Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 31, 2015

| china energy technology corp., ltd. |

(Exact name of registrant as specified in its charter)

| Nevada | 000-55001 | 45-4380591 | ||

| (State

or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

No. 1122 South Yanan Street New District, Bengbu, Anhui Province P. R. China |

|

| (Address of Principal Executive Offices) | |

Registrant’s telephone number, including area code: +86-552-411-6868

Copy to:

Mark E. Crone, Esq.

CKR Law LLP

1330 Avenue of the Americas, 35th Floor

New York, NY 10019

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

TABLE OF CONTENTS

| 2 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report (the “Report”) contains forward-looking statements, including, without limitation, in the sections captioned “Description of Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Plan of Operations,” and elsewhere. Any and all statements contained in this Report that are not statements of historical fact may be deemed forward-looking statements. Terms such as “may,” “might,” “would,” “should,” “could,” “project,” “estimate,” “pro-forma,” “predict,” “potential,” “strategy,” “anticipate,” “attempt,” “develop,” “plan,” “help,” “believe,” “continue,” “intend,” “expect,” “future,” and terms of similar import (including the negative of any of the foregoing) may be intended to identify forward-looking statements. However, not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements in this Report may include, without limitation, statements regarding (i) the plans and objectives of management for future operations, including plans or objectives relating to the growth of our solar water heating business in China, (ii) a projection of income (including income/loss), earnings (including earnings/loss) per share, capital expenditures, dividends, capital structure or other financial items, (iii) our future financial performance, including any such statement contained in a discussion and analysis of financial condition by management or in the results of operations included pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”), and (iv) the assumptions underlying or relating to any statement described in points (i), (ii) or (iii) above.

The forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which we have no control over. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence or contribute to the accuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation, our ability to obtain adequate financing, cash flows and resulting liquidity, our ability to expand our business, government regulations, lack of diversification, our ability to innovate, diversify our product offering and reduce manufacturing costs, our ability to expand sale of our products into foreign markets, increased competition, results of any arbitration and litigation, stock volatility and illiquidity, and our ability to implement our business plans or strategies. A description of some of the risks and uncertainties that could cause our actual results to differ materially from those described by the forward-looking statements in this Report appears in the section captioned “Risk Factors” and elsewhere in this Report.

Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them and to the risk factors. We disclaim any obligation to update the forward-looking statements contained in this Report to reflect any new information or future events or circumstances or otherwise, except as required by law.

Readers should read this Report in conjunction with the discussion under the caption “Risk Factors,” our financial statements and the related notes thereto in this Report, and other documents which we may file from time to time with the SEC.

| 3 |

We were incorporated as Redfield Ventures Inc in Nevada on January 27, 2012, to act as a marketing and business support services firm dedicated to serve in the areas of strategic marketing research and consultancy, marketing communications, and business alliance synergy providing clients with key solutions in achieving business objectives. We were not successful in our efforts and discontinued this line of business. Prior to the Share Exchange (defined below), we were a “shell company” (as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)).

On March 6, 2015, we entered into an Agreement and Plan of Merger, pursuant to which we merged (the “Name Change Merger”) with our newly formed, wholly owned subsidiary, China Energy Technology Corp., Ltd., a Nevada corporation (“Merger Sub”). Upon the consummation of the Name Change Merger, the separate existence of Merger Sub ceased and our shareholders became shareholders of the surviving company named “China Energy Technology Corp., Ltd.” As permitted by Chapter 92A.180 of Nevada Revised Statutes, the sole purpose of the Name Change Merger was to effect a change of our name from Redfield Ventures Inc to China Energy Technology Corp., Ltd. Upon the filing of Articles of Merger with the Secretary of State of Nevada on March 10, 2015 to effect the Name Change Merger, our Articles of Incorporation were deemed amended to reflect the change in our corporate name, effective as of March 16, 2015.

On March 31, 2015, we closed a share exchange (the “Share Exchange”) with Fine Progress Group Limited., Ltd., a corporation formed under the laws of the British Virgin Islands on July 1, 2014 (“FPGL BVI”), pursuant to which the three shareholders of FPGL BVI sold all of their capital stock in FPGL BVI to us in exchange for 190,000,000 shares of our common stock $0.001 par value per share (“Common Stock”). As a result of the Share Exchange, FPGL BVI became our wholly owned subsidiary. All of the outstanding FPGL BVI capital stock was exchanged for shares of our Common Stock, as described in more detail below. FPGL BVI controls Anhui Renrenjia Solar Co., Ltd. (“Anhui Solar”), our operating company based in the People’s Republic of China (the “PRC”), through Ren Re Jia International Limited, its 100% owned subsidiary organized in the Hong Kong Special Administrative Region (“RRJI HK”). RRJI HK is the 100% owner of Anhui Zhijia Cornerstone Electronics Technology Co., Ltd. (“Anhui Electronics”), our subsidiary organized in the PRC. Anhui Electronics controls Anhui Solar through contractual arrangements commonly known as “VIE” or “variable interest entity” arrangements on the mainland in the PRC. See Item 2.01, “Share Exchange and Related Transactions—The Share Exchange”, below.

In connection with the Share Exchange and pursuant to the Split-Off Agreement (defined below), we transferred our pre-Share Exchange assets and liabilities to Innovestica LP, our majority shareholder, in exchange for its surrender and cancellation of an aggregate of 20,000,000 shares of our Common Stock (the “Split-Off”). See Item 2.01, “Share Exchange and Related Transactions—The Split-Off”, below.

As a result of the Share Exchange and Split-Off , we changed our business focus to the business of Anhui Solar, which is the manufacture and sale of solar powered water heater systems in the People’s Republic of China, and will continue the existing business operations of Anhui Solar as a publicly-traded company under the name China Energy Technology Corp., Ltd.

In accordance with “reverse acquisition” accounting treatment, our historical financial statements as of period ends, and for periods ended, prior to the Share Exchange will be replaced with the historical consolidated financial statements of Anhui Solar prior to the Share Exchange in all future filings with the SEC.

As used in this Report, unless otherwise stated or the context clearly indicates otherwise, the terms “China Energy Tech. Corp.,” the “Company,” the “Registrant,” “we,” “us,” and “our” refer to China Energy Technology Corp., Ltd. (formerly known as Redfield Ventures Inc) incorporated in Nevada, and its consolidated subsidiaries, after giving effect to the Share Exchange and the Split-Off.

| 4 |

This Report is being filed in connection with a series of transactions consummated by the Company and certain related events and actions taken by the Company. This Report contains summaries of the material terms of various agreements executed in connection with the transactions described herein, which are filed as exhibits hereto and incorporated herein by reference.

This Report responds to the following Items in Form 8-K:

| Item 1.01. | Entry into a Material Definitive Agreement | |

| Item 2.01. | Completion of Acquisition or Disposition of Assets | |

| Item 3.02. | Unregistered Sales of Equity Securities | |

| Item 4.01. | Changes in Registrant’s Certifying Accountant | |

| Item 5.01. | Changes in Control of Registrant | |

| Item 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers | |

| Item 5.03. | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year | |

| Item 5.06. | Change in Shell Company Status | |

| Item 5.07. | Submission of Matters to a Vote of Security Holders | |

| Item 8.01. | Other Events | |

| Item 9.01. | Financial Statements and Exhibits |

Prior to the Share Exchange, we were a “shell company” (as such term is defined in Rule 12b-2 under the Exchange Act”). As a result of the Share Exchange, we have ceased to be a shell company. The information contained in this Report, together with the information contained in our Annual Report on Form 10-K for the fiscal year ended December 31, 2013, and our subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, as filed with the SEC, constitute the current “Form 10 information” necessary to satisfy the conditions contained in Rule 144(i)(2) under the Securities Act of 1933, as amended (the “Securities Act”).

| Item 1.01 | Entry into a Material Definitive Agreement |

The information contained in Item 2.01 below relating to the various agreements described therein is incorporated herein by reference.

| 5 |

| Item 2.01 | Completion of Acquisition or Disposition of Assets |

THE SHARE EXCHANGE AND RELATED TRANSACTIONS

The Share Exchange

On March 31, 2015 (the “Closing Date”), the Company entered into a Share Exchange Agreement (the “Share Exchange Agreement”) with Fine Progress Group Limited, a British Virgin Islands company (“FPG BVI”), and its shareholders, which closed on the same date. Pursuant to the terms of the Share Exchange Agreement, FPG BVI became our wholly-owned subsidiary.

