Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - ANGIODYNAMICS INC | an32685423-8k.htm |

Needham & Company 14 th Annual Healthcare Conference Joseph M. DeVivo, President & CEO Mark Frost, Executive Vice President & CFO April 14, 2015

Forward - Looking Statements Notice Regarding Forward Looking Statements This presentation contains forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 . All statements regarding AngioDynamics’ expected future financial position, results of operations, cash flows, business strategy, budgets, projected c ost s, capital expenditures, products, competitive positions, growth opportunities, plans and objectives of management for future operations, as well as statements tha t include the words such as “expects,” “reaffirms” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “estimates,” “optimistic,” or variations of su ch words and similar expressions, are forward - looking statements. These forward looking statements are not guarantees of future performance and are subject to risks and un cer tainties. Investors are cautioned that actual events or results may differ from AngioDynamics’ expectations. Factors that may affect the actual results achieve d b y AngioDynamics include, without limitation, the ability of AngioDynamics to develop its existing and new products, technological advances and patents attaine d b y competitors, future actions by the FDA or other regulatory agencies, domestic and foreign health care reforms and government regulations, results of pending or fut ure clinical trials, overall economic conditions, the results of on - going litigation, the effects of economic, credit and capital market conditions, general market co nditions, market acceptance, foreign currency exchange rate fluctuations, the effects on pricing from group purchasing organizations and competition, the ability of AngioDynamics to integrate purchased businesses, as well as the risk factors listed from time to time in AngioDynamics’ SEC filings, including but not limited to its Annual Report on Form 10 - K for the year ended May 31, 2014; its Annual Report on Form 10 - K/A for the fiscal year ended May 31, 2014; its quarterly reports on form 10 - Q for the fiscal quarters ended August 31, 2014, and November 30, 2014; and the current report on Form 8 - K, filed with the SEC on March 2, 2015 . AngioDynamics does not assume any obligation to publicly update or revise any forward - looking statements for any reason. In the United States, NanoKnife has been cleared by the FDA for use in the surgical ablation of soft tissue. NanoKnife has not b een cleared for the treatment or therapy of a specific disease or condition. This document may discuss the use of NanoKnife for specific clinical indications for which it is not cleared in the United States at this time . EmboMedics microsphere products have not been reviewed by the U.S. Food and Drug Administration or any other international re gul atory body at this time; as such they are currently not available for sale by AngioDynamics. Notice Regarding Non - GAAP Financial Measures Management uses non - GAAP measures to establish operational goals, and believes that non - GAAP measures may assist investors in an alyzing the underlying trends in AngioDynamics’ business over time. Investors should consider these non - GAAP measures in addition to, not as a substitute for or as superior to, financial reporting measures prepared in accordance with GAAP. In this presentation, AngioDynamics has reported non - GAAP sales growth, non - GAAP gros s margin, non - GAAP operating income, adjusted EBITDA (income before interest, taxes, depreciation and amortization), non - GAAP net income and non - GAAP earning s per share. Additionally, this press release evaluates results on a constant currency basis. As a non - GAAP measure, constant currency excludes the impact of fo reign currency exchange rate fluctuations . Management uses these measures in its internal analysis and review of operational performance. Management believes that the se measures provide investors with useful information in comparing AngioDynamics’ performance over different periods. By using these non - GAAP measur es, management believes that investors get a better picture of the performance of AngioDynamics’ underlying business. Management encourages investors to r evi ew AngioDynamics’ financial results prepared in accordance with GAAP to understand AngioDynamics’ performance taking into account all relevant factors, i ncl uding those that may only occur from time to time but have a material impact on AngioDynamics’ financial results. Please see the tables that follow for a rec onc iliation of non - GAAP measures to measures prepared in accordance with GAAP. 2

