Attached files

| file | filename |

|---|---|

| EX-4.6 - EX-4.6 - Invuity, Inc. | d852944dex46.htm |

| EX-4.4 - EX-4.4 - Invuity, Inc. | d852944dex44.htm |

| EX-4.2 - EX-4.2 - Invuity, Inc. | d852944dex42.htm |

| EX-4.5 - EX-4.5 - Invuity, Inc. | d852944dex45.htm |

| EX-10.8 - EX-10.8 - Invuity, Inc. | d852944dex108.htm |

| EX-23.1 - EX-23.1 - Invuity, Inc. | d852944dex231.htm |

| EX-10.7 - EX-10.7 - Invuity, Inc. | d852944dex107.htm |

| EX-10.2 - EX-10.2 - Invuity, Inc. | d852944dex102.htm |

| EX-10.5 - EX-10.5 - Invuity, Inc. | d852944dex105.htm |

| S-1 - S-1 - Invuity, Inc. | d852944ds1.htm |

| EX-4.3 - EX-4.3 - Invuity, Inc. | d852944dex43.htm |

Exhibit 10.6

OFFICE LEASE AGREEMENT

Between

444 DE HARO - VEF VI, LLC,

a Delaware limited liability company

(“Landlord”)

And

INVUITY, INC.

a California corporation

(“Tenant”)

TABLE OF CONTENTS

LEASE AGREEMENT

| Page | ||||||||

| Basic Lease Provisions |

iv | |||||||

| A. |

Premises/Term/Possession |

1 | ||||||

| 1. | Premises |

1 | ||||||

| 2. | Lease Term/Early Access |

2 | ||||||

| 3. | Intentionally Omitted |

2 | ||||||

| 4. | Quiet Enjoyment |

2 | ||||||

| B. |

Rent/Payment/Security Deposit |

3 | ||||||

| 5. | Base Rent |

3 | ||||||

| 6. | Rent Payment |

3 | ||||||

| 7. | Operating Expenses/Taxes/Electricity Costs/Janitorial Expenses/Impositions |

