Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SEACOAST BANKING CORP OF FLORIDA | v405978_8k.htm |

| EX-2.1 - EXHIBIT 2.1 - SEACOAST BANKING CORP OF FLORIDA | v405978_ex2-1.htm |

| EX-99.1 - EXHIBIT 99.1 - SEACOAST BANKING CORP OF FLORIDA | v405978_ex99-1.htm |

| EX-99.2 - EXHIBIT 99.2 - SEACOAST BANKING CORP OF FLORIDA | v405978_ex99-2.htm |

Exhibit 99.3

March 25, 2015 Acquisition of Grand Bankshares , Inc. For further information, contact: Denny Hudson Chief Executive Officer Phone: 772 - 288 - 6085 Email: denny.hudson@seacoastnational.com William R. Hahl Chief Financial Officer Phone: 772 - 221 - 2825 Email: w.hahl@seacoastnational.com

Acquisition of Grand Bankshares , Inc. 2 Important Information for Investors and Shareholders This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of an y vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior t o r egistration or qualification under the securities laws of such jurisdiction. Seacoast Banking Corporation of Florida ("Seacoast") will file with the Secur iti es and Exchange Commission ("SEC") a registration statement on Form S - 4 containing a proxy statement of Grand Bankshares , Inc. ("Grand") and a prospectus of Seacoast, and Seacoast will file other documents with respect to the proposed merger. A definitive proxy statement/prospectus will be maile d t o shareholders of Grand. Investors and security holders of Grand are urged to read the proxy statement/prospectus and other documents that will be filed with the SEC carefully and in their entirety when they become available because they will contain important information. Investors and sec uri ty holders will be able to obtain free copies of the registration statement and the proxy statement/prospectus (when available) and other documents f ile d with the SEC by Seacoast through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Seaco ast will be available free of charge on Seacoast's internet website or by contacting Seacoast. Seacoast, Grand, their respective directors and executive officers and other members of management and employees may be consi der ed participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive office rs of Seacoast is set forth in its proxy statement for its 2014 annual meeting of shareholders, which was filed with the SEC on April 8, 2014 and its Curren t R eports on Form 8 - K. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect intere sts , by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when the y b ecome available . Cautionary Notice Regarding Forward - Looking Statements This press release contains "forward - looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, and is intended to be protected by the safe harbor provided by the same. These statements a re subject to numerous risks and uncertainties. These risks and uncertainties include, but are not limited to, the following: failure to obtain the app roval of shareholders of Grand in connection with the merger; the timing to consummate the proposed merger; the risk that a condition to closing of th e p roposed merger may not be satisfied; the risk that a regulatory approval that may be required for the proposed merger is not obtained or is obta ine d subject to conditions that are not anticipated; the parties' ability to achieve the synergies and value creation contemplated by the proposed merge r; the parties' ability to promptly and effectively integrate the businesses of Seacoast and Grand; the diversion of management time on issues related t o t he merger; the failure to consummate or delay in consummating the merger for other reasons; changes in laws or regulations; and changes in general e con omic conditions. For additional information concerning factors that could cause actual conditions, events or results to materially differ from th ose described in the forward - looking statements, please refer to the factors set forth under the headings "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in Seacoast's most recent Form 10 - K report and to Seacoast's most recent Form 8 - K reports, which are available online at www.sec.gov. No assurances can be given that any of the events anticipated by the forward - looking statements will transpire or occur, or if any of them do so, what impact they will have on the results of operations or financial condition of Seacoast or Gr and.

