Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST KEYSTONE CORP | v409756_8k.htm |

Exhibit 99.1

First Keystone Corporation May 5, 2015 Annual Stockholders’ Meeting

Matthew Prosseda President and CEO This presentation contains certain forward - looking statements, which are included pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, and reflect management’s beliefs and expectations based on information currently available. These forward - looking statements are inherently subject to significant risks and uncertainties, including changes in general economic and financial market conditions, the Corporation’s ability to effectively carry out its business plans and changes in regulatory or legislative requirements. Other factors that could cause or contribute to such differences are changes in competitive conditions, and pending or threatened litigation. Although management believes the expectations reflected in such forward - looking statements are reasonable, actual results may differ materially.

$ Amounts in thousands

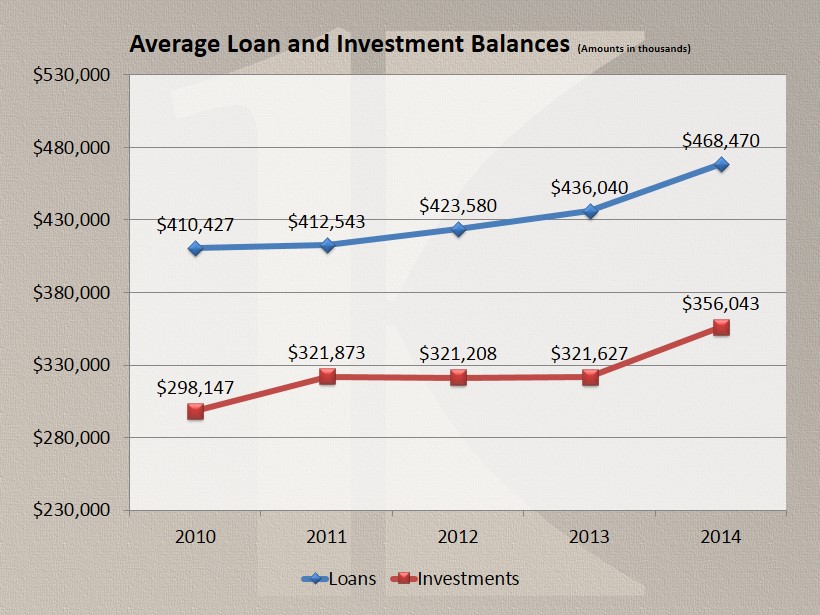

$410,427 $412,543 $423,580 $436,040 $468,470 $298,147 $321,873 $321,208 $321,627 $356,043 $230,000 $280,000 $330,000 $380,000 $430,000 $480,000 $530,000 2010 2011 2012 2013 2014 Average Loan and Investment Balances (Amounts in thousands) Loans Investments

6.01% 5.75% 5.45% 4.83% 4.51% 5.13% 4.83% 4.58% 3.85% 3.28% 3.00% 3.50% 4.00% 4.50% 5.00% 5.50% 6.00% 6.50% 2010 2011 2012 2013 2014 Loan and Investment Yields (tax equivalent) Loan Yields Investment Yields

