Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - EPIQ SYSTEMS INC | d916281dex312.htm |

| EX-31.1 - EX-31.1 - EPIQ SYSTEMS INC | d916281dex311.htm |

| EX-32.1 - EX-32.1 - EPIQ SYSTEMS INC | d916281dex321.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014 or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

001-36633

(Commission File Number)

Epiq Systems, Inc.

(Exact name of registrant as specified in its charter)

| Missouri |

48-1056429 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

501 Kansas Avenue,

Kansas City, Kansas 66105

(Address of principal executive offices, Zip Code)

Registrant’s telephone number, including area code: 913-621-9500

Securities registered pursuant to Section 12 (b) of the Act:

| Title of each class |

Name of exchange on which registered | |

| Common Stock, $0.01 par value Preferred Stock Purchase Rights |

The NASDAQ Stock Market, LLC The NASDAQ Stock Market, LLC |

Securities registered pursuant to Section 12 (g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by checkmark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer” and “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of voting common stock held by non-affiliates of the registrant based upon the last reported sale price on June 30, 2014, was $438 million. There were 37,041,224 shares of common stock, $0.01 par value, outstanding at February 23, 2015.

Table of Contents

Explanatory Note

Epiq Systems, Inc. (the “Company” , “we” or “us”) is filing this Amendment No. 1 on Form 10-K/A (this “Amendment”) to its Annual Report on Form 10-K for the year ended December 31, 2014 (the “Original Report”) to include Items 10, 11, 12, 13 and 14 of Part III to Form 10-K. No changes are being made to the Original Report. Unless expressly stated, this Amendment does not reflect events occurring after the filing of the Original Report and it does not modify or update in any way the disclosures contained in the Original Report, which speak as of the date of the original filing.

The Report of the Compensation Committee on Executive Compensation included in this Amendment No. 1 on Form 10-K/A is not to be incorporated by reference into any other filings made with the Securities and Exchange Commission unless otherwise stated in those filings.

Table of Contents

PART III

Table of Contents

PART III

Item 10. Directors, Executive Officers and Corporate Governance

Directors and Executive Officers

Set forth below is a description of the age, background and skills qualifications and attributes of our directors and executive officers.

Tom W. Olofson

Director since: 1988

Age: 73

Chief Executive Officer and Chairman of the Board of Directors

Experience. Mr. Olofson acquired the Company in July 1988 and has served continuously as the Company’s Chief Executive Officer and Chairman of the Board of Directors (the “Board”) since that time. In 1997, Mr. Olofson led the Company’s initial public offering, and the Company has been continuously listed on NASDAQ since February 1997. Prior to that, he held various management positions at Xerox Corporation and was a senior vice president and member of the Office of the President of Marion Laboratories, Inc. Mr. Olofson has also served as a director of, and advisor to, various private companies in which he has been an investor. In the past five years, Mr. Olofson has not served on the board of any other publicly traded company or any company registered as an investment company under the Investment Company Act of 1940, as amended. Mr. Olofson earned a BBA from the University of Pittsburgh and is currently Chairman of the Tom W. and Jeanne H. Olofson Foundation and an emeritus member of the Board of Visitors of the Katz Graduate School of Business at the University of Pittsburgh.

Specific Qualifications, Skills and Attributes. The Board believes that Mr. Olofson’s experience as a senior executive and his general executive management skills and financial acumen are exceedingly valuable to Epiq. He has transformed Epiq from a privately held small business in July 1988 to a publicly traded, global technology services leader in 2015. Mr. Olofson has extensive knowledge of all aspects of Epiq’s business, including its management and personnel, financials and operations. He also serves as the cultural leader of Epiq, responsible for guiding Epiq’s business values and senior management and other personnel at Epiq through his committed, ethical and accountable leadership.

James A. Byrnes

Director since: 2003

Age: 68

Experience. Mr. Byrnes served as vice president of international marketing for Hoechst Marion Roussel, Inc. until his retirement in 1996. Prior to that, he was vice president of global commercial development for Marion Merrell Dow. Prior to these positions, he held several executive sales and marketing positions at Marion Merrell Dow and Marion Laboratories, predecessor companies to Hoechst Marion Roussel. In recent years, Mr. Byrnes has served as an advisor to various entrepreneurial companies. In the past five years, Mr. Byrnes has not served on the board of any other publicly traded company or any company registered as an investment company under the Investment Company Act of 1940, as amended. He holds a BS degree in general science from Gannon University and an MBA degree from Rockhurst College.

Specific Qualifications, Skills and Attributes. The Board believes that Mr. Byrnes brings significant executive-level sales, marketing, global commercial and strategic expertise to the Board.

1

Table of Contents

Charles C. Connely, IV

Director since: 2012

Age: 67

Experience. Since March 2012, Mr. Connely has served as a Managing Director of EPR Financial Services, a subsidiary of EPR Properties, a real estate investment trust traded on the New York Stock Exchange. Prior to this position, Mr. Connely was the President of C.C. Connely & Associates, a private financial services company. He previously served as the General Manager-Vice President of a division of Butler Manufacturing Company, a steel manufacturing company that was previously traded on the New York Stock Exchange, and was the Chief Executive Officer of the D.H. Pace Company, a private construction company. Mr. Connely has over twenty years of investment banking experience as he previously served as Managing Director of KPMG LLP’s Corporate Finance Group and as Vice President of Corporate Finance with George K. Baum & Company, an investment banking firm. In the past five years, Mr. Connely has not served on the board of any other publicly traded company or any company registered as an investment company under the Investment Company Act of 1940, as amended. Mr. Connely is an associate teaching professor at the University of Missouri-Kansas City Bloch School. He is a graduate of the University of Missouri-Kansas City with BBA and MBA degrees and is also a graduate of the Stonier Graduate School of Banking at Georgetown University. Mr. Connely holds CCIM, CFP and CPM designations.

Specific Qualifications, Skills and Attributes. The Board believes that Mr. Connely brings significant accounting, financial and management expertise to the Board.

Edward M. Connolly, Jr.

Director since: 2001

Age: 72

Experience. Mr. Connolly is a retired executive from Aventis Pharmaceuticals, where he served as president of the Aventis Pharmaceuticals Foundation and vice president of community affairs. Prior to that, he held various executive human resources positions at Hoechst Marion Roussel, Marion Merrell Dow, and Marion Laboratories, predecessor companies to Aventis. Since 2000, Mr. Connolly has served as an executive-level human resources consultant at Rights Management Consultants, and led CEO Groups comprised of executives from various industries. In the past five years, Mr. Connolly has not served on the board of any other publicly traded company or any company registered as an investment company under the Investment Company Act of 1940, as amended. He holds a BA degree in psychology from Bellarmine University.

Specific Qualifications, Skills and Attributes. The Board believes that Mr. Connolly brings significant executive leadership, human resources and community affairs expertise to the Board.

Douglas M. Gaston

Director since: 2014

Age: 63

Experience. In 2014, Mr. Gaston retired as Regional Managing Director for BKD, LLP, a national accounting and advisory firm where he had been a partner for close to 25 years. In the past five years, Mr. Gaston has not served on the board of any other publicly traded company or any company registered as an investment company under the Investment Company Act of 1940, as amended. Mr. Gaston holds a master’s degree in accounting from Kansas State University.

Specific Qualifications, Skills and Attributes. Mr. Gaston was appointed to the Board in 2014 upon recommendation of the Nominating and Corporate Governance Committee after being brought to the attention of

2

Table of Contents

one of the Company’s independent directors and considered by the Nominating and Corporate Governance Committee. The Board believes that Mr. Gaston brings significant accounting and finance and management expertise to the Board.

