Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Metaldyne Performance Group Inc. | v406115_8k.htm |

Exhibit 99.1

0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 LIGHT VEHICLE COMMERCIAL INDUSTRIAL Metaldyne Performance Group New York Auto Summit Conference April 1, 2015

0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 169, 219, 195 2 Disclaimer This presentation and any related statements contains certain “forward - looking statements” about MPG’s financial results and estimates, guidance, backlog, and business prospects within the meaning of the Private Securities Litigation Reform Act of 1995. Forward - looking statements ma y be identified by words such as “expects,” “intends,” “anticipates,” “plans,” “project,” “intends,” “believes,” “seeks,” “targets,” “forecast,” “estimates,” “will” or o the r words of similar meaning and include, but are not limited to, statements regarding the outlook for the Company’s future business, prospects, and financial performance. Forward - lo oking statements are based on management’s current expectations and assumptions, which are subject to inherent uncertainties, risks, and changes in circumstances that a re difficult to predict. Actual outcomes and results may differ materially due to global political, economic, business, competitive, market, regulatory, and other factors and ris ks, including, but not limited to, the following: volatility in the global economy impacting demand for new vehicles and our products; a decline in vehicle production levels, particularl y w ith respect to platforms for which we are a significant supplier, or the financial distress of any of our major customers; seasonality in the automotive industry; our si gni ficant competition; our dependence on large - volume customers for current and future sales; a reduction in outsourcing by our customers, the loss or discontinuation of material pro duction or programs, or a failure to secure sufficient alternative programs; our failure to offset continuing pressure from our customers to reduce our prices; our failure to incre ase production capacity or over - expanding our production in times of overcapacity; our inability to realize all of the sales expected from awarded business or fully recove r p re - production costs; our reliance on key machinery and tooling to manufacture components for powertrain and safety - critical systems that cannot be easily replicated; program launch di fficulties; a disruption in our supply or delivery chain which causes one or more of our customers to halt production; work stoppages or production limitations at one or more o f o ur customer’s facilities; a catastrophic loss of one of our key manufacturing facilities; failure to protect our know - how and intellectual property; the disruption or harm to ou r business as a result of any acquisitions or joint ventures we make; a significant increase in the prices of raw materials and commodities we use; the damage to or termination of our relationships with key third - party suppliers; our failure to maintain our cost structure; the incurrence of significant costs if we close any of our manufacturing faciliti es; potential significant costs at our facility in Sandusky, Ohio; the failure of or disruptions in our information technology networks and systems, or the inability to successfully impl eme nt upgrades to our enterprise resource planning systems; the incurrence of significant costs, liabilities, and obligations as a result of environmental requirements and othe r r egulatory risks; extensive and growing governmental regulations; the adverse impact of climate change and related energy legislation and regulation; the incurrence of material c ost s related to legal proceedings; our inability to recruit and retain key personnel; any failure to maintain satisfactory labor relations; pension and other postretirement bene fit obligations; risks related to our global operations; competitive threats posed by global operations and entering new markets; foreign exchange rate fluctuations; increased costs and obligations as a result of becoming a public company; the failure of our internal controls to meet the standards required by Sarbanes - Oxley; our substantial indebtedness; ou r inability, or the inability of our customers or our suppliers, to obtain and maintain sufficient debt financing, including working capital lines; our exposure to a number of dif fer ent tax uncertainties; the mix of profits and losses in various jurisdictions adversely affecting our tax rate; disruption from the combination of our operations and diversion of ma nag ement’s attention; our limited history of working as a single company and the inability to integrate HHI, Metaldyne, and Grede successfully and achieve the anticipated benefits. For the reasons described above, we caution you against relying on any forward - looking statements, which should also be read in conj unction with the other cautionary statements that are included elsewhere in this press release and in our public filings, including under the headin g “ Risk Factors” in our filings that we make from time to time with the Securities and Exchange Commission and Annual Report on Form 10 - K for the year ended December 31, 2014 to be filed in the next few days. You should not consider any list of such factors to be an exhaustive statement of all of the risks, uncertainties, or potentially inaccurate assumpti ons that could cause our current expectations or beliefs to change. Further, any forward - looking statement speaks only as of the date on which it is made, and we undertake no obligation to update or revise any forward - looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipate d e vents, except as otherwise may be required by law. We refer to certain non - GAAP financial measures in this presentation. Reconciliations of these non - GAAP financial measures to the m ost directly comparable GAAP financial measures can be found within this presentation. We believe these measures are used by investors to measure our performance and are considered to be useful, supplemental indicators of our performance by our management. They are not a substitute for the comparable GAAP measures. 2

