Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - UNIFI INC | ex99-1.htm |

| 8-K - FORM 8-K - UNIFI INC | ufi20150422_8k.htm |

Exhibit 99.2

|

Unifi, Inc. Preliminary Results For the Third Quarter Ended March 29, 2015 Conference Call Slide Presentation |

|

2 Cautionary Statement Certain statements included herein contain forward-looking statements within the meaning of federal securities laws about the financial condition and results of operations of Unifi, Inc. (the “Company”) that are based on management’s beliefs, assumptions and expectations about our future economic performance, considering the information currently available to management. The words “believe,” “may,” “could,” “will,” “should,” “would,” “anticipate,” “estimate,” “project,” “expect,” “intend,” “seek,” “strive,” and words of similar import, or the negative of such words, identify or signal the presence of forward-looking statements. These statements are not statements of historical fact; they involve risk and uncertainties that may cause our actual results, performance or financial condition to differ materially from the expectations of future results, performance or financial condition that we express or imply in any forward-looking statement. Factors that could contribute to such differences include, but are not limited to: the competitive nature of the textile industry and the impact of worldwide competition; changes in the trade regulatory environment and governmental policies and legislation; the availability, sourcing and pricing of raw materials; general domestic and international economic and industry conditions in markets where the Company competes, such as recession and other economic and political factors over which the Company has no control; changes in consumer spending, customer preferences, fashion trends and end-uses; the financial condition of the Company’s customers; the loss of a significant customer; the success of the Company’s strategic business initiatives; the continuity of the Company’s leadership; volatility of financial and credit markets; the ability to service indebtedness and fund capital expenditures and strategic initiatives; availability of and access to credit on reasonable terms; changes in currency exchange, interest and inflation rates; the ability to reduce production costs; the ability to protect intellectual property; employee relations; the impact of environmental, health and safety regulations; the operating performance of joint ventures and other equity investments; and the accurate financial reporting of information from equity method investees. All such factors are difficult to predict, contain uncertainties that may materially affect actual results and may be beyond our control. New factors emerge from time to time, and it is not possible for management to predict all such factors or to assess the impact of each such factor on the Company. Any forward-looking statement speaks only as of the date on which such statement is made, and we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made, except as may be required by federal securities law. The above and other risks and uncertainties are described in the Company’s most recent annual report on Form 10-K, and additional risks or uncertainties may be described from time to time in other reports filed by the Company with the Securities and Exchange Commission pursuant to the Securities Exchange Act of 1934, as amended. Unifi, Inc. Third Qtr. Conf. Call April 23, 2015 (Unaudited) |

|

3 Net Sales and Gross Profit Highlights (Amounts in Thousands, Except Percentages) Unifi, Inc. Third Qtr. Conf. Call April 23, 2015 (Unaudited) Quarter over Quarter Year over Year For the Three Months Ended For the Nine Months Ended March 29, 2015 vs. March 30, 2014 March 29, 2015 vs. March 30, 2014 Volume Price Volume Price Net Sales: Polyester (3.6%) (1.4%) (2.3%) 0.6% Nylon 14.4% (10.5%) 10.4% (5.4%) International 5.4% (13.4%) 9.7% (9.2%) Consolidated 0.5% (4.1%) 2.2% (1.9%) For the Three Months Ended For the Nine Months Ended March 29, 2015 March 30, 2014 March 29, 2015 March 30, 2014 Gross Profit: Polyester $13,025 $11,013 $36,019 $31,170 Nylon 4,224 5,040 15,078 14,493 International 5,014 3,706 15,404 12,578 Consolidated $22,263 $19,759 $66,501 $58,241 |

|

4 Income Statement Highlights (Amounts in Thousands, Except Percentages and Per Share Amounts) Unifi, Inc. Third Qtr. Conf. Call April 23, 2015 (Unaudited) For the Three Months Ended March 29, 2015 March 30, 2014 Net sales $170,530 100.0% $176,864 100.0% Gross profit 22,263 13.1% 19,759 11.2% Selling, general and administrative expenses 12,260 7.2% 12,290 6.9% Operating income 9,031 5.3% 6,093 3.4% Interest expense, net 962 748 Equity in earnings of unconsolidated affiliates 5,459 3,585 Income before income taxes 12,488 8,930 Earnings per share (basic) $0.55 $0.25 Weighted average shares outstanding 18,186 18,825 |

