Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE DATED MARCH 27, 2015 - Aleris Corp | a4q14earningsrelease.htm |

| 8-K - 8-K - Aleris Corp | alerisform8-kq42014earning.htm |

Fourth Quarter & Full Year 2014 Earnings Presentation March 27, 2015

2 FORWARD-LOOKING AND OTHER INFORMATION IMPORTANT INFORMATION This information is current only as of its date and may have changed. We undertake no obligation to update this information in light of new information, future events or otherwise. This information contains certain financial projections and forecasts and other forward looking information concerning our business, prospects, financial condition and results of operations, and we are not making any representation or warranty that this information is accurate or complete. See “Forward-Looking Information” below. BASIS OF PRESENTATION We have recently completed the sale of our recycling and specification alloys and extrusions businesses. We have reported these businesses as discontinued operations for all periods presented, and reclassified the results of operations of these businesses as discontinued operations. Except as otherwise indicated, the discussion of the Company’s business and financial information throughout this presentation refers to the Company’s continuing operations and the financial position and results of operations of its continuing operations. FORWARD-LOOKING INFORMATION Certain statements contained in this press release are “forward-looking statements” within the meaning of the federal securities laws. Statements under headings with “Outlook” in the title and statements about our beliefs and expectations and statements containing the words “may,” “could,” “would,” “should,” “will,” “believe,” “expect,” “anticipate,” “plan,” “estimate,” “target,” “project,” “look forward to,” “intend” and similar expressions intended to connote future events and circumstances constitute forward-looking statements. Forward-looking statements include statements about, among other things, future costs and prices of commodities, production volumes, industry trends, anticipated cost savings, anticipated benefits from new products, facilities, acquisitions or divestitures, projected results of operations, achievement of production efficiencies, capacity expansions, future prices and demand for our products, and estimated cash flows and sufficiency of cash flows to fund capital expenditures. Forward-looking statements involve known and unknown risks and uncertainties, which could cause actual results to differ materially from those contained in or implied by any forward-looking statement. Some of the important factors that could cause actual results to differ materially from those expressed or implied by forward-looking statements include, but are not limited to, the following: (1) our ability to successfully implement our business strategy; (2) the success of past and future acquisitions and divestitures; (3) the cyclical nature of the aluminum industry, material adverse changes in the aluminum industry or our end-use segments, such as global and regional supply and demand conditions for aluminum and aluminum products, and changes in our customers’ industries; (4) our ability to enter into effective metal, natural gas and other commodity derivatives or arrangements with customers to manage effectively our exposure to commodity price fluctuations and changes in the pricing of metals, especially London Metal Exchange- based aluminum prices; (5) increases in the cost of raw materials and energy; (6) our ability to generate sufficient cash flows to fund our capital expenditure requirements and to meet our debt service obligations; (7) our ability to fulfill our substantial capital investment requirements; (8) our ability to retain the services of certain members of our management; (9) our internal controls over financial reporting and our disclosure controls and procedures may not prevent all possible errors that could occur; (10) the loss of order volumes from any of our largest customers; (11) our ability to retain customers, a substantial number of whom do not have long-term contractual arrangements with us; (12) competitor pricing activity, competition of aluminum with alternative materials and the general impact of competition in the industry segments we serve; (13) risks of investing in and conducting operations on a global basis, including political, social, economic, currency and regulatory factors; (14) variability in general economic conditions on a global or regional basis; (15) current environmental liabilities and the cost of compliance with and liabilities under health and safety laws; (16) labor relations (i.e., disruptions, strikes or work stoppages) and labor costs; (17) our levels of indebtedness and debt service obligations, including changes in our credit ratings, material increases in our cost of borrowing or the failure of financial institutions to fulfill their commitments to us under committed credit facilities; (18) our ability to access the credit and capital markets; (19) the possibility that we may incur additional indebtedness in the future; (20) limitations on operating our business as a result of covenant restrictions under our indebtedness, and our ability to pay amounts due under the Senior Notes; and (21) other factors discussed in our filings with the Securities and Exchange Commission, including the sections entitled “Risk Factors” contained therein. Investors, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements, whether in response to new information, futures events or otherwise, except as otherwise required by law. NON-GAAP INFORMATION The non-GAAP financial measures contained in this presentation (including, without limitation, EBITDA, Adjusted EBITDA, commercial margin, and variations thereof) are not measures of financial performance calculated in accordance with U.S. GAAP and should not be considered as alternatives to net income and loss attributable to Aleris Corporation or any other performance measure derived in accordance with GAAP or as alternatives to cash flows from operating activities as a measure of our liquidity. Non-GAAP measures have limitations as analytical tools and should be considered in addition to, not in isolation or as a substitute for, or as superior to, our measures of financial performance prepared in accordance with GAAP. Management believes that certain non-GAAP performance measures may provide investors with additional meaningful comparisons between current results and results in prior periods. Management uses non-GAAP financial measures as performance metrics and believes these measures provide additional information commonly used by the holders of our senior debt securities and parties to the ABL Facility with respect to the ongoing performance of our underlying business activities, as well as our ability to meet our future debt service, capital expenditures and working capital needs. These adjustments are based on currently available information and certain adjustments that we believe are reasonable and are presented as an aid in understanding our operating results. They are not necessarily indicative of future results of operations that may be obtained by the Company. INDUSTRY INFORMATION Information regarding market and industry statistics contained in this presentation is based on information from third party sources as well as estimates prepared by us using certain assumptions and our knowledge of these industries. Our estimates, in particular as they relate to our general expectations concerning the aluminum industry, involve risks and uncertainties and are subject to changes based on various factors, including those discussed under “Risk Factors” in our filings with the Securities and Exchange Commission.

