Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WORLD WRESTLING ENTERTAINMENTINC | form8-kwwenetworkrelease.htm |

| EX-99.1 - EXHIBIT 99.1 - WORLD WRESTLING ENTERTAINMENTINC | exhibit991pressrelease.htm |

NETWORK PRESENTATION MARCH 30, 2015

This presentation contains forward-looking statements pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995, which are subject to various risks and uncertainties. These risks and uncertainties include, without limitation, risks relating to: WWE Network; major distribution agreements; our need to continue to develop creative and entertaining programs and events; a decline in the popularity of our brand of sports entertainment; the continued importance of key performers and the services of Vincent K. McMahon; possible adverse changes in the regulatory atmosphere and related private sector initiatives; the highly competitive, rapidly changing and increasingly fragmented nature of the markets in which we operate and greater financial resources or marketplace presence of many of our competitors; uncertainties associated with international markets; our difficulty or inability to promote and conduct our live events and/or other businesses if we do not comply with applicable regulations; our dependence on our intellectual property rights, our need to protect those rights, and the risks of our infringement of others’ intellectual property rights; the complexity of our rights agreements across distribution mechanisms and geographical areas; potential substantial liability in the event of accidents or injuries occurring during our physically demanding events including, without limitation, claims relating to CTE; large public events as well as travel to and from such events; our feature film business; our expansion into new or complementary businesses and/or strategic investments; our computer systems and online operations; a possible decline in general economic conditions and disruption in financial markets; our accounts receivable; our revolving credit facility; litigation; our potential failure to meet market expectations for our financial performance, which could adversely affect our stock; Vincent K. McMahon exercising control over our affairs, and his interests may conflict with the holders of our Class A common stock; a substantial number of shares which are eligible for sale by the McMahons and the sale, or the perception of possible sales, of those shares could lower our stock price; and the relatively small public “float” of our Class A common stock. In addition, our dividend is dependent on a number of factors, including, among other things, our liquidity and cash flow, strategic plan (including alternative uses of capital), our financial results and condition, contractual and legal restrictions on the payment of dividends (including under our revolving credit facility), general economic and competitive conditions and such other factors as our Board of Directors may consider relevant. Forward-looking statements made by the Company speak only as of the date made, are subject to change without any obligation on the part of the Company to update or revise them, and undue reliance should not be placed on these statements. This presentation contains non-GAAP financial information, including OIBDA. We define OIBDA as operating income before depreciation and amortization, excluding feature film and television production amortization and related impairments. OIBDA is a non-GAAP financial measure and may be different than similarly-titled non-GAAP financial measures used by other companies. A limitation of OIBDA is that it excludes depreciation and amortization, which represents the periodic charge for certain fixed assets and intangible assets used in generating revenues for the Company's business. OIBDA should not be regarded as an alternative to operating income or net income as an indicator of operating performance, or to the statement of cash flows as a measure of liquidity, nor should it be considered in isolation or as a substitute for financial measures prepared in accordance with GAAP. We believe that operating income is the most directly comparable GAAP financial measure to OIBDA. Reconciliations of OIBDA to operating income can be found in the Company’s earnings release issued February 12, 2015. FORWARD-LOOKING STATEMENTS 2

WWE NETWORK UPDATE Executive Summary WWE Network Accomplishments New Original Content Paths to Potential Subscriber Growth Questions & Answers 3

Launched WWE Network Feb. 24, 2014 Features all 12 pay-per-view events live – including WrestleMania, original series, reality shows and VOD library Scheduled and on-demand content distributed via web, mobile, gaming consoles, media players, and Smart TVs Made available internationally in 170+ countries Network reflects significant feats in technology and design Following WWE’s leadership, CBS, HBO and Nickelodeon, have launched or announced plans to bring content direct to consumers WWE NETWORK: BLAZING A NEW TRAIL 4 4

