Attached files

| file | filename |

|---|---|

| 8-K - ROSETTA RESOURCES 8-K 5-5-2015 - NBL Texas, LLC | form8k.htm |

Exhibit 99.1

Rosetta Resources, Inc. FIRST QUARTER 2015 EARNINGS REVIEW MAY 5, 2015

NASDAQ: ROSE | * Earnings Call Agenda Overview Jim CraddockOperational Update John ClaytonClosing Remarks Jim Craddock

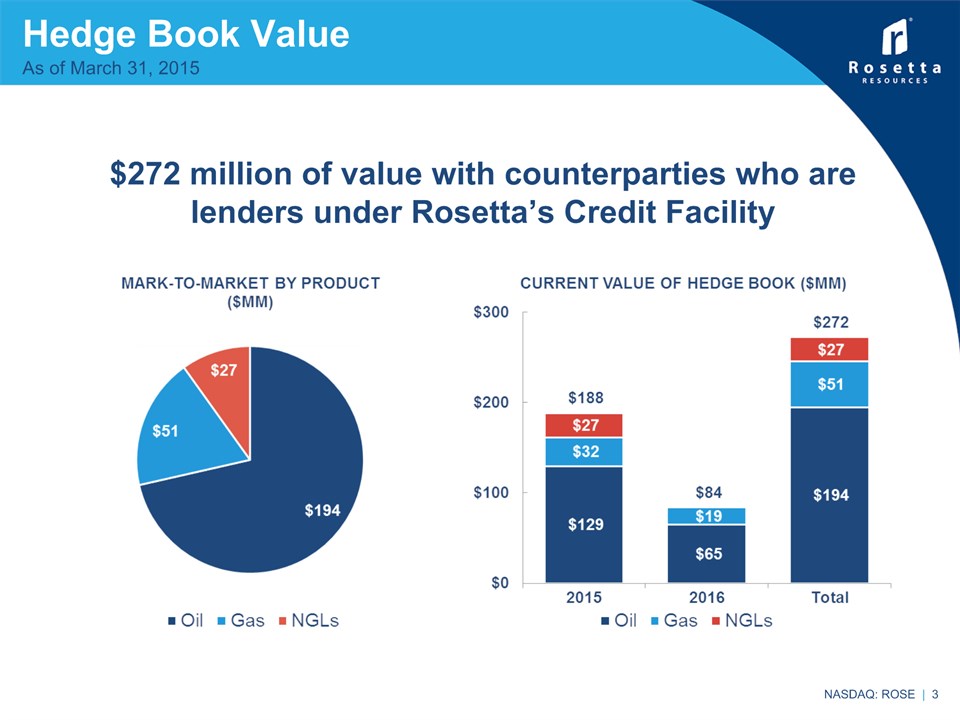

Hedge Book Value NASDAQ: ROSE | * As of March 31, 2015 $272 million of value with counterparties who are lenders under Rosetta’s Credit Facility

