Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STAAR SURGICAL CO | v409904_8k.htm |

Exhibit 99.1

NASDAQ: STAA May 7 th 1

All statements in this presentation that are not statements of historical fact are forward - looking statements, including statements about any of the following: any projections of earnings, revenue, sales, profit margins, cash, effective tax rate or any other financial items; the plans, strategies, and o bje ctives of management for future operations or prospects for achieving such plans; statements regarding new, existing, or improved products, including but not limited to, expectations for success of new, existing, or improved products in the U.S. or international markets or government approval of new or improved products (including the Toric ICL in the U.S.); the nature , t iming and likelihood of resolving issues cited in the FDA’s 2014 Warning Letter or 2015 FDA Form 483; future economic conditions or size of market opportunities; expected costs of quality system or FDA remediation; statements of belief, including as to achieving 2015 plans; expected regulatory activities and approvals, product launches, and any statements of assumptions underlying any of the foreg oin g. Important additional factors that could cause actual results to differ materially from those indicated by such forward - looking s tatements are set forth in the company’s Annual Report on Form 10 - K for the year ended January 2 , 2015 under the caption “Risk Factors,” which is on file with the Securities and Exchange Commission and available in the “Investor Information” section of the company’s website under the heading “SEC Filings .” These statements are based on expectations and assumptions as of the date of this press release and are subject to numerous r isk s and uncertainties, which could cause actual results to differ materially from those described in the forward - looking statements. The risks and uncertainties include the following : our limited capital resources and limited access to financing; the negative effect of unstable global economic conditions on sales of products, especially products such as the I CL used in non - reimbursed elective procedures; the challenge of managing our foreign subsidiaries; backlog or supply delays as we fully integrate our manufacturing facility con sol idation; the risk of unfavorable changes in currency exchange rate; the discretion of regulatory agencies to approve or reject new or improved products, or to require additional act ions before approval (including but not limited to FDA requirements regarding the TICL and/or actions related to the 2014 FDA Warning Letter or 2015 FDA Form 483); unexpected costs or delays that could reduce or eliminate the expected benefits of our consolidation plans; the risk that research and development efforts will not be successful or may be delayed in delivering for launch; the purchasing patterns distributors carrying inventory in the market; the willingness of surgeons and patients to adopt a new or improved product and procedure; patterns of Visian ICL use that have typically limited our penetration of the refractive procedure market, negative media coverage in different regions regarding refractive procedures, and a general decline in the demand for refractive surgery particularly in the U.S. and the Asia Pacific region, which STAAR believes has resulted from both concerns ab out the safety and effectiveness of laser procedures and current economic conditions. The Visian Toric ICL and the Visian ICL with CentraFLOW are not yet approved for sale in the Un ite d States . In addition, to supplement the GAAP numbers, this presentation includes supplemental non - GAAP financial information, which STAAR believes investors will find helpful in understanding its operating performance. “Adjusted Net Income” excludes the following items that are included in “Net Income (L oss)” as calculated in accordance with U.S. generally accepted accounting principles (“GAAP”): manufacturing consolidation expenses, gain or loss on foreign currency transactions , stock - based compensation expenses and FDA panel and remediation expenses. A table reconciling the GAAP information to the non - GAAP information is included in our financial release which can b e found in our Form 8 - K filed on April 29, 2015 and also available on our website . 2 FORWARD - LOOKING STATEMENTS

