Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Forestar Group Inc. | earningsq1158-k.htm |

| EX-99.1 - EXHIBIT 99.1 - Forestar Group Inc. | exh991forreleaseq115.htm |

First Quarter 2015 Financial Results May 6, 2015

Notice to Investors This presentation contains “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements are typically identified by words or phrases such as “will,” “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “target,” “forecast,” and other words and terms of similar meaning. These statements reflect management’s current views with respect to future events and are subject to risk and uncertainties. We note that a variety of factors and uncertainties could cause our actual results to differ significantly from the results discussed in the forward-looking statements, including but not limited to: general economic, market, or business conditions; changes in commodity prices; opportunities (or lack thereof) that may be presented to us and that we may pursue; fluctuations in costs and expenses including development costs; demand for new housing, including impacts from mortgage credit rates or availability; lengthy and uncertain entitlement processes; cyclicality of our businesses; accuracy of accounting assumptions; competitive actions by other companies; changes in laws or regulations; and other factors, many of which are beyond our control. Except as required by law, we expressly disclaim any obligation to publicly revise any forward-looking statements contained in this presentation to reflect the occurrence of events after the date of this presentation. This presentation includes Non-GAAP financial measures. The required reconciliation to GAAP financial measures can be found as an exhibit to this presentation and on our website at www.forestargroup.com. 2

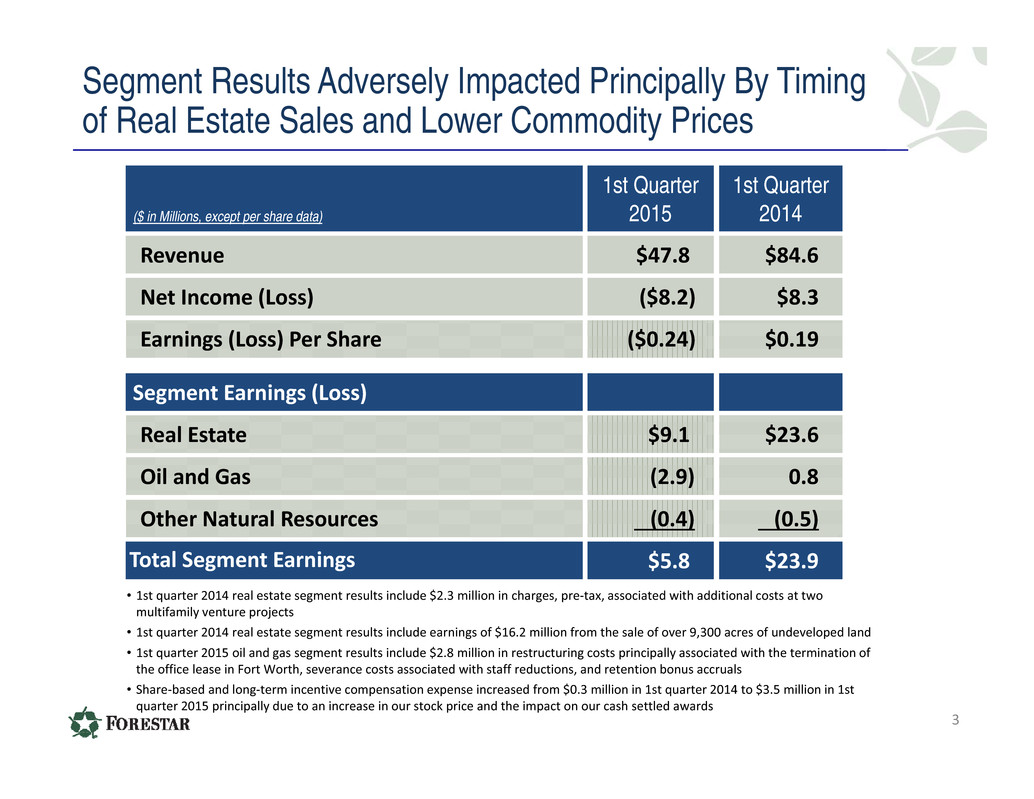

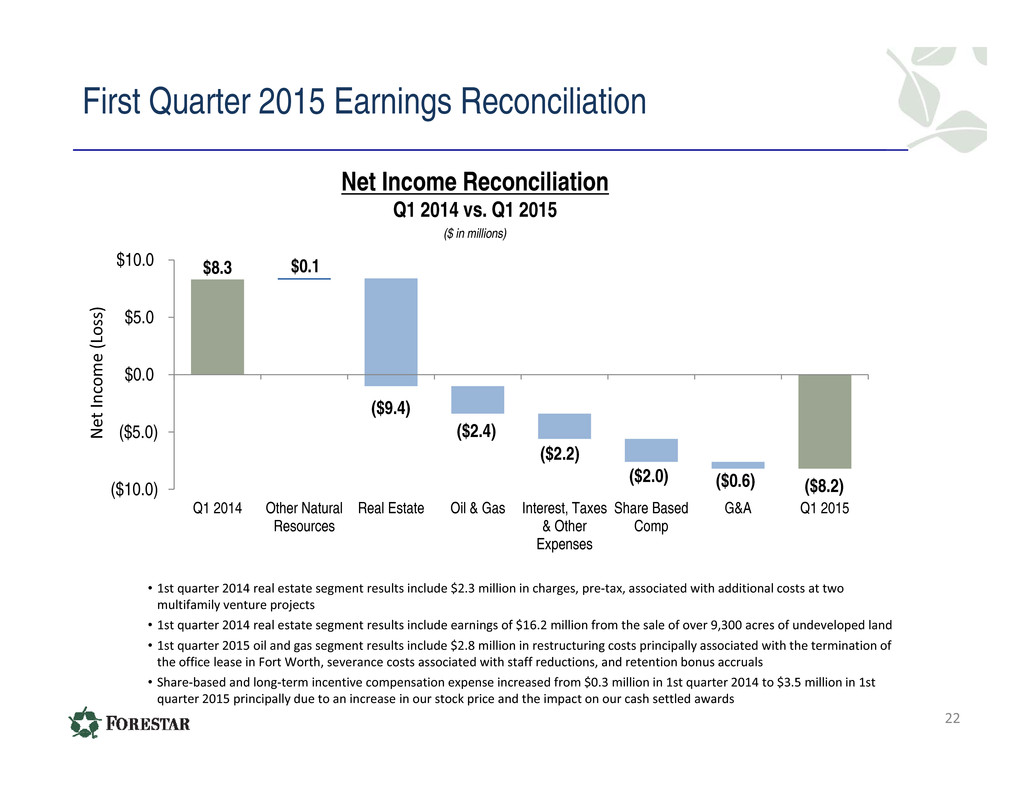

Segment Results Adversely Impacted Principally By Timing of Real Estate Sales and Lower Commodity Prices • 1st quarter 2014 real estate segment results include $2.3 million in charges, pre‐tax, associated with additional costs at two multifamily venture projects • 1st quarter 2014 real estate segment results include earnings of $16.2 million from the sale of over 9,300 acres of undeveloped land • 1st quarter 2015 oil and gas segment results include $2.8 million in restructuring costs principally associated with the termination of the office lease in Fort Worth, severance costs associated with staff reductions, and retention bonus accruals • Share‐based and long‐term incentive compensation expense increased from $0.3 million in 1st quarter 2014 to $3.5 million in 1st quarter 2015 principally due to an increase in our stock price and the impact on our cash settled awards 3 ($ in Millions, except per share data) 1st Quarter 2015 1st Quarter 2014 Revenue $47.8 $84.6 Net Income (Loss) ($8.2) $8.3 Earnings (Loss) Per Share ($0.24) $0.19 Segment Earnings (Loss) Real Estate $9.1 $23.6 Oil and Gas (2.9) 0.8 Other Natural Resources (0.4) (0.5) Total Segment Earnings $5.8 $23.9

