Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - ALLTEMP, INC. | f8k041615_sourcefin.htm |

Exhibit 10.1

Information Memorandum

Moneytech Finance Pty Ltd

(ABN 75 112 110 906)

Issue of Australian Dollar Subordinated Notes

unconditionally and irrevocably guaranteed on a joint and several and subordinated basis by

Moneytech Limited

(ABN 77 106 249 852)

Moneytech Services Pty Ltd

(ABN 81 112 110 933)

Lead Manager and Initial Subscriber

FIIG Securities Limited

(ABN 68 085 661 632)

8 April 2015

Contents

| Important Notice | 3 | |

| Summary of the Subordinated Notes | 8 | |

| Summary description of the Deed of Subordination | 15 | |

| Corporate Profile | 20 | |

| Key Risk Factors | 27 | |

| Conditions | 38 | |

| Form of Determination Date Statement | 77 | |

| Form of Pricing Supplement | 78 | |

| Selling Restrictions | 82 | |

| Australian Taxation | 85 | |

| Directory | 90 |

| 2 |

Important Notice

Introduction

This Information Memorandum relates to an issue of Australian dollar notes (“Subordinated Notes”) by Moneytech Finance Pty Ltd (ABN 75 112 110 906) (“Issuer”).

The Subordinated Notes are unconditionally and irrevocably guaranteed on a joint and several and subordinated basis by Moneytech Limited (ABN 77 106 249 852) (“Parent Guarantor”) and each other entity described as an “Initial Guarantor” in the section entitled “Summary” below (together, the “Initial Guarantors”) pursuant to the guarantee (“Subordinated Guarantee”) set out in the note trust deed dated 8 April 2015 (“Note Trust Deed”) between the Issuer, the Initial Guarantors and BNY Trust Company of Australia Limited (ABN 49 050 294 052) (“Trustee”). The Issuer may, from time to time, and in accordance with the terms of the Note Trust Deed appoint or procure the appointment of any subsidiary of the Issuer or of the Parent Guarantor which is not an Initial Guarantor as an additional guarantor (each such guarantor, a “New Guarantor” and together with the Initial Guarantors, the “Guarantors”) or, in accordance with the terms of the Note Trust Deed, obtain a release of the guarantee provided by a Guarantor other than the Parent Guarantor (and such released entity shall no longer be a Guarantor).

References to “Moneytech Group” or “Group” are to the Parent Guarantor and its Subsidiaries (within the meaning of Part 1.2 Division 6 of the Corporations Act 2001 of Australia (“Corporations Act”)).

References to “Information Memorandum” are to this Information Memorandum and any other document incorporated by reference and to any of them individually.

Prospective investors should read this Information Memorandum carefully prior to making any decision in relation to purchasing, subscribing for or investing in the Subordinated Notes.

Issuer’s responsibility

This Information Memorandum has been prepared and issued by the Issuer and the Parent Guarantor. The Issuer and the Parent Guarantor accept responsibility for the information contained in this Information Memorandum other than information provided by the Lead Manager and Initial Subscriber, the Trustee and the Agents (each as defined in the section entitled “Summary” below) in relation to their respective details in the section entitled “Directory” below.

Place of issuance

Subject to applicable laws, regulations and directives, the Issuer may issue the Subordinated Notes in any country including Australia and countries in Europe and Asia but not in the United States of America unless such Subordinated Notes are registered under the United States Securities Act of 1933 (as amended) (“Securities Act”) or an exemption from the registration requirements under the Securities Act is available.

Terms and conditions of issue

THE SUBORDINATED NOTES ARE SUBORDINATED ON THE TERMS OF THE DEED OF SUBORDINATION (AS DEFINED BELOW).

The Subordinated Notes will be issued in a single series under the Note Trust Deed. The series may comprise one or more tranches (each a “Tranche”) having one or more issue dates and on conditions that are otherwise identical (other than, to the extent relevant, in respect of the issue price and date of the first payment of interest).

A pricing supplement (“Pricing Supplement”) will be issued for each Tranche of Subordinated Notes. A Pricing Supplement will contain details of the initial aggregate principal amount, issue price, issue date, maturity date, details of interest payable (if any) together with any other terms and conditions not set out in the section entitled “Conditions” below that may be applicable to that series of Subordinated Notes. The terms and conditions (“Conditions”) applicable to the series of Subordinated Notes are included in this Information Memorandum and may be supplemented, amended, modified or replaced by the Pricing Supplement applicable to those Subordinated Notes.

| 3 |

A Pricing Supplement or another supplement to this Information Memorandum may also supplement, amend, modify or replace any statement or information incorporated by reference in this Information Memorandum or a supplement to this Information Memorandum.

Documents incorporated by reference

This Information Memorandum is to be read in conjunction with all documents which are deemed to be incorporated into it by reference as set out below. This Information Memorandum shall, unless otherwise expressly stated, be read and construed on the basis that such documents are so incorporated and form part of this Information Memorandum. Investors should review, amongst other things, the documents which are deemed to be incorporated in this Information Memorandum by reference when deciding whether to purchase any Subordinated Notes.

The following documents are incorporated in, and taken to form part of, this Information Memorandum:

| ● | the Note Trust Deed; |

| ● | the deed of subordination dated 8 April 2015 (“Deed of Subordination”) between the Issuer, the Initial Guarantors, the Senior Financier (as defined in the Conditions) and the Trustee; |

| ● | the most recent audited consolidated annual financial statements and unaudited consolidated semi-annual financial statements (if any) of the Moneytech Group which are publicly available on its website at http://www.moneytech.com.au/; |

| ● | all amendments and supplements to this Information Memorandum prepared by the Issuer from time to time and all documents stated herein or therein to be incorporated in this Information Memorandum; |

| ● | all other documents issued by the Issuer and stated to be incorporated by reference in this Information Memorandum by reference; and |

| ● | the Pricing Supplement and all documents stated therein to be incorporated in this Information Memorandum. |

Any statement contained in this Information Memorandum or in any of the documents incorporated by reference in, and forming part of, this Information Memorandum shall be modified or superseded in this Information Memorandum to the extent that a statement contained in any document subsequently incorporated by reference into this Information Memorandum modifies or supersedes such statement (including whether expressly or by implication).

Copies of the Note Trust Deed, the Deed of Subordination, each Pricing Supplement and any documents incorporated by reference in this Information Memorandum may be obtained from the office of the Issuer, the Trustee or such other person specified in the Pricing Supplement.

Except as provided above, no other information, including any document incorporated by reference in any of the documents described above, is incorporated by reference into this Information Memorandum.

Any internet site addresses provided in this Information Memorandum are for reference only and the content of any such internet site is not incorporated by reference into, and does not form part of, this Information Memorandum.

No independent verification

The only role of the Lead Manager and Initial Subscriber, the Trustee and the Agents in the preparation of this Information Memorandum has been to confirm to the Issuer that their respective details in the section entitled “Directory” below are accurate as at the Preparation Date (as defined below).

Apart from the foregoing, none of the Lead Manager and Initial Subscriber, the Trustee and the Agents has independently verified the information contained in this Information Memorandum. Accordingly, no representation, warranty or undertaking, express or implied, is made, and no responsibility is accepted, by any of them, as to the accuracy or completeness of this Information Memorandum or any further information supplied by the Issuer in connection with the Subordinated Notes.

The Lead Manager and Initial Subscriber, the Trustee and the Agents expressly do not undertake to any holder of a Subordinated Note to review the financial condition or affairs of the Issuer, the Guarantors or any of their affiliates at any time or to advise any holder of a Note of any information coming to their attention with respect to the Issuer or a Guarantor and make no representations as to the ability of the Issuer or a Guarantor to comply with their respective obligations under the Subordinated Notes.

| 4 |

Intending purchasers to make independent investment decision and obtain tax advice

This Information Memorandum contains only summary information concerning the Issuer, the Guarantors and the Subordinated Notes and should be read in conjunction with all of the documents which are deemed to be incorporated by reference herein. The information contained in this Information Memorandum is not intended to provide the basis of any credit or other evaluation in respect of the Issuer, any Guarantor or any Subordinated Notes and should not be considered or relied on as a recommendation or a statement of opinion (or a representation or report of either of those things) by any of the Issuer, any Guarantor, the Lead Manager and Initial Subscriber, the Trustee or the Agents that any recipient of this Information Memorandum should subscribe for, purchase or otherwise deal in any Subordinated Notes or any rights in respect of any Subordinated Notes.

