Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Summit Materials, Inc. | d912219d8k.htm |

| EX-2.1 - EX-2.1 - Summit Materials, Inc. | d912219dex21.htm |

| EX-2.2 - EX-2.2 - Summit Materials, Inc. | d912219dex22.htm |

| EX-99.1 - EX-99.1 - Summit Materials, Inc. | d912219dex991.htm |

April 2015

Davenport Assets Acquisition Discussion Materials

Exhibit 99.2 |

Disclaimer

2

Forward-Looking Statements and Other Matters

During the course of this presentation, we may make forward-looking statements or provide

forward-looking information. All statements that address expectations or projections

about the future, including with respect to our expected acquisition of Lafarge North America’s

Davenport, IA cement plant and select terminals, are forward-looking statements. Some of

these statements include words such as “expects,” “anticipates,”

“believes,” “estimates,” “plans,” “intends,” “projects,” and “indicates.” Although they reflect our current

expectations, these statements are not guarantees of future performance, but involve a number

of risks, uncertainties, and assumptions that are difficult to predict, including those

described in “Risk Factors” in our prospectus dated March 11, 2015 filed with the Securities and

Exchange Commission (the “SEC”), as such factors may be updated from time to time in

our periodic filings with the SEC. Some of the factors that may cause actual outcomes

and results to differ materially from those expressed in, or implied by, the forward-looking

statements include, but are not necessarily limited to, general economic conditions,

competitive pressures, the commodity nature of our products and their price movements,

raw material costs and availability, and the ability to retain key employees. We do not undertake to

update any forward-looking statements as a result of future developments or new

information. This presentation (including any oral

briefing and any question-and-answer in connection with it) is not intended to, and does not constitute,

represent or form part of any offer, invitation or solicitation of any offer to purchase,

otherwise acquire, subscribe for, sell or otherwise dispose of, any securities. |

Summit

Materials’ Acquisition of Lafarge North America’s

Davenport Cement Plant & Seven Cement Terminals

3

Funding Summary

Transaction Highlights

On April 16, 2015, Summit Materials (NYSE: SUM), a leading vertically-integrated

construction materials company, signed a definitive agreement to acquire Lafarge North

America’s 1.2M short ton (1.1M metric ton) capacity Davenport, IA cement plant and

seven cement distribution terminals along the Mississippi River (“Davenport

Assets”) for $450 million plus Summit’s Bettendorf, IA cement distribution terminal

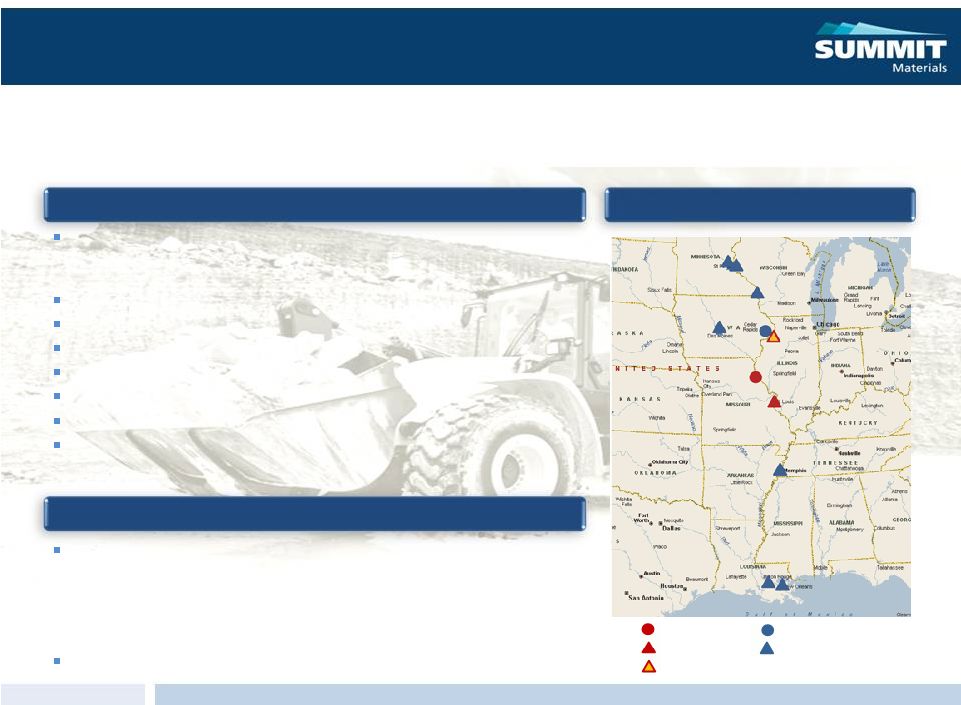

Geographic Footprint

Combination of the Davenport Assets and Summit’s Continental Cement

(“CCC”) business creates a strategically compelling and complementary

multi-plant cement business

PF ’14A Adj. EBITDA cash purchase price multiple of approximately 9x

(1)

