Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CyrusOne Inc. | a1stqtr8-k.htm |

| EX-99.1 - EXHIBIT 99.1 - CyrusOne Inc. | exhibit991-earningsrelease.htm |

First Quarter 2015 Earnings Presentation May 7, 2015

CyrusOne First Quarter 2015 Earnings Presentation www.cyrusone.com 2 Forward-looking statements Safe Harbor This presentation contains forward-looking statements regarding future events and our future results that are subject to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, are statements that could be deemed forward-looking statements. These statements are based on current expectations, estimates, forecasts, and projections about the industries in which we operate and the beliefs and assumptions of our management. Words such as “expects,” “anticipates,” “predicts,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “continues,” “endeavors,” “strives,” “may,” variations of such words and similar expressions are intended to identify such forward-looking statements. In addition, any statements that refer to projections of our future financial performance, our anticipated growth and trends in our businesses, and other characterizations of future events or circumstances are forward-looking statements, including statements about the potential financial and other benefits of our proposed acquisition of Cervalis and the expected timing of completion of the transaction. Readers are cautioned these forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results to differ materially and adversely from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this release, risks related to our acquisition of Cervalis, which include, but are not limited to, the risk that a condition to closing of the acquisition may not be satisfied or that the expected increased revenues, funds from operations, net income and cost savings and other synergies from the transaction may not be fully realized or may take longer to realize than expected, and those discussed in other documents we file with the Securities and Exchange Commission (SEC). More information on potential risks and uncertainties is available in our recent filings with the SEC, including CyrusOne’s Form 10-K report, Form 10-Q reports, and Form 8-K reports. Actual results may differ materially and adversely from those expressed in any forward-looking statements. We undertake no obligation to revise or update any forward-looking statements for any reason.

First Quarter 2015 Overview

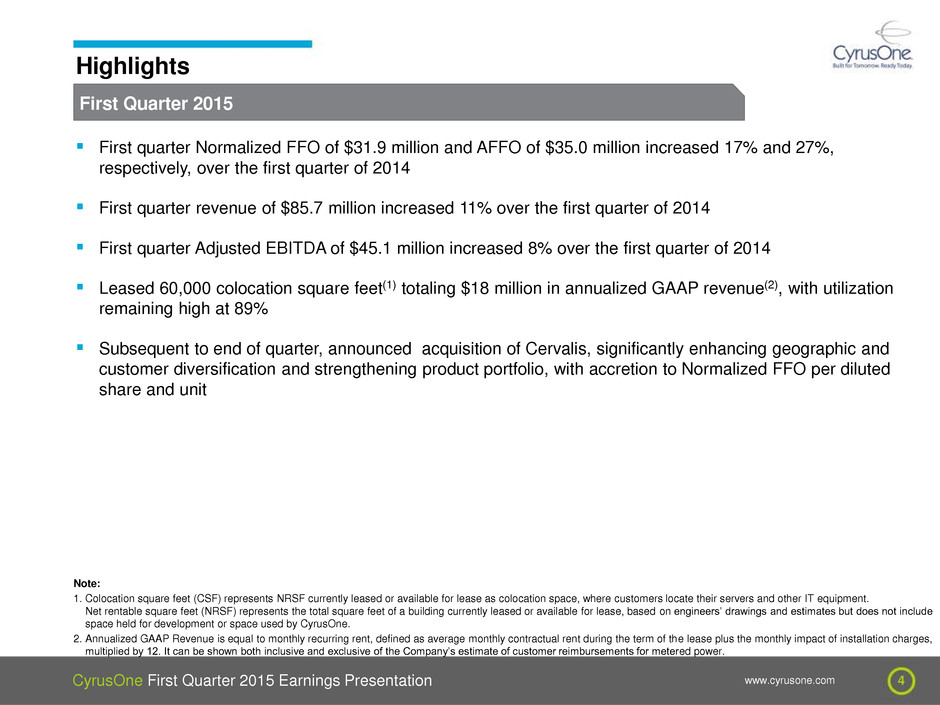

CyrusOne First Quarter 2015 Earnings Presentation www.cyrusone.com 4 First Quarter 2015 Highlights First quarter Normalized FFO of $31.9 million and AFFO of $35.0 million increased 17% and 27%, respectively, over the first quarter of 2014 First quarter revenue of $85.7 million increased 11% over the first quarter of 2014 First quarter Adjusted EBITDA of $45.1 million increased 8% over the first quarter of 2014 Leased 60,000 colocation square feet(1) totaling $18 million in annualized GAAP revenue(2), with utilization remaining high at 89% Subsequent to end of quarter, announced acquisition of Cervalis, significantly enhancing geographic and customer diversification and strengthening product portfolio, with accretion to Normalized FFO per diluted share and unit Note: 1. Colocation square feet (CSF) represents NRSF currently leased or available for lease as colocation space, where customers locate their servers and other IT equipment. Net rentable square feet (NRSF) represents the total square feet of a building currently leased or available for lease, based on engineers’ drawings and estimates but does not include space held for development or space used by CyrusOne. 2. Annualized GAAP Revenue is equal to monthly recurring rent, defined as average monthly contractual rent during the term of the lease plus the monthly impact of installation charges, multiplied by 12. It can be shown both inclusive and exclusive of the Company’s estimate of customer reimbursements for metered power.