FPGL BVI controls Anhui Renrenjia Solar Co., Ltd. (“Anhui Solar”), our operating company based in the People’s Republic of China (the “PRC”), through Ren Re Jia International Limited, FPG BVI’s 100% owned subsidiary organized in the Hong Kong Special Administrative Region (“RRJI (HK)”). RRJI (HK) is the 100% owner of Anhui Zhijia Cornerstone Electronics Technology Co., Ltd. (“Anhui Electronics”), our subsidiary organized in the PRC. Anhui Electronics controls Anhui Solar through contractual arrangements commonly known as “VIE” or “variable interest entity” arrangements on the mainland in the PRC.

Pursuant to the Share Exchange, we acquired the business of Anhui Solar, which is to manufacture and sale of solar powered water heater systems in the Peoples’ Republic of China. As a result, we have ceased to be a shell company.

At the closing of the Share Exchange, pursuant to the Share Exchange Agreement, FPG BVI’s 100 shares of capital stock issued and outstanding immediately prior to the closing of the Share Exchange were exchanged for an aggregate of 190,000,000 shares of our Common Stock.

The Share Exchange Agreement contains customary representations and warranties, pre- and post-closing covenants of each party and customary closing conditions. Breaches of the representations and warranties are subject to customary indemnification provisions, subject to specified aggregate limits of liability.

The Share Exchange will be treated as a recapitalization of the Company for financial accounting purposes. FPG BVI will be considered the acquirer for accounting purposes, and the historical financial statements of China Energy Technology Corp., Ltd. (formerly known as Redfield Ventures Inc) before the Share Exchange will be replaced with the historical financial statements of FPG BVI and its consolidated entities before the Share Exchange in all future filings with the SEC.

The Share Exchange is intended to be treated as a tax-free reorganization under Section 368 of the Internal Revenue Code of 1986, as amended.

The issuance of shares of our Common Stock to holders of FPG BVI’s capital stock in connection with the Share Exchange has not been registered under the Securities Act, in reliance upon the exemption from registration provided by Section 4(a)(2) of the Securities Act, which exempts transactions by an issuer not involving any public offering, and Regulation D and/or Regulation S promulgated by the SEC under that section. These securities may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirement.

The Share Exchange Agreement is filed as Exhibit 2.1 to this Report and incorporated herein by reference.

The Split-Off

Upon the closing of the Share Exchange, pursuant to the terms of a split-off agreement (the “Split-Off Agreement”) and a general release agreement (the “General Release Agreement”), we transferred all of our pre-Share Exchange operating assets and liabilities to our wholly-owned special-purpose subsidiary, Redfield Operating Corp., a Nevada corporation (“Split-Off Subsidiary”), formed on March 31, 2015. Thereafter, pursuant to the Split-Off agreement, we transferred all of the outstanding shares of capital stock of Split-Off Subsidiary to Innovestica LP, our majority shareholder (the “Split-Off”), in consideration of and in exchange for (i) the surrender and cancellation of 20,000,000 shares of our Common Stock held by Innovestica LP (which were cancelled and will resume the status of authorized but unissued shares of our Common Stock) and (ii) certain representations, covenants and indemnities.

The Split-Off Agreement and the General Release Agreement are filed as Exhibits 10.1 and 10.2 to this Report, respectively, and incorporated herein by reference.

| 6 |

Departure and Appointment of Directors and Officers

Our Board is authorized to consist of not less than one (1) and not more than ten (10) members. Upon the Closing of the Share Exchange, Carlos G. Alarcon Ocampo, Mauricio Gonzalez and Carlos G. Alarcon Gonzalez, our directors before the Share Exchange, resigned from their positions as directors, and Quan Ji was appointed to the Board.

Also, upon closing of the Share Exchange, Mauricio Gonzalez, our President and Chief Executive Officer, Carlos G. Alarcon Ocampo, our Treasurer and Chief Financial Officer, and David Price, our Secretary, before the Share Exchange, resigned from these positions, and Quan JI was appointed as our President, Chief Executive Officer, Treasurer, Chief Financial Officer and Secretary by the Board. See “Management – Directors and Executive Officers” below for information about our new director and executive officer.

Pro Forma Ownership

Immediately after giving effect to the Share Exchange and the Split-Off, there were 190,000,000 issued and outstanding shares of our Common Stock, as follows:

| ● | the stockholders of FPG BVI prior to the Share Exchange held approximately 180,500,000 shares of our Common Stock; and |

| ● | the pre-Share Exchange stockholders held 9,500,000 shares of our Common Stock. |

No other securities convertible into or exercisable or exchangeable for our Common Stock (including options or warrants) are outstanding.

Our Common Stock was quoted on the OTC Markets QB Tier under the symbol “RFIE”. Effective March 16, 2015, tour symbol was changed to “CETH”, to better reflect our new corporate name.

Accounting Treatment; Change of Control

The Share Exchange is being accounted for as a “reverse acquisition,” and FPG BVI is deemed to be the acquirer. Consequently, the assets and liabilities and the historical operations that will be reflected in the financial statements prior to the Share Exchange will be those of FPG BVI and its consolidated entities and will be recorded at the historical cost basis of FPG BVI, and the consolidated financial statements after completion of the Share Exchange will include the assets and liabilities of Anhui Solar, historical operations of Anhui Solar, and operations of Anhui Solar from the closing date of the Share Exchange.

As a result of the issuance of the shares of our Common Stock pursuant to the Share Exchange, a change in control of the Company occurred as of the date of consummation of the Share Exchange. Except as described in this Current Report, no arrangements or understandings exist among present or former controlling stockholders with respect to the election of members of our Board and, to our knowledge, no other arrangements exist that might result in a change of control of the Company.

We continue to be a “smaller reporting company,” as defined under the Exchange Act, following the Share Exchange. We believe that, as a result of the Share Exchange, we have ceased to be a “shell company” (as such term is defined in Rule 12b-2 under the Exchange Act).

| 7 |

Immediately following the Share Exchange, the business of Anhui Solar, to engage in the the manufacture and sale of solar powered water heater systems in the Peoples’ Republic of China, became the business of the Company.

History

As described above, we were incorporated as Redfield Ventures Inc in Nevada on January 27, 2012. Our original business plan was to engage in strategic marketing research and consultancy, marketing communications, and business alliance synergy providing clients with key solutions in achieving business objectives. We were not successful in our efforts and discontinued this line of business. Since that time, and prior to the Share Exchange, we were a “shell company” (as such term is defined in Rule 12b-2 under the Exchange Act). As a result of the Share Exchange, we acquired the business of Anhui Solar and have ceased to be a shell company.

