Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AMEDISYS INC | d924255d8k.htm |

Right care. Right time. Right place

.

Investor Presentation

May 2015

EXHIBIT 99.1 |

Right care. Right time. Right place

.

Forward-looking Statements

This presentation may include forward-looking statements as defined by the

Private Securities Litigation Reform Act of 1995. These forward-looking

statements are based upon current expectations and assumptions about our

business that are subject to a variety of risks and uncertainties that could

cause actual results to differ materially from those described in this

presentation. You should not rely on forward-looking statements as a

prediction of future events. Additional

information

regarding

factors

that

could

cause

actual

results

to

differ

materially

from those discussed in any forward-looking statements are described in reports

and registration statements we file with the SEC, including our Annual

Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q

and Current Reports on Form 8-K, copies

of

which

are

available

on

the

Amedisys

internet

website

http://www.amedisys.com

or by contacting the Amedisys Investor Relations department at (225) 292-2031.

We disclaim any obligation to update any forward-looking statements or

any changes in events, conditions or circumstances upon which any

forward-looking statement may be based except as required by law.

www.amedisys.com

NASDAQ: AMED

We encourage everyone to visit the

Investors Section of our website at

www.amedisys.com, where we have

posted additional important

information such as press releases,

profiles concerning our business and

clinical operations and control

processes, and SEC filings.

We intend to use our website to

expedite public access to time-critical

information regarding the Company in

advance of or in lieu of distributing a

press release or a filing with the SEC

disclosing the same information.

1 |

Right care. Right time. Right place

.

Amedisys Snapshot

Founded in 1982, publicly

listed 1994

395 care centers in 34

states

13,000 employees

57,000 patients currently

on census

2014 revenue of $1.2

billion

355,000 patients seen

annually

Over 7.5 million annual

patient visits

Amedisys Home Health Care Centers (316 locations)

Amedisys Hospice Care Centers (79 locations)

2

Overview |

Right care. Right time. Right place

.

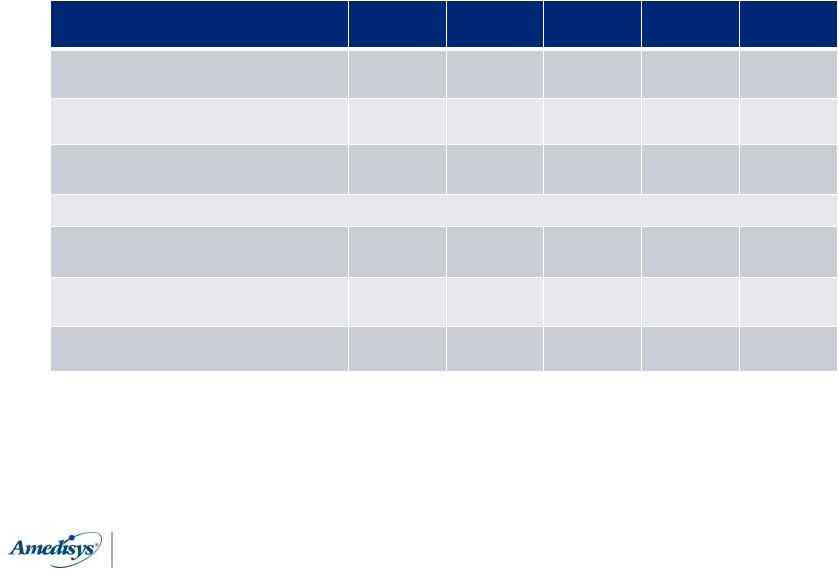

($ in millions, except per share data)

1Q14

2Q14

3Q14

4Q14

1Q15

Net Revenue

$299

$305

$300

$301

$302

Gross Margin %

41.0%

43.4%

43.3%

43.0%

43.3%

Total G&A Expenses

126

118

114

113

111

EBITDA

$5

$22

$24

$23

$26

EBITDA Margin

1.8%

7.3%

7.9%

7.6%

8.7%

EPS

($0.07)

$0.25

$0.28

$0.27

$0.30

Summary Adjusted Financials –

Quarterly

1

3 |

Right care. Right time. Right place

.

Business Overview

Business

$ (in millions) /

% of Revenue

Revenue per

Visit / Revenue

per Day

Gross Margin %

Reimbursement Type

Home Health

Episodic

$207 / 69%

$160

46.1%

60-day episode of care

Non-Medicare Per Visit

$35 / 11%

$110

21.6%

Per visit

Total Home Health

$241 / 80%

Hospice

$60 / 20%

$147

46.4%

98% routine care; daily rate

Total

$302 / 100%

Based on 1Q15 financials. Gross margin computed by subtracting cost per visit from

revenue per visit in home health and cost per day from hospice revenue per day

4 |

Right care. Right time. Right place

.