Each investor contemplating subscribing for, purchasing or otherwise dealing in any Notes or any rights in respect of any Subordinated Notes should:

| ● | make and rely upon (and shall be taken to have made and relied upon) its own independent investigation of the financial condition and affairs of, and its own appraisal of the creditworthiness of, the Issuer, the Guarantors and the Subordinated Notes; |

| ● | determine for themselves the relevance of the information contained in this Information Memorandum (including the Deed of Subordination), and must base their investment decision solely upon their independent assessment and such investigations as they consider necessary; and |

| ● | consult their own tax advisers concerning the application of any tax (including stamp duty) laws applicable to their particular situation. |

No advice is given in respect of the legal or taxation treatment of investors or purchasers in connection with an investment in any Subordinated Notes or rights in respect of them and each investor should consult their own professional adviser.

This Information Memorandum does not describe the risks of an investment in any Subordinated Notes. Prospective investors should consult their own professional, financial, legal and tax advisers about risks associated with an investment in any Subordinated Notes and the suitability of investing in the Subordinated Notes in light of their particular circumstances.

No offer

This Information Memorandum does not, and is not intended to, constitute an offer or invitation by or on behalf of the Issuer, any Guarantor, the Lead Manager and Initial Subscriber, the Trustee or the Agents to any person to subscribe for, purchase or otherwise deal in any Subordinated Notes.

Selling restrictions and no disclosure

EACH INVESTOR SUBSCRIBING FOR, PURCHASING OR OTHERWISE DEALING IN ANY SUBORDINATED NOTES IS DEEMED TO HAVE REPRESENTED AND WARRANTED THAT IT IS A PERSON TO WHOM IT IS LAWFUL TO MAKE ANY OFFER OF SUBORDINATED NOTES AND IT IS A PERSON TO WHOM AN OFFER OF SUBORDINATED NOTES FOR ISSUE OR SALE MAY BE MADE WITHOUT DISCLOSURE UNDER PART 6D.2 OR CHAPTER 7 OF THE CORPORATIONS ACT.

The distribution and use of this Information Memorandum, including any Pricing Supplement, advertisement or other offering material, and the offer or sale of Subordinated Notes may be restricted by law in certain jurisdictions and intending purchasers and other investors should inform themselves about them and observe any such restrictions. In particular, no action has been taken by any of the Issuer, the Guarantors, the Lead Manager and Initial Subscriber or the Trustee or the Agents which would permit a public offering of any Subordinated Notes or distribution of this Information Memorandum in any jurisdiction where action for that purpose is required.

| 5 |

Neither this Information Memorandum nor any other disclosure document in relation to the Subordinated Notes has been lodged with the Australian Securities and Investments Commission (“ASIC”). A person may not make or invite an offer of the Subordinated Notes for issue or sale in Australia (including an offer or invitation which is received by a person in Australia) or distribute or publish this Information Memorandum or any other offering material or advertisement relating to the Subordinated Notes in Australia unless the minimum aggregate consideration payable by each offeree is at least A$500,000 (or its equivalent in another currency, in each case disregarding moneys lent by the offeror or its associates) or the offer or invitation otherwise does not require disclosure to investors in accordance with Part 6D.2 or Chapter 7 of the Corporations Act and such action complies with all applicable laws and directives.

This Information Memorandum is not a prospectus or other disclosure document for the purposes of the Corporations Act.

For a description of certain restrictions on offers, sales and deliveries of the Subordinated Notes, and on distribution of this Information Memorandum, any Pricing Supplement or other offering material relating to the Subordinated Notes, see the section entitled “Selling Restrictions” below.

A person may not (directly or indirectly) offer for subscription or purchase or issue an invitation to subscribe for or buy Subordinated Notes, nor distribute or publish this Information Memorandum or any other offering material or advertisement relating to the Subordinated Notes except if the offer or invitation complies with all applicable laws, regulations and directives.

No authorisation

No person has been authorised to give any information or make any representations not contained in or consistent with this Information Memorandum in connection with the Issuer, the Guarantors or the issue or sale of the Subordinated Notes and, if given or made, such information or representation must not be relied on as having been authorised by the Issuer, the Guarantors, the Lead Manager and Initial Subscriber, the Trustee or the Agents.

No registration in the United States

The Subordinated Notes have not been, and will not be, registered under the Securities Act. The Subordinated Notes may not be offered, sold, delivered or transferred, at any time, within the United States of America, its territories or possessions or to, or for the account or benefit of, U.S. Persons (as defined in Regulation S under the Securities Act (“Regulation S”)) except in a transaction exempt from, or not subject to, the registration requirements of the Securities Act.

Agency and distribution arrangements

The Issuer has agreed or may agree to pay fees to the Trustee and the Agents for undertaking their respective roles and reimburse them for certain of their expenses properly incurred in connection with the Subordinated Notes.

The Issuer may also pay a fee to the Lead Manager and Initial Subscriber in respect of the Subordinated Notes subscribed by it, and may agree to reimburse the Lead Manager and Initial Subscriber for certain expenses properly incurred in connection with the Subordinated Notes and may indemnify the Lead Manager and Initial Subscriber against certain liabilities in connection with the offer and sale of Subordinated Notes.

The Issuer, the Guarantors, the Lead Manager and Initial Subscriber, the Trustee and the Agents, and their respective related entities, directors, officers and employees may have pecuniary or other interests in the Subordinated Notes and may also have interests pursuant to other arrangements and may receive fees, brokerage and commissions and may act as a principal in dealing in any Subordinated Notes.

The distribution and use of this Information Memorandum, including any Pricing Supplement, advertisement or other offering material, and the offer or sale of Subordinated Notes may be restricted by law in certain jurisdictions and intending purchasers and other investors should inform themselves about them and observe any such restrictions. In particular, no action has been taken by any of the Issuer, the Guarantors, the Lead Manager and Initial Subscriber, the Trustee or any Agents which would permit a public offering of any Subordinated Notes or distribution of this Information Memorandum or any such document in any jurisdiction where action for that purpose is required.

Currency

In this Information Memorandum, references to “$”, “A$” or “Australian dollars” are to the lawful currency of the Commonwealth of Australia.

| 6 |

Currency of information

The information contained in this Information Memorandum is prepared as of its Preparation Date. Neither the delivery of this Information Memorandum nor any offer, issue or sale made in connection with this Information Memorandum at any time implies that the information contained in it is correct, that any other information supplied in connection with the Subordinated Notes is correct or that there has not been any change (adverse or otherwise) in the financial conditions or affairs of the Issuer or any Guarantor at any time subsequent to the Preparation Date. In particular, neither the Issuer nor any Guarantor is under any obligation to any person to update this Information Memorandum at any time after an issue of Subordinated Notes.

In this Information Memorandum, “Preparation Date” means:

| ● | in relation to this Information Memorandum, the date indicated on its face or, if this Information Memorandum has been amended, or supplemented, the date indicated on the face of that amendment or supplement; |

| ● | in relation to any annual reports and financial statements incorporated in this Information Memorandum, the date up to, or as at, the date on which such annual reports and financial statements relate; and |

| ● | in relation to any other item of information which is to be read in conjunction with this Information Memorandum, the date indicated on its face as being its date of release or effectiveness. |

| 7 |

Summary of the Subordinated Notes

The following is a brief summary only and should be read in conjunction with the rest of this Information Memorandum and, in relation to any Subordinated Notes, the Note Trust Deed, the Deed of Subordination, the applicable Conditions and any relevant Pricing Supplement. A term used below but not otherwise defined has the meaning given to it in the Conditions. A reference to a “Pricing Supplement” does not limit provisions or features which may be supplemented, amended, modified or replaced by a Pricing Supplement in relation to an issue of Subordinated Notes.

| Issuer: | Moneytech Finance Pty Ltd (ABN 75 112 110 906).

