Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - JRSIS HEALTH CARE Corp | Financial_Report.xls |

| EX-31.1 - EXHIBIT 31.1 - JRSIS HEALTH CARE Corp | v405465_ex31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - JRSIS HEALTH CARE Corp | v405465_ex32-1.htm |

| EX-32.2 - EXHIBIT 32.2 - JRSIS HEALTH CARE Corp | v405465_ex32-2.htm |

| EX-31.2 - EXHIBIT 31.2 - JRSIS HEALTH CARE Corp | v405465_ex31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Mark One)

FORM 10-K

| R | ANNUAL REPORT PURSUANT TO SECTION13OR15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 333-194359

| JRSIS HEALTH CARE CORPORATION |

| (Exact name of registrant as specified in its charter) |

| Florida | 46-4562047 | |

| State or other jurisdiction of Incorporation or organization | (I.R.S. Employer Identification No.) |

| 1 st – 7 th Floor, Industrial and Commercial Bank Building, |

| Xingfu Street, Hulan Town, Hulan District, Harbin City, |

| Heilongjiang Province, China 150025 |

| (Address of principal executive offices)(Zip Code) |

| Registrant’s telephone number, including area code 0086-451-56888933 |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered |

| None | Not Applicable |

Securities registered pursuant to Section 12(g) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered |

| Common Stock, $0.001 par value | Not Applicable |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule405 of the Securities Act. Yes ¨ No R

Indicate by check mark if the registrant is not required to file reports pursuant to Section13 or Section 15(d) of the Act. Yes ¨ No R

| 1 |

Indicate by check mark whether the registrant(1) has filed all reports required to be filed by Section13or15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes R No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule405 of Regulation S-T (§232.405of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes R No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form10-K or any amendment to this Form 10-K.R

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the Definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule12b-2 of the Exchange Act.

Large accelerated filer ¨Accelerated filer ¨

Non-accelerated filer ¨ (Do not check if a smaller reporting company) Smaller reporting company R

Indicate by check mark whether the registrant is a shell company (as defined in Rule12b-2 of the Act). Yes ¨ No R

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

¨Yes ¨No

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

As of March 31, 2015, there were 13,915,000 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980).

| 2 |

Table of Contents

| 3 |

PART I

Cautionary Statement Regarding Forward Looking Statements

The discussion contained in this Annual Report on Form 10-K contains “forward-looking statements” within the meaning of Section 27A of the United States Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the United States Securities Exchange Act of 1934, as amended, or the Exchange Act. Any statements about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases like “anticipate,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “target,” “expects,” “management believes,” “we believe,” “we intend,” “we may,” “we will,” “we should,” “we seek,” “we plan,” the negative of those terms, and similar words or phrases. We base these forward-looking statements on our expectations, assumptions, estimates and projections about our business and the industry in which we operate as of the date of this Form 10-K. These forward-looking statements are subject to a number of risks and uncertainties that cannot be predicted, quantified or controlled and that could cause actual results to differ materially from those set forth in, contemplated by, or underlying the forward-looking statements. Statements in this Form 10-K describe factors, among others, that could contribute to or cause these differences. Actual results may vary materially from those anticipated, estimated, projected or expected should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect. Because the factors discussed in this Form 10-K could cause actual results or outcomes to differ materially from those expressed in any forward-looking statement made by us or on our behalf, you should not place undue reliance on any such forward-looking statement. New factors emerge from time to time, and it is not possible for us to predict which will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement. Except as required by law, we undertake no obligation to publicly revise our forward-looking statements to reflect events or circumstances that arise after the date of this Form 10-K or the date of documents incorporated by reference herein that include forward-looking statements.

| Item 1. | Business |

History

Harbin Jiarun Hospital Company Limited (“Jiarun Hospital”) was established in Harbin in the Province of Heilongjiang of the People’s Republic of China (“PRC”) by the owner Junsheng Zhang on February 17, 2006

Jiarun is a private hospital serving patients on a municipal and county level and providing both Western and Chinese medical practices to the residents of Harbin. Jiarun specializes in the areas of Pediatrics, Dermatology, ENT, Traditional Chinese Medicine (TCM), Ophthalmology, Internal Medicine Dentistry, General Surgery, Rehabilitation Science, Gynecology, General Medical Services, etc.

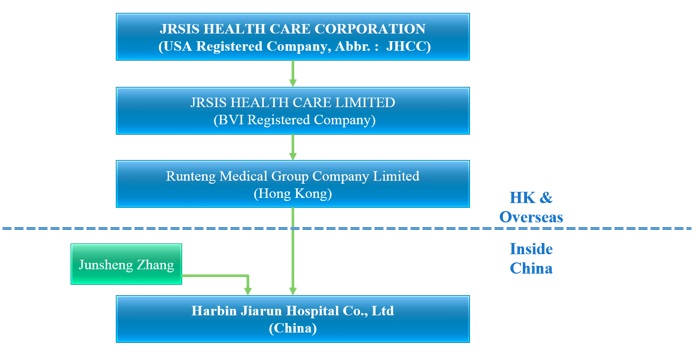

On November 20, 2013, the officer of Jiarun Hospital established JRSIS HEALTH CARE CORPORATION, a Florida corporation (“JHCC” or the “Company”). On February 25, 2013, the officer of Jiarun Hospital established JRSIS HEALTH CARE LIMITED ("JHCL"), a wholly owned subsidiary of the Company and On September 17, 2012, the officer of Jiarun Hospital established Runteng Medical Group Co., Ltd (“Runteng”), a wholly owned subsidiary of JHCL. Runteng, a Hong Kong registered Investment Company holds a seventy percent (70%) ownership interest in Harbin Jiarun Hospital Company Ltd, a Heilongjiang registered company.

On December 20, 2013, the Company acquired One Hundred Percent (100%) of the issued and outstanding capital stock of JRSIS Health Care Limited, a privately held Limited Liability Company registered in the British Virgin Islands (“JHCL”) for Twelve Million (12,000,000) shares of our common stock. JHCL, through its wholly owned subsidiary, Runteng Medical Group Co., Ltd (“Runteng”), holds majority ownership in Harbin Jiarun Hospital Co., Ltd, a company duly incorporated, organized and validly existing under the laws of China (“Jiarun”). As the parent company, JHCC rely on Jiarun Hospital to conduct One Hundred Percent (100%) of our businesses and operations.

| 4 |

| Item 1. | Business - continued |

Corporate Structure

Our present corporate structure is as follows:

Our Business

We operate Jiarun Hospital, a private hospital with 650 open beds. Jiarun Hospital offers patients care and sale of medicine in the areas of both Western and Chinese medical practices to the residents of Harbin. Jiarun specializes in the areas of Pediatrics, Dermatology, Ears, Nose and Throat (ENT), Traditional Chinese Medicine (TCM), Ophthalmology, Internal Medicine Dentistry, General Surgery, Rehabilitation Science, Gynecology, General Medical Services, etc. Our ambulances are open 24 hours a day.