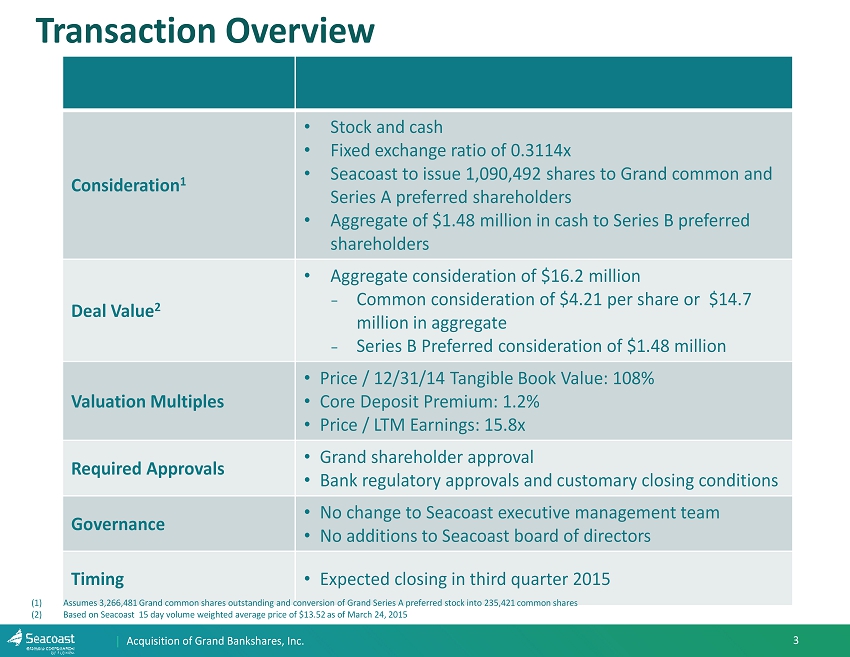

3 Transaction Overview Acquisition of Grand Bankshares , Inc. Consideration 1 • Stock and cash • Fixed exchange ratio of 0.3114x • Seacoast to issue 1,090,492 shares to Grand common and Series A preferred shareholders • Aggregate of $1.48 million in cash to Series B preferred shareholders Deal Value 2 • Aggregate consideration of $16.2 million − Common consideration of $4.21 per share or $14.7 million in aggregate − Series B Preferred consideration of $1.48 million Valuation Multiples • Price / 12/31/14 Tangible Book Value: 108% • Core Deposit Premium: 1.2% • Price / LTM Earnings: 15.8x Required Approvals • Grand shareholder approval • Bank regulatory approvals and customary closing conditions Governance • No change to Seacoast executive management team • No additions to Seacoast board of directors Timing • Expected closing in third quarter 2015 (1) Assumes 3,266,481 Grand common shares outstanding and conversion of Grand Series A preferred stock into 235,421 common shares (2) Based on Seacoast 15 day volume weighted average price of $13.52 as of March 24, 2015

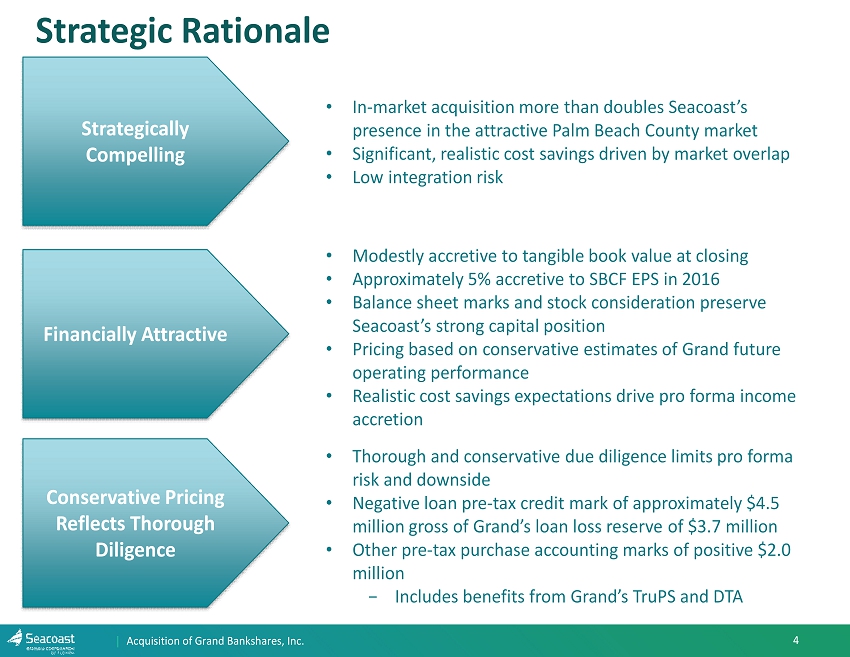

4 Strategic Rationale Acquisition of Grand Bankshares , Inc. • Thorough and conservative due diligence limits pro forma risk and downside • Negative loan pre - tax credit mark of approximately $4.5 million gross of Grand’s loan loss reserve of $3.7 million • Other pre - tax purchase accounting marks of positive $2.0 million − Includes benefits from Grand’s TruPS and DTA Strategically Compelling Financially Attractive Conservative Pricing Reflects Thorough Diligence • In - market acquisition more than doubles Seacoast’s presence in the attractive Palm Beach County market • Significant, realistic cost savings driven by market overlap • Low integration risk • Modestly accretive to tangible book value at closing • Approximately 5% accretive to SBCF EPS in 2016 • Balance sheet marks and stock consideration preserve Seacoast’s strong capital position • Pricing based on conservative estimates of Grand future operating performance • Realistic cost savings expectations drive pro forma income accretion