Performance Update Q3 FY15 Results Q3 FY15 Actual $ 86.6 M $0.12 Sales Adjusted EPS (a) • EmboMedics Agreement • Next generation AngioVac launch • Celerity “no chest x - ray” claim received • Morpheus recall and discontinuance • HealthTrust PICC contract • Chris Crisman named SVP, Global PV Franchise • NanoKnife German OPS procedure codes received • ANGO Added to S&P SmallCap 600 Index • Celerity U.S. launch • BioFlo DuraMax chronic hemodialysis catheter CE Mark • Launch of Novation new technology contract for BioFlo PICCs & Ports • Five NanoKnife clinical papers • AVA meeting includes BioFlo PICC data, first Celerity data • FDA warning letter regarding Glens Falls and Marlborough facilities Recent Events 3 a) Adjusted results exclude costs relating to acquisitions, debt financing, business restructuring, litigation, facility consoli dat ions, amortization of basis step - up of acquired inventory, revaluation of contingent earn outs related to acquisitions, recalls, product discontinuat ions and amortization of intangible assets. b) On a constant currency basis. Q 3 FY 15 b $87.6M $ 0.14

Profile of AngioDynamics Global, leading provider of innovative, image guided, minimally invasive solutions. • Three Franchises – Peripheral Vascular, Vascular Access and Oncology/Surgery • Founded 1988 | IPO May 2004 — ANGO (NASDAQ) • Worldwide presence with 1,300 employees and 7 operating locations, as well as a 210+ global sales team in U.S., Australia, Canada, France, Germany, Netherlands and UK • Present in 50+ markets through 110+ distributors Innovative Technology Develop innovative technology that improves patient outcomes while reducing overall healthcare costs Operational Excellence Enhancing profitability by driving operation excellence across the entire organization Above Market Growth Focusing investments in categories and geographic markets that offer sustainable, profitable growth 4

Leadership Joseph M. DeVivo President & CEO Mark Frost EVP & CFO John Soto EVP & CCO Stephen Trowbridge SVP & General Counsel Barbara Kucharczyk VP, Operations Mark Stephens SVP, Administration Gary Barrett VP, RA/QA 5 Benjamin Davis SVP, Business Development

Our Strategy is Working Growth Driver Performance* 6 76 % YTD FY 15 over YTD FY 14 BioFlo GROWTH 30 % YTD FY15 over YTD FY14 Microwave Ablation GROWTH 38% YTD FY15 over YTD FY14 AngioVac GROWTH 18 % YTD FY15 over YTD FY14 NanoKnife GROWTH • • • * As of the close of the third quarter on Feb. 28, 2015.

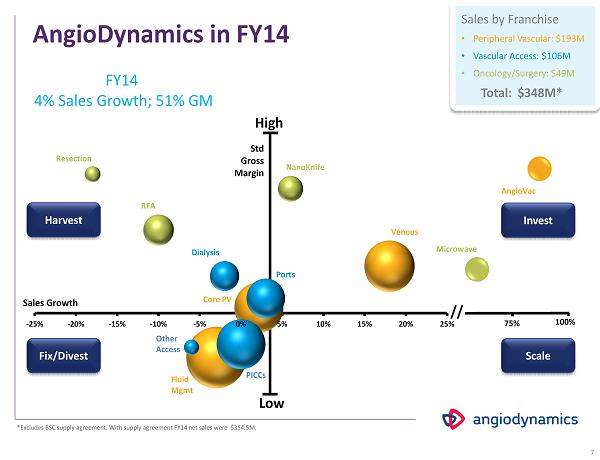

AngioDynamics in FY 14 $100.4 $ 81.2 $87.3 $50.0 $109.3 $ 51.5 $24.8 $ 16.1 $25.9 $ 34.0 $51.0 $4.1 30% 40% 50% 60% 70% 80% 90% 100% -10% -5% 0% 5% 10% 15% 20% 25% 30% 35% 40% 7 -25% -20% -15% -10% -5% 0% 5% 10% 15% 20% 25% RFA Resection NanoKnife Microwave Venous Ports Dialysis PICCs Other Access Core PV Fluid Mgmt Sales Growth Std Gross Margin // 100% AngioVac Harvest Fix/Divest Invest Scale FY 14 4 % Sales Growth; 51 % GM Sales by Franchise • Peripheral Vascular: $193M • Vascular Access: $106M • Oncology/Surgery: $49M Total: $348M* 75% *Excludes BSC supply agreement. With supply agreement FY14 net sales were $354.5M. High Low