As a hospital in China, we must register with and maintain an operating license from the local Administration of Health.

As is common in China, we generate revenues from providing both patients services and the sale of medicine, these two areas respectively making up 51% and 49% of the total revenues for the year ended December 31, 2014, 52% and 48% of the total revenues for the year ended December 31, 2013.

We generate revenues from medicine revenue and patient services.

Medicine

Revenue from the sale of medicine is recognized when it is both earned and realized. The Company’s policy is to recognize the sale of medicine when the title of the medicine, ownership and risk of loss have transferred to the purchasers, and collection of the sales proceeds is reasonably assured, all of which generally occur when the patient receives the medicine.

Given the nature of this revenue source of the Company’s business and the applicable rules guiding revenue recognition, the revenue recognition practices for the sale of medicine do not contain estimates that materially affect results of operations nor any policy for return of products.

The Company is serving patients on both Western and Traditional Chinese medicines to the citizens of Harbin.

Patient Services

In accordance with the medical licenses of Jiarun, the approved medical patient service scope of the Company include medical consulting, surgery, obstetrics and gynecology, pediatrics, anesthesia, clinic laboratory, medical imaging, and traditional Chinese medicine, etc.

Patient service revenue is recognized when it is both earned and realized. The Company’s policy is to recognize patient service revenue when the medical service has been provided to the patient and collection of the revenue is reasonably assured.

The Company provides services to both patients covered by social insurance and patients who are not covered by social insurance. The Company charges the same rates for patient services regardless of the coverage by social insurance.

| 5 |

| Item 1. | Business - continued |

Patients who are not covered by social insurance are liable for the total cost of medical treatment.

| l | For out-patient medical services, revenue is recognized when the Company provides medical service to the patient. The Company collects payment when the patient checks out from the hospital, which is the same day the services are provided. |

| l | For in-patient medical services, the Company estimates the approximate fee the patients will spend in the hospital based on patients’ symptom. This is when the patients check in to the hospital. At that time, the Company collects the estimated fees from the patient and records the payment as deposits received. |

During the in-patient services period, the Company recognizes revenue when the patient service is provided and deducts the cost of service from the deposit received. The Company records these transactions based on daily reports generated by the respective medical department. When medical services exceed patient deposits received the Company records revenue and accounts receivable when the patient services are provided.

When patients check out from the hospital, the Company calculates and determines the remaining deposit, if any, and refunds the unused portion of the deposit to the patients. In the case where the patients have a balance in accounts receivable during the in-patient period, accounts receivable are required to be paid in full at checkout.

Patients covered by social insurance will receive a portion or full medical services reimbursed or paid by the social insurance agencies via prepaid cards or insurance claim settlement process.

On a three (3) year basis, the company’s revenue has been growing at a compound rate of approximately 31% annually, we have secured a new, much larger location to allow for our fast organic growth. Our operations moved into the new building in December of 2014.

The hospital building is being constructed by Harbin Baiyi Real Estate Development Co., Ltd, which is owned by Junsheng Zhang, a related party. The building was leased from the related party by financial leasing, the price of leasing agreement referred to the local market price and audited by the auditor. The Leasing terms consist of 30 payments. Each payment will be made on an annual basis when 7 million RMB per payment will be paid upfront for each leasing period. The first payment was made on September 1st, 2014. At the end of the leasing period, a final payment will be made to settle the total leasing amount. Both parties agreed for the leasee to pay 3 million RMB as deposit at the execution of the Leasing agreement, which will be deducted from the final rental settlement. The lending interest rate was calculated at 6.55%, which is the benchmark interest rate announced from The People’s Bank of China. After the completion of all payments, the ownership of the lease item will be transferred to the Leasee (Jiarun hospital).

After our operating move into the new hospital building in December 2014, JHCC is establishing an Intensive Care Unit and a Hemodialysis Center department.

In Q2 2015, JHCC plans to acquire one pharmaceuticals wholesale and one medicine retail company. This will complete the industrial chain and guarantee the provision of drugs to our hospitals. After this merger, we believe that JHCC will get greater competitiveness and profits space. In addition, medicine retail and wholesale business itself has great profits.

JHCC also plans to acquire other hospitals and companies involved in the healthcare industry in the PRC using cash and shares of our common stock. Substantial capital may be needed for these acquisitions and we may need to raise additional funds through the sale of our common stock, debt financing or other arrangements. We do not have any commitments or arrangements from any person to provide us with any additional capital. Additional capital may not be available to us, or if available, on acceptable terms, in which case we would not be able to acquire other hospitals or businesses in the healthcare industry.

Regulations pertaining to our Business

According to the PRC Regulation of Healthcare Institutions, hospitals shall register with the Administration of Health of the local government to obtain the necessary business license for the provision of hospital services. We received our business license from Harbin City government in February of 2006. Other existing regulations having material effects on our business include those dealing with physician's licensing, usage of medicine and injection, public security in health and medical advertising.

| 6 |

| Item 1. | Business - continued |

Customers

The Company has successfully marketed our value proposition to a large number of corporate customers as well as individual customers. We are in direct competition with two government-owned hospitals in the Hulan district of Harbin City, we are able to offer a more comprehensive examination menu at competitive prices, and provide an affordable “one-stop” service to our corporate customers who contract us to provide healthcare services to their employees and clients across the country. We are also able to provide our customers with satisfying experiences by providing customized services, streamlined processes, access to advanced equipment, a comfortable environment, customer services-oriented staff and greater privacy, characteristics which are highly valued by our corporate and individual customers.

Suppliers

Over the years of operations, we have developed a solid and reliable image to the general public and to the medical academia and industry. Leveraging our positive track record and brand name, we have established supplier relationship with a number of well-known local and international healthcare and financial companies and medical academia. The following are some of the most recognized supplier’s name the hospitals have established working relationships with:

| Company | Content of cooperation | |

| Shanghai Weidi Biological Technology Co., Ltd. | Supplier of Medical Supplies | |

| Heilongjiang Zhanhong Economic and Trade Co., Ltd. | Supplier of Medical CT Film | |

| Heilongjiang Dahua Pharmaceutical Co., Ltd. | Supplier of Medical | |

| China Medical Equipment And Technical Service Company | Supplier of Medical Equipment | |

| Longrun Medical Equipment Co., Ltd. | Supplier of Medical reagent | |

| Anguo Linshi Medicinal Material Co., Ltd. | Supplier of Chinese Herbal Medicine | |

| Heilongjiang CMEC International Trading Company Limited | Supplier of Medical Equipment | |

| Changchun Shenglian Medical Equipment Co., Ltd. | Supplier of Medical reagent | |