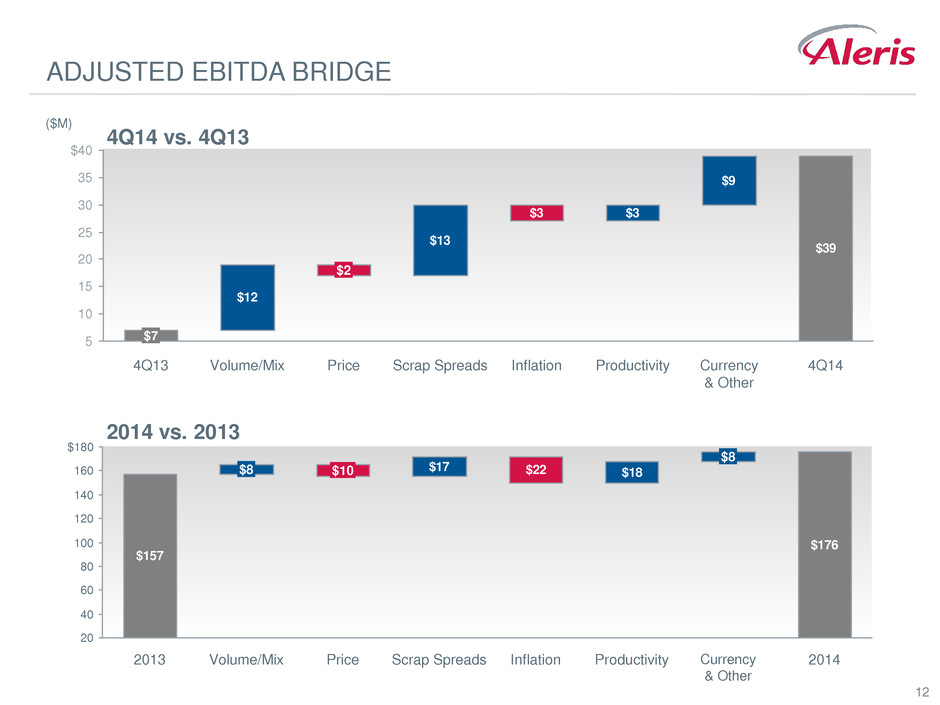

3 FOURTH QUARTER OVERVIEW 4Q14 Adjusted EBITDA of $39M; income from continuing operations of $92M Nichols integration progressing; raising synergy target to $20M Auto body sheet volumes up 21% Improved N.A. scrap spreads Strong USD benefiting Europe results 4Q Historical Adjusted EBITDA ($M)1 $39 $7 $50 $40 $30 $20 $10 $0 2013 2014 Momentum returns in 2H14 Adjusted EBITDA 1Continuing operations only Adjusted EBITDA1 ($M): 1H v 2H $106 $51 $83 $94 $120 $0 $20 $100 $80 $60 $40 $140 2H 1H -22% +85% 2013 2014

