Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - iNeedMD Holdings, Inc. | Financial_Report.xls |

| EX-3.1 - iNeedMD Holdings, Inc. | ex3_1.htm |

| EX-31.1 - CERTIFICATION - iNeedMD Holdings, Inc. | f10k2014ex31i_ineedmdhold.htm |

| EX-32.1 - CERTIFICATION - iNeedMD Holdings, Inc. | f10k2014ex32i_ineedmdhold.htm |

| EX-31.2 - CERTIFICATION - iNeedMD Holdings, Inc. | f10k2014ex31ii_ineedmdhold.htm |

| EX-32.2 - CERTIFICATION - iNeedMD Holdings, Inc. | f10k2014ex32ii_ineedmdhold.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2014

or

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 333-187248

INEEDMD HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 45-4487461 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

650 First Avenue, Third Floor

New York, New York 10016

(Address of principal executive offices)

(212) 256-9669

(Registrant’s telephone number, including area code)

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act: Common Stock, par value $0.001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by checkmark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.:

| Large accelerated filer | ☐ | Non-accelerated filer | ☐ | |

| Accelerated filer | ☐ | Smaller reporting company | ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Aggregate market value of the voting and non-voting common equity held by non-affiliates as of June 30, 2014: $0.

As of April 15, 2015, the registrant has one class of common equity, and the number of shares issued and outstanding of such common equity is 48,014,424.

Documents Incorporated By Reference: None.

TABLE OF CONTENTS

| 2 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Included in this Annual Report on Form 10-K are “forward-looking” statements, as well as historical information. Although we believe that the expectations reflected in these forward-looking statements are reasonable, we cannot assure you that the expectations reflected in these forward-looking statements will prove to be correct. Our actual results could differ materially from those anticipated in forward-looking statements as a result of certain factors, including matters described in the section titled “Risk Factors.” Forward-looking statements include those that use forward-looking terminology, such as the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “project,” “plan,” “will,” “shall,” “should,” and similar expressions, including when used in the negative. Although we believe that the expectations reflected in these forward-looking statements are reasonable and achievable, these statements involve risks and uncertainties and we cannot assure you that actual results will be consistent with these forward-looking statements. Important factors that could cause our actual results, performance or achievements to differ from these forward-looking statements include the following:

| ● | the availability and adequacy of our cash flow to meet our requirements; |

| ● | economic, competitive, demographic, business and other conditions in our local and regional markets; |

| ● | changes in our business and growth strategy; |

| ● | changes or developments in laws, regulations or taxes in the healthcare industry; |

| ● | actions taken or not taken by third-parties, including our contractors and competitors; |

| ● | the availability of additional capital; and |

| ● | other factors discussed under the section entitled “Risk Factors” or elsewhere in this Annual Report. |

All forward-looking statements attributable to us are expressly qualified in their entirety by these and other factors. We undertake no obligation to update or revise these forward-looking statements, whether to reflect events or circumstances after the date initially filed or published, to reflect the occurrence of unanticipated events or otherwise unless required by applicable law.

| 3 |

BUSINESS OF INEEDMD

Corporate History

Clutterbug Move Management, Inc. (“Clutterbug”) was incorporated on February 1, 2012 under the laws of the State of Nevada. Clutterbug provided personalized moving assistance and organization support services to the elderly who were seeking a transition to a new location. As senior citizen move managers, the Clutterbug team serviced all aspects of a life move for the elderly including, but not limited to, space and timetable planning, downsizing belongings, sorting possessions, organizing sales and donations, overseeing the transition of items to storage, packing and unpacking and setting up our client’s new residence.

Due to the lack of results in Clutterbug’s attempt to implement its original business plan, management determined it was in the best interests of the shareholders to look for other potential business opportunities that might be available. Effective December 24, 2014, Clutterbug, Clutterbug Acquisition Corp., a Nevada corporation and wholly-owned subsidiary of Clutterbug (“Merger Sub”), iNeedMD, Inc., a privately-held Delaware corporation headquartered in New York and Victoria Young an individual (the “Majority Shareholder”), entered into an Acquisition Agreement and Plan of Merger (the “Agreement”) pursuant to which the Merger Sub was merged with and into iNeedMD, Inc. with iNeedMD, Inc. surviving as a wholly-owned subsidiary of Clutterbug (the “Merger”). The transaction (the “Closing”) took place on December 24, 2014 (the “Closing Date”). Immediately following the Closing of the Agreement, Clutterbug changed its business plan to that of iNeedMD, Inc.

On February 12, 2015, Clutterbug filed an amendment to its Articles of Incorporation with the State of Nevada and changed its corporate name from Clutterbug Move Management, Inc. to iNeedMD Holdings, Inc. On February 25, 2015, the Company received notice from the Financial Industry Regulatory Authority (“FINRA”) that the Company’s name change application has been approved and effective February 27, 2015, Clutterbug began trading under its new name, iNeedMD Holdings, Inc. (“iNeedMD”). Additionally, on February 25, 2015, Clutterbug received notice from FINRA that effective February 27, 2015, it will be quoted on the OTC Markets under its new trading symbol, “NEMD”.

iNeedMD, Inc. is a medical device development company that was incorporated in the State of Delaware on February 16, 2000. Over the course of the last twelve years, it has built a balanced portfolio of intellectual property to support the mobile health and telehealth industry. Our pioneering product development programs focus on easy-to-use systems for collecting a plurality of diagnostic information and transmitting that data to local and/or remote locations.

iNeedMD Holdings, Inc. Overview

One of the Company’s commercialized products, The EKG GloveTM is an FDA-cleared and CE-marked medical device that we believe will transform the way 12-lead, diagnostic electrocardiograms (EKG/ECG) are administered. The ECG is a key component of every cardiac monitoring program for “at risk” patients. According to the American Heart Association, factors that classify patients as “at risk” are old age, tobacco smoking, high blood triglyceride levels, high low-density lipoprotein (LDL) cholesterol levels, low high-density lipoprotein (HDL) cholesterol levels, high blood pressure, diabetes, obesity, chronic kidney disease, excessive alcohol consumption, anxiety, drug abuse, family history and having experienced a prior cardiac event.

According to the World Health Organization, ischemic heart disease (“IHD”), which includes Myocardial Infarctions (MI/AMI), angina, and heart failure due to MI, was the leading cause of death, for both men and women, in the United States and worldwide in 2011. According to the Agency for Healthcare Research and Quality, five of the top 20 most expensive conditions treated in U.S. hospitals by all payers in 2011 were due to cardiac related events (10.4%) with aggregate hospital costs of more than $45 billion. According to the U.S. Department of Health and Human Services, in 2010, 24% of all deaths within the United States were caused by heart disease and in 2011, 45% of men and 31% of women aged 75 years or older had reported that they were told they had heart disease at some point in their life by a physician or other health care professional.

Given the expansive, global impact of various cardiac diseases, The EKG Glove provides healthcare workers with a standardized ECG solution that will enable them to quickly and accurately assess an individual’s cardiac health. As a result, iNeedMD’s products may assist in the management of healthcare costs and ultimately save lives. The sanitary, disposable EKG Glove is applied to the chest in under 30 seconds as the electrodes and conductive circuitry are fully integrated into a single, flexible shell. A single coaxial cable connects The EKG Glove to most ECG acquisition devices, eliminating the use of the numerous “spaghetti wires” that have been indicated in the spread of Hospital Acquired Infections (HAIs) and are easily positioned incorrectly leading to erroneous test results. In essence, The EKG Glove is an ECG “peel-and-stick” solution that facilitates the faster and more accurate collection of data that remains the mainstay in the assessment of cardiac health. We believe The EKG Glove can immediately be put into service in hospitals and other medical facilities that are looking for time-saving and infection-limiting disposable products.

| 4 |

iNeedMD is also focused on innovation as it relates to the acquisition and transmission of ECGs and other health data so that doctors, regardless of their physical proximity to a patient, can diagnose or rule-out a variety of medical disorders. The Company’s research efforts include the development of portable, wireless platform technologies that are Bluetooth- and WIFI-enabled. When paired with iNeedMD’s easy-to-use EKG Glove and similar products, these devices will enable individuals of various skill levels to obtain critical patient information and transmit results to skilled medical professionals at any location. In addition, the flexibility of The EKG Glove and evolving products, make partnering with other medical device manufacturers feasible where synergistic and volume-driven market opportunities exist in the point-of-care and telehealth markets. The Company is currently in discussions to pair The EKG Glove with 510(k) cleared wireless ECG devices (“EKG Glove System”) to enable immediate penetration into a variety of target markets.