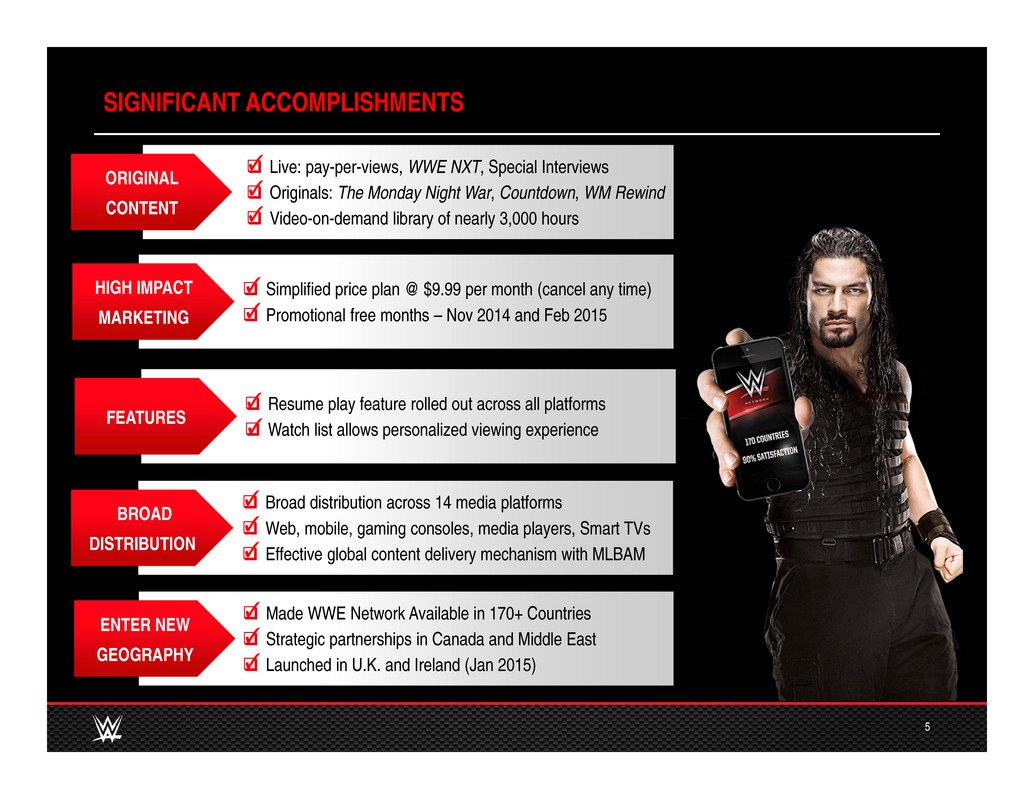

SIGNIFICANT ACCOMPLISHMENTS Live: pay-per-views, WWE NXT, Special Interviews Originals: The Monday Night War, Countdown, WM Rewind Video-on-demand library of nearly 3,000 hours ORIGINAL CONTENT Made WWE Network Available in 170+ Countries Strategic partnerships in Canada and Middle East Launched in U.K. and Ireland (Jan 2015) ENTER NEW GEOGRAPHY ✓ ✓ ✓ ✓ ✓ ✓ Resume play feature rolled out across all platforms Watch list allows personalized viewing experienceFEATURES ✓ ✓ Simplified price plan @ $9.99 per month (cancel any time) Promotional free months – Nov 2014 and Feb 2015 HIGH IMPACT MARKETING ✓ ✓ 5 Broad distribution across 14 media platforms Web, mobile, gaming consoles, media players, Smart TVs Effective global content delivery mechanism with MLBAM BROAD DISTRIBUTION ✓ ✓ ✓

