Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AutoWeb, Inc. | abtl8k_may72015.htm |

| EX-99.1 - PRESS RELEASE DATED MAY 7, 2015 - AutoWeb, Inc. | ex99-1.htm |

Exhibit 99.2

AUTOBYTEL INC.

Moderator: Jeffrey Coats

May 7, 2015

5:00 p.m. ET

|

Operator:

|

This is conference # 28443285.

|

|

|

Good afternoon, everyone, and thank you for participating in today's conference call to discuss Autobytel's financial results for the first quarter ended March 31, 2015. Joining us today are Autobytel's President and CEO, Jeff Coats; the Company's CFO, Kim Boren; and the Company's outside investor relations advisor, Sean Mansouri with Liolios Group. Following their remarks, we'll open the call for your questions.

|

|

|

I would now like to turn the call over to Mr. Mansouri for some introductory comments.

|

|

Sean Mansouri:

|

Thank you, Kaylee. Before I introduce Jeff, I remind you that during today's call, including the question-and-answer session, any projections and forward-looking statements made regarding future events or Autobytel's future financial performance are covered by the Safe Harbor statements contained in today's press release, the slides accompanying this presentation and the Company's public filings with the SEC. Actual events may differ materially from those forward-looking statements.

|

Specifically, please refer to the Company's Form 10-Q for the quarter ended March 31, 2015, which was filed prior to this call, as well as other filings made by Autobytel with the SEC from time to time. These filings identify factors that could cause results to differ materially from those forward-looking statements.

|

|

There are slides included with today's presentation to help illustrate some of the points being made and discussed during the call. The slides can be accessed by visiting Autobytel's website at www.Autobytel.com. When there, go to “Investor Relations” and then click on “Events & Presentations.”

|

|

|

Please also note that during this call and/or in the accompanying slides, management will be disclosing non-GAAP income and non-GAAP EPS, which are non-GAAP financial measures as defined by SEC Regulation G. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures are included in today's press release and/or in the slides which are posted on the Company's website.

|

|

|

And with that, I'll now turn the call over to Jeff. Jeff?

|

AUTOBYTEL INC.

Moderator: Jeff Coats

5/7/2015 5:00 p.m. ET

Confirmation # 28443285

Page 2

|

Jeffrey Coats:

|

Thank you, Sean. Good afternoon, everyone. Thank you for joining us today to discuss our first quarter 2015 results.

|

|

|

Following a strong fourth quarter in 2014, our first quarter of the year was highlighted by a 110 basis point increase in gross margin and continued growth in our advertising business, as well as an 11% increase in non-GAAP income to $2.4 million. As expected, overall revenues were essentially flat due to dealer churn from last year's AutoUSA acquisition. However, this trend is bottoming, and we expect to return to dealer count growth during the second quarter.

|

|

|

We advanced several of our growth initiatives in the first quarter, particularly in our used car leads business and our suite of mobile products. In fact, today we have more active dealers utilizing our mobile platform than ever before. We also recently announced a virtual showroom program between our SaleMove product and Toyota's Scion brand, which features SaleMove's technology on Toyota's consumer-facing website, Scion.com.

|

|

|

But before commenting further, I'd like to turn the call over to Kim and have her take us through the important details of our financial results for the first quarter. Kim?

|

|

Kim Boren:

|

Thanks Jeff, and good afternoon everyone. For those of you following along with our earnings presentation, on Slide 4 you can see our first quarter revenues were essentially flat compared to the prior year, at $26.2 million.

|

Lead revenue from Autobytel [automotive] dealers (our retail channel) declined 7% to $11.3 million due to dealer churn from AutoUSA as well as an overall decline in car sales growth compared to the same period last year. Lead revenue from auto manufacturers and wholesale partners (our wholesale channel) declined 6% to $11.7 million during the first quarter. This was due to the fact that leads we previously sold into AutoUSA as wholesale, which they then sold to retail, were reclassified as retail because we now sell directly into that channel.

|

|

Advertising revenues were $1.6 million, roughly flat on a sequential basis but up 138% compared with last year, as we continued to optimize our relationship with Jumpstart and generated a higher volume of page views. Our increase in advertising revenue was also driven by growth in our commercial relationship with AutoWeb, which continues to meaningfully contribute to our advertising results and is further highlighted on Slide 5.

|

AUTOBYTEL INC.

