Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GAIN Capital Holdings, Inc. | form8-kx3x31x15earnings.htm |

| EX-99.1 - PRESS RELEASE - GAIN Capital Holdings, Inc. | earningsreleaseq115.htm |

First Quarter Financial and Operating Results May 5, 2015

Safe Harbor Statement 2 Forward Looking Statements The forward-looking statements contained herein include, without limitation, statements relating to GAIN Capital’s and/or City Index (Holdings) Limited (“City Index”) expectations regarding the opportunities and strengths of the combined company created by the proposed business combination, anticipated cost and revenue synergies, the strategic rationale for the proposed business combination, including expectations regarding product offerings, growth opportunities, value creation, and financial strength, and the timing of the closing. All forward looking statements are based upon current expectations and beliefs and various assumptions. There can be no assurance that GAIN Capital or City Index will realize these expectations or that these beliefs will prove correct. In addition, a variety of important factors could cause results to differ materially from such statements. These factors are noted throughout GAIN Capital’s annual report on Form 10- K, as filed with the Securities and Exchange Commission on March 16, 2015, and include, but are not limited to, the actions of both current and potential new competitors, fluctuations in market trading volumes, financial market volatility, evolving industry regulations, including changes in regulation of the futures companies, errors or malfunctions in GAIN Capital’s systems or technology, rapid changes in technology, effects of inflation, customer trading patterns, the success of our products and service offerings, our ability to continue to innovate and meet the demands of our customers for new or enhanced products, our ability to successfully integrate assets and companies we have acquired, our ability to effectively compete in the futures industry, changes in tax policy or accounting rules, fluctuations in foreign exchange rates and commodity prices, adverse changes or volatility in interest rates, as well as general economic, business, credit and financial market conditions, internationally or nationally, and our ability to continue paying a quarterly dividend in light of future financial performance and financing needs. The forward-looking statements included herein represent GAIN Capital’s views as of the date of this release. GAIN Capital undertakes no obligation to revise or update publicly any forward-looking statement for any reason unless required by law. Non-GAAP Financial Measures This presentation contains various non-GAAP financial measures, including Adjusted EBITDA, Adjusted Net Income, Adjusted EPS and Cash EPS. These non-GAAP financial measures have certain limitations, including that they do not have a standardized meaning and, therefore, our definitions may be different from similar non-GAAP financial measures used by other companies and/or analysts. Thus, it may be more difficult to compare our financial performance to that of other companies. We believe our reporting of these non-GAAP financial measures assist investors in evaluating our historical and expected operating performance. However, because these are not measures of financial performance calculated in accordance with GAAP, such measures should be considered in addition to, but not as a substitute for, other measures of our financial performance reported in accordance with GAAP, such as net income.

First Quarter Results • Delivered double digit growth in quarterly revenue, net income and adjusted EBITDA on a year-over-year basis • Increased scale and expense management discipline continues with fixed operating expenses down 19% • Successfully navigated the Swiss franc event in mid-January as a result of our strong risk management capabilities • Positive momentum in operating metrics points to continued client engagement • Completed the acquisition of City Index on April 1, bringing combined annualized retail OTC trading volume to >$3 trillion and client assets >$1.1 billion 3

