhance

crew welfare, training

effectiveness

and

skill retention

Cellular, Microwave and Satellite

Backhaul link services at the edge to

core networks,

delivering true end-

to-end Digital Technology

Solutions worldwide

VSAT and Microwave Systems enable

future proof access, adaptable to

changing bandwidth needs

Remote Access and LAN/WAN Networks

enable Big Data, Industrial Internet of Things and other

data-intensive needs in real time at the edge

End-to-End HQ Integration

improves system performance

and

operational productivity

RigNet Helps Enable The Digital Oilfield

1

NPT –

Non-Productive Time

1 |

Large

and Attractive Core “Life of the Field” Energy

Market

8

Life of the Field Energy Market

Offshore rigs

(a)

U.S. Onshore

(b)

Production

(a)

Energy Maritime

(a)

Intl land

(b)

Assets

Jackups,

Semisubmersibles

and Drillships

Rigs, Remote

Offices, Man

Camps, etc.

Fixed and Floating

Installations

Supply, Seismic,

Support and

Construction

Rigs, Remote

Offices, Man

Camps, etc.

Characteristics

Highly complex

and regulated

drilling operations

Smaller

installations with

shorter contracts

Long lived assets;

large crew size

drives data needs

Global fleets that

are highly mobile

Stable and growing

markets

Addressable units

760+

850+

8,980+

4,080+

2,300+

RigNet market share

32%

15%

NA

NA

NA

Management estimates that RigNet’s communications day rates

represent <1% of offshore rig day rates

(a) Addressable units exclude scrapped, canceled, cold stacked and assets not yet

delivered (b) Addressable units include only rigs; Intl land count excludes

Russia and Central Asia NA = Not Available

Source: IHS-Petrodata (January 1, 2015), Baker Hughes Rig Count (February 27,

2015), Spears and Associates (December 2014), Company Estimates |

9

Oil & Gas Asset owners

Oil & Gas Operators

Contractors/Service Companies

Diverse customer base with no excessive concentration

RigNet Supports the Digital Oilfield Needs of a

Blue-Chip Customer Base |

10

Bandwidth Needs Growing at the Edge

Source:

Northern

Sky

Research,

Energy

Markets

via

Satellite

5 Edition

(February

2015)

1

NPT –

Non-Productive Time

2

TPE –

Transponder Equivalent

Total Oil & Gas VSAT Market

Fixed-Service Satellite (FSS) and

High-Throughput Satellite (HTS)

2014 –

2024 Capacity Demand

Key drivers

•

•

•

Overseeing and directing offshore activities from

onshore decision centers

•

•

Aftermath of BP Macondo spill

•

•

Keeping crews happy and healthy in their off hours

•

•

More remote, harsh and complex

•

Average bandwidth per offshore rig expected

to increase from 1.0 Mbps in 2012 to 2.2

Mbps in 2017

•

Favorable technology changes in downhole

communications and satellite backhaul

(high-throughput satellites)

Video-related services

Integrated operations (reducing NPT

1

)

Safety focus / increased regulatory oversight

Crew welfare

Ultra-deep water exploration

5.0

10.0

15.0

20.0

25.0

30.0

0

20

40

60

80

100

120

2014

2016

2018

2020

2022

2024

Oil & Gas Markets Capacity Demand

By Bands

FSS C-band

FSS Ku-band

GEO-HTS, C

GEO-HTS, Ku

GEO-HTS, Ka

Non-GEO HTS

th |

Outlook for Ultra-Deep Water (UDW) Market Strong Over the Long-

Term Will Drive the Need for Reliable Remote Communications

(1) Current UDW activity defined as rigs with 7,500’+ water depth capability

and contracted as of March 1, 2015 (2) Visible supply includes rigs with

7,500’+ water depth capability either currently under construction, planned or on order

Source: IHS-Petrodata RigBase Current Activity Data (March 1, 2015)

Future UDW Rig Supply

Current UDW Activity

•

UDW drilling is more complex and remote with high safety, operational and

performance requirements

•

Additional UDW markets are expanding, which requires robust, remote communications in new

areas •

UDW rig supply growing to meet demand

11

38

29

50

Existing UDW

Markets

Emerging UDW

Markets

1

2

1

5

2

5

8

6

RigNet POP

RigNet Offices

RigNet Teleport

RigNet CoreHUB

146

146

146

146

146

146

146

22

25

42

56

65

69

70

168

171

188

202

211

215

216

2014

2015

2016

2017

2018

2019

2020

Delivered

Visable supply

1

2 |

Growth Driven by Market Share Gains

12

Global Market Share by Revenue

•

RigNet is the only major provider to have grown market share over the past few years

