Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WESCO INTERNATIONAL INC | wccq120158-k.htm |

| EX-99.1 - PRESS RELEASE - WESCO INTERNATIONAL INC | wccq12015pressrelease.htm |

Webcast Presentation April 23, 2015 Q1 2015 Earnings

2 Q1 2015 Earnings Webcast, 04/23/2015 Safe Harbor Statement Note: All statements made herein that are not historical facts should be considered as “forward- looking statements” within the meaning of the Private Securities Litigation Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results to differ materially. Such risks, uncertainties and other factors include, but are not limited to: adverse economic conditions; increase in competition; debt levels, terms, financial market conditions or interest rate fluctuations; risks related to acquisitions, including the integration of acquired businesses; disruptions in operations or information technology systems; expansion of business activities; litigation, contingencies or claims; product, labor or other cost fluctuations; exchange rate fluctuations; and other factors described in detail in the Form 10-K for WESCO International, Inc. for the year ended December 31, 2014 and any subsequent filings with the Securities & Exchange Commission. Any numerical or other representations in this presentation do not represent guidance by management and should not be construed as such. The following presentation includes a discussion of certain non-GAAP financial measures. Information required by Regulation G with respect to such non-GAAP financial measures can be found in the appendix and obtained via WESCO’s website, www.wesco.com.

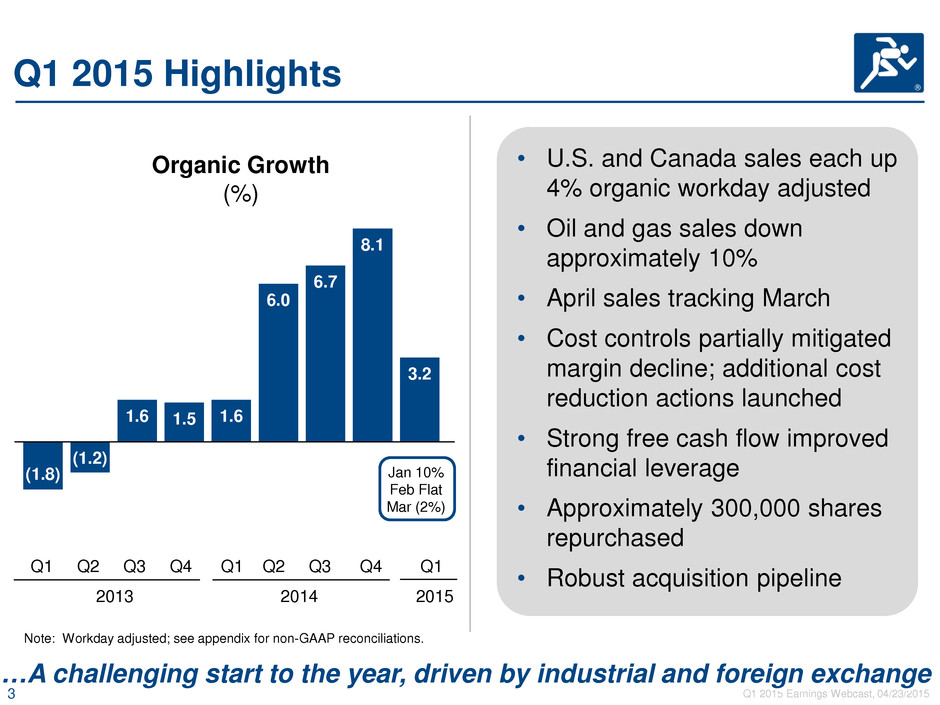

3 Q1 2015 Earnings Webcast, 04/23/2015 (1.8) (1.2) 1.6 1.5 1.6 6.0 6.7 8.1 3.2 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 2013 2014 2015 Q1 2015 Highlights Organic Growth (%) …A challenging start to the year, driven by industrial and foreign exchange • U.S. and Canada sales each up 4% organic workday adjusted • Oil and gas sales down approximately 10% • April sales tracking March • Cost controls partially mitigated margin decline; additional cost reduction actions launched • Strong free cash flow improved financial leverage • Approximately 300,000 shares repurchased • Robust acquisition pipeline Jan 10% Feb Flat Mar (2%) Note: Workday adjusted; see appendix for non-GAAP reconciliations.