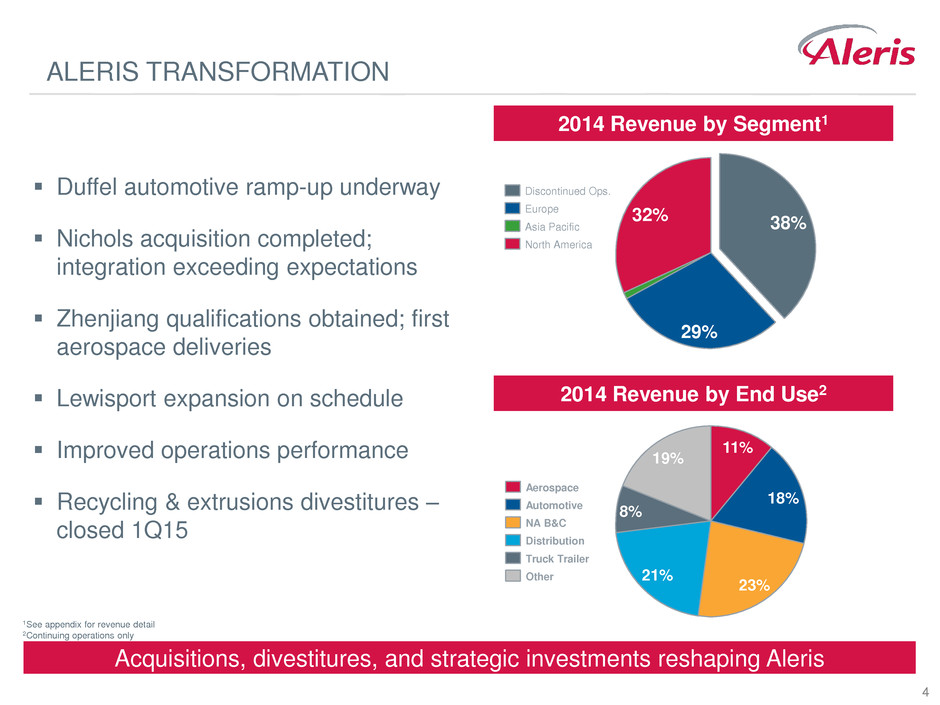

4 ALERIS TRANSFORMATION Duffel automotive ramp-up underway Nichols acquisition completed; integration exceeding expectations Zhenjiang qualifications obtained; first aerospace deliveries Lewisport expansion on schedule Improved operations performance Recycling & extrusions divestitures – closed 1Q15 Acquisitions, divestitures, and strategic investments reshaping Aleris 2014 Revenue by Segment1 2014 Revenue by End Use2 1See appendix for revenue detail 2Continuing operations only 23% 18% 19% 11% 21% 8% Distribution NA B&C Automotive Truck Trailer Other Aerospace 38% 29% 32% North America Discontinued Ops. Europe Asia Pacific

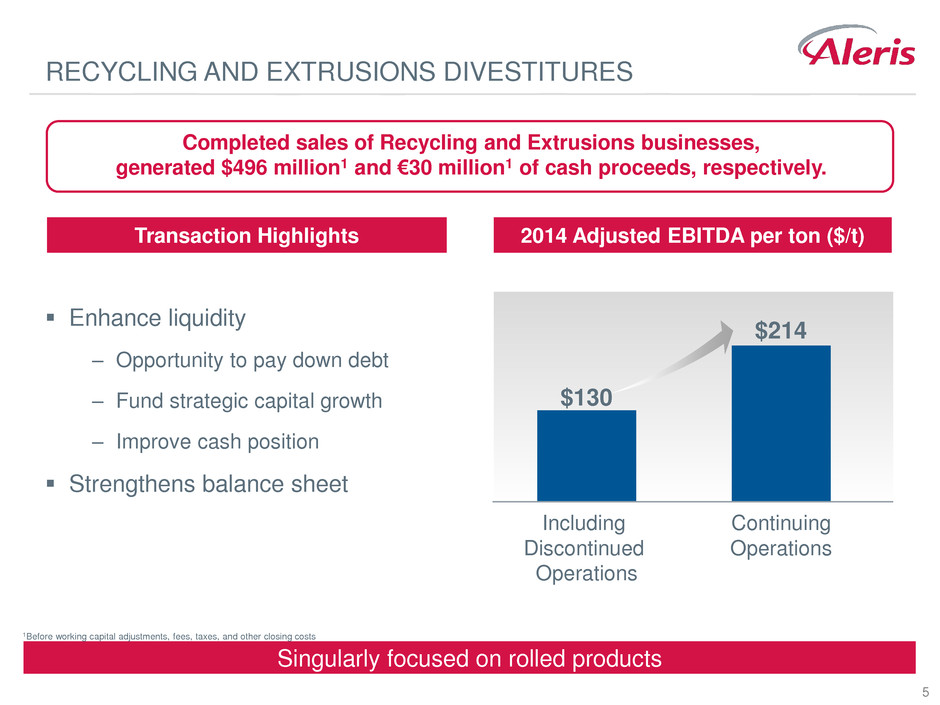

5 RECYCLING AND EXTRUSIONS DIVESTITURES Enhance liquidity ‒ Opportunity to pay down debt ‒ Fund strategic capital growth ‒ Improve cash position Strengthens balance sheet Completed sales of Recycling and Extrusions businesses, generated $496 million1 and €30 million1 of cash proceeds, respectively. Transaction Highlights 2014 Adjusted EBITDA per ton ($/t) Singularly focused on rolled products Including Discontinued Operations $130 Continuing Operations $214 1Before working capital adjustments, fees, taxes, and other closing costs

6 NICHOLS ACQUISITION Purchase price of ~$110M proving to be very attractive Well timed acquisition with B&C recovery underway Initiated Decatur plant closure – Optimize network and improve flow between plants Initial synergy target of $10M raised for second time to $20M Transaction Update Nichols acquisition very beneficial to North America business

7 ZHENJIANG ROLLING MILL Nadcap accreditation; AS9100 certification Attained key qualifications – Bombardier – COMAC – Airbus (January 2015) – Boeing (March 2015) Shipped first aerospace plate Growth opportunities in high value commercial plate end uses – Aerospace, LNG, High Speed Rail, Semiconductor, Tool / Mold 2014 Highlights Shipments by quarter (tons) 1142 1852 1649 2324 2809 3806 3872 3Q13 1Q13 1Q14 4Q13 132 2Q13 3Q14 4Q14 2Q14 First mill in China with western aerospace OEM qualifications