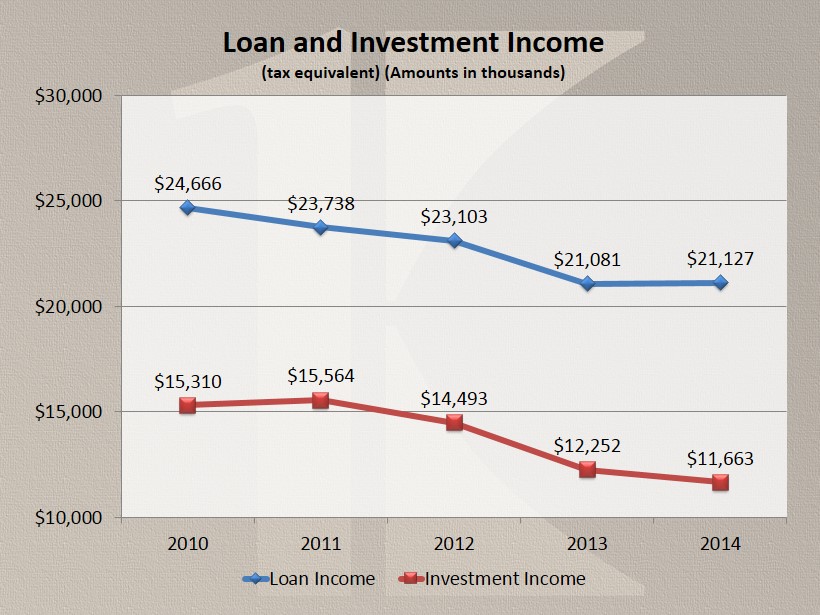

$24,666 $23,738 $23,103 $21,081 $21,127 $15,310 $15,564 $14,493 $12,252 $11,663 $10,000 $15,000 $20,000 $25,000 $30,000 2010 2011 2012 2013 2014 Loan and Investment Income (tax equivalent) (Amounts in thousands) Loan Income Investment Income

$819,625 $821,148 $812,980 $838,560 $900,952 $749,733 $748,785 $747,579 $765,696 $825,683 $700,000 $750,000 $800,000 $850,000 $900,000 2010 2011 2012 2013 2014 Average Total and Earning Assets (amounts in thousands) Average Total Assets Average Earning Assets

$557,506 $558,321 $538,549 $569,235 $566,243 $101,366 $92,265 $86,839 $75,296 $129,788 $0 $100,000 $200,000 $300,000 $400,000 $500,000 $600,000 2010 2011 2012 2013 2014 Average Interest Bearing Deposits and Borrowings (amounts in thousands) Average Interest Bearing Deposits Average Borrowings

Liability Costs 1.63% 1.20% 0.85% 0.64% 0.52% 3.58% 2.91% 2.25% 1.77% 1.15% 0.00% 1.00% 2.00% 3.00% 4.00% 2010 2011 2012 2013 2014 Deposit and Borrowing Costs Deposits Borrowings

Interest Expense $9,111 $6,718 $4,556 $3,623 $2,953 $3,631 $2,687 $1,958 $1,331 $1,499 $0 $5,000 $10,000 2010 2011 2012 2013 2014 Deposit and Borrowing Expense (amounts in thousands) Deposit Interest Borrowing Interest

$27,234 $29,897 $31,082 $28,397 $28,344 $25,000 $26,000 $27,000 $28,000 $29,000 $30,000 $31,000 $32,000 2010 2011 2012 2013 2014 Net Interest Income (tax equivalent) (amounts in thousands)

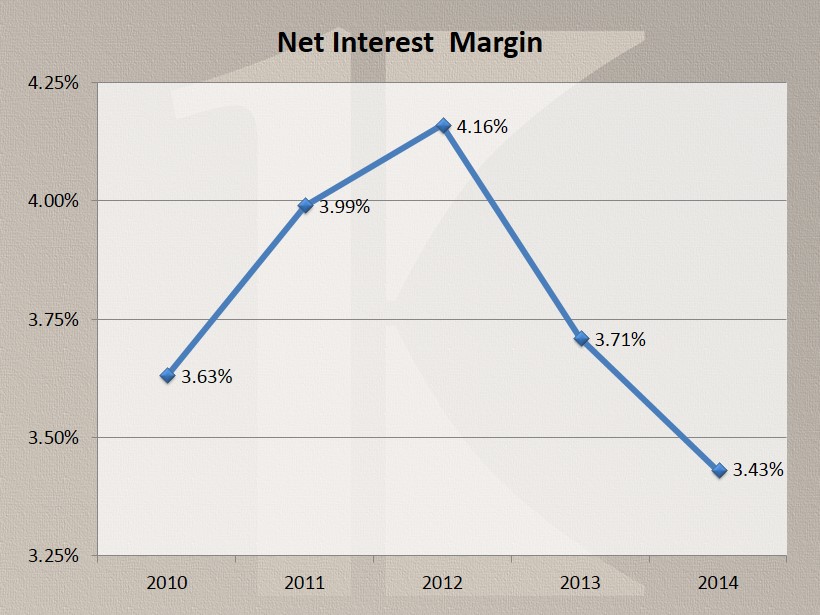

3.63% 3.99% 4.16% 3.71% 3.43% 3.25% 3.50% 3.75% 4.00% 4.25% 2010 2011 2012 2013 2014 Net Interest Margin

