Attached files

Exhibit 10.1

LEASE WITH OPTION FOR MEMBERSHIP INTEREST PURCHASE

This LEASE WITH OPTION FOR MEMBERSHIP INTEREST PURCHASE (this "Agreement") is made and effective as of April 30, 2015 (the "Effective Date"), by and between Bango Oil, LLC, a Nevada limited liability company ("Landowner") and Vertex Refining NV, LLC, a Nevada limited liability company ("Lessee") (At times, Landowner and Lessee are collectively referenced as the "Parties" or individually as a "Party").

1. Premises and Term.

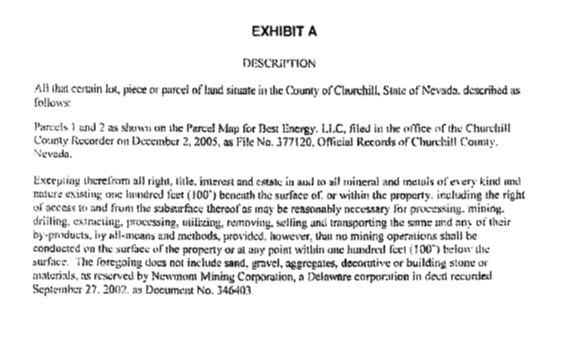

1.1 Premises. In consideration of the obligation of Lessee to pay Rent (defined below) as hereinafter provided and in consideration of the other terms, provisions, and covenants hereof, Landowner hereby demises and leases to Lessee, and Lessee hereby takes from Landowner, a leasehold interest in those certain tracts or parcels of land located in Churchill County, Nevada, described on Exhibit "A" attached hereto and incorporated herein by this reference (the "Land"), together with the structures and other improvements currently erected thereon, including, without limitation, the current used oil re-refining plant, storage tanks, and warehouse, and related improvements owned by Landowner (collectively, the "Facility"), and together with any rights, privileges, easements, entitlements, permits, and appurtenances belonging or in any way pertaining to the Land not otherwise inconsistent with the terms of this Agreement (all of the foregoing hereinafter collectively referred to as the "Property"). Landowner makes no representations or warranties concerning the Property, or any matters with respect thereto, except as expressly stated herein. Except for such representations and warranties memorialized in this Agreement, Lessee acknowledges that it is entering into this Agreement based on its own investigation and analysis of the Property as well as Lessee's experience in the type of facility contemplated by this Agreement.

1.2 Encumbrances. Except with the written consent of Lessee, which consent shall not be unreasonably withheld, or except as directed by a governmental or quasi-governmental agency, or the Union Pacific Railroad, Landowner shall not grant any easement, lease, encumbrance, or other interest in the Property.

1.3 Term. The term of this Agreement shall commence on the Effective Date, and shall continue, unless sooner terminated pursuant to the provisions this Agreement, until August 10, 2025 (the "Lease Term").

1.4 Right to Terminate.

(a) Subject to Section 3.4.1 of this Agreement, at any time after six (6) months from the Effective Date have passed, and if no Event of Default (defined below) shall then exist, Lessee shall have the right to terminate this Agreement; provided, however, that Lessee must provide twelve (12) months written notice to Landowner of Lessee's termination of this Agreement. If Lessee exercises its right to terminate the Lease, Landowner shall then have the right to, during Lessee's twelve (12) month termination period, terminate the Lease upon thirty (30) days written notice to Lessee. In the event this Agreement is terminated, Rent shall be prorated on the basis of a thirty (30) day month.

1

(b) If no Event of Default shall then exist (outside of Lessee's ability to operate at the Property due to creditor issues of the Prior Lessee), Lessee shall have the right to terminate this Agreement upon five (5) days written notice to Landowner in the limited event either Pac West Equipment Finance or Republic Bank: (i) physically removes, over Lessee’s commercially reasonable objections, a material portion of the improvements or equipment located at the Property or (ii) obtains a preliminary injunction (as differentiated from a temporary restraining order) preventing the use of a material portion of such improvements or equipment, and in either case such removal or preliminary injunction materially interferes with Lessee's operations at the Property. This Section 1.4(b) shall automatically terminate and be of no force or effect as of the date that is six (6) months after the Effective Date unless either Pac West Equipment Finance or Republic Bank have filed an action seeking to retake, or to prevent Lessee’s use of, such improvements or equipment by that date.

2. Payments and Required Improvements.

2.1 Intentionally Deleted.

2.2 Rent. In order to keep this Agreement in effect during the Lease Term, Lessee shall pay rent to Landowner as follows ("Rent"):

(a) Abatement Period. No Rent shall be payable until January 1, 2016.

(b) Commencement of Rent Payments. Beginning on January 1, 2016, and continuing on a monthly basis until the termination of the Lease Term, Lessee shall pay Landowner Rent in the amount of Two Hundred Forty-Four Thousand Dollars ($244,000.00) per month.

(c) Payment of Rent During 2016. During 2016, Lessee shall have the option of paying Rent in the stock of Lessee's parent company, Vertex Energy, Inc., a Nevada corporation ("Vertex"). Should Lessee exercise its option of paying rent in Vertex stock as opposed to immediately available funds, Lessee shall cause Vertex to issue stock to Landowner in an amount equal to 110% of the otherwise applicable $244,000.00 Rent amount ($268,400.00), as calculated using the Volume Weighted Average Price ("VWAP") of Vertex's stock for the 10-day period preceding the first day of each month. Landlord acknowledges that Vertex's stock is restricted under Rule 144 and, as a result, may not be traded until the six-month anniversary of the issuance date of such stock. If on the six-month anniversary of the date that Vertex stock is issued as Rent, the value of such stock (as calculated using the VWAP for the 10-day period immediately prior to the six-month anniversary of the issuance date (the "New Value")) is less than $268,400.00, then Lessee shall either (i) pay Landowner in immediately available funds or (ii) cause Vertex to issue additional shares of Vertex stock to Landowner, in either instance in the amount necessary to cause Landowner to have at least $268,400.00 in cash and/or Vertex stock (as calculated based upon the New Value) associated with the Rent payment in question. For the purpose of clarity, if on the six-month anniversary of the date that Vertex stock is issued as Rent the value of such stock is greater than $268,400.00, then Landowner may keep this excess value as consideration for agreeing to accept equity in lieu of immediately available funds, and no further action shall be required by Lessee, Vertex, or Landowner with respect to such Rent payment.

2

(d) Payment of Rent Beginning January 1, 2017. Beginning with the Rent payment due on January 1, 2017, all payments of Rent shall be made by Lessee to Landowner in immediately available funds.

Except as provided in Section 2.2(a) above, Rent is due and payable on the first (1st) day of each calendar month during the Lease Term. Any amount due from Lessee to Landowner which is not paid upon, or prior to, the date due for such payment, shall bear interest in the per annum amount equal to two percent (2%) in excess of the reference rate of interest announced from time to time by Bank of America, N.A. (or an equivalent rate announced by a comparable national bank selected by Landowner in the event Bank of America no longer announces a Reference Rate) (the "Reference Rate of Interest"), but in no event in excess of the maximum interest rate permitted by law, from the date such payment is due until paid, but the payment of such interest shall not excuse or cure any default by Lessee under this Agreement. In the event Lessee is more than five (5) days late in paying any installment of Rent due under this Agreement, Lessee shall additionally pay Landowner a late charge equal to ten percent (10%) of the delinquent installment of Rent. The parties agree that the amount of such late charge represents a reasonable estimate of the cost and expense that would be incurred by Landowner in processing each delinquent payment of Rent by Lessee, but the payment of such late charge shall not excuse or cure any default by Lessee under this Agreement. The parties further agree that the payment of late charges and the payment of interest provided for in this Section are distinct and separate from one another.

