Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SEELOS THERAPEUTICS, INC. | a8-kapril302015.htm |

Taglich Brothers 12th Annual Conference NASDAQ: APRI May 5, 2015

2 Forward-Looking Statements This corporate presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act, as amended. Statements in this presentation that are not purely historical are forward-looking statements. Such forward-looking statements include, among other things: references to the timing of initial and re-order shipments of Vitaros® and royalty revenues from the sale of Vitaros in various countries by Apricus’ commercial partners; the planned launch of Vitaros in France, Spain, Italy and other countries; the planned production of the required 12-month stability data and the expected timing of approval in Europe for the Vitaros room temperature device; the ongoing enrollment in the RayVa™ Phase 2a clinical trial of patients with Raynaud's phenomenon secondary to scleroderma; the planned commencement of clinical trials for fispemifene and an approved pathway for RayVa and fispemifene; the timing and success of current and planned clinical trials; the size of the commercial opportunity for Vitaros, RayVa and fispemifene and the potential for such products to achieve commercial success; the opportunity of potential indications for fispemifene; the expected funding under the credit facility of a second term loan subject to initiation of a Phase 2 development program for fispemifene; the planned out-license of Vitaros and RayVa; the timing of patent expirations and potential for additional patent protection; and Apricus’ 2015 financial outlook, including cash projections. Actual results could differ from those projected in any forward-looking statements due to a variety of reasons that are outside the control of Apricus, including, but not limited to: its ability to further develop its product Vitaros for the treatment of erectile dysfunction, such as the room temperature version of Vitaros, and its product candidates RayVa for the treatment of Raynaud’s phenomenon and fispemifene for the treatment of secondary hypogonadism, chronic prostatitis and lower urinary tract symptoms in men, as well as the timing of such events; Apricus’ ability to carry out clinical studies for RayVa and fispemifene, as well as the timing and success of the results of such studies; Apricus’ dependence on its commercial partners to carry out the commercial launch or grow sales of Vitaros in various territories, such as Takeda in the United Kingdom, Sandoz in Sweden, Germany and Belgium, and Majorelle in France, and the potential for delays in the timing of commercial launches in additional countries; competition in the erectile dysfunction market and other markets in which Apricus and its partners operate; Apricus’ ability to obtain and maintain intellectual property protection for Vitaros, RayVa, fispemifene or any other product candidates; Apricus’ ability to raise additional funding that it may need to continue to pursue its commercial and business development plans; Apricus’ ability to draw the second term loan under the credit facility when expected, or at all, including Apricus’ failure to meet the conditions required to draw under the loan and security agreement; Apricus’ ability to remain in compliance with the terms and restrictions under the credit facility; Apricus’ ability to access additional capital under the equity facility; Apricus’ ability to obtain the requisite governmental approval for the room temperature version of Vitaros, RayVa and fispemifene; and market conditions. These forward-looking statements are made as of the date of this presentation, and Apricus assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements. Readers are urged to read the risk factors set forth in Apricus’ most recent annual report on Form 10-K, subsequent quarterly reports filed on Form 10-Q, and other filings made with the SEC. Copies of these reports are available from the SEC’s website at www.sec.gov or without charge from Apricus.

3 Apricus Overview Advancing Innovations in Specialty Urology and Rheumatology Markets ―Headquarters: San Diego, CA ―NASDAQ: APRI

4 2 0 Multiple Vitaros launches by our commercial partners in Europe in 2015 Generation of Vitaros revenue via milestone and royalty payments Establish RayVa Phase 2a clinical POC in Q2 2015 Vitaros Room Temperature Device EU Approval Submission in 2016 Out-licensing Vitaros ROW in 2015 Initiation of Fispemifene Phase 2b clinical trial in 2Q 2015 Creating Value

5 Apricus: Recent Developments ―Expanded Vitaros license agreement with existing partner Sandoz in certain Asia-Pacific countries ―Completed an $11MM private placement with strategic investors ―Positive Vitaros reimbursement decision in France obtained by our commercial partner Laboratoires-Majorelle ―Received regulatory guidance for fispemifene from the FDA ―Finalized fispemifene Phase 2 development plan to support trial initiation in June