$4,795 $4,320 $5,120 $4,905 $5,146 $17,272 $17,695 $19,587 $19,597 $21,208 $0 $5,000 $10,000 $15,000 $20,000 $25,000 2010 2011 2012 2013 2014 Non - Interest Income and Expense* (amounts in thousands) Total Non-Interest Income Total Non-Interest Expense *Before Net Investment Securities Gains, FHLB Prepayment Penalties and Recovery due to Defalcation (2010)

$8,961 $9,907 $10,170 $10,273 $10,211 $8,000 $9,000 $10,000 $11,000 2010 2011 2012 2013 2014 Net Income After Taxes (amounts in thousands)

$1.65 $1.82 $1.86 $1.87 $1.84 $0.93 $0.97 $1.01 $1.04 $1.05 $0.80 $1.00 $1.20 $1.40 $1.60 $1.80 $2.00 2010 2011 2012 2013 2014 Earnings and Dividends per Share Earnings Dividends

Income Statement ($ in thousands, except per share data) Net Interest Income +Non - Interest Income =Operating Revenue - Loan Loss Provision =Pre - Tax Income - Income Tax Expense =Net Income Earnings Per Share 3 Months Ended March 31, 2015 3 Months Ended March 31, 2014 %Change $6,717 1,857 $8,574 212 5,283 $3,079 630 $2,449 3.2 8.3 4.3 59.4 0.6 8.5 16.7 6.6 - Non - Interest Expense $0.44 4.8 $6,508 1,715 $8,223 133 5,252 $2,838 540 $2,298 $0.42 Unaudited

