Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Timber Pharmaceuticals, Inc. | Financial_Report.xls |

| EX-31.1 - EX-31.1 - Timber Pharmaceuticals, Inc. | a2223386zex-31_1.htm |

| EX-4.3 - EX-4.3 - Timber Pharmaceuticals, Inc. | a2223386zex-4_3.htm |

| EX-23.1 - EX-23.1 - Timber Pharmaceuticals, Inc. | a2223386zex-23_1.htm |

| EX-21.1 - EX-21.1 - Timber Pharmaceuticals, Inc. | a2223386zex-21_1.htm |

| EX-32.1 - EX-32.1 - Timber Pharmaceuticals, Inc. | a2223386zex-32_1.htm |

| EX-10.4 - EX-10.4 - Timber Pharmaceuticals, Inc. | a2223386zex-10_4.htm |

| EX-10.15 - EX-10.15 - Timber Pharmaceuticals, Inc. | a2223386zex-10_15.htm |

| EX-4.2 - EX-4.2 - Timber Pharmaceuticals, Inc. | a2223386zex-4_2.htm |

Use these links to rapidly review the document

Table of Contents

FINANCIAL STATEMENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| (Mark One) | ||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2014 |

||

or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission File No. 000-54871

BioPharmX Corporation

(Exact name of registrant as specified in its charter)

| Delaware (State or Other Jurisdiction of Incorporation or Organization) |

59-3843182 (I.R.S. Employer Identification No.) |

|

1098 Hamilton Court, Menlo Park, California (Address of principal executive offices) |

94025 (Zip Code) |

Registrant's telephone number, including area code: 650-889-5020

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.001 Par Value.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company ý |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

As of June 30, 2014, the last day of the Registrant's most recently completed second fiscal quarter, the aggregate market value of the shares of the Registrant's common stock held by non-affiliates was $1,300,000. Shares of the Registrant's common stock held by each executive officer and director and by each person who owns 10 percent or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates of the Registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of March 24, 2015, there were outstanding 11,415,416 shares of the registrant's common stock, $.001 par value.

Documents incorporated by reference: None.

BioPharmX Corporation

Form 10-K

2

This Annual Report on Form 10-K, including the section entitled "Management's Discussion and Analysis of Financial Condition and Results of Operations," contains forward-looking statements regarding future events and our future results that are subject to the safe harbors created under the Securities Act of 1933, as amended (the Securities Act), and the Securities Exchange Act of 1934, as amended (the Exchange Act). Words such as "expect," "anticipate," "target," "goal," "project," "hope," "intend," "plan," "believe," "seek," "estimate," "continue," "may," "could," "should," "might," variations of such words and similar expressions are intended to identify such forward-looking statements. In addition, any statements other than statements of historical fact are forward-looking statements, including statements regarding overall trends, operating cost and revenue trends, liquidity and capital needs and other statements of expectations, beliefs, future plans and strategies, anticipated events or trends and similar expressions. We have based these forward-looking statements on our current expectations about future events. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Our actual results may differ materially from those suggested by these forward-looking statements for various reasons. Given these risks, uncertainties and assumptions you are cautioned not to place undue reliance on forward-looking statements. The forward-looking statements included in this report are made only as of the date hereof. Except as required under federal securities laws and the rules and regulations of the Securities and Exchange Commission (SEC), we do not undertake, and specifically decline, any obligation to update any of these statements or to publicly announce the results of any revisions to any forward-looking statements after the distribution of this report, whether as a result of new information, future events, changes in assumptions or otherwise.

Unless the context otherwise requires, we use the terms "BioPharmX," "company," "we," "us" and "our" in this Annual Report on Form 10-K to refer to BioPharmX Corporation and its subsidiary.

3

Overview

BioPharmX Corporation is incorporated under the laws of the State of Delaware and originally incorporated on August 30, 2010 in Nevada under the name Thompson Designs, Inc. We have one wholly-owned subsidiary, BioPharmX, Inc., a Nevada corporation. Our headquarters are located at 1098 Hamilton Court, Menlo Park, California.

We are a specialty pharmaceutical company focused on utilizing our proprietary drug delivery technologies to develop and commercialize novel prescription and over-the-counter, or OTC, products that address large markets in women's health and dermatology. Our objective is to develop products that treat health or age-related conditions that: (1) are not presently being addressed or treated at all or (2) are currently treated with drug therapies or drug delivery approaches that are sub-optimal. Our strategy is designed to bring new products to market by identifying optimal delivery mechanisms and/or alternative applications for FDA-approved active pharmaceutical ingredients, or APIs, while, in appropriate circumstances, reducing the time, cost and risk typically associated with new product development by repurposing drugs with demonstrated safety profiles and taking advantage of the regulatory approval pathway under Section 505(b)(2) of the Federal Food, Drug, and Cosmetic Act, or FDC Act. We believe the 505(b)(2) regulatory pathway may reduce drug development risk and could reduce the time and resources we spend during development. Our current platform technologies include innovative delivery mechanisms for molecular iodine, or I2, and antibiotics.

Our management team has experience in formulation development, intellectual property generation, clinical trial execution, regulatory strategy definition and commercialization of products through licensing as well as direct to consumer. Our business model is to outsource our manufacturing and at times commercialization activities in order to maintain our focus on technology sourcing, acquisitions, and strategic partner development to create new products to address unmet needs in well-defined global markets. Our current portfolio of product candidates targets significant market opportunities and includes two clinical stage product candidates: (1) BPX01, a topical antibiotic for the treatment of acne and (2) BPX03, a molecular iodine (I2) tablet for the treatment of benign breast pain associated with fibrocystic breast condition, or FBC, and cyclic mastalgia.

Since our inception, we have devoted our efforts to developing our product candidates including conducting preclinical and clinical trials and providing general and administrative support for these operations, and we commercially launched our breast health dietary supplement at the end of 2014. To date we have not generated any revenue from product sales. We have financed our operations primarily through the sale of equity securities and convertible debt securities from which we raised $9.6 million of net cash from our inception through December 31, 2014.

Share Exchange

On January 23, 2014, we (then operating as Thompson Designs, Inc.), BioPharmX, Inc. and stockholders of BioPharmX, Inc., who collectively owned 100% of BioPharmX, Inc., entered into and consummated transactions pursuant to a share exchange agreement, such transaction referred to as the Share Exchange, whereby we issued to the stockholders of BioPharmX, Inc. an aggregate of 7,025,000 shares of our common stock, in exchange for 100% of the shares of BioPharmX, Inc. held by stockholders. The shares of our common stock received by the stockholders of BioPharmX, Inc. in the Share Exchange constituted approximately 77.8% of our then issued and outstanding common stock, after giving effect to the issuance of shares pursuant to the share exchange agreement. As a result of the Share Exchange, BioPharmX, Inc. became our wholly-owned subsdidiary. For accounting purposes, the Share Exchange was treated as a reverse acquisition with BioPharmX, Inc. as the acquirer and us

4

as the acquired party, and as a result the historical financial statements prior to the Share Exchange included in this Annual Report on Form 10-K are the historical financial statements of BioPharmX, Inc. On March 3, 2014, we changed our name to BioPharmX Corporation. On April 25, 2014, we reincorporated from Nevada to Delaware.

