Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TELEFLEX INC | a4-30x20158xkreq12015earni.htm |

| EX-99.1 - EXHIBIT 99.1 - TELEFLEX INC | exhibit991to4-30x20158xkre.htm |

| EX-99.2 - EXHIBIT 99.2 - TELEFLEX INC | exhibit992to4-30x20158xkre.htm |

1 TELEFLEX INCORPORATED FIRST QUARTER 2015 EARNINGS CONFERENCE CALL 1 Exhibit 99.3

Conference Call Logistics The release, accompanying slides, and replay webcast are available online at www.teleflex.com (click on “Investors”) Telephone replay available by dialing 888-286-8010 or for international calls, 617- 801-6888, pass code number 72082025 2

Introductions Benson Smith Chairman, President and CEO Liam Kelly Executive Vice President and COO 3 Jake Elguicze Treasurer and Vice President of Investor Relations Thomas Powell Executive Vice President and CFO

Forward-Looking Statements/Non-GAAP Financial Measures This presentation and our discussion contain forward-looking information and statements including, but not limited to, our expectations regarding the timing for completion of, and annual savings expected to be realized from, our manufacturing footprint realignment plan and our 2015 restructuring plan; forecasted 2015 constant currency revenue growth, adjusted gross and operating margins and adjusted earnings per share; and other matters which inherently involve risks and uncertainties which could cause actual results to differ from those projected or implied in the forward–looking statements. These risks and uncertainties are addressed in the Company’s SEC filings, including its most recent Form 10-K. This presentation includes the following non-GAAP financial measures: • Adjusted diluted earnings per share. This measure excludes, depending on the period presented (i) the effect of charges associated with our restructuring programs; (ii) losses and other charges, including acquisition and integration costs, charges related to facility consolidations, and charges related to contingent consideration liabilities, net of specified reversals, including a reversal of liabilities related to certain contingent consideration arrangements during the quarter ended March 31, 2014; (iii) amortization of the debt discount on the Company’s convertible notes; (iv) intangible amortization expense; and (v) tax benefits resulting from the resolution of, or expiration of the statute of limitations with respect to, prior years’ tax matters. In addition, the calculation of diluted shares within adjusted earnings per share gives effect to the anti-dilutive impact of the Company’s convertible note hedge agreements, which reduce the potential economic dilution that otherwise would occur upon conversion of the Company’s senior subordinated convertible notes (under GAAP, the anti-dilutive impact of the convertible note hedge agreements is not reflected in diluted shares). • Constant currency revenue growth. This measure excludes the impact of translating the results of international subsidiaries at different currency exchange rates from period to period. • Adjusted gross margin. This measure excludes, depending on the period presented, certain losses, other charges and charge reversals, primarily related to acquisition and integration costs and charges related to facility consolidations. • Adjusted operating margin. This measure excludes, depending on the period presented, (i) the impact of restructuring and other impairment charges; (ii) losses, other charges and charge reversals primarily related to acquisition and integration costs, facility consolidation charges, contingent consideration liabilities and, for 2014, the reversal of contingent consideration liabilities. • Adjusted tax rate. This measure is the percentage of the Company’s adjusted taxes on income from continuing operations to its adjusted income from continuing operations before taxes. Adjusted taxes on income from continuing operations excludes, depending on the period presented, the impact of tax benefits or costs associated with (i) restructuring and impairment charges, (ii) amortization of the debt discount on the Company’s convertible notes, (iii) intangible amortization expense, (iv) the resolution of, or expiration of statutes of limitations with respect to, various prior years’ tax matters and (v) losses and other charges primarily related to related to acquisition and integration costs, facility consolidation charges, charges related to contingent consideration liabilities and, for 2014, the reversal of contingent consideration liabilities. Reconciliation of these non-GAAP financial measures to the most comparable GAAP measures is contained within this presentation. Unless otherwise noted, the following slides reflect continuing operations. 4