– RigNet’s managed services model is preferred to transport providers

•

RigNet delivers on criteria important to demanding oil and gas customers

•

RigNet is the last remaining independent global provider of remote communications to

the oil and gas industry after recent provider consolidation wave

•

Customer quote from recent industry study: “RigNet is flexible, pragmatic, responsive and they smell like

oil people” (a) 2013 shows RigNet and Stratos market share combined to

illustrate RigNet’s acquisition of the Inmarsat Energy Broadband business

Source: Various; Company analysis

Industry Ranking vs. Key Success Criteria

Global Footprint

Strong

Value-Added

Solutions

Strong

Network

Reliability

Strong

Customer

Support

Strong

’05-’13

7%

15%

22%

30%

38%

14%

6%

7%

6%

51%

48%

44%

43%

43%

27%

31%

26%

21%

19%

100%

100%

100%

100%

100%

2005

2007

2009

2011

2013(a)

RigNet

Stratos

Harris Caprock

Other |

History of Strong Growth

13

Revenue

1

$ in millions

(1)

2007 –

2013 financials exclude Inmarsat Energy Broadband transaction

(2)

UFCF

defined

as

net

income

(loss)

plus

interest

expense,

income

tax

expense

(benefit),

depreciation

and

amortization,

impairment

of

goodwill,

foreign

exchange

impact

of

intercompany

financing

activities,

(gain)

loss

on

retirement

of

property,

plant

and

equipment,

change

in

fair

value

of

derivatives,

stock-based

compensation, IPO or merger/acquisition costs and related bonuses, restructuring

charges and non-recurring items less capital expenditures Source:

Company data •

High EBITDA margins from operating leverage; favorable free cash

flow

•

Strong balance sheet and debt capacity to support future organic

and inorganic growth

•

All organic growth until Nessco acquired in Q3, 2012 and Inmarsat EE in Q1, 2014

EBITDA and UFCF

1,2

$ in millions

$67

$90

$81

$93

$109

$162

$221

$330

2007

2008

2009

2010

2011

2012

2013

2014

$18

$30

$29

$30

$33

$44

$56

$74

$10

$22

$19

$16

$14

$22

$26

$33

2007

2008

2009

2010

2011

2012

2013

2014

EBITDA

UFCF |

% margin

21.6%

22.0%

21.4%

8.7%

11.6%

10.8%

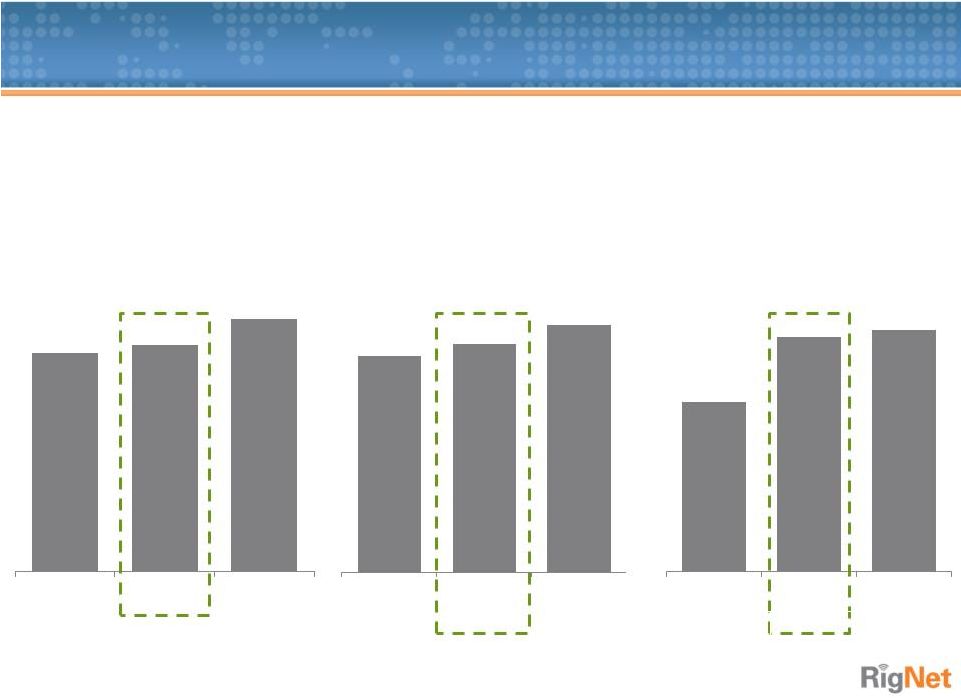

Q1’15 Performance

14

Revenue

$ in millions

EBITDA

$ in millions

UFCF

1

$ in millions

(1)

UFCF

defined

as

net

income

(loss)

plus

interest

expense,

income

tax

expense

(benefit),

depreciation

and

amortization,

impairment

of

goodwill,

foreign

exchange

impact

of

intercompany

financing

activities,

(gain)

loss

on

retirement

of

property,

plant

and

equipment,

change

in

fair

value

of

derivatives,

stock-based

compensation, IPO or merger/acquisition costs and related bonuses, restructuring

charges and non-recurring items less capital expenditures •

Revenue increased to $77.7 million in Q1’15 up 3.5% compared to the same

quarter last year •

Achieved

quarterly

adjusted

EBITDA

of

$17.1

million

up

5.6%

over

the

same

quarter

last

year

•

UFCF

1

of $9.0 million, up 37.9% over the same quarter last year

•

Capital expenditures of $8.1MM were $1.6 million below the same quarter last year,

contributing to even higher cash conversion from lower capital expenditures

in times of cyclically lower volume growth $75.0

$77.7

$86.7

Q1'14

Q1'15

Q4'14

$16.2

$17.1

$18.5

Q1'14

Q1'15

Q4'14

$6.6

$9.0

$9.3

Q1'14

Q1'15

Q4'14 |

Outstanding Share Price Performance

15

Source: FactSet

5/8/2015:

Up

202% since IPO;

RNET stock price at

$36.28 per share

7/5/2012

Announced

Nessco acquisition;

RNET stock price at

$16.90 per share

12/14/2010:

IPO

priced at $12 per

share

8/1/2013:

Announced acquisition of

Inmarsat Energy Broadband assets and GX

commercial distribution agreement; RNET

stock price at $27.93 per share

8/20/2013:

KKR announced

agreement to acquire 27% of

RigNet from Cubera ; RNET

stock price at $33.63 per share

S&P 500 (indexed)