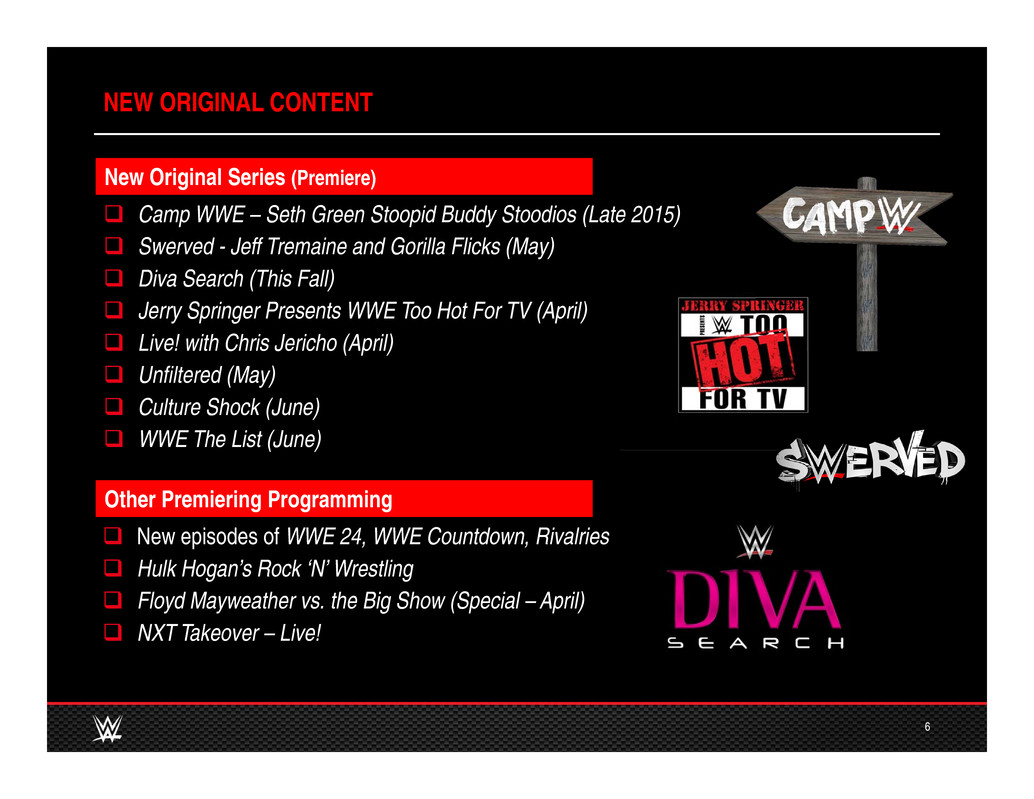

NEW ORIGINAL CONTENT 6 New Original Series (Premiere) Camp WWE – Seth Green Stoopid Buddy Stoodios (Late 2015) Swerved - Jeff Tremaine and Gorilla Flicks (May) Diva Search (This Fall) Jerry Springer Presents WWE Too Hot For TV (April) Live! with Chris Jericho (April) Unfiltered (May) Culture Shock (June) WWE The List (June) Other Premiering Programming New episodes of WWE 24, WWE Countdown, Rivalries Hulk Hogan’s Rock ‘N’ Wrestling Floyd Mayweather vs. the Big Show (Special – April) NXT Takeover – Live!