5 EXECUTIVE SUMMARY 5

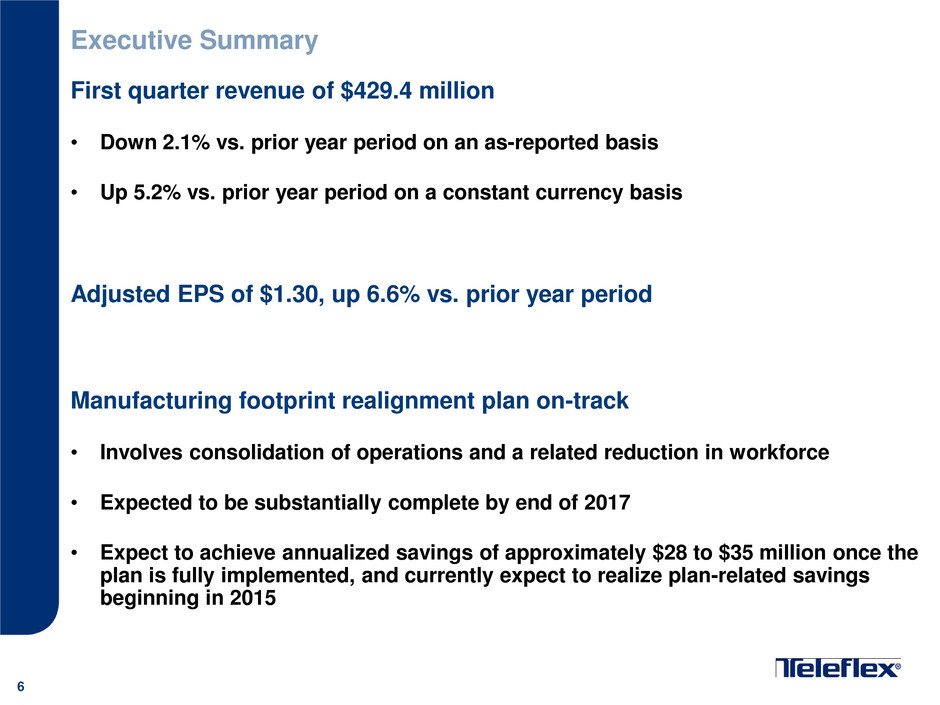

Executive Summary First quarter revenue of $429.4 million • Down 2.1% vs. prior year period on an as-reported basis • Up 5.2% vs. prior year period on a constant currency basis Adjusted EPS of $1.30, up 6.6% vs. prior year period Manufacturing footprint realignment plan on-track • Involves consolidation of operations and a related reduction in workforce • Expected to be substantially complete by end of 2017 • Expect to achieve annualized savings of approximately $28 to $35 million once the plan is fully implemented, and currently expect to realize plan-related savings beginning in 2015 6

Executive Summary 2015 restructuring initiatives • Initiated programs associated with segment realignment and consolidation of certain facilities in North America • Expected to be substantially complete by the end of 2017 • Expect to achieve annualized savings of approximately $12 million to $14 million once programs have been fully implemented, and currently expect to realize savings related to these programs beginning in 2015 Re-affirming 2015 financial guidance • Constant currency revenue growth of between 4% to 6% • Adjusted earnings per share of between $6.10 and $6.35 Promoted Liam Kelly to Executive Vice President and Chief Operating Officer 7

8 FIRST QUARTER PRODUCT LINE AND GEOGRAPHIC REVENUE REVIEW 8

First Quarter Highlights First quarter 2015 constant currency revenue growth of 5.2% • 124 bps improvement in sales volume of core products • Vidacare contributes 132 bps of constant currency growth • 126 bps improvement resulting from introduction of new products • Core product pricing drives 19 bps of year-over-year revenue growth Contribution from Mini-Lap acquisition and distributor conversions added 118 bps of constant currency revenue growth 9