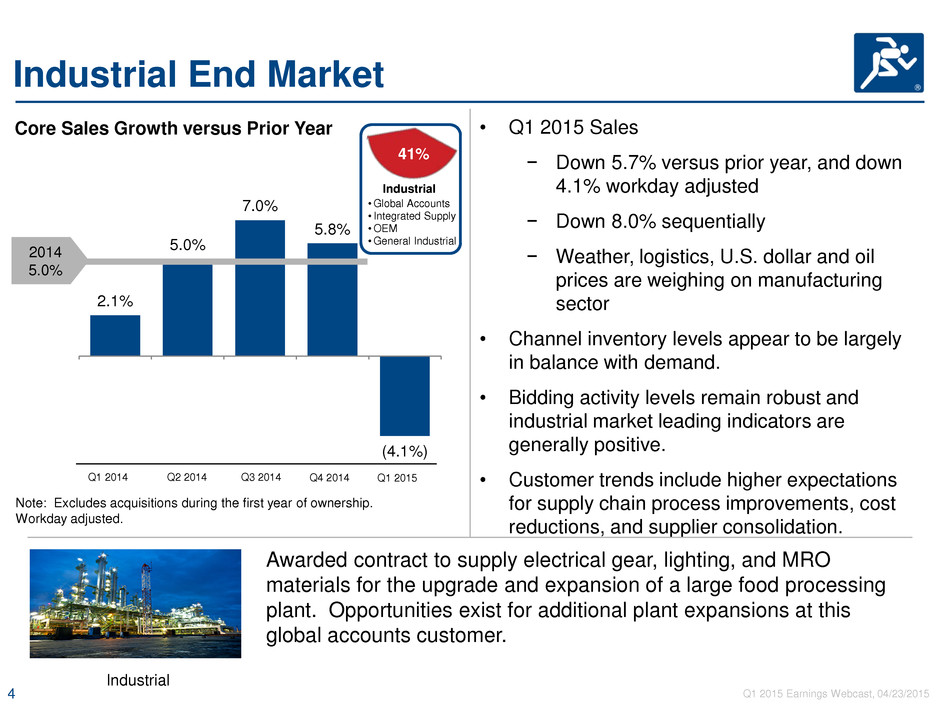

4 Q1 2015 Earnings Webcast, 04/23/2015 2.1% 5.0% 7.0% 5.8% (4.1%) Q1 2014 Q2 2014 Q3 2014 Q4 2014 Industrial End Market • Q1 2015 Sales − Down 5.7% versus prior year, and down 4.1% workday adjusted − Down 8.0% sequentially − Weather, logistics, U.S. dollar and oil prices are weighing on manufacturing sector • Channel inventory levels appear to be largely in balance with demand. • Bidding activity levels remain robust and industrial market leading indicators are generally positive. • Customer trends include higher expectations for supply chain process improvements, cost reductions, and supplier consolidation. Industrial Core Sales Growth versus Prior Year 41% Industrial • Global Accounts • Integrated Supply • OEM • General Industrial Note: Excludes acquisitions during the first year of ownership. Workday adjusted. 2014 5.0% Awarded contract to supply electrical gear, lighting, and MRO materials for the upgrade and expansion of a large food processing plant. Opportunities exist for additional plant expansions at this global accounts customer. Q2 2014 Q1 2014 Q3 2014 Q4 2014 Q1 2015

5 Q1 2015 Earnings Webcast, 04/23/2015 • Q1 2015 Sales − Up 2.3% versus prior year, and up 3.9% workday adjusted − Down 14.3% sequentially • U.S. and Canada construction sales each up approximately 8% organic workday adjusted • Backlog increased 5% sequentially in the quarter and was flat versus prior year. • Non-residential construction market leading indicators are generally positive despite expected cutbacks in oil and gas spending. • Non-residential construction market still well below its prior peak in 2008. Construction • Non- Residential • Residential 32% Core Sales Growth versus Prior Year Construction End Market Construction Note: Excludes acquisitions during the first year of ownership. Workday adjusted. Q2 2014 Q1 2014 2.3% 3.8% Awarded a contract to provide upgraded electrical gear and controls for several municipal water treatment facilities in Canada. (5.9%) Q3 2014 Q4 2014 5.2% Q1 2015 3.9% 2014 1.5%

