Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CIVISTA BANCSHARES, INC. | d913732d8k.htm |

First

Citizens

Banc

Corp

Annual

Shareholder

Meeting

April

21,

2015

Exhibit 99.1 |

Cautionary Statement Regarding Forward-Looking Information

Comments made in this presentation include

“forward-looking statements”

within the meaning of the Private Securities

Litigation Reform Act of 1995.

Forward-looking statements are subject to numerous assumptions, risks and

uncertainties. Although management believes that the expectations

reflected in the forward-looking statements are reasonable, actual

results or future events could differ, possibly materially, from those

anticipated in these forward-

looking statements. The forward-looking statements speak only as of the

date of this presentation, and First Citizens Banc Corp assumes no duty to

update any forward-looking statements to reflect events or

circumstances after the date of this presentation, except to the extent

required by law. |

9

th

Largest

Publicly

Traded Commercial

Bank in Ohio

Community Bank

Operating in 11 Ohio

Counties

Commercial Banking

Retail Banking

Wealth Management

Key Facts

(as of 3/31/15)

($ millions)

Assets

$1,407.2

Loans

$ 984.1

Deposits

$1,197.3

Market Cap

$ 86.4

Company Overview |

December

31, 2014 December 31, 2013

Change

Balance Sheet

Assets

$1,213,191,000

$1,167,546,000

3.91%

Gross Loans

$ 914,857,000

$ 861,241,000

6.23%

Deposits

$ 968,918,000

$ 942,475,000

2.81%

Performance

Net Income

$ 9,528,000

$ 6,179,000

54.20%

Return on Average Assets

0.77%

0.53%

45.28%

Return on Average Equity

8.34%

5.97%

39.70%

Return on Average Tangible

Common Equity

12.44%

9.93%

25.28%

Financial Highlights |

Last Year’s

Strategy Commitment Long-term Shareholder Value

through Growth and

Profitability |

2014 Company

Successes Completed the placement of $25,000,000 in preferred stock

-

strengthening the capital of the company

Opening of Loan Production office in Mayfield Heights

Agreement to acquire TCNB, Dayton, Ohio -

growing the

company $100,000,000 and opening a new market

Recognition by SNL Securities for a 61% return in our

common stock for 2014

Consolidation of our brand identity under Civista Bank and

Civista Bancshares, Inc. |

Mayfield Heights

Office |

Dayton

Offices Huber Heights

Springboro Pike

Whipp Road |

Sandusky / Akron,

Ohio $556 million in loans

$590 million in deposits

11 branch locations

#1 deposit market share

in Sandusky, Ohio with

~ 43% market share

North Central Ohio

$101 million in loans

$187million in deposits

7 branch locations

~40% deposit market

share

West Central Ohio

$258 million in loans

$192 million in deposits

7 branch locations

23% deposit market

share in the rural

markets

Greater Dayton, Ohio

$78 million in loans

$90 million in deposits

3 branch locations

~1.47% deposit market

share

First Citizens Banc Corp Locations |

Target

Market

Highlights |

SNL Financial

Recognition Top Returning Bank Stock for Banks Under $100M in Capitalization

