Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ARUBA NETWORKS, INC. | d909033d8k.htm |

| EX-10.2 - EX-10.2 - ARUBA NETWORKS, INC. | d909033dex102.htm |

Exhibit 10.1

Building C

LEASE

BY AND BETWEEN

Santa Clara Campus Property Owner I LLC,

a Delaware limited liability company

as Landlord

and

Aruba Networks, Inc.,

a Delaware corporation

as Tenant

April 15, 2015

Building C

TABLE OF CONTENTS

| Page | ||||||

| ARTICLE 1 |

REFERENCE | 1 | ||||

| 1.1 | References | 1 | ||||

| ARTICLE 2 |

LEASED PREMISES, TERM AND POSSESSION | 6 | ||||

| 2.1 | Demise Of Leased Premises | 6 | ||||

| 2.2 | Right To Use Common Areas | 6 | ||||

| 2.3 | Lease Commencement Date And Lease Term | 7 | ||||

| 2.4 | Delivery Of Possession | 7 | ||||

| 2.5 | Performance Of Tenant Improvement Work; Acceptance Of Possession | 8 | ||||

| 2.6 | Surrender Of Possession | 8 | ||||

| ARTICLE 3 |

RENT | 10 | ||||

| 3.1 | Base Monthly Rent | 10 | ||||

| 3.2 | Additional Rent | 10 | ||||

| 3.3 | Year-End Adjustments | 11 | ||||

| 3.4 | Late Charge, And Interest On Rent In Default | 11 | ||||

| 3.5 | Payment Of Rent | 12 | ||||

| ARTICLE 4 |

USE OF LEASED PREMISES AND COMMON AREA | 12 | ||||

| 4.1 | Permitted Use | 12 | ||||

| 4.2 | General Limitations On Use | 12 | ||||

| 4.3 | Noise And Emissions | 12 | ||||

| 4.4 | Trash Disposal | 12 | ||||

| 4.5 | Parking | 13 | ||||

| 4.6 | Signs | 13 | ||||

| 4.7 | Compliance With Laws And Restrictions | 13 | ||||

| 4.8 | Compliance With Insurance Requirements | 14 | ||||

| 4.9 | Landlord’s Right To Enter | 14 | ||||

| 4.10 | Use Of Common Areas | 14 | ||||

| 4.11 | Environmental Protection | 14 | ||||

| 4.12 | Rules And Regulations | 16 | ||||

| 4.13 | Reservations | 16 | ||||

| ARTICLE 5 |

REPAIRS, MAINTENANCE, SERVICES AND UTILITIES | 17 | ||||

| 5.1 | Repair And Maintenance | 17 | ||||

| (a) Tenant’s Obligations |

17 | |||||

| (b) Landlord’s Obligation |

17 | |||||

| 5.2 | Utilities | 18 | ||||

| 5.3 | Security | 19 | ||||

| 5.4 | Energy And Resource Consumption | 19 | ||||

| 5.5 | Limitation Of Landlord’s Liability | 19 | ||||

| ARTICLE 6 |

ALTERATIONS AND IMPROVEMENTS | 19 | ||||

| 6.1 | By Tenant | 19 | ||||

| 6.2 | Ownership Of Improvements | 20 | ||||

| 6.3 | Alterations Required By Law | 20 | ||||

| 6.4 | Liens | 21 | ||||

| ARTICLE 7 |

ASSIGNMENT AND SUBLETTING BY TENANT | 21 | ||||

| 7.1 | By Tenant | 21 | ||||

| 7.2 | Merger, Reorganization, or Sale of Assets | 22 | ||||

| 7.3 | Landlord’s Election | 22 | ||||

| 7.4 | Conditions To Landlord’s Consent | 23 | ||||

| 7.5 | Assignment Consideration And Excess Rentals Defined | 24 | ||||

| 7.6 | Payments | 24 | ||||

| 7.7 | Good Faith | 24 | ||||

| 7.8 | Effect Of Landlord’s Consent | 24 | ||||

i

Building C

| ARTICLE 8 |

LIMITATION ON LANDLORD’S LIABILITY AND INDEMNITY | 26 | ||||

| 8.1 | Limitation On Landlord’s Liability And Release | 26 | ||||

| 8.2 | Tenant’s Indemnification Of Landlord | 26 | ||||

| ARTICLE 9 |

INSURANCE | 26 | ||||

| 9.1 | Tenant’s Insurance | 26 | ||||

| 9.2 | Landlord’s Insurance | 27 | ||||

| 9.3 | Mutual Waiver Of Subrogation | 28 | ||||

| ARTICLE 10 |

DAMAGE TO LEASED PREMISES | 28 | ||||

| 10.1 | Landlord’s Duty To Restore | 28 | ||||

| 10.2 | Insurance Proceeds | 28 | ||||

| 10.3 | Landlord’s Right To Terminate | 29 | ||||

| 10.4 | Tenant’s Right To Terminate | 29 | ||||

| 10.5 | Tenant’s Waiver | 29 | ||||

| 10.6 | Abatement Of Rent | 30 | ||||

| ARTICLE 11 |

CONDEMNATION | 30 | ||||

| 11.1 | Tenant’s Right To Terminate | 30 | ||||

| 11.2 | Landlord’s Right To Terminate | 30 | ||||

| 11.3 | Restoration | 30 | ||||

| 11.4 | Temporary Taking | 30 | ||||

| 11.5 | Division Of Condemnation Award | 31 | ||||

| 11.6 | Abatement Of Rent | 31 | ||||

| 11.7 | Taking Defined | 31 | ||||

| ARTICLE 12 |

DEFAULT AND REMEDIES | 31 | ||||

| 12.1 | Events Of Tenant’s Default | 31 | ||||

| 12.2 | Landlord’s Remedies | 32 | ||||

| 12.3 | Landlord’s Default And Tenant’s Remedies | 33 | ||||

| 12.4 | Limitation Of Tenant’s Recourse | 34 | ||||

| 12.5 | Tenant’s Waiver | 34 | ||||

| ARTICLE 13 |

GENERAL PROVISIONS | 34 | ||||

| 13.1 | Taxes On Tenant’s Property | 34 | ||||

| 13.2 | Holding Over | 35 | ||||

| 13.3 | Subordination To Mortgages | 35 | ||||

| 13.4 | Tenant’s Attornment Upon Foreclosure | 36 | ||||

| 13.5 | Mortgagee Protection | 36 | ||||

| 13.6 | Estoppel Certificate | 36 | ||||

| 13.7 | Tenant’s Financial Information | 36 | ||||

| 13.8 | Transfer By Landlord | 37 | ||||

| 13.9 | Force Majeure | 37 | ||||

| 13.10 | Notices | 37 | ||||

| 13.11 | Attorneys’ Fees and Costs | 38 | ||||

| 13.12 | Definitions | 38 | ||||

| (a) Real Property Taxes |

38 | |||||

| (b) Landlord’s Insurance Costs |

39 | |||||

| (c) Property Maintenance Costs |

39 | |||||

| (d) Property Operating Expenses |

40 | |||||

| (e) Law |

43 | |||||

| (f) Lender |

43 | |||||

| (g) Rent |

43 | |||||

| (h) Restrictions |

43 | |||||

| 13.13 | General Waivers | 43 | ||||

| 13.14 | Miscellaneous | 43 | ||||

| 13.15 | Patriot Act Compliance | 44 | ||||

| ARTICLE 14 |

LEGAL AUTHORITY BROKERS AND ENTIRE AGREEMENT | 45 | ||||

| 14.1 | Legal Authority | 45 | ||||

| 14.2 | Brokerage Commissions | 45 | ||||

ii

Building C

| 14.3 | Entire Agreement | 46 | ||||

| 14.4 | Landlord’s Representations | 46 | ||||

| ARTICLE 15 |

OPTIONS TO EXTEND | 46 | ||||

| 15.1 | Option to Extend | 46 | ||||

| 15.2 | Fair Market Rent | 46 | ||||

| 15.3 | Tenant’s Election | 47 | ||||

| 15.4 | Rent Arbitration | 47 | ||||

| ARTICLE 16 |

TELEPHONE SERVICE | 48 | ||||

iii

Building C

LEASE

THIS LEASE, dated April 15, 2015 for reference purposes only, is made by and between SANTA CLARA CAMPUS PROPERTY OWNER I LLC, a Delaware limited liability company (“Landlord”) and ARUBA NETWORKS, INC., a Delaware corporation [NASDAQ: ARUN] (“Tenant”), to be effective and binding upon the parties as of the date the last of the designated signatories to this Lease shall have executed this Lease (the “Effective Date of this Lease”).