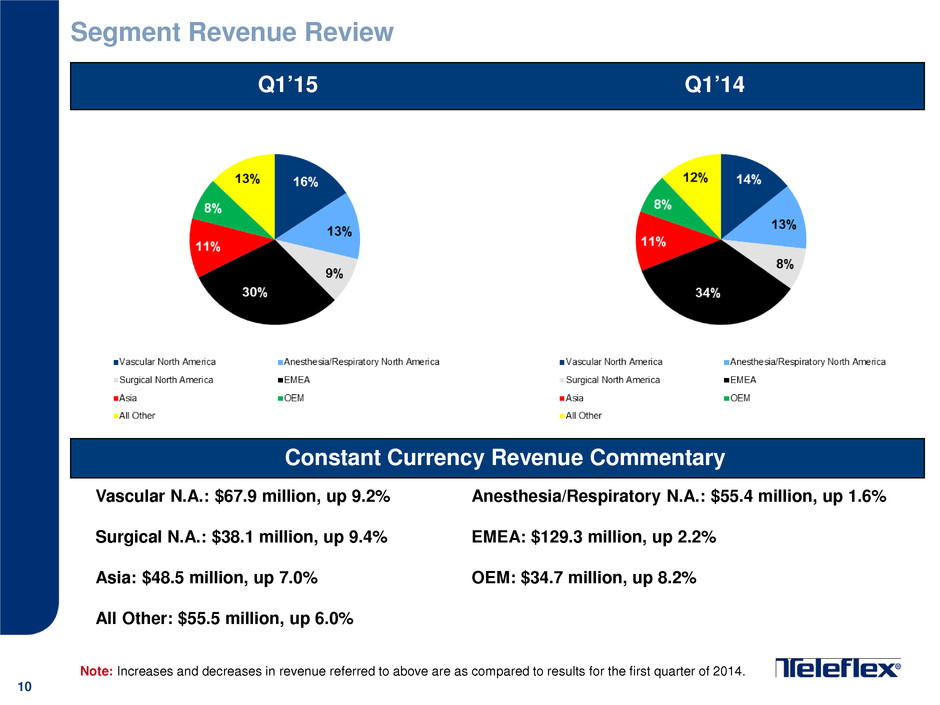

Segment Revenue Review Q1’15 Vascular N.A.: $67.9 million, up 9.2% Anesthesia/Respiratory N.A.: $55.4 million, up 1.6% Surgical N.A.: $38.1 million, up 9.4% EMEA: $129.3 million, up 2.2% Asia: $48.5 million, up 7.0% OEM: $34.7 million, up 8.2% All Other: $55.5 million, up 6.0% Note: Increases and decreases in revenue referred to above are as compared to results for the first quarter of 2014. 10 Constant Currency Revenue Commentary Q1’14

Group Purchasing Organization and IDN Review Group Purchasing Organization Update • 2 new agreements • 6 renewed agreements IDN Update • 2 new agreements 11 Track record of expansion of contractual agreements continues in Q1’15

12 FIRST QUARTER NEW PRODUCT INTRODUCTIONS AND REGULATORY APPROVALS 12

Pressure-injectable ARROW® PICCs with Chlorag+ard® Technology are the world’s first FDA- cleared central venous catheters to significantly reduce the risk of central line-associated bloodstream infections and PICC-related vessel thrombosis, compared to traditional uncoated catheters. They are also the only PICCs in the IV catheter marketplace that have received FDA 510(k) clearance for both broad-spectrum antimicrobial and antithrombogenic protection. World’s first FDA cleared antimicrobial and antithrombogenic PICC now available in complete portfolio of single-, double- and triple-lumen formats and related kits. PRODUCT DESCRIPTION 13 New Product Introductions and Regulatory Approvals Triple-Lumen ARROW® PICC with Chlorag+ard® Technology

Rusch® Airtraq™ Avant™ Video Laryngoscope System provides improved visibility for intubating pre-hospital patients where overcoming challenging patient positioning and difficult airways is vital. The system provides an affordable per-use option with single-use disposable blades. The addition of a snap-on video camera (sold separately) provides a rotating screen, recording capability, and multiple display options, including viewing via a smartphone. PRODUCT DESCRIPTION 14 New Product Introductions and Regulatory Approvals Rusch® Airtraq™ Avant™ Video Laryngoscope System

Percuvance™ Percutaneous Surgical System is intended to manipulate tissue and includes components that introduce a variety of instrument configurations into the abdominal cavity and requires a smaller incision site than traditional laparoscopic surgery. It offers a reusable handle that is compatible with interchangeable instrument tips, which include graspers, scissors and dissectors. Unlike other laparoscopic devices, the Percuvance™ System affords a percutaneous insertion into the patient without the use of a trocar. It is indicated for the means to penetrate soft tissue to access certain areas of the abdomen and used to grasp, hold and manipulate tissue during laparoscopic surgery. PRODUCT DESCRIPTION 15 New Product Introductions and Regulatory Approvals Percuvance™ Percutaneous Surgical System PRODUCT UPDATE Percuvance™ Percutaneous Surgical System was percutaneously inserted into a human for the first time in a procedure at a large U.S. hospital system.