6 First-in-class topical cream treatment for erectile dysfunction

7 Vitaros - Alprostadil/DDAIP.HCl ―Only topically delivered cream approved for ED ―Approved in Canada and Europe ―Rapid onset (generally 5-15 minutes) ―Significant efficacy and safety profile— including difficult to treat populations and those with greatest need: • Diabetics • Hypertensives • Post-prostatectomy • Patients on nitrates/alpha blockers • PDE-5 (e.g. Viagra®) failures Vitaros®: Treatment for Erectile Dysfunction (ED)

8 Vitaros®: Targeting the Untreated Drop out after initial prescription (31%) or drop out after 3 years from start (48%)3 Non-responders 2 Contraindicated due to medications or concurrent diseases1 ED Market Segmentation Significant ED patient population with an unmet need

9 Vitaros®: Attractive Market Opportunity ― Large ED market - $5.5B worldwide with $1.3B in Europe4 ― Unique profile has potential to double the number of treatable patients1,2,3 ― Launched in United Kingdom, Germany, Sweden and Belgium ― Additional launches expected in 2015 in DCP approved countries ― Royalty and milestone revenues expected through 2032 ―Out-licensed in Canada, Europe, Africa, Asia-Pacific, Israel and the Middle East for up to approximately $180 million in total value ― Exploring options to advance the US clinical development program ― Licensing opportunities in Latin America, Japan and China ― Room Temperature Device (RTD) in development ― No refrigeration required ― Key driver of Vitaros global market growth and expansion

10 — Over 580,000 commercial doses manufactured and shipped to date — Rx growth continues to exceed expectations — Positive revenue growth since first launch Vitaros Successfully Launched in Europe — United Kingdom, Germany, Belgium, and Sweden — Regulatory approval activities underway in non-DCP countries by existing partners Additional Vitaros Launches Expected — Majorelle launch expected in France pending final pricing decision — Additional EU launches expected throughout 2015 to include key markets such as Spain and Italy Positive Growth Continues Vitaros®: Launch Update

11 2 0 Fispemifene Novel SERM for Urological Conditions in Men

12 Fispemifene: A Novel Development Stage Asset ―Novel new chemical entity (NCE) ―First tissue-specific selective estrogen receptor modulator (SERM) designed specifically for men ―Multi-indication potential to treat symptoms related to secondary hypogonadism (low testosterone), chronic prostatitis and lower urinary tract symptoms ―Clinical proof-of-concept established in secondary hypogonadism ―Composition of matter patent (through 2025), expected patent term extension, additional issues and pending applications expected to extend to 2028 and beyond