| Harbin Jiarun Pharmacy Co., Ltd. | Supplier of Medical | |

| Harbin Shengtai Pharmaceutical Co., Ltd. | Supplier of Chinese Herbal Medicine | |

| Harbin Zhengda Longxiang Pharmaceutical Co., Ltd. | Supplier of Medical | |

| Shenzhen Zheng Tong Electronic Co., Ltd. | Supplier of Medical Equipment | |

| Harbin Ming Yang Medical Equipment Co., Ltd. | Supplier of Medical reagent | |

| Heilongjiang Guolong Medical Co., Ltd. | Supplier of Medical | |

| Harbin Pharmaceutical Group | Supplier of Medical | |

| Yuan Dong International Leasing Co., Ltd. | Financial Lease of Medical Equipment | |

| GE Medical Systems Trade and Development (Shanghai) Co., Ltd. | Supplier of Medical Equipment |

| 7 |

| Item 1. | Business - continued |

Competition

We compete with two government-owned hospitals in the city of Harbin. We believe that we will be able to effectively compete with them because we:

| l | Extensive marketing tactics will reach a large segment of customers |

Extensive marketing tactics will reach a large segment of customers, such as our especial "Mobile clinics free medical service " program, which provide free medical services around Jiarun Hospital community and neighboring towns, more as an expanded customer base and expand the influence of the marketing plan.

| l | Provide advanced medical facilities and comfortable environments |

| l | Maintain the highest level of professional healthcare |

| l | Offer competitive prices for medical treatment and drugs and medications. |

Marketing

To increase our visibility, in April 2014, Jiarun purchased a clinicar. This mobile clinic will promote the business by providing free clinical services in Jiarun Hospital’s local community. With the new hospital building in use, Jiarun is able to further improve its healthcare services ability and expand its service coverage area to additional communities and towns. We are also planning to send out our experts and medical team to communities to provide free public services including consultation and medical services to attract customers.

In the future, we plan to further strengthen our marketing efforts and improve our brand awareness through advertising on newspapers, magazines and television. We will continue to focus on community medical service by maintaining good relationship with our communities, and providing quality medical service to the neighborhood residents. We will set up our marketing department and team to focus on specific market and patients. We understand that the key to success is to provide quality services.

PRC Laws and Regulations Affecting Our Business

Healthcare providers in China are required to comply with many laws and regulations at the national and local government levels. These laws and regulations include the following:

| n | We must register with and maintain an operating license from the local Administration of Health. We are subject to review by the local Administration of Health at an annual inspection. |

| n | Personnel and employees directly performing medical services in medical institutions are required to obtain qualification certificates. |

| n | Pursuant to the Interim Provisions on the Administration of Medical Examinations, or the Medical Examination provisions, issued in August 2009 by the NHFPC, the NHFPC or its local branches are responsible for the regulation of medical examination activities. Medical institutions that plan to operate medical examination businesses should apply to the NHFPC or its local branches for the approval of such medical examination business and register such business with the NHFPC or its local branches by including the business in their medical institution practicing licenses. |

| n | Pursuant to the Rules on Administration of Radiation-related Diagnose and Treatment issued in January 2006 by the NHFPC, medical institutions that plan to conduct radiation-related diagnosis and treatment businesses should apply to the NHFPC or its local branches and obtain radiation-related diagnosis and treatment licenses. JHCC that engage in radiation-related diagnosis and treatment business have obtained radiation-related diagnosis and treatment licenses. |

| n | All waste materials from our hospital must be properly collected, sterilized, deposited, transported and disposed of. We are required to keep records of the origin, type and amount of all waste materials generated by our hospital. |

| n | We must have at least 20 beds and at least 14 medical professionals on staff, including three doctors and five nurses. |

| n | We must establish and follow protocols to prevent medical malpractice. The protocols require us to: |

| o | insure that patients are adequately informed before they consent to medical operations or procedures; |

| o | maintain complete medical records which are available for review by the patient, physicians and the courts; |

| o | voluntarily report any event of malpractice to a local government agency; |

| o | support the medical services we provide in any administrative investigation or litigation. |

If we fail to comply with applicable laws and regulations, we could suffer penalties, including the loss of our license to operate.

Before we can acquire a hospital or a company in the healthcare field in the PRC, we will be required to submit an application to the PRC Ministry of Commerce. As part of the application we must submit a number of documents, including:

| 8 |

| Item 1. | Business - continued |

| · | The financial statements and the financial statements of the company we propose to acquire, |

| · | A copy of the business license of the company we propose to acquire, |

| · | Evidence that the shareholders of the company we propose to acquire have approved the transaction, and |

| · | An appraisal, conducted by an independent party, of the value of the company we propose to acquire. |

Taxes

Enterprise income tax is defined under the Provisional Regulations of PRC Concerning Income Tax on Enterprises promulgated by the PRC, income tax is payable by enterprises at a rate of 25% of their taxable income.

Jiarun's medical services have been exempt from enterprise income tax since March 1, 2006, which has been approved by the Local Taxation Bureau.

Jiarun was incorporated in accordance with the law of medical and health institutions mainly provide medical services, with the "PRC Business Tax Tentative Regulations" Article 8 (3) medical service income tax-free provisions (hospital, clinics and other medical institutions to provide medical services shall be exempt from business tax). The Company's medical services have been exempted from business tax since March 1, 2006. The tax exempt status will remain effective until notification from the tax bureau.

In considering the achievement of the hospital, it could not have been done without the support of local authorities, Jiarun hospital has voluntarily paid income tax of $2,157, $1,984 and $1,987 for the years ended December 31, 2014, 2013 and 2012, respectively to the local tax bureau.

Employees

As of December 31, 2014, we have 253 employees, consisting of 86 licensed doctors and 18 surgeons, 20 drug management staff, 93 nurses, 2 dentists and supported by 34 non-medical employees. None of our employees are represented by a labor union or similar collective bargaining organization. We believe that our relationship with our employees is good.

| Item 1A. | Risk Factors. |

An investment in our common stock involves a high degree of risk. You should carefully consider the following risk factors and other information in this 10K before deciding to invest in our Company. If any of the following risks actually occur, our business, financial condition and results of operations for growth could be seriously harmed. As a result, the trading price of our common stock could decline and you could lose all or part of your investment.

Risks Related to Our Business

If we fail to properly manage the employment of our doctors and nurses, we may be subject to penalties including fines, loss of licenses, or an order to cease practice against our medical centers, which could materially and adversely affect our business.

The practicing activities of doctors and nurses are strictly regulated under the PRC laws and regulations. Doctors and nurses who practice at medical institutions must hold practicing licenses and may only practice within the scope and at the specific medical institutions for which their practicing licenses are registered.

