Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - Invuity, Inc. | ivty-20171231ex32186e624.htm |

| EX-31.2 - EX-31.2 - Invuity, Inc. | ivty-20171231ex31234ab13.htm |

| EX-31.1 - EX-31.1 - Invuity, Inc. | ivty-20171231ex311ac9356.htm |

| EX-23.1 - EX-23.1 - Invuity, Inc. | ivty-20171231ex2317163fc.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

FOR THE TRANSITION PERIOD FROM ________________ TO ________________

Commission File Number 001-37417

Invuity, Inc.

(Exact name of Registrant as specified in its Charter)

|

Delaware (State or other jurisdiction of incorporation or organization) |

04-3803169 (I.R.S. Employer Identification No.) |

|

|

|

|

444 De Haro Street San Francisco, CA (Address of principal executive offices) |

94107 (Zip Code) |

Registrant’s telephone number, including area code: (415) 665-2100

Securities registered pursuant to Section 12(b) of the Act: Common Stock, par value $0.001 per share; Common Stock traded on the NASDAQ Stock Market

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☐ NO ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ☒ NO ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

x |

|

|

|

|

|

Large accelerated filer |

☐ |

|

Accelerated filer |

☒ |

|

|

|

|

|

|

|

Non-accelerated filer |

☐ |

(Do not check if a small reporting company) |

Small reporting company |

☐ |

|

|

|

|

|

|

|

|

|

|

Emerging growth company |

☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ☐ NO ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, based on the closing price of a share of common stock on June 30, 2017 (the last business day of the registrant’s most recently completed second fiscal quarter) as reported by the NASDAQ Stock Market on such date was $119,135,219.

The number of shares of registrant’s Common Stock outstanding as of February 28, 2018 was 17,204,000.

Portions of the registrant’s Definitive Proxy Statement relating to the Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10K where indicated. Such Definitive Proxy Statement will be filed with the Securities and Exchange Commission within 120 days after the end of the registrant’s fiscal year ended December 31, 2017.

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which statements involve substantial risks and uncertainties. Some of the statements under the captions “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business” and elsewhere in this Annual Report on Form 10-K are forward-looking statements. These statements are based on our current expectations, assumptions, estimates and projections about our business and our industry and involve known and unknown risks, uncertainties and other factors that may cause our company’s or our industry’s results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied in, or contemplated by, the forward-looking statements. Words such as “believe,” “anticipate,” “expect,” “intend,” “plan,” “focus,” “assume,” “goal,” “objective,” “will,” “may” “should,” “would,” “could,” “estimate,” “predict,” “potential,” “continue,” “encouraging” or the negative of such terms or other similar expressions identify forward-looking statements. Our actual results and the timing of events may differ significantly from the results discussed in the forward-looking statements. Factors that might cause such a difference include those discussed in Item 1A. “Risk Factors” as well as those discussed elsewhere in this Annual Report on Form 10-K. These and many other factors could affect our future financial and operating results. We undertake no obligation to update any forward-looking statement to reflect events after the date of this report.

Unless the context otherwise requires, references to “Invuity,” “we,” “us,” “our” or “the Company” in this Annual Report on Form 10-K refer to Invuity, Inc.

Overview of Our Company

We are a leading medical technology company focused on developing and marketing advanced surgical devices to improve the ability of physicians to perform minimal access surgery through smaller and hidden incisions. Our patented Intelligent Photonics® technology delivers enhanced visualization which facilitates surgical precision, efficiency and safety. In addition, we utilize comprehensive strategic marketing programs to create stronger institutional partnerships. Clinical applications include women's health, encompassing breast cancer and breast reconstruction surgery, gynecology and thyroid surgery. Additional applications include procedures for electrophysiology, spine, orthopedic, cardiothoracic, and general surgery.

We channel our development through two broad categories of innovation. First, we integrate our Intelligent Photonics® technology platform into our single-use and reusable advanced surgical devices to address some of the critical intracavity illumination and visualization challenges facing surgeons today. We utilize this proprietary technology to develop optical waveguides that direct and shape thermally cool, brilliant light into broad, uniform and volumetric illumination of the surgical target. We believe that improving a surgeon’s ability to see critical anatomical structures can lead to better clinical and aesthetic outcomes, improved patient safety and reduced surgical time and healthcare costs.

Our second broad category of innovations for minimally invasive and minimal access surgical procedures is in the development and commercialization of a novel advanced energy platform. In September 2016, we received U.S. Food and Drug Administration, or FDA, 510(k) clearance of PhotonBlade® , a dynamic precision illuminator with enhanced energy delivery. PhotonBlade® is a first-of-its-kind device, delivering directed, thermally cool illumination at the precise point of surgical treatment in conjunction with a novel advanced energy platform allowing for precise tissue cutting and coagulation with minimal tissue damage. As such, PhotonBlade® represents a new category of Intelligent Photonics® and strategically expands our current product portfolio. After a preliminary market launch in March 2017, we fully launched the PhotonBlade® in September 2017.

Finally, in the third quarter of 2017, through a distribution arrangement with our manufacturing partner, Fluoptics Imaging Inc., we began a limited market launch of a fluorescence imaging system, called PhotonVue, which is used for the visual assessment of blood flow in adults as an adjunctive method for the evaluation of tissue perfusion

2

We sold our devices to approximately 870 hospitals in the fourth quarter of 2017, as compared to approximately 745 hospitals in the fourth quarter of 2016. Based on the number of single-use units we have shipped as of December 31, 2017, we estimate that our devices have been used in approximately 367,000 surgical procedures. We are also using our advanced photonics technology to develop new devices and modalities to broaden the application and adoption of minimal access procedures and enable new advanced surgical techniques.

Recent Developments

On February 27, 2018, Philip Sawyer informed the board of directors that he will resign from his role as President, Chief Executive Officer, and a member of our board of directors, effective as of February 28, 2018. Scott Flora, currently serving as a member of our board of directors, assumed the additional role of Interim President and Chief Executive Officer, and as such became the Company’s principal executive officer effective on March 1, 2018.

Illumination and Visualization

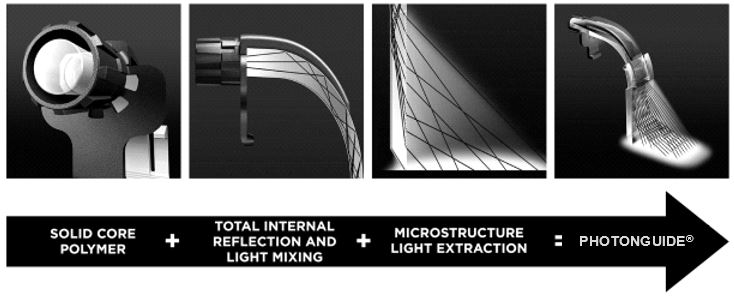

Photonics is the science and technological applications of light. We have applied advanced principles of photonics to develop our Intelligent Photonics® technology platform, which enables the transmission, management and manipulation of light in surgical procedures. Our initial application of this technology is integrated into our family of proprietary optical waveguides, which we call Photonguides. Photonguides are sophisticated devices that rely on the principles of optics to shape and direct light. They are coupled to a modified fiber optic cable and are designed to work with the standard xenon or light-emitting diode, or LED, light sources typically found and utilized in the operating room. Photonguides are incorporated into surgical devices, including our customized line of illuminated surgical retractors, handheld illuminated aspiration devices, drop-in intracavity illuminators and, most recently, PhotonBlade®. Our handheld illuminated aspiration devices, drop-in intracavity illuminator, and PhotonBlade® are single-use products. Our retractors are reusable, but utilize a single-use optical Photonguide with each procedure.