Morgan Farms - Tennessee

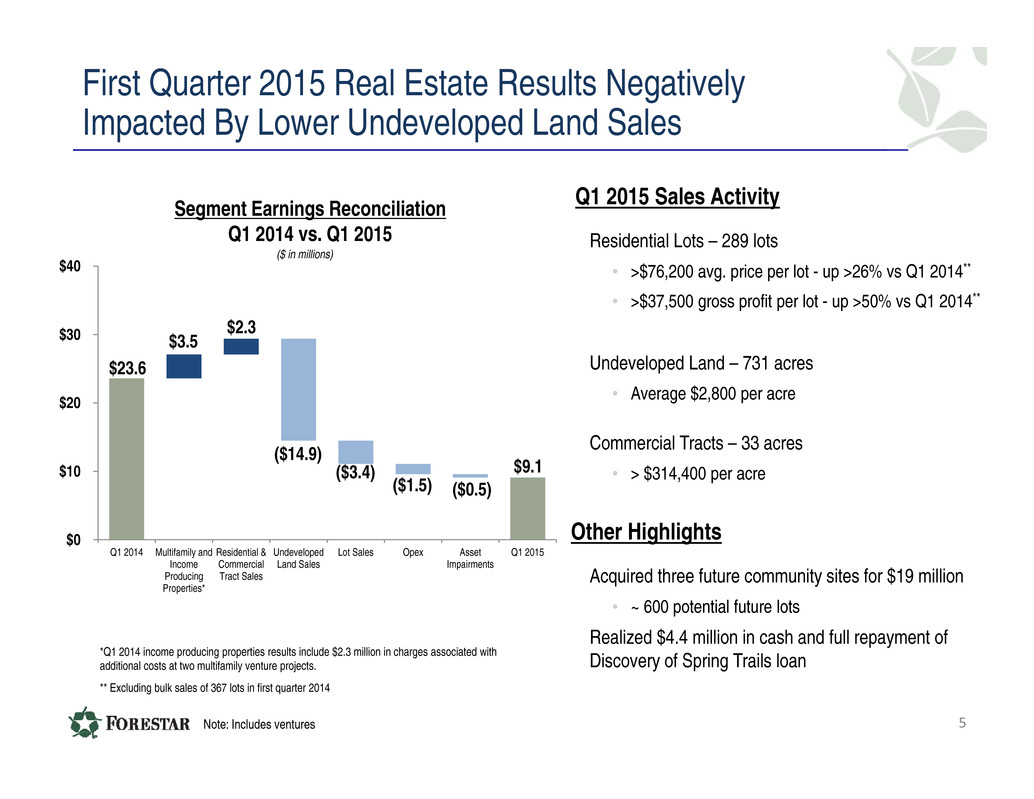

First Quarter 2015 Real Estate Results Negatively Impacted By Lower Undeveloped Land Sales ($3.4) ($1.5) $23.6 $3.5 $2.3 ($14.9) ($0.5) $9.1 $0 $10 $20 $30 $40 Q1 2014 Multifamily and Income Producing Properties* Residential & Commercial Tract Sales Undeveloped Land Sales Lot Sales Opex Asset Impairments Q1 2015 Segment Earnings Reconciliation Q1 2014 vs. Q1 2015 ($ in millions) Q1 2015 Sales Activity Residential Lots – 289 lots • >$76,200 avg. price per lot - up >26% vs Q1 2014** • >$37,500 gross profit per lot - up >50% vs Q1 2014** Undeveloped Land – 731 acres • Average $2,800 per acre Commercial Tracts – 33 acres • > $314,400 per acre Other Highlights Acquired three future community sites for $19 million • ~ 600 potential future lots Realized $4.4 million in cash and full repayment of Discovery of Spring Trails loan 5Note: Includes ventures *Q1 2014 income producing properties results include $2.3 million in charges associated with additional costs at two multifamily venture projects. ** Excluding bulk sales of 367 lots in first quarter 2014