0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 169, 219, 195 3 Agenda □ Introduction Paul Suber Vice President of Investor Relations □ Company Overview George Thanopoulos Chief Executive Officer □ Financial Results and 2015 Guidance Mark Blaufuss Chief Financial Officer and Treasurer □ Long Term Growth Opportunities George Thanopoulos □ Q & A Session George Thanopoulos Mark Blaufuss Paul Sube r

0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 169, 219, 195 COMPANY OVERVIEW Metaldyne Performance Group

0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 169, 219, 195 0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 5 October 2014 MPG debt consolidation August 2014 HHI, Metaldyne and Grede merge to form MPG 2014 Highlights December 2014 MPG IPO Metaldyne Performance Group Becomes Public o Key Strategy Points □ Capturing expected growth in powertrain and safety critical components □ Delivering strong profitability and cash flow generation □ Capitalizing on our global s cale and cross - sell opportunities Transformative Merger Positions MPG for Future Growth

0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 169, 219, 195 6 Leading Metal Forming Technologies and Value Add Processes Deep Process and Product Expertise Technology Vehicle Application Products Advanced Machining and Assembly ▪ Powertrain ▪ Safety - Critical ▪ Other Aluminum Die Casting ▪ Powertrain Cold and Warm Forging and Machining ▪ Powertrain Ductile Iron Casting and Machining ▪ Powertrain ▪ Safety - Critical ▪ Other Grey Iron Casting and Machining ▪ Powertrain Hot Forging and Machining ▪ Powertrain ▪ Safety - Critical ▪ Other Powder Metal ▪ Powertrain Rubber and Viscous Dampening Assemblies ▪ Powertrain

0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 169, 219, 195 0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 7 Advanced Machining and Assembly Aluminum Die Casting Forging and Related Machining Iron Casting and Related Machining Powder Metal and Related Machining Administrative/Sales/Engineering Warehouse Premier Asset Base Positions MPG for Global Growth Highly Valuable Global Manufacturing Footprint U.S. Mexico Brazil England Spain France Czech Republic Germany China India South Korea x 61 locations x Ability to meet anticipated growth by adding select equipment x Combined manufacturing, technical and commercial footprint across four continents x Serves customers’ global Powertrain manufacturing needs Geographic Footprint Advantages Luxembourg Japan

0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 169, 219, 195 FINANCIAL RESULTS AND 2015 GUIDANCE Metaldyne Performance Group