ARTICLE 1

REFERENCE

1.1 References. All references in this Lease (subject to any further clarifications contained in this Lease) to the following terms shall have the following meaning or refer to the respective address, person, date, time period, amount, percentage, calendar year or fiscal year as below set forth:

| Tenant’s Representative: | Michael Phelps | |

| Phone Number: | (408) 419-0296 | |

| Landlord’s Representative: | Henry Bullock/Richard Holmstrom | |

| Phone Number: | (650) 326-9300 | |

| Targeted Commencement Date: | March 1, 2017 | |

| Intended Term: | One hundred thirty-two (132) months | |

| Lease Expiration Date: | One hundred thirty-two (132) months from the Lease Commencement Date (defined in Paragraph 2.3 below), unless earlier terminated in accordance with the terms of this Lease, or extended by Tenant pursuant to Paragraph 2.3 or Article 15 below. Notwithstanding the foregoing or any other provision of this Lease, if the Lease Commencement Date is other than the first calendar day of a calendar month, then the Lease Expiration Date shall be one hundred thirty-two (132) months from the last calendar day of the calendar month in which the Lease Commencement Date occurs, subject to the terms of Paragraph 2.3 and Article 15 below. | |

| Options to Extend: | Two (2) option(s) to extend, each for a term of five (5) years. | |

| Tenant’s Security Deposit: | None | |

| Late Charge Amount: | Five Percent (5%) of the Delinquent Amount | |

| Tenant’s Required Liability Coverage: | $5,000,000 Combined Single Limit | |

| Tenant’s Broker: | Jones Lang LaSalle | |

| Landlord’s Broker: | Colliers International | |

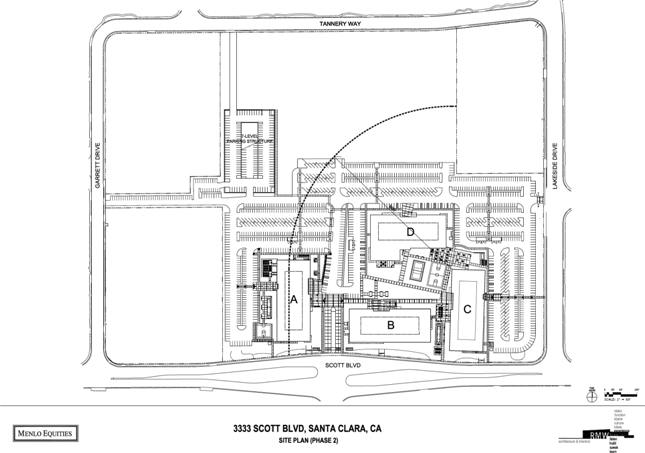

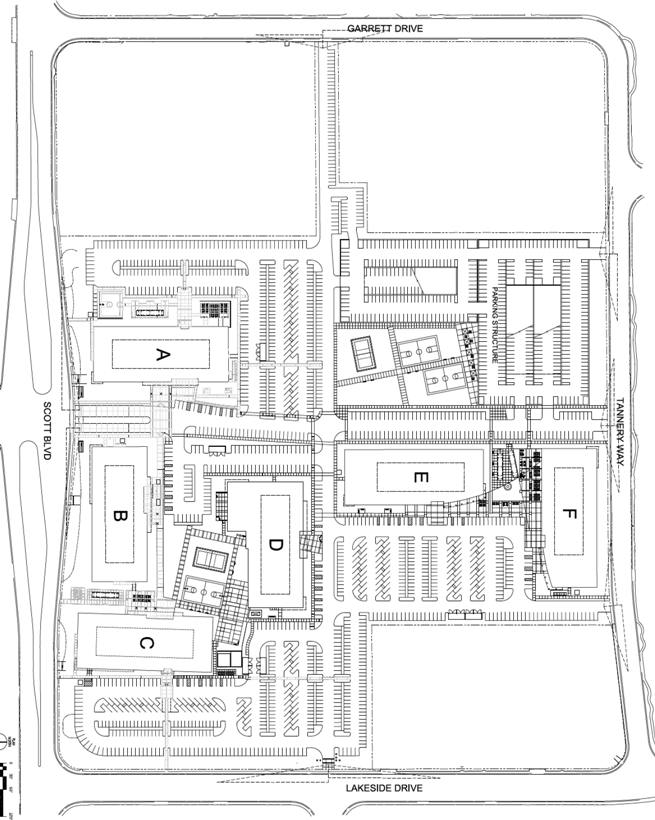

| Project: | That certain real property situated in the City of Santa Clara, County of Santa Clara, State of California, identified as Assessor’s Parcel Nos.:

(1) 216-31-084, with a street address of 3355 Scott Boulevard (shown on the Site Plan as the location of “Building A”),

(2) 216-31-085, with a street address of 3325 Scott Boulevard (shown on the Site Plan as the location of “Building B” and most of “Building D”),

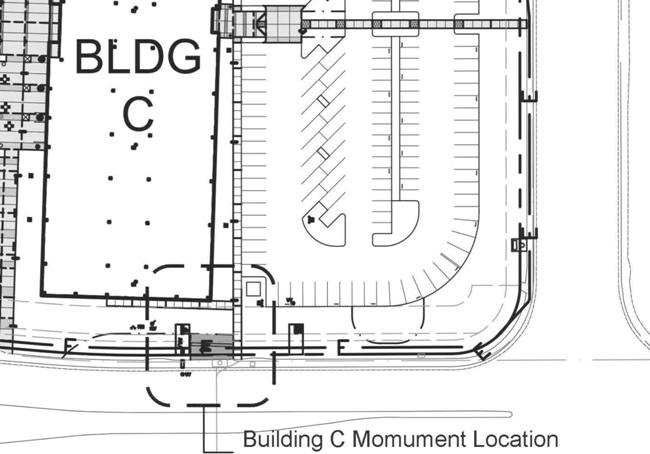

(3) 216-31-086, with a street address of 3315 Scott Boulevard (shown on the Site Plan as the location of “Building C” and the balance of “Building D”),

(4) 216-31-083, shown on the Site Plan as the location of future “Building E” and future “Building F” with a current with a street address of 3335 Scott Boulevard but which address will change after completion of the adjustments described below in the definition of “property”, | |

1

Building C

| and

(5) 216-31-082, with a current street address of 3345 Scott Boulevard (shown on the Site Plan as the location of the future “Parking Structure”), and such other buildings as Landlord may elect to construct in the future, | ||

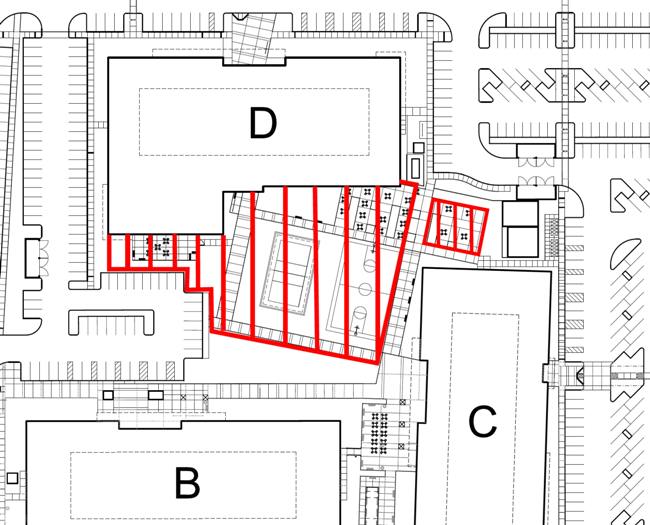

| which real property is shown on the preliminary Site Plan attached hereto as Exhibit A (the “Site Plan”). Construction will commence on Building D after the Effective Date of this Lease. Future Building E (“Building E”), future Building F (“Building F”), and future Parking Structure (“Parking Structure”) have not yet been constructed and Landlord may elect not to construct them; provided however that if Landlord elects not to construct the Parking Structure, Landlord shall install surface parking sufficient to satisfy a parking ratio of 3.3 parking spaces per 1,000 rentable square feet of space constructed in the Project, and a minimum of 3.3 parking spaces for each 1,000 rentable square feet of Leased Premises shall continue to be located within the area depicted by a curved dotted line on Schedule 2.2(a) attached to the Lease. Landlord reserves the right to adjust the boundaries of the Project and the sizes and locations of Building E, Building F, and the Parking Structure at any time, provided that the Required Conditions are satisfied. The Site Plan and Landlord’s proposed adjustments to it and the applicable Assessor’s Parcel Map are subject to approval by the City of Santa Clara. | ||

| Property: | That certain separate legal parcel of real property currently identified as Assessor’s Parcel No. 216-31- 086, on which is situated the Building and a portion of Building D as delineated on the Site Plan, with a street address of 3315 Scott Boulevard, Santa Clara, California. Landlord is currently processing adjustments to the boundaries of the Property so Building D will not be located on the Property, and reserves the right to adjust the boundaries of the Property at any time, provided in all cases that the Required Conditions are satisfied. | |

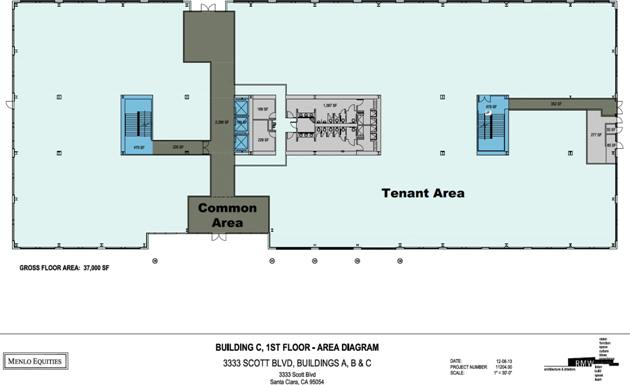

| Building: | That certain building located on the Property in which the Leased Premises will be located commonly known as 3315 Scott Boulevard, Santa Clara, California (the “Building”), which Building is shown outlined on the Site Plan (and denoted thereon as “Building C”), containing approximately 156,889 rentable square feet of space, which rentable square footage has been determined by utilizing the Building Owners and Managers Association International Single Tenant Full Building Standard Method for Measuring Floor Area in Office Buildings ANSI Z65-1-1996, pages 10 and 11 (the “BOMA”), and to which has been added a proportionate share of café and the fitness center in the Other Building located at 3355 Scott Boulevard (the “Cafe & Fitness Center”), which will be allocated across the rentable square footage of the Building and the Other Buildings, bringing the total rentable square footage of the Building to approximately 156,889 and, for purposes of this Lease, the Building is agreed to contain said number of rentable square feet. | |

| Other Buildings: | (a) Those certain buildings currently constructed in the Project (but outside the Property) commonly known as 3355 Scott Boulevard (“Building A”), containing approximately 144,499 rentable square feet of space, 3325 Scott Boulevard (“Building B”), containing approximately 157,412 rentable square feet of space, and 3335 Scott Boulevard (“Building D”), containing (once construction is completed) approximately 245,804 rentable square feet of space, as such rentable | |