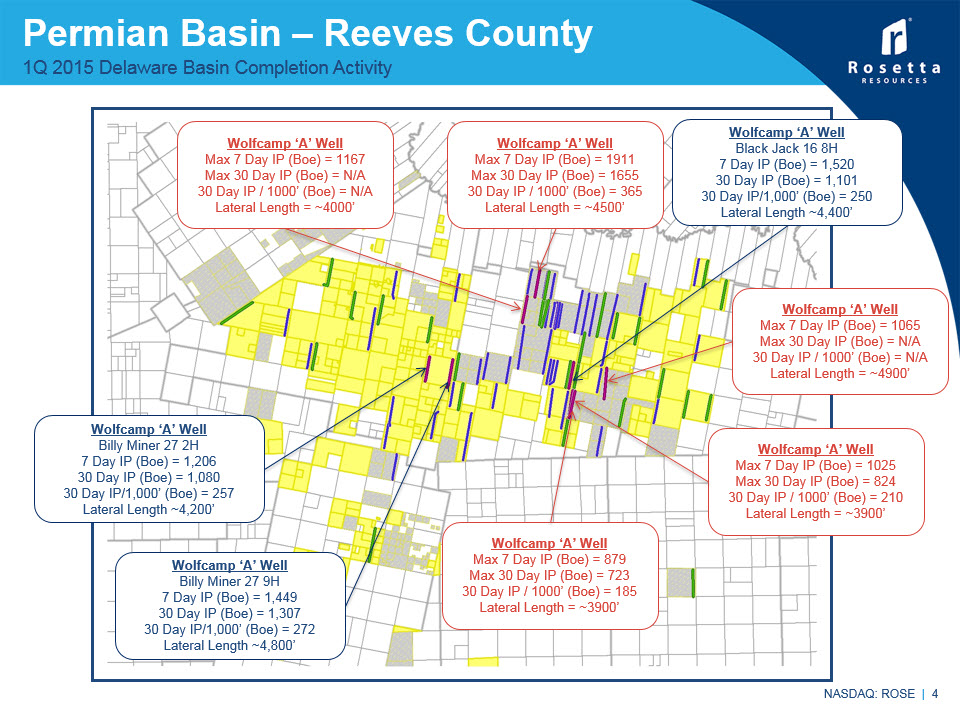

NASDAQ: ROSE | * Permian Basin 1Q 2015 Delaware Basin Completion Activity Wolfcamp ‘A’ WellBilly Miner 27 2H7 Day IP (Boe) = 1,20630 Day IP (Boe) = 1,08030 Day IP/1,000’ (Boe) = 257 Lateral Length ~4,200’ Wolfcamp ‘A’ WellBilly Miner 27 9H7 Day IP (Boe) = 1,44930 Day IP (Boe) = 1,30730 Day IP/1,000’ (Boe) = 272 Lateral Length ~4,800’ Wolfcamp ‘A’ WellBlack Jack 16 8H7 Day IP (Boe) = 1,52030 Day IP (Boe) = 1,10130 Day IP/1,000’ (Boe) = 250Lateral Length ~4,400’ Wolfcamp ‘A’ WellMax 7 Day IP (Boe) = 1167Max 30 Day IP (Boe) = N/A30 Day IP / 1000’ (Boe) = N/ALateral Length = ~4000’ Wolfcamp ‘A’ WellMax 7 Day IP (Boe) = 879Max 30 Day IP (Boe) = 72330 Day IP / 1000’ (Boe) = 185Lateral Length = ~3900’ Wolfcamp ‘A’ WellMax 7 Day IP (Boe) = 1025Max 30 Day IP (Boe) = 82430 Day IP / 1000’ (Boe) = 210Lateral Length = ~3900’ Wolfcamp ‘A’ WellMax 7 Day IP (Boe) = 1065Max 30 Day IP (Boe) = N/A30 Day IP / 1000’ (Boe) = N/ALateral Length = ~4900’ Wolfcamp ‘A’ WellMax 7 Day IP (Boe) = 1911Max 30 Day IP (Boe) = 165530 Day IP / 1000’ (Boe) = 365Lateral Length = ~4500’