Further information (which information is not incorporated by reference in this Information Memorandum) regarding the Issuer can be obtained from the Parent Guarantor’s website at http://www.moneytech.com.au/ or from the documents specifically incorporated by reference in this Information Memorandum. |

| Subordinated Guarantee and Initial Guarantors: | (a) Moneytech Limited (ABN 77 106 249 852); and

(b) Moneytech Services Pty Ltd (ABN 81 112 110 93).

The Subordinated Notes are issued with the benefit of the Subordinated Guarantee and the payment of principal and interest in respect of the Subordinated Notes will be unconditionally and irrevocably guaranteed on a joint and several and subordinated basis by the Guarantors as more fully set out in the Note Trust Deed.

As more fully described below, the Issuer may, from time to time, as required under Condition 5.2(d) (“Financial covenants”) and in accordance with the terms of the Note Trust Deed appoint or procure the appointment of any Subsidiary of the Issuer or of the Parent Guarantor which is not an Initial Guarantor as an additional guarantor or obtain a release of a guarantor other than the Parent Guarantor (each entity from time to time appointed as a guarantor which has not been released, a “Guarantor”). |

| Lead Manager and Initial Subscriber: | FIIG Securities Limited (ABN 68 085 661 632). |

| Registrar: | BTA Institutional Services Australia Limited (ABN 48 002 916 396) or such other person appointed by the Issuer under an Agency Agreement to perform registry functions and establish and maintain a Register (as defined below) on the Issuer’s behalf from time to time (“Registrar”). |

| Issuing & Paying Agent: | BTA Institutional Services Australia Limited (ABN 48 002 916 396) or any other person appointed by the Issuer under an Agency Agreement to act as issuing or paying agent on the Issuer’s behalf from time to time (“Issuing & Paying Agent”). |

| Calculation Agent: | BTA Institutional Services Australia Limited (ABN 48 002 916 396) or any other person appointed by the Issuer to act as calculation agent on the Issuer’s behalf from time to time (“Calculation Agent”). |

| Agents: | Each of the Registrar, Issuing & Paying Agent, Calculation Agent and any other person appointed by the Issuer to perform other agency functions with respect to any Tranche or series of Subordinated Notes (each an “Agent” and, together, the “Agents”). |

| Trustee: | BNY Trust Company of Australia Limited (ABN 49 050 294 052) or such other person appointed under the Note Trust Deed as trustee of the Moneytech Note Trust from time to time (“Trustee”). |

| 8 |

| Form of Subordinated Notes: | Subordinated Notes will be issued in registered form and will be debt obligations of the Issuer which are constituted by, and owing under, the Note Trust Deed.

Subordinated Notes take the form of entries in a register (“Register”) maintained by the Registrar.

No certificates in respect of any Subordinated Notes will be issued unless the Issuer determines that certificates should be available or if certificates are required by any applicable law or directive. |

| Negative pledge: | Subordinated Notes will have the benefit of a negative pledge, as described in Condition 5.1 (“Negative pledge”). |

| Financial covenants: | Subordinated Notes will have the benefit of certain financial covenants as described in Condition 5.2 (“Financial covenants”). |

| Status and ranking of the Subordinated Notes: | Subordinated Notes will be direct and (subject to Condition 5.1 (“Negative pledge”)) unsecured obligations of the Issuer and will be subordinated to, and rank junior in right of payment to, the obligations of the Issuer to the Senior Financier as set out in the Deed of Subordination. All such obligations to the Senior Financier must be paid in full before any payment on account of any sums payable in respect of the Subordinated Notes other than a Permitted Payment.

This means that no payment of principal, interest or other amounts owing under the Subordinated Notes may be made to Noteholders unless: |

| · | such payments constitute Permitted Payments; | ||

| · | such payments follow acceleration and enforcement of the Subordinated Notes on the terms set out in the Deed of Subordination; | ||

| · | the Senior Debt has been discharged or repaid in full; | ||

| · | with respect to payment of principal on the Subordinated Notes, the Senior Financier is reasonably satisfied that a further loan or advance of funds or other monetary obligation of similar amount to the principal amount of the Subordinated Notes has been provided to the Issuer and that lender or investor has agreed to enter into a deed with the Senior Financer or terms similar, or substantially similar on materially no less favourable to the Senior Financier, in each case, in substance as those set out in the Deed of Subordination or as may be otherwise agreed with the Senior Financier; or | ||

| · | the Senior Financier gives its written consent. | ||

| See the section entitled “Summary description of the Deed of Subordination” below for more information. | |||

| The obligations of the Issuer to: | |||

| · | the Senior Financier; and | |

| · | all other permitted secured creditors under the Conditions, |

| will have the benefit of the security provided by the Issuer to secure its obligations to such secured creditors. Consequently, claims of any holder of Subordinated Notes will also be subordinated to the claims of these secured creditors by virtue of that security. | ||

| 9 |

| Status and ranking of the Subordinated Guarantee: | The Subordinated Notes will be unconditionally and irrevocably guaranteed on a joint and several and subordinated basis by the Guarantors, subject to the release of such Guarantors and the addition of new entities as Guarantors as set out in the Note Trust Deed. The obligations of each Guarantor under the Subordinated Guarantee will be direct and (subject to Condition 5.1 (“Negative pledge”)) unsecured obligations of that Guarantor and will be subordinated to, and rank junior in right of payment to, the obligations of that Guarantor to the Senior Financier as set out in the Deed of Subordination.

See the section entitled “Summary description of the Deed of Subordination” below for more information.

In addition, the Issuer undertakes (and the Parent Guarantor will ensure that the Issuer will undertake): |

| (a) | that, at all times, the aggregate of the Total Tangible Assets of the Issuer and the Guarantors is at least 90 per cent. of the Total Tangible Assets of the Group, based on the then latest Financial Statements; or | |

| (b) | to cause such of its Subsidiaries to accede as a Guarantor pursuant to the Note Trust Deed to ensure that, at all times, the aggregate of the Total Tangible Assets of the Issuer and the Guarantors is at least 90 per cent. of the Total Tangible Assets of the Group, based on the then latest Financial Statements. | |

| The obligations of a Guarantor to: | ||

| (i) | the Senior Financier; and | |

| (ii) | any other permitted secured creditors under the Conditions, | |

| will have the benefit of the security provided by the Guarantor to secure its obligations to such secured creditors. Consequently, claims of any holder of Subordinated Notes against a Guarantor will also be subordinated to the claims of these secured creditors by virtue of that security. | ||

| Interest: | Each Subordinated Note bears interest on its outstanding principal amount from (and including) its Interest Commencement Date to (but excluding) its Maturity Date (unless redeemed earlier) at the Interest Rate.

Interest is payable in arrear on each Interest Payment Date or such other date on which a Subordinated Note is redeemed, and adjusted, if necessary, in accordance with the Business Day Convention.

All such information will be set out in the relevant Pricing Supplement. |

| Interest Reserve Account: | As set out in more detail in the Note Trust Deed and the Deed of Subordination, the Issuer has undertaken to, on the Issue Date, pay into an Interest Reserve Account held in the name of the Trustee, an amount equal to the first two payments of interest that shall become due and payable on the Notes.

The Issuer undertakes, at all times, to maintain the balance amount in the Interest Reserve Account equal to, or at least equal to, an amount equal to the next two succeeding payments of interest.

For the purposes of determining the amount of interest due and payable on the next two succeeding Interest Payment Dates to be paid into the Interest Reserve Account, the amount of interest that is to be payable on those Interest Payment Dates is calculated using the BBSW Rate applicable on the day immediately prior to the date on which the payment into the Interest Reserve Account is made.