Our Product Candidates

Our first commercial product, VI2OLET iodine, is a once-a-day OTC dietary supplement molecular iodine tablet that promotes overall breast health and is for the alleviation of benign breast pain associated with fibrocystic breast condition, or FBC. We launched VI2OLET iodine in December 2014 and are rolling out the product in drug store and retail chains throughout the United States. We are also developing a prescription molecular iodine tablet, BPX03, for the treatment of benign breast pain associated with FBC and cyclic mastalgia, intended for global distribution, where products such as ours may require a prescription due to regulatory requirements. We are preparing to conduct clinical studies under institutional review board, or IRB, oversight to inform the study design for our Phase 3 safety and efficacy study. We are planning to commence a Phase 3 clinical trial for BPX03 to support FDA and foreign regulatory requirements upon completion of the IRB studies and submission of our investigational new drug application, or IND, for BPX03. We shall seek approval only in those countries where we will seek to market the prescription product. It is our intent to commence a Phase 3 study in 2016.

We are also developing BPX01, a non-lipophilic, topical antibiotic for the treatment of acne. BPX01 utilizes a transepidermal delivery mechanism for minocycline and other APIs that we believe has the potential to kill p. acnes bacteria without the systemic side effects of orally-administered antibiotics. In addition, BPX01 has been shown in pre-clinical studies to possess anti-inflammatory properties, which reduce swelling and slow hyper-cornification. We are currently conducting an animal toxicity study, after which we expect to submit our IND to the FDA to initiate our first Phase 2a clinical trial of BPX01. We are also preparing to conduct a bridging safety study using oral minocycline as the comparator and a Phase 2 dose-finding clinical study for BPX01. We intend to pursue regulatory approval under Section 505(b)(2) of the FDC Act. We believe the 505(b)(2) regulatory pathway, which permits us to rely in part on FDA's prior findings of safety and/or efficacy for an approved product, may reduce the drug development risk and could reduce the time and resources we spend during development of BPX01.

Our product pipeline includes additional applications for the delivery of iodine, FDA-approved antibiotics, and biologics. Product candidates may be developed for delivery in oral, topical, inhalant and/or injectable forms depending on the platform technology employed and the underlying condition being treated.

Target Markets

We believe that the industry dynamics in the areas of women's health and dermatology represent significant opportunities for innovative new products to emerge as attractive solutions for unmet needs in multi-billion dollar therapeutic categories. In particular, we believe that both the women's health and dermatology markets are large specialty markets with significant global patient demand. We believe that our focus on these markets coupled with our proprietary platform technologies will enable us to develop and commercialize attractive products within these areas of women's health and dermatology.

5

Products and Pipeline

Overview

Our product portfolio has been developed using our proprietary drug delivery technologies including innovative delivery mechanisms for molecular iodine and antibiotics. We currently have one marketed product, VI2OLET iodine, and two clinical-stage product candidates, BPX01 and BPX03.

VI2OLET Iodine

Our first commercial product, VI2OLET iodine, is the only OTC molecular iodine dietary supplement that addresses cyclic breast discomfort and is clinically demonstrated to alleviate the symptoms associated with fibrocystic breast changes including tenderness, swelling and aches. Our patented molecular iodine (I2) formula is delivered to breast tissue and reduces the breast cell build-up that results in breast discomfort. Women who suffer from menstrual-related breast discomfort are recommended to take one tablet per day on an empty stomach for at least 60 days to realize initial symptom relief. They may take a second tablet every evening if they have more severe symptoms. Additionally, with consistent daily use, VI2OLET iodine has been shown to help maintain healthy breast tissue.

The product is currently available for sale in approximately 2,960 CVS retail pharmacy chains and 650 Vitamin Shoppe stores throughout the United States, as well as online through drugstore.com and walgreens.com.

The commercial launch of VI2OLET iodine is supported by an extensive consumer marketing program targeting women between the ages of 30 and 44. With a combination of brand and shopper marketing, both nationally and locally, we generate awareness, engagement, education, consideration and purchase interest.

BPX03

In addition to our VI2OLET iodine product, we are also developing BPX03, a prescription drug version of our molecular iodine (I2) tablet for the treatment of benign breast pain associated with FBC and cyclic mastalgia. We have licensed the patent rights to a set of iodine technologies. The licensors previously sponsored and completed Phase 1 and Phase 2 clinical studies. We intend to approach the FDA in 2016 for a pre-IND discussion regarding the study design for a Phase 3 clinical trial intended to commence in 2016 with a new IND submission.

BPX01

We are developing BPX01, a novel, topical formulation of minocycline. BPX01 delivers minocycline directly to the target sebaceous glands in the skin. We believe that our proprietary topical minocycline acne treatment is designed to have several advantages compared to both orally-administered and other topically-administered retinoid- and antibiotic-based solutions. Since BPX01 is not administered orally, its delivery route to the target site is not primarily through the bloodstream, and it therefore has the potential to lower the risk of systemic side effects common to orally-administered antibiotics. The gel form of BPX01, when applied topically, is designed to penetrate through the intercellular space among corneocytes in the stratum corneum to increase the delivery of the antibiotic at low dosages directly to the affected area. Unlike other topical lipophilic solutions formulated to ensure active pharmaceutical ingredient, or API, stability, BPX01 is non-lipophilic, which improves the aesthetic appearance and feel of the topical and is designed to allow the topical to be absorbed more quickly by the skin, and, we believe, without sacrificing long-term API stability.

6

Research and Development

Our core competency is providing the link between concept and commercialization through focused, practical product development based on innovative research. We employ highly-qualified scientists and consultants specializing in our various product development areas.

As a Silicon Valley-based company, we are located in a region with many strong biotechnology and pharmaceutical companies, which have drawn a high caliber of scientists and scientific support staff to the region. While there is intense competition for this type of personnel, we believe our location will enable us to expand our product development and consultant resources as our business grows. Our location also provides us with convenient access to local formulation resources and pre-clinical testing facilities.

Technology and Intellectual Property

Overview

Our success depends in large part upon our ability to obtain and maintain proprietary protection for our products and platform technologies. Our goal is to develop a strong intellectual property portfolio that enables us to capitalize on the research and development that we have performed to date and will perform in the future, particularly for each of the products in our development pipeline and each of the products marketed by us. We rely on a combination of patent, copyright, trademark and trade secret laws in the United States and other countries to obtain and maintain our intellectual property. We protect our intellectual property by, among other methods, filing for patent applications on inventions that are important to the development and conduct of our business with the United States Patent and Trademark Office and its foreign counterparts.

We also rely on a combination of non-disclosure, confidentiality, and other contractual restrictions to protect our technologies and intellectual property. We require our employees and consultants to execute confidentiality agreements in connection with their employment or consulting relationships with us. We also require them to agree to disclose and assign to us all inventions conceived in connection with the relationship.

Patents

Patent protection is an important aspect of our product development process and we are actively developing intellectual property in-house. In addition to an aggressive licensing strategy, we have several pending patent applications related to our novel iodine-based technologies for women's health and topical compositions for dermatological conditions. We have both United States provisional and utility patent applications pending. We also have pending international patent applications, which were filed according to the Patent Cooperation Treaty and which enable us to apply for patent protection for the described inventions in key individual countries in the future.

Our patent applications may not result in issued patents and we cannot assure you that any patents that issue will provide a competitive advantage. Moreover, any patents issued to us may be challenged by third parties as invalid or parties may independently develop similar or competing technology or design around our patents. We cannot be certain that the steps we have taken will prevent the misappropriation of our intellectual property, particularly in foreign countries where the laws may not protect our proprietary rights as fully as in the United States.

