Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Century Communities, Inc. | d899486d8k.htm |

Exhibit 99.1

CENTURY

COMMUNITIES

Investor Presentation

March 2015

CENTURY

COMMUNITIES

Forward-Looking Statements

Certain statements in this Investor Presentation may be regarded as “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Certain forward-looking statements discuss the Company’s plans, strategies and intentions, and may be identified by reference to a future period or periods or by the use of forward-looking terminology, such as “expects,” “may,” “will,” “believes,” “should,” “would,” “could,” “approximately,” “anticipates,” “estimates,” “targets,” “intends,” “likely,” “projects,” “positioned,” “strategy,” “future,” and “plans.” In addition, these words may use the positive or negative or other variations of those terms. All statements other than statements of historical fact are “forward–looking statements” for purposes of federal and state securities laws. There is no guarantee that any of the events anticipated by these forward-looking statements will occur. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to differ from those expressed or implied by the forward-looking statement.

These forward-looking statements are based on various assumptions and the current expectations of the management of the Company, and may not be accurate because of risks and uncertainties surrounding these assumptions and expectations. Certain factors may cause actual results to differ significantly from these forward-looking statements. If any of the events occur, there is no guarantee what effect they will have on the operations or financial condition of the Company. Major risks, uncertainties and assumptions include, but are not limited to, risks relating to: the Company’s capital and financing needs and availability; any unforeseen changes to or effects on liabilities, future capital expenditures, revenues, expenses, earnings, synergies, indebtedness, financial condition, losses and future prospects; the Company’s ability to integrate and operate assets successfully after the closing of an acquisition; the effect of general economic conditions, including employment rates, housing starts, interest rate levels, availability of financing for home mortgages, and the strength of the U.S. dollar; and other factors. However, it is not possible to predict or identify all such factors.

In addition, the Company has disclosed under the heading “Risk Factors” in its Annual Report on Form 10-K for the fiscal year ended December 31, 2014 (the “Annual Report”), filed with the U.S. Securities and Exchange Commission on March 6, 2015, the risk factors which materially affect its business, financial condition and operating results. Investors are encouraged to review the Annual Report for additional information regarding the risks and uncertainties that may cause actual results to differ materially from those expressed in any forward-looking statement. Forward-looking statements included herein are made as of the date hereof, and the Company undertakes no obligation to publicly update or revise any forward-looking statement to reflect future events, developments or otherwise, except as may be required by applicable law.

2

CENTURY

COMMUNITIES

Seasoned and Aligned Management Team

Dale Francescon

Chairman & Co-Chief Executive Officer Co-founded Century and served as Co-CEOs since 2002.

Since then, Century has become a Top-50 U.S. Builder(1)

Robert Francescon

Co-Chief Executive Officer & President Own a combined 27% of the Company(2)

David Messenger 10 years of public company experience at UDR, Inc., a

Chief Financial Officer multi-billion dollar multifamily REIT, served as CFO, CAO

and Controller

(1) Based on 2013 closings, as ranked by BUILDER Online, including recent acquisitions.

(2) As of March 27, 2015.

3

CENTURY

COMMUNITIES

Key Credit Highlights

CENTURY

COMMUNITIES

Premier Homebuilder Focused On Markets With Exceptional Growth Potential

Potential

Top-50 U.S. homebuilder(1) based on closings from recent acquisition activity

Top-five fastest growing homebuilder by revenue(2)

Profitable every year since founding in 2002

Attractive land positions in 140 communities(3)

11,463 lots owned and controlled(3)

83 active selling communities(3)

Strategically located in attractive major metropolitan markets, across Denver, Northern Colorado, and Colorado Springs, CO; Austin, San Antonio and Houston, TX; Las Vegas, NV and Atlanta, GA.

Diversified product offering for a wide buyer universe

Company snapshot:

$599.4 million pro forma revenue in 2014(4)

$57.2 million further acquisition adjusted EBITDA in 2014(5)

(1) Based on 2013 closings, as ranked by BUILDER Online. including recent acquisitions.

(2) Based on 2012-2013 home sales revenue growth, as ranked by BUILDER Online.

(3) As of December 31, 2014

(4) Pro Forma for Jimmy Jacobs, LVLH, Grand View and Peachtree acquisitions.

(5) Adjusted for LVLH and Peachtree acquisitions.

5

CENTURY

COMMUNITIES

Key Credit Highlights

Cycle-Tested and Aligned Management Team

Superior Operating Performance

Diversified Operating Strategy

Strong and Growing Geographical Footprint

Attractive and Well-Located Land Positions

Proven and Profitable Results

Conservative Capital Structure

6

CENTURY

COMMUNITIES

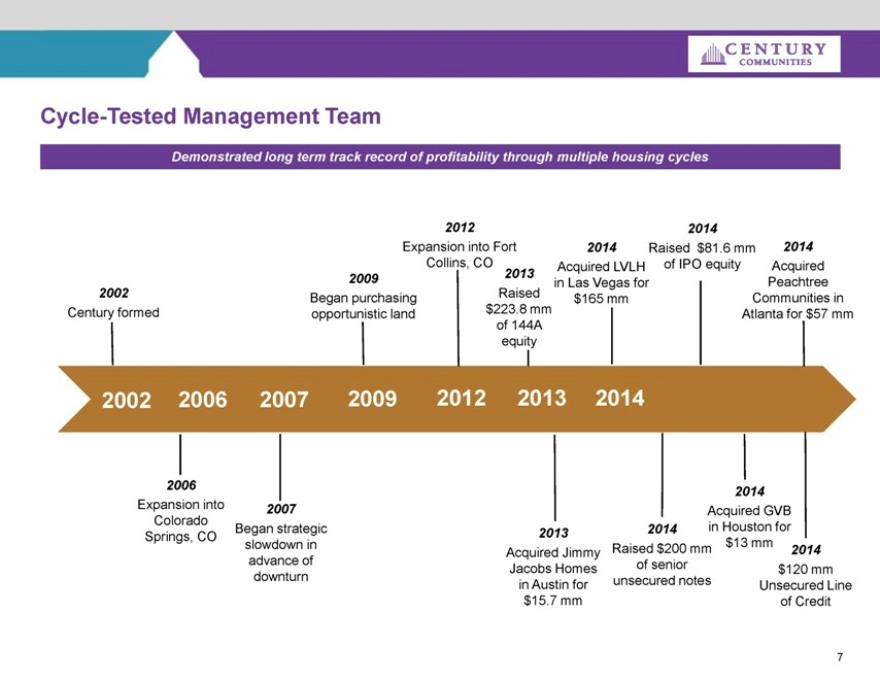

Cycle-Tested Management Team

Demonstrated long term track record of profitability through multiple housing cycles