In practice, it usually takes four to nine weeks for doctors and nurses to transfer their practicing licenses from one medical institution to another or add another medical institution to their permitted practicing institutions. Some of our recently hired doctors have submitted applications to transfer their practicing licenses from their previous employers to our medical centers but have not finished the process. We cannot assure you that these doctors will complete the transfer of their practicing licenses or the government procedures timely, or at all. Our failure to properly manage the employment of our doctors and nurses may subject us to administrative penalties including fines, loss of licenses, or, in the worst case scenario, an order to cease practice against our medical centers, which could materially and adversely affect our business.

| 9 |

Our business exposes us to liability risks that are inherent in the operation of complex medical equipment, which may experience failures or cause injury either because of defects, faulty maintenance or repair, or improper use.

Our business exposes us to liability risks that are inherent in the operation of complex medical equipment, which may experience failures or cause injury either because of defects, faulty maintenance or repair, or improper use. Extended downtime of our medical equipment could result in lost revenues, dissatisfaction on the part of customers and damage to our reputation. Any injury caused by our medical equipment in our medical centers due to equipment defects, improper maintenance or improper operation could subject us to liability claims. Regardless of their merit or eventual outcome, such liability claims could result in significant legal defense costs for us, harm our reputation, and otherwise have a material adverse effect on our business, financial condition and results of operations.

We primarily rely on equipment manufacturers or third-party service providers to maintain and repair the complex medical equipment used in our medical centers. If any of these manufacturers or third-party service providers fails to perform its contractual obligations to provide such services, or refuses to renew these service agreements on terms acceptable to us, or at all, we may not be able to find a suitable alternative service provider or establish our own maintenance and repair team in a timely manner. Similarly, any failure of or significant quality deterioration in such service providers’ services could materially and adversely affect customer experience. We also rely on both equipment manufacturers and our own internal expertise to provide technical training to our staff on the proper operation of such equipment. If such medical technicians are not properly and adequately trained, or if they make errors in the operation of the complex medical equipment even if they are properly trained, they may misuse or ineffectively use the complex medical equipment in our medical centers. Such failure could result in unsatisfactory medical examination results, diagnosis, treatment outcomes, patient injury or possibly death, any of which could materially and adversely affect our business, financial condition, results of operations and prospects.

Financial projections included with this 10k may prove to be inaccurate.

Any projections are based on certain assumptions which could prove inaccurate and which would be subject to future conditions, which may be beyond our control, such as general industry conditions. We may experience unanticipated costs, or anticipated revenues may not materialize, resulting in lower operating results than forecasted. We cannot assure that the results illustrated in any financial projections will in fact be realized by us. Any financial projections would be prepared by our management and would not be examined or compiled by independent certified public accountants. Counsel to us has had no participation in the preparation or review of any financial projections prepared by us. Accordingly, neither the independent certified public accountants nor our counsel would be able to provide any level of assurance on them. We cannot assure that we will have sufficient capital to expand our business operations. We cannot assure that we could obtain additional financing or capital from any source, or that such financing or capital would be available to us on terms acceptable to us.

We may not be able to compete against companies with substantially greater resources.

The hospital industry is intensely competitive and we expect competition to intensify further in the future. This is a very capital intensive business and companies with greater resources may have advantages that make our model weaker in comparison.

Our business is subject to various government regulations.

We are subject to various federal, state and local laws affecting medical products in China. The State Food and Drug Administration (“SFDA”), Ministry of Health of The People’s Republic of China (“MoHPRC”) and equivalent state agencies regulate healthcare services made by businesses in the offering of service, which apply to us. We are also subject to government laws and regulations governing health, safety, working conditions, employee relations, wrongful termination, wages, taxes and other matters applicable to businesses in general. Any such new regulation, or the application of laws or regulations from jurisdictions whose laws do not currently apply to our business, could have a material adverse effect on our business, results of operations, and financial condition.

| 10 |

We cannot assure that we will earn a profit or that our products will be accepted by consumers.

Our business is speculative and reliant on acceptance of our brand name by local communities, physicians, patients and advertisers. Our operating performance is also heavily dependent on our ability to earn a profit from our services. We cannot assure as to whether we will be successful or earn any revenue or profit, or that investors will not lose their entire investment.

We may incur uninsured losses.

Although we maintain vehicle insurance and basic Chinese social insurances and related insurance, we cannot assure that we will not incur uninsured liabilities and losses as a result of the conduct of our business. Should uninsured losses occur, the holders of our common stock and debt could lose their invested capital.

Like most providers of medical services, we are subject to potential litigation.

We are exposed to the risk of litigation for a variety of reasons, including service liability lawsuits, employee lawsuits, commercial contract disputes, government enforcement actions, and other legal proceedings. We cannot assure that future litigation in which we may become involved will not have a material adverse effect on our financial condition, operating results, business performance, and business reputation.

We do not maintain any business liability insurance, insurance companies in China offer limited business insurance products. While business liability insurance is available to a limited extent in China, we have determined that the risks, cost of such insurance and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical for us to purchase such insurance. Product or medical malpractice liability or uninsured damage to any of our medical centers or the medical equipment in our medical centers could result in significant disruption to the operation of our medical centers and result in a material adverse effect to our business, financial condition and results of operations.

We may incur cost overruns in the distribution of our various services.

We may incur substantial cost overruns in the distribution of our services. Unanticipated costs may force us to obtain additional capital or financing from other sources, or may cause us to lose our entire investment if we are unable to obtain the additional funds necessary to implement our business plan. We cannot assure that we will be able to obtain sufficient capital to successfully continue the implementation of our business plan. If a greater investment in the business is required due to cost overruns, the probability of earning a profit or a return of the Shareholders’ investment in us diminishes.

Directors and officers have limited liability.

Our bylaws provide that we will indemnify and hold harmless our officers and directors against claims arising from our activities, to the maximum extent permitted by business laws of the State of Florida. If we were called upon to perform under our indemnification agreement, then the portion of our assets expended for such purpose would reduce the amount otherwise available for our business. We have no executed indemnification agreement.

If we are unable to hire, retain or motivate qualified personnel, consultants, independent contractors, and advisors, we may not be able to grow effectively.

Our performance will be largely dependent on the talents and efforts of highly skilled individuals. Future success depends on our continuing ability to identify, hire, develop, motivate and retain highly qualified personnel for all areas of our organization. Competition for such qualified employees is intense. If we do not succeed in attracting excellent personnel or in retaining or motivating them, we may be unable to grow effectively. In addition, all future success depends largely on our ability to retain key consultants and advisors. We cannot assure that any skilled individuals will agree to become an employee, consultant, or independent contractor of JRSIS. Our inability to retain their services could negatively impact our business and our ability to execute our business strategy. From our past experiences, we have never had difficulties hiring or retaining qualified personnel, independent contractors or advisors.

| 11 |

Risks Related to the Company’s Corporate Structure

The failure to comply with PRC regulations relating to mergers and acquisitions of domestic enterprises by offshore special purpose vehicles may subject us to severe fines or penalties and create other regulatory uncertainties regarding our corporate structure.