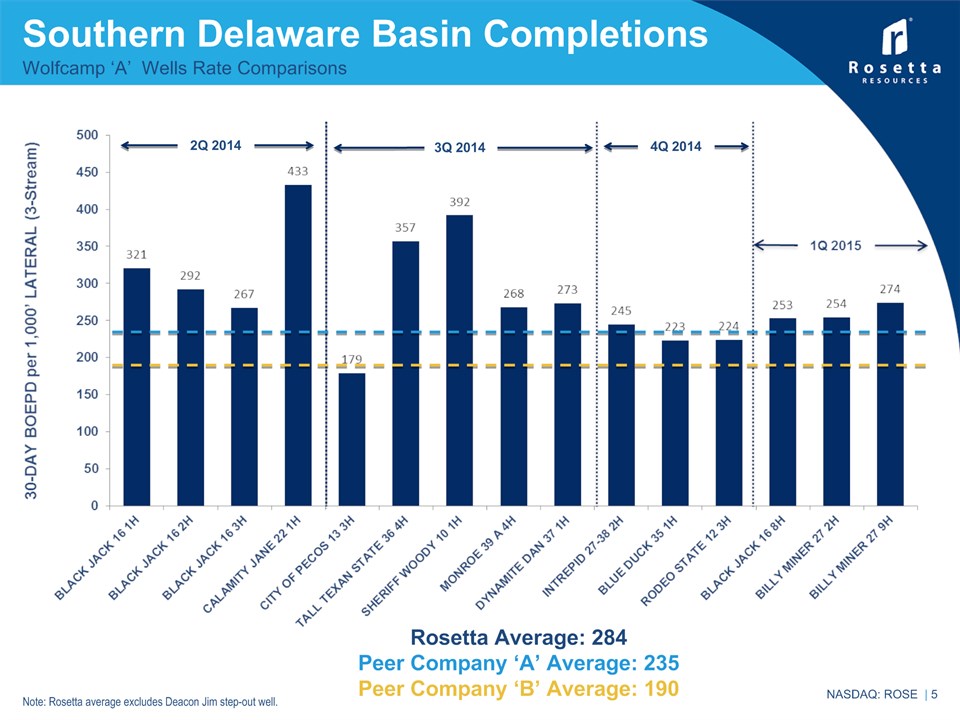

Southern Delaware Basin Completions Wolfcamp ‘A’ Wells Rate Comparisons NASDAQ: ROSE | * Rosetta Average: 284Peer Company ‘A’ Average: 235Peer Company ‘B’ Average: 190 2Q 2014 3Q 2014 4Q 2014 Note: Rosetta average excludes Deacon Jim step-out well.

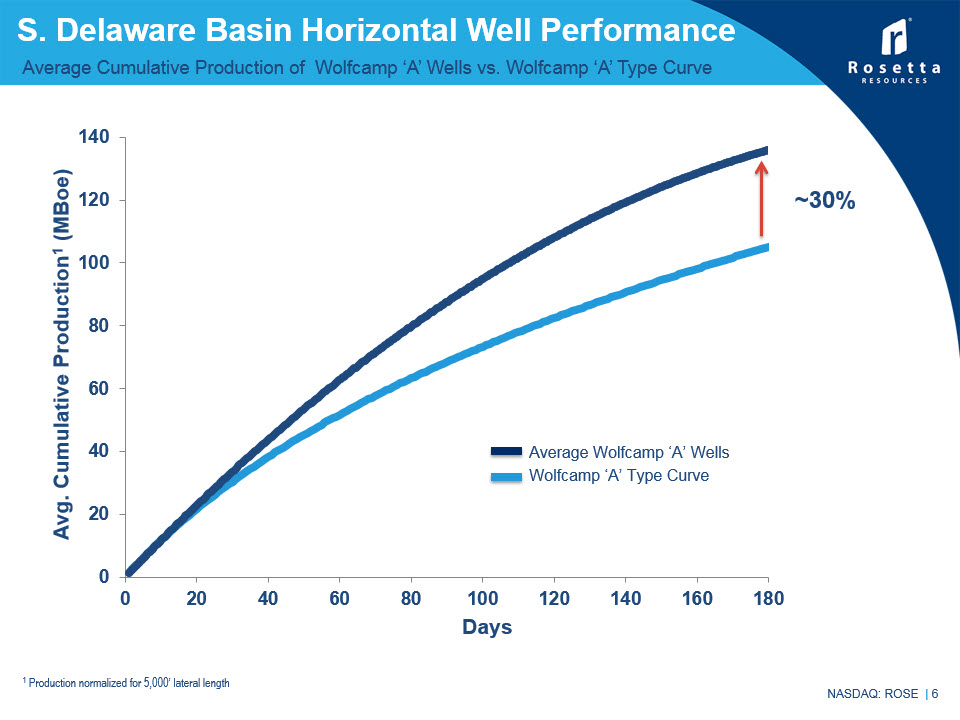

Average Cumulative Production of Wolfcamp ‘A’ Wells vs. Wolfcamp ‘A’ Type Curve NASDAQ: ROSE | * S. Delaware Basin Horizontal Well Performance Days 1 Production normalized for 5,000’ lateral length Avg. Cumulative Production1 (MBoe)