2002

Century formed

2009

Began purchasing opportunistic land

2012

Expansion into Fort Collins, CO

2013

Raised $223.8 mm of 144A equity

2014

Acquired LVLH in Las Vegas for $165 mm

2014

Raised $81.6 mm of IPO equity

2014 Acquired Peachtree Communities in Atlanta for $57 mm

2002 2006 2007 2009 2012 2013 2014

2006

Expansion into Colorado Springs, CO

2007

Began strategic slowdown in advance of downturn

2013

Acquired Jimmy Jacobs Homes in Austin for $15.7 mm

2014

Raised $200 mm of senior unsecured notes

2014

Acquired GVB in Houston for $13 mm

2014

$120 mm Unsecured Line of Credit

7

CENTURY

COMMUNITIES

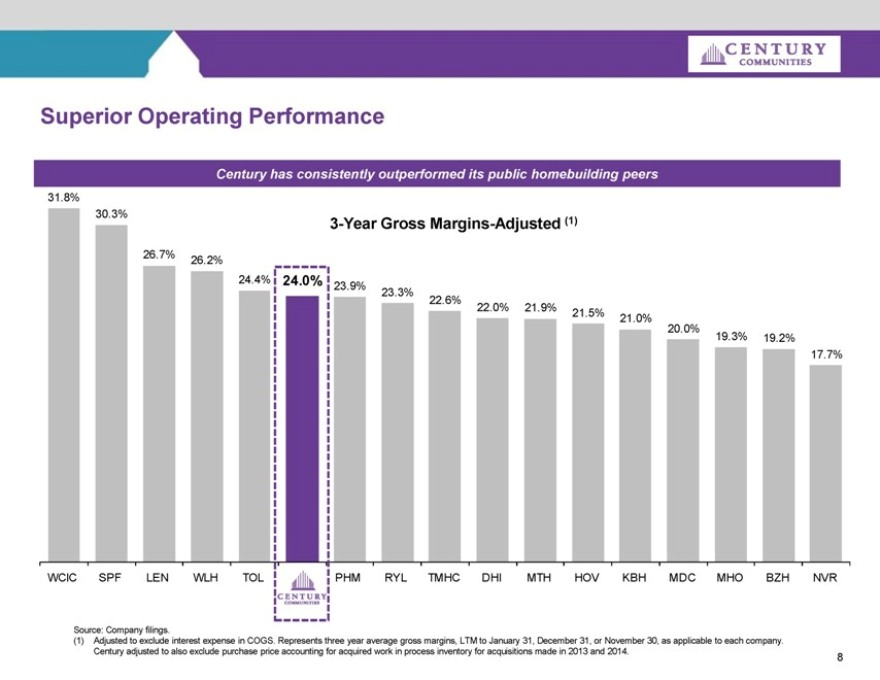

Superior Operating Performance

Century has consistently outperformed its public homebuilding peers

31.8%

30.3%

3-Year Gross Margins-Adjusted (1)

26.7% 26.2%

24.4% 24.0% 23.9%

23.3%

22.6%

22.0% 21.9% 21.5% 21.0%

20.0%

19.3% 19.2%

17.7%

WCIC SPF LEN WLH TOL CENTURY COMMUNITIES PHM RYL TMHC DHI MTH HOV KBH MDC MHO BZH NVR

Source: Company filings.

(1) Adjusted to exclude interest expense in COGS. Represents three year average gross margins, LTM to January 31, December 31, or November 30, as applicable to each company. Century adjusted to also exclude purchase price accounting for acquired work in process inventory for acquisitions made in 2013 and 2014.

8

CENTURY

COMMUNITIES

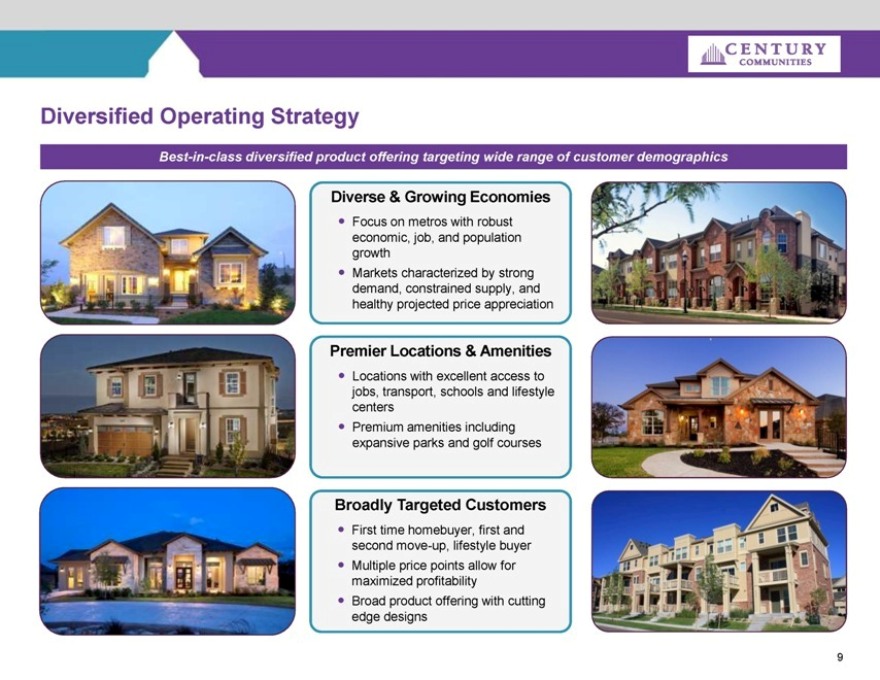

Diversified Operating Strategy

Best-in-class diversified product offering targeting wide range of customer demographics

Diverse & Growing Economies

Focus on metros with robust economic, job, and population growth

Markets characterized by strong demand, constrained supply, and healthy projected price appreciation

Premier Locations & Amenities

Locations with excellent access to jobs, transport, schools and lifestyle centers

Premium amenities including expansive parks and golf courses

Broadly Targeted Customers

First time homebuyer, first and second move-up, lifestyle buyer

Multiple price points allow for maximized profitability

Broad product offering with cutting edge designs

9

CENTURY

COMMUNITIES

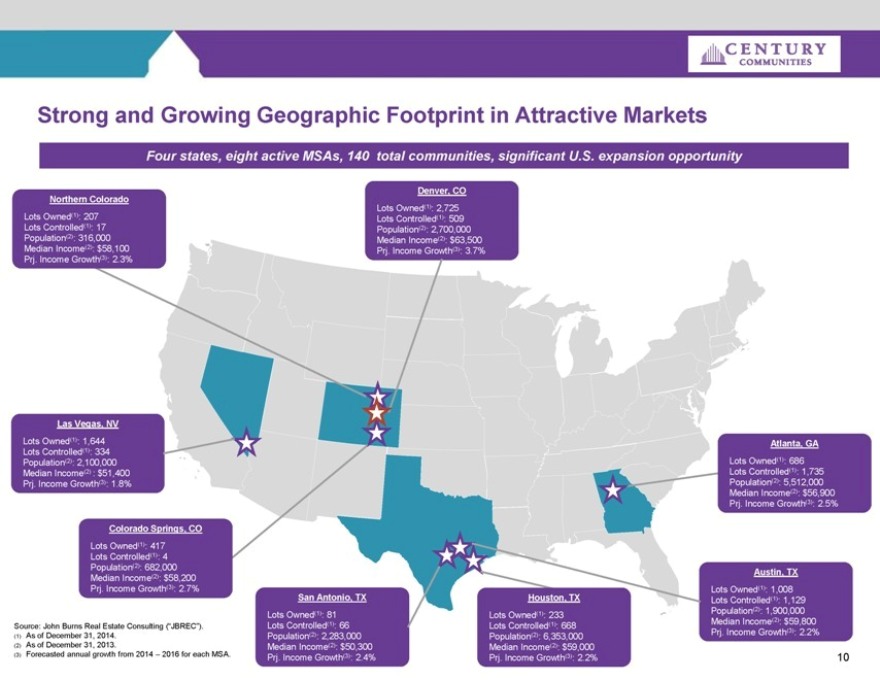

Strong and Growing Geographic Footprint in Attractive Markets

Four states, eight active MSAs, 140 total communities, significant U.S. expansion opportunity