Amedisys Vision

5

high margins

Strengthen & grow the core

Lead Industry

consolidation

Become employer of choice

Outstanding clinical outcomes

Extend the core

Simplify

Op Model

Build

Capacity

Clinical

Excellence

Organic

Growth

Adjacent

Growth

Options

Deliver superior patient outcomes using a simple, efficient, and

clinically driven operating model to drive growth and lead in a

consolidating industry

Leading cost structure driving |

Right care. Right time. Right place

.

Operating Platform Transition –

HomeCare HomeBase

•

AMS3 testing resulted in significant operational disruption

•

Conducted third-party comparison of AMS3 to commercially available

solutions •

HomeCare HomeBase presents a compelling alternative to proprietary

development at lower cost

•

Company-wide implementation targeted in 18-24 months

•

Anticipate

$20

million

in

annual

G&A

savings

after

implementation

and

reduction

in

annual

capital

expenditures

below

$10

million

beginning

in

2016

6 |

Right care. Right time. Right place

.

Strategic Plan –

Moving to Execution

Goals

Improved Clinical Quality

Movement to value-based reimbursement

Continued margin expansion

Operational streamlining and standardization

Maximizing efficiency of field clinicians

Leverage operational scale

Growth

Organic

Increasing capacity

Optimizing business development efforts

Inorganic / M&A

Near-term –

tuck-ins

Long-term –

regional expansion and adjacencies

7

People

Managed Care

Processes and Workflow

Business Development

Amedisys Priorities

IT Optimization

Clinical Distinction and Protocols |

Right care. Right time. Right place

.

Selective tuck-ins

while

platform and operating processes are

being optimized

More aggressive acquisitions

once our cost structure provides us an

advantage in the form of operating synergies

Short Term:

Tuck-in

Focus

Long Term:

Strategic

Accretive

Acquisitions

Expand our footprint strategically

Counties in CON states

Key referral partners (e.g.,

hospitals / hospital systems)

Home care / hospice alignment

Local density to enhance efficiency

(e.g., scheduling)

New geographies

Scale to leverage

investments

M&A Strategy –

Short and Long-Term

8 |

Right care. Right time. Right place

.

Adjusted

Cash

Flow

2

9

($ in Millions)

1Q14

2Q14

3Q14

4Q14

1Q15

Operating cash flow

(4)

27

31

29

30

Changes in working capital

(2)

(3)

(6)

11

(16)

Operating cash flow, net

(6)

24

25

40

14

Capital Expenditures

(6)

(4)

(1)

(2)

(2)

Required Debt Repayments

(3)

(3)

(3)

(3)

(3)

Free Cash Flow

(15)

17

21

34

9

($ in Millions)

LTM

Free Cash Flow

81

Required Debt Repayments

12

Other Sources

4

LTM Debt Reduction

$97 |

Right care. Right time. Right place

.

Balance Sheet

Assets ($ in MM)

12/31/14

3/31/15

Cash

$8

$3

Accounts Receivable, net

99

111

Property and Equipment

137

57

Goodwill

206

206

Deferred Tax Asset

125

147

Other

95

99

Total Assets

670

623

Liabilities and Equity

Other Liabilities

$155

$156

Long-Term Debt

118

100

Equity

397

367

Total Liabilities and Equity

670

623

Total Leverage Ratio

1.5x

1.1x

Days Sales Outstanding

29

32

10 |

Right care. Right time. Right place

.

($ in millions)

1Q14

4Q14

1Q15

Net Revenue

$237

$240

$241

Gross Margin %

39.5%

42.1%

42.6%

Key Operating Statistics

Same store Medicare revenue growth

(7%)

4%

6%

Same store non-Medicare revenue growth

1%

26%

20%

Medicare recert rate

38%

37%

37%

Cost per visit

$90.28

$86.29

$86.33

Home

Health

Segment

1

11 |

Right care. Right time. Right place

.

($ in millions)

1Q14

4Q14

1Q15

Net Revenue

$62

$61

$60

Gross Margin %

46.8%

46.4%

46.3%

Key Operating Statistics

Same store ADC growth

(6%)

(3%)

1%

Same store admission growth

(5%)

2%

7%

Revenue per day

$145.95

$147.16

$147.48

Cost per day

$77.47

$78.62

$79.12

Hospice

Segment

1

12 |

Right care. Right time. Right place

.

Contact Information

Ronnie LaBorde

Vice Chairman and Chief Financial Officer

ronnie.laborde@amedisys.com

David Castille

Managing Director, Finance

david.castille@amedisys.com

Amedisys, Inc.

5959 S. Sherwood Forest Blvd.

Baton Rouge, LA 70816

Office: 225.292.2031

13 |

Right care. Right time. Right place

.

Endnotes

1.

The financial results for the three month periods ended March 31, 2014, June 30,

2014, September 30, 2014, December 31, 2014 and March 31, 2015 are adjusted

for certain items and should be considered a non-GAAP financial measure. A reconciliation of these non-

GAAP financial measures is included in the corresponding 8-K detailing quarterly results for each respective reporting period.

2.

Operating cash flow detailed in this schedule is adjusted for DOJ settlement

payments made in 2Q14 ($115 million) and 4Q14 ($35 million).

14 |