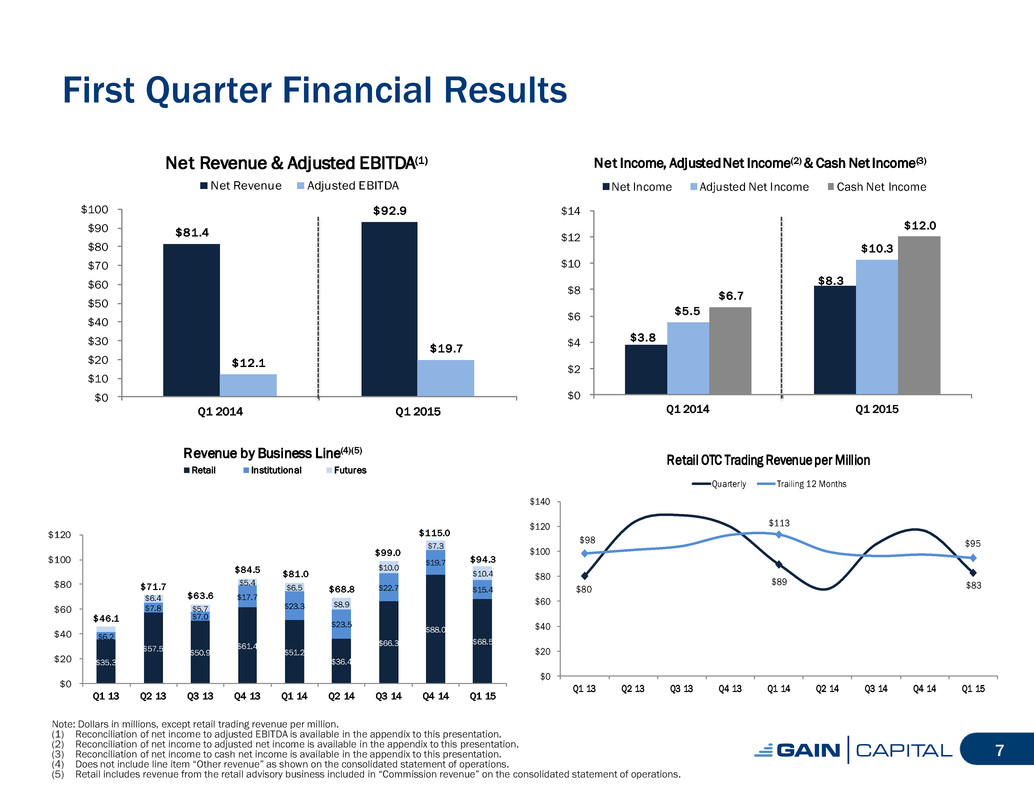

First Quarter 2015 Financial and Operating Results • Financial Results(1) • Net revenue: $92.9 million (up 14%) • Net income: $8.3 million (up 118%) • Adjusted EBITDA(2): $19.7 million (up 63%) • EPS (Diluted): $0.18 (up 100%) • Adjusted EPS (Diluted)(3): $0.23 (up 77%) • Cash EPS(4): $0.27 (up 69%) • Operating Metrics(1)(5) • Retail volume: $798.6 billion (ADV: $12.6 billion) (up 40%) • GTX volume: $1.2 trillion (ADV: $19.6 billion) (up 2%) • Institutional volume: $1.3 trillion (down 1%) • Futures contracts: 2.4 million (up 51%) • Total active accounts: 107,579 (up 3%) 4 (1) Comparisons are referenced to the first quarter of 2014. (2) Adjusted EBITDA is a non-GAAP financial measure that represents our earnings before interest, taxes, depreciation, amortization, restructuring, acquisition, non- controlling interest, integration expenses and bad debt expense related to the SNB event in January of 2015. A reconciliation of net income to adjusted EBITDA is available in the appendix to this presentation. (3) Adjusted EPS is a non-GAAP financial measure that represents net income per share excluding the impact of restructuring, acquisition, integration expenses and bad debt expense related to the SNB event in January of 2015. A reconciliation of GAAP EPS to adjusted EPS is available in the appendix to this presentation. (4) Cash EPS is a non-GAAP financial measure that represents net income per share excluding the impact of depreciation, amortization, purchased intangible amortization and non-cash interest expense. (5) Definitions for all our operating metrics are available in the appendix to this presentation.

Strength of Key Operating Metrics Note: Definitions for all our operating metrics are available in the appendix to this presentation. 5 • GAIN’s leading retail brand coupled with our strong partner relationships drive growth in our key operating metrics • Compound annual growth rate (“CAGR”) of 25% in retail OTC active accounts • CAGR of 21% in retail OTC client assets • CAGR of 37% in trading volume 62.6 97.3 99.0 6.6 7.4 8.6 69.2 104.7 107.6 Q1 13 Q1 14 Q1 15 Total Active Accounts (in thousands) Retail OTC Futures $6.7 $9.1 $12.6 Q1 13 Q1 14 Q1 15 Average Daily Retail OTC Volume (in billions) $340 $464 $496 $1 7 $165 $228 $457 $630 $724 Q1 13 Q1 14 Q1 15 Retail Client Assets (in millions) Retail OTC Futures

Growth of Commission-Based Businesses • GAIN continues to deliver on revenue diversification with expansion of commission-based businesses • Commission-based businesses delivered $28.2mm(1) of revenue representing 30% of total revenue • Growth in revenue driven by: • Organic growth of GAIN’s GTX business • Expansion of retail futures offering 6 Note: Dollars in millions except where noted otherwise. 1) Includes $5.5 million of revenue generated from GAIN’s Sales Trader business and $2.4 million of revenue generated from GAIN’s retail advisory business. $6.2 $8.8 $9.9 Q1 13 Q1 14 Q1 15 GTX Revenue $4.6 $6.5 $10.4 Q1 13 Q1 14 Q1 15 Futures Revenue

First Quarter Financial Results Note: Dollars in millions, except retail trading revenue per million. (1) Reconciliation of net income to adjusted EBITDA is available in the appendix to this presentation. (2) Reconciliation of net income to adjusted net income is available in the appendix to this presentation. (3) Reconciliation of net income to cash net income is available in the appendix to this presentation. (4) Does not include line item “Other revenue” as shown on the consolidated statement of operations. (5) Retail includes revenue from the retail advisory business included in “Commission revenue” on the consolidated statement of operations. 7 $35.3 $57.5 $50.9 $61.4 $51.2 $36.4 $66.3 $88.0 $68.5 $6.2 $7.8 $7.0 $17.7 $23.3 $23.5 $22.7 $19.7 $15.4 $6.4 $5.7 $5.4 $6.5 $8.9 $10.0 $7.3 $10.4 $46.1 $71.7 $63.6 $84.5 $81.0 $68.8 $99.0 $115.0 $94.3 $0 $20 $40 $60 $80 $100 $120 Q1 13 Q2 13 Q3 13 Q4 13 Q1 14 Q2 14 Q3 14 Q4 14 Q1 15 Revenue by Business Line(4)(5) Retail Institutional Futures$81.4 $92.9 $12.1 $19.7 $ $10 $20 $3 $40 $50 $60 $70 $80 $90 $100 Q1 2014 Q1 2015 Net Revenue & Adjusted EBITDA(1) Net Revenue Adjusted EBITDA $80 $89 $83 $98 $113 $95 $0 $20 $40 $60 $80 $100 $120 $140 Q1 13 Q2 13 Q3 13 Q4 13 Q1 14 Q2 14 Q3 14 Q4 14 Q1 15 Retail OTC Trading Revenue per Million Quarterly Trailing 12 Months $3.8 $8.3 $5.5 $10.3 $6.7 $12.0 $0 $2 $4 $6 $8 $10 $12 $14 Q1 2014 Q1 2015 Net Income, justed Net Income(2) & Cash Net Income(3) N t Income Adjusted Net Income Cash Net Income