2

Building C

| square footage amounts were determined (with respect to Building A and Building B) and will be determined (with respect to Building D) based on BOMA (to which has been added, or subtracted in the case of Building A, a proportionate share of the Cafe & Fitness Center as described above) and, for purposes of this Lease, Building A and Building B are agreed to contain said number of rentable square feet, and (b) such other buildings as may be built on the Project from time to time. | ||

| Building D Lease: | That certain Lease dated as of the date of this Lease, entered into by and between Landlord and Tenant for the first through fifth floors of Building D (the “Building D Lease”). | |

| Building D Premises: | The premises leased by Tenant pursuant to the Building D Lease (the “Building D Premises”). | |

| Common Areas: | The “Common Areas” shall mean the areas within the Building or the Project not reserved for the exclusive use of Landlord, Tenant or any other tenant, including, without limitation, lobbies, plazas, walkways, private roadways, loading docks, parking areas, parking structures, and landscaped areas. Common Areas shall not include the interior of any Other Buildings, other than such portions thereof as Landlord may designate for the use of all occupants of the Property. | |

| Parking: | With respect to the Leased Premises, Tenant shall be entitled to utilize 3.3 unreserved and unassigned parking spaces for each 1,000 rentable square feet of Leased Premises (as the same may change from time to time in accordance with the terms of this Lease or an amendment hereto), such spaces to be located in the parking area of the Common Areas. For the avoidance of confusion, so long as Tenant is leasing the entire Leased Premises of 35,121 rentable square feet, Tenant would be entitled to 116 such parking spaces. Tenant may (within sixty (60) days after the Effective Date of this Lease, if at all) designate up to three (3) site standard parking spaces (out of Tenant’s overall parking count described above) within the area noted on the Site Plan as “Available Exclusive Parking Area,” for Tenant’s exclusive use so long as it is in occupancy of the entire initial Leased Premises (“Tenant’s Exclusive Parking Spaces”). In addition, if Tenant so desires, Tenant may elect (within sixty (60) days after the Effective Date of this Lease, if at all) to have Landlord designate up to an additional two (2) site standard parking spaces (out of Tenant’s overall parking count described above) to be for Tenant’s exclusive use so long as it is in occupancy of the entire initial Leased Premises (“Tenant’s Additional Exclusive Parking Spaces”). In the event Tenant at any time leases less than the entire initial Leased Premises, the number of Tenant’s Exclusive Parking Spaces and Tenant’s Additional Exclusive Parking Spaces shall be proportionately reduced. Parking is provided to Tenant by Landlord without additional charge for the entire Lease Term including any expansion and/or extension periods, including but not limited to the First Extension Period and the Second Extension Period (as defined in Article 15 below). | |

| Required Conditions: | The term “Required Conditions” is defined in Paragraph 2.2(a) below). | |

3

Building C

| Building Standard Hours: | The term “Building Standard Hours” means from 7:00 a.m. and 7:00 p.m. Monday through Friday and on Saturdays from 8:00 a.m. to noon, excluding Sundays and New Year’s Day, Presidents Day, Memorial Day, Independence Day, Labor Day, Thanksgiving, Christmas and such other holidays as are generally recognized in the vicinity of the Project. | |

| HVAC: | Heating, ventilating, and/or air conditioning. | |

| Leased Premises: | The space located on the first floor of the Building and shown on the floor plan attached hereto as Exhibit B, plus the load factor associated therewith, estimated to contain approximately 35,121 rentable square feet, which rentable square footage has been determined by utilizing Landlord’s method of measurement (the “Premises Measurement Method”), which has been explained to Tenant, which is illustrated on Exhibit C attached hereto. Such rentable area calculation includes, without limitation, a proportionate share of the common Building lobby, and (i) the café portion of the Cafe & Fitness Center allocated across the rentable square footage of the Building and Buildings A and B, and (ii) the fitness center portion of the Cafe & Fitness Center allocated across the rentable square footage of the Building and Buildings A, B, and D. | |

| The Building and the Leased Premises are not subject to re-measurement unless, pursuant to a written amendment to this Lease, space is subtracted therefrom or additional space is added thereto. Recognizing that both Landlord and Tenant have agreed to the foregoing rentable square footage number and have agreed that there will be no re-measurement except as expressly provided above, Landlord has given Tenant the opportunity to measure the Building and the Leased Premises and has encouraged Tenant to do so, and Tenant hereby confirms that it has measured the Building and the Leased Premises and is in agreement with the foregoing number of square feet. | ||

|

Tenant’s Initials | ||

| Work Letter: | The term “Work Letter” shall mean the Work Letter attached as Exhibit D to and made a part of this Lease, the terms and provisions of which are hereby incorporated into this Lease. | |

| Tenant’s Building Share: | The term “Tenant’s Building Share” shall mean the percentage obtained by dividing the rentable square footage of the Leased Premises at the time of calculation by the rentable square footage of the Building at the time of calculation. Such percentage is 22.39%. In the event that the rentable square footage of the Leased Premises or the Building is changed (other than by mere re-measurement), Tenant’s Building Share shall be recalculated to equal the percentage described in the first sentence of this paragraph, so that the aggregate Tenant’s Building Share of all tenant space in the Building shall equal 100% (calculated as if the Building were fully occupied). Landlord and Tenant agree that any mere re-measurement, as opposed to an actual physical change, shall not result in a change in rentable square footage. | |

4

Building C

| Tenant’s Project Share: | The term “Tenant’s Project Share” shall mean the percentage obtained by dividing the rentable square footage of the Leased Premises at the time of calculation by the rentable square footage of the Building and the Other Buildings at the time of calculation. Such percentage is currently 4.98%. In the event that any portion of the Project is sold by Landlord, or if new improvements are constructed on the Project, or if the rentable square footage of the Leased Premises, the Building, or the Other Buildings is otherwise changed (other than by mere re-measurement), Tenant’s Project Share shall be recalculated to equal the percentage described in the first sentence of this paragraph, so that the aggregate Tenant’s Project Share of all tenant space in the Project shall equal 100% (calculated as if the Building and the Other Buildings were fully occupied). Landlord and Tenant agree that any mere re-measurement (as opposed to an actual physical change) shall not result in a change in rentable square footage. | |

| Standard Interest Rate: | The term “Standard Interest Rate” shall mean the greater of (a) 6%, or (b) the sum of that rate quoted by Wells Fargo Bank, N.T. & S. A., from time to time as its prime rate, plus two percent (2%), but in no event more than the maximum rate of interest not prohibited or made usurious. | |

| Default Interest Rate: | The term “Default Interest Rate” shall mean the Standard Interest Rate, plus five percent (5%), but in no event more than the maximum rate of interest not prohibited or made usurious. | |

| Base Monthly Rent: | The term “Base Monthly Rent” shall mean the following: | |

| Period |

Base Monthly Rent per rentable square foot (rounded)* |

Base Monthly Rent |

||||||

| Months 1-9 |

$ | 2.90 | $ | 0.00 | ||||

| Months 10-24 |

$ | 2.90 | $ | 101,850.90 | ||||

| Months 25-36 |

$ | 2.97 | $ | 104,142.55 | ||||

| Months 37-48 |

$ | 3.03 | $ | 106,485.75 | ||||

| Months 49-60 |

$ | 3.10 | $ | 108,881.68 | ||||

| Months 61-72 |

$ | 3.17 | $ | 111,331.52 | ||||

| Months 73-84 |

$ | 3.24 | $ | 113,836.48 | ||||

| Months 85-96 |

$ | 3.31 | $ | 116,397.80 | ||||

| Months 97-108 |

$ | 3.39 | $ | 119,016.75 | ||||

| Months 109-120 |

$ | 3.47 | $ | 121,694.63 | ||||

| Months 121-132 |

$ | 3.54 | $ | 124,432.76 | ||||

| * | These “per square foot” numbers are rounded. Actual numbers used for Base Monthly Rent are to equal rentable square footage of 35,121 multiplied by $2.90 in months 10-24, and then increased by 2.25% each year thereafter. |