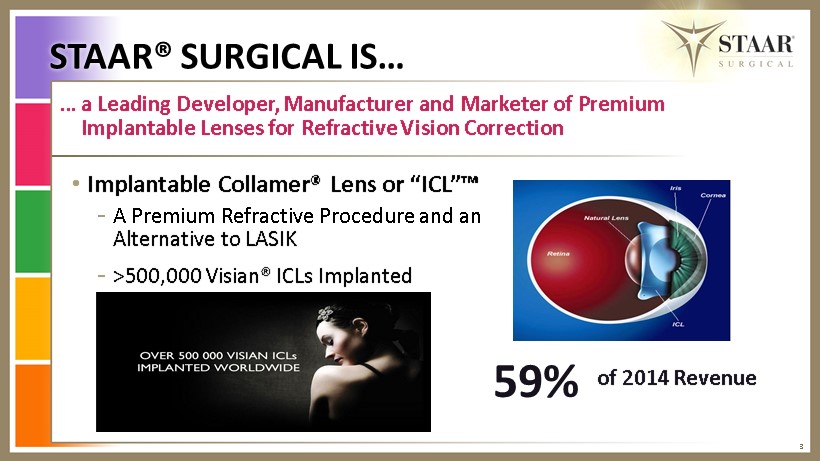

3 … a Leading Developer, Manufacturer and Marketer of Premium Implantable L enses for Refractive V ision Correction • Implantable Collamer® Lens or “ ICL”™ - A Premium R efractive P rocedure and an A lternative to LASIK - >500,000 Visian® ICLs I mplanted 59% of 2014 Revenue STAAR® SURGICAL IS…

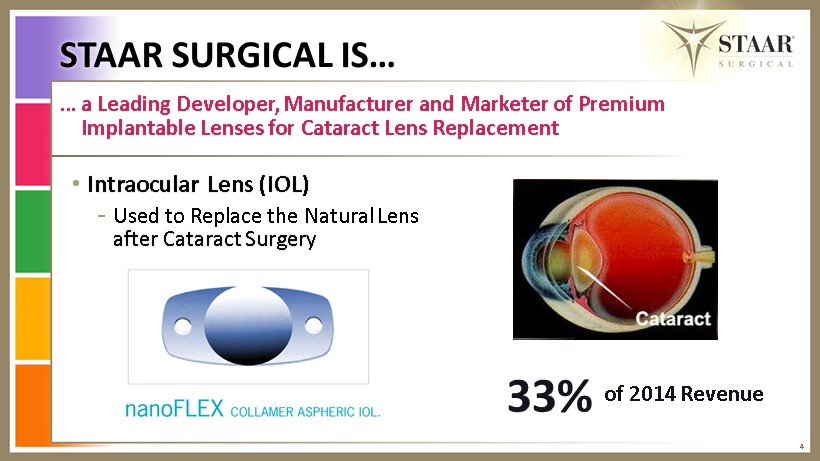

4 … a Leading Developer, Manufacturer and Marketer of Premium Implantable L enses for Cataract L ens R eplacement • Intraocular L ens (IOL) - U sed to Replace the Natural L ens after Cataract S urgery 33% of 2014 Revenue STAAR SURGICAL IS…

• Engender Culture of Quality - FDA Remediation and Systemic Change • Build R & D Continuum “EV3 ”: CentraFLOW®/ Presbyopia/ Cataract Care • Invest in Proprietary Technology and Process Improvements • Develop Global Clinical Validation and Clinical Utility Competency • Properly Size Commercial Strategic Investment – People and Services • Create an Extraordinary Surgeon and Patient Experience • Deliver Shareholder Value 5 BUILDING A FOUNDATION FOR CONSISTENT GROWTH OUR FOCUS 2015 - 2017

• Culture of Quality - FDA Remediation and Systemic Change & Upgrade » Diligently Focus on Meeting or Exceeding Remediation Requirements » Hire Top Talent to Manage and Direct Systemic Correction and Upgrade » Building Fully Compliant Quality System Including IT Infrastructure » Engender Employee Ownership as Culture of Quality » Meet 2015 Incremental Remediation Budget of $ 4M Quality Clarity 6 BUILDING A FOUNDATION FOR CONSISTENT GROWTH OUR FOCUS 2015 - 2017