3 | ||||||

| 8. | Late Charge |

9 | ||||||

| 9. | Partial Payment |

10 | ||||||

| 10. | Security Deposit |

10 | ||||||

| 11. | Letter of Credit |

11 | ||||||

| C. |

Use/Laws/Rules |

11 | ||||||

| 12. | Use of Premises |

11 | ||||||

| 13. | Compliance with Laws |

13 | ||||||

| 14. | Waste Disposal |

14 | ||||||

| 15. | Rules and Regulations |

14 | ||||||

| D. |

Services/Tenant Buildout |

14 | ||||||

| 16. | Services |

14 | ||||||

| 17. | Telecommunications and Data Equipment |

18 | ||||||

| 18. | Signs |

18 | ||||||

| 19. | Parking |

18 | ||||||

| 20. | Storage |

19 | ||||||

| 21. | Buildout Allowance and Tenant Finishes |

19 | ||||||

| 22. | Force Majeure |

19 | ||||||

| E. |

Repairs/Alterations/Casualty/Condemnation |

19 | ||||||

| 23. | Repairs By Landlord |

20 | ||||||

| 24. | Repairs By Tenant |

20 | ||||||

| 25. | Alterations and Improvements |

20 | ||||||

| 26. | Destruction or Damage |

21 | ||||||

| 27. | Eminent Domain |

22 | ||||||

| 28. | Damage or Theft of Personal Property |

23 | ||||||

i

| F. |

Insurance/Indemnities/Waiver/Estoppel |

23 | ||||||

| 29. | Insurance; Waivers |

23 | ||||||

| 30. | Indemnities |

25 | ||||||

| 31. | Acceptance and Waiver |

26 | ||||||

| 32. | Tenant’s Estoppel |

26 | ||||||

| G. |

Default/Remedies/Surrender/Holding Over |

26 | ||||||

| 33. | Notices |

26 | ||||||

| 34. | Abandonment of Premises |

26 | ||||||

| 35. | Default |

27 | ||||||

| 36. | Landlord’s Remedies |

27 | ||||||

| 37. | Service of Notice |

29 | ||||||

| 38. | Advertising |

29 | ||||||

| 39. | Surrender of Premises |

29 | ||||||

| 40. | Cleaning Premises |

29 | ||||||

| 41. | Liens |

29 | ||||||

| 42. | Holding Over |

30 | ||||||

| 43. | Attorney’s Fees |

30 | ||||||

| 44. | Mortgagee’s Rights |

30 | ||||||

| H. |

Landlord Entry/Assignment and Subletting |

32 | ||||||

| 45. | Entering Premises |

32 | ||||||

| 46. | [Intentionally Deleted] |

32 | ||||||

| 47. | Assignment and Subletting |

32 | ||||||

| I. |

Sale of Building; Limitation of Liability |

35 | ||||||

| 48. | Sale |

35 | ||||||

| 49. | Limitation of Liability |

35 | ||||||

| J. |

Brokers/Construction/Authority |

36 | ||||||

| 50. | Broker Disclosure |

36 | ||||||

| 51. | Definitions |

36 | ||||||

| 52. | Construction of this Agreement |

36 | ||||||

| 53. | No Estate In Land |

36 | ||||||

| 54. | Paragraph Title; Severability |

37 | ||||||

| 55. | Cumulative Rights |

37 | ||||||

| 56. | Waiver of Jury Trial |

37 | ||||||

| 57. | Entire Agreement |

37 | ||||||

| 58. | Submission of Agreement |

37 | ||||||

| 59. | Authority; Counterparts |

38 | ||||||

| 60. | Guaranty |

38 | ||||||

| 61. | Joint and Several Obligations |

38 | ||||||

| 62. | Name of Building |

38 | ||||||

| 63. | Governing Law |

38 | ||||||

| 64. | Obligations Independent |

38 | ||||||

| 65. | Exhibits |

38 | ||||||

ii

| 66. | Hazardous Substances Disclosure |

38 | ||||||

| 67. | OFAC and Anti-Money Laundering Compliance Certifications |

39 | ||||||

| 68. | No Recording |

40 | ||||||

| 69. | Financial Statements |

40 | ||||||

| 70. | Disclosure Pursuant to Section 1938 of the California Civil Code |

41 | ||||||

| 71. | Right of First Offer |

41 | ||||||

| 72. | Option to Renew |

42 | ||||||

| 73. | Right to Cure |

43 | ||||||

| LIST OF EXHIBITS |

||||||||

| A |

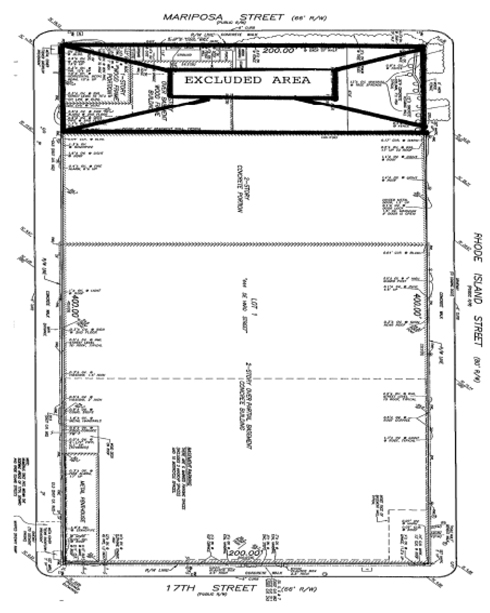

Legal Description |

|||||||

| B |

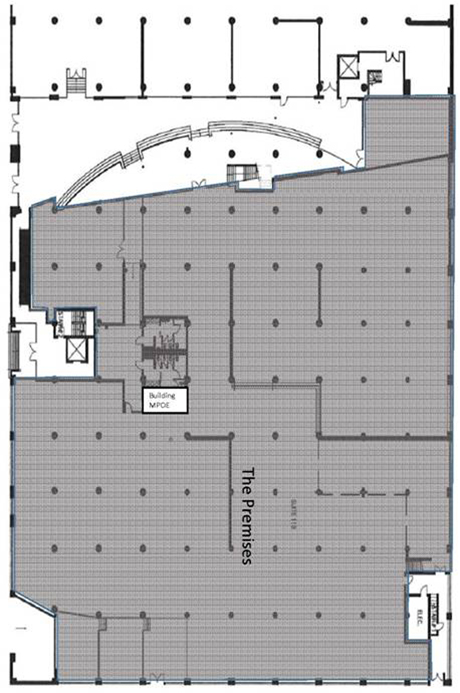

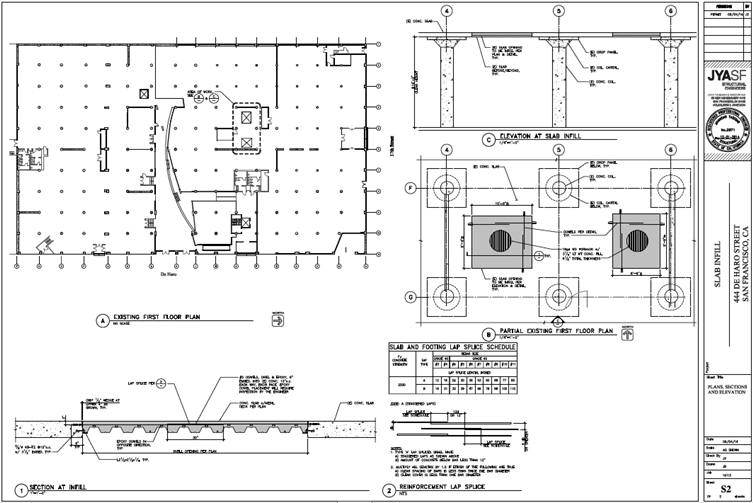

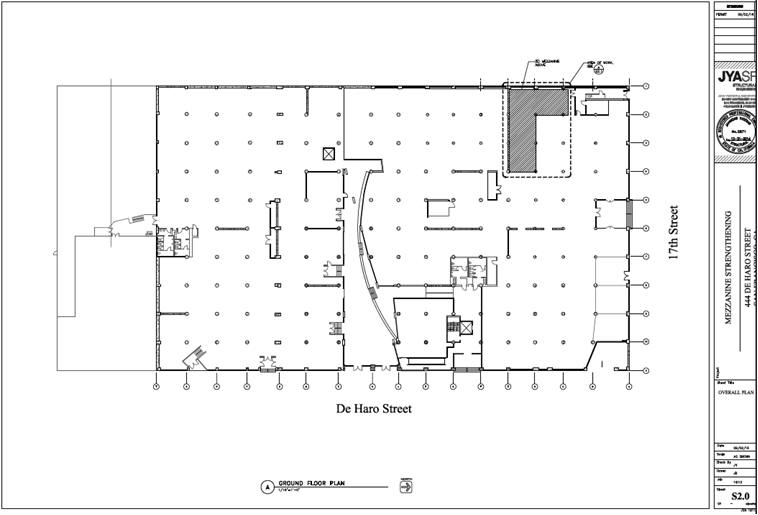

Plan of Premises |

|||||||

| C |

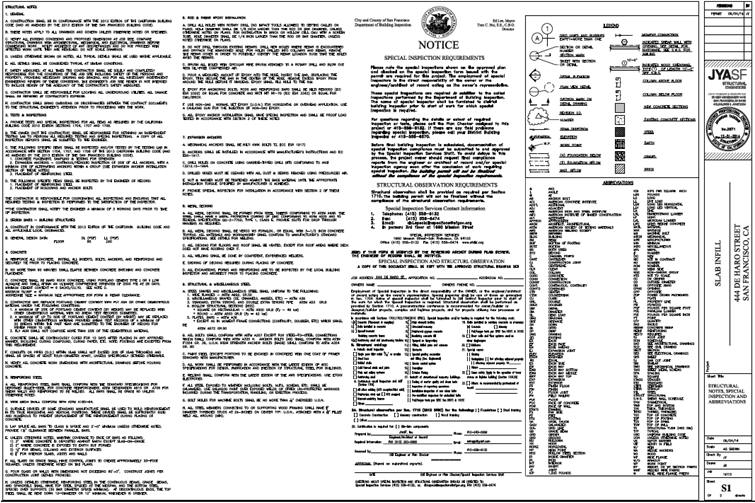

Work Letter |

|||||||

| D |

Landlord’s Work |

|||||||

| E |

Substantial Completion/Acceptance Letter |

|||||||

| F |

Rules and Regulations |

|||||||

| G |

Environmental Reports |

|||||||

| H |

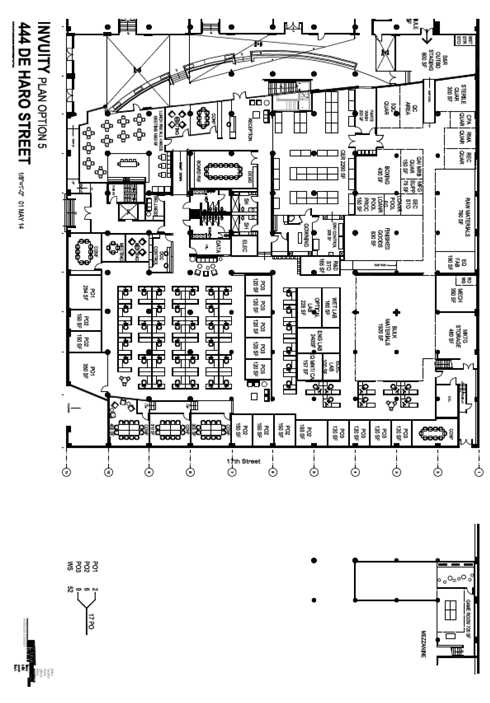

Approved Space Plan |

|||||||

| I |

Excluded Area |

|||||||

iii

BASIC LEASE PROVISIONS

The following sets forth the “Basic Lease Provisions”. In the event of any conflict between the terms of these Basic Lease Provisions and the referenced Sections of the Lease, the referenced Sections of the Lease shall control. In addition to the following Basic Lease Provisions, all of the other terms and conditions and sections of the Office Lease Agreement hereinafter set forth are hereby incorporated as an integral part of this Lease.

| 1. | Date of Lease: May 9, 2014 (“Lease Date”) | |||

| 2. | “Building” (See Section 1): | 444 De Haro Street, San Francisco, CA 94107 | ||

| 3. | “Premises” (See Section 1): | Suite: 110 | ||

| Floor: First | ||||

| Rentable Square Footage”: 38,135 | ||||

| 4. | Term (See Section 2): 120 full calendar months after the Commencement Date. | |||

| 5. | Commencement Date: November 1, 2014, subject to Section 7 of the Work Letter. The 30 day period immediately prior to the Commencement Date is referred to herein as the “Move-In-Period”. | |||

| 6. | Base Rent (See Section 5): | |||

| Lease Year | Rate Per Rentable Square Foot of Premises |

Monthly Installments | ||||||

| 1 |

$ | 52.00 | $ | 165,251.67 | ||||

| 2 |

$ | 53.56 | $ | 170,209.22 | ||||

| 3 |

$ | 55.17 | $ | 175,325.66 | ||||

| 4 |

$ | 56.82 | $ | 180,569.23 | ||||

| 5 |

$ | 58.52 | $ | 185,971.68 | ||||

| 6 |

$ | 60.28 | $ | 191,564.82 | ||||

| 7 |

$ | 62.09 | $ | 197,316.85 | ||||

| 8 |

$ | 63.95 | $ | 203,227.77 | ||||

| 9 |

$ | 65.86 | $ | 209,297.59 | ||||

| 10 |

$ | 67.84 | $ | 215,589.87 | ||||

| 7. | Rent Payment Address (See Section 5): | c/o Winthrop Management LP | ||

| 201 California Street, Suite 300 | ||||

| San Francisco, CA 94111 | ||||

| 8. | Base Year (See Section 7): | |||

| “Tax Base Year”: | 2014 | |||

| “Operating Expense Base Year”: | 2014 | |||

iv

| 9. | Tenant’s Share (See Section 7): | 28.25%, determined by dividing the rentable square footage of the Premises divided by the rentable square footage of the Building (135,010 rsf). | ||

| 10. | Security Deposit (See Sections 10 and 11): | $1,089,944.34, initially, subject to reduction as provided in Section 10 below. | ||

| 11. | Parking Spaces (See Section 19): | 18 | ||

| 12. | Tenant Improvement Allowance (See Section 21): | $65.00 per rentable square foot, plus the Special Floor Allowance set forth in Section 15 of Exhibit “C”. | ||

| 13. | Landlord’s Broker (See Section 50): | Cornish & Carey Commercial Newmark Knight Frank | ||

| Tenant’s Broker (See Section 50): | CBRE, Inc. | |||

| 14. | Notice Address (See Section 33): | |||

| Landlord |

Tenant | |

| 444 De Haro – VEF VI, LLC c/o Winthrop Management LP 201 California Street, Suite 300 San Francisco, CA 94111 Attn: Daniel Cushing Fax No.: 415-247-2108 Email: dcushing@aresmgmt.com

With a copy to:

Levenfeld Pearlstein, LLC 2 North LaSalle Street, Suite 1300 Chicago, Illinois 60602 Attn: Thomas G. Jaros Fax No: 312-346-8434 Email: tjaros@lplegal.com |

Prior to the Commencement Date:

Invuity, Inc. 39 Stillman Street San Francisco, CA 94107 Attn: Brett Robertson, General Counsel and Vice President, Corporate Development Fax No.: 415-223-8607 Email: brobertson@invuity.com

After the Commencement Date:

Invuity, Inc. 444 De Haro Street, Suite 110 San Francisco, CA 94107 Attn: Brett Robertson, General Counsel and Vice President, Corporate Development Fax No.: 415-223-8607 Email: brobertson@invuity.com | |

[signature page immediately follows]

v

IN WITNESS WHEREOF, Landlord and Tenant have executed this instrument as of the date set forth on the first page hereof.

| Landlord: | ||||||||||

| 444 DE HARO - VEF VI, LLC, a Delaware limited liability company |

||||||||||

| By: | 444 De Haro Member, LLC, | |||||||||

| a Delaware limited liability company, its sole member | ||||||||||

| By: | Value Enhancement Fund VI, L.P., | |||||||||

| a Georgia limited partnership, its sole member | ||||||||||

| By: | VEF Group Management, LLC, | |||||||||

| a Delaware limited liability company,its manager | ||||||||||

| By: | /s/ Joseph A. Hill |

|||||||||

| Name: Joseph A. Hill | ||||||||||

| Title: Secretary | ||||||||||

TENANT:

| INVUITY, INC., a California corporation | ||

| By: | /s/ Philip Sawyer | |

| Name: | Philip Sawyer | |

| Title: | CEO | |

OFFICE LEASE AGREEMENT

THIS OFFICE LEASE AGREEMENT (hereinafter called the “Lease”) is made and entered into as of the date appearing in the Basic Lease Provisions by and between the Landlord and Tenant identified above. The Basic Lease Provisions are incorporated herein by this reference.