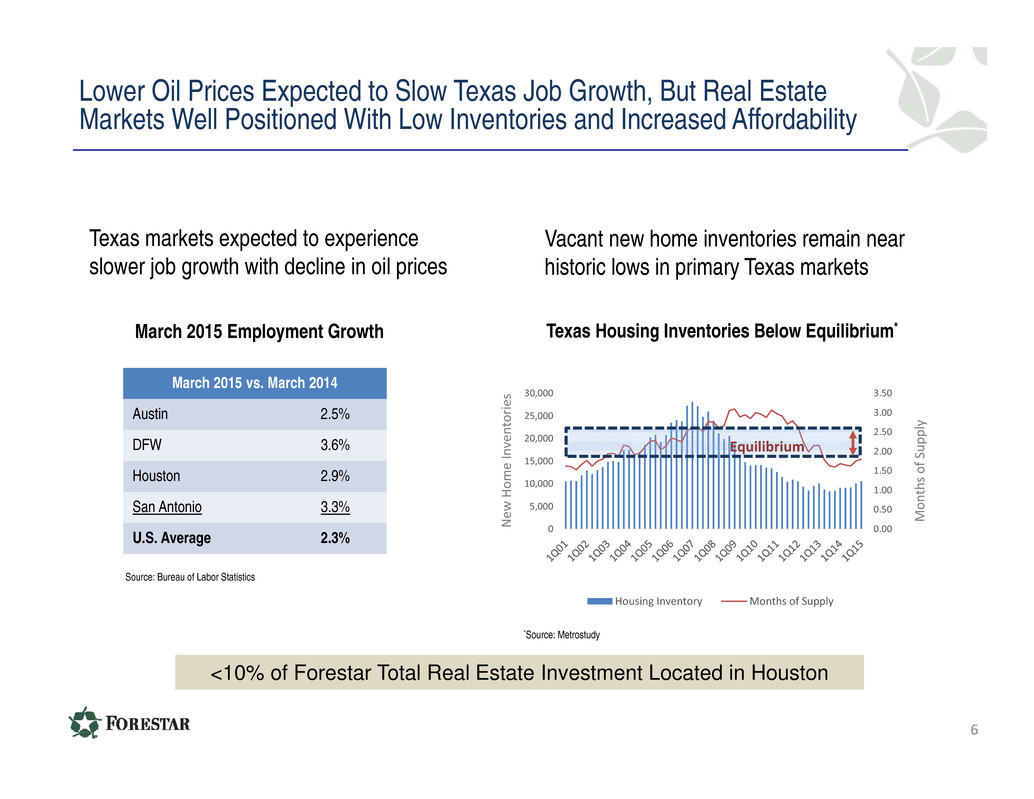

Lower Oil Prices Expected to Slow Texas Job Growth, But Real Estate Markets Well Positioned With Low Inventories and Increased Affordability 6 Texas markets expected to experience slower job growth with decline in oil prices Texas Housing Inventories Below Equilibrium* 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 0 5,000 10,000 15,000 20,000 25,000 30,000 Housing Inventory Months of Supply Equilibrium M o n t h s o f S u p p l y N e w H o m e I n v e n t o r i e s March 2015 Employment Growth March 2015 vs. March 2014 Austin 2.5% DFW 3.6% Houston 2.9% San Antonio 3.3% U.S. Average 2.3% <10% of Forestar Total Real Estate Investment Located in Houston Vacant new home inventories remain near historic lows in primary Texas markets Source: Bureau of Labor Statistics *Source: Metrostudy

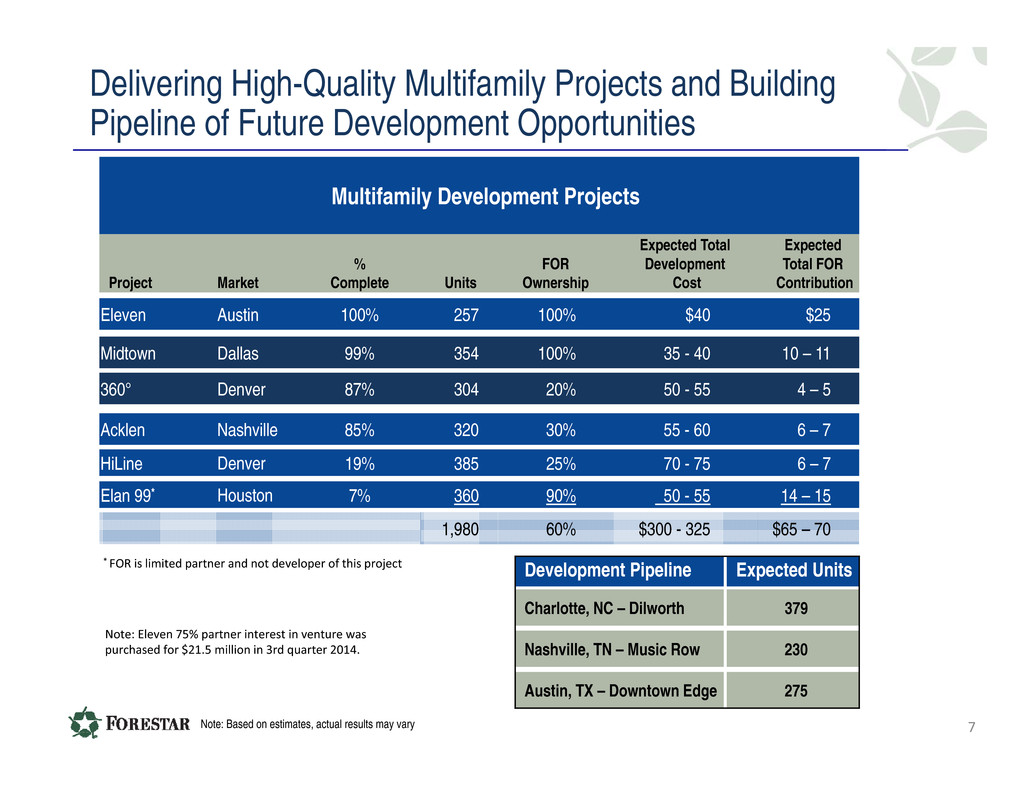

Delivering High-Quality Multifamily Projects and Building Pipeline of Future Development Opportunities Multifamily Development Projects Project Market % Complete Units FOR Ownership Expected Total Development Cost Expected Total FOR Contribution Eleven Austin 100% 257 100% $40 $25 Midtown Dallas 99% 354 100% 35 - 40 10 – 11 360° Denver 87% 304 20% 50 - 55 4 – 5 Acklen Nashville 85% 320 30% 55 - 60 6 – 7 HiLine Denver 19% 385 25% 70 - 75 6 – 7 Elan 99* Houston 7% 360 90% 50 - 55 14 – 15 1,980 60% $300 - 325 $65 – 70 Development Pipeline Expected Units Charlotte, NC – Dilworth 379 Nashville, TN – Music Row 230 Austin, TX – Downtown Edge 275 * FOR is limited partner and not developer of this project Note: Eleven 75% partner interest in venture was purchased for $21.5 million in 3rd quarter 2014. 7Note: Based on estimates, actual results may vary