2014 Total Return of 61.15% |

Stock

Recovery

from

September

2011

Low |

Company

Rebranding 316 Citizens Banks in the country

16 Citizens in the State of Ohio

Citizens/Champaign confusing

Identity confusion on the internet

Need to set ourselves apart from the others |

Company

Rebranding Bank Logo |

Company

Rebranding Logo Extensions |

2014 Operating

Successes Grew Loans by $53,600,000

Grew Deposits by $26,400,000

Grew Net Interest Income by $1,892,000

Grew Noninterest Income by $1,812,000

Reduced Noninterest Expense by $1,834,000

Reduced Non-Performing Assets from 2.2% to 1.6% of assets |

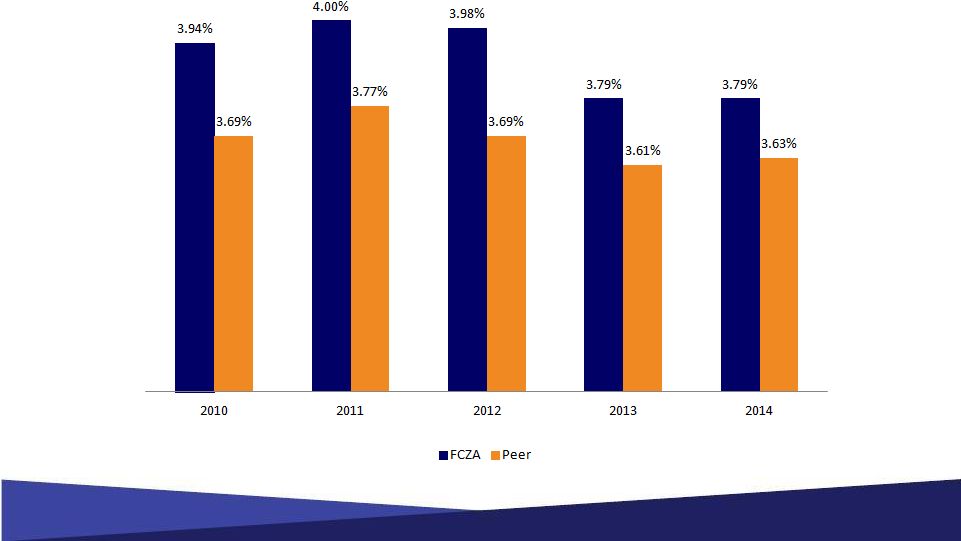

Peer

Leading

Net

Interest

Margin |

Non-Interest

Metrics and Initiatives From AB Magazine, November ©

2014 SourceMedia, Inc.. All rights reserved. Used by permission and protected by the

Copyright Laws of the United States. The printing, copying, redistribution, or

retransmission of this Content without expressed written permission is

prohibited. *Civista Bank, formerly Citizens and Champaign Banks. Improving

efficiency and operating leverage Investment

in

people

*

Revised retirement plan in Q2 2014

reducing net expenses $195 thousand in

2014

Rightsizing branch network

Projected annual cost savings of $450

thousand

Growing fee income platform

Wealth management

~$464 million in AUM

Earned $3.2 million during 2014, a

19% increase from the prior year

Income tax refund processing program

Evaluated / refined our process

over four tax seasons

Specialized payment processing

earned $2.3 million during 2014

Non-Interest Income / Average Assets

Net Operating Expense / Average Assets

0.85%

0.89%

0.98%

1.00%

1.12%

2010

2011

2012

2013

2014

2.20%

2.24%

2.31%

2.63%

2.17%

2010

2011

2012

2013

2014 |

Operating

Results ($s in thousands, except per share data)

For the Years Ended December 31,

2010

2011

2012

2013

2014

Net Interest Income

$41,461

$41,361

$40,578

$39,974

$41,866

Provision for Loan Losses

17,940

9,800

6,400

1,100

1,500

Noninterest Income

9,154

9,971

11,200

12,062

13,874

Noninterest Expense

35,774

36,727

38,074

43,384

41,550

Net Income

(1,268)

3,958

5,579

6,179

9,528

Net Income Available to Common

Shareholders

(2,444)

2,782

4,386

5,020

7,655

Basic EPS per Common Share

($0.32)

$0.36

$0.57

$0.65

$0.99

Diluted EPS per Common Share

(0.32)

0.36

0.57

0.64

0.85

Return on Average Assets (ROAA)

(0.11%)

0.35%

0.49%

0.53%

0.77%

Return on Average Equity (ROAE)

(1.27)

3.96

5.36

5.97

8.34 |

Our Strategy

Remains Unchanged Grow the Company

Grow to spread expenses over a larger base

Cost of Regulation and Compliance

Cost of Technology

Grow to spread Risk

Diversity of markets and customer base

Grow to increase attractiveness of company

Expand and diversify shareholder base

Increase liquidity of stock |

Our Strategy

Remains Unchanged Grow the Company

Leading to Increased

Shareholder Value |

Our Story to the

Investment Community |

|

THANK

YOU |