Target Markets

The EKG Glove has six distinct markets:

| 1. | Hospitals - Gaining acceptance of The EKG Glove as an essential component of institutions’ cardiac screen programs, will assist the Company in solidifying the benefits of the product within the aggregate medical community. The emergency department is a targeted user base in hospitals as minimizing time and maximizing accuracy are keys to effective patient triage and treatment. In addition, the disposability of The EKG Glove, along with its all-in-one design and single cable connection to existing EKG machines supports the Center for Disease Control’s (CDC) directive that patient care equipment as it relates to infection prevention and control, preferably be disposable. Since hospital acquired infections are always of concern, and in light of the preparatory steps that many hospitals are taking to prevent the spread of infectious disease, The EKG Glove can be a helpful solution for delivering efficient, infection-limiting cardiac monitoring services throughout the hospital. The Company has already conducted several successful clinical studies and trials in a variety of New York hospitals including NYU Medical, Mount Sinai Hospital and Peconic Bay Hospital and is working to expand its reach to other private, public and military institutions in the United States and internationally. |

| 2. | Nursing Homes and Skilled Nursing Facilities - According to the American Association of Cardiovascular and Pulmonary Rehabilitation, acute cardiac events such as myocardial infarction and heart failure affect over two million individuals in the United States each year, and over half of these individuals are over the age of 65. Also common in older adults are cardiac surgical procedures such as coronary artery bypass and valve surgery. After cardiac events, these older adults often require rehabilitation at a skilled nursing facility (SNF) or Nursing Home; these centers often lack in-house cardiac care programs. The Company’s pairing of its easy–to-use EKG Glove with a wireless, portable ECG acquisition device (the “EKG Glove System”) provides the Company with an opportunity to deliver one of the most important and basic cardiac testing methodologies to these facilities to improve patient care. Healthcare workers, of any skill level, can be trained to adhere The EKG Glove to the patient and obtain an accurate ECG; the data is then captured for immediate interpretation by a physician and/or transmitted to the facility’s electronic health record for remote analysis or interpretation at a later time based on the medical staff’s schedule. As a result, the Company believes that integration of the EKG Glove System into nursing facilities will fill an unmet market need. |

| 3. | Heart Rhythm Monitoring Market - With the rise in the number of patients in the United States suffering from various stages of heart disease, it is becoming increasingly necessary to monitor a patient’s heart function on a regular basis. Most people are familiar with the use of ambulatory Holter Monitors used by cardiologists to record a patient’s heart function over a 24 or 48 hour period. In addition, according to the National Center on Sleep Disorders Research, about 70 million Americans suffer from sleep problems, with nearly 60 percent of those individuals being categorized as having a chronic disorder. Sleep studies aimed at diagnosis of these disorders like sleep apnea, have ECG monitoring at the core of the assessment. In both cardiac and sleep monitoring applications, The EKG Glove when paired with the Company’s wireless, portable ECG acquisition device that is currently in development (the “iNeedMD EKG Glove System”) plus a lightweight vest to hold the devices in place, will have the added advantage of recording and transmitting ECG data via a wireless connection through a software interface to a tablet, personal computer or cell phone back to the doctor’s office in real-time. This feature will provide physicians with the capability to discover serious problems before the end of the test and ultimately help patients understand and monitor their own health status. The remote communications capability of the iNeedMD EKG Glove System is likely to alleviate the burden on the medical services by allowing the ECG test to be self-administered at home. |

| 5 |

Other attractive segments within the Heart Rhythm Monitoring market include the use of The EKG Glove, with existing ECG machines or paired with a wireless portable ECG acquisition device, by Clinical Research Organizations (CROs) involved in pharmaceutical drug development. Throughout the multi-phase process, assessment of a chemical compound’s potential impact on cardiac health must be completed. A research professional can utilize The EKG Glove to quickly and precisely position leads on the patient or volunteer and acquire an accurate ECG tracing while effectively minimizing the risk of lead misplacement or transmission of infection as compared to the utilization of traditional reusable, “spaghetti wire” leads.

| 4. | Medical Transport - When emergency medical technicians (EMTs) wirelessly transmit electrocardiograms (ECG) directly to a cardiologist or attending physician’s Bluetooth-enabled device for immediate interpretation, heart attack patients can potentially receive an artery-opening procedure in half the usual time. The physician, upon observing definitive signs of a heart attack via remote acquisition, can direct hospital staff to have the patient bypass the emergency department upon arrival and go directly to the catheterization laboratory for treatment. Since The EKG Glove can facilitate accurate ECG lead placement in under 30 seconds, the product’s ease-of-use can improve the efficiency of the EMT and helps ensure the precision of the ECG tracing is of diagnostic quality. The American College of Cardiology (ACC) and the American Heart Association recommend that patients have their arteries opened directly within 90 minutes of arriving at the hospital; as a result if the EKG Glove System facilitates a quicker "door-to-reperfusion" rate, the more likely the heart muscle and the patient will be saved. | |

| 5. | Remote Medical Assessment - As previously noted above,wirelessly transmitting electrocardiograms (ECG) via Bluetooth-enabled devices directly to physicians for immediate assessment and interpretation improves the quality of patient care. This is especially true in geographically isolated regions or other settings where cardiac care physicians are absent or inaccessible. In remote locations such as in rural communities, telehealth adoption is significantly higher as compared to hospitals in urban areas. For example, Alaska hospitals reported the highest percent of telehealth adoption at 75 percent; Arkansas at 71 percent; South Dakota at 70 percent; and Maine at 69 percent. In addition, the Department of Veterans Affairs recently reported that 690,000 veterans received care via 2 million telehealth visits in fiscal year 2014 which ended in September 2014 – that’s 12 percent of all veterans enrolled in VA health care. Home telehealth is a growing segment of the category and often only encompasses the acquisition of vital signs such as pulse, weight, blood pressure and temperature. Since The EKG Glove is capable of being self-adhered given its all-in-one design, and the Bluetooth ECG acquisition device can be configured to facilitate ECG transmission with minimal patient interface, this user-friendly system has the potential to enable off-site cardiac assessments into a home telehealth menu of services. |

In addition, according to the Western Journal of Emergency Medicine, medical incidents that occur during commercial air travel, often require assistance from a medical professional facilitated through the services of remote emergency response centers. “MedAire,” “The First Call,” and the University of Pittsburgh Medical Center’s “StatMD,” for example, offer 24-hour consultations via call centers staffed by physicians. MedAire responds to an average of 17,000 cases per year. Emergency medical kits onboard aircraft are not required to include cardiac monitoring equipment such as The EKG Glove System. Adding this device system to an emergency response protocol to enable the acquisition ECGs for interpretation by doctors at a call center, can assist in ruling out of events initially perceived as cardiac, or confirm the need for the crew/pilot to request further medical assistance that may require diversion of the flight to the nearest airport capable of landing the aircraft. The act of diverting a full aircraft is expensive and is estimated to range between $3,000 and $100,000 depending on the size of the plane and the basic costs of refueling, plus the financial consequences of re-routing passengers. We believe the development of the iNeedMd EKG Glove System is timely as on-board Wi-Fi access becomes more prominent on commercial airlines which will facilitate the remote transmission of critical cardiac data. We believe this will allow medical and airline professionals to make well-informed and potentially life-and cost-saving decisions.