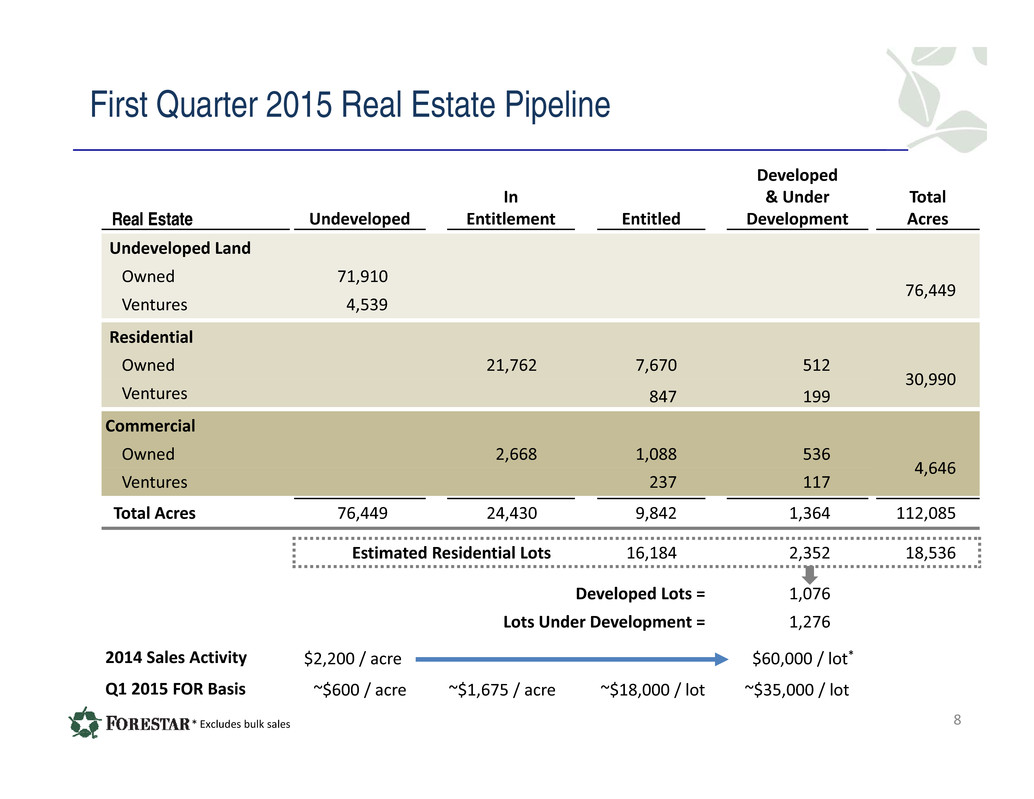

First Quarter 2015 Real Estate Pipeline 8 Real Estate Undeveloped In Entitlement Entitled Developed & Under Development Total Acres Undeveloped Land Owned 71,910 76,449 Ventures 4,539 Residential Owned 21,762 7,670 512 30,990 Ventures 847 199 Commercial Owned 2,668 1,088 536 4,646 Ventures 237 117 Total Acres 76,449 24,430 9,842 1,364 112,085 Estimated Residential Lots 16,184 2,352 18,536 Developed Lots = 1,076 Lots Under Development = 1,276 2014 Sales Activity $2,200 / acre $60,000 / lot* Q1 2015 FOR Basis ~$600 / acre ~$1,675 / acre ~$18,000 / lot ~$35,000 / lot * Excludes bulk sales

Real Estate Business Focused on Delivering the Greatest Value From Every Acre Maximizing Value Realization Capitalizing on housing markets by increasing lot margins • Average residential lot prices and margins at record levels • Over 1,200 residential lots under contract • Anticipate 2015 lot sales of 1,800 – 1,900 lots Marketing $15 million of commercial tracts (~36 acres) Strategic and disciplined acquisitions • Q1 2015 Community development acquisitions = $19 million • Acquired 3 future community sites (600 future lots) in Charlotte, Houston and Tucson • Building solid pipeline of multifamily properties • 6 projects - 1,980 units stabilized or under construction • 3 future development sites with over 880 expected units 9 1,707 $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 0 500 1,000 1,500 2,000 2,500 3,000 3,500 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Est. Bulk Lot Sales Lot Sales Average Lot Margin Average Lot Margin Excl. Bulk Sales A v e r a g e L o t M a r g i n Annual Lot Sales and Average Lot Margin 3,539 1,060 642 804 1,117 1,365 1,883 2,343 ~1,850

Georgia

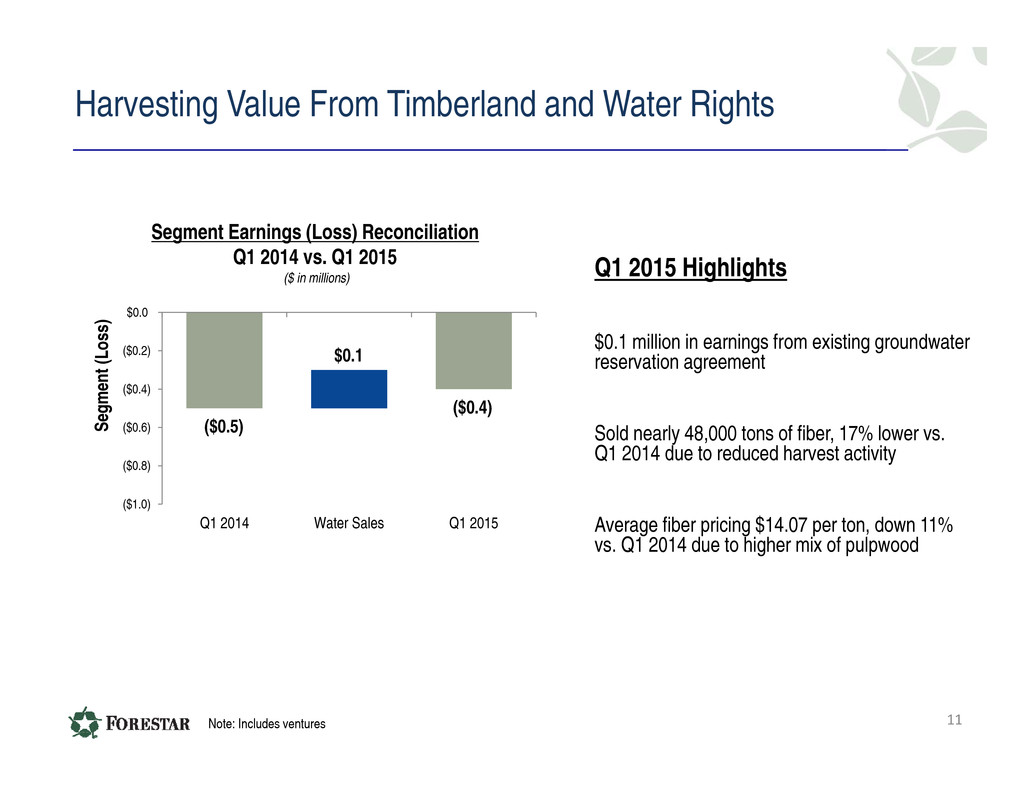

Harvesting Value From Timberland and Water Rights Segment Earnings (Loss) Reconciliation Q1 2014 vs. Q1 2015 ($ in millions) ($0.5) ($0.4) $0.1 ($1.0) ($0.8) ($0.6) ($0.4) ($0.2) $0.0 Q1 2014 Water Sales Q1 2015 S e g m e n t ( L o s s ) Q1 2015 Highlights $0.1 million in earnings from existing groundwater reservation agreement Sold nearly 48,000 tons of fiber, 17% lower vs. Q1 2014 due to reduced harvest activity Average fiber pricing $14.07 per ton, down 11% vs. Q1 2014 due to higher mix of pulpwood 11Note: Includes ventures