The fundamental attributes of Photonguides include a solid core optical-grade polymer, total internal reflection of light waves, light mixing and extraction by a complex geometry of refractive microstructures or microlenses. The solid core optical-grade polymer Photonguide is coupled to a fiber optic cable in order to facilitate the efficient transfer of light. This unique coupling results in Photonguides capturing maximum light with minimal heat build-up. Photonguides use critical angles and the properties of total internal reflection to retain and transmit maximum light as it travels through the device. In addition, each Photonguide utilizes various novel optical methods to mix light during the total internal reflection transmission process to enable more uniform light extraction across its output surface. The output surface consists of a complex geometry of refractive microstructures or microlenses that extract, direct and shape volumetric illumination into the surgical cavity while virtually eliminating shadows and glare. This complex geometric structure extracts and directs light at numerous different angles to enable illumination of the surgical target, even if blood or debris accumulates on the surface of the Photonguide. The uniform distribution of light extraction from the microstructures or microlenses throughout the entire output surface of the Photonguide, as well as the proprietary solid core optical-grade polymer and patented design of Photonguides, results in thermally cool illumination.

Advances in medical technology have resulted in growing adoption of minimally invasive and minimal access surgical procedures. Minimally invasive surgery refers to surgeries performed through one or more small incisions, which offer several benefits over traditional invasive open surgery, such as fewer surgical target complications and infections, overall reduced trauma to the anatomy, less bleeding, shorter hospitalization time, less postoperative pain, faster recovery time and improved aesthetic outcomes. Some minimally invasive procedures, such as endoscopic, laparoscopic and arthroscopic procedures, use small tubes, tiny cameras and surgical instruments to access, visualize and perform the surgery. Other procedures also use smaller incisions than conventional open surgery, but still provide the surgeon with direct visualization of the surgical target and the ability to use traditional surgical instruments. We refer to these procedures as minimal access procedures. We estimate that approximately 40% of all surgical procedures in the United States are open or minimal access, representing a sizable clinical and commercial opportunity. We are targeting our sales and marketing efforts to surgeons for the following women’s health clinical applications: breast cancer and breast reconstruction surgery, gynecology and thyroid surgery. Additional applications include procedures for electrophysiology, spine, orthopedic, cardiothoracic, and general surgery. Furthermore, our current illuminated surgical devices have a broader indication for use and can be marketed to other specialties with limited or no additional regulatory clearance. We currently estimate the annual total addressable market for our devices in these surgical specialties in the United States to be approximately $2.0 billion, based on the estimate of our average revenue per procedure.

3

In the last several years, we have transitioned from a focus on research and development to the commercialization of our device portfolio. As of December 31, 2017, we market six categories of illuminated surgical devices, consisting of over 40 devices. Our goal is to develop advanced surgical devices to improve the ability of physicians to perform minimal access surgery through smaller and hidden incisions. The company's patented Intelligent Photonics™ technology delivers enhanced visualization, which facilitates surgical precision, efficiency and safety. We market and sell our devices in the United States primarily through a direct sales force, which has changed from 67 representatives as of December 31, 2016 to 58 representatives as of December 31, 2017. Throughout the year, we have continued to work on optimizing the sales force, and we believe that a sales force in the low 60s strikes the right balance between sales force investment and revenue growth.

In June 2017, we initiated commercial activity in Japan, our first market outside of the U.S. We partnered with MC Medical, a division of Mitsubishi Corp., for distribution. MC Medical is an established entity in the Japanese surgical market and is involved in multiple specialties that pertain to the Invuity portfolio of products.

Traditional Illumination Devices and Their Limitations

Lighting is a critical element of every open surgical procedure. Traditional surgical lighting options in the operating room include overhead lighting systems, surgical headlights and on-field fiber optic lighting systems. The most common illumination method in the operating room setting today is overhead lighting systems. When used in open and minimal access procedures, overhead lighting systems can present numerous challenges. It can be difficult to maintain the required direct path of illumination given changes of patient and surgeon positioning. Adjustments to the lighting position may be required which may inconvenience the surgeon, disrupt the surgical flow, increase operating procedure time, and increase risk of contamination given that overhead lighting systems are not sterile. Moreover, overhead lighting systems may be inadequate for surgery in deeper cavities due to the creation of shadows and the inability of the light to reach the depth of the incision.

Surgical headlights overcome some of the shortcomings of overhead lighting systems by bringing the light source closer to the surgical cavity, eliminating shadows caused by the surgeons head, and reducing the need to adjust the overhead lighting system. Despite these benefits, we believe headlights still present limitations. Use of headlights can cause head, neck and shoulder fatigue from the prolonged improper posture during their use. Because the source of light is still above the surgical cavity, we believe the use of headlights can create shadows and glare caused by hands, instruments and anatomy, which may limit visualization in deep surgical cavities. Headlights can also generate considerable amounts of heat during use, which can further limit comfort and can cause burns if an operator accidently mishandles the device.

Due to the limitations of overhead lighting systems and surgical headlights, on-field fiber optic lighting systems have been developed in an effort to provide intracavity lighting of the surgical field. On-field fiber optic lighting systems consist of a fiber optic cable attached to a fiber optic retractor. While traditional on-field fiber optic lighting systems can be effective at bringing the light source closer to the surgical field, we believe they also have inherent limitations and risks. Traditional on-field fiber optic lighting systems represent a thermal hazard in the operating room, creating the risk of burns to patients, surgeons and hospital staff, and operating room fires. The light generated by the xenon or LED light source is extremely powerful and can create temperatures exceeding 100°C. Thermal heat builds up whenever light is obstructed. We believe another limitation of traditional on-field fiber optic lighting systems is the potential for hot spots and glare. The general light output shape emanating from a fiber optic cable that resembles a cone and is circular, with a common center around the mechanical axis of the fiber bundle. Since this bright, narrow outlet of light exits the fiber in a straight line in the direction and orientation of the fiber, the light may be reflected back in the same direction, and can create glare in the line of vision of the surgeon. In an attempt to minimize this glare, the surgeon may be required to constantly reposition the fiber optic retractor during the procedure.

Market Need for Advanced Intracavity Illumination and Visualization Devices

Given the limitations of traditional surgical lighting options in the operating room, we believe there is a significant opportunity to enhance intracavity illumination and visualization during open and minimal access procedures. In addition, we believe that an advanced illumination and visualization technology could broaden the application and adoption of less invasive surgical techniques.

