Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FIRST HORIZON CORP | d909879d8k.htm |

| EX-99.1 - EX-99.1 - FIRST HORIZON CORP | d909879dex991.htm |

First Horizon

National Corporation First Quarter 2015 Earnings

April 17, 2015

Exhibit 99.2 |

2

Portions of this presentation use non-GAAP financial information. Each of those portions is

so noted, and a reconciliation

of

that

non-GAAP

information

to

comparable

GAAP

information

is

provided

in

a

footnote

or

in

the

appendix at the end of this presentation.

This presentation contains forward-looking statements, which may include guidance,

involving significant risks and uncertainties

which

will

be

identified

by

words

such

as

“believe”,“expect”,“anticipate”,“intend”,“estimate”,

“should”,“is

likely”,“will”,“going

forward”

and

other

expressions

that

indicate

future

events

and

trends

and

may

be

followed by or reference cautionary statements.

A number of factors could cause actual results to differ materially

from those in the forward-looking information.

These factors are outlined in our recent earnings and other press

releases

and

in

more

detail

in

the

most

current

10-Q

and

10-K.

FHN

disclaims

any

obligation

to

update

any

such

factors or to publicly announce the result of any revisions to any of the forward-looking

statements included herein or therein to reflect future events or developments.

|

Building Franchise

Value Executing “Blue Chip”

Priorities

Being easy to do business with

Providing differentiated customer service

Using the Bonefish to drive profitability

3 |

4

All

Non-GAAP

numbers

are

reconciled

in

the

appendix.

1

Regional

Banking

pre-tax

pre-provision

net

revenue

is

a

Non-GAAP

number.

2

EPS

and

expenses

excluding

litigation

charge

are

Non-GAAP

numbers.

3

Revenue

excluding

positive

impact

of

mortgage

servicing

sale

was

$278mm

in

1Q14

and

excludes

$20mm

of

previously

unrecognized

servicing

fees

associated

with

the

MSR

sale.

This

number

is

Non-GAAP.

Regional Bank Pre-Tax, Pre-Provision Net Revenue (PPNR) up 13% year over

year

1

Regional Bank average loan growth of 14% year over year

Regional Bank average core deposits up 9% year over year

Capital markets’

pre-tax income increased ~50% year over year

EPS,

excluding

litigation

charge,

at

$0.18

2

First Quarter 2015 Accomplishments

Core Business

Strength

Improving

Productivity

& Efficiency

Deploying Capital

Prudently

Reached an agreement in principle with DOJ/HUD to settle potential claims

on FHA loans

Improved Regional Bank efficiency ratio 234 bps year over year

Revenues, excluding positive impact of mortgage servicing sale, up 3% year

over year

3

Expenses,

excluding

litigation

charge,

declined

2%

year

over

year

2

Repurchased $16 million or 1 million common shares in 1Q15

TrustAtlantic acquisition progressing |

FINANCIAL

RESULTS 5 |

1Q15 Consolidated

Financial Results 6

Net Interest Income

Fee Income

Expense

NIAC

Excluding

Litigation

Charge

(Non-GAAP)

1

$ in millions, except EPS

Financial Results

1Q15

$157

Loan Loss Provision

$130

$376

$5

$(77)

$(0.33)

1Q15 vs

+$5

-$16

+$158

-$5

-$122

-$0.52

4Q14

$159

$120

$207

$6

$47

$0.20

1Q14

$152

$146

$218

$10

$46

$0.19

4Q14

-$2

+$10

+$169

-$1

-$124

-$0.53

1Q14

Actuals

Revenue,

excluding

positive

impact

of

mortgage

servicing

sale,

up

3%

linked

quarter

and

year

over

year

2

Expense,

excluding

litigation

charge,

up

3%

linked

quarter

and

down

2%

year

over

year

1

Total average loans up 2% linked quarter and 7% year over year

Total average core deposits up 7% linked quarter and 11% year over year

Net interest income slightly down linked quarter due to fewer days in 1Q15 but up 3% year over

year Loan

loss

provision

of

$5mm

with

NCOs

of

$9mm

in

1Q15

vs

$6mm

of

provision

and

$12mm

of

NCOs

in

4Q14

Common

Equity

Tier

1

(CET1)

of

10.3%

3

Net Income Available to Common Shareholders (NIAC)

Expense

Excluding

Litigation

Charge

(Non-GAAP)

1

$214

EPS

$42

EPS

Excluding

Litigation

Charge

(Non-GAAP)

1

$0.18

Adjusted Financial Results

$46

$0.19

$207

$47

$0.20

$218

-$4

-$4

-$0.01

+$7

-$5

-$0.02

EPS

excluding

DOJ/HUD

settlement

is

based

on

diluted

share

count

of

235mm

FHN

would

have

reported

assuming

net

income

available

to

common

instead

of

net

loss

available

to

common.

Numbers

may

not

add

to

total

due

to

rounding.

1

Expense,

NIAC

and

EPS

excluding

litigation

charge

are

Non-GAAP

numbers

and

a

reconciliation

is

provided

in

the

appendix.

3

1Q15

Common

Equity

Tier

1

is

an

estimate.

This

number

is

Non-GAAP.

2

Revenue

excluding

positive

impact

of

mortgage

servicing

sale

was

$278mm

in

1Q14

and

excludes

$20mm

of

previously

unrecognized

servicing

fees

associated

with

the

MSR

sale. |

1Q15 Segment

Highlights 7

1

Corporate and Consolidated show net income available to common, which reflects $3mm of

noncontrolling interest and $1.6mm of preferred stock dividends in each quarter. 2

Segment

EPS

impacts

are

Non-GAAP

numbers

and

reconciled

in

the

table.

EPS

impacts

are

calculated

using

the

1Q15

net

income

column

divided

by

the

233

million

diluted

shares

outstanding.