16 ACQUISITION UPDATE 16

Acquisition Update Acquired Truphatek • Private Israeli company established in 1993 with a broad range of disposable and reusable laryngoscope devices • Teleflex was Truphatek’s primary distributor of laryngoscopes in the U.S. and acquisition positions Teleflex to de-layer supply chain in U.S. market and strengthens O.U.S. competitive position • Accretive, all-cash transaction completed in April 2015 17

Acquisition Update Acquired Trintris Medical, Inc. • Private company OEM for balloons and catheters • Balloon forming and attaching capability complements existing catheter business and fills product gap • Accretive, all-cash transaction completed in March 2015 18

19 FIRST QUARTER 2015 FINANCIAL REVIEW 19

Financial Results Revenue of $429.4 million • Down 2.1% vs. prior year period on an as-reported basis • Up 5.2% vs. prior year period on a constant currency basis Adjusted gross margin of 52.3%, up 190 bps vs. prior year period Adjusted operating margin of 20.5%, up 160 bps vs. prior year period Adjusted tax rate of 22.3%, down 220 bps vs. prior year period Adjusted EPS of $1.30, up 6.6% vs. prior year period Cash flow from operations of $42.4 million, in-line with prior year period 20

21 2015 FINANCIAL OUTLOOK 21

22 Constant currency revenue growth expected to be between 4% and 6% Adjusted Gross margin anticipated to be 53.0% to 54.0%, an improvement of 150bps to 250bps vs. prior year Adjusted operating margin expected to be between 22.0% and 22.5% Adjusted earnings per share anticipated to be between $6.10 and $6.35 per share 2015 Financial Outlook

23 QUESTION & ANSWER 23

24 APPENDICES 24

Appendix A – Reconciliation of Constant Currency Revenue Growth Dollars in Millions 25 March 29, 2015 March 30, 2014 Constant Currency Currency Total Vascular North America 67.9$ 62.5$ 9.2% (0.5%) 8.7% Anesthesia/Respiratory North America 55.4 54.7 1.6% (0.4%) 1.2% Surgical North America 38.1 35.2 9.4% (1.4%) 8.0% EMEA 129.3 150.2 2.2% (16.2%) (14.0%) Asia 48.5 49.6 7.0% (9.2%) (2.2%) OEM 34.7 33.2 8.2% (3.6%) 4.6% All Other 55.5 53.1 6.0% (1.3%) 4.7% Net Revenues 429.4$ 438.5$ 5.2% (7.3%) (2.1%) Three Months Ended % Increase / (Decrease)

Appendix B – Reconciliation of Revenue Growth Dollars in Millions 26 1: amount is comprised of incremental price on existing products and the sale of new products of $1.6 million and $3.6 million, respectively, both of which are a result of the businesses acquired. % Basis Points Three Months Ended March 30, 2014 Revenue As-Reported $438.5 Foreign Currency (31.8) -7.3% (726) Sales Volume Core Products 5.4 1.2% 124 Vidacare 5.8 1.3% 132 New Product Sales 5.5 1.3% 126 Core Product Pricing 0.8 0.2% 19 Mini-Lap and Distributor to Direct Conversions 1 5.2 1.2% 118 Three Months Ended March 29, 2015 Revenue As-Reported $429.4 -2.1% (208) Year-over-year growth