6 Q1 2015 Earnings Webcast, 04/23/2015 Utility End Market Core Sales Growth versus Prior Year 14% Utility • Investor Owned • Public Power • Utility Contractors • Q1 2015 Sales − Up 4.9% versus prior year, and up 6.5% workday adjusted − Down 5.0% sequentially • Sixteenth consecutive quarter of year-over-year sales growth. • Scope expansion and value creation with IOU, public power, and generation customers providing utility sales growth. • Housing market expected to be positive catalyst for future distribution grid spending. • Increased capital spending is underway and planned for certain investor owned utilities. • Continued interest for Integrated Supply solution offerings. Utility Note: Excludes acquisitions during the first year of ownership. Workday adjusted. 1.5% 6.1% 10.6% 7.9% 6.5% Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Awarded a multi-year contract to provide supply chain management, logistics, and inventory handling services for a high-voltage transmission project with an Investor Owned Utility customer. 2014 6.6%

7 Q1 2015 Earnings Webcast, 04/23/2015 CIG End Market • Q1 2015 Sales − Up 2.7% versus prior year, and up 4.3% workday adjusted − Down 3.4% sequentially • Bidding levels remain active in commercial, institutional, and government markets. • Focus remains on energy efficiency (lighting, automation, metering) and security. • Opportunities exist to support data center construction and retrofits and cloud technology projects. Government Core Sales Growth versus Prior Year CIG • Commercial • Institutional • Government 13% Note: Excludes acquisitions during the first year of ownership. Workday adjusted. Awarded a multi-year contract with a large national wireless carrier in Canada to provide data communication products for system conversion upgrade. Additional MRO products sales are expected as the project rolls out. 3.3% 5.2% 2.3% 7.4% 4.3% Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 2014 4.5%

8 Q1 2015 Earnings Webcast, 04/23/2015 Q1 2015 Results Outlook Actual YOY Sales 5% to 7% growth $1.82B 0.3% growth 3.2% organic workday adjusted Gross Margin 20.2% Down 50 bps (flat sequentially) SG&A 14.6% Down 10 bps Operating Profit $87M Down 6% Operating Margin 5.0% to 5.2% 4.8% Down 30 bps Effective Tax Rate 29% to 30% 29.4% Up 1.2% 120 bps 0.3% Growth (4.0)% Growth 4.1% Growth 4.0% Growth 250 bps 60 bps 100 bps 280 bps $1.82B $1.81B Q1 2015 Sales Acquisitions Foreign Exchange Rest of World Canada U.S. Q1 2014 Sales 160 bps Workday Impact 3.2% Organic Growth

9 Q1 2015 Earnings Webcast, 04/23/2015 EPS Walk Q1 2014 $0.97 Core Operations ~0.00 Foreign Exchange Impact (0.07) Share count 0.02 Tax rate (0.02) Q1 2015 $0.90

10 Q1 2015 Earnings Webcast, 04/23/2015 1.5 2 2.5 3 3.5 4 4.5 5 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 41.7 85.1 Q1 2014 Q1 2015 Cash Generation Free Cash Flow ($ Millions) See appendix for non-GAAP reconciliations. 181% of net income 80% of net income ~ $1B of free cash flow over last 5 years 2013 2014 Target Leverage 2.0x – 3.5x 2.9X Leverage (Total Par Debt to TTM EBITDA) 2015

11 Q1 2015 Earnings Webcast, 04/23/2015 2015 Outlook Q2 FY Sales (3)% growth to flat (3)% to 3% growth Operating Margin 5.3% to 5.5% 5.8% to 5.9% Effective Tax Rate 29% to 30% ~ 29% EPS $5.00 to $5.40 Free Cash Flow ~ 80% of net income Notes: Excludes unannounced acquisitions. Assumes a CAD/USD exchange rate of 0.79.