3

Regional Banking pre-tax pre-provision net revenue is a Non-GAAP number and a

reconciliation is provided in the appendix. Drivers and Impacts

Net Income

$ in millions,

except EPS

1Q15

Per Share

Impact

Regional

Banking

Capital

Markets

Corporate

Non-

Strategic

Total

4Q14

$51

$4

$(13)

$5

$47

1Q14

$36

$5

$(8)

$12

$46

1Q15

$48

$7

$(18)

$(114)

$(77)

$0.20

$0.03

$(0.07)

$(0.49)

$(0.33)

Fixed income ADR of $877k in 1Q15 vs $630k in 4Q14

Expenses up 18% linked quarter and 4% year over year, primarily due to

variable compensation

1Q15 included $163mm expense related to legal matters

Loan loss provision of $0.1mm in 1Q15 vs $0.4mm in 4Q14 and credit of

$3mm in 1Q14

PPNR up 13% year over year

NII up 9% year over year, but down 2% linked quarter primarily due to

day count

Average loans up 3% linked quarter and 14% year over year

1Q15 provision of $5mm vs 4Q14 provision of $6mm

Tax benefit of $12mm in 1Q15 vs $20mm in 4Q14

Security gains of $0.3 in 1Q15 vs $6mm in 1Q14

Numbers may not add to total due to rounding.

1

2

3

1

1 |

Regional Banking

Financial Results 8

Net Interest Income

Fee Income

Expense

$ in millions

Financial Results

1Q15

$154

Loan Loss Provision

Pre-Provision Net Revenue

1

$60

$136

$79

$5

1Q15 vs

+$12

$0

+$3

+$9

-$8

4Q14

$158

$64

$138

$84

$6

1Q14

$142

$60

$133

$69

$13

4Q14

-$3

-$4

-$2

-$6

-$1

1Q14

Actuals

PPNR and net income up 13% and 31%, respectively, year over year, but down linked quarter

largely due to seasonal factors

Average loans increased 3% linked quarter and 14% year over year

Average core deposits up 6% linked quarter and up 9% year over year

Revenues down 3% linked quarter, but up 6% year over year

NII down 2% from fewer days in quarter, but up 9% year over year

Fee income down 6% linked quarter largely due to seasonal decline in deposit, brokerage and

trust fees Efficiency ratio improvement of 234

bps

year over year

1Q15 net charge-offs of $6mm,

or annualized 0.17%

of average loans, compared to $7mm, or annualized

0.20%, in 4Q14

Numbers may not add to total due to rounding.

Net Income

$48

$51

$36

+11

-$3

1

Regional Banking pre-tax pre-provision net revenue is a Non-GAAP number and a

reconciliation is provided in the appendix. |

9

1

Average Regional Banking loan growth from 4Q14 to 1Q15.

Profitable Growth Opportunities: Regional Banking

Double Digit Loan Growth Year over Year

Regional

Banking

Loan

Growth

by

Lending

Area

1

Regional Banking average loan growth of 14% year

over year and 3% linked quarter

Commercial loans up 15% year over year and 4%

linked quarter

Commercial loan utilization rate up ~300bps

linked quarter

Continued growth in specialty lending areas

Asset-based lending growth due to funding of

commitments

Loans to mortgage companies increase driven by

higher refi activity

+3%

Loans to Mortgage Companies

Commercial

Asset-Based Lending

Regional

Bank

Areas

of

Linked

Quarter

Loan

Growth

1

Commercial

Business

PC/WM

Retail

Loans to

Mortgage Cos

CRE

ABL

Other

Specialty

$3.26B

$3.39B

$0.76B

$0.76B

$1.86B

$1.88B

$2.13B

$2.11B

$0.93B

$1.04B

$1.24B

$1.24B

$1.37B

$1.44B

$1.58B

$1.66B

4Q14

1Q15

$0

$2

$4

$6

$8

$10

$12

$14B

12%

5%

4% |

10

FTN Financial Capital Markets

Capital Markets’

Distribution Platform Demonstrates Strength

$750mm

Capital Markets Revenue and Expense

Fixed income average daily revenue at $877k in 1Q15, up

~40% linked quarter

Increased flows due to higher rate volatility

Expenses up linked quarter due to higher variable

compensation and seasonal FICA expense in 1Q15

Focused on investing in extensive fixed income distribution

platform:

Expansion of municipal products platform

Continued development of public finance capability

Numbers may not add to total due to rounding.

$3mm

Left Axis:

Right Axis:

NII

Fee Income

$ in millions, except ADR

Financial Results

1Q15

$4

Pre-Tax Income

$62

$11

1Q15 vs

+$1

+$5

+$4

4Q14

$4

$49

$6

1Q14

$3

$57

$8

4Q14

+$1

+$13

+$5

1Q14

Actuals

Expense

$55

+$2

$46

$53

+$8

Average Daily Revenue (ADR)

$877k

$630k

$813k

+$64k

+$247k

$0

$1

$2

$0

$250

$500

Revenue

Expense

ADR

2

1Q15 annualized.

These are Non-GAAP numbers and a reconciliation is provided in the appendix.

1

2011 excludes $36.7mm of expense associated with the Sentinel settlement. 2014 excludes the

$47mm recovery of the Sentinel settlement expense and legal fees. |

11

Numbers may not add to total due to rounding.

1

NII sensitivity analysis uses FHN’s balance sheet as of 1Q15 and is Non-GAAP. Long

End +50bps assumes yield curve spreads widen ~50bps. Long end -50bps assumes yield curve spreads compress

~50bps. Bps impact assumes increase in Fed Funds rate. Non-Strategic is interest rate

neutral, thus nearly all the sensitivity impact would be allocated to the Core Businesses.

Net Interest Income Sensitivity Impact

1

NII and Net Interest Margin

Balance Sheet Positioned to Benefit from Rising Rates

Average core deposits up 7% linked quarter, 11% YOY

Regional Banking average deposit rate paid of 14bps in

1Q15 and 4Q14

Floating rate loans comprise 66% of loan portfolio vs

fixed rate loans at 34%

Attractive and stable low-cost funding mix in Regional

Banking with 58% DDA and interest checking deposits

Average Deposit Growth

15%

1Q15

$157

2.74%

NII and NIM Change Drivers

NII

NIM

($ in millions)

4Q14

$159

2.86%

Deposit Growth/Higher Fed Balances

Loan Fees & Cash Basis Income/Other

Commercial Loan Yields

Reduction of Non-Strategic Loans

Pre-Funding

of

Debt

Maturity

Increased Commercial Loan Volumes

+4%

+6%

+9%

+14%

Linked Quarter:

Year Over Year:

Consumer

Consumer

Commercial

Commercial

Fewer Days in Quarter

-$0.8

-5bp

-1bp

-$0.5

-1bp

$0.5

-$1.2

-6bp

1bp

$1.9

-

-

-$2.1

-

-1.7%

-$11mm

+1.5%

+$9mm

+6.3%

+$40mm

+12.2%

+$78mm

Long End

-50bps

Long End

+50bps

+100bps

+200bps

-3%

0%

3%

6%

9%

12% |

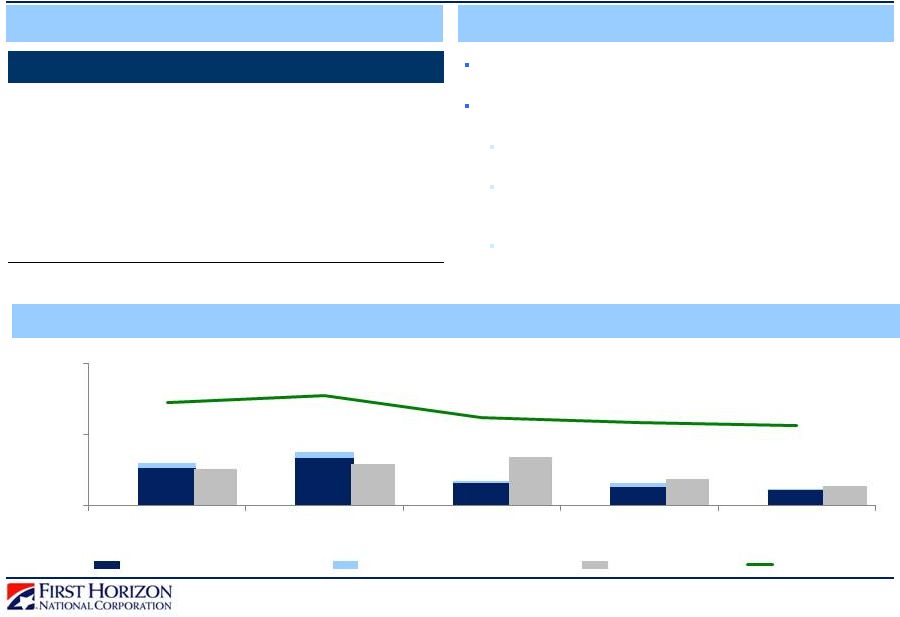

12

Delivering Efficiencies

Expenses down 2% year over year

Annualized noninterest expense declined 22% since 2012

Ongoing efficiency opportunities:

Continued wind-down of Non-Strategic segment (decreased legal/professional fees,

credit, and repurchase expense)

Streamline end-to-end processes

Reduce corporate real estate footprint

Right-size branch network as consumer usage shifts to FHN’s expanded digital banking

platforms All

Non-GAAP

numbers

are

reconciled

in

the

appendix.

1

Expenses

excluding

litigation

charge

is

a

Non-GAAP

number.

2

1Q12 excludes ~$49mm in mortgage repurchase provision. 1Q13 excludes ~$5mm in litigation

expense. 1Q14 excludes ~$0.1mm in litigation expense, and 1Q15 excludes ~$163mm in

litigation expense. These are Non-GAAP numbers . 3

Non-Strategic excludes ~$0.1mm and ~$163mm in litigation expense in 2014 and 2015

respectively. These are Non-GAAP numbers. Annualized Noninterest Expense

-22%

Noninterest Expense Trends by Segment 1Q14-1Q15

Regional Banking

Capital Markets

Corporate

Non-Strategic

$1,090mm

$941mm

$872mm

$855mm

1Q12

1Q13

1Q14

1Q15

-41%

-

18%

4%

2%

Annualized

Annualized

Annualized

Annualized

3

2

1

2 |

13

Non-Performing Assets

Net Charge-Offs

Asset Quality Trends

Continued Improvement in Credit Trends

Reserves

Net charge-offs of $9mm in 1Q15, compared to

$12mm in 4Q14 and $17mm in 1Q14

Annualized net charge-off ratio improvement of 7

bps to 0.23% from 4Q14

NPL levels at $207mm, down 2% linked quarter and

32% year over year

Commercial

NPLs

down

2%

linked

quarter

and

30% year over year

Numbers may not add to total due to rounding.

1

Net charge-off % is annualized.

$0

$100

$200

$300

1Q14

2Q14

3Q14

4Q14

1Q15

NPLs

NPLs Held for Sale

ORE

1.00%

1.25%

1.50%

1.75%

2.00%

$200

$220

$240

1Q14

2Q14

3Q14

4Q14

1Q15

Reserves $

Reserves / Loans %

0.00%

0.13%

0.25%

0.38%

0.50%

$0

$5

$10

$15

1Q14

2Q14

3Q14

4Q14

1Q15

NCOs $

Provision $

NCO %¹

$400mm

$260mm

$20mm |

Tier 1 Common to

Common Equity Tier 1: Remain Well Capitalized

14

Numbers

may

not

add

to

total

due

to

rounding

1

4Q14

Tier

1

Common

is

a

Non-GAAP

number

and

a

reconciliation

is

provided

in

the

appendix.

2

1Q15

Common

Equity

Tier

1

is

an

estimate.

4Q14

Tier 1

Common

1

1Q15

Common

Equity

Net Retained

Income

Excluding

After-tax

DOJ/HUD

Settlement

Phase-in of

Basel III

11.4%

-10bp

-60bp

10.3%

+10bp

DOJ/HUD

Settlement

Transition

to

Common

Equity

Tier

1

(CET1)

from

Tier

1

Common

due

to

phase-in

of

Basel

III

Utilizing excess capital via earning asset growth

Strong capital ratios provide continued flexibility

RWA Increase

from Earning

Asset Growth /

Other

-50bp

Tier 1

2

0%

2%

4%

6%

8%

10%

12% |

15

1Q15

Consolidated

Core Businesses

4

Long-Term Targets

ROTCE

1,2

8.30%

8.99%

15.0 –

20.0%

ROA

1,2

0.73%

0.73%

1.25 -

1.45%

NIM

2.74%

2.81%

3.50 -

4.00%

CET1 (Consolidated) &

Allocated CET1 (Core)

10.3%

9.7%

8.0 –

9.0%

NCO / Average Loans

0.23%

0.17%

0.30 -

0.70%

Fee Income / Revenue

45%

47%

40 -

50%

Efficiency Ratio

75%

76%

60 -

65%

Building Long-Term Earnings Power: Bonefish Targets

Focused on Growing Our Company Selectively and Profitably While Positioning

Our Balance Sheet for Sustainable, Higher Returns in the Long Term

Annualized Net Charge-Offs

0.30% -

0.70%

% Fee Income

40% -

50%

Efficiency Ratio

60% -

65%

Return on Tangible

Common Equity

15% -

20%

Equity / Assets

Risk Adjusted Margin

Total Assets

Earning Assets

Pre-tax Income

Tax Rate

Common Equity

Tier 1

8% -

9%

Return on Assets

1.25% -

1.45%

Net Interest Margin

3.50% -

4.00%

1

3

1

2

2

Consolidated ROTCE, ROA and Efficiency Ratio are adjusted for litigation expense and are