2.3 Intentionally Deleted.

2.4 Required and Proposed Improvements.

2.4.1 Fire Suppression System. Notwithstanding anything to the contrary contained in this Agreement, Lessee acknowledges that the Facility is presently out of compliance with certain fire suppression system requirements imposed by certain governmental authorities of the State of Nevada. One of these requirements is the installation of the improvements described on Exhibit “H” attached hereto and incorporated herein by this reference (the "Fire Suppression System"). Lessee agrees to install, at no cost to Landowner, the Fire Suppression System, and to diligently pursue such installation; provided, however, that if Lessee fails to complete the installation of the Fire Suppression System by the time that a governmental authority commences an enforcement action against the Facility arising from a failure to timely install the Fire Suppression System, such enforcement action shall not be a default under Section 11.1 of this Agreement so long as Lessee is diligently pursuing all commercially reasonable efforts to complete the installation of the Fire Suppression System as soon as practicable; further provided, however, that Landowner may declare a default under Section 11.1 in the event that Landowner is subjected to a fine as a result of an enforcement action unless Lessee pays such fine within five (5) days of receiving notice of such fine. Notwithstanding anything to the contrary in this Agreement, the Fire Suppression System shall conclusively be deemed a fixture of the Land, and title to the Fire Suppression System shall automatically transfer to Landlord without the need of a bill of sale upon the expiration or earlier termination of this Agreement.

3

2.4.2 Intentionally Deleted.

2.4.3 Status of Second Distillation Column. Notwithstanding anything to the contrary contained in this Agreement, if Lessee does not exercise the Option (defined below), the second distillation column previously installed at the Facility, which allows the Facility to have the capacity to produce no less than 50,000 gallons of vacuum gas oil per day (the "SDC"), shall remain the property of Landowner, and Lessee agrees that the SDC shall remain free and clear of any liens, financing statements, or other encumbrances.

2.4.4 Lessee's Additional Processing Equipment. Lessee may add, at its expense, additional processing equipment to supplement the refining capabilities of the Facility as of the Effective Date ("Lessee's Additional Processing Equipment"); Landowner agrees to allow Lessee to construct and operate Lessee's Additional Processing Equipment upon the condition that Lessee's Additional Processing Equipment is permitted by the terms of the Existing Permits (defined below); or Lessee obtains any additional permits necessary to permit the construction and operation of Lessee's Additional Processing Equipment. In order to avoid disputes as to the ownership of Lessee’s Additional Processing Equipment following a termination of this Lease, Lessee shall create and periodically supplement a schedule of Lessee’s Additional Processing Equipment as such equipment is installed at the Facility by Lessee (“Additional Processing Equipment Schedule”). Lessee shall provide updates of the Additional Processing Equipment Schedule to Landowner no later than ten (10) business days’ after Lessee completes installation of any equipment comprising Lessee’s Additional Processing Equipment at the Facility.

2.4.5 Status of Improvements Installed by Prior Lessee. Landowner and Lessee agree that Lessee has a perfected security interest (recorded deed of trust and filed UCC financing statement) in the personal property owned by Bango Refining NV, LLC (“Prior Tenant”) and brought onto the Property pursuant to that certain Lease With Option for Membership Interest Purchase dated as of August 4, 2010 by and between Landowner and Prior Tenant (“Prior Lease”). Lessee will obtain permission from Prior Tenant to use Prior Tenant's personal property that is located at the Property ("Prior Tenant Property") and may obtain title to all or a portion of the Prior Tenant Property by enforcing its security interest. Upon the expiration or earlier termination of this Lease, Lessee's security interest in the Prior Tenant Property shall terminate and Lessee's ownership interest in the Prior Tenant Property, if any, shall be deemed to have been conveyed to Landowner, without the need for a bill of sale to formally transfer title. For the purpose of clarity, the Prior Tenant Property does not include the SDC installed by Prior Tenant pursuant to the Prior Lease.

4

3. Purpose of this Agreement; Permitted Uses; Additional Construction.

3.1 Purpose of this Agreement. This Agreement is for the purpose of using the Facility and any Additional Facilities (defined below) to (i) re-refine used lubricating oils, blending re-refined lubricating oils, and each and every related and/or ancillary purpose or function (the "Existing Use") and (ii) design, construct, install, and operate a biorefinery for the purpose of producing renewable diesel fuel, renewable jet fuel, biochemicals and related byproducts (the "Proposed Use"), each to the extent permitted by applicable law, the Existing Permits and permits obtained after the date of this Agreement (collectively, the "Permitted Use"), and throughout the term of this Agreement, Lessee shall have the sole and exclusive right to use the Property for the Permitted Use. Lessee shall not use the Property for any purpose other than the Permitted Use without the prior written consent of Landowner, which consent may be withheld, in Landowner's reasonable discretion. Notwithstanding anything to the contrary in this Agreement, In no event shall Lessee construct or install any underground storage tanks on the Property. Lessee shall not construct or install any underground piping at the Property without Landowner's prior written consent, which consent shall not be unreasonably withheld, delayed or conditioned.

3.2 Use of the Property. Subject to Lessee's compliance with Section 3.1 of this Agreement, the rights granted to Lessee in this Agreement permit Lessee, by way of example and not limitation, to do the following:

3.2.1 Extract soil samples, perform geotechnical tests, and conduct such other tests, studies, inspections, and analysis on the Land as Lessee deems necessary, useful, or appropriate.

3.2.2 Construct, erect, install, operate, maintain, reinstall, enhance, replace, relocate and remove from time to time, the following "Additional Facilities" on, above, and under the Land:

(a) foundations and concrete pads, support structures, footings, anchors, fences, maintenance, security, office facilities, storage tanks and warehouses, staging areas for the assembly of equipment, and related facilities and equipment to be operated in conjunction with used oil re-refining equipment;

(b) electrical wires and cables required for the gathering and transmission of electrical energy and/or for communication purposes; water and sewage lines, leech fields, and wells; and roadway and railroad improvements including siding and spurs, and other related infrastructure improvements; and

(c) any other improvements, including facilities, machinery and equipment that Lessee reasonably determines are necessary, useful or appropriate to accomplish the Permitted Use, regardless of whether such improvements are located above, upon, or below the surface of the Property (subject, however, to Section 3.1 of this Agreement).

5

3.2.3 Remove, trim, prune, top or otherwise control the growth of any tree, shrub, plant or other vegetation that could obstruct, interfere with, or impair the Facility, Additional Facilities, or the Permitted Use;

3.2.4 Excavating, grading, leveling and otherwise modifying the Land, all in Lessee's sole discretion as Lessee may deem desirable or necessary in connection with the Permitted Use.

3.3 Lessee's Improvement Work. Should Lessee decide to construct any Additional Facilities, Lessee's improvement work shall be subject to the following requirements, the failure to comply with which is an explicit default under this Agreement:

3.3.1 Improvements; Approval of Plans. Lessee shall consult with Landowner on its site development plan prior to construction of any Additional Facilities, which plan shall depict the proposed location of new or expanded structures, transportation improvements, and utility lines, before making Lessee's final decisions (including applying for any construction permits) as to the location of such Additional Facilities on the Property. Within thirty (30) days of receiving Lessee's site development plan, Landowner shall notify Lessee of any concerns of Landowner, and Lessee shall make any reasonable modifications to its site development plan necessary to reasonably address Landowner's concerns; provided, however, that Lessee shall make all final siting decisions at its discretion, subject to working in good faith to address the concerns of Landowner. Within thirty (30) days after completion of the Additional Facilities, Lessee shall deliver a complete set of the as-built plans for the Additional Facilities, as well as any governmental permits, to Landowner.

3.3.2 General Contractor. Selection of a general contractor to construct the Additional Facilities shall be made by Lessee. The general contractor shall be licensed in the State of Nevada. All engineering shall be performed by, or under the supervision of, professional engineers licensed in the State of Nevada.

3.3.3 Liability. The Additional Facilities shall be constructed without cost or expense to Landowner and in accordance with the requirements of all laws, ordinances, codes, orders, rules, regulations, and any applicable entitlements, permits or approvals, of all governmental authorities having jurisdiction over the Property. Lessee agrees to defend, protect, indemnify, and hold Landowner, its successors, assigns, agents and employees harmless from and against any and all cost, liability, expense, damage, or injury resulting from, or arising in connection with, the construction, operation, repair, and maintenance of the Additional Facilities during the Lease Term.