On March 6, 2015, we entered into an Agreement and Plan of Merger, pursuant to which we merged (the “Name Change Merger”) with our newly formed, wholly owned subsidiary, China Energy Technology Corp., Ltd., a Nevada corporation (“Merger Sub”). Upon the consummation of the Name Change Merger, the separate existence of Merger Sub ceased and our shareholders became shareholders of the surviving company named “China Energy Technology Corp., Ltd.” As permitted by Chapter 92A.180 of Nevada Revised Statutes, the sole purpose of the Name Change Merger was to effect a change of our name from Redfield Ventures Inc to China Energy Technology Corp., Ltd. Upon the filing of Articles of Merger with the Secretary of State of Nevada on March 10, 2015 to effect the Name Change Merger, our Articles of Incorporation were deemed amended to reflect the change in our corporate name, effective as of March 16, 2015. We changed our name to more accurately represent our new business focus. In connection with the name change, we changed our OTC trading symbol to “CETH” effective March 16, 2015.

We currently have authorized 200,000,000 shares of capital stock, consisting of (i) 200,000,000 shares of Common Stock, and (ii) no shares of Preferred Stock.

Our principal executive offices are located at No. 1122 South Yanan Street, New District, Bengbu, Anhui Province P. R. China. Our telephone number is +86 552-411-6868. Our primary website address is www.rrjtyn.com. The information contained on our website is not incorporated by reference into this Current Report on Form 8-K.

Corporate History and Structure of our PRC Operations

We began our operations in China in 2009 through Anhui Solar, a PRC limited liability company, which became one of our consolidated affiliated entities through certain contractual arrangements.

In July 2014, in anticipation of this Share Exchange, we undertook a reorganization to establish an offshore holding company structure, to comply with PRC regulations restricting foreign ownership of an entity with operations in China.

On July 1, 2014, we incorporated Fine Progress Group Limited, or FPG BVI, a holding company established in the British Virgin Islands. Subsequently, on October 31, 2014, FPG BVI established Ren Ren Jia International Limited, or RRJI HK, a Hong Kong limited liability company, as its wholly owned subsidiary. RRJI HK then, on February 2, 2015, established Anhui Zhijia Cornerstone Electronics Technology Co., Ltd., or Anhui Electronics, as a wholly foreign-owned enterprise in China. Anhui Electronics entered into a series of contractual agreements with Anhui Solar and its shareholders, including the exclusive business cooperation agreement, the equity pledge agreement, the exclusive option agreement and the power of attorney, under which Anhui Electronics exercises effective control over the operations of Anhui Solar. The shareholders of Anhui Solar received nominal monetary benefits in return for entering into the contractual arrangements with Anhui Electronics.

| 8 |

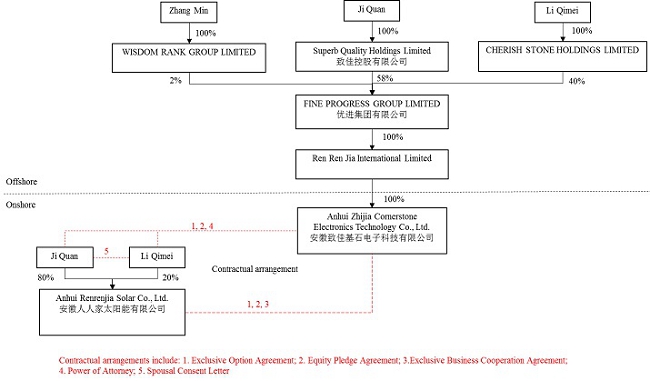

The following diagram illustrates our corporate structure, including our principal subsidiaries and consolidated affiliated entities as of the date of this current report:

We own directly 100% of the equity interests of FPG BVI, which owns directly 100% of the equity interests of RRJI HK, which owns directly 100% of the equity interests of Anhui Electronics.

The registered owners of Anhui Solar, Quan Ji and Qimei Li, Own 80% and 20% of the outstanding capital of Anhui Solar, respectively. Quan Ji owns 100% of Superb Quality Holdings Limited, a British Virgin Islands corporation which owns 58% of FPG BVI, and Qimei Li owns 100% of Cherish Stone Holdings Limited, a British Virgin Islands corporation which owns 40% of FPG BVI. Quan Ji and Qimei Li, husband and wife, through spousal consents, have each unconditionally and irrevocably agreed that the other may enter into and be bound by the exclusive option agreement, equity pledge agreement and power of attorney with Anhui Electronics.

Due to PRC legal restrictions and qualification requirements on foreign ownership and investment in companies in China, we operate our business through our consolidated affiliated entity, Anhui Solar. We do not hold any equity interest in Anhui Solar; however, through a series of contractual arrangements with Anhui Solar and its shareholders discussed below, we effectively control Anhui Solar and enjoy its economic benefits. Anhui Solar is considered a "variable interest entity" of our company under U.S. generally accepted accounting principles. Therefore, we have consolidated the financial results of Anhui Solar into our financial statements. If Anhui Solar or its shareholders fail to perform their respective obligations under the contractual arrangements, we could be limited in our ability to enforce the contractual arrangements that give us effective control over Anhui Solar. Furthermore, if we are unable to maintain effective control over Anhui Solar, we would not be able to continue to consolidate the financial results of Anhui Solar with ours. See "Risk Factors—Risks Relating to Our Corporate Structure,” below.

| 9 |

Contractual Arrangements with Anhui Solar

We have entered into contractual arrangements with Anhui Solar and its shareholders described below, through which we exercise effective control over the operations of Anhui Solar and receive substantially all its economic benefits and residual returns. Through the exclusive business cooperation agreement between Anhui Solar and Anhui Electronics, Anhui Electronics agrees to provide certain technical and business support and related consulting services to Anhui Solar in exchange for service fees. In addition, pursuant to the exclusive option agreement, Anhui Solar is prohibited from declaring and paying any dividends without Anhui Electronics' prior consent and Anhui Electronics enjoys an irrevocable and exclusive option to purchase Anhui Solar shareholders' equity interests, to the extent permitted by applicable PRC laws, at a nominal price. If the lowest price permitted under PRC law is higher than the above price, the lowest price permitted under PRC law shall apply. Through the arrangements, we can obtain all of Anhui Solar's income and all of its residual interests, such as undistributed earnings, either through dividend distribution or purchase of Anhui Solar's equity interests from its existing shareholders. On the other hand, we will not receive all of Anhui Solar's revenues, are not legally entitled to residual interest as a shareholder upon Anhui Solar's liquidation, and are not legally responsible for Anhui Solar's debts or other liabilities. As a result of the contractual arrangements, we consolidate Anhui Solar's financial results in our consolidated financial statements in accordance with U.S. GAAP.

Exclusive Business Cooperation Agreement. Under the exclusive business cooperation agreement between Anhui Solar and Anhui Electronics, Anhui Electronics has the exclusive right to provide, among other things, technical support and business support and related consulting services to Anhui Solar and Anhui Solar agrees to accept all the consultation and services provided by Anhui Electronics. Without Anhui Electronics' prior written consent, Anhui Solar is prohibited from engaging any third party to provide any of the services under this agreement. In addition, Anhui Electronics exclusively owns all intellectual property rights arising out of or created during the performance of this agreement. Anhui Solar agrees to pay a quarterly service fee to Anhui Electronics at an amount determined solely by Anhui Electronics after taking into account factors including the complexity and difficulty of the services provided, the time consumed, the seniority of the Anhui Electronics employees providing services to Anhui Solar, the value of services provided, the market price of comparable services and the operating conditions of Anhui Solar. This agreement will remain effective unless Anhui Electronics terminates the agreement in writing or a competent governmental authority rejects the renewal applications by either Anhui Solar or Anhui Electronics to renew its respective business license upon expiration. Anhui Solar is not permitted to terminate this agreement in any event unless required by applicable laws. Anhui Solar shall pay a service fee to Anhui Electronics each month. This fee, which shall be determined by the parties through negotiation, shall consist of a management fee and a fee for services provided.