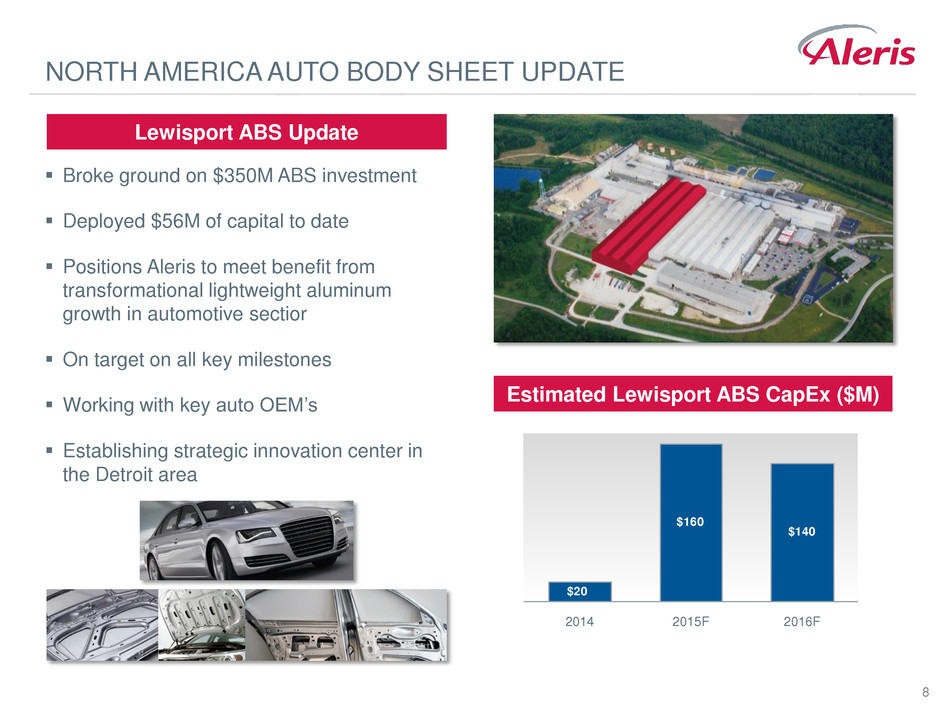

8 NORTH AMERICA AUTO BODY SHEET UPDATE Broke ground on $350M ABS investment Deployed $56M of capital to date Positions Aleris to meet benefit from transformational lightweight aluminum growth in automotive sectior On target on all key milestones Working with key auto OEM’s Establishing strategic innovation center in the Detroit area $160 $140 $20 2014 2016F 2015F Estimated Lewisport ABS CapEx ($M) Lewisport ABS Update

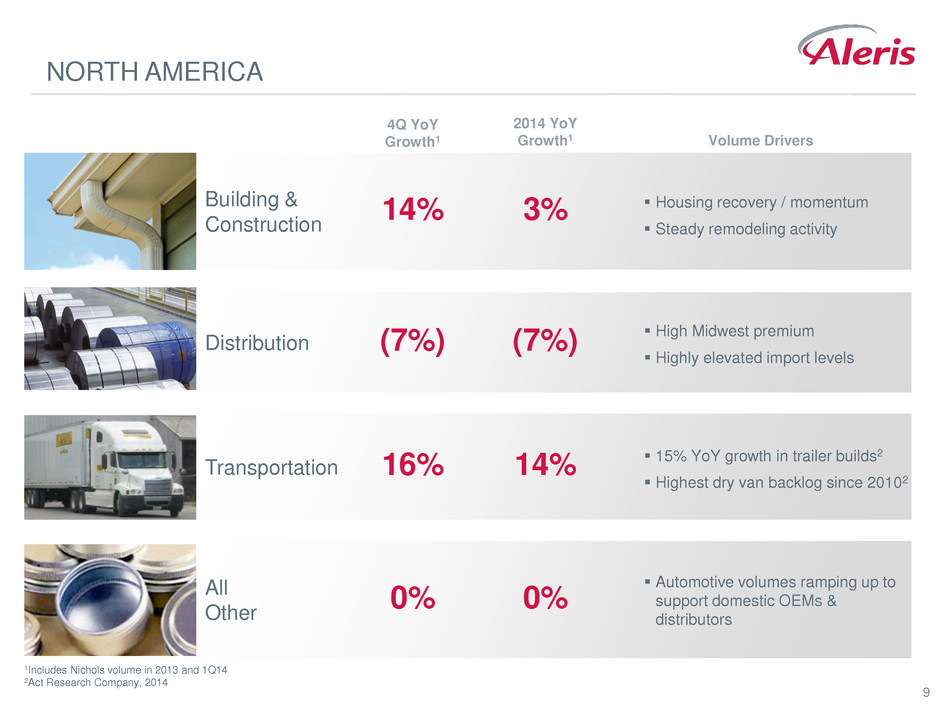

9 4Q YoY Growth1 2014 YoY Growth1 NORTH AMERICA 1Includes Nichols volume in 2013 and 1Q14 2Act Research Company, 2014 Volume Drivers Housing recovery / momentum Steady remodeling activity Building & Construction 14% 3% High Midwest premium Highly elevated import levels Distribution (7%) (7%) 15% YoY growth in trailer builds2 Highest dry van backlog since 20102 Transportation 16% 14% Automotive volumes ramping up to support domestic OEMs & distributors All Other 0% 0%