On August 8, 2006, the PRC Ministry of Commerce (“MOFCOM”), joined by the China Securities Regulatory Commission (the “CSRC”), the State-owned Assets Supervision and Administration Commission of the State Council (the “SASAC”), the State Administration of Taxation (the “SAT”), the State Administration for Industry and Commerce (the “SAIC”), and the State Administration of Foreign Exchange (“SAFE”), jointly promulgated regulations entitled the Provisions Regarding Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (the "M&A Rules"), which took effect as of September 8, 2006. This regulation, among other things, has certain provisions that require offshore special purpose vehicles (“SPVs”) formed for the purpose of acquiring PRC domestic companies and controlled directly or indirectly by PRC individuals and companies, to obtain the approval of MOFCOM prior to engaging in such acquisitions and to obtain the approval of the CSRC prior to publicly listing their securities on an overseas stock market. On September 21, 2006, the CSRC published on its official website a notice specifying the documents and materials that are required to be submitted for obtaining CSRC approval.

The application of the M&A Rules with respect to our corporate structure and to this offering remains unclear, with no current consensus existing among leading PRC law firms regarding the scope and applicability of the M&A Rules. We believe that the MOFCOM and CSRC approvals under the M&A Rules were not required in the context of our share exchange transaction because at such time the share exchange was a foreign related transaction governed by foreign laws, not subject to the jurisdiction of PRC laws and regulations. However, we cannot be certain that the relevant PRC government agencies, including the CSRC and MOFCOM, would reach the same conclusion, and we cannot be certain that MOFCOM or the CSRC may deem that the transactions effected by the share exchange circumvented the M&A Rules, and other rules and notices, and that prior MOFCOM or CSRC approval is required for this offering. Further, we cannot rule out the possibility that the relevant PRC government agencies, including MOFCOM, would deem that the M&A Rules required us or our entities in China to obtain approval from MOFCOM or other PRC regulatory agencies in connection with JRSIS’s control of Jiarun.

If the CSRC, MOFCOM, or another PRC regulatory agency subsequently determines that CSRC, MOFCOM or other approval was required for the share exchange transaction and/ or the VIE arrangements between JRSIS and Jiarun, or if prior CSRC approval for this offering is required and not obtained, we may face severe regulatory actions or other sanctions from MOFCOM, the CSRC or other PRC regulatory agencies. In such event, these regulatory agencies may impose fines or other penalties on our operations in the PRC, limit our operating privileges in the PRC, delay or restrict the repatriation of the proceeds from this offering into the PRC, restrict or prohibit payment or remittance of dividends to us or take other actions that could have a material adverse effect on our business, financial condition, results of operations and reputation, as well as the trading price of our common stock. The CSRC or other PRC regulatory agencies may also take actions requiring us, or making it advisable for us, to delay or cancel this offering, to restructure our current corporate structure, or to seek regulatory approvals that may be difficult or costly to obtain.

The M&A Rules, along with certain foreign exchange regulations discussed below, will be interpreted or implemented by the relevant government authorities in connection with our future offshore financings or acquisitions, and we cannot predict how they will affect our acquisition strategy. For example, our operating companies' ability to remit dividends to us, or to engage in foreign-currency-denominated borrowings, may be conditioned upon compliance with the SAFE registration requirements by such Chinese domestic residents, over whom we may have no control.

SAFE regulations relating to offshore investment activities by PRC residents may increase our administrative burdens and restrict our overseas and cross-border investment activity. If our shareholders and beneficial owners who are PRC residents fail to make any required applications, registrations and filings under such regulations, we may be unable to distribute profits and may become subject to liability under PRC laws.

SAFE has promulgated several regulations, including Notice on Relevant Issues Concerning Foreign Exchange Administration for PRC Residents to Engage in Financing and Inbound Investment via Oversea Special Purpose Vehicles, or "Circular No. 75," issued on October 21, 2005 and effective as of November 1, 2005 and certain implementation rules issued in recent years, requiring registrations with, and approvals from, PRC government authorities in connection with direct or indirect offshore investment activities by PRC residents and PRC corporate entities. These regulations apply to our shareholders and beneficial owners who are PRC residents, and may affect any offshore acquisitions that we make in the future.

| 12 |

SAFE Circular No. 75 requires PRC residents, including both PRC legal person residents and/or natural person residents to register with the local SAFE branch before establishing or controlling any company outside of China for the purpose of equity financing with assets or equities of PRC companies, referred to in the notice as an "offshore special purpose company." In addition, any PRC resident who is a direct or indirect shareholder of an offshore company is required to update his registration with the relevant SAFE branches, with respect to that offshore company, in connection with any material change involving an increase or decrease of capital, transfer or swap of shares, merger, division, equity or debt investment or creation of any security interest. Moreover, the PRC subsidiaries of that offshore company are required to coordinate and supervise the filing of SAFE registrations by the offshore company's shareholders who are PRC residents in a timely manner. If a PRC shareholder with a direct or indirect stake in an offshore parent company fails to make the required SAFE registration, the PRC subsidiaries of such offshore parent company may be prohibited from making distributions of profit to the offshore parent and from paying the offshore parent proceeds from any reduction in capital, share transfer or liquidation in respect of the PRC subsidiaries, and the offshore parent company may also be prohibited from injecting additional capital into its PRC subsidiaries. Furthermore, failure to comply with the various SAFE registration requirements described above may result in liability for the PRC shareholders and the PRC subsidiaries under PRC law for foreign exchange registration evasion.

Although we have requested our PRC shareholders to complete the SAFE Circular No. 75 registration, we cannot be certain that all of our PRC resident beneficial owners will comply with the SAFE regulations. The failure or inability of our PRC shareholders to receive any required approvals or make any required registrations may subject us to fines and legal sanctions, restrict our overseas or cross-border investment activities, prevent us from transferring the net proceeds of this offering or making other capital injection into our PRC subsidiaries, limit our PRC subsidiaries' ability to make distributions or pay dividends or affect our ownership structure, as a result of which our acquisition strategy and business operations and our ability to distribute profits to you could be materially and adversely affected.

Under Operating Rules on the Foreign Exchange Administration of the Involvement of Domestic Individuals in the Employee Stock Ownership Plans and Share Option Schemes of Overseas Listed Companies, issued and effective as of March 28, 2007 by the State Administration of Foreign Exchange, or "SAFE" ("Circular No. 78"), the employee stock option plan or share incentive plan should be registered with the SAFE or its local branches and complete certain other procedures related to the share option or other share incentive plan through the PRC subsidiary of such overseas listed company or any other qualified PRC agent before such grants are made. We believe that all of our PRC employees who are granted share options are subject to SAFE No. 78. In addition, PRC residents who are granted shares or share options by an overseas listed company according to its employee share option or share incentive plan are required to obtain approval from the SAFE or its local branches. We intend to grant our PRC employees stock options pursuant to an employee stock option plan. We will request our PRC management, personnel, directors and employees who are to be granted stock options to register them with local SAFE pursuant to Circular No.78. However, we cannot assure you that each of these individuals will successfully comply with all the required procedures above. If we or our PRC security holders fail to comply with these regulations, we or our PRC security holders may be subject to fines and legal sanctions. Further, failure to comply with the various SAFE registration requirements described above could result in liability under PRC law for foreign exchange evasion and we may become subject to a more stringent review and approval process with respect to our foreign exchange activities.