CyrusOne First Quarter 2015 Earnings Presentation www.cyrusone.com 5 Steady growth in customer base New Customers 526 679 Q4 '1 2 Q1 '1 3 Q2 '1 3 Q3 '1 3 Q4 '1 3 Q1 '1 4 Q2 '1 4 Q3 '1 4 Q4 '1 4 Q1 '1 5 500 550 600 650 700 115 146 Q4 '1 2 Q1 '1 3 Q2 '1 3 Q3 '1 3 Q4 '1 3 Q1 '1 4 Q2 '1 4 Q3 '1 4 Q4 '1 4 Q1 '1 5 100 110 120 130 140 150 Total Customers(1) Note: 1. Customers as of quarter-end for each period, including customers that are under lease but have yet to occupy space. 2. Customer’s ultimate parent is a Fortune 1000 company or a foreign or private company of equivalent size. Fortune 1000 Customers(1,2)

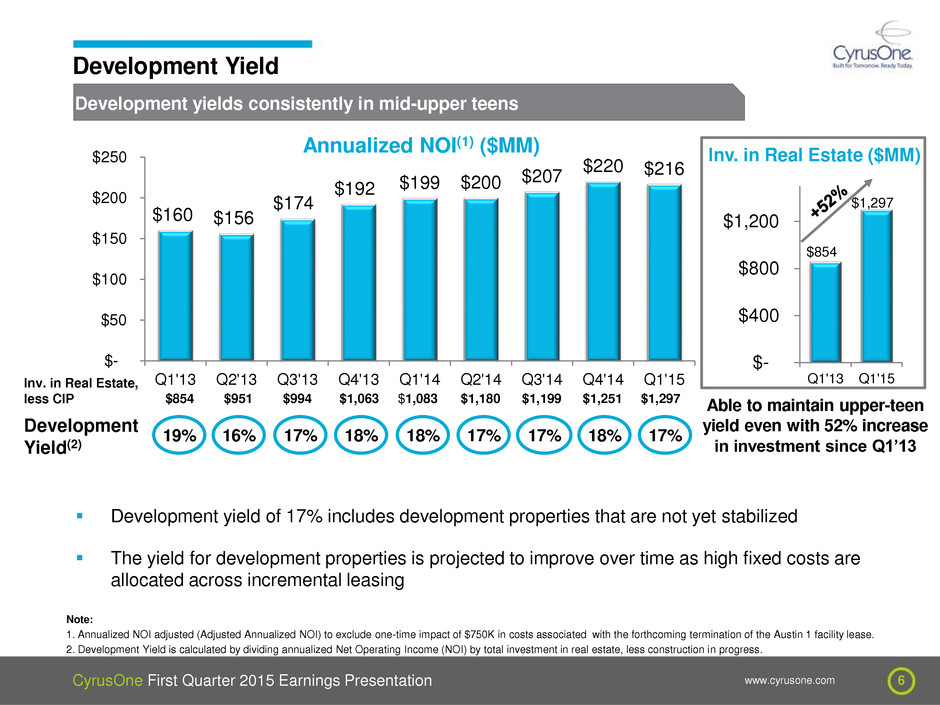

CyrusOne First Quarter 2015 Earnings Presentation www.cyrusone.com 6 Development yields consistently in mid-upper teens Development Yield $160 $156 $174 $192 $199 $200 $207 $220 $216 Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14 Q4'14 Q1'15 $- $50 $100 $150 $200 $250 Annualized NOI(1) ($MM) Development Yield(2) Inv. in Real Estate, less CIP $994 $1,063 $1,083 17% $1,180 Development yield of 17% includes development properties that are not yet stabilized The yield for development properties is projected to improve over time as high fixed costs are allocated across incremental leasing Note: 1. Annualized NOI adjusted (Adjusted Annualized NOI) to exclude one-time impact of $750K in costs associated with the forthcoming termination of the Austin 1 facility lease. 2. Development Yield is calculated by dividing annualized Net Operating Income (NOI) by total investment in real estate, less construction in progress. $951 Q1'13 Q1'15 $- $400 $800 $1,200 $1,297 $854 Able to maintain upper-teen yield even with 52% increase in investment since Q1’13 Inv. in Real Estate ($MM) $1,199 $854 17% 18% 18% 17% 16% 19% 18% $1,251 $1,297 17%

CyrusOne First Quarter 2015 Earnings Presentation www.cyrusone.com 7 Both “same-store” and “development” growth Multiple Sources of Growth Notes: 1. Monthly recurring rent is defined as average monthly contractual rent during the term of the lease. Contractual rent does not include metered power reimbursements. Escalators IX / Ancillary Services High-margin products and services such as IX, office space, and Smart Hands are often incremental add- ons that enhance returns Q1’15 IX revenue 77% higher compared to Q1’13 and up 8% sequentially from Q4’14 10% of new MRR(1) signed in Q1’15 from products and services that did not include additional data center space Emphasis on incorporating into leases since IPO On an MRR-weighted(1) basis, 78% of new leases signed in Q1’15 have rent escalators at a weighted average annual rate of 2.5% Lease-up of Existing Inventory Lease-up of available space and power by existing and new customers 76% of new MRR(1) signed in Q1’15 was from existing customers Growth from new customers; nearly 30% increase in customer base since end of 2012 Robust Development Pipeline Land and powered shell capacity to grow to 5M CSF Low cost of development Lease-up of existing inventory is catalyst for additional development Limited capital at risk given construction efficiency