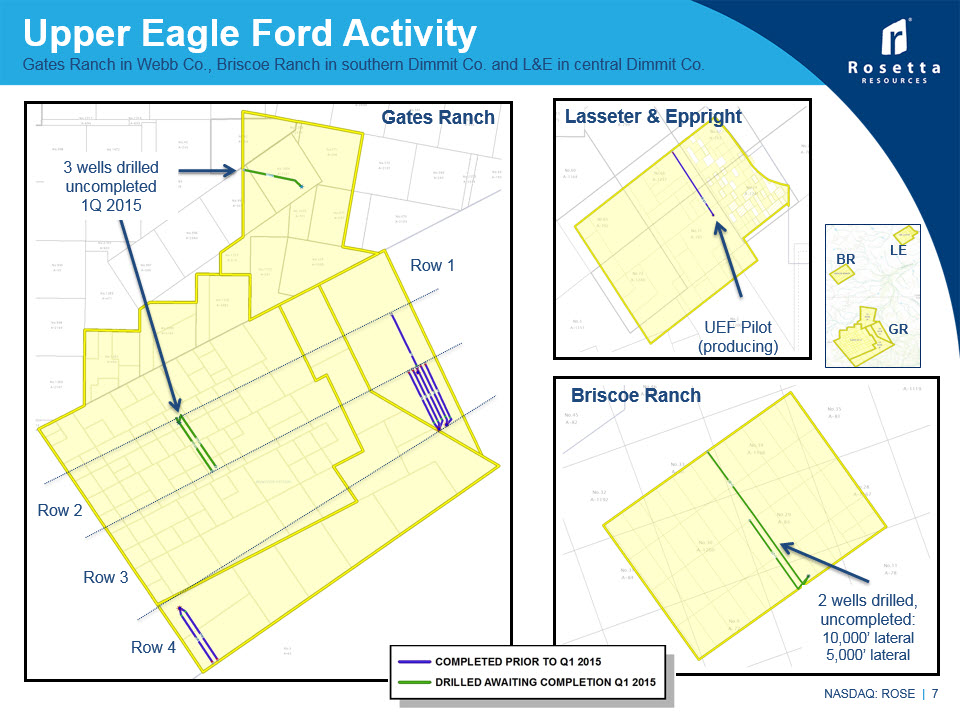

Upper Eagle Ford Activity Gates Ranch in Webb Co., Briscoe Ranch in southern Dimmit Co. and L&E in central Dimmit Co. NASDAQ: ROSE | * Lasseter & Eppright UEF Pilot(producing) Briscoe Ranch 2 wells drilled, uncompleted:10,000’ lateral5,000’ lateral Gates Ranch 3 wells drilled uncompleted1Q 2015 LE BR GR Row 2 Row 3 Row 1 Row 4

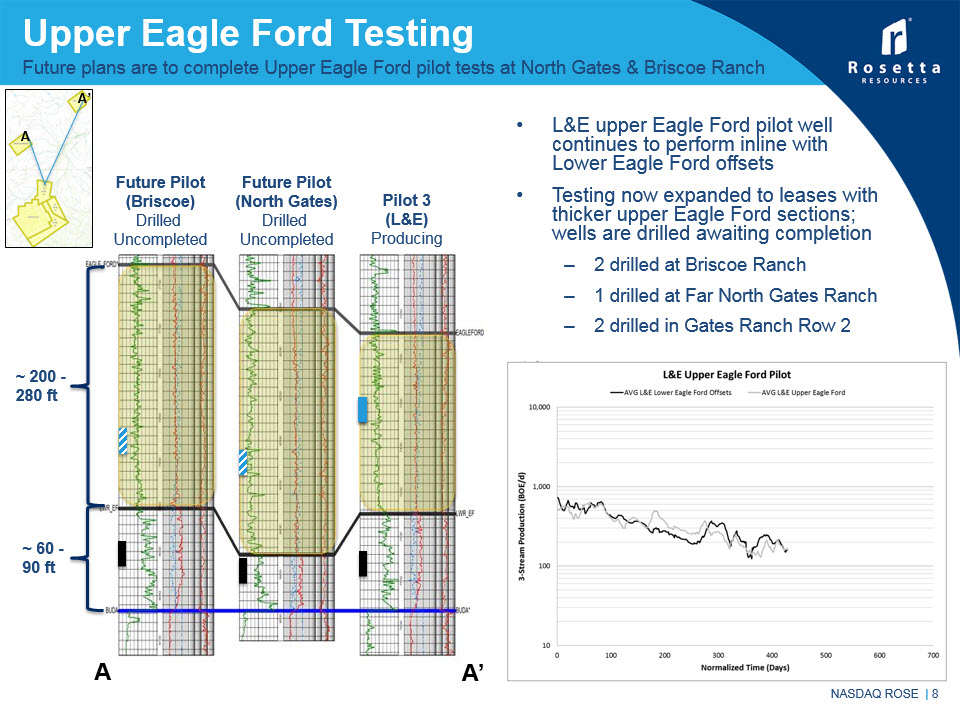

Upper Eagle Ford Testing Future plans are to complete Upper Eagle Ford pilot tests at North Gates & Briscoe Ranch NASDAQ ROSE | * L&E upper Eagle Ford pilot well continues to perform inline with Lower Eagle Ford offsetsTesting now expanded to leases with thicker upper Eagle Ford sections; wells are drilled awaiting completion2 drilled at Briscoe Ranch1 drilled at Far North Gates Ranch2 drilled in Gates Ranch Row 2 A A’ A’ A ~ 200 -280 ft Future Pilot(Briscoe)Drilled Uncompleted Future Pilot(North Gates)Drilled Uncompleted Pilot 3(L&E)Producing ~ 60 -90 ft