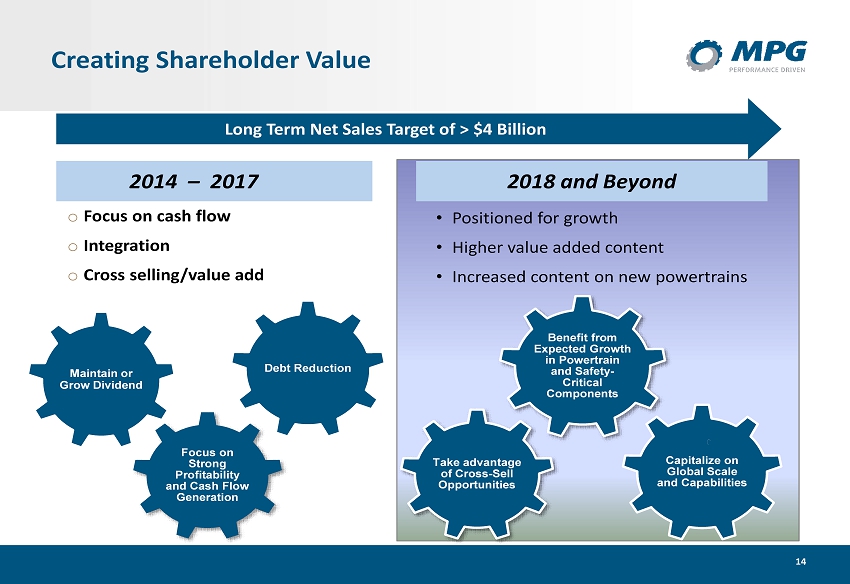

0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 169, 219, 195 9 Creating Shareholder Value • Focus on cash flow • Integration • Cross selling/value add o Positioned for growth o Higher value added content o Increased content on new powertrains Focus on Strong Profitability and Cash Flow Generation Debt Reduction Maintain or Grow Dividend Benefit from Expected Growth in Powertrain and Safety - Critical Components Capitalize on Global Scale and Capabilities Take advantage of Cross - Sell Opportunities 2014 – 2017 Long Term Net Sales Target of > $4 Billion 2018 and Beyond

0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 169, 219, 195 10 2014 Results and Cash Flow ($ in Millions) 2014 Combined Non - GAAP Results 1 Net Sales $3,144.0 Adjusted EBITDA 545.1 Percent of Net Sales 17.3% Capex 168.2 Adjusted Free Cash Flow 2 376.9 Percent of Net Sales 11.9% 1 See Appendix for reconciliation to GAAP 2 Defined as Adjusted EBITDA less CapEx Financials information is presented on a combined non - GAAP basis to give affect to the combination of the three business units as of January 1, 2014 o 2014 combined net sales were $3.14 billion, an increase of $91.1 million versus 2013 o Combined Adjusted EBITDA for 2014 was $545.1 million (17.3% of net sales), an increase of $36.3 million versus 2013 o Combined Adjusted Free Cash Flow was $376.9 million in 2014, an increase of $29.8 million versus 2013 o MPG’s board of directors approved a voluntary repayment of $10 million of its outstanding Term Loan in December 2014 and an additional $10 million before the end of the first quarter 2015 o MPG’s board of directors also declared a 1 st quarter $.09/share dividend payable on May 26, 2015 to stockholders of record as of May 12, 2015

0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 169, 219, 195 11 2015 Guidance Ranges Guidance 1 2015 E Net Sales $3.0 - $3.15 billion Adjusted EBITDA $520 - $560 million Capital Expenditures $210 - $220 million Adjusted Free Cash Flow 2 $310 - $335 million 1 As communicated in March 12, 2015 Earnings Release 8 - K 2 Defined as Adjusted EBITDA less CapEx , utilizing high and low ends of EBITDA and CapEx o Incorporates assumptions included on page 25 of appendix

0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 169, 219, 195 0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 12 MPG Growth – Net New Business Backlog 1 o MPG growth is focused on powertrain components. (Transmission , engine and driveline) o MPG is typically awarded programs one to three years prior to the start of production o 12/31/14 Net New Business Backlog was $190 million o Tracking programs not included in net new business backlog definition due to variability in timing/amount (consistent with 12/31/13 definition). o Tracking includes identified programs in active dialog at an early stage, but is not included in backlog 1. Backlog = New Business Awards + High Probability – Attrition 1500 2000 2500 3000 3500 4000 2014 2015 2016 2017 Forecast Components In Production/Attrition Awarded High Probability Tracking (Excluded from Backlog) Amount of tracking in forward forecast varies based on timing of programs

0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 169, 219, 195 LONG TERM GROWTH OPPORTUNITIES Metaldyne Performance Group