4

Our Illumination and Visualization Solution

We utilize our Intelligent Photonics technology platform to develop surgical devices designed to overcome the significant limitations of traditional surgical lighting options in the operating room. Based on surgeon feedback, surgeon observation and bench testing, we believe our technology may provide the following benefits:

|

· |

Enhanced illumination and visualization of the surgical field. Our devices are designed to provide enhanced intracavity illumination and visualization of the surgical field during open and minimal access surgeries. The proprietary complex geometry of refractive microstructures or microlenses along the surface of the Photonguides allow for the extraction of light in a manner that distributes light at different angles in a broad, uniform and volumetric pattern that is intended to reduce shadows, glare and excessive heat that are commonly associated with traditional surgical lighting options. In bench testing comparing light distribution and thermal profile of our Eikon retractor to a traditional fiber optic retractor, we found our Eikon retractor system had approximately five times the illumination area with a thermal profile that is below the risk of burn. |

|

· |

Improved surgical precision during open and minimal access procedures. Our technology is designed to improve intracavity visualization to allow surgeons to identify, differentiate and avoid vital anatomical structures. We believe this enables surgeons to dissect with great precision, while also allowing them to differentiate tissue planes, identify and avoid nerves and blood vessels, and quickly locate and control bleeding vessels to achieve rapid hemostasis. With this precise visualization, we believe surgeons may be able to use smaller, and in some cases fewer, incisions. |

|

· |

Reduced risks to patients and surgeons. Our technology is developed with design elements to help create thermally cool illumination as well as ergonomics to improve ease of use while performing a procedure. Our advanced surgical devices incorporate a solid core optical-grade polymer that facilitates efficient coupling to the surgical instrument to offer significantly improved light transfer while concurrently reducing heat transfer. We believe this is an important advancement over traditional on-field fiber optic lighting systems that do not efficiently transfer light through the fiber-to-fiber coupling, resulting in the generation of excess heat, which can increase the risk of burn to patients and surgical staff and create the potential for operating room fires. In addition, by improving visualization, our devices may also decrease risk of unintended retained foreign objects by improving the surgeon’s ability to see and dispose of such objects that might have otherwise been left in the surgical cavity inadvertently. Finally, by being directly incorporated into a variety of illuminated surgical retractors, handheld illuminated aspiration devices, and drop-in intracavity illuminators, we believe our technology may help to decrease surgeon fatigue by reducing or eliminating the need for surgical headlights, thereby helping to reduce some of the associated head, neck and shoulder fatigue, frequent headaches, neck pain and injury to the cervical spine. In addition, our non-conductive Eikon LT retractors virtually eliminate the potential for burns due to arcing from electrosurgical devices coming in contact with traditional stainless steel retractors. |

|

· |

Enhanced operating room efficiency. We believe our technology improves operating room workflow by reducing the need for perioperative repositioning of traditional surgical lighting options. Overhead lighting systems and headlights require frequent readjustment, which may interrupt operating room workflow and extend surgical procedure time. Many open and minimal access procedures are time sensitive and the treatment area requires constant attention of the surgeon and operating team. Because the Photonguides are directly connected to the surgical instrument that is used to access the deep surgical cavity, surgeons are able to clearly illuminate the surgical target and effectively focus on performing the procedure. As an example, in a survey we conducted with 12 surgeons that use our devices, each of whom is considered a leading breast surgeon, 11 of these surgeons reported that procedure time during nipple-sparing mastectomy procedures when using our devices was reduced by an average of 24%. |

|

· |

Economic value proposition to healthcare systems. We believe our devices have the potential to substantially reduce procedure costs as well as create incremental revenue opportunities. We believe the improved efficiency of the operating room workflow and the related reduced procedure and anesthesia time can translate to meaningful cost savings for the hospital. In addition, we believe the reduction in procedure times also creates additional capacity in the operating room for surgeons to perform more procedures, which we believe can create incremental revenue for the hospital. |

5

Our Intelligent Photonics Technology

Photonics is the science and technical application of light. We have applied advanced principles of photonics to develop our Intelligent Photonics technology platform, which enables the transmission, management and manipulation of light in surgical procedures. Our initial application of this technology is our family of proprietary optical waveguides, called Photonguides. The fundamental attributes of Photonguides include a solid core optical-grade polymer, total internal reflection of light waves, light mixing and extraction by a complex geometry of refractive microstructures or microlenses.

Fundamental Attributes of Photonguides

Solid Core Optical-Grade Polymer

Photonguides are fabricated from a proprietary solid core optical-grade polymer, specifically selected for its key optical and mechanical characteristics, which enable the efficient transmission and management of light. These optical characteristics include the ability to mold the material into various complex geometries, which is of particular importance when molding ultra-precise structures. Certain mechanical properties of the polymer, such as structural integrity, hydrophobicity and thermal stability, are critical to its use during surgical procedures. In addition, our solid core design facilitates the coupling of the Photonguide to the modified fiber optic cable in order to allow the efficient transfer of light into the solid core Photonguide, while remaining thermally cool. All these characteristics are critical in order for the Photonguide to function as an advanced illuminated surgical device.

Total Internal Reflection of Light Waves

One of the key aspects of the Photonguide technology is the ability to transmit light in a highly efficient manner prior to its extraction. Light travels in waves. As a wave travels through a medium it will reach a boundary where there is a different medium on the other side of the boundary. At the point where the wave meets the boundary, three phenomena can occur: reflection, refraction or some combination of both. Reflection occurs when light bounces off the boundary and refraction occurs when waves pass through a boundary and change direction. The angle at which the wave hits the boundary is referred to as the angle of incidence. That angle is usually referenced to the line that is perpendicular to the boundary. A zero incidence angle means that the wave is traveling perpendicular to the boundary. At that angle most of the light will pass most of its energy through the boundary and will not refract as long as the index of refraction is less on the other side of the boundary than in the medium the light is traveling. As the angle of incidence increases, the wave will get split into two components: one portion will pass the boundary and refract and the other portion will reflect back into the medium in which the wave was originally traveling. As the angle increases, the amount of refraction will decrease and reflection will increase. The smallest angle where the light is completely reflected and not refracted is called the critical angle. At any angle of incidence greater than the critical angle, all of the light is reflected off the boundary with no refraction. This is referred to as total internal reflection. We designed the structural and material properties of our devices to maximize locations of total internal reflection as the light propagates along the central axis of the Photonguide.

6

Light Mixing

Photonguides utilize various novel optical methods to mix light, or randomize its reflections, during the total internal reflection transmission process. The design and shape of the optical stem, or area of the Photonguide that is between the input of the Photonguide and the array of refractive microstructures or microlenses, enhance the mixing of light waves, while maintaining total internal reflection. Photonguides utilize light mixing before extraction to significantly reduce glare and bright spots, leading to a more uniform illumination profile across the surgical target while remaining thermally cool.

Complex Geometry of Refractive Microstructures and Microlenses

We designed a proprietary complex geometry of refractive microstructures and microlenses that are placed on the surface of the optical waveguide to extract light from the device in a manner that distributes light over the surgical target. This distribution of light from the Photonguide also reduces the energy density in the device, thus reducing heat. Without the microstructures to extract the light uniformly on the surgical target, the Photonguide would dissipate an energy density across its surface that is in excess of the amount that the tissue could absorb without causing thermal injury. The surface of the Photonguide contains a complex geometry of zones with corresponding refractive microstructures or microlenses at varying angles. These extraction zones allow the Photonguide to direct the extracted light onto the surgical target and shape it into a broad, uniform and volumetric pattern. The ability to direct light is especially important when the Photonguide is mounted on surgical retractors, because our device is able to push the light away from the retractor, thus maintaining its efficiency on the surgical target. We believe this is a significant advantage over traditional on-field fiber optic lighting systems, which lack the microstructures to direct light and instead direct light in a straight line in the shape of a cone from the end of the fiber. As a result, a portion of the illumination is obstructed and absorbed by the surgical retractors when the fiber is adjacent to the surgical instrument. The ability to shape light is also critical, as it reduces the focal intensity of light. With traditional fiber optic retractors, light is directed in a narrow beam, with intensity at a maximum in the center of the spot of light, and dropping off exponentially toward the edges. As a result, it typically does not illuminate the entire surgical cavity and heat builds up significantly in that focal zone. In contrast, Photonguides broaden this intensity of distribution, which allows the pattern of light to have uniform brightness across the surface of the surgical target, while minimizing the thermal profile.