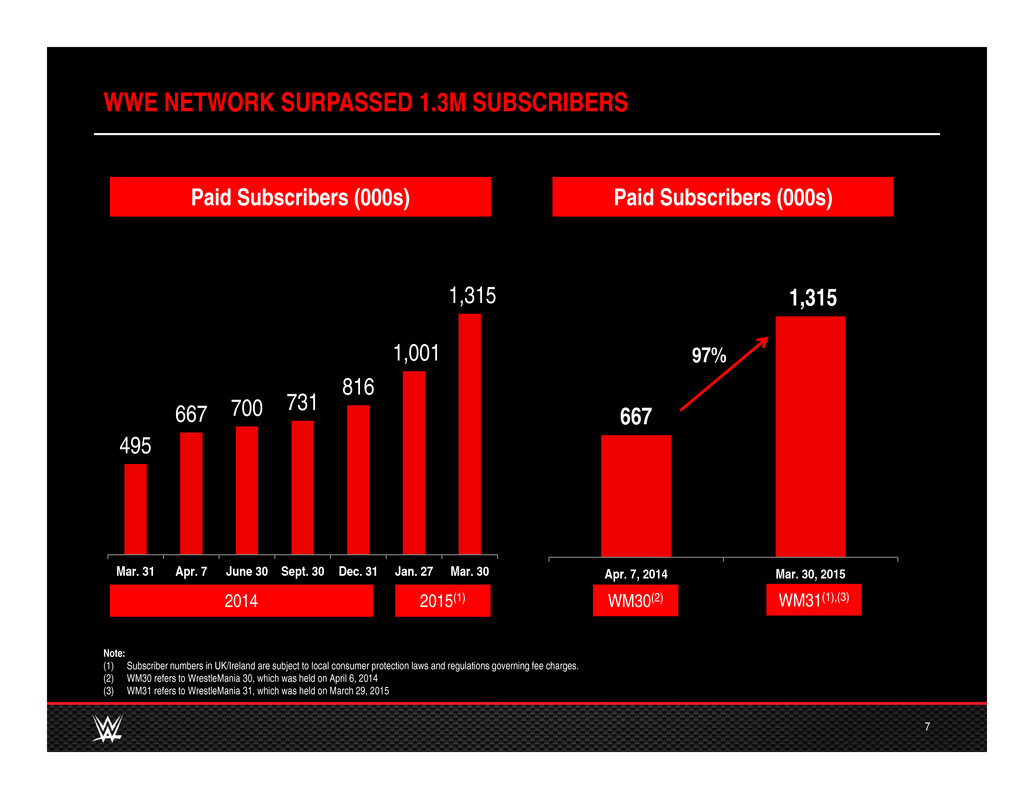

WWE NETWORK SURPASSED 1.3M SUBSCRIBERS 7 495 667 700 731 816 1,001 1,315 Mar. 31 Apr. 7 June 30 Sept. 30 Dec. 31 Jan. 27 Mar. 30 Paid Subscribers (000s) 2014 2015(1) Note: (1) Subscriber numbers in UK/Ireland are subject to local consumer protection laws and regulations governing fee charges. (2) WM30 refers to WrestleMania 30, which was held on April 6, 2014 (3) WM31 refers to WrestleMania 31, which was held on March 29, 2015 667 1,315 Apr. 7, 2014 Mar. 30, 2015 WM31(1),(3)WM30(2) Paid Subscribers (000s) 97%

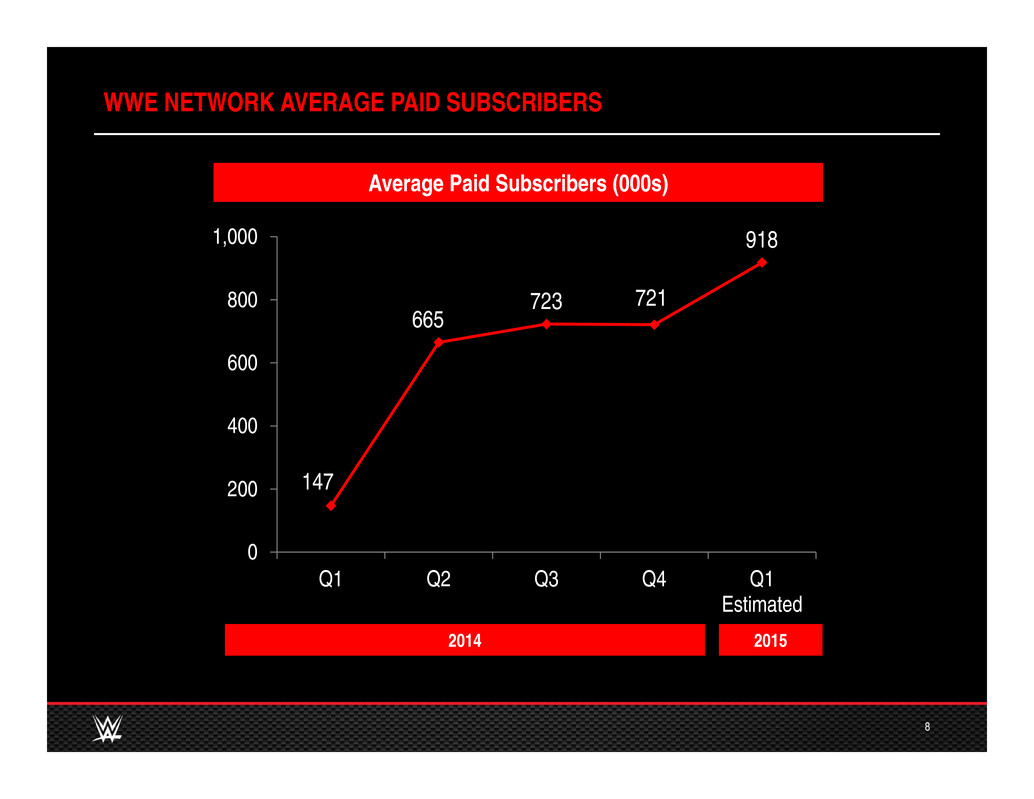

WWE NETWORK AVERAGE PAID SUBSCRIBERS 8 Average Paid Subscribers (000s) 2014 2015 147 665 723 721 918 0 200 400 600 800 1,000 Q1 Q2 Q3 Q4 Q1 Estimated

E n d i n g S u b s c r i b e r s E n d i n g S u b s c r i b e r s WWE NETWORK: MULTIPLE PATHS TO REACH POTENTIAL 9 Sequential Growth Seasonal Year-over-year Growth Time (Months/ Quarters)Time (Months/ Quarters)