Moderator: Jeff Coats

5/7/2015 5:00 p.m. ET

Confirmation # 28443285

Page 3

|

|

We delivered nearly 92,000 specialty finance leads during the first quarter, up from 88,000 in the corresponding year-ago period, reflecting our continued efforts to ease supply constraints. Specialty finance lead revenue was $1.6 million in the first quarter, unchanged from the same quarter last year. While lead volume was slightly higher, revenue remained flat due to channel mix.

|

|

|

Moving now to Slide 6, you'll see that we delivered approximately 1.6 million automotive leads during the first quarter, a 7% decrease over last year, reflecting the expected dealer churn. Retail new leads decreased 14% while used leads increased 2%. 68% of the leads were delivered to the wholesale channel with the remaining 32% to the retail channel.

|

|

|

With regard to dealer count, we've given much thought into the use of this metric and have concluded that it does not serve as an appropriate barometer of the health and success of our business. For example, we could lose 10 dealers where we provide 50 leads and sign three new dealers that we provide 1,000 leads. The use of dealer count simply indicates that we netted a loss of 7 dealers, when in reality we're providing 2,500 more leads – an obvious positive.

|

|

|

With that said, we expect this to be the last time we provide the dealer count metric and will begin providing a new capacity metric on the next quarterly update that should serve as a more appropriate way to track the strong growth of our leads business. On Slide 7 you'll see that at March 31st, our dealer count stood at 4,054, which is a 2% decline from December 31st, again resulting from the expected dealer churn from our AutoUSA acquisition.

|

|

|

On Slide 8, you'll see that we continued to experience strong page view growth in the first quarter, with total page views up 146% year-over-year and 19% sequentially, to 84 million. In February, Google announced that beginning April 21st, they would be expanding their use of mobile friendliness as a ranking signal, which they stated would change mobile searches worldwide and have a significant impact in search results. This new Google algorithm update took effect two weeks ago and is not reflected in these Q1 metrics, though we have not seen any significant changes to our page view growth since then.

|

|

|

On Slide 9, I'd like to point you to an approximate 110 basis point year-over-year improvement in gross margin to 38.5%.

|

This improvement continues to reflect the delivery of a higher percentage of internally-generated leads to former AutoUSA dealers and leveraging purchase power from our outside suppliers for those dealers. It's also worth reminding our listeners that our advertising revenue through Jumpstart currently flows through to our P&L at approximately 99% margins, while advertising revenue from our AutoWeb relationship flows through at 100% margins. As this part of our business continues to grow, we anticipate seeing the incremental benefit contribute to our bottom line.

AUTOBYTEL INC.

Moderator: Jeff Coats

5/7/2015 5:00 p.m. ET

Confirmation # 28443285

Page 4

|

|

Total operating expenses were $8.9 million, or 34% of total revenues, compared with $9.3 million, or 34.6%, for the same quarter last year. This improvement is primarily due to transaction costs associated with last year's AutoUSA acquisition.

|

|

|

On a GAAP basis, net income was $800,000, or $0.07 per diluted share, compared to $400,000, or $0.04 per diluted share, in last year's first quarter.

|

|

|

As we mentioned during our last quarterly update, we are now including non-GAAP financial information to help investors better understand Autobytel's financial performance. You'll see that non-GAAP income, which adds back amortization on acquired intangibles, non-cash stock-based compensation, acquisition costs, litigation settlements, severance costs and income taxes, increased 11% to $2.4 million, or $0.21 per diluted share.

|

|

|

Cash used in operations for the 2015 first quarter was $500,000 compared to cash provided by operations of $900,000 in the prior-year quarter. The decrease in cash was largely the result of changes in working capital.

|

|

|

On Slide 10, you can see that we've maintained a strong balance sheet with cash and cash equivalents of $19.3 million at March 31st, from $20.7 million at the end of 2014.

|

|

|

Finally, on April 27th, we announced that Auto Holdings acquired the $5.0 million convertible subordinated promissory note and a warrant to purchase 400,000 shares of our common stock issued by us in September 2010, which was in connection with our acquisition of Cyber Ventures and Autotropolis, collectively referred to as Cyber. Auto Holdings is affiliated with the management team and other owners of AutoWeb.

|

|

|

Our acquisition of Cyber in 2010 marked a significant turning point for our organization as we strengthened our lead generation capabilities with superior search engine optimization and marketing techniques developed by some of the most talented individuals in the industry. April's transaction represents another decisive moment for our Company. We've aligned our common interests to enhance stockholder value for both Autobytel and AutoWeb and look forward to the many combined opportunities ahead.