| 6 |

| 6. | Urgent Care Health Clinics - According to AMN Healthcare, walk-in facilities afford widespread access to care for minor illnesses and a less-expensive alternative to after-hours care. The professional staff is also trained to recognize an urgent matter and refer the patient to the nearest emergency department. Many of the established retail clinics, such as Walgreens’ Healthcare Clinic, are expanding into diagnosing and treating chronic illnesses. Regardless of the treatment scenario, the addition of the user-friendly EKG Glove System for a rapid and accurate assessment of an individual’s cardiac health may provide clinics with more efficient and cost-effective care programs that ultimately improve patient outcomes. |

Manufacturing

The services of an outside operator, Wilson-Hurd Manufacturing (WH) of Berlin, Wisconsin, are utilized to run, build and manage the manufacturing process of the EKG Glove. WH has manufacturing and quality control systems that comply with ISO 9001:2008, ISO 13485:2013 and FDA regulatory requirements.

A semi-automated process is currently used to manufacture the EKG Glove, where human interaction is necessary to move each individual glove through the assembly line. Under the current assembly line configuration, bulk production of the disposable EKG Glove is approximately 25,000 gloves per month (per shift). WH can expand production capacity by adding up to 2 additional shifts for a maximum of 75,000 gloves per month. Should volume requirements warrant an incremental increase in production capacity, iNeedMD is ready to commence the construction of one fully automated, no-touch assembly line. Such a line can be operated in two eight hour shifts producing 83,000 EKG Gloves monthly (per shift). This would increase the production capacity to approximately 166,000 gloves per month (assuming 2 shifts per day) and it is estimated that the fully automated line will reduce the per-unit cost of The EKG Glove by approximately 25% (assuming two shifts).

Products and Usage

| 1. | The EKG Glove |

The EKG Glove is a single-use, disposable medical device that replaces the traditional EKG lead wires and electrodes used in the diagnosis of and screening for cardiovascular disease. The EKG Glove has been designed to obtain a full, diagnostic, 12 lead, resting electrocardiogram (ECG/EKG) using embedded printed circuitry connected to pre-positioned electrodes affixed to the underside of a glove-like sheath (or shell).

The EKG Glove is FDA-cleared, CE Marked and protected by eight (8) U.S. and three (3) international patents:

The key distinction between The EKG Glove and the traditional method of EKG administration is the removal of the 10 wire leads, commonly referred to as “spaghetti wires” and having the electrodes embedded into the form factor of The EKG Glove.

To obtain a tracing, the operator need only (i) remove the backing; (ii) slip on The EKG Glove; (iii) properly position and apply it to the patient’s chest; (iv) attach the three extendable electrodes, (vv) plug the 10 pin connector of the accessory cable into The EKG Glove, and (v) plug the other connector to any compatible ECG monitoring device. A full 12-Lead, diagnostic ECG will be produced and viewable. This entire procedure can be completed in under 1 minute. The EKG Glove can be utilized with most existing EKG machines in hospitals or doctors’ offices.

| 7 |

| 2. | Proprietary Acquisition Devices |

iNeedMD is in the process of formalizing relationships with third party device manufacturers to supply wireless, FDA-cleared, Bluetooth-enabled (with USB-connected capability) ECG acquisition devices that will allow the cardiac tracings to be transmitted to a wide variety of devices including laptops, tablets and ultimately cell phones. Device software will permit live streaming of the ECG and the saving and forwarding of various file types that are compatible with data stored within Electronic Health Record (EHR) systems. All partners will provide some customization of their software interface to ensure compatibility with existing EHRs.

The Company is also developing its own wireless, portable health information acquisition device that will be Bluetooth- and Wi-Fi-enabled, and be application driven to offer a seamless, user-friendly interface with laptops, tablets and cell phones. iNeedMD is also exploring an agreement with an India-based interpretation services providers that will allow the Company to provide healthcare clients with interpretations service from certified cardiologists and other specialists if local access is not feasible.

The Company is dependent on third-party service providers to develop, deliver and maintain certain aspects of its product and operations, including the manufacturing of its ECG acquisition devices. Until such time as the Company’s own acquisition device is fully developed, the Company will rely on third parties for the initial pairing, development and clearance of the ECG acquisition device with The EKG Glove. The Company has limited control over these third parties. Any discontinuation of these third-party services, or any reduction in performance or increase in price that would require the Company to replace such services, would disrupt its business. In the event that these service providers are unable to operate to the Company’s satisfaction, it would be forced to seek other firms to provide these services. There can be no assurance that services from substitute providers would be available on reasonable terms, if at all. Such an occurrence would involve significant delay and expense and would have a material adverse effect on the Company’s business, prospects, results of operations and financial condition.

Competition

We believe the Company is in an unprecedented position in having the only FDA-cleared 12-lead diagnostic EKG product that is sanitary, disposable and is easy enough to apply that even a patient has the potential to position accurately on himself/herself which can improve patient comfort and care. The product features may also decrease the personnel demands within the healthcare system as it can allow less technical staff to assist healthcare professionals in preparing the patient for an electrocardiogram. It may also help facilitate the implementation of telehealth initiatives related to heart health in a more streamlined, accessible manner. Its innovations are protected by 8 patents (international patents are held in China, India and Israel), which we believe will make it difficult for any company to compete with a similar product. In addition, iNeedMD’s intellectual property portfolio encompasses a system for collecting and transmitting a plurality of diagnostic information to remote locations, as well as receiving data which helps to safeguard future product development efforts. Aside from an EKG diagnostic device, patent-protections include blood pressure, pulse rate, and temperature monitoring, as well as an auscultation device, all within the easy-to-use glove framework.

The Company believes the primary obstacle for market penetration will come from apathy to change, fear of financial uncertainty due to change, fear of the application of new and innovative technologies and the unwillingness to learn new products and methods even if that change would enhance the workplace. Primary competition should be segmented by two distinct markets. For The EKG Glove used in tandem with standard legacy ECG machinery via a single coaxial cable, other non-disposable or single-use leadwire systems that are less user-friendly pose a competitive threat as they may have long terms contracts (purchase orders and maintenance agreements) and/or be associated with larger companies.

| 8 |

Snapshot of EKG Glove versus Leadwire Competitors:

| Company EKG Devices | iNeedMD,

Inc. EKG Glove |

LifeSYNC, Corp. LeadWear |

Various Manufacturers Traditional ECG Electrodes |

| Universally Compatible | YES | No | Yes |

| Prescription Ready | YES | Yes | Yes |

| Always Sanitary | YES | Yes | No |

| Electromagnetic Interference Protected | YES | No | No |

| Limited/No Patient Prep Required | YES | No | No |

| Disposable | YES | Yes | Available |

| No “Spaghetti Wire” | YES | Yes | No |

| No Additional Electrodes | YES | No | No |

| Wireless Availability | YES | Yes | No |

| Can be applied in under 1 minute | YES | No | No |

| Radiolucent | YES | Yes | No |

| Compact Light Weight | YES | Yes | Yes |

| Mobile | YES | Yes | Yes |

| No External leads from device needed | YES | No | No |

| Hypoallergenic | YES | Yes | Yes |

| No Arms and Legs Leads | YES | Yes | No |

| Made in the USA | YES | No | Yes/No |

| MSRP for 12 Lead | $20.00 | $15.00 | $0.85 to $3.00 |

As noted in the table above, The EKG Glove is currently the only disposable, all-in-one, 12-Lead system that offers a time-efficient, accurate application in less than 1 minute, regardless of the skill level of the individual/technician positioning the device on the patient.