|

5 Income Statement Highlights (Amounts in Thousands, Except Percentages and Per Share Amounts) Unifi, Inc. Third Qtr. Conf. Call April 23, 2015 (Unaudited) For the Nine Months Ended March 29, 2015 March 30, 2014 Net sales $507,861 100.0% $506,150 100.0% Gross profit 66,501 13.1% 58,241 11.5% Selling, general and administrative expenses 36,130 7.1% 33,895 6.7% Operating income 26,582 5.2% 20,152 4.0% Interest expense, net 2,364 1,547 Equity in earnings of unconsolidated affiliates 12,461 14,830 Income before income taxes 35,639 33,435 Earnings per share (basic) $1.46 $1.05 Weighted average shares outstanding 18,218 19,075 |

|

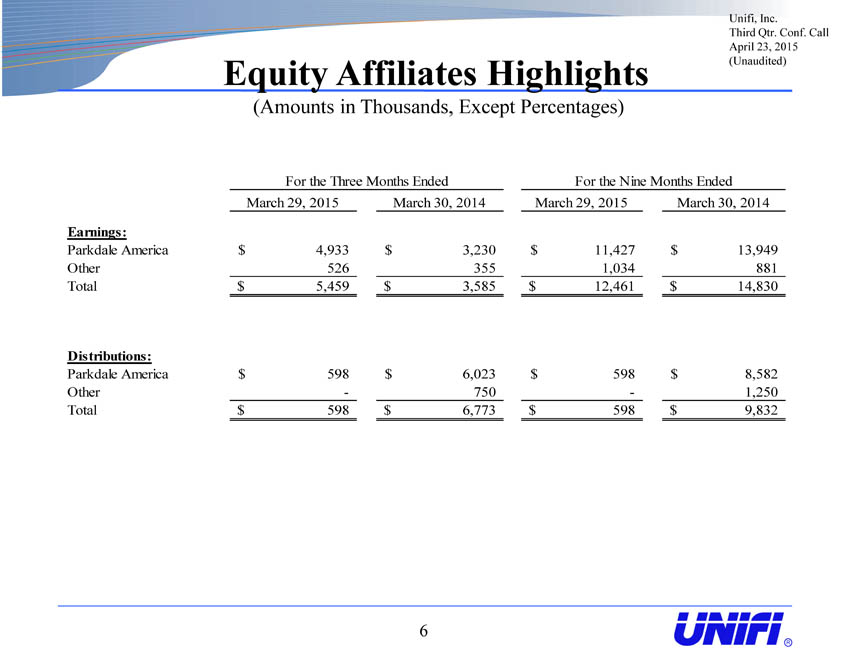

6 Equity Affiliates Highlights (Amounts in Thousands, Except Percentages) Unifi, Inc. Third Qtr. Conf. Call April 23, 2015 (Unaudited) For the Three Months Ended For the Nine Months Ended March 29, 2015 March 30, 2014 March 29, 2015 March 30, 2014 Earnings: Parkdale America $4,933 $3,230 $11,427 $13,949 Other 526 355 1,034 881 Total $5,459 $3,585 $12,461 $14,830 Distributions: Parkdale America $598 $6,023 $598 $8,582 Other - 750 - 1,250 Total $598 $6,773 $598 $9,832 |

|

7 Reconciliations of Net Income to Adjusted EBITDA (Amounts in Thousands) Unifi, Inc. Third Qtr. Conf. Call April 23, 2015 (Unaudited) For the Three Months Ended For the Nine Months Ended March 29, 2015 March 30, 2014 March 29, 2015 March 30, 2014 Net income attributable to Unifi, Inc. $10,016 $4,743 $26,511 $20,056 Interest expense, net 962 748 2,364 1,547 Provision for income taxes 2,729 4,476 10,083 14,151 Depreciation and amortization expense 4,154 4,525 12,803 12,874 EBITDA 17,861 14,492 51,761 48,628 Non-cash compensation expense 565 480 2,462 2,091 Loss on extinguishment of debt 1,040 - 1,040 - Other 847 1,203 2,439 3,749 Adjusted EBITDA Including Equity Affiliates 20,313 16,175 57,702 54,468 Equity in earnings of unconsolidated affiliates (5,459) (3,585) (12,461) (14,830) Adjusted EBITDA $14,854 $12,590 $45,241 $39,638 |