5

Building C

| Permitted Use: | General office, administration, research and development, engineering laboratories, and other legal uses ancillary thereto, to the extent all such uses are in compliance with all Laws and Restrictions. | |

| Exhibits: | The term “Exhibits” and “Schedules” shall mean the Exhibits and Schedules of this Lease which are described as follows: | |

| Schedule 2.1 – Existing Title Encumbrances | ||

| Schedule 2.2(a) – Approved Parking Area | ||

| Exhibit A – Site Plan showing the Project and delineating the Building in which the Leased Premises are located | ||

| Exhibit B – Floor Plan | ||

| Exhibit C – Premises Measurement Method | ||

| Exhibit D – Work Letter | ||

| Exhibit E – Lease Commencement Date Certificate | ||

| Exhibit F – Reserved | ||

| Exhibit G – Lump Sum Payment Amendment | ||

| Exhibit H – Building Signage Exhibit | ||

| Exhibit I – Subordination, Nondisturbance and Attornment Provisions | ||

| Exhibit J – Form of Tenant Estoppel Certificate | ||

ARTICLE 2

LEASED PREMISES, TERM AND POSSESSION

2.1 Demise Of Leased Premises. Landlord hereby leases to Tenant and Tenant hereby leases from Landlord, for the Lease Term and upon the terms and subject to the conditions of this Lease, that certain interior space described in Article 1 as the Leased Premises, reserving and excepting to Landlord the right to fifty percent (50%) of all assignment consideration and excess rentals as provided in Article 7 below. Tenant’s lease of the Leased Premises, together with the appurtenant right to use the Common Areas as described in Paragraph 2.2 below, shall be conditioned upon and be subject to the continuing compliance by Tenant with (i) all the terms and conditions of this Lease, (ii) all Laws and Restrictions governing the use or occupancy of the Leased Premises, the Property, and the Project, (iii) all easements and other matters now of public record respecting the use of the Leased Premises, the Property, and the Project, shown on Schedule 2.1 attached hereto (the “Existing Title Encumbrances”), and (iv) all reasonable, non-discriminatory rules and regulations from time to time established by Landlord. Notwithstanding any provision of this Lease to the contrary, Landlord hereby reserves to itself and its other tenants all rights of access, use and occupancy of the Building roof, and Tenant shall have no right of access, use or occupancy of the Building roof except as provided for in Paragraph 4.14 below; provided, however, during the period, if any, that Tenant is leasing one hundred percent (100%) of all of the rentable square footage in the Building, Tenant shall have the exclusive right to one hundred percent (100%) of the Available Rooftop Space (as defined in Paragraph 4.14 below).

2.2 Common Areas, Cafe & Fitness Center, and Exclusive Use Area.

(a) As an appurtenant right to Tenant’s right to the use and occupancy of the Leased Premises, Tenant shall have the right to use the Common Areas in conjunction with its use of the Leased Premises solely for the purposes for which they were designed and intended and for no other purposes whatsoever. Tenant’s right to so use the Common Areas shall terminate concurrently with any termination of this Lease. Further, Landlord shall have the right, from time to time, to reconfigure the Common Areas or modify the size of the Common Areas in connection with new construction on the Project or sales or subdivisions of portions of the Project, provided that the following conditions (the “Required Conditions”) are satisfied: (i) Tenant’s access to the Leased Premises (including access through the lobby and the elevators of the Building) or Tenant’s access to the number of parking spaces

6

Building C

provided to Tenant hereunder, are not materially adversely affected thereby, (ii) Tenant’s parking allocation under Article 1 hereof is not reduced thereby, (iii) a minimum of 3.3 parking spaces for each 1,000 net rentable square feet of Leased Premises continue to be located within the area depicted by a curved dotted line on Schedule 2.2(a) attached to this Lease, (iv) Tenant shall have access to: (A) the Cafe & Fitness Center contemplated by Paragraph 2.2(b) below, (B) if applicable, the Exclusive Use Areas described in Paragraph 2.2(c) below, and (v) the exterior Common Area in the proximity of the Building continues to be consistent in quality and design with that existing as of the Effective Date of this Lease.

(b) Additionally, on the Lease Commencement Date, Tenant shall have the right to use the Cafe & Fitness Center solely for the purposes for which they were designed and intended and for no other purposes whatsoever. Tenant’s right to use the Cafe & Fitness Center shall be subject to such reasonable rules and regulations as Landlord or its vendors may issue from time to time, provided that in no event shall Landlord charge Tenant or any Tenant Party a fee for the use of the Cafe & Fitness Center. Tenant’s right to use the Cafe & Fitness Center shall terminate concurrently with any termination of this Lease. Landlord retains the right to relocate the Cafe & Fitness Center to another location on the Project (and change the size of the Cafe & Fitness Center if it is relocated), so long as the Required Conditions are satisfied, the size is not reduced by more than ten percent (10%) and, in the event of any such change, the quality and nature of the facilities provided in the Cafe & Fitness Center at such new location shall not be materially diminished. If Landlord exercises this option, the rentable area of the Leased Premises, Base Monthly Rent, and Tenant’s Building Share and Tenant’s Property Share shall be adjusted accordingly, based on the Premises Measurement Method.

(c) So long as Tenant is leasing at least one (1) full floor of the Building and five (5) full floors of Building D, Tenant will have exclusive access to the areas in the general locations denoted on the Site Plan as “Exclusive Use Areas” (and defined herein as the “Exclusive Use Common Areas”) for purposes of developing its own exterior eating area and two (2) sport courts.

2.3 Lease Commencement Date And Lease Term. Subject to Paragraph 2.4 below, the term of this Lease shall begin, and the Lease Commencement Date shall be deemed to have occurred, on the later of (a) March 1, 2017, (b) the date that the Landlord’s Additional Work is substantially completed, and (c) ninety (90) days after Landlord has delivered the Leased Premises to Tenant in the condition required by Paragraph 2.4(c) below, subject to extension for Landlord Delays (as defined in Paragraph 7of the Work Letter) and for up to twenty (20) days of Unavoidable Tenant Improvement Delays, as defined in Paragraph 8 of the Work Letter (such later date, the “Lease Commencement Date”). Notwithstanding the foregoing or any other contrary or inconsistent provision of this Lease, if the date upon which Tenant occupies the Leased Premises for the purpose of conducting business occurs earlier than the Lease Commencement Date as defined in the prior sentence, then such date Tenant so occupies the Leased Premises shall be the Lease Commencement Date. The term of this Lease shall in all events end on the Lease Expiration Date (as set forth in Article 1, as the same may be extended pursuant to Article 15 below); provided, however, that if the Lease Expiration Date of this Lease or the Building D Lease shall not be simultaneous because of any differences in the dates on which Landlord delivers this Leased Premises and the Building D Leased Premises to Tenant, then, at Tenant’s option, which option must be exercised by written notice thereof to Landlord delivered no later than the Lease Commencement Date of the later of such leases to commence, the Lease Expiration Date of this Lease or the Building D Lease, as relevant, shall be extended such that the Lease Expiration Date of both this Lease and the Building D Lease shall be upon the later Lease Expiration Date of this Lease or the Building D Lease. The Lease Term shall be that period of time commencing on the Lease Commencement Date and ending on the Lease Expiration Date (the “Lease Term”). Promptly after the Lease Commencement Date has been determined, Landlord and Tenant shall execute and deliver a Lease Commencement Date Certificate in the form of Exhibit E attached hereto.

2.4 Delivery Of Possession.

(a) Landlord has constructed the Building as described in Paragraph 1(a) of the Work Letter and shall deliver the Leased Premises to Tenant on the date (the “Delivery Date”) that the Landlord’s Additional Work (as defined in Paragraph 1(b) of the Work Letter), but excluding the upgrade of the base building transformer, is substantially completed. Landlord currently estimates that the Delivery Date will occur during the month of November, 2015, and that the upgrade of the base building transformer will be completed during the month of July, 2016.

(b) [Reserved]

(c) In addition, on or prior to March 1, 2017 (as such date may be extended due to Tenant Delays and a maximum of (30) days of such Force Majeure delays), Landlord shall deliver possession of the Leased Premises “Substantially Complete,” defined herein to mean (i) the Building shall have been substantially completed in accordance with the Final Base Building Plans (as defined in Paragraph 1 of the Work Letter) therefor and the City of Santa Clara shall have signed off on the building

7

Building C

permit for the Building, but for minor punch list items, (ii) all Building systems and subsystems described in Exhibit A-1 to the Work Letter, the structural elements of the Leased Premises and the Building, and the foundation of the Building, are in good working order and repair, (iii) all improvements needed for the Building (excluding the Leased Premises) and the Common Areas to be in compliance with the Santa Clara Building Code and the Americans With Disabilities Act have been completed, (iv) the number of parking spaces required by this Lease shall have been completed, (v) the Cafe & Fitness Center shall have been completed and Tenant and the Tenant Parties shall have access thereto and use thereof (which Tenant hereby acknowledges has been completed), (vi) the elevators, stairwells, shared restrooms, ground floor lobby, and associated mechanical, engineering, and plumbing shall have been substantially completed, and (vii) all scaffolding shall have been removed from the Building. Substantial Completion of the Building and Warm Shell Components (as defined in Paragraph 1 of the Work Letter) shall be deemed to have occurred when the City has signed off on the final building permit. Tenant hereby acknowledges for purposes of this Lease (including but not limited to this Paragraph 2.4 and Paragraph 2.8 below) that the Leased Premises and the Warm Shell Components (as defined in the Work Letter) and the Common Areas supporting the Building (as delineated in Paragraph 2.8 below) have been Substantially Completed prior to the Effective Date of this Lease, except only for the completion of the Landlord’s Additional Work.

(d) If by four (4) months after the date set forth in Paragraph 2.4(c) above (as such date may be extended any Tenant Delays and up to thirty (30) days of Force Majeure), Landlord shall not have delivered possession of the Leased Premises Substantially Complete, Tenant shall have the right to terminate this Lease by written notice to Landlord delivered within ten (10) business days of such date (as extended if extended).

(e) Any Tenant Delay during the period after the Delivery Date shall serve to extend the March 1, 2017 date set forth in Paragraph 2.4(c) above on a day-for-day basis.

(f) Notwithstanding any other provision of this Lease or the Work Letter to the contrary, Tenant shall be responsible for payment of all utility charges reasonably attributable to the construction of the Tenant Improvements (and not the Landlord’s Additional Work) relating to the period from the Delivery Date through the Lease Commencement Date, after which Paragraph 3.2 below shall govern.