Joel Pelofsky

Director since: 2004

Age: 77

Experience. Mr. Pelofsky is currently Of Counsel with Berman, DeLeve, Kuchan & Chapman, L.C. Prior to that, he was Of Counsel with Spencer Fane Britt & Browne LLP from 2003 through 2009. From 1995 through 2003 he served as United States Trustee for Missouri, Arkansas and Nebraska. From 1986 through 1995, Mr. Pelofsky was a partner and chairman of the bankruptcy department of Shugart Thomson & Kilroy. From 1980 through 1985, Mr. Pelofsky was a United States Bankruptcy Judge in the United States Bankruptcy Court for the Western District of Missouri. In the past five years Mr. Pelofsky has not served on the board of any other publicly traded company or any company registered as an investment company under the Investment Company Act of 1940, as amended. Mr. Pelofsky holds a BA degree from Harvard College and a LLB degree from Harvard Law School.

Specific Qualifications, Skills and Attributes. The Board believes that Mr. Pelofsky brings significant bankruptcy and legal expertise to the Board.

Kevin L. Robert

Director since: 2014

Age: 58

Experience. Mr. Robert served as Global Chief Executive Officer of Wolters Kluwer Tax and Accounting from 2010 to 2013. He previously served as the firm’s President/Chief Executive Officer, North America and as President/Chief Executive Officer, North America and Asia Pacific, where he developed strategies to increase revenue and profit growth and drove marketing and growth strategies. Mr. Robert began his career with Wolters Kluwer after it acquired CCH in 1995, where he held multiple positions, including Vice President of Sales and Marketing, Head of Customer Management and Vice President of Sales and Marketing for CCH Publishing. Mr. Robert also serves on the board of directors of Vertex, Inc., a privately held integrated tax technology solutions provider. Mr. Robert graduated from the University of New Orleans with a BS in Marketing and holds an MBA from Pepperdine University. In the past five years, Mr. Robert has not served on the board of any other publicly traded company or any company registered as an investment company under the Investment Company Act of 1940, as amended. However, Mr. Robert serves on the board of directors of Vertex, Inc., a privately held integrated tax technology solutions provider.

Specific Qualifications, Skills and Attributes. Mr. Robert was appointed to the Board in 2014 upon recommendation of the Nominating and Corporate Governance Committee in connection with the entry into the Director Appointment Agreement with St. Denis J. Villere & Company, L.L.C. (“Villere”) and Mr. Robert. The Board believes that Mr. Robert brings extensive experience driving business development and expansion after working in the accounting and tax industry for over 30 years.

W. Bryan Satterlee

Director since: 1997

Lead independent director since: 2014

Age: 80

Experience. Mr. Satterlee has been a partner at NorthEast Ventures, a strategic consulting firm that specializes in business development services and financial evaluations of technology-based venture companies since 1989.

3

Table of Contents

Mr. Satterlee’s background includes ten years of management experience with IBM, as well as having been a founder of a computer leasing/software business, a telecommunications company, and a venture investment services business. Mr. Satterlee earned a BS degree from Lafayette College.

Specific Qualifications, Skills and Attributes. The Board believes that Mr. Satterlee brings significant executive leadership, financial, and technological expertise to the Board.

Brad D. Scott

Director since: 2015

Age: 61

President and Chief Operating Officer

Experience. Mr. Scott was appointed as President and Chief Operating Officer in May 2014. Prior to that, he served as the Executive Vice President, Co-Chief Operating Officer and Chief of Staff since January 2014 and prior to that, as an executive officer of Epiq since February 28, 2013. His previous position with Epiq was Senior Vice President, Chief Human Resources Officer. Mr. Scott was President of De Novo Legal, LLC prior to joining Epiq in December 2011 upon acquisition of that company. Prior to that, he served in various executive leadership roles at WilmerHale, LLP, Heller Ehrman, LLP and Weil, Gotshal and Manges, LLP and served as a strategic consultant and executive at IBM. Mr. Scott holds a BS degree in engineering from the United States Military Academy at West Point and an MS degree from the University of Illinois.

Specific Qualifications, Skills and Attributes. Mr. Scott was appointed to the Board in 2015 upon recommendation of the Nominating and Corporate Governance Committee. The Board believes that Mr. Scott brings significant experience in the management and leadership of complex organizations and skills in risk management, business development and strategic planning to the Board.

Karin-Joyce Tjon

Age: 53

Executive Vice President and Chief Financial Officer

Experience. Ms. Tjon was appointed as Executive Vice President and Chief Financial Officer effective July 1, 2014. Ms. Tjon has extensive financial management and leadership experience, most recently as the Chief Financial Officer of Hawker Beechcraft Corporation (“HBC”), an international manufacturer of business and special mission aircraft. Prior to joining HBC in 2011, Ms. Tjon served for close to 10 years at Alvarez & Marsal (“A&M”) as Director, Senior Director and Managing Director. A&M is a global professional services firm specializing in business turnaround and business advisory services. Ms. Tjon holds an MBA in management and finance from Columbia University’s Graduate School of Business and a B.S.S. degree in Organizational Behavior and Management from Ohio University.

Section 16(a) Beneficial Ownership Reporting Compliance

We are required to identify any director, officer or 10% or greater beneficial owner of common stock who failed to timely file a report with the Securities and Exchange Commission (“SEC”) required under Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), relating to ownership and changes in ownership of our common stock. The required reports consist of initial statements on Form 3, statements of changes on Form 4 and annual statements on Form 5 (if applicable). Based solely upon a review of reports filed under Section 16(a) of the Exchange Act and certain written representations of directors and officers of Epiq, we are not aware of any director, officer or beneficial owner of more than 10% of our common stock who failed to file on a timely basis any report required by Section 16(a) of the Exchange Act for calendar year 2014.

4

Table of Contents

Code of Business Conduct and Ethics

Our Code of Business Conduct and Ethics is reviewed periodically by the Nominating and Corporate Governance Committee and the Board and applies to all of our officers, directors and associates, and specifically our principal executive officer, president, principal financial officer and principal accounting officer. Shareholders may access a copy of our Code of Business Conduct and Ethics in the Investors section of our Internet website at www.epiqsystems.com. We will promptly disclose any waivers of our Code of Business Conduct and Ethics involving our directors or executive officers. We intend to satisfy any disclosure requirements regarding any amendment or waiver of our Code of Business Conduct and Ethics by posting the information on our Internet website at http://www.epiqsystems.com and in our public filings with the SEC as legally required.

Identifying and Evaluating Director Candidates

The Nominating and Corporate Governance Committee is responsible for identifying, recruiting, and recommending candidates for the Board and is responsible for reviewing and evaluating any candidates recommended by shareholders. The Nominating and Corporate Governance Committee is responsible for developing the criteria for, and reviewing periodically with the Board, the requisite skills and characteristics of nominees, as well as the composition of the Board as a whole. These criteria include independence, diversity, age, skills, and experience in the context of the needs of the Board. The Nominating and Corporate Governance Committee considers a combination of factors for each nominee, including the nominee’s ability to represent all shareholders without a conflict of interest; the nominee’s ability to work in and promote a productive environment; whether the nominee has sufficient time and willingness to fulfill the substantial duties and responsibilities of a director; whether the nominee has demonstrated a high level of character and integrity; whether the nominee possesses the broad professional and leadership experience and skills necessary to effectively respond to complex issues encountered by a publicly-traded company; and the nominee’s ability to apply sound and independent business judgment.

Our Amended and Restated Bylaws contain a procedure allowing for the nomination by shareholders of proposed directors. The Nominating and Corporate Governance Committee considers all director candidates, including candidates proposed by shareholders in accordance with our Amended and Restated Bylaws, based on the same criteria.

The Nominating and Corporate Governance Committee may engage third-party search firms to identify potential director nominees.

Audit Committee

The Audit Committee of the Board is responsible for overseeing management’s financial reporting practices and internal controls. The Audit Committee will act in a manner intended to fulfill its responsibility to the shareholders, potential shareholders, and investment community relating to corporate accounting and reporting practices of Epiq, and to fulfill its duty to assess the quality and integrity of the financial reports of Epiq. In so doing, it is the responsibility of the Audit Committee to maintain free and open means of communication among the directors, the independent auditor, the internal auditors (if any) and the financial management of Epiq.

