Attached files

| file | filename |

|---|---|

| EX-31.1 - EX-31.1 - Freshpet, Inc. | frpt-ex311_20141231283.htm |

| EX-32.1 - EX-32.1 - Freshpet, Inc. | frpt-ex321_20141231282.htm |

| EX-31.2 - EX-31.2 - Freshpet, Inc. | frpt-ex312_20141231284.htm |

| EX-23.1 - EX-23.1 - Freshpet, Inc. | frpt-ex231_20141231306.htm |

| EX-10.17 - EX-10.17 - Freshpet, Inc. | frpt-ex1017_20141231280.htm |

| EX-10.18 - EX-10.18 - Freshpet, Inc. | frpt-ex1018_20141231281.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Freshpet, Inc. | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

Commission File Number 001-36729

Freshpet. Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

20-1884894 |

|

(State of Incorporation) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

400 Plaza Drive, 1st Floor Secaucus, New Jersey |

|

07094 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

(201) 520-4000

(Registrant’s telephone number, including area code)

__________________

Securities registered pursuant to Section 12(g) of the Act: None

|

Title of each class |

|

Name of exchange on which registered |

|

Common Stock, $0.001 par value per share |

|

NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

¨ |

|

|

|

|

|

|||

|

Non-Accelerated filer |

|

x (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

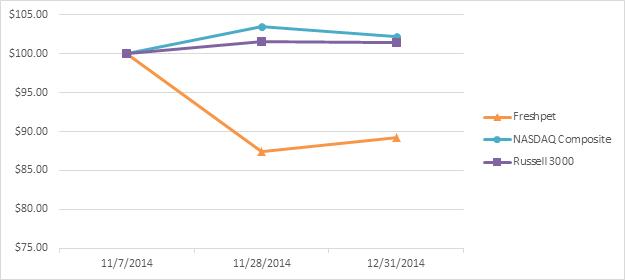

As of June 30, 2014, the last business day of the registrant’s most recently completed third fiscal quarter, there was no established public trading market for the registrant’s equity securities. The registrant’s common stock, par value $0.001, began trading on the NASDAQ Global Market on November 7, 2014.

As of March 27, 2015, 33,470,732 shares of common stock of the registrant were outstanding.

Documents Incorporated By Reference

Portions of the definitive Proxy Statement of the registrant to be filed pursuant to Regulation 14A of the general rules and regulations under the Securities Exchange Act of 1934, as amended, for the 2015 annual meeting of stockholders of the registrant are incorporated by reference into Part III of this Annual Report on Form 10-K. The Proxy Statement or an amended report on Form 10-K will be filed within 120 days of the registrant’s year ended December 31, 2014.

Table of Contents

Freshpet, Inc.

Annual Report on Form 10-K

TABLE OF CONTENTS

|

|

|

|||

|

Item 1 |

|

|

4 |

|

|

Item 1A |

|

|

10 |

|

|

Item 1B |

|

|

22 |

|

|

Item 2 |

|

|

22 |

|

|

Item 3 |

|

|

22 |

|

|

Item 4 |

|

|

23 |

|

|

|

|

|

|

|

|

|

|

|||

|

Item 5 |

|

|

24 |

|

|

Item 6 |

|

|

26 |

|

|

Item 7 |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operation |

|

30 |

|

Item 7A |

|

|

44 |

|

|

Item 8 |

|

|

45 |

|

|

Item 9 |

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

|

67 |

|

Item 9A |

|

|

67 |

|

|

Item 9B |

|

|

67 |

|

|

|

|

|

|

|

|

|

|

|||

|

Item 10 |

|

|

68 |

|

|

Item 11 |

|

|

68 |

|

|

Item 12 |

|

Security Ownership of Certain Beneficial Owners and Management and Relate Stockholder Matters |

|

68 |

|

Item 13 |

|

Certain Relationships and Related Transactions, and Director Independence |

|

68 |

|

Item 14 |

|

|

68 |

|

|

|

|

|

|

|

|

|

|

|||

|

Item 15 |

|

|

69 |

|

|

Signatures |

|

|

|

|

2

Forward-Looking Statements

This report contains forward-looking statements that are subject to risks and uncertainties. All statements other than statements of historical fact included in this report are forward-looking statements. Forward-looking statements discuss our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “aim,” “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “outlook,” “potential,” “project,” “projection,” “plan,” “intend,” “seek,” “may,” “could,” “would,” “will,” “should,” “can,” “can have,” “likely,” the negatives thereof and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. They appear in a number of places throughout this report and include statements regarding our intentions, beliefs or current expectations concerning, among other things, our results of operations, financial condition, liquidity, prospects, growth, strategies and the industry in which we operate. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected, including:

|

· |

our ability to successfully implement our growth; |

|

· |

our ability to generate sufficient cash flow or raise capital on acceptable terms; |

|

· |

the loss of key members of our senior management team; |

|

· |

allegations that our products cause injury or illness or fail to comply with government regulations; |

|

· |

the loss of a significant customer; |

|

· |

the effectiveness of our marketing and trade spending programs; |

|

· |

our ability to introduce new products and improve existing products; |

|

· |

our limited manufacturing capacity; |

|

· |

the impact of government regulation, scrutiny, warning and public perception; |

|

· |

the effect of false marketing claims; |

|

· |

adverse weather conditions, natural disasters, pestilences and other natural conditions affecting our operations; |

|

· |

our ability to develop and maintain our brand; |

|

· |

volatility in the price of our common stock; and |

|

· |

other factors discussed under the headings “Risk Factors”, “Business”, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this report. |

While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and it is impossible for us to anticipate all factors that could affect our actual results. Important factors that could cause actual results to differ materially from our expectations, or cautionary statements, are disclosed under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this report. All forward-looking statements are expressly qualified in their entirety by these cautionary statements. You should evaluate all forward-looking statements made in this report in the context of these risks and uncertainties.

3

Overview

Freshpet is disrupting the $22.5 billion North American pet food industry by driving consumers to reassess conventional dog and cat food offerings that have remained essentially unchanged for decades. We position our brand to benefit from mainstream trends of growing pet humanization and consumer focus on health and wellness. We price our products to be accessible to the average consumer, providing us with broad demographic appeal and allowing us to penetrate multiple classes of retail including grocery, mass, club, pet specialty and natural. We have successfully expanded our network of Freshpet Fridges within leading blue-chip retail chains including Albertsons, BJ’s, Kroger, Petco, PetSmart, Publix, Safeway, Target, Wal-Mart and Whole Foods. The strength of our business model extends to our customers, who we believe find that Freshpet grows their pet category sales, drives higher traffic, increases shopper frequency and delivers category leading margins. As of December 31, 2014, Freshpet Fridges were located in over 13,300 stores, and we believe there is an opportunity to install a Freshpet Fridge in at least 35,000 stores across North America.