Risks Related to Doing Business in China

We depend upon the acquisition and maintenance of licenses to conduct our business in the PRC.

In order to conduct business, especially in chemical production activities in the PRC, we are required to maintain various licenses from the appropriate government authorities, including general business licenses and licenses and/or permits specific to our pharmaceutical product retail and distribution operations. We are required to maintain valid safety service licenses and other relevant licenses and permits to conduct our activities. The applicable licenses are subject to periodic renewal. An application for renewal needs to be submitted at least 30 days before the expiration date and the extension will be approved if the applicant satisfies all applicable requirements and pays appropriate resource fee. The PRC government may amend relevant laws and discontinue approval of renewal of pharmaceutical related licenses. Further, fees for such licenses may increase in the future. Our failure to obtain or maintain these licenses and any change of the relevant PRC laws to our disadvantage will have a material adverse impact on our ability to conduct our business and on our financial condition. No assurance can be given regarding the timing or magnitude of these types of government actions or that the same will not have a negative impact on our operations.

| 13 |

Changes in current policies of the PRC government could have a significant impact upon the business we conduct in the PRC and the profitability of our operations.

Current policies adopted by the PRC government indicate that it seeks to encourage a market oriented economy. We believe that the PRC government will continue to develop policies that strengthen its economic and trading relationships with foreign countries and as a consequence, business development in the PRC will follow current market forces. While we believe that this trend will continue, we cannot assure you that such beneficial policies will not change in the future. A change in the current policies of the PRC government could result in confiscatory taxation, restrictions on currency conversion, or the expropriation or nationalization of private enterprises, all of which would have a negative impact on our current corporate structure and our operations. The PRC laws and regulations governing our current business operations are sometimes vague and uncertain. Any changes in such PRC laws and regulations may have a material and adverse effect on our business.

There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including, but not limited to, those laws and regulations governing our business and those relating to the enforcement and operation of our contractual arrangements. At this time, we believe that the relevant PRC laws and regulations validate our current contractual arrangements and that our corporate structure is in keeping with such laws. However, no assurance can be given that PRC court rulings to be decided in the future will be consistent with our current interpretations. Further, new laws or regulations may be enacted which could have a negative impact on foreign investors. We cannot predict what effect the interpretation of existing or new PRC laws or regulations may have on our business and no assurance can be given that our operations will not be affected by such laws and/or regulations.

The PRC government exerts substantial influence over the manner in which companies in China must conduct their business activities.

The PRC only recently has permitted greater provincial and local economic autonomy and private economic activities. The government of the PRC has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in the PRC or particular regions thereof. If this were to occur, we may be required to divest the interests we then control in Chinese properties. Any such developments could have a material adverse effect on our business, operations, financial condition and prospects.

Future inflation in China may inhibit economic activity and adversely affect our operations.

The Chinese economy has experienced periods of rapid expansion in recent years which has led to high rates of inflation and deflation. This has caused the PRC government to, from time to time, enact various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. While inflation has subsided since 1995, high inflation may in the future cause the PRC government to once again impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China. Any action on the part of the PRC government that seeks to control credit and/or prices may adversely affect our business operations.

A slowdown or other adverse developments in the PRC economy may materially and adversely affect our customers, demand for our products and our business.

We are a holding company and our operations are entirely conducted in the PRC. In addition, all of our revenues are currently generated from sales in the PRC. Although the PRC economy has grown at a remarkable pace in recent years, we cannot assure you that such growth will continue. A slowdown in overall economic growth, an economic downturn or recession or other adverse economic developments in the PRC may materially reduce the demand for our products and have a materially adverse effect on our business.

| 14 |

We may be restricted from freely converting the Renminbi to other currencies in a timely manner.

At the present time, the RMB is not a freely convertible currency. We receive all of our revenue in RMB, which may need to be converted to other currencies, primarily U.S. dollars, in order to be remitted outside of the PRC. Effective July 1, 1996, foreign currency “current account” transactions by foreign investment enterprises are no longer subject to the approval of State Administration of Foreign Exchange (“SAFE,” formerly, “State Administration of Exchange Control”), but need only a ministerial review, according to the Administration of the Settlement, Sale and Payment of Foreign Exchange Provisions promulgated in 1996 (the “FX regulations”). “Current account” items include international commercial transactions, which occur on a regular basis, such as those relating to trade and provision of services. Distributions to joint venture parties also are considered “current account transactions.” Other non-current account items, known as “capital account” items, remain subject to SAFE approval. Under current regulations, we can obtain foreign currency in exchange for RMB from swap centers authorized by the government. While we do not anticipate problems in obtaining foreign currency to satisfy our requirements; however, no assurance can be given that foreign currency shortages or changes in currency exchange laws and regulations by the PRC government will not restrict us from freely converting RMB in a timely manner.

Governmental control of currency conversion may affect the value of your investment.

The PRC government imposes controls on the convertibility of Renminbi into foreign currencies and, in certain cases, the remittance of foreign currency out of the PRC. We receive all of our revenues in Renminbi, which is currently not a freely convertible currency. Shortages in the availability of foreign currency may restrict our ability to remit sufficient foreign currency to pay dividends, or otherwise satisfy foreign currency denominated obligations. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from the transaction, can be made in foreign currencies without prior approval from the PRC State Administration of Foreign Exchange by complying with certain procedural requirements. However, approval from appropriate governmental authorities is required where Renminbi is to be converted into foreign currency and remitted out of the PRC to pay capital expenses such as the repayment of bank loans denominated in foreign currencies.

Further, the PRC government may also restrict access to foreign currencies for current account transactions. If the foreign exchange control system prevents us from obtaining sufficient foreign currency to satisfy our currency demands, we may not be able to pay certain of our expenses as they come due.

Fluctuations in the exchange rate could have an adverse effect upon our business and reported financial results.