When The EKG Glove is paired with an ECG acquisition device, different competitive profiles emerge. The institutional/hospital market is dominated by existing, mainline EKG machines sold by large well-known manufacturers and their distributors. In this scenario, we define our competition as companies that sell fixed or large, ECG machines that are far from portable, or complex PC-based ECG systems. Many of these competitors have greater access to capital than iNeedMD which can help maintain or expand their market-share. As a result, this market may have substantial barriers to entry when the pairing of The EKG Glove with a more portable ECG acquisition device. However, iNeedMD’s EKG Glove has the benefit of being uniquely compatible with these devices via a single coaxial cable; therefore, The EKG Glove can be integrated into most hospital systems as a valued accessory that can improve workflow and patient comfort and care.

The traditional ECG machines and PC-based systems are costly to acquire and service. For example, General Electric, sells its smallest PC-based system for approximately $3,500 in the U.S. The overwhelming majority require a certified trained professional to place a complicated system of individual lead wires on an individual in the correct configuration to obtain an ECG tracing. For office-based practitioners, retail health clinics, and other non-institutional healthcare environments, the acquisition cost and personnel requirements for traditional ECG systems may prohibit healthcare professionals from offering their patients one of the basic assessment tools to determine cardiac health. As a result, portable ECQ acquisition devices, some with USB and/or wireless capability, have emerged in the marketplace as viable alternatives. However, none of the current offerings provide the convenience and accuracy of the “peel-and-stick”, disposable EKG Glove design that takes the complexity out of proper lead placement and can improve the accuracy of ECG tracings.

| 9 |

Snapshot of The EKG Glove paired with a Wireless ECG Acquisition Device versus the Competition:

| Company EKG Devices | iNeedMD,

Inc. EKG Glove + Acquisition Device |

LifeSYNC, Corp. LeadWear System | Commwell Medical, Inc. Physio Glove ET | SHL SmartHeartPRO |

| Universally Compatible | YES | No | No | No |

| Prescription Ready | YES | Yes | Yes | Yes |

| Always Sanitary | YES | Yes | No | No |

| Electromagnetic Interference Protected | YES | Yes | No | No |

| Limited/No Patient Prep Required | YES | No | Yes | Yes |

| Disposable | YES | Yes | No | No |

| No “Spaghetti Wire” | YES | Yes | Yes | Yes |

| No Additional Electrodes | YES | No | Yes | Yes |

| Wireless Availability | YES | Yes | Yes | Yes |

| Can be applied in under 1 minute | YES | No | Yes | Yes |

| Radiolucent | YES | Yes | No | No |

| Compact Light Weight | YES | Yes | No | No |

| Mobile | YES | Yes | Yes | Yes |

| No External leads from device needed | YES | No | Yes | Yes |

| Hypoallergenic | YES | Yes | Yes | Yes |

| No Arms and Legs Leads | YES | Yes | No | Yes |

| Made in the USA | YES | No | No | No |

| MSRP for ECG Acquisition Device + 12 Lead System | $2,500.00 | $3,000.00 | $2,400.00 | $1,225.00 |

The overwhelming majority of competitive offerings still require the assistance of a certified trained professional to place a complicated system of ten lead wires on an individual in the correct configuration to obtain an electrocardiogram. Overall, the Company believes that the primary competitive factors in the EKG/ECG markets include:

| ● | The quality and reliability of the overall patient data delivery solution; | |

| ● | Access to distribution channels necessary to achieve broad distribution and use of products; | |

| ● | The availability of diagnostic equipment with the ability to generate digital results that can be delivered over the Internet and the access to necessary intellectual property rights; | |

| ● | The ability to license or develop and support secure formats for digital patient data delivery; | |

| ● | The ability to obtain appropriate regulatory clearances and certifications when required; | |

| ● | The ability to license and support popular and emerging media formats for digital media delivery, particularly video in live and replay formats, in a market where competitors may control the intellectual property rights for these formats; | |

| ● | The size of the patient community for streaming and digital media and its appeal to content providers and the medical community; |

| 10 |

| ● | Features for care givers to act on and their adaption to the diagnostic information gained over the Internet; | |

| ● | Ease of use and interactive user features in products; | |

| ● | Ease of finding and accessing patient information over the Internet; | |

| ● | Ability of streaming media, media delivery, and network capacity technology and cost per user; | |

| ● | Pricing and licensing terms; | |

| ● | Compatibility with new and existing electronic medical/health record systems; | |

| ● | Compatibility with the user’s existing network components and software systems; | |

| ● | The size and financial resources of our competitors; | |

| ● | The customer loyalty and in-elasticity of the consumer markets for medical supplies; and | |

| ● | Challenges caused by bandwidth constraints and other limitations of the Internet infrastructure. |

When The EKG Glove is paired with portable, wireless ECG acquisition devices, the system should have appeal in a variety of healthcare scenarios previously noted in the Target Market analysis, even as compared to other wireless device systems. Currently, our system is the only FDA-cleared, user-friendly EKG monitoring device system that has a sanitary, single-patient disposable lead wire system that helps ensure proper lead placement regardless of the skill level of the individual facilitating the ECG tracing. These factors comprise iNeedMD’s belief that the Company’s products will be valued by various target markets in the United States and abroad.

| 1) | The EKG Glove offers a sanitary, disposable model, with all circuitry and leads built-in to the single, easy- to-use device. |

| 2) | The EKG Glove is the only disposable ECG lead system that does not require the assistance of a skilled technician to accurately position on a patient. |

| 3) | The EKG Glove is compatible with most existing ECG machines via a single connector cable. |

| 4) | When paired with a wireless ECG acquisition device and software, The EKG Glove is the only disposable, sanitary ECG system with the potential for self-administration. |

Sales and Marketing

The Company’s marketing strategy is to stress the ease-of-use, accuracy, speed and flexibility of The EKG Glove. Our research suggests that the Company should initially introduce The EKG Glove paired with a wireless ECG acquisition device to Health Care Professionals with an aggressive campaign targeting Nursing Homes/Skilled Nursing Facilities, Medical Transport Companies, Retail Health Clinics and Hospitals.

iNeedMD is currently forging relationships with established sales agents and healthcare distributors, both domestic and international, with strong relationships in the targeted market segments. The Company is also building a technical sales and service team that will facilitate training of the aforementioned outside sales network and drive product integration and account servicing. iNeedMD is also planning to participate in market-specific trade shows and conferences that will expose the Company and its products to potential users within the nursing home, telehealth, government and urgent care sectors.

Price: The EKG Glove does not require a skilled technician for precise placement on an individual and therefore minimizes the potential for repeat testing that often exists when traditional lead-wires are positioned incorrectly. Pairing with a portable, compact ECG acquisition device can eliminate the need for healthcare professionals to purchase bulky, expensive ECG machines. These benefits have numerous cost-saving implications related to reducing expensive capital equipment purchases and limiting the need for highly compensated technical personnel. Although The EKG Glove will be priced higher than traditional “spaghetti wire” lead systems, the speed, accuracy, cost-reducing and other tangible benefits justify the user cost of approximately $20. In addition, through market research and sales trials conducted by iNeedMD, management, the cost to a hospital, per EKG done in the conventional manner is calculated to be approximately $22 to $26. Based on the same research, management believes that The EKG Glove can reduce the per unit (EKG) cost down to approximately $21. This creates approximately a $5 saving, per EKG. If the integration of The EKG Glove will be paired with the purchase of a wireless ECG acquisition device, the cost of the hardware will be expected to range between $1500 and $2500, depending on a facility’s need to also integrate the purchase of a Bluetooth or Wi-Fi enabled device.

| 11 |

Compensation: Compensation for the sales efforts of the Company is commission-based. The structure rewards external sales agents and an initially small internal staff with a target compensation of 20% of gross sales.