|

8 Reconciliations of GAAP Results To Adjusted Results (Amounts in Thousands, Except Per Share Amounts) Unifi, Inc. Third Qtr. Conf. Call April 23, 2015 (Unaudited) For the Three Months Ended March 29, 2015 For the Three Months Ended March 30, 2014 Income Before Income Taxes Net Income Basic EPS Income Before Income Taxes Net Income Basic EPS GAAP results $12,488 $10,016 $0.55 $8,930 $4,743 $0.25 Change in valuation allowance - (924) (0.05) - 616 0.03 Gain on bargain purchase for an equity affiliate - - - - - - Renewable energy tax credits - (782) (0.04) - - - Loss on extinguishment of debt 1,040 676 0.03 - - - Restructuring charges, net - - - 178 116 0.01 Interest income related to judicial claim - - - - - - Net (gain) loss on sale or disposal of assets (30) (20) - (71) (46) - Adjusted results $13,498 $8,966 $0.49 $9,037 $5,429 $0.29 For the Nine Months Ended March 29, 2015 For the Nine Months Ended March 30, 2014 Income Before Income Taxes Net Income Basic EPS Income Before Income Taxes Net Income Basic EPS GAAP results $35,639 $26,511 $1.46 $33,435 $20,056 $1.05 Change in valuation allowance - (1,260) (0.07) - 1,457 0.08 Gain on bargain purchase for an equity affiliate (1,506) (1,506) (0.08) - - - Renewable energy tax credits - (782) (0.04) - - - Loss on extinguishment of debt 1,040 676 0.03 - - - Restructuring charges, net - - - 1,296 842 0.04 Interest income related to judicial claim - - - (1,084) (715) (0.04) Net (gain) loss on sale or disposal of assets (13) (8) - 269 175 0.01 Adjusted results $35,160 $23,631 $1.30 $33,916 $21,815 $1.14 |

|

9 Working Capital Highlights (Amounts in Thousands) Unifi, Inc. Third Qtr. Conf. Call April 23, 2015 (Unaudited) March 29, 2015 December 28, 2014 June 29, 2014 Receivables, net $88,492 $76,319 $93,925 Inventories 105,550 115,703 113,370 Accounts payable (44,007) (41,853) (51,364) Accrued expenses (1) (15,147) (11,376) (18,487) Adjusted Working Capital $134,888 $138,793 $137,444 Adjusted Working Capital $134,888 $138,793 $137,444 Cash 14,752 17,897 15,907 Other current assets 10,355 11,858 8,025 Accrued interest (219) (263) (102) Other current liabilities (14,162) (13,553) (10,349) Working capital $145,614 $154,732 $150,925 (1) Excludes accrued interest |

|

10 Capital Structure (Amounts in Thousands) Unifi, Inc. Third Qtr. Conf. Call April 23, 2015 (Unaudited) March 29, 2015 December 28, 2014 June 29, 2014 ABL Revolver $17,100 $19,000 $26,000 ABL Term Loan 84,375 87,187 68,000 Other 10,792 5,071 5,488 Total debt $112,267 $111,258 $99,488 Cash 14,752 17,897 15,907 Net debt $97,515 $93,361 $83,581 Cash $14,752 $17,897 $15,907 Revolver availability, net 67,767 60,919 61,103 Total liquidity $82,519 $78,816 $77,010 |