Non-GAAP numbers. 3

Common Equity Tier 1 (CET1): Current quarter is an estimate. Allocated CET1 refers to implied

CET1 of ~9.7% in core businesses. 4

Core Businesses include Regional Banking, Capital Markets, and Corporate segments. Core data

is Non-GAAP. All Non-GAAP numbers are reconciled in the appendix. ¹ROTCE, ROA, NIM, and NCO / Average Loans are annualized. |

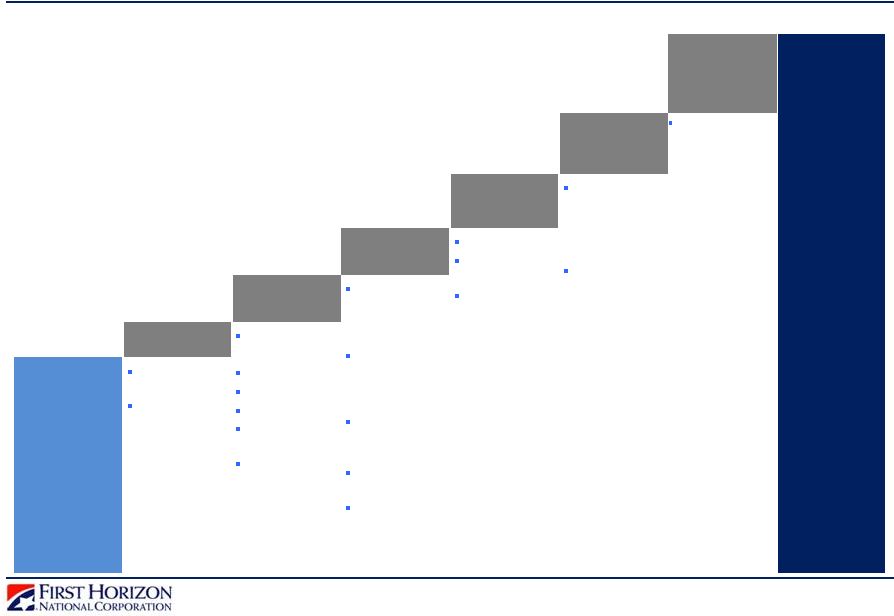

16

Closing the Gap to Bonefish Targets

Building a Foundation for Long-Term Earnings Power

Current

ROTCE /

EPS

Rise in

Interest

Rates

1

Target

Bonefish

ROTCE /

EPS

Growth

Opportunities

Economic

Profit

Improvement

Optimize/

Redeploy

Capital

Continued

Efficiencies

Non-Strategic

Wind-Down

Infrastructure

Reductions

Established

Market

Profitability/

Growth

Product/

Relationship

Profitability

Improvement

Sales

Productivity

Improvement

Process

Improvements

Branch

Network

Rationalization

Dividends

Share

Buybacks

M&A

Latent Income

Embedded in

Asset-Sensitive

Balance Sheet

Specialty

Lending

Mid-Atlantic

Middle TN

Houston

Wealth /

Investments

Municipals

(FTN

Financial)

1

Rise in interest rates represents cumulative growth rate in net interest income over a

3-year strategic time horizon. Chart illustrates a quantified path to long-term

goals; it contains no forecasts. 0.5% to 1.0%

1.0% to 1.5%

1.0% to 1.5%

1.0% to 1.5%

1.0% to 2.5%

3.0% to 3.8%

Latent Income

Embedded in

Fixed Income

Platform

Capacity

ADR at

$1.0-$1.5mm

Increased

Capital

Markets

Activity |

17

Building a Foundation for Attractive Long-Term Earnings Power

Proven execution capabilities

Unique size, scope, and strengths

Focused

on

efficiency,

productivity,

economic

profitability,

and

growth

opportunities

Organizational alignment on the path to achieving long-term bonefish profitability

Breadth and depth of talent that will be able to profitably run and grow the company

Successfully Executing on Key Priorities

FHN is Well Positioned for Attractive Long-Term Earnings Power |

APPENDIX

18 |

Notable

Items 19

Impact to EPS²

Previously Unrecognized Servicing Fees

Associated with the MSR Sale

$12.3mm

After-Tax Amount¹

$0.05

Securities Gain on an Equity Investment

$3.4mm

$0.01

Notable Item

Pre-Tax Amount

$20.0mm

$5.6mm

Refer to financial supplements for other notable items.

1

After-tax

impact

assumes

a

tax

rate

of

~38.6%

in

1Q14,

~33.3%

in

2Q14,

~37%

in

3Q14,

and

~23.6%

in

1Q15,.

2

EPS impact calculated by dividing the after-tax impact by the 237mm diluted shares

outstanding in 1Q14-3Q14. 3

EPS impact of agreement in principle with DOJ/HUD is reconciled in the appendix.

Lease Abandonment & Other Restructuring

Charges

($3.5)mm

$(0.01)

$(5.7)mm

Held-for-Sale (Primarily NPL) Portfolio Valuation

Adjustment

$5.5mm

$0.02

$8.2mm

Net Impact from Resolution/ Collapse of On-

Balance Sheet Consumer Securitizations

($3.9)mm

$(0.02)

$(6.4)mm

Litigation Expense Recovery

$31.4mm

$0.13

$47.1mm

Gains on Sales of Held-for-Sale Loans in Non-

Strategic Portfolio

$25.2mm

$0.11

$39.7mm

Loss Accruals Related to Legal Matters

$(31.5)mm

$(0.13)

$(50.0)mm

Litigation Expense Recovery

$9.5mm

$0.04

$15.0mm

$(35.0)mm

$(22.0)mm

$(0.09)

Net Loss Accruals Related to Legal Matters

None

Agreement in principle with DOJ/HUD to settle

potential claims on FHA loans

$(162.5)mm

$(124.1)mm

$(0.51)³ |

20

1Q15 Credit Quality Summary by Portfolio

Numbers

may

not

add

to

total

due

to

rounding.

Data

as

of

1Q15.