Photonguides are also designed to extract light from multiple zones, allowing the surgical target to be illuminated from various angles. As light is extracted across the Photonguide at numerous different points along the surface at slightly different angles, if any of the features on the surface become blocked by an instrument, blood or tissue, there are multiple other microstructures from which light is extracted to provide illumination. This proprietary complex geometry also provides off-axis illumination on the surgical target, meaning that the light originates from a different angle than in direct orientation to the Photonguide. As such, when light reflects off the tissue of the surgical target, instead of reflecting upwards towards the surgeon, the light is generally reflected onto the surface opposite the retractor. This feature of the Photonguide is important because it allows the surgeon and operating staff much better visual perception of the surgical target with less shadows and glare.

Advanced/Enhanced Energy

In September 2016, we received FDA 510(k) clearance of PhotonBlade®, a dynamic precision illuminator with enhanced energy delivery. The PhotonBlade® is a first-of-its-kind device, delivering directed, thermally cool illumination at the precise point of surgical treatment in conjunction with a novel energy platform allowing for precise tissue cutting and coagulation with minimal tissue damage. As such, PhotonBlade® represents a new category of Intelligent Photonics®and strategically expands our current product portfolio. After a preliminary market launch in March 2017, we fully launched the PhotonBlade® in September 2017.

7

Market Need for Improved Advanced/Enhanced Energy Devices

We estimate at least 16 million surgical procedures in the U.S. use some form of electrical energy for cutting of tissue and/or coagulation of blood. While effective and standard for surgery, there are applications where more precise tissue cutting is needed and minimal impact on collateral tissue is preferred. For these cases, enhanced energy devices were introduced to address those needs. Further, while surgeons operate in dark cavities or difficult to see areas, illumination is needed to provide a greater measure of safety and efficiency. PhotonBlade® is a precision illuminator that adds the attributes of Advanced/Enhanced energy, giving surgeons the ability to see better while addressing tissue in a more precise fashion as compared to standard electrosurgical instruments.

Our Advanced Energy Solution

PhotonBlade® has the following benefits as compared to other energy devices:

|

· |

Intelligent Photonics: Dynamic, precision illumination ~2cm from the point of treatment; |

|

· |

Enhanced Energy Delivery: Proprietary insulated tip design for the lowest thermal spread of all competitive devices; |

|

· |

Universal Compatibility: Compatible with any 510k cleared electrosurgical unit, eliminating the need to manage dedicated generators; and |

|

· |

Adjustable Illumination and Energy: 2”-5” adjustable shaft length. |

Our Market Opportunity

Advances in medical technology have resulted in growing adoption of minimal access surgical procedures. The increased utilization of these procedures by surgeons is primarily driven by their significant benefits compared to conventional open surgery including:

|

· |

smaller incisions resulting in less scarring and fewer complications; |

|

· |

less trauma to the organs, muscles, nerves, and tissue; |

|

· |

less bleeding and reduced need for blood transfusions; |

|

· |

fewer surgical infections; |

|

· |

shortened hospital stays, potentially reducing hospital costs; |

|

· |

less postoperative pain and reduced need for associated narcotics; |

|

· |

faster recovery time; and |

|

· |

improved aesthetic outcomes. |

Though some minimally invasive procedures, such as endoscopic, laparoscopic and arthroscopic procedures, have several of the benefits described above, surgeons are only able to view the surgical target through a tiny camera, which can cause reduced depth perception and field of vision, diminished hand-eye coordination, limited mobility of the surgical instruments, and reduced tactile feedback. These limitations can increase the cognitive and physical load on the surgeon and, consequently, increase the possibility of surgical error. We believe that minimal access procedures provide many of the benefits described above. However, the small incisions used in these procedures inherently reduce a surgeon’s ability to directly see the surgical target, particularly deep within the surgical cavity, which can impact surgical precision, procedural efficiency and patient safety.

8

Our Products

Our advanced photonics technology has allowed us to design multiple variations of Photonguides in order to target different illumination patterns for different shapes of surgical cavities. Because we can mold our solid core optical-grade polymer into different shapes, we are able to design Photonguides that either directs the light narrowly for deep cavities, or broadly for larger blade cavities. Photonguides also come in narrow or wide configurations to accommodate various retractor widths that are designed for varying patient anatomies. Our versatile design and manufacturing capabilities allow us to develop Photonguides with a variety of extraction patterns. For example, our current retractor based Photonguides utilize a complex geometry of refractive microstructures and microlenses, whereas as our handheld illuminated aspiration devices have integrated microlens arrays. Using advanced ray-trace software modeling programs, we are able to perform three-dimensional optical performance modeling of Photonguides, as well as an entire assembly including the retractor. We are capable of analyzing the entire optical performance of the assembly as we monitor various characteristics such as extracted light direction, uniformity on the target, glare to the user, as well as thermal profile. This ray-trace modeling process helps us develop illuminated surgical devices that are designed to provide optimal intracavity illumination.

We currently market six categories of illuminated surgical devices, consisting of over 40 devices. Our advanced photonics technology is integrated into each of these device families. Our device portfolio includes reusable illuminated surgical retractors that include a single-use Photonguide, single-use handheld illuminated aspiration devices and single-use drop-in intracavity illuminators. Photonguides are integrated into these customized devices to deliver improved visualization of the surgical cavity without generating excessive heat. Our accessories include sterilization trays and light cables.

|

Product Family |

|

Image |

|

Description |

|

Surgical Specialties |

|

|

|

|

|

|

|

|

|

Eikon LT Illuminated Retractor System |

|

|

|

Illuminated surgical retractor with a low-profile design. Lightweight, radiolucent, non-conductive retractors provide electrical insulation from electrosurgical device preventing inadvertent thermal damage. Atraumatic and elevated tip for easy maneuverability, dissection and retraction. Available in multiple blade sizes, with or without teeth, for varying patient anatomies, surgeon preferences, and surgical specialties. |

|

Breast / Oncoplastic / Surgery / Gynecology / EP / Plastic / Endocrine |

|

|

|

|

|

|

|

|

|

PhotonBlade® |

Dynamic recision illuminator with enhanced energy. Precise tissue cutting and coagulation with minimal collateral damage. No need for propriety generator. |