The Bakken - North Dakota The Bakken - North Dakota

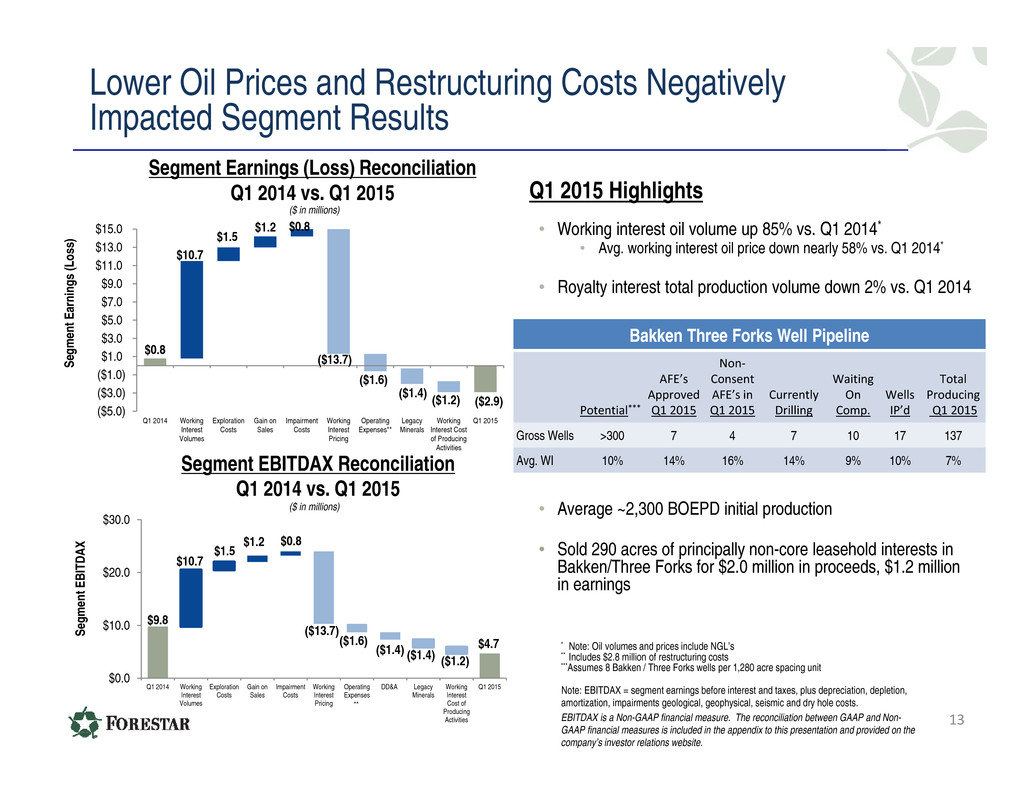

Lower Oil Prices and Restructuring Costs Negatively Impacted Segment Results $0.8 $1.2 $1.5 ($1.6) ($1.4) ($13.7) ($2.9)($1.2) ($5.0) ($3.0) ($1.0) $1.0 $3.0 $5.0 $7.0 $9.0 $11.0 $13.0 $15.0 Q1 2014 Working Interest Volumes Exploration Costs Gain on Sales Impairment Costs Working Interest Pricing Operating Expenses** Legacy Minerals Working Interest Cost of Producing Activities Q1 2015 S e g m e n t E a r n i n g s ( L o s s ) $0.8 $10.7 $9.8 $10.7 $1.5 ($1.4) ($13.7) $0.8 ($1.4) ($1.6) $4.7 ($1.2) $0.0 $10.0 $20.0 $30.0 Q1 2014 Working Interest Volumes Exploration Costs Gain on Sales Impairment Costs Working Interest Pricing Operating Expenses DD&A Legacy Minerals Working Interest Cost of Producing Activities Q1 2015 S e g m e n t E B I T D A X $1.2 Segment Earnings (Loss) Reconciliation Q1 2014 vs. Q1 2015 ($ in millions) Segment EBITDAX Reconciliation Q1 2014 vs. Q1 2015 ($ in millions) Note: EBITDAX = segment earnings before interest and taxes, plus depreciation, depletion, amortization, impairments geological, geophysical, seismic and dry hole costs. EBITDAX is a Non-GAAP financial measure. The reconciliation between GAAP and Non- GAAP financial measures is included in the appendix to this presentation and provided on the company’s investor relations website. Q1 2015 Highlights • Working interest oil volume up 85% vs. Q1 2014* • Avg. working interest oil price down nearly 58% vs. Q1 2014* • Royalty interest total production volume down 2% vs. Q1 2014 • Average ~2,300 BOEPD initial production • Sold 290 acres of principally non-core leasehold interests in Bakken/Three Forks for $2.0 million in proceeds, $1.2 million in earnings 13 * Note: Oil volumes and prices include NGL’s ** Includes $2.8 million of restructuring costs ***Assumes 8 Bakken / Three Forks wells per 1,280 acre spacing unit ** Bakken Three Forks Well Pipeline Potential*** AFE’s Approved Q1 2015 Non‐ Consent AFE’s in Q1 2015 Currently Drilling Waiting On Comp. Wells IP’d Total Producing Q1 2015 Gross Wells >300 7 4 7 10 17 137 Avg. WI 10% 14% 16% 14% 9% 10% 7%

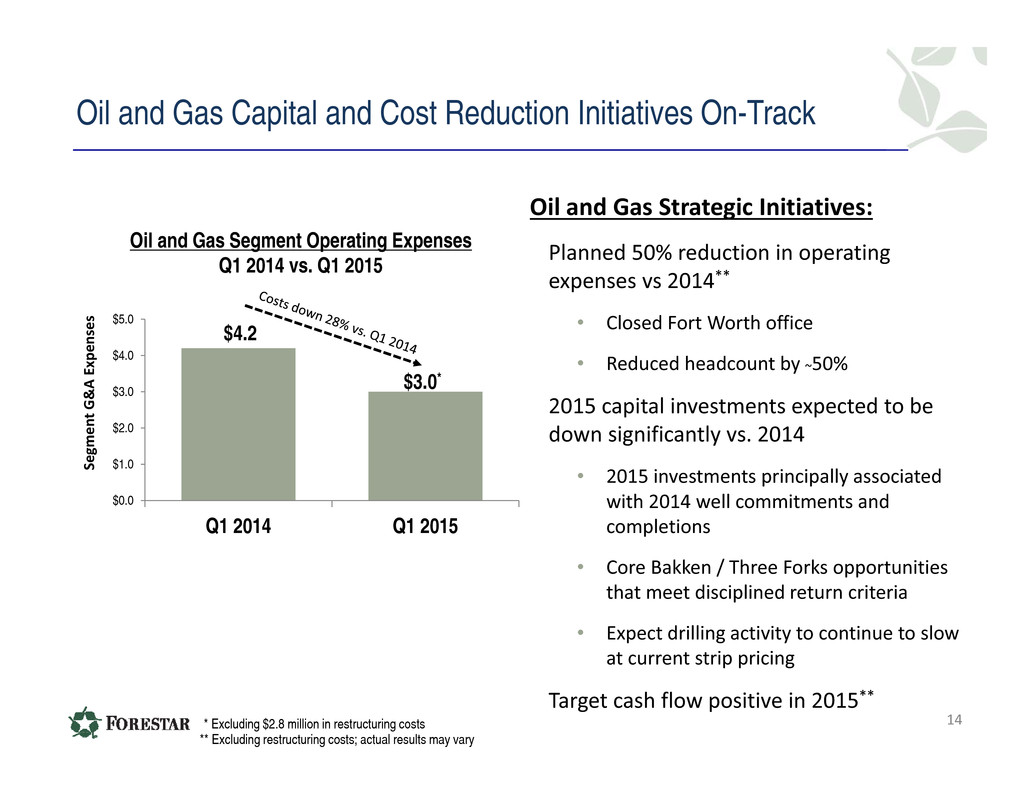

Oil and Gas Capital and Cost Reduction Initiatives On-Track Oil and Gas Strategic Initiatives: Planned 50% reduction in operating expenses vs 2014** • Closed Fort Worth office • Reduced headcount by ~50% 2015 capital investments expected to be down significantly vs. 2014 • 2015 investments principally associated with 2014 well commitments and completions • Core Bakken / Three Forks opportunities that meet disciplined return criteria • Expect drilling activity to continue to slow at current strip pricing Target cash flow positive in 2015** 14* Excluding $2.8 million in restructuring costs $4.2 $3.0* $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 Q1 2014 Q1 2015 S e g m e n t G & A E x p e n s e s Oil and Gas Segment Operating Expenses Q1 2014 vs. Q1 2015 ** Excluding restructuring costs; actual results may vary

