Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - SWK Holdings Corp | Financial_Report.xls |

| EX-21.01 - SWK Holdings Corp | e00129_ex21-01.htm |

| EX-32.01 - SWK Holdings Corp | e00129_ex32-01.htm |

| EX-10.27 - SWK Holdings Corp | e00129_ex10-27.htm |

| EX-32.02 - SWK Holdings Corp | e00129_ex32-02.htm |

| EX-31.01 - SWK Holdings Corp | e00129_ex31-01.htm |

| EX-31.02 - SWK Holdings Corp | e00129_ex31-02.htm |

| EX-23.01 - SWK Holdings Corp | e00129_ex23-01.htm |

| 10-K - SWK Holdings Corp | e00129_swkh-10k.htm |

| EX-23.02 - SWK Holdings Corp | e00129_ex23-02.htm |

HOLMDEL PHARMACEUTICALS, LP FINANCIAL STATEMENTS DECEMBER 31, 2014 and 2013

Holmdel Pharmaceuticals, LP Contents Report of Independent Registered Public Accounting Firm 2 Financial Statements Balance sheets as of December 31, 2014 and 2013 3 Statements of income for the years ended December 31, 2014 and 2013 4 Statements of partners’ equity for the years ended December 31, 2014 and 2013 5 Statements of cash flows for the years ended December 31, 2014 and 2013 6 Notes to financial statements 7

EisnerAmper LLP 111 Wood Avenue South Iselin, NJ 08830-2700 T 732.243.7000 F 732.951.7400 www.eisneramper.com REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM The Board of Directors and Partners Holmdel Pharmaceuticals, LP We have audited the accompanying balance sheets of Holmdel Pharmaceuticals, LP (the “Company”) as of December 31, 2014 and 2013, and the related statements of income, partners’ equity, and cash flows for each of the years in the two-year period ended December 31, 2014. The financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion. In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Holmdel Pharmaceuticals, LP as of December 31, 2014 and 2013, and the results of its operations and its cash flows for each of the years in the two-year period ended December 31, 2014, in conformity with accounting principles generally accepted in the United States of America. Iselin, New Jersey March 26, 2015 New York New Jersey Pennsylvania California Cayman Islands EisnerAmper is an independent member of PKF International Limite

HOLMDEL PHARMACEUTICALS, LP BALANCE SHEETS AS OF DECEMBER 31, 2014 AND 2013 2014 2013 ASSETS Current assets: Cash $ 66,339 $ 63,379 Royalties receivable – related party 2,100,194 2,473,063 Due from related party 31,168 1,500 Prepaid expenses and other current assets - 3,649 Total current assets 2,197,701 2,541,591 Intangible asset, net 9,755,598 11,197,799 Total Assets $ 11,953,299 $ 13,739,390 LIABILITIES AND PARTNERS’ EQUITY Current liabilities: Distributions payable to partners $ 2,434,934 $ 2,349,397 Total Liabilities 2,434,934 2,349,397 Commitments and contingencies (Note 4) Partners’ equity: General partners’ interest 953 1,140 Limited partners’ interest 9,517,412 11,388,853 Total partners’ equity 9,518,365 11,389,993 Total Liabilities and Partners’ Equity $ 11,953,299 $ 13,739,390 See accompanying notes to the financial statements.

HOLMDEL PHARMACEUTICALS, LP STATEMENTS OF INCOME FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013 2014 2013 Net Revenues – related parties InnoPran XL royalty $ 6,637,890 $ 7,135,981 Primlev royalty 1,060,878 860,203 Inderal XL royalty 35,284 - Total Net Revenues – related parties 7,734,052 7,996,184 Costs and expenses: Amortization of intangible assets 1,442,201 1,442,201 General and administrative 81,214 109,157 Income from operations 6,210,637 6,444,826 Other income, net 17 914 Net income $ 6,210,654 $ 6,445,740 See accompanying notes to the financial statements.