NM:

Not

meaningful.

($ in millions)

CRE

HE &

HELOC

Other

1

Total

Permanent

Mortgage

Commercial

(C&I & Other)

CRE

HE &

HELOC

Permanent

Mortgage

Other

2

Total

Period End Loans

$9,185

$1,320

$3,358

$337

$14,200

$123

$453

$1

$1,565

$379

$11

$16,732

30+ Delinquency

0.07%

0.32%

0.55%

1.29%

0.24%

3.41%

0.08%

14.87%

1.92%

2.50%

1.40%

0.47%

Dollars

$7

$4

$18

$4

$34

$4

$0

$0

$30

$9

$0

$78

NPL %

0.24%

1.00%

0.84%

0.15%

0.45%

2.29%

2.68%

18.31%

5.83%

7.82%

6.66%

1.20%

Dollars

$22

$13

$28

$0

$64

$3

$12

$0

$91

$30

$1

$200

Net Charge-offs

3

%

0.08%

0.03%

0.15%

3.22%

0.17%

NM

NM

2.64%

0.64%

0.59%

9.24%

0.23%

Dollars

$2

$0

$1

$3

$6

NM

$0

$0

$3

$1

$0

$9

Allowance

$63

$18

$33

$13

$126

NM

$5

$0

$77

$20

$1

$228

Allowance / Loans %

0.68%

1.33%

0.97%

3.88%

0.89%

NM

1.09%

8.22%

4.90%

5.32%

4.69%

1.36%

Allowance / Charge-offs

9.42x

52.33x

6.45x

1.16x

5.41x

NM

NM

1.06x

7.36x

8.82x

0.49x

6.17x

Regional Banking

Corporate

4

Non-Strategic

Commercial

(C&I & Other)

1

Creditcard,

Permanent

Mortgage,

and

Other.

2

Credit

card,OTC,

and

Other

Consumer.

3

Net

charge-offs

are

annualized.

4

Exercised

clean-up

calls

on

jumbo

securitizations

in

1Q13,

3Q12,

2Q11,

and

4Q10,

which

are

now

on

balance

sheet

in

the

Corporate

segment. |

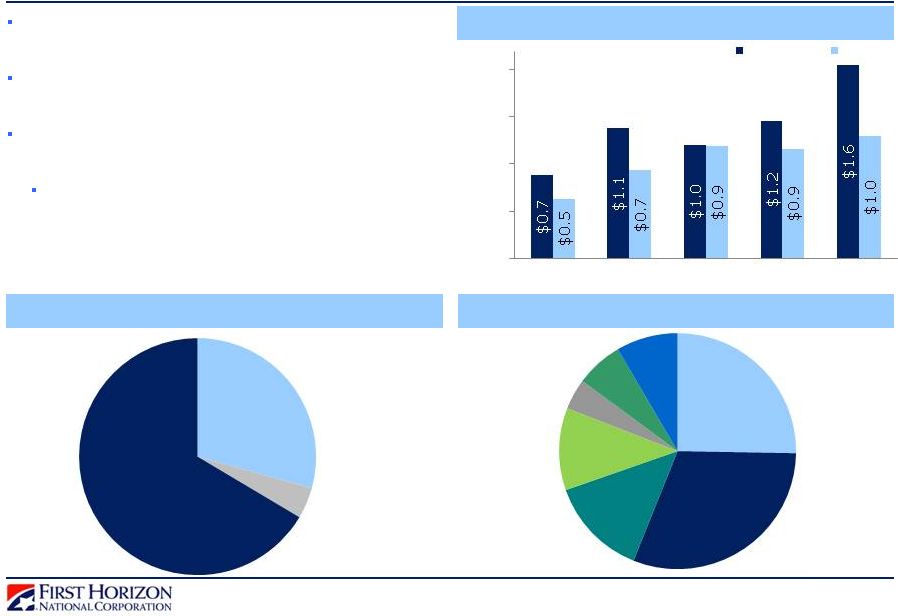

21

C&I and CRE Portfolio Detail

$9.6B C&I portfolio, diversified by industry, managed

primarily in Regional Banking

$1.3B CRE portfolio, comprising 8% of period-end

consolidated loans

Commercial (C&I and CRE) net charge-offs were $2mm

for the quarter

Charge-offs were $4.3mm with recoveries of

$2.6mm

Data as of 1Q15. Numbers may not add to total due to rounding.

CRE: Loan Type

CRE: Collateral Type

C&I: Loans to Mortgage Companies

Construction

29%

Land

4%

Mini-

Perm/Non-

Construction

66%

Retail

25%

Multi-Family

31%

Office

14%

Industrial

11%

Land

4%

Other

6%

Hospitality

8%

$0.0

$0.4

$0.8

$1.2

$1.6

1Q14

2Q14

3Q14

4Q14

1Q15

Period End

Average |

22

Consumer Portfolio Overview

Data as of 1Q15. Numbers may not add to total due to rounding.

HELOC Draw vs

Repayment Balances

Percent of Home Equity Portfolio:

Months Left in Draw Period

Home Equity Portfolio Characteristics

Home Equity Geographic Distribution

Non-Strategic Consumer

Real Estate Run-Off

First

Second

Total

Balance

$2.8B

$2.1B

$4.9B

Original FICO

753

735

745

Refreshed FICO

752

723

739

Original CLTV

77%

81%

79%

Full Doc

93%

74%

85%

Owner Occupied

93%

95%

94%

HELOCs

$0.7B

$1.7B

$2.4B

Weighted Average

HELOC Utilization

47%

56%

54%

22%

15%

17%

8%

5%

32%

0%

5%

10%

15%

20%

25%

30%

35%

0-12

13-24

25-36

37-48

49-60

>60

$1.7

$0.7

$0.0

$0.5

$1.0

$1.5

In Draw

In

Repayment

19%

19%

21%

25%

28%

15%

18%

21%

24%

27%

30%

$0.0

$0.5

$1.0

$1.5

$2.0

1Q14

2Q14

3Q14

4Q14

1Q15

Period End Balance

Constant Pre-Payment Rate (Right Axis)

Core

Banking

Customers

TN

60%

CA

8%

VA

3%

GA

3%

Other

26%

$2.0B

$2.5B |

23

Agency & Non-Agency Update

Repurchase Resolution Agreements with Both GSEs

Data

as

of

1Q15.

Numbers

may

not

add

to

total

due

to

rounding.