Concurrent with the acquisition of the Cyber convertible note and warrant, Auto Holdings converted the entire note and fully exercised the warrant at the conversion exercise price of $4.65 per share. Upon conversion of the note, we issued approximately 1.1 million shares of our common stock, and upon exercise of the warrant, issued an additional 400,000 shares. As a result of the conversion and exercise, Auto Holdings owns approximately 14.25% of Autobytel's current issued and outstanding shares.

|

|

|

In addition, we removed the liability from the balance sheet related to the $5.0 million note and increased equity related to the note and our receipt of the $1.9 million of cash from exercise of the warrant. After giving effect to the shares issued to Auto Holdings, we have approximately 10.4 million shares of common stock outstanding. We estimate Q2 average diluted shares to be approximately 11.0 million based on the average stock price for the second quarter to date.

|

AUTOBYTEL INC.

Moderator: Jeff Coats

5/7/2015 5:00 p.m. ET

Confirmation # 28443285

Page 5

|

|

When the convertible note and warrant were issued in September 2010, Autobytel granted Cyber an exemption under our Tax Benefit Preservation Plan. We have now granted Auto Holdings that same exemption with respect to the acquired shares.

|

|

|

Now I'll turn the call back over to Jeff. Jeff?

|

|

Jeffrey Coats:

|

Thank you, Kim.

|

As I mentioned earlier, we are very pleased with our first quarter results, particularly the progress within two of our key focal points for this year – advertising and used car leads. While our retail new car leads continued to be negatively affected by dealer churn from our AutoUSA acquisition last year, this churn is bottoming, and we expect to return to dealer count growth during this quarter. On Slide 11, you'll note that for several of our OEM customers, we continue to estimate the consumers submitting leads that we delivered to these OEMs and their dealers accounted for over 6% of their respective total new retail sales in 2014, with the majority of these leads growing on a year-over-year basis for every OEM.

|

|

You can also see that we experienced healthy organic growth last year as most of our existing OEM customers significantly expanded their leads programs with us. In fact, the manufacturer that reviewed its business rules and began increasing the monthly volume of leads purchased through Autobytel during the fourth quarter of 2014 has rolled strongly into the first quarter of 2015, increasing lead volume by 223% over the first quarter of 2014.

|

|

|

Retail new leads invoiced per dealer was up 6% year-over-year in the first quarter of 2015, and retail used leads invoiced per dealer was up 25% in the same period, which further illustrates our shift in focus to larger, more profitable dealers and also highlights our retention of a much higher percentage of revenue from the AutoUSA overlap dealers.

|

AUTOBYTEL INC.

Moderator: Jeff Coats

5/7/2015 5:00 p.m. ET

Confirmation # 28443285

Page 6

|

|

The ramp within our existing client base demonstrates what we believe is the pent-up demand for our high quality leads, especially as OEMs and dealers are becoming increasingly cognizant of the ROI they provide. As indicated on Slide 12, our estimated average buy rate for Autobytel internally-generated leads in the first quarter was 18%. We believe this high buy rate from our new car leads is actually conservative. Not all sales can be matched, given that many consumers buy outside the 90-day measurement window, buy a used car instead, or register a vehicle under a different name than the original lead submission. So the 18% buy rate may very well be higher.

|

|

|

And as you can see on Slide 13, these buy rates have remained consistently strong over the last 2 years, with Autobytel.com generating above 21% and all Autobytel internally-generated leads above 16%.

|

|

|

Our estimated buy rate realization is largely due to our unique relationship with IHS Automotive, formerly R.L. Polk, which provides us with a credible, consistent and quantifiable way to measure the conversion of online leads into actual vehicle sales. Reflecting our innovative use of IHS's data, this week they awarded us with the 2015 IHS Spectrum Award. This award is a global recognition that honors outstanding accomplishments of strategic planners, engineers and operational leaders from a host of industries worldwide. Details about the award and the actual Autobytel case study can be found in the awards section of IHS's website, which also highlights other 2015 award winners like Cargill, Chevron and Saab, among others. You can also reference the press release we issued this morning.

Moving on to our used car business … as Kim and I noted earlier, used car leads grew 2% in the first quarter, and used car leads invoiced per dealer was up 25%. Our used car business remains a focal point for growth in 2015 and beyond. We believe it's much easier to finance a used car today than ever before, especially given current interest rates. Used car sales in the United States are also roughly 2 to 3 times that of new car sales, providing us with a large opportunity. It's worth noting that retail used car leads only represent about 9% of our total leads business today and approximately 12% of revenue. With that said, our commercial acquisition team launched a beta test earlier this year of the used car platform in which we've been investing. We expect this to ramp slowly but steadily as we collect the information we need to optimize for quality, volume and margin and grow our internally-generated used car business.

|

AUTOBYTEL INC.