The Audit Committee’s responsibilities include, but are not limited to, the following:

| • | selecting and evaluating the independent auditor; |

| • | reviewing the adequacy and effectiveness of the accounting and financial controls of Epiq; |

| • | reviewing financial disclosure and accounting principles with financial management of Epiq and the independent auditor; |

| • | reviewing the independent auditor’s communications regarding management’s internal controls; |

5

Table of Contents

| • | reviewing with financial management and the independent auditor Epiq’s financial statements and SEC filings; |

| • | reviewing and approving all material related party transactions; |

| • | administering Epiq’s whistleblower policy; and |

| • | investigating any other matter brought to the Audit Committee’s attention within the scope of its duties. |

At the end of each quarter, the Audit Committee reviews and discusses with management and Epiq’s independent registered public accounting firm Epiq’s financial results, audit assurance processes, press releases concerning Epiq’s financial performance and earnings estimates, any control deficiencies identified and steps management has taken or plans to take to remediate any control deficiencies, significant estimates and proposed audit adjustments, audit activities, reports to Epiq’s ethics hotline, risk management and corporate governance best practices, and the results of Epiq’s independent registered public accounting firm’s review or audit of its financial statements, among other things.

Each year Epiq evaluates the performance of Epiq’s independent registered public accounting firm and considers whether it is in the best interests of Epiq and its shareholders to engage the firm for another year. As part of its evaluation, the Audit Committee considers the qualifications of the persons who will be staffed on Epiq’s engagement, including the lead partner, quality of work, audit assurance services, PCAOB inspections, firm reputation, independence, fees, retail experience, and understanding of Epiq’s financial reporting processes, policies, and procedures. The Audit Committee solicits feedback from management as part of its evaluation process.

The Board has affirmatively determined that (1) each of the Audit Committee members meets the definition of “independent director” for purposes of serving on the Audit Committee under both Rule 10A-3 of the Exchange Act, and the NASDAQ rules, and (2) Mr. Satterlee qualifies as an “audit committee financial expert” as such term is defined in Item 407(d)(5) of Regulation S-K. The SEC has determined that the audit committee financial expert designation does not impose on the person with that designation any duties, obligations or liability that are greater than the duties, obligations or liabilities imposed on such person as a member of the Audit Committee of the Board in the absence of such designation.

The Audit Committee acts under a written charter that was adopted by the Board and is amended as necessary to conform to the regulatory initiatives of the SEC and NASDAQ. The Audit Committee charter can be found on Epiq’s corporate website at www.epiqsystems.com. Our separately designated standing Audit Committee was established in accordance with all applicable rules of the SEC, including Section 3(a)(58)(A) of the Exchange Act.

6

Table of Contents

Item 11. Executive Compensation

Compensation Discussion and Analysis

This Compensation Discussion and Analysis (the “CD&A”) describes the principles, objectives, and features of our executive compensation program, which is generally applicable to each of our senior officers. However, this CD&A focuses primarily on the program as applied to our Chief Executive Officer and the other executive officers included in the Summary Compensation Table, whom we refer to collectively in this Amendment as the named executive officers, or NEOs. For 2014, our NEOs were:

| Name |

Position | |

| Tom W. Olofson |

Chairman and Chief Executive Officer | |

| Brad D. Scott |

President and Chief Operating Officer and Director; former Executive Vice President and Co-Chief Operating Officer and Chief of Staff | |

| Karin-Joyce Tjon |

Executive Vice President and Chief Financial Officer | |

| Christopher E. Olofson |

Former President and Chief Operating Officer | |

| Elizabeth M. Braham |

Former Executive Vice President and Chief Financial Officer |

Overview of Fiscal 2014 Business Results

Epiq is a provider of global managed technology solutions for the electronic discovery, bankruptcy and class action markets offering capabilities to support litigation, investigations, financial transactions, regulatory compliance and other legal matters. The markets Epiq serves are very specialized and highly competitive. Certain business results for 2014 include:

| • | Achievement or substantial achievement of the key financial measures of operating revenue of $444.1 million and operating cash flows of $69.7 million established to measure Executive Management performance. See “—What We Pay and Why: Elements of Compensation—Annual Performance Based Incentive Awards.” |

| • | Non-GAAP earnings per share (“EPS”) of $0.80 and non-GAAP adjusted EBITDA of $97.0 million in 2014 did not meet the goals established to measure Executive Management Performance. See “—What We Pay and Why: Elements of Compensation—Equity Incentive Awards.” |

| • | We paid quarterly cash dividends totaling $0.36 per share. |

Changes to Executive Compensation Programs as a Result of Shareholder Engagement and Consideration of Last Year’s Say-On-Pay Vote

Epiq regularly engages its shareholders and shares their feedback with the Compensation Committee. The Compensation Committee carefully considers this feedback in consultation with the Company’s independent compensation consultant, Exequity, LLP (“Exequity”) when making executive compensation decisions. At Epiq’s 2014 Annual Meeting of Shareholders, we held a shareholder advisory vote on executive compensation. Shareholders did not approve the advisory vote on the compensation of our NEOs. As a result, we performed an evaluation of our executive compensation program and in response to shareholder feedback, the Compensation Committee took several actions to enhance the program. We believe these changes improve alignment with market practices. Following are the key changes to our executive compensation program:

| • | Adopted multi-year vesting period for restricted stock awards—Commencing in 2015, restricted stock awards for our NEOs vest, subject to the determination by the Compensation Committee of certain performance measures having been met, in three years (instead of one) and only if the executive continues to be employed by us. We believe that multi-year vesting better aligns with the interests of shareholders and long-term investors. |

7

Table of Contents

| • | Diversified the metrics used for long-term incentive awards and for short-term incentive awards—Adjusted EBITDA and operating cash flow are now used as metrics for long-term incentive awards while operating revenue and EPS are used for short-term incentive awards. We believe using adjusted EBITDA and operating cash flow for long-term incentive awards aligns our executive’s interests with our long-term performance as these are financial metrics that are commonly used by investors to gauge Epiq’s enterprise value in the form of fair value per share and also are key measures in determining our ability to generate positive cash flows to fund working capital, fund strategic capital investments, service our indebtedness, support the incurrence of incremental debt for acquisitions and return capital to investors in the form of regular quarterly cash dividends and periodic stock repurchases. We believe using operating revenue and EPS for short-term incentive awards aligns our executives’ interests with our short-term performance as these are financial metrics which best measure our year-over-year revenue growth objectives and the delivery of current earnings to shareholders relative to our operating budget for a specific fiscal year. This diversification of metrics was included in the incentive compensation plan that was approved by Epiq’s shareholders in June 2014 and became effective for annual incentive awards for 2014 and thereafter. |

| • | Eliminated dividends on unvested performance-based equity awards—Dividends are now payable only if and when performance goals are achieved and awards vest. This change was included in our incentive compensation plan that was approved by Epiq’s shareholders in June 2014 and became effective for annual incentive awards for 2014 and thereafter. |

| • | Adopted director and executive stock ownership guidelines—Effective February 2015, our executive officers and non-employee directors are required to hold stock equivalent to 5x annual base salary in the case of our Chief Executive Officer, 3x annual base salary in the case of our other executive officers, and 3x annual cash retainer in the case of our non-employee directors. We believe the stock ownership guidelines build commonality of interest between management and shareholders and encourage executives to think and act like owners. |

| • | Included disclosure of clawback policy—In this Amendment we are disclosing the existence of our clawback policy applicable to our Chief Executive Officer and Chief Financial Officer. |

| • | Changed the composition of Compensation Committee; revised Corporate Guidelines—Following our 2014 Annual Meeting of Shareholders, we changed the composition and leadership of our Compensation Committee and added a new independent director to the Compensation Committee. We also adopted revised Corporate Guidelines to further align with market practices. The revised Corporate Guidelines are available on our website at www.epiqsystems.com/Corporate-Governance. |

Executive Compensation Objectives and Practices

The core objectives that serve as the foundation for our compensation program are:

| Program Objective |

Achievement of Objective | |

| Pay for Performance |

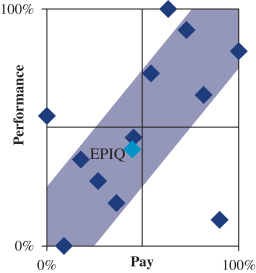

• A significant portion of our executives’ pay is not guaranteed and is tied to business performance.