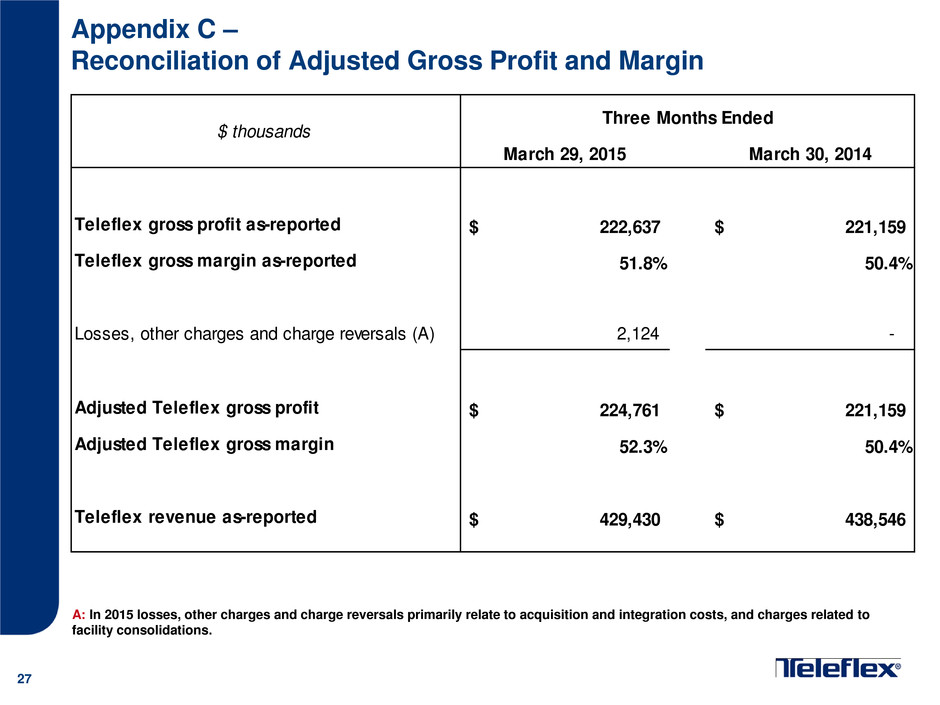

27 Appendix C – Reconciliation of Adjusted Gross Profit and Margin March 29, 2015 March 30, 2014 Teleflex gross profit as-reported 222,637$ 221,159$ Teleflex gross margin as-reported 51.8% 50.4% Losses, other charges and charge reversals (A) 2,124 - Adjusted Teleflex gross profit 224,761$ 221,159$ Adjusted Teleflex gross margin 52.3% 50.4% Teleflex revenue as-reported 429,430$ 438,546$ $ thousands Three Months Ended A: In 2015 losses, other charges and charge reversals primarily relate to acquisition and integration costs, and charges related to facility consolidations.

28 Appendix D – Reconciliation of Adjusted Operating Profit and Margin March 29, 2015 March 30, 2014 Teleflex income from continuing operations before interest and taxes 65,608$ 59,020$ Teleflex income from continuing operations before interest and taxes margin 15.3% 13.5% Restructuring and other impairment charges 4,448 7,780 Losses, other charges and charge reversals (A) 3,037 (106) Intangible amortization expense 14,740 16,019 Adjusted Teleflex income from continuing operations before interest, taxes and intangible amortization expense 87,833$ 82,713$ Adjusted Teleflex income from continuing operations before interest, taxes and intangible amortization expense margin 20.5% 18.9% Teleflex revenue as-reported 429,430$ 438,546$ $ thousands Three Months Ended A: In 2015, losses, other charges and charge reversals primarily relate to acquisition and integration costs; charges related to facility consolidations; and charges related to contingent consideration liabilities. In 2014, losses, other charges and charge reversals primarily relate to acquisition and integration costs; and the reversal of contingent consideration liabilities.

Appendix E – Reconciliation of Adjusted EPS from Continuing Operations Quarter Ended – March 29, 2015 Dollars in millions, except per share data 29 Cost of goods sold Selling, general and administrative expenses Restructuring and other impairment charges Interest expense, net Income taxes Net income (loss) attributable to common shareholders from continuing operations Diluted earnings per share available to common shareholders Shares used in calculation of GAAP and adjusted earnings per share GAAP Basis $206.8 $139.7 $4.4 $17.0 $9.3 $39.1 $0.83 47,295 Adjustments Restructuring and other impairment charges Losses and other charges (A) Amortization of debt discount on convertible notes Intangible amortization expense — 14.7 — — 3.8 11.0 $0.23 — Tax adjustment (B) — — — — (0.2) 0.2 — — Shares due to Teleflex under note hedge (C) Adjusted basis $204.7 $124.0 — $13.8 $16.5 $57.3 $1.30 44,239 — — 4.4 — 1.6 2.8 $0.06 — 2.1 0.9 — — 0.8 2.2 $0.05 — — $0.09 (3,056) — — — 3.2 1.2 2.0 (A) In 2015, losses and other charges include approximately $1.9 million, net of tax, or $0.04 per share, related to acquisition and integration costs, and charges related to facility consolidations; approximately $0.3 million, net of tax, or $0.01 per share, related to contingent consideration liabilities. (B) The tax adjustment represents a net benefit resulting from the resolution of, or the expiration of statute of limitations with respect to various prior years’ U.S. federal, state and foreign tax matters. (C) Adjusted diluted shares are calculated by giving effect to the anti-dilutive impact of the Company’s convertible note hedge agreements, which reduce the potential economic dilution that otherwise would occur upon conversion of our senior subordinated convertible notes. Under GAAP, the anti-dilutive impact of the convertible note hedge agreements is not reflected in diluted shares. $0.04 — — — — — —