Distribution: The Company is strategically partnering with carefully-selected distributors (national and international) with existing sales relationships with customers within the varied target markets previously noted.

International Scale: Given the scope of some of the technology to be deployed, the Company must think globally. iNeedMD is currently negotiating licensing arrangements with groups in Saudi Arabia (for the Middle East Market), India, South America, and China.

Strategic Partnerships: In order to take advantage of immediate market opportunities with customers looking to adopt The EKG Glove paired with a portable ECG device, iNeedMD has solidified relationships with suppliers of FDA-cleared ECG acquisition devices; therefore at this time, iNeedMD relies on third parties for the manufacturing of such devices. Other business alliances with companies in the related healthcare industries may be considered if opportunities warrant such collaborations.

Intellectual Property Rights

iNeedMD, Inc. has patented technology on mounting biosensors on a glove (mitten) platform that will generate vital signs, including blood pressure, pulse rate, oxygen saturation, temperature and a full twelve-lead EKG, which can be transmitted via Internet, wireless or commercial telephone lines to any remote location. iNeedMD currently has eight patents issued (US patent Nos. 6,224,548; 6,248,064; 6,595,918; 6,540,673; 6757, 556; 7,112,175; 7,435,222 and; 7,753,845), two for the original glove design and two for a two-glove mapping system intended for use in future product offerings beyond the first four products.

The Company also has a number of additional patents for the original glove design and a two-glove system, as well as applications for its electrodes and twelve-lead design. International patents are held in China, India and Israel and will be applied for in Canada, Europe, Brazil and Mexico. All of the applications are for utility patents and some include method claims or technology patents.

U.S. PATENT No. 6,224,548 - Tele-diagnostic device

File Date: May 26, 1998

Issued Date: May 1, 2001

Expire Date: May 26, 2018

|

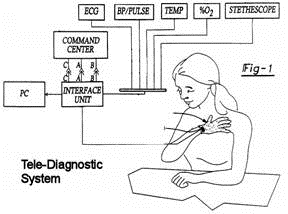

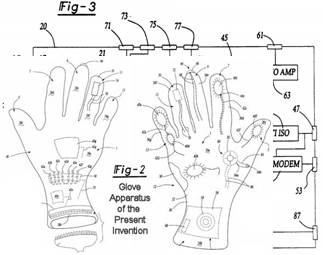

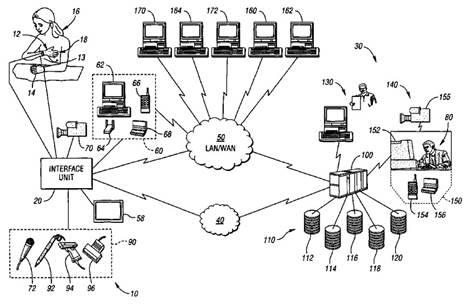

The objective of this patent is to provide a system for collecting a plurality of diagnostic information and transmitting the diagnostic information to a remote location. The system (Fig-1) comprises a glove member (Fig-2) adaptable to be worn on a person's hand and an interface unit (Fig. 3) in electrical communication with the glove member. The interface unit is capable of transmitting information to, and receiving information from, a remote location. The glove member comprises a palm portion, a wrist portion and five phalange portions. The glove member further comprises an EKG diagnostic device, a blood pressure and pulse rate diagnostic device and a temperature device. The glove member may also further comprise a diagnostic device and an auscultation device. |

| 12 |

U.S. PATENT No. 6,248,064 - Continuation of U.S. PATENT No. 6,224,548

File Date: Nov 10, 1998

Issued Date: Jun 19, 2001

Expire Date: May 26, 2018

Added: Additional

Glove apparatus (Two Glove system)

The objective of this patent is to create a system for collecting a plurality of diagnostic information and transmitting the diagnostic information to a remote location for providing emergency treatment. The system comprises a first member adaptable to be worn on a person's first hand and a second member adaptable to be worn on a person's second hand. The members comprise a plurality of diagnostic devices and a defibrillator device. A transmitting unit for transmitting information to, and receiving information from, a remote location is provided.

The patents granted below are all related to the Two Glove system and were issued as a continuation of U.S. PATENT No. 6,224,548.:

U.S. PATENT No. 6,595,918 - Continuation of U.S. PATENT No. 6,224,548

File Date: Jun 19, 2001

Issued Date: Jul 22, 2003

Expire Date: May 26, 2018

U.S. PATENT No. 6,540,673 - Continuation of U.S. PATENT No. 6,224,548

File Date: Dec 19, 2000

Issued Date: Apr 1, 2003

Expire Date: May 26, 2018

U.S. PATENT No. 7,753,845 - Divisional of U.S. PATENT No. 6,540,673 which is a Continuation of U.S. PATENT No. 6,224,548

File Date: Mar 27, 2003

Issued Date: Jul 13, 2010

Expire Date: May 26, 2018

| 13 |

U.S. PATENT No. 7,112,175 - Continuation of U.S. PATENT No. 6,595,918 which is a Continuation of U.S. PATENT No. 6,224,548

File Date: Dec 18, 2001

Issued Date: Sep 26, 2006

Expire Date: May 26, 2018

U.S. PATENT No. 7,435,222 - Continuation of U.S. PATENT No. 7,112,175 which is a Continuation of U.S. PATENT No. 6,595,918 which is a Continuation of U.S. PATENT No. 6,224,548

File Date: Sep 25, 2006

Issued Date: Oct 14, 2008

Expire Date: May 26, 2018

U.S. PATENT No. 6,757,556 - Continuation of U.S. PATENT No. 6,595,918 and U.S. PATENT No. 6,540,673 and both are a Continuation of U.S. PATENT No. 6,224,548

File Date: Oct 4, 2001

Issued Date: Jun 29, 2004

Expire Date: May 26, 2018

Spring loaded Electrode Sensor.

|

The patent related to the spring loaded electric sensor involves an electrode sensor attachable to a substrate for sensing electrical activity of a patient. The electrode sensor comprises an elongated conductive body having first and second ends, wherein the first end is adapted to contact the patient for sensing electrical activity of the patient. The second end is configured to conductively attach to the substrate. The elongated conductive body is greater than about 2 millimeters in length and is configured to extend from the substrate. |

INTERNATIONAL PATENTS

CANADA PATENT No. 2332892 - Same as U.S. PATENT No. 6,224,548

File Date: May 19, 1999

Issued Date: Nov 3, 2009

Expire Date: May 19, 2019

INDIA PATENT No. 246790 - Same as U.S. PATENT No. 6,224,548

File Date: May 19, 1999

Issued Date: Mar 16, 2011

Expire Date: May 19, 2019

CHINA PATENT No. ZL98815542.X - Same as U.S. PATENT No. 6,224,548

File Date: Dec Nov 1, 1999

Issued Date: Mar 27, 2002

Expire Date: Nov 1, 2019

ISRAEL PATENT No. 139781 - Same as U.S. PATENT No. 6,224,548

File Date: May 19, 1999

Issued Date: Oct 6, 2006

Expire Date: May 19, 2019

| 14 |

METHOD FOR REMOTE MEDICAL CONSULT AND CARE (TELE-HEALTH)

U.S. PATENT No. 7,860,725

File Date: Dec 19, 2000

Issued Date: Apr 1, 2003

Expire Date: May 19, 2019

A method for remote medical consulting includes collecting diagnostic data using at least one wearable device contoured to at least a portion of a person's hand, transmitting the diagnostic data to a remote location, transmitting audio data and video images of the patient to the remote location, and communicating diagnosis and/or treatment information to the patient based at least in part on the diagnostic data. The treatment information may include a prescription electronically transmitted to the patient or a pharmacy. The method includes billing of the patient via credit or debit card, bank account, or a third party, such as an insurance company. The diagnostic data as well as the audio and video data may be transmitted wirelessly via cellular or satellite communication networks and/or using a wide area computer network such as the internet.