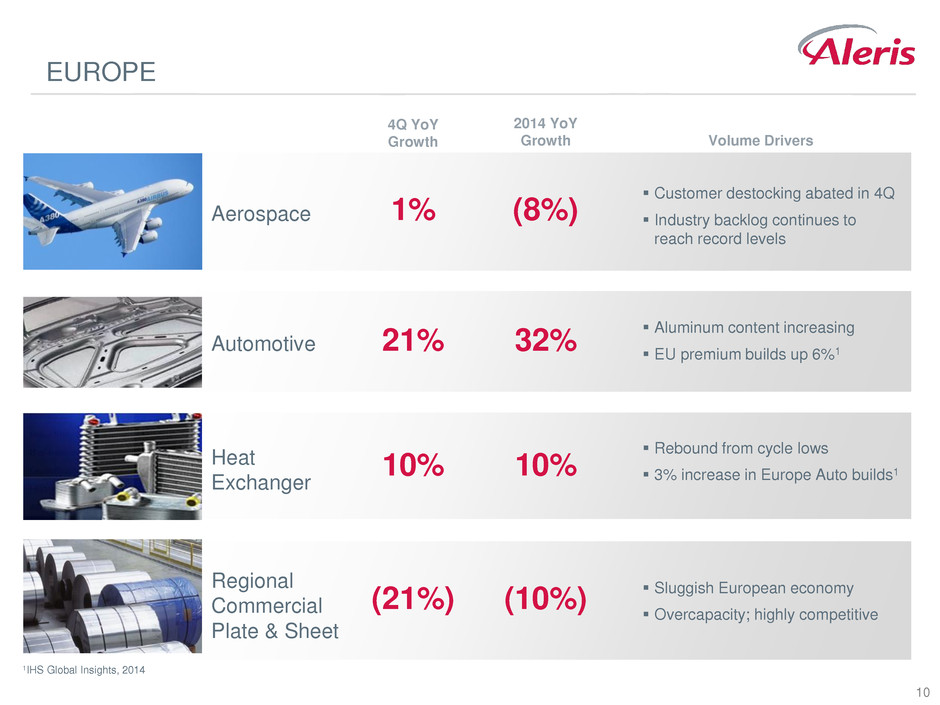

10 EUROPE 1IHS Global Insights, 2014 Customer destocking abated in 4Q Industry backlog continues to reach record levels Aerospace 1% (8%) Rebound from cycle lows 3% increase in Europe Auto builds1 Heat Exchanger 10% 10% Sluggish European economy Overcapacity; highly competitive Regional Commercial Plate & Sheet (21%) (10%) Aluminum content increasing EU premium builds up 6%1 Automotive 21% 32% Volume Drivers 4Q YoY Growth 2014 YoY Growth

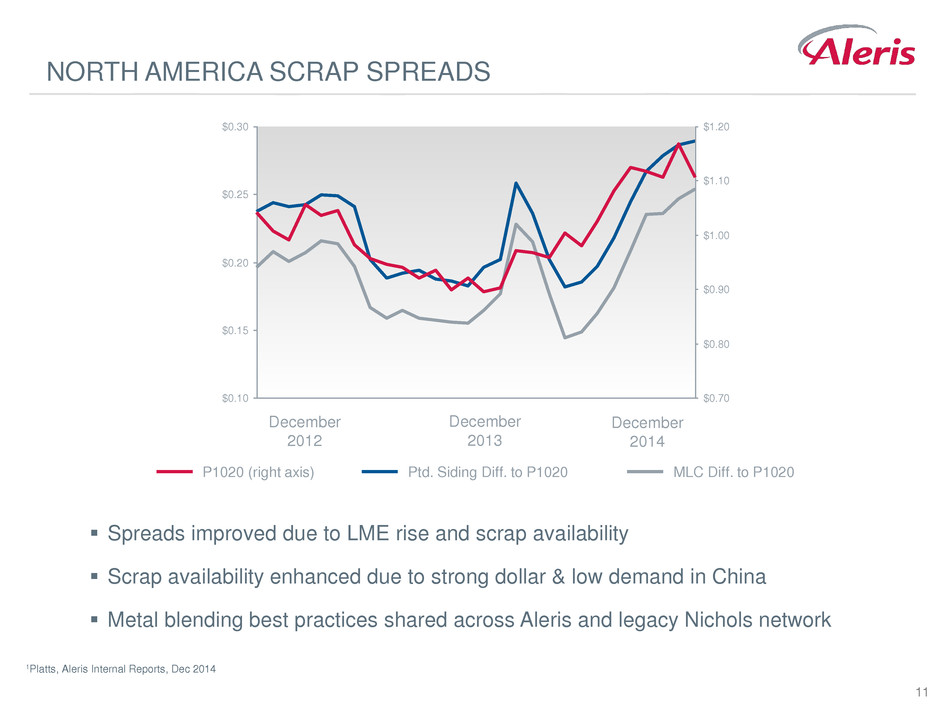

11 NORTH AMERICA SCRAP SPREADS $1.20 $1.10 $0.70 $1.00 $0.90 $0.80 $0.30 $0.25 $0.20 $0.15 $0.10 MLC Diff. to P1020 P1020 (right axis) Ptd. Siding Diff. to P1020 Spreads improved due to LME rise and scrap availability Scrap availability enhanced due to strong dollar & low demand in China Metal blending best practices shared across Aleris and legacy Nichols network December 2012 December 2013 December 2014 1Platts, Aleris Internal Reports, Dec 2014

12 ADJUSTED EBITDA BRIDGE 4Q14 vs. 4Q13 ($M) 2014 vs. 2013 $12 $13 $3 $3 $9 $39 $40 35 30 25 20 15 10 5 4Q14 Currency & Other Productivity Inflation Scrap Spreads Price $2 Volume/Mix 4Q13 $7 $157 $17 $22 $18 $176 $180 160 80 140 120 100 60 40 Scrap Spreads Price $10 Volume/Mix $8 2013 Inflation 2014 Currency & Other $8 Productivity 20