3.3.4 Insurance. In addition to the other insurance requirements of this Agreement, prior to the commencement of any construction on the Property, Lessee shall obtain, or cause its contractors to obtain, on behalf of Lessee, its contractors and agents, without cost to Landowner, such additional insurance coverages as Landowner shall reasonably request in light of existing policies maintained by Lessee. Lessee shall also obtain general liability insurance for the mutual benefit of Landowner, Lessee, and the Property, and shall name Landowner an Additional Insured on such policy of insurance. To the extent not inconsistent with this Section, all of the aforementioned policies shall comply with the requirements of Section 7.3 of this Agreement.

6

3.3.5 No Subordination of Landowner's Fee Title. Landowner shall not be required to subordinate Landowner's fee interest in the Property or encumber its reversionary interest in the Property to any lien securing Lessee's construction loan or other financing.

3.3.6 No Waiver of Notice of Nonresponsibility. Lessee acknowledges that Landowner expressly does not waive its rights under NRS 108.234, including but not limited to, the right to record a Notice of Nonresponsibility prior to the commencement of any work of improvement on the Property, including the Additional Facilities. Lessee agrees to provide Landowner with at least thirty (30) days advance written notice of any contemplated construction activities in order to provide Landowner sufficient time to record Notices of Nonresponsibility and similar documents.

3.3.7 Liens and Fees. Lessee shall at all times indemnify, protect, defend, and hold harmless Landowner and Landowner's successors, assigns, agents and employees and the Property against all liens, or claims which may ripen into liens, and against all attorneys' fees and other costs and expenses, growing out of, incurred by reason of, or with respect to any construction done by or for Lessee on the Property. Lessee shall pay or otherwise secure payment (by bonding, letter of credit or other similar method of guaranteeing payment), no less than five (5) days in advance of their respective due dates, all invoices related to any construction work of Lessee that could potentially ripen into a lien. Should Lessee fail to fully discharge any lien or claim, or in the alternative fail to post a bond sufficient to discharge such lien or claim within twenty (20) days after written request by Landowner, then Landowner, at its option, may pay the same or any part thereof. Landowner shall be the sole judge of the legality of such lien or claim. All amounts so paid by Landowner, together with interest in the per annum amount equal to two percent (2%) in excess of the Reference Rate of Interest, but in no event in excess of the maximum interest rate permitted by law, from the time of payment until repayment, shall be repaid by Lessee as additional Rent on the next Rent payment date after written notice by Landowner is delivered to Lessee.

3.4 Entitlements and Environmental Permits.

3.4.1 Existing Entitlements and Permits. Lessee acknowledges that certain state and local entitlements, permits, and other governmental approvals, as well as certain transportation and service agreements, are currently in use with respect to the operation of the Property (the "Existing Permits"). A non-exhaustive listing of the Existing Permits is attached hereto as Exhibit "B" and incorporated herein by this reference. Notwithstanding anything to the contrary contained in this Agreement, the Amended Special Use Permit issued by Churchill County, Nevada to Landowner on or about May 10, 2010 ("ASUP") shall be considered an Existing Permit under this Agreement, and Lessee agrees to use its best efforts to ensure that the ASUP remains in full force and effect. To the extent permitted by law, and to the extent necessary to allow Lessee to perform the Existing Use, upon Lessee's written request, Landowner agrees to assign, transfer, or convey the Existing Permits held in Landowner's name to Lessee, or, to the extent not otherwise transferrable to Lessee, to use its best efforts to make available to Lessee the operating rights and privileges associated with any such non-transferrable permit. Lessee agrees to fully cooperate with Landowner's efforts to make available to Lessee the operating rights and privileges associated with any such non-transferrable permit, and Lessee further agrees to apply for any non-transferrable permits that Lessee determines are necessary to the Existing Use. Lessee agrees to assign any such assigned permits to Landowner upon the expiration or earlier termination of the Lease Term. Lessee expressly acknowledges that a substantial portion of the Facility's and the Property's value is dependent on the Existing Permits; accordingly, subject to Section 2.4.1 of this Agreement, Lessee agrees to use its best efforts to ensure that none of the Existing Permits lapse, expire, terminate, become subject to revocation or are revoked, or are materially conditioned by reason of any action or inaction on the part of Lessee without Landowner's express written consent. Landowner agrees that so long as Lessee complies with Section 2.4.1 of this Agreement, the suspension, revocation or other action by applicable governmental authorities with respect to any of the Existing Permits due to the lack of the Fire Suppression System shall not constitute a breach of this provision. Lessee expressly acknowledges that Lessee's breach of this provision could materially reduce the value of the Property, and that such reduction in value could be equal to the total Purchase Consideration (defined below) without offset for Rent, and Lessee agrees that it shall have the burden of proving that Landowner's damages in such event are less than the total Purchase Consideration without offset for Rent. Lessee acknowledges that its breach of this provision shall constitute an Event of Default under this Agreement and shall, notwithstanding anything to the contrary contained in this Agreement, have the effect of both: (i) subjecting Lessee to Consequential Damages (defined below) claims by Landowner; and (ii) prohibiting Lessee from exercising its right to terminate this Agreement pursuant to Section 1.4 of this Agreement; provided, however, that Lessee's right to exercise the Option (defined below) shall not be impaired.

7

3.4.2 New Entitlements and Permits. Landowner agrees to execute or join with Lessee as necessary in the execution of any governmental or private entitlement or permit applications to obtain such entitlements or permits as may be reasonably necessary for the Lessee's permitted development and use of the Property, all at Lessee's expense and without cost or expense to Landowner. If Lessee is threatened with any governmental action that could have the effect of revoking or materially conditioning any entitlement or permit obtained by Lessee, Landowner shall have the right, but not the obligation, to participate in any relevant governmental proceeding, but at Landowner's own cost. To the extent permitted by law, Lessee shall assign any new entitlements or permits relating to the Property to Landowner upon the expiration or earlier termination of the Lease Term; upon Lessee's exercise of the Option, Landowner agrees to use its best efforts to assist Lessee in assigning all new permits to the Landowner entity.

3.4.3 Lessee's Right of Rescission. Subject to the provisions of Section 3.4.1 of this Agreement, which are acknowledged to waive Landowner's obligation to assign any Existing Permit to Lessee if and to the extent that Lessee does not need such permit assigned to engage in the Existing Use and such permit was not assigned to Prior Tenant, in the event Landowner is unable to transfer, or otherwise make available for Lessee's use in operating the Facility, any Existing Permit (each, a "Non-Transferrable Privilege") which Non-Transferrable Privilege is essential to Lessee's operation of the Facility for the Existing Use or in the event Lessee is unable to obtain any other permit necessary for the Operation of the Facility for the Existing Use, including without limitation, any permits held by Prior Lessee that cannot be transferred to Lessee or reissued to Lessee, Lessee shall have the option of rescinding this agreement by sending written notice thereof to Landowner, which notice shall identify the Non-Transferrable Privilege or other permit and the reason why it is essential to Lessee's operation of the Facility for the Existing Use, and specifying an effective date of sixty (60) days after the date of such notice, whereupon each Party shall, as nearly as practicable, and with the exception of rental paid to Landowner through the effective date of Lessee's rescission notice, if any, be placed in the same position such Party was in prior to entering into this Agreement. Notwithstanding anything to the contrary contained in this Section 3, but subject to Landowner using its best efforts to make available the necessary rights granted under the respective Non-Transferable Privilege, Lessee's right of rescission shall not be not triggered by issues related to: (i) Existing Permits that by their own terms, or by state law, are non-transferrable, but which remain effective by virtue of Landowner's ownership of the Property for Lessee's use in operating the Facility; or (ii) any matters related to the Proposed Use. In no event shall Lessee be entitled to exercise its right of rescission until and unless it has applied for a Non-Transferrable Permit or other necessary permit (or an assignment of same) and been denied by the appropriate governmental agency.

8

4. Ownership and Operation of Fixtures and Personal Property; Water Rights Matters; Existing Security Interests and Mechanics' Liens.