12 Q1 2015 Earnings Webcast, 04/23/2015 Appendix

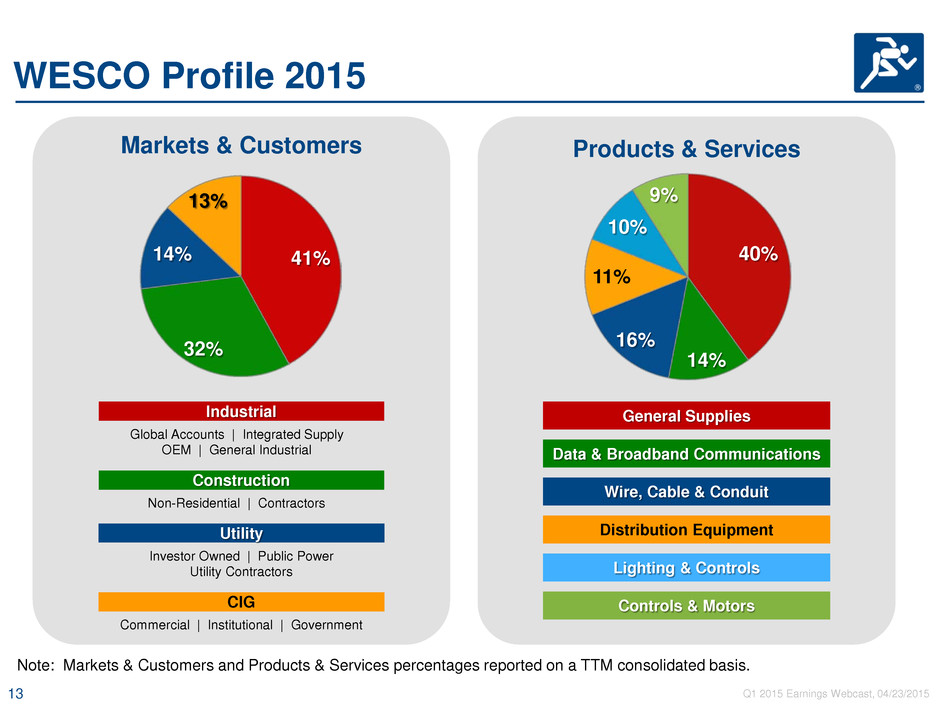

13 Q1 2015 Earnings Webcast, 04/23/2015 WESCO Profile 2015 41% 32% 14% 13% 40% 14% 16% 11% 10% 9% Controls & Motors Lighting & Controls General Supplies Data & Broadband Communications Wire, Cable & Conduit Distribution Equipment Note: Markets & Customers and Products & Services percentages reported on a TTM consolidated basis. Products & Services Markets & Customers Utility CIG Industrial Construction Investor Owned | Public Power Utility Contractors Commercial | Institutional | Government Global Accounts | Integrated Supply OEM | General Industrial Non-Residential | Contractors