CyrusOne First Quarter 2015 Earnings Presentation www.cyrusone.com 8 Positive Recent Leasing Trends Energy Update Notes: 1. Monthly recurring rent is defined as average monthly contractual rent during the term of the lease. Contractual rent does not include metered power reimbursements. 2. Annualized Rent represents cash rent, including metered power reimbursements, for the month of March 2015 multiplied by 12. Energy vertical accounted for more than $190K of new MRR(1) signed in the first quarter, or nearly 15% of total, up more than 40% from approximately $125-$135K in each quarter of 2014 - Orders from more than 20 energy customers, including 2 new logos, in Q1’15 Subsequent to end of quarter, signed three-year renewal extension with our second largest energy customer (6th overall) at existing rates Geographic diversification and expansion across other verticals have reduced our exposure to energy from 37% of annualized rent(2) as of December 2012 to 27% as of March 2015 Cervalis transaction further enhances diversification of portfolio Q1-Q4'14 Q1'15 $50 $100 $150 $200 $125-$135K > $190K Quarterly MRR(1) Signed ($000) - Energy Jan. 29 May 6 $20 $30 $40 $50 $60 $70 $44 / bbl. $61 / bbl. WTI Crude Oil Spot Price ($ / bbl.)

Acquisition of Cervalis

CyrusOne First Quarter 2015 Earnings Presentation www.cyrusone.com 10 Acquisition of Cervalis Transaction Highlights CyrusOne has entered into an agreement to acquire Cervalis, LLC for $400MM Premier financial services platform in New York Will Strengthen CyrusOne’s leadership position in U.S. colocation market Highly complementary to CyrusOne’s strategic enterprise colocation focus Will Enhance CyrusOne’s scale for future growth and customer value proposition Financially accretive deal with attractive incremental opportunities to deploy capital

CyrusOne First Quarter 2015 Earnings Presentation www.cyrusone.com 11 Summary of Key Transaction Terms Multiple Purchase Price $400 million ~10.5x LQA Adjusted EBITDA(1) Compares favorably to recent M&A multiples and current public trading multiples Closing Conditions At least 5% accretive to Normalized FFO per diluted share and unit in 2H 2015 Potential accretion of 9+% in 2016 based on lease up of existing inventory, synergies, and financing mix Financing Financing structure to take into consideration accretion to shareholders, credit rating considerations, and balance sheet flexibility Notes: 1. Based on LQA Q1’15 Adjusted EBITDA. Acquisition of Cervalis Accretive to Shareholders Contingent on customary closing conditions Anticipated closing within 45 to 60 days

CyrusOne First Quarter 2015 Earnings Presentation www.cyrusone.com 12 (1 ) (1 ) (1 ) (1 ) (1 ) DC/WAR- Wappingers Falls, NY DC/WAR- Norwalk, CT DC -Stamford, CT WAR -Stamford, CT DC/WAR - Totowa, NJ WAR -Totowa, NJ Cervalis Highlights Premier financial services platform in New York Founded in 2000; 100+ employees Four Tier 3+ data center facilities and two standalone Work Area Recovery (“WAR”) facilities - 500K+ gross square feet of space, including 125K+ colocation square feet and 100K+ square feet of WAR space Approximately 220 loyal and high quality enterprise customers, including 15 unique Fortune 1000 customers - Depth in financial services industry, accounting for approximately two-thirds of revenue Strong track record of financial growth - 14% revenue CAGR over the past 5 years - 2014 revenue of nearly $70 million, with approximately two-thirds from colocation 77% of colocation square feet utilized, providing opportunity for lease up of existing raised floor

CyrusOne First Quarter 2015 Earnings Presentation www.cyrusone.com 13 IT 26% Energy 22% Financial Services 21% Industrial 9% Telecom 9% Healthcare 3% Other 10% IT 30% Energy 27% Financial Services 10% Industrial 11% Telecom 11% Healthcare 2% Other 9% Customer Diversification Notes: 1. Based on Mar’15 Annualized Rent for CyrusOne and Feb’15 Annualized Rent for Cervalis. Annualized Rent represents cash rent, including metered power reimbursements, for CyrusOne and Cervalis for the months of Mar’15 and Feb’15, respectively, multiplied by 12. 2. Customer’s ultimate parent is a Fortune 1000 company or a foreign or private company of equivalent size. Financial services vertical diversifies customer base Pro Forma Revenue(1) by Industry CyrusOne Standalone Revenue(1) by Industry Transaction doubles size of financial services vertical within portfolio, in line with energy vertical 15 new Fortune 1000(2) customers