0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 169, 219, 195 14 Creating Shareholder Value o Focus on cash flow o Integration o Cross selling/value add • Positioned for growth • Higher value added content • Increased content on new powertrains Focus on Strong Profitability and Cash Flow Generation Debt Reduction Maintain or Grow Dividend Benefit from Expected Growth in Powertrain and Safety - Critical Components Capitalize on Global Scale and Capabilities Take advantage of Cross - Sell Opportunities 2014 – 2017 Long Term Net Sales Target of > $4 Billion 2018 and Beyond

0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 169, 219, 195 0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 15 17.0 17.4 17.9 18.3 18.6 2014 2015 2016 2017 2018 North America Light Vehicle Production 1 Industry Growth Projections 20.1 20.1 20.5 21.3 22.1 2014 2015 2016 2017 2018 294 320 266 263 270 219 220 233 245 247 513 540 499 508 517 2014 2015 2016 2017 2018 FTR Class 8 ACT Class 5-7 European Light Vehicle Production 1 North America Class 5 - 8 Vehicle Production 2 45.0 46.6 48.8 50.7 52.3 2014 2015 2016 2017 2018 Asian Light Vehicle Production 1 Positive Outlook for Primary Regions and Markets 1. Vehicle Production in millions: IHS January 2015 2. Vehicle Production in thousands: FTR and ACT December 2014 U.S. 75% Europe 15% Rest of World 10% MPG 2014 End Market Contribution Light Vehicle 78% Commercial 12% Industrial 9% Other 1% MPG 2014 Geographic Contribution

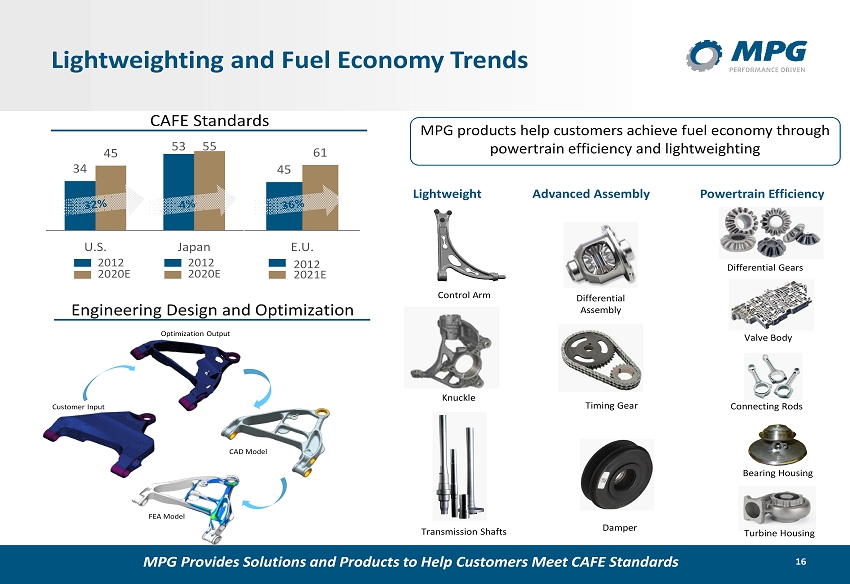

0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 169, 219, 195 16 Lightweighting and Fuel Economy Trends MPG products help customers achieve fuel economy through powertrain efficiency and lightweighting 34 53 45 55 U.S. Japan 45 61 E.U. 2012 2021E 2012 2020E 2012 2020E Customer Input Optimization Output CAD Model FEA Model CAFE Standards Engineering Design and Optimization Lightweight Advanced Assembly Powertrain Efficiency MPG Provides Solutions and Products to Help Customers Meet CAFE Standards Control Arm Differential Gears Valve Body Connecting Rods Bearing Housing Turbine Housing Differential Assembly Timing Gear Damper Transmission Shafts Knuckle