HOLMDEL PHARMACEUTICALS, LP STATEMENTS OF PARTNERS’ EQUITY FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013 General Partners Limited Partners Total Balances at December 31, 2012 $ 1,365 $ 13,646,555 $ 13,647,920 Net income 645 6,445,095 6,445,740 Distributions paid (635 ) (6,353,635) (6,354,270) Distributions declared and payable (235 ) (2,349,162) (2,349,397) Balances at December 31, 2013 1,140 11,388,853 11,389,993 Net income 621 6,210,033 6,210,654 Distributions paid (565 ) (5,646,783) (5,647,348) Distributions declared and payable (243 ) (2,434,691) (2,434,934) Balances at December 31, 2014 $ 953 $ 9,517,412 $ 9,518,365 See accompanying notes to the financial statements

HOLMDEL PHARMACEUTICALS, LP STATEMENTS OF CASH FLOWS FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013 2014 2013 Cash flows from operating activities: Net income $ 6,210,654 $ 6,445,740 Adjustments to reconcile net income to net cash provided by operating activities: Amortization of intangible asset 1,442,201 1,442,201 Changes in operating assets and liabilities: Royalties receivable 372,869 (2,473,063) Due from related party (29,668) (1,500) Prepaid expenses and other current assets 3,649 439,900 Accrued liabilities - (162,096) Due to GlaxoSmithKline LLC - (220,549) Net cash provided by operating activities 7,999,705 5,470,633 Cash flows from financing activities: Distribution paid to general and limited partners (7,996,745 ) (6,354,270) Net cash used in financing activities (7,996,745 ) (6,354,270) Net increase (decrease) in cash 2,960 (883,637) Cash at beginning of year 63,379 947,016 Cash at end of year $ 66,339 $ 63,379 Non-cash financing activities: Distributions payable to partners $ 2,434,934 $ 2,349,397 See accompanying notes to the financial statements.

Holmdel Pharmaceuticals, LP Notes to Financial Statements 7 Note 1. Nature of Operations Holmdel Pharmaceuticals, LP (the “Partnership”, or “Holmdel”), was formed pursuant to a certificate of limited partnership filed with the Secretary of State of the State of Delaware on December 12, 2012 (“Inception”). On December 20, 2012, Holmdel entered in to an Asset Purchase Agreement (“APA”) with GlaxoSmithKline LLC (“GSK”) and acquired the U.S. marketing authorization rights to InnoPran XL ®, a beta blocker pharmaceutical product indicated for the treatment of hypertension, for a total purchase price of approximately $13 million (“the Acquisition”). Holmdel was organized solely for the purpose of (i) consummating the Acquisition, (ii) owning the purchased assets, (iii) entering into a License and Supply Agreement, (iv) entering into a Sublicense and Distribution Agreement and (v) engaging in any other lawful act or activity that is ancillary or incidental to the foregoing. At December 31, 2014, HP General Partner LLC (the “General Partner”) owned a 0.01% general partner interest in Holmdel, through which it manages and effectively controls Holmdel. The General Partner is an equity method investment of SWK Holdings Corporation. As of December 31, 2014, SWK HP Holdings LP an affiliate of SWK Holdings Corporation and Holmdel Therapeutics, LLC (see below) owned limited partnership interests of 69.56% and 30.43%, respectively, which are subject to adjustment under the terms of the limited partnership agreement. In connection with the Acquisition, and also on December 20, 2012, Holmdel entered into a license and supply agreement with Aptalis Pharmatech, Inc. (the “Aptalis Agreement”) pursuant to which Holmdel was granted a sole and exclusive royalty bearing license to the Aptalis extended release technology (“the Aptalis Technology”) and other technology (“the Holmdel Technology Rights”) to use in the manufacture of InnoPran XL (together, “the Product”). In addition, and also pursuant to the Aptalis Agreement, Aptalis agreed to manufacture and supply the Product to Holmdel (the “Manufacturing Agreement"). Contemporaneously upon entering into the Aptalis Agreement, Holmdel entered into a Sublicense and Distribution Agreement (“the Mist Agreement”) with Mist Pharmaceuticals, LLC (“Mist”), a related party as described below, to grant to Mist (i) an exclusive right and sublicense to the Aptalis Technology, (ii) an exclusive right and license to the related intellectual property, and (iii) an exclusive assignment and delegation of Holmdel’s rights and obligations under the Aptalis license and supply agreement to grant one or more third parties co-promotion and distribution rights, to use the Aptalis Technology and other rights as defined in the Mist Agreement to market, sell and distribute InnoPran XL within the United States and its territories. In consideration for the items above, Mist agreed to pay royalties, based on a percentage of net sales of the Product, starting at 56% of net sales and growing to 97% of net sales in 2017. With respect to any renewal period after 2017, Holmdel and Mist shall agree on a royalty amount. Mist shall be permitted to deduct cost of goods sold and, upon Board approval each year, an administrative fee of $240,000 per year which includes a yearly insurance premium. In addition, until Holmdel receives $15 million in the aggregate from the Mist Agreement, Mist shall pay to Holmdel all amounts related to the net sales of Primlev® received by Mist from Akrimax Pharmaceuticals, LLC (“Akrimax”), a related party as described below, pursuant to an agreement between Mist and Akrimax dated October 4, 2011. The initial term of this agreement is two years and shall be automatically renewed for successive periods of one year. The agreement may be terminated (i) by either party if the other party shall commit a material breach if not cured within 60 days written notice; (ii) by Mist, if the trailing twelve months net sales are less than $16 million through the fiscal quarter ended June 30, 2014, upon 90 days’ written notice; or (iii) after the expiration of the initial term, by either party upon 180 days’ written notice. On December 20, 2012, Mist entered into a co-promotion and distribution agreement with Akrimax (“the Akrimax Agreement”) whereby Mist assigned and delegated to Akrimax all of the rights and duties that were assigned or delegated to Mist under the Aptalis Agreement, including (i) the Aptalis manufacturing rights under the Manufacturing Agreement, and (ii) all of the Holmdel obligations delegated to Mist. In addition, Akrimax and Mist agreed that Aptalis shall be deemed a third party beneficiary of the Akrimax Agreement with all rights to enforce the Akrimax Agreement against Akrimax in Aptalis’ own name as if Aptalis were a signatory.