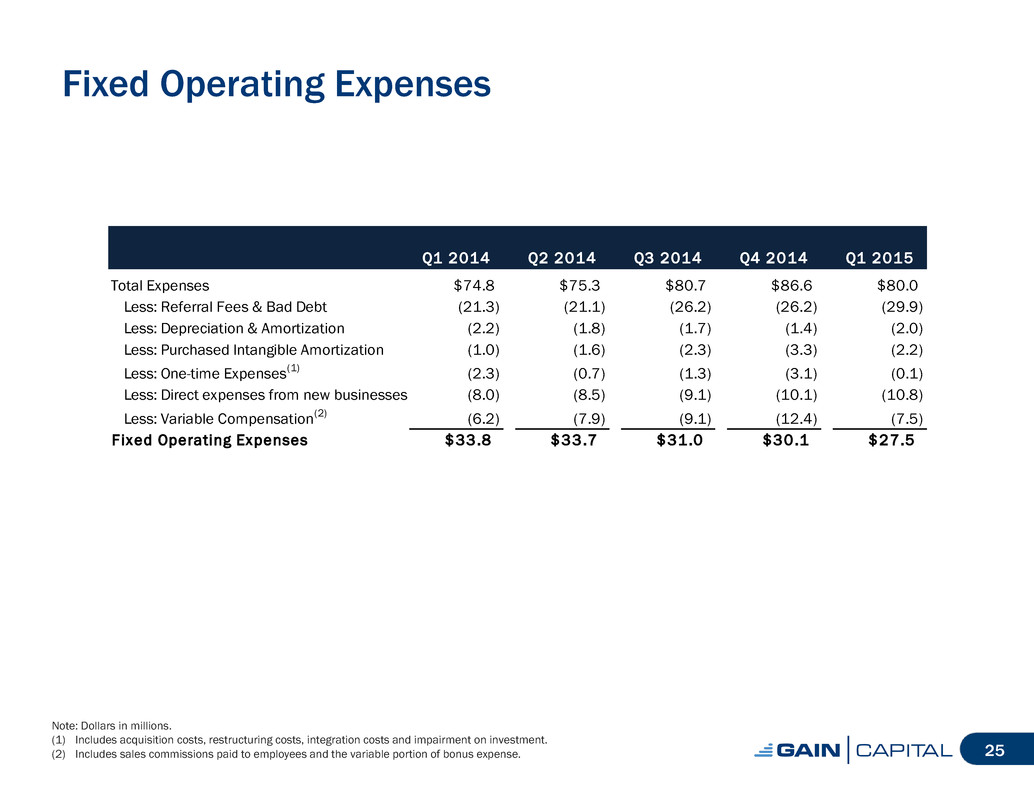

Controlling Operating Expenses Note: Dollars in millions. (1) Core fixed operating expenses calculated as total expenses less referral fees, bad debt, depreciation & amortization, purchased intangible amortization, acquisition costs, restructuring costs, integration costs, a one-time charge taken by GFT prior to the acquisition, direct expenses from new businesses and variable compensation expense (sales commissions and the variable portion of bonus expense). (2) Total fixed operating expenses calculated as core operating expenses plus the direct expenses from new businesses. 8 • Full achievement of GFT synergies has driven reduction in fixed operating expenses demonstrating focus on expense management • Core fixed operating expenses in the quarter of $27.5 million down 9% and 19% versus last quarter and the first quarter a year ago (1), respectively • Total fixed operating expenses down 5% and 9% compared to last quarter and the first quarter of 2014(2), respectively $33.8 $33.7 $31.0 $30.1 $27.5 $8.0 $8.5 $9.1 $10.1 $10.8 $33.0 $33.1 $40.6 $46.4 $41.7 $74.8 $75.3 $80.7 $86.6 $80.0 $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 Q1 14 Q2 14 Q3 14 Q4 14 Q1 15 Core Fixed Operating Expenses Direct expenses from new businesses Variable Expenses

Capital Utilization and Return • GAIN continuing to strategically deploy cash to grow the business and generate returns for shareholders • Recent acquisitions which provide revenue and expense synergies • GFT – Over $50mm of synergies achieved • City Index – Estimated $45-$55mm of synergies • GAA/TT – Growth of futures offering in a fragmented industry • Galvan – Expand product offering with margins >35% • Track record of returning capital to shareholders • $0.05 per share quarterly dividend approved • Record date: June 12, 2015 • Payment date: June 23, 2015 9

City Index Transaction Update • Acquisition closed on April 1 • Total purchase price: $148 million; net purchase price: $77mm • Convertible debt: $60mm • Interest: 4.125% • Term: 5 years • Cash: $36mm • Stock: 5.3mm shares • Value at closing: $52mm • Net cash received at closing: $71mm • Transaction price represents 4.5x FY 2014 EBITDA • Creates a market leading provider of retail OTC products across the US, UK, Europe and Asia that expands GAIN’s scale, global footprint and diversifies revenue 10

Operating Expense Synergies • Reaffirming previously announced expense synergy estimates of $45- $55mm to be achieved over the first 24 months post-closing • Expect to achieve 20% of savings in first year following closing • Savings will be achieved through combination of offices, key functions and other operational efficiencies Note: Dollars in millions. 11 $134.9 $128.6 $122.3 $77.5 $78.3 $79.7 $212.4 $206.9 $202.0 $0 $50 $100 $150 $200 $250 TTM 9/30/14 LTM 12/31/14 TTM 3/31/15 GAIN City Index 66% 5% 13% 17% Overlapping Functions Consolidation of Office Locations Trading Efficiencies Reduced Software Development Costs Breakdown of Synergies Pro Forma Fixed Operating Expenses

Pro Forma GAIN Results and Metrics 12 $507.8 $130.1 $91.4 $21.7 $0 $100 $200 $300 $400 $500 $600 TTM 3/31/2015 Q1 2015 Net Revenue Adjusted EBITDA $801 $840 $850 $760 $827 $360 $356 $334 $308 $300 $1,161 $1,196 $1,184 $1,068 $1,127 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 Q1 14 Q2 4 Q3 14 Q4 14 Q1 15 GAIN City Index $572 $522 $605 $731 $799 $235 $202 $220 $271 $286 $807 $724 $825 $1,002 $1,085 $0 $200 $400 $600 $800 $1,000 $1,200 Q1 14 Q2 14 Q3 14 Q4 14 Q1 15 GAIN City Index 104,650 101,508 101,557 103,079 107,579 50,853 47,963 46,865 46,156 45,961 155,503 149,471 148,422 149,235 153,540 - 20,000 40,000 60,000 80,000 100,000 120, 0 140,000 160,000 180,000 Q1 14 Q2 14 Q3 14 Q4 14 GAIN City Index Client Assets (in millions) Total Active Accounts Retail OTC Trading Volume (in billions) Pro Forma Revenue & Adjusted EBITDA(1) (in millions) Note: Pro forma represents the simple addition of GAIN and City Index results. (1) Reconciliation of net income to adjusted EBITDA is available in the appendix to this presentation.