Northern Colorado

Lots Owned(1): 207 Lots Controlled(1): 17 Population(2): 316,000 Median Income(2): $58,100 Prj. Income Growth(3): 2.3%

Denver, CO

Lots Owned(1): 2,725 Lots Controlled(1): 509 Population(2): 2,700,000 Median Income(2): $63,500 Prj. Income Growth(3): 3.7%

Las Vegas, NV

Lots Owned(1): 1,644 Lots Controlled(1): 334 Population(2): 2,100,000 Median Income(2) : $51,400 Prj. Income Growth(3): 1.8%

Colorado Springs, CO

Lots Owned(1): 417 Lots Controlled(1): 4 Population(2): 682,000 Median Income(2): $58,200 Prj. Income Growth(3): 2.7%

San Antonio, TX

Lots Owned(1): 81 Lots Controlled(1): 66 Population(2): 2,283,000 Median Income(2): $50,300 Prj. Income Growth(3): 2.4%

Houston, TX

Lots Owned(1): 233 Lots Controlled(1): 668 Population(2): 6,353,000 Median Income(2): $59,000 Prj. Income Growth(3): 2.2%

Atlanta, GA

Lots Owned(1): 686 Lots Controlled(1): 1,735 Population(2): 5,512,000 Median Income(2): $56,900 Prj. Income Growth(3): 2.5%

Austin, TX

Lots Owned(1): 1,008 Lots Controlled(1): 1,129 Population(2): 1,900,000 Median Income(2): $59,800 Prj. Income Growth(3): 2.2%

Source: John Burns Real Estate Consulting (“JBREC”).

(1) As of December 31, 2014.

(2) As of December 31, 2013.

(3) Forecasted annual growth from 2014 – 2016 for each MSA.

10

CENTURY

COMMUNITIES

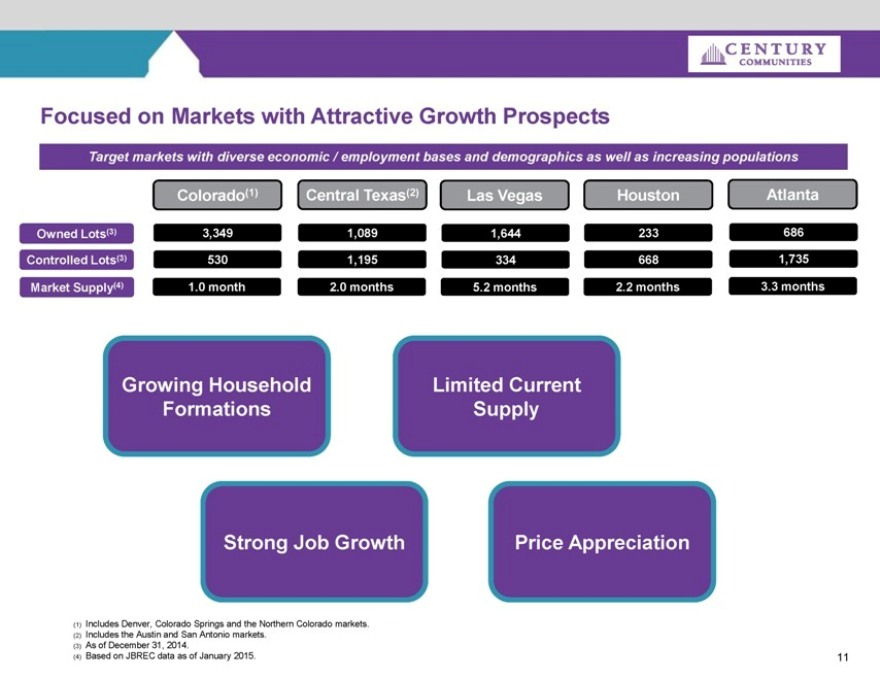

Focused on Markets with Attractive Growth Prospects

Target markets with diverse economic / employment bases and demographics as well as increasing populations

Colorado(1) Central Texas(2) Las Vegas Houston Atlanta

Owned Lots(3) 3,349 1,089 1,644 233 686

Controlled Lots(3) 530 1,195 334 668 1,735

Market Supply(4) 1.0 month 2.0 months 5.2 months 2.2 months 3.3 months

Growing Household Formations

Limited Current Supply

Strong Job Growth

Price Appreciation

(1) Includes Denver, Colorado Springs and the Northern Colorado markets.

(2) Includes the Austin and San Antonio markets.

(3) As of December 31, 2014.

(4) Based on JBREC data as of January 2015.

11

CENTURY

COMMUNITIES

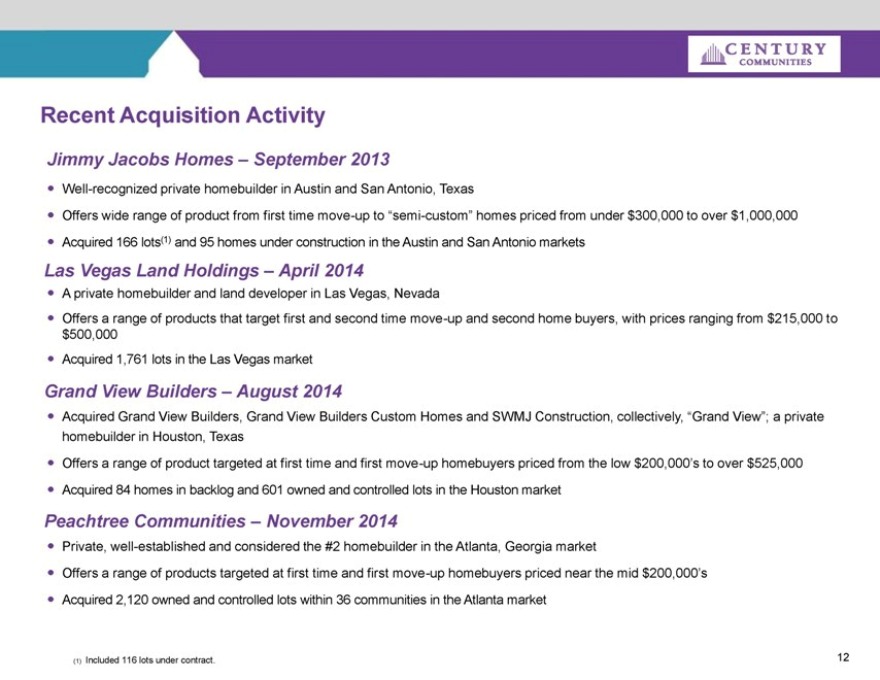

Recent Acquisition Activity

Jimmy Jacobs Homes – September 2013

Well-recognized private homebuilder in Austin and San Antonio, Texas

Offers wide range of product from first time move-up to “semi-custom” homes priced from under $300,000 to over $1,000,000