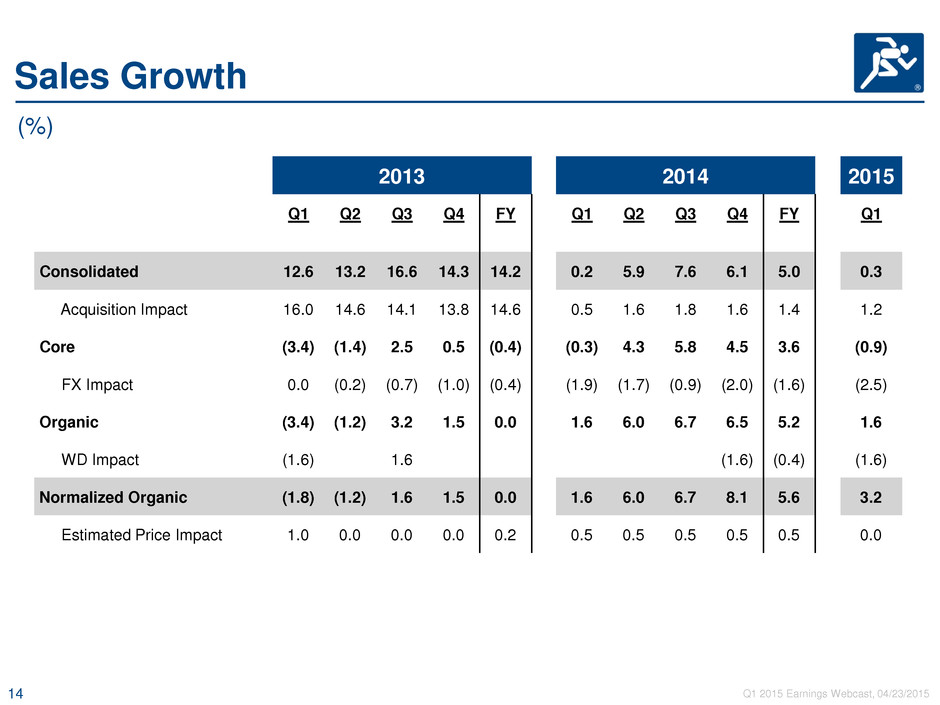

14 Q1 2015 Earnings Webcast, 04/23/2015 Sales Growth 2013 2014 2015 Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Q1 Consolidated 12.6 13.2 16.6 14.3 14.2 0.2 5.9 7.6 6.1 5.0 0.3 Acquisition Impact 16.0 14.6 14.1 13.8 14.6 0.5 1.6 1.8 1.6 1.4 1.2 Core (3.4) (1.4) 2.5 0.5 (0.4) (0.3) 4.3 5.8 4.5 3.6 (0.9) FX Impact 0.0 (0.2) (0.7) (1.0) (0.4) (1.9) (1.7) (0.9) (2.0) (1.6) (2.5) Organic (3.4) (1.2) 3.2 1.5 0.0 1.6 6.0 6.7 6.5 5.2 1.6 WD Impact (1.6) 1.6 (1.6) (0.4) (1.6) Normalized Organic (1.8) (1.2) 1.6 1.5 0.0 1.6 6.0 6.7 8.1 5.6 3.2 Estimated Price Impact 1.0 0.0 0.0 0.0 0.2 0.5 0.5 0.5 0.5 0.5 0.0 (%)

15 Q1 2015 Earnings Webcast, 04/23/2015 Sales Growth – Geography U.S. Canada International Total Change in net sales 3.1 (5.4) (11.2) 0.3 Impact from acquisitions 0.7 2.9 - 1.2 Impact from foreign exchange rates - (10.8) (5.6) (2.5) Impact from number of workdays (1.6) (1.6) (1.6) (1.6) Normalized organic sales growth 4.0 4.1 (4.0) 3.2 (%)

16 Q1 2015 Earnings Webcast, 04/23/2015 Note: The prior period end market amounts noted above may contain reclassifications to conform to current period presentation. ($ Millions) Sales Growth – End Markets Q1 2015 vs. Q1 2014 Q1 2015 vs. Q4 2014 Q10 Q10 Q10 Q40 2015 2014 %00 Growth 2015 2014 %00 Growth Industrial Core 757 804 (5.7)% 760 826 (8.0)% Construction Core 540 527 2.3% 547 639 (14.3)% Utility Core 262 250 4.9% 272 286 (5.0)% CIG Core 242 236 2.7% 243 251 (3.4)% Total Core Gross Sales 1,801 1,817 (0.8)% 1,822 2,002 (9.0)% Total Gross Sales from Acquisitions 21 - - - - - Total Gross Sales 1,822 1,817 0.3% 1,822 2,002 (9.0)% Gross Sales Reductions/Discounts (6) (6) - (6) (7) - Total Net Sales 1,816 1,811 0.3% 1,816 1,995 (9.0)%