4.1 Ownership of the Facility and Additional Facilities. Title to the Facility (except for Lessee's Additional Processing Equipment), regardless of whether the improvements comprising the Facility are considered real property, fixtures, or personal property, is reserved to Landowner and shall remain the sole property of Landowner. Lessee's use of the Facility is merely usufructary in nature. Lessee has no right to, and shall not attempt to, remove, convey, or encumber any portion of, or interest in, the Facility, and no such conveyance or encumbrance shall have any force or effect. Upon the expiration or earlier termination of the Lease Term, Lessee shall return the Facility, together with any and all Additional Facilities, save and except for Lessee's Additional Processing Equipment (which Lessee shall be entitled to remove subject to Lessee's obligation to restore the Facility to the condition existing as of the Effective Date reasonable wear and tear and loss by casualty excepted), to Landowner in substantially the same condition as it exists on the Effective Date or, in the case of Additional Facilities, the date on which such Additional Facilities were first placed in service, reasonable wear and tear excepted.

4.2 Operation and Repair of the Facility and Additional Facilities. The manner of operation of the Facility and the Additional Facilities is within the discretion of Lessee, so long as Lessee's operations are undertaken in a prudent and safe manner; provided, however, that Lessee shall not operate the Facility or the Additional Facilities in such a manner as to allow the Facility or the Additional Facilities to fall into a state of disrepair, to cause a common law nuisance, or to cause the violation of any state, local, or federal law, regulation, standard, or of any condition of any permit, approval, or entitlement. Lessee shall perform reasonable maintenance of the Facilities and, as and when necessary, repair or replace components of the Facility in order to ensure that the Facility remains in substantially the same condition as on the Effective Date.

4.3 Water Rights and Agreements. Notwithstanding anything to the contrary contained in this Agreement, Landowner shall retain any and all existing water rights, existing interests in water rights, including, without limitation, NDWR Permits 73000 and 80516, existing claims to water (including applications now pending with the State Engineer), and existing water banking agreements, water credits, and will-serve letters (whether governmental or quasi-governmental in nature) which are appurtenant and/or related to the Property and all such rights shall be made available to Lessee pursuant to this Agreement. Lessee shall have the obligation to obtain any additional water rights necessary to the operation of the Facility ("Additional Water Rights"), which Additional Water Rights, once obtained, shall remain the property of Lessee; provided, however, that Landowner shall have the option to acquire the Additional Water Rights, for the price paid by Lessee to acquire the Additional Water Rights, in the event that Lessee either declines to exercise the Option or commits or causes to occur an Event of Default (defined below).

9

4.4 Previously Leased or Encumbered Equipment. The Parties agree that in the event of a conflict between the terms of this Section 4.4 and the remainder of Section 4, the terms and conditions of this Section 4.4 shall prevail. Effective as of February 21, 2015 (the "Trigger Date"), if Lessee satisfies any security interests existing against equipment and other property located at the Facility (the "Third-Party Collateral"), except for the Existing Mechanics' Liens (defined below) Lessee shall be entitled to receive a fifty percent (50%) reimbursement for Lessee's documented costs in satisfying such security interests against the Third-Party Collateral in the event that (i) Lessee defaults under this Agreement and (ii) Landowner retakes possession of the Property and the Third-Party Collateral; provided, however, that in order to be entitled to such reimbursement, Lessee shall provide Landowner a running schedule of all such costs Lessee may seek reimbursement of, which schedule shall be prepared and updated by Lessee upon any payment related to the Third-Party Collateral, and which schedule Landowner shall be entitled to audit and obtain any reasonably necessary backup documentation with respect to. Lessee's fifty percent (50%) reimbursement for the Third-Party Collateral shall be paid by Landowner either (x) out of the proceeds of a sale or lease of the Property by Landowner to an unrelated third-party or (y) out of Landowner's operational profits from the Facility should Landowner engage a third-party operator to operate the Facility on Landowner's behalf, in either case on an equal, 50/50, basis (i.e., of each dollar of proceeds or profits, as the case may be, received by Landowner, Landowner shall be entitled to fifty cents, and Lessee shall be entitled to fifty cents) until such time as Landowner has satisfied its reimbursement obligation under this Section 4.4. Upon Lessee’s request, Lessee shall have the right to receive documentation in reasonable detail of Landowner's proceeds or profits, as applicable. Notwithstanding anything to the contrary in this Agreement, Lessee will not grant any security interests or liens purporting to encumber Landowner’s fee interest in and to the Land or any fixtures at the Facility (other than Lessee's Additional Processing Equipment) without Landowner's prior written consent; provided, however, that for the purpose of clarity, as between Landowner and Lessee, Landowner consents to, but does not concede to the effectiveness of, the security interests purporting to encumber the Facility as of the Effective Date, as the same are scheduled on Schedule 4.4 attached hereto and incorporated herein by this reference, and Landowner will not assert a default against Lessee under this Agreement as a result of such existing security interests.

4.5 Existing Mechanics Liens. The Parties agree that in the event of a conflict between the terms of this Section 4.5 and the remainder of Section 4, the terms and conditions of this Section 4.5 shall prevail. Landowner and Lessee agree to cooperate toward the timely removal (whether through direct payment, expungement, or bonding-over) of all mechanics' liens filed against the Land as of the Effective Date, which liens are scheduled on Schedule 4.5 attached hereto and incorporated herein by this reference (the "Existing Mechanics' Liens"). To the extent such Existing Mechanics’ Liens are not first satisfied or expunged by Prior Lessee, Landowner agrees to take the lead role in negotiating the removal of the Existing Mechanics' Liens and in responding to any litigation filed by any such lien claimants; provided, however, that Landowner and Lessee shall equally share, on a 50/50 basis, the responsibility for any payments to mechanics' lien claimants with respect to the Existing Mechanics' Liens. For the purpose of clarity, any mechanics' liens occasioned by Prior Lessee's (defined below) operations at the Property shall be subject to the cost-sharing mechanism expressed in this Section 4.5; provided, however, that Lessee shall have the sole responsibility to remove any mechanics' liens arising from Lessee's operations at the Property occurring on or after the Trigger Date. For the purpose of clarity, it is expressly agreed by and between the Parties that there are no third-party beneficiaries, express or implied, of this Section 4.5.

10

5. Taxes. During the Lease Term, in addition to the Rent, Lessee shall pay, on a pro-rated basis, all property taxes and assessments that are levied against the Property, including taxes that are attributable to the installation of Additional Facilities on the Property or any reclassification of the Property as a result of the Additional Facilities or this Agreement, to the extent that such increase is not separately assessed as personal property to Lessee and paid directly by Lessee to the taxing authorities. For the purpose of clarity, Lessee shall be responsible for the payment of all property taxes assessed against the Facility during the Lease Term, regardless of whether such taxes are directly charged to Lessee (as in the case of new personal property) or are changed to Landowner (as is the case with real property and existing personal property). Landowner shall submit the property tax bill and the bill for any assessments against the Property to Lessee within ten (10) days after Landowner receives the bill from the taxing authority. No later than fifteen (15) days prior to the due date of any installment, Lessee shall pay the property taxes and assessments for which Lessee is responsible under the terms of this Agreement directly to the taxing authority. Lessee shall have the right, upon prior written notice to Landowner, to contest or review the amount, applicability or validity of any real or personal property taxes which are assessed against the Property by appropriate lawful proceedings, which, if instituted, shall be diligently conducted by Lessee in good faith at its own cost and expense, and free of any expense to Landowner, and Landowner shall, upon the request of Lessee, execute all documents reasonably necessary to accomplish such contest or review; provided, however, that Landowner shall not be required to assume any expenses, obligations, or liabilities with respect thereto. Lessee shall indemnify and hold Landowner harmless from and against all claims arising out of such contest or review conducted by Lessee. If at any time the Property or any part thereof shall then be subject to forfeiture, or if Landowner shall be subject to any liability arising out of the nonpayment of real property or personal property taxes, Lessee shall, notwithstanding any pending contest or review, either pay such taxes or post such bonds as the taxing authority may require to prevent such forfeiture or liability.