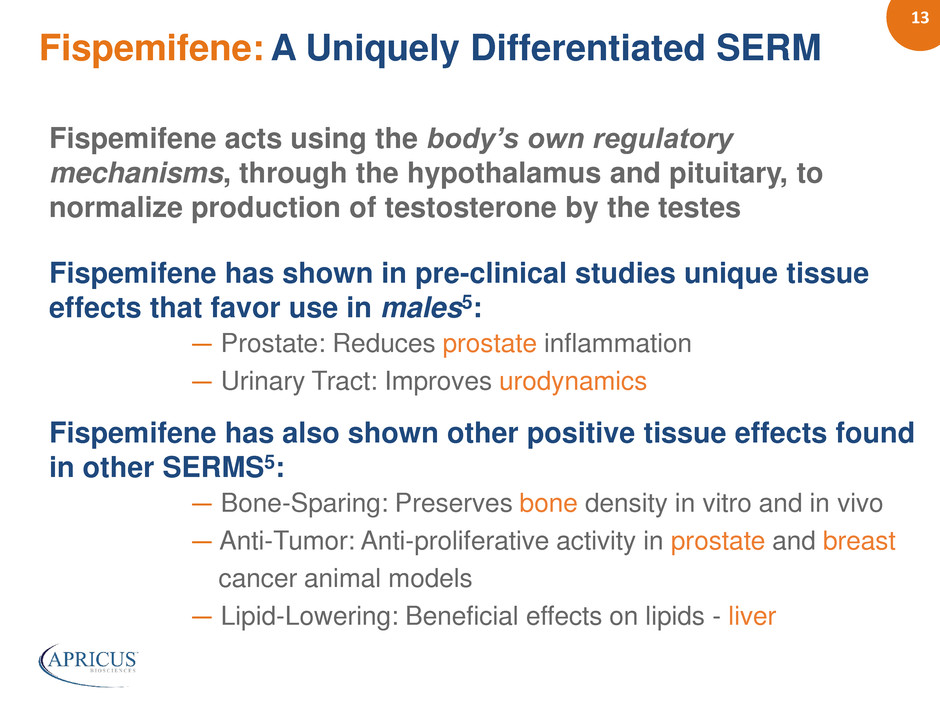

13 Fispemifene acts using the body’s own regulatory mechanisms, through the hypothalamus and pituitary, to normalize production of testosterone by the testes Fispemifene has shown in pre-clinical studies unique tissue effects that favor use in males5: ― Prostate: Reduces prostate inflammation ― Urinary Tract: Improves urodynamics Fispemifene has also shown other positive tissue effects found in other SERMS5: ― Bone-Sparing: Preserves bone density in vitro and in vivo ― Anti-Tumor: Anti-proliferative activity in prostate and breast cancer animal models ― Lipid-Lowering: Beneficial effects on lipids - liver Fispemifene: A Uniquely Differentiated SERM

14 Fispemifene: Multi-Indication Opportunity Potential Value in Multiple Male Urological Conditions Strategic Development Considerations – Non-clinical work supports broad safety package for compound – Urology therapeutic focus helps to further strengthen FDA relationship – Enhances risk profile of compound with “multiple shots on goal” Assessment of Additional Indications – Scientific review – clinical indications based on MOA – Regulatory review – establishing path to approval – Commercial evaluation – understand market potential – Clinical evaluation – conduct a proof-of-concept clinical study in US in 2H 2015

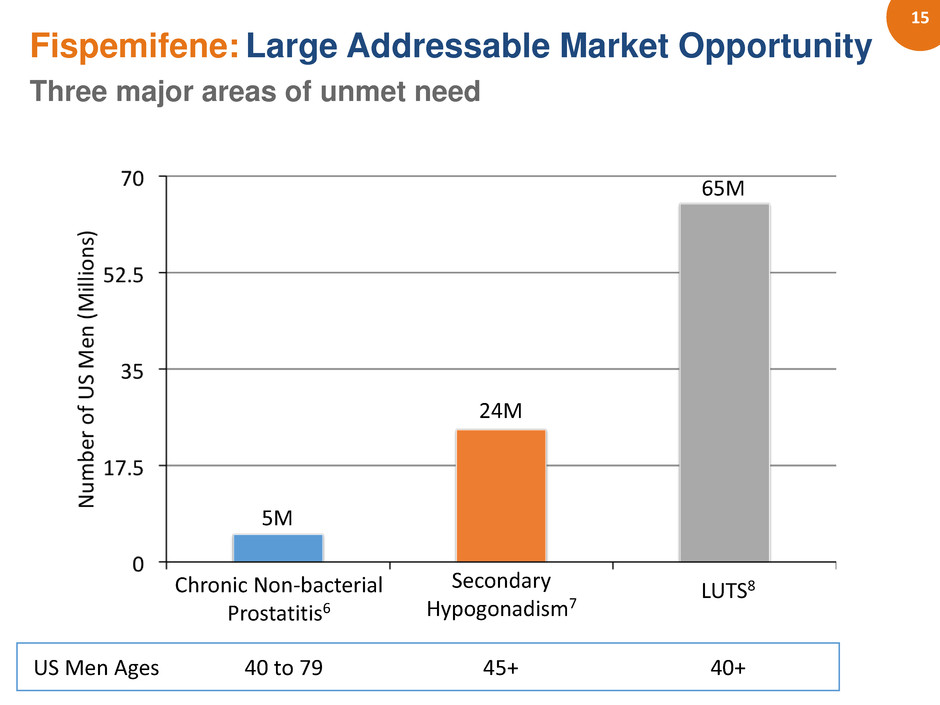

15 LUTS8 Chronic Non-bacterial Prostatitis6 Secondary Hypogonadism7 5M 24M 65M Fispemifene: Large Addressable Market Opportunity Three major areas of unmet need US Men Ages 40 to 79 40+ 45+