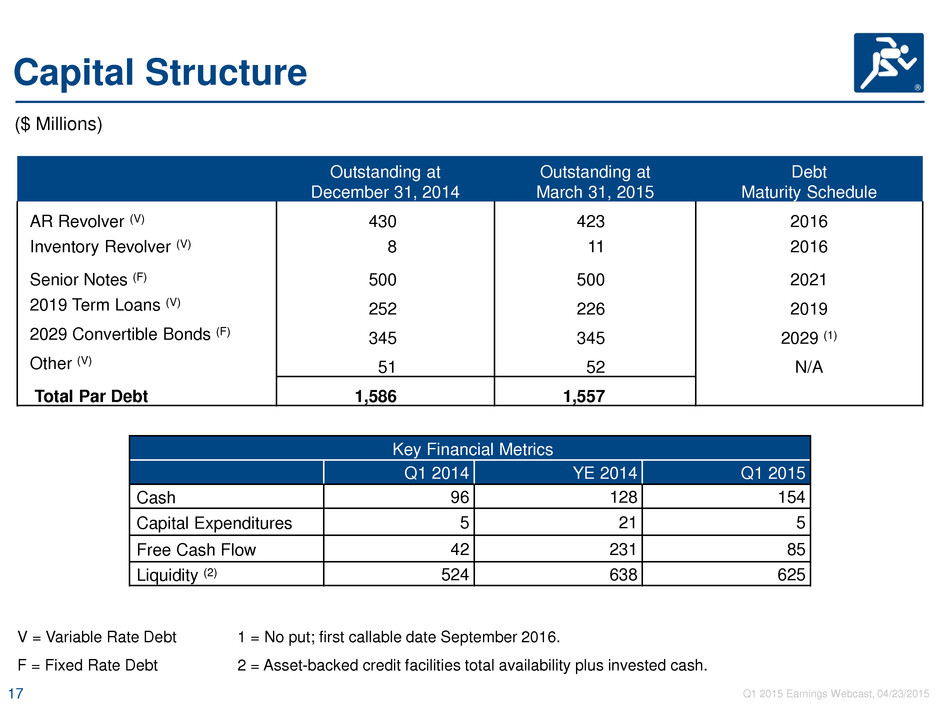

17 Q1 2015 Earnings Webcast, 04/23/2015 Outstanding at December 31, 2014 Outstanding at March 31, 2015 Debt Maturity Schedule AR Revolver (V) 430 423 2016 Inventory Revolver (V) 8 11 2016 Senior Notes (F) 500 500 2021 2019 Term Loans (V) 252 226 2019 2029 Convertible Bonds (F) 345 345 2029 (1) Other (V) 51 52 N/A Total Par Debt 1,586 1,557 Capital Structure Key Financial Metrics Q1 2014 YE 2014 Q1 2015 Cash 96 128 154 Capital Expenditures 5 21 5 Free Cash Flow 42 231 85 Liquidity (2) 524 638 625 ($ Millions) V = Variable Rate Debt 1 = No put; first callable date September 2016. F = Fixed Rate Debt 2 = Asset-backed credit facilities total availability plus invested cash.

18 Q1 2015 Earnings Webcast, 04/23/2015 Financial Leverage Twelve Months Ended March 31, 2015 Financial leverage ratio: Income from operations $ 460 Depreciation and amortization 68 EBITDA $ 528 March 31, 2015 Current debt and short-term borrowings $ 52 Long-term debt 1,337 Debt discount related to convertible debentures (1) 168 Total debt including debt discount $ 1,557 Financial leverage ratio 2.9X (1)The convertible debentures and term loan are presented in the condensed consolidated balance sheets in long-term debt net of the unamortized discount. ($ Millions)

19 Q1 2015 Earnings Webcast, 04/23/2015 ($ Millions) Maturity Par Value of Debt Debt Discount Debt per Balance Sheet 2029 344.9 (166.3) 178.6 Convertible Debt At March 31, 2015 Non-Cash Interest Expense ($ Millions) 2013 2014 Q1 2015 Convertible Debt 4.3 4.1 1.7 Amortization of Deferred Financing Fees 4.9 4.4 1.8 FIN 48 0.6 1.0 0.3 Accrued Interest in Excess of Paid 0.4 0.0 1.6 Total 10.2 9.5 5.4 Convertible Debt and Non-Cash Interest