Our Industry

We compete in the North American dog and cat food market, which had 2014 retail sales of over $22.5 billion and has grown at an average compounded annual growth rate of over 3% from 2007 to 2014, according to Euromonitor. According to the American Pet Products Association, or APPA, U.S. pet food spending is expected to continue to increase at a similar rate over the next 5 years. Of the total market, dog food, cat food, and treats & mixers accounted for retail sales of $12.1 billion, $6.8 billion, and $3.5 billion, respectively. The U.S. represented $20.8 billion or over 92% of North American dog and cat food sales. The pet food market has historically been resilient as consumers continue to spend on their pets even during economic downturns. Within the pet food market, premium and/or natural brands are gaining market share, according to Packaged Facts. According to a report from Packaged Facts, from 2008 to 2012, natural pet food in the United States grew at a compounded annual growth rate of 18% and is expected to grow at an annual rate of 17% for 2012 to 2017.

We believe the following trends are driving growth in our industry:

Pet ownership. There are currently over 84.6 million pet-owning households in the United States, according to the APPA. The percentage of U.S. households with dogs or cats (or both) has increased from 47.8% in 2006 to 52.3% in 2014. More U.S. households today have pets than have children, which we believe to be a result of demographic shifts and changing attitudes towards pets.

Pet humanization. According to Packaged Facts, 83% of U.S. pet owners view their pets as members of the family. As pets are increasingly viewed as companions, friends, and family members, pet owners are being transformed into “pet parents” who spare no expense for their loved ones, driving premiumization across pet categories. This trend is reflected in food purchasing decisions. Nearly 80% of U.S. pet owners are as concerned about the quality of their pet’s food as they are about their own, according to Market researcher Mintel.

Increasing consumer focus on health & wellness. Consumers are increasingly purchasing fresh, natural, and organic food products. According to Euromonitor, from 2002 to 2014, the U.S. natural and organic food market grew at a compound annual growth rate of over 9%, compared to the overall U.S. food market’s growth rate of 2.8%. We believe consumers are seeking simple, fresh and easy to understand food products from brands they trust and made with ingredients that are transparently sourced.

The pet food purchasing decision is underpinned by higher brand loyalty than many other consumer packaged goods categories. A consumer selecting a pet food brand resists frequent switching in order to avoid disrupting the pet’s diet, resulting in high repeat purchasing behavior. As a result, we believe that as consumers try fresh, refrigerated pet food, they are likely to become repeat users of the product.

Our Opportunity

Even though long-term consumer trends of pet humanization and health and wellness are well documented, conventional pet food sold as dry kibble or in wet cans has not changed substantially for decades. We believe that the pet food industry has not kept pace with how consumers think about food for their families, including their pets. As a result, consumers are

4

searching for higher quality, less processed food for their dogs and cats—meals that measure up to today’s sensibilities of what actually constitutes “good food.” Freshpet was specifically designed to address this growing need with affordable offerings accessible to the average consumer.

Our Mission and Values

We started Freshpet with a single-minded mission—to bring the power of real, fresh food to our dogs and cats. And, we are committed to doing so in ways that are good for Pets, People and Planet.

Pets

Our pets are members of our family and deserve to eat the kind of fresh, healthy food that we do. We cook our fresh, nutritious pet food with the same care that we would take in preparing human food. Through the Freshpet Foundation, we support nutritional research in areas of prevention, care and treatment of diseases in dogs. Since founding Freshpet, we have donated over two million fresh meals to pets via shelters, charitable organizations and humane societies. Our team members get paid time off to pursue activities that help pets in their community. We also participate in Random Acts of Kindness to do our part to improve the lives of pets and pet parents.

People

People include our team members, our partners and pet parents. We treat our team members with respect and are committed to helping them develop professionally and personally. We try to be good partners with customers, distributors and suppliers by conducting business with honesty and transparency. Additionally, we strive to help pet owners by providing pet parenting resources.

Planet

We are committed to being socially responsible and minimizing our environmental impact. The electricity used in the Freshpet Kitchens is 100% wind-powered. We also strive to conserve energy by continually improving the efficiency of our Freshpet Fridges and partnering with freight and logistics providers committed to sustainable practices.

Our commitment to our values helps us engage with consumers, motivate our team members and attract strong partners, which allows us to fulfill our mission of delivering the best nutritional product choices to improve the well-being of our pets, enrich pet parents’ lives and contribute to communities. Freshpet—Pets, People, Planet.

Our Products

Our products consist of dog food, cat food and dog and cat treats. All Freshpet products are made according to our nutritional philosophy of fresh, meat-based nutrition and minimal processing. Our proprietary recipes include real, fresh meat and varying combinations of vitamin-rich vegetables, leafy greens and anti-oxidant rich fruits, without the use of preservatives, additives or artificial ingredients. Our unique product attributes appeal to diverse consumer needs across multiple classes of retail where Freshpet is sold. Consequently, our brand resonates across a broad cross-section of pet parent demographics.

All of our products are sold under the Freshpet brand name, with ingredients, packaging and labeling customized by class of retail. Our products are available in multiple forms, including slice and serve rolls, bagged meals and tubs.

5

We also offer fresh and frozen treats across all classes of retail under the Dognation and Dog Joy labels, which accounted for 12% of total net sales in 2014.

Our Product Innovation

As the first and only manufacturer of fresh, refrigerated pet food distributed across North America, product innovation is core to our strategy. We take a fresh approach to pet food and are not constrained by conventional pet food products, attributes and production capabilities. We employ a tightly-knit, creative team of marketing and research and development professionals, and we consult with outside experts through our Nutrition Council, which includes leading microbiologists and veterinary nutritionists. Our team often identifies pet parents’ needs by evaluating emerging demand trends in both pet food and human food. Our fully equipped research and development facility located near the Freshpet Kitchens tests small batches of new recipes and tries out new cooking techniques. New products are refined iteratively with the help of consumer panel data to arrive at products that we believe can be commercially successful.

The success of our approach is evidenced by our broad product portfolio today. We began Freshpet by producing fresh, refrigerated slice and serve rolls, and over time have steadily expanded into successful new product forms including bags, tubs and treats. We also introduced new recipes and ingredients, such as proteins and grain-free options, never before seen in pet food that cater to the specific dietary requirements of pets.

For the year ended 2014, new product introductions since 2011 represented 37% of our net sales. We have a strong innovation pipeline, including entirely new product platforms, which expand the breadth of our fresh offerings. We expect that new product introductions will continue to meaningfully drive growth going forward.

Our Supply Chain

Manufacturing: All of our products are manufactured in the United States. We own and operate what we believe to be the only fresh, refrigerated pet food manufacturing facility in North America, the Freshpet Kitchens at Bethlehem, Pennsylvania. This 58,000 square foot facility completed in 2013 was built to human grade food standards and houses two production lines customized to produce fresh, refrigerated food. In 2014, over 95% of our product volume was manufactured by us. For manufacture of some low volume products, we strategically partner with a select group of contract manufacturers that operate human food manufacturing facilities.