A. Premises/Term/Possession

1. Premises.

(a) Landlord does hereby rent and lease to Tenant and Tenant does hereby rent and lease from Landlord, for the purposes set forth in Section 12(a) hereof, the Premises located in the Building identified in the Basic Lease Provisions, situated on the real property described in Exhibit “A” attached hereto (the “Property”), such Premises as all further shown by diagonal lines on the drawing attached hereto as Exhibit “B” and made a part hereof by reference. The Premises shall be prepared for Tenant’s occupancy in the manner and subject to the provisions of Exhibit “C” and Exhibit “D” attached hereto and made a part hereof. Landlord and Tenant agree that the number of rentable square feet described in Paragraph 3 of the Basic Lease Provisions has been confirmed and conclusively agreed upon by the parties. No easement for light, air or view is granted hereunder or included within or appurtenant to the Premises. The parties hereto hereby acknowledge that the purpose of Exhibit “B” is to show the approximate location of the Premises in the Building, only, and such Exhibit “B” is not meant to constitute an agreement, representation or warranty as to the construction of the Premises, the precise area thereof or the specific location of any Common Areas (defined below), or the elements thereof or of the accessways to the Premises or the Building. The Property, the Building and the Common Areas are collectively referred to herein as the “Project”. Tenant also acknowledges that neither Landlord nor any agent of Landlord has made any representation or warranty regarding the condition of the Premises or the Building or with respect to the suitability of any of the foregoing for the conduct of Tenant’s business, except as specifically set forth in this Lease or the Work Letter. Subject only to other provisions of this Lease (including Landlord’s obligation to complete the Landlord’s Work), Tenant accepts the Premises on an AS IS condition as of the Lease Date. Notwithstanding the foregoing, Landlord warrants and represents that, as of the Delivery Date, (i) the Premises, the Building and the Project will comply with all Legal Requirements, and (ii) the electrical, mechanical, HVAC, plumbing, sewer, elevator and other Building systems serving the Premises will be in good operating condition and repair. To the extent that Tenant discovers within six (6) months of the Commencement Date that the foregoing warranty and representation was untrue, Landlord shall, promptly after written receipt of notice from Tenant, which must occur within six (6) months of the Commencement Date, remedy any non-compliance with the foregoing sentence at Landlord’s sole cost and expense (and not as an Operating Expense).

(b) Tenant shall have the non-exclusive right to use in common with other tenants in the Building, and subject to the rules and regulations referred to in this Lease, those portions of the Building which are provided, from time to time, for use in common by Landlord, Tenant and any other tenants of the Project (such areas, together with such other portions of the Project designated by Landlord, in its discretion, including certain areas designated for the exclusive use of certain tenants, or to be shared by Landlord and certain tenants, are collectively referred to herein as the

-2-

“Common Areas”). For purposes of clarity, Landlord and Tenant acknowledge that the area denoted on Exhibit “I” hereto as the “Excluded Area” shall not be part of the Common Areas for purposes of this Lease. The manner in which the Common Areas are maintained and operated shall be at the sole discretion of Landlord and the use thereof shall be subject to such rules, regulations and restrictions as Landlord may make from time to time. Landlord reserves the right to close temporarily, make alterations or additions to, or change the location of elements of the Building and the Common Areas so long as the same does not unreasonably interfere with Tenant’s use of the Premises.

(c) Notwithstanding anything to the contrary contained herein, it is acknowledged that Tenant may utilize the De Haro street lobby portion of the Common Areas (the “De Haro Lobby”) for the delivery of equipment to the Premises subject to the following conditions: (i) Tenant’s utilization of the De Haro Lobby shall only be allowed if the freight lift of the Building cannot accommodate the delivery of such equipment; (ii) at least 24 hours prior notice is given to Landlord such that Landlord may control access and entry through the De Haro Lobby; (iii) Landlord reserves the right to require Tenant’s use of the De Haro Lobby during off-peak or non-business hours; (iv) Tenant shall be responsible for all damage done to the De Haro Lobby or other Common Elements by virtue of such use; (v) such equipment shall be brought through the De Haro Lobby only by means as reasonably approved by Landlord with proper wall and floor protection; and (vi) Tenant shall observe such other reasonable conditions or restrictions as Landlord may impose on such use of the De Haro Lobby.

2. Lease Term/Early Access.

(a) Tenant shall have and hold the Premises for the term (“Term”) identified in the Basic Lease Provisions commencing on the Commencement Date, and shall terminate at midnight on the last day of the Term (the “Expiration Date”), unless sooner terminated or extended as hereinafter provided. Promptly following the Commencement Date, Landlord and Tenant shall enter into a letter agreement in the form attached hereto as Exhibit “E”, specifying and/or confirming the Commencement Date and the Expiration Date.

(b) Tenant shall have the right to access the Premises commencing on the Lease Date for the sole and limited purpose of completing the Tenant Improvement Work in compliance with this Lease (including the Work Letter), to otherwise prepare the Premises for occupancy and, during the Move-In-Period, occupying the Premises. Tenant’s use, occupancy and access to the Premises for such purposes shall be subject to all of the terms of the lease except the obligation to pay Rent (which obligation to pay Rent shall commence as otherwise set forth herein).

3. Intentionally Omitted.

4. Quiet Enjoyment. Tenant, upon payment in full of the required Rent and full performance of the terms, conditions, covenants and agreements contained in this Lease, shall peaceably and quietly have, hold and enjoy the Premises during the Term hereof. Landlord shall not be responsible for the acts or omissions of any other tenant, Tenant or third party that may interfere with Tenant’s use and enjoyment of the Premises.

-3-

B. Rent/Payment/Security Deposit.

5. Base Rent.

(a) Tenant shall pay to Landlord, at the address stated in the Basic Lease Provisions or at such other place as Landlord shall designate in writing to Tenant, annual base rent (“Base Rent”) in the amounts set forth in the Basic Lease Provisions. The term “Lease Year”, as used in the Basic Lease Provisions and throughout this Lease, shall mean each and every consecutive twelve (12) month period during the Term of this Lease, with the first such twelve (12) month period commencing on the Commencement Date; provided, however, if the Commencement Date occurs other than on the first day of a calendar month, the first Lease Year shall be that partial month in which the Commencement Date actually occurs (the “Stub Month”) plus the first full twelve (12) months thereafter.

(b) Notwithstanding anything to the contrary contained herein: (i) no Rent shall be payable during the Move-In Period, but Tenant shall otherwise observe all terms and provisions of this Lease during the Move-In Period; and (ii) the first three monthly installments of Base Rent due during the first Lease Year (the “Abatement Period”) shall be abated and shall not be payable; provided, however, in the event this Lease is terminated as a result of a Default by Tenant beyond any applicable notice, cure or grace period, Landlord may recover the unamortized portion of the abated rent for the Abatement Period (using a straight line amortization over 120 months and interest at 8%).

6. Rent Payment. The Base Rent for each Lease Year shall be payable in equal monthly installments, due on the first day of each calendar month, in advance, in legal tender of the United States of America, without abatement, demand, deduction or offset whatsoever. One full monthly installment of Base Rent shall be due and payable on the date of execution of this Lease by Tenant and shall be applied to the first month’s Base Rent (after accounting for the Abatement Period), and a like monthly installment of Base Rent shall be due and payable on or before the first day of each calendar month following the Abatement Period during the Term hereof (provided, that if the Commencement Date should be a date other than the first day of a calendar month, the monthly Base Rent installment paid on the date of execution of this Lease by Tenant shall be applied first to the Stub Month, and the excess shall be applied as a credit against the next monthly Base Rent installment due after the Abatement Period and Tenant shall pay any amount remaining due on such Base Rent installment). Tenant shall pay, as Additional Rent, all other sums due from Tenant to Landlord under this Lease (the term “Rent”, as used herein, means all Base Rent, Additional Rent and all other amounts payable hereunder from Tenant to Landlord).