0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 169, 219, 195 17 2.3 1.5 9.2 7.6 7.0 5.2 3.4 Source: IHS September 2013 for North American; production in millions Content Growth Opportunity 8/9/10 and CVT Transmission Forecast 1.8 2.3 2.9 3.6 4.1 4.3 4.3 4.4 0.7 1.1 1.4 2.0 2.6 2.5 3.1 3.5 0.6 0.7 1.3 2.3 3.1 3.4 3.5 3.6 0.2 0.9 1.5 2.0 2.3 2.4 3.1 4.2 5.9 8.9 11.3 12.2 13.2 14.0 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 16.0 2014 2015 2016 2017 2018 2019 2020 2021 CVT 8-Speed 9-Speed 10- Speed Total Powertrain conversion to more efficient transmissions expected to create growth opportunities for MPG

0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 169, 219, 195 0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 18 586870_1.wor / NY00813G Capitalize on Global Scale and Capabilities Differential Gears Output Shafts Aluminum Valve Bodies Balance Shaft Modules Example: Connecting Rods Idler Gears Robust Opportunity to Expand Sales of Our Leading Products Globally Engine Transmission Crank Shaft Dampers Turbo Charger Housings Connecting Rods Connecting rods are a significant contributor to our ~$430mm powder metal and related machining processes and provides a good example of our global leadership products and future expansion opportunities Globalization of MPG’s Products For Engine and Transmission Platforms

0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 169, 219, 195 19 Metaldyne – Net formed gears and pinions Grede – Ductile cast housing HHI – Hot forged cover MPG – Designed, engineered, fully machined and assembled. MPG Combination Broadens Range of Content and Value Added Opportunities x Expand customer relationships to increase content opportunities across processes and product portfolio x Collectively MPG can enhance its growth through capturing value add opportunities x Key cross selling strategy Example: Differential Case Cross Selling – Product Integration Capabilities

