Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - CAMDEN NATIONAL CORP | earningsreleaseq12015.htm |

| EX-99.3 - EXHIBIT 99.3 - CAMDEN NATIONAL CORP | a2015annualmeetingv42715.htm |

| 8-K - 8-K - CAMDEN NATIONAL CORP | a8k_042815earnings.htm |

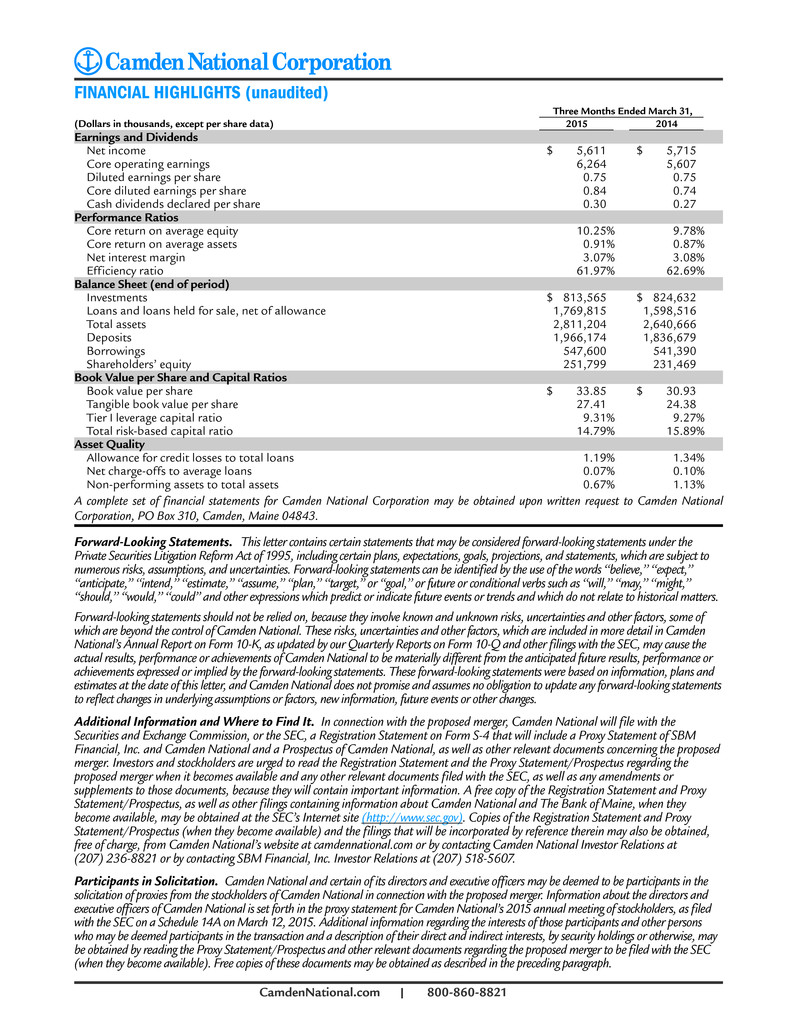

FIRST QUARTER REPORT − 2015 Dear Fellow Shareholders: We entered 2015 with a focus on growing earnings through leveraging our past strategic investments and increasing market share across Maine’s key markets. Yet, during the first few months of 2015, a signif icant opportunity arose that not only complemented our previous investments, but aligned with our long-term strategic plans that will reshape both Camden National and Maine’s banking landscape. On March 30, 2015, Camden National Corporation announced that SBM Financial, Inc., the parent company of The Bank of Maine, would merge into our organization, creating the strongest Northern New England banking franchise with $3.6 billion of assets, $2.4 billion of loans, and $2.6 billion of deposits delivered through 71 locations — including lending offices in Manchester, New Hampshire, and Boston and Braintree, Massachusetts — and over 750 employees. While much of our efforts over the past few years have been concentrated on reshaping our organization for the future, our focus has equally been on profitability. The first quarter of 2015 saw the return on those investments with continued balance sheet and earnings growth. We are pleased with our core operating results for the first quarter of 2015, which exclude one-time merger related expenses of $735,000, and compare favorably to the same period a year ago with: • Core operating earnings up $657,000, or 12% • Core diluted earnings per share increased 14% • Net interest income increased $1.0 million, or 6%, driven by growth in average loan balances of $189.8 million, or 12%, for the first quarter of 2015 compared to a year ago • Core return on average shareholders’ equity of 10.25% and core return on average assets of 0.91% The merger of SBM Financial, Inc. into Camden National Corporation will provide many strategic and financial benefits. We gain an immediate presence in the Portland and southern Maine markets and strengthen our Midcoast and Central Maine franchises. Along with this geographic expansion come strong commercial and retail lending teams supported by experienced credit professionals. While this investment will initially dilute tangible book value of Camden National’s stock by 14%, we expect to earn back that dilution in 5 years. Earnings per share accretion is expected to be in the mid-teens in 2016 and beyond. The market capitalization of Camden National Corporation is estimated to be nearly $390 million immediately following the closing of the merger. This will help all shareholders as we expect a more actively traded stock, which will provide additional liquidity. Our quarterly dividend rate will remain unchanged at $0.30 per common share. This transaction requires both regulatory and shareholder approvals and has an anticipated completion in the fall of this year. In addition to our normal annual shareholder meeting scheduled for April 28, 2015, we will schedule a special meeting of Camden National Corporation shareholders during the summer to approve the transaction. Over the past several years we have made investments to strengthen our organization, so that it remains dynamic, vibrant and well-positioned for the future. Acquisitions, divestitures, expansions, investment in technology, and hiring talented employees are all strategies within that objective. With our continued focus on profitability and the support of shareholders, Camden National will continue its tradition of being a strong community bank headquartered in Maine. Sincerely, Gregory A. Dufour President and Chief Executive Officer CamdenNational.com | 800-860-8821