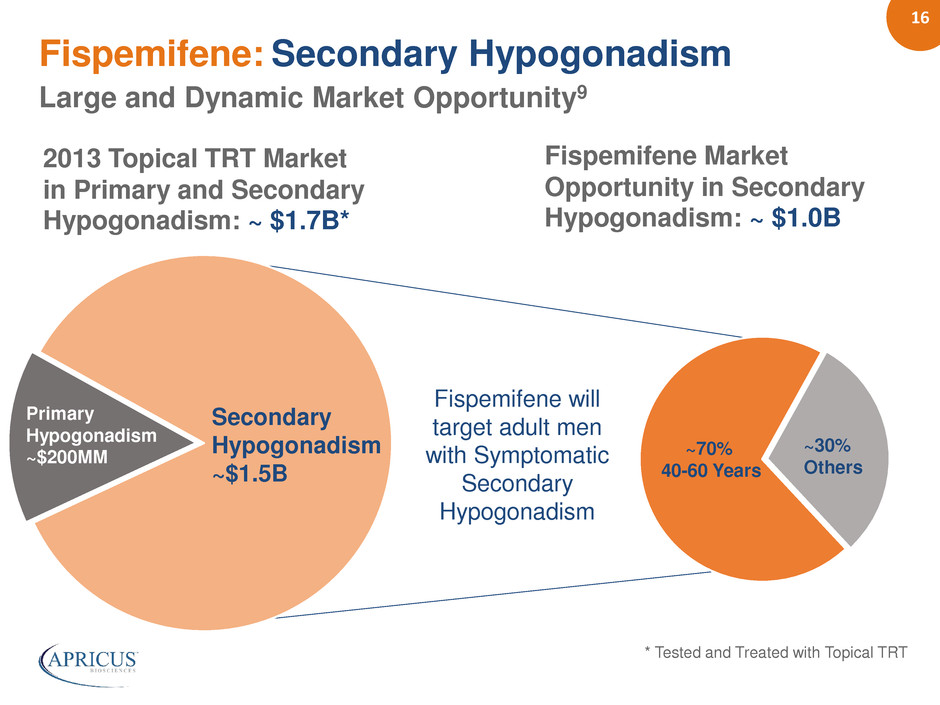

16 Fispemifene: Secondary Hypogonadism Large and Dynamic Market Opportunity9 Primary Hypogonadism ~$200MM Fispemifene will target adult men with Symptomatic Secondary Hypogonadism Secondary Hypogonadism ~$1.5B 2013 Topical TRT Market in Primary and Secondary Hypogonadism: ~ $1.7B* * Tested and Treated with Topical TRT ~30% Others ~70% 40-60 Years Fispemifene Market Opportunity in Secondary Hypogonadism: ~ $1.0B