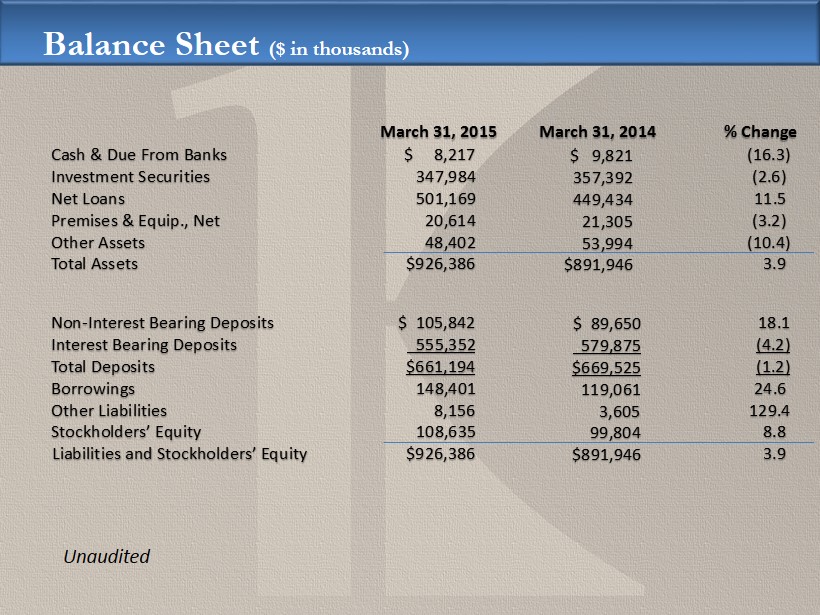

Balance Sheet ($ in thousands) Cash & Due From Banks Investment Securities Net Loans Premises & Equip., Net Other Assets Total Assets Non - Interest Bearing Deposits Interest Bearing Deposits Total Deposits Borrowings Other Liabilities Stockholders’ Equity Liabilities and Stockholders’ Equity $ 8,217 347,984 501,169 20,614 48,402 $926,386 (16.3) (2.6) 11.5 (3.2) (10.4) 3.9 March 31, 2015 March 31, 2014 % Change $ 105,842 555,352 $661,194 148,401 8,156 108,635 $926,386 18.1 (4.2) (1.2) 24.6 129.4 8.8 3.9 $ 9,821 357,392 449,434 21,305 53,994 $891,946 $ 89,650 579,875 $669,525 119,061 3,605 99,804 $891,946 Unaudited

0 50 100 150 200 250 01/01/09 01/01/10 01/01/11 01/01/12 01/01/13 01/01/14 First Keystone Corporation NASDAQ Composite SNL Bank $500M-$1B Period Ending Index 12/31/09 12/31/10 12/31/11 12/31/12 12/31/13 12/31/14 First Keystone Corporation 100.00 108.87 134.25 166.11 177.91 182.95 NASDAQ Composite 100.00 118.15 117.22 138.02 193.47 222.16 SNL Bank $500M - $1B 100.00 109.16 96.03 123.12 159.65 175.15 First Keystone Corporation – 5 year Total Return Performance

Elaine A. Woodland Executive Vice - President Chief Operating Officer

Summer 1864 – • I nformal meetings of Berwick business men • Intention of providing Berwick with banking facilities Charter Granted September 21, 1864 • First National Bank of Berwick • Charter No. 568 • Directors were named • Bank President elected

Mordecai W. Jackson Term: 1864 - 1894

150 th Anniversary Celebration

• February 2014: Launched high - yield suite of checking and savings rewards products – Free: No monthly service fee; no minimum balance required – Rewards: High Interest (2% up to $10,000); or Cash Back (up to $7.00 per month); or iTunes or Amazon Credits – Refunds: ATM refunds up to $12.00 per month – Qualify: e - Statements; Online banking login once a month; and 12 debit card swipes per month – No penalty for not qualifying

A video was viewed of the Kasasa Product suite offered by First Keystone Community Bank. The television ads are currently airing on WBRE and WYOU. The ads were developed by BancVue and branded to First Keystone Community Bank, the wholly-owned subsidiary of First Keystone Corporation.

Kasasa

Features: – Manage your accounts from your personal computer 24/7 – View account balances in real time – Review Transactions – Transfer Funds between FKCB accounts – Pay bills and make loan payments, and set up recurring payments – Sign up and receive notice for e - Statements – Encrypted for your security Online Banking and Bill Pay

Mobile Banking Features: – Free benefit with First Keystone checking and savings accounts – Manage accounts around the clock from the convenience of your mobile phone or device – View account balances – Review Transaction History – Transfer Funds between FKCB accounts – Make loan payments – Encrypted for your security

Features: – Deposit checks 24/7 with your mobile phone or tablet device – Fast, easy, and convenient – Encrypted for your security How: – Enroll in online banking, then download the free app for your Apple or Android device – Deposit checks from almost anywhere, any time - day or night – Snap. Tap. Done.

A customer information video was viewed on First Keystone Community Bank’s Mobile Remote Deposit product. It is currently posted on First Keystone’s website instructing customers on how to download and use the app. To view, go to www.fkcbank.com.

Mobile Remote Deposit

Features: – Save paper and the environment – Fast, free, and easy alternative to paper statements – Eliminate a paper trail – Reduce chances of fraud and identity theft – Arrive faster than paper statements – Easy access to previous statements – Ability to download for permanent storage

Debit Cards Features: – Free Visa debit card accepted around the globe and online – Use your debit card to qualify for rewards with the free Kasasa Cash, Kasasa Cash Back and Kasasa Tunes checking accounts – Safer than carrying cash – More convenient than checks – 24/7 access to your money via ATMs – EMV card launch plans are in place