2.5 Performance Of Tenant Improvement Work; Acceptance Of Possession. Tenant shall, pursuant to the Work Letter, perform the work and make the installations in the Leased Premises substantially as set forth in the Work Letter (such work and installations hereinafter referred to as the “Tenant Improvements”). Subject to the terms of Paragraph 2.8 below, it is agreed that by accepting possession of the Substantially Complete Leased Premises, Tenant agrees that it will have accepted the same and acknowledged that the Leased Premises are in the condition called for under this Lease (including the Work Letter).

2.6 Surrender Of Possession. Immediately prior to the expiration or upon the sooner termination of this Lease, Tenant shall remove all of Tenant’s signs from the exterior of the Building and shall remove all of Tenant’s equipment (including telecommunications wiring and cabling), trade fixtures, furniture, supplies, wall decorations and other personal property from within the Leased Premises, the Building and the Common Areas, and shall vacate and surrender the Leased Premises, the Building, the Common Areas, the Property, and the Project to Landlord in the same condition, broom clean, as existed at the Lease Commencement Date, reasonable wear and tear and damage caused by Landlord or Landlord’s employees, agents, contractors, or subcontractors (collectively with Landlord, the “Landlord Parties”) and casualty not caused by Tenant or Tenant Parties, excepted. Tenant shall repair all damage to the Leased Premises, the exterior of the Building and the Common Areas caused by Tenant’s removal of Tenant’s property. Tenant shall patch and refinish, to Landlord’s reasonable satisfaction, all penetrations made by Tenant or its employees to the floor, walls or ceiling of the Leased Premises, whether such penetrations were made with Landlord’s approval or not. Tenant shall repair or replace all stained or damaged ceiling tiles, wall coverings and floor coverings to the reasonable satisfaction of Landlord. Subject to the terms of Paragraph 9.3 below, Tenant shall repair all damage caused by Tenant to the exterior surface of the Building and the Exclusive Use Common Areas and, where necessary, replace or resurface same. Additionally, to the extent that Landlord shall have notified or is deemed to have notified Tenant in writing at the time the applicable improvements were consented to, that it desired to have certain Non-Standard Office Improvements made by or at the request of Tenant removed at the expiration or sooner termination of this Lease, Tenant shall, upon the expiration or sooner termination of this Lease: (A) remove such Non-Standard Office Improvements constructed or installed by Landlord or Tenant (including any backup generator or other mechanical equipment), but only if they had been identified as Non-Standard Office Improvements by Landlord at the time consented to pursuant to Paragraph 6.1 below or the Work Letter, as applicable, and (B) repair all damage caused by such removal. If the Leased Premises, the Building, and the Exclusive Use Common Areas are not surrendered to Landlord in the condition required by this paragraph at the expiration or sooner termination of this Lease, Landlord may, at Tenant’s expense, so remove Tenant’s signs, property and/or improvements not so

8

Building C

removed and make such repairs and replacements not so made or hire, at Tenant’s expense, independent contractors to perform such work. Tenant shall be liable to Landlord for all costs incurred by Landlord in returning the Leased Premises, the Building and the Exclusive Use Common Areas to the required condition, together with interest on all costs so incurred from the date paid by Landlord at the Default Interest Rate until paid. Tenant shall pay to Landlord the amount of all costs so incurred plus such interest thereon, within thirty (30) days of Landlord’s billing Tenant for same. Tenant shall not be required to remove its initial Tenant Improvements constructed pursuant to and in accordance with the Work Letter, except to the extent they constitute “Non-Standard Office Improvements,” defined herein to mean alterations, modifications, and improvements that (i) affect the Building façade or structure, (ii) are other than typical leasehold improvements for office tenants in the Building or in buildings similar to the Building in the area in which the Property is located, or (iii) in Landlord’s reasonable judgment would materially increase Landlord’s cost of preparing the Leased Premises for another tenant (such as, without limitation, interior staircases). As further illustration of items that may or may not be considered Non-Standard Office Improvements: (1) Tenant improvements of a type or quantity that would not be installed by or for a typical tenant using space for general office or research and development purposes, such as internal stairwells or high density mobile filing systems, auditoriums, movie theaters or film projection rooms, private restrooms, data center rooms, swimming pools, basketball courts, laboratories and, supplemental HVAC units or ducting would be considered Non-Standard Office Improvements; and (2) “open ceilings”, kitchens, lunch rooms, cafés, break rooms, small, non-specialized server rooms, and expanded restroom areas built by Tenant would be considered Non-Standard Office Improvements.

2.7 Accessibility. In accordance with California Civil Code section 1938, Landlord hereby informs Tenant that as of the Effective Date of this Lease, neither the Leased Premises nor the Building have been inspected by a Certified Access Specialist (as defined in California Civil Code section 55.52(3)).

2.8 Condition Upon Substantial Completion. Landlord hereby warrants that the Warm Shell Components (as defined in the Work Letter) and the Common Areas supporting the Building, consisting of (i) a minimum of 3.3 parking spaces for each 1,000 net rentable square feet of Leased Premises located within the area depicted by a curved dotted line on Schedule 2.2(a) attached to this Lease, (ii) such sidewalks or paths as are necessary to allow Tenant access from the parking areas to the Building, and (iii) the landscaping in front of the Building (defined for purposes of this Lease as the “Building Specific Common Areas”) shall be in good working condition as of the date of Substantial Completion thereof (the “Substantial Completion Date”). In the event that Tenant believes, and Tenant notifies Landlord in writing within twelve (12) months after the Substantial Completion Date, that the Warm Shell Components or Building Specific Common Areas were not in good working condition and repair on the Substantial Completion Date, then unless Landlord disagrees, Landlord shall, at Landlord’s sole cost and expense (which shall not be deemed a Property Maintenance Cost), repair or replace any failed or inoperable portion of such Warm Shell Components or Building Specific Common Areas, as applicable (“Landlord’s Warranty”), provided that the need to repair or replace was not caused by the misuse, misconduct, damage, destruction, acts, omissions, and/or negligence (collectively, “Tenant Damage”) of Tenant or any Tenant Parties, or by any modifications, alterations, or improvements (including the Tenant Improvements) constructed by or on behalf of Tenant. Landlord’s Warranty shall not be deemed to require Landlord to replace any portion of any Warm Shell Components or Building Specific Common Areas, as applicable, as opposed to repair such portion of such Warm Shell Components or Building Specific Common Areas, as applicable, unless prudent commercial property management practices dictate replacement rather than repair of the item in question. To the extent repairs which Landlord is required to make pursuant to this Paragraph 2.8 are necessitated in part by Tenant Damage and not fully covered by Landlord’s insurance, then Tenant shall reimburse Landlord for an equitable proportion of the cost of such repair. If it is determined that the Warm Shell Components or Building Specific Common Areas (or any portion thereof) were not in good working condition and repair as of the Substantial Completion Date, Landlord shall not be liable to Tenant for any damages, but Landlord, at no cost to Tenant, shall promptly commence such work or take such other action as may be necessary to place the same in good working condition and repair, and shall thereafter diligently pursue the same to completion; and Landlord shall repair any damage to the Tenant Improvements arising in connection with Landlord’s work. Tenant’s failure to give such written notice to Landlord within twelve (12) months after the Substantial Completion Date shall constitute a conclusive presumption that the Warm Shell Components (or Building Specific Common Areas, as applicable) are in good working condition and repair, and any required correction after that date shall be performed by the party responsible for such repair pursuant to the terms of this Lease; provided, however, the foregoing shall not constitute a waiver by Tenant or a release of Landlord with respect to Landlord’s obligations under this Lease relating to the construction of the Building and the Project. In the event that Tenant notifies Landlord in writing within twelve (12) months after the Substantial Completion Date, that the Warm Shell Components or Building Specific Common Areas were not in good working condition and repair on the Substantial Completion Date, and Landlord disagrees, then Landlord and Tenant shall meet and confer in good faith to try to reach agreement within thirty (30) days, failing which the matter shall be referred to arbitration before a single arbitrator at JAMS in San Francisco.

9

Building C

ARTICLE 3

RENT

3.1 Base Monthly Rent.

(a) Commencing on the Lease Commencement Date (as determined pursuant to Paragraph 2.3 above) and continuing throughout the Lease Term, Tenant shall pay to Landlord, without prior demand therefor, in advance on the first day of each calendar month, cash or other immediately available good funds in the amount set forth as Base Monthly Rent in Article 1.

(b) Base Monthly Rent is not payable during the first nine (9) months of the Lease Term (the “Rent Abatement Period”). Notwithstanding anything to the contrary contained in this Lease, Landlord shall have the option (the “Lump Sum Payment Option”) to require Tenant to pay Base Monthly Rent for so much of the Rent Abatement Period as remains following Landlord’s notice as hereinafter provided at the rate of $101,850.90 per month, beginning on the date (the “Base Monthly Rent Start Date”) set forth in the Lump Sum Payment Option Notice (defined below), which shall in no event be a date prior to payment to Tenant of the Abated Rent Lump Sum Payment. To exercise the Lump Sum Payment Option, Landlord must (i) provide written notice to Tenant of such exercise (the “Lump Sum Payment Option Notice”) and (ii) pay to Tenant the Base Monthly Rent that would be payable for the remaining Rent Abatement Period (the “Abated Rent Lump Sum Payment”). If Landlord elects its Lump Sum Payment Option, the Abated Rent Lump Sum Payment shall be made, at Landlord’s election (a) within thirty (30) days of Tenant’s receipt of the Lump Sum Payment Option Notice, or (b) on the closing date of any financing or sale of the Building by Landlord (the date of such payment is hereinafter referred to as the “Lump Sum Payment Date”). If Landlord fails to pay the Abated Rent Lump Sum Payment by the Lump Sum Payment Date or the financing or sale transaction for the Building, if applicable, expires or is terminated or deemed null and void for any reason, Landlord’s exercise of the Lump Sum Payment Option shall be deemed null and void and of no further force or effect and the Abated Rent Lump Sum Payment, if theretofore paid by Landlord to Tenant, shall promptly be returned by Tenant to Landlord. If Landlord’s Lump Sum Payment Notice is effective on a day other than the first day of a calendar month and Landlord has then paid the Abated Rent Lump Sum Payment, then Tenant shall pay any Base Monthly Rent payable hereunder for the period from Landlord’s Lump Sum Payment Option Notice through the last day of the calendar month, with the next installment of Base Monthly Rent due for the following calendar month.