7. Operating Expenses/Taxes/Electricity Costs/Janitorial Expenses/Impositions.

(a) Tenant agrees to reimburse Landlord throughout the Term, as Additional Rent hereunder, for Tenant’s Share (as defined below) of: (i) the annual Operating Expenses (as defined below) in excess of the Operating Expenses for the Operating Expense Base Year set forth in the Basic Lease Provisions (hereinafter called the “Base Year Expense Amount” and the Operating Expenses of a given year in excess of the Base Year Expense Amount is hereinafter called the “Excess Operating Expenses”); and (ii) the annual Taxes (as defined below) in excess of the Taxes

-4-

for the Tax Base Year set forth in the Basic Lease Provisions (hereinafter called the “Base Year Tax Amount” and the Taxes of a given year in excess of the Base Year Tax Amount is hereinafter called the “Excess Taxes”). The term “Tenant’s Share” as used in this Lease shall mean the percentage determined by dividing the Rentable Square Footage of the Premises by the rentable square footage of the Building. Landlord and Tenant hereby agree that Tenant’s Share with respect to the Premises initially demised by this Lease is the percentage amount set forth in the Basic Lease Provisions. Tenant’s Share of Excess Operating Expenses and Excess Taxes for any calendar year shall be equitably prorated for any partial year occurring during the Term.

(b) “Operating Expenses” shall mean, without duplication, all of those expenses of operating, servicing, managing, maintaining and repairing the Property, Building, and all parking areas and all related Common Areas (as well as the reasonable allocation by Landlord of any expenses incurred and related to facilities located on other property but serving the Property, if the Property is part of a project involving more than one building and/or property). Operating Expenses shall include, without limitation, the following: (1) insurance premiums and deductible amounts, including, without limitation, for commercial general liability, “all risks” property, rent loss and other coverages carried by Landlord on the Building and Property; (2) all costs related to the providing of water, heating, lighting, ventilation, air quality monitoring (if any), sanitary sewer, air conditioning and other utilities in the Building, excluding those utility charges actually paid separately by Tenant (including Electricity Costs defined below) or any other tenants of the Building; (3) janitorial and maintenance expenses, including: (a) janitorial services and janitorial supplies and other materials used in the operation and maintenance of the Building, excluding those janitorial charges actually paid separately by Tenant (including Janitorial Expenses defined below) or any other tenants of the Building; and (b) the cost of maintenance and service agreements on equipment, window cleaning, grounds maintenance, pest control, security, trash removal, and other similar services or agreements; (4) management fees (or a charge equal to fair market management fees if Landlord provides its own management services) and the market rental value of a management office; (5) the costs of capital improvements (a) which are intended to effect economies in the operation or maintenance of the Building (but not to exceed the anticipated savings therefrom), or any portion thereof, or which is acquired to improve the safety of the Building or Property (b) which are replacements of nonstructural items located in the Common Areas required to keep the Common Areas in good order or condition, or (d) that are required under any governmental law or regulation first becoming effective after the Commencement Date; provided, however, that any capital expenditure shall be amortized with interest over its useful life as Landlord shall reasonably determine; (6) all services, supplies, repairs, replacements or other expenses directly and reasonably associated with servicing, maintaining, managing and operating the Building, including, but not limited to the lobby, vehicular and pedestrian traffic areas and other common use areas; (7) wages and salaries of Landlord’s employees engaged in the maintenance, operation, repair and services of the Building, including taxes, insurance and customary fringe benefits; (8) legal and accounting costs (but not including legal costs incurred in collecting delinquent rent from any occupants of the Property); (9) costs to maintain and repair the Building and Property; (10) landscaping and security costs unless Landlord hires a third party to provide such services pursuant to a service contract and the cost of that service contract is already included in Operating Expenses as described above; (11) costs, fees, charges or assessments imposed by, or resulting from any mandate imposed on Landlord by, any federal, state or local government for fire and police protection, trash removal, community services, or other services which do not constitute Taxes; and

-5-

(12) payments under any easement, license, operating agreement, declaration, restrictive covenant, or instrument pertaining to the sharing of costs by the Building, including, without limitation, any covenants, conditions and restrictions affecting the property, and reciprocal easement agreements affecting the property, any parking licenses, and any agreements with transit agencies affecting the Property.

(c) Operating Expenses shall specifically further exclude, however, the following: (i) costs of alterations of tenant spaces (including all tenant improvements to such spaces); (ii) costs of capital improvements and expenditures, except as provided in item (5) of the preceding paragraph; (iii) depreciation, interest and principal payments on mortgages, and other debt costs, if any; (iv) real estate brokers’ leasing commissions or compensation and advertising and other marketing expenses; (v) payments to affiliates of the Landlord for goods and/or services in excess of what would be paid to non-affiliated parties for such goods and/or services in an arm’s length transaction; (vi) costs or other services or work performed for the singular benefit of another tenant or occupant (other than for Common Areas of the Building); (vii) legal, space planning, construction, and other expenses incurred in procuring tenants for the Building or renewing or amending leases with existing tenants or occupants of the Building; (viii) costs of advertising and public relations and promotional costs and attorneys’ fees associated with the leasing of the Building; (ix) any expense for which Landlord actually receives reimbursement from insurance, condemnation awards, other tenants or any other source; (x) costs incurred in connection with the pursuit or consummation of the sale, financing, refinancing, mortgaging, or other change of ownership of the Building; (xi) all expenses in connection with the installation, operation and maintenance of any observatory, broadcasting facilities, luncheon club, athletic or recreation club, cafeteria, dining facility, or other facility not generally available to all office tenants of the Building, including Tenant; (xii) Taxes; (xiii) rental under any ground or underlying lease or leases; (xiv) legal fees in connection with disputes with any other occupant of the Building and costs arising from the violation by Landlord or any occupant of the Building (other than Tenant), or their respective agents, employees or contractors, of any law or the terms and conditions of any lease or other agreement; (xv) costs occasioned by casualty or by the exercise of the power of eminent domain; and (xvi) costs incurred in connection with the presence of any hazardous or toxic material (including the operation, maintenance and/or removal of the System), except any costs which Tenant is required to indemnify Landlord from pursuant to Section 12. To the extent that the Operating Expenses for the Operating Expense Base Year do not include insurance expenses for earthquake or environmental insurance, and Landlord subsequently obtains such pursuant to the terms of this Lease, then Operating Expenses for the Operating Expense Base Year shall be increased as if Landlord maintained and provided such insurance during the entirety of the Operating Expense Base Year. The Operating Expenses during the Operating Expense Base Year shall be deemed to be increased as if the shuttle service set forth in Section 16(a)(xi) were provided throughout the entire Operating Expense Base Year.

(d) “Taxes” shall mean all taxes and assessments of every kind and nature which Landlord shall become obligated to pay with respect to each calendar year of the Term or portion thereof because of or in any way connected with the ownership, leasing, and operation of the Building and the Property, subject to the following: (i) the amount of ad valorem real and personal property taxes against Landlord’s real and personal property to be included in Taxes shall be the amount required to be paid for any calendar year, notwithstanding that such Taxes are assessed for a

-6-

different calendar year (the amount of any tax refunds received by Landlord during the Term of this Lease shall be deducted from Taxes for the calendar year to which such refunds are attributable); (ii) the amount of special taxes and special assessments to be included shall be limited to the amount of the installments (plus any interest, other than penalty interest, payable thereon) of such special tax or special assessment payable for the calendar year in respect of which Taxes are being determined; (iii) the amount of any tax or excise levied by the State or the City where the Building is located; any political subdivision of either, or any other taxing body, on rents or other income from the Property (or the value of the leases thereon) to be included shall not be greater than the amount which would have been payable on account of such tax or excise by Landlord during the calendar year in respect of which Taxes are being determined had the income received by Landlord from the Building [excluding amounts payable under this subparagraph (iii)] been the sole taxable income of Landlord for such calendar year; (iv) there shall be excluded from Taxes all income taxes [except those which may be included pursuant to the preceding subparagraph (iii) above], excess profits taxes, franchise, capital stock, and inheritance or estate taxes; (v) Taxes shall also include Landlord’s reasonable costs and expenses (including reasonable attorneys’ fees) in contesting or attempting to reduce any Taxes assessed for a different calendar year; and (vi) Tenant and Landlord acknowledge that Proposition 13 (“Proposition 13”) was adopted by the voters of the State of California in the June 1978 election and that assessments, taxes, fees, levies and charges may be imposed by governmental agencies for such services as fire protection, street, sidewalk and road maintenance, refuse removal and for other governmental services formerly provided without charge to property owners or occupants and, in further recognition of the decrease in the level and quality of governmental services and amenities as a result of Proposition 13, Taxes shall also include any governmental or private assessments or the contribution by the Building or such projects towards a governmental or private cost-sharing agreement for the purpose of augmenting or improving the quality of services and amenities normally provided by governmental agencies.

(e) Notwithstanding anything to the contrary set forth in this Lease, the amount of Taxes for the Tax Base Year shall be calculated:

(x) without taking into account any decreases in real estate taxes obtained in connection with Proposition 8, and, therefore, the Taxes in the Base Year may be greater than those actually incurred by Landlord, but shall, nonetheless, be the Taxes due under this Lease; provided that (i) any costs and expenses incurred by Landlord in securing any Proposition 8 reduction shall not be included in Operating Expenses or Taxes for purposes of this Lease, and (ii) tax refunds under Proposition 8 shall not be deducted from Taxes, but rather shall be the sole property of Landlord. Landlord and Tenant acknowledge that this subsection (x) is not intended to in any way affect (A) the inclusion in Taxes of the statutory two percent (2.0%) annual increase in Taxes (as such statutory increase may be modified by subsequent legislation), or (B) the inclusion or exclusion of Taxes pursuant to the terms of Proposition 13, which shall be governed pursuant to the terms above; and

(y) with inclusion of the actual amount of any supplemental assessment which is actually levied pursuant to Proposition 13 on account of the performance of substantial improvements by the Landlord which were completed during calendar year 2013.