CyrusOne First Quarter 2015 Earnings Presentation www.cyrusone.com 14 Dallas 21% Cincinnati 28% Houston 29% Other 3% Austin 5% Geographic Diversification Size and scale resulting in increased revenue opportunities Expanded Footprint CyrusOne Revenue(1) by Market Pro Forma CyrusOne Revenue(1) by Market Wappingers Falls, NY Norwalk, CT Stamford, CT Totowa, NJ Dallas, TX Houston, TX Austin, TX San Antonio, TX Northern VA South Bend, IN Chicago, IL Phoenix, AZ Cincinnati, OH Florence, KY +2 +5 +2 +4 +6 +2 +4 3 countries, 10 states, 16 cities Phoenix 8% NY/NJ/CT 18% Houston 24% Other 2% San Antonio 5% Austin 4% Phoenix 6% San Antonio 6% Dallas 18% Cincinnati 23% Notes: 1. Based on Mar’15 Annualized Rent for CyrusOne and Feb’15 Annualized Rent for Cervalis. Annualized Rent represents cash rent, including metered power reimbursements, for CyrusOne and Cervalis for the months of Mar’15 and Feb’15, respectively, multiplied by 12.

CyrusOne First Quarter 2015 Earnings Presentation www.cyrusone.com 15 Benefits to CyrusOne Acquisition of Cervalis Size Scale Interconnection Growth Increases size of the company by approximately 20% on both revenue and Adjusted EBITDA Greater scale enables stronger offering to customers, with greater geographic diversity Enhances value proposition of CyrusOne’s National IX platform by adding one of the world’s largest internet hubs Interconnection further enables our core colocation business and increases stickiness of the customer base Opportunities for revenue synergies, both from leasing colocation into a new market, as well as from ancillary product lines High-end managed services portfolio can be selectively leveraged across CyrusOne’s existing customer base

CyrusOne First Quarter 2015 Earnings Presentation www.cyrusone.com 16 Financial Impact Acquisition of Cervalis Lease up opportunity / revenue synergies - 77% utilization provides opportunity for lease up of existing inventory - Ability to offer respective customer bases expansion into broader data center portfolio Construction efficiency - Leverage CyrusOne construction expertise to deliver deployments at lower build costs Expected to be immediately accretive to Normalized FFO per diluted share and unit - At least 5% accretive to Normalized FFO per diluted share and unit in 2H 2015, with potential accretion of 9+% in 2016 based on lease up of existing inventory, synergies, and financing mix Financing structure to take into consideration accretion to shareholders, credit rating considerations, and balance sheet flexibility - Expected to be combination of additional bank financing and public debt and / or equity CyrusOne will provide updated guidance subsequent to transaction close

First Quarter 2015 Financial Review

CyrusOne First Quarter 2015 Earnings Presentation www.cyrusone.com 18 $77.5 $85.7 Q1'14 Q1'15 1.3% 1.4% 2.9% 1.7% 3.1% Q1'14 Q2'14 Q3'14 Q4'14 Q1'15 Continued strong growth driven by existing and new customers Revenue, Normalized FFO, and AFFO Revenue ($ Millions) Churn Recurring Rent Quarterly Churn (1) Revenue growth of 11% driven by: Expansion of customer base to 679, an increase of 67 since beginning of FY’14 Increases in leased CSF(2) and annualized rent (3) of 15% and 13%, respectively, compared to Q1’14 Strong Normalized FFO and AFFO growth Driven by Adjusted EBITDA as a result of strong growth in leasing Notes: 1. Recurring Rent Quarterly Churn is defined as any reduction in recurring rent due to customer terminations, service reductions or net pricing decreases as a percentage of rent at the beginning of the quarter, excluding any impact from metered power reimbursements or other usage-based or variable billing. 2. Colocation square feet (CSF) represents NRSF leased or available for lease as colocation space, where customers locate their servers and other IT equipment. Net rentable square feet (NRSF) represent the total square feet of a building leased or available for lease based on engineers’ drawings and estimates but does not include space held for development or space used by CyrusOne. 3. Annualized Rent represents cash rent, including metered power reimbursements, for the month of March 2015 multiplied by 12. Churn Elevated churn for Q1’15 in line with guidance provided on Q4’14 earnings call; expected to return to more normal historical levels in the range of 1-2% per quarter Normalized FFO ($ Millions) $27.2 $31.9 Q1'14 Q1'15 $27.5 $35.0 Q1'14 Q1'15 AFFO ($ Millions)