The balance amount in the Interest Reserve Account is only to be used to pay the amounts that become due and payable on each Interest Payment Date, other than the interest that may accrue on the balance amount in the Interest Reserve Account to the extent that it is payable to the Issuer. On instructions from the Issuer, the Trustee will transfer such amount from the Interest Reserve Account to the account of the Issuing & Paying Agent to facilitate payment to the Noteholders of the amount due and payable under the Subordinated Notes. The Issuer’s liability in respect of the payment under the Subordinated Notes is not discharged until a payment is made to the Noteholders. |

| 10 |

Failure to comply with the undertaking to maintain the balance described above in the Interest Reserve Account will not result in an Unwind Event or Event of Default of the Subordinated Notes under the Conditions. If the Issuer then fails to pay interest when due and payable to the Noteholders, such non-payment of interest could result in an Unwind Event or Event of Default in respect of their Subordinated Notes.

If additional series of Notes are issued and the Interest Reserve Account is applicable to those Notes, it is not intended for the moneys in the Interest Reserve Account to be segregated by series.

See the section entitled “Summary description of the Deed of Subordination” below for more information. |

| Denomination: | Subordinated Notes will be issued in the single denomination of A$1,000. |

| Minimum parcel size on initial issue: | A$50,000. |

| Clearing System: | Subordinated Notes may be transacted either within or outside a clearing system.

The Issuer intends to apply to Austraclear Ltd (ABN 94 002 060 773) (“Austraclear”) for approval for Subordinated Notes to be traded on the clearing and settlement system operated by Austraclear (“Austraclear System”). Upon approval by Austraclear, the Subordinated Notes will be traded through Austraclear in accordance with the rules and regulations of the Austraclear System. Such approval by Austraclear is not a recommendation or endorsement by Austraclear of such Subordinated Notes.

Transactions relating to interests in the Subordinated Notes may also be carried out through the settlement system operated by Euroclear Bank S.A./N.V. (“Euroclear”) or the settlement system operated by Clearstream Banking, société anonyme (“Clearstream, Luxembourg”).

Interests in the Subordinated Notes traded in the Austraclear System may be held for the benefit of Euroclear or Clearstream, Luxembourg. In these circumstances, entitlements in respect of holdings of interests in Subordinated Notes in Euroclear would be held in the Austraclear System by a nominee of Euroclear (currently HSBC Custody Nominees (Australia) Limited) while entitlements in respect of holdings of interests in Subordinated Notes in Clearstream, Luxembourg would be held in the Austraclear System by a nominee of J.P. Morgan Chase Bank, N.A. as custodian for Clearstream, Luxembourg.

The rights of a holder of interests in a Subordinated Note held through Euroclear or Clearstream, Luxembourg are subject to the respective rules and regulations for accountholders of Euroclear and Clearstream, Luxembourg, the terms and conditions of agreements between Euroclear and Clearstream, Luxembourg and their respective nominee and the rules and regulations of the Austraclear System. In addition, any transfer of interests in a Subordinated Note, which is held through Euroclear or Clearstream, Luxembourg will, to the extent such transfer will be recorded on the Austraclear System, be subject to the Corporations Act and the requirements for minimum consideration as set out in the Conditions. |

| 11 |

| None of the Issuer, any Guarantor, the Lead Manager and Initial Subscriber, the Trustee or any Agent will be responsible for the operation of the clearing arrangements which is a matter for the clearing institutions, their nominees, their participants and the investors. | |

| Title: | Entry of the name of the person in the Register in respect of Subordinated Notes in the registered form constitutes the obtaining or passing of title and is conclusive evidence that the person so entered is the registered holder of that Subordinated Note subject to correction for fraud or error.

Title to Subordinated Notes which are held in the Austraclear System will be determined in accordance with the rules and regulations of the Austraclear System.

Subordinated Notes which are held in the Austraclear System will be registered in the name of Austraclear. |

| Payments: | Payments to persons who hold Subordinated Notes through the Austraclear System will be made in accordance with the rules and regulations of the Austraclear System. |

| Payment Date: | A Payment Date for a Subordinated Note is the Maturity Date, an Interest Payment Date or any other relevant date on which a payment in respect of that Subordinated Note is due, adjusted in accordance with the applicable Business Day Convention. |

| Record Date: | The Record Date is the close of business (in the place where the Register is maintained) on the eighth day before the Payment Date. |

| Maturity and redemption: | Subject to compliance with all relevant laws, regulations and directives, each Subordinated Note will be redeemed on its Maturity Date at its outstanding principal amount, unless the Subordinated Note has been previously redeemed or purchased and cancelled.

Subordinated Notes are also redeemable prior to their scheduled maturity: |

| ● | at the option of the Issuer on certain Optional Redemption Dates; and/or | |

| ● | at the option of a holder of a Subordinated Note following the occurrence of a Change of Control, | |

| each as more fully set out in the Conditions and the relevant Pricing Supplement. | ||

| Subordinated Notes entered in the Austraclear System will be redeemed through the Austraclear System in a manner that is consistent with the rules and regulations of the Austraclear System. | ||

| Selling restrictions: | The offer, sale and delivery of Subordinated Notes and the distribution of this Information Memorandum and other material in relation to any Subordinated Notes are subject to such restrictions as may apply in any country in connection with the offer and sale of a the Subordinated Notes. In particular, restrictions on the offer, sale or delivery of Subordinated Notes in Australia and Singapore are set out in the section entitled “Selling Restrictions” below. |

| 12 |

| Transfer procedure: | Subordinated Notes may only be transferred in whole and in accordance with the Conditions.

In particular, the Subordinated Notes may only be transferred if the offer or invitation for the sale or purchase of Subordinated Notes is received by a person: |

| (a) | in Australia, only if the minimum aggregate consideration payable at the time of the transfer is at least A$500,000 (or its equivalent in an alternative currency and, in each case, disregarding moneys lent by the transferor or its associates to the transferee) or the Subordinated Notes are transferred in circumstances that do not otherwise require disclosure to investors under Part 6D.2 or Chapter 7 of the Corporations Act and the transfer complies with all applicable laws and directives; and | |

| (b) | if, in a jurisdiction outside Australia, the transfer complies with all other applicable laws and directives in the jurisdiction in which the transfer takes place. |

| Transfers of Subordinated Notes held in the Austraclear System will be made in accordance with the rules and regulations of the Austraclear System. | ||

| Investors

to obtain independent advice with respect to investment and other risks: |

Investing in the Subordinated Notes entails a number of risks. Certain risks associated with Moneytech Group's business are outlined in the section entitled "Key Risk Factors". However, this Information Memorandum does not describe all of the risks associated with Moneytech Group's business and the risks associated with an investment in any Subordinated Notes or the market generally. As such, prospective investors or purchasers should consult their own professional, financial, legal and tax advisers about risks associated with an investment in any Subordinated Notes and the suitability of investing in the Subordinated Notes in light of their particular circumstances. |

| Taxes, withholdings, deductions and stamp duty: | All payments in respect of the Subordinated Notes must be made without any withholding or deduction in respect of taxes, unless such withholding or deduction is required by law.

In the event that any such withholding or deduction is made, the Issuer will, save in certain limited circumstances, be required to pay additional amounts to cover the amounts so withheld or deducted.

Holders of Subordinated Notes who do not provide their Tax File Number, (if applicable) Australian Business Number or proof of an exemption may have tax withheld or deducted from payments at the highest marginal rate plus the Medicare levy. No additional amounts will be payable by the Issuer in respect of any such withholding or deduction.

A brief overview of the Australian taxation treatment of payment of interest on Subordinated Notes is set out in the section entitled “Australian Taxation” below.

Investors should obtain their own taxation and other applicable advice regarding the taxation and other fiscal status of investing in any Subordinated Notes and none of the Issuer, a Guarantor, the Lead Manager and Initial Subscriber, the Trustee or any Agent makes any representation regarding the taxation treatment of the Subordinated Notes for any particular investor. |

| FATCA: | The Foreign Account Tax Compliance Act provisions of the U.S. Hiring Incentives to Restore Employment Act of 2010 (“FATCA”) establish a new due diligence, reporting and withholding regime. FATCA aims to detect U.S. taxpayers who use accounts with “foreign financial institutions” (“FFIs”) to conceal income and assets from the U.S. Internal Revenue Service (“IRS”).