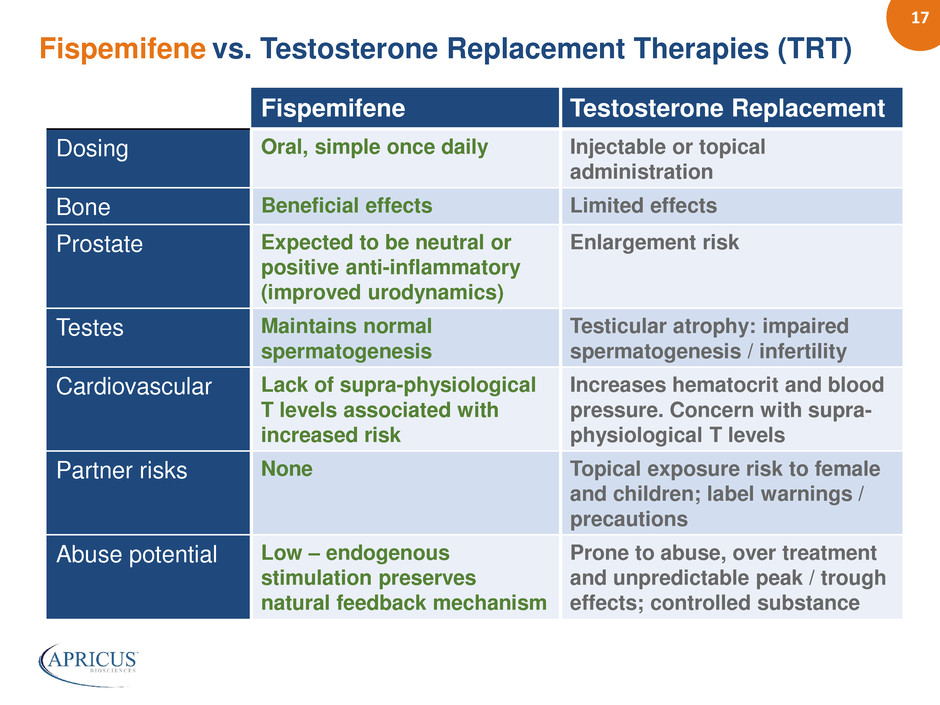

17 Fispemifene vs. Testosterone Replacement Therapies (TRT) Fispemifene Testosterone Replacement Dosing Oral, simple once daily Injectable or topical administration Bone Beneficial effects Limited effects Prostate Expected to be neutral or positive anti-inflammatory (improved urodynamics) Enlargement risk Testes Maintains normal spermatogenesis Testicular atrophy: impaired spermatogenesis / infertility Cardiovascular Lack of supra-physiological T levels associated with increased risk Increases hematocrit and blood pressure. Concern with supra- physiological T levels Partner risks None Topical exposure risk to female and children; label warnings / precautions Abuse potential Low – endogenous stimulation preserves natural feedback mechanism Prone to abuse, over treatment and unpredictable peak / trough effects; controlled substance

18 2 0 Fispemifene: Proof of Concept Follow-up Visit Week 6 FIS 100 mg FIS 300 mg FIS 200 mg 4 wks R A N D O M I Z E D Screening Placebo ― 77 hypogonadal men at 23 centers in the US ― Primary endpoint – change in serum testosterone ― PSA, LH, FSH, lipids, prostate ultrasound and safety labs Phase 2a Clinical Study in Secondary Hypogonadism5

19 2 0 Fispemifene: Phase 2a Clinical Study – Mean Morning Testosterone levels increased up to 78% (300 mg) – Other hormonal parameters (↑LH) confirm mechanism of action Changes in Serum Total Testosterone5

20 Fispemifene: Summary of Early Clinical Safety Fispemifene has been safe and well tolerated at all dose levels No clinically significant changes were found in: – Serum biochemistry – Hematology or urinalysis parameters – Vital signs, physical examination or ECG – Prostate health (PSA and prostate volume) examined in Phase 2 clinical trials – Obstructive symptoms, or urinary QoL Most common adverse reactions (191 subjects): – Upper respiratory tract infection (6 subjects) – Nausea, dizziness (5 subjects each) – Abdominal pain, diarrhea, headache and spontaneous penile erection (2 subjects each)

21 Fispemifene: Clinical Development Update – Asset Acquired in October 2014 – IND successfully transfered to APRI – Scientific Advisory Board meeting completed – Received FDA regulatory guidance on the clinical development plan, indication and endpoints – FDA input on nonclinical safety, tox and carc studies received – Formulation development work to optimize late stage and commercial product underway – Phase 2 trial Contract Research Organization (CRO) selected – US clinical site selection completed – IRB submission completed – Phase 2 clinical trial material (CTM) manufactured On-track for June 2015 start of Phase 2 clinical trial in symptomatic secondary hypogonadism Road to the Clinic in Secondary Hypogonadism

22 Potential first-in-class topical cream treatment for Raynaud’s Phenomenon Secondary to Scleroderma (alprostadil cream)

23 RayVa™: Treatment for Raynaud’s Phenomenon Secondary to Scleroderma (SSc) RayVa – Alprostadil/DDAIP.HCl ― Topical, on-demand route of administration ― RayVa - increased blood flow observed in preclinical models of Raynaud’s Phenomenon with RayVa, using a cold challenge test Clear and Defined Pathway to Approval ― Enrollment ongoing in Phase 2a proof-of-concept trial at four sites ― Late-stage trials in US expected in 2016 ― May qualify for Priority Review following NDA submission, which could occur as early as 2017 Attractive Commercial Opportunity ― Currently no approved Raynaud’s treatments in the US ― Targeted call point – only 4,500 rheumatologist treating secondary Raynaud’s patients in US10 ― Broad IP position with potential exclusivity to 2032