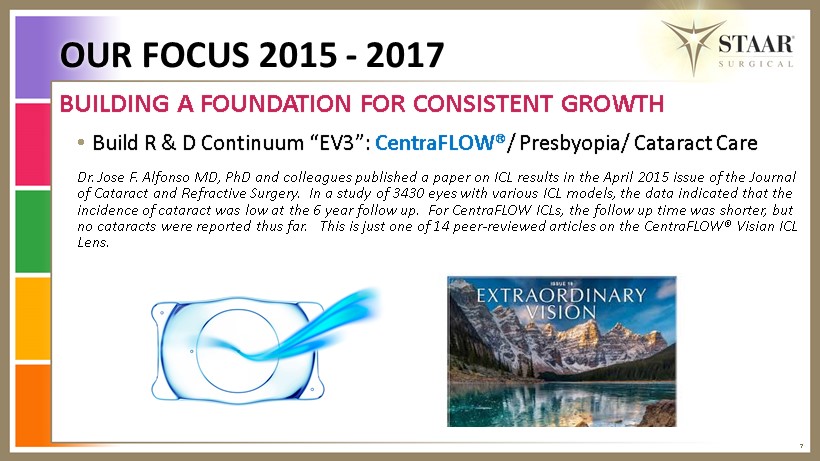

• Build R & D Continuum “EV3”: CentraFLOW® / Presbyopia/ Cataract Care Dr . Jose F. Alfonso MD, PhD and colleagues published a paper on ICL results in the April 2015 issue of the Journal of Cataract and Refractive Surgery. In a study of 3430 eyes with various ICL models, the data indicated that the incidence of cataract was low at the 6 year follow up. For CentraFLOW ICLs, the follow up time was shorter, but no cataracts were reported thus far. This is just one of 14 peer - reviewed articles on the CentraFLOW® Visian ICL Lens. 7 BUILDING A FOUNDATION FOR CONSISTENT GROWTH OUR FOCUS 2015 - 2017

ICL POST SURGICAL OUTCOME STUDY RESULTS V4 V4B V4C N 1106 1276 1048 Cases of Cataract 16 5 0 % of cases 0.5% 0.2% 0 Years of follow - up Up to 12y Up to 4y Up to 2y 8 Visian ICL with CentraFLOW not yet approved in the U.S. Prevalence of cataract after collagen copolymer phakic intraocular lens implantation for myopia, hyperopia, and astigmatism José F. Alfonso, MD, PhD, Carlos Lisa, MD, Luis Fernández - Vega, MD, PhD, Dagoberto Almanzar, MD, Cari Pérez - Vives, MSc, Robert Montés - Micó, PhD Journal of Cataract & Refractive Surgery Volume 41, Issue 4, Pages 800 - 805 (April 2015) DOI: 10.1016/j.jcrs.2014.07.039

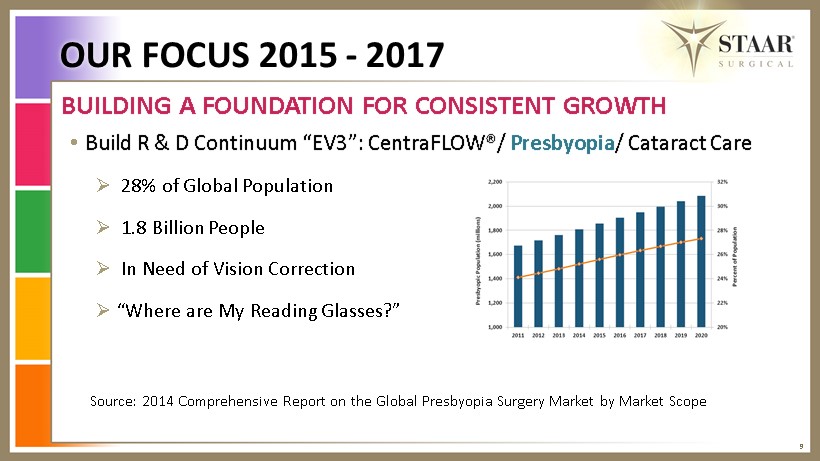

• Build R & D Continuum “EV3”: CentraFLOW®/ Presbyopia / Cataract Care » 28% of Global Population » 1.8 Billion People » In Need of Vision Correction » “Where are My Reading Glasses?” 9 BUILDING A FOUNDATION FOR CONSISTENT GROWTH OUR FOCUS 2015 - 2017 Source: 2014 Comprehensive Report on the Global Presbyopia Surgery Market by Market Scope

• Build R & D Continuum“EV3”: CentraFLOW®/ Presbyopia/ Cataract Care 10 BUILDING A FOUNDATION FOR CONSISTENT GROWTH OUR FOCUS 2015 - 2017 » 22M IOLs Implanted in 2013 » 26M Estimated IOLs Implanted in 2018 » STAAR Strategy F ocused on Premium IOLs » Currently Assessing N ew M aterials and T echnology to Address this Substantial and Growing M arket Source: 2014 Comprehensive Report on the Global IOL Market by Market Scope