Attractive growth markets throughout U.S. mid-continent

Favorable timing as domestic cement supply tightens

Well positioned for EBITDA growth and margin expansion

Enhances Summit’s margin profile and materials exposure

Immediately accretive to Summit’s earnings

Expected to close in July 2015, contingent on final regulatory approval and

the Lafarge-Holcim merger closing

Cash purchase price of $450 million plus Bettendorf, IA cement terminal

o

Initial purchase price of $370 million due at closing, to be funded by 2019

Term Debt

o

Remaining purchase price of $80m due no later than 12/31/15; expected to

be funded with a combination of debt and equity

Summit’s ‘15E net leverage ratio is not expected to exceed 4.75x

(1)

(1) Estimated based on currently available information, including unaudited financial

information provided by the seller and certain assumptions by management. Audited carve-out financials are not yet available and actual results may vary.

CCC Hannibal Plant

CCC Terminal

CCC Bettendorf Terminal

Lafarge Davenport Plant

Lafarge Terminal |

Transaction

Overview 4

What

Acquisition of Lafarge North America’s Davenport cement plant and seven mid-continent

cement distribution terminals for $450M plus CCC’s Bettendorf, IA cement

distribution terminal How

Lafarge has agreed to sell the Davenport Assets to Summit in order to obtain approval of the

Lafarge-Holcim merger from U.S. antitrust authorities

Summit Materials’

signed a definitive agreement on April 16, 2015 to acquire the Davenport Assets,

contingent on final regulatory approval and the Lafarge-Holcim merger closing

Where

Cement plant is located in Davenport, IA and the seven terminals

are located along the Mississippi

river system as far north as Minneapolis and as far south as New

Orleans

Terminal locations are: Minneapolis, MN; St. Paul, MN; LaCrosse,

WI; Des Moines, IA; Memphis, TN;

Union, LA; and New Orleans, LA

When

Deal is expected to close in July 2015, within 10 days of the Lafarge-Holcim merger

closing Why

Premier assets

Compelling strategic fit

Attractive markets

Favorable timing

Strong operational fit

Increased materials exposure

Margin expansion

Immediately accretive |

Compelling

Transaction Fundamentals 5

Premier Assets

Most northern cement plant (1.2M short ton / 1.1M metric

ton capacity) on the Mississippi River

Davenport Assets distributed approximately 1.5M short

tons of cement in ’14; volume over the Davenport plant

capacity will be serviced with CCC capacity

Well-run, low-cost plant with strong management

Efficient barge, rail and truck distribution modes

1 of 4 terminal operators in New Orleans that can supply

imported cement into the southern Mississippi River

On-site limestone reserves of ~50 years

Compelling Strategic Fit

100% materials business in attractive cement sector

Increases Summit’s geographical diversity

Expands Summit’s exposure to private-led demand

New market platforms for downstream growth

Provides distribution infrastructure to support cement

capacity expansion at CCC’s Hannibal, MO plant

Attractive Markets

Low-cost supplier in growing upriver markets

Downriver growth markets represent an expansion

opportunity

Enables CCC to utilize its excess capacity and bring

additional supply to the Davenport terminal network

Favorable Timing

Projected U.S. demand > U.S. domestic supply by ’17

Positive pricing trends

Source: USGS, PCA. |

Unique Opportunity

to Drive Growth & Create Shareholder Value

6

Margin Expansion

Strong Operational Fit

Increased Materials Exposure

Immediately Accretive

Davenport and CCC’s Hannibal, MO plant are the two most

northerly cement plants on the Mississippi river

Many synergy opportunities between Davenport and CCC’s

Hannibal, MO plant

o

Distribution efficiencies

o

Alternative fuels optimization

o

Operational best practices

Complementary, experienced management teams across

Davenport and CCC

Pure-play cement business

More than doubles Summit’s cement operations

Increases Summit’s materials-related earnings exposure by

approximately 900 bps

(1)

Expected to be accretive to Summit’s EPS from closing

Anticipated cost savings of approximately $3m

Favorable financing structure

Strong free cash flow –

mature plant with low maintenance

capex

Higher margin cement business enhances Summit’s margin

profile by approximately 200 bps

(1)

Further margin expansion expected from improving

industry fundamentals

(1) Estimated based on currently available information, including unaudited financial

information provided by the seller and certain assumptions by management. Audited carve-out financials are not yet available and actual results may vary. |

Premier Cement

Assets Significantly Enhances Summit’s Margin Profile

7

Successfully Continuing Execution of Summit’s Growth

Strategy

Leading Positions in Attractive Markets

Positioned to Benefit from Improving Industry Fundamentals

Substantially Increases Summit’s Materials-Related Earnings Exposure

Immediately Accretive with Strong Free Cash Flow |