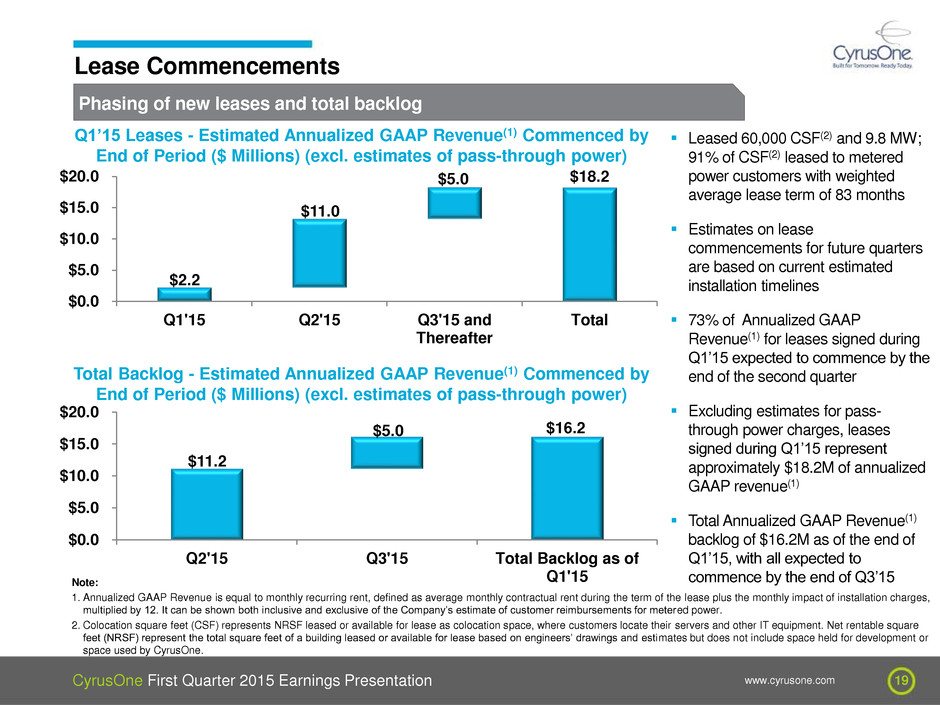

CyrusOne First Quarter 2015 Earnings Presentation www.cyrusone.com 19 Phasing of new leases and total backlog Lease Commencements Note: 1. Annualized GAAP Revenue is equal to monthly recurring rent, defined as average monthly contractual rent during the term of the lease plus the monthly impact of installation charges, multiplied by 12. It can be shown both inclusive and exclusive of the Company’s estimate of customer reimbursements for metered power. 2. Colocation square feet (CSF) represents NRSF leased or available for lease as colocation space, where customers locate their servers and other IT equipment. Net rentable square feet (NRSF) represent the total square feet of a building leased or available for lease based on engineers’ drawings and estimates but does not include space held for development or space used by CyrusOne. $2.2 $18.2 $11.0 $5.0 Q1'15 Q2'15 Q3'15 and Thereafter Total $0.0 $5.0 $10.0 $15.0 $20.0 Q1’15 Leases - Estimated Annualized GAAP Revenue(1) Commenced by End of Period ($ Millions) (excl. estimates of pass-through power) $11.2 $16.2 $5.0 Q2'15 Q3'15 Total Backlog as of Q1'15 $0.0 $5.0 $10.0 $15.0 $20.0 Total Backlog - Estimated Annualized GAAP Revenue(1) Commenced by End of Period ($ Millions) (excl. estimates of pass-through power) Leased 60,000 CSF(2) and 9.8 MW; 91% of CSF(2) leased to metered power customers with weighted average lease term of 83 months Estimates on lease commencements for future quarters are based on current estimated installation timelines 73% of Annualized GAAP Revenue(1) for leases signed during Q1’15 expected to commence by the end of the second quarter Excluding estimates for pass- through power charges, leases signed during Q1’15 represent approximately $18.2M of annualized GAAP revenue(1) Total Annualized GAAP Revenue(1) backlog of $16.2M as of the end of Q1’15, with all expected to commence by the end of Q3’15