On March 1, 2013, we entered into a collaboration and license agreement with Iogen LLC, or Iogen, to license certain patents, formulations, and know-how relating to molecular iodine formulations. Our license is an exclusive, royalty-bearing license agreement with the right to enforce and sublicense. These patents have expiration dates between 2017 and 2029.

7

Strategic Alliances and Partnerships

We have entered into strategic alliances/partnerships with Iogen and NuTech Medical, Inc., or NuTech.

Iogen

We have executed collaboration and licensing agreements with Iogen, a biotechnology company with iodine-based solutions and associated intellectual property. Our molecular iodine dietary OTC product, VI2OLET iodine, and the development of our molecular iodine prescription product, BPX03, build upon this licensed technology and its associated intellectual property. Under the terms of the agreement, we received an exclusive worldwide perpetual irrevocable license to Iogen's patented technology relating to an oral iodine tablet. In consideration of the license granted under the agreement, we agreed to pay to Iogen a non-refundable license issue fee of $150,000, which we paid in full, and 30% of net profit associated with direct commercialization of an OTC iodine tablet product or 30% of net royalties received from any sub-licensee. For other products developed and commercialized using licensed technology and associated intellectual property covered by this agreement, including a prescription iodine tablet, we agreed to pay to Iogen a royalty of 3% of net sales for the first 12 months of commercialization and 2% of net sales thereafter.

NuTech

We have executed a collaboration and supply agreement with NuTech, a biologics company specializing in the spinal and orthopedics market. This agreement describes the collaboration between Nutech and us to develop products in the field of dermatology. Products and intellectual property developed under this agreement are exclusively owned by us and licensed to NuTech for use in indications outside of dermatology. In exchange for an exclusive license to NuTech's intellectual property in the field of dermatology, we will pay to NuTech a royalty of 3% of net sales on product sold in the field of dermatology. In exchange for granting NuTech an exclusive license to our intellectual property and intellectual property developed in collaboration with NuTech in indications outside of dermatology, we shall receive from NuTech a royalty of 3% of net sales on products sold by them.

Trademarks

We have applied for trademark protection for several trademarks in the United States. The United States Patent and Trademark Office has issued us a Notice of Acceptance of Statement of Use for the trademark "VIOLET" which means the mark will now register barring any extraordinary circumstances. We have received a Notice of Allowance from the United States Patent and Trademark Office for "BIOPHARMX," "VI2OLET," and "GET IT OFF YOUR CHEST." In the future, we may apply for trademark protection for one or more of these trademarks in key markets outside the United States.

Manufacturing, Supply and Production

Suppliers

The company has in place a commercial supply agreement with UPM Pharmaceuticals, or UPM, to manufacture and package its VI2OLET iodine tablets. As our volume grows, we will consider expanding to multiple suppliers to mitigate the risk of having a single source. Our joint development agreement with NuTech specifies that NuTech will supply materials for certain of our dermatological products.

8

Manufacturing

The company utilizes contract manufacturers to produce its products for commercial distribution. We have no plans to establish in-house manufacturing capabilities for large-scale production at this time.

UPM, an independent drug development and contract manufacturer serving the pharmaceutical and biotechnology industries and a division of Gregory Pharmaceutical Holdings, Inc., manufactures solid dose iodine supplement tablets for our VI2OLET iodine product. VI2OLET iodine is manufactured at UPM's 475,000 square-foot manufacturing facility in Bristol, Tennessee, under a commercial supply agreement. UPM provides high-quality drug development services including formulation development, the FDA's current good manufacturing practices, or cGMP clinical and commercial manufacturing, analytical methods development and stability testing. As our volume grows, we will consider expanding to multiple manufacturers to mitigate the risk of having a single source.

Marketing, Sales & Distribution

We plan to commercialize women's health and dermatology products in our pipeline into various channels, beginning with our VI2OLET iodine dietary supplement, which we launched in December 2014 and are currently rolling out in drug stores and retail chains throughout the United States.

Our product launch for VI2OLET iodine is supported by a marketing program, including in-store merchandising, a digital strategy focused on education and activation, public relations events and traditional media to drive awareness and a physician and pharmacist influencer program.

Customers

Potential customers for our products and product candidates include: pharmaceutical companies physician's practices, including OB-Gyn's, dermatologists and general practioners; and retail customers via retail sales channels and/or pharmacy outlets.

Competition

FBC and Cyclic Mastalgia

Our competitors, typically large pharmaceutical companies, vary from product to product. In the area of women's health, many companies sell iodine supplements, mostly for the purpose of delivering iodine with iodide salts to address hypothyroidism as iodine replacement therapy, as opposed to targeting breast tissue. We believe our competitive advantage is our solid dose proprietary formulation which delivers molecular iodine in a stable manner allowing the consumer to ingest orally and specifically to address breast symptoms. Addressing a condition that has long been neglected, we believe that VI2OLET iodine dietary supplement and, if approved, BPX03, are essentially new products in a new category.

9

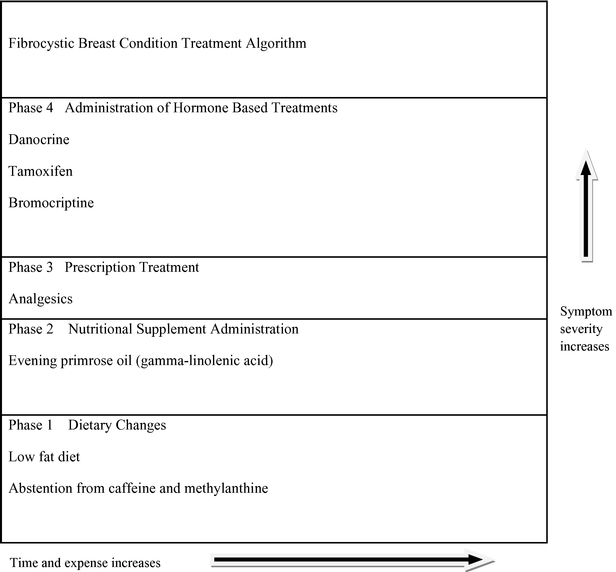

The following figure presents a typical treatment algorithm for FBC given the current/limited options available to physicians.

Some limitations of competitive approaches to addressing FBC and/or cyclic mastalgia include serious and sometimes dangerous side effects caused by prescription drugs and the temporary nature of relief provided by analgesics. Because optimal solutions do not exist, the majority of women choose to live with chronic pain.

Acne

While the acne market has a number of competitive products, BPX01 is being developed to combine the most successful oral approach for the treatment of moderate-severe acne without systemic side effects with a targeted topical antibiotic technology specifically designed to localize the delivery of the API. At the present time, there is no FDA-approved topical solution for this API that provides similar or equal clinical efficacy to that of oral treatments.

A number of approved prescription acne products currently exist in oral form such as isotretinoins, antibiotics, antimicrobials and contraceptives. These treatments are marketed by a number of large pharmaceutical and specialty pharmaceutical companies including, but not limited to, Valeant, Allergan, Pharmacia, Pfizer, Galderma S.A., Teva, and Bayer Healthcare. Additionally, there are also several

10

prescription acne products that exist in topical form such as antimicrobials, retinoids, or some combination of the two. The majority of these topical solutions are marketed by GlaxoSmithKline, Galderma S.A., Allergan, Valeant, and Mylan.