AngioDynamics in FY20 $ 100.4 $81.2 $ 87.3 $50.0 $ 109.3 $51.5 $24.8 $16.1 $ 25.9 $34.0 $ 51.0 $4.1 30% 40% 50% 60% 70% 80% 90% 100% -10% -5% 0% 5% 10% 15% 20% 25% 30% 35% 40% 8 -15% -10% -5% 0% 5% 10% 15% 20% 25% 30% Harvest Fix/Divest Invest Scale Resection Core PV Dialysis NanoKnife AngioVac PICCs Fluid Mgmt Ports Other Access Microwave RFA Venous Sales Growth Std Gross Margin Sales by Franchise • Peripheral Vascular: ̴$ 300 M • Vascular Access: ̴$ 200 M • Oncology/Surgery: ̴$ 100 M Total: ̴$ 600 M High Low FY 20 10 % 5 YR Sales CAGR; 60 % GM

Operational Excellence Enterprise resource planning implementation Consolidation of N.Y. distribution center Consolidation of N.Y. manufacturing plants Supply chain optimization Product rationalization Lean initiatives x x Gross Margin Improvement FY 15 FY 16 FY17 FY 18 Basis Points 100 200 300 400 500 $15 - 18M TO BE SAVED OVER FOUR YEARS 450 BP Improvement 9

Strong Product Development Pipeline* PV VA O/S Celerity X - Ray FY 15 BioFlo New Product Launch FY16 Celerity Navigation FY 16 BioFlo Port Line Extension FY 16 BioFlo PICC Line Extension FY 16 Next Generation Radio Frequency Ablation System FY17 Next Generation Microwave Ablation FY 16 Next Generation NanoKnife System FY 18 AngioVac Enhancements FY 15 PV Line Extension FY16 Drainage Line Extension FY 16 Fluid Management Line Extension FY 16 Pain - Free Laser Procedure FY 17 AngioVac Line Extension FY16 Next Generation Laser FY 17 Automated Fluid Management FY 17 New Thrombus Management Product FY 17 *Timelines are estimated and subject to change. 10 Next Generation BioFlo Port FY 18 Next Generation BioFlo PICC FY 18

Clinical Studies* PV O/S SeCure IDE for Expanded EVLT Indication FY18 Pancreas NanoKnife Pre - Clinical FY 16 Next Generation Microwave Ablation Pre - Clinical FY15 CROES II NanoKnife Prostate Study FY17 Prostate NanoKnife IDE FY18 O/S • LEIDEN – NanoKnife Pancreas • CROES Registry • NEAT – NanoKnife Prostate • CROES II – NanoKnife Prostate • AHPBA Registry Investigator Initiated Trials PV • EVLT Registry • AngioVac Registry VA • BioFlo Dialysis • BioFlo PICCs • BioFlo Ports *Timelines are estimated and subject to change. 11

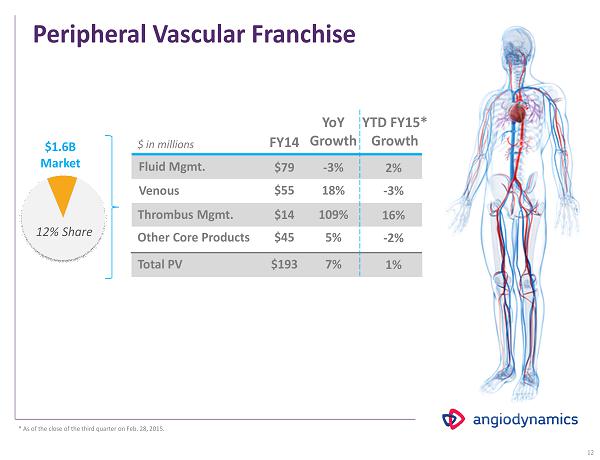

Peripheral Vascular Franchise FY 14 Fluid Mgmt. Venous $79 $55 $ in millions $ 1.6 B Market 12% Share Thrombus Mgmt. $14 Other Core Products $45 Total PV $ 193 YoY Growth - 3% 18 % 109% 5 % 7% 12 YTD FY 15 * Growth 2 % - 3% 16 % - 2% 1 % * As of the close of the third quarter on Feb. 28, 2015.