Strategic Review Update 15

Comprehensive Strategic Review Driven By Commitment To Maximize Long‐Term Shareholder Value Board, management and financial advisors continue to explore strategic alternatives to enhance shareholder value, including review of oil and gas business ̶ Concurrently, Company plans to reduce 2015 oil and gas operating expenses by 50%* vs. 2014 and significantly lower oil and gas capital investments 16* Excluding restructuring costs

17

18

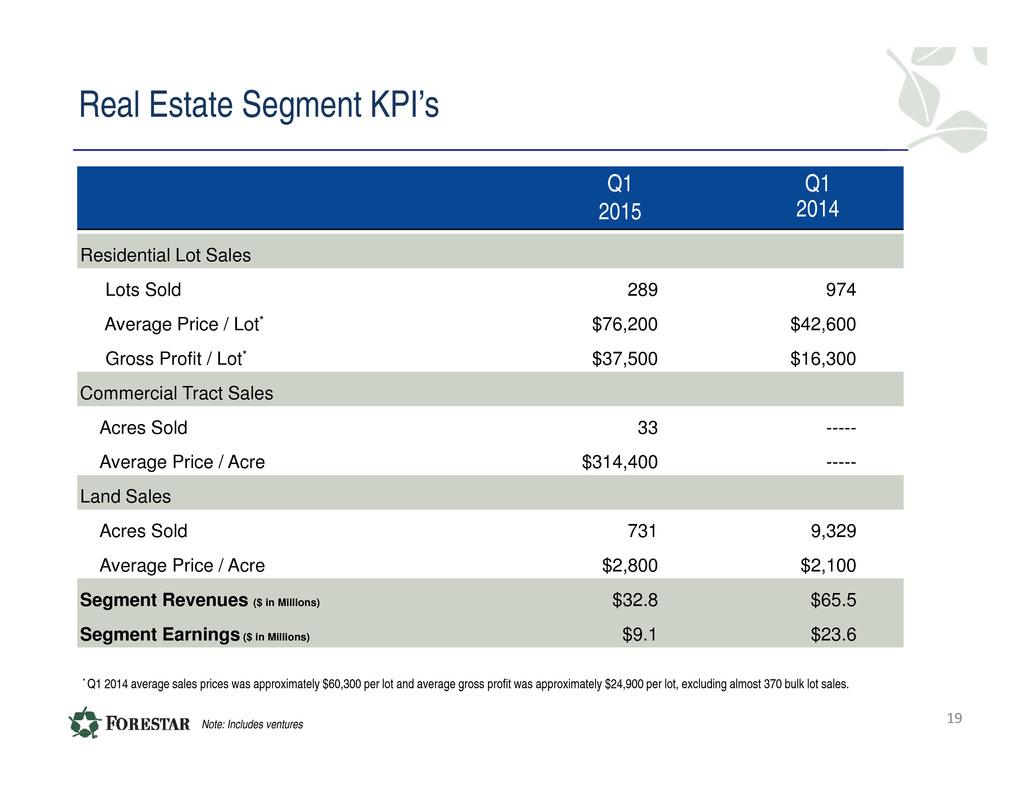

Real Estate Segment KPI’s Q1 2015 Q1 2014 Residential Lot Sales Lots Sold 289 974 Average Price / Lot* $76,200 $42,600 Gross Profit / Lot* $37,500 $16,300 Commercial Tract Sales Acres Sold 33 ----- Average Price / Acre $314,400 ----- Land Sales Acres Sold 731 9,329 Average Price / Acre $2,800 $2,100 Segment Revenues ($ in Millions) $32.8 $65.5 Segment Earnings ($ in Millions) $9.1 $23.6 * Q1 2014 average sales prices was approximately $60,300 per lot and average gross profit was approximately $24,900 per lot, excluding almost 370 bulk lot sales. Note: Includes ventures 19

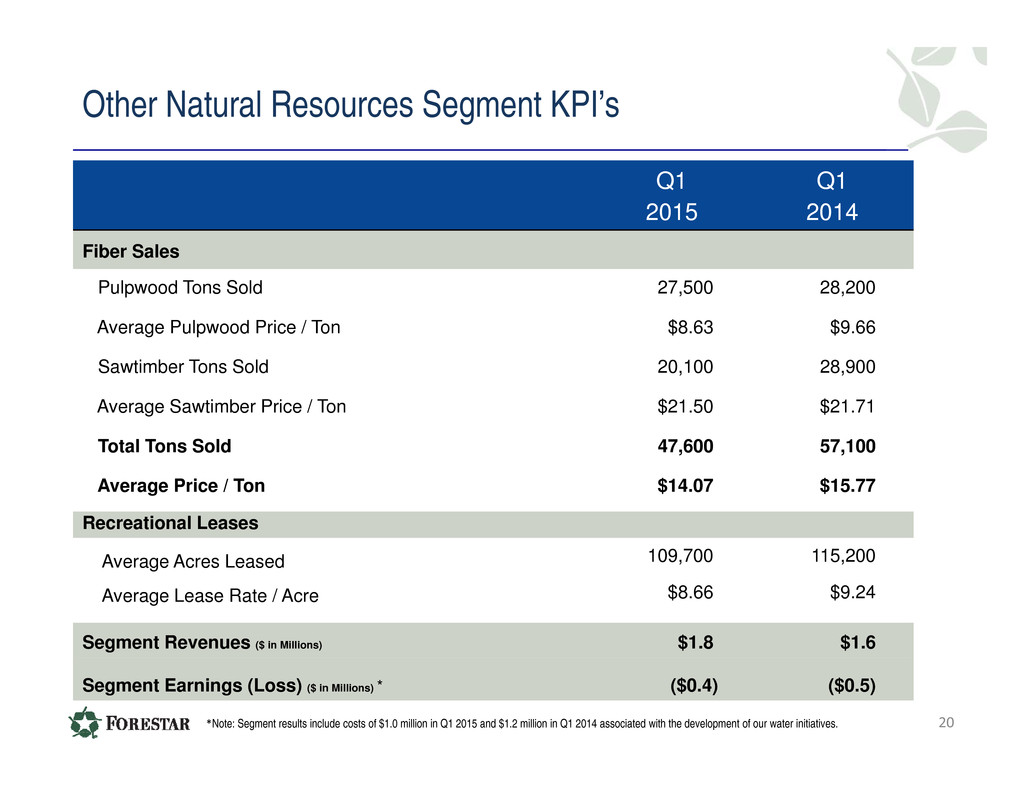

Other Natural Resources Segment KPI’s Q1 2015 Q1 2014 Fiber Sales Pulpwood Tons Sold 27,500 28,200 Average Pulpwood Price / Ton $8.63 $9.66 Sawtimber Tons Sold 20,100 28,900 Average Sawtimber Price / Ton $21.50 $21.71 Total Tons Sold 47,600 57,100 Average Price / Ton $14.07 $15.77 Recreational Leases Average Acres Leased 109,700 115,200 Average Lease Rate / Acre $8.66 $9.24 Segment Revenues ($ in Millions) $1.8 $1.6 Segment Earnings (Loss) ($ in Millions) * ($0.4) ($0.5) *Note: Segment results include costs of $1.0 million in Q1 2015 and $1.2 million in Q1 2014 associated with the development of our water initiatives. 20