• North Palm Beach is one of Seacoast’s fastest growing markets • Palm Beach County has the second highest per capita income in Florida¹ • Top employers include:² • Palm Beach housing comeback is among the best in the nation³ • Consumer confidence in Florida the highest in the past 7 years⁴ (1) http :// www.sun - sentinel.com/business/personal - finance/fl - broward - palm - personal - income - 20141120 - story.html (2) http :// www.bdb.org/clientuploads/Research/0_2010_data/Topemployers_2009.pdf (3) http :// www.sun - sentinel.com/business/realestate/fl - freddie - mac - mimi - 20141126 - story.html (4) http :// www.bebr.ufl.edu/sites/default/files/csi_2014 - 11 - november.pdf 5 Palm Beach County is a Premier Florida Market Acquisition of Grand Bankshares , Inc.

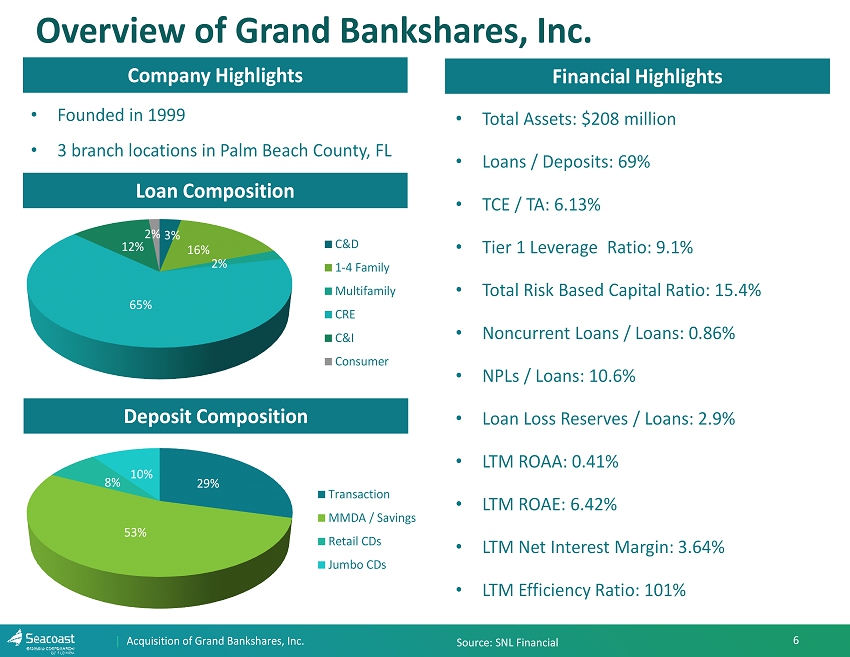

• Total Assets: $208 million • Loans / Deposits: 69% • TCE / TA: 6.13% • Tier 1 Leverage Ratio: 9.1% • Total Risk Based Capital Ratio: 15.4% • Noncurrent Loans / Loans: 0.86% • NPLs / Loans: 10.6% • Loan Loss Reserves / Loans: 2.9% • LTM ROAA: 0.41% • LTM ROAE: 6.42% • LTM Net Interest Margin: 3.64% • LTM Efficiency Ratio: 101 % 6 Overview of Grand Bankshares , Inc. Acquisition of Grand Bankshares , Inc. Company Highlights Financial Highlights Loan Composition • Founded in 1999 • 3 branch locations in Palm Beach County, FL Deposit Composition 29% 53% 8% 10% Transaction MMDA / Savings Retail CDs Jumbo CDs 3% 16% 2% 65% 12% 2% C&D 1-4 Family Multifamily CRE C&I Consumer Source: SNL Financial