In addition to prescription acne therapies discussed above, there are numerous OTC products in the form of benzoyl peroxide and salicylic acid topical solutions available from various cosmetic and cosmeceutical companies such as Neutrogena, Clean & Clear, Aveeno, Proactiv, and Clearasil. Energy-based devices have also been widely used by dermatologists, such as intense pulsed light, or IPL, by Ellipse and combination of IPL and radiofrequency, or RF, devices, elos, by Syneron. Combination drug-device treatments such as photodynamic therapy, or PDT, with Blu-U by Dusa Pharmaceuticals, has been used off-label for treating acne, while the Blu-U light source without its PDT drug has been indicated for acne treatment.

Government Regulation

In the United States, foods (including dietary supplements), drugs (including biological products), medical devices, cosmetics, tobacco products, and radiation-emitting products are subject to extensive regulation by the FDA. The FDC Act and other federal and state statutes and regulations govern, among other things, the manufacture, distribution, and sale of these products. These laws and regulations prescribe criminal and civil penalties that can be assessed, and violation of these laws and regulations can result in enforcement action by the FDA and other regulatory agencies.

Regulation of Dietary Supplements

The formulation, manufacturing, packaging, labeling, advertising, distribution and sale (hereafter, "sale" or "sold" may be used to signify all of these activities) of dietary supplements are subject to regulation by one or more federal agencies, primarily the FDA and the Federal Trade Commission, or the FTC, and to a lesser extent the Consumer Product Safety Commission, or the CPSC.

Dietary supplements are also regulated by various governmental agencies for the states and localities in which product are sold. Among other matters, regulation by the FDA and the FTC is concerned with product safety, efficacy, and claims made with respect to a dietary supplement's ability to provide health related benefits. The FDA, under the FDC Act, regulates the formulation, manufacturing, packaging, labeling, distribution and sale of food, including dietary supplements. The FTC regulates the advertising of these products. The National Advertising Division, or NAD, of the Council of Better Business Bureaus oversees an industry sponsored, self-regulatory system that permits competitors to resolve disputes over advertising claims. The NAD has no enforcement authority of its own, but may refer matters that appear to violate the Federal Trade Commission Act, or FTC Act, or the FDC Act to the FTC or the FDA for further action, as appropriate.

Federal agencies, primarily the FDA and the FTC, have a variety of procedures and enforcement remedies available to them, including initiating investigations, issuing warning letters and cease and desist orders, requiring corrective labeling or advertising, requiring consumer redress (for example, requiring that a company offer to repurchase products previously sold to consumers), seeking injunctive relief or product seizures, imposing civil penalties or commencing criminal prosecution. In addition, certain state agencies have similar authority.

The Dietary Supplement Health and Education Act, or DSHEA, was enacted in 1994 and amended the FDC Act. DSHEA establishes a statutory class of dietary supplements, which includes vitamins, minerals, herbs, amino acids and other dietary ingredients for human use to supplement the diet. Dietary ingredients marketed in the U.S. before October 15, 1994 may be marketed without the submission of a new dietary ingredient, or NDI, premarket notification to the FDA. Dietary ingredients not marketed in the U.S. before October 15, 1994 may require the submission, at least 75 days before marketing, of an NDI notification containing information establishing that the ingredient is reasonably

11

expected to be safe for its intended use. Among other things, DSHEA prevents the FDA from regulating dietary ingredients in dietary supplements as food additives.

The FDA issued a draft guidance document in July 2011 that clarifies when the FDA believes a dietary ingredient is an NDI, when a manufacturer or distributor must submit an NDI premarket notification to the FDA, the evidence necessary to document the safety of an NDI and the methods for establishing the identity of an NDI. The FDA's interpretation of what constitutes an NDI is extremely broad and seems to imply that virtually every new dietary supplement requires a premarket notification. Although the industry has objected and questioned FDA's authority, it is unclear whether the FDA will make any changes to the draft guidance, and, if the agency does make changes, what changes will be made. In addition, the FDA may begin to take enforcement actions consistent with the interpretations in the draft guidance before issuing a final version.

The FDA's current good manufacturing practices, or cGMPs, regulations for dietary supplements apply to manufacturers and holders of finished dietary supplement products, including dietary supplements manufactured outside the U.S. that are imported for sale into the U.S. Among other things, the FDA's cGMPs: (a) require identity testing on all incoming dietary ingredients, (b) call for a scientifically valid system for ensuring finished products meet all specifications, (c) include requirements related to process controls, including statistical sampling of finished batches for testing and requirements for written procedures and (d) require extensive recordkeeping.

Under the Dietary Supplement and Nonprescription Drug Consumer Protection Act, FDA requires, among other things, that companies that manufacture or distribute nonprescription drugs or dietary supplements report serious adverse events associated with their products to the FDA and institute recordkeeping requirements for all adverse events. Based on serious adverse event (or other) information, the FDA or another agency may take actions against dietary supplements or dietary ingredients that in its determination present a significant or unreasonable risk of illness or injury, which could make it illegal to sell those products.

The FDA Food Safety Modernization Act, or FSMA, enacted January 4, 2011, amended the FDC Act to significantly enhance FDA's authority over various aspects of food regulation, including dietary supplements. Under FSMA, FDA may use the mandatory recall authority when the FDA determines there is a reasonable probability that a food is adulterated or misbranded and that the use of, or exposure to, the food will cause serious adverse health consequences or death to humans or animals. Also under FSMA, FDA has expanded access to records; the authority to suspend food facility registrations and require high risk imported food to be accompanied by a certification; stronger authority to administratively detain food; the authority to refuse admission of an imported food if it is from a foreign establishment to which a U.S. inspector is refusing entry for an inspection; and the requirement that importers verify that the foods they import meet domestic standards.

One of FSMA's more significant changes is the requirement of preventive controls for food facilities required to register with the FDA, except dietary supplement facilities in compliance with both cGMPs and the serious adverse event reporting requirements. Although dietary supplement facilities are exempt from the preventive controls requirements, dietary ingredient facilities might not qualify for the exemption. The FDA's proposed preventive controls regulations, issued in February 2013 and supplemented in September 2014, would require that facilities develop and implement preventive controls (including supplier controls) to assure that identified hazards are significantly minimized or prevented, monitor the effectiveness of the preventive controls, and maintain numerous records related to those controls. FSMA also requires that importers implement a foreign supplier verification program, or FSVP. The FDA's proposed FSVP regulations, issued in July 2013 and supplemented in September 2014, would require importers to implement supplier verification activities to ensure that the foods they import meet domestic standards, with a partial exemption that might or might not apply to

12

certain importers of dietary ingredients. When implemented, the FSVP requirements may affect the cost and the availability of dietary supplements and dietary ingredients.

The new FSMA requirements, as well as the FDA enforcement of the NDI draft guidance, can result in the detention and refusal of admission of imported products, the injunction of manufacturing of any dietary ingredients or dietary supplements until the FDA determines that such ingredients or products are in compliance, and the potential imposition of fees for re-inspection of noncompliant facilities.

The FDC Act, as amended by DSHEA, permits statements of nutritional support often referred to as "structure/function claims" to be included in labeling for dietary supplements without FDA pre-market approval. FDA regulation requires that FDA be notified of those statements within 30 days of marketing. Among other things, the statements may describe the role of a dietary ingredient intended to affect the structure or function of the body or characterize the documented mechanism of action by which a dietary ingredient maintains such structure or function, but may not expressly or implicitly represent that a dietary supplement will diagnose, cure, mitigate, treat, or prevent a disease. A company that uses a statement of nutritional support in labeling must possess information substantiating that the statement is truthful and not misleading. If the FDA determines that a particular statement of nutritional support is an unacceptable drug claim or an unauthorized version of a health claim, or if the FDA determines that a particular claim is not adequately supported by existing information or is otherwise false or misleading, the claim could not be used and any product bearing the claim could be subject to regulatory action.