1

Based

on

UPB.

The

pipeline

represents

active

investor

claims

and

mortgage

insurance

(MI)

cancellations

under

review,

both

of

which

could occur on the same loan. Excludes MI cancellation notices that have been reviewed and

coverage has been lost. MI cancellations that have resulted in lost coverage are included in management’s

assessment

of

the

adequacy

of

repurchase

reserves.

1Q14,

2Q14,

3Q14,

4Q14,

and

1Q15

resolutions

include

$13.7mm,

$6.5mm,

$4.8mm,

$4.2mm,

and

$5.0mm

in

other

claims,

respectively,

that

pose

no risk to the repurchase reserve but require formal acknowledgment with Fannie.

Total

Pipeline

of

Repurchase

Requests

1

$300mm

Mortgage Repurchase Reserve

($ in millions)

Beginning Balance

Net Realized Losses

Ending Balance

Provision

2Q14

$145

$(4)

$141

$0

3Q14

$141

$(13)

$125

$(4)

4Q14

$125

$(6)

$119

$0

1Q14

$165

$(20)

$145

$0

Other Whole Loan Sales and Non-Agency

Represent 48% of all active repurchase/make whole

requests in 1Q15 pipeline

Some non-Agency FHN loans were bundled with other

companies’

loans and securitized by the purchasers

A trustee for a bundler has commenced a legal

action seeking repurchase of FHN loans

Certain purchasers have requested indemnity

related to FHN loans included in their

securitizations

Loan file review process regarding certain bundled

FHN loans has been initiated

1Q15

$119

$(3)

$116

$0

Loan Sales

$0

$2

$0

$0

$0

$0

$150

1Q14

2Q14

3Q14

4Q14

1Q15

GSE New Requests

Other New Requests

Resolved

Pipeline |

FH Proprietary

Securitizations Litigation Certificate Breakdown

24

$627mm

FHAMS 2005-FA10

($ in millions)

Deal

FHASI 2007-AR2

1

(Schwab)

Senior

$50.0

$33.4

$14.3

$12.6

$1.7

$2.3

FHAMS 2006-FA6

(FDIC Alabama)

Senior

$11.1

$3.4

$6.2

$5.1

$1.1

$1.5

FHAMS 2006-FA6

(FDIC Alabama)

Senior

$15.2

$5.1

$8.9

$7.2

$1.7

$1.3

FHAMS 2006-FA7

(FDIC Alabama)

Senior

$20.7

$6.7

$11.4

$9.4

$2.0

$2.6

FHAMS 2007-FA4

1

(FDIC Alabama)

Senior

$14.4

$4.1

$8.3

$6.7

$1.6

$1.9

FHAMS 2007-FA1

(FDIC New York)

Senior

$44.5

$15.1

$23.2

$18.9

$4.3

$6.2

FHAMS 2007-FA2

(FDIC New York)

Senior

$34.9

$12.5

$17.9

$14.4

$3.5

$4.5

FHAMS 2005-FA8

(FHLB Indemnification)

Senior

$100.0

$79.6

$19.9

$17.7

$2.2

$0.5

FHAMS 2007-FA3

(MetLife Indemnification)

Senior

$103.0

$61.6

$33.0

$27.1

$5.9

$8.5

2

(Royal Park Indemnification)

Senior

$100.0

$66.3

$29.6

$26.1

$3.5

$4.1

FHAMS 2006-FA2

1

(Royal Park Indemnification)

Senior

$30.0

$23.5

$5.3

$4.5

$0.8

$1.2

FHAMS 2005-FA9

(Integra REC Indemnification)

Junior

$2.3

$0.1

$0.0

$0.0

$0.0

$2.2

FHAMS 2006-FA8

(Integra REC Indemnification)

Senior

$101.5

$63.4

$30.5

$25.3

$5.1

$7.6

Total

$627.5

$374.7

$208.4

$175.1

$33.3

$44.4

Cumulative

Loss

Certificate

Original

UPB

Paid

Off

Current

UPB

Performing

UPB

60D+

Delinquent

Paid Off

60%

Performing UPB

28%

60D+ Delinquent

³

5%

Cumulative Loss 7%

Numbers and percentages may not add to total due to rounding. Data source: March 2015 Trustee

Reports. Table excludes three FHAMS certificates at issue in the Tennessee CRS matter as to which FHN

is not a defendant but indemnity recently has been demanded. 1

The complainants only purchased a portion of these tranches. Original UPB estimated based on

the purchase price stated in the complaints. All other metrics prorated based on the ratio of

purchase price to the total original UPB of the entire tranche. ²Royal Park is asking for indemnification on $100mm of the $190mm tranche as stated in

the indemnification request. ³60D+

Delinquent defined as a delinquency status of 60 days or more and also bankruptcies,

foreclosures and REO in such status for 60 days or more. |

Reconciliation to

GAAP Financials 25

Slides in this presentation use non-GAAP information of risk weighted assets, tangible

common equity, net income, non-controlling interest,

average

common

equity,

intangibles,

and

various

ratios

using

those

measures.

That

information

is

not

presented

according

to

generally

accepted

accounting

principles

(GAAP)

and

is

reconciled

to

GAAP

information

below.

Numbers may not add to total due to rounding.

1

Core Businesses include the Regional Banking, Capital Markets, and Corporate segments.

($ in millions)

1Q15

Core Businesses Return On Tangible Common Equity

(Segment equity based on internal risk-based methodology)

Corporate Average Equity (GAAP)

$1,145

Less: Corporate Non-Controlling Interest (GAAP)

$295

Less: Corporate Preferred Stock (GAAP)

$96

Corporate Average Common Equity (GAAP)

$754

Regional Banking Average Common Equity (GAAP)

$936

Capital Markets Average Common Equity (GAAP)

$156

Core

Businesses

Average

Common

Equity

(Non-GAAP)

1

$1,846

Non-Strategic Average Common Equity (GAAP)

$371

FHN Average Common Equity (GAAP)

$2,216

Regional Banking Average Intangible Assets (GAAP)

$62

Capital Markets Average Intangible Assets (GAAP)

$113

Coporate Average Intangible Assets (GAAP)

$0

Core

Businesses

Average

Intangible

Assets

(Non-GAAP)

1

$175

Non-Strategic Average Intangible Assets (GAAP)

$0

FHN Average Intangible Assets (GAAP)

$175

FHN Average Common Equity (GAAP)