Breast / Plastics / EP / Orthopedics |

||||

|

|

|

|

|

|

|

|

|

Eiberg Illuminated Retractor System |

|

|

|

Illuminated hohmann-style retractor with a low-profile design. Made of stainless steel, with an ergonomic design to be comfortable to hold. Designed with subtle curvatures and smooth edges to provide atraumatic, secure retraction. |

|

Orthopedic |

9

|

|

|

|

|

|

|

|

|

PhotonSaber Y |

|

|

|

Handheld illuminator incorporated in a traditional Yankauer aspiration platform. Provides on-field illumination, aspiration, smoke evacuation, soft tissue retraction and blunt dissection in one device. Low-profile design enables surgeons to work efficiently in deep, dark cavities through smaller incisions. Available in multiple tip configurations (taper, metal, and bulb) for various surgical needs and in an optional pistol grip handle for improved ergonomics and visualization. |

|

Orthopedic / Spine / Cardiothoracic / Breast / General / Gynecology / Plastic |

|

|

|

|

|

|

|

|

|

PhotonSaber F |

|

|

|

Handheld illuminator incorporated in a traditional Frazier aspiration platform. Provides on-field illumination, aspiration, smoke evacuation, and soft tissue retraction in one device. Low-profile design enables surgeons to work efficiently in deep, dark cavities through smaller incisions. Available in multiple tip configurations (8 Fr and 12 Fr). |

|

Spine / Orthopedic / Neurosurgery |

|

|

|

|

|

|

|

|

|

Breiten Illuminated Retractor System |

|

|

|

Illuminated surgical retractor with a low-profile design. Radiolucent to enable visibility during fluoroscopy. Color-coded for easy identification. Provides an offset hub for blade positioning. Available in multiple blade sizes and blade tips for varying patient anatomies and surgeon preferences. |

|

Spine / Orthopedics |

|

|

|

|

|

|

|

|

|

Photonguide XT System |

Drop-in intracavity illuminator with a low-profile design. Anchors to the incision wall providing a stand-alone, hands-free device. Minimal profile design is compatible with existing retractors and instrumentation and accommodates preferred surgical exposure techniques. |

Spine |

||||

|

Eika Illuminated Retractor System |

Illuminated surgical retractor with a low-profile design. Self-retracting handle design enables either hands-free or manual retraction. Includes a handle slot for ideal cable management and placement. Available in multiple blade sizes for varying patient anatomies and surgeon preferences. Designed for anterior neck approaches, including thyroid and cervical spine surgeries. |

Endocrine / Spine / Orthopedics |

||||

|

PhotonVue®* |

System used in conjunction with IC Indocyanine for identifying and verifying blood flow in tissue. Small, portable system with attractive economic options. |

Breast / Plastics / Colorectal |

* By way of distribution and manufacturing agreement with Fluoptics Imaging Inc.

10

Selected Surgical Applications

Our commercial strategy is initially focused on targeting open and minimal access procedures where there is a significant need for improved illumination and direct visualization. These procedures span a broad spectrum of women’s health clinical applications: breast cancer and breast reconstruction surgery, gynecology and thyroid surgery. Additional applications include procedures for electrophysiology, spine, orthopedic, cardiothoracic, and general surgery. We believe our technology has enabled surgeons to perform procedures that were previously difficult to perform due to visualization and illumination challenges. The selected procedures discussed below illustrate some of the benefits of our technology.

Breast: Nipple Sparing Mastectomy

Surgical management of breast cancer has evolved dramatically over the past several decades. Surgeons have continuously looked for ways to improve oncologic outcomes while combining the techniques of oncoplastic surgery to maximize both the treatment of cancer and the aesthetic outcome with the optimal goal of preserving the nipple areola complex. Skin and nipple preservation during breast cancer surgery is essential to attain ideal aesthetic results.

A nipple sparing mastectomy, or NSM, is a procedure in which the cancerous breast tissue is removed but the breast skin and nipple are left intact. We believe the relatively limited adoption to date of the NSM procedure is attributed to a number of surgical limitations. Some of these limitations include limited access and visualization through smaller and distant incision location, and difficulty in maintaining consistent breast flap thickness and viability. We believe our advanced photonics technology can facilitate a surgeon’s ability to:

|

· |

use a single infra-mammary fold incision in NSM to access and visualize deep into the surgical cavity; |

|

· |

access and visualize the lymphatic tree without a second axillary incision in most cases; and |

|

· |

assess the breast flap thickness and viability via trans-illumination. |

Electrophysiology: Pacemaker and ICD changeouts

In the U.S. there are approximately 200,000 procedures to remove or replace pacemakers or implantable cardiac defibrillators (“ICDs”). When accessing pacemakers/ICDs, surgeons must make an incision in the chest and work around leads that run into the chambers of the heart. In many of these procedures, complications may occur such as:

|

· |

damage to the leads from the use of mechanical or electrosurgical devices; |

|

· |

untreated bleeding vessel on the chest wall due to poor visualization, which can result in a post-operative hematoma; and |

|

· |

post-operative infection, which is highly correlated with post-operative hematoma and patient mortality. |

PhotonBlade® allows the surgeon to effectively see in a dark chest pocket during the procedure. The illumination which enhances the ability to see may allow the surgeon to address bleeding during the procedure and avoid a post-operative hematoma and subsequent complications.

GYN: Vaginal Hysterectomy

Hysterectomy, or removal of the uterus, is one of the most common types of surgery for women in the United States. Depending on the condition, many women will be presented with several surgical procedural options. Such surgical approaches may be an abdominal, robotic, vaginal, laparoscopic or laparoscopically assisted hysterectomy. All options, other than vaginal hysterectomy will result in some form of visible scarring and a potentially greater degree of postoperative pain.

A vaginal hysterectomy allows the surgeon to perform a total or radical hysterectomy through the vagina, a natural opening in the body. We believe that our advanced photonics technology can facilitate the surgeon’s ability to:

|

· |

effectively perform a vaginal hysterectomy through enhanced visualization of key structures and anatomy |

11

|

· |

optimally treat pelvic organ prolapse, concomitant in approximately 40% of vaginal or laparoscopically assisted hysterectomies; and |

|

· |

provide for a safe and effective operation through the use of illuminated non-conductive retractors. |

Orthopedics: Total Hip Arthroplasty including the Anterior Approach

The growth of minimally invasive surgery in orthopedics has been dramatic worldwide, as clinical results indicate that patients who undergo these procedures typically experience improved clinical outcomes, shorter hospital stays, faster rehabilitation and improved aesthetic outcomes. Our technology has been used in a range of procedures including, among others, hip arthroplasty, within which the use of our technology has enabled a less invasive approach.

Traditional hip replacement, also known as hip arthroplasty, involves operating from the side or the back of the hip, which can create a significant disturbance of the muscles and tendons and an incision approximately eight to twelve inches long. In comparison, the direct frontal, or anterior, approach requires an incision that is only three to four inches long and located at the front of the hip. In this position, the surgeon does not need to detach any of the muscles or tendons, but rather can move them aside along their natural tissue planes. This approach often results in faster recovery, less pain and more normal function after hip replacement. In addition, there is a lower risk of dislocating the new prosthesis when placed via the anterior approach, as the strength and integrity of the adjacent tendons and muscles surrounding the hip are maintained.

To date, we believe the less invasive anterior approach has been underutilized due, in part, to the visualization challenges associated with the procedure. More specifically, because the acetabulum and femoral canal are difficult to visualize using this approach, component positioning, sizing, and stability are more likely to be compromised, all of which are critical factors to yielding a successful and durable clinical outcome.