U.S. PATENT No. 8,285,560 - Continuation of U.S. PATENT No. 7,860,725

File Date: Dec 23, 2010

Issued Date: Oct 9, 2012

Expire Date: May 19, 2019

In October 2013, the Company was also granted a provisional patent for a Glove base ultra sound. This patent is currently pending approval.

DESCRIPTION OF PROPERTY

We currently lease commercial office space located at 650 First Avenue, Third Floor, New York, New York 10016 for $3,855 per month. The Company entered into the lease in July 2014 for a term of 5 years with the option to renew.

RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in this Annual Report on Form 10-K before making an investment decision with regard to our securities. The statements contained in or incorporated herein that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, you may lose all or part of your investment.

| 15 |

RISKS RELATED TO OUR COMPANY AND OUR INDUSTRY

THE COMPANY OPERATES IN A COMPETITIVE ENVIRONMENT.

Many of the Company’s current and potential competitors have longer operating histories, greater name recognition, more employees, and significantly greater financial, technical, marketing, public relations, and distribution resources than the Company. The competitive environment may require the Company to make changes in the Company’s products, pricing, licensing, services, or marketing to maintain and extend the Company’s current brand and technology franchise. Price concessions or the emergence of other pricing or distribution strategies of competitors may diminish the Company’s revenues, impact the Company’s margins, or lead to a reduction in the Company’s market share, any of which will harm the Company’s business.

The Company believes that the primary competitive factors in the medical device market include:

| ● | access to distribution channels necessary to achieve broad distribution and use of products; | |

| ● | the availability for delivery over the Internet and ownership of necessary intellectual property rights; | |

| ● | the ability to license or develop and support its devices; | |

| ● | the ability to license and support its products where competitors may control the market; | |

| ● | the market penetration and size of product use and its appeal to hospitals, EMS, and other medical institutions; | |

| ● | features for the analysis of the data that is obtained; | |

| ● | ease of use and interactive user features in products; | |

| ● | compatibility with new and existing software; | |

| ● | compatibility with the user’s existing network components and software systems; and | |

| ● | challenges caused by the introduction of new medical devices into the established market. |

The Company’s failure to adequately address any of the above factors could harm the Company’s business strategy and operating results.

WE HAVE LIMITED OPERATING HISTORY.

To date, our efforts have been focused primarily on the development and marketing of our business model. We have limited operating history for investors to evaluate the potential of our business development. We may not operate profitably and we may not have adequate working capital to meet our obligations as they become due.

THE COMPANY’S QUARTERLY FINANCIAL RESULTS MAY FLUCTUATE SIGNIFICANTLY.

The Company expects its quarterly revenues, expenses and operating results to fluctuate significantly in the future as a result of a variety of factors, some of which are outside of the Company’s control. These factors include:

| ● | the number of the Company customers; | |

| ● | the Company’s ability to establish and strengthen brand awareness; | |

| ● | the Company’s success, and the success of its strategic partners, in marketing the Company’s products and services; | |

| ● | the amount and timing of the costs relating to marketing efforts or other initiatives; | |

| ● | the timing of contracts with strategic partners and other parties; | |

| ● | fees the Company may pay for distribution, service agreements and promotional arrangements or other costs the Company incurs as it expands operations; | |

| ● | the level of acceptance of the Internet by the healthcare industry; | |

| ● | the Company’s ability to compete in a highly competitive market, and the introduction of new sites and services by the Company or its competitors; | |

| ● | technical difficulties, system downtime, undetected software errors and other problems affecting the Internet generally or the operation of the Company Web site; and | |

| ● | economic conditions specific to the Internet and online media and general economic conditions. |

| 16 |

In addition, in an attempt to enhance the Company’s long-term competitive position, the Company may from time to time, make decisions regarding pricing, marketing, services and technology that could have a near-term material adverse effect on its business, financial condition and operating results. Due to the foregoing factors, the Company believes that quarter-to-quarter comparisons of its operating results are not a good indication of its future performance.

THE MARKET STUDIES DESCRIBED HEREIN WERE COMMISSIONED AND PAID FOR BY THE COMPANY AND ARE NOT INDEPENDENT.

The Company’s market studies were not prepared by or reviewed by an independent source. The results of these studies may not be representative or indicative of the actual consumer response to the Company’s products. The Company has only made minimal sales to date. There can be no assurance that the Company’s projections will or can be realized and actual results may differ materially from those set forth in the Company’s projections. Because of the above limitations, investors are cautioned against placing undue reliance on these market studies.

THE IMPLEMENTATION OF THE COMPANY’S BUSINESS STRATEGY WILL REQUIRE SIGNIFICANT EXPENDITURE OF CAPITAL AND WILL REQUIRE ADDITIONAL FINANCING.

The implementation of the Company’s business strategy will require significant expenditures of capital, and the Company will require additional financing. Additional funds may be sought through equity or debt financings. The Company cannot offer any assurances that commitments for such financings will be obtained on favorable terms, if at all. Equity financings could result in dilution to holders and debt financing could result in the imposition of significant financial and operational restrictions on the Company. The Company’s inability to access adequate capital on acceptable terms could have a material adverse effect on the Company’s business, results of operations and financial condition.

If the Company fails to generate revenue as anticipated or if its development costs continue to exceed available funds, the Company may be required to undertake unplanned additional financing(s). If such additional financing is required, the Company can offer no assurance that additional funds will be available or that they will be obtained on economically acceptable terms.

THE COMPANY MAY NOT SUCCESSFULLY DEVELOP NEW PRODUCTS AND SERVICES.

The Company’s growth depends on its ability to develop leading edge medical device products and services. The Company’s business and operating results would be harmed if the Company fails to develop products and services that achieve widespread market acceptance or that fail to generate significant revenues to offset development costs. The Company may not be able to timely and successfully identify, develop and market new product and service opportunities. If the Company introduces new products and services, they may not attain broad market acceptance or contribute meaningfully to the Company’s revenues or profitability.

Because the markets for the Company’s products and services are rapidly changing, the Company must develop new offerings of its products and services quickly. The Company has experienced development delays and cost overruns in its development efforts in the past and the Company may encounter such problems in the future. Delays and cost overruns could affect its ability to respond to technological changes, evolving industry standards, competitive developments, or customer requirements. The Company’s products also may contain undetected errors that could cause increased development costs, loss of revenues, adverse publicity, reduced market acceptance of the products or lawsuits by customers.

| 17 |

THE COMPANY MAY NOT SUCCESSFULLY MANAGE ITS GROWTH.

The Company cannot successfully implement its business model if the Company fails to manage its growth. The Company must rapidly and significantly expand its operations domestically and internationally and anticipate the need for further expansion to take advantage of market opportunities. Managing this substantial expansion will place a significant strain on the Company’s management, operational and financial resources. If the Company’s growth accelerates, the Company will need to continue to improve its financial and managerial control and reporting systems and procedures.

The Company will have to implement new management information software systems. This will affect many aspects of its business, including its accounting, operations, electronic commerce, customer service, purchasing, and sales and marketing functions. The purchase, implementation and testing of these systems will result in significant capital expenditures and could disrupt the Company’s day-to-day operations. If these systems are not implemented as expected, the Company’s ability to provide products and services to its customers on a timely basis will suffer and delays in the recording and reporting of its operating results could occur.