The FTC and the FDA have pursued a coordinated effort to challenge the scientific substantiation for dietary supplement claims. Their efforts to date have focused on manufacturers and marketers as well as media outlets and have resulted in a significant number of investigations and enforcement actions, some resulting in civil penalties under the FTC Act of several million dollars. If the FTC and the FDA continue to focus on health related claims, including structure/function claims for dietary supplements, dietary supplements could be the subject of FTC and/or FDA inquiries, inquiries from the NAD and states Attorney Generals, as well as private class action lawsuits.

All states regulate foods and drugs under laws that generally parallel federal statutes. These products are also subject to state consumer health and safety regulations, such as California Safe Drinking Water and Toxic Enforcement Act of 1986, or Proposition 65. Violation of Proposition 65 may result in substantial monetary penalties.

FDA Regulation of Drugs

New Drug Approval Process

Pharmaceutical products are subject to extensive regulation by the FDA. The FDC Act, and other federal and state statutes and regulations, govern, among other things, the research, development, testing, manufacture, storage, recordkeeping, approval, labeling, promotion and marketing, distribution, post-approval monitoring and reporting, sampling, and import and export of pharmaceutical products. Failure to comply with applicable U.S. requirements may subject a company to a variety of administrative or judicial sanctions, such as FDA refusal to approve pending new drug applications, or NDAs, warning or untitled letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, fines, civil penalties, and criminal prosecution.

Pharmaceutical product development for a new product or certain changes to an approved product in the United States typically involves preclinical laboratory and animal tests, the submission to the FDA of an investigational new drug application, or IND, which must become effective before clinical testing may commence, and adequate and well-controlled clinical trials to establish the safety and effectiveness of the drug for each indication for which FDA approval is sought. Satisfaction of FDA

13

pre-market approval requirements typically takes many years and the actual time required may vary substantially based upon the type, complexity, and novelty of the product or disease.

Preclinical tests include laboratory evaluation of product chemistry, formulation, and toxicity, as well as animal trials to assess the characteristics and potential safety and efficacy of the product. The conduct of the preclinical tests must comply with federal regulations and requirements, including good laboratory practices. The results of preclinical testing are submitted to the FDA as part of an IND along with other information, including information about product chemistry, manufacturing and controls, and a proposed clinical trial protocol. Long term preclinical tests, such as animal tests of reproductive toxicity and carcinogenicity, may continue after the IND is submitted.

A 30-day waiting period after the submission of each IND is required prior to the commencement of clinical testing in humans. If the FDA has neither commented on nor questioned the IND within this 30-day period, the clinical trial proposed in the IND may begin.

Clinical trials involve the administration of the investigational new drug to healthy volunteers or patients under the supervision of a qualified investigator. Clinical trials must be conducted: (i) in compliance with federal regulations; (ii) in compliance with good clinical practice, or GCP, an international standard meant to protect the rights and health of patients and to define the roles of clinical trial sponsors, administrators, and monitors; as well as (iii) under protocols detailing the objectives of the trial, the parameters to be used in monitoring safety, and the effectiveness criteria to be evaluated. Each protocol involving testing on U.S. patients and subsequent protocol amendments must be submitted to the FDA as part of the IND.

The FDA may order the temporary, or permanent, discontinuation of a clinical trial at any time, or impose other sanctions, if it believes that the clinical trial is not being conducted in accordance with FDA requirements or presents an unacceptable risk to the clinical trial patients. The study protocol and informed consent information for patients in clinical trials must also be submitted to an institutional review board, or IRB, for approval. An IRB may also require the clinical trial at the site to be halted, either temporarily or permanently, for failure to comply with the IRB's requirements, or may impose other conditions.

Clinical trials to support NDAs for marketing approval are typically conducted in three sequential phases, but the phases may overlap. In Phase 1, the initial introduction of the drug into healthy human subjects or patients, the drug is tested to assess metabolism, pharmacokinetics, pharmacological actions, side effects associated with increasing doses, and, if possible, early evidence on effectiveness. Phase 2 usually involves trials in a limited patient population to determine the effectiveness of the drug for a particular indication, dosage tolerance, and optimum dosage, and to identify common adverse effects and safety risks. If a compound demonstrates evidence of effectiveness and an acceptable safety profile in Phase 2 evaluations, Phase 3 trials are undertaken to obtain the additional information about clinical efficacy and safety in a larger number of patients, typically at geographically dispersed clinical trial sites, to permit the FDA to evaluate the overall benefit-risk relationship of the drug and to provide adequate information for the labeling of the drug. In most cases the FDA requires two adequate and well-controlled Phase 3 clinical trials to demonstrate the efficacy of the drug. A single Phase 3 trial with other confirmatory evidence may be sufficient in rare instances where the study is a large multicenter trial demonstrating internal consistency and a statistically very persuasive finding of a clinically meaningful effect on mortality, irreversible morbidity or prevention of a disease with a potentially serious outcome and confirmation of the result in a second trial would be practically or ethically impossible.

After completion of the required clinical testing, an NDA is prepared and submitted to the FDA. FDA approval of the NDA is required before marketing of the product may begin in the U.S. The NDA must include the results of all preclinical, clinical, and other testing and a compilation of data relating to the product's pharmacology, chemistry, manufacture, and controls. The cost of preparing

14

and submitting an NDA is substantial. The submission of most NDAs is additionally subject to a substantial application user fee, currently exceeding $2,335,000, and the manufacturer and/or sponsor under an approved new drug application are also subject to annual product and establishment user fees, currently exceeding $110,000 per product and $569,000 per establishment. These fees are typically increased annually.

The FDA has 60 days from its receipt of an NDA to determine whether the application will be accepted for filing based on the agency's threshold determination that it is sufficiently complete to permit substantive review. Once the submission is accepted for filing, the FDA begins an in-depth review. The FDA has agreed to certain performance goals in the review of new drug applications. Most such applications for standard review drug products are reviewed within ten to twelve months; most applications for priority review drugs are reviewed in six to eight months. Priority review can be applied to drugs that the FDA determines offer major advances in treatment, or provide a treatment where no adequate therapy exists. For biologics, priority review is further limited to drugs intended to treat a serious or life-threatening disease relative to the currently approved products. The review process for both standard and priority review may be extended by the FDA for three additional months to consider certain late-submitted information, or information intended to clarify information already provided in the submission.

The FDA may also refer applications for novel drug products, or drug products that present difficult questions of safety or efficacy, to an advisory committee—typically a panel that includes clinicians and other experts—for review, evaluation, and a recommendation as to whether the application should be approved. The FDA is not bound by the recommendation of an advisory committee, but it generally follows such recommendations. Before approving an NDA, the FDA will typically inspect one or more clinical sites to assure compliance with GCP. Additionally, the FDA will inspect the facility or the facilities at which the drug is manufactured. The FDA will not approve the product unless compliance with current good manufacturing practices, or cGMPs, is satisfactory and the NDA contains data that provide substantial evidence that the drug is safe and effective in the indication studied.