-7-

(f) Landlord shall, on or before the Commencement Date and as soon as reasonably possible after the commencement of each calendar year thereafter, provide Tenant with a statement of the estimated monthly installments of Tenant’s Share of Excess Operating Expenses and Excess Taxes which will be due for the remainder of the calendar year in which the Commencement Date occurs or for the next ensuing calendar year, as the case may be. The failure of Landlord to timely furnish such statement for any calendar year shall not preclude Landlord from enforcing its rights to collect any Additional Rent hereunder, nor shall Landlord be prohibited from revising any statement theretofore delivered to the extent necessary. Until a new statement is furnished (which Landlord shall have the right to deliver to Tenant at any time), Tenant shall pay monthly, with the monthly Base Rent installments, an amount equal to one-twelfth (1/12) of the total Excess Taxes and Excess Operating Expenses set forth in the previous statement delivered by Landlord to Tenant. Landlord agrees to keep books and records showing the Operating Expenses and Taxes in accordance with commercially reasonable accounting practices consistently maintained on a year-to-year basis in compliance with such provisions of this Lease as may affect such accounts, and Landlord shall deliver to Tenant after the close of each calendar year (including the calendar year in which this Lease terminates), a statement (“Landlord’s Statement”) containing the following: (1) the amount of any Excess Operating Expenses for such calendar year; (2) the amount of any Excess Taxes for such calendar year; and (3) Tenant’s Share of Excess Taxes and Excess Operating Expenses. Upon reasonable prior written request given not later than ninety (90) days following the date Landlord’s Statement is delivered to Tenant, Tenant may audit the books, records and supporting documents of Landlord to the extent necessary to determine the accuracy of Landlord’s Statement during normal business hours. If Tenant does not notify Landlord of any objection to Landlord’s Statement within the later of ninety (90) days after the later of delivery of Landlord’s Statement or thirty (30) days after the delivery of such requested supporting documentation, Tenant shall be deemed to have accepted Landlord’s Statement as true and correct and shall be deemed to have waived any right to dispute the Excess Operating Expenses, and Excess Taxes due pursuant to that Landlord’s Statement. Tenant shall bear the cost of such audit, unless such audit discloses that Landlord has overstated the Excess Taxes or Excess Operating Expenses, as the case may be, by more than five percent (5%) of the actual amount of such costs, in which event Landlord shall pay the cost of Tenant’s audit. Landlord shall promptly refund any overcharges to Tenant.

(i) Tenant shall pay to Landlord, together with its monthly payment of Base Rent as provided in Section 5 above, as Additional Rent hereunder, the estimated monthly installment of Tenant’s Share of the Excess Operating Expenses and Excess Taxes for the calendar year in question. At the end of any calendar year, if Tenant has paid to Landlord an amount in excess of Tenant’s Share of Excess Operating Expenses and Excess Taxes for such calendar year (as disclosed by the Landlord Statement), Landlord shall reimburse to Tenant any such excess amount (or shall apply any such excess amount to any amount then owing to Landlord hereunder, and if none, to the next due installment or installments of Additional Rent due hereunder, at the option of Landlord). At the end of any calendar year if Tenant has paid to Landlord less than Tenant’s Share of Excess Operating Expenses and Excess Taxes for such calendar year (as disclosed by the Landlord Statement), Tenant shall pay to Landlord any such deficiency within thirty (30) days after Tenant receives the annual statement.

-8-

(ii) For the calendar year in which this Lease terminates and is not extended or renewed, the provisions of this Paragraph shall apply, but Tenant’s Share of Excess Operating Expenses and Excess Taxes for such calendar year shall be subject to a pro rata adjustment based upon the number of days prior to the expiration of the Term of this Lease. Tenant shall make monthly estimated payments of the pro rata portion of Tenant’s Share of Excess Operating Expenses and Excess Taxes for such calendar year (in the manner provided above) and when the actual prorated Tenant’s Share of Excess Operating Expenses and Excess Taxes for such calendar year is determined, Landlord shall send Landlord’s Statement to Tenant for such year and if such Landlord Statement reveals that Tenant’s estimated payments for the prorated Tenant’s Share of Excess Operating Expenses and Excess Taxes for such calendar year exceeded the actual prorated Tenant’s Share of Excess Operating Expenses and Excess Taxes for such calendar year, Landlord shall include a refund for that amount along with the Landlord Statement (subject to offset in the event of a Default by Tenant hereunder). If Landlord’s Statement reveals that Tenant’s estimated payments for the prorated Tenant’s Share of Excess Operating Expenses and Excess Taxes for such calendar year were less than the actual prorated Tenant’s Share of Excess Operating Expenses and Excess Taxes for such calendar year, Tenant shall pay the shortfall to Landlord within thirty (30) days after the date of receipt of Landlord’s Statement.

(iii) If the Building is less than completely occupied throughout any calendar year of the Term (including the Tax Base Year and Operating Expense Base Year), then the actual Taxes and Operating Expenses (as well as the Base Year Tax Amount and the Base Year Expense Amount) which vary with occupancy levels in the Building (e.g. freight lift maintenance, elevator maintenance, management fees) shall be increased to the amount of Taxes and Operating Expenses which Landlord reasonably determines would have been incurred during that calendar year if the Building had been completely occupied throughout such calendar year. If the provisions of this subsection are applied in any calendar year, the Base Year Taxes and Base Year Expense Amount shall likewise be adjusted to reflect such level of occupancy.

(g) In addition to the monthly rental and other charges to be paid by Tenant under this Lease, Tenant shall pay Landlord for all of the following items (collectively, “Impositions”): (i) taxes, other than local, state, and federal personal or corporate income taxes measured by the net income of Landlord; (ii) assessments, including without limitation, all assessments for public improvements, services, or benefits, irrespective of when commenced or completed; (iii) excises; (iv) levies; (v) business taxes; (vi) license, permit, inspection, and other authorization fees; (vii) transit development fees; (viii) assessments or charges for housing funds; (ix) service payments in lieu of taxes and; (x) any other fees or charges that are levied, assessed, confirmed, or imposed by a public authority; provided, however, that Impositions shall not include amounts otherwise included in Operating Expenses or Taxes. Tenant is obligated to pay the foregoing Impositions only to the extent that such Impositions are (a) on, measured by, or reasonably attributable to, the cost or value of Tenant’s equipment, furniture, fixtures, and other personal property located in the Premises, or the cost or value of any leasehold improvements made to the Premises by or for Tenant, regardless of whether title to the improvements shall be in Tenant or Landlord; (b) based on or measured by the monthly rental or other charges payable under this Lease, including without limitation, any gross receipts tax levied by a municipality, the State of California, the Federal Government, or any other governmental body with respect to the receipt of the rental; (c) based on the development, possession, leasing, operation, management, maintenance, alteration, repair, use, or occupancy by

-9-

Tenant of the Premises or any portion of the Premises; or (d) on this transaction or any document to which Tenant is a party creating or transferring an interest or an estate in the Premises. If it is unlawful for Tenant to reimburse Landlord for the Impositions, but lawful to increase the monthly rental to take into account Landlord’s payment of the Impositions, the monthly rental payable to Landlord shall be revised to net Landlord the same net return without reimbursement of the Impositions as would have been received by Landlord with reimbursement of the Impositions.

(h) In addition to the monthly rental and other charges to be paid by Tenant under this Lease, Tenant shall pay Landlord all of those costs and expenses of every kind and nature whatsoever which Landlord shall incur in connection with providing various electricity and power services to the Premises (“Electricity Costs”) or any portion thereof with respect to each calendar year of the Term or portion thereof. The electricity and power provided to the Premises shall be separately metered. For purposes of clarity, it is agreed that Tenant shall pay the entirety of all Electricity Costs and not simply Tenant’s Share thereof.

(i) In addition to the monthly rental and other charges to be paid by Tenant under this Lease, Tenant shall pay Landlord all janitorial expenses incurred to clean the Premises (“Janitorial Expenses”). All janitorial services shall be performed by the janitorial service company designated by Landlord as providing services to the Building so long as such service is competitively priced and is of a quality reasonably acceptable to Tenant, except that the janitorial service company shall bill Tenant directly for Janitorial Expenses incurred with respect to the Premises. Notwithstanding the foregoing, Tenant shall have the right to hire a Tenant’s Janitor (defined below) to provide janitorial service for the clean room within the Premises at Tenant’s sole cost and expense. For purposes of clarity, it is agreed that Tenant shall pay the entirety of all Janitorial Expenses and not simply Tenant’s Share thereof. If Tenant objects to cost or identity of the Landlord’s janitorial service, Tenant may contract with its own janitorial service (a “Tenant’s Janitor”) to provide janitorial service for the Premises provided that: (i) the identity of Tenant’s Janitor is reasonably acceptable to Landlord and shall provide insurance in favor of Landlord comparable to the other janitorial service providers in the Building, (ii) Tenant shall enter into any contract for such services in its name directly with Tenant’s Janitor and Landlord shall have no liability therefor; (iii) Tenant shall pay any and all costs of Tenant’s Janitor; and (iv) Tenant’s Janitor shall agree to perform a scope of janitorial services consistent with those required for first class building (as reasonably approved by Landlord) in advance of executing the janitorial service contract. In such an event, Tenant’s indemnity under Section 30 shall extend to the acts and omissions of the Tenant’s Janitor.