Holmdel Pharmaceuticals, LP Notes to Financial Statements 8 Note 1. Nature of Operations (continued) Holmdel is owned and controlled by the same individuals who own and control Mist and Akrimax. As such, all transactions between Holmdel and Mist and/or Akrimax are considered related party transactions. On February 4, 2014 the Partnership entered into an agreement with Cranford Pharmaceuticals LLC (“Cranford”), a Company with a minority ownership by the same individuals who own and control Mist and Akrimax and thereby a related party. Refer to Note 5 for further information. Note 2. Summary of Significant Accounting Policies Basis of Presentation: The financial statements reflect the accounts of Holmdel Pharmaceuticals, LP. Use of Estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”), requires the Partnership’s management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Risks and Uncertainties: The Partnership is subject to risks common to companies in the pharmaceutical industry including, but not limited to, dependence on key products, dependence on key customers and suppliers, and protection of intellectual property rights. Cash: The Partnership maintains cash on deposit in a financial institution in amounts which, at times, may be in excess of insured limits. Royalty Revenue: The Partnership’s sole source of revenue is royalty revenue from a related party. As discussed above in Note 1, the Partnership currently has royalty agreements in place for which it receives quarterly royalty payments, based on the net sales of InnoPran XL, Primlev and Inderal XL (which is discussed in Note 5). The Partnership recognizes royalty revenue based upon amounts contractually due pursuant to the underlying royalty agreements. Specifically, revenue is recognized in accordance with the terms of the underlying royalty agreements when (i) persuasive evidence of an arrangement exists; (ii) the risks and rewards have been transferred; (iii) the royalty is fixed or determinable; and (iv) the collectability of the royalty is reasonably assured. As discussed in Note 1 above, The Partnership recognizes and records royalty revenue based on a percentage of Akrimax’s reported net sales to the Partnership for InnoPran XL® and Primlev®, as defined in the agreement, and as reported to the Partnership by Akrimax, net of all costs incurred by Mist related to the Mist Agreement. The Partnership receives quarterly sales information from Akrimax and makes no adjustments to the amounts reported to it by Akrimax. The agreement provides for gross sales to be reduced by estimates of sales returns, credits and allowances, normal trade and cash discounts, and other costs as defined in the agreement and in accordance with GAAP, all of which are determined by Akrimax. Similarly, the Partnership recognizes and records quarterly royalty revenues as defined in the agreement, based on a percentage of all net sales of Inderal XL by Cranford, any copromoter, Mist or any other sub licensee, sold during the applicable calendar quarter.