• Invest in Proprietary Technology and Process Improvements » Building Research Lab for Materials Science with Emphasis on Collamer Versions II, III and Beyond » Assessing Opportunities to Expand Patent Estate (Patents and Trade Secrets) » Initiating PRD N ew P roduct D evelopment P roject M anagement C apability including Planning for IT Enabled Support » Charting Investments in Supply Chain and Equipment Upgrade 11 BUILDING A FOUNDATION FOR CONSISTENT GROWTH OUR FOCUS 2015 - 2017

• Enhance Global Clinical Validation and Clinical Utility Competency » Recruiting C linically L auded O phthalmic S urgeons for Working Groups by Market » First Working Group Focused on Sizing Solutions » Assigning Working Group Participation by Strengths and Strong I nterest » Charting “ EV3” Platforms: CentraFLOW®/ Presbyopia/ Cataract Care » Building C linical Validation/ Clinical Utility/Patient E xperience P rofiles for the “EV 3” 12 BUILDING A FOUNDATION FOR CONSISTENT GROWTH OUR FOCUS 2015 - 2017

• Properly Size Commercial Strategic Investment – People and Services » March 2015 Combined EMEA and ASIA PAC under International Leadership Team » April 2015 Completed NA Leadership and Direct Representation Consolidation 13 BUILDING A FOUNDATION FOR CONSISTENT GROWTH OUR FOCUS 2015 - 2017

• Create an Extraordinary Surgeon and Patient Experience » Prof. Kimiya Shimizu – paper authored with other leading doctors from Japan, published in December of 2014 in the Journal of Cataract and Refractive Surgery. It provided that the Visian® ICL may offer significant vision related quality of life benefits over wave front guided LASIK for myopia in the long term. 14 BUILDING A FOUNDATION FOR CONSISTENT GROWTH OUR FOCUS 2015 - 2017

• Engender Culture of Quality - FDA Remediation and Systemic Change • Build R & D Continuum “EV3 ”: CentraFLOW®/ Presbyopia/ Cataract Care • Invest in Proprietary Technology and Process Improvements • Develop Global Clinical Validation and Clinical Utility Competency • Properly Size Commercial Strategic Investment – People and Services • Create an Extraordinary Surgeon and Patient Experience • Deliver Shareholder Value 15 BUILDING A FOUNDATION FOR CONSISTENT GROWTH OUR FOCUS 2015 - 2017

Q1 2015 GAAP ($ millions, except per share) RECENT FINANCIAL RESULTS 16 Income Statement Q1 2015 Q1 2014 Revenue $ 18.9 $ 20.2 Gross Profit $ 12.9 $ 13.9 Gross Profit Margin 68.4% 68.8% Operating Expenses $ 14.4 $ 15.2 Other Income (Loss) $ (0.9) $ 0.2 Income (Loss) Before Taxes $ (2.4) $ (1.1) Net Income (Loss) $ ( 2.3) $ (1.4) Net Inc. (Loss) per Dil. Share $ (0.06) $ (0.04)

Q1 2015 Non - GAAP ($ millions, except per share) RECENT FINANCIAL RESULTS 17 Adjusted Net Income Q1 2015 Q1 2014 Net Income (Loss) $ (2.3) $ (1.4) Manufacturing Consolidation Expenses - $ 0.2 Foreign Currency Impact $ 0.9 $ (0.1) Stock - Based Compensation Expense $ 1.1 $ 1.5 FDA Panel / Remediation Expense $ 1.4 $ 1.4 Adjusted Net Income (Loss) $ 1.1 $ 1.6 Adj. Net Income (Loss) Per Dil. Share $ 0.03 $ 0.04

FINANCIAL HIGHLIGHTS 18 • Sales of $18.9M: - 7% from prior year and - 3% in constant currency - ICL double - digit unit growth in North America and; CentraFLOW® acceptance in China positive • Gross Margin at 68.4%: moderate decline from prior year of 68.8% - Unit cost improvements of 110+ basis points offset by currency, other selling costs • Operating Expense reduced 5% from prior year - FDA remediation costs of $1.4M approximately same of FDA panel expenses in prior year • Net Loss of 6 cents per share; Adjusted Net Income of 3 cents per share • Cash of $10.8M with use of $2.2M in 1 st quarter - Expect to fund FDA remediation expenses and other company needs with operating income

NASDAQ: STAA May 7 th 19