Acquired 166 lots(1) and 95 homes under construction in the Austin and San Antonio markets

Las Vegas Land Holdings – April 2014

A private homebuilder and land developer in Las Vegas, Nevada

Offers a range of products that target first and second time move-up and second home buyers, with prices ranging from $215,000 to $500,000

Acquired 1,761 lots in the Las Vegas market

Grand View Builders – August 2014

Acquired Grand View Builders, Grand View Builders Custom Homes and SWMJ Construction, collectively, “Grand View”; a private homebuilder in Houston, Texas

Offers a range of product targeted at first time and first move-up homebuyers priced from the low $200,000’s to over $525,000

Acquired 84 homes in backlog and 601 owned and controlled lots in the Houston market

Peachtree Communities – November 2014

Private, well-established and considered the #2 homebuilder in the Atlanta, Georgia market

Offers a range of products targeted at first time and first move-up homebuyers priced near the mid $200,000’s

Acquired 2,120 owned and controlled lots within 36 communities in the Atlanta market

(1) Included 116 lots under contract.

12

CENTURY

COMMUNITIES

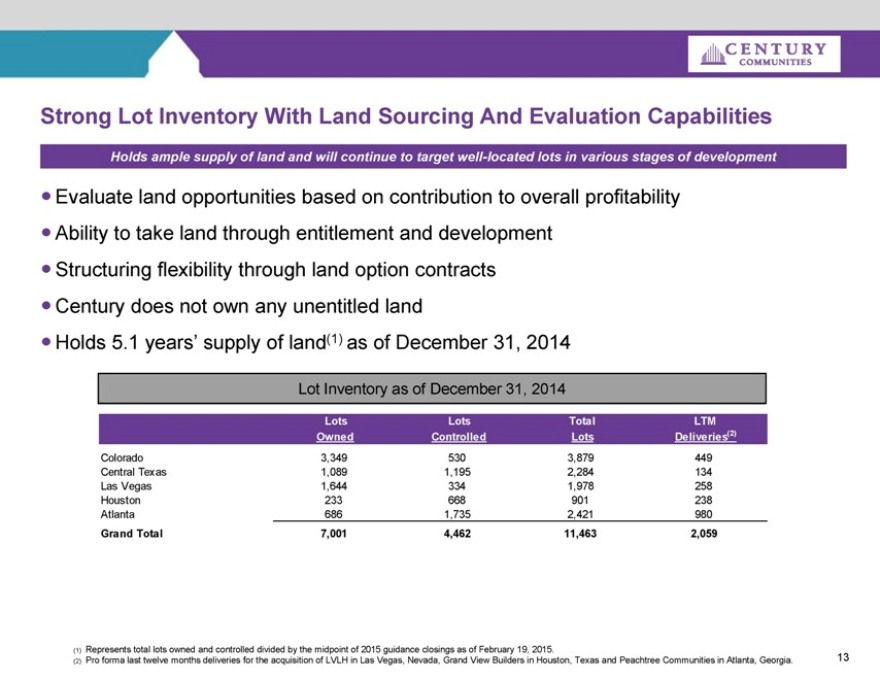

Strong Lot Inventory With Land Sourcing And Evaluation Capabilities

Holds ample supply of land and will continue to target well-located lots in various stages of development

Evaluate land opportunities based on contribution to overall profitability

Ability to take land through entitlement and development

Structuring flexibility through land option contracts

Century does not own any unentitled land

Holds 5.1 years’ supply of land(1) as of December 31, 2014

Lot Inventory as of December 31, 2014

Lots Lots Total LTM

Owned Controlled Lots Deliveries(2)

Colorado 3,349 530 3,879 449

Central Texas 1,089 1,195 2,284 134

Las Vegas 1,644 334 1,978 258

Houston 233 668 901 238

Atlanta 686 1,735 2,421 980

Grand Total 7,001 4,462 11,463 2,059

(1) Represents total lots owned and controlled divided by the midpoint of 2015 guidance closings as of February 19, 2015.

(2) Pro forma last twelve months deliveries for the acquisition of LVLH in Las Vegas, Nevada, Grand View Builders in Houston, Texas and Peachtree Communities in Atlanta, Georgia.

13

CENTURY

COMMUNITIES

Capacity to Execute Growth Strategy

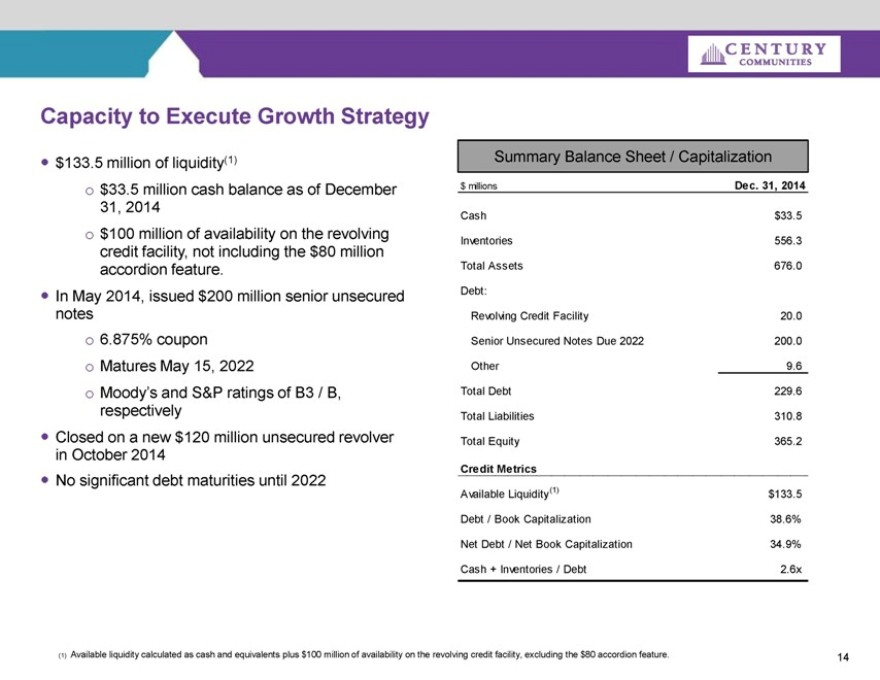

$133.5 million of liquidity(1)

$33.5 million cash balance as of December 31, 2014

$100 million of availability on the revolving credit facility, not including the $80 million accordion feature.