Holmdel Pharmaceuticals, LP Notes to Financial Statements 9 Note 2. Summary of Significant Accounting Policies (continued) Intangible Assets: The Partnership accounts for recognized intangible assets based on their estimated useful lives. Intangible assets with finite useful lives are amortized while intangible assets with indefinite useful lives are not amortized. The useful life is the period over which the assets are expected to contribute directly or indirectly to future cash flows. Straight-line amortization is used to expense recognized amortizable intangible assets. Intangible assets are not written off in the period of acquisition unless they become impaired during that period. The Partnership evaluates the remaining useful life of each intangible asset that is being amortized each reporting period to determine whether events and circumstances warrant a revision to the remaining period of amortization. If the estimate of the intangible asset’s remaining useful life is changed, the remaining carrying amount of the intangible asset is amortized prospectively over that revised remaining useful life. The Partnership did not record any impairments of intangible assets for the years ended December 31, 2014 and 2013. Income Taxes: The Partnership is generally not subject to U.S. federal and most state income taxes. The partners of the Partnership are liable for income tax in regard to their distributive share of the Partnership’s taxable income. Such taxable income may vary substantially from net income reported in the accompanying financial statements. The Partnership evaluates tax positions taken or expected to be taken in the course of preparing the Partnership’s tax returns and disallows the recognition of tax positions not deemed to meet a “more-likely-than-not” threshold of being sustained by the applicable tax authority. The Partnership’s management does not believe it has any tax positions taken within its financial statements that would not meet this threshold. The Partnership’s policy is to reflect interest and penalties related to uncertain tax positions, when and if they become applicable. The Partnership has not recognized any potential interest or penalties in its financial statements for the years ended December 31, 2014 and 2013. The Partnership's federal and state tax returns for the tax years for which the applicable statutes of limitations have not expired, which is since Inception, are subject to examination. Recent Accounting Pronouncements: The Financial Accounting Standards Board (FASB) issued Accounting Standard Update (ASU) 2015-02, Consolidation (Topic 810): Amendments to the Consolidation Analysis, which amended the existing accounting standards for consolidation under both the variable interest model and the voting model. Under ASU No. 2015-02, companies will need to reevaluate whether an entity meets the criteria to be considered a VIE, whether companies still meet the definition of primary beneficiaries, and whether an entity needs to be consolidated under the voting model. ASU No. 2015-02 may be applied using a modified retrospective approach or retrospectively, and is effective for reporting periods beginning after December 15, 2015. Early adoption is permitted. The Company is currently evaluating the potential impact of the pending adoption of this new guidance. In May 2014, ASU No. 2014-09, “Revenue from Contracts with Customers” (“ASU 2014-09”). ASU 2014-09 represents a comprehensive new revenue recognition model that requires a company to recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the Partnership expects to be entitled to receive in exchange for those goods or services. This ASU sets forth a new fivestep revenue recognition model which replaces the prior revenue recognition guidance in its entirety and is intended to eliminate numerous industry-specific pieces of revenue recognition guidance that have historically existed. This ASU is effective for annual reporting periods beginning after December 15, 2016 and interim reporting periods within that reporting period. Early adoption is not permitted. Accordingly, the Partnership will adopt this ASU on January 1, 2017. Companies may use either a full retrospective or a modified retrospective approach to adopt this ASU. The Partnership is currently evaluating the impact of ASU 2014-09 on the Partnership's consolidated financial statements

Holmdel Pharmaceuticals, LP Notes to Financial Statements 10 Note 2. Summary of Significant Accounting Policies (continued) Subsequent Events: The Company has evaluated subsequent events through the date that the financial statements were available to be issued on March 26, 2015 and noted no events other than those disclosed in the financial statement footnotes. Note 3. Intangible asset The following reflects the details of the InnoPran XL license at December 31, 2014 and 2013: 2014 2013 InnoPran license (estimated useful life of 9 years) $ 12,640,000 $ 12,640,000 Less: Accumulated amortization (2,884,402) (1,442,201) Intangible asset, net $ 9,755,598 $ 11,197,799 Amortization expense was $1,442,201 for each of the years ended December 31, 2014 and 2013. The estimated future amortization for InnoPran XL license is as follows: 2015 $ 1,442,201 2016 1,446,150 2017 1,442,201 2018 1,442,201 2019 1,442,201 Thereafter 2,540,644 $ 9,755,598 Note 4. Commitments and Contingencies Pursuant to the Amended and Restated Limited Partnership Agreement dated December 20, 2012, all liquid assets of the Partnership, including royalty payments received in connection with product sales and all other proceeds of the Partnership, less an amount reasonably determined by the General Partner to cover operating expenses, shall be distributed no less frequently than quarterly to the Partners, pro rata in accordance with their respective partner percentages. Note 5. Related Party Transactions On February 4, 2014 the Partnership entered into an agreement with Cranford, a Company with a minority ownership by the same individuals who own and control Mist and Akrimax and hence a related party, whereby Holmdel granted to Cranford an exclusive right and license to sublicense to Mist and other sub licensees, and to grant to one or more third parties, co-promotion and distribution rights, to use the Holmdel Technology Rights pursuant to the Aptalis Agreement discussed above in Note 1, to develop, market, sell and distribute within the United States and its territories, a product which Cranford wishes to develop and market as Inderal XL (propranolol hydrochloride) extended release capsules (a beta blocker) based on the formulation for InnoPran XL (“the Cranford Agreement”) .