Moderator: Jeff Coats

5/7/2015 5:00 p.m. ET

Confirmation # 28443285

Page 7

|

|

Another significant growth opportunity in 2015 is the advancement of our mobile offerings. On Slide 14, you'll see our various mobile products currently being offered. TextShield, the centerpiece of our mobile suite, continues to gain market traction. In fact, we currently have over 600 dealersusing one or more of our mobile products. In March, we launched our newest enhancements to our cutting-edge TextShield product, which enables dealers to receive mobile text messages from in-market consumers on their existing dealership landlines – a significant innovation. Needless to say, the consumer car shopping experience continues to evolve, and it's becoming all the more important for dealers to accommodate consumers through mobile and text-based applications. We are receiving strong initial interest from dealers regarding this new lead management system for text. We plan to continue to advance our mobile products and expect this part of our business to meaningfully contribute in 2015.

|

|

|

You may also recall that we made a small strategic investment in a company called GoMoto this past December. In just a few months, we are already seeing strong dealer interest in the GoMoto dealership digital hub, which has interactive kiosks providing detailed product information for 17 different auto brands. The kiosks also have a new finance and insurance module that assists consumers with financing their vehicle, which has been well received by consumers. We have a pilot that is scheduled to launch with a major OEM in June of this year, and a retail mall implementation using this technology just launched in Orlando, Florida.

Another key area of focus this year is dealer-facing marketing as well as education and training. We've recently begun to ramp up our sales team to help drive this important initiative. The better we can educate our dealer customers, the better they will understand our true value proposition and the high return on investment we believe our high quality leads can provide, especially relative to our competitors. I am sure that many of you may be familiar with a version of the pay-per-sale model currently being pursued in the market by one of our competitors and the $299 cost to dealers per new car sold and $399 per used car sold under this model. In addition to these high fees, this model gets between the dealer and the consumer on actual vehicle price, which also takes additional profit out of the dealer's pockets. We continue to hear anecdotally from many of our dealer customers that they maintain higher gross profit per sale from Autobytel leads than they do from this version of the pay-per-sale model. Our dealer marketing and education activities this year will be designed to highlight these differences and ensure our dealers understand the higher ROI they should achieve from Autobytel leads.

|

AUTOBYTEL INC.

Moderator: Jeff Coats

5/7/2015 5:00 p.m. ET

Confirmation # 28443285

Page 8

|

|

On Slide 17, you'll see how our pay-per-lead model compares with pay-per-sale. At our estimated average current buy rate of 18% for leads we deliver to our dealer customers, the hypothetical pay-per-sale in our model is about $120, assuming a $22 price per lead. Even at an 8% average dealer close rate, which is significantly less than our high quality leads but more in line with other lead providers, the equivalent pay-per-sale is only $275.

|

|

|

It's also worth noting that the cost of our used car leads is currently only $1 to $2 more than our new car leads. This creates a significant margin opportunity for used car dealers, given the lower pay-per-sale economics from our leads and the higher profit generally made on used cars compared to new cars.

|

|

|

We continue to be excited about our strategic investment in, and commercial relationship with, AutoWeb, a company whose platform enables specialized targeting to high intent online car shoppers while allowing advertisers to optimize their campaigns efficiently. As you may already know, Autobytel currently owns approximately 16% of AutoWeb, and we have an option for additional AutoWeb shares priced at our original attractive investment price, which will increase our ownership to approximately 21% based upon their current share count. We do plan to exercise this option before it expires in mid-September. And, as Kim noted earlier, our relationship with AutoWeb was further strengthened just last week when a new group of investors purchased 14.25% ownership stake in Autobytel from Cyber Ventures. This new group largely consists of the senior management and investors of AutoWeb. We believe this investment reinforces our joint efforts related to the future of the leads and clicks businesses in the automotive markets.

|

|

|

In addition to our transaction with Cyber and Auto Holdings last week, we promoted Billy Ferriolo to the new position of Executive Vice President, Consumer Acquisitions, and extended his contract to March 31, 2018. Billy was a co-founder of Cyber and joined Autobytel in 2010 after our acquisition. The Auto Holdings transaction allowed Billy to diversify his family net worth in conjunction with receiving new incentives in the form of additional stock options, restricted stock units under his new contract, part of which only vest over the life of his contract, and part if our stock trades at $30 per share, and then at $45 per share for specific periods of time.

|

AUTOBYTEL INC.