In May 2014, issued $200 million senior unsecured notes

6.875% coupon

Matures May 15, 2022

Moody’s and S&P ratings of B3 / B, respectively

Closed on a new $120 million unsecured revolver in October 2014

No significant debt maturities until 2022

Summary Balance Sheet / Capitalization

$ millions Dec. 31, 2014

Cash $33.5

Inventories 556.3

Total Assets 676.0

Debt:

Revolving Credit Facility 20.0

Senior Unsecured Notes Due 2022 200.0

Other 9.6

Total Debt 229.6

Total Liabilities 310.8

Total Equity 365.2

Credit Metrics

Available Liquidity(1) $133.5

Debt / Book Capitalization 38.6%

Net Debt / Net Book Capitalization 34.9%

Cash + Inventories / Debt 2.6x

(1) Available liquidity calculated as cash and equivalents plus $100 million of availability on the revolving credit facility, excluding the $80 accordion feature.

14

CENTURY

COMMUNITIES

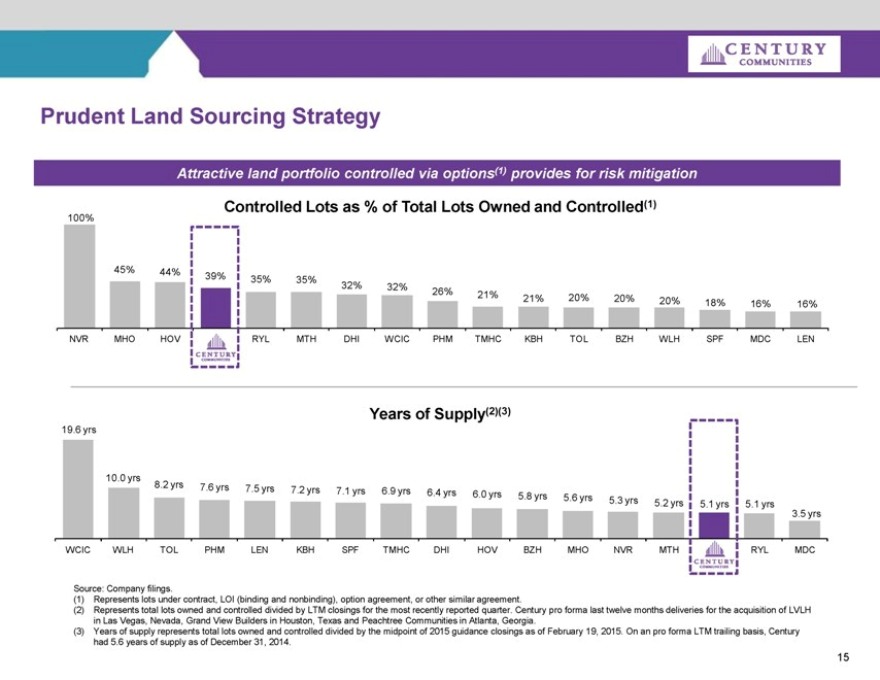

Prudent Land Sourcing Strategy

Attractive land portfolio controlled via options(1) provides for risk mitigation

Controlled Lots as % of Total Lots Owned and Controlled(1)

100%

45% 44% 39% 35% 35%

32% 32% 26%

21% 21% 20% 20% 20% 18% 16% 16%

NVR MHO HOV CENTURY COMMUNITIES RYL MTH DHI WCIC PHM TMHC KBH TOL BZH WLH SPF MDC LEN

Years of Supply(2)(3)

19.6 yrs

10.0 yrs

8.2 yrs 7.6 yrs 7.5 yrs 7.2 yrs 7.1 yrs 6.9 yrs 6.4 yrs 6.

0 yrs 5.8 yrs 5.6 yrs 5.3 yrs 5.2 yrs 5.1 yrs 5.1 yrs

3.5 yrs

WCIC WLH TOL PHM LEN KBH SPF TMHC DHI HOV BZH MHO NVR MTH CENTURY COMMUNITIES RYL MDC

Source: Company filings.

(1) Represents lots under contract, LOI (binding and nonbinding), option agreement, or other similar agreement.

(2) Represents total lots owned and controlled divided by LTM closings for the most recently reported quarter. Century pro forma last twelve months deliveries for the acquisition of LVLH in Las Vegas, Nevada, Grand View Builders in Houston, Texas and Peachtree Communities in Atlanta, Georgia.

(3) Years of supply represents total lots owned and controlled divided by the midpoint of 2015 guidance closings as of February 19, 2015. On an pro forma LTM trailing basis, Century had 5.6 years of supply as of December 31, 2014.

15

CENTURY

COMMUNITIES

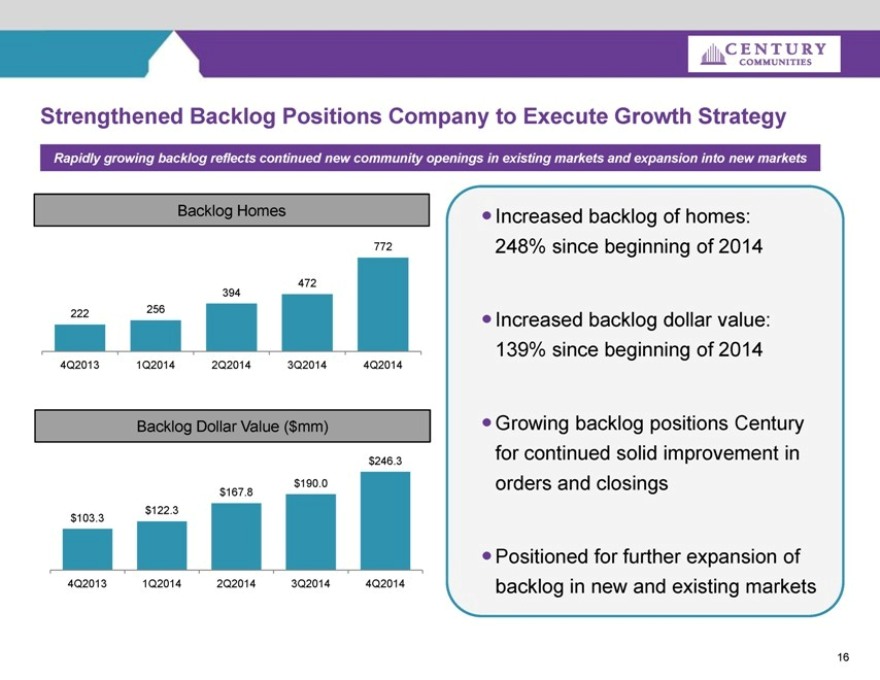

Strengthened Backlog Positions Company to Execute Growth Strategy

Rapidly growing backlog reflects continued new community openings in existing markets and expansion into new markets

Backlog Homes

772

472

394

222 256

4Q2013 1Q2014 2Q2014 3Q2014 4Q2014

Backlog Dollar Value ($mm)

$246.3

$190.0

$167.8

$122.3

$103.3

4Q2013 1Q2014 2Q2014 3Q2014 4Q2014

Increased backlog of homes: 248% since beginning of 2014

Increased backlog dollar value: 139% since beginning of 2014

Growing backlog positions Century for continued solid improvement in orders and closings