After FDA evaluates the NDA and the manufacturing facilities, it issues either an approval letter or a complete response letter. A complete response letter generally outlines the deficiencies in the submission and may require substantial additional testing, or information, in order for the FDA to reconsider the application. If, or when, those deficiencies have been addressed to the FDA's satisfaction in a resubmission of the NDA, the FDA will issue an approval letter. FDA has committed to reviewing such resubmissions in two or six months depending on the type of information included.

An approval letter authorizes commercial marketing of the drug with specific prescribing information for specific indications. As a condition of NDA approval, the FDA may require a risk evaluation and mitigation strategy, or REMS, to help ensure that the benefits of the drug outweigh the potential risks. REMS can include medication guides, communication plans for healthcare professionals, and elements to assure safe use, or ETASU. ETASU can include, but are not limited to, special training or certification for prescribing or dispensing, dispensing only under certain circumstances, special monitoring, and the use of patient registries. The requirement for a REMS can materially affect the potential market and profitability of the drug. Moreover, product approval may require substantial post-approval testing and surveillance to monitor the drug's safety or efficacy. Once granted, product approvals may be withdrawn if compliance with regulatory standards is not maintained or problems are identified following initial marketing.

15

Changes to some of the conditions established in an approved application, including changes in indications, labeling, or manufacturing processes or facilities, require submission and FDA approval of a new NDA or NDA supplement before the change can be implemented. An NDA supplement for a new indication typically requires clinical data similar to that in the original application, and the FDA uses the same procedures and actions in reviewing NDA supplements as it does in reviewing NDAs.

Pediatric Information

Under the Pediatric Research Equity Act, or PREA, NDAs or supplements to NDAs must contain data to assess the safety and effectiveness of the drug for the claimed indications in all relevant pediatric subpopulations and to support dosing and administration for each pediatric subpopulation for which the drug is safe and effective. The FDA may grant full or partial waivers, or deferrals, for submission of data. Unless otherwise required by regulation, PREA does not apply to any drug for an indication for which orphan designation has been granted.

The Best Pharmaceuticals for Children Act, or BPCA, provides NDA holders a six-month extension of any exclusivity—patent or non-patent—for a drug if certain conditions are met. Conditions for exclusivity include the FDA's determination that information relating to the use of a new drug in the pediatric population may produce health benefits in that population, the FDA making a written request for pediatric studies, and the applicant agreeing to perform, and reporting on, the requested studies within the statutory timeframe. Applications under the BPCA are treated as priority applications, with all of the benefits that designation confers.

Disclosure of Clinical Trial Information

Sponsors of clinical trials of FDA-regulated products, including drugs, are required to register and disclose certain clinical trial information. Information related to the product, patient population, phase of investigation, study sites and investigators, and other aspects of the clinical trial is then made public as part of the registration. Sponsors are also obligated to discuss the results of their clinical trials after completion. Disclosure of the results of these trials can be delayed until the new product or new indication being studied has been approved. Competitors may use this publicly available information to gain knowledge regarding the progress of development programs.

The Hatch-Waxman Amendments

Orange Book Listing

In seeking approval for a drug through an NDA, applicants are required to list with the FDA each patent whose claims cover the applicant's product. Upon approval of a drug, each of the patents listed in the application for the drug is then published in the FDA's Approved Drug Products with Therapeutic Equivalence Evaluations, commonly known as the Orange Book. Drugs listed in the Orange Book can, in turn, be cited by potential generic competitors in support of approval of an abbreviated new drug application, or ANDA. An ANDA provides for marketing of a drug product that has the same active ingredients in the same strengths and dosage form as the listed drug and has been shown through bioequivalence testing to be therapeutically equivalent to the listed drug. Other than the requirement for bioequivalence testing, ANDA applicants are not required to conduct, or submit results of, pre-clinical or clinical tests to prove the safety or effectiveness of their drug product. Drugs approved in this way are commonly referred to as "generic equivalents" to the listed drug, and can often be substituted by pharmacists under prescriptions written for the original listed drug.

The ANDA applicant is required to certify to the FDA concerning any patents listed for the approved product in the FDA's Orange Book. Specifically, the applicant must certify that: (i) the required patent information has not been filed; (ii) the listed patent has expired; (iii) the listed patent has not expired, but will expire on a particular date and approval is sought after patent expiration; or

16

(iv) the listed patent is invalid or will not be infringed by the new product. The ANDA applicant may also elect to submit a section viii statement certifying that its proposed ANDA label does not contain (or carves out) any language regarding the patented method-of-use rather than certify to a listed method-of-use patent. If the applicant does not challenge the listed patents, the ANDA application will not be approved until all the listed patents claiming the referenced product have expired.

A certification that the new product will not infringe the already approved product's listed patents, or that such patents are invalid, is called a Paragraph IV certification. If the ANDA applicant has provided a Paragraph IV certification to the FDA, the applicant must also send notice of the Paragraph IV certification to the NDA and patent holders once the ANDA has been accepted for filing by the FDA. The NDA and patent holders may then initiate a patent infringement lawsuit in response to the notice of the Paragraph IV certification. The filing of a patent infringement lawsuit within 45 days of the receipt of a Paragraph IV certification automatically prevents the FDA from approving the ANDA until the earlier of 30 months, expiration of the patent, settlement of the lawsuit, or a decision in the infringement case that is favorable to the ANDA applicant.

The ANDA application also will not be approved until any applicable non-patent exclusivity listed in the Orange Book for the referenced product has expired.

Exclusivity

Upon NDA approval of a new chemical entity or NCE, which is a drug that contains no active moiety that has been approved by the FDA in any other NDA, that drug receives five years of marketing exclusivity during which FDA cannot receive any ANDA seeking approval of a generic version of that drug. Certain changes to a drug, such as the addition of a new indication to the package insert, are associated with a three-year period of exclusivity during which FDA cannot approve an ANDA for a generic drug that includes the change.

An ANDA may be submitted one year before NCE exclusivity expires if a Paragraph IV certification is filed. If there is no listed patent in the Orange Book, there may not be a Paragraph IV certification, and, thus, no ANDA may be filed before the expiration of the exclusivity period.

Patent Term Extension

After NDA approval, owners of relevant drug patents may apply for up to a five year patent extension. The allowable patent term extension is calculated as half of the drug's testing phase—the time between IND application and NDA submission—and all of the review phase—the time between NDA submission and approval up to a maximum of five years. The time can be shortened if the FDA determines that the applicant did not pursue approval with due diligence. The total patent term after the extension may not exceed 14 years.

For patents that might expire during the application phase, the patent owner may request an interim patent extension. An interim patent extension increases the patent term by one year and may be renewed up to four times. For each interim patent extension granted, the post-approval patent extension is reduced by one year. The director of the U.S. Patent and Trademark Office must determine that approval of the drug covered by the patent for which a patent extension is being sought is likely. Interim patent extensions are not available for a drug for which an NDA has not been submitted.

Section 505(b)(2) New Drug Applications

Most drug products obtain FDA marketing approval pursuant to an NDA or an ANDA. A third alternative is a special type of NDA, commonly referred to as a Section 505(b)(2), or 505(b)(2), NDA,

17

which enables the applicant to rely, in part, on the FDA's previous approval of a similar product, or published literature, in support of its application.