6. Hazardous Materials and Substances.

6.1. Covenant. Lessee covenants to Landowner that it will not use, or allow to be used on the Property, or bring onto, or allow to be brought onto, the Property, any Hazardous Substance (defined below), except as may be required in connection with the Permitted Use, and then only in full compliance with all applicable federal, state and local laws, regulations, and any conditions of permits, entitlements, and approvals. Lessee shall not violate, and does hereby agree to indemnify, protect, defend and hold Landowner harmless against, any violation by Lessee or Lessee's agents, invitees, sublessees (including, without limitation, Aemetis Advanced Fuels, Inc.) or contractors of any federal, state, or local law, ordinance, regulation, permit, approval, or entitlement relating to the generation, manufacture, production, use, storage, release or threatened release, discharge, disposal, transportation or presence of any substance, material or waste which is introduced, released, or brought onto the Property by Lessee and which is now or hereafter classified as hazardous or toxic, or which is regulated under current or future federal, state or local laws or regulations, or which otherwise qualifies as a Hazardous Substance. Further, Lessee shall not install, or allow to be installed, any underground fuel storage tanks on the Property.

11

6.2. Right of Entry. Subject to Lessee's normal security policies, Landowner reserves the right to enter the Property at any reasonable time and upon reasonable notice, and at any time in exigent circumstances, for the purpose of inspecting and examining the Property for the presence of any Hazardous Substance. If the results of such inspection or examination reveal the presence of Hazardous Substances in violation of any law, permit, approval, or regulation in, on, or about the Property, the presence of which would constitute a violation of any provision of this Agreement, then Lessee shall reimburse Landowner for its costs incurred in undertaking such inspection and examination, and, at Landowner's option, Landowner may remediate the Hazardous Substances at Lessee's sole cost and expense.

6.3. Hazardous Materials Indemnity. Lessee shall indemnify, defend, protect, save, and hold Landowner and its successors, assigns, agents, employees and representatives harmless in accordance with and subject to the provisions of the Environmental Responsibilities Addendum attached hereto as Exhibit "C" and incorporated herein by this reference. For the purpose of clarity, Lessee acknowledges that the indemnity granted in this Section 6.3, as well as the Environmental Responsibility Addendum, each require Lessee to assume Prior Lessee's environmental obligations and indemnities under the Prior Lease and Lessee hereby assumes such obligations.

6.4. Hazardous Substances Defined. As used in this Agreement, the term "Hazardous Substances" shall include: (i) explosives, radioactive materials, hazardous wastes or substances, toxic wastes or substances or any other similar materials or pollutants which pose a hazard to the Property, or to persons on or about same, cause the Property to be in violation of any law or local approval, or are defined as or included in the definition of "hazardous substances", "hazardous wastes", "hazardous materials", or "toxic", or words of similar import under any applicable law, including, but not limited to: (A) the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended, 42 U.S.C. § 9601, et seq.; (B) the Hazardous Materials Transportation Act, as amended. 49 U.S.C. § 1801. et seq.; (C) the Resource Conservation and Recovery Act, as amended. 42 U.S.C. § 6901, et seq.; and (D) regulations adopted and publications promulgated pursuant to the aforesaid laws, and similar laws of the State of Nevada, including, without limitation, the Nevada Administrative Code regulations adopted by the Nevada Division of Environmental Protection (collectively. the "Environmental Laws"); (ii) asbestos in any form which is or could become friable, urea formaldehyde foam insulation, transformers or other equipment which contain dielectric fluid containing levels of polychlorinated biphenyls in excess of 50 parts per million; and (iii) any other chemical, material or substance, exposure to which is prohibited, limited or regulated by any governmental authority under any Environmental Laws now or hereafter in effect.

12

7. Lessee's Representations, Warranties and Covenants. In addition to Lessee's other representations, warranties, and covenants expressed in this Agreement, Lessee hereby represents, warrants and covenants to as follows:

7.1 Lessee's Authority. Lessee is a limited liability company organized under the laws of the State of Nevada, is duly qualified to do business in Nevada, and has the unrestricted right and authority to execute this Agreement. The person signing this Agreement on behalf of Lessee is authorized to do so. When signed by Lessee, this Agreement constitutes a valid and binding agreement enforceable against Lessee in accordance with its terms. No consent or other approval, authorization or action by, or filing with, any person is required to be made or obtained by such party for Lessee's lawful execution, delivery and performance of this Agreement.

7.2 Landowner's Continuing Rights. Landowner shall have no right to use the Property during the Lease Term; provided, however, that except with respect to the Additional Water Rights, Landowner shall continue to have any and all rights related to water appurtenant to the Property, as well as to any and all subsurface resources, except to the extent that Landowner's exercise of its subsurface rights would unreasonably interfere with the Permitted Use. As used in this Agreement, "unreasonable interference" means any activities that materially lessen, or reasonably threaten to materially lessen, the Lessee's ability to use the Facility in accordance with the Permitted Use including, without limitation, excess vibration or blasting impacts.

7.3 Insurance. Lessee shall, at its expense, maintain the insurance coverages set forth in Exhibit "D" attached hereto and incorporated by this reference, or as otherwise required in this Agreement. Lessee shall name Landowner as an additional insured on all such policies. Certificates of insurance evidencing the coverages required by this Agreement shall be provided to Landowner annually, as well as at Landowner's periodic request. Such certificates of insurance shall provide evidence that the insurance will not be cancelled, materially changed, or not renewed until the expiration of thirty (30) days after written notice of cancellation, material change, or nonrenewal has been received by Landowner.

7.4 Indemnity. Lessee will indemnify, defend, protect, and hold harmless Landowner against costs and other liabilities for physical damage to property, for fines and/or governmental liabilities, for physical injuries or death, for environmental claims (except as otherwise set forth in, and subject to the provisions of, the Environmental Responsibilities Addendum), for claims related to the infringement of Landowner's Proprietary Information (defined below), for claims of nuisance, caused by, in connection with, or in any manner related to, Lessee's or any sublessee's (including, without limitation, Aemetis Advanced Fuels, Inc.) construction, operation, maintenance, repair, replacement, or removal of the Facilities or the Additional Facilities, the Permitted Use, or otherwise related to Lessee's, or any sublessee's (including, without limitation, Aemetis Advanced Fuels, Inc.), use of, or occupancy on, the Property, except to the extent such damages, injuries or death arose before the Effective Date (exempting claims arising under Section 6.3 or the Environmental Responsibilities Addendum) or are caused by the gross negligence or willful misconduct of Landowner or Landowner's invitees. Landowner authorizes Lessee, at Lessee's sole expense, to take all reasonable safety and security measures to reduce the risk that the Facility or Additional Facilities will cause damage, injury, or death to people, livestock, other animals, and real and personal property. The terms set forth in this Section 7.4 shall survive termination of this Agreement.

13

7.5 Governmental Approvals. During the Lease Term, Lessee, at its expense, shall comply in all respects with all laws, ordinances, statutes, orders, and regulations, and conditions of permits, approvals and entitlements of any governmental agency applicable to the Property. Additionally, Lessee shall, at its expense, use its best efforts to maintain in full force and effect all governmental permits or other authorizations connected with the Property, the Facility, or the Additional Facilities, including, without limitation, compliance with minimum work and renewal requirements. Landowner shall, to the extent required by law or as otherwise requested by Lessee, cooperate in such activities, provided Lessee reimburses Landowner for its out-of-pocket expenses incurred in connection with such cooperation. Any breach of Lessee's obligations pursuant to this Section is specifically acknowledged by Lessee to be material, and any such breach shall allow Landowner to pursue each and every of its remedies pursuant to this Agreement.

7.6 Construction Liens. Except as provided in Section 4.5, Lessee shall keep the Property free and clear of all liens and claims of liens for labor and services performed on, and materials, supplies or equipment furnished to, the Property; provided, however, that if Lessee wishes to contest any such lien, Lessee shall, within thirty (30) days after it receives notice of the filing of such lien, remove or bond around such lien pursuant to applicable law.

7.7 Brokers' Agreements. Lessee hereby represents and warrants that no broker's commission or fee is due to any party engaged by Lessee in connection with this Agreement, and Lessee agrees to indemnify, defend, protect, and hold Landowner harmless from any claims or actions by any such third parties for a broker's commission or fee.

