Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Manitex International, Inc. | d923742d8k.htm |

| EX-99.1 - EX-99.1 - Manitex International, Inc. | d923742dex991.htm |

“Focused manufacturer

of engineered lifting

equipment”

Manitex International, Inc.

(NASDAQ:MNTX)

Conference Call

First Quarter 2015

May 11th, 2015

Exhibit 99.2 |

2

Forward Looking Statements &

Non GAAP Measures

“Focused manufacturer

of engineered lifting

equipment”

Safe Harbor Statement under the U.S. Private Securities Litigation Reform Act of

1995: This presentation contains statements that are forward-looking in

nature which express the beliefs and expectations of management including

statements regarding the Company’s expected results of operations or liquidity;

statements concerning projections, predictions, expectations, estimates or forecasts

as to our business, financial and operational results and future economic

performance; and statements of management’s goals and objectives and

other similar expressions concerning matters that are not historical facts. In some

cases, you can identify forward-looking statements by terminology such as

“anticipate,” “estimate,”

“plan,”

“project,”

“continuing,”

“ongoing,”

“expect,”

“we believe,”

“we intend,”

“may,”

“will,”

“should,”

“could,”

and similar expressions. Such statements are based on current plans, estimates and

expectations and involve a number of known and unknown risks, uncertainties

and other factors that could cause the Company's future results, performance

or achievements to differ significantly from the results, performance or

achievements expressed or implied by such forward-looking statements. These factors and additional

information are discussed in the Company's filings with the Securities and Exchange

Commission and statements in this presentation should be evaluated in light of

these important factors. Although we believe that these statements are based

upon reasonable assumptions, we cannot guarantee future results.

Forward-looking statements speak only as of the date on which they are made, and

the Company undertakes no obligation to update publicly or revise any

forward-looking statement, whether as a result of new information, future

developments or otherwise. Non-GAAP

Measures:

Manitex

International

from

time

to

time

refers

to

various

non-GAAP

(generally

accepted accounting principles) financial measures in this presentation.

Manitex believes that this information is useful to understanding its

operating results without the impact of special items. See Manitex’s

First Quarter 2015 Earnings Release on the Investor Relations section of our website

www.manitexinternational.com

for a description and/or reconciliation of these measures.

|

3

“Focused manufacturer

of engineered lifting

equipment”

Overview

•

Cost reductions through sourcing and operating efficiency initiatives

•

Continued integration of ASV and PM Group

•

Optimize our capital allocation, multi year process:

Invest in and grow our higher margin businesses-PM, ASV, Manitex are our

portfolio’s “top producers”

with respect to margins and addressable markets

Consider

“addition

by

subtraction”

for

lower

margin

units

that

could

have

synergies elsewhere

All proceeds to retire debt and bring our capital ratios to historic ranges

|

4

“Focused manufacturer

of engineered lifting

equipment”

Commercial Overview

Q1 market conditions generally slow.

Growth of 2% over 12/31/2014

Broad based order book: ASV 10%, PM 15% Manitex 75%

3/31/15 Backlog of $109.6 million (12/31/14, $107.3 million; 3/31/14,

$100.0 million): PM

ASV

Significant

activity

and

interest

related

to

our

new

acquisition

products.

Oil and gas demand significantly lower

N. American general construction demand for our equipment flat in the

quarter European and international markets modest improvement,

together with benefit from more competitive Euro.