8. Late Charge. Other remedies for non-payment of Rent notwithstanding, if any monthly installment of Base Rent or Additional Rent is not received by Landlord on or before the date due, or if any payment due Landlord by Tenant which does not have a scheduled due date is not received by Landlord on or before the tenth (10th) day following the date Tenant was invoiced, a late charge of five percent (5%) of such past due amount shall be immediately due and payable as Additional Rent and interest shall accrue on all delinquent amounts from the date past due until paid at the lower of a rate of ten percent (10%) per annum from the date such payment is due until paid, or the highest rate permitted by applicable law. Notwithstanding the foregoing, Tenant shall be entitled to one (1) notice of nonpayment and five (5)-day cure period for each calendar year before any such late charges shall accrue.

-10-

9. Partial Payment. No payment by Tenant or acceptance by Landlord of an amount less than the Rent herein stipulated shall be deemed a waiver of any other Rent due. No partial payment or endorsement on any check or any letter accompanying such payment of Rent shall be deemed an accord and satisfaction, but Landlord may accept such payment without prejudice to Landlord’s right to collect the balance of any Rent due under the terms of this Lease or any late charge assessed against Tenant hereunder.

10. Security Deposit.

(a) Within ten (10) business days of the Lease Date, Tenant shall pay Landlord the amount identified as the Security Deposit in the Basic Lease Provisions (hereinafter referred to as “Security Deposit”) as evidence of good faith on the part of Tenant in the fulfillment of the terms of this Lease, which shall be held by the Landlord during the Term of this Lease, or any renewal thereof. Under no circumstances will Tenant be entitled to any interest on the Security Deposit.

(b) Provided no Default shall be then continuing and further provided that Tenant shall not have previously defaulted on the payment of Base Rent (beyond any applicable grace period) more than once per each calendar year: (i) the Security Deposit shall be reduced to the amount of $908,286.95 on and as of the first day of the third Lease Year; (ii) the Security Deposit shall be reduced to the amount of $726,629.56 on and as of the first day of the fourth Lease Year; and (iii) the Security Deposit shall be reduced to the amount of $544,972.17 on and as of the first day of the fifth Lease Year and such amount shall not be further reduced for the balance of the Term. If Landlord shall be required to so reduce the Security Deposit as provided above, then Landlord shall return any cash portion of the Security Deposit then held by Landlord in excess of such amount or (if a Letter of Credit shall serve as the Security Deposit pursuant to Section 11), then Landlord shall reasonably cooperate with Tenant (at no cost to Landlord) in Tenant’s efforts to have the Letter of Credit amended or replaced to reflect the amount of the then required Security Deposit amount.

(c) The Security Deposit may be used by Landlord, at its discretion, (i) to apply to any amount owing to Landlord hereunder then in Default, (ii) to perform any obligation of the Tenant hereunder which is not timely performed by Tenant after the expiration of applicable notice and cure periods; or (iii) to pay the expenses of repairing any damage to the Premises caused by Tenant, except natural wear and tear occurring from normal use of the Premises and except damage from casualty or condemnation, which exists on the day Tenant vacates the Premises, but this right shall not be construed to limit Landlord’s right to recover additional sums from Tenant for damages to the Premises.

(d) If Landlord applies all or any portion of the Security Deposit to the performance of Tenant’s obligations hereunder upon a Default by Tenant hereunder, Tenant shall, upon ten (10) days’ notice thereof, pay such sums to Landlord as were applied by Landlord and reestablish the Security Deposit in the amount set forth in the Basic Lease Provisions. If there are no payments to be made from the Security Deposit as set out in this paragraph, or if there is any balance of the Security Deposit remaining after all payments have been made, the Security Deposit, or such balance thereof remaining, will be refunded to the Tenant within thirty days after the expiration or earlier termination of this Lease.

-11-

(e) Tenant hereby waives the benefit of the provisions of California Civil Code Section 1950.7. In no event shall Tenant be entitled to apply the Security Deposit to any Rent due hereunder. In the event of an act of bankruptcy by or insolvency of Tenant, or the appointment of a receiver for Tenant or a general assignment for the benefit of Tenant’s creditors, then the Security Deposit shall be deemed immediately assigned to Landlord. The right to retain the Security Deposit shall be in addition and not alternative to Landlord’s other remedies under this Lease or as may be provided by law and shall not be affected by summary proceedings or other proceedings to recover possession of the Premises. Upon sale or conveyance of the Building, Landlord shall transfer or assign the Security Deposit to the successor Landlord, and upon such transfer all liability of the transferring Landlord for the Security Deposit shall terminate. Landlord shall be entitled to commingle the Security Deposit with its other funds.

11. Letter of Credit. In lieu of the cash deposit described in Section 10 of the Lease, Tenant may, upon signing this Lease (or at any time thereafter to replace the cash deposit), deliver or cause to be delivered to Landlord an irrevocable and unconditional letter of credit (the “Letter of Credit”) governed by the Uniform Customs and Practice for Documentary Credits (1993 revisions), International Chamber of Commerce Publication No. 500, as revised from time to time, in the amount of the security deposit, issued to Landlord, as beneficiary, in form and substance satisfactory to Landlord, by a bank (an “Approved Bank”) approved by Landlord qualified to transact banking business in California with an office in either the City and County of San Francisco or the County of Santa Clara at which drafts drawn on the Letter of Credit may be presented for payment. The full amount of the Letter of Credit shall be available to Landlord upon presentation of Landlord’s sight draft accompanied only by the Letter of Credit and Landlord’s signed statement that Landlord is entitled to draw on the Letter of Credit pursuant to this Lease. Tenant shall maintain the Letter of Credit throughout the duration of the Term of this Lease and the right to draw thereunder shall be transferred or assigned by Landlord to any successor Landlord under this Lease. Tenant shall pay any fees related to the issuance, amendment or transfer of the Letter of Credit, including without limitation, any transfer fees. The Letter of Credit shall also provide that it shall be deemed automatically renewed, without amendment, for consecutive periods of one (1) year each during the term of this Lease (plus a period of thirty (30) days after the Expiration Date), unless the Approved Bank sends written notice (“Issuer Notice”) to Landlord by any method specified in Section 33 of this Lease, not less than sixty (60) days next preceding the then expiration date of the Letter of Credit that it elects not to have such Letter of Credit renewed. If Landlord receives an Issuer Notice, and not later than thirty (30) days prior to the expiry date of the Letter of Credit Tenant fails to furnish Landlord with a replacement Letter of Credit pursuant to the terms and conditions of this Section 11, then Landlord shall have the right to draw the full amount of the Letter of Credit, by sight draft, and shall hold the proceeds of the Letter of Credit as a cash Security Deposit pursuant to the terms and conditions of Section 10 of this Lease.

C. Use/Laws/Rules.

12. Use of Premises.

(a) Tenant may use and occupy the Premises for pilot manufacturing, general office purposes, research and development, shipping, receiving and distribution (the “Permitted Use”) and for no other purpose. Notwithstanding the foregoing, the Premises shall not be used for

-12-

any illegal purpose, nor in violation of any valid regulation of any governmental body, nor in any manner to create any nuisance or trespass (including vibration, emissions or noise from pilot manufacturing equipment that affect any area outside of the Premises), nor in any manner which will void the insurance. Further, if the Permitted Use shall result in an increase the rate of insurance on the Premises or the Building, such shall be paid for solely by Tenant.

(b) Tenant shall not cause or permit the receipt, storage, use, location or handling on the Property (including the Building and Premises) of any product, material or merchandise which is explosive, highly inflammable, or a “hazardous or toxic material,” as that term is hereafter defined, except to the extent: (i) such is reasonably required for the Permitted Use at the Premises; (ii) Tenant provides Landlord with prior written notice of its intention to bring hazardous or toxic materials upon the Premises; (iii) Landlord approves such hazardous or toxic materials in writing (which may be granted or withheld in Landlord’s sole discretion and which may be subject to such controls as Landlord may reasonably impose with respect thereto); and (iv) in all event Tenant’s activities with respect to such hazardous or toxic materials must in all events be at all times in compliance with applicable laws, ordinances and regulations. “Hazardous or toxic material” shall include all materials or substances which have been determined to be hazardous to health or the environment and are regulated or subject to all applicable laws, rules and regulations from time to time, including, without limitation hazardous waste (as defined in the Resource Conservation and Recovery Act); hazardous substances (as defined in the Comprehensive Emergency Response, Compensation and Liability Act, as amended by the Superfund Amendments and Reauthorization Act); gasoline or any other petroleum product or by-product or other hydrocarbon derivative; toxic substances, (as defined by the Toxic Substances Control Act); insecticides, fungicides or rodenticide, (as defined in the Federal Insecticide, Fungicide, and Rodenticide Act); mold, asbestos and radon and substances determined to be hazardous under the Occupational Safety and Health Act or regulations promulgated thereunder. Notwithstanding the foregoing, Tenant shall not be in breach of this provision as a result of the presence in the Premises of minor amounts of hazardous or toxic materials which are in compliance with all applicable laws, ordinances and regulations and are either customarily present in a general office use (e.g., copying machine chemicals and kitchen cleansers).