Ingredients and Packaging: Our products are made with natural and fresh ingredients including meat, vegetables, fruits, whole grains, vitamins and minerals. We use high quality food grade plastic packaging materials. Over 70% of our ingredients are sourced locally from within a 175 mile radius of the Freshpet Kitchens, 97% are from North America and none are sourced from China. We maintain rigorous standards for ingredient quality and safety. By volume, our largest input, antibiotic-free fresh chicken, represents approximately 50% of total ingredients. In order to retain operating flexibility and negotiating leverage, we do not enter into exclusivity agreements or long term commitments with any of our suppliers. All of our suppliers are well-established companies that have the scale to support our growth. For every ingredient, we either use multiple suppliers or have identified alternative sources of supply that meet our quality and safety standards.

Distribution: Outbound transportation from our facility is handled through a partnership with a leading human food manufacturer, which also warehouses and delivers our refrigerated products to grocery retail accounts across North America. This partnership is governed by a written agreement pursuant to which our products are stored and shipped on a cost-plus basis. As a result, as our volumes grow, we expect to be able to leverage our distribution costs. We use national and regional distributors to cover the mass, pet specialty and natural retail classes. Our agreements with other distributors are based on regional mutual exclusivity within each region for the fresh refrigerated pet category.

Our Product Quality and Safety

We go to great lengths to ensure product quality, consistency and safety from ingredient sourcing to finished product. Our company-owned manufacturing facility allows us to exercise significant control over production. Our quality assurance team includes nine professionals with significant experience in pet and human food production.

6

Our production processes are designed to meet science-based quality standards with documented plans for Hazard Analysis Critical Control Points and Hazard Analysis Risk Based Preventive Control to monitor established production controls, calibrate instruments, record data and perform corrective actions. Our on-site laboratory has microbial and composition testing capabilities. Quality control approvals are based on a positive release strategy, wherein a batch can only be shipped when it passes control point record reviews and laboratory testing. At the end of each working day, a third shift consisting of a cleaning crew sanitizes all equipment that is in contact with food material. Before commencing production the next day, quality assurance professionals swab equipment to test for potential contaminants.

Freshpet’s food safety program is certified at Safe Quality Food Level III, which is the highest standard determined under the Global Food Safety Initiative Benchmarks. We believe our systems and standards for product quality and safety can support our growth and ensure continued success in the market.

Our Customers and Distributors

We sell our products throughout North America, generating the vast majority of our sales in the United States. The strength of our business model makes us an attractive partner for leading blue-chip retailers, who we believe find that Freshpet grows the sales of their pet category, drives higher traffic, increases shopper frequency and delivers category-leading margins. Our Freshpet Fridge locations have been consistently increasing as we add new retail accounts and add stores in existing accounts. We are in over 13,300 stores and believe there is opportunity for us to install a Freshpet Fridge in at least 35,000 stores in North America. We sell our products through the following classes of retail: grocery, mass, club, pet specialty and natural.

Our customers determine whether they wish to purchase our products either directly from us or through a third party distributor. In 2014, our largest distributor by net sales, McLane Company, Inc., which sells to three of our customers, including Wal-Mart and Target, accounted for 22% of our net sales. No other distributor or customer accounted for more than 10% of our net sales in 2014.

The Freshpet Fridge

We sell our products through a growing network of company-owned branded refrigerators, the Freshpet Fridges. Our Freshpet Fridges are typically four feet wide by seven feet high, and replace standard shelving in the pet aisle or an end-cap of a retail store. Our Freshpet Fridge designs are constantly evolving with all new models featuring prominent edge-lit LED headers, LED interior lighting, crisp black interiors, and frameless glass swing doors for aesthetics and easy access. We use state-of-the-art refrigeration technology and environmentally friendly refrigerants to minimize energy consumption and environmental impact.

We design, produce, install and maintain the Freshpet Fridge through a combination of in-house resources and world-class partners. We source our Freshpet Fridges from three leading global commercial refrigerator manufacturers with whom we have a collaborative approach to refrigerator design and innovation. Once ordered by us, Freshpet Fridges are shipped to distribution centers for delivery and installation in retail stores.

Installation into retail locations and ongoing maintenance of the Freshpet Fridge is coordinated by Freshpet and executed through leading third-party service providers. All of our Freshpet Fridges are protected by a manufacturer warranty for one to three years. Our refrigerators are designed to be highly reliable, and at any given time less than 1% of the network is out of service for maintenance. Moreover, to ensure quality, cleanliness and appropriate in-stock levels, we employ brokerage partners to conduct a physical audit of the Freshpet Fridge network on an ongoing basis, with photographic results of every Freshpet Fridge in the network transmitted back to Freshpet and reviewed by members of our sales team.

We currently estimate less than 15 month cash-on-cash payback for the average Freshpet Fridge installation, calculated by comparing our total current costs for a refrigerator (including installation and maintenance) to our current margin on net revenues. We believe our attractive value proposition to retailers and pet parents will allow us to continue penetrating store locations of existing and new customers. The Freshpet Fridge provides a highly-visible merchandising platform, allows us to control how our brand is presented to consumers at point-of-sale and represents a significant point of differentiation from other pet food competitors.

Marketing and Advertising

Our marketing strategy is designed to educate consumers about the benefits of fresh refrigerated pet food and build awareness of the Freshpet brand. We deploy a broad set of marketing tools across television, digital and public relations to reach consumers through multiple touch points and increase product trials.

7

Our network of over 13,300 branded Freshpet Fridges in prominent locations within blue-chip retailers helps to introduce consumers to our brand and instantly distinguish Freshpet from traditionally merchandised pet food. Since 2011, we have effectively used national TV advertising to drive incremental consumers to try Freshpet products. We expect to realize greater benefits from national TV advertising as we continue to grow the network of Freshpet store locations nationwide. More recently, we have expanded our online presence to better target consumers seeking information on healthy pet food. We reach consumers across multiple digital and social media platforms including websites, blogs and online reviews, as well as with tailored messaging on popular digital hubs including Facebook, Twitter and YouTube. Our public relations strategy includes event marketing and the use of our Freshpet truck to create buzz among pet parents at high pet traffic areas.

Our marketing strategy has allowed us to drive new consumers to our brand and develop a highly engaged community of users who actively advocate for Freshpet.

Competition

Pet food is a highly competitive industry. We compete with manufacturers of conventional pet food such as Mars, Nestlé and Big Heart Pet Brands (part of The J.M. Smucker Company). We also compete with specialty and natural pet food manufacturers such as Colgate-Palmolive, Blue Buffalo and Merrick. In addition, we compete with many regional niche brands in individual geographic markets.

Given a North American retail landscape dominated by large retailers, with limited shelf space and a significant number of competing products, competitors actively support their brands through marketing, advertising, promotional spending and discounting.