|

5

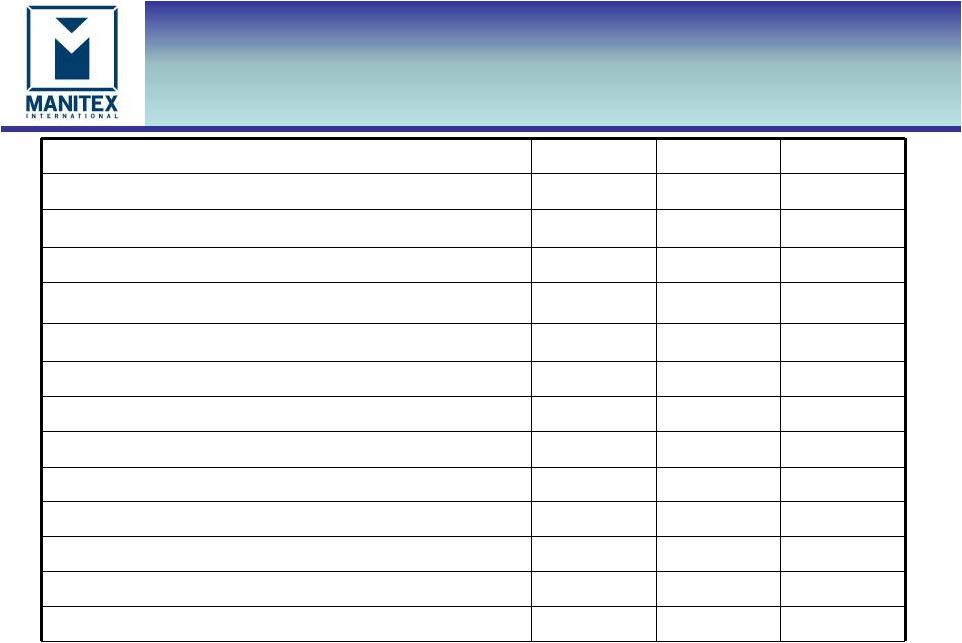

Key Figures -

Quarterly

“Focused manufacturer

of engineered lifting

equipment”

USD thousands

Q1-2015*

Q1-2014

Q4-2014*

Net sales

$105,882

$62,576

$66,909

% change in Q1-2015 to prior period

69.2%

58.3%

Gross profit

21,163

11,604

12,623

Gross margin %

20.0%

18.5%

18.9%

Operating expenses

15,993

7,993

8,531

Adjusted Net Income

$1,518

1,877

2,185

Adjusted Earnings Per Share

$0.10

$0.14

$0.16

Adjusted Ebitda

8,030

4,722

5,330

Adjusted Ebitda % of Sales

7.6%

7.5%

8.0%

Working capital

98,938

75,171

89,970

Current ratio

1.8

2.5

2.1

Backlog

109,625

100,023

107,327

% change in Q1-2015 to prior period

9.6%

2.1%

*As adjusted. See reconciliation to US GAAP on appendix

|

6

“Focused

manufacturer of

engineered lifting

equipment”

Q1-2015 Operating Performance

$m

Q1-2014 sales

$62.6

Currency translation

(3.4)

Sales from acquisitions

48.6

Volume

(1.9)

Q1-2015 sales

$105.9

$m

Q1-2014 Net income

$1.9

Increase in gross margin from sales

9.6

Operating expenses from acquisitions

(9.0)

Reduced SG&A & R&D

1.0

Interest expense

(2.1)

Other income (expense)

0.9

Tax & other

(0.1)

Attributable to noncontrolling interest

(0.7)