The Exclusive Business Cooperation Agreement is filed as Exhibit 10.3 to this Report and incorporated herein by reference.

Equity Interest Pledge Agreements. Under the equity interest pledge agreements between Anhui Electronics, Anhui Solar and the shareholders of Anhui Solar, the shareholders pledged all of their equity interests in Anhui Solar to Anhui Electronics to guarantee Anhui Solar's and Anhui Solar's shareholders' performance of their obligations under the contractual arrangements including, but not limited to, the payments due to Anhui Electronics for services provided. If Anhui Solar or any of Anhui Solar's shareholders breaches its contractual obligations under the contractual arrangements, Anhui Electronics, as the pledgee, will be entitled to certain rights and entitlements, including receiving proceeds from the auction or sale of whole or part of the pledged equity interests of Anhui Solar in accordance with legal procedures. Anhui Electronics has the right to receive dividends generated by the pledged equity interests during the term of the pledge. If any event of default as provided in the contractual arrangements occurs, Anhui Electronics, as the pledgee, will be entitled to dispose of the pledged equity interests in accordance with PRC laws and regulations. The pledge will become effective on the date when the pledge of equity interests contemplated in these agreements are registered with the relevant local administration for industry and commerce and will remain binding until Anhui Solar and its shareholders discharges all their obligations under the contractual arrangements. We registered these equity interest pledge agreements with the Bengbu Administration for Industry and Commerce on March 11, 2015.

| 10 |

The Equity Interest Pledge Agreements are filed as Exhibit 10.4 to this Report and incorporated herein by reference.

Exclusive Option Agreements. Under the exclusive option agreements between Anhui Electronics, each of the shareholders of Anhui Solar and Anhui Solar, each of the shareholders irrevocably granted Anhui Electronics or its designated representative(s) an exclusive option to purchase, to the extent permitted under PRC law, all or part of his, her or its equity interests in Anhui Solar, for a nominal price from the individual shareholders. If the lowest price permitted under PRC law is higher than the above price, the lowest price permitted under PRC law shall apply. Anhui Electronics or its designated representative(s) has sole discretion as to when to exercise such options, either in part or in full. Without Anhui Electronics' prior written consent, Anhui Solar's shareholders shall not transfer, donate, pledge, or otherwise dispose any equity interests in Anhui Solar. These agreements will remain effective until all equity interests held in Anhui Solar by the Anhui Solar's shareholders are transferred or assigned to Anhui Electronics or Anhui Electronics' designated representatives. At the moment, we cannot exercise the exclusive option to purchase the current shareholders' equity interests in Anhui Solar due to the PRC regulatory restrictions on foreign ownership of operating companies in China. We intend to exercise such option once China opens up these industries to foreign investment.

The Form of Exclusive Option Agreement is filed as Exhibit 10.5 to this Report and incorporated herein by reference.

Powers of Attorney. Pursuant to the powers of attorney, the shareholders of Anhui Solar each irrevocably appointed Anhui Electronics as the attorney-in-fact to act on their behalf on all matters pertaining to Anhui Solar and to exercise all of their rights as a shareholder of Anhui Solar, including but not limited to attend shareholders' meetings, vote on their behalf on all matters of Anhui Solar requiring shareholders' approval under PRC laws and regulations and the articles of association of Anhui Solar, designate and appoint directors and senior management members. Anhui Electronics may authorize or assign its rights under this appointment to any other person or entity at its sole discretion without prior notice to the shareholders of Anhui Solar. Each power of attorney will remain in force until the shareholder ceases to hold any equity interest in Anhui Solar.

The Form of Power of Attorney is filed as Exhibit 10.6 to this Report and incorporated herein by reference.

Spousal Consent Letters. Under spousal consent letters dated February 11, 2015, each of Quan Ji and Qimei Li has unconditionally and irrevocable agreed to the execution by the other of the equity interest pledge agreement, the exclusive option agreement and the power of attorney, and the disposal of each of their equity interests in Anhui Solar by the other pursuant to the indicated agreements. Additionally, each of Quan Ji and Qimei Li has agreed not to make any assertions in connection with the equity interests in Anhui Solar held by the other. Each has agreed to execute all necessary documents and take all necessary actions to ensure the appropriate performance of the above listed agreements and that if either of them obtains the equity interests of the other in Anhui Solar, he or she will be bound by these agreements with respect to those equity interests.

| 11 |

The Form of Spousal Consent Letter is filed as Exhibit 10.7 to this Report and incorporated herein by reference.

In the opinion of our PRC counsel, Han Kun Law Offices, these contractual arrangements are valid, binding and enforceable under current PRC laws. However, these contractual arrangements may not be as effective in providing control as direct ownership. There are substantial uncertainties regarding the interpretation and application of current or future PRC laws and regulations. For a description of the risks relating to our corporate structure, please see "Risk Factors—Risks Relating to Our Corporate Structure and Restrictions on Our Industry."

Our Business

Overview

Immediately following completion of the Share Exchange, the business of Anhui Solar, our PRC-based operating company, became our business. Anhui Solar is a modern high-tech company specializing in the development, production, sales and service provider of new solar energy. Anhui Solar has developed four series of products - the vacuum tube solar energy collector, the balcony flat panel solar energy collector, the air energy heater and the air energy floor heating system. Anhui Solar currently manufactures and sells the vacuum tube solar energy collector and the balcony flat panel solar energy collector type solar water heating systems.

Business Background

Anhui Solar was established in 2009 in Bengbu City, Anhui Province, PRC. The Company began its operations by selling solar power water heater systems manufactured by other companies. In 2011, the Company built a manufacturing facility in Guzhen County of Bengbu City and started manufacturing and selling its own brand of solar water heating system produced in its own facilities.

Product Description

Solar Water Heaters

Our primary products are solar water heaters are used to generate hot water for residential use. We manufacture and sell two types of solar hot water heaters: vacuum tube solar water heaters and balcony flat panel, or tablet, solar water heaters.

Solar water heaters use sunlight to heat either water or a heat-transfer fluid in collectors. The solar collector is installed either on roof top or balcony facing south. As sunlight passes through the collector's glazing, it strikes an absorbing material. This material converts sunlight into heat, and the glazing prevents the heat from escaping. The two most common types of solar collectors used in solar water heaters in the PRC market are vacuum tube collectors and glazed flat panels. Solar-heated water is stored in an insulated tank until use. Hot water is drawn off the tank when tap water is used, and cold make-up water enters at the bottom of the tank. Solar water heaters tend to have a slightly larger hot water storage capacity than conventional water heaters. This is because solar heat is available only during the day and sufficient hot water must be stored to meet evening and morning requirements.

For the first few years of our business, through 2013, we primarily sold traditional, vacuum tube array solar water heater systems to rural residential users through direct sales and third party distributor channels. In 2014, we began to focus on the local, urban property developers market for the sale our newly developed flat panel, platform style solar water heater systems which could be installed on the balcony or wall outside of each individual apartment in multi-unit, multi-story apartment buildings.

| 12 |

In our traditional vacuum tube solar water heating system, vacuum tubes are installed on the top of a stainless tripod which is mounted and installed on the roof of a house or apartment building. In the flat panel platform style product, vacuum tubes are installed inside a flat panel rectangular box, or shell, which fully covers the vacuum tubes. The manufacturing process for the flat panel system is much more complex than that for the traditional vacuum tube system as it requires specially machinery to produce the one piece molded shell. The shell not only holds the vacuum tubes, but also acts as a solar collector through the box cover which includes an absorption layer on the surface. Unlike the traditional vacuum tube system which can only be installed on a roof, the flat panel system can be hung vertically outside of an apartment balcony, thus saving space and enabling the installation of one panel style system for each apartment.