Moderator: Jeff Coats

5/7/2015 5:00 p.m. ET

Confirmation # 28443285

Page 9

|

|

Since joining Autobytel, Billy has been an exceptional leader for our consumer acquisitions team. His highly successful development of complex SEO and SEM techniques have been a vital part of our growth. Billy has also led his team to develop numerous initiatives that significantly enhanced our lead generation capabilities and has continued to develop and build his team with additional highly skilled personnel. Furthermore, Billy plays an important role in our relationship with AutoWeb and has been instrumental in our joint development projects with them. Billy brings the right talent, experience and leadership to our executive group, and we expect his vision and skilled execution to continue supplementing our growth in the years to come.

|

|

|

Today, I'm also happy to announce a new growth initiative that is a direct result of our partnership with AutoWeb. In June, AutoWeb plans to officially launch a new platform called Autobytel Direct, which will be powered by Autobytel's high quality traffic and resold by our retail dealer sales team. This pay-per-click platform drives high intent, low funnel car shoppers right to dealers' online inventory pages and enables dealers to target car shoppers by make, model and geography. The ad platform also provides real-time performance tracking with an advanced reporting dashboard which can track impressions, clicks, conversions and click-through rates. Several dealers have been piloting this program since last fall and have since experienced a high conversion of leads and calls, all while creating a unique online shopping experience for high intent consumers, which will ultimately maximize the dealer's branding. We expect this new initiative to supplement our various avenues for growth.

|

|

|

As many of you may have seen in our earnings press release this afternoon, we plan to re-launch our Car.com website during the second quarter. The new Car.com is a consumer-focused, mobile-friendly website designed and built as a data-driven web platform to simplify the automotive decision process for consumers. By providing a set of easy-to-use tools, consumers can quickly identify cars and trucks that match the key features they desire. Unique content will provide consumers with our industry expert reviews in a consumable and friendly format. The new Car.com will also showcase AutoWeb listings, which builds upon the significant opportunity to drive growth in our advertising business.

|

|

|

I'd like to quickly touch on the acquisition landscape since this topic seems to be addressed in Q&A on a regular basis. We continue to see market consolidation, and we remain opportunistic. We are constantly on the outlook for companies that could add to our dealership retail channels as well as companies with advanced technologies that could enhance our lead generation and web traffic monetization.

|

AUTOBYTEL INC.

Moderator: Jeff Coats

5/7/2015 5:00 p.m. ET

Confirmation # 28443285

Page 10

|

|

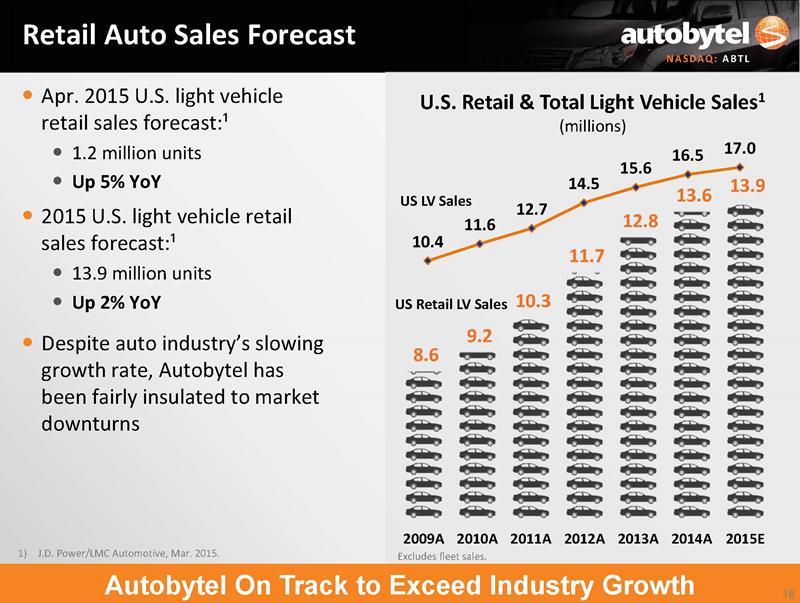

Moving on to the industry outlook… As you can see on Slide 18, J.D. Power is holding its total light-vehicle sales forecast for 2015 at 17.0 million units, but has slightly reduced its retail forecast to 13.9 million units from its previous outlook of 14.0 million units. The April retail Seasonally Adjusted Annual Run rate, or SAAR, is expected to be 13.7 million units, which is down 200,000 units from March 2015, but up 400,000 units than April 2014.