(c) If Landlord exercises its Lump Sum Payment Option in accordance with the above paragraph, Landlord shall prepare an amendment in the form of Exhibit G attached hereto (the “Lump Sum Payment Amendment”) that documents the effect of Landlord’s exercise of the Lump Sum Payment Option and sets forth a revised rent schedule reflecting Tenant’s payment of the Base Monthly Rent for the remaining Rent Abatement Period following the Lump Sum Payment Option Notice. A copy of the Lump Sum Payment Amendment shall be sent to Tenant and Tenant shall execute and return the Lump Sum Payment Amendment to Landlord within ten (10) business days thereafter, but Landlord’s otherwise valid exercise of the Lump Sum Payment Option shall be fully effective whether or not the Lump Sum Payment Amendment is executed.

3.2 Additional Rent. Commencing on the Lease Commencement Date (as determined pursuant to Paragraph 2.3 above) and continuing throughout the Lease Term, in addition to the Base Monthly Rent and to the extent not required by Landlord to be contracted for and paid directly by Tenant, Tenant shall pay to Landlord as additional rent (the “Additional Rent”), cash or other immediately available good funds in the following amounts:

(a) An amount equal to all Property Operating Expenses (as defined in Article 13) incurred or to be incurred by Landlord. Landlord shall deliver to Tenant Landlord’s reasonable estimate of any given expense (such as Landlord’s Insurance Costs or Real Property Taxes), or group of expenses, which it anticipates will be paid or incurred for the ensuing calendar or fiscal year, as Landlord may determine, and Tenant shall pay to Landlord an amount equal to Tenant’s Building Share or Tenant’s Project Share, as applicable, of the estimated amount of such expenses for such year in equal monthly installments during such year with the installments of Base Monthly Rent. Landlord reserves the right to revise such estimate from time to time but not more than once during the applicable year and, in any event shall provide Tenant with at least one (1) month advance notice of such adjusted estimates taking effect.

(b) Landlord’s share of the consideration received by Tenant upon certain assignments and sublettings as required by Article 7.

(c) Any legal fees and costs that Tenant is obligated to pay or reimburse to Landlord pursuant to Article 13; and

10

Building C

(d) Any other charges or reimbursements due Landlord from Tenant pursuant to the terms of this Lease.

Notwithstanding the foregoing, at any time that Tenant leases all of the rentable square footage in the Building, Landlord may elect by written notice to Tenant to have Tenant pay Real Property Taxes or any portion thereof directly to the applicable taxing authority, in which case Tenant shall make such payments and deliver satisfactory evidence of payment to Landlord no later than ten (10) days before such Real Property Taxes become delinquent. In the event Tenant is responsible to pay taxes directly, Landlord shall have no obligation to make such payments, whether or not Landlord receives evidence of payment from Tenant, and Tenant shall in all cases be responsible for any fines, penalties, interest and damages for late payment.

3.3 Year-End Adjustments. Landlord shall furnish to Tenant within four months following the end of the applicable calendar or fiscal year, as the case may be, a statement setting forth (i) the amount of such expenses paid or incurred during the just ended calendar or fiscal year, as appropriate, and (ii) the amount that Tenant has paid to Landlord for credit against such expenses for such period. If Tenant shall have paid more than its obligation for such expenses for the stated period, Landlord shall, at its election, either (i) credit the amount of such overpayment toward the next ensuing payment or payments of Additional Rent that would otherwise be due or (ii) refund in cash to Tenant the amount of such overpayment within thirty (30) days after discovery of such surplus; provided, however, that if this Lease shall have terminated, Landlord shall be deemed to have chosen option (ii) above. If such year-end statement shall show that Tenant did not pay its obligation for such expenses in full, then Tenant shall pay to Landlord the amount of such underpayment within thirty (30) days from Landlord’s billing of same to Tenant. Tenant may, at Tenant’s sole cost and expense, cause an audit of Landlord’s books and records to determine the accuracy of Landlord’s billings for Property Operating Expenses under this Lease, provided Tenant completes (and delivers to Landlord the written results of) such audit within two hundred seventy (270) days after Tenant’s receipt of the year-end statement described above setting forth the annual reconciliation of the Property Operating Expenses, and provided further that the person or entity performing such audit is not compensated on any type of contingent basis. If such audit reveals that the actual Property Operating Expenses for any given year were less than the amount that Tenant paid for Property Operating Expenses for any such year, then unless Landlord contests such audit results as provided below, Landlord shall credit the excess to Tenant’s next payment of Additional Rent. If such audit reveals that the actual Property Operating Expenses for any given year were more than the amount that Tenant paid for Property Operating Expenses for any such year, Tenant shall pay such amount to Landlord within thirty (30) days after completion of the audit. Landlord shall have the right to contest the results of Tenant’s audit and thereafter promptly have an audit performed (“Landlord’s Audit”) by a certified public accounting firm acceptable to Landlord and Tenant in their reasonable discretion. In such case, the results of Landlord’s Audit shall be binding and conclusive on Landlord and Tenant, and any resulting overpayment or underpayment shall be handled as provided above. If Landlord’s Audit, or Tenant’s audit in the event Landlord does not elect to have Landlord’s Audit performed, confirms that Tenant was overcharged by more than five percent (5%), then Landlord shall pay the cost of Tenant’s audit (up to a maximum of $7,500) and Landlord’s Audit. If Tenant’s audit confirms that Tenant was not overcharged, then Tenant shall pay the cost of Landlord’s Audit (up to a maximum of $7,500) and Tenant’s audit. In all other cases, each party shall pay for its own audit. The provisions of this Paragraph shall survive the expiration or sooner termination of this Lease.

3.4 Late Charge, And Interest On Rent In Default. Tenant acknowledges that the late payment by Tenant of any monthly installment of Base Monthly Rent or any Additional Rent will cause Landlord to incur certain costs and expenses not contemplated under this Lease, the exact amounts of which are extremely difficult or impractical to fix. Such costs and expenses will include without limitation, administration and collection costs and processing and accounting expenses. Therefore, if any installment of Base Monthly Rent is not received by Landlord from Tenant within five (5) calendar days after the same becomes due, Tenant shall immediately pay to Landlord a late charge in an amount equal to the amount set forth in Article 1 as the “Late Charge Amount,” and if any Additional Rent is not received by Landlord when the same becomes due, Tenant shall immediately pay to Landlord a late charge in an amount equal to 5% of the Additional Rent not so paid; provided, however, that once but only once in any twelve (12) month period during the Lease Term, Tenant shall be entitled to written notice of non-receipt of Base Monthly Rent or Additional Rent from Landlord, and Tenant shall not be liable for any Late Charge Amount or other late charge hereunder with respect thereto if such installment of Base Monthly Rent or Additional Rent is received by Landlord within three (3) business days after Tenant’s receipt of such written notice from Landlord. Landlord and Tenant agree that this late charge represents a reasonable estimate of such costs and expenses and is fair compensation to Landlord for the anticipated loss Landlord would suffer by reason of Tenant’s failure to make timely payment. In no event shall this provision for a late charge be deemed to grant to Tenant a grace period or extension of time within which to pay any rental installment or prevent Landlord from exercising any right or remedy available to Landlord upon Tenant’s failure to pay each rental installment due under this Lease when due, including the right to terminate this Lease. If any rent remains delinquent for a period in excess of five (5) calendar days, then, in addition to such late charge, Tenant shall pay to Landlord interest on any rent that is not so paid from said fifth (5th) day at the Default Interest Rate until paid.

11

Building C

3.5 Payment Of Rent. Except as specifically provided otherwise in this Lease, all rent shall be paid in lawful money of the United States, without any abatement, reduction or offset for any reason whatsoever, to Landlord at such address as Landlord may designate from time to time at least thirty (30) days in advance of the date the next payment of rent is due. Tenant’s obligation to pay Base Monthly Rent and all Additional Rent shall be appropriately prorated at the commencement and expiration of the Lease Term. The failure by Tenant to pay any Additional Rent as required pursuant to this Lease when due shall be treated the same as a failure by Tenant to pay Base Monthly Rent when due, and Landlord shall have the same rights and remedies against Tenant as Landlord would have had Tenant failed to pay the Base Monthly Rent when due.

ARTICLE 4

USE OF LEASED PREMISES AND COMMON AREA

4.1 Permitted Use. Tenant shall be entitled to use the Leased Premises on a 24/7/365 basis solely for the Permitted Use as set forth in Article 1 and for no other purpose whatsoever. Tenant shall have the right to vacate the Leased Premises at any time during the Term of this Lease, provided Tenant maintains the Leased Premises in the same condition as if fully occupied and as otherwise required by the terms of this Lease. Tenant shall have the right to use the Common Areas in conjunction with its Permitted Use of the Leased Premises solely for the purposes for which they were designed and intended and for no other purposes whatsoever.