Large Unmet Opportunity Additional: Annual Incidence Venous Thromboembolism (VTE) Incidence • ~ 1 Million VTE Events per Year in US • ~ 300 , 000 VTE Deaths per Year in US - # 3 cause Heit JA, et al. Blood. 2005 ; 106 : 267 A. Murphy SL, et al. Deaths: Preliminary Data for 2010 . National Vital Statistics Reports; 2012 Catheter/Lead RA 200,000 RA Mass 47 , 000 IVCF Thrombosis 14,000 TV Endocarditis 2 , 500 Mechanical / PharmacoMechanical Oral Anticoagulation Systemic and Catheter Directed Thrombolysis Current Options Surgical Embolectomy 13

Solution: AngioVac FDA cleared & CE Mark approved Attractive pricing & higher margins Scalable platform for next generation devices Newly expanded U.S. indication 14

Solution: AngioVac FDA cleared & CE Mark approved Attractive pricing & higher margins Scalable platform for next generation devices Newly expanded U.S. indication 15

Solution: Laser Vein Treatment 30 M People in U.S. w/ varicose veins Large Market Opportunity < 2 % Receive treatment Projected Growth FY 20 Sales ̴ $ 80 M FY 14 Sales $ 55 M 16

Vascular Access Franchise FY 14 PICCs Ports $ 51 $32 $ in millions Dialysis $ 19 Total VA $ 106 $1.0B Market 11 % Share YoY Growth 0 % 3% - 2 % 0 % 17 YTD FY15* Growth - 2 % 9% 5 % 3% * As of the close of the third quarter on Feb. 28 , 2015 .

BioFlo Technology The BioFlo family of products, including PICCs, ports and dialysis catheters, are the only vascular access products manufactured with Endexo Technology, a permanent and non - eluting integral polymer. Less Thrombus Accumulation BioFlo PICCs BioFlo Ports Vs. common PICC Vs. non - coated conventional port catheters Vs. non - coated conventional dialysis catheters Vs. heparin - coated dialysis catheters 87 % 1 – BioFlo Dialysis – 96 % 2 – – – – – – 90 % 3 83 % 4 1. Based on benchtop test results which may not be indicative of clinical results. Data on file. 2. Based on benchtop testing pe rformed up to two hours using bovine blood, which may not be indicative of clinical results. Data on file. 3. The reduction in thrombus accumul ati on (based on platelet count) is supported by acute in - vitro testing. Pre - clinical in - vitro evaluations do not necessarily predict clinical performanc e with respect to thrombus formation. 4. Based on benchtop testing performed up to two hours using bovine blood which may not be indicative of clinical res ults. Data on file. 18

Reducing Healthcare Costs Facility 1 • 1,251 BioFlo PICCs placed • 85 % reduction in symptomatic UEDVT • 7 UEDVTs reported from 1251 PICCs • UEDVT rate of .45% versus prior 3.1% Facility 2 • 272 BioFlo PICCs placed • 42% reduction in Occlusions • 19.7 % reduction in baseline occlusion rate Facility 3 • 776 BioFlo PICCs placed • 65% reduction in tPA use • 47% reduction in occlusions Facility 4 • 1,212 BioFlo PICCs placed • 65 % reduction in declots • 36 % reduction in DVTs Clinical Results* *Clinical results were publicly reported by independent facilities based upon their individual clinical experience. These res ult s do not reflect data gathered by AngioDynamics pursuant to a clinical trial. Individual results may vary from those set forth above. Facility 5 • 533 BioFlo PICCs placed • 66 % reduction on occlusions • 75 % reduction in tPA • 25 % reduction in DVTs 19

Celerity Tip Location Tip location, coupled with our innovative BioFlo Technology, will improve our competitive position in the PICC market. Ease of use • Use with existing ultrasound • Three lead EKG - based platform • Predictable and reliable confirmation • 50% less cost vs. competitors Clinical efficacy Cost effective x x x Fall 2013 – Canadian Launch March 6, 2014 – Acquired regulatory control over Celerity platform and rights to next generation technology Mid - summer 2014 – U.S. Clearance Fall 2014 – File for no x - ray Winter 2014/15 – No x - ray clearance Summer 2015 - Navigation x 20 x