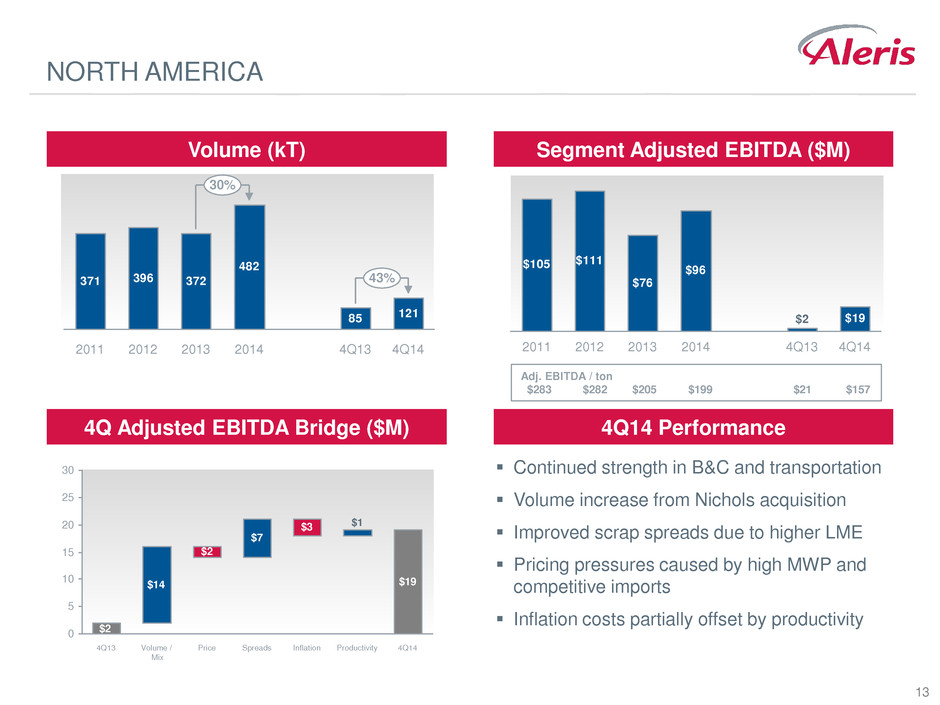

13 NORTH AMERICA Continued strength in B&C and transportation Volume increase from Nichols acquisition Improved scrap spreads due to higher LME Pricing pressures caused by high MWP and competitive imports Inflation costs partially offset by productivity Volume (kT) Segment Adjusted EBITDA ($M) 4Q14 Performance 4Q Adjusted EBITDA Bridge ($M) 371 396 372 482 85 121 43% 4Q14 4Q13 2014 2013 2012 2011 30% $105 $111 $76 $96 $19 4Q14 4Q13 $2 2014 2013 2012 2011 Adj. EBITDA / ton $283 $282 $205 $199 $21 $157 $14 $2 $7 $3 $19 $20 5 10 15 20 25 30 4Q14 Price Volume / Mix Productivity $1 Inflation Spreads 4Q13