Competitive factors in the pet food industry include product quality, ingredients, brand awareness and loyalty, product variety, product packaging and design, reputation, price, advertising, promotion and nutritional claims. We believe that we compete effectively with respect to each of these factors. Moreover, our fresh, refrigerated product offering and secured shelf space in the form of the Freshpet Fridge offer significant advantages against competitors.

Team Members

As of December 31, 2014, we had 162 employees all of whom are located in the United States. None of our employees is represented by a labor union or by any collective bargaining arrangements with respect to his or her employment with us. We believe that our employee relations are good.

Our Corporate Information

We were incorporated in Delaware in November 2004 and currently exist as a Delaware corporation. Our principal executive offices are located at 400 Plaza Drive, 1st Floor, Secaucus, New Jersey 07094. Our telephone number is (201) 520-4000.

Website Information

The address of our corporate website is www.freshpet.com. Our Annual Report on Form 10-K, annual proxy statement and related proxy card will be made available on our website at the same time they are mailed to stockholders. Our quarterly reports on Form 10-Q, periodic reports on Form 8-K and amendments to those reports that we file or furnish pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available through our website, free of charge, as soon as reasonably practicable after they have been electronically filed or furnished to the SEC. Our website also provides access to reports filed by our directors, executive officers and certain significant shareholders pursuant to Section 16 of the Securities Exchange Act of 1934. In addition, our Corporate Governance Guidelines, General Code of Ethics, Code of Ethics for Executive Officers and Principal Accounting Personnel and charters for the committees of our board of directors are available on our website as well as other shareholder communications. The information contained in or that can be accessed through our website does not constitute a part of, and is not incorporated by reference into, this report. The SEC also maintains a website, www.sec.gov, which contains reports, proxy and information statements and other information that we file electronically with the SEC.

Trademarks and Other Intellectual Property

We believe that our rights in our trademarks and service marks are important to our marketing efforts to develop brand recognition and differentiate our brand from our competitors and are a valuable part of our business. We own a number of trademarks and service marks that have been registered, or for which applications are pending, with the United States

8

Patent and Trademark Office including, among others, Freshpet, Vital, Nature’s Fresh, Roasted Meals, Freshpet Dog Joy Treats and Dognation.

We believe that our intellectual property has substantial value and has significantly contributed to our success to-date. We are continually developing new technology and enhancing proprietary technology related to our pet food, Fridges and manufacturing operations.

We also rely on unpatented proprietary expertise, recipes and formulations, continuing innovation and other trade secrets to develop and maintain our competitive position.

Government Regulation

Along with our brokers, distributors, and ingredients and packaging suppliers, we are subject to extensive laws and regulations in the United States by federal, state and local government authorities. In the United States, the federal agencies governing the manufacture, distribution and advertising of our products include, among others, the FTC, the FDA, the USDA, the United States Environmental Protection Agency and the Occupational Safety and Health Administration. Under various statutes, these agencies, among other things, prescribe the requirements and establish the standards for quality and safety and regulate our marketing and advertising to consumers. Certain of these agencies, in certain circumstances, must not only approve our products, but also review the manufacturing processes and facilities used to produce these products before they can be marketed in the United States. We are also subject to the laws of Canada, including the Canadian Food Inspection Agency, as well as provincial and local regulations.

We are subject to labor and employment laws, laws governing advertising, privacy laws, safety regulations and other laws, including consumer protection regulations that regulate retailers or govern the promotion and sale of merchandise. Our operations, and those of our distributors and suppliers, are subject to various laws and regulations relating to environmental protection and worker health and safety matters. We monitor changes in these laws and believe that we are in material compliance with applicable laws.

Information Systems

We employ a comprehensive enterprise resource planning (ERP) system provided and supported by a leading global software partner. This system covers order entry, customer service, accounts payable, accounts receivable, purchasing, asset management and manufacturing. Our order management process is automated via Electronic Data Interchange with virtually all our customers, which feeds orders directly to our ERP platform. From time to time, we enhance and complement the system with additional software. We are currently expanding our ERP system with a Warehouse Management System which will allow us to improve tracking and management of ingredients, streamline manufacturing and provide the ability to ship direct to customers. We expect the system to be operational during the first half of 2015.

We backup data every hour and store a copy locally for immediate restoration if needed. All data is transmitted to a secure offsite cloud storage service daily for disaster recovery needs. We believe our systems infrastructure is scalable and can support our future growth.

9

Investing in our common stock involves a high degree of risk. Before you purchase our common stock, you should carefully consider the risks described below and the other information contained in this prospectus, including our consolidated financial statements and accompanying notes. If any of the following risks actually occurs, our business, financial condition, results of operations or cash flows could be materially adversely affected. In any such case, the trading price of our common stock could decline, and you could lose all or part of your investment.

Risks Related to Our Business and Industry

We may not be able to successfully implement our growth strategy on a timely basis or at all.

Our future success depends, in large part, on our ability to implement our growth strategy of expanding distribution by installing new Freshpet Fridges, attracting new consumers to our brand and launching new products. Our ability to increase awareness, consumer trial and adoption of our products, and to implement this growth strategy depends, among other things, on our ability to:

|

· |

partner with customers to secure space for our Freshpet Fridges; |

|

· |

implement our marketing strategy; |

|

· |

develop new product lines and extensions; |

|

· |

partner with distributors to deliver our products to customers; |

|

· |

continue to compete effectively in multiple classes of retail, including grocery, mass, club, pet specialty and natural; and |

|

· |

expand and maintain brand loyalty. |

We may not be able to successfully implement our growth strategy or to grow consistently from period to period. Our business, financial condition and results of operations will be adversely affected if we fail to implement our growth strategy or if we invest resources in a growth strategy that ultimately proves unsuccessful.

We expect to need capital in the future, and we may not be able to generate sufficient cash flow or raise capital on acceptable terms to meet our needs.

Developing our business will require significant capital in the future. To meet our capital needs, we expect to rely on our cash flow from operations, the proceeds from our initial public offering, our credit facilities, and other third-party financing. Third-party financing in the future may not, however, be available on terms favorable to us, or at all. Our ability to obtain additional funding will be subject to various factors, including general market conditions, our operating performance, the market’s perception of our growth potential, lender sentiment and our ability to incur additional debt in compliance with other contractual restrictions, such as financial covenants under our debt documents.

Additionally, our ability to make payments on and to refinance our indebtedness and to fund planned expenditures for our growth plans will depend on our ability to generate cash in the future. If our business does not achieve the levels of profitability or generate the amount of cash that we anticipate or if we expand faster than anticipated, we may need to seek additional debt or equity financing to operate and expand our business.