Q1-2015 Adjusted net income

$1.5 |

7

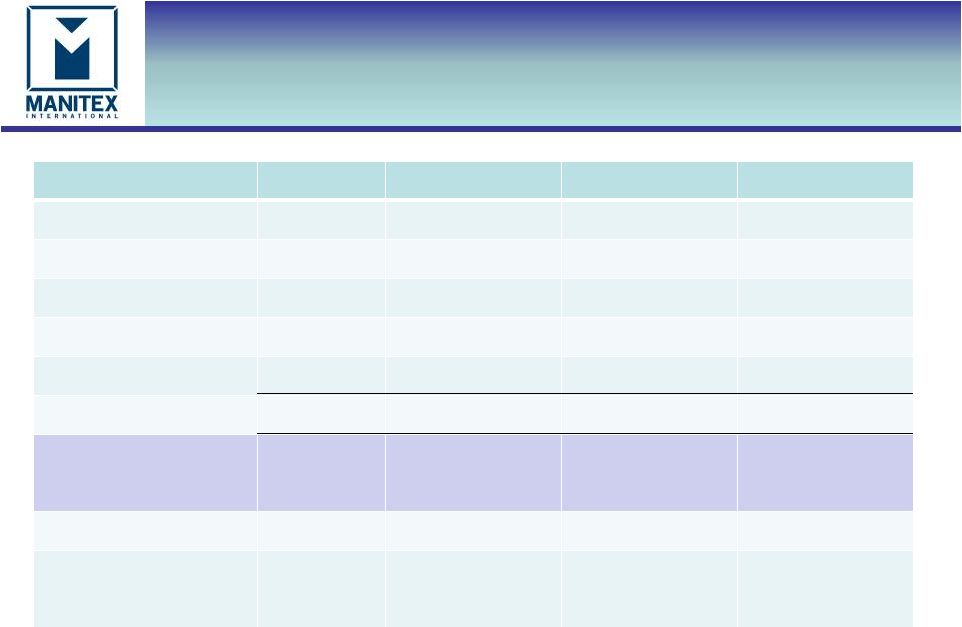

Working Capital

“Focused manufacturer

of engineered lifting

equipment”

$000

March 31,

2015

December 31,

2014

Working Capital

$98,938

$89,470

Days sales outstanding (DSO)

74

83

Days payable outstanding (DPO)

62

60

Inventory turns

2.8

2.2

Current ratio

1.8

2.1

Operating working capital

147,943

122,031

Operating working capital % of annualized LQS

34.9%

45.6%

Operating working capital increase of $25.9m of which $20.3m from PM

acquisition Working capital ratios now reflect higher

proportion of international activity. N. America based

operations DSO is 66 days and DPO is 45 days Current ratio

would be 2.1 at March 2015 adjusting for PM working capital facilities of

$20.3m that are transactional and therefore current, (compared to

N. American term lines of credit that are long term)

|

8

“Focused manufacturer

of engineered lifting

equipment”

$000

March 31,

2015

December 31,

2014

Total Cash

$5,578

$4,370

Total Debt

200,375

112,294

Total Equity

135,186

128,006

Net capitalization

$329,983

$235,930

Net debt / capitalization

59.0%

45.7%

Adjusted EBITDA (for three months ended)

$8,030

$5,330

Adjusted EBITDA % of sales

7.6%

8.0%

Repayments of debt principal of $2.8m in Q1-2015; This

includes prepayment of $1.5m on Comerica term loan.

Availability,

based

on

collateral,

under

working

capital

lines

in

N.

America

of

$14.8m

and

$6.6m

in

ASV

Average Debt Cost approximates 6%

Debt & Liquidity

•

Net capitalization is the sum of debt plus equity minus cash

•

Net debt is total debt less cash |

9

“Focused manufacturer

of engineered lifting

equipment”

Debt

As at March 31, 2015

PM

ASV

Other

Total

Working capital facilities

20,295

16,219

46,225

82,739

Term debt

36,002

39,500

12,000

87,502

Capital leases

4,983

4,983

Convertible notes

20,951

20,951

Other acquisition notes

4,200

4,200

$56,297

$55,719

$88,359

$200,375

Note:

Non-recourse to Manitex

International Inc.

$56,297

$55,719

$112,016

Interest cost for three

months ended March

31, 2015

$2,934 |

10

Summary

“Focused manufacturer

of engineered lifting

equipment”