Under FATCA, a 30% withholding may be imposed from (i) 1 July 2014 in respect of certain U.S. source payments, (ii) 1 January 2017 in respect of gross proceeds from the sale of assets that give rise to U.S. source interest or dividends and (iii) 1 January 2017, at the earliest, in respect of “foreign passthru payments” (a term which is not yet defined under FATCA), which are, in each case, paid to or in respect of entities that fail to meet certain certification or reporting requirements (“FATCA withholding”). |

| 13 |

|

The Issuer and other financial institutions through which payments on the Subordinated Notes are made may be required to withhold on account of FATCA if (i) an investor does not provide information sufficient for the Issuer or the relevant financial institution to determine whether the investor is subject to FATCA withholding or (ii) an FFI to or through which payments on the Subordinated Notes are made is a “non-participating FFI”.

FATCA withholding is however not expected to apply if the Subordinated Notes are treated as debt for U.S. federal income tax purposes and the grandfathering provisions from withholding under FATCA are applicable. The grandfathering provisions require, amongst other things, that the Subordinated Notes are issued on or before the date that is six months after the date on which final regulations defining the term “foreign passthru payment” are filed with the U.S. Federal Register.

Further, Australia and the United States signed an intergovernmental agreement (“Australian IGA”) in respect of FATCA on 28 April 2014. The Australian Government has enacted legislation amending, among other things, the Taxation Administration Act 1953 of Australia to give effect to the Australian IGA (“Australian Amendments”). Under the Australian Amendments, Australian FFIs will generally be able to be treated as “deemed compliant” with FATCA. Depending on the nature of the relevant FFI, FATCA withholding may not be required from payments made with respect to the Subordinated Notes other than in certain prescribed circumstances. Under the Australian Amendments, an FFI may be required to provide the Australian Taxation Office with information on financial accounts (for example, the Subordinated Notes) held by U.S. persons and recalcitrant account holders and on payments made to non-participating FFIs. The Australian Taxation Office is required to provide that information to the IRS.

In the event that any amount is required to be withheld or deducted from a payment on the Subordinated Notes as a result of FATCA, pursuant to the terms and conditions of the Subordinated Notes, no additional amounts will be paid by the Issuer as a result of the deduction or withholding.

FATCA is particularly complex legislation. The above description is based in part on U.S. Treasury regulations published on 28 January 2013 and 6 March 2014, official guidance and the Australian Amendments, all of which are subject to change. Investors should consult their own tax advisers on how these rules may apply to them under the Subordinated Notes. | |

| Listing: | It is not intended that the Subordinated Notes be listed or quoted on any stock or securities exchange. |

| Rating: | Neither the Issuer nor the Subordinated Notes have been, nor is it intended that they will be, rated by any credit ratings agency. |

| Governing law: | The Subordinated Notes and all related documentation will be governed by the laws of New South Wales, Australia. |

| Use of proceeds: | The Issuer will use the proceeds from the issue of the Subordinated Notes for general corporate purposes, including the purchase of Eligible Receivables and meeting the conditions of the Interest Reserve Account. |

| 14 |

Summary description of the Deed of Subordination

The Issuer, the Initial Guarantors, the Senior Financier and the Trustee have entered into the Deed of Subordination to agree to the subordination arrangement of the amounts owing under the Subordinated Notes. The following summary is not exhaustive and is subject to and qualified in its entirety by reference to all of the provisions of the Deed of Subordination, including the definitions therein of certain terms that are not otherwise defined in the Conditions or this Information Memorandum.

| Deed of Subordination: | The Issuer, the Initial Guarantors, the Senior Financier and the Trustee are parties to the Deed of Subordination, which provides as follows: |

| ● | all amounts owing under the Subordinated Notes and payment of, and the rights and claims of the Noteholders and the Trustee in respect of the amounts owing under the Subordinated Notes, are subordinated and postponed and made subject in right of payment to all of the Senior Debt and payment of, and the rights and claims of the Senior Financier in respect of, all the Senior Debt; and | |

| ● | no payment of principal, interest or other amounts owing under the Subordinated Notes may be made to Noteholders unless: |

| ● | such payments constitute Permitted Payments; | ||

| ● | such payments follow acceleration and enforcement of the Subordinated Notes on the terms set out in the Deed of Subordination; | ||

| ● | the Senior Debt has been discharged or repaid in full; | ||

| ● | with respect payment of principal due and payable on the Subordinated Notes, the Senior Financier is reasonably satisfied that a further loan or advance of funds or other monetary obligation of similar amount to the principal amount of the Subordinated Notes has been provided to the Issuer and that lender or investor has agreed to enter into a deed with the Senior Financer on terms similar, or substantially similar or materially no less favourable to the Senior Financier, in each case, in substance as those set out in the Deed of Subordination or as may be otherwise agreed with the Senior Financier; or | ||

| ● | the Senior Financier gives its written consent. |

Senior Debt:

|

Senior Debt means all monies owing at any time by the Issuer or an Initial Guarantor to the Senior Financier in connection with the RPA and any Security Interests created or entered into as security for payment of any of the RPA.

The Subordinated Notes rank behind and are subordinated to the Senior Debt. It is estimated that the Senior Debt will be drawn to at least A$20 million following the issue of the Subordinated Notes, with a current facility limit of A$25 million. The drawn amount and the facility limit of the Senior Debt may increase in the future.

In an insolvency situation affecting the Moneytech Group, it is possible that insufficient monies will be available after the Senior Debt has been repaid in full to repay in full, or at all, amounts owed to the Noteholders in respect of their Subordinated Notes. |

| 15 |

| Permitted Payments: | Payments that are due to the Noteholders on account of any payment under the Subordinated Notes must be held by the Trustee on trust and remain on trust for the Senior Financier unless such payments constitute Permitted Payments or as otherwise provided in the Deed of Subordination, namely: |

| (a) | payments made following acceleration and enforcement of the Subordinated Notes on the terms set out in the Deed of Subordination; | |

| (b) | payments made to the Interest Reserve Account subject to the following conditions: |

| (i) | no RPA Amortisation Event or RPA Event of Default has occurred or would subsist immediately following or as a result of such payment; | ||

| (ii) | no enforcement action has been taken to recover any monies owing under the Senior Debt; | ||

| (iii) | with respect to a payment made to the Interest Reserve Account: |

| (B) | the initial payment made into the Interest Reserve Account will be made on the Issue Date from the proceeds of the issue of the Subordinated Notes; and | ||

| (C) | after the relevant payment is made, the aggregate amount held in the Interest Reserve Account at any time is not greater than the amount of interest payable on the Subordinated Notes for the next two succeeding Interest Payment Dates (the determination of such amount is set out in “Summary of the Subordinated Notes – Interest Reserve Account” above); |

| (iv) | with respect to a payment other than a payment made to the Interest Reserve Account, the aggregate amount paid in any one Interest Period is not greater than the amount of interest or Additional Amounts payable on the Subordinated Notes for such Interest Period; | ||

| (v) | there has been no failure to pay amounts owing to the Senior Financier in relation to the Senior Debt; and | ||

| (vi) | there is sufficient evidence that the amount of such payment is not more than the Distributable Cash available at the time of that payment. |

| For the avoidance of doubt, once a payment is made into the Interest Reserve Account as a Permitted Payment, it will continue to be a Permitted Payment, including at the time a payment with respect of any amount of interest or Additional Amounts due and payable on an Interest Payment Date is made from the Interest Reserve Account and is paid to the Trustee or a Noteholder. In addition, interest payments or Additional Amounts will be paid from the Interest Reserve Account while there is a credit balance in the Interest Reserve Account and the aggregate amount to be paid from the Interest Reserve Account in any one Interest Period will not be greater than the amount of interest or Additional Amounts payable on the Notes for such Interest Period; |

| 16 |

| (c) | a payment of principal due and payable on the Subordinated Notes on the Maturity Date or, if redeemed earlier, the Optional Redemption Date where: |

| (i) | no RPA Amortisation Event or RPA Event of Default has occurred or would subsist immediately following or as a result of such payment; | ||

| (ii) | no enforcement action has been taken to recover any monies owing under the Senior Debt; and | ||

| (iii) | there has been no failure to pay amounts owing to the Senior Financier in relation to the Senior Debt; and |

| (d) | payments made at any time in respect of the Subordinated Notes with the written consent of the Senior Financier. |

| Notification of a Permitted Payment: | The Issuer may make a Permitted Payment to the Trustee subject to the Issuer having provided a written report (a “Permitted Payment Report”) to the Senior Financier and the Trustee at least 3 business days prior to making a Permitted Payment, confirming that, to the best of its knowledge after making reasonable enquiries, the payment is a Permitted Payment.