Business Cash Management Product Suite Merchant Card Services: – FKCB provides credit and debit card merchant services to retailers, service providers, and anyone accepting debit and credit cards for payment ACH Services: – Employee Direct Deposit of payroll – payroll funds are deposited directly into employee bank accounts – Debit consumer accounts for payment of service provided by your business

Business Cash Management Product Suite Remote Deposit Capture – Make deposits from your office 24/7 with a check scanner, PC and high speed internet connection – Reduce transportation risks and costs – Increase operational efficiency Online Banking – Available for business customers

Looking to the Future The Board and Senior Management are committed to upholding the independent spirit and progressive attitude of the Bank’s first CEO, Mordecai William Jackson By leveraging the need for growth and prosperity with a continuing focus on serving the needs of its customers, First Keystone Community Bank intends to be part of its local communities for another 150 years.

Matt Mensinger Senior Vice - President Director of Lending

FIRST KEYSTONE CORPORATION AND SUBSIDIARY CONDENSED CONSOLIDATED STATEMENTS OF INCOME ( Amounts in thousands) For the twelve months ended December 31 , 2013 INTEREST INCOME Interest and fees on loans $20,471 Interest and dividends on investment securities 10,472 Interest on deposits in banks 18 TOTAL INTEREST INCOME $30,961 NON - INTEREST INCOME Trust department $841 Service charges and fees 1,402 Bank owned life insurance 687 ATM fees and debit card income 1,000 Gains on sales of mortgage loans 618 Investment securities gains – net 2,900 Other 427 TOTAL NON - INTEREST INCOME $7,875

$0 $100,000 $200,000 $300,000 $400,000 $500,000 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 $229,972 $230,917 $248,086 $371,557 $403,172 $401,375 $403,950 $410,066 $427,124 $439,999 $481,071 NET OUTSTANDING LOANS

Who made it happen ? First Keystone Community Bank: 1. Board of Directors 2. Advisory Board Members 3. Senior Management 4. Trust Department 5. The Loan Officers 6. Operations Staff 7. Customer Service Representatives 8. Tellers 9. Our Own Customers

What types of loans were originated? Commercial Loans - $106,522,802 Residential Loans - $34,176,152 Consumer Loans - $10,936,424

When during the year did the loans close? $0 $5,000,000 $10,000,000 $15,000,000 $20,000,000 $25,000,000 $30,000,000 $35,000,000 $40,000,000 $45,000,000 $50,000,000 3/31/2014 6/30/2014 9/30/2014 12/31/2014

Where did we loan the money? We extended monies to individuals, families, businesses, schools, municipalities, churches, and non - profit organizations in the greater Lewisburg, Danville, Bloomsburg, Berwick, Nescopeck, Shickshinny, Wilkes - Barre, Dallas, and Stroudsburg areas.

Why did we loan the money? 1. Grow the balance sheet and increase gross interest income. 2. Support the community and the local economy.

How did we do it? 1. Brought in new relationships. 2. Kept loan run - off to the lowest it has been in 15 years. 3. Earned trust by being a part of the community through volunteering. 4. Met all of our customers’ needs.

Our Story: “First Keystone Community Bank grew the loan portfolio by 9.3% by meeting the financing needs of the community it serves while assisting in growing the local economy.”

T ools for another great year in 2015 : 1. Personnel 2. Policy 3. Products

First Keystone Community Bank Trust and Financial Services Team John O’Reilly Rebecca Hooper Wendy Bacher Cindy Thorne Dan Fuhr Trust and Financial Services 5/6/2015 47

5/6/2015 48 Trust and Financial Services

Trust and Financial Services 5/6/2015 49 Our Firm Founded in 2003, MainStreet Advisors is a Chicago-based Investment Advisory Firm registered with the Securities and Exchange Commission (SEC). We are a full-service, independent investment advisory firm committed to providing high quality advisory services to our clients. We offer timely, unbiased investment advice. Our Commitment We understand that portfolio management doesn’t just happen. It requires attention, skill and continuous care. Our team of dedicated professional investment managers is here to assist with your investment needs. With MainStreet Advisors you can expect: Disciplined process with a long-term focus Outstanding client service Sound advice based on investment models Highly motivated and experienced group of investment professionals Want to learn more? Contact us at:info@mainstreetadv.com