Closing Remarks • Solid Q1 performance demonstrates ability to grow the retail OTC business organically • Strengthened competitive position helps drive positive operating metrics • Successful execution on product and revenue diversification strategies • Retail customers trading non-FX products • Growth of institutional and futures businesses • Addition of City Index adds further scale, diversification and potential for significant operating expense synergies 13

14 Appendix

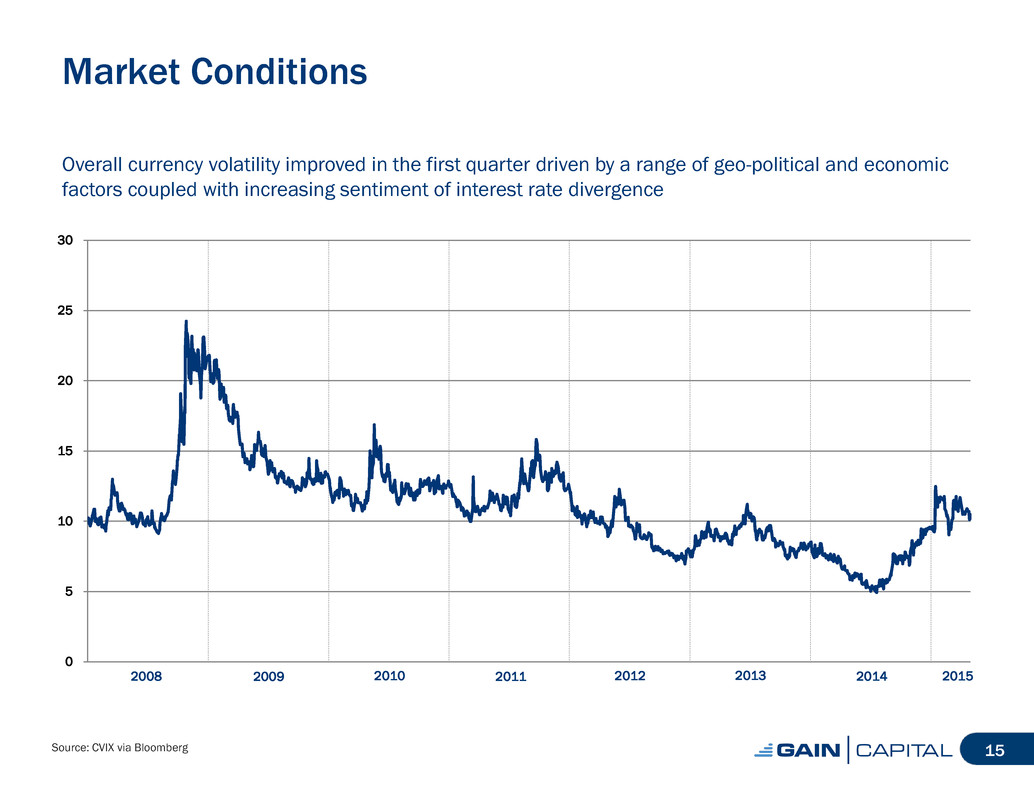

0 5 10 15 20 25 30 Market Conditions Overall currency volatility improved in the first quarter driven by a range of geo-political and economic factors coupled with increasing sentiment of interest rate divergence Source: CVIX via Bloomberg 15 2009 2011 2008 2014 2012 2010 2013 2015

Executing on M&A Strategy 16 • Successful execution of M&A strategy has provided: • Scale: Pro forma for the City Index acquisition, GAIN Capital’s asset base has nearly tripled in the past 2 years and increased by >4x since IPO • New business lines: Futures, Sales Traders, retail advisory services • Diversification of products: CFDs, spread-bets, futures • Positioned to take on additional acquisitions as consolidator of choice 2008 Client Assets: $124mm 2010 Client Assets: $257mm 2012 Client Assets: $446mm 12/31/14(1) Client Assets: $1.1bn 2013 Client Assets: $739mm Fortune Capital (Retail Forex) MG Financial (Retail Forex) CMS (Retail Forex) dbFX (Retail Forex) Open E Cry (Futures) GFT U.S. (Retail Forex) FX Solutions (Retail Forex) GFT (Retail Forex & Institutional) GAA and Top Third (Futures) Galvan Research (Advisory) City Index (Retail Forex) Post-IPO Pre-IPO Mar. 18, 2008 Sept. 13, 2010 Oct. 18, 2010 Feb. 22, 2013 Dec. 6, 2012 Sept. 6, 2012 April 21, 2011 Sept. 24, 2013 March 13, 2014 April 7, 2014 Oct. 30, 2014 (1) Pro forma for acquisition of City Index.