505(b)(2) NDAs often provide an alternate path to FDA approval for new or improved formulations or new uses of previously approved products. Section 505(b)(2) permits the filing of an NDA where at least some of the information required for approval comes from studies not conducted by, or for, the applicant and for which the applicant has not obtained a right of reference. If the 505(b)(2) applicant can establish that reliance on the FDA's previous approval is scientifically appropriate, it may eliminate the need to conduct certain preclinical or clinical studies of the new product. The FDA may also require companies to perform additional studies or measurements to support the change from the approved product. The FDA may then approve the new product candidate for all, or some, of the label indications for which the referenced product has been approved, as well as for any new indication sought by the Section 505(b)(2) applicant.

To the extent that the Section 505(b)(2) applicant is relying on studies conducted for an already approved product, the applicant is required to certify to the FDA concerning any patents listed for the approved product in the Orange Book to the same extent that an ANDA applicant would. Thus approval of a 505(b)(2) NDA can be stalled until all the listed patents claiming the referenced product have expired, until any non-patent exclusivity, such as exclusivity for obtaining approval of a new chemical entity, listed in the Orange Book for the referenced product has expired, and, in the case of a Paragraph IV certification and subsequent patent infringement suit, until the earlier of 30 months, settlement of the lawsuit or a decision in the infringement case that is favorable to the Section 505(b)(2) applicant.

Post-Approval Requirements

Once an NDA is approved, a product will be subject to certain post-approval requirements. For instance, the FDA closely regulates the post-approval marketing and promotion of drugs, including standards and regulations for direct-to-consumer advertising, off-label promotion, industry-sponsored scientific and educational activities and promotional activities involving the internet. Drugs may be marketed only for the approved indications and in accordance with the provisions of the approved labeling.

Adverse event reporting and submission of periodic reports is required following FDA approval of an NDA. The FDA also may require post-marketing testing, known as Phase 4 testing, risk evaluation and mitigation strategies, or REMS, and surveillance to monitor the effects of an approved product, or the FDA may place conditions on an approval that could restrict the distribution or use of the product. In addition, quality-control, drug manufacture, packaging, and labeling procedures must continue to conform to cGMPs after approval. Drug manufacturers and certain of their subcontractors are required to register their establishments with the FDA and certain state agencies. Registration with the FDA subjects entities to periodic unannounced inspections by the FDA, during which the agency inspects manufacturing facilities to assess compliance with cGMPs. Accordingly, manufacturers must continue to expend time, money, and effort in the areas of production and quality-control to maintain compliance with cGMPs. Regulatory authorities may withdraw product approvals or request product recalls if a company fails to comply with regulatory standards, if it encounters problems following initial marketing, or if previously unrecognized problems are subsequently discovered.

Regulation Outside the United States

In order to market any product outside of the United States, a company must also comply with numerous and varying regulatory requirements of other countries and jurisdictions regarding quality, safety and efficacy and governing, among other things, clinical trials, marketing authorization, commercial sales and distribution of drug products. Whether or not it obtains FDA approval for a

18

product, the company would need to obtain the necessary approvals by the comparable foreign regulatory authorities before it can commence clinical trials or marketing of the product in those countries or jurisdictions. The approval process ultimately varies between countries and jurisdictions and can involve additional product testing and additional administrative review periods. The time required to obtain approval in other countries and jurisdictions might differ from and be longer than that required to obtain FDA approval. Regulatory approval in one country or jurisdiction does not ensure regulatory approval in another, but a failure or delay in obtaining regulatory approval in one country or jurisdiction may negatively impact the regulatory process in others.

Regulation and Marketing Authorization in the European Union

The process governing approval of medicinal products in the European Union follows essentially the same lines as in the United States and, likewise, generally involves satisfactorily completing each of the following:

- •

- preclinical laboratory tests, animal studies and formulation studies all performed in accordance with the applicable E.U. Good

Laboratory Practice regulations;

- •

- submission to the relevant national authorities of a clinical trial application, or CTA, which must be approved before human clinical

trials may begin;

- •

- performance of adequate and well-controlled clinical trials to establish the safety and efficacy of the product for each proposed

indication;

- •

- submission to the relevant competent authorities of a marketing authorization application, or MAA, which includes the data supporting

safety and efficacy as well as detailed information on the manufacture and composition of the product in clinical development and proposed labelling;

- •

- satisfactory completion of an inspection by the relevant national authorities of the manufacturing facility or facilities, including

those of third parties, at which the product is produced to assess compliance with strictly enforced current cGMP;

- •

- potential audits of the non-clinical and clinical trial sites that generated the data in support of the MAA; and

- •

- review and approval by the relevant competent authority of the MAA before any commercial marketing, sale or shipment of the product.

Preclinical Studies

Preclinical tests include laboratory evaluations of product chemistry, formulation and stability, as well as studies to evaluate toxicity in animal studies, in order to assess the potential safety and efficacy of the product. The conduct of the preclinical tests and formulation of the compounds for testing must comply with the relevant E.U. regulations and requirements. The results of the preclinical tests, together with relevant manufacturing information and analytical data, are submitted as part of the CTA.

Clinical Trial Approval

Requirements for the conduct of clinical trials in the European Union including Good Clinical Practice, or GCP, are implemented in the Clinical Trials Directive 2001/20/EC and the GCP Directive 2005/28/EC. Pursuant to Directive 2001/20/EC and Directive 2005/28/EC, as amended, a system for the approval of clinical trials in the European Union has been implemented through national legislation of the member states. Under this system, approval must be obtained from the competent national authority of an E.U. member state in which a study is planned to be conducted, or in multiple member states if the clinical trial is to be conducted in a number of member states. To this end, a CTA is

19

submitted, which must be supported by an investigational medicinal product dossier, or IMPD, and further supporting information prescribed by Directive 2001/20/EC and Directive 2005/28/EC and other applicable guidance documents. Furthermore, a clinical trial may only be started after a competent ethics committee has issued a favorable opinion on the clinical trial application in that country.

In April 2014, the E.U. legislator passed the new Clinical Trials Regulation, (EU) No 536/2014, which will replace the current Clinical Trials Directive 2001/20/EC. To ensure that the rules for clinical trials are identical throughout the European Union, the new E.U. clinical trials legislation was passed as a regulation that is directly applicable in all E.U. member states. All clinical trials performed in the European Union are required to be conducted in accordance with the Clinical Trials Directive 2001/20/EC until the new Clinical Trials Regulation (EU) No 536/2014 becomes applicable, which will be no earlier than May 28, 2016.

The new Regulation (EU) No 536/2014 aims to simplify and streamline the approval of clinical trial in the European Union. The main characteristics of the regulation include:

- •

- A streamlined application procedure via a single entry point, the E.U. portal.

- •

- A single set of documents to be prepared and submitted for the application as well as simplified reporting procedures that will spare

sponsors from submitting broadly identical information separately to various bodies and different member states.

- •

- A harmonized procedure for the assessment of applications for clinical trials, which is divided in two parts. Part I is

assessed jointly by all member states concerned. Part II is assessed separately by each member state concerned.

- •

- Strictly defined deadlines for the assessment of clinical trial application.

- •

- The involvement of the ethics committees in the assessment procedure in accordance with the national law of the member state concerned but within the overall timelines defined by the Regulation Regulation (EU) No 536/2014.

Marketing Authorization

Authorization to market a product in the member states of the European Union proceeds under one of four procedures: a centralized authorization procedure, a mutual recognition procedure, a decentralized procedure or a national procedure.