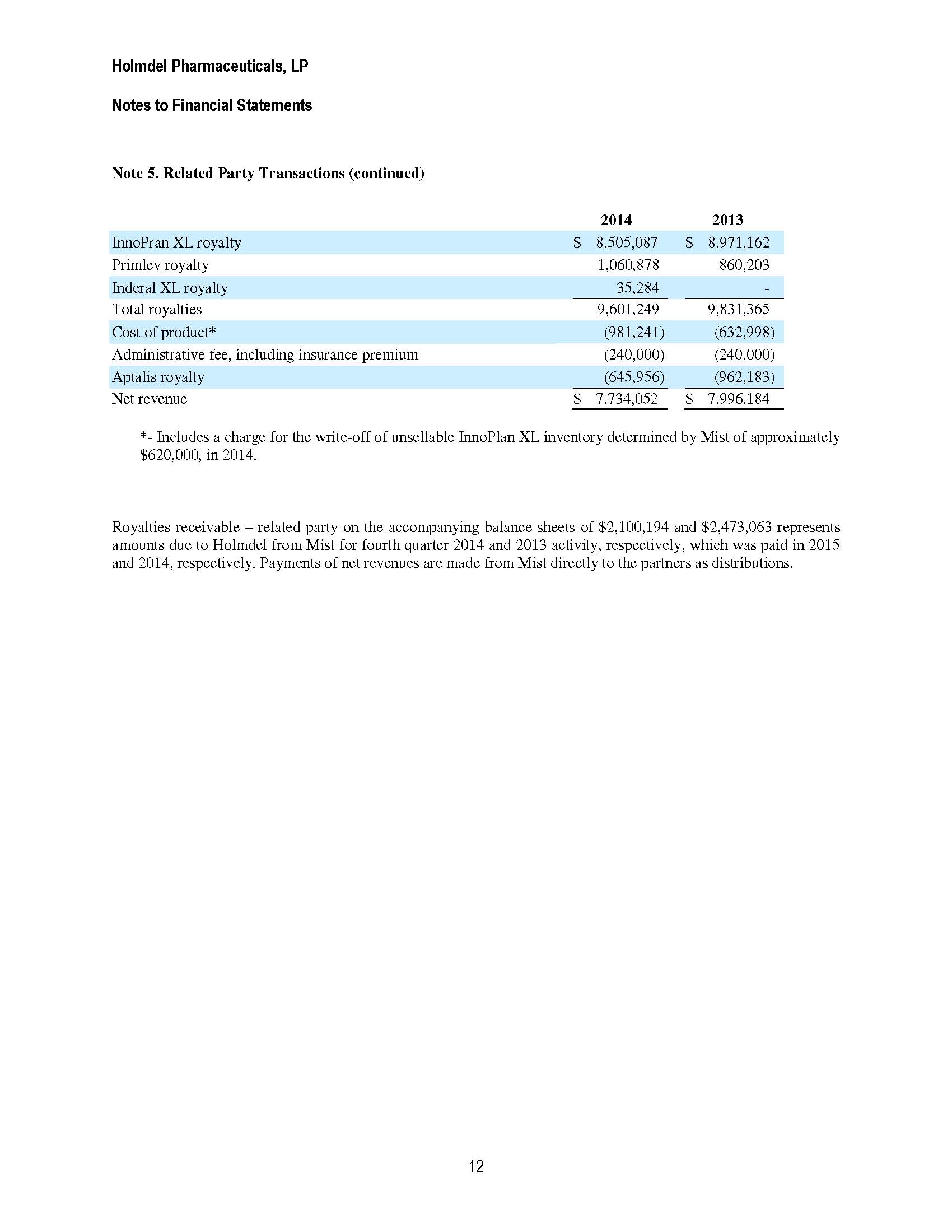

Holmdel Pharmaceuticals, LP Notes to Financial Statements 11 Note 5. Related Party Transactions (continued) Pursuant to the Cranford Agreement, Cranford will pay Holmdel a quarterly royalty payment based on a percentage of all net Sales of Inderal XL by Cranford, any co-promoter, Mist or any other sub licensee, sold during the applicable calendar quarter. Contemporaneously upon entering into the Cranford Agreement, Cranford entered into an agreement with Aptalis, and Holmdel amended its existing agreement with Mist resulting in Holmdel and Cranford having exclusive rights to use the Aptalis technology. Also pursuant to the amended Mist Agreement, Holmdel has acknowledged and agreed that it and its affiliates may not use the Aptalis Technology and the Holmdel Technology Rights for any other extended release product containing propranolol hydrochloride, other than the use of Holmdel Technology in connection with the manufacture, marketing, sale and distribution of Inderal XL and InnoPran XL, provided however, the parties acknowledge and agree that in the event Mist fails to meet a certain sales milestone for any calendar year, ranging from $22,600,000 in 2014 to $37,000,000 in 2021, then Holmdel no longer will be obligated by the covenant provided in this sentence. In the event Holmdel is no longer obligated by the covenant and Holmdel or any affiliate determines to use the Aptalis Technology and the Holmdel Technology Rights for any other extended release product containing propranolol hydrochloride, then Holmdel shall provide prompt written notice to Mist and Mist will have the right for a period of thirty (30) days following receipt of such notice to terminate the Mist Agreement upon written notice to Holmdel. In addition, if payments to Holmdel for Net Sales pursuant to the Akrimax Agreement with respect to the period from December 20, 2013 through December 20, 2014 are less than $11,500,000, then Akrimax will pay to Holmdel the difference between the amount of such payments and $11,500,000 and in the event that royalty payments for Net Sales paid to Holmdel with respect to the period from December 20, 2014 through December 