Consolidated Statements of Operations Note: Dollars in millions, except per share data. 17 Three Months Ended Three Months Ended March 31, March 31, 2015 2014 Revenue Trading revenue 66.1$ 51.2$ Commission revenue 28.2 29.8 Other revenue (1.4) 0.1 Total non-interest revenue 92.9 81.1 Interest revenue 0.3 0.4 Interest expense 0.3 0.1 Total net interest revenue - 0.3 Net revenue 92.9 81.4 Expenses Employee compensation and benefits 22.1 21.8 Selling and marketing 4.6 6.1 Referral fees 26.6 20.7 Trading expense 7.0 6.9 General & Administrative 9.3 9.2 Depreciation and amortization 2.0 2.2 Purchased intangible amortization 2.2 1.0 Communication and technology 2.8 4.0 Bad debt provision 3.3 0.6 Acquisition costs - 0.4 Restructuring - 0.4 Integration costs 0.1 1.5 Total operating expense 80.0 74.8 Operating income 12.9 6.6 Interest on long term borrowings 1.5 1.4 Income before tax expense 11.4 5 .2 Income tax expense 2.8 1.3 Net income 8.6 3.9 Net income attributable to non-controlling interest 0.3 0.1 Net income applicable to Gain Capital Holdings Inc. 8.3$ 3 .8$ Earnings per common share ( 1) Basic $0.19 $0.10 Diluted $0.18 $0.09 Weighted averages common shares outstanding used in computing earnings per common share: Basic 43,206,628 39,543,586 Diluted 44,150,505 42,627,628

Consolidated Balance Sheet Note: Dollars in millions. 18 March 31, December 31, 2015 2014 ASSETS: Cash and cash equivalents 90.1$ 139.4$ Cash and securities held for customers 826.8 759.6 Short term investments 0.2 0.2 Receivables from banks and brokers 176.2 134.9 Property and equipment - net of accumulated depreciation 17.9 18.8 Prepaid assets 3.0 2.5 Goodwill 33.7 34.6 Intangible assets, net 58.5 60.8 Other assets 33.0 35.1 Total assets 1,239.4$ 1,185.9$ LIABILITIES AND SHAREHOLDERS' EQUITY: Payables to customer, brokers, dealers, FCM'S and other regulated entities 826.8$ 759.6$ Accrued compensation & benefits 5.8 16.9 Accrued expenses and other liabilities 54.4 64.4 Income tax payable 0.9 1.5 Loan payable 69.0 68.4 Total l iabilities 956.9$ 910.8$ Non-controlling interest 10.5$ 10.2$ Shareholders' Equity 272.0 264.9 Total l iabilities and shareholders' equity 1,239.4$ 1,185.9$

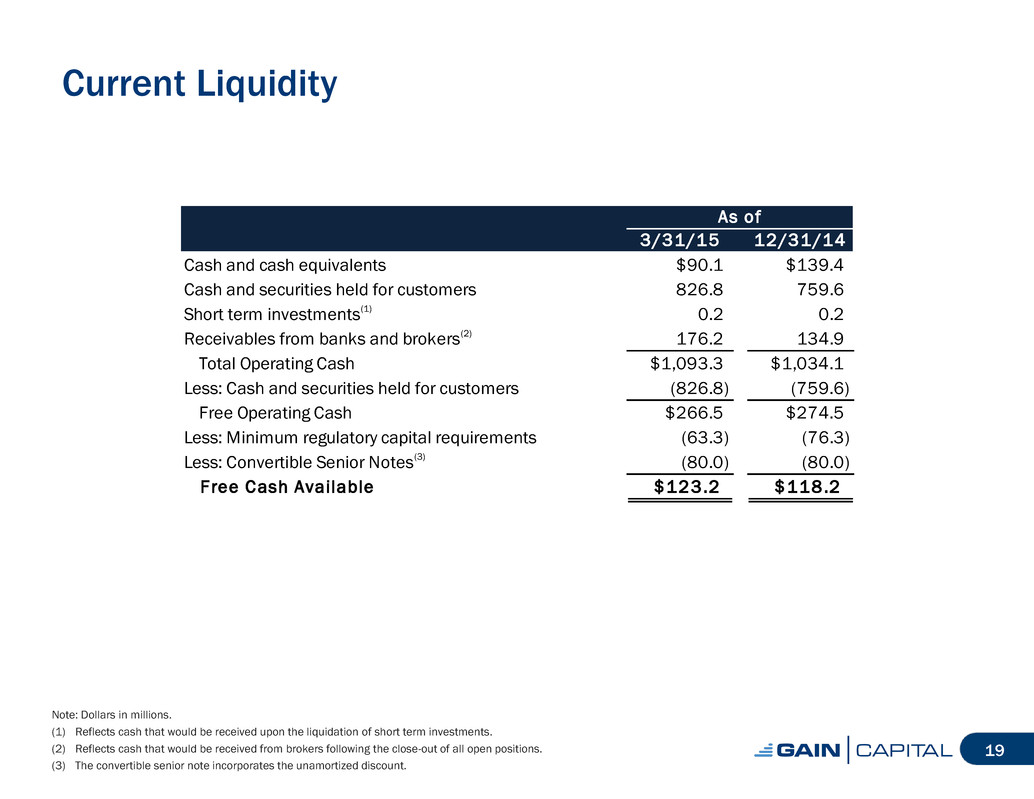

Current Liquidity Note: Dollars in millions. (1) Reflects cash that would be received upon the liquidation of short term investments. (2) Reflects cash that would be received from brokers following the close-out of all open positions. (3) The convertible senior note incorporates the unamortized discount. 19 As of 3/31/15 12/31/14 Cash and cash equivalents $90.1 $139.4 Cash and securities held for customers 826.8 759.6 Short term investments(1) 0.2 0.2 Receivables from banks and brokers(2) 176.2 134.9 Total Operating Cash $1,093.3 $1,034.1 Less: Cash and securities held for customers (826.8) (759.6) Free Operating Cash $266.5 $274.5 Less: Minimum regulatory capital requirements (63.3) (76.3) Less: Convertible Senior Notes(3) (80.0) (80.0) Free Cash Available $123.2 $118.2