$2,216

Less: FHN Average Intangible Assets (GAAP)

$175

FHN Average Tangible Common Equity (Non-GAAP)

$2,042

Core

Businesses

Average

Common

Equity

(Non-GAAP)

1

$1,846

Less: Core Businesses Average Intangible Assets (Non-GAAP)

$175

Core Businesses Average Tangible Common Equity (Non-GAAP)

$1,671

Core Businesses Net Income Available to Common

Corporate Net Income (GAAP)

-$13

Less: Corporate Non-Controlling Interest (GAAP)

$3

Less: Corporate Preferred Stock Dividends (GAAP)

$2

Corporate Net Income Available to Common (GAAP)

-$18

Regional Banking Net Income Available to Common (GAAP)

$48

Capital Markets Net Income Available to Common (GAAP)

$7

Core Businesses Net Income Available to Common (Non-GAAP)

$37

Non-Strategic Net Income Available to Common (GAAP)

-$114

FHN Net Income Available to Common (GAAP)

-$77

Core Businesses Return on Tangible Common Equity

FHN Annualized Return on Average Common Equity (Non-GAAP)

-15.24%

Core Businesses Annualized Return on Average Common Equity (Non-GAAP)

8.99%

1

1

1

1

1

1

1 |

Reconciliation to

GAAP Financials 26

Numbers may not add to total due to rounding.

1

Core Businesses include the Regional Banking, Capital Markets, and Corporate segments.

2

All else equal, a 200bps rate shock results in ~$78mm increase in Core Businesses annual NII

(see slide 11), as Non-Strategic is interest rate neutral. Slides in this

presentation use non-GAAP information of expense, revenue, repurchase provision, and various ratios using one or

more of those measures. That information is not presented according to generally accepted

accounting principles (GAAP) and is reconciled to GAAP information below.

Net Interest Margin

($ in millions)

1Q15

4Q14

3Q14

2Q14

1Q14

Regional Banking Net Interest Income (GAAP)

$154

$158

$154

$149

$142

Regional Banking FTE Adjustment

$2

$2

$2

$2

$2

Regional Banking Net Interest Income Adjusted for Impact of FTE (Non-GAAP)

$157

$160

$156

$151

$144

Capital Markets Net Interest Income (GAAP)

$4

$4

$3

$3

$3

Capital Markets FTE Adjustment

$0

$0

$0

$0

$0

Capital Markets Net Interest Income Adjusted for Impact of FTE (Non-GAAP)

$5

$4

$3

$3

$4

Corporate Net Interest Income (GAAP)

-$16

-$18

-$14

-$12

-$10

Corporate FTE Adjustment

$0

$0

$0

$0

$0

Corporate Net Interest Income Adjusted for Impact of FTE (Non-GAAP)

-$16

-$18

-$14

-$12

-$10

Core Businesses Net Interest Income (Non-GAAP)

1

$143

$143

$143

$139

$136

Core Businesses FTE Adjustment (Non-GAAP)

1

$3

$3

$2

$2

$2

Core Businesses Net Interest Income Adjusted for Impact of FTE (Non-GAAP)

$145

$146

$145

$142

$138

Non-Strategic Net Interest Income (GAAP)

$14

$16

$17

$17

$17

Non-Strategic FTE Adjustment

$0

$0

$0

$0

$0

Non-Strategic Net Interest Income Adjusted for Impact of FTE (Non-GAAP)

$14

$16

$17

$17

$17

Consolidated Net Interest Income (GAAP)

$157

$159

$160

$157

$152

Consolidated FTE Adjustment

$3

$3

$2

$2

$2

Consolidated Net Interest Income Adjusted for Impact of FTE (Non-GAAP)

$159

$162

$162

$159

$154

Average Earning Assets

1Q15

Regional Banking Earning Assets (GAAP)

$13,561

Capital Markets Earning Assets (GAAP)

$2,147

Corporate Earning Assets (GAAP)

$5,162

Core Businesses Earning Assets (Non-GAAP)

$20,870

Non-Strategic Earning Assets (GAAP)

$2,604

Consolidated Earning Assets (GAAP)

$23,474

Core Businesses NIM with 200bps Rate Shock

1

1Q15

Annualized Core Businesses Net Interest Income Adjusted for Impact of FTE (Non-GAAP)

a

$589

Core Businesses Average Earning Assets (Non-GAAP)

b

$20,870

Core Businesses NIM (Non-GAAP)

a/b

2.81%

Core Businesses Additional Annual NII from a 200bps Rate Shock (Non-GAAP)

c

$78

Core Businesses NIM with 200bps Rate Shock (Non-GAAP)

(a+c)/b

3.19%

Annualized Consolidated Net Interest Income Adjusted for Impact of FTE (Non-GAAP)

d

$646

Consolidated Average Earning Assets (GAAP)

e

$23,474

Consolidated NIM (GAAP)

d/e

2.74%

Consolidated Additional Annual NII from a 200bps Rate Shock (Non-GAAP)

f

$78

Consolidated NIM with 200bps Rate Shock (Non-GAAP)

(d+f)/e

3.09%

²

²

1

1 |

Reconciliation to

GAAP Financials 27

Numbers may not add to total due to rounding.

1

Includes goodwill and other intangible assets, net of

amortization.

2

Current quarter is an

estimate.

Slides in this presentation use non-GAAP information of expense, revenue, repurchase

provision, and various ratios using one or more of those measures. That information is

not presented according to generally accepted accounting principles (GAAP) and is

reconciled to GAAP information below.