7.8 Accounting Matters. Lessee represents and warrants that Lessee will perform and utilize substantially similar accounting methods to those utilized by Landowner as of the Effective Date, it being acknowledged by Lessee that Landowner's current accounting methods generate reports that are necessary for required reporting to governmental agencies.

7.9 Turnover and Restoration. Lessee will be permitted thirty (30) days after the expiration or earlier termination of this Agreement to remove Lessee’s Additional Processing Equipment, without additional charge or rental for such entry and removal, and without such entry constituting a holdover. Lessee hereby warrants that Lessee’s removal of Lessee’s Additional Processing Equipment shall be performed in a good and workmanlike manner, and Lessee shall be obligated to restore the Facility to the condition existing as of the Effective Date, reasonable wear and tear and loss by casualty excepted. Lessee hereby further represents and warrants that, upon the expiration or earlier termination of this Agreement and the removal of Lessee’s Additional Processing Equipment, the Facility shall be left in operable condition and in substantially the same condition as of the Effective Date, reasonable wear and tear excluded.

14

8. Landowner's Representations, Warranties and Covenants. In addition to Landowner's other representations, warranties and covenants expressed in this Agreement, Landowner hereby represents, warrants and covenants to Lessee as follows:

8.1 Landowner's Authority. Landowner is a limited liability company organized under the laws of the State of Nevada and duly qualified to do business in Nevada, is the sole owner of the Property, and has the unrestricted right and authority to execute this Agreement and to grant to Lessee the rights granted hereunder. The person signing this Agreement on behalf of Landowner is authorized to do so. When signed by Landowner, this Agreement constitutes a valid and binding agreement enforceable against Landowner in accordance with its terms. No consent or other approval, authorization or action by, or filing with, any person is required to be made or obtained by such party for Landowner's lawful execution, delivery and performance of this Agreement.

8.2 No Interference. Landowner's activities and any grant of rights Landowner makes to any person or entity shall not impede or interfere with the Permitted Use or Lessee's right to possess the Property free of unreasonable interference.

8.3 Title Policy and Cooperation. Lessee shall have the right, but not the obligation, to obtain a title insurance policy insuring its leasehold interest in the Property from a title insurer of its choice, and at its sole cost. Landowner shall cooperate with Lessee to obtain non-disturbance, subordination, and attornment agreements as requested by Lessee from any person with a lien, encumbrance, mortgage, lease, or other material exception to Landowner's fee title to the Property, to the limited extent necessary to eliminate any actual interference by any such person with any rights granted to Lessee under this Agreement.

8.4 Requirements of Governmental Agencies. Landowner, at no cost to Landowner, shall assist and fully cooperate with Lessee in complying with or obtaining any land use and environmental entitlements, permits, and approvals, tax-incentive or tax-abatement program approvals, building and site improvement permits, environmental permits, or any other approvals required or deemed desirable by Lessee in connection with the Permitted Use, including execution of applications for such approvals and delivery of information and documentation related thereto, and execution, if required, of any orders or conditions of approval. Lessee shall reimburse Landowner for its out-of-pocket expenses incurred in connection with such cooperation, to the extent Lessee has approved such expenses in advance.

8.5 Indemnity. Landowner will defend, indemnify, protect, and hold harmless Lessee for, from, and against liability by reason of, resulting from, or arising out of: (i) the inaccuracy of any representation or warranty of Landowner set forth in this Agreement; (ii) the non-fulfillment or nonperformance of any covenant of Landowner set forth in this Agreement; (iii) for fines and/or governmental liabilities, for physical injuries or death, for environmental claims, or for claims of nuisance, caused by, in connection with, or in any manner related to, Landowner's operation, maintenance and repair of the Facility prior to the Effective Date (except as otherwise set forth in, and subject to the provisions of, the Environmental Responsibilities Addendum); (iv) the gross negligence or willful misconduct of Landowner or its representatives and agents in the performance of their obligations under this Agreement; (v) for physical damage to the Property, and for physical injuries or death to Lessee or its employees, invitees, contractors or the public, to the extent caused by the gross negligence or willful misconduct of Landowner; and (vi) any claims or losses asserted by Prior Lessee in relation to the Prior Lease, except for those claims caused or occasioned by Lessee’s actions, omissions, or negligence.

15

8.6 Hazardous Materials. As of the effective date of the Prior Lease, Landowner was in material compliance with all state, federal, and local environmental laws as the same were applicable to the Property, and Landowner was not subject to any environmental proceedings with respect to the Property. Landowner has not received any written notice of any violation, that, as of the effective date of the Prior Lease, remained uncured, and to Landowner's actual knowledge no writs, injunctions, decrees, orders or judgments have been instituted or filed, under any Environmental Laws with respect to the ownership, use or occupation of the Property. Landowner shall not violate, and shall indemnify Lessee for, from and against any violation by Landowner of any federal, state or local law, ordinance or regulation relating to the generation, manufacture, production, use, storage, release, discharge, disposal, transportation or presence of any Hazardous Substance.

8.7 Quiet Enjoyment. Landowner covenants and warrants that Lessee shall peacefully hold and enjoy all of the rights granted by this Agreement for the Lease Term without hindrance or interruption by Landowner, or any person claiming by, through, or under Landowner.

8.8 Utilities. Landowner shall cooperate with Lessee in Lessee's efforts to obtain utility services to and from the Property, including executing any applications or assignments necessary for such service to the Property, and, to the extent necessary, granting service providers easements or licenses to cross the Property for terms coextensive with the Lease Term, provided that Lessee shall be solely responsible for all costs related to such services, including those costs related to construction and operation of the facilities necessary to provide such services, and those costs related to Landowner's legal review of any such instruments.

8.9 Brokers' Agreements. Landowner hereby represents and warrants that no broker's commission or fee is due to any party engaged by Landowner in connection with this Agreement and agrees to indemnify, defend and hold Lessee harmless from any claims or actions by any such third parties for a broker's commission or fee in connection with this Agreement.

8.10 Condemnation. Landowner hereby represents that there are no pending or, to Landowner's actual knowledge, threatened condemnation proceedings affecting the Property.

16

8.11 Absence of Changes/No Undisclosed Liabilities. Landowner shall provide Lessee with a current balance sheet, accurately detailing Landowner's assets, liabilities and ownership equity as of the Effective Date in a form substantially similar to that attached hereto as Exhibit "E" and incorporated herein by this reference. Landowner hereby represents that, during the Lease Term, Landowner will take no action whatsoever that will result in any material adverse change in Landowner's business, condition, capitalization, assets (tangible or intangible), liabilities, operations and financial performance. Furthermore, during the Lease Term, Landowner will not incur or accrue any material contingent or other liabilities of any nature. Notwithstanding anything to the contrary contained in this Section 8.11, intra-company loans or liabilities shall not be considered a violation of this Section 8.11. For purposes of this Section 8.11, "intra-company loans or liabilities" shall mean transactions between Landowner and its LLC members. In the event that Lessee exercises its option to purchase all of the Landowner entity as provided in Section 13 of this Agreement, any change or deviation from Landowner's balance sheet shall be adjusted by the parties prior to the Closing (as defined in the Membership Interest Purchase Agreement).