Approximately 0% of our total revenues for 2013 were derived from sales of our flat panel solar water heaters compared to 100% of our total revenues for 2013 from sales of our vacuum tube collector solar water heaters. Approximately 86% of our total revenues for the first nine months of 2014 were derived from sales of our flat panel solar water heaters compared to 14% of our total revenues for the first nine months of 2014 from sales of our vacuum tube collector solar water heaters. Our traditional, vacuum tube system models sell at from approximately RMB 1,700 (approx. $275) to RMB 2,500 (approx. $400) per unit while our flat panel system sells at approximately RMB 2,900 (approx. $465) per unit.

Energy Heating Products

We also have developed air energy heaters and air energy floor heating systems although we are not manufacturing and selling these products in significant numbers at this time. In our air energy system, the heat available in low temperature air is absorbed by the system and compressed to produce high temperature heated air which heats water in the water storage tank. To date, we have produced only small numbers of these units as models for exhibition purposes only and they do not contribute materially to our overall sales.

Manufacturing

Facilities - Process, Cost, and Capacity

Guzhen County Existing Facilities

Anhui Solar assembles and manufactures all of its products in a 9,500 square meter (102,257 square foot) production facility in Guzhen County of Bengbu City. Anhui Solar has rented these facilities since February 1, 2012 on a year to year lease basis from Bengbu Boyuanzhiye Co., Ltd. (“BBC Ltd.”), a real estate company owned by Ms. Qimei Li, a stockholder of the Company and wife of Mr. Quan Ji, the Company’s sole officer and director and majority stockholder. Under the lease arrangement, Anhui Solar is responsible for its own electricity, water and maintenance costs but has not had to pay any rent. It is expected that now that the Share Exchange has closed, the Company will begin to pay rent of approximately RMB 30,000 (approximately $4,800) per month on these facilities in the near future.

Anhui Solar also leases a 1,139 square meters (12,260 square feet) office building from BBC Ltd. for a monthly fee of 6,000 RMB (US $958). Anhui Solar built an approximately 3,000 square meter (32,000 square foot) four story addition to this office building at a cost of approximately RMB 4,000,000 (US $604,285). BBC Ltd. agreed to be responsible for the cost of this construction and, as a result, has signed a loan agreement agreeing to repay the $604,285 construction amount to Anhui Solar by January 1, 2016.

| 13 |

Copies of the English translations of (i) the factory space rental agreement for 2014, (ii) the office space lease agreement for 2014 and (iii) the loan agreement, each between Anhui Solar and BBC Ltd., are attached hereto as Exhibit 10.8, Exhibit 10.9 and Exhibit 10.10, respectively, and are incorporated herein by reference.

Anhui Solar’s Guzhen County facilities are built on an eight acre (50 Mu) plot of land leased by BBC Ltd. for a term of fifty (50) years from the Guzhen County government. BBC Ltd. provides this land to Anhui Solar at no cost. In 2012, we completed construction of a factory building at a cost of approximately RMB 1,000,000 (US $161,000). This facility includes dormitories for up to approximately 20 employees who, from time to time, utilize these facilities when they work late shifts and live too far from the factory to commute.

Anhui Solar utilizes an automated production line for the manufacture of water tanks, while our other products are manufactured utilizing manual labor. We completed the production line for out platform style water heating system in 2014.

Set forth below is certain information regarding our current manufacturing capacity:

Current Manufacturing Capacity

| Daily

Unit No. | Annual

Unit No. | |||||||

| Solar Water Heaters | 300 | 90,000 | ||||||

| Air Energy Heaters and Air Energy Heating Systems | 30 | 9,000 | ||||||

Guzhen County New Facilities

In January 2009, the Bengbu city government issued a regulation requiring all local factories to relocate to the city’s industrial development zone in Guzhen County. As a result of this regulation, the Company, in April 2014, leased from the Guzhen County government 24 acres (150 Mu) of land in the industrial development zone at a price of approximately RMB 8,400,000 (US $ 1,350,000) for a term of fifty (50) years for a new manufacturing facility which it has begun constructing. According to the agreement between Anhui Solar and the Guzhen County government, the new facilities must be completed by December 1, 2017, by which time Anhui must vacate its existing manufacturing facilities. We expect these new facilities to be completed prior to that date. The Guzhen County government will compensate Anhui Solar for vacating its currently existing facilities. The new facilities will have a manufacturing capacity of 100,000 flat panel solar water heating systems per year.

A copy of the English translation of the investment contract between Anhui Solar and Guzhen County relating to the new Guzhen facilities is attached hereto as Exhibit 10.11 and incorporated herein by reference.

| 14 |

Fengyang City Facility

To increase our manufacturing capacity, we have also leased for a term of fifty (50) years an 24 acre (150 Mu) parcel of land in Fengyang City where we have begun construction of a new production facility at an expected cost of approximately RMB 23,000,000 (USD 3,700,000) and a total investment cost of approximately RMB 320,000,000 (US $51, 500,000). This facility will include approximately 1,184,030 square feet (110,000 square meters) of manufacturing space, a 150,695 square foot (14,000 square meter) testing lab, 215,280 square feet (20,000 square meters) of warehousing and raw materials storage space, 182,986 square feet (17,000 square meters) of employee dormitory space, 53,820 square feet (5,000 square meters) of senior management townhouse space, and 269,100 square feet (25,000 square meters) of office space. This facility is designed to manufacture 600,000 solar power water heating systems annually. Construction will be divided into four phases with the first phase having a 100,000 unit per year manufacturing capacity to be ready by the end of 2015 and the remaining phases to be built upon the availability of the required financing. There can be no assurance at this time that financing for the three remaining construction phases will be available at acceptable terms or at all.

A copy of the English translation of the agreement between Anhui Solar and the Investment Promotion Bureau of Fengyang County relating to the new Fengyang facilities is attached hereto as Exhibit 10.11 and incorporated herein by reference.

Raw Materials and Principal Suppliers

The primary raw materials for manufacturing our products are stainless steel plate, vacuum tubes, iron and regular steel plate. These raw materials are generally available on the market and we have not experienced any raw material shortage in the past. Because of the general availability of these raw materials, it has not been our standard practice to enter into long-term contracts or arrangements with most of our raw materials suppliers. We believe that this gives us the flexibility to select the most suitable suppliers based on product quality and price terms provided by suppliers each year. We generally have at least three suppliers that are pre-approved for each raw material supply. However, this arrangement does not provide any guarantee that necessary raw materials will continue to be available at prices or delivery terms acceptable to us.

During the past two (2) years, we have purchased stainless steel plate primarily from Wuxi Guoxing stainless steel Ltd in Jiangsu Province. Our top five (5) suppliers of vacuum tubes are Shandong Huashenglong Solar Energy Technology Co.Ltd., Haining Juguan Insulation Material Technology Co. ltd., Shandong Changhong Solar Energy Co. Ltd., Haining Huafeng Evacuated Solar Energy Collector Tube Co. Ltd and Shandong Spectrum Solar Engineering Co. Ltd. Our principal suppliers of steel and iron plate are from Shandong and Zhejiang Provinces. We do not rely on any particular suppliers to procure other raw materials.

Quality Control Certifications

Our manufacturing processes follow strict guidelines and standard operating procedures. Anhui Solar has been issued ISO14001 certification on April 10, 2014and ISO9001 certification on September 28, 2014.