We believe the visualization provided by our devices can facilitate the surgeon’s ability to:

|

· |

expose, prepare and seat the acetabular shell and liner within the acetabulum; |

|

· |

place the acetabular screw; |

|

· |

evaluate stability and impingement of the ball against the socket; |

|

· |

prepare and mobilize the femur; and |

|

· |

internally inspect the femoral canal. |

Additional Applications

Our existing portfolio of devices is also eligible for use in, and could potentially improve the viability of, a multitude of additional surgical procedures. Importantly, our devices could be marketed and sold for a broad spectrum of surgical specialties without the need for any additional regulatory clearance. We believe our technology could help address the illumination and visualization challenges associated with various general surgery procedures, including appendectomy and herniorrhaphy; hysterectomy and other urological, gynecological and colorectal procedures; thyroidectomy and parathyroidectomy and other ear, nose and throat procedures; cardiac, cardiothoracic and cardiovascular procedures; craniomaxillofacial procedures and aesthetic plastic surgery.

We also continue to research and develop new devices, as well as pursue new clinical applications.

Sales and Marketing

We began selling our first FDA-cleared Photonguide-based device in March 2009. As a result, we have limited experience marketing and selling our devices. We currently sell our devices through our direct sales representatives only in the United States. While we primarily sell directly to hospitals, surgeons typically drive the purchasing decision. We sold our devices to approximately 870 hospitals in the fourth quarter of 2017. As of December 31, 2017, we had a sales and marketing team of 92 employees. Our sales team consisted of 58 direct sales representatives and 18 independent

12

sales agents or agencies, whom we refer to as independent sales agents, all of whom had significant sales experience before joining our sales team. The direct sales representatives are supported by 28 employees in sales management, training and customer support. Additionally, we have six employees in marketing. Over the past two years, we have significantly expanded our direct sales force to help facilitate further adoption among existing hospital accounts, as well as to broaden awareness of our advanced photonics technology to new hospitals. Using our expanded direct sales force, we intend to continue to educate and train surgeons on the advantages of our advanced photonics technology compared to traditional operating room lighting options. We believe the benefits of our technology should also enable the broader application and adoption of minimal access surgical procedures by more surgeons. Our operating results are directly dependent upon the sales and marketing efforts of our employees.

Our marketing efforts are focused on developing a strong reputation with major teaching institutions and hospitals, as well as surgeons that we have identified as key opinion leaders based on their knowledge of our devices, clinical expertise and reputation. We developed the Invuity Hidden ScarTM Surgery program to train and certify surgeons on minimal access surgical approaches and designate Centers of Excellence in Hidden Scar Surgery at hospitals and medical centers. Breast cancer surgery is our initial focus with the Hidden Scar Breast Surgery program and we are expanding into other specialties to include Hidden Scar Breast Reconstruction and Hidden Scar Hysterectomy to form a broader women’s health initiative.

We also sell and market to third-party medical device manufacturers. There were no sales to any customer in excess of 10% of our total revenue for any of the years ended December 31, 2017, 2016, and 2015.

Coverage and Reimbursement

Payment for patient care in the United States is generally made by third-party payors, including private insurers and government insurance programs. The reimbursement to the facility from third-party payors is intended to cover the overall cost of treatment, including the cost of our devices used during the procedure as well as the overhead cost associated with the facility where the procedure is performed. We do not directly bill any third-party payors; instead, we receive payment from the hospital or surgical center for our devices. Failure by physicians, hospitals, ambulatory surgery centers and other users of our devices to obtain sufficient coverage and reimbursement from healthcare payors for procedures in which our devices are used, or adverse changes in government and private third-party payors’ policies could have a material adverse effect on our business, financial condition, results of operations and future growth prospects.

In addition, there are periodic changes to reimbursement. Third-party payors regularly update reimbursement amounts and also from time to time revise the methodologies used to determine reimbursement amounts. This includes annual updates to payments to physicians, hospitals and ambulatory surgery centers for procedures during which our devices are used. Because the cost of our devices generally is recovered by the healthcare provider as part of the payment for performing a procedure and not separately reimbursed, these updates could directly impact the demand for our devices. An example of such payment updates is the Medicare program’s updates to hospital and physician payments, which are done on an annual basis using a prescribed statutory formula. In the past, with respect to reimbursement for physician services under the Medicare Physician Fee Schedule, when the application of the formula resulted in lower payment, Congress has passed interim legislation to prevent the reductions.

Any changes in coverage and reimbursement that lowers reimbursement for procedures using our devices could materially affect our business.

Competition

The medical device industry is highly competitive. We believe that the primary competitive factors in the surgical illumination and visualization and advanced energy market segments are clinical safety and effectiveness, price, surgeon experience and comfort with use of particular systems, reliability and durability, ease of use, device support and service, sales force experience and relationships. We face significant competition from competitors that are based in the United States and internationally in these market segments, and we expect the intensity of competition will increase over time. Many of the companies developing or marketing competing products enjoy several competitive advantages, including:

|

· |

more established sales and marketing programs and distribution networks; |

13

|

· |

long established relationships with surgeons and hospitals; |

|

· |

contractual relationships with customers; |

|

· |

products that have already received approval from the relevant value analysis committees, or VACs,; |

|

· |

greater financial and human resources for product development, sales and marketing; |

|

· |

greater name recognition; |

|

· |

the ability to offer rebates or bundle multiple product offerings to offer greater discounts or incentives; and |

|

· |

greater experience in and resources for conducting research and development, clinical studies, manufacturing, preparing regulatory submissions, obtaining regulatory clearance or approval for products and marketing approved products. |

Any device we develop must compete for market acceptance and market share. Our success in selling our devices to hospitals is dependent on our ability to demonstrate that the clinical, qualitative and economic value delivered by our products outweighs their increase to the cost per procedure. Our ability to compete on price depends on our ability to demonstrate to surgeons, hospitals and surgery centers that the potential benefits of improved clinical outcomes and reduced procedure costs from the increased efficiency in the operating room workflow and related reduced procedure and anesthesia time using our medical devices outweigh the price of our devices compared to our competitors’ products.

Intellectual Property

In order to remain competitive, we must protect the proprietary technology that we believe is important to our business, including seeking and, if granted, maintaining patents intended to cover our products and inventions that are commercially important to the development of our business. We also rely on trademarks, trade secret laws and confidentiality and invention assignment agreements to protect our intellectual property rights.

It is our policy to require our employees, consultants, contractors, outside scientific collaborators and other advisors to execute non-disclosure and assignment of invention agreements on commencement of their employment or engagement. Agreements with our employees also forbid them from using the proprietary rights of third parties in their work for us. We also require confidentiality agreements from third parties that receive our confidential data or materials.

Our success will depend on our ability to obtain and maintain patent and other proprietary protection for commercially important technology, inventions and know-how related to our business, defend and enforce our patents, preserve the confidentiality of our trade secrets and operate without infringing the valid and enforceable patents and proprietary rights of third parties. For more information, please see “Risk Factors—Risks Related to Our Intellectual Property.”

As of December 31, 2017, we held 97 issued U.S. and foreign patents and had 100 U.S. and foreign utility patent applications, and 14 Patent Cooperation Treaty, or PCT, applications pending. As we continue to research and develop our Intelligent Photonics technology, we intend to file additional U.S. and foreign patent applications related to the design, manufacture and clinical uses of our illuminated devices and other products. Our issued patents expire between the years 2026 and 2035. Our pending patent applications and issued patents include claims directed to coupling of an illumination device with a light source or an instrument, as well as efficient and safe transmission of light through the illumination device.