20, 2015 are less than $16,700,000, then Akrimax will pay to Holmdel the difference between the amount of such payments and $16,700,000. The purpose of this agreement is to compensate Holmdel if Inderal XL has a major impact on the sales of InnoPran XL. For the period ended December 20, 2014, under the terms of this agreement, Akrimax owes Holmdel $2,994,913. Akrimax has requested that the Holmdel Board discuss the matter and come to a resolution that will work for all parties. As such collectability of this amount is not reasonably assured and no related party receivable has been recorded. The Partnership has agreements in place with Mist based on the December 20, 2012 Sublicense and Distribution Agreement and with Akrimax as a result of the co-promotion and distribution agreement between Mist and Akrimax, which assigned and delegated to Akrimax all of the rights and duties that were assigned or delegated to Mist under the Aptalis Agreement. Pursuant to the Mist Agreement, Holmdel is entitled to a quarterly payment from Mist of the royalties earned, net of the fees for cost of products, the Aptalis royalty (under the Aptalis Agreement) and administrative fees. Accordingly, Holmdel records the net amount from Mist as net revenues. As of December 31, 2014 and 2013 net revenues included:

Holmdel Pharmaceuticals, LP Notes to Financial Statements 12 Note 5. Related Party Transactions (continued) 2014 2013 InnoPran XL royalty $ 8,505,087 $ 8,971,162 Primlev royalty 1,060,878 860,203 Inderal XL royalty 35,284 - Total royalties 9,601,249 9,831,365 Cost of product* (981,241) (632,998) Administrative fee, including insurance premium (240,000) (240,000) Aptalis royalty (645,956) (962,183) Net revenue $ 7,734,052 $ 7,996,184 *- Includes a charge for the write-off of unsellable InnoPlan XL inventory determined by Mist of approximately $620,000, in 2014. Royalties receivable – related party on the accompanying balance sheets of $2,100,194 and $2,473,063 represents amounts due to Holmdel from Mist for fourth quarter 2014 and 2013 activity, respectively, which was paid in 2015 and 2014, respectively. Payments of net revenues are made from Mist directly to the partners as distributions.