|

|

|

Although the bar chart shows the deceleration in U.S. retail light vehicle sales growth, as I have stated before, we do consider our business somewhat insulated to market downturns. So if sales do slow in 2015, dealers and manufacturers would likely turn to the highest ROI activities available to sell more cars, which we believe includes Autobytel leads, and now, clicks.

|

|

|

Now moving on to our outlook for 2015 on Slide 19… we are reiterating our previously disclosed guidance, expecting fiscal year 2015 revenue to range between $114 million and $120 million, representing an increase of approximately 7% to 13% from 2014. We also continue to expect non-GAAP diluted EPS in fiscal year 2015 to range between $0.97 and $1.16 compared to $0.83 in 2014, representing an increase of approximately 17% to 40%.

|

Our primary focus for 2015, as always, is to provide value to all of our customers, which we believe will ultimately translate to enhanced value for our stockholders. Through the continued growth of our dealers, high quality leads and value-added products, we expect to carry our momentum through 2015 and capitalize on the evolving consumer and automotive marketplace.

|

|

Operator, at this time we'll take questions.

|

|

Operator:

|

Thank you, sir. Ladies and gentlemen, if you have a question at this time, please press star then one on your touch tone telephone. If your question has been answered or you wish to remove yourself from the queue, please press the pound key. And once again, that is star and then one to ask a question.

|

|

|

And our first question comes from the line of Sameet Sinha with B. Riley. Your line is now.

|

|

Austin Drake:

|

Hi. This is Austin on for Sameet. Thanks for taking my questions. Can you talk about the trends in lead generation in 2Q so far? Are there any deviations from the norm that you are seeing?

|

|

Jeffrey Coats:

|

Hi Austin. No, there's no deviation from the norm.

|

AUTOBYTEL INC.

Moderator: Jeff Coats

5/7/2015 5:00 p.m. ET

Confirmation # 28443285

Page 11

|

Austin Drake:

|

OK, got it. And how would you characterize the health of the industry? It seems some OEMs are doing better than others. Are you seeing any reduction or increase in incentive activity?

|

|

Jeffrey Coats:

|

We seem to be still chugging along pretty strongly. We do see reports in the industry of some manufacturers being up a little bit more than others periodically. We see that a little bit in our lead volumes with some of those manufacturers. And as we have stated, we do consider ourselves somewhat countercyclical in that as sales do slow down at the manufacturer and dealership levels, we do generally see an increase in lead volume, certainly in lead volume demand from those customers. So we don't currently see a slowdown.

|

|

Austin Drake:

|

Okay. And with Google announcing that it will favor sites that are mobile-enabled, do you expect any momentum in your site development business that you acquired a couple of years back?

|

|

Jeffrey Coats:

|

We do expect to see some pickup in that from the mobile websites that we're generating. That is part of our mobile suite. Certainly, dealers are much more focused on being mobile-savvy today than they were historically, so we do expect to see some pickup from that over time.

|

|

Austin Drake:

|

Okay, great. And then last question from me. You had indicated that one large OEM has just started ramping on your platform. How is that trajectory, and could they ramp to be a top 5 customer, potentially?

|

|

Jeffrey Coats:

|

They could ramp to be a top 5 customer, potentially. Yes.

|

|

Austin Drake:

|

All right. Thank you very much.

|

|

Operator:

|

Thank you. As a reminder, ladies and gentlemen, if you would like to ask a question at this time, please press star then one on your touch tone telephone. And our next question comes from the line of Ed Woo with Ascendiant Capital. Your line is now open.

|

|

Ed Woo:

|

Yes, thanks for taking my question. I had a question in terms of cost-per-click trends, and also, you mentioned that Google just implemented a mobile change, and did you specifically say that you had not seen any impact so far?

|

|

Jeffrey Coats:

|

Sorry, Ed. We seem to have a little bit of a bad connection. Can you repeat your questions?

|

AUTOBYTEL INC.