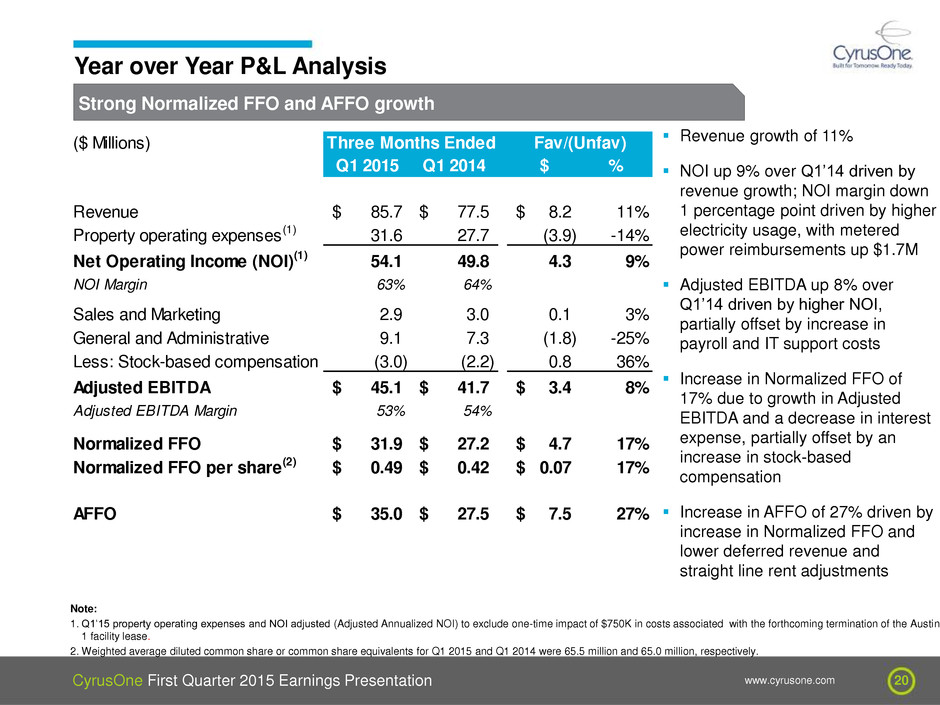

CyrusOne First Quarter 2015 Earnings Presentation www.cyrusone.com 20 Strong Normalized FFO and AFFO growth Year over Year P&L Analysis Note: 1. Q1’15 property operating expenses and NOI adjusted (Adjusted Annualized NOI) to exclude one-time impact of $750K in costs associated with the forthcoming termination of the Austin 1 facility lease. 2. Weighted average diluted common share or common share equivalents for Q1 2015 and Q1 2014 were 65.5 million and 65.0 million, respectively. Revenue growth of 11% NOI up 9% over Q1’14 driven by revenue growth; NOI margin down 1 percentage point driven by higher electricity usage, with metered power reimbursements up $1.7M Adjusted EBITDA up 8% over Q1’14 driven by higher NOI, partially offset by increase in payroll and IT support costs Increase in Normalized FFO of 17% due to growth in Adjusted EBITDA and a decrease in interest expense, partially offset by an increase in stock-based compensation Increase in AFFO of 27% driven by increase in Normalized FFO and lower deferred revenue and straight line rent adjustments ($ Millions) Q1 2015 Q1 2014 $ % Revenue 85.7$ 77.5$ 8.2$ 11% Property operating expenses(1) 31.6 27.7 (3.9) -14% Net Operating Income (NOI)(1) 54.1 49.8 4.3 9% NOI Margin 63% 64% Sales and Marketing 2.9 3.0 0.1 3% General and Administrative 9.1 7.3 (1.8) -25% Less: Stock-based compensation (3.0) (2.2) 0.8 36% Adjusted EBITDA 45.1$ 41.7$ 3.4$ 8% Adjusted EBITDA Margin 53% 54% Normalized FFO 31.9$ 27.2$ 4.7$ 17% Normalized FFO er share(2) 0.49$ 0.42$ 0.07$ 17% AFFO 35.0$ 27.5$ 7.5$ 27% Three Months Ended Fav/(Unfav)

CyrusOne First Quarter 2015 Earnings Presentation www.cyrusone.com 21 Strong AFFO growth Sequential P&L Analysis Note: 1. Q1’15 property operating expenses and NOI adjusted (Adjusted Annualized NOI) to exclude one-time impact of $750K in costs associated with the forthcoming termination of the Austin 1 facility lease. 2. Weighted average diluted common share or common share equivalents for Q1 2015 and Q4 2014 were 65.5 million and 65.3 million, respectively. Sequential revenue down slightly driven by $1.7 million decline in metered power reimbursements (corresponding decline in electricity expense that is passed through) Property operating expenses down slightly driven by reduced electricity usage and lower maintenance due to timing, partially offset by higher property taxes Lower G&A expenses driven by Q4’14 impacts of consulting fees and timing of accounting fees Normalized FFO increase driven by higher Adjusted EBITDA and lower interest expense, partially offset by higher stock-based compensation AFFO increase primarily driven by higher Normalized FFO and lower leasing commissions, straight-line rent adjustments, and recurring capital expenditures ($ Millions) Q1 2015 Q4 2014 $ % Revenue 85.7$ 86.9$ (1.2)$ -1% Property operating expenses(1) 31.6 32.0 0.4 1% Net Operating Income (NOI)(1) 54.1 54.9 (0.8) -1% NOI Margin 63% 63% Sales and Marketing 2.9 3.1 0.2 6% General and Administrative 9.1 9.9 0.8 8% Less: Stock-based compensation (3.0) (2.7) 0.3 11% Adjusted EBITDA 45.1$ 44.6$ 0.5$ 1% Adjusted EBITDA Margin 53% 51% Normalized FFO 31.9$ 31.2$ 0.7$ 2% Normalized FFO p r share(2) 0.49$ 0.48$ 0.01$ 2% AFFO 35.0$ 29.8$ 5.2$ 17% Three Months Ended Fav/(Unfav)

CyrusOne First Quarter 2015 Earnings Presentation www.cyrusone.com 22 Utilization remains high on 16% year-over-year increase in capacity Portfolio Overview As of March 31, 2015 As of March 31, 2014 Market CSF Capacity(1) (Sq Ft) % Utilized(2) CSF Capacity(1) (Sq Ft) % Utilized(2) Cincinnati 420,223 91% 419,277 90% Dallas 294,969 90% 231,958 99% Houston 255,094 86% 268,094 80% Phoenix 114,026 98% 77,504 93% Austin 59,995 90% 54,003 79% San Antonio 43,843 100% 43,487 100% Northern Virginia 37,461 71% - - Chicago 23,298 52% 23,298 53% International 13,200 80% 13,200 78% Total Footprint 1,262,109 89% 1,130,821 89% Capacity / Utilization (2) Highlights 16% increase in available CSF capacity(1) compared to March 31, 2014, with strong leasing maintaining Utilization (2) at 89% Northern Virginia came online in January, with Utilization(2) already at 71% as of end of quarter - Demand triggering construction of second data hall expected to begin in the second quarter Capital expenditures of $49.2 million, including purchase of new Austin facility for $17.3 million, compared to $49.7 million in Q1’14 Notes: 1. Colocation square feet (CSF) represents NRSF currently leased or available for lease as colocation space, where customers locate their servers and other IT equipment. Net rentable square feet (NRSF) represent the total square feet of a building currently leased or available for lease based on engineers’ drawings and estimates but does not include space held for development or space used by CyrusOne. 2. Utilization is calculated by dividing CSF under signed leases for available space (whether or not the lease has commenced billing) by total CSF.