The Trustee is entitled to fully and conclusively rely on the Permitted Payment Report and is not obliged to investigate any reason or amount contained in such report and shall have no liability to any party for acting upon any such report. Notwithstanding anything contrary to the Deed of Subordination, the Trustee shall have no liability if it is subsequently determined by any person that the relevant payment was a Permitted Payment or was not a Permitted Payment (as the case may be).

If the Permitted Payment Report is not received by the Trustee accordingly: |

| (a) | the Issuer (or the Guarantors, as the case may be) must not make the relevant payment to the Trustee; and | |

| (b) | if, notwithstanding paragraph (a), the Trustee receives such payment, the Trustee must apply such amount first to the Senior Financier to repay any monies owing under the Senior Debt within 60 days of receipt thereof. |

| What are the implications for Noteholders of subordination? | This means that the Subordinated Notes currently rank behind the Senior Debt. If more money is drawn down under the Senior Debt, the Subordinated Notes would rank behind that debt.

Investors should be aware that an investment in Subordinated Notes involves risks in that the Moneytech Group must: |

| ● | refinance or repay the Senior Debt (and potential further amounts, for example, any additional amount drawn on the Senior Debt) plus any unpaid interest in respect of that Senior Debt in full before it can repay the Subordinated Notes upon their maturity unless such payment under the Subordinated Notes constitutes a Permitted Payment. Repayment of principal on the Subordinated Notes will not be made unless certain conditions set out in the Deed of Subordination have been satisfied for such payments to constitute Permitted Payments. In the case of winding up of the Moneytech Group where the assets of the Group were sold, the proceeds would be applied to repay holders of the Subordinated Notes only after all Senior Debt plus any due and unpaid interest thereon was repaid in full; and |

| 17 |

| ● | pay interest on the Senior Debt referred to above before it can pay interest on the Subordinated Notes unless such payment under the Subordinated Notes constitutes a Permitted Payment. Interest payments on the Subordinated Notes will be not be made unless certain conditions set out in the Deed of Subordination have been satisfied for such payments to constitute Permitted Payments. |

| Further, the Trustee must not prove in any bankruptcy, liquidation or other insolvency proceedings of the Moneytech Group in respect of the Subordinated Notes in competition with the Senior Financier, unless it does so in accordance with the instructions of the Senior Financier. | |

| The Trustee agrees to prove for payment of any amounts owing under the Subordinated Notes during any bankruptcy or liquidation of the Moneytech Group in accordance with the instructions of the Senior Financier. At the same time the Trustee lodges proof of the amounts owing under the Subordinated Notes, the amount under the Subordinated Notes (up to the amount claimed in proof in accordance with the Senior Financier’s instructions) is payable. |

| What are the consequences of being subordinated on the ability to accelerate and enforce repayment of the Subordinated Notes? | Until the Senior Debt has been repaid in full, the right to accelerate the Subordinated Notes (that is, declare the Subordinated Notes immediately due and payable) and to seek payment of principal, interest and any other amount on the Subordinated Notes, is limited as set out in the Deed of Subordination.

Whilst any monies are owing to the Senior Financier under the Senior Debt, the Trustee agrees to hold any amount received or recovered by the Trustee (on behalf of any Noteholder) on account of the Subordinated Notes in the bankruptcy, liquidation or other insolvency or resolution proceedings of the Moneytech Group and any amount received or recovered by the Trustee (on behalf of any Noteholder) in connection with failure by the Trustee or the Moneytech Group to comply with its obligations under the Deed of Subordination (other than a Permitted Payment or a payment made with the written consent of the Senior Financier) on trust for the Senior Financier and distribute such amounts in the order described below.

The Trustee must not, without the prior written consent of the Senior Financier, demand repayment or take any action against the Issuer in respect of the Subordinated Notes whilst any monies are owing to the Senior Financier under the Senior Debt unless 180 days have passed since the Senior Financier has received written notice from the Trustee that either: |

| ● | an Unwind Event or Event of Default in connection with the Subordinated Notes has occurred and the Trustee intends to enforce its rights; or | |

| ● | some or all of the Subordinated Notes remain outstanding and the Issuer fails to redeem such Subordinated Notes on the Maturity Date or, if redeemed earlier, the Optional Redemption Date and the Trustee has notified the Senior Financier that it intends to enforce its rights. | |

| If an amount is received or recovered by the Trustee on account of the Subordinated Notes (other than an amount expressly excluded in the Deed of Subordination), the Trustee must apply that amount in the following order: | ||

| ● | first, to the Senior Financier to repay the monies owing under the Senior Debt (in such order as the Senior Financier may determine); and | |

| ● | next, to the Trustee or the Noteholders to repay the Subordinated Notes | |

| 18 |

Even if the Subordinated Notes are declared immediately due and payable, the Subordinated Notes continue to be subordinated and the restrictions on payment will continue to apply. The Deed of Subordination also restricts the Trustee from taking any other action that would be inconsistent with the subordination of the Subordinated Notes.

Generally, in the absence of the Deed of Subordination, the Trustee (or a Noteholder) has the right to enforce any right or remedy under or in respect of Subordinated Notes (whether or not any Senior Debt is outstanding).

Noteholders should be aware that although the Trustee or a Noteholder may be empowered to do certain things under the Note Trust Deed, or the Trustee may be directed by Noteholders to undertake certain actions, including declaring Subordinated Notes to be due and payable on the occurrence of an Event of Default, the Trustee and the Noteholders are restrained from actually enforcing such rights by the terms of the Deed of Subordination. In particular, each Noteholder and the Trustee are unable declare the Subordinated Notes are immediately due and payable while the Senior Debt is outstanding. | |

| Inconsistency with Note Trust Deed: | Notwithstanding anything to the contrary in the Deed of Subordination, the Note Trust Deed or any other relevant transaction document, in the event of any conflict between the Deed of Subordination and the Note Trust Deed, the provisions of the Deed of Subordination shall prevail. |

| 19 |

Corporate Profile

The information in this section is a brief summary only of the Issuer and the Guarantors and their respective businesses and does not purport to be, nor is it, complete.

Investors should review, amongst other things, this Information Memorandum and the documents which are deemed to be incorporated in this Information Memorandum by reference when deciding whether to purchase any Subordinated Notes.

This Information Memorandum contains only summary information concerning the Issuer, the Guarantors and the Subordinated Notes. It should be read in conjunction with the documents which are deemed to be incorporated by reference in it, the Conditions and the Note Trust Deed. The information contained in this Information Memorandum is not intended to provide the basis of any credit or other evaluation in respect of the Issuer, the Guarantors or any Subordinated Notes and should not be considered or relied on as a recommendation or a statement of opinion (or a representation or report of either of those things) by any of the Issuer, the Guarantors, the Lead Manager and Initial Subscriber, the Trustee or the Agents that any recipient of this Information Memorandum should subscribe for, purchase or otherwise deal in any Subordinated Notes or any rights in respect of any Subordinated Notes.

Investing in the Subordinated Notes entails a number of risks. Certain risks associated with Moneytech Group's business are outlined in the section entitled “Key Risk Factors” below. However, this Information Memorandum does not describe all of the risks associated with Moneytech Group's business or the risks associated with an investment in any Subordinated Notes or the market generally. Prospective investors or purchasers should consult their own professional, financial, legal and tax advisers about risks associated with an investment in any Subordinated Notes and the suitability of investing in the Subordinated Notes in light of their particular circumstances.