Implementation and execution of integration of PM & ASV JV

Progression on cost savings

Decrease working capital

Reduce outstanding debt

Begin program of strategic rationalization

|

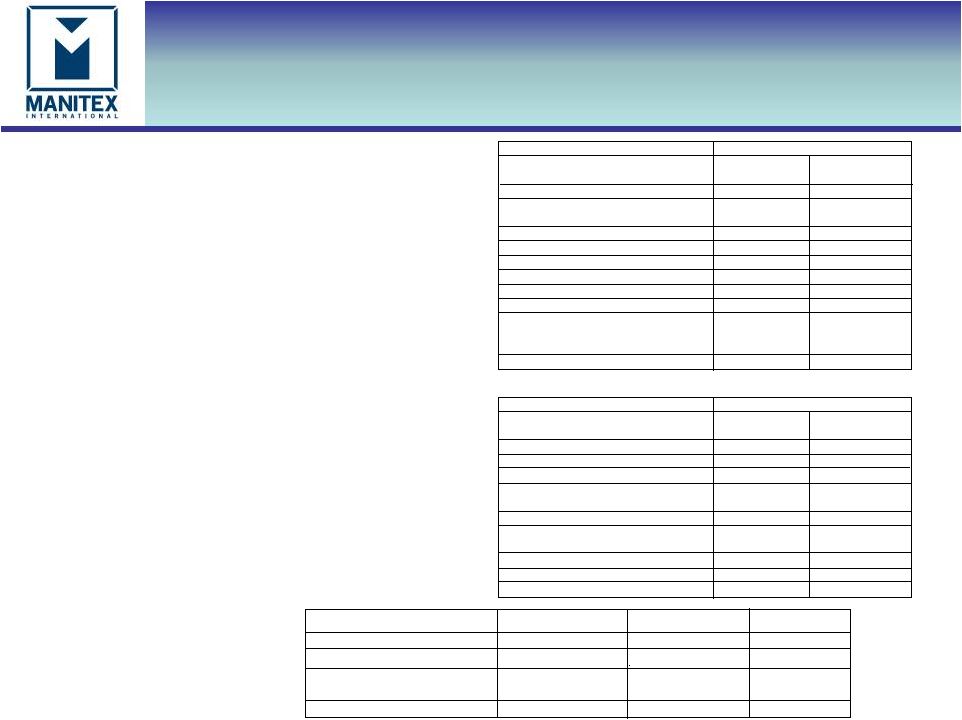

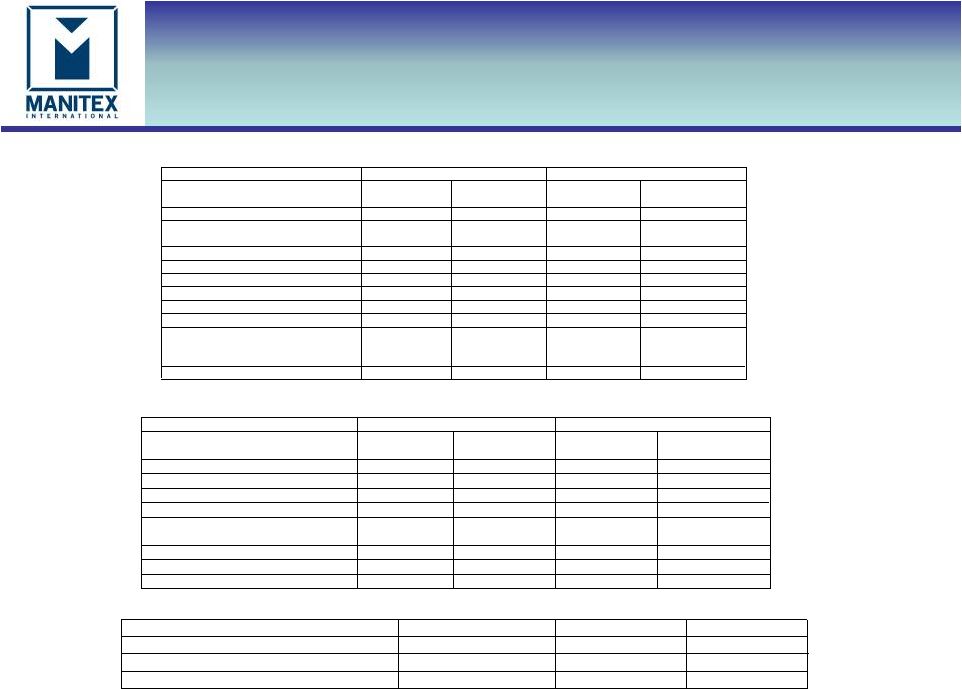

11

APPENDIX

“Focused manufacturer

of engineered lifting

equipment”