First Quarter Financial Summary Note: Dollars in millions, except per share data. (1) See page 21 for a reconciliation of GAAP net income to adjusted EBITDA. (2) See page 22 for a reconciliation of GAAP EPS to cash EPS. (3) See page 23 for a reconciliation of GAAP EPS to adjusted EPS. (4) Adjusted EBITDA margin is calculated as adjusted EBITDA divided by net revenue. 20 3 Months Ended March 31, 15 v '14 2015 2014 % Change Net Revenue $92.9 $81.4 14% Operating Expenses 73.2 69.3 6% Adjusted EBITDA(1) $19.7 $12.1 63% Net Income $8.3 $3.8 118% Cash EPS (Diluted)(2) $0.27 $0.16 69% Adjusted EPS (Diluted)(3) $0.23 $0.13 77% EPS (Diluted) $0.18 $0.09 100% Adjusted EBITDA Margin %(1)(3) 21% 15% 6 pts Net Income Margin % 9% 5% 4 pts

Adjusted EBITDA & Margin Reconciliation Note: Dollars in millions. (1) Adjusted EBITDA margin is calculated as adjusted EBITDA divided by net revenue. 21 2015 2014 Net Revenue 92.9$ 81.4$ Net Income 8.3 3.8 Net Income Margin % 9% 5% Net Income 8.3$ 3 .8$ Depreciation & amortization 2.0 2.2 Purchase intangible amortization 2.2 1.0 Interest expense 1.5 1.4 Income tax expense 2.8 1.3 Acquisition costs - 0.4 Restructuring - 0.4 Integration costs 0.1 1.5 Bad debt related to SNB event in January of 2015 2.5 - Net income attributable to non-controlling interest 0.3 0.1 Adjusted EBITDA 19.7$ 12.1$ Adjusted EBITDA Margin % (1) 21% 15% 3 Months Ended March 31,

Cash Net Income and EPS Reconciliation Note: Dollars in millions. 22 3 Months Ended March 31, 3 Months Ended March 31, 2015 2014 GAAP Earnings per Share (Diluted) 0.18$ 0.09$ Non-cash items 0.09 0.07 Cash Earnings per Share (Diluted) 0.27$ 0 .16$ 3 Months Ended March 31, 3 Months Ended March 31, 2015 2014 Net Income 8.3$ 3 .8$ Depreciation & amortization, net of tax 1.5 1.7 Purchase intangible amortization, net of tax 1.7 0.8 Non-cash interest expense, net of tax 0.5 0.4 Cash Net Income 12.0$ 6 .7$ Cash Earnings per Common Share: Basic 0.28$ 0.17$ Diluted 0.27$ 0.16$

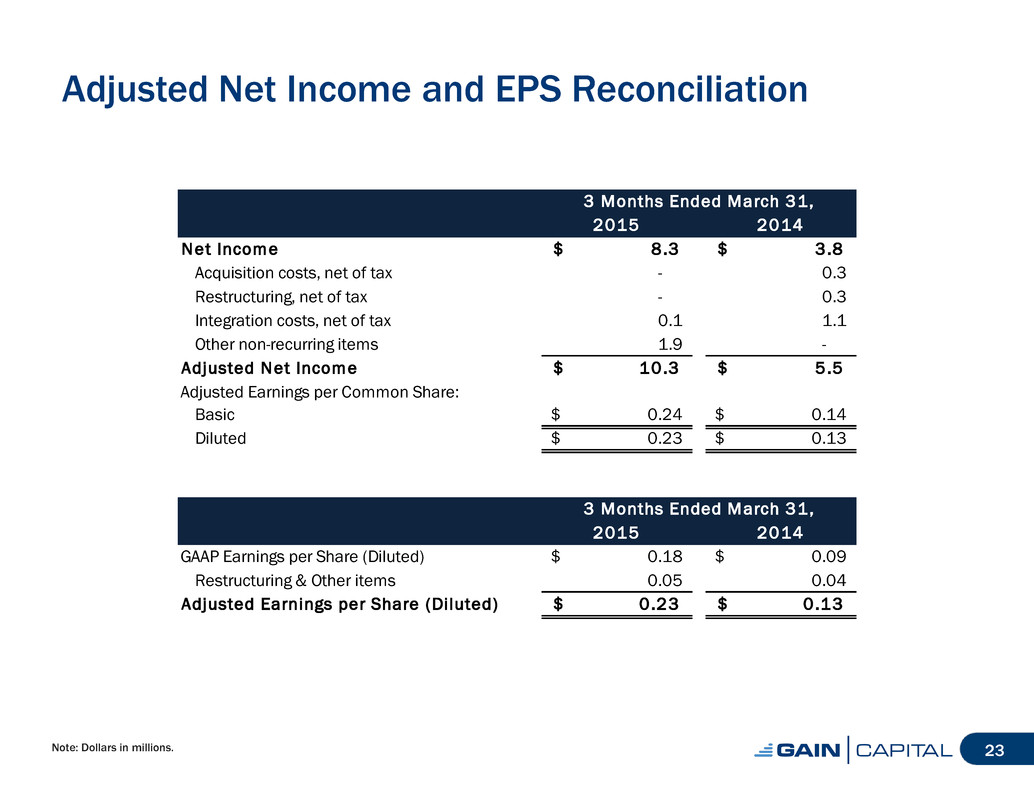

Adjusted Net Income and EPS Reconciliation Note: Dollars in millions. 23 3 Months Ended March 31, 3 Months Ended March 31, 2015 2014 Net Income 8.3$ 3 .8$ Acquisition costs, net of tax - 0.3 Restructuring, net of tax - 0.3 Integration costs, net of tax 0.1 1.1 Other non-recurring items 1.9 - Adjusted Net Income 10.3$ 5 .5$ Adjusted Earnings per Common Share: Basic 0.24$ 0.14$ Diluted 0.23$ 0.13$ 3 Months Ended March 31, 3 Months Ended March 31, 2015 2014 GAAP Earnings per Share (Diluted) 0.18$ 0.09$ Restructuring & Other items 0.05 0.04 Adjusted Earnings per Share (Diluted) 0.23$ 0 .13$