Moderator: Jeff Coats

5/7/2015 5:00 p.m. ET

Confirmation # 28443285

Page 12

|

Ed Woo:

|

Sure. What are the cost-per-click trends that you're seeing out there? And also, I think Kim mentioned that Google made a pretty big change in their mobile algorithm. Have there been any impacts to your business?

|

|

Jeffrey Coats:

|

With regard to the mobile update that Google did a couple of weeks ago, we have not seen any impact on our business. Certainly we've seen no negative impact at all. Our page view growth is continuing. We understand they're doing rolling implementations, so we may not be affected yet, but we've not seen anything negative at all coming out of it. And we would expect over time to see something positive, since we are very mobile-friendly, and that's what this update is designed to enhance and reward.

|

|

Ed Woo:

|

Great. Do you see any trends in cost-per-click trends?

|

|

Kim Boren:

|

With Google, I'm assuming you're asking?

|

|

Ed Woo:

|

Or with any of the major search engines in general.

|

|

Kim Boren:

|

We haven't seen any marked jump lately. As we disclosed previously, there has been increasing costs, which we've been able to offset for the most part with increasing conversions. We're not seeing any change in that trend to accelerate cost or anything along those lines.

|

|

Ed Woo:

|

Great. And the last question I have is you mentioned that Car.com, your own website, is going to go through a major change. Will you be doing a major update on Autobytel as well, and how will you differentiate between the sites?

|

|

Jeffrey Coats:

|

We've been continuing to invest in and update Autobytel over the last probably 3 to 4 years, so we have been constantly enhancing Autobytel. We have not -- this will be the first actual complete overhaul for Car.com, actually for many, many years. It's being built on a new technology platform, and it's a very different look and feel, so we will be launching it shortly. It will be during the second quarter, and it’ll be a little bit more of an inventory-based site -- much more simple, much easier to navigate.

|

|

Ed Woo:

|

Great. Well, thank you, and good luck.

|

|

Jeffrey Coats:

|

Thanks, Ed.

|

AUTOBYTEL INC.

Moderator: Jeff Coats

5/7/2015 5:00 p.m. ET

Confirmation # 28443285

Page 13

|

Operator:

|

Thank you, and we have a follow up question from the line of Sameet Sinha with B. Riley. Your line is now open.

|

|

Sameet Sinha:

|

Yes. Thank you. Just a couple of questions here. First, I'm sorry I jumped onto the call a little late, but any updates on the AutoWeb front? How's that business coming along? Could you give us an update since the CEO of that company had provided some information to an industry newsletter. And the second question was, in terms of any updates on your cost-per-sale product. Where is that headed? Any incremental deep data points that you can give to us that shows us the trajectory? And if you think longer term with that product, what is the potential of developing affinity programs around that product? Thank you.

|

|

Jeffrey Coats:

|

Hi Sameet. AutoWeb is scaling nicely. They disclosed, I think a few weeks ago publicly, that they expected to do approximately $10 million of revenue this year. They are on track to achieve that. So I'd say our outlook vis a vis AutoWeb is quite bullish. You know, we announced today a new initiative with them, where we will be bringing a new product to the dealer level related to click traffic to dealers' websites. We're excited about that. It's a new revenue stream for us and for them.

|

|

|

With regards to pay-per-sale, we do still maintain a pay-per-sale product. It is still relatively limited. We play with it mostly in California. And actually, honestly, we've been devoting more time recently to our used car business in terms of scaling that, because we actually see fundamentally a greater opportunity there. That doesn't mean that we're not still interested in pay-per-sale, but it has not been the priority while we've been focused on enhancing our used car business.

|

|

|

And I think you asked another question, and I can't quite remember what it was.

|

|

Sameet Sinha:

|

Right. It was basically around as to whether the cost-per-sale product – is there an opportunity, do you think, to develop an affinity network around that? You could offer it to on a white-label basis.

|

|

Jeffrey Coats:

|

Sure. Well, actually, I think we could develop an affinity product even without a cost-per-sale product. But I do think there are likely to be affinity opportunities in the market going forward. A lot of people are focused on that, so we see opportunities there down the road for us. Yes.

|

|

Sameet Sinha:

|

Okay. Thank you very much.

|

|

Jeffrey Coats:

|

Thank you.

|

|

Operator:

|

Thank you. As a reminder, ladies and gentlemen, if you would like to ask a question at this time, please press star then one on your touch tone telephone. Our next question comes from the line of Eric Martinuzzi with Lake Street Capital. Your line is now open.

|

AUTOBYTEL INC.