Because of our stringent quality control system, most of our products are certified by governmental quality control testing centers, such as the Anhui Provincial Supervising and Testing Research Institute for Product quality. We also have been awarded the China solar energy heat utilization engineering design and construction qualification certification by China Energy Saving Association and China Rural energy industrial association, the China Nation Mandatory Product Certification by the China Quality Certification Center and the High-tech Enterprise Certification by Anhui Science and technology Center, Anhui Provincial Department of Finance and Anhui Administration of Taxation

| 15 |

The Market

General PRC/Anhui Province Market Characteristics

Due to the implementation of the Chinese government’s subsidy programs starting in 2007 and related energy saving demands with respect to new construction, the domestic solar power industry in China has grown steadily on a yearly basis. Total sales of all solar power usage products including, but not limited to, the solar water heating sector, as reported by the China Solar Power Association, reached 100 billion RMB (approximately$12 billion) in 2012, and estimated to reach 300 billion RMB (approximately $48 billion) in 2020.

The solar power water heater industry in China has two major sectors, traditional household water heater systems and urban, multi-unit real estate development apartment water heater systems. Due to the energy saving demand of multi-unit apartment building construction, local governments have issued various regulations to support and promote this water heater sector in recent years. The market share for this sector has increased from 35% in 2007 to more than 60% in 2013. This increase was mainly due to the dramatic increase in local commercial building demand in the past couple of years. Since 2014, Anhui Solar has been focusing on this real estate development sector as well.

Anhui Solar’s Market

Anhui Solar is located in the northern part of Anhui Province and that is where its primary market is located, although it does sell into other provinces such as Shandong, Jiangsu, Zhejiang and Henan. Historically, Anhui Solar its solar water heating products locally to rural residents through direct sales and various third party distributors. In the past two years, Anhui Solar has shifted its sales focus to the urban areas where it has begun to concentrate on selling its flat panel, platform solar water heating systems to real estate developers for multi-unit construction projects.

Seasonality of our Business

Sales of our solar hot water heaters to the residential market are affected by seasonality with the first and fourth quarters of the year being the best for sales in this market. Sales to the real estate developer market is not affected by seasonality.

Government Supportive Programs

Anhui Solar received $2,699,176 in government of China subsidies for the year ended December 31, 2013. This amount equaled approximately 26.5% of Anhui Solar’s total revenue for 2013. Anhui Solar participated in a government rural residents benefit program titled “Home Electric Appliances to the Countryside” to sell its products and receive the governmental subsidies. Under this program, which was established in 2007 to stimulate the domestic economy, Anhui Solar received 13% of the retail price of every water heater system sold in 2013. Anhui Solar did not qualify for this program prior to 2013. This subsidy program has been ended by the Chinese government and was not in place for 2014. We have no knowledge of additional government subsidy programs and there can be no assurances that any such programs will be established in the future.

Anhui Solar’s Marketing and Growth Strategy

As competition in the market for traditional solar power water heater systems intensifies, profit margins for that product line have become very low. As a result of this trend, Anhui Solar has determined to concentrate its sales and marketing efforts on the flat panel heating system that can be installed outside of apartment balconies and sold to multi-unit apartment building developers. Anhui Solar has already shifted its product line toward the new flat panel system and has expanded its sales force in this sector. We expect, although we cannot guarantee, that this the new product area will contribute a larger percentage of our revenues in the future.

| 16 |

The new manufacturing facilities that Anhui Solar is building in Fengyang city and Guzhen County, Bengbu City will provide a better manufacturing environment, larger capacity and much improved cost efficient production lines. This will help to control the overall cost of production and, we expect, increase profit margin.

Anhui Solar is also planning to open four to five representative offices outside of Anhui province, to develop new market in 2015. The first representative office, in Yantai city, Shandong province, was operational in early 2015. We expect that these new sale offices will contribute more revenue in the future.

Our Distribution and Agency Network

Anhui Solar has more than 120 home appliance sales agencies in all major villages and towns in Anhui province. These distributors are responsible for the installation and servicing of the our solar hot water units. We continue to develop new agency relationships and we eliminate those agencies whose quarterly sales underperform. We expect to maintain over the long term more than 100 agencies in Anhui province, to maximize steady revenue input from the sale of our household solar water heater systems.

Anhui Solar also has a direct sales department with a staff of more than 40 employees and we maintain a fleet of 15 delivery vans. The sales department is responsible for local distributor management and support, and direct sales to real estate developers for our flat panel, platform water heater system for apartment buildings. We are expanding the sales force for these water heater systems by acquiring experienced staff from other big brand name companies in the sector. These new sales personnel are expected to contribute significantly to our revenue growth through increased multiple sales of these platform units.

Additionally, we have opened a representative office in Yantai, Shandong Province, and we are preparing to open an additional four such offices in 2015 in Shandong and Jiangsu provinces.

Our After-Sales Services

Our traditional, roof mounted household solar water heater system has a very simple design and, once it properly installed on a roof, its operation is very reliable and it needs little maintenance. We do maintain an inventory of spare vacuum tubes at our warehouse and, if a unit becomes damaged, our distributors are able to replace vacuum tubes and make repairs on location.

Our flat panel, platform style water heater systems are typically installed on the vertical edge of an apartment balcony. With this product, the vacuum tubes are shielded by the shell, therefore, they are better protected and the unit is more sturdy than the traditional household system. Any damage to these units, such as leaking, is normally repaired by the onsite property management companies responsible for the buildings where these units are installed. In any case, we have a team of repairman ready to assist as needed.

Intellectual Property

Trademarks

“Renrenjia” is the trade mark for all of Anhui Solar’s products. This trade mark was registered with the Anhui Bureau for Industry and Commerce on December 28, 2006 and the registration expires on December 7, 2016. The registration number is 4225424. This trademark is authorized by the Bureau of Trade Mark of State Administration for Industry and Commerce (“SAIC”) of the PRC.

| 17 |

Patents

Anhui owns eight (8) utility model patents, and one (1) invention patent. All patents were issued by the State Bureau of Intellectual property of the PRC. The protection period for utility patents is 10 years, and for invention patent is 20 years. All patents of the company were registered between 2010 and 2013; therefore, the intellectual property of Anhui Solar is protected for an extended period of time.

Set forth below is a listing of our patents:

| patent name | patent number | date of grant | jurisdiction | |||

| Strong Thermal insulation solar water heater | ZL 2009 1 0116257.2 | 03/11/2010 | State Intellectual Property Bureau of the PRC | |||

| A flat plate type solar anti freezing device | ZL 2012 2 0464929.6 | 20/02/2013 | State Intellectual Property Bureau of the PRC | |||

| Air thermal cycling switch | ZL 2012 2 0464952.5 | 20/02/2013 | State Intellectual Property Bureau of the PRC | |||

| Flat Plate Solar Water Heater Which could be installed in the straight | ZL 2012 2 0464980.7 | 20/02/2013 | State Intellectual Property Bureau of the PRC | |||

| Instant Heating Type Solar Water Heater | ZL 2014 2 0002515.0 | 06/08/2014 | State Intellectual Property Bureau of the PRC | |||

| Solar auxiliary air source heat pump system | ZL 2012 2 0464915.4 | 20/02/2013 | State Intellectual Property Bureau of the PRC | |||

| Solar energy adsorption heat pump ground heating air conditioner | ZL 2014 2 0002491.9 | 06/08/2014 | State Intellectual Property Bureau of the PRC | |||

| Structure for improving air energy and air condition safety | ZL 2012 2 0464944.0 | 20/03/2013 | State Intellectual Property Bureau of the PRC | |||

| Warm water floor heating type heating plate | ZL 2014 2 0002512.7 | 06/08/2014 | State Intellectual Property Bureau of the PRC |

Competition

After years of industry operation in a subsidized environment with programs such as the “Home Electric Appliances to the Countryside” program, the trend of industry consolidation is very noticeable. With more than 2,000 manufactures in 2012 across the PRC, as reported by the China Solar Power Association, four or five of these companies have become the top industry manufacturers, 20 are large scales manufacturers, and 100 are local top tier manufacturers. These 100 local manufactures accounted for more than 40% of the total market share. Anhui Solar is in this group of 100 companies.

| 18 |

According to available statistics, there are more than 80 solar power water heater related manufactures in Anhui province, 50 of them are whole set manufactures, and approximately 30 of them are parts manufactures. Anhui Solar is the second tier of this group; the top tier often has manufacturing capacity for more than 100,000 units annually and annual sales over RMB 200,000,000 (approximately $32,000,000).