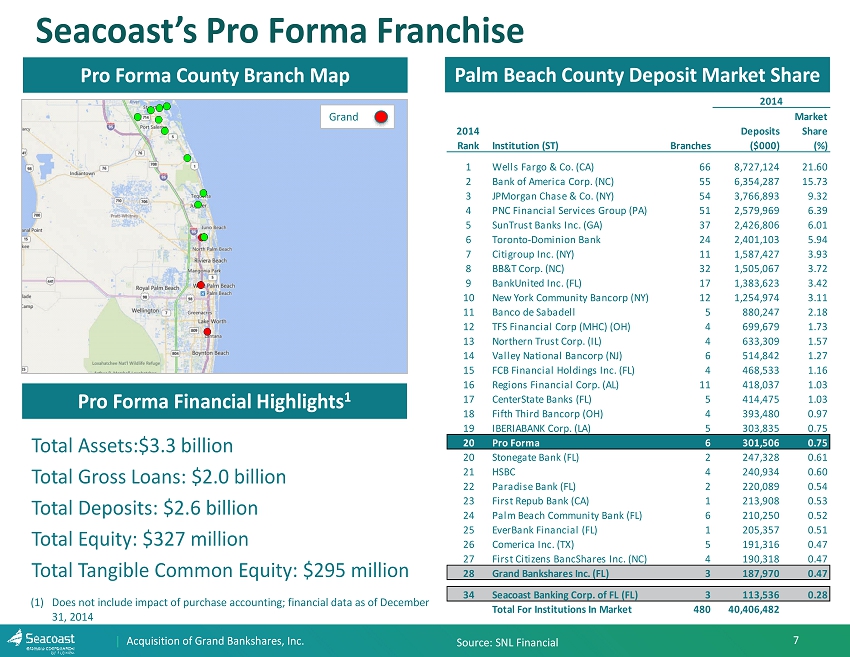

7 Seacoast’s Pro Forma Franchise Acquisition of Grand Bankshares , Inc. Pro Forma County Branch Map Palm Beach County Deposit Market Share Pro Forma Financial Highlights 1 2014 Rank Institution (ST) Branches Deposits ($000) Market Share (%) 1 Wells Fargo & Co. (CA) 66 8,727,124 21.60 2 Bank of America Corp. (NC) 55 6,354,287 15.73 3 JPMorgan Chase & Co. (NY) 54 3,766,893 9.32 4 PNC Financial Services Group (PA) 51 2,579,969 6.39 5 SunTrust Banks Inc. (GA) 37 2,426,806 6.01 6 Toronto-Dominion Bank 24 2,401,103 5.94 7 Citigroup Inc. (NY) 11 1,587,427 3.93 8 BB&T Corp. (NC) 32 1,505,067 3.72 9 BankUnited Inc. (FL) 17 1,383,623 3.42 10 New York Community Bancorp (NY) 12 1,254,974 3.11 11 Banco de Sabadell 5 880,247 2.18 12 TFS Financial Corp (MHC) (OH) 4 699,679 1.73 13 Northern Trust Corp. (IL) 4 633,309 1.57 14 Valley National Bancorp (NJ) 6 514,842 1.27 15 FCB Financial Holdings Inc. (FL) 4 468,533 1.16 16 Regions Financial Corp. (AL) 11 418,037 1.03 17 CenterState Banks (FL) 5 414,475 1.03 18 Fifth Third Bancorp (OH) 4 393,480 0.97 19 IBERIABANK Corp. (LA) 5 303,835 0.75 20 Pro Forma 6 301,506 0.75 20 Stonegate Bank (FL) 2 247,328 0.61 21 HSBC 4 240,934 0.60 22 Paradise Bank (FL) 2 220,089 0.54 23 First Repub Bank (CA) 1 213,908 0.53 24 Palm Beach Community Bank (FL) 6 210,250 0.52 25 EverBank Financial (FL) 1 205,357 0.51 26 Comerica Inc. (TX) 5 191,316 0.47 27 First Citizens BancShares Inc. (NC) 4 190,318 0.47 28 Grand Bankshares Inc. (FL) 3 187,970 0.47 34 Seacoast Banking Corp. of FL (FL) 3 113,536 0.28 Total For Institutions In Market 480 40,406,482 2014 Grand Total Assets:$3.3 billion Total Gross Loans: $2.0 billion Total Deposits: $2.6 billion Total Equity: $327 million Total Tangible Common Equity: $295 million Source: SNL Financial (1) Does not include impact of purchase accounting; financial data as of December 31, 2014