9. Transfers. Lessee and, as applicable, any Permitted Transferee (defined below) shall have the right, subject to Landowner's written consent, which shall not be unreasonably withheld, conditioned or delayed, to do any of the following: (i) finance Additional Facilities; (ii) encumber with a deed of trust or other security instrument this Agreement, or Lessee's leasehold estate in the Property; or (iii) assign this Agreement to a Permitted Transferee; provided that in no event shall Landowner be required to subordinate or encumber its fee title interest in the Property, or any part thereof or interest therein, in connection with any such mortgage, deed of trust, hypothecation, or other transfer, and further provided that, for purposes of clarity, that in no event shall Lessee encumber, or attempt to encumber, Landowner's fee interest in the Property. Landowner consents to the existing security interests against the Facility, as the same are scheduled on Schedule 4.4 attached hereto and incorporated herein by this reference, and Landowner will not assert a default against Lessee under this Agreement as a result of such existing security interests. A "Permitted Transferee" is any of the following: (i) any purchaser of more than seventy percent (70%) of the membership interests in, or stock of, Lessee; (ii) a wholly-owned U.S. subsidiary of Vertex or Vertex Energy Operating, LLC qualified to do business in Nevada; or (iii) any entity to which Landowner gives Lessee written consent to a proposed transfer; provided, however, that Landowner may unreasonably withhold such consent in its sole and absolute discretion; and further provided, however, that Landowner's refusal to provide its written consent to any proposed assignee that has an audited net worth lower than that of Lessee shall not be deemed unreasonable or made in bad faith. Notwithstanding anything to the contrary contained in this Agreement, Lessee shall continue to be liable, jointly and severally, with any Permitted Transferee, for all liabilities and obligations of Lessee under this Agreement, including, without limitation, the representation and warranty and indemnity provisions of this Agreement, after this Agreement has been assigned to a Permitted Transferee. Subject to Section 8.11 of this Agreement, this Agreement may be assigned or otherwise encumbered by Landowner, and Landowner may sell the Land and the Facility, without the prior written consent of Lessee.

17

10. EXPROPRIATION AND CASUALTY.

10.1 Expropriation of Entire Property or Portions of the Facility. If, during the Term of this Agreement, the entire Property, or any portion of the Property such that Lessee's ability to operate the Facility for the Permitted Use is materially and adversely affected and such operations or facilities cannot be relocated to another part of the Property, as reasonably determined by Landowner and Lessee, shall be taken as the result of the exercise of the power of expropriation (a "Major Taking"), this Agreement and all right, title and interest of Lessee hereunder shall cease and come to an end on the date of vesting of title pursuant to the Major Taking and Landowner shall be entitled to and shall receive the total award allocable to the Property with respect to the Major Taking; provided, however, that nothing contained in this Section 10 shall be deemed to give Landowner any interest in, or to require Lessee to assign to Landowner, any award made to Lessee for the taking of the Lessee's business operations or any personal property belonging to Lessee, reasonable expenses of relocation, and any interest accruing thereon (collectively, the "Lessee's Recoverable Damages").

10.2 Partial Expropriation/Continuation of Lease. If any part of the Property shall be taken in an expropriation proceeding other than a Major Taking ("Minor Taking"), then this Agreement shall, upon vesting of title in the Minor Taking, terminate as to the parts so taken, and Lessee shall have no claim or interest in the award, damages, consequential damages and compensation, or any part thereof other than for Lessee's Recoverable Damages. Landowner shall be entitled to and shall receive the total award made in such Minor Taking, Lessee hereby assigning any interest in such award, damages, consequential damages and compensation to Landowner, and Lessee hereby waiving any right Lessee has now or may have under present or future law to receive any separate award of damages for its interest in the Property, or any portion thereof, or its interest in this Agreement; provided, however, that nothing contained herein shall be deemed to give Landowner any interest in, or to require Lessee to assign to Landowner, any award made to Lessee for Lessee's Recoverable Damages.

10.3 Continuance of Obligations. In the event of any termination of this Agreement as a result of any such Major Taking or Minor Taking, Lessee shall pay to Landowner all Rent and all additional Rent and other charges payable hereunder, justly apportioned to the date of such termination. If this Agreement is not terminated, then, from and after the date of vesting of title in such proceedings, Lessee shall continue to pay all of the Rent and additional Rent and other charges payable hereunder provided in this Agreement, to be paid by Lessee, it being expressly agreed to by Landowner and Lessee that there shall in no event be any abatement or adjustment of any rental amounts due under this Agreement as a result of any such proceedings or the exercise of any power of eminent domain.

10.4 Fire and Casualty Damage. Notwithstanding anything to the contrary contained in this Agreement, Lessee shall obtain fire and other casualty insurance in the amount of the full replacement value of the Facility and, as applicable, any Additional Facilities. If any of the Property shall be damaged by fire or other casualty, then Lessee shall give prompt written notice thereof to Landowner, and Lessee shall proceed to restore such portion of the Property that is damaged by the casualty to substantially the same or better condition as on the Effective Date, reasonable wear and tear excepted. Lessee shall commence the restoration and reconstruction work within a reasonable period following the casualty, and shall use reasonable diligence to complete such work as soon as reasonably possible. Lessee shall have the right to adjust and settle all property insurance claims relating thereto, subject to Landowner's approval, not to be unreasonably withheld, conditioned or delayed. Lessee shall have the sole responsibility for restoring and rebuilding the Property, and Landowner shall have no obligation to Lessee and shall not be liable for any inconvenience or annoyance to Lessee or injury to the business of Lessee resulting in any way from such damage or the repair thereof. Lessee shall not be entitled to any diminution in Rent during the time and to the extent any of the Property are unfit for occupancy. If the insurance proceeds received by, or for the account of, Lessee, shall be insufficient to pay the entire cost of necessary repairs and restoration, Lessee shall supply the amount of any such deficiency and shall apply the same to the payment of the cost of such repair and restoration. Under no circumstances shall Landowner be obligated to make any payment or contribution toward the cost of any repairs or restoration.

18

11. Default.

11.1 Event of Default. With respect to a Party, an event of default ("Event of Default") shall exist under this Agreement if:

(a) such Party fails to pay any amount within ten (10) business days after receipt of written notice that such amount is past due;

(b) except as otherwise expressly set forth, such Party is in breach of any representation or warranty set forth herein or fails to perform any material obligation set forth in this Agreement, and such breach or failure is not cured within thirty (30) days after notice from the non-defaulting Party; provided, however, that if the breach or failure is such that it cannot be cured within such thirty (30) day period using commercially reasonable efforts ,the cure period shall be extended so long as the defaulting Party is diligently pursuing such cure; and further provided, however, that the cure period shall be extended by the number of days during which the defaulting Party is prevented from taking curative action solely by Force Majeure (defined below) if the defaulting Party had begun curative action and was proceeding diligently, using commercially reasonable efforts, to complete such curative action;

(c) as to Lessee, Lessee files a petition or answer seeking reorganization or arrangement under the federal bankruptcy laws or any other applicable law or statute of the United States of America or any State, district, or territory thereof;

(d) as to Lessee, Lessee is determined to be, by the relevant governmental entity, whether administratively or judicially, in violation of a federal, state, or local law or regulation, or of a permit or governmental approval, and such breach or failure is not cured within ten (10) days after notice from the non-defaulting party; or

(e) as to Lessee, any material breach of Section 3.4.1 of this Agreement.

11.2 Remedies. Upon an Event of Default by one Party, the other Party shall have the right, but not the obligation, to terminate or suspend this Agreement, in part or in whole as to the Property, with respect to all obligations arising after the effective date of such termination or suspension (other than payment obligations relating to obligations arising prior to such termination or suspension), or to pursue any appropriate civil action against the defaulting Party. The defaulting Party shall be liable to reimburse the non-defaulting Party for such non-defaulting Party's expenses and costs relating to such default (including, but not limited to, reasonable attorneys' fees).

19

11.3 Cumulative Remedies. Each Party shall have all rights and remedies available at law and in equity for any breach of this Agreement by the other Party.

11.4 Consequential Damages. The Parties agree that it is the intent that, neither Landowner nor Lessee, nor their respective officers, directors, partners, shareholders, agents, employees, contractors or affiliates, shall be liable to the other party or to its affiliates, officers, directors, shareholders, partners, agents, employees, successors or assigns, for claims for incidental, special, indirect, punitive or consequential damages of any nature connected with or resulting from performance or non-performance of this Agreement, including claims in the nature of lost revenue, income or profits, losses, damages or liabilities under any financing, lending, construction or other contracts, agreements or arrangements to which either may be a party irrespective of whether such claims are based upon negligence, strict liability, contract, operation of law or otherwise ("Consequential Damages"); notwithstanding anything to the contrary contained in this Agreement, however, Landowner shall be entitled to recover any Consequential Damages derived or occasioned as a result of Lessee's breach of the provisions set forth in Section 3.4.1 of this Agreement.