CyrusOne First Quarter 2015 Earnings Presentation www.cyrusone.com 23 Continued low net leverage Net Debt and Market Capitalization ($ Millions except per share amounts) Shares or Equivalents Outstanding(2) Market Price as of March 31, 2015 Market Value Equivalents Common Shares 39.1 million $31.12 $1,215.5 Operating Partnership Units 26.6 million $31.12 827.8 Total Equity Value $2,043.3 Net Debt 666.4 Total Enterprise Value (TEV) $2,709.7 ($ Millions) March 31, 2015 6.375% Senior Unsecured Notes due 2022 $374.8 Revolver and Term Loan 305.0 Capital lease obligations 12.6 Less: Cash and cash equivalents (26.0) Net debt $666.4 Liquidity $321.0 Net leverage of 3.7x(1) Paid dividend of $0.315 per share and share equivalent on April 15, an increase of 50% over quarterly 2014 dividend, and announced dividend for the second quarter of $0.315 per share and share equivalent Note: 1. Calculated as net debt as of March 31, 2015, divided by Adjusted EBITDA for the last quarter annualized. 2. Subsequent to the quarter, CBB monetized 14.3M operating partnership units, increasing the number of common shares

CyrusOne First Quarter 2015 Earnings Presentation www.cyrusone.com 24 Reaffirming guidance for full year 2015 2015 Guidance Category ($ Millions except for Normalized FFO) 2015 Guidance(1) Total Revenue $370 - $385 Base Revenue $322 - $332 Metered Power Reimbursements $48 - $53 Adjusted EBITDA $185 - $195 Normalized FFO per diluted common share or common share equivalent(2) $1.90 - $2.00 Capital Expenditures $215 - $240 Development(3) $210 - $230 Recurring $5 - $10 Notes: 1. The guidance does not include any pro forma impacts related to the recently announced Cervalis acquisition. 2. Assumes weighted average diluted common share or common share equivalents for 2015 of 66 million. 3. Development capital is inclusive of capital used for the acquisition of land for future development

CyrusOne First Quarter 2015 Earnings Presentation www.cyrusone.com 25 Expected to deliver approximately 300K CSF in 2015 2015 Development Market YTD CSF Delivered CSF Under Dev.(1) YTD UPS Capacity(2) Delivered UPS Capacity(2) Under Dev. Dallas - 56K - 3 MW Houston - 53K - 6 MW Phoenix - 36K - 6 MW Austin - 62K - 6 MW San Antonio - 30K - 3 MW No. Virginia 37K 37K 6 MW - Total 37K 274K 6 MW 24 MW Notes: 1. Represents square footage at a facility for which activities have commenced or are expected to commence in the next 2 quarters to prepare the space for its intended use. Estimates and timing are subject to change. 2. Represents aggregate power available for lease to and exclusive use by customers from the facility’s installed universal power supplies expressed in terms of megawatts. The capacity presented is for non-redundant megawatts, as we can develop flexible solutions to our customers at multiple resiliency levels. 2015 Development Projects Northern Virginia facility came online in January (37K CSF and 6 MW); construction on second data hall (37K CSF) expected to begin Q2’15 Began construction on data halls at Carrollton and Phoenix 2 facilities (combined 92K CSF and 9 MW of power capacity) Phoenix 3 construction expected to begin in Q2’15 Construction on recently acquired Austin 3 facility expected to begin in Q2’15 (62K CSF, 6 MW of power capacity Year-End Inventory 2015 development projects leave CyrusOne well positioned to capture future growth Estimated ~1.5M of CSF online and ~1.0M NRSF of additional powered shell available for future development by end of 2015 before taking into account impact of Cervalis acquisition