We believe that cash and cash equivalents, expected cash flow from operations and planned borrowing capacity are adequate to fund debt service requirements, operating lease obligations, capital expenditures and working capital obligations for the foreseeable future. However, our ability to continue to meet these requirements and obligations will depend on, among other things, our ability to achieve anticipated levels of revenue and cash flow from operations and our ability to manage costs and working capital successfully. Additionally, our cash flow generation ability is subject to general economic, financial, competitive, legislative and regulatory factors and other factors that are beyond our control. We cannot assure you that our business will generate cash flow from operations in an amount sufficient to enable us to fund our liquidity needs. Further, our capital requirements may vary materially from those currently planned if, for example, our revenues do not reach expected levels or we have to incur unforeseen capital expenditures and make investments to maintain our competitive position. If this is the case, we may seek alternative financing, such as selling additional debt or equity securities, and we cannot assure you that we will be able to do so on favorable terms, if at all. Moreover, if we issue new debt securities, the debt holders would have rights senior to common stockholders to make claims on our assets, and the terms of any debt could restrict our operations, including our ability to pay dividends on our common stock. If we issue additional equity or convertible debt securities, existing stockholders may experience dilution, and such new securities could have rights senior to those of our common stock. These factors may make the timing, amount, terms and conditions

10

of additional financings unattractive. Our inability to raise capital could impede our growth or otherwise require us to forego growth opportunities and could materially adversely affect our business, financial condition and results of operations.

Failure to retain our senior management may adversely affect our operations.

Our success is substantially dependent on the continued service of certain members of our senior management, including Richard Thompson, our Chief Executive Officer. These members of senior management have been primarily responsible for determining the strategic direction of our business and for executing our growth strategy and are integral to our brand and culture, and the reputation we enjoy with suppliers, contract manufacturers, distributors, customers and consumers. The loss of the services of any of these employees could have a material adverse effect on our business and prospects, as we may not be able to find suitable individuals to replace them on a timely basis, if at all. In addition, any such departure could be viewed in a negative light by investors and analysts, which may cause the price of our common stock to decline.

If our products are alleged to cause injury or illness or fail to comply with governmental regulations, we may suffer adverse public relations, need to recall our products and experience product liability claims.

We may be exposed to product recalls, including voluntary recalls or withdrawals, and adverse public relations if our products are alleged to cause injury or illness or if we are alleged to have mislabeled or misbranded our products or otherwise violated governmental regulations. We may also voluntarily recall or withdraw products that we consider below our standards, whether for taste, appearance or otherwise, in order to protect our brand reputation. Consumer or customer concerns (whether justified or not) regarding the safety of our products could adversely affect our business. A product recall or withdrawal could result in substantial and unexpected expenditures, destruction of product inventory, and lost sales due to the unavailability of the product for a period of time, which could reduce profitability and cash flow. In addition, a product recall or withdrawal may require significant management attention. Product recalls, product liability claims (even if unmerited or unsuccessful), or any other events that cause consumers to no longer associate our brands with high quality and safe products may also result in adverse publicity, hurt the value of our brands, lead to a decline in consumer confidence in and demand for our products, and lead to increased scrutiny by federal and state regulatory agencies of our operations, which could have a material adverse effect on our business, financial condition and results of operations.

We also may be subject to product liability claims and adverse public relations if consumption or use of our products is alleged to cause injury or illness. While we carry product liability insurance, our insurance may not be adequate to cover all liabilities we may incur in connection with product liability claims. For example, punitive damages are generally not covered by insurance. In addition, we may not be able to continue to maintain our existing insurance, obtain comparable insurance at a reasonable cost, if at all, or secure additional coverage (which may result in future product liability claims being uninsured). A product liability judgment against us or our agreement to settle a product liability claim could also result in substantial and unexpected expenditures, which would reduce profitability and cash flow. In addition, even if product liability claims against us are not successful or are not fully pursued, these claims could be costly and time-consuming and may require management to spend time defending the claims rather than operating our business.

The loss of a significant customer, certain actions by a significant customer or financial difficulties of a significant customer could adversely affect our results of operations.

A relatively limited number of customers account for a large percentage of our net sales. During 2014, ten customers, who purchase either directly from us or through third party distributors, collectively accounted for more than 68% of our net sales. Wal-Mart and Target (which purchase through a distributor) are the only customers who accounted for more than 10% of our net sales during 2014. These percentages may increase if there is consolidation among retailers or if mass merchandisers grow disproportionately to their competition. We expect that a significant portion of our revenues will continue to be derived from a small number of customers; however, these customers may not continue to purchase our products in the same quantities as they have in the past. Our customers are generally not contractually obligated to purchase from us. Changes in our customers’ strategies, including a reduction in the number of brands they carry, shipping strategies, a shift of shelf space to or increased emphasis on private label products (including “store brands”), a reduction in shelf space for pet food items or a reduction in the space allocated for our Freshpet Fridges may adversely affect our sales. Requirements that may be imposed on us by our customers, such as sustainability, inventory management or product specification requirements, may have an adverse effect on our results of operations. Additionally, especially during economic downturns, our customers may face financial difficulties, bankruptcy or other business disruptions that may impact their operations and their purchases from us and may affect their ability to pay us for products purchased from us. Customers may grow their inventory in anticipation of a price increase, or in anticipation of, or during, our promotional events, which typically provide for reduced prices during a specified time or other customer or consumer

11

incentives. To the extent customers seek to reduce their usual or customary inventory levels or change their practices regarding purchases in excess of consumer consumption, our sales and results of operations could be adversely impacted in that period. If our sales of products to one or more of our significant customers are reduced, this reduction could have a material adverse effect on our business, financial condition and results of operations.

Our operating results depend, in part, on the sufficiency and effectiveness of our marketing and trade spending programs.

In general, due to the highly competitive nature of the businesses in which we compete, we must execute effective and efficient marketing investments and trade spending programs with respect to our businesses overall to sustain our competitive position in our markets. Marketing investments may be costly. Additionally, we may, from time to time, change our marketing and trade spending strategies, including the timing, amount or nature of television advertising and related promotional programs. The sufficiency and effectiveness of our marketing and trade spending practices is important to our ability to retain or improve our market share or margins. If our marketing and trade spending programs are not successful or if we fail to implement sufficient and effective marketing and trade spending programs, our business, financial condition and results of operations may be adversely affected.

The growth of our business depends on our ability to introduce new products and improve existing products in anticipation of changes in consumer preferences and demographics.

Our business is focused on the development, manufacture, marketing and distribution of pet food products. If consumer demand for our products decreased, our business would suffer. Sales of pet food products are subject to evolving consumer preferences and changing demographics. A significant shift in consumer demand away from our products or a decline in pet ownership could reduce our sales or the prestige of our brand, which would harm our business, financial condition and results of operations.

A key element of our growth strategy depends on our ability to develop and market new products and improvements to our existing products that meet our standards for quality and appeal to consumer preferences. The success of our innovation and product development efforts is affected by our ability to anticipate changes in consumer preferences and demographics, the technical capability of our product development staff in developing and testing product prototypes, including complying with governmental regulations, and the success of our management and sales team in introducing and marketing new products. Failure to develop and market new products that appeal to consumers could negatively impact our business, financial condition and results of operations.