Positioned for further expansion of backlog in new and existing markets

16

Century Communities

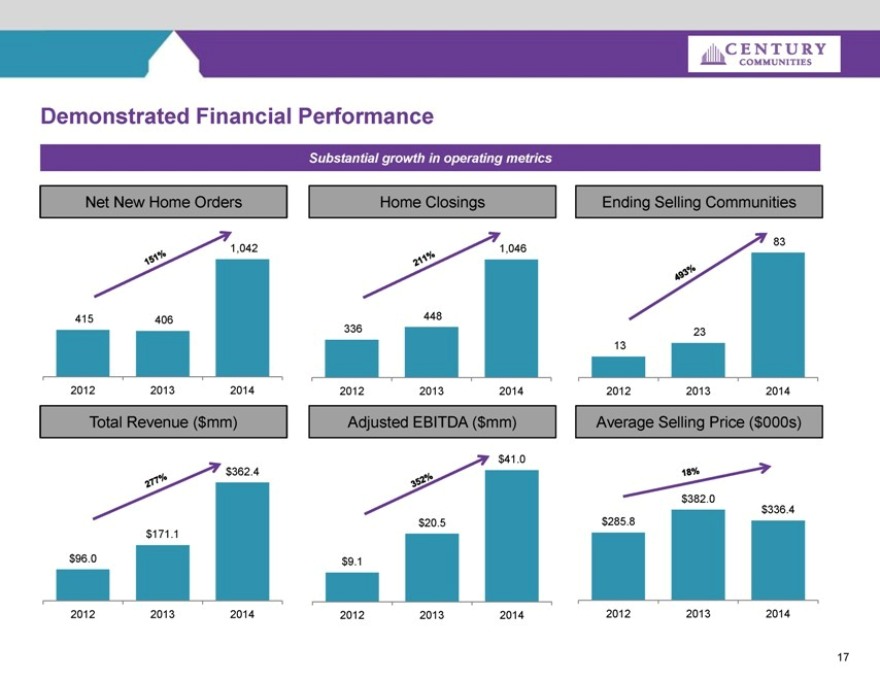

Demonstrated Financial Performance

Substantial growth in operating metrics

Net New Home Orders Home Closings Ending Selling Communities

151% 1,042 211% 1,046 493% 83

415 406 448

336 23

13

2012 2013 2014 2012 2013 2014 2012 2013 2014

Total Revenue ($mm) Adjusted EBITDA ($mm) Average Selling Price ($000s)

$41.0

277% $362.4 352% 18%

$382.0

$336.4

$20.5 $285.8

$171.1

$96.0 $9.1

2012 2013 2014 2012 2013 2014 2012 2013 2014

17

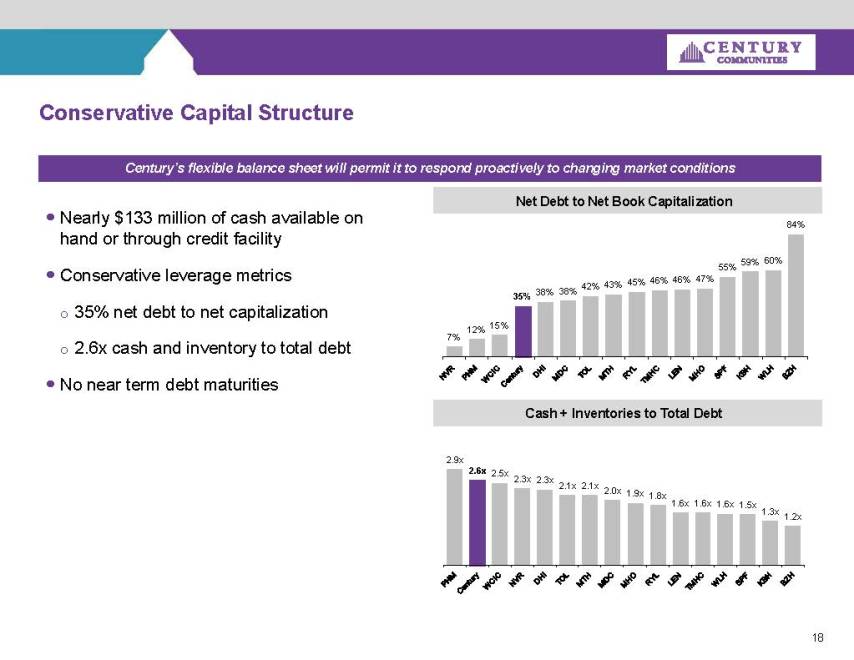

Century’s flexible balance sheet will permit it to respond proactively to changing market conditions

Nearly $133 million of cash available on hand or through credit facility

Conservative leverage metrics

35% net debt to net capitalization

2.6x cash and inventory to total debt

No near term debt maturities

Net Debt to Net Book Capitalization

84%

59% 60% 55% 45% 46% 46% 47% 42% 43% 38% 38%

35%

15%

7% 12%

NVR PHM WCIC CENTURY DHI MDC TOL MTH RYL TMHC LEN MHO SPF KBH BZH

Cash + Inventories to Total Debt

2.9x

2.6x 2.5x

2.3x 2.3x

2.1x 2.1x

2.0x 1.9x

1.8x

1.6x 1.6x 1.6x 1.5x 1.3x

1.2x

PHM CENTURY WCIC NVR DHI TOL MTH MDC MHO RYL LEN TMHC WLH SPF KBH BZH

18

CENTURY

COMMUNITIES

Key Credit Highlights

Cycle-Tested and Aligned Management Team

Superior Operating Performance

Diversified Operating Strategy

Strong and Growing Geographical Footprint

Attractive and Well-Located Land Positions

Proven and Profitable Results

Conservative Capital Structure

19

CENTURY

COMMUNITIES

Recent Acquisitions

CENTURY

COMMUNITIES

Jimmy Jacobs Homes Acquisition – September 2013

Established and highly capable local team in the Central Texas market

Acquired Jimmy Jacobs Homes (“JJH”), a leading, well-recognized private homebuilder in the Austin and San Antonio, TX markets, for a purchase price of approximately $16 million on September 12, 2013

JJH builds a wide range of product from first time move-up to “semi-custom” homes priced from under $300,000 to over $1,000,000

JJH and Century share a similar approach to the business – a focus on building and selling high quality homes to a wide universe of buyers

Acquired 166 lots(1) and 95 homes under construction in Austin and San Antonio

The acquisition also included an additional 129 controlled lots in the Austin and San Antonio market.