City Index Adjusted EBITDA & Margin Reconciliation Note: Dollars in millions. (1) Adjusted EBITDA margin is calculated as adjusted EBITDA divided by net revenue. 24 2015 2014 Revenue $37.2 $27.9 Net Income ($3.7) ($8.3) Depreciation & Amortization 5.5 6.9 One-Time Expenses 0.2 2.5 Adj usted EB ITDA $2.0 $1.1 Adjusted EBITDA Margin % 5% 4% 3 Months Ended March 31,

Fixed Operating Expenses Note: Dollars in millions. (1) Includes acquisition costs, restructuring costs, integration costs and impairment on investment. (2) Includes sales commissions paid to employees and the variable portion of bonus expense. 25 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Total Expenses $74.8 $75.3 $80.7 $86.6 $80.0 Less: Referral Fees & Bad Debt (21.3) (21.1) (26.2) (26.2) (29.9) Less: Depreciation & Amortization (2.2) (1.8) (1.7) (1.4) (2.0) Less: Purchased Intangible Amortization (1.0) (1.6) (2.3) (3.3) (2.2) Less: One-time Expenses(1) (2.3) (0.7) (1.3) (3.1) (0.1) Less: Direct expenses from new businesses (8.0) (8.5) (9.1) (10.1) (10.8) Less: Variable Compensation(2) (6.2) (7.9) (9.1) (12.4) (7.5) F ixed Operating Expenses $33.8 $33.7 $31.0 $30.1 $27.5

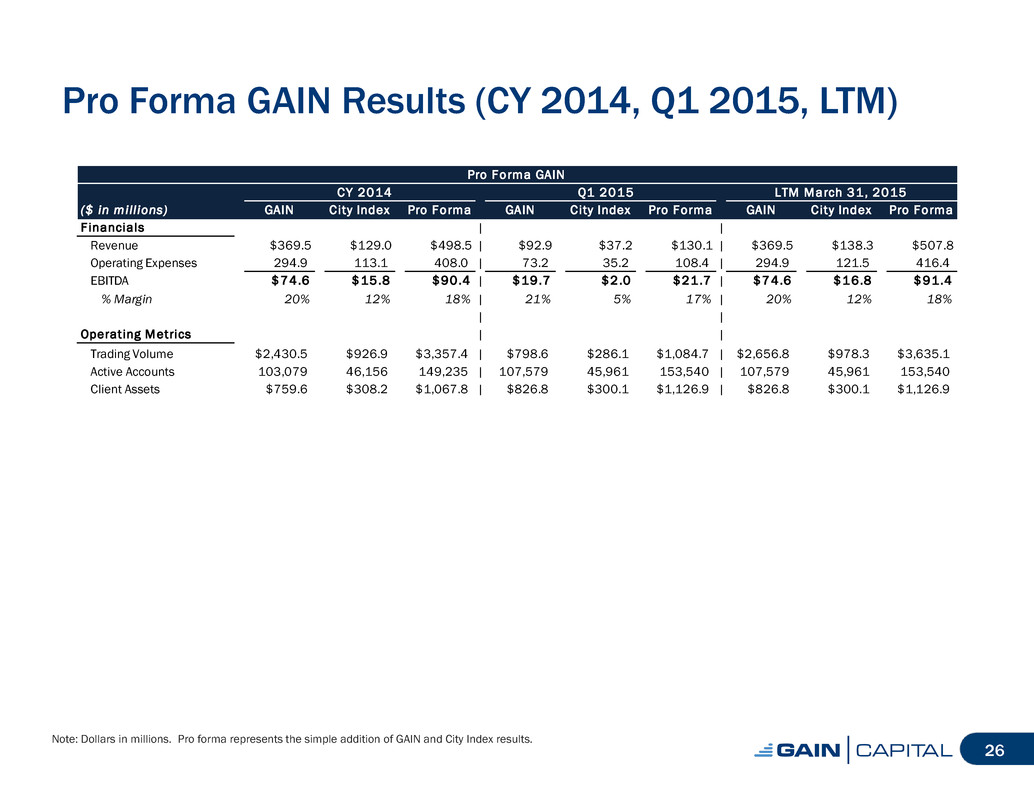

Pro Forma GAIN Results (CY 2014, Q1 2015, LTM) Note: Dollars in millions. Pro forma represents the simple addition of GAIN and City Index results. 26 Pro Forma GAIN CY 2014 Q1 2015 LTM March 31, 2015 ($ in mill ions) GAIN City Index Pro Forma GAIN City Index Pro Forma GAIN City Index Pro Forma Financials | | Revenue $369.5 $129.0 $498.5 | $92.9 $37.2 $130.1 | $369.5 $138.3 $507.8 Operating Expenses 294.9 113.1 408.0 | 73.2 35.2 108.4 | 294.9 121.5 416.4 EBITDA $74.6 $15.8 $90.4 | $19.7 $2.0 $21.7 | $74.6 $16.8 $91.4 % Margin 20% 12% 18% | 21% 5% 17% | 20% 12% 18% | | Operating Metrics | | Trading Volume $2,430.5 $926.9 $3,357.4 | $798.6 $286.1 $1,084.7 | $2,656.8 $978.3 $3,635.1 Active Accounts 103,079 46,156 149,235 | 107,579 45,961 153,540 | 107,579 45,961 153,540 Client Assets $759.6 $308.2 $1,067.8 | $826.8 $300.1 $1,126.9 | $826.8 $300.1 $1,126.9