4.2 General Limitations On Use. Tenant shall not do or permit anything to be done in or about the Leased Premises, the Building, the Common Areas, the Property, or the Project which does or could (i) jeopardize the structural integrity of the Building or (ii) cause damage to any part of the Leased Premises, the Building, the Common Areas, the Property, or the Project. Tenant shall not operate any equipment within the Leased Premises which does or could (A) injure, vibrate or shake the Leased Premises or the Building, (B) damage, overload or impair the efficient operation of any electrical, plumbing, and HVAC systems within or servicing the Leased Premises or the Building, or (C) damage or impair the efficient operation of the sprinkler system (if any) within or servicing the Leased Premises or the Building. Tenant shall not install any equipment or antennas on or make any penetrations of the exterior walls or roof of the Building, except to the extent specifically set forth in the Tenant Improvement Working Drawings approved by Landlord pursuant to Paragraph 2 of the Work Letter or as otherwise provided in Paragraph 4.14 below. Tenant shall not affix any equipment to or make any penetrations or cuts in the floor, ceiling, walls or roof of the Leased Premises except to the extent specifically set forth in the Tenant Improvement Working Drawings approved by Landlord pursuant to Paragraph 2 of the Work Letter or any alterations to the Leased Premises approved by Landlord pursuant to Paragraph 6.1 below. Tenant shall not place any loads upon the floors, walls, ceiling or roof systems which could endanger the structural integrity of the Building or damage its floors, foundations or supporting structural components. Tenant shall not place any explosive, flammable or harmful fluids or other waste materials in the drainage systems of the Leased Premises, the Building, the Common Areas, the Property, or the Project. Tenant shall not drain or discharge any fluids in the landscaped areas or across the paved areas of the Property or the Project. Tenant shall not use any of the Common Areas for the storage of its materials, supplies, inventory or equipment and all such materials, supplies, inventory or equipment shall at all times be stored within the Leased Premises. Tenant shall not commit nor permit to be committed by any of its employees, agents, vendors, invitees, guests, permittees, assignees, sublessees, contractors, or subcontractors (the “Tenant Parties”), any physical waste in or about the Leased Premises, the Building, the Common Areas, the Property, or the Project.

4.3 Noise And Emissions. All noise generated by Tenant in its use of the Leased Premises shall be confined or muffled so that it does not interfere with the businesses of or annoy the occupants and/or users of adjacent properties. All dust, fumes, odors and other emissions generated by Tenant’s use of the Leased Premises shall be sufficiently dissipated in accordance with sound environmental practice and exhausted from the Leased Premises in such a manner so as not to interfere with the businesses of or annoy the occupants and/or users of adjacent properties, or cause any damage to the Leased Premises, the Building, the Common Areas, the Property, or the Project or any component part thereof or the property of adjacent property owners.

4.4 Trash Disposal. Landlord shall provide trash bins or other adequate garbage disposal facilities within the trash enclosure areas provided or permitted by Landlord outside the Leased Premises sufficient for the interim disposal of all of its trash, garbage and waste. All such trash, garbage and waste temporarily stored in such areas by Tenant or any of the Tenant Parties shall be stored in such a manner so that it is not visible from outside of such areas. Landlord shall cause such trash, garbage and waste to be regularly removed from the trash bins/garbage disposal facilities and the Property. Subject to the foregoing removal obligation of Landlord, Tenant shall keep the interior of the Leased Premises in a clean, safe and neat condition and shall keep the Common Areas free and clear of all of Tenant’s trash, garbage, waste and/or boxes, pallets and containers containing same at all times.

12

Building C

4.5 Parking. Tenant shall not, at any time, park or permit to be parked any recreational vehicles, inoperative vehicles or equipment in the Common Areas or on any portion of the Project. Tenant agrees to assume responsibility for compliance by its employees and invitees with the parking provisions contained herein. If Tenant or its employees park any vehicle within the Property or the Project in violation of these provisions, then Landlord may, upon prior written notice to Tenant giving Tenant two (2) days (or any applicable statutory notice period, if longer than two (2) days) to remove such vehicle(s), cause the same to be removed at Tenant’s expense. Tenant agrees to assume responsibility for compliance by the Tenant Parties with the parking provisions contained herein. Landlord reserves the right to grant easements and access rights to others for use of the parking areas on the Property and/or Project, provided that the Required Conditions are satisfied. Tenant shall have the right to install electric vehicle charging stations (“ECV Stations”) on the Property in a location acceptable to Landlord in its reasonable discretion, all at Tenant’s sole cost, including but not limited to the cost of running conduit; provided, however, that Tenant may (within sixty (60) days after the Effective Date of this Lease, if at all) request Landlord to provide conduit to up to such number of Tenant’s Exclusive Parking Spaces as Tenant shall request, from the Building electrical room, in which case Landlord shall provide such conduit at Landlord’s sole cost. Further, Tenant may (within sixty (60) days after the Effective Date of this Lease, if at all) request Landlord to provide conduit to up to such number of Tenant’s Additional Exclusive Parking Spaces as Tenant shall request, from the Building electrical room, in which case Landlord shall provide such conduit at Tenant’s sole cost (which may be paid out of the Tenant Improvement Allowance).

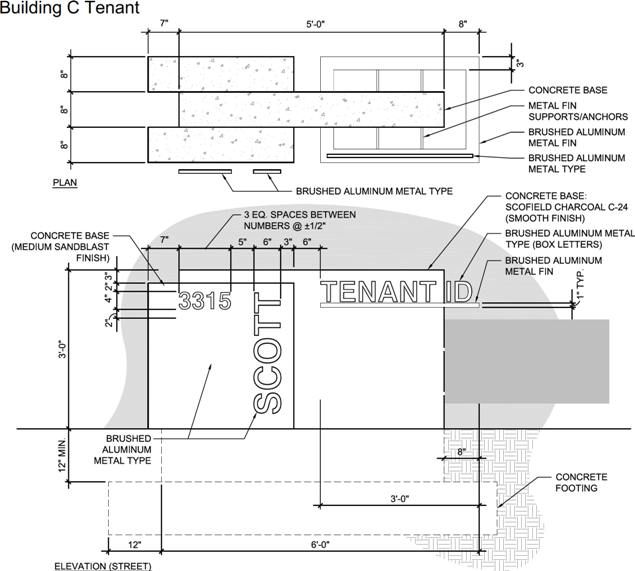

4.6 Signs. Tenant shall not place or install on or within any portion of the Leased Premises, the exterior of the Building, the Common Areas, the Property, or the Project any sign, advertisement, banner, placard, or picture which is visible from the exterior of the Leased Premises, except as expressly allowed pursuant to this Paragraph 4.6. Subject to the other terms and conditions of this Paragraph 4.6, Tenant, at Tenant’s sole cost and expense, shall: (i) have the right to install its name on the lobby directory sign, (ii) be entitled to place its name on the Building top in the location generally as depicted on Exhibit H, and (iii) be entitled to place its name on the Building monument sign generally as depicted on Exhibit H, in all cases in accordance with Landlord’s Building signage program and to the extent approved by the City of Santa Clara. The size, location, and configuration of all signage shall be subject to Landlord’s building standards and its prior written approval, which shall not be unreasonably withheld, and shall be governed by and subject to the rules, regulations and permit requirements of the City of Santa Clara. All of the foregoing rights set forth in this paragraph shall be personal to Aruba Networks, Inc., or a sublessee of more than 50% of the initial Leased Premises, or an assignee, and no other party shall have any such right. Except as provided above, Tenant shall not place or install on or within any portion of the Leased Premises, the exterior of the Building, the Common Areas, the Property, or the Project any business identification sign which is visible from the exterior of the Leased Premises until Landlord shall have approved in writing and in its sole discretion the location, size, content, design, method of attachment and material to be used in the making of such sign; provided, however, that so long as such signs are normal and customary business directional or identification signs within the Building, Tenant shall not be required to obtain Landlord’s approval. Any sign, once approved by Landlord, shall be installed at Tenant’s sole cost and expense and only in strict compliance with Landlord’s approval and any applicable Laws and Restrictions, using a person approved by Landlord to install same. Landlord may remove any signs (which have not been approved in writing by Landlord), advertisements, banners, placards or pictures so placed by Tenant on or within the Leased Premises, the exterior of the Building, the Common Areas, the Property, or the Project and charge to Tenant the cost of such removal, together with any costs incurred by Landlord to repair any damage caused thereby, including any cost incurred to restore the surface (upon which such sign was so affixed) to its original condition. Tenant shall remove all of Tenant’s signs, repair any damage caused thereby, and restore the surface upon which the sign was affixed to its original condition, all to Landlord’s reasonable satisfaction, upon the termination of this Lease. Notwithstanding the signage rights granted to Tenant pursuant to this Paragraph 4.6, Landlord reserves and retains the right to place Landlord’s name and/or ownership affiliation in or on the Leased Premises, the Building, the Common Areas, the Property, or the Project, or on any of the signs located thereon, as determined in Landlord’s sole discretion.