Moderator: Jeff Coats

5/7/2015 5:00 p.m. ET

Confirmation # 28443285

Page 14

|

Eric Martinuzzi:

|

A couple of housekeeping questions first, and then a couple on the ops. So just to understand the impact of the note conversion and the warrant, on the cash side we pick up $1.9 million on the warrant exercise, so that $19.3 million March 31 balance goes up by $1.9 million. Is that correct?

|

|

Kim Boren:

|

Correct.

|

|

Eric Martinuzzi:

|

Okay. And then on the debt side, we clear out the $5 million of its convertible note, and so that, the March 31, between the convertible notes and the term loans we had about $12.2 million. If I back off the $5 million of the converts, then I'm basically $7.2 million. Is that correct?

|

|

Kim Boren:

|

That sounds -- yes.

|

|

Eric Martinuzzi:

|

Okay. I realize that I mixed apples and oranges into the same debt bucket, but that's how I look at it. So, okay. So that gives me a pro forma look at where we are, and you're roughly $14 million of net cash. Does that sound right?

|

|

Jeffrey Coats:

|

Yes. The way you're looking at it, yes. That would be about that net cash number.

|

|

Eric Martinuzzi:

|

Okay, all right. And then the interest expense -- you gave us a Q2 pro forma share count. Do you have an interest expense for Q2?

|

|

Kim Boren:

|

Yes. I believe we disclosed it was $200,000, roughly. Excuse me, it's $200,000 previous year, $100,000 this year.

|

|

Jeffrey Coats:

|

He's asking Q2.

|

|

Kim Boren:

|

Oh, for Q2 looking forward.

|

|

Jeffrey Coats:

|

Are you asking for Q2 or Q1, Eric?

|

|

Eric Martinuzzi:

|

Q2.

|

|

Jeffrey Coats:

|

That's what I thought.

|

|

Kim Boren:

|

Okay, for Q2, it will be close, in rounding, to the $200,000 range.

|

|

Eric Martinuzzi:

|

There's no relief there with it not staying on two-thirds of the quarter?

|

|

Kim Boren:

|

I'm sorry.

|

|

|

(Crosstalk)

|

AUTOBYTEL INC.

Moderator: Jeff Coats

5/7/2015 5:00 p.m. ET

Confirmation # 28443285

Page 15

|

Jeffrey Coats:

|

We can't hear you very well, Eric.

|

|

Eric Martinuzzi:

|

Okay. I was just -- I'll take it offline. Let me shift over to the guidance for 2015. I've got you -- you've obviously reiterated the year, and I know you don't want to be in the quarterly guidance business, but just directionally, I want to make sure I'm not too far off base. A year ago, you had the sequential decline because of AutoUSA. This year I've got you going up sequentially, so the $20.62 goes up to $27.00. I don't need you to comment specifically, but just directionally, does that make sense? I know seasonally, you guys do better in the warm weather quarters. Would you care to comment on that?

|

|

Kim Boren:

|

Yes. So we expect our sequential trends to be similar to how they've performed historically, with the one difference in Q2 being the large OEM program that we discussed that was reduced mid-Q2 2014.

|

|

Eric Martinuzzi:

|

Okay. I think I follow that. So historical trends absent the AutoUSA impact of 2014?

|

|

Kim Boren:

|

Correct.

|

|

Eric Martinuzzi:

|

Okay. And then I'm assuming that EPS will flow through as well – a sequential improvement there. And then just on the used car business here, you're going more direct to consumer with Car.com. How are you going to be driving traffic there? Should be looking for an ad spend, a traffic spend, SEM, OpEx? Is our OpEx affected here as we model for 2015?

|

|

Jeffrey Coats:

|

Yes. You won't really see anything meaningfully different than the way we currently do stuff. Car.com is a very old URL. It gets a lot of traffic just by virtue of it being an old and very simple URL, and so we don't -- you will not see us doing television commercials. You will not see us doing radio for it. We may beef up a little bit some of our SEM related to it. We do drive some traffic to Car.com via SEM, but I would not expect that you would really see anything pronounced enough to stand out in the P&L. We expect it to scale organically pretty nicely.

|

|

Eric Martinuzzi:

|

Okay. That covers my questions, and congratulations on the quarter.

|

|

Jeffrey Coats:

|

Thank you, Eric.

|

|

Operator:

|

Thank you. At this time, this concludes our question-and-answer session. I would now like to turn the call back over to Mr. Coats for closing remarks.

|

AUTOBYTEL INC.

Moderator: Jeff Coats

5/7/2015 5:00 p.m. ET

Confirmation # 28443285

Page 16

|

Jeffrey Coats:

|

Thank you. Thanks to everybody for joining us on the call today. I also want to thank our team of very hard-working employees. We look forward to speaking to all of you next quarter and to seeing many of you at the conferences we'll be doing in Los Angeles and Chicago next week and in New York the week after Memorial Day. Thank you.

|

|

Operator:

|

Ladies and gentlemen, this does conclude today's teleconference. You may disconnect your lines at this time. Thank you for your participation.

|

|

|

END

|