Due to the government’s recent subsidy programs including the “Home Electric Appliances to the Countryside” program, almost all solar power heating system manufacturers have operated at very low margins, with most recorded profit deriving from the available subsidies. We believe our success lies in our quality control, brand recognition strategy, comprehensive distribution network and advertising.

Government Regulation

We are not subject to any requirements for governmental permits or approvals or any self-regulatory professional associations for the manufacture and sale of solar hot water heaters. We are required to obtain a production approval from the Quality and Technology Supervisory and Control Bureau at the provincial level for the manufacture and sale of space heating products. Other than the foregoing, Anhui Solar is not subject to any other significant government regulation of its business or production, or any other government permits or approval requirements, except for the laws and regulations of general applicability for corporations formed under the laws of the PRC. We are not aware of any PRC environmental law which affects the production or sale of our products.

Employees

As of March 31, 2015 we had approximately 270 full time employees, 138 of whom have a junior college degree or above.

Our senior manufacturing personnel include a number of professional engineers and senior technology consultants.

See the discussion of our properties and facilities in Bengbu City and Fengyang City set forth above.

| 19 |

We face a variety of risks that may affect our operations or financial results and many of those risks are driven by factors that we cannot control or predict. you should carefully consider the following risks, together with the financial and other information contained in this report. If any of the following risks actually occurs, our business, prospects, financial condition and results of operations could be materially adversely affected.

THIS REPORT CONTAINS CERTAIN STATEMENTS RELATING TO FUTURE EVENTS OR THE FUTURE FINANCIAL PERFORMANCE OF OUR COMPANY. SUCH STATEMENTS ARE ONLY PREDICTIONS AND INVOLVE RISKS AND UNCERTAINTIES, AND THAT ACTUAL EVENTS OR RESULTS MAY DIFFER MATERIALLY. IN EVALUATING SUCH STATEMENTS, YOUSHOULD SPECIFICALLY CONSIDER THE VARIOUS FACTORS IDENTIFIED IN THIS REPORT, INCLUDING THE MATTERS SET FORTH BELOW, WHICH COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE INDICATED BY SUCH FORWARD-LOOKING STATEMENTS.

If any of the following or other risks materialize, the Company’s business, financial condition, and results of operations could be materially adversely affected which, in turn, could adversely impact the value of our Common Stock.

The risks described below do not purport to be all the risks to which the Company could be exposed. This section is a summary of certain risks and is not set out in any particular order of priority. They are the risks that we presently believe are material to the operations of the Company. Additional risks of which we are not presently aware or which we presently deem immaterial may also impair the Company’s business, financial condition or results of operations.

Risks Related to Our Business

We have a limited operating history and are subject to the risks encountered by early-stage companies.

Anhui Solar was organized in the PRC in November 2009. Because our operating company has a limited operating history, you should consider and evaluate our operating prospects in light of the risks and uncertainties frequently encountered by early-stage companies in rapidly evolving markets. For us, these risks include:

| ● | risks that we may not have sufficient capital to achieve our growth strategy; |

| ● | risks that we may not develop our product and service offerings in a manner that enables us to be profitable and meet our customers’ requirements; |

| ● | risks that our growth strategy may not be successful; | |

| ● | risks that we will not be able to compete; and |

| ● | risks that fluctuations in our operating results will be significant relative to our revenues. |

| 20 |

These risks are described in more detail below. Our future growth will depend substantially on our ability to address these and the other risks described in this section. If we do not successfully address these risks, our business would be significantly harmed.

We have a history of net losses, may incur substantial net losses in the future and may not achieve profitability.

Although we have begun to generate substantial revenues, we have incurred significant losses since inception. We expect to incur increased costs to implement our business plan and increase revenues, such as costs relating to expanding our product offerings into additional markets, both in the PRC and abroad. If our revenues do not increase to offset these additional expenses or if we experience unexpected increases in operating expenses, we will continue to incur significant losses and will not become profitable. If we are not able to significantly increase our revenues, we will likely not be able to achieve profitability in the future.

Investing in our securities is considered a high risk investment.

An investment in an early stage company such as ours involves a degree of risk, including the possibility that your entire investment may be lost. There can be no assurance that the business of Anhui Solar in China will be successful or profitable.

Our management team does not have experience in U.S. public company matters, which could impair our ability to comply with legal and regulatory requirements.

Our management team has had no U.S. public company management experience or responsibilities, which could impair our ability to comply with legal and regulatory requirements such as the Sarbanes-Oxley Act of 2002 and applicable U.S. federal securities laws, including filing required reports and other information required on a timely basis. There can be no assurance that our management will be able to implement and affect programs and policies in an effective and timely manner that adequately respond to increased legal, regulatory compliance and reporting requirements imposed by such laws and regulations. Our failure to comply with such laws and regulations could lead to the imposition of fines and penalties and result in the deterioration of our business.

Our principal shareholders have borrowed considerable sums of money from Anhui Solar.

Our Principal shareholders, Mr. Quan Ji, also our Chief Executive Officer, and Ms. Qimei Li, the wife of Mr. Ji, have borrowed approximately $12 million ($ six million each) from Anhui Solar during the past few years, for their personal use. Although Anhui Solar has stopped the practice of lending funds to Mr. Ji and Ms. Li as of January 1, 2015 and they have agreed to repay in full the amount owed by June 30, 2015, a delay or failure to repay could negatively impact out cash flow position and our ability to continue to do business.

If we lose the services of our founder or other members of our senior management team, we may not be able to execute our business strategy.

Our success depends in a large part upon the continued service of our senior management team. In particular, the continued service of Quan Ji, our Chief Executive Officer, is critical to our vision, strategic direction, culture, products and technology. We do not maintain key-man insurance for any of our founders or other members of our senior management team. The loss of any of our founders, even temporarily, or any other member of senior management could harm our business.

| 21 |

We may experience difficulty in establishing business controls and procedures that meet Western standards.

The PRC historically has not adopted a Western style of management and financial reporting concepts and practices, modern banking, computer or other control systems. We may have difficulty in hiring and retaining a sufficient number of qualified employees to work in the PRC. As a result of these factors, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet Western standards.

If we fail to maintain proper and effective internal controls, our ability to produce accurate and timely financial statements could be impaired, which could harm our operating results, our ability to operate our business and investors’ views of us.

Ensuring that we have adequate internal financial and accounting controls and procedures in place so that we can produce accurate financial statements on a timely basis is a costly and time-consuming effort that will need to be evaluated frequently. Section 404 of the Sarbanes-Oxley Act requires public companies to conduct an annual review and evaluation of their internal controls. Our failure to maintain the effectiveness of our internal controls in accordance with the requirements of the Sarbanes-Oxley Act could have a material adverse effect on our business. We could lose investor confidence in the accuracy and completeness of our financial reports, which could have an adverse effect on the price of our common stock. In addition, if our efforts to comply with new or changed laws, regulations, and standards differ from the activities intended by regulatory or governing bodies due to ambiguities related to practice, regulatory authorities may initiate legal proceedings against us and our business may be harmed.