($ in millions)

1Q15

4Q14

3Q14

2Q14

1Q14

Tangible Common Equity (Non-GAAP)

Total Equity (GAAP)

$2,499

$2,582

$2,615

$2,621

$2,542

Less: Noncontrolling Interest

$295

$295

$295

$295

$295

Less: Preferred Stock

$96

$96

$96

$96

$96

Total Common Equity

$2,108

$2,191

$2,224

$2,230

$2,151

$174

$175

$161

$162

$163

Tangible Common Equity (Non-GAAP)

$1,934

$2,015

$2,063

$2,068

$1,988

Tangible Assets (Non-GAAP)

Total Assets (GAAP)

$25,716

$25,668

$23,986

$24,225

$23,946

$174

$175

$161

$162

$163

Tangible Assets (Non-GAAP)

$25,542

$25,493

$23,825

$24,063

$23,783

Tier 1 Common (Non-GAAP)

Tier 1 Capital

$2,452

$2,814

$2,783

$2,752

$2,666

Less:

Noncontrolling

Interest

-

FTBNA

Preferred

Stock

N/A

$295

$295

$295

$295

Less: Preferred Stock

N/A

$96

$96

$96

$96

Less: Trust Preferred

N/A

$200

$200

$200

$200

Tier 1 Common (Non-GAAP)

N/A

$2,223

$2,193

$2,161

$2,076

Risk Weighted Assets

Risk Weighted Assets

$20,795

$19,453

$19,238

$19,400

$18,695

Ratios

Tangible Common Equity to Tangible Assets (TCE/TA) (Non-GAAP)

7.57%

7.90%

8.66%

8.60%

8.36%

Total Equity to Total Assets (GAAP)

9.72%

10.06%

10.90%

10.82%

10.61%

Tier 1 Common to Risk Weighted Assets (Non-GAAP)

N/A

11.43%

11.40%

11.14%

11.10%

Tier 1 Capital to Total Assets (GAAP)

9.54%

10.96%

11.60%

11.36%

11.14%

Less: Intangible Assets (GAAP)

Less: Intangible Assets (GAAP)

1

1

2

2

2

2

2 |

28

Slides in this presentation use non-GAAP information of expense, revenue, repurchase

provision, and various ratios using one or more of those measures. That information is

not presented according to generally accepted accounting principles (GAAP) and is

reconciled to GAAP information below.

Numbers may not add to total due to rounding.

1

Core Businesses include the Regional Banking, Capital Markets, and Corporate segments.

2

ROA and Net Charge-offs / Average loans are annualized for 1Q15.

Reconciliation to GAAP Financials

($ in millions)

Net Interest Available to Common/EPS Excluding Litigation Charge

1Q15

-$95

$163

$68

$22

$46

$3

$2

$42

235

$0.18

Impact to EPS of Litigation Charge

Earnings Per Share (GAAP)

-$0.33

Less: Earnings Per Share Excluding Litigation Charge (Non-GAAP)

$0.18

Impact to EPS of Litigation Charge (Non-GAAP)

-$0.51

Adjusted Annualized Net Income Available to Common Shareholders Excluding Litigation Charge

(Non-GAAP) $169

FHN Average Tangible Common Equity (GAAP)

$2,042

Consolidated Return on Average Tangible Common Equity Excluding Litigation Charge

(Non-GAAP) 8.30%

$187

Average Total Assets (GAAP)

$25,645

Consolidated Return on Assets Excluding Litigation Charge (Non-GAAP)

0.73%

Consolidated Efficiency Ratio Excluding Litigation Charge

Adjusted Consolidated Noninterest Expense (Non-GAAP)

$214

Total Revenue Excluding Securities Gains (GAAP)

$286

Consolidated Efficiency Ratio Excluding Litigation Charge (Non-GAAP)

75%

Return

on Assets²

Net Interest

Margin

Regional Banking (GAAP)

1.35%

4.68%

Capital Markets (GAAP)

1.17%

0.83%

Corporate (GAAP)

-0.84%

-1.28%

Core Businesses (Non-GAAP)¹

0.73%

2.81%

Non-Strategic (GAAP)

-18.05%

2.19%

Consolidated (GAAP)

-1.15%

2.74%

Adjusted Annualized Consolidated Net Income Excluding Litigation Charge (Non-GAAP)

Less: Preferred Stock Dividends (GAAP)

Assumed Diluted Shares with Net Income Instead of Net Loss (Non-GAAP)

Consolidated Return on Assets Excluding Litigation Charge

Consolidated Return on Average Tangible Common Equity Excluding Litigation Charge

Key Ratios Excluding Litigation Charge

Earnings Per Share Excluding Litigation Charge (Non-GAAP)

Net Income Available to Common Shareholders Excluding Litigation Charge (Non-GAAP)

Consolidated Pre-tax Loss (GAAP)

Plus: Litigation Charge (GAAP)

Adjusted Consolidated Pre-tax Income (Non-GAAP)

Less: Adjusted Tax Using Estimated Tax Rate of ~32% (Non-GAAP)

Less: Net Income Attributable to Noncontrolling Interest (GAAP)

Adjusted Net Income Excluding Litigation Charge (Non-GAAP)

0.55%

15%

NM

0.23%

45%

NM

Net Charge-Offs/

Average Loans²

Fee Income /

Total Revenue

Efficiency

Ratio

0.17%

28%

63%

0.00%

93%

83%

NM

NM

NM

0.17%

47%

76% |

29

Slides in this presentation use non-GAAP information of expense, revenue, repurchase

provision, and various ratios using one or more of those measures. That information is

not presented according to generally accepted accounting principles (GAAP) and is

reconciled to GAAP information below.

Numbers may not add to total due to rounding.

Reconciliation to GAAP Financials

($ in millions)

1Q15

4Q14

1Q14

Regional Banking Pre-Provision Net Revenue

$215

$222

$202

$136

$138

$133

$79

$84

$69

1Q15 Changes vs

Adjusted Consolidated Noninterest Expense

1Q15

1Q14

1Q13

1Q12

1Q14

1Q12

$376

$218

$241

$322

73%

17%

$0

$0

$0

$49

$163

$0

$5

$0

$214

$218

$235

$273

-2%

-22%

$855

$872

$941

$1,090

2014

2011

Capital Markets Noninterest Expense (GAAP)

$147

$321

Sentinel Noninterest Expense/(Recovery) (GAAP)

($47)

$37

Adjusted Capital Markets Noninterest Expense (Non-GAAP)

$194

$284

1Q15

1Q14

Change

$172

$16

$0

$0

$163

$0

$9

$15

-41%

Adjusted Capital Markets Noninterest Expense

Adjusted Annualized Noninterest Expense (Non-GAAP)

Regional Banking Total Revenue (GAAP)

Regional Banking Total Expense (GAAP)

Regional Banking Pre-Provision Net Revenue (Non-GAAP)

Consolidated Noninterest Expense (GAAP)

Less: Repurchase and Foreclosure Provision (GAAP)

Adjusted Non-Strategic

Adjusted Non-Strategic Noninterest Expense (Non-GAAP)

Less: Repurchase and Foreclosure Provision (GAAP)

Less: Litigation Charge (GAAP)

Less: Litigation Charge (GAAP)

Adjusted Consolidated Noninterest Expense (Non-GAAP)

Non-Strategic Noninterest Expense (GAAP) |