4.7 Compliance With Laws And Restrictions. Subject to Paragraph 6.3 below, Tenant shall abide by and shall promptly observe and comply with, at its sole cost and expense, all Laws and Restrictions respecting the use and occupancy of the Leased Premises, the Building, the Common Areas, the Property, or the Project including, without limitation, Title 24, building codes, the Americans with Disabilities Act and the rules and regulations promulgated thereunder, and all Laws governing the use and/or disposal of hazardous materials, and shall defend with competent counsel, indemnify and hold Landlord harmless from any claims, damages or liability resulting from Tenant’s failure to so abide, observe, or comply. Tenant’s obligations hereunder shall survive the expiration or sooner termination of this Lease.

13

Building C

4.8 Compliance With Insurance Requirements. With respect to any insurance policies required or permitted to be carried by Landlord in accordance with the provisions of this Lease, Tenant shall not conduct nor permit any other person to conduct any activities nor keep, store or use (or allow any other person to keep, store or use) any item or thing within the Leased Premises, the Building, the Common Areas, the Property, or the Project which (i) is prohibited under the terms of any such policies, (ii) could result in the termination of the coverage afforded under any of such policies, (iii) could give to the insurance carrier the right to cancel any of such policies, or (iv) could cause an increase in the rates (over standard rates) charged for the coverage afforded under any of such policies. Tenant shall comply with all requirements of any insurance company, insurance underwriter, or Board of Fire Underwriters which are necessary to maintain, at standard rates, the insurance coverages carried by either Landlord or Tenant pursuant to this Lease.

4.9 Landlord’s Right To Enter. Landlord and its agents shall have the right to enter the Leased Premises during normal business hours after giving Tenant reasonable notice (which shall be prior written notice except in the event of a circumstance which Landlord in good faith believes to be an emergency) and subject to Tenant’s reasonable security measures for the purpose of (i) inspecting the same; (ii) showing the Leased Premises to prospective purchasers, mortgagees or, during the last nine (9) months of the Lease Term or during any period that Tenant is in monetary or material non-monetary default beyond the applicable cure period, if any, expressly set forth in this Lease, tenants; (iii) making necessary alterations, additions or repairs; and (iv) performing any of Tenant’s obligations when Tenant has failed to do so after the expiration of any applicable notice and cure period expressly set forth in this Lease. Landlord shall have the right to enter the Leased Premises during normal business hours (or as otherwise agreed), subject to Tenant’s reasonable security measures, for purposes of supplying any maintenance or services agreed to be supplied by Landlord. Landlord shall have the right to enter the Common Areas during normal business hours for purposes of (i) inspecting the exterior of the Building and the Common Areas; (ii) posting notices of nonresponsibility (and for such purposes Tenant shall provide Landlord at least ten (10) days’ prior written notice of any work to be performed on the Leased Premises, as well as notice within one (1) day after the commencement of such work); and (iii) supplying any services to be provided by Landlord. Landlord shall also have the right, upon reasonable advance notice to Tenant, to access the Building’s vertical risers and the interstitial space above Tenant’s acoustical ceiling to connect new utility and communications lines from other floors to the base Building utility lines; all of such work shall be done after hours or on weekends. Any entry into the Leased Premises or the Common Areas obtained by Landlord in accordance with this paragraph shall not under any circumstances be construed or deemed to be a forcible or unlawful entry into, or a detainer of, the Leased Premises, or an eviction, actual or constructive of Tenant from the Leased Premises or any portion thereof. Landlord shall conduct all of Landlord’s activities on the Leased Premises during such period of entry in a manner designed to cause minimal interference to Tenant and Tenant’s use of the Leased Premises.

4.10 Use Of Common Areas. Tenant, in its use of the Common Areas, shall at all times keep the Common Areas clear of Tenant’s and the Tenant Parties’ materials, equipment, debris, trash (except within existing enclosed trash areas), inoperable vehicles, and other items which are not specifically permitted by Landlord to be stored or located thereon by Tenant. If, in the opinion of Landlord, unauthorized persons are using any of the Common Areas by reason of, or under claim of, the express or implied authority or consent of Tenant, then Tenant, upon demand of Landlord, shall restrain, to the fullest extent then allowed by Law, such unauthorized use, and shall initiate such appropriate proceedings as may be required to so restrain such use. Landlord reserves the right to grant easements and access rights to others for use of the Common Areas so long as the Required Conditions are satisfied, and shall not be liable to Tenant for any diminution in Tenant’s right to use the Common Areas as a result.

4.11 Environmental Protection. Tenant’s obligations under this Paragraph 4.11 shall survive the expiration or termination of this Lease.

(a) As used herein, the term “Hazardous Materials” shall mean any toxic or hazardous substance, material or waste or any pollutant or infectious or radioactive material, including but not limited to those substances, materials or wastes regulated now or in the future under any of the following statutes or regulations and any and all of those substances included within the definitions of “hazardous substances,” “hazardous materials,” “hazardous waste,” “hazardous chemical substance or mixture,” “imminently hazardous chemical substance or mixture,” “toxic substances,” “hazardous air pollutant,” “toxic pollutant,” or “solid waste” in the (a) Comprehensive Environmental Response, Compensation and Liability Act of 1990 (“CERCLA” or “Superfund”), as amended by the Superfund Amendments and Reauthorization Act of 1986 (“SARA”), 42 U.S.C. § 9601 et seq., (b) Resource Conservation and Recovery Act of 1976 (“RCRA”), 42 U.S.C. § 6901 et seq., (c) Federal Water Pollution Control Act (“FSPCA”), 33 U.S.C. § 1251 et seq., (d) Clean Air Act (“CAA”), 42 U.S.C. § 7401 et seq., (e) Toxic Substances Control Act (“TSCA”), 14 U.S.C. § 2601 et seq., (f) Hazardous Materials Transportation Act, 49 U.S.C. § 1801, et seq., (g) Carpenter-Presley-Tanner Hazardous Substance Account Act (“California Superfund”), Cal. Health & Safety Code § 25300 et seq., (h) California

14

Building C

Hazardous Waste Control Act, Cal. Health & Safety code § 25100 et seq., (i) Porter-Cologne Water Quality Control Act (“Porter-Cologne Act”), Cal. Water Code § 13000 et seq., (j) Hazardous Waste Disposal Land Use Law, Cal. Health & Safety codes § 25220 et seq., (k) Safe Drinking Water and Toxic Enforcement Act of 1986 (“Proposition 65”), Cal. Health & Safety code § 25249.5 et seq., (l) Hazardous Substances Underground Storage Tank Law, Cal. Health & Safety code § 25280 et seq., (m) Air Resources Law, Cal. Health & Safety Code § 39000 et seq., and (n) regulations promulgated pursuant to said laws or any replacement thereof, or as similar terms are defined in the federal, state and local laws, statutes, regulations, orders or rules. Hazardous Materials shall also mean any and all other biohazardous wastes and substances, materials and wastes which are, or in the future become, regulated under applicable Laws for the protection of health or the environment, or which are classified as hazardous or toxic substances, materials or wastes, pollutants or contaminants, as defined, listed or regulated by any federal, state or local law, regulation or order or by common law decision, including, without limitation, (i) trichloroethylene, tetrachloroethylene, perchloroethylene and other chlorinated solvents, (ii) any petroleum products or fractions thereof, (iii) asbestos, (iv) polychlorinated biphenyls, (v) flammable explosives, (vi) urea formaldehyde, (vii) radioactive materials and waste, and (viii) materials and wastes that are harmful to or may threaten human health, ecology or the environment.

(b) Notwithstanding anything to the contrary in this Lease, Tenant, at its sole cost, shall comply with, and shall cause the Tenant Parties to comply with, all Laws relating to the storage, use and disposal of Hazardous Materials at the Property; provided, however, that Tenant shall not be responsible for contamination of the Leased Premises and/or the Building, the Property, or the Project (including the Parking Structure) by Hazardous Materials existing as of the date the Leased Premises are delivered to Tenant (whether before or after the Lease Commencement Date) excepting only contamination caused by Tenant or the Tenant Parties. Tenant shall not store, use or dispose of any Hazardous Materials except for ordinary office and cleaning supplies used in compliance with all Laws and Restrictions (“Office & Cleaning Supplies”). In no event shall Tenant cause, or permit to be discharged by any of the Tenant Parties, into the plumbing or sewage system of the Building or onto the land underlying or adjacent to the Building, any Hazardous Materials. Tenant shall be solely responsible for and shall defend, indemnify, and hold Landlord and its agents harmless from and against all claims, costs and liabilities, including reasonable attorneys’ fees and costs, arising out of or in connection with Tenant’s storage, use and/or disposal of Hazardous Materials at the Project. If the presence of Hazardous Materials on the Leased Premises caused by Tenant or any of the Tenant Parties results in contamination or deterioration of water or soil, then Tenant shall promptly take any and all action necessary to clean up such contamination, but the foregoing shall in no event be deemed to constitute permission by Landlord to allow the presence of such Hazardous Materials. At any time prior to the expiration of the Lease Term if Tenant has a reasonable basis to suspect that there has been any release or the presence of Hazardous Materials in the ground or ground water on the Leased Premises which did not exist upon commencement of the Lease Term, Tenant shall have the right to conduct appropriate tests of water and soil and to deliver to Landlord the results of such tests to demonstrate that no contamination in excess of permitted levels has occurred as a result of Tenant’s use of the Leased Premises. Tenant shall further be solely responsible for, and shall defend, indemnify, and hold Landlord and its agents harmless from and against all claims, costs and liabilities, including attorneys’ fees and costs, arising out of or in connection with any removal, cleanup and restoration work and materials required hereunder to return the Leased Premises and any other property of whatever nature to their condition existing prior to the appearance of the Hazardous Materials, to the extent such Hazardous Materials were introduced to the Property or the Project by Tenant or any of the Tenant Parties.