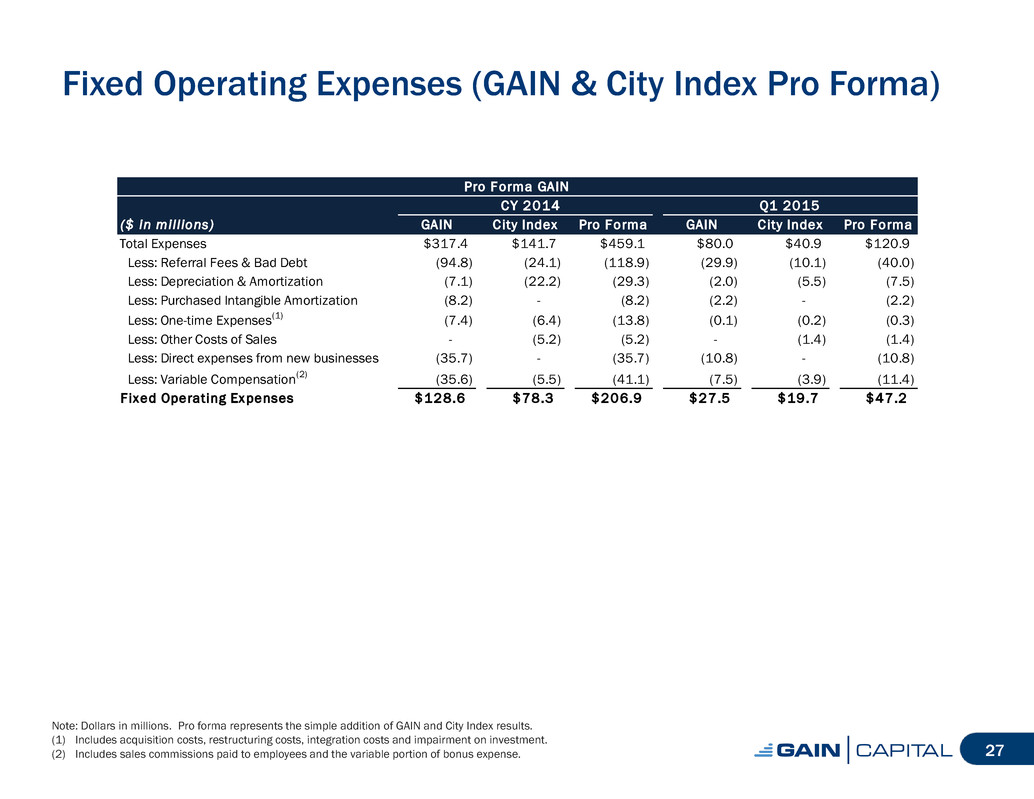

Fixed Operating Expenses (GAIN & City Index Pro Forma) Note: Dollars in millions. Pro forma represents the simple addition of GAIN and City Index results. (1) Includes acquisition costs, restructuring costs, integration costs and impairment on investment. (2) Includes sales commissions paid to employees and the variable portion of bonus expense. 27 CY 2014 Q1 2015 ($ in mill ions) GAIN City Index Pro Forma GAIN City Index Pro Forma Total Expenses $317.4 $141.7 $459.1 $80.0 $40.9 $120.9 Less: Referral Fees & Bad Debt (94.8) (24.1) (118.9) (29.9) (10.1) (40.0) Less: Depreciation & Amortization (7.1) (22.2) (29.3) (2.0) (5.5) (7.5) Less: Purchased Intangible Amortization (8.2) - (8.2) (2.2) - (2.2) Less: One-time Expenses(1) (7.4) (6.4) (13.8) (0.1) (0.2) (0.3) Less: Other Costs of Sales - (5.2) (5.2) - (1.4) (1.4) Less: Direct expenses from new businesses (35.7) - (35.7) (10.8) - (10.8) Less: Variable Compensation(2) (35.6) (5.5) (41.1) (7.5) (3.9) (11.4) F ixed Operating Expenses $128.6 $78.3 $206.9 $27.5 $19.7 $47.2 Pro Forma GAIN

Quarterly Operating Metrics Note: Definitions for all our operating metrics are available on page 29. 28 (Volume in billions; assets in millions) Mar-14 Jun-14 Sep-14 Dec-14 Mar-15 Retail Metrics OTC Trading Volume $572.3 $522.2 $605.4 $730.6 $798.6 Average Daily Volume $9.1 $8.0 $9.2 $11.2 $12.6 Active OTC Accounts 97,253 94,261 93,777 94,895 99,017 Customer Assets $635.3 $663.6 $641.3 $562.9 $599.0 Institutional Metrics Total Institutional Volume $1,353.6 $1,348.7 $1,181.0 $1,234.7 $1,328.3 Average Daily Volume $21.4 $20.7 $17.9 $19.0 $21.1 GTX Volume $1,212.4 $1,237.0 $1,089.0 $1,143.9 $1,232.3 Average Daily GTX Volume $19.2 $19.0 $16.5 $17.6 $19.6 Exchange-based Futures Metrics Futures Contracts 1,572,465 1,710,944 1,764,586 1,979,013 2,381,073 Average Daily Futures Contracts 24,960 26,322 26,736 30,446 39,034 Active Futures Accounts 7,397 7,247 7,780 8,184 8,562 Customer Assets $165.4 $176.4 $208.4 $196.7 $227.8 3 Months Ended,

Definition of Metrics • Active Accounts • Retail accounts who traded in the trailing 12 months • Trading Volume • Represents the U.S. dollar equivalent of notional amounts traded • Futures Contracts • Represents the total contracts transacted by customers of GAIN’s futures division • Client Assets • Represents amounts due to clients, including customer deposits and unrealized gains or losses arising from open positions 29

First Quarter Financial and Operating Results May 5, 2015