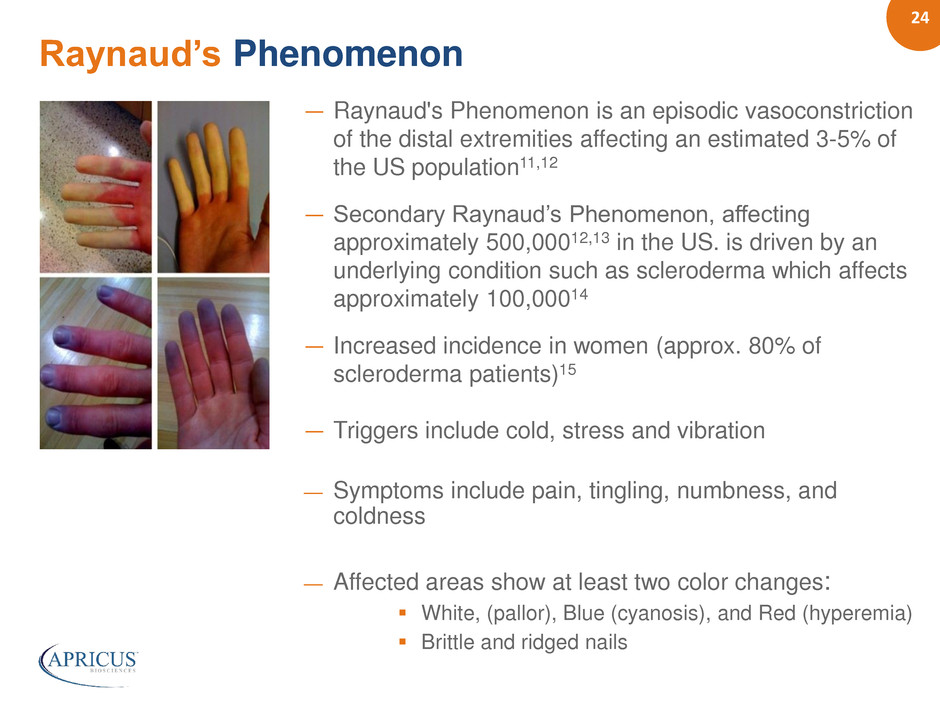

24 ― Raynaud's Phenomenon is an episodic vasoconstriction of the distal extremities affecting an estimated 3-5% of the US population11,12 ― Secondary Raynaud’s Phenomenon, affecting approximately 500,00012,13 in the US. is driven by an underlying condition such as scleroderma which affects approximately 100,00014 ― Increased incidence in women (approx. 80% of scleroderma patients)15 ― Triggers include cold, stress and vibration — Symptoms include pain, tingling, numbness, and coldness — Affected areas show at least two color changes: White, (pallor), Blue (cyanosis), and Red (hyperemia) Brittle and ridged nails Raynaud’s Phenomenon