Trust and Financial Services 5/6/2015 50

Trust and Financial Services 5/6/2015 51

Trust and Financial Services 5/6/2015 52

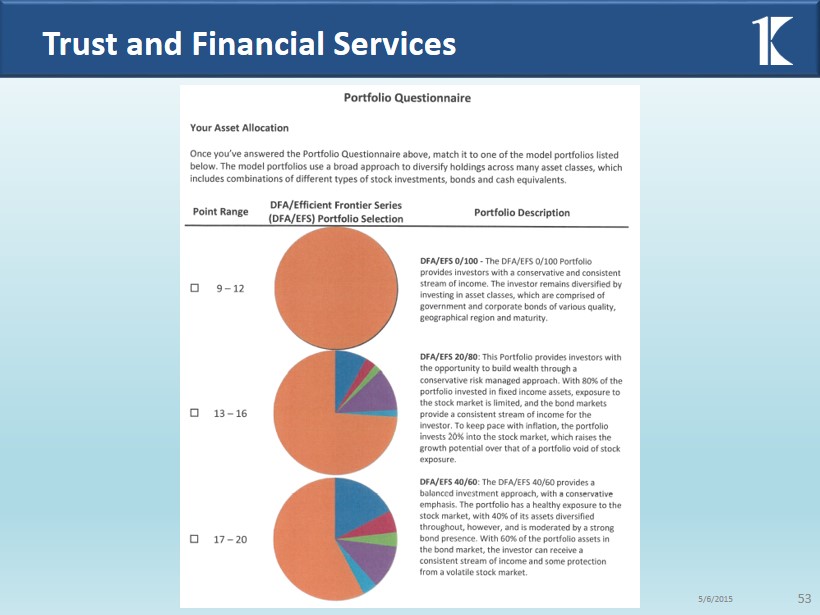

Trust and Financial Services 5/6/2015 53

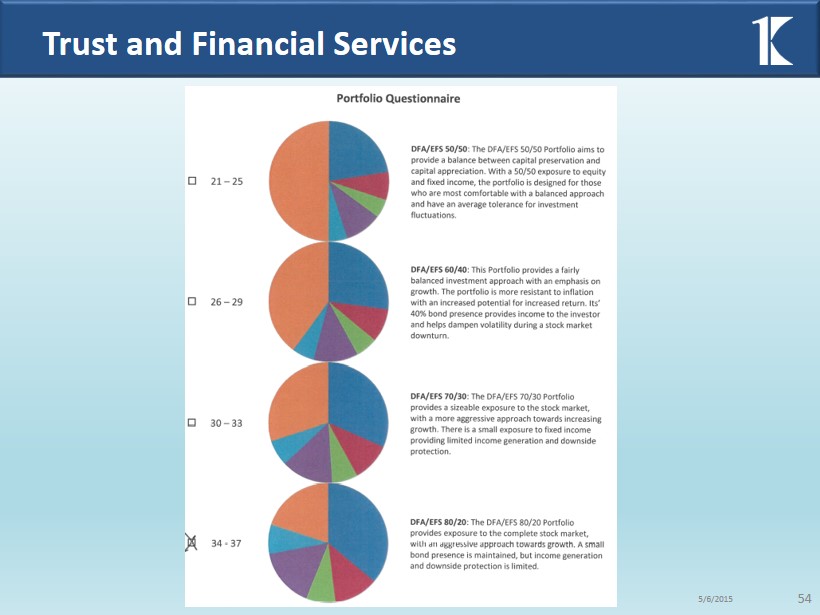

Trust and Financial Services 5/6/2015 54

Trust and Financial Services 5/6/2015 55

THANK YOU FOR ATTENDING! Our Key To a great bank is you!