Additionally, the development and introduction of new products requires substantial research, development and marketing expenditures, which we may be unable to recoup if the new products do not gain widespread market acceptance. Efforts to accelerate our innovation may exacerbate risks associated with innovation. If we are unsuccessful in meeting our objectives with respect to new or improved products, our business, financial condition and results of operations could be harmed.

Limited manufacturing capacity could have a material adverse effect on our business, financial condition, and results of operations.

All of the products we manufacture in-house are processed through our Freshpet Kitchens in Bethlehem, Pennsylvania, which we believe is North America’s only fresh, refrigerated pet food manufacturing facility. Accordingly, we have limited available manufacturing capacity to meet our quality standards. An unforeseen event, such as a natural disaster or work stoppage, at our Freshpet Kitchens could significantly limit our manufacturing capacity.

Accurate forecasting of sales demand is critical to ensuring available capacity. Our forecasts are based on multiple assumptions, which may cause our estimates to be inaccurate, affecting our ability to obtain adequate manufacturing capacity. Our current plans to meet expected production needs rely in large part on the successful expansion of our Freshpet Kitchens. Any substantial delay may hinder our ability to produce all of the product needed to meet orders and achieve financial performance.

If our growth exceeds our expectations, we may not be able to increase our own manufacturing capacity to, or obtain contract manufacturing capacity at, a level that meets demand for our products, which could prevent us from meeting increased customer demand and harm our business. However, if we overestimate our demand and overbuild our capacity, we may have significantly underutilized assets, and we may experience reduced margins. If we do not accurately align our manufacturing capabilities with demand, it could have a material adverse effect on our business, financial condition and results of operations.

12

Government regulation, scrutiny, warnings and public perception could increase our costs of production and increase legal and regulatory expenses.

Manufacturing, processing, labeling, packaging, storing and distributing pet products are activities subject to extensive federal, state and local regulation, as well as foreign regulation. In the United States, these aspects of our operations are regulated by the U.S. Food and Drug Administration (“FDA”), and various state and local public health and agricultural agencies. The FDA Food Safety Modernization Act provides direct recall authority to the FDA and includes a number of other provisions designed to enhance food safety, including increased inspections by the FDA of domestic and foreign food facilities and increased review of food products imported into the United States. In addition, many states have adopted the Association of American Feed Control Officials’ model pet food regulations or variations thereof, which generally regulate the information manufacturers provide about pet food. Complying with government regulation can be costly or may otherwise adversely affect our business. Failure to comply with applicable laws and regulations could subject us to civil remedies, including fines, injunctions, recalls or seizures, as well as potential criminal sanctions, which could have a material adverse effect on our business, financial condition and results of operations.

Our business is also affected by import and export controls and similar laws and regulations, both in the United States and elsewhere. Issues such as national security or health and safety, which slow or otherwise restrict imports or exports, could adversely affect our business. In addition, the modification of existing laws or regulations or the introduction of new laws or regulations could require us to make material expenditures or otherwise adversely affect the way that we have historically operated our business.

Our business may be subject to false marketing claims.

From time to time we may be subject to claims from competitors or consumers, including consumer class actions, alleging that our product claims are deceptive. Regardless of their merit, these claims can require significant time and expense to investigate and defend. Whether or not a false marketing claim is successful, such assertions could have an adverse effect on our business, financial condition and results of operations, and the negative publicity surrounding them could harm our reputation and brand image.

Adverse weather conditions, natural disasters, pestilences and other natural conditions can disrupt our operations, which can adversely affect our business, financial condition and results of operations.

The ingredients that we use in the production of our products (including, among others, meat, vegetables, fruits, carrageenans, whole grains, vitamins and minerals) are vulnerable to adverse weather conditions and natural disasters, such as floods, droughts, frosts, fires, earthquakes, tornadoes and pestilences. Adverse weather conditions may be impacted by climate change and other factors. Adverse weather conditions and natural disasters can reduce crop size and crop quality, which in turn could reduce our supply of ingredients, lower recoveries of usable ingredients, increase the prices of our ingredients, increase our transportation costs or increase our cost of storing ingredients if harvests are accelerated and processing capacity is unavailable. Additionally, the growth of crops, as well as the manufacture and processing of our products, requires significant amounts of water. Drought or other causes of a reduction of water in aquifers may affect availability of water, which in turn may adversely affect our results of operations. Competing manufacturers may be affected differently by weather conditions and natural disasters depending on the location of their supplies or operations. If our supply of ingredients is reduced, we may not be able to find enough supplemental supply sources on favorable terms, if at all, which could impact our ability to supply product to our customers and adversely affect our business, financial condition and results of operations. Increased costs for ingredients or other inputs could also adversely affect our business, financial condition and results of operations as described in “—The inputs, commodities, and ingredients that we require are subject to price increases and shortages that could adversely affect our results of operations.”

Additionally, adverse weather conditions, natural disasters or other natural conditions affecting our operating activities or major facilities could cause an interruption or delay in our production or delivery schedules and loss of inventory and/or data or render us unable to accept and fulfill customer orders in a timely manner, or at all. If our operations are damaged by a fire, flood or other disaster, for example, we may be subject to supply or delivery interruptions, destruction of our facilities and products or other business disruptions, which could adversely affect our business, financial condition and results of operations.

If we fail to develop and maintain our brand, our business could suffer.

We believe that developing and maintaining our brand is critical to our success. The importance of our brand recognition may become even greater as competitors offer more products similar to ours. Our financial success is directly dependent on consumer perception of our brand. Our brand-building activities involve providing high-quality products, increasing awareness of our brand, creating and maintaining brand loyalty and increasing the availability of our products.

13

The success of our brand may suffer if our marketing plans or product initiatives do not have the desired impact on our brand’s image or its ability to attract customers. Further, our brand value could diminish significantly due to a number of factors, including consumer perception that we have acted in an irresponsible manner, adverse publicity about our products (whether or not valid), our failure to maintain the quality of our products, product contamination, the failure of our products to deliver consistently positive consumer experiences, or the products becoming unavailable to consumers. The growing use of social and digital media by consumers increases the speed and extent that information and opinions can be shared. Negative posts or comments about us or our brands or products on social or digital media could damage our brands and reputation. If we fail to maintain the favorable perception of our brands, our business, financial condition and results of operations could be negatively impacted.

The pet food product category in which we participate is highly competitive. If we are unable to compete effectively, our results of operations could be adversely affected.