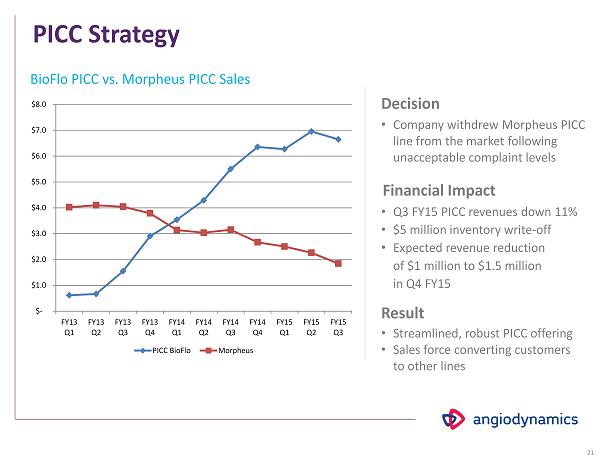

PICC Strategy Decision • Company withdrew Morpheus PICC line from the market following unacceptable complaint levels • Q 3 FY 15 PICC revenues down 11 % • $ 5 million inventory write - off • Expected revenue reduction of $ 1 million to $ 1.5 million in Q 4 FY 15 • Streamlined, robust PICC offering • Sales force converting customers to other lines Financial Impact Result x x x x 21 x $- $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 FY13 Q1 FY13 Q2 FY13 Q3 FY13 Q4 FY14 Q1 FY14 Q2 FY14 Q3 FY14 Q4 FY15 Q1 FY15 Q2 FY15 Q3 PICC BioFlo Morpheus BioFlo PICC vs. Morpheus PICC Sales

Oncology/Surgery Franchise FY14 Thermal Ablation NanoKnife $ 30 $14 $ in millions Resection/Other $ 5 Total O/S $ 49 $ 2 25M Market 22 % Share YoY Growth 10 % 6 % - 18 % 5% 22 YTD FY15* Growth 5 % 18% 7 % 9 % * As of the close of the third quarter on Feb. 28 , 2015 .

Expanding Leadership in Tissue Ablation Radiofrequency Microwave IRE THERMAL NON - THERMAL AngioDynamics offers a full complement of tissue ablation products that provide clinicians maximum choice in treating patients. 23

Re - Entering the Embolization Market On April 9 , 2015 , AngioDynamics entered an agreement with EmboMedics Inc., which develops injectable & resorbable microspheres and expects to file for U.S. FDA 510 (k) clearance for the embolization of hypervascular tumors by January 2016 . x x x Novel Technology Highly margin accretive Worldwide rights for direct and distributor sales Pathway to own technology x 24 Investment Strategy Terms • Initial $ 2 M equity investment • May make $ 9 M additional investments based on milestones $150M Worldwide Addressable Market

International Growth Strategy Market Led, Efficient & Aligned • Region - based business model improves competitiveness • Increased direct market expansion • New product introductions and full registration of product portfolio • Delivering operating margin improvement • Align talent and organization to ensure consistent execution of Company’s strategy Q 1 FY 14 Q 2 FY 14 Q3 FY14 Q 4 FY 14 Q1 FY15 International Quarterly Growth Rates 25 Q 2 FY 15 -10% -5% 0% 5% 10% 15% 20% 25% Q 3 FY 15 a YTD FY 15 a,b 13 % Growth a a) On a constant currency basis. b) As of the close of the third quarter on Feb. 28, 2015.