(c) Notwithstanding subsection (b) above, Tenant shall be permitted to store and use small quantities of hazardous or toxic materials required for Tenant’s business operations including, without limitation, adhesives, decontaminants, isopropyl alcohol, non-toxic petroleum products (such as plastic resins) and the like (collectively “Operational Substances”), subject to the following: (i) the use and storage of all Operational Substances shall be in all events be at all times in compliance with applicable laws, ordinances and regulations; (ii) Tenant shall store amounts of Operational Substances only in such reasonable quantities as may be necessary for its Permitted Use; and (iii) Tenant shall provide Landlord with a detailed list of all Operational Substances located with this Premises (and the approximate quantities thereof) upon demand from Landlord.

(d) Without limiting in any way Tenant’s obligations under any other provision of this Lease, Tenant and its successors and assigns shall indemnify, protect, defend (with counsel reasonably satisfactory to Landlord) and hold Landlord, its property manager, partners, officers, directors, shareholders, employees, agents, attorneys, lenders, contractors and each of their respective successors and assigns (the “Indemnified Parties”) harmless from any and all claims, damages, liabilities, losses, costs and expenses of any nature whatsoever, known or unknown,

-13-

contingent or otherwise (including, without limitation, reasonable attorneys’ fees, litigation, arbitration and administrative proceedings costs, expert and consultant fees and laboratory costs, as well as damages arising out of the diminution in the value of the Premises or any portion thereof, damages for the loss of the Premises, damages arising from any adverse impact on the marketing of space in the Premises, and sums paid in settlement of claims), which arise during or after the Term in whole or in part as a result of the presence or suspected presence of any hazardous or toxic materials (including Operational Substances), in, on, under, from or about the Premises due to Tenant’s acts or omissions, on or about the Premises, unless such claims, damages, liabilities, losses, costs and expenses arise out of or are caused by the negligence or willful misconduct of any of the Indemnified Parties.

(e) Except as set forth in the environmental reports delivered to Tenant set forth in Exhibit “G”, which collectively describe a condition (the “Existing Condition”) which resulted in the installation of the System (as defined in Section 66 herein), to the best knowledge of Landlord: (i) no hazardous or toxic material is present in the Premises, the Building or at the Project or the soil, surface water or groundwater thereof, (ii) no underground storage tanks are present on the Project, and (iii) no action, proceeding or claim is pending or threatened regarding the Building or the Project concerning any hazardous or toxic material or pursuant to any applicable Legal Requirements.

(f) Subject to all of the provisions of this Lease, and Landlord’s right to temporarily restrict access from time to time for health and safety purposes, Tenant shall have access to the Premises, the Building and the parking facilities 24 hours per day, 7 days per week, 52 weeks per year.

(g) Under no circumstance shall Tenant be liable for, and Landlord shall indemnify, defend, protect and hold harmless Tenant, its agents, contractors, shareholders, directors, successors, representatives, and assigns from and against, all losses, costs, claims, liabilities and damages, including without limitation, attorneys’ fees and costs, arising out of or in connection with any hazardous or toxic material present at any time in, on or about the Building, the Project, or the soil, air, improvements, groundwater or surface water thereof, or the violation of any applicable Legal Requirements, except to the extent that any of the foregoing actually results from hazardous or toxic material released by Tenant or brought onto the Premises, the Building or the Project by Tenant, its subtenants or their agents or employees (including Operational Substances).

13. Compliance with Laws.

(a) Tenant shall operate within the Premises and the Building in compliance with all applicable federal, state, and municipal laws, ordinances and regulations (including, without limitation, the Americans with Disabilities Act) (collectively “Legal Requirements”) applicable to Tenant’s use or occupancy of, or business conducted in, the Premises, and shall maintain the Premises and all portions thereof in compliance with all applicable Legal Requirements. Tenant shall not knowingly, directly or indirectly, make any use of the Premises or the Building which is prohibited by any such Legal Requirements. Landlord makes no representation or warranty that the Permitted Use is permitted under such Legal Requirements.

-14-

(b) Notwithstanding the foregoing in subsection (a), Tenant shall not be responsible for making any capital improvements to the Premises except to the extent such changes are necessitated by (i) Tenant’s unique or particular manner of use or occupancy of, or business conducted in, the Premises, (ii) any alterations installed or conditions created by Tenant or Tenant’s employees, agents, contractors, licensees, invitees, officers, directors or members, or (iii) any event of Default by Tenant. In the event that Tenant is responsible for making structural changes to the Premises as a result any of the scenarios set forth in items (i), (ii) or (iii) above, Tenant shall (after obtaining Landlord’s approval of the plans therefor) perform such structural changes at its sole expense, or, at Landlord’s election, Landlord may perform such structural changes at Tenant’s expense. The judgment of any court of competent jurisdiction, or the admission of Tenant in any action or proceeding involving Tenant, whether or not Landlord is party thereto, that Tenant is in non-compliance with any Legal Requirement shall be conclusive of that fact.

14. Waste Disposal.

(a) All normal trash and waste (i.e., waste that does not require special handling pursuant to subparagraph (b) below) shall be disposed of through the janitorial service and paid for by Tenant as part of the Janitorial Expenses.

(b) Tenant shall be responsible for the removal and disposal of any waste generated or released by Tenant which is deemed by any governmental authority having jurisdiction over the matter to be hazardous or infectious waste or waste requiring special handling, such removal and disposal to be in accordance with any and all applicable governmental rules, regulations, codes, orders or requirements. Tenant agrees to separate and mark appropriately all waste to be removed and disposed of through the janitorial service pursuant to (a) above and hazardous, infectious or special waste generated or released by Tenant to be removed and disposed of by Tenant pursuant to this subparagraph (b). Tenant hereby indemnifies and holds harmless Landlord from and against any loss, claims, demands, damage or injury Landlord may suffer or sustain as a result of Tenant’s failure to comply with the provisions of this subparagraph (b).

15. Rules and Regulations. The rules and regulations in regard to the Building, a copy of which is attached hereto as Exhibit “F,” and all reasonable rules and regulations and modifications thereto which Landlord may hereafter from time to time adopt and promulgate after notice thereof to Tenant, for the government and management of the Building, are hereby made a part of this Lease and shall during the Term be observed and performed by Tenant, its agents, employees and invitees. Landlord shall apply such rules and regulations in a nondiscriminatory manner.

D. Services/Tenant Buildout.

16. Services.

(a) The normal business hours of the Building shall be from 7:00 A. M. to 6:00 P.M. on Monday through Friday, and at such other hours and times as determined by Landlord to be required for the majority of the occupants of the Building, exclusive of Building holidays as reasonably designated by Landlord (“Building Holidays”). Initially and until further notice by

-15-

Landlord to Tenant, the Building Holidays shall be: New Year’s Day, Memorial Day, Independence Day, Labor Day, Thanksgiving (and the day after Thanksgiving) and Christmas. Landlord shall furnish the following services during the normal business hours of the Building except as noted:

(i) Elevator service for passenger needs at all times, and for delivery needs during normal business hours;

(ii) Condenser water for Tenant’s air conditioning in amounts reasonably adequate to cool the Premises, in accordance with the regulations of governmental authorities having jurisdiction over the Building;

(iii) Hot and cold running water for all restrooms and lavatories and tepid water for office kitchens/pantries;

(iv) Soap, paper towels, and toilet tissue for public restrooms;

(v) Janitorial service Monday through Friday, in keeping with the standards generally maintained in similar office buildings in the city where the Building is located;

(vi) Custodial, electrical and mechanical maintenance services in the Building;

(vii) Electric power for lighting and outlets in amounts normally and customarily provided by Landlord to general office users of the Building (Landlord shall furnish and Tenant shall pay for any electrical service installed as a component of the Landlord’s Work or Tenant Improvement Work in excess of such amount to the extent permitted by the Premises’ electrical capacity, including without limitation for that electricity used and separately metered in connection with Tenant’s server room, if any);

(viii) Replacement of Building standard lamps and ballasts as needed from time to time;

(ix) Repairs and maintenance as described in Section 23 of this Lease;

(x) General Building management, including supervision, inspections, recordkeeping, accounting, leasing and related management functions;

(xi) As of the Commencement Date and throughout the Term, a shuttle service between the Building, BART and Caltrain. Such shuttle service shall be provided in a manner reasonably determined by Landlord (and free of charge to Tenant’s employees but includable as an Operating Expense) and shall provide not less than five (5) round trips between the Building and Caltrain and between the Building and the Civic Center BART station between the hours of 7:00 a.m. and 10:00 a.m. and five (5) such round trips (to each destination) between the hours of 4:00 p.m. and 7:00 p.m. every day, Monday through Friday. Such service provided by Landlord shall not preclude Tenant from arranging its own separate service for Tenant’s employees at Tenant’s sole expense provided such does not interfere with the Landlord’s shuttle service to be provided above;

-16-

(xii) 24/7 onsite security to the Building. Such security shall be provided in a manner reasonably determined by Landlord, including a card key system at the entrance to the Building;

(xiii) Bike storage for Tenant’s non-exclusive use in the garage or other location in the Building as determined by Landlord from time to time; provided, however, that Landlord shall not be responsible for any loss or damage to the bikes. Tenant acknowledges that approximately thirty (30) bike stalls currently exist in the garage. Tenant shall be permitted to bring bikes in the Premises as a convenience to their employees who bike to the Premises;

(xiv) Subject to subsection (b)(iii) below, use of the freight lift (the “Freight Lift”) in the Building which shall comply with the following: (A) minimum door opening size (at the street level and lower floors) of 54 inches wide; (B) minimum lift size of 54 inches wide, 54 inches deep and 8 feet high; (C) a minimum load capacity of 1,000 pounds.