We cannot assure you that our organic growth strategy will be successful.

Our strategy is to grow organically by increasing the distribution and sales of our products in new markets outside of northern Anhui Province, into other provinces of the PRC and, possibly, overseas as well. However, entering new markets faces many obstacles, including the costs to entering into new markets, developing and implementing effective marketing efforts, and maintaining attractive foreign exchange ratios for sales outside the PRC. We cannot assure you that we will be able to successfully overcome such obstacles and establish our products in any additional markets. Our inability to successfully implement our organic growth strategy may have a negative impact on our growth strategy, our future financial condition, results of operations, and cash flows.

Our dependence on a limited number of customers may cause significant fluctuations or declines in our revenues.

Although historically we have sold traditional solar water heating units in the residential rural market, we have begun to manufacture and sell platform style solar water heating systems to real estate developers for large urban apartment building projects. A substantial portion of our recent sales has been to such real estate developers and we expect this trend to continue in the future. We anticipate that our dependence on a limited number of such real estate development customers will increase in the foreseeable future. Consequently, any one of the following events may cause material fluctuations or declines in our revenues and have a material adverse effect on our results of operations:

| ● | reduction, delay or cancellation of orders from one or more significant customers; |

| ● | selection by one or more significant customers of products competitive with ours; | |

| ● | loss of one or more significant customers and our failure to identify additional or replacement customers; and |

| ● | failure of any significant customers to make timely payment for our products. |

| 22 |

Risks Related to Our Industry

Because the markets in which we compete are highly competitive and many of our competitors have greater resources than us, we may not be able to compete successfully and we may lose or be unable to gain market share.

We mainly focus on the local solar water heater market in northern Anhui Province, PRC. Competition in our primary residential market has led to oversupply and price cutting. Some of our competitors have a stronger market position than ours, more sophisticated technologies greater resources and better name recognition than we do. As a result, it is a challenge for us to establish our competitive market position in the industry. In order to acquire more market share, we must maintain our corporate integrity by keeping our focus on quality products, continue to improve our good image within the industry and the market, respond more quickly to changing customer demands or market conditions and continue to devote substantial resources to the marketing and promotion.

New competitors or alliances among existing competitors could emerge and rapidly acquire a significant market share, which would harm our business. If we fail to compete successfully, our business will suffer and we may lose or be unable to gain market share.

Risks Related to Our Corporate Structure

We control Anhui Solar through a series of contractual arrangements, which may not be as effective in providing control over the entity as direct equity ownership and may be difficult to enforce.

We operate our business in the PRC through our variable interest entity, Anhui Solar. Anhui Solar holds the licenses, approvals and assets necessary to operate our business in the PRC. We have no equity ownership interest in Anhui Solar and rely on contractual arrangements with Anhui Electronics, Anhui Solar and its shareholders that allow us to substantially control and operate Anhui Solar. These contractual arrangements may not be as effective as direct equity ownership in providing control over Anhui Solar because Anhui Solar or its shareholders could breach these arrangements.

Our contractual arrangements with Anhui Solar are governed by PRC law. Accordingly, these contracts would be interpreted in accordance with PRC law and any disputes would be resolved in accordance with PRC legal procedures. If Anhui Solar or its shareholders fail to perform their respective obligations under these contractual arrangements, we may incur substantial costs to enforce such arrangements and rely on legal remedies under PRC law, including seeking specific performance or injunctive relief, and claiming damages.

The legal environment in the PRC is not as developed as in the United States and uncertainties in the Chinese legal system could limit our ability to enforce these contractual arrangements. In the event that we are unable to enforce these contractual arrangements, our business, financial condition and results of operations could be materially adversely affected.

Because the relationship between Anhui Solar and Anhui Electronics is entirely contractual, our interest in Anhui Solar depends on the enforceability of those agreements under the laws of the PRC. We are not aware of any judicial decision as to the enforceability of similar agreements under PRC law.

| 23 |

If the PRC government determines that the contractual arrangements through which we control Anhui Solar do not comply with applicable laws and regulations, our business may be adversely affected.

Although we believe the contractual arrangements through which we control Anhui Solar comply with current licensing, registration and regulatory requirements of the PRC, we cannot assure you that the PRC government would agree, or that new and burdensome regulations will not be adopted in the future. If the PRC government determines that our structure or operating arrangements do not comply with applicable law and regulations, it could revoke our business and operating licenses, require us to discontinue or restrict our operations, restrict our right to collect revenues, require us to restructure our operations, impose additional conditions or requirements with which we may not be able to comply, impose restrictions on our business operations or on our customers, or take other regulatory or enforcement actions against us that may be harmful to our business.

We rely on dividends and working capital advances paid by our subsidiaries and VIEs for our cash needs.

We conduct substantially all of our operations in China through our subsidiary, Anhui Electronics, and our variable interest entity, Anhui Solar. We rely on dividends and working capital advances from these affiliated entities for our cash needs, including the funds necessary to pay any dividends which we may declare and other cash distributions to our shareholders, to service any debt we may incur and to pay our operating expenses. The payment of dividends and working capital advances by entities organized in China is subject to limitations. Regulations in China currently permit payment of dividends only out of accumulated profits as determined in accordance with accounting standards and regulations in China. Each of our subsidiary and variable interest entity is also required to set aside at least 10% of its after-tax profit based on China’s accounting standards each year to its general reserves until the accumulated amount of such reserves reaches 50% of its registered capital. These reserves are not distributable as cash dividends. Our affiliated companies in China are also required to allocate a portion of their after-tax profits to their staff welfare and bonus funds, which may not be distributed to equity owners except in the event of liquidation. In addition, if our subsidiaries incur debt, the instruments governing the debt may restrict their ability to pay dividends or make other distributions to us.

China’s Unified Corporate Income Tax Law also imposes a withholding income tax of 10% on dividends distributed by a foreign invested enterprise to its immediate holding company outside of China, if such immediate holding company is considered as a non-resident enterprise without any establishment or place within China or if the received dividends have no connection with the establishment or place of such immediate holding company within China, unless such immediate holding company’s jurisdiction of incorporation has a tax treaty with China that provides for a different withholding arrangement.

Potential conflicts of interest may arise between the Company and Mr. Quan Ji, the controlling stockholder and chief executive officer of Anhui Solar, which could adversely affect our business.

Mr. Quan Ji, General Manager of our China operations, is the controlling stockholder and chief executive officer of Anhui Solar. The Company, through its wholly owned subsidiary in Chine, Anhui Electronics, has entered into a series of contractual agreements with Anhui Solar through which we operate our business in China. Because Mr. Ji is a significant stockholder and employee of the Company and the controlling stockholder and chief executive officer of Anhui Solar, conflicts of interest may arise due to his relationship with both companies. We cannot assure investors that, when conflicts of interest arise, Mr. Ji will act in the best interests of the Company or that conflicts of interest will be resolved in our favor. In addition, Mr. Ji may breach or cause Anhui Solar to breach or refuse to renew the existing contractual agreements with Anhui Electronics that allow us to operate our business in China and receive economic remuneration from Anhui Solar. We rely on Mr. Ji to act in good faith and in the best interests of the Company, and not use his positions for personal gain. If we cannot resolve any conflicts of interest or disputes between us and Mr. Ji, we may have to rely on legal proceedings, which could result in disruption of our business and substantial uncertainty as to the outcome of any such legal proceedings.

| 24 |

Our contractual arrangements with our consolidated affiliated entities may result in adverse tax consequences to us.