Fiscal Third Quarter Results (a) There is no difference in the number of sales days between the first quarter of fiscal 2014 and the first quarter of fiscal 2015 . (b) Adjusted results exclude costs relating to acquisitions, debt financing, business restructuring, litigation, facility consoli dat ions, direct costs of the Quality Call to Action program, amortization of basis step - up of acquired inventory, revaluation of contingent earn outs related to acquisitions, recalls, product discontinuations and amortization of intangible assets. (c) Excludes impact of our supply agreement. (d) Constant currency. (e) As of the close of the third quarter on Feb. 28 , 2015 . Sales $ in millions, except per share amounts Q 3 2015 (a) YOY Growth WW WW (c)(d) PV VA O/S U.S. (c) Int’l $86.6 $ 86.5 $46.2 $ 26.4 $ 13.1 $ 68.4 $17.3 - 2 % 0% - 2 % - 3% 9 % - 2 % 3 % Adjusted EBITDA Adjusted EPS $13.5 $ 0.12 - 3% - 13 % Q 3 2015 (b) YOY Growth 26 YTD FY 15 Growth (e) 2% 3 % 1% 3 % 9 % 1 % 10% 11 % 16% YTD FY 15 Growth (e) Int’l (d) $ 18.3 8 % 13 % Fiscal Guidance $ in millions, except per share amounts Q3 Full - Year Sales (d) Adjusted EPS (b) $ 90 - $ 94 $ 0.13 - $ 0.16 $356 - $360 $ 0.57 - $ 0.60 Adjusted EPS (d) $ 0.14 0% 19 %

Balance Sheet & Cash Flow $ in millions Feb 28, 2015 May 31 , 2014 Cash & investments $ 21.4 $17.9 Net working capital $ 97.6 $ 85.0 Total assets $ 783.1 $798.9 Total debt $148.9 $ 142.7 Total stockholder’s equity $ 543.8 $536.8 $ in millions, except per share amounts 9 months ended Feb 28, 2015 9 Months ended Feb 28 , 2014 Cash flow from operations $ 15.4 $ 15.2 CFFO/share $0.43 $ 0.43 Free cash flow $ 4.4 $6.2 27

Adjusted Income Statement (a) $ in millions, except per share amounts 9 months ended Feb 28, 2015 9 Months ended Feb 28 , 2014 Sales $ 266.1 $260.4 Gross margins 51.2 % 50.8 % Operating expenses $ 105.4 $105 Operating income $31.0 $ 27.3 Operating margin 11.6 % 10.5% Net income $16.2 $ 13.8 EPS $ 0.45 $ 0.39 EBITDA $43.8 $ 39.5 a) Adjusted results exclude costs relating to acquisitions, debt financing, business restructuring, litigation, facility consoli dat ions, amortization of basis step - up of acquired inventory, revaluation of contingent earn outs related to acquisitions, recalls, product discontinuati ons and amortization of intangible assets. 28

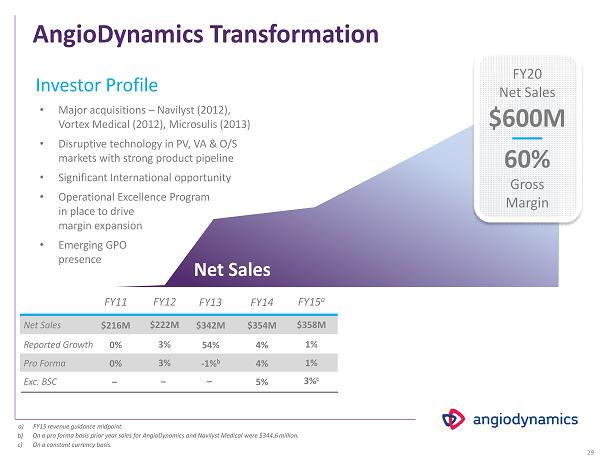

AngioDynamics Transformation FY 11 FY12 FY 13 FY 14 Net Sales $216M $ 222 M $342M $ 354 M Pro Forma 0 % 3 % - 1 % b 4% a) FY 15 revenue guidance midpoint. Exc. BSC – 5% b) On a pro forma basis prior year sales for AngioDynamics and Navilyst Medical were $ 344.6 million. Investor Profile – – • Major acquisitions – Navilyst ( 2012 ), Vortex Medical ( 2012 ), Microsulis ( 2013 ) • Disruptive technology in PV, VA & O/S markets with strong product pipeline • Significant International opportunity • Operational Excellence Program in place to drive margin expansion • Emerging GPO presence Reported Growth 0 % 3% 54 % 4 % Net Sales FY20 Net Sales $600M 60% Gross Margin 29 FY15 a $ 358 M 1% 3 % c 1 % c) On a constant currency basis.

Needham & Company 14 th Annual Healthcare Conference Joseph M. DeVivo, President & CEO Mark Frost, Executive Vice President & CFO April 14 , 2015