• Our performance goals are based on budget and are challenging, yet achievable. For information regarding Epiq’s 2014 performance goals and their effect on 2014 pay, see “—What We Pay and Why: Elements of Compensation.” The chart below illustrates our Chief Executive Officer’s pay for performance relationship based on the degree of alignment of our Chief Executive Officer’s pay and Epiq’s total shareholder return for the last three years relative to the peer group selected by the Compensation Committee. Using this quantitative test, compared to our peer group, our Chief Executive Officer earned at the 43rd percentile while Epiq also delivered total shareholder return at the 41st percentile of our peer group. The |

8

Table of Contents

| Program Objective |

Achievement of Objective | |

| Compensation Committee believes this graph clearly illustrates a strong pay for performance correlation. For more information and additional quantitative tests applied to measure our pay for performance, see “—What We Pay and Why: Elements of Compensation—Determining Compensation for the Chief Executive Officer.”

| ||

| Pay Competitively |

• Our executive compensation program is designed to enable us to compete effectively for the executive talent we need to be able to successfully execute our strategic plans.

• Executives are rewarded when Company goals are exceeded or substantially met. | |

| Pay Responsibly—Shareholder Alignment |

• A meaningful portion of NEO pay opportunity is variable (delivered through the combination of short-term and long-term incentive awards) where the value is linked to achievement or substantial achievement of Company financial performance goals.

• Each of our NEOs is subject to stock ownership requirements. Short-term incentive compensation is typically awarded in restricted stock and as a result of the stock ownership requirements, our NEOs are required to hold such restricted stock to meet required holdings.

• Commencing in 2015, and subject to the determination by the Compensation Committee of certain performance measures having been met, restricted stock awards will vest in three years (instead of one) and only if the executive continues to be employed by us. | |

| Pay Responsibly—Discourage Excessive Risk Taking |

• The mix between short-term incentives and long-term incentives is intended to discourage executives from maximizing short-term performance at the expense of long-term performance.

• Our short-term incentive plan has a performance goal based on operating revenue or non-GAAP EPS and our performance-based equity awards have performance goals based on adjusted EBITDA or operating cash flow, thereby discouraging participants from | |

9

Table of Contents

| Program Objective |

Achievement of Objective | |

| focusing on the achievement of one performance measure at the expense of another.

• Our NEOs are subject to policies prohibiting hedging and other speculative activity.

• Our Chief Executive Officer and Chief Financial Officer are subject to a clawback policy. | ||

Current Best Practices Employed by Epiq

We have implemented the following principal compensation policies and practices to ensure that our executive compensation program achieves our objectives consistent with sound corporate governance:

| What We DO: |

What We DON’T DO: | |

|

þ Pay for Performance

þ Performance-Based Equity Awards

þ Set Challenging Performance Goals

þ Stock Ownership Guidelines

þ Annual Advisory Vote on Executive Compensation

þ Clawback Policy

þ Independent Compensation Consultant |

x No Payment of Dividends on Restricted Stock Until Fully Vested Subject to Performance- Based Goals Being Met

x No Guaranteed Bonuses(1)

x No Repricing of Underwater Stock Options

x No Excise Tax Gross-ups

x No Excessive Retirement Benefits

x No Hedging Transactions |

| (1) | New hires may receive a guaranteed bonus for their first year based upon individual negotiations. |

How We Determine Executive Compensation

Determining Compensation for the Chief Executive Officer

The Compensation Committee consults with Exequity to obtain independent market data, analysis and advice related to the Chief Executive Officer’s total compensation package. Mr. Olofson does not participate in any deliberations with regard to his own compensation. The Compensation Committee takes multiple factors into consideration including: the Chief Executive Officer’s existing compensation, Epiq’s performance, the Chief Executive Officer’s individual performance, peer group Chief Executive Officer pay levels, competitor and industry performance, our compensation objectives, and our business and succession plans.

Mr. Olofson’s experience, talents, and track record make him a recognized industry leader and have played an important part in our success. Since 1988, the following have been some of his contributions to Epiq:

| • | transformed the Company from a privately-held small business in July 1988 that provided U.S.-based Chapter 13 bankruptcy services to a publicly-traded, global technology services leader in 2015 by providing leadership in the largest, most complex and highest profile matters worldwide; |

| • | led the Company’s initial public offering in February 1997 and has maintained the Company’s listing on NASDAQ since that time; and |

| • | provided executive leadership and strategic vision to diversify the Company’s businesses through organic growth and strategic acquisitions, to expand the Company’s service reach globally with over 20 locations worldwide delivering solutions in over 50 countries and created a global best-in-class infrastructure with unparalleled data security. |

10

Table of Contents

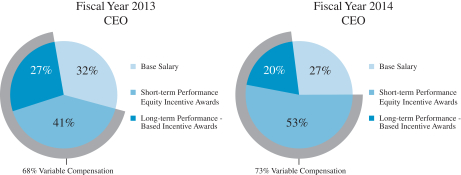

The Compensation Committee believes the most significant portion of Mr. Olofson’s earnings opportunity should reside in the performance-based components of the Chief Executive Officer’s compensation package. Base salary represents a small portion of our Chief Executive Officer’s compensation and is the only component of his total compensation that is not tied to performance. The Compensation Committee awarded our Chief Executive Officer a bonus in common stock in lieu of a cash bonus for 2014 performance in order to further align Mr. Olofson’s interests with shareholders. In 2013 and 2014, 68% and 73% of total direct compensation for our Chief Executive Officer, respectively, was performance-based. The chart below illustrates the composition of our Chief Executive Officer’s total direct compensation for 2013 and 2014.

Epiq rewards achievement of specific goals that improve the Company’s financial performance. Based on the application of the three quantitative tests described below to measure the current relationship of our pay to performance, our pay-for-performance relationship is aligned with that of our peers and with our total shareholder return. The three quantitative tests are (1) degree of alignment of our Chief Executive Officer’s pay and Epiq’s total shareholder return for the last three years relative to our peer group, (2) multiple of median relative to median of peers, and (3) pay-to-total shareholder return alignment. The charts and graphs below illustrate Epiq’s results under these tests.

11

Table of Contents

Relative Degree of Alignment (RDA)

Relative degree of alignment measures the degree of alignment of our Chief Executive Officer’s pay and Epiq’s total shareholder return for the last three years relative to our peer group. The charts below provide detail of our results and the results of our peer group.

| Company | CEO Pay %ile | TSR Performance %ile |

%ile Difference |

|||||||||||||||||

| 1-Year | 3-Year | 1-Year | 3-Year | 3-Year | ||||||||||||||||

| ACI Worldwide, Inc. |

63.6 | % | 54.5 | % | 45.4 | % | 72.7 | % | 18.2 | % | ||||||||||

| Bottomline Technologies |

27.3 | % | 27.3 | % | 9.0 | % | 27.3 | % | 0.0 | % | ||||||||||

| Ciber, Inc. |

72.7 | % | 36.4 | % | 27.2 | % | 18.2 | % | -18.2 | % | ||||||||||

| Computer Task Group, Incorporate |

9.1 | % | 9.1 | % | 0.0 | % | 0.0 | % | -9.1 | % | ||||||||||

| CoreLogic, Inc. |

100.0 | % | 100.0 | % | 36.3 | % | 81.8 | % | -18.2 | % | ||||||||||

| Crawford & Company |

0.0 | % | 0.0 | % | 72.7 | % | 54.5 | % | 54.5 | % | ||||||||||

| Euronet Worldwide, Inc. |

54.5 | % | 63.6 | % | 81.8 | % | 100.0 | % | 36.4 | % | ||||||||||

| Fair Isaac Corporation |

90.9 | % | 81.8 | % | 90.9 | % | 63.6 | % | -18.2 | % | ||||||||||

| FTI Consulting, Inc. |

36.4 | % | 90.9 | % | 54.5 | % | 9.1 | % | -81.8 | % | ||||||||||

| Huron Consulting Group Inc. |

45.5 | % | 45.5 | % | 63.6 | % | 45.5 | % | 0.0 | % | ||||||||||

| MAXIMUS, Inc. |

81.8 | % | 72.7 | % | 100.0 | % | 90.9 | % | 18.2 | % | ||||||||||

| Navigant Consulting, Inc. |

18.2 | % | 18.2 | % | 18.1 | % | 36.4 | % | 18.2 | % | ||||||||||

| Epiq Systems, Inc. |

43.1 | % | 43.3 | % | 63.2 | % | 40.7 | % | -2.6 | % | ||||||||||

Multiple of Median (MOM)