Disclosure of information to Noteholders

Noteholders may access information in relation to the Moneytech Group as follows:

| 1 | to view the full annual reviews of the Moneytech Group, go to http://www.moneytech.com.au where full and summary accounts of the Moneytech Group for each financial year (from 2010) will be available; |

| 2 | to gain access to the full annual reviews and monthly reports of the Moneytech Group (which will include an updated commentary on the performance of the Eligible Receivables, the monthly Determination Date Statement and details of any other issue that may impact the Moneytech Group), Noteholders will need to obtain an investor login by sending an email request to Peta De Michele at peta.demichele@moneytech.com.au or ir@moneytech.com.au and the Noteholder will be provided with a user name and password in an email response. The Noteholder will then log in at: http://www.moneytech.com.au; |

| 3 | when the Noteholder logs into the investor centre for the first time, they may be prompted to change their password - this will only happen once. The new password must be a minimum of 6 characters containing an alpha/numeric combination; and |

| 4 | information will be uploaded to the investor centre, including the monthly reports of the Moneytech Group and any other investor communications as may be required. |

| 20 |

Description of Moneytech Group

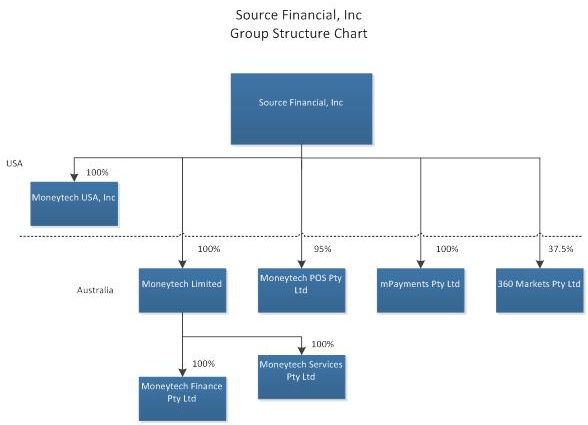

The Issuer is a wholly-owned subsidiary of the United States company Source Financial, Inc (“Source”). Source is traded on OTC Markets OTCQB marketplace. While not including the full requirements of other US exchanges, Source is required to fulfil U.S. Securities and Exchange Commission continuous disclosure obligations.

Moneytech Limited is the Australian asset finance segment of Source. The Issuer, Moneytech Finance Pty Ltd, is the primary operating subsidiary of Moneytech Limited. The Subordinated Notes will also benefit from a guarantee from Moneytech Limited and Moneytech Services Pty Ltd. The Subordinated Notes will not benefit from a guarantee from any of Source’s other subsidiaries in either the United States or Australia.

The following chart reflects Source’s current organisational structure.

Operational Overview

Moneytech commenced operations in 2003 as an Australian based, technology driven, commercial finance company. Moneytech offers asset based, trade finance or accounts receivable finance and working capital solutions to small and medium enterprises (“SMEs”) throughout Australia. Moneytech has built a portfolio of more than 5,000 high-quality business customers with its existing range of financing solutions and has experienced strong organic growth since inception.

To distinguish itself from traditional asset based lenders, and to manage and facilitate the advance of money to its customers, Moneytech has developed, operates and maintains its own real time core money transfer platform called the Moneytech Exchange. The Moneytech Exchange stores and tracks every invoice and payment entered into the system and automatically communicates with the major Australian transactional banks to settle thousands of transactions per day, in real time.

| 21 |

The Moneytech Exchange is fully automated, real time and online. Human intervention only occurs to manage exceptions and provide necessary transaction approvals or authorisations. The Moneytech Exchange provides significant benefits over traditional non-technology based systems such as:

| ● | simple, secure two factor authenticated login to initiate transactions through the web; |

| ● | automatic processing up to pre-approved limits; |

| ● | same day settlement for all transactions; |

| ● | real-time reporting for all parties to each transaction, allowing for easy record keeping, reconciliation and auditing; and |

| ● | parameters can be assigned to each transaction to vary the cost, settlement timeframe and interest rate, depending on the industry, product, payment terms or any other criteria. |

Moneytech has invested approximately A$10 million developing this banking platform technology, including approximately A$1.375 million in 2014, A$1.161 million in 2013 and A$873,685 in 2012, respectively, and continues to invest in research and development to expand and improve its technology and product suite to maintain and further its competitive position.

Moneytech is seeking financing to expand Moneytech’s asset based credit solutions operations in Australia through a combination of organic growth and strategic acquisitions and are considering introducing those operations in the United States, most likely through a strategic acquisition.

Our Services – Provision of Capital

Credit Express

Moneytech offers two products which provide small and medium sized businesses with access to capital – Credit Express and Confirmed Capital. The underwriting criteria, fee structure and approval process for both of these products is discussed below.

Credit Express

Credit Express offers approved businesses, including retailers, resellers, wholesalers and manufacturers (“Buyers” or “Sellers”), with commercial lines of credit and provides them access to the Moneytech Exchange. The Moneytech Exchange allows pre-approved Buyers and Sellers to automatically access financing up to pre-approved limits when a Buyer purchases inventory from a Seller. Moneytech’s client may be either the Buyer or the Seller, depending upon which party requests the financing and only the party which requests the financing needs to be pre-approved.

Each transaction is conducted electronically and is based on predetermined criteria to ensure that the Moneytech receivable is acceptable to the provider of financing, including the defined parameters for ‘Eligible Receivables’ included in this document. By utilising Credit Express:

| ● | Buyers are able to fund the purchase of inventory with Moneytech delivering the proceeds directly to the Seller’s bank account; or |

| ● | Sellers can fund working capital without having to wait for Buyers to pay invoices. After paying the Seller directly for the goods, Moneytech assumes the risk and collects the money from the Buyer, relieving the Seller of collection costs and cash flow challenges. |

Confirmed Capital

Confirmed Capital is unique because of its accounts receivable/asset based financing capability. Moneytech funds 100% of the face amount of invoices on the day each transaction is conducted. This is more flexible than other accounts receivable financiers who typically provide a maximum of 80% of the invoice value and release funds periodically.

Moneytech’s “Moneytech Exchange” stores every invoice and payment entered into the system and automatically communicates with the major Australian banks per day, enabling Moneytech to check the status of each customer’s account automatically, facilitating additional advances and enabling Moneytech to receive alerts advising it as to which customers are in default. This ease of access decreases Moneytech’s risk of loss by allowing it to automatically monitor thousands of clients and increases its efficiency.

For both Credit Express and Confirmed Capital, customers have agreed repayment terms (which may include an interest free period) for repayment of the amount advanced by Moneytech. In addition to an ownership or security interest in the goods which are the subject of a transaction or an interest in the receivable, Moneytech often secures the credit provided by having its customer grant liens on all or a portion of its assets, or by providing personal guarantees. Moneytech generates profits by charging an interest on the amounts funded above its own cost of funds and by charging service fees on transactions and account management fees.

| 22 |

Fee Structure

Moneytech has two primary ways of charging fees to clients for Credit Express and Confirmed Capital:

| ● | Moneytech charges an interest rate on amounts outstanding in excess of the rate incurred by Moneytech’s to access its funds; and |

| ● | Moneytech charges an initial transaction fee when a customer is accepted and seeks to charge a fee for performing each transaction, calculated as either a percentage of the transaction value or a fixed amount, or a combination of the two, but in all events in excess of the corresponding fee charged Moneytech by its lender. |

The actual fees charged to clients on an ongoing basis are usually a combination of the above, but depending on the terms of the facility may be limited to only an interest rate or only a fee for conducting the transaction.

Pre-Approval Process

Customers seeking access to either Confirmed Capital or Credit Express are required to complete an application on-line or manually downloaded from the Moneytech Exchange and furnish financial and other information concerning the applicant, all of which is input and stored on the Moneytech Exchange. The application contains terms and conditions which applicants must review and acknowledge.

Moneytech assesses the creditworthiness of each applicant using on-line verification services and in certain instances third party sources, and regularly reviews and conducts audits of customer accounts.