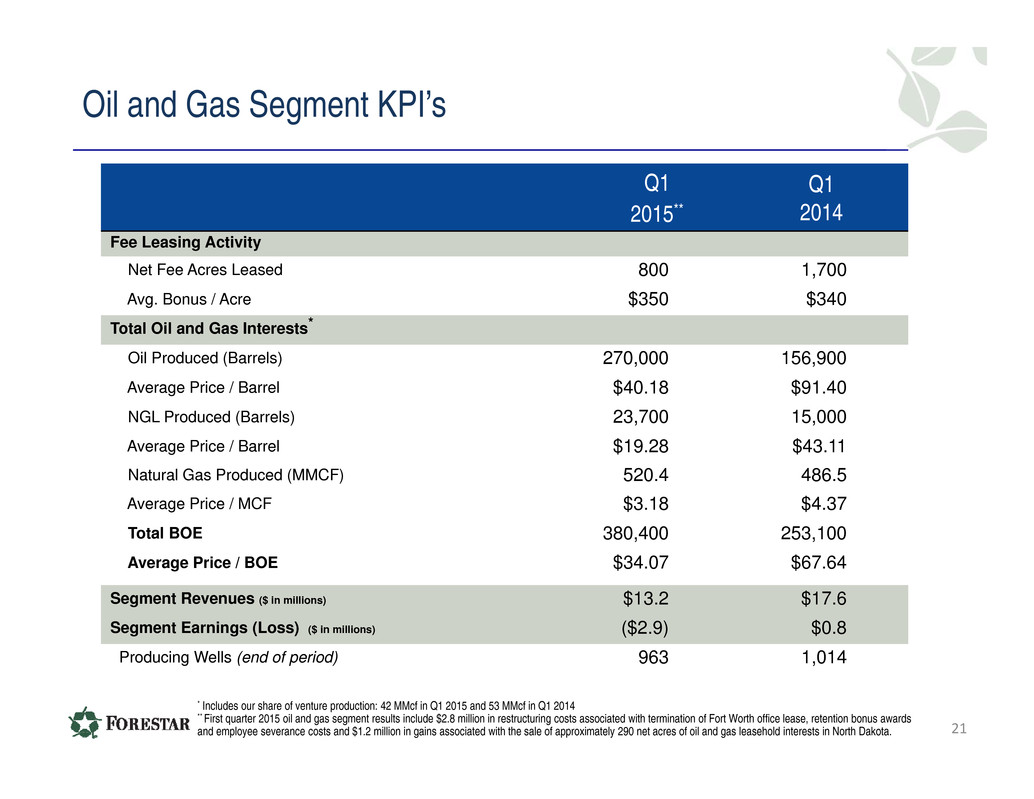

Oil and Gas Segment KPI’s Q1 2015** Q1 2014 Fee Leasing Activity Net Fee Acres Leased 800 1,700 Avg. Bonus / Acre $350 $340 Total Oil and Gas Interests* Oil Produced (Barrels) 270,000 156,900 Average Price / Barrel $40.18 $91.40 NGL Produced (Barrels) 23,700 15,000 Average Price / Barrel $19.28 $43.11 Natural Gas Produced (MMCF) 520.4 486.5 Average Price / MCF $3.18 $4.37 Total BOE 380,400 253,100 Average Price / BOE $34.07 $67.64 Segment Revenues ($ in millions) $13.2 $17.6 Segment Earnings (Loss) ($ in millions) ($2.9) $0.8 Producing Wells (end of period) 963 1,014 * Includes our share of venture production: 42 MMcf in Q1 2015 and 53 MMcf in Q1 2014 ** First quarter 2015 oil and gas segment results include $2.8 million in restructuring costs associated with termination of Fort Worth office lease, retention bonus awards and employee severance costs and $1.2 million in gains associated with the sale of approximately 290 net acres of oil and gas leasehold interests in North Dakota. 21

First Quarter 2015 Earnings Reconciliation $8.3 ($8.2) ($9.4) $0.1 ($2.4) ($2.2) ($2.0) ($0.6) ($10.0) ($5.0) $0.0 $5.0 $10.0 Q1 2014 Other Natural Resources Real Estate Oil & Gas Interest, Taxes & Other Expenses Share Based Comp G&A Q1 2015 N e t I n c o m e ( L o s s ) Net Income Reconciliation Q1 2014 vs. Q1 2015 ($ in millions) 22 • 1st quarter 2014 real estate segment results include $2.3 million in charges, pre‐tax, associated with additional costs at two multifamily venture projects • 1st quarter 2014 real estate segment results include earnings of $16.2 million from the sale of over 9,300 acres of undeveloped land • 1st quarter 2015 oil and gas segment results include $2.8 million in restructuring costs principally associated with the termination of the office lease in Fort Worth, severance costs associated with staff reductions, and retention bonus accruals • Share‐based and long‐term incentive compensation expense increased from $0.3 million in 1st quarter 2014 to $3.5 million in 1st quarter 2015 principally due to an increase in our stock price and the impact on our cash settled awards