Multiple of median measures our Chief Executive Officer’s pay as a multiple of our peer group’s median chief executive pay. The chart below indicates our results.

| 1-Year CEO Pay ($000) | Median 1- Year Pay of Peers ($000) |

MOM | ||||||

| $3,848 |

$ | 4,258 | 0.90x | |||||

12

Table of Contents

Pay-to-Total Shareholder Return Alignment

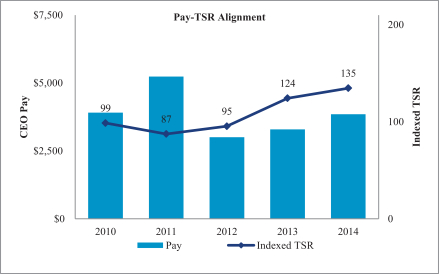

Pay-to-total shareholder return alignment measures the alignment of our Chief Executive Officer’s pay and total shareholder return over the last three years. The charts and graphs below illustrate Epiq’s results under this test.

| 2010 | 2011 | 2012 | 2013 | 2014 | ||||||||||||||||

| Pay |

$ | 3,910 | $ | 5,237 | $ | 3,004 | $ | 3,292 | $ | 3,848 | ||||||||||

| % Change |

— | 34.0 | % | -42.6 | % | 9.6 | % | 16.9 | % | |||||||||||

| Indexed TSR |

99 | 87 | 95 | 124 | 135 | |||||||||||||||

| 1-Year TSR |

-1.3 | % | -11.5 | % | 9.2 | % | 30.2 | % | 8.3 | % | ||||||||||

| TSR | Pay | |||||||

| Weighted Average |

111 | $ | 3,795 | |||||

| Annual Trend (%) |

7.9 | % | -4.9 | % | ||||

| Difference |

12.8% | |||||||

13

Table of Contents

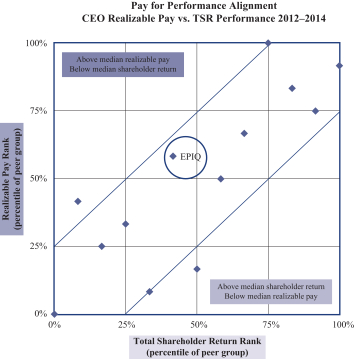

In addition, the compensation of our Chief Executive Officer reflects the alignment between executive pay and shareholder interests. The following chart shows our Chief Executive Officer’s realizable pay through all elements of compensation for the last three years compared to total shareholder return delivered. Using this test, compared to our peer group, our Chief Executive Officer earned at the 58th percentile while Epiq delivered total shareholder return at the 42nd percentile of our peer group.

| • | This graph is based on the 2014 proxy filings of our peer group. |

| • | Total shareholder return reflects share price appreciation, adjusted for dividends and stock splits. |

| • | Realizable pay consists of: |

| • | actual base salary paid over the three-year period, |

| • | actual performance-based incentive awards for the three-year period, and |

| • | equity incentive awards based on December 31, 2014 market value for each company; |

| • | in-the-money value of stock options granted over the three-year period; |

| • | service-based restricted stock awards granted over the three-year period; |

| • | performance share awards: |

| • | actual shares earned using actual performance achievement for grant cycles beginning and ending between 2012 and 2014; and |

| • | target shares granted over the three-year period assuming target performance, for performance cycles that have not yet been completed. |

| • | performance cash awards: |

| • | actual cash paid using actual performance achievement for grant cycles beginning and ending between 2012 and 2014; and |

| • | target cash levels provided over the three-year period assuming target performance, for performance cycles that have not yet been completed. |

14

Table of Contents

| • | The graph reflects chief executive officer compensation for each company regardless of who actually served in such role. This allows us to compare chief executive officer compensation for a full three- year period for each company and focuses on the chief executive officer position rather than specific individuals. |

Determining Compensation for Executive Management (Other than Chief Executive Officer)

Each year, the Compensation Committee approves a compensation package for Executive Management that is consistent with our compensation objectives. The Chief Executive Officer annually reviews the performance of each member of Executive Management (other than himself). Following the performance reviews, the Chief Executive Officer presents compensation recommendations to the Compensation Committee for consideration. The recommendations are based on individual performance, compensation data compiled from independent third-party executive compensation surveys, publicly available data from our peer group companies, and feedback and insights from Exequity, all of which is summarized and shared with the Compensation Committee. The Compensation Committee considers the recommendations from the Chief Executive Officer in its sole and final determination of the compensation awards made to other members of Executive Management.

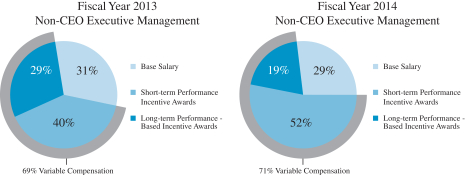

As with our Chief Executive Officer, the most significant portion of the earnings opportunity of the other members of Executive Management resides in the performance-based components of their compensation package. Base salary represents a small portion of total compensation and is the only component of their total compensation that is not tied to performance. The Compensation Committee awarded our Executive Management a bonus in common stock in lieu of a cash bonus for 2014 performance in order to further align their interests with shareholders. In 2013 and 2014, 69% and 71% of total direct compensation for the other members of our Executive Management, respectively, was performance-based. The chart below illustrates the composition of our Executive Management’s total direct compensation for 2013 and 2014. The 2014 chart excludes former executive officers and Ms. Tjon, our Chief Financial Officer, who joined the Company in July 2014.

The Role of Peer Companies and Benchmarking

How The Peer Group is Determined: The Compensation Committee selects our peer group companies based on such factors as business focus, service areas, products and services, competition for executive talent, geographic proximity of corporate locations, size of business and publicly available compensation data. The size of the group has been established so as to provide sufficient market data across the range of senior positions at Epiq. The Compensation Committee annually evaluates whether companies should be added to or removed from our peer group companies.

The Compensation Committee reviewed its peer group practices with Exequity and expanded the new peer group from what was used in 2012 when reviewing and assessing 2013 and 2014 compensation. For fiscal 2013 and 2014, the peer group consisted of professional service firms focused on technology-based solutions. Public companies used for comparison purposes consisted of FTI Consulting, Inc., Huron Consulting Group, Inc.,

15

Table of Contents

Navigant Consulting Inc., Crawford & Company, MAXIMUS, Inc., Bottomline Technologies (DE) Inc., Computer Task Group Inc., CIBER, ACI Worldwide, Euronet Worldwide, Fair Isaac Corp., and CoreLogic, Inc.