THE COMPANY MAY NOT SUCCESSFULLY DEVELOP ITS MARKETING CAPABILITY.

The Company has limited experience developing and marketing its products and related services. Developing and assembling a technical development team and sales and marketing strategy and team to adequately support its business will require substantial effort and require significant management and financial resources. The Company may be unable to find the appropriate employees or consultants to assist with the commercialization of its products, build a suitable sales force, or enter into satisfactory marketing arrangements with third parties, and its sales and marketing efforts may be unsuccessful.

THE COMPANY RELIES ON THIRD-PARTY PROVIDERS.

The Company will be dependent upon third-party service providers to develop, deliver and maintain certain aspects of its product and operations, including the manufacturing of its ECG acquisition devices. The Company relies on third parties for the initial pairing, development and clearance of the ECG acquisition device with The EKG Glove. The Company has limited control over these third parties. Any discontinuation of these third-party services, or any reduction in performance or increase in price that would require the Company to replace such services, would disrupt its business. In the event that these service providers are unable to operate to the Company’s satisfaction, it would be forced to seek other firms to provide these services. There can be no assurance that services from substitute providers would be available on reasonable terms, if at all. Such an occurrence would involve significant delay and expense and would have a material adverse effect on the Company’s business, prospects, results of operations and financial condition.

THE SUCCESS OF THE COMPANY DEPENDS ON ITS ABILITY TO ATTRACT A CRITICAL MASS OF CUSTOMERS.

The Company business strategy is to create a new paradigm for connecting doctors to patients for both urgent and non-urgent medical care, including the monitoring of vital statistics of medical patients and the marketing of related medical devices. The volume of business depends in part on the perceived value of the Company’s monitoring and assessments products and services. In order for the Company’s business to become valuable in the marketplace, it needs to attract customers, which may be hospitals, medical professionals, medical education institutions, insurance companies and individuals, as well as a large number of vendors, sponsors and advertisers. The Company cannot assure you that it will be successful in attracting a large number of vendors, sponsors or advertisers, nor can it assure you that consumers will use its online services. If medical professionals do not purchase the Company’s product and/or consumers do not use its Web site, it will have a material adverse effect on the Company’s business.

| 18 |

THE COMPANY COULD LOSE STRATEGIC RELATIONSHIPS THAT ARE ESSENTIAL TO ITS BUSINESS.

The loss of certain current strategic relationships, the inability to find other strategic partners or the failure of the Company’s existing relationships to achieve meaningful positive results could harm the Company’s business. The Company intends to rely in part on strategic relationships to help it:

| ● | maximize adoption of the Company’s products through distribution arrangements; | |

| ● | increase the amount and type of data that can be processed to help boost the demand for the Company’s products and services; | |

| ● | enhance the Company’s brand; | |

| ● | expand the range of commercial activities based on the Company’s technology; | |

| ● | increase the performance and utility of the Company’s products and services. |

Many of these goals are beyond the Company’s expertise. The Company anticipates that the efforts of the Company’s strategic partners will become more important as the medical device business matures. In addition, the efforts of the Company’s strategic partners may be unsuccessful. Furthermore, these strategic relationships may be terminated before the Company realizes any benefit.

THE COMPANY’S BUSINESS WILL SUFFER IF ITS SYSTEMS FAIL OR BECOME UNAVAILABLE.

A reduction in the performance, reliability and availability of the Company’s website and network infrastructure will harm the Company’s ability to distribute its products and services to its users, as well as its reputation and ability to attract and retain users and customers. The Company’s systems and operations could be damaged or interrupted by fire, flood, power loss, telecommunications failure, Internet breakdown, earthquake, acts of terrorism, and similar events. The Company’s systems are also subject to break-ins, sabotage, intentional acts of vandalism and similar misconduct. The Company does not have fully redundant systems or a formal disaster recovery plan, and the Company does not carry adequate business interruption insurance to compensate the Company for losses that may occur from a system outage.

A sudden and significant increase in traffic on the Company’s website could strain the capacity of the software, hardware and telecommunications systems that the Company deploys or uses. This could lead to slower response times or system failures. The Company depends on Web browsers, Internet service providers (“ISPs”) and online service providers to provide Internet users access to the Company’s website. Many of these providers have experienced significant outages in the past, and could experience outages, delays, and other difficulties due to system failures unrelated to the Company’s systems.

THE COMPANY’S NETWORK IS SUBJECT TO SECURITY RISKS THAT COULD HARM THE COMPANY’S REPUTATION AND EXPOSE IT TO LITIGATION OR LIABILITY.

Online communications depend on the ability to transmit confidential information securely over public networks. Any compromise of the Company’s ability to transmit confidential information securely, and costs associated with preventing or eliminating any problems, could harm the Company’s business. Online transmissions are subject to a number of security risks, including:

| ● | the Company’s encryption architecture or licensed encryption and authentication technology may be compromised, breached or otherwise be insufficient to ensure the security of customer information; | |

| ● | the Company could experience unauthorized access, computer viruses and other disruptive problems, whether intentional or accidental; | |

| ● | a third party could circumvent the Company’s security measures and misappropriate proprietary information or interrupt operations; and |

The occurrence of any of these or similar events could damage the Company’s reputation and expose it to litigation or liability. The Company may also be required to expend significant capital or other resources to protect against the threat of security breaches or to alleviate problems caused by such breaches.

| 19 |

THE COMPANY MAY BE UNABLE TO ADEQUATELY PROTECT ITS PROPRIETARY RIGHTS.

The Company’s inability to protect its proprietary rights, and the costs of doing so, could harm its business. The Company’s success and ability to compete partly depend on the superiority, uniqueness or value of its technology, including both internally developed technology and technology licensed from third parties. To protect its proprietary rights, the Company plans to rely on a combination of patent, trademark, copyright and trade secret laws, confidentiality agreements with its employees and third parties, protective contractual provisions and its ability to encrypt its programming. The Company currently has eight patents issued (US patent Nos. 6,224,548; 6,248,064; 6,595,918; 6,540,673; 6757,556; 7,112,175; 7,435,222; and 7,753,845), two for the original glove design and two for a two-glove mapping system intended for use in future product offerings. The Company also has a number of additional patents for the original glove design and a two-glove system, as well as applications for its electrodes and twelve-lead design. International patents are held in China, India, Israel, Canada, and will be applied for in Europe, Brazil and Mexico. Despite the Company’s efforts to protect its proprietary rights, unauthorized parties may copy or infringe aspects of its technology, products, services, or trademarks, or obtain and use information the Company regards as proprietary. The Company’s proprietary rights may be especially difficult to protect in foreign countries, where unrelated third parties may have registered the Company’s domain names and trademarks under their own names in an attempt to prevent the Company from using the domain names and trademarks in those countries without paying them a significant sum of money. This could prevent the Company from using the Company’s valuable brands in those countries, and reduce the value of the Company’s intellectual property. In addition, others may independently develop technologies that are similar or superior to ours, which could reduce the value of the Company’s intellectual property.

Companies in the medical device industry have frequently resorted to litigation regarding intellectual property rights. The Company may have to litigate to enforce the Company’s intellectual property rights, to protect the Company’s trade secrets or to determine the validity and scope of other parties’ proprietary rights. The Company may lack the financial and legal resources to effectively pursue infringers of its intellectual property rights. Moreover, the Company’s products and services may possibly infringe upon proprietary rights held by others, and in the event there are patent infringement suits by other companies, any litigation could result in its incurring substantial costs, could prevent the sale of a specific product or service, or could require the Company to direct its efforts away from its business plan.