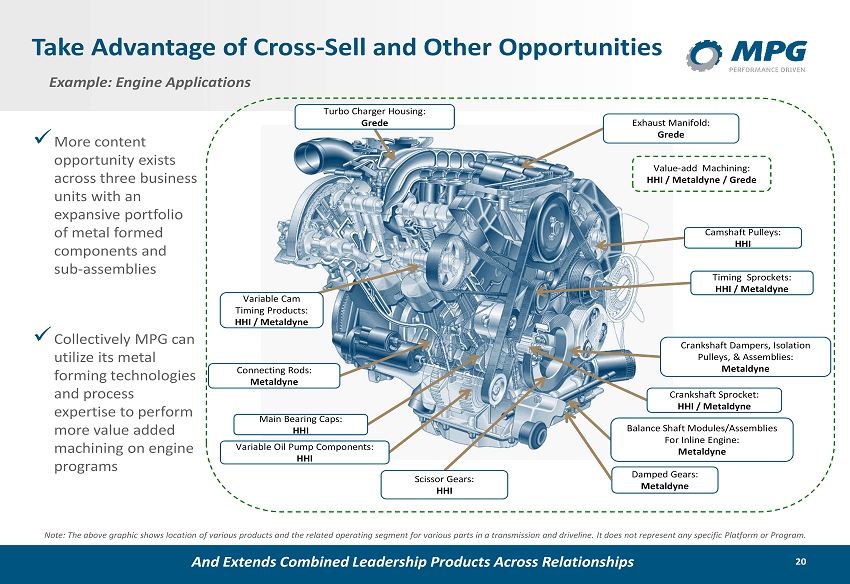

0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 169, 219, 195 0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 20 Balance Shaft Modules/Assemblies For Inline Engine: Metaldyne Main Bearing Caps: HHI Connecting Rods: Metaldyne Crankshaft Sprocket: HHI / Metaldyne Damped Gears: Metaldyne Crankshaft Dampers, Isolation Pulleys, & Assemblies: Metaldyne Camshaft Pulleys: HHI Timing Sprockets: HHI / Metaldyne Variable Oil Pump Components: HHI Scissor Gears: HHI Exhaust Manifold: Grede Turbo Charger Housing: Grede Variable Cam Timing Products: HHI / Metaldyne Example: Engine Applications x More content opportunity exists across three business units with an expansive portfolio of metal formed components and sub - assemblies x Collectively MPG can utilize its metal forming technologies and process expertise to perform more value added machining on engine programs Note: The above graphic shows location of various products and the related operating segment for various parts in a transmiss ion and driveline. It does not represent any specific Platform or Program. Value - add Machining: HHI / Metaldyne / Grede Take Advantage of Cross - Sell and Other Opportunities And Extends Combined Leadership Products Across Relationships

0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 169, 219, 195 Q & A SESSION Metaldyne Performance Group

0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 169, 219, 195 APPENDIX Metaldyne Performance Group

0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 169, 219, 195 23 MPG Light Vehicle Product Portfolio Focus on High Growth Product Categories Within the Vehicle Engine Powertrain Driveline Transmission Key Product Lines ▪ Balance Shaft Assemblies ▪ Crankshaft Dampers ▪ Bearing Caps ▪ Gears and Sprockets ▪ Connecting Rods Key Product Lines ▪ Axle Carriers ▪ Differential Cases ▪ Transfer Case Sprockets Gears and Shafts ▪ Axle Gears Key Product Lines ▪ Aluminum Valve Bodies ▪ Clutch Modules and Assemblies ▪ Gears and Hubs ▪ Hollow and Solid Shafts Key Product Lines ▪ Brake Components ▪ Control Arms ▪ Inner and Outer Bearing Rings ▪ Steering Knuckles and Shafts Chassis and Suspension Other Specialty Products Key Product Lines ▪ Anchors, Housings and Supports ▪ Brackets ▪ Spacers ▪ Structural Components Safety - Critical Other Note: The above graphic represents the location and use of our products on a vehicle in general and not on any specific Platf orm , Program, or Vehicle Nameplate.