Where a customer displays a good credit history, Moneytech may offer an increased credit limit. In such cases, Moneytech will issue the account holder a letter of acceptance subject to acceptance by the account holder. The letter of acceptance states that in the event the offer is accepted, the account holder shall remain subject to the terms and conditions of the original Buyer Account Application form and Moneytech Buyer Terms and Conditions. This ensures that Moneytech is in a position to reduce the credit limit or put the account on hold in the event of default.

Underwriting Standards

When a new Business Account is opened, a credit limit must be established for all authorised Business Account members/users. This is achieved by assessing each applicant’s personal circumstances. Determination of individual credit limits are based on the assessment criteria described in Moneytech’s Statement of Credit Policy. The criteria are both qualitative and quantitative, and include but are not limited to:

| ● | current and historic financial performance of the business based on assessment of its income statement and balance sheet; |

| ● | the net asset position of any individuals or entities providing guarantees in support of the application; |

| ● | the tenure of the business, the industry in which the business operates; and |

| ● | credit reports from reporting agencies on both the applicant and the principals or proprietors of the applicant. |

No credit limit must be set above that which this Statement of Credit Policy allows unless the Credit and Risk Committee approve it. The Managing Director reserves the right to veto such approval. Unless the benefits associated with the proposed credit limit are determined to significantly outweigh the risks involved, no such limit increases will generally be approved.

For credit limits not in excess of A$50,000, the approval of the designated money manager and Moneytech’s national credit manager are required; for credit limits in excess of A$50,000 to A$150,000, the approval of the money manager and one member of Moneytech’s Credit and Risk Committee is required; and for credit limits in excess of A$150,000, the approval of the money manager, two members of Moneytech’s Credit and Risk Committee and Moneytech’s insurer is required.

The credit limits of existing customers are re-assessed regularly based on need and application by individual accounts. The credit limit re-assessment process is critical to ensuring customer growth within the confines of its commercial risk framework. Accounts that change adversely against their original risk category must be reassessed and adjusted with reference to the account holder’s circumstances and the then current assessment criteria.

| 23 |

The Moneytech Exchange prevents customers from exceeding their credit limits except where the account is delinquent or when interest or fees and charges are added to the account balance.

Collateral

Moneytech routinely obtains liens on customer assets and also requires personal guarantees (other than public companies) which often are secured by liens on individuals’ assets.

Profitability

Profitability for the account of any customer is determined by measuring the difference between Moneytech’s revenue derived from the transaction fees or interest rates charged to the customer and the interest rates and fees charged by Moneytech’s senior debt provider to it. Moneytech internally targets a gross profit margin of 50% using these measures. Facilities may have a higher or lower margin, depending on the amount of risk Moneytech determines (based on its credit and collections policy) is present in the deal. Moneytech will target higher margins where it believes the risk is relatively higher, and will accept lower margins where it has determines that the risk is relatively low.

Recent and Historical Statistics as to Nonpayment

The percentage of delinquent balances in the portfolio was 1.53% as at 30 June 2014 (1.65%: pcp) and averaged 1.77% (1.87% pcp).

The average collection period in the portfolio decreased from 47 days at the beginning of the 2013 financial years to 45 days at 30 June 2013 and remained at 45 days at 30 June 2014.

Bad debts as a percentage of amount funded was 0.40% as at 30 June 2014 (0.21% pcp).

Actions Taken in the Event of Nonpayment

In the event of non-payment, a Moneytech staff member will first contact the Buyer to request prompt payment. If a payment or an acceptable payment arrangement is not forthcoming, Moneytech will utilise a collections agent to pursue the debt.

Business Strategy

As a non-bank lender, Moneytech targets high growth and established small to medium enterprises with unique financial solutions, including Confirmed Capital and Credit Express. This is a niche market, and differentiated from the target market of the large Australian banking institutions.

Moneytech believes it is in a strong position to capitalise on opportunity in this space, as:

| ● | Moneytech’s product offerings (particularly Confirmed Capital and Credit Express) are unique and market leading in that they can finance up to 100% of the value of an individual invoice and track the details of each transaction in real time utilising Moneytech’s proprietary Moneytech Exchange system; |

| ● | Moneytech’s small size relative to the large Australian banking institutions allows it to be more agile, responding to and developing opportunities; |

| ● | Moneytech has a full suite of financial products, both transactional and lending, all operated through the Moneytech Exchange, affording it a competitive advantage over similar non-bank lenders; and |

| ● | Moneytech has an ongoing and historic entrepreneurial spirit with a customer focus, aiming to creatively and profitably satisfy customer needs and exceed customer expectations in the delivery of financial products. |

| 24 |

Moneytech’s Markets

Moneytech operates in the commercial financial services market in Australia, targeting small to medium businesses (revenues between A$1 million and A$100 million) for their asset based lending solutions (including trade and accounts receivable finance) generally seeking funding for purchased receivables of up to A$5 million. Any business involved in the provision of products or services to other businesses which require funds to grow or that is not satisfied with its existing finance provider is a candidate for a Moneytech financial solution.

Inasmuch as Moneytech’s services are generally provided to smaller businesses which are not eligible for facilities for purchased receivables from larger, established lenders, its customers are more likely to default than larger, more established borrowers. Businesses sourcing their products overseas for resale to business in Australia are a particularly good fit, as Moneytech is able to assist them with the payment of their overseas supplier, the hedging and conversion into a foreign currency, and the conversion of their receivables into cash. When doing business with such customers, although Moneytech may provide foreign exchange services, it does not assume the foreign exchange risk. If a client wishes to pay Moneytech in a currency other than the one provided by Moneytech, the client will be required to enter a currency hedge for the protection of Moneytech.

Moneytech believes that the number of potential customers for its financial services will increase as banks and other financial institutions in Australia raise the minimum amount they are willing to make extend to potential borrowers and the categories of eligible potential borrowers.

Competition

The competition to provide financing to small and medium sized businesses remains intense. Competitive factors vary depending upon the financial services products offered, the nature of the customer and geographic region. Competitive forces may limit the ability of Moneytech to charge its customary fees and may raise fees to customers in the future. Pressure on margins is intense and there is no assurance that Moneytech will be able to successfully compete with its competitors.

Moneytech is currently an insignificant competitor in the industry, which includes national, regional and local independent banks and finance companies and other full service financing organisations. Many of these competitors are larger than Moneytech and have access to capital at a lower cost.

Government Regulation

ASIC regulates corporations, markets and financial services in Australia and the Australian Prudential Regulatory Authority oversees banks, credit unions, building societies, general insurance and reinsurance companies, life insurance companies, friendly societies and most members of the superannuation industry. The Reserve Bank of Australia serves as the central bank of Australia and is responsible for the payments system.

Receivables and purchase order financing in the style provided by Moneytech in Australia is not subject to regulation in Australia, as confirmed in an interpretation issued by ASIC concerning the exemption available to factoring arrangements under the Corporations Act.

Senior Funding Arrangements

Moneytech currently has an asset backed wholesale debt facility (the “Wholesale Facility”, “Receivables Purchase Agreement” or “RPA”) with the structured finance division of a leading Australian bank. This facility is renewed annually on 31 December. The borrowing limit under the RPA is currently A$50 million and subject to interim agreed upon limits determined by various tests and covenants.

As at 30 June 2014 the total amount drawn against the facility was A$27,746,303. The facility has been renewed until 31 December 2015, and the interim agreed upon credit limit is currently A$40 million. Upon issue of the Subordinated Notes under this Information Memorandum, the interim agreed upon credit limit will be reduced to A$25 million, with a minimum draw requirement of A$20 million.

Moneytech intends to seek further funding under this Wholesale Facility at the next review date.

| 25 |

The RPA has delinquency, net loss ratio limits, dilution and day sales outstanding limits that, if exceeded, would increase the level of credit enhancement requirements for that facility and redirect all excess cash to the lender. Generally, these limits are calculated based on the aggregate portfolio performance across all clients; however, delinquency, net loss ratios and dilutions are calculated with respect to some individual obligors.