The pet food product category in which we participate is highly competitive. There are numerous brands and products that compete for shelf space and sales, with competition based primarily upon brand recognition and loyalty, product packaging, quality and innovation, taste, nutrition, breadth of product line, price and convenience. We compete with a significant number of companies of varying sizes, including divisions or subsidiaries of larger companies. We face strong competition from competitors’ products that are sometimes sold at lower prices. Price gaps between our products and our competitors’ products may result in market share erosion and harm our business. A number of our competitors have broader product lines, substantially greater financial and other resources and/or lower fixed costs than we have. Our competitors may succeed in developing new or enhanced products, including fresh, refrigerated pet food, that are more attractive to customers or consumers than our products. These competitors may also prove to be more successful in marketing and selling their products or may be better able to increase prices to reflect cost pressures. We may not compete successfully with these other companies or maintain or grow the distribution of our products. We cannot predict the pricing or promotional activities of our competitors or whether they will have a negative effect on us. Many of our competitors engage in aggressive pricing and promotional activities. There are competitive pressures and other factors which could cause our products to lose market share or decline in sales or result in significant price or margin erosion, which would have a material adverse effect on our business, financial condition and results of operations.

If the operating capacity or reputation of our Freshpet Fridges is harmed, our business, financial condition and results of operations may suffer.

Our success depends on our network of company-owned branded refrigerators, known as Freshpet Fridges. If the operating capacity of our Freshpet Fridges is harmed by external factors, such as adverse weather or energy supply, or internal factors, such as faulty manufacturing or insufficient maintenance, our products contained in those fridges may be damaged and need to be discarded. In addition, if our Freshpet Fridges fail to operate as intended, for any reason, the reputation of our Freshpet Fridges with customers and the reputation of our brand with consumers may decline. In such event, customers may choose to discontinue, or not to expand, their use of Freshpet Fridges and our products and consumers may choose to forgo purchasing our products. Additionally, growing concern about the environmental impact of refrigerators could likewise harm the reputation of our Freshpet Fridges with customers and our brand with consumers. Any such harm to the operating capacity or reputation of our Freshpet Fridges could adversely affect our business, financial condition and results of operations.

If we are not successful in protecting our intellectual property rights, our business, financial conditions and results of operations may be harmed.

We rely on trademark, copyright, trade secret, patent and other intellectual property laws, as well as nondisclosure and confidentiality agreements and other methods, to protect our intellectual property rights as well as the intellectual property of third parties with respect to which we are subject to non-use and non-disclosure obligations. We may need to engage in litigation or similar activities to enforce our intellectual property rights, to protect our trade secrets or to determine the validity and scope of proprietary rights of others. Any such litigation could require us to expend significant resources and divert the efforts and attention of our management and other personnel from our business operations. The steps we take to prevent misappropriation, infringement or other violation of our intellectual property or the intellectual property of others may not be successful. In addition, effective patent, copyright, trademark and trade secret protection may be unavailable or limited for some of our trademarks and patents in some foreign countries. Failure to protect our intellectual property could harm our business, financial condition and results of operations.

Our brand names and trademarks are important to our business, and we have registered or applied to register many of these trademarks. We cannot assure you that our trademark applications will be approved. Third parties may also oppose our trademark applications, or otherwise challenge our use of the trademarks. In the event that our trademarks are successfully challenged, we could be forced to rebrand our products, which could result in the loss of brand recognition

14

and could require us to devote resources advertising and marketing new brands. Further, we cannot assure you that competitors will not infringe our trademarks, or that we will have adequate resources to enforce our trademarks.

We rely on unpatented proprietary know-how in the areas of recipes, ingredients sourcing, cooking techniques, packaging, transportation and delivery. It is possible that others will independently develop the same or similar know-how or otherwise obtain access to our proprietary knowhow. To protect our trade secrets and other proprietary know-how, we require employees, consultants, advisors and collaborators to enter into confidentiality agreements. We cannot assure you that these agreements will provide meaningful protection in the event of any unauthorized use, misappropriation or disclosure of our trade secrets, know-how or other proprietary information. If we are unable to maintain the proprietary nature of our recipes, methods and other know-how, we could be materially adversely affected.

We may not be able to successfully implement initiatives to improve productivity and streamline operations to control or reduce costs. Failure to implement such initiatives could adversely affect our results of operations.

Because our ability to effectively implement price increases for our products can be affected by factors outside of our control, our profitability and growth depend significantly on our efforts to control our operating costs. Because many of our costs, such as energy and logistics costs, packaging costs and ingredient, commodity and raw product costs, are affected by factors outside or substantially outside our control, we generally must seek to control or reduce costs through operating efficiency or other initiatives. If we are not able to identify and complete initiatives designed to control or reduce costs and increase operating efficiency on time or within budget, our results of operations could be adversely impacted. In addition, if the cost savings initiatives we have implemented to date, or any future cost-savings initiatives, do not generate expected cost savings, our business, financial condition and results of operations could be adversely affected.

The inputs, commodities, and ingredients that we require are subject to price increases and shortages that could adversely affect our results of operations.

The primary inputs, commodities, and ingredients that we use include meat, vegetables, fruits, carrageenans, whole grains, vitamins, minerals, packaging and energy (including wind power). Prices for these and other items we use may be volatile, and we may experience shortages in these items due to factors beyond our control, such as commodity market fluctuations, availability of supply, increased demand (whether for the item we require or for other items, which in turn impacts the item we require), weather conditions, natural disasters, currency fluctuations, governmental regulations (including import restrictions), agricultural programs or issues, energy programs, labor strikes and the financial health of our suppliers. Input, commodity, and ingredient price increases or shortages may result in higher costs or interrupt our production schedules, each of which could have a material adverse effect on our results of operations. Production delays could lead to reduced sales volumes and profitability as well as loss of market share. Higher costs could adversely impact our earnings. For example, fuel prices affect our transportation costs for both ingredients and finished product. If we are not able to implement our productivity initiatives or increase our product prices to offset price increases of our inputs, commodities, and ingredients, as a result of consumer sensitivity to pricing or otherwise, or if sales volumes decline due to price increases, our results of operations could be adversely affected. Our competitors may be better able than we are to implement productivity initiatives or effect price increases or to otherwise pass along cost increases to their customers. Moreover, if we increase our prices in response to increased costs, we may need to increase marketing spending, including trade promotion spending, in order to retain our market share. Such increased marketing spending may significantly offset the benefits, if any, of any price increase and negatively impact our business, financial condition and results of operations.

If the ingredients we use in our products are contaminated, alleged to be contaminated or are otherwise rumored to have adverse effects, our results of operations could be adversely affected.

We buy our ingredients from third-party suppliers. If these materials are alleged or prove to include contaminants that affect the safety or quality of our products or are otherwise rumored to have adverse effects, for any reason, we may need to find alternate ingredients for our products, delay production of our products, or discard or otherwise dispose of our products, which could adversely affect our results of operations. Additionally, if this occurs after the affected product has been distributed, we may need to withdraw or recall the affected product and we may experience adverse publicity or product liability claims. In either case, our business, financial condition and results of operations could be adversely affected.

Restrictions imposed in reaction to outbreaks of animal diseases could have a material adverse effect on our business, financial condition and results of operations.