|

Non-GAAP Financial Measures Certain non-GAAP financial measures included herein are designed to complement the financial information presented in accordance with generally accepted accounting principles in the United States of America ("GAAP") because management believes such measures are useful to investors. These non-GAAP financial measures include, Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”), Adjusted EBITDA Including Equity Affiliates, Adjusted EBITDA and Adjusted EPS. EBITDA represents net income or loss attributable to Unifi, Inc. before net interest expense, income tax expense, and depreciation and amortization expense. Adjusted EBITDA Including Equity Affiliates represents EBITDA adjusted to exclude non-cash compensation expense, gains or losses on extinguishment of debt, loss on previously held equity interest, and certain other adjustments. Such other adjustments include operating expenses for Repreve Renewables, restructuring charges and start-up costs, gains or losses on sales or disposals of property, plant and equipment, currency and derivative gains or losses, and other operating or non-operating income or expense items necessary to understand and compare the underlying results of the Company. Adjusted EBITDA represents Adjusted EBITDA Including Equity Affiliates adjusted to exclude equity in earnings and losses of unconsolidated affiliates. Adjusted EPS represents basic earnings per share calculated under GAAP, adjusted to exclude changes in the deferred tax valuation allowance, gain on bargain purchase for an equity affiliate, renewable energy tax credits, loss on extinguishment of debt, restructuring charges, net, interest income related to a judicial claim and net gains or losses on sale or disposal of assets. Such amounts are excluded from Adjusted EPS in order to better reflect the Company’s underlying basic earnings per share. Adjusted EPS excludes certain amounts which management believes do not reflect the ongoing operations and performance of the Company. EBITDA, Adjusted EBITDA Including Equity Affiliates, Adjusted EBITDA and Adjusted EPS are alternative views of performance used by management, and we believe that investors’ understanding of our performance is enhanced by disclosing these performance measures. We believe that the use of EBITDA, Adjusted EBITDA Including Equity Affiliates, Adjusted EBITDA and Adjusted EPS as operating performance measures provides investors and analysts with a measure of operating results unaffected by differences in capital structures, capital investment cycles, and ages of related assets, among otherwise comparable companies. The Company may, from time to time, change the items included within Adjusted EBITDA and Adjusted EPS. Management uses Adjusted EBITDA: (i) as a measurement of operating performance because it assists us in comparing our operating performance on a consistent basis, as it removes the impact of (a) items directly related to our asset base (primarily depreciation and amortization) and (b) items that we would not expect to occur as a part of our normal business on a regular basis; (ii) for planning purposes, including the preparation of our annual operating budget; (iii) as a valuation measure for evaluating our operating performance and our capacity to incur and service debt, fund capital expenditures and expand our business; and (iv) as one measure in determining the value of other acquisitions and dispositions. Adjusted EBITDA is also a key performance metric utilized in the determination of variable compensation. We also believe Adjusted EBITDA is an appropriate supplemental measure of debt service capacity, because cash expenditures on interest are, by definition, available to pay interest, and tax expense is inversely correlated to interest expense because tax expense decreases as deductible interest expense increases; and depreciation and amortization are non-cash charges. Equity in earnings and losses of unconsolidated affiliates is excluded because such earnings or losses do not reflect our operating performance. The other items excluded from Adjusted EBITDA and Adjusted EPS are excluded in order to better reflect the performance of our continuing operations. Unifi, Inc. Third Qtr. Conf. Call April 23, 2015 (Unaudited) |

|

12 Non-GAAP Financial Measures - continued In evaluating EBITDA, Adjusted EBITDA Including Equity Affiliates, Adjusted EBITDA and Adjusted EPS, you should be aware that, in the future, we may incur expenses similar to the adjustments included herein. Our presentation of EBITDA, Adjusted EBITDA Including Equity Affiliates, Adjusted EBITDA and Adjusted EPS should not be construed as indicating that our future results will be unaffected by unusual or non-recurring items. EBITDA, Adjusted EBITDA Including Equity Affiliates, Adjusted EBITDA and Adjusted EPS are not determined in accordance with GAAP and should not be considered as substitutes for net income, operating income or any other performance measures determined in accordance with GAAP or as an alternative to cash flow from operating activities as a measure of our liquidity. Each of our EBITDA, Adjusted EBITDA Including Equity Affiliates, Adjusted EBITDA and Adjusted EPS measures has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are: • it is not adjusted for all non-cash income or expense items that are reflected in our statements of cash flows; • it does not reflect the impact of earnings or charges resulting from matters we consider not indicative of our ongoing operations; • it does not reflect changes in, or cash requirements for, our working capital needs; • it does not reflect the cash requirements necessary to make payments on our debt; • it does not reflect our future requirements for capital expenditures or contractual commitments; • it does not reflect limitations on or costs related to transferring earnings from our subsidiaries to us; and • other companies in our industry may calculate this measure differently than we do, limiting its usefulness as a comparative measure. Because of these limitations, EBITDA, Adjusted EBITDA Including Equity Affiliates, and Adjusted EBITDA should not be considered as a measure of discretionary cash available to us to invest in the growth of our business or as a measure of cash that will be available to us to meet our obligations, including those under our outstanding debt obligations. You should compensate for these limitations by relying primarily on our GAAP results and using these measures only as supplemental information. Unifi, Inc. Third Qtr. Conf. Call April 23, 2015 (Unaudited) |