(b) In addition to the services outlined in subsection (a) above, Landlord and Tenant agree as follows:

(i) Tenant shall have the nonexclusive use of the dock area of the Building (the “Loading Dock”). Landlord shall provide a power supply to the street level dock area for the charging of Tenant’s pallet jack, which pallet jack may be stored within such dock area at Tenant’s sole risk, but without any separate change for such storage.

(ii) Tenant shall have the nonexclusive use of a portion of the lower floor freight vestibule consisting of approximately 400 square feet.

(iii) To the extent approved by Landlord in the Working Drawings in connection with the Tenant Improvement Work or thereafter approved as an alteration pursuant to Section 25 of this Lease, Tenant shall have the right to the nonexclusive use of the vertical shafts and risers of the Building as necessary for the operation of Tenant’s equipment and systems.

(iv) Tenant’s use of the Freight Lift and Loading Dock shall be nonexclusive, but subject to the terms of this subsection. Tenant may freely use the Freight Lift and Loading Dock without any need to coordinate such use with Landlord. Except for the Priority Time (defined below), Tenant’s use of the Freight Lift and Loading Dock shall be in common with all other tenants of the Building (including delivery services to other tenants). Other tenants of the Building shall be required to coordinate use of the Freight Lift and Loading Dock through Landlord and shall be requested to provide at least 24 hours’ notice of such required use, other than customary delivery services that will be entitled to utilize the Freight Lift and Loading Dock subject to this subsection. Landlord shall coordinate the use of the Freight Lift and Loading Dock by the other tenants through its on-site security. Absent exigent circumstances, Landlord shall not allow other tenants of the Building to use the Freight Lift and Loading Dock between the hours of 1:00 p.m. and 4:00 p.m. Monday through Friday (the “Priority Time”) and Tenant shall have the first right to use of the Freight Lift and Loading Dock during the Priority Time; provided, however if Tenant is not using the Freight Lift during the Priority Time, Landlord may allow the use thereof by: (A) customary delivery services wishing to make deliveries to other tenants of the Building; or (B) other tenants of the Building if such is first coordinated by Landlord with Tenant.

-17-

(c) Landlord shall have no obligation to provide services in excess of those provided herein. If Tenant uses services in an amount or for a period in excess of that provided for herein, then Landlord reserves the right to charge Tenant as Additional Rent hereunder a reasonable sum as reimbursement for the direct cost of such added services, and to charge Tenant for the cost of any additional equipment or facilities or modifications thereto which are necessary to provide the additional services and/or to discontinue providing such excess services to Tenant.

(d) Landlord shall not be liable for any damages directly or indirectly resulting from the interruption in any of the services described above, nor shall any such interruption entitle Tenant to any abatement of Rent or any right to terminate this Lease. Landlord shall use all reasonable efforts to furnish uninterrupted services as required above. Notwithstanding the foregoing, in the event that any interruption or discontinuance of services provided pursuant to this Section 16 was within the reasonable control of Landlord to prevent and such interruption or discontinuance continues beyond seven (7) days after written notice to Landlord and materially and adversely affects Tenant’s ability to conduct business in the Premises, or any portion thereof, and on account of such interruption or disturbance Tenant ceases doing business in the Premises or the applicable portion thereof, Base Rent and Additional Rent shall thereafter abate proportionately for so long as Tenant remains unable to conduct its business in the Premises or such portion thereof. To the extent within Landlord’s reasonable control, Landlord agrees to use reasonable efforts to restore such interrupted or discontinued service as soon as reasonably practicable.

(e) If Tenant shall use heat-generating machines, machines other than normal fractional horsepower office machines, or equipment or lighting other than Building standard lights in the Premises, which affect the temperature otherwise maintained by the air conditioning system or increase the water normally furnished for the Premises by Landlord pursuant to the terms of this Lease, Landlord shall have the right to install supplementary air conditioning units or other facilities in the Premises, including supplementary or additional metering devices, and the cost thereof, including the cost of installation, operation and maintenance, increased wear and tear on existing equipment and other similar charges, shall be paid by Tenant to Landlord upon billing by Landlord. If Tenant uses water, electricity, heat or air conditioning in excess of that supplied by Landlord pursuant to this Lease, Tenant shall pay to Landlord, upon billing, the cost of such excess consumption, the cost of the installation, operation, and maintenance of equipment which is installed in order to supply such excess consumption, and the cost of the increased wear and tear on existing equipment caused by such excess consumption; and Landlord may install devices to separately meter any increased use and in such event Tenant shall pay the increased cost directly to Landlord, on demand, at the rates charged by the public utility company furnishing the same, including the cost of such additional metering devices. Tenant’s use of electricity shall never exceed the capacity of the feeders to the Building or the risers or wiring installation. If Tenant desires to use heat, ventilation or air conditioning during hours other than those for which Landlord is obligated to supply such utilities pursuant to the terms of this Lease, Tenant shall give Landlord such prior notice, if any, as Landlord shall from time to time establish as appropriate, of Tenant’s desired use in order to supply such utilities, and Landlord shall supply such utilities to Tenant at such hourly cost to Tenant (which shall be treated as Additional Rent) as Landlord shall from time to time reasonably establish as being Landlord’s estimate of the actual cost thereof.

-18-

17. Telecommunications and Data Equipment. Landlord shall have no responsibility for providing to Tenant any telecommunications equipment, including wiring, within the Premises or for providing telecommunications service or connections from the utility to the Premises, except as required by law. Tenant shall not alter, modify, add to or disturb any telecommunications or data wiring in the Premises or elsewhere in the Building without the Landlord’s prior written consent, which consent shall not be unreasonably withheld, conditioned or delayed. Tenant shall be liable to Landlord for any damage to the telecommunications or data wiring in the Building due to the act, negligent or otherwise, of Tenant or any employee, contractor or other agent of Tenant. Tenant shall have access to the telecommunications closets within the Building in the manner and under procedures reasonably established by Landlord. Tenant shall promptly notify Landlord of any actual or suspected failure of telecommunications or data service to the Premises. All costs incurred by Landlord for the installation, maintenance, repair and replacement of telecommunications wiring within the Building shall be an Operating Expense unless Landlord is reimbursed for such costs by other tenants of the Building. Landlord shall not be liable to Tenant and Tenant waives all claims against Landlord whatsoever, whether for personal injury, property damage, loss of use of the Premises, or otherwise, due to the interruption or failure of telecommunications services to the Premises. Tenant hereby agrees to hold Landlord harmless and agrees to indemnify, protect and defend Landlord from and against any liability for any damage, loss or expense to Tenant due to any failure or interruption of telecommunications or data service to the Premises for any reason.

18. Signs. As part of the Landlord’s Work described on Exhibit “C”, a Building standard suite entry sign shall be installed on the door to the Premises or adjacent to the entry to the Premises and Landlord shall also provide Building standard directory signage for Tenant. Otherwise, Tenant shall not paint or place any signs, placards, or other advertisements of any character upon the windows or inside walls of the Premises (except with the prior consent of Landlord, which consent may be withheld by Landlord in its absolute discretion). Tenant shall place no signs upon the outside walls, Common Areas or the roof of the Building.

19. Parking. No rights to specific parking spaces are granted under this Lease; however, subject to Landlord’s rights pursuant to this Section 19, Tenant shall be entitled to use up to the total number of parking spaces set forth in the Basic Lease Provisions in the parking facilities located on the Property. All parking spaces provided to Tenant shall be unreserved and are to be used by Tenant, its employees and invitees in common with the other tenants of the Building and their employees and invitees. Landlord reserves the right to build improvements upon, reduce the size of, relocate, reconfigure, and/or make alterations or additions to such parking facilities at any time (including the elimination of certain spaces); provided in all instances that Tenant shall have the use of the required number of spaces provided by this Lease. The use of the parking spaces is provided by Landlord to Tenant at the published rates charged by Landlord to third parties from time to time. Landlord’s current published rate is currently $225.00 per parking space. Such payments for parking shall be considered Additional Rent. Tenant shall have the right to reduce the number of parking spaces by giving Landlord thirty days prior written notice in which event the number of spaces set forth in Section 11 of the Basic Lease Provisions shall be automatically surrendered by Tenant and reduced to the number of spaces set forth in such notice. In such an event, Landlord may be free to

-19-