Appendix Non-GAAP Reconciliations

CyrusOne First Quarter 2015 Earnings Presentation www.cyrusone.com 27 Non-GAAP Reconciliations Appendix ($ Millions) LQA Q1 2015 Reconciliation of Net Loss to EBITDA and Adjusted EBITDA: Net (loss) income (28.8)$ (7.2)$ (11.8)$ 0.7$ Adjustments: Interest expense 33.6 8.4 9.1 10.7 Income tax expense 1.6 0.4 0.3 0.4 Depreciation and amortization 124.4 31.1 30.6 27.6 EBITDA 130.8 32.7 28.2 39.4 Transaction costs 0.4 0.1 0.1 0.1 Stock-based compensation 12.0 3.0 2.7 2.2 Loss on extinguishment of debt - - 13.6 - Lease exit costs 2.8 0.7 - - Asset impairments 34.4 8.6 - - Adjusted EBITDA 180.4$ 45.1$ 44.6$ 41.7$ Three Months Ended March 31, 2015 December 31, 2014 March 31, 2014 ($ Millions) Net Operating Income R venue 85.7$ 86.9$ 8 .8$ 81.7$ 77.5$ 72.3$ 67.5$ 63.6$ 60.1$ Property operating expenses 32.3 32.0 33.0 31.8 27.7 24.3 24.2 24.6 20.1 Net Operating Income (NOI) 53.4$ 54.9$ 51.8$ 49.9$ 49.8$ 48.0$ 43.3$ 39.0$ 40.0$ Add Back: Lea e exit costs 0.7 - - - - - - - - Adjusted Net Operating Income (Adjusted NOI) 54.1$ 54.9$ 51.8$ 49.9$ 49.8$ 48.0$ 43.3$ 39.0$ 40.0$ March 31, 2015 Three Months Ended December 31, 2014 September 30, 2014 June 30, 2014 March 31, 2014 December 31, 2013 September 30, 2013 June 30, 2013 March 31, 2013

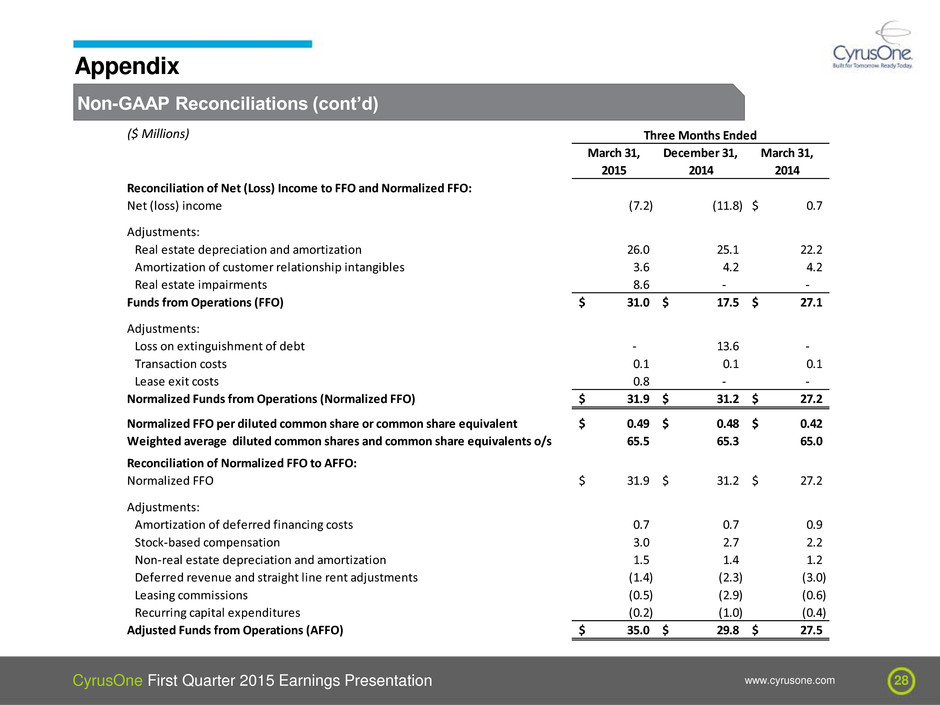

CyrusOne First Quarter 2015 Earnings Presentation www.cyrusone.com 28 Reconciliation of Net (Loss) Income to FFO and Normalized FFO: Net (loss) income (7.2) (11.8) 0.7$ Adjustments: Real estate depreciation and amortization 26.0 25.1 22.2 Amortization of customer relationship intangibles 3.6 4.2 4.2 Real estate impairments 8.6 - - Funds from Operations (FFO) 31.0$ 17.5$ 27.1$ Adjustments: Loss on extinguishment of debt - 13.6 - Transaction costs 0.1 0.1 0.1 Lease exit costs 0.8 - - Normalized Funds from Operations (Normalized FFO) 31.9$ 31.2$ 27.2$ Normalized FFO per diluted common share or common share equivalent 0.49$ 0.48$ 0.42$ Weighted average diluted common shares and common share equivalents o/s 65.5 65.3 65.0 Reconciliation of Normalized FFO to AFFO: Normalized FFO 31.9$ 31.2$ 27.2$ Adjustments: Amortization of deferred financing costs 0.7 0.7 0.9 Stock-based compensation 3.0 2.7 2.2 Non-real estate depreciation and amortization 1.5 1.4 1.2 Deferred revenue and straight line rent adjustments (1.4) (2.3) (3.0) Leasing commissions (0.5) (2.9) (0.6) Recurring capital expenditures (0.2) (1.0) (0.4) Adjusted Funds from Operations (AFFO) 35.0$ 29.8$ 27.5$ March 31, 2015 December 31, 2014 March 31, 2014 Three Months Ended Non-GAAP Reconciliations (cont’d) Appendix ($ Millions)