(1) Included 116 lots under contract. 21

CENTURY

COMMUNITIES

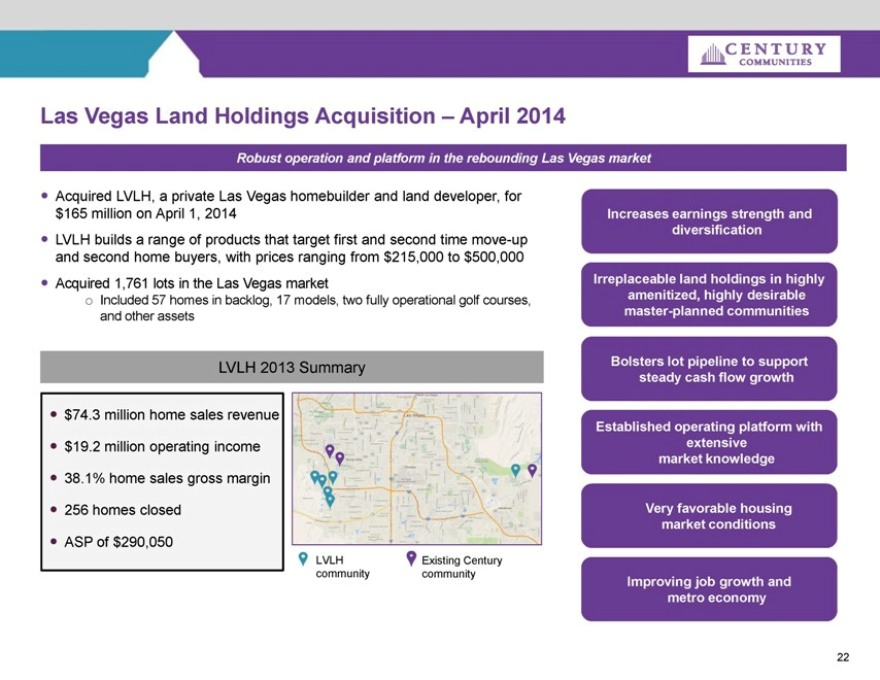

Las Vegas Land Holdings Acquisition – April 2014

Robust operation and platform in the rebounding Las Vegas market

Acquired LVLH, a private Las Vegas homebuilder and land developer, for $165 million on April 1, 2014

LVLH builds a range of products that target first and second time move-up and second home buyers, with prices ranging from $215,000 to $500,000

Acquired 1,761 lots in the Las Vegas market

Included 57 homes in backlog, 17 models, two fully operational golf courses, and other assets

LVLH 2013 Summary

$74.3 million home sales revenue

$19.2 million operating income

38.1% home sales gross margin

256 homes closed

ASP of $290,050

LVLH

community

Existing Century

community

Increases earnings strength and diversification

Irreplaceable land holdings in highly amenitized, highly desirable master-planned communities

Bolsters lot pipeline to support steady cash flow growth

Established operating platform with extensive market knowledge

Very favorable housing market conditions

Improving job growth and metro economy

22

CENTURY

COMMUNITIES

Grand View Builders Acquisition – August 2014

Established local team in the expansive and growing Houston market

Acquired Grand View Builders, Grand View Builders Custom Homes and SWMJ

Construction, collectively, “Grand View”, for a purchase price of approximately $13 million

Grand View builds a range of product targeted at first time and first move-up homebuyers priced from the low $200,000’s to over $525,000

Grand View also has to the capability to build custom homes through Grand View

Builders Custom Homes “Build-On-Your-Lot” program

Acquired 84 homes in backlog and 601 owned and controlled lots.

23

CENTURY

COMMUNITIES

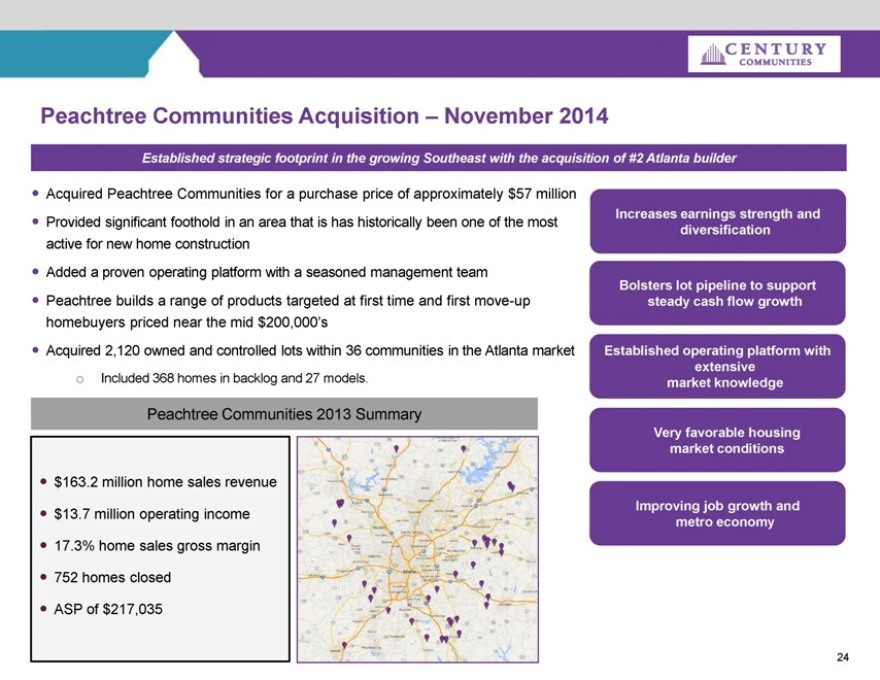

Peachtree Communities Acquisition – November 2014

Established strategic footprint in the growing Southeast with the acquisition of #2 Atlanta builder

Acquired Peachtree Communities for a purchase price of approximately $57 million

Provided significant foothold in an area that is has historically been one of the most active for new home construction

Added a proven operating platform with a seasoned management team

Peachtree builds a range of products targeted at first time and first move-up homebuyers priced near the mid $200,000’s

Acquired 2,120 owned and controlled lots within 36 communities in the Atlanta market

Included 368 homes in backlog and 27 models.

Peachtree Communities 2013 Summary

$163.2 million home sales revenue

$13.7 million operating income

17.3% home sales gross margin

752 homes closed

ASP of $217,035

Increases earnings strength and diversification

Bolsters lot pipeline to support steady cash flow growth

Established operating platform with extensive market knowledge

Very favorable housing market conditions

Improving job growth and metro economy

24

CENTURY

COMMUNITIES

Historical Financial Performance

25

CENTURY

COMMUNITIES

Fiscal Year 2014 Update

Revenues totaled $362.4 million, an increase of $191.3 million from a year earlier

Overall average selling price totaled $336.4 thousand

Closings totaled 1,046, up 133.5% year-over-year

Operating income of $31.1 million compared to $17.9 million for the prior-year, an increase of 74.1%

Adjusted EBITDA was $41.0 million compared to $20.5 million for the prior-year, an increase of approximately $20.5 million or 99.6%

Improved overhead as a percentage of homebuilding revenue at 13.3%, down 50 bps from 2013

Pre-tax income of $31.0 million compared to $18.1 million for the prior-year, an increase of 71.3%