We conduct our business in Renminbi (“RMB”), thus our functional currency is the RMB, while our reporting currency is the U.S. dollar. The value of the RMB against the U.S. dollar and other currencies may fluctuate and is affected by, among other things, the political situation as well as economic policies and conditions. On July 21, 2005, the PRC government changed its decade old policy of pegging its currency to the U.S. currency. Under that policy, the RMB is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. This change in policy has resulted in an approximate 21% appreciation of the RMB against the U.S. dollar between 2005 and 2008. However, the PRC government decided to repeg the RMB to U.S.dollars in response to the financial crisis in 2008. On June 19, 2010, China ended the pegging of the RMB to the U.S.dollar, allowing for a greater flexibility of its exchange rate. There remains significant international pressure on the significant appreciation of the RMB against the U.S. dollar. To the extent any of our future revenues are denominated in currencies other than the United States dollar, we would be subject to increased risks relating to foreign currency exchange rate fluctuations which could have a material adverse effect on our financial condition and operating results since operating results are reported in United States dollars and significant changes in the exchange rate could materially impact our reported earnings.

Changes in PRC State Administration of Foreign Exchange (“SAFE”) Regulations regarding offshore financing activities by PRC residents may increase the administrative burden we face and create regulatory uncertainties that could adversely affect the implementation of our acquisition strategy.

In 2005, SAFE promulgated regulations which require registrations with, and approval from, SAFE on direct or indirect offshore investment activities by PRC legal person resident and/or natural person resident. The SAFE regulations require that if an offshore company formed by or controlled by PRC legal person resident and/or natural person resident, whether directly or indirectly, intends to acquire a PRC company, such acquisition shall be subject to strict examination and registration with SAFE. Without such registration, the PRC entity cannot remit any of its profits out of the PRC, whether as dividends or otherwise. As such, the failure by our shareholders who are PRC residents to make any required applications, filings or registrations pursuant to such SAFE regulations may prevent us from being able to distribute profits and could expose us, as well as our PRC resident shareholders to liability under PRC law.

| 15 |

Because our principal assets are located outside of the United States and most of our directors and officers reside outside of the United States, it may be difficult for an investor to enforce any right founded on U.S. Federal Securities Laws against us and/or our officers and directors, or to enforce a judgment rendered by a United States court against us or our officers and directors.

Our operation and principle assets are located in the PRC, and our officers and directors are non-residents of the United States. Therefore, it may be difficult to effect service of process on such persons in the United States, and it may be difficult to enforce any judgments rendered against us or our officers and/or directors. As a result, it may be difficult or impossible for you to bring an action against us or against these individuals in China in the event that you believe that your rights have been infringed under the securities laws or otherwise. Even if you are successful in bringing an action of this kind, the laws of the PRC may render you unable to enforce a judgment against our assets or the assets of our directors and officers. As a result of all of the above, our shareholders may have more difficulty in protecting their interests through actions against our management, directors or major shareholders compared to shareholders of a corporation doing business entirely within the United States.

Regulatory Risks

State and Local Regulation

The Company may be subject to the separate regulations pertaining to commercial private lenders, specific property types or specific types of borrowers in each particular state, county, municipality or country. The Company may fail to comply with all of such regulations, or may incur significant costs in complying with such regulations.

Usury Laws

Although the Company intends for the Company’s debt to be fully compliant with law, the terms of such debts may be determined by a court to be usurious.

Risks Relating to Our Common Stock

We are an emerging growth company and, as a result of the reduced disclosure and governance requirements applicable to emerging growth companies, our common stock may be less attractive to investors.

We are an emerging growth company, as defined in the JOBS Act, and we are eligible to take advantage of certain exemptions from various reporting requirements applicable to other public companies, but not to emerging growth companies, including, but not limited to, a requirement to present only two years of audited financial statements, an exemption from the auditor attestation requirement of Section 404 of the Sarbanes-Oxley Act, reduced disclosure about executive compensation arrangements pursuant to the rules applicable to smaller reporting companies and no requirement to seek non-binding advisory votes on executive compensation or golden parachute arrangements, although some of these exemptions are available to us as a smaller reporting company (i.e. a company with less than $75 million of its voting equity held by affiliates). We have elected to adopt these reduced disclosure requirements. We cannot predict if investors will find our common stock less attractive as a result of our taking advantage of these exemptions. If some investors find our common stock less attractive as a result of our choices, there may be a less active trading market for our common stock and our stock price may be more volatile.

Pursuant to Section 107(b) of the JOBS Act, we have elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(2) of The JOBS Act. This election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result, our financial statements may not be comparable to companies that comply with public company effective dates. The decision to opt out is irrevocable.

Because the worldwide market value of our common stock held by non-affiliates, or public float, is below $75 million, we are also a “smaller reporting company” as defined under the Exchange Act. Some of the foregoing reduced disclosure and other requirements are also available to us because we are a smaller reporting company and may continue to be available to us even after we are no longer an emerging growth company under the JOBS Act but remain a smaller reporting company under the Exchange Act. As a smaller reporting company we are not required to:

| · | have an auditor report on our internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; and |

| · | present more than two years of audited financial statements in our registration statements and annual reports on Form 10-K and present any selected financial data in such registration statements and annual reports filings made by the Company on the EDGAR Company Search page of the Securities and Exchange Commission's Web site, the address for which is www.sec.gov. The public may read and copy any materials the Company files with the SEC at the SEC's Public. |

| 16 |

Because we are subject to “penny stock” rules, the level of trading activity in our stock may be reduced.

Broker-dealer practices in connection with transactions in “penny stocks” are regulated by penny stock rules adopted by the Securities and Exchange Commission. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on some national securities exchanges). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market, and monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, broker-dealers who sell these securities to persons other than established customers and “accredited investors” must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. Consequently, these requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a security subject to the penny stock rules. If a trading market does develop for our common stock, these regulations will likely be applicable, and investors in our common stock may find it difficult to sell their shares.

FINRA sales practice requirements may limit a stockholder’s ability to buy and sell our stock.

FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may have the effect of reducing the level of trading activity in our common stock. As a result, fewer broker-dealers may be willing to make a market in our common stock, reducing a stockholder’s ability to resell shares of our common stock.

The price of our common stock may be volatile, which substantially increases the risk that you may not be able to sell your shares at or above the price that you may pay for the shares.

Our common stock is not currently quoted or listed on any exchange or electronic quotation system. There is no assurance that any trading market will ever develop for our shares of common stock. Even if a trading market does develop for our common stock, the market price of our common stock may be volatile. It may fluctuate significantly in response to the following factors:

| · | Variations in quarterly operating results; |

| · | Our announcements of significant contracts and achievement of milestones; |

| · | Our relationships with other companies or capital commitments; |

| 17 |

| · | Additions or departures of key personnel; |

| · | Sales of common stock or termination of stock transfer restrictions; |

| · | Changes in financial estimates by securities analysts, if any; and |

| · | Fluctuations in stock market price and volume. |

Your inability to sell your shares during a decline in the price of our stock may increase losses that you may suffer as a result of your investment.

Our insiders beneficially own a significant portion of our stock, and accordingly, may have control over stockholder matters, the Company’s business and management.