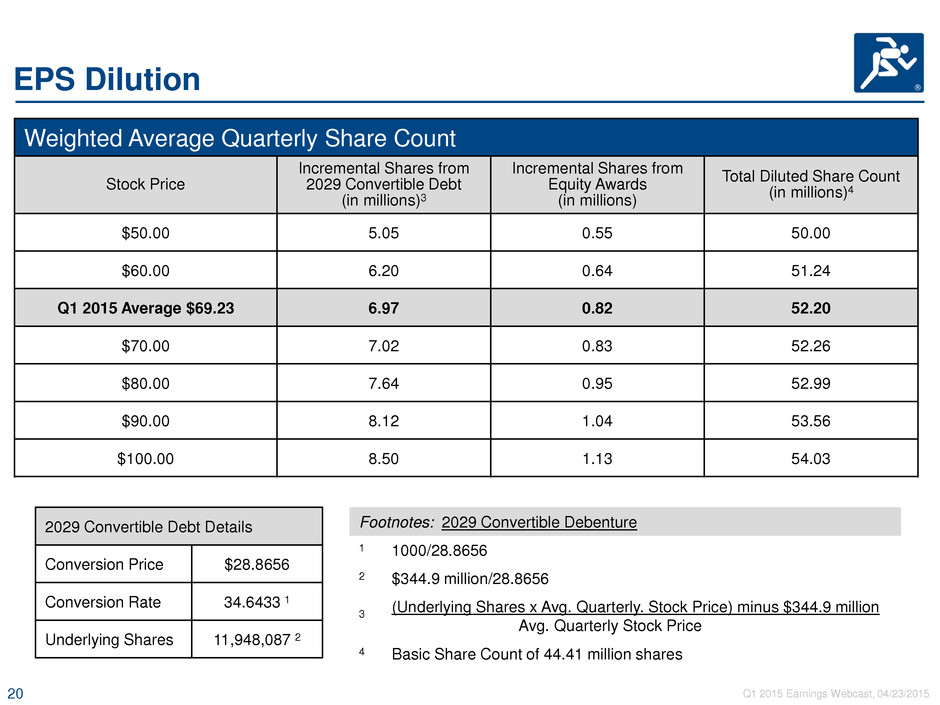

20 Q1 2015 Earnings Webcast, 04/23/2015 EPS Dilution Weighted Average Quarterly Share Count Stock Price Incremental Shares from 2029 Convertible Debt (in millions)3 Incremental Shares from Equity Awards (in millions) Total Diluted Share Count (in millions)4 $50.00 5.05 0.55 50.00 $60.00 6.20 0.64 51.24 Q1 2015 Average $69.23 6.97 0.82 52.20 $70.00 7.02 0.83 52.26 $80.00 7.64 0.95 52.99 $90.00 8.12 1.04 53.56 $100.00 8.50 1.13 54.03 2029 Convertible Debt Details Conversion Price $28.8656 Conversion Rate 34.6433 1 Underlying Shares 11,948,087 2 Footnotes: 2029 Convertible Debenture 1 1000/28.8656 2 $344.9 million/28.8656 3 (Underlying Shares x Avg. Quarterly. Stock Price) minus $344.9 million Avg. Quarterly Stock Price 4 Basic Share Count of 44.41 million shares

21 Q1 2015 Earnings Webcast, 04/23/2015 Work Days Q1 Q2 Q3 Q4 FY 2014 63 64 64 62 253 2015 62 64 64 63 253

22 Q1 2015 Earnings Webcast, 04/23/2015 Free Cash Flow Reconciliation Q1 2014 Q1 2015 Cash flow provided by operations 46.7 90.1 Less: Capital expenditures (5.0) (5.0) Free Cash Flow 41.7 85.1 Note: Free cash flow is provided by the Company as an additional liquidity measure. Capital expenditures are deducted from operating cash flow to determine free cash flow. Free cash flow is available to fund the Company's financing needs. ($ Millions)