As of December 31, 2017, we held 55 U.S., foreign and international trademark registrations and had nine U.S. and foreign trademark applications.

Manufacturing, Raw Materials and Quality Assurance

Our manufacturing involves the combined utilization of our internal manufacturing resources and expertise, approved suppliers and contract manufacturers. Our internal manufacturing activities, located in San Francisco, California, include the inspection, assembly and packaging of the Photonguides, retractor systems, aspiration devices and accessories associated with each of our device families. We outsource the manufacture of components, subassemblies and certain

14

finished devices that are produced to our specifications and shipped to our facilities for final assembly or inspection, and certification. Finished products are stored at and distributed from our facility. Quality control, risk management, efficiency and the ability to respond quickly to changing requirements are the primary goals of our manufacturing operations. Unlike our other products, PhotonVue® is manufactured by Fluoptics Imaging Inc.

We have arrangements with our suppliers that allow us to adjust the delivery quantities of components, subassemblies and finished products, as well as delivery schedules, to match our changing requirements. The forecasts we use are based on historical trends, current utilization patterns and sales forecasts of future demand. Lead times for components, subassemblies and finished products may vary significantly depending on the size of the order, specific supplier requirements and current market demand for the components and subassemblies. Most of our suppliers have no contractual obligations to supply us with, and we are not contractually obligated to purchase from them, the components used in our devices.

We obtain the optical polymer used in the manufacture of Photonguides and certain accessories from single suppliers, for which we attempt to mitigate risks through inventory management and purchase order commitments. While we believe alternate sources exist for the optical polymer, we have not qualified an alternate provider. Other products and components come from single suppliers, but alternate suppliers have been qualified or, we believe, can be readily identified and qualified. In addition, we rely on a single provider for sterilization of our devices that require sterilization. While we believe replacement suppliers exist for all components, materials and services we obtain from single sources, establishing additional or replacement suppliers for any of these components, materials or services, if required, may not be accomplished quickly. Even if we are able to find a replacement supplier, the replacement supplier may need to be qualified and may require additional regulatory authority approval, which could result in further delay. While we seek to maintain adequate inventory of the single-source components and materials used in our products, in the event of disruption, those inventories may not be sufficient. To date, we have not experienced material delays in obtaining any of our components, subassemblies or finished products, nor has the ready supply of finished products to our customers been adversely affected. To date, we have not experienced any material delays by our sterilization provider and will continue to evaluate the cost and benefit of qualifying a second sterilization provider.

We have implemented a quality management system designed to comply with FDA regulations and International Standards Organization, or ISO, standards governing medical device products. These regulations govern the design, manufacture, testing and release of diagnostic products as well as raw material receipt and control. We have received ISO 13485 certification as well as an European Counsel, or EC, Certificate under Directive 93/42/EEC on Medical Devices, Annex II, excluding section 4. Our key outsourcing partners are ISO-certified.

We use small quantities of common cleaning products in our manufacturing operations, which are lawfully disposed of through a normal waste management program. We do not forecast any material costs due to compliance with environmental laws or regulations.

Segment Reporting

We manage our operations as a single operating segment for the purposes of assessing performance and making operating decisions. All of our assets are maintained in the United States. We derive our revenue primarily from sales to customers in the United States, based upon the billing address of the customer. In 2017, we started selling into Asia.

Government Regulation

Our products are medical devices and are therefore subject to extensive regulation by the FDA under the authority of the Federal Food, Drug and Cosmetic Act, or FDCA, and the regulations promulgated thereunder, as well as by corresponding state and international regulatory authorities. The regulations govern the following activities that we and our suppliers, licensors and partners engage in:

|

· |

product design and development; |

|

· |

pre-clinical and clinical testing; |

|

· |

establishment registration and product listing; |

15

|

· |

product manufacturing; |

|

· |

labeling and storage; |

|

· |

pre-market clearance or approval; advertising and promotion; |

|

· |

product sales and distribution; |

|

· |

recalls and field safety corrective actions; and |

|

· |

servicing and post-market surveillance. |

Regulatory Clearances and Approvals. Unless an exemption applies, each medical device that we wish to commercially distribute in the United States will require either prior 510(k) clearance or Premarket Approval Application, or PMA, approval from the FDA. The FDA classifies medical devices into one of three classes. Devices requiring fewer controls because they are deemed to pose low or moderate risk are placed in Classes I or II, which, unless subject to an exemption, requires the manufacturer to submit to FDA a 510(k) premarket notification requesting clearance for commercial distribution. Exempt Class I and II devices do not require submission of a 510(k) but are otherwise subject to general controls such as labeling, pre-market notification and adherence to the FDA’s Quality System Regulation, or QSR, which cover manufacturers’ methods and documentation of the design, testing, production, control quality assurance, labeling, packaging, sterilization, storage and shipping of products. Certain Class II devices are also subject to special controls such as performance standards, post-market surveillance, FDA guidelines, or particularized labeling. The Photonguides, retractor and aspiration devices are marketed as Class I exempt devices. The fiber optic cables we supply as part of our illuminated retractor and aspiration systems are marketed as Class II exempt devices. The metal and plastic sterilization trays used by the customer to sterilize our reusable retractors and fiber optic cables are Class II 510(k) products.

To obtain 510(k) clearance, we must submit a premarket notification demonstrating that the proposed device is substantially equivalent to a previously cleared 510(k) device or a device that was in commercial distribution before May 28, 1976 and for which the FDA has not yet called for the submission of PMAs. The FDA’s 510(k) clearance pathway usually takes between three and twelve months from the date the notification is submitted, but can take considerably longer, depending on the extent of requests for additional information from the FDA and the amount of time a sponsor takes to fulfill them. FDA requests for additional information can include clinical data that the FDA determines is necessary to make a determination regarding substantial equivalence. We obtained 510(k) clearance for the BriteField McCulloch Retractor System, in April of 2009 and for the Eigr Surgical Illumination System in February of 2012. All of our other commercial products to date have been commercialized as Class I, Class II exempt or Class II devices.

After a device receives 510(k) clearance or is commercialized as a Class I or II exempt device, any modification that could significantly affect its safety or effectiveness, or that would constitute a major change in its intended use, will require a new 510(k) clearance or could require premarket approval. The FDA requires each manufacturer to make this decision initially, but the FDA can review any such decision and can disagree with a manufacturer’s determination. If the FDA disagrees with a manufacturer’s determination, the FDA can require the manufacturer to cease marketing and/or recall the modified device until 510(k) clearance or premarket approval is obtained. We have made, and plan to continue to make, product enhancements that we believe do not require new 510(k) clearances. If the FDA requires us to seek 510(k) clearance or premarket approval for any such modifications to previously commercialized products, we may be required to cease marketing or recall the modified device until we obtain this clearance or approval, and we could be subject to significant regulatory fines or penalties.

A PMA must be submitted if a device cannot be cleared through the 510(k) clearance process. A PMA application must be supported by extensive data, including, but not limited to, technical information, preclinical data, clinical trial data, manufacturing data and labeling to demonstrate to the FDA’s satisfaction the safety and efficacy of the device for its intended use. None of our existing products are currently approved under a PMA, and we have no plans to develop products that would require a PMA.