Appendix F – Reconciliation of Adjusted EPS from Continuing Operations Quarter Ended – March 30, 2014 Dollars in millions, except per share data 30 Cost of goods sold Selling, general and administrative expenses Restructuring and other impairment charges Interest expense, net Income taxes Net income (loss) attributable to common shareholders from continuing operations Diluted earnings per share available to common shareholders Shares used in calculation of GAAP and adjusted earnings per share GAAP Basis $217.4 $140.3 $7.8 $15.2 $8.5 $35.1 $0.77 45,749 Adjustments Restructuring and other impairment charges Losses and other charges (A) Amortization of debt discount on convertible notes Intangible amortization expense — 16.0 — — 5.5 10.5 $0.23 — Tax adjustment (B) — — — — 0.2 (0.2) — — Shares due to Teleflex under note hedge (C) Adjusted basis $217.4 $124.4 — $12.2 $17.2 $53.0 $1.22 43,299 (C) Adjusted diluted shares are calculated by giving effect to the anti-dilutive impact of the Company’s convertible note hedge agreements, which reduce the potential economic dilution that otherwise would occur upon conversion of our senior subordinated convertible notes. Under GAAP, the anti-dilutive impact of the convertible note hedge agreements is not reflected in diluted shares. (A) In 2014, losses and other charges include approximately ($2.3) million, net of tax, or ($0.05) per share, related to the reversal of contingent consideration liabilities; and approximately $1.4 million, net of tax, or $0.03 per share, related to acquisition and integration costs. $0.04 — — — — — — — $0.06 (2,450)— 1.9 (B) The tax adjustment represents a net benefit resulting from the resolution of, or the expiration of statute of limitations with respect to various prior years’ U.S. federal, state and foreign tax matters. — — 3.0 1.1 $0.15 — — (0.1) — — 0.8 (0.9) ($0.02) — — — 7.8 — 1.1 6.7

31 Appendix G – Reconciliation of Adjusted Tax Rate Dollars in Thousands Three Months Ended March 29, 2015 Income from continuing operations before taxes Taxes on income from continuing operations Tax rate GAAP basis $48,605 $9,332 19.2% Restructuring and impairment charges 4,448 1,613 Losses, other charges and charge reversals (A) 3,037 805 Amortization of debt discount on convertible notes 3,211 1,171 Intangible amortization expense 14,740 3,761 Tax adjustment (B) 0 (162) Adjusted basis $74,041 $16,520 22.3% Three Months Ended March 30, 2014 GAAP basis $43,803 $8,534 19.5% Restructuring and impairment charges 7,780 1,072 Losses, other charges and charge reversals (A) (106) 819 Amortization of debt discount on convertible notes 2,974 1,086 Intangible amortization expense 16,019 5,533 Tax adjustment (B) 0 203 Adjusted basis $70,470 $17,247 24.5% (A) In 2015, losses, other charges and charge reversals primarily relate to acquisition and integration costs; charges related to facility consolidations; and charges related to contingent consideration liabilities. In 2014, losses, other charges and charge reversals primarily relate to acquisition and integration costs; and the reversal of contingent consideration liabilities. (B) The tax adjustment represents a net benefit resulting from the resolution of, or the expiration of statute of limitations w ith respect to various prior years’ U.S. federal, state and foreign tax matters.

Appendix H – Reconciliation of 2015 Constant Currency Revenue Growth Guidance 32 Low High Forecasted GAAP Revenue Growth (2%) ─ Estimated impact of foreign currency fluctuations 6% 6% Forecasted Constant Currency Revenue Growth 4% 6%

Appendix I – Reconciliation of 2015 Adjusted Gross Margin Guidance 33 Note: In 2015, losses, other charges and charge reversals relate to expenses associated with the Restructuring Plan approved by the Board of Directors on April 28, 2014. Low High GAAP Gross Margin 52.35% 53.10% Losses, other charges and charge reversals 0.65% 0.90% Adjusted Gross Margin 53.00% 54.00%

Appendix J – Reconciliation of 2015 Adjusted Operating Margin Guidance 34 Note: In 2015, losses, other charges and charge reversals include expenses associated with the Restructuring Plan approved by the Board of Directors on April 28, 2014; acquisition and integration costs, and charges related to facility consolidations; and the reversal of contingent consideration liabilities. Low High GAAP Operating Margin 18.00% 18.15% Losses, other charges and charge reversals 0.75% 1.00% Intangible amortization expense 3.25% 3.35% Adjusted Operating Margin 22.00% 22.50%

Appendix K – Reconciliation of 2015 Adjusted Earnings per Share Guidance 35 Low High Diluted earnings per share attributable to common shareholders $4.13 $4.28 Restructuring, impairment charges and special items, net of tax $0.90 $0.95 Intangible amortization expense, net of tax $0.90 $0.95 Amortization of debt discount on convertible notes, net of tax $0.17 $0.17 Adjusted diluted earnings per share $6.10 $6.35