In addition, the Compensation Committee considers, but does not use for benchmarking purposes, compensation information concerning private companies and subsidiaries of larger public companies gleaned as part of past executive recruiting activities. These companies and divisions are either direct competitors or are companies from which we have recruited or sought to recruit senior executives in the past because these companies offer services

How The Peer Group is Used: The Compensation Committee reviews both compensation and performance at peer companies to inform its decision-making process so it can set total compensation levels that it believes are consistent with our compensation objectives to pay for performance and pay competitively. The Compensation Committee does not strictly set compensation at a given level relative to its peers (e.g., median). However, the Compensation Committee uses information about its peer group to ensure that the objectives of the Company’s compensation program are maintained and applies quantitative tests relative to our peer group, as the ones described under “—What We Pay and Why: Elements of Compensation—Determining Compensation for the Chief Executive Officer.” The pay positioning of individual executives varies based on their competencies, skills, experience, and performance, as well as internal alignment and pay relationships. Actual total compensation earned is based on Company performance results during the performance period.

The Role of the Compensation Committee’s Compensation Consultant

The Compensation Committee works with an independent executive compensation consultant engaged by the Compensation Committee for executive compensation advice and perspective regarding market trends that may impact decisions we make about our executive compensation program and practices. The Compensation Committee selected Exequity as its independent compensation consultant for 2014.

The Compensation Committee has determined that the work of Exequity did not raise any conflicts of interest in 2014. In making this assessment, the Compensation Committee considered the independence factors enumerated in new Rule 10C-1(b) under the Exchange Act, including the fact that Exequity does not provide any other services to Epiq, the level of fees received from Epiq as a percentage of Exequity’s total revenue, policies, and procedures employed by Exequity to prevent conflicts of interest, and whether the individual Exequity advisers to the Compensation Committee own any of Epiq’s stock or have any business or personal relationships with members of the Compensation Committee or our executive officers.

Risk Considerations

Each year, the Compensation Committee reviews Epiq’s various incentives and other compensation programs and practices and the processes for implementing these programs to determine whether they encourage decision-making that could expose Epiq to unreasonable risks of material adverse consequences. Based on its review, the Compensation Committee confirmed that Epiq’s compensation program is not likely to encourage unnecessary risk taking and the risks arising from Epiq’s compensation practices and policies are not reasonably likely to have a material adverse effect on Epiq. Refer to “Corporate Governance—Risk Management—Analysis of Risk in our Compensation Program.”

What We Pay and Why: Elements of Compensation

As discussed throughout this CD&A, the compensation policies applicable to our NEOs are reflective of our objective to pay for performance, whereby a significant portion of both cash and equity-based compensation is contingent upon achievement of measurable financial objectives and enhanced equity value, as opposed to base salary and perquisites not directly linked to objective financial performance. This compensation mix is intended to drive executive officers to enhance shareholder value over the long term.

16

Table of Contents

The elements of our compensation program are:

| • | base salary; |

| • | annual performance-based incentive awards; |

| • | equity incentive awards; and |

| • | certain additional executive benefits and perquisites. |

The design of our compensation mix is established to encourage Executive Management to achieve annual performance results and to drive our strategy and build long-term shareholder value. The purpose of each of these compensation elements is summarized in the following table and described in more detail below.

| Compensation Component |

Designed to Reward |

Relationship to |

2014 Actions/Results | |||

| Base Salary |

Scope of responsibilities, experience, industry knowledge. | Provides predictable amount of fixed income as short-term compensation. | Base salaries of our NEOs were unchanged for 2014 (except with respect to Mr. Scott in connection with his promotion to President and Chief Operating Officer). | |||

| Short-term Performance-Based Incentive Awards |

Achievement of financial measures that represent strategic components of Company performance. | Focuses executives on our financial goals and objectives for the year and motivates them to achieve or exceed annual financial performance goals. | The Compensation Committee used a judgment-based methodology in exercising its negative discretion to determine the actual payout for Executive Management based upon substantial achievement of pre-established levels of operating revenue. The Compensation Committee awarded Executive Management a bonus in common stock in lieu of cash bonus for 2014 performance in order to further align their interests with shareholders. | |||

| Long-term Performance-Based Equity Incentive Awards |

Achievement of financial measures that represent strategic components of the business aimed at increasing long-term shareholder return and value. | Motivates executives to align their interests with shareholders to increase overall shareholder value and retains executives in an increasingly competitive market for talent. | The 2014 equity awards were awarded in the form of restricted stock that would vest if either non-GAAP adjusted EBITDA for 2014 exceeded $103.0 million or operating cash flows for 2014 exceeded $33.6 million. The operating cash flow performance goal was achieved and the shares of restricted stock vested on February 20, 2015. | |||

17

Table of Contents

Base Salary

On an annual basis, the Compensation Committee is responsible for establishing the base salary of Executive Management. Base salary is set primarily upon an assessment of market requirements for similarly positioned executives and the responsibilities of the executives, as well as the base salary of each executive relative to the other executive officers. In addition, the Compensation Committee considers information learned in recruiting new executives to Epiq and shareholder feedback, including the results of the prior year say-on-pay vote. For fiscal year 2014 the Compensation Committee did not increase base salaries, except with respect to Mr. Scott in connection with his promotion to President and Chief Operating Officer.

Short-Term Performance-Based Incentive Awards

The Compensation Committee set 2014 performance objectives with annual goals for each of the following financial measures: operating revenue and non-GAAP EPS. For the year ended December 31, 2014, these measures were calculated as follows:

| • | Operating revenue is total revenue before reimbursable expenses. |

| • | Non-GAAP EPS is calculated as net income adjusted for amortization of acquisition intangibles, share-based compensation, acquisition-related expense, one-time technology expense, loan fee amortization, litigation expense, timing of recognition of expense versus revenue, reorganization expense, gain (loss) on disposition of assets, strategic and financial review expense and the effect of tax adjustments that are outside of Epiq’s anticipated effective tax rate, all net of tax. |

These measures are regularly used by Executive Management to manage and evaluate the business and make operating decisions and are the financial measures consistently communicated to investors during quarterly earnings conference calls. We believe these financial metrics best measure our year-over-year revenue growth objectives and the delivery of current earnings to shareholders relative our operating budget for a specific fiscal year. Using these varied measures for the annual performance-bonus plan further aligns Executive Management interest with our business goals and discourage executives from focusing on the achievement of one performance measure at the expense of another.

Our short-term performance-based incentive awards are paid in cash and/or stock. Under the qualified executive performance plan, the Compensation Committee has discretion to grant awards upon substantial achievement of the financial goals. The Compensation Committee used a judgment-based methodology in exercising its negative discretion to determine the actual payout for 2014. Based upon the actual performance achieved in 2014, the total eligible payout for 2014 performance was $1.25 million. This amount excludes $150,000 of guaranteed annual incentive compensation awarded to Ms. Tjon as described in her employment offer letter dated June 17, 2014. The Compensation Committee awarded Executive Management a bonus in common stock in lieu of a cash bonus related to 2014 performance to further align their interests with shareholders.

18

Table of Contents

The following table sets forth our aggregate variable compensation goals and actual performance and shows the impact of Epiq’s financial performance on the aggregate annual performance-based incentive awards of our NEOs in 2014.

| Performance Period |

Performance Metric |

Goal Amount |

Actual Performance |

Potential |

Actual Compensation Awarded | |||||||

| Short-Term Performance-Based Incentive Awards |

2014 | Operating Revenue

And |

$450.0 million |

$444.1 million |

$0—$3.0 million | $1.25 million (paid in Company common stock at the discretion of the Compensation Committee for approximate 99% achievement of goal) | ||||||

| Non-GAAP EPS |

$1.00 | $0.80 | $0—$3.0 million | None | ||||||||

Long-Term Performance-Based Equity Incentive Awards

Equity-based compensation has always been considered to be an important part of the overall compensation of Executive Management. The Compensation Committee is the administrator of our equity compensation plans and determines the type, number of shares, terms and timing of awards to Executive Management. The Compensation Committee primarily uses equity awards to provide continuing incentives that will keep Executive Management engaged and vested with the interest of shareholders. The Compensation Committee generally, but not specifically, considers corporate performance, stock price and individual responsibilities and performance to determine awards. Until 2014, equity awards vested within one year of grant. Commencing in 2015, and subject to the determination no earlier than February 20, 2016 by the Compensation Committee of certain performance measures having been met, awards for our NEOs will vest within three years of the grant. We believe that multi-year vesting better aligns with the interests of shareholders and long-term investors.