16

Continuing FDA Regulation. Even after a device receives clearance or approval and is placed in commercial distribution, numerous regulatory requirements apply. These include:

|

· |

establishment registration and device listing with FDA; |

|

· |

Quality System Regulation, or QSR, which requires manufacturers, including third-party manufacturers, to follow stringent design, testing, production, control, supplier/contractor selection, complaint handling, documentation and other quality assurance procedures during all aspects of the manufacturing process; |

|

· |

labeling regulations that prohibit the promotion of products for uncleared, unapproved or “off-label” uses, and impose other restrictions on labeling, advertising and promotional activities; |

|

· |

Medical Device Reporting, or MDR, regulations, which require that manufacturers report to the FDA if their device may have caused or contributed to a death or serious injury or malfunctioned in a way that would likely cause or contribute to a death or serious injury if the malfunction were to recur; |

|

· |

voluntary and mandatory device recalls to address problems when a device is defective and could be a risk to health; and |

|

· |

corrections and removals reporting regulations, which require that manufacturers report to the FDA field corrections and product recalls or removals if undertaken to reduce a risk to health posed by the device or to remedy a violation of the FDCA that may present a risk to health. |

We and our contract manufacturers, specification developers and some suppliers of components or device accessories, also are required to manufacture our products in compliance with current Good Manufacturing Practice, or GMP, requirements set forth in the QSR. The QSR requires a quality system for the design, manufacture, packaging, labeling, storage, installation and servicing of marketed devices, and it includes extensive requirements with respect to quality management and organization, device design, buildings, equipment, purchase and handling of components or services, production and process controls, packaging and labeling controls, device evaluation, distribution, installation, complaint handling, servicing, and record keeping. The FDA and the California Food and Drug Branch evaluate compliance with the QSR through periodic unannounced inspections that may include the manufacturing facilities of our subcontractors. If the FDA or the California Food and Drug Branch believes that we or any of our contract manufacturers or regulated suppliers are not in compliance with these requirements, it can shut down our manufacturing operations, require recall of our products, refuse to clear new marketing applications, institute legal proceedings to detain or seize products, enjoin future violations or assess civil and criminal penalties against us or our officers or other employees.

Failure to comply with applicable regulatory requirements can result in enforcement actions by the FDA and other regulatory agencies. These may include any of the following sanctions or consequences:

|

· |

warning letters or untitled letters that require corrective action; |

|

· |

fines and civil penalties; |

|

· |

delays in clearing or refusal to clear future products; |

|

· |

FDA refusal to issue certificates to foreign governments needed to export products for sale in other countries; |

|

· |

suspension or withdrawal of FDA clearances; |

|

· |

product recall or seizure; |

|

· |

interruption or total shutdown of production; |

|

· |

operating restrictions; |

17

|

· |

injunctions; and |

|

· |

criminal prosecution. |

Fraud and Abuse Laws. There are numerous U.S. federal and state laws pertaining to healthcare fraud and abuse, including anti-kickback, false claims, physician payment and privacy and security laws. Our relationships with healthcare providers and other third parties are subject to scrutiny under these laws. Violations of these laws are punishable by criminal and civil sanctions, including, in some instances, imprisonment and exclusion from participation in federal and state healthcare programs, including the Medicare, Medicaid and Veterans Administration health programs.

Federal Anti-Kickback Laws. The Federal Anti-Kickback Statute prohibits persons from knowingly and willfully soliciting, receiving, offering or providing remuneration, directly or indirectly, to induce either the referral of an individual, or the furnishing, recommending, or arranging of a good or service, for which payment may be made under a federal healthcare program, such as Medicare and Medicaid. The definition of “remuneration” has been broadly interpreted to include anything of value, including such items as gifts, discounts, the furnishing of supplies or equipment, credit arrangements, waiver of payments and providing anything at less than its fair market value. The Department of Health and Human Services, or HHS, has issued regulations, commonly known as safe harbors, that set forth certain provisions which, if fully met, will assure healthcare providers and other parties that they will not be prosecuted under the Anti-Kickback Statute. The failure of a transaction or arrangement to fit precisely within one or more safe harbors does not necessarily mean that it is illegal or that prosecution will be pursued. However, conduct and business arrangements that do not fully satisfy each applicable safe harbor may result in increased scrutiny by government enforcement authorities such as the HHS Office of Inspector General.

The penalties for violating the Anti-Kickback Statute include imprisonment for up to ten years, fines of up to $100,000 per violation and possible exclusion from federal healthcare programs such as Medicare and Medicaid. Many states have adopted prohibitions similar to the federal Anti-Kickback Statute, some of which apply to the referral of patients for healthcare items and services reimbursed by any source, not only by the Medicare and Medicaid programs. Further, the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Affordability Reconciliation Act, or PPACA, amends the intent requirement of the Anti-Kickback Statute and criminal healthcare fraud statutes. A person or entity no longer needs to have actual knowledge of this statute or specific intent to violate it. The PPACA also provides that the government may assert that a claim including items or services resulting from a violation of the Anti-Kickback Statute constitutes a false or fraudulent claim for purposes of the false claims statutes.

Federal False Claims Act. The Federal False Claims Act provides, in part, that the federal government may bring a lawsuit against any person whom it believes has knowingly presented, or caused to be presented, a false or fraudulent request for payment from the federal government, or who has made a false statement or used a false record to get a claim approved. In addition, amendments in 1986 to the Federal False Claims Act have made it easier for private parties to bring “qui tam” whistleblower lawsuits against companies under the Federal False Claims Act. Penalties include fines ranging from $11,181 to $22,363 for each false claim, plus three times the amount of damages that the federal government sustained because of the act of that person. Qui tam actions have increased significantly in recent years, causing greater numbers of healthcare companies to have to defend a false claim action, pay fines or be excluded from Medicare, Medicaid or other federal or state healthcare programs as a result of an investigation arising out of such action.

Civil Monetary Penalties Law. The Federal Civil Monetary Penalties Law prohibits the offering or transferring of remuneration to a Medicare or Medicaid beneficiary that the person knows or should know is likely to influence the beneficiary’s selection of a particular supplier of Medicare or Medicaid payable items or services. Noncompliance can result in civil money penalties of up to $15,270 for each wrongful act, assessment of three times the amount claimed for each item or service and exclusion from the federal healthcare programs.

State Fraud and Abuse Provisions. Many states have also adopted some form of anti-kickback and anti-referral laws and a false claims act. A determination of liability under such laws could result in fines and penalties and restrictions on our ability to operate in these jurisdictions.

Health Insurance Portability and Accountability Act of 1996. The Health Insurance Portability and Accountability Act of 1996, or HIPAA, created two new federal crimes: healthcare fraud and false statements relating to healthcare

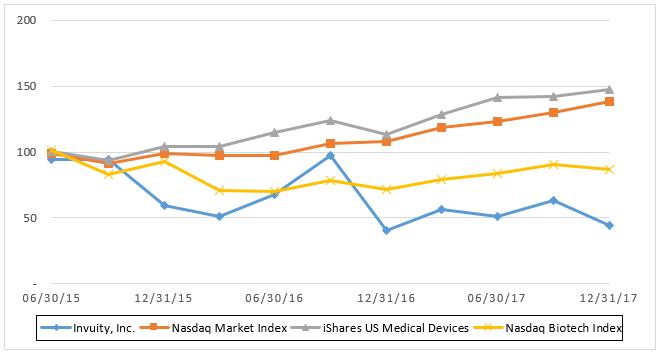

18