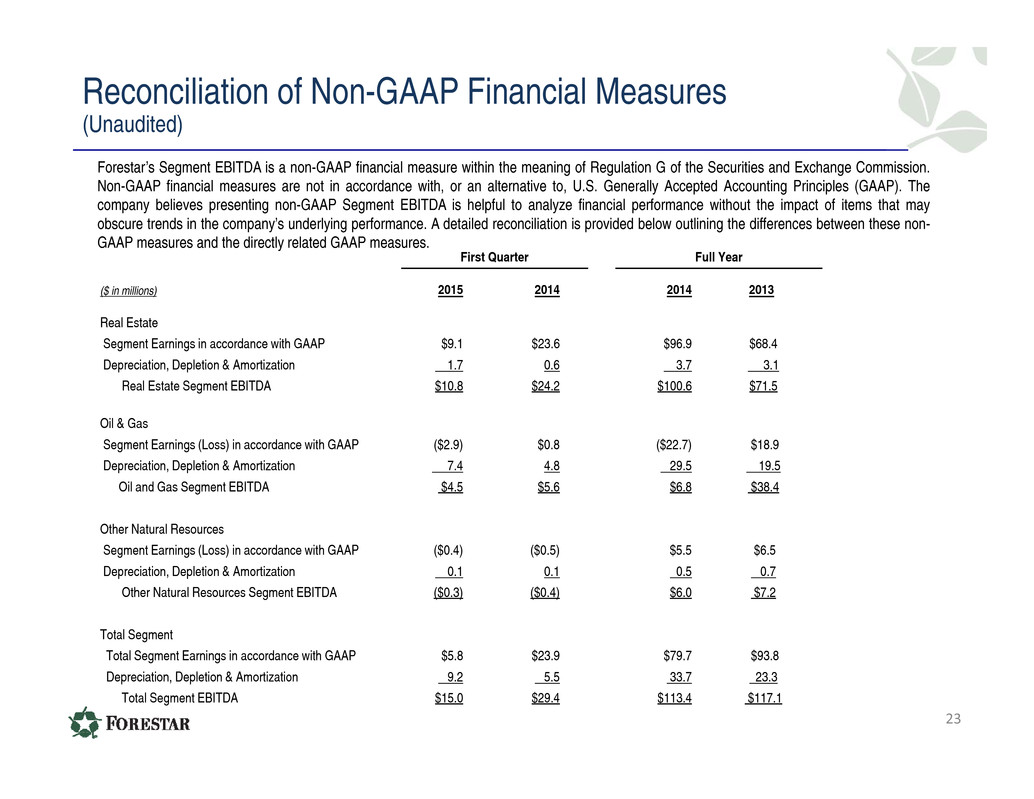

Reconciliation of Non-GAAP Financial Measures (Unaudited) Forestar’s Segment EBITDA is a non-GAAP financial measure within the meaning of Regulation G of the Securities and Exchange Commission. Non-GAAP financial measures are not in accordance with, or an alternative to, U.S. Generally Accepted Accounting Principles (GAAP). The company believes presenting non-GAAP Segment EBITDA is helpful to analyze financial performance without the impact of items that may obscure trends in the company’s underlying performance. A detailed reconciliation is provided below outlining the differences between these non- GAAP measures and the directly related GAAP measures. First Quarter Full Year ($ in millions) 2015 2014 2014 2013 Real Estate Segment Earnings in accordance with GAAP $9.1 $23.6 $96.9 $68.4 Depreciation, Depletion & Amortization 1.7 0.6 3.7 3.1 Real Estate Segment EBITDA $10.8 $24.2 $100.6 $71.5 Oil & Gas Segment Earnings (Loss) in accordance with GAAP ($2.9) $0.8 ($22.7) $18.9 Depreciation, Depletion & Amortization 7.4 4.8 29.5 19.5 Oil and Gas Segment EBITDA $4.5 $5.6 $6.8 $38.4 Other Natural Resources Segment Earnings (Loss) in accordance with GAAP ($0.4) ($0.5) $5.5 $6.5 Depreciation, Depletion & Amortization 0.1 0.1 0.5 0.7 Other Natural Resources Segment EBITDA ($0.3) ($0.4) $6.0 $7.2 Total Segment Total Segment Earnings in accordance with GAAP $5.8 $23.9 $79.7 $93.8 Depreciation, Depletion & Amortization 9.2 5.5 33.7 23.3 Total Segment EBITDA $15.0 $29.4 $113.4 $117.1 23

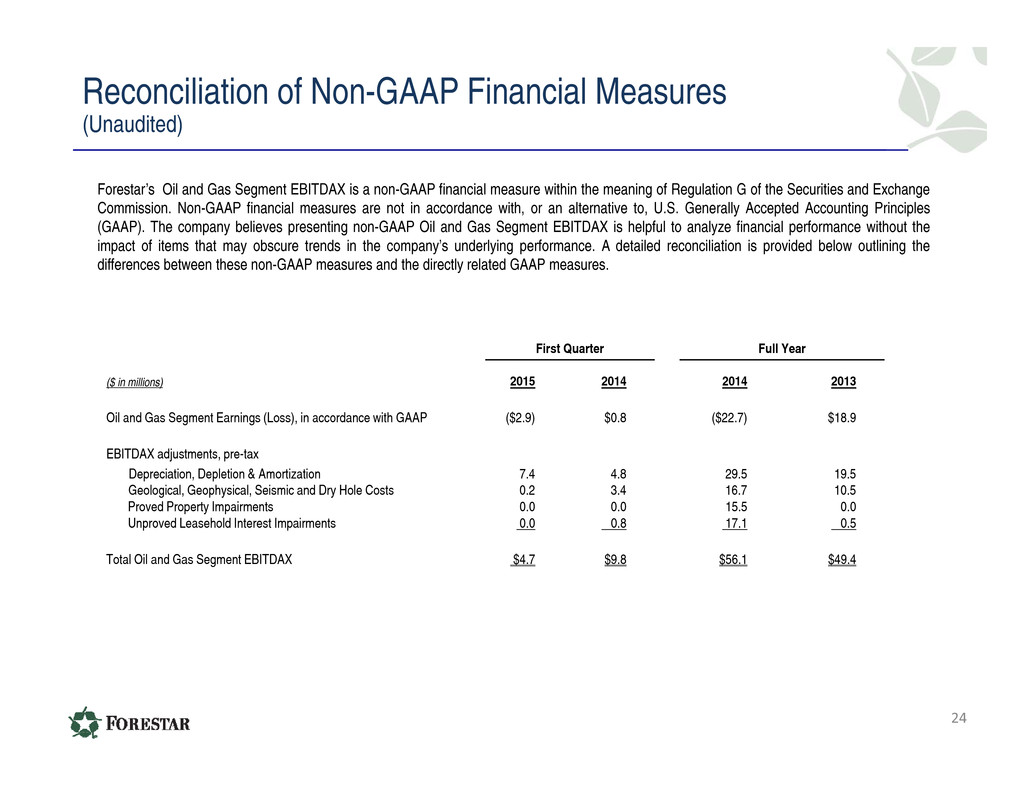

Reconciliation of Non-GAAP Financial Measures (Unaudited) Forestar’s Oil and Gas Segment EBITDAX is a non-GAAP financial measure within the meaning of Regulation G of the Securities and Exchange Commission. Non-GAAP financial measures are not in accordance with, or an alternative to, U.S. Generally Accepted Accounting Principles (GAAP). The company believes presenting non-GAAP Oil and Gas Segment EBITDAX is helpful to analyze financial performance without the impact of items that may obscure trends in the company’s underlying performance. A detailed reconciliation is provided below outlining the differences between these non-GAAP measures and the directly related GAAP measures. First Quarter Full Year ($ in millions) 2015 2014 2014 2013 Oil and Gas Segment Earnings (Loss), in accordance with GAAP ($2.9) $0.8 ($22.7) $18.9 EBITDAX adjustments, pre-tax Depreciation, Depletion & Amortization 7.4 4.8 29.5 19.5 Geological, Geophysical, Seismic and Dry Hole Costs 0.2 3.4 16.7 10.5 Proved Property Impairments 0.0 0.0 15.5 0.0 Unproved Leasehold Interest Impairments 0.0 0.8 17.1 0.5 Total Oil and Gas Segment EBITDAX $4.7 $9.8 $56.1 $49.4 24

25