Total backlog increased to 772 homes from 222 homes a year earlier

Backlog value of $246.3 million at December 31, 2014, up 138.6% year-over-year

26

CENTURY

COMMUNITIES

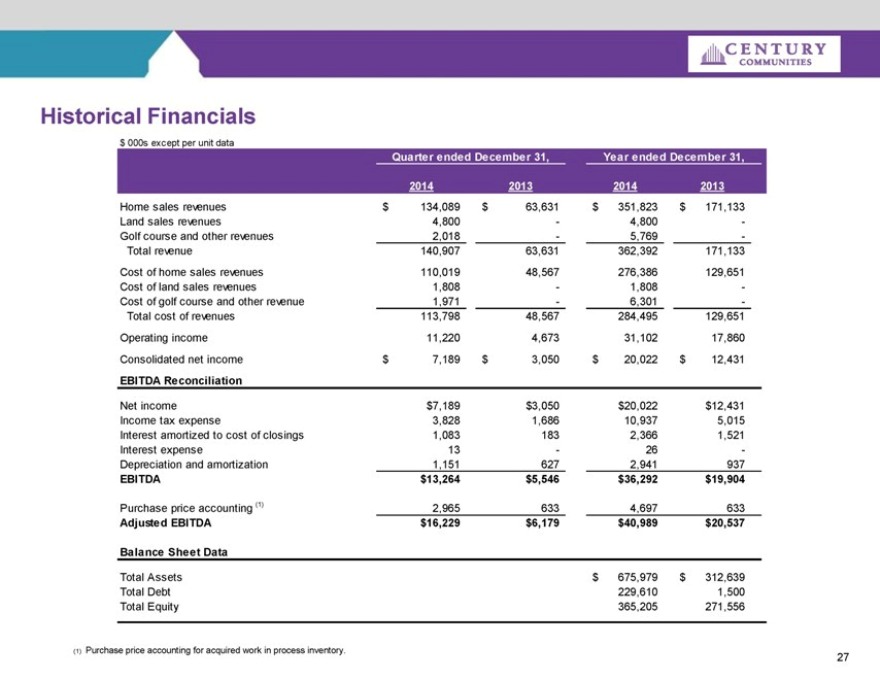

Historical Financials

$ 000s except per unit data

Quarter ended December 31,

Year ended December 31,

2014

2013

2014

2013

Home sales revenues

$134,089

$63,631

$351,823

$171,133

Land sales revenues

4,800

-

4,800

-

Golf course and other revenues

2,018

-

5,769

-

Total revenue

140,907

63,631

362,392

171,133

Cost of home sales revenues

110,019

48,567

276,386

129,651

Cost of land sales revenues

1,808

-

1,808

-

Cost of golf course and other revenue

1,971

-

6,301

-

Total cost of revenues

113,798

48,567

284,495

129,651

Operating income

11,220

4,673

31,102

17,860

Consolidated net income

$7,189

$3,050

$20,022

$12,431

EBITDA Reconciliation

Net income

$7,189

$3,050

$20,022

$12,431

Income tax expense

3,828

1,686

10,937

5,015

Interest amortized to cost of closings

1,083

183

2,366

1,521

Interest expense

13

-

26

-

Depreciation and amortization

1,151

627

2,941

937

EBITDA

$13,264

$5,546

$36,292

$19,904

Purchase price accounting (1)

2,965

633

4,697

633

Adjusted EBITDA

$16,229

$6,179

$40,989

$20,537

Balance Sheet Data

Total Assets

$675,979

$312,639

Total Debt

229,610

1,500

Total Equity

365,205

271,556

(1) Purchase price accounting for acquired work in process inventory.

27

CENTURY

COMMUNITIES

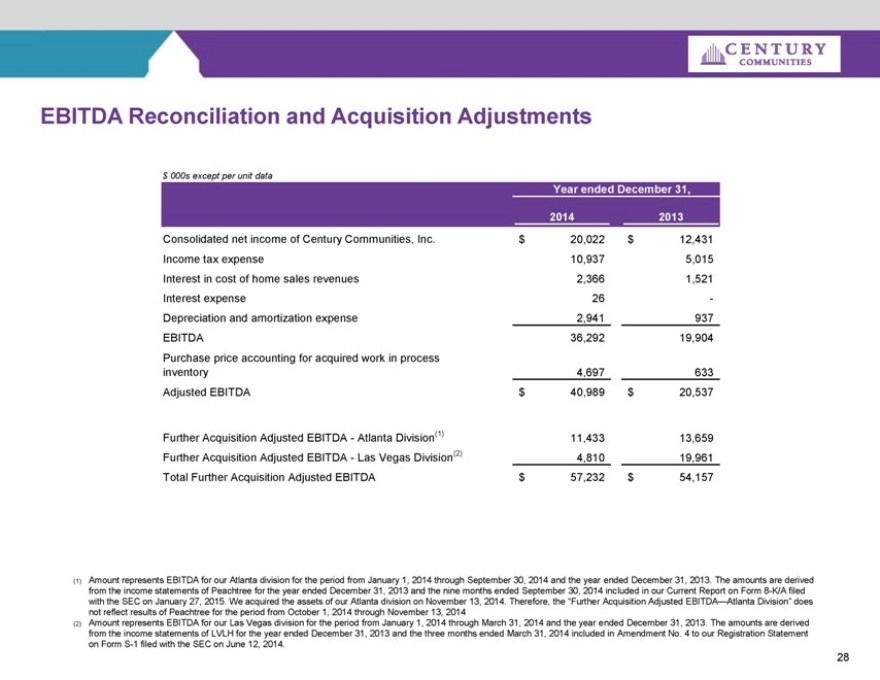

EBITDA Reconciliation and Acquisition Adjustments

$ 000s except per unit data

Year ended December 31,

2014

2013

Consolidated net income of Century Communities, Inc.

$20,022

$12,431

Income tax expense

10,937

5,015

Interest in cost of home sales revenues

2,366

1,521

Interest expense

26

-

Depreciation and amortization expense

2,941

937

EBITDA

36,292

19,904

Purchase price accounting for acquired work in process inventory

4,697

633

Adjusted EBITDA

$40,989

$20,537

Further Acquisition Adjusted EBITDA - Atlanta Division(1)

11,433

13,659

Further Acquisition Adjusted EBITDA - Las Vegas Division(2)

4,810

19,961

Total Further Acquisition Adjusted EBITDA

$57,232

$54,157

(1) Amount represents EBITDA for our Atlanta division for the period from January 1, 2014 through September 30, 2014 and the year ended December 31, 2013. The amounts are derived from the income statements of Peachtree for the year ended December 31, 2013 and the nine months ended September 30, 2014 included in our Current Report on Form 8-K/A filed with the SEC on January 27, 2015. We acquired the assets of our Atlanta division on November 13, 2014. Therefore, the “Further Acquisition Adjusted EBITDA—Atlanta Division” does not reflect results of Peachtree for the period from October 1, 2014 through November 13, 2014

(2) Amount represents EBITDA for our Las Vegas division for the period from January 1, 2014 through March 31, 2014 and the year ended December 31, 2013. The amounts are derived from the income statements of LVLH for the year ended December 31, 2013 and the three months ended March 31, 2014 included in Amendment No. 4 to our Registration Statement on Form S-1 filed with the SEC on June 12, 2014.

28

CENTURY

COMMUNITIES

CENTURY

COMMUNITIES

29