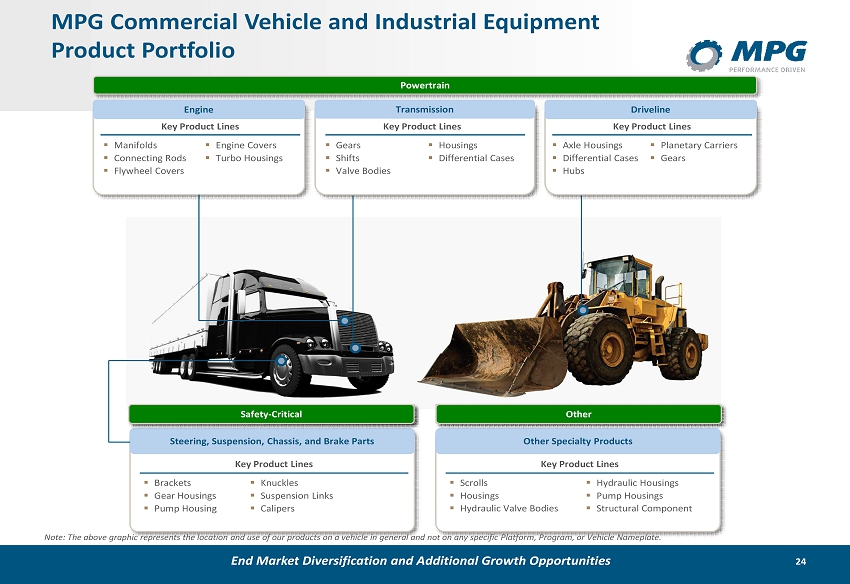

0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 169, 219, 195 24 Powertrain MPG Commercial Vehicle and Industrial Equipment Product Portfolio ▪ Engine Covers ▪ Turbo Housings Engine Key Product Lines ▪ Manifolds ▪ Connecting Rods ▪ Flywheel Covers Key Product Lines ▪ Brackets ▪ Gear Housings ▪ Pump Housing ▪ Knuckles ▪ Suspension Links ▪ Calipers Steering, Suspension, Chassis, and Brake Parts Other Specialty Products Key Product Lines ▪ Scrolls ▪ Housings ▪ Hydraulic Valve Bodies ▪ Hydraulic Housings ▪ Pump Housings ▪ Structural Component Safety - Critical Transmission Key Product Lines ▪ Gears ▪ Shifts ▪ Valve Bodies ▪ Housings ▪ Differential Cases Other End Market Diversification and Additional Growth Opportunities Safety - Critical Other Note: The above graphic represents the location and use of our products on a vehicle in general and not on any specific Platf orm , Program, or Vehicle Nameplate. Key Product Lines Driveline ▪ Planetary Carriers ▪ Gears ▪ Axle Housings ▪ Differential Cases ▪ Hubs

0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 169, 219, 195 25 Assumptions Industry Production / Assumptions 2015E Light Vehicle SAAR North America ~2.5% Light Vehicle SAAR Europe ~0% Light Vehicle SAAR Asia ~3.5% NAFTA Heavy Truck Class 5 - 8 ~5% FX Rate February Month End 12/31/14 Reference Rate Euro/USD 1.12 1.22 USD/Mexican Peso 14.94 14.78 USD/Chinese Yuan 6.16 6.14 USD/Korean Won 1,100 1,096 Metal Markets – Chicago #1 Bundles $250 per gross ton $347 per gross ton IHS January 2015 FTR and ACT December 2014 FX Rate and Metal Markets Rate February 2015

0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 169, 219, 195 26 GAAP Reconciliation Full Year Metaldyne Performance Group (MPG) Adjustments to Reconcile Net Income to EBITDA Consolidation Full Year Full Year 12/31/2014 12/31/2013 Net income attributable to shareholders $72.8 $57.6 Minority Interest Income/Loss 0.4 0.3 Net income 73.3 57.9 Addbacks to Arrive at Unadjusted EBITDA Interest Expense 99.9 74.7 Loss on Debt Transactions 60.7 - Income Tax Expenses ( 19.1) 35.0 Total Depreciation and Amortization 210.8 163.4 Unadjusted EBITDA 425.6 330.9 Adjustments to Arrive at Adjusted EBITDA G(L) on Foreign Currency (15.7 ) 2.3 Total Gain or (Loss) on Fixed Assets 2.1 1.4 Debt transaction expenses 3.0 6.0 Stock - based Compensation 17.3 6.2 Sponsor Management Fee 5.1 4.0 Non - recurring acquisition and purchase accounting related items (1) 23.0 10.5 Non - recurring operational items (2) 18.2 1.8 Adjusted EBITDA $478.6 $363.1 (1) Acquisition and related purchase accounting items including transaction costs, adjustments to inventory step - ups and other. (2) Non - recurring operational items including charges for disposed operations, impairment charges, insurance proceeds, curtailment gain and other.

0, 84, 128 163, 135, 97 184, 209, 237 89, 89, 89 45, 123, 158 200, 200, 200 169, 219, 195 27 US GAAP Reconciliation Full Year Metaldyne Performance Group (MPG) U.S. GAAP Reconciliation Consolidation Full Year Full Year 12/31/2014 12/31/2013 Net sales $2,717.0 2,017.3 Grede pre - acquisition net sales 427.0 1,035.6 Combined Non - GAAP net sales $3,144.0 3,052.9 Adjusted EBITDA $478.6 363.1 Grede pre - acquisition Adjusted EBITDA 66.5 145.7 Combined Adjusted EBITDA $545.1 508.8 Non - GAAP diluted EPS $1.31 0.86 Reconciling Items: Goodwill impairment ( 0.17) - Loss on debt extinguishment, net of tax ( 0.54) - Tax benefit from change in foreign earnings reinvestment assertion 0.46 - GAAP diluted EPS $1.06 0.86