The performance stock-based awards have performance goals based on operating cash flows and non-GAAP adjusted EBITDA. For the year ended December 31, 2014, these measures were calculated as follows:

| • | Operating cash flows is calculated in accordance with U.S. GAAP. |

| • | Non-GAAP adjusted EBITDA is calculated as net income adjusted for depreciation and amortization expense, share-based compensation expense, acquisition and related expense, one-time technology expense, net expense related to financing, litigation recovery and expense, timing of recognition of income and expense, reorganization expense, gain (loss) on disposition of assets, strategic and financial review expense, and provision for income taxes. |

In 2014, our performance-based equity incentive compensation required the achievement of these performance measures at levels which provided growth versus the prior year of at least 4% in order for the performance-based equity incentive awards to vest. These measures are regularly used by Executive Management to manage and evaluate the business and make operating decisions and are the financial measures consistently communicated to investors during quarterly earnings conference calls. These are financial metrics that are commonly used by investors to gauge the Company’s enterprise value in the form of fair value per share and also are key measures in determining our ability to generate positive cash flows to fund working capital, fund strategic capital investments, service our indebtedness, support the incurrence of incremental debt for acquisitions and return capital to investors in the form of regular quarterly cash dividends and periodic stock repurchases. The varied performance measures are designed to discourage executives from focusing on the achievement of one performance measure at the expense of another.

19

Table of Contents

Our long-term incentives include a mix of stock, stock options and performance-based stock awards, which are contingent upon continued employment through the vesting date. In 2014, the Compensation Committee authorized the following equity compensation awards to the NEOs. The fair value amounts reported for fiscal year 2014 in the Stock Awards column in the Summary Compensation Table represent the grant date fair value of stock awards determined pursuant to ASC 718. The Compensation Committee believes that the mix of performance-based and time-based vesting of these restricted stock awards reflects the emphasis on performance-driven compensation while also providing a measure of retention value, which is also an important component of overall executive compensation.

| Named Executive Officer |

Restricted Stock (shares) |

|||

| Tom W. Olofson |

125,000 | (1) | ||

| Brad D. Scott |

100,000 | (1) | ||

| Karin-Joyce Tjon |

100,000 | (2) | ||

| Christopher E. Olofson |

125,000 | (3) | ||

| Elizabeth M. Braham |

100,000 | (4) | ||

| (1) | The shares of restricted stock vested upon certification by the Compensation Committee of the achievement of an established threshold level of operating cash flows of $69.7 million for the year ended December 31, 2014. |

| (2) | The shares of restricted stock were granted in connection with Ms. Tjon’s appointment as Executive Vice President and Chief Financial Officer effective on July 1, 2014 and not as part of performance-based awards. 25,000 shares of restricted stock vested immediately in connection with Ms. Tjon’s appointment, the remaining 75,000 shares of restricted stock will vest 25,000 each on July 9, 2015, 2016 and 2017. |

| (3) | Mr. Christopher E. Olofson resigned as an executive officer on June 30, 2014 and forfeited all unvested restricted stock. He also resigned as a director effective December 1, 2014. |

| (4) | Ms. Braham resigned as an executive officer on March 14, 2014 and forfeited all unvested restricted stock. |

The following table sets forth our aggregate variable compensation target goals and actual performance and shows the impact of Epiq’s financial performance on the aggregate annual equity incentive awards on the compensation of our NEOs in 2014.

| Performance Period |

Performance Metric |

Goal Amount |

Actual Performance |

Potential Compensation Opportunity |

Actual Compensation Awarded | |||||||

| Long-Term Performance-Based Equity Incentive |

2014 | Adjusted EBITDA

|

$103 million |

$97.0 million |

0—450,000 shares of performance- based restricted stock awards(1) |

225,000 shares of performance based restricted stock awards with an aggregate fair value on the vesting date of $4.1 million based upon the achievement of the operating cash flow performance metric | ||||||

| Or |

||||||||||||

|

Operating cash |

$33.6 million |

$69.7 million |

||||||||||

| (1) | Including 125,000 for each of Tom W. Olofson and Christopher E. Olofson and 100,000 shares for each for Mr. Brad D. Scott and Ms. Elizabeth M. Braham. Christopher E. Olofson and Elizabeth M. Braham each forfeited all unvested restricted stock upon their respective resignations from the Company in 2014. |

20

Table of Contents

Perquisites and Other Personal Benefits

We provide our executive officers with perquisites and other personal benefits that we believe are reasonable and consistent with our overall compensation program to better enable us to attract and retain high quality executives. Our executive officers are provided use of Company automobiles. Our Chairman and Chief Executive Officer uses a corporate aircraft in which we have a fractional interest for personal use and his spouse will at times accompany him on business trips, as permitted by our senior executive business travel policy. For purely personal use, the Chairman and Chief Executive Officer reimburses Epiq for the cost of the flight. On business trips that include the presence of his spouse, no incremental costs are incurred by Epiq, and we do not record any compensation for this executive. The incremental cost of the use of aircraft for commuting travel by our Chairman and Chief Executive Officer in excess of any reimbursements to Epiq under this policy is treated as compensation in the Summary Compensation Table in accordance with SEC executive compensation disclosure regulations relating to perquisites. In addition, Epiq pays for certain personal tax services and the premiums on certain personal life insurance for our Chairman and Chief Executive Officer.

Our former President and Chief Operating Officer, Christopher E. Olofson, maintained his primary residence in Chicago, worked at our Chicago office and traveled to and worked from our other office locations. Travel by Christopher E. Olofson from Chicago to our other various offices was not considered to be personal commuting expense. A corporate apartment was maintained in Kansas City for Christopher E. Olofson. While we do not consider the corporate apartment expenses as a perquisite for purposes of determining his overall compensation package, the incremental costs of the corporate apartment are reflected in the Summary Compensation Table as additional compensation for Christopher E. Olofson in accordance with SEC executive compensation disclosure regulations relating to perquisites.

Attributed costs of the personal benefits described above for the NEOs for 2012, 2013 and 2014 are included as “All Other Compensation” in the Summary Compensation Table.

Retirement and Other Benefits

All Company employees in the United States are eligible to participate in our 401(k) profit sharing plans. Executive officers participate on the same basis as all other participants. We do not maintain any other retirement plan or arrangement for our executive officers. The Compensation Committee has noted the absence of other types of traditional compensation arrangements when it has considered and approved executive base salaries, cash incentive compensation, equity compensation and perquisites.

Other Corporate Governance Considerations in Compensation

Compensation Clawback Policy

Our clawback policy allows us to recapture any cash or bonus incentive compensation paid in the event of a restatement of our financial statements due to fraud, willful misconduct or gross negligence of the Chief Executive Officer or Chief Financial Officer, which discourages inappropriate risk-taking behavior. Under the policy, the independent directors have the discretion and authority to require that such officers repay Epiq the amount of any cash or bonus compensation paid to that officer minus the amount of such cash bonus or incentive compensation that would have been earned by that officer based on the information contained in the restated financial statements. This policy is in addition to any requirements which might be imposed pursuant to Section 304 under the Sarbanes-Oxley Act of 2002, and will be modified to the extent required by the Dodd-Frank Act of 2010.