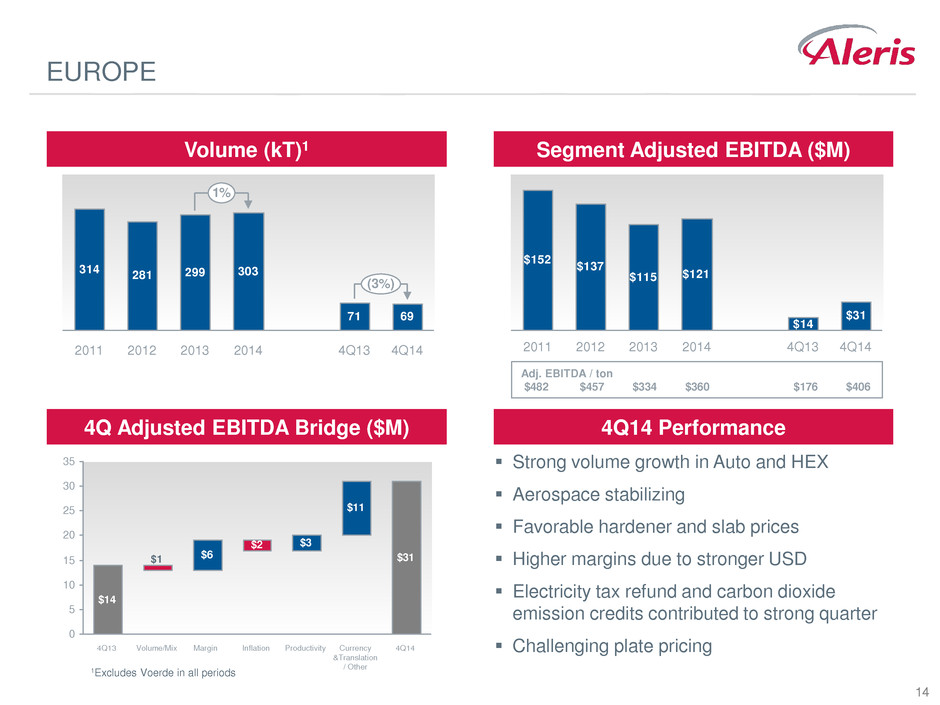

14 EUROPE Strong volume growth in Auto and HEX Aerospace stabilizing Favorable hardener and slab prices Higher margins due to stronger USD Electricity tax refund and carbon dioxide emission credits contributed to strong quarter Challenging plate pricing Volume (kT)1 Segment Adjusted EBITDA ($M) 4Q14 Performance 4Q Adjusted EBITDA Bridge ($M) 314 281 299 303 71 69 (3%) 4Q14 4Q13 2014 2013 2012 2011 1% $6 $2 $3 $11 $31 $14 0 5 10 15 20 25 30 35 4Q14 Currency &Translation / Other Productivity Inflation Margin Volume/Mix $1 4Q13 $137 $115 $121 $31 $14 $152 4Q14 4Q13 2014 2013 2012 2011 Adj. EBITDA / ton $482 $457 $334 $360 $176 $406 1Excludes Voerde in all periods

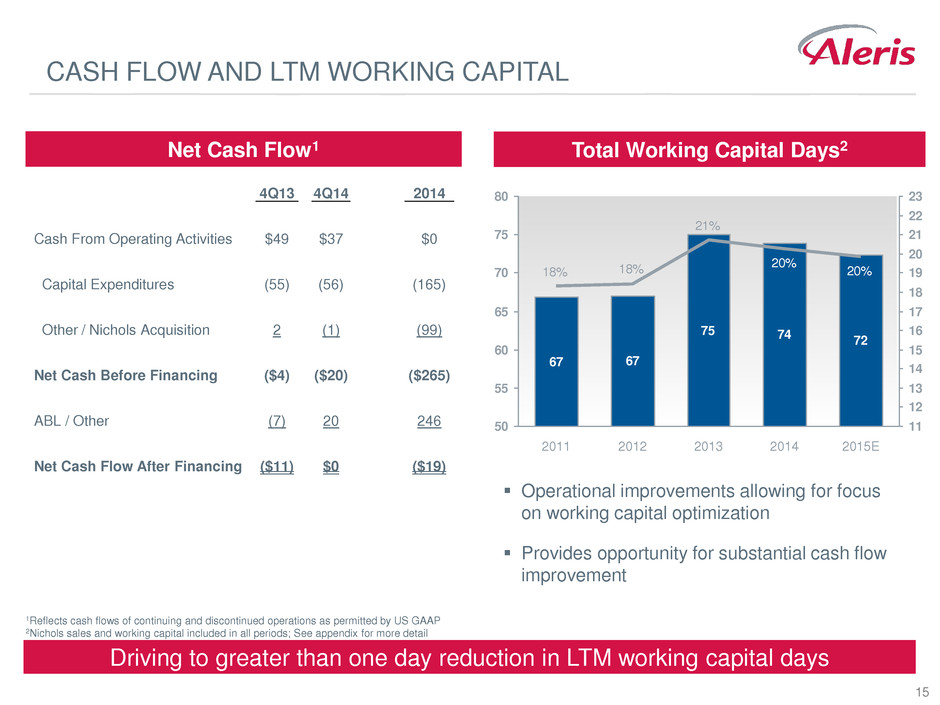

15 CASH FLOW AND LTM WORKING CAPITAL Net Cash Flow1 Total Working Capital Days2 4Q13 4Q14 2014 Cash From Operating Activities $49 $37 $0 Capital Expenditures (55) (56) (165) Other / Nichols Acquisition 2 (1) (99) Net Cash Before Financing ($4) ($20) ($265) ABL / Other (7) 20 246 Net Cash Flow After Financing ($11) $0 ($19) 67 67 75 74 72 21% 18%18% 20% 20% 50 55 60 65 70 75 80 11 12 13 14 15 16 17 18 19 20 21 22 23 2015E 2014 2013 2012 2011 1Reflects cash flows of continuing and discontinued operations as permitted by US GAAP 2Nichols sales and working capital included in all periods; See appendix for more detail Operational improvements allowing for focus on working capital optimization Provides opportunity for substantial cash flow improvement Driving to greater than one day reduction in LTM working capital days