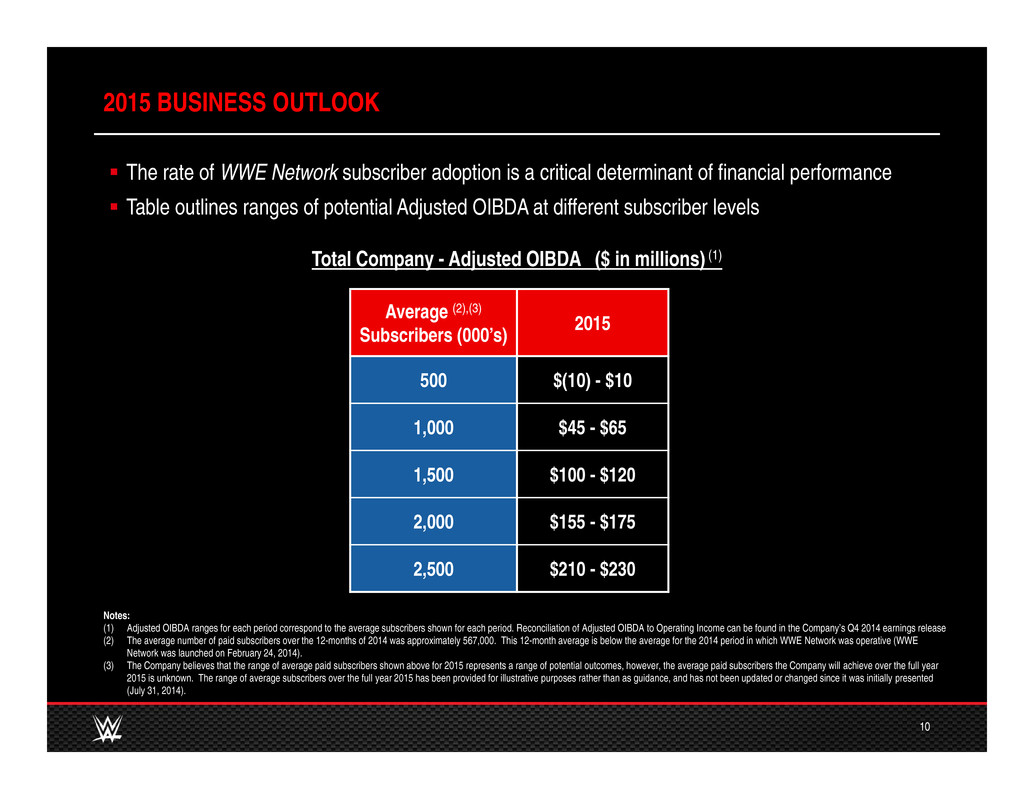

2015 BUSINESS OUTLOOK 10 Notes: (1) Adjusted OIBDA ranges for each period correspond to the average subscribers shown for each period. Reconciliation of Adjusted OIBDA to Operating Income can be found in the Company’s Q4 2014 earnings release (2) The average number of paid subscribers over the 12-months of 2014 was approximately 567,000. This 12-month average is below the average for the 2014 period in which WWE Network was operative (WWE Network was launched on February 24, 2014). (3) The Company believes that the range of average paid subscribers shown above for 2015 represents a range of potential outcomes, however, the average paid subscribers the Company will achieve over the full year 2015 is unknown. The range of average subscribers over the full year 2015 has been provided for illustrative purposes rather than as guidance, and has not been updated or changed since it was initially presented (July 31, 2014). The rate of WWE Network subscriber adoption is a critical determinant of financial performance Table outlines ranges of potential Adjusted OIBDA at different subscriber levels Total Company - Adjusted OIBDA ($ in millions) (1) Average (2),(3) Subscribers (000’s) 2015 500 $(10) - $10 1,000 $45 - $65 1,500 $100 - $120 2,000 $155 - $175 2,500 $210 - $230

We believe the success of our subscriber initiatives will derive from the strength of our brands. Measures such as the magnitude of our digital and social media presence and the top ratings of our programs all reflect WWE’s tremendous appeal In 2015, we expect year-over-year adjusted OIBDA growth in every quarter driven by the performance of WWE Network as well as the escalation of television rights fees and continued innovation LONG-TERM PERSPECTIVE 11 Over the long-term, regardless of whether WWE follows a pattern of sequential or seasonal year-over-year growth, achieving the network’s subscriber potential could drive significant economic returns