Reconciliation of Q1-2015 Adjusted net income and adjusted EPS

Reconciliation of Q1-2015 Adjusted EBITDA to GAAP net income

Q1-2015 Acquisition and other expense

Three Months Ended

March 31,

2015

March 31,

2014

Net (loss) income

(224)

1,877

Net income attributable to noncontrolling

interest

294

-

Income tax

34

905

Interest expense

2,934

805

Foreign currency transaction losses (gain)

(945)

11

Other (income) expense

10

13

Acquisition and other expense

3,027

-

Depreciation & Amortization

2,900

1,111

Adjusted Earnings before interest,

taxes, depreciation and amortization

(Adjusted EBITDA)

$8,030

$4,722

Adjusted EBITDA % to sales

7.6%

7.5%

Three Months Ended

March 31,

2015

March 31,

2014

Net (loss) income as reported

(224)

1,877

Pre – tax acquisition and other expenses

3,027

--

Tax effect based on jurisdictional blend

(879)

--

Increase in net income to noncontrolling

interest

(406)

Adjusted Net Income

$1,518

$1,877

Weighted average diluted shares

outstanding

15,836,423

13,840,506

Diluted earnings per share as reported

($0.01)

$0.14

Total EPS Effect

$0.11

--

Adjusted Diluted earnings per share

$0.10

$0.14

First

Quarter 2015

Pre-tax

After-tax

EPS

Deal transaction related

$2,6

87

$1,

903

$0.12

Exceptional operating cost

$357

$245

$0.02

Change

in noncontrolling

interest

$(406)

$(406)

$(0.03)

Total

$2,638

$1,742

$0.11 |

12

APPENDIX

“Focused manufacturer

of engineered lifting

equipment”

Reconciliation of Q4-2014 Adjusted net income and adjusted EPS

Reconciliation of Q4-2014 Adjusted EBITDA to GAAP net income

Q4-2014 Acquisition and other expense

Three Months Ended

Twelve Months Ended

December 31,

2014

December 31,

2013

December 31,

2014

December 31,

2013

Net income as reported

472

2,991

7,103

10,178

Pre – tax acquisition and other expenses

2,517

--

2,517

-

Tax effect based on jurisdictional blend

(804)

--

(804)

-

Adjusted Net Income

$2, 185

$2,991

$8,816

$10,178

Weighted average diluted shares

outstanding

14,029,205

13,821,352

13,904,289

12,717,575

Diluted earnings per share as reported

$0.03

$0.22

$0.51

$0.80

Total EPS Effect

$0.13

--

$0.12

--

Adjusted Diluted earnings per share

$0.16

$0.22

$0.63

$0.80

Three Months Ended

Twelve Months Ended

December 31,

2014

December 31,

2013

December 31,

2014

December 31,

2013

Net income

472

2,991

7,103

10,178

Net loss attributable to noncontrolling

interest

(136)

--

(136)

--

Income tax

393

1,182

3,676

4,269

Interest expense

958

765

3,150

2,946

Foreign currency transaction losses (gain)

80

23

107

95

Other (income) expense

(31)

59

36

50

Acquisition and other expense

2,356

-

2,356

-

Depreciation & Amortization

1,238

1,205

4,572

3,945

Adjusted Earnings before interest,

taxes, depreciation and amortization

(Adjusted EBITDA)

$5,330

$6,225

$20,864

$21,483

Adjusted EBITDA % to sales

8.0%

9.5%

7.9%

8.8%

Fourth Quarter 2014

Pre-tax

After-tax

EPS

Deal transaction related

$2,176

$1,481

$0.11

Exceptional operating cost

341

232

0.02

Total

$2,517

$1,713

$0.12

|