Centralized Authorization Procedure

The centralized procedure enables applicants to obtain a marketing authorization that is valid in all E.U. member states based on a single application. Certain medicinal products, including products developed by means of biotechnological processes, must undergo the centralized authorization procedure for marketing authorization, which, if granted by the European Commission, is automatically valid in all 28 E.U. member states. The EMA and the European Commission administer this centralized authorization procedure pursuant to Regulation (EC) No 726/2004.

Pursuant to Regulation (EC) No 726/2004, this procedure is mandatory for:

- •

- medicinal products developed by means of one of the following biotechnological processes:

- •

- recombinant DNA technology;

- •

- controlled expression of genes coding for biologically active proteins in prokaryotes and eukaryotes including

transformed mammalian cells; and

- •

- hybridoma and monoclonal antibody methods;

20

- •

- advanced therapy medicinal products as defined in Article 2 of Regulation (EC) No. 1394/2007 on advanced therapy

medicinal products;

- •

- medicinal products for human use containing a new active substance that, on the date of effectiveness of this regulation, was not

authorized in the European Union, and for which the therapeutic indication is the treatment of any of the following diseases:

- •

- acquired immune deficiency syndrome;

- •

- cancer;

- •

- neurodegenerative disorder;

- •

- diabetes;

- •

- auto-immune diseases and other immune dysfunctions; and

- •

- viral diseases;

- •

- medicinal products that are designated as orphan medicinal products pursuant to Regulation (EC) No 141/2000.

The centralized authorization procedure is optional for other medicinal products if they contain a new active substance or if the applicant shows that the medicinal product concerned constitutes a significant therapeutic, scientific or technical innovation or that the granting of authorization is in the interest of patients in the European Union.

Administrative Procedure

Under the centralized authorization procedure, the EMA's Committee for Human Medicinal Products, or CHMP, serves as the scientific committee that renders opinions about the safety, efficacy and quality of medicinal products for human use on behalf of the EMA. The CHMP is composed of experts nominated by each member state's national authority for medicinal products, with expert appointed to act as Rapporteur for the co-ordination of the evaluation with the possible assistance of a further member of the Committee acting as a Co-Rapporteur. After approval, the Rapporteur(s) continue to monitor the product throughout its life cycle. The CHMP has 210 days to adopt an opinion as to whether a marketing authorization should be granted. The process usually takes longer in case additional information is requested, which triggers clock-stops in the procedural timelines. The process is complex and involves extensive consultation with the regulatory authorities of member states and a number of experts. When an application is submitted for a marketing authorization in respect of a drug that is of major interest from the point of view of public health and in particular from the viewpoint of therapeutic innovation, the applicant may pursuant to Article 14(9) Regulation (EC) No 726/2004 request an accelerated assessment procedure. If the CHMP accepts such request, the time-limit of 210 days will be reduced to 150 days but it is possible that the CHMP can revert to the standard time-limit for the centralized procedure if it considers that it is no longer appropriate to conduct an accelerated assessment. Once the procedure is completed, a European Public Assessment Report, or EPAR, is produced. If the opinion is negative, information is given as to the grounds on which this conclusion was reached. After the adoption of the CHMP opinion, a decision on the MAA must be adopted by the European Commission, after consulting the E.U. member states, which in total can take more than 60 days.

Conditional Approval

In specific circumstances, E.U. legislation (Article 14(7) Regulation (EC) No 726/2004 and Regulation (EC) No 507/2006 on Conditional Marketing Authorisations for Medicinal Products for Human Use) enables applicants to obtain a conditional marketing authorization prior to obtaining the

21

comprehensive clinical data required for an application for a full marketing authorization. Such conditional approvals may be granted for product candidates (including medicines designated as orphan medicinal products) if (1) the risk-benefit balance of the product candidate is positive, (2) it is likely that the applicant will be in a position to provide the required comprehensive clinical trial data, (3) the product fulfills unmet medical needs and (4) the benefit to public health of the immediate availability on the market of the medicinal product concerned outweighs the risk inherent in the fact that additional data are still required. A conditional marketing authorization may contain specific obligations to be fulfilled by the marketing authorization holder, including obligations with respect to the completion of ongoing or new studies, and with respect to the collection of pharmacovigilance data. Conditional marketing authorizations are valid for one year, and may be renewed annually, if the risk-benefit balance remains positive, and after an assessment of the need for additional or modified conditions and/or specific obligations. The timelines for the centralized procedure described above also apply with respect to the review by the CHMP of applications for a conditional marketing authorization.

Marketing Authorization under Exceptional Circumstances

Under Article 14(8) Regulation (EC) No 726/2004, products for which the applicant can demonstrate that comprehensive data (in line with the requirements laid down in Annex I of Directive 2001/83/EC, as amended) cannot be provided (due to specific reasons foreseen in the legislation) might be eligible for marketing authorization under exceptional circumstances. This type of authorization is reviewed annually to reassess the risk-benefit balance. The fulfillment of any specific procedures/obligations imposed as part of the marketing authorization under exceptional circumstances is aimed at the provision of information on the safe and effective use of the product and will normally not lead to the completion of a full dossier/approval.

Market Authorizations Granted by Authorities of E.U. Member States

In general, if the centralized procedure is not followed, there are three alternative procedures as pecribed in Directive 2001/83/EC:

- •

- The decentralized procedure allows applicants to file identical applications to several E.U. member states and receive simultaneous

national approvals based on the recognition by E.U. member states of an assessment by a reference member state.

- •

- The national procedure is only available for products intended to be authorized in a single E.U. member state.

- •

- A mutual recognition procedure similar to the decentralized procedure is available when a marketing authorization has already been obtained in at least one E.U. member state.

A marketing authorization may be granted only to an applicant established in the European Union.

Pediatric Studies

Prior to obtaining a marketing authorization in the European Union, applicants have to demonstrate compliance with all measures included in an EMA-approved Paediatric Investigation Plan, or PIP, covering all subsets of the paediatric population, unless the EMA has granted a product-specific waiver, a class waiver, or a deferral for one or more of the measures included in the PIP. The respective requirements for all marketing authorization procedures are set forth in Regulation (EC) No 1901/2006, which is referred to as the Pediatric Regulation. This requirement also applies when a company wants to add a new indication, pharmaceutical form or route of administration for a medicine that is already authorized. The Pediatric Committee of the EMA, or PDCO, may grant deferrals for

22

some medicines, allowing a company to delay development of the medicine in children until there is enough information to demonstrate its effectiveness and safety in adults. The PDCO may also grant waivers when development of a medicine in children is not needed or is not appropriate, such as for diseases that only affect the elderly population.

Before a marketing authorization application can be filed, or an existing marketing authorization can be amended, the EMA determines that companies actually comply with the agreed studies and measures listed in each relevant PIP.

Periods of Authorization and Renewals

A marketing authorization is valid for five years in principle and the marketing authorization may be renewed after five years on the basis of a re-evaluation of the risk-benefit balance by the EMA or by the competent authority of the authorizing member state. To this end, the marketing authorization holder must provide the EMA or the competent authority with a consolidated version of the file in respect of quality, safety and efficacy, including all variations introduced since the marketing authorization was granted, at least six months before the marketing authorization ceases to be valid. Once renewed, the marketing authorization is valid for an unlimited period, unless the European Commission or the competent authority decides, on justified grounds relating to pharmacovigilance, to proceed with one additional five-year renewal. Any authorization which is not followed by the actual placing of the drug on the E.U. market (in case of centralized procedure) or on the market of the authorizing member state within three years after authorization ceases to be valid (the so-called sunset clause).

Regulatory Data Protection