25 2 0 Financial Overview

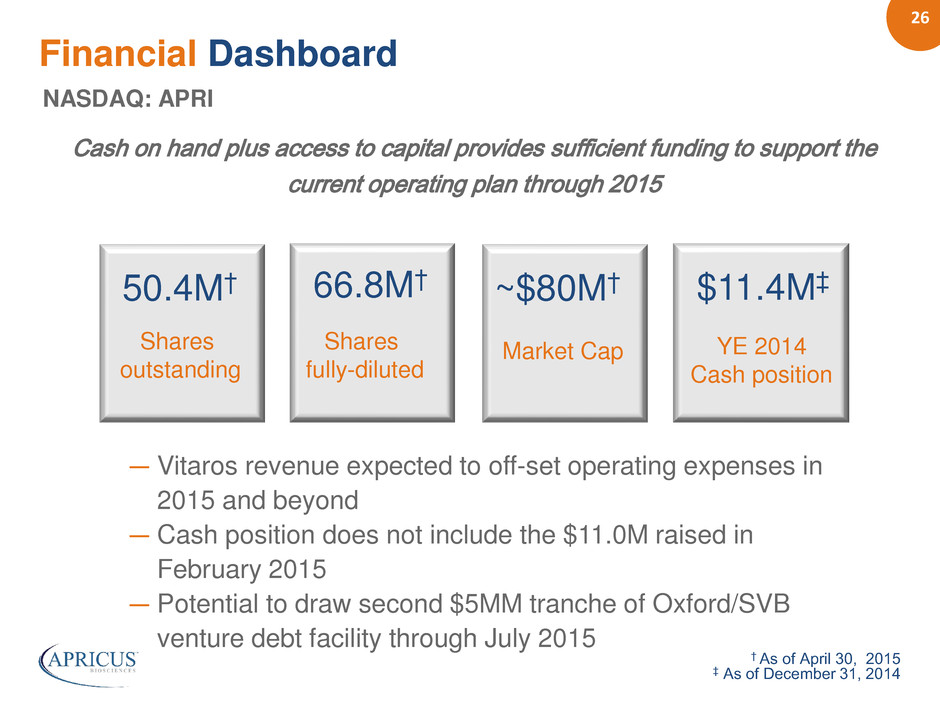

26 Financial Dashboard NASDAQ: APRI Cash on hand plus access to capital provides sufficient funding to support the current operating plan through 2015 50.4M† 66.8M† ~$80M† $11.4M‡ Shares outstanding Shares fully-diluted Market Cap YE 2014 Cash position † As of April 30, 2015 ‡ As of December 31, 2014 ― Vitaros revenue expected to off-set operating expenses in 2015 and beyond ― Cash position does not include the $11.0M raised in February 2015 ― Potential to draw second $5MM tranche of Oxford/SVB venture debt facility through July 2015

27 Milestones: Advancing the Pipeline Vitaros ― Additional launches in major EU markets expected in 2015 ― Expected quarterly cash flows from milestone and royalty payments ― Pursue additional ex-US commercial partnerships and determine potential path forward in US with Actavis and in Canada with Mylan in 2015 ― Generate room temperature device data required to support 2016 approval submission in Europe Fispemifene ― Initiation of Phase 2b clinical trial in lead indication in 2Q 2015 ― Phase 2b clinical trial complete enrollment targeted for 4Q 2015 with data expected in Q1 2016 ― Initiate exploratory clinical trial in one additional indication by year-end RayVa ― Establish proof-of-concept through ongoing Phase 2a trial in 2Q 2015 ― Seek additional US regulatory guidance for clinical program in 2H 2015 ― Pursue potential ex-US development and commercialization partner(s) in 2H 2015

28 Contacts Institutional Investors: Angeli Kolhatkar angeli@areciaadvisors.com Arecia Advisors, LLC (917) 387-4770 Retail Investors: Chris Eddy, David Collins apri@catalyst-ir.com Catalyst Global (212) 924-9800

29 1 D2 Market Research, June 2007. 2 J Sex Med 2012; 9: 2361–2369. 3 International Journal of Urology 2007; 14: 339-342. 4 IMS Health 2013. 5 Data on file. 6 Estimates based on 2014 US Census data, Longitudinal Association between Prostatitis and Development of Benign Prostatic Hyperplasia, Urology. 2008 March ; 71(3): 475–479, and Epidemiology of prostatitis, Int J Antimicrob Agents. 2008 February ; 31(Suppl 1): S85–S90. 7 Estimates based on 2014 US Census data and Mulligan T et al. Prevalence of hypogonadism in males aged at least 45 years: the HIM study. Int J Clin Pract. 2006 Jul;60(7):762-9 8 Benign Prostatic Hyperplasia and Male Lower Urinary Tract Symptoms Report, Decision Resources; December 2012 9 According to data on file with the Company, certain published data and information presented at the September 17, 2014 Joint Meeting of the Bone, Reproductive and Urologic Drugs Advisory Committee and the Drug Safety and Risk Management Advisory Committee. 10 American Medical Association 2011. 11 N Engl J Med 2002; 347: 1001–1008. 12 Drugs 2007; 67: 517-525. 13 2012 U.S. Census Bureau: State and County QuickFacts (http://quickfacts.census.gov/qfd/states/00000.html). 14 Curr Opin Rheumatol 2012; 24: 165–170; American College of Rheumatology (http://www.rheumatology.org/Practice/Clinical/Patients/Diseases_And_Conditions/Scleroderma). 15 Medicine 2013; 92: 191-205. References

Taglich Brothers 12th Annual Conference NASDAQ: APRI May 5, 2015