12. General Right of Inspection. In addition to Landowner's rights concerning environmental inspections, Landowner and its agents and representatives shall be entitled to enter upon and inspect the Property at any time during normal business hours and upon prior reasonable notice, provided only that such inspection shall not unreasonably interfere with Lessee's business activities. Lessee reserves the right to require that Landowner be accompanied by a representative of Lessee while on the Property.

13. Option to Purchase the Landowner Entity.

13.1. Grant of Option. If no Event of Default on the part of Lessee shall then exist, Lessee shall have the option at any time during the Lease Term to purchase the equity of Landowner upon the terms and conditions set forth in this Agreement (the "Option"). Should Lessee choose to exercise the Option, the purchase of Landowner's equity shall be effectuated through a Membership Interest Purchase Agreement in substantially similar form as that attached hereto as Exhibit "F" and incorporated herein by this reference. The Parties acknowledge that the consideration for this grant of Option is encompassed in the Rent payable by Lessee to Landowner.

13.2. Exercise and Delivery. If Lessee elects to exercise the Option, such Option shall be exercised by Lessee by irrevocable written notice to Landowner. The closing date of the Option transaction (the effective date of the transfer of Landowner's equity to Lessee) shall be sixty (60) days after Lessee provides written notice to Landowner of its decision to exercise the Option, unless the Parties hereto agree to close this purchase transaction earlier ("Option Effective Date").

20

13.3. Purchase Consideration. Concurrently with the Option Closing Date, Lessee shall pay to Landowner consideration in the amount calculated as follows: (i) if paid on or prior to August 31, 2015, the Purchase Consideration (defined below) shall be EIGHT MILLION FIVE HUNDRED THOUSAND DOLLARS ($8,500,000.00) ("Discounted Purchase Price"); (ii) if not paid on or prior to August 31, 2015, effective as of (and starting as of) September 1, 2015, the Purchase Consideration shall increase, starting from the Discounted Purchase Price, by ONE HUNDRED TWENTY-FIVE THOUSAND DOLLARS ($125,000.00) per month until July 1, 2016, on which date, and effective every month thereafter, the Purchase Consideration shall increase by TWO HUNDRED FORTY-FOUR THOUSAND DOLLARS ($244,000.00) per month; provided, however, that (x) the Purchase Consideration shall be capped at THIRTEEN MILLION DOLLARS ($13,000,000.00) and (y) the Purchase Consideration shall be reduced by the sum of ONE HUNDRED TWENTY-TWO THOUSAND DOLLARS ($122,000.00) for each payment of Rent fully and timely made (for the purpose of clarity, the net effect of these provisions is that (1) from the period of September 1, 2015 through December 31, 2015, the Purchase Consideration will increase by ONE HUNDRED TWENTY-FIVE THOUSAND DOLLARS ($125,000.00) per month; (2) as long as Rent is fully and timely paid, during the period of January 1, 2016 through June 30, 2016, the Purchase Consideration will increase by THREE THOUSAND DOLLARS ($3,000.00) per month; and (3) as long as Rent is fully and timely paid, during the period of July 1, 2016 until the Closing Date (defined below) the Purchase Consideration will increase by ONE HUNDRED TWENTY-TWO THOUSAND DOLLARS ($122,000.00) per month) (as applicable, the "Purchase Consideration"). Landowner acknowledges that, depending on when the Option is exercised, that the Purchase Consideration may be zero dollars pursuant to the formula set forth in this Section; in that event, the Purchase Consideration payable upon the Option Closing Date shall be ONE HUNDRED DOLLARS ($100.00).

13.4. Termination of Option. In the event that Lessee does not exercise its Option on or before the expiration or earlier termination of the Lease Term, or prior to giving Landowner notice of termination pursuant to Section 1.4, the Option shall automatically terminate and be of no further force and effect, and shall not be deemed to encumber Landowner's fee estate in the Property in any manner.

14. Proprietary Information.

14.1 Definition of "Proprietary Information". "Proprietary Information" means all information developed by Landowner and its employees, consultants, and agents with respect to, in connection with, or necessary or useful for, the operation of the Facility, including, without limitation, the following: data, know-how, trade secrets, processes, specifications, drawings, sketches, models, samples, tools, technical information, mask works, software, firmware, designs, methodologies, ideas, concepts, inventions, plans, techniques, hardware, works of authorship, and studies. Proprietary Information includes all intellectual property rights of Landowner, including without limitation, copyrights, patents, industrial design rights, trademarks, logos, slogans, corporate names, trade names, rights of priority, and applications and registrations for any of the foregoing. Proprietary Information does not include: (i) information of Landowner that at the time furnished to Lessee is in the public domain or becomes part of the public domain by publication or otherwise through no fault of the other Party or its employees or agents; or (ii) information of Landowner that at the time furnished to Lessee was in the possession of Lessee as shown by written records and was independently developed by Lessee or obtained from a source on a non-confidential basis by a Person entitled to disclose it.

21

14.2 Permitted Use of Proprietary Information. During the Lease Term, Landowner may furnish Proprietary Information to Lessee without the payment of any license fee to Landowner. Landowner acknowledges and agrees that any Proprietary Information furnished to Lessee by Landowner shall be solely for the purpose of Lessee's operation of the Facility, and the care, maintenance and proper settings of the Facility, and that all Proprietary Information is confidential and, as between Lessee and Landowner, proprietary to Landowner. As between Lessee and Landowner, Landowner shall, at all times, have the exclusive right and interest in and to such Proprietary Information and the goodwill associated therewith. Lessee shall not directly or indirectly contest the ownership by Landowner of Proprietary Information. The use of the Proprietary Information of Landowner in the operation of the Facility does not give Lessee any ownership interest or other interest in or to such information; provided, however, that Landowner, if Lessee exercises the Option, and upon the Option Closing Date, will grant to Lessee at no additional cost a nonexclusive perpetual limited license (which license shall not be sublicensed, assigned, conveyed or otherwise transferred in any fashion by Lessee) to use, solely for the continued operation of the Facility (but not any similar facility or plant), such Proprietary Information of Lessee that is then utilized in the operation of the Facility and necessary for the continued operations of the Facility. Nothing in this Agreement shall be construed as requiring Landowner to furnish any Proprietary Information to Lessee, or allowing Lessee to utilize any Proprietary Information previously furnished to Lessee, with respect to any facility or plant other than the Facility. Should Lessee desire to utilize any Proprietary Information of Landowner at a facility or plant other than the Facility, Lessee must first negotiate and enter into a license agreement with Landowner requiring the payment of consideration separate from that required under this Agreement. Any such license agreement must be mutually agreed upon by Landowner and Lessee and Landowner is not, and shall not be, obligated by virtue of entering into this Agreement, to enter into any such license agreement with Lessee.

Lessee shall keep the Proprietary Information of Landowner confidential and shall use all reasonable efforts to maintain the Proprietary Information as secret and confidential in perpetuity. Failure to so maintain the Proprietary Information of Landowner as confidential will entitle Landowner to any damages stemming from such failure, to include, without limitation, reasonable attorneys' fees. Lessee will not at any time without the prior written consent of Landowner, copy, duplicate, record, or otherwise reproduce the Proprietary Information of Landowner, in whole or in part, or otherwise make the same available to any unauthorized person. Lessee agrees that Landowner would be irreparably damaged by reason of any violation of the confidentiality provisions contained herein and that any remedy at law for a breach of such provisions would be inadequate. Therefore, Landowner will be entitled to seek injunctive or other equitable relief in a court of competent jurisdiction against Lessee, its agents, employees, affiliates, officers or other associates, for any breach or threatened breach of the confidentiality covenants contained herein without the necessity of proving actual monetary loss. It is expressly understood that the remedy described herein will not be the exclusive remedy of Landowner for any breach of such covenants, and Landowner will be entitled to seek such other relief or remedy, at law or in equity, to which it may be entitled as a consequence of any breach of such covenants. The terms set forth in this Section shall survive termination of this Agreement.

22

15. Miscellaneous.

15.1 Business Days. If an action required under this Agreement falls on a weekend or a national holiday recognized by national banks operating in Reno, Nevada, such action shall be excused until the next business day.