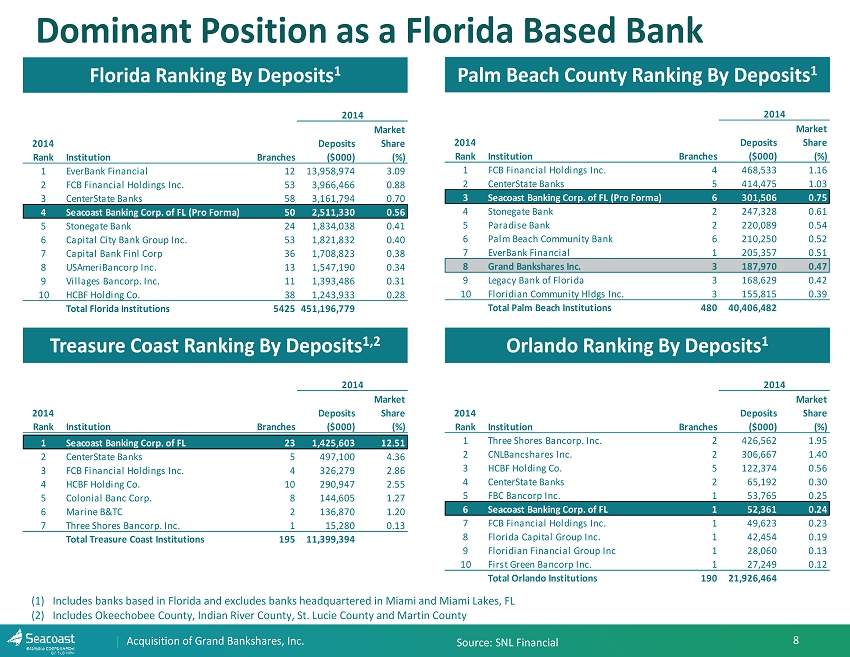

8 Dominant Position as a Florida Based Bank Acquisition of Grand Bankshares , Inc. Source: SNL Financial (1) Includes banks based in Florida and excludes banks headquartered in Miami and Miami Lakes, FL (2) Includes Okeechobee County , Indian River County, St. Lucie County and Martin County Florida Ranking By Deposits 1 Palm Beach County Ranking By Deposits 1 Treasure Coast Ranking By Deposits 1,2 Orlando Ranking By Deposits 1 2014 2014 Rank Institution Branches Deposits ($000) Market Share (%) 1 EverBank Financial 12 13,958,974 3.09 2 FCB Financial Holdings Inc. 53 3,966,466 0.88 3 CenterState Banks 58 3,161,794 0.70 4 Seacoast Banking Corp. of FL (Pro Forma) 50 2,511,330 0.56 5 Stonegate Bank 24 1,834,038 0.41 6 Capital City Bank Group Inc. 53 1,821,832 0.40 7 Capital Bank Finl Corp 36 1,708,823 0.38 8 USAmeriBancorp Inc. 13 1,547,190 0.34 9 Villages Bancorp. Inc. 11 1,393,486 0.31 10 HCBF Holding Co. 38 1,243,933 0.28 Total Florida Institutions 5425451,196,779 2014 2014 Rank Institution Branches Deposits ($000) Market Share (%) 1 FCB Financial Holdings Inc. 4 468,533 1.16 2 CenterState Banks 5 414,475 1.03 3 Seacoast Banking Corp. of FL (Pro Forma) 6 301,506 0.75 4 Stonegate Bank 2 247,328 0.61 5 Paradise Bank 2 220,089 0.54 6 Palm Beach Community Bank 6 210,250 0.52 7 EverBank Financial 1 205,357 0.51 8 Grand Bankshares Inc. 3 187,970 0.47 9 Legacy Bank of Florida 3 168,629 0.42 10 Floridian Community Hldgs Inc. 3 155,815 0.39 Total Palm Beach Institutions 480 40,406,482 2014 2014 Rank Institution Branches Deposits ($000) Market Share (%) 1 Three Shores Bancorp. Inc. 2 426,562 1.95 2 CNLBancshares Inc. 2 306,667 1.40 3 HCBF Holding Co. 5 122,374 0.56 4 CenterState Banks 2 65,192 0.30 5 FBC Bancorp Inc. 1 53,765 0.25 6 Seacoast Banking Corp. of FL 1 52,361 0.24 7 FCB Financial Holdings Inc. 1 49,623 0.23 8 Florida Capital Group Inc. 1 42,454 0.19 9 Floridian Financial Group Inc 1 28,060 0.13 10 First Green Bancorp Inc. 1 27,249 0.12 Total Orlando Institutions 190 21,926,464 2014 2014 Rank Institution Branches Deposits ($000) Market Share (%) 1 Seacoast Banking Corp. of FL 23 1,425,603 12.51 2 CenterState Banks 5 497,100 4.36 3 FCB Financial Holdings Inc. 4 326,279 2.86 4 HCBF Holding Co. 10 290,947 2.55 5 Colonial Banc Corp. 8 144,605 1.27 6 Marine B&TC 2 136,870 1.20 7 Three Shores Bancorp. Inc. 1 15,280 0.13 Total Treasure Coast Institutions 195 11,399,394