21

Table of Contents

Stock Ownership Guidelines

In February 2015, we established stock ownership requirements for our non-employee directors and executives to further build commonality of interest between management and shareholders and to encourage executives to think and act like owners. Our current stock ownership guidelines are as follows:

| Officer |

Threshold | |

| Chief Executive Officer |

5x annual base salary | |

| Executive Officers |

3x annual base salary | |

| Non-Employee Board Members |

3x annual cash retainer |

The Chief Executive Officer and non-employee Board members have five years beginning on the day after the Annual Meeting is held to meet the guidelines. Other executive officers have five years beginning on February 26, 2015. To avoid fluctuating ownership requirements, except upon a promotion, once our executives have achieved the ownership guidelines, they will be considered to have satisfied the requirements as long as the shares used to meet the underlying requirements are retained. To determine compliance with these guidelines, a calculation will be made before the end of the first quarter of each year based on the current salary or annual retainer and the value of the shares using the average closing price of the Company’s common stock for the prior calendar year. Our Chief Executive Officer holds 3,901,047 shares of stock, including 437,500 fully vested stock options, that qualify towards ownership for purposes of the guidelines well in excess of five times his annual base salary. Mr. Olofson has pledged 1,200,000 shares to collateralize lines of credit for his investments. The pledged shares are not compensatory shares, i.e., shares Mr. Olofson received as compensation from Epiq, are not involved in hedging or derivative arrangements and are not held in margin accounts at brokerage firms.

Mr. Scott and Ms. Tjon currently hold 132,954 and 97,471 shares of stock that qualify towards ownership for purposes of the guidelines, representing 2.3x and 2.4x annual base salary, respectively. The restricted stock received as incentive compensation based upon the achievement of goals for the year ended December 31, 2014 is counted towards the requirement under the guidelines.

Policy Regarding Timing of Stock-Based Awards

The Compensation Committee recognizes the importance of adhering to specific practices and procedures in the granting of equity awards and has adopted a specific policy around this process.

The Compensation Committee generally grants equity awards annually during the first quarter in a given fiscal year at the Board’s first regularly scheduled in-person meeting for the year.

Trading Controls

Under our Insider Trading Policy, our Chief Executive Officer is required to receive pre-approval from Epiq’s Chief Financial Officer or General Counsel prior to entering into any transactions in Company securities during a blackout period. Other executive officers, including the NEOs, are required to receive pre-approval from Epiq’s Chief Executive Officer, Chief Financial Officer or General Counsel, as applicable, prior to entering into any transactions in Company securities during a blackout period. Generally, trading is permitted only during specified trading periods unless the officer is in possession of material non-public information.

We have also adopted a Prohibited Company Security Transactions Policy that prohibits all Company employees, officers and directors from short-term trading, short sales, options trading, trading on margin and hedging on Company securities.

Tax and Accounting Implications

In determining which elements of compensation are to be paid, and how they are weighted, the Compensation Committee also takes into account the deductibility of executive compensation under Section 162(m) of the

22

Table of Contents

Internal Revenue Code of 1986, as amended (the “Code”), which provides that we may not deduct non-exempt compensation of more than $1,000,000 that is paid to certain individuals.

We consider the impact of Section 162(m) when developing and implementing our executive compensation program. Cash incentive awards and performance-based equity awards generally are designed to meet the deductibility requirements. However, we have not adopted a policy that all compensation must qualify as deductible under Section 162(m). Amounts paid under any of our compensation programs, including salaries, cash incentive awards, performance stock awards, and other equity awards, may not qualify as performance-based compensation that is excluded from the limitation on deductibility.

While the deductibility of executive compensation for federal income tax purposes is important to Epiq, the Compensation Committee believes that tax consequences should not be the primary driver of executive compensation decisions. Many other Code provisions, SEC regulations, and accounting rules affect the payment of executive compensation and are generally taken into consideration as programs are developed. Our goal is to create and maintain plans that are efficient, effective, and maintain flexibility in order to accomplish executive compensation program objectives.

Report of the Compensation Committee

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis set forth above with management. Based on this review and discussion, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in this Amendment.

Compensation Committee:

Charles C. Connely, IV, Chairman

James A. Byrnes

Douglas M. Gaston

Joel Pelofsky

23

Table of Contents

The purpose of the following tables is to provide information regarding the compensation earned by our NEOs during the fiscal years indicated.

The Summary Compensation Table and the Grants of Plan-Based Awards should be viewed together for a more complete representation of both the annual and long-term incentive compensation elements of our executive compensation program.

Summary Compensation Table

The following table sets forth all compensation paid to or earned by our NEOs for the years ended December 31, 2014, 2013 and 2012.

| Name and Principal Position |

Year | Salary ($) | Stock Awards ($)(1) |

Non-Equity Incentive Plan Compensation ($)(2) |

All Other Compensation ($)(3) |

Total ($) | ||||||||||||||||||

| Tom W. Olofson |

2014 | 975,000 | 1,877,500 | 700,000 | 295,094 | 3,847,594 | ||||||||||||||||||

| Chairman/Chief Executive |

2013 | 975,000 | 1,244,000 | 814,985 | 258,324 | 3,292,309 | ||||||||||||||||||

| Officer(4) |

2012 | 975,000 | 1,777,500 | — | 251,080 | 3,003,580 | ||||||||||||||||||

| Brad D. Scott |

2014 | 850,000 | 1,502,000 | 550,000 | 10,730 | 2,912,730 | ||||||||||||||||||

| President/Chief Operating Officer and |

2013 | 500,000 | 746,400 | 684,987 | 14,790 | 1,946,177 | ||||||||||||||||||

| Former Executive Vice President/Co- Chief Operating Officer(4)(5) |

2012 | — | — | — | — | — | ||||||||||||||||||

| Karin-Joyce Tjon |

2014 | 300,000 | 1,380,000 | 150,000 | 48,665 | 1,878,665 | ||||||||||||||||||

| Executive Vice President/Chief |

2013 | — | — | — | — | — | ||||||||||||||||||

| Financial Officer(6) |

2012 | — | — | — | — | — | ||||||||||||||||||

| Christopher E. Olofson |

2014 | 487,500 | 1,877,500 | — | 2,660,096 | (7) | 5,025,096 | |||||||||||||||||

| Former President/Chief |

2013 | 975,000 | 1,244,000 | 814,985 | 84,528 | 3,118,513 | ||||||||||||||||||

| Operating Officer(4) |

2012 | 975,000 | 1,777,500 | — | 95,393 | 2,847,893 | ||||||||||||||||||

| Elizabeth M. Braham |

2014 | 177,083 | 1,502,000 | — | 2,792,986 | (8) | 4,472,069 | |||||||||||||||||

| Former Executive Vice |

2013 | 850,000 | 995,200 | 684,987 | 58,888 | 2,589,075 | ||||||||||||||||||

| President/Chief Financial Officer |

2012 | 850,000 | 1,540,500 | — | 68,197 | 2,458,697 | ||||||||||||||||||

| (1) | The amounts reported in the Stock Awards column represent the grant date fair value of nonvested share awards, commonly referred to as restricted stock awards determined pursuant to ASC 718. The amounts for Christopher E. Olofson and Elizabeth M. Braham represent 125,000 and 100,000 shares of restricted stock, respectively, that were forfeited in connection with their resignations from Epiq. |

With respect to 2014 Stock Awards, the amounts for Tom W. Olofson and Brad D. Scott include restricted stock awards, which vested on February 20, 2015 upon certification by the Compensation Committee of the achievement of operating cash flows of $69.7 million for the year ended December 31, 2014. The amount for Karin-Joyce Tjon includes 100,000 shares of restricted stock, of which 25,000 vested immediately upon her appointment to Chief Financial Officer in July 2014, the remaining 75,000 vests 25,000 each on July 9, 2015, 2016 and 2017.

With respect to 2013 Stock Awards, the restricted stock awards granted in 2013 vested on February 28, 2014 upon certification by the Compensation Committee of the achievement of non-GAAP adjusted EBITDA of $99.3 for the year ended December 31, 2013.

24

Table of Contents

With respect to 2012 Stock Awards, the restricted stock awards granted in 2012 vested on February 28, 2013 upon certification by the Compensation Committee of the achievement of non-GAAP earnings per share of $0.96 for the year ended December 31, 2012.

Reference is made to Note 12 to Epiq’s consolidated financial statements in Epiq’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014, filed with the SEC on March 2, 2015, which identifies the assumptions made in the valuation of stock awards in accordance with ASC 718 for the years ended December 31, 2014, 2013 and 2012.

Epiq grants restricted stock awards under our incentive compensation plan.