The cost of the protein-based ingredients we use in our products has been adversely impacted in the past by the publicity surrounding animal diseases, such as bovine spongiform encephalopathy, or “mad cow disease.” As a result of extensive

15

global publicity and trade restrictions imposed to provide safeguards against mad cow disease, the cost of alternative sources of the protein-based ingredients we use in our products, such as soybeans, pork meat and bone meal, has from time to time increased significantly and may increase again in the future if additional cases of mad cow disease are found.

If mad cow disease or other animal diseases, such as foot-and-mouth disease or highly pathogenic avian influenza, also known as “bird flu,” impacts the availability of the protein-based ingredients we use in our products, we may be required to locate alternative sources for protein based ingredients. Those sources may not be available to sustain our sales volumes, may be more costly and may affect the quality and nutritional value of our products. If outbreaks of mad cow disease, foot-and-mouth disease, bird flu or any other animal disease or the regulation or publicity resulting therefrom impacts the cost of the protein-based ingredients we use in our products, or the cost of the alternative protein-based ingredients necessary for our products as compared to our current costs, we may be required to increase the selling price of our products to avoid margin deterioration. However, we may not be able to charge higher prices for our products without negatively impacting future sales volumes.

We rely on co-packers to provide our supply of treat products. Any failure by co-packers to fulfill their obligations or any termination or renegotiation of our co-packing agreements could adversely affect our results of operations.

We have supply agreements with co-packers that require them to provide us with specific finished products. We rely on co-packers as our sole-source for treat products. We also anticipate that we will rely on sole suppliers for future products. The failure for any reason of a co-packer to fulfill its obligations under the applicable agreements with us or the termination or renegotiation of any such co-packing agreement could result in disruptions to our supply of finished goods and have an adverse effect on our results of operations. Additionally, from time to time, a co-packer may experience financial difficulties, bankruptcy or other business disruptions, which could disrupt our supply of finished goods or require that we incur additional expense by providing financial accommodations to the co-packer or taking other steps to seek to minimize or avoid supply disruption, such as establishing a new co-packing arrangement with another provider. During an economic downturn, our co-packers may be more susceptible to experiencing such financial difficulties, bankruptcies or other business disruptions. A new co-packing arrangement may not be available on terms as favorable to us as the existing co-packing arrangement, if at all.

If we do not manage our supply chain effectively, including inventory levels, our business, financial condition and results of operation may be adversely affected.

The inability of any supplier, co-packer, third-party distributor or transportation provider to deliver or perform for us in a timely or cost-effective manner could cause our operating costs to increase and our profit margins to decrease. We must continuously monitor our inventory and product mix against forecasted demand or risk having inadequate supplies to meet consumer demand as well as having too much inventory on hand that may reach its expiration date and become unsaleable. If we are unable to manage our supply chain effectively and ensure that our products are available to meet consumer demand, our operating costs could increase and our profit margins could decrease.

Failure by our transportation providers to deliver our products on time or at all could result in lost sales.

We use third-party transportation providers for our product shipments. We rely on one such provider for almost all of our shipments. Transportation services include scheduling and coordinating transportation of finished products to our customers, shipment tracking and freight dispatch services. Our use of transportation services for shipments is subject to risks, including increases in fuel prices, which would increase our shipping costs, and employee strikes and inclement weather, which may impact the ability of providers to provide delivery services that adequately meet our shipping needs, including keeping our products adequately refrigerated during shipment. Any such change could cause us to incur costs and expend resources. Moreover, in the future we may not be able to obtain terms as favorable as those we receive from the third-party transportation providers that we currently use, which in turn would increase our costs and thereby adversely affect our business, financial condition and results of operations.

If we are unable to maintain or increase prices for our products, our results of operations may be adversely affected.

We rely in part on price increases to neutralize cost increases and improve the profitability of our business. Our ability to effectively implement price increases or otherwise raise prices for our products can be affected by a number of factors, including competition, our competitors’ pricing and marketing, aggregate industry supply, category limitations, market demand and economic conditions, including inflationary pressures. During challenging economic times, our ability to increase the prices of our products may be particularly constrained. Additionally, customers may pressure us to rescind price increases that we have announced or already implemented (either through a change in list price or increased

16

promotional activity). If we are unable to maintain or increase prices for our products (or must increase promotional activity), our results of operations could be adversely affected. Furthermore, price increases generally result in volume losses, as consumers purchase fewer units. If such losses (also referred to as the elasticity impact) are greater than expected or if we lose distribution due to a price increase (which may result from a customer response or otherwise), our business, financial condition and results of operations could be adversely affected.

We may face difficulties as we expand into countries in which we have no prior operating experience.

We may choose to expand our global footprint by entering into new markets. As we expand our business into new countries we may encounter regulatory, personnel, technological and other difficulties that increase our expenses or delay our ability to become profitable in such countries. This may have an adverse effect on our business.

If we are unable to attract, train and retain employees, we may not be able to grow or successfully operate our business.

Our success depends in part upon our ability to attract, train and retain a sufficient number of employees who understand and appreciate our culture and are able to represent our brand effectively and establish credibility with our business partners and consumers. If we are unable to hire and retain employees capable of meeting our business needs and expectations, our business and brand image may be impaired. Any failure to meet our staffing needs or any material increase in turnover rates of our employees may adversely affect our business, financial condition and results of operations.

Unionization activities or labor disputes may disrupt our operations and affect our profitability.

Although none of our employees are currently covered under collective bargaining agreements, our employees may elect to be represented by labor unions in the future. If a significant number of our employees were to become unionized and collective bargaining agreement terms were significantly different from our current compensation arrangements, it could adversely affect our business, financial condition and results of operations. In addition, a labor dispute involving some or all of our employees may harm our reputation, disrupt our operations and reduce our revenues, and resolution of disputes may increase our costs.

As an employer, we may be subject to various employment-related claims, such as individual or class actions or government enforcement actions relating to alleged employment discrimination, employee classification and related withholding, wage-hour, labor standards or healthcare and benefit issues. Such actions, if brought against us and successful in whole or in part, may affect our ability to compete or could materially adversely affect our business, financial condition and results of operations.

Disruptions in the worldwide economy may adversely affect our business, results of operations and financial condition.

Adverse and uncertain economic conditions may impact distributor, customer and consumer demand for our products. In addition, our ability to manage normal commercial relationships with our suppliers, contract manufacturers, distributors, customers, consumers and creditors may suffer. Consumers have access to lower-priced offerings and, during economic downturns, may shift purchases to these lower-priced or other perceived value offerings. Customers may become more conservative in response to these conditions and seek to reduce their inventories. For example, during the economic downturn from 2007 through 2009, customers significantly reduced their inventories, and inventory levels have not returned to, and are not expected to return to, pre-downturn levels. Our results of operations depend upon, among other things, our ability to maintain and increase sales volume with our existing customers, to attract new consumers and to provide products that appeal to consumers at prices they are willing and able to pay. Prolonged unfavorable economic conditions may have an adverse effect on our sales and profitability.