THE EXPIRATION OR LOSS OF PATENT PROTECTION MAY ADVERSELY AFFECT OUR FUTURE REVENUES AND OPERATING INCOME.

iNeedMD will rely on patent, trademark and other intellectual property protection in the discovery, development, manufacturing, and sale of its products. In particular, patent protection is, in the aggregate, important in the Company’s marketing of The EKG Glove in the United States and most major markets outside of the United States. The expiration or loss of patent protection for a product typically is followed promptly by substitutes that may significantly reduce sales for that product in a short amount of time. If our competitive position is compromised it could have a material adverse effect on our business and results of operations.

THE COMPANY MAY NEED TO INCUR LITIGATION EXPENSES IN ORDER TO DEFEND INTELLECTUAL PROPERTY RIGHTS AND MIGHT NEVERTHELESS BE UNABLE TO ADEQUATELY PROTECT THESE RIGHTS.

The Company believes that its future success will depend in part on its ability to protect its internally developed technologies, which it seeks to protect through a combination of patent, trademark, copyright and trade secret laws. Protection of the Company’s trademarks is crucial as it attempts to build its brand name and reputation. Despite actions the Company takes to protect its intellectual property rights, it may be possible for third parties to copy or otherwise obtain and use its intellectual property without authorization or to develop similar technology independently. The Company may need to engage in costly litigation to enforce its intellectual property rights, to protect its trade secrets or to determine the validity and scope of the intellectual property rights of others. The Company cannot assure you that its efforts to prevent misappropriation or infringement of its intellectual property will be successful. An adverse determination in any litigation of this type could require the Company to make significant changes to the structure and operation of its products or online services and features or to license alternative technology from another party. Implementation of any of these alternatives could be costly and time- consuming and may not be successful. Any intellectual property litigation would be likely to result in substantial costs and diversion of resources and management attention. In addition, legal standards relating to the validity, enforceability and scope of protection of intellectual property rights in Internet-related businesses are uncertain and still evolving.

| 20 |

THE COMPANY MAY NOT BE ABLE TO DEVELOP NEW PRODUCT OR SERVICE OFFERINGS IF IT IS UNABLE TO OBTAIN NEEDED TECHNOLOGY.

The Company relies upon third parties to develop technologies that will enhance its planned product and service offerings. If the Company’s relationships with these third parties are impaired or terminated, then the Company would have to find other developers on a timely basis or develop technology completely on its own. The Company cannot predict whether it will be able to obtain the third-party technology necessary for continued development and introduction of new and enhanced products and services.

THE COMPANY MAY INCUR SUBSTANTIAL COSTS AND DIVERSION OF THE COMPANY’S MANAGEMENT’S RESOURCES IF THE COMPANY INFRINGES UPON THE PROPRIETARY RIGHTS OF OTHERS.

The Company intends to have the permission of, and, in some cases, licenses from, any developer of a software program that the Company uses in the Company’s software. Although the Company has not, at this time, obtained an opinion of counsel, the Company does not believe that the software or the trademarks the Company uses or will use or any of the other elements of the Company’s business infringe on the proprietary rights of any third parties. Third parties may assert claims against the Company for infringement of their proprietary rights and these claims may be successful.

The Company could incur substantial costs and diversion of management resources in the defense of any claims relating to proprietary rights. Parties making these claims could secure a judgment awarding substantial damages as well as injunctive or other equitable relief that could effectively block the Company’s ability to license the Company’s products in the United States or abroad. If a third party asserts a claim relating to proprietary technology or information against the Company, the Company may seek licenses to the intellectual property from the third party. The Company cannot be certain, however, that third parties will extend licenses to it on commercially reasonable terms, or at all. If the Company fails to obtain the necessary licenses or other rights, it could materially and adversely affect the Company’s ability to operate the Company’s business.

The Company could be exposed to significant legal liability if new case law is decided, or new government regulation is enacted, regarding the Internet and Internet service providers. The law relating to the Company’s business and operations is evolving and no clear legal precedents have been established. The adoption of new laws or the application of existing laws may decrease the growth in the use of the Internet, affect telecommunications costs or increase the likelihood or scope of competition from regional telephone companies. These results could decrease the demand for the Company’s services or increase the Company’s cost of doing business, each of which would hurt the Company’s projected gross margins and revenues.

THE COMPANY MAY BE UNABLE TO SUCCESSFULLY COMPETE WITH ESTABLISHED ECG MANUFACTURERS AND TELEMEDICINE COMPANIES IN THE MEDICAL DEVICE AND TELEHEALTH MARKETS.

The market for telemedicine software and services, for the delivery, diagnosis, and care of patient over the Internet is relatively new, constantly changing, and intensely competitive. As medical care evolves into a central component of the Internet experience, more companies are entering the market for, and expending increasing resources to develop, patient diagnostic delivery software and services. The Company expects that competition will continue to intensify.

Many of the Company’s current and potential competitors have longer operating histories, greater name recognition, more employees, and significantly greater financial, technical, marketing, public relations, and distribution resources than the Company does. The competitive environment may require us to make changes in the Company’s products, pricing, licensing, services, or marketing to maintain and extend the Company’s current brand and technology franchise. Price concessions or the emergence of other pricing or distribution strategies of competitors may diminish the Company’s revenues, impact the Company’s margins, or lead to a reduction in the Company’s market share, any of which will harm the Company’s business. The Company’s failure to adequately address any of the above factors could harm the Company’s business strategy and operating results.

| 21 |

General Electric and Cisco are the principal competitors in the development and distribution of ECG machines and real-time telemedicine network technology. General Electric currently competes in the market for ECG equipment and controls over 50% of the U.S. market. Cisco is currently the market leader in assisting large medical institutions in developing and deploying their telehealth networks. The Company believes that General Electric’s and Cisco’s commitments to, and presences in, the telehealth and telemedicine markets has increased and that both companies will continue to increase competitive pressure in the overall market for medical product distribution.

In addition to General Electric and Cisco, multiple other Fortune 500 companies are entering this marketplace which will lead to the Company face increasing competition from other well-established companies that are developing and marketing telemedical products. The Company expects that other large communication and software companies will devote more resources to developing and marketing medical applications, and will seek to compete more vigorously with us in the marketplace. As more companies enter the market with products that compete with the Company’s solutions and tools the competitive landscape could change rapidly to the Company’s disadvantage.

THE COMPANY IS REGULATED BY THE FDA.

The Company’s products are subject to regulation by the federal Food and Drug Administration (“FDA”) and, in some jurisdictions, by state and foreign governmental authorities. In particular, the Company must obtain specific clearance from the FDA before it can market products in the United States. The process of obtaining such clearances can be time-consuming and expensive, and there can be no assurance that all clearances sought by the Company will be granted or that FDA review will not involve delays adversely affecting the marketing and sale of Company products. Current FDA enforcement policy prohibits the promotion or labeling of approved medical devices for unapproved uses. The Company is also required to adhere to the manufacturing, testing, control, labeling, documentation and product surveillance requirements of the FDA. These regulations may have a material impact on the Company’s business. Medical device laws exist in many of the foreign countries where the Company will do business. Federal state and foreign regulations regarding the manufacture and sale of medical devices are subject to future changes. Such revisions may have a material impact on the Company’s business. If the FDA believes that a company is not in compliance with applicable regulations, it can institute proceedings to detain or seize products, issue a recall, impose operating restrictions, enjoin future violations and assess civil and criminal penalties against the Company, its officers or its employees and can recommend criminal prosecution to the Department of Justice. Other regulatory agencies may have similar powers. In addition, product clearances could be withdrawn due to the failure to comply with regulatory standards or the occurrence of unforeseen problems following initial marketing. An adverse regulatory action, depending on its magnitude, may have a material adverse effect on the Company.

THE COMPANY MAY BE SUBJECT TO INCREASED GOVERNMENT REGULATION IN THE FUTURE.