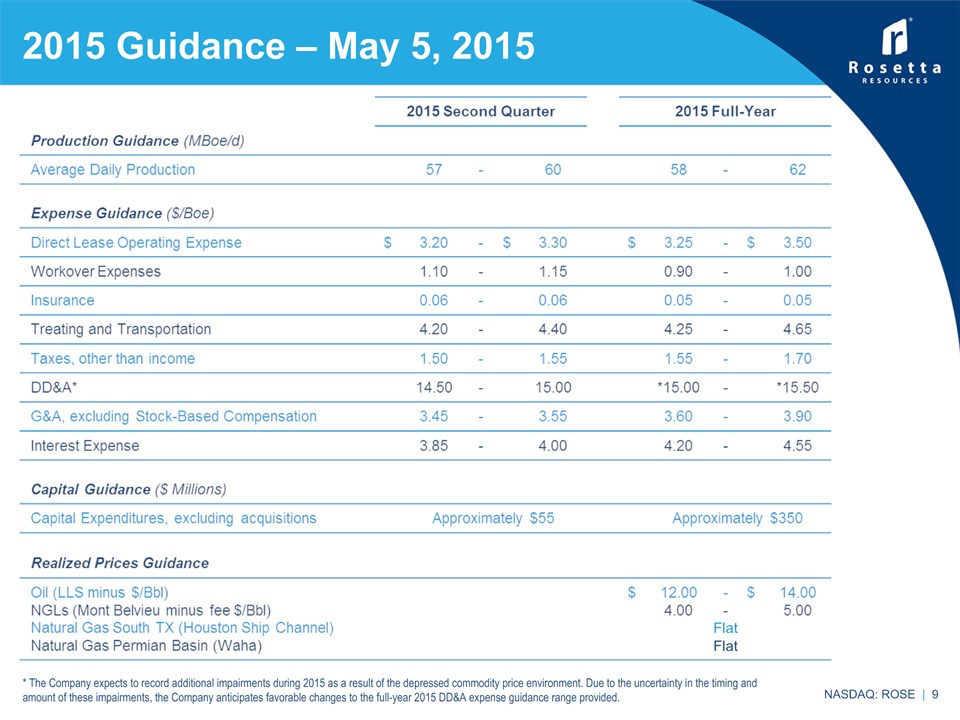

NASDAQ: ROSE | * 2015 Guidance – May 5, 2015 * The Company expects to record additional impairments during 2015 as a result of the depressed commodity price environment. Due to the uncertainty in the timing and amount of these impairments, the Company anticipates favorable changes to the full-year 2015 DD&A expense guidance range provided. Flat Flat

NASDAQ: ROSE | * Cautionary Statements This presentation includes forward-looking statements. Forward-looking statements related to future events, such as expectations regarding our capital program, development plans, production rates, resource potential, transportation capacity, net present value and projected liquidity. These statements are not guarantees of future performance and actual outcomes may differ materially. Factors that could affect the Company's business include, but are not limited to: oil and gas prices, operating hazards, drilling risks, unsuccessful exploratory activities; unexpected cost increases; potential liability for remedial actions under existing or future environmental regulations; potential liability resulting from pending or future litigation; limited access to capital or significantly higher cost of capital related to illiquidity or uncertainty in the domestic or international financial markets; as well as changes in tax, environmental and other laws applicable to our business. Other factors that could cause actual results to differ materially from those described in the forward-looking statements include other economic, business, competitive and/or regulatory factors affecting our business generally as set forth in our filings with the Securities and Exchange Commission. Unless legally required, the Company undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. For filings reporting year-end 2014 reserves, the SEC permits the optional disclosure of probable and possible reserves. The Company has elected not to report probable and possible reserves in its filings with the SEC. We use the term “net risked resources” or “inventory” to describe the Company’s internal estimates of volumes of natural gas and oil that are not classified as proved reserves but are potentially recoverable through exploratory drilling or additional drilling or recovery techniques. Estimates of unproved resources are by their nature more speculative than estimates of proved reserves and accordingly are subject to substantially greater risk of actually being realized by the Company. Estimates of unproved resources may change significantly as development provides additional data, and actual quantities that are ultimately recovered may differ substantially from prior estimates.