FINANCIAL HIGHLIGHTS (unaudited) Three Months Ended March 31, (Dollars in thousands, except per share data) 2015 2014 Earnings and Dividends Net income $ 5,611 $ 5,715 Core operating earnings 6,264 5,607 Diluted earnings per share 0.75 0.75 Core diluted earnings per share 0.84 0.74 Cash dividends declared per share 0.30 0.27 Performance Ratios Core return on average equity 10.25% 9.78% Core return on average assets 0.91% 0.87% Net interest margin 3.07% 3.08% Efficiency ratio 61.97% 62.69% Balance Sheet (end of period) Investments $ 813,565 $ 824,632 Loans and loans held for sale, net of allowance 1,769,815 1,598,516 Total assets 2,811,204 2,640,666 Deposits 1,966,174 1,836,679 Borrowings 547,600 541,390 Shareholders’ equity 251,799 231,469 Book Value per Share and Capital Ratios Book value per share $ 33.85 $ 30.93 Tangible book value per share 27.41 24.38 Tier I leverage capital ratio 9.31% 9.27% Total risk-based capital ratio 14.79% 15.89% Asset Quality Allowance for credit losses to total loans 1.19% 1.34% Net charge-offs to average loans 0.07% 0.10% Non-performing assets to total assets 0.67% 1.13% A complete set of financial statements for Camden National Corporation may be obtained upon written request to Camden National Corporation, PO Box 310, Camden, Maine 04843. Forward-Looking Statements. This letter contains certain statements that may be considered forward-looking statements under the Private Securities Litigation Reform Act of 1995, including certain plans, expectations, goals, projections, and statements, which are subject to numerous risks, assumptions, and uncertainties. Forward-looking statements can be identified by the use of the words ‘‘believe,’’ ‘‘expect,’’ ‘‘anticipate,’’ ‘‘intend,’’ ‘‘estimate,’’ ‘‘assume,’’ ‘‘plan,’’ ‘‘target,’’ or ‘‘goal,’’ or future or conditional verbs such as ‘‘will,’’ ‘‘may,’’ ‘‘might,’’ ‘‘should,’’ ‘‘would,’’ ‘‘could’’ and other expressions which predict or indicate future events or trends and which do not relate to historical matters. Forward-looking statements should not be relied on, because they involve known and unknown risks, uncertainties and other factors, some of which are beyond the control of Camden National. These risks, uncertainties and other factors, which are included in more detail in Camden National’s Annual Report on Form 10-K, as updated by our Quarterly Reports on Form 10-Q and other filings with the SEC, may cause the actual results, performance or achievements of Camden National to be materially different from the anticipated future results, performance or achievements expressed or implied by the forward-looking statements. These forward-looking statements were based on information, plans and estimates at the date of this letter, and Camden National does not promise and assumes no obligation to update any forward-looking statements to reflect changes in underlying assumptions or factors, new information, future events or other changes. Additional Information and Where to Find It. In connection with the proposed merger, Camden National will file with the Securities and Exchange Commission, or the SEC, a Registration Statement on Form S-4 that will include a Proxy Statement of SBM Financial, Inc. and Camden National and a Prospectus of Camden National, as well as other relevant documents concerning the proposed merger. Investors and stockholders are urged to read the Registration Statement and the Proxy Statement/Prospectus regarding the proposed merger when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to those documents, because they will contain important information. A free copy of the Registration Statement and Proxy Statement/Prospectus, as well as other filings containing information about Camden National and The Bank of Maine, when they become available, may be obtained at the SEC’s Internet site (http://www.sec.gov). Copies of the Registration Statement and Proxy Statement/Prospectus (when they become available) and the filings that will be incorporated by reference therein may also be obtained, free of charge, from Camden National’s website at camdennational.com or by contacting Camden National Investor Relations at (207) 236-8821 or by contacting SBM Financial, Inc. Investor Relations at (207) 518-5607. Participants in Solicitation. Camden National and certain of its directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Camden National in connection with the proposed merger. Information about the directors and executive officers of Camden National is set forth in the proxy statement for Camden National’s 2015 annual meeting of stockholders, as filed with the SEC on a Schedule 14A on March 12, 2015. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction and a description of their direct and indirect interests, by security holdings or otherwise, may be obtained by reading the Proxy Statement/Prospectus and other relevant documents regarding the proposed merger to be filed with the SEC (when they become available). Free copies of these documents may be obtained as described in the preceding paragraph. CamdenNational.com | 800-860-8821