The percentage ownership information shown in the table below is calculated based on 13,604,000 shares of our common stock issued and outstanding as of December 31, 2014. We do not have any outstanding options, warrants or other securities exercisable for or convertible into shares of our common stock.

| Amount and Nature | ||||||||||

| Title of | of Beneficial | |||||||||

| Class | Name of Beneficial Owner | Ownership | Percentage | |||||||

| Common Stock | Junsheng Zhang | 11,160,000 | 82 | % | ||||||

| President, Chairman of the board. | Direct | |||||||||

| Common Stock | Weiguang Song | 252,000 | 1.9 | % | ||||||

| Direct | ||||||||||

| Common Stock | Yanhua Xing | 588,000 | 4.3 | % | ||||||

| Direct | ||||||||||

| All Officers and Directors as a Group | 12,000,000 | 88.2 | % | |||||||

As a result, our executive officers, directors and affiliated persons will have significant influence to:

| · | Elect or defeat the election of our directors; |

| · | Amend or prevent amendment of our articles of incorporation or bylaws; |

| · | Effect or prevent a merger, sale of assets or other corporate transaction; and |

| · | Affect tome of any other matter submitted to the stockholders for vote. |

Moreover, because of the significant ownership position held by our insiders, new investors will not be able to effect a change in the Company’s business or management, and therefore, shareholders would be subject to decisions made by management and the majority shareholders.

In addition, sales of significant amounts of shares held by our directors and executive officers, or the prospect of these sales, could adversely affect the market price of our common stock. Management’s stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over our stock price.

The sale of securities by us in any equity or debt financing could result in dilution to our existing stockholders and have a material adverse effect on our earnings.

| 18 |

We are authorized to issue up to 100,000,000 shares of common stock, of which 13, 604,000 shares are issued and outstanding. Our Board of Directors has the authority to cause us to issue additional shares of common stock, and to determine the rights, preferences and privilege of such shares, without consent of any of our stockholders. Any sale of common stock by us in a future private placement offering could result in dilution to the existing stockholders as a direct result of our issuance of additional shares of our capital stock. In addition, our business strategy may include expansion through internal growth by acquiring complementary businesses, acquiring or licensing additional brands, or establishing strategic relationships with targeted customers and suppliers. In order to do so, or to finance the cost of our other activities, we may issue additional equity securities that could dilute our stockholders’ stock ownership. We may also assume additional debt and incur impairment losses related to goodwill and other tangible assets, and this could negatively impact our earnings and results of operations.

If securities or industry analysts do not publish research or reports about our business, or if they downgrade their recommendations regarding our common stock, our stock price and trading volume could decline.

The trading market for our common stock may be influenced by the research and reports that industry or securities analysts publish about us or our business. If any of the analysts who cover us downgrade our common stock, our common stock price would likely decline. If analysts cease coverage of our company or fail to regularly publish reports on us, we could lose visibility in the financial markets, which in turn could cause our common stock price or trading volume to decline.

If we continue to fail to maintain an effective system of internal controls, we might not be able to report our financial results accurately or prevent fraud; in that case, our stockholders could lose confidence in our financial reporting, which could negatively impact the price of our stock.

Effective internal controls are necessary for us to provide reliable financial reports and prevent fraud. In addition, Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, requires us to evaluate and report on our internal control over financial reporting for all our current operations. The process of implementing our internal controls and complying with Section 404 will be expensive and time - consuming, and will require significant attention of management. We cannot be certain that these measures will ensure that we implement and maintain adequate controls over our financial processes and reporting in the future. Even if we conclude, and our independent registered public accounting firm concurs, that our internal control over financial reporting provides reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles, because of its inherent limitations, internal control over financial reporting may not prevent or detect fraud or misstatements. Failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm our operating results or cause us to fail to meet our reporting obligations. If we or our independent registered public accounting firm discover a material weakness or a significant deficiency in our internal control, the disclosure of that fact, even if quickly remedied, could reduce the market’s confidence in our financial statements and harm our stock price. In addition, a delay in compliance with Section 404 could subject us to a variety of administrative sanctions, including ineligibility for short form resale registration, action by the Securities and Exchange Commission, and the inability of registered broker-dealers to make a market in our common stock, which could further reduce our stock price and harm our business.

Because we do not intend to pay any dividends on our common stock, holders of our common stock must rely on stock appreciation for any return on their investment.

There are no restrictions in our Articles of Incorporation or Bylaws that prevent us from declaring dividends. The Florida Revised Statutes, however, do prohibit us from declaring dividends where, after giving effect to the distribution of the dividend we would not be able to pay our debts as they become due in the usual course of business; or our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution. We paid dividends on our common stock in 2013, we do not anticipate paying any such dividends for the foreseeable future. Accordingly, holders of our common stock will have to rely on capital appreciation, if any, to earn a return on their investment in our common stock.

The requirements of being a public company may strain our resources, divert management’s attention and affect our ability to attract and retain qualified members for our Board of Directors.

As a public company, we will be subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Sarbanes-Oxley Act. The requirements of these rules and regulations increase our legal, accounting and financial compliance costs, may make some activities more difficult, time-consuming and costly and may also place undue strain on our personnel, systems and resources.

| 19 |

In order to maintain and improve the effectiveness of our disclosure controls and procedures and internal control over financial reporting, we will need to expend significant resources and provide significant management oversight. We have a substantial effort ahead of us to implement appropriate processes, document our system of internal control over relevant processes, assess their design, remediate any deficiencies identified and test their operation. As a result, management’s attention may be diverted from other business concerns, which could harm our business, operating results and financial condition. These efforts will also involve substantial accounting-related costs.

As a result of these and other factors, our operating results may not meet the expectations of investors or public market analysts who choose to follow our company. Our failure to meet market expectations would likely result in decreases in the trading price of our common stock.

| Item 2. | Properties. |

On November 10, 2013, Jiarun Hospital entered into a Rental Agreement to lease an old hospital building from Junsheng Zhang, the renting agreement for the old hospital building contains the following provisions:

| • | Rental payments of RMB85, 000 per month. |

| • | The renting period is from January 1, 2014 to September 30, 2014 |

| • | Jiarun Hospital is responsible for paying and undertaking all expenses incurred during the rental period, expenses are include: water charge, electricity charge, gas fee, telephone costs, cleaning, heating fee and property management fee, as well as other taxes and expenses. |

| • | The building is to be used solely for Harbin Jiarun Hospital Co., Ltd’s operations. |

| • | During the rental period, the building maintenance costs will be paid by Jiarun Hospital. |

On September 30, 2014, Jiarun Hospital renewed the Rental Agreement extending the renting period from October 1, 2014 to November 30, 2014.

| 20 |

| Item 2. | Properties - continued |

The old hospital building has over 3,200 square meters on 7 floors. It is working close to its maximum capacity. Current organic growth is limited by operation capacity. With the increase of our business, the old hospital building is not sufficient for our purposes.