Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Extended Stay America, Inc. | d915208d8k.htm |

| EX-99.1 - EX-99.1 - Extended Stay America, Inc. | d915208dex991.htm |

Exhibit 99.2

Recent Developments

Because the reporting period for the first quarter has recently ended, the estimated financial information presented below for the three months ended March 31, 2015 reflects assumptions and estimates based only upon preliminary information available to us as of the date of this offering memorandum. As a result of the foregoing, while this information is presented with numerical specificity and considered reasonable by us, it is subject to change pending finalization and is not a comprehensive statement of our financial results for the three months ended March 31, 2015. During the course of our financial statement closing process, we may identify items that would require us to make adjustments to the financial information described below. As a result, the following discussion constitutes forward-looking statements and, therefore, we caution you that these statements are subject to risks and uncertainties, including possible adjustments. See “Risk Factors” and “Special Note Regarding Forward-Looking Statements.”

The Company is in the process of finalizing its results of operations and other financial and operating data for the three months ended March 31, 2015. While full financial information and operating data for such period are not available as of the date of this preliminary offering memorandum, the Company currently estimates the following:

| • | Revenue. The Company anticipates revenue to be in the range of $286 million to $288 million, representing an increase of approximately 5.8% to 6.5% compared to the three months ended March 31, 2014. |

| • | Adjusted EBITDA. Adjusted EBITDA is anticipated to be in the range of $122 million to $123 million, representing an increase of approximately 8.7% to 9.6% compared to the three months ended March 31, 2014. |

On April 2, 2015, ESH REIT repaid a portion of Component A of the 2012 Mortgage Loan (as defined herein) in the amount of $0.8 million, reducing the outstanding balance of Component A to $347.3 million.

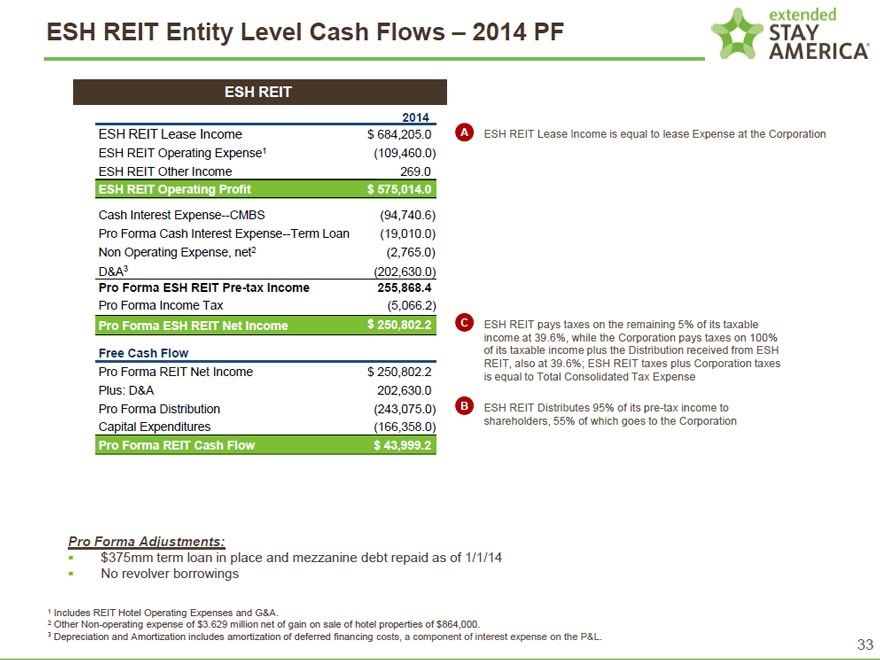

ESH REIT Entity Level Cash Flows - 2014 PF

Extended

STAY AMERICA®

ESH REIT

2014

ESH REIT Lease Income $684,205.0

ESH REIT Operating Expense1 (109,460.0)

ESH REIT Other Income 269.0

ESH REIT Operating Profit $575,014.0

Cash Interest Expense-CMBS (94,740.6)

Pro Forma Cash Interest Expense-Term Loan (19,010.0)

Non Operating Expense, net2 (2,765.0)

D&A3 (202,630.0)

Pro Forma ESH REIT Pre-tax Income 255,868.4

Pro Forma Income Tax (5,066.2)

Pro Forma ESH REIT Net Income $250,802.2

Free Cash Flow

Pro Forma REIT Net Income $250,802.2

Plus: D&A 202,630.0

Pro Forma Distribution (243,075.0)

Capital Expenditures (166,358.0)

Pro Forma REIT Cash Flow $43,999.2

A ESH REIT Lease Income is equal to lease Expense at the

Corporation

C ESH REIT pays taxes on the remaining 5% of its taxable income at 39.6%, while the Corporation pays taxes on 100% of its taxable income plus the

Distribution received from ESH REIT, also at 39.6%; ESH REIT taxes plus Corporation taxes is equal to Total Consolidated Tax Expense

B ESH REIT Distributes 95% of

its pre-tax income to shareholders, 55% of which goes to the Corporation

Pro Forma Adjustments:

$375mm term loan in place and mezzanine debt repaid as of 1/1/14

No revolver borrowings

1 Includes REIT Hotel Operating Expenses and G&A.

2 Other Non-operating

expense of $3.629 million net of gain on sale of hotel properties of $864,000.

3 Depreciation and Amortization includes amortization of deferred financing costs, a

component of interest expense on the P&L.

33