Annotations

$10.00

$15.00

$20.00

$25.00

$30.00

$35.00

$40.00

$45.00

$50.00

$55.00

$60.00

12/15/2010

9/8/2011

6/2/2012

2/24/2013

11/19/2013

8/13/2014

5/8/2015 |

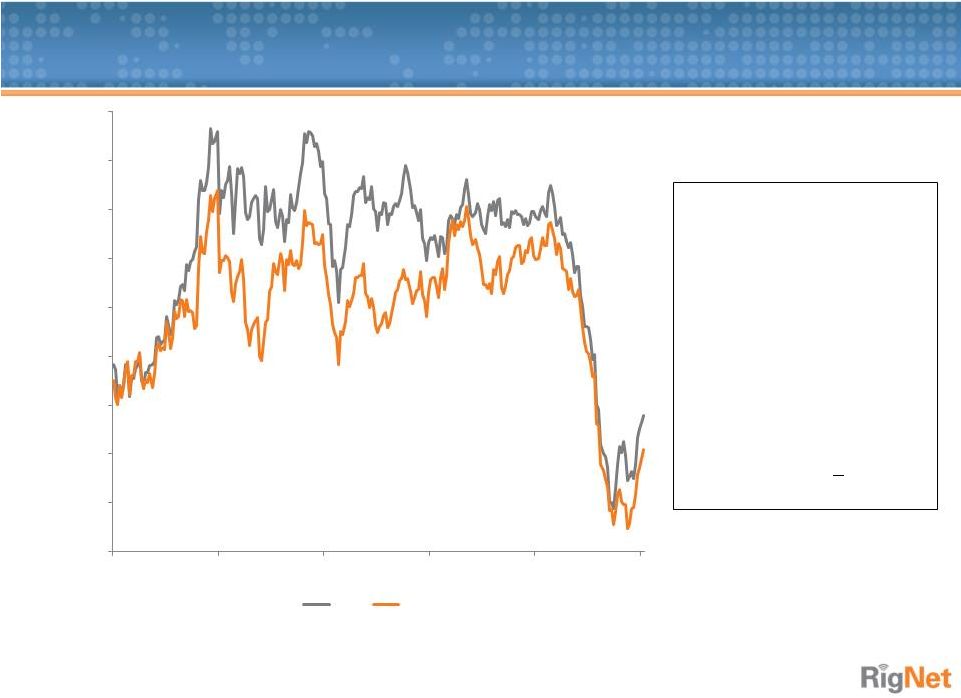

Five

Year Oil Price Chart 16

Source: FactSet

•

Five market downturns

since the late 1980’s

•

Each downturn has lasted 1

–

2 years on average

•

This downturn has occurred

quicker than any other

•

Question is not if

there will

be a recovery, but………

$40.00

$50.00

$60.00

$70.00

$80.00

$90.00

$100.00

$110.00

$120.00

$130.00

5/7/2010

5/6/2011

5/4/2012

5/3/2013

5/2/2014

5/1/2015

Brent

WTI |

RigNet Investment Highlights

17

Strong Historic Organic Growth within the Oil and Gas Industry

Growing and Attractive Long-Term Market Runway in the Digital

Oilfield

High Operating Leverage / Free Cash Flow

RigNet (NASDAQ: RNET) provides digital technology solutions for offshore and

onshore drilling rigs, production facilities, energy maritime vessels and

other remote locations, effectively spanning the global oil and gas

industry Strong Balance Sheet with Significant Debt Capacity to Support

Growth

Leverages Best in Class Remote Communications Technologies

Low Customer Churn, Stable End-User Pricing and High Barriers

to Entry |

THANK YOU

18 |

APPENDIX

19 |

Reconciliation of Net Income to Adj. EBITDA

20

($ in thousands)

2011

2012

2013

Q1’14

Q2’14

Q3’14

Q4’14

2014

Q1’15

Net income (loss)

$9,752

$12,021

$16,544

$2,308

$5,748

$5,930

$1,997

$15,983

$(942)

Interest expense

1,249

1,552

2,283

481

565

588

551

2,185

511

Depreciation and

amortization

14,584

17,534

21,049

6,797

7,280

7,530

7,855

29,462

8,096

Impairment of goodwill

0

0

0

0

0

0

2,719

2,719

0

Foreign exchange impact

of intercompany financing

activities

0

0

0

0

0

0

856

856

0

(Gain) loss on retirement

of property and

equipment

(165)

(131)

66

(73)

(10)

74

(35)

(44)

(12)

Stock based

compensation

1,534

2,502

2,963

1,148

1,195

1,307

602

4,252

949

Restructuring costs

0

0

0

0

0

0

0

0

6,198

Acquisition costs

0

1,372

4,115

2,332

590

0

0

2,922

0

Income tax expense

6,502

8,733

9,158

3,215

3,438

4,751

3,996

15,400

2,314

Adjusted EBITDA (non-

GAAP measure)

$33,456

$43,583

$56,178

$16,208

$18,806

20,180

18,541

73,735

$17,114 |

Reconciliation of Net Income to Cash EPS and

Unlevered Free Cash Flow

21

($ in thousands)

Q1’15

Net income (loss)

$(942)

Interest expense

511

Depreciation and amortization

8,096

Impairment of goodwill

0

Foreign exchange impact of intercompany financing activities

0

(Gain) on retirement of property and equipment

(12)

Stock based compensation

949

Restructuring costs

6,198

Acquisition costs

0

Income tax expense

2,314

Adjusted EBITDA (non-GAAP measure)

$17,114

Interest Expense

(511)

Income Tax Expense

(2,314)

Cash Earnings (non-GAAP measure)

$14,289

Diluted Shares

17,463

Cash EPS (non-GAAP measure)

$0.82

Adjusted EBITDA (non-GAAP measure)

$17,114

Capital expenditures

8,073

Unlevered Free Cash Flow (non-GAAP measure)

$9,041 |