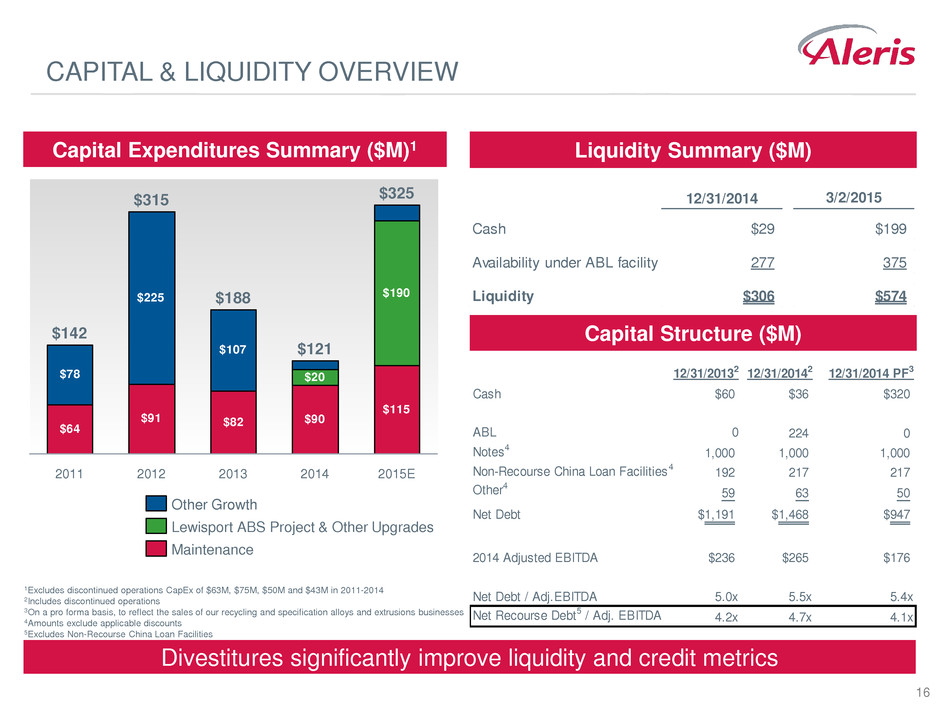

16 12/31/2014 3/2/2015 Cash $29 $199 Availability under ABL facility 277 375 Liquidity $306 $574 CAPITAL & LIQUIDITY OVERVIEW Divestitures significantly improve liquidity and credit metrics Capital Structure ($M) Liquidity Summary ($M) $64 $91 $82 $90 $115 $78 $225 $107 $190 $20 2015E $325 2014 $121 2013 $188 2012 $315 2011 $142 Maintenance Lewisport ABS Project & Other Upgrades Other Growth Capital Expenditures Summary ($M)1 1Excludes discontinued operations CapEx of $63M, $75M, $50M and $43M in 2011-2014 2Includes discontinued operations 3On a pro forma basis, to reflect the sales of our recycling and specification alloys and extrusions businesses 4Amounts exclude applicable discounts 5Excludes Non-Recourse China Loan Facilities 12/31/20132 12/31/20142 12/31/2014 PF3 Cash 60 $36 $320 ABL 0 224 0 Notes4 1,000 1,000 1,000 Non-Recourse China Loan Facilities4 1 2 217 217 Other4 59 63 50 Net Debt $1,19 $1,468 $947 2014 Adjusted EBITDA $236 $265 $176 Net Debt / Adj.EBITDA 5.0x 5.5x 5.4x Net Recourse Debt5 / Adj. EBITDA 4.2x 4.7x 4.1x

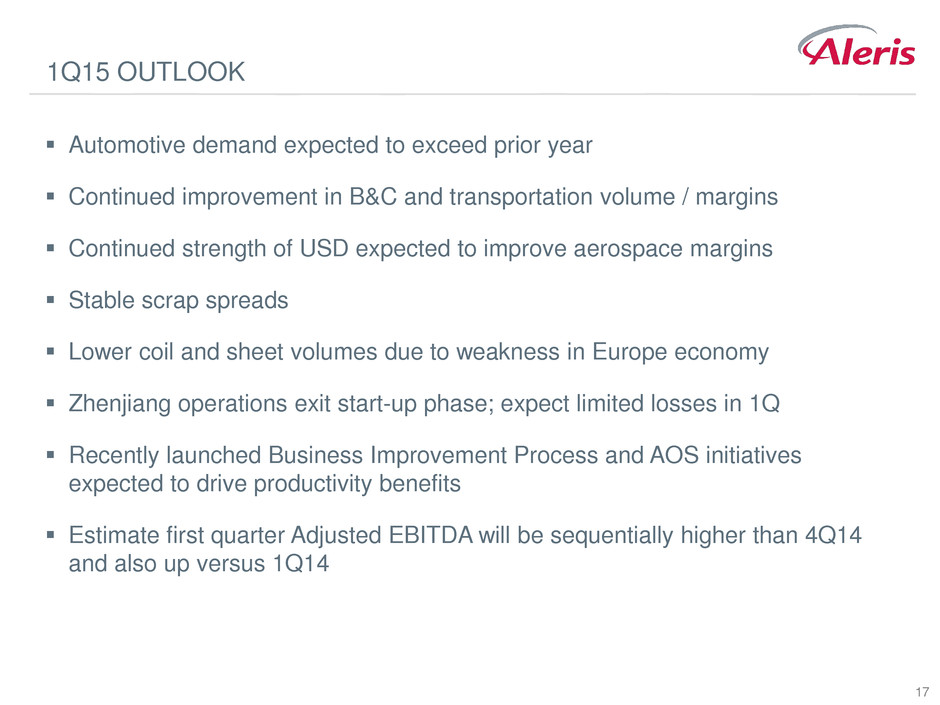

17 1Q15 OUTLOOK Automotive demand expected to exceed prior year Continued improvement in B&C and transportation volume / margins Continued strength of USD expected to improve aerospace margins Stable scrap spreads Lower coil and sheet volumes due to weakness in Europe economy Zhenjiang operations exit start-up phase; expect limited losses in 1Q Recently launched Business Improvement Process and AOS initiatives expected to drive productivity benefits Estimate first quarter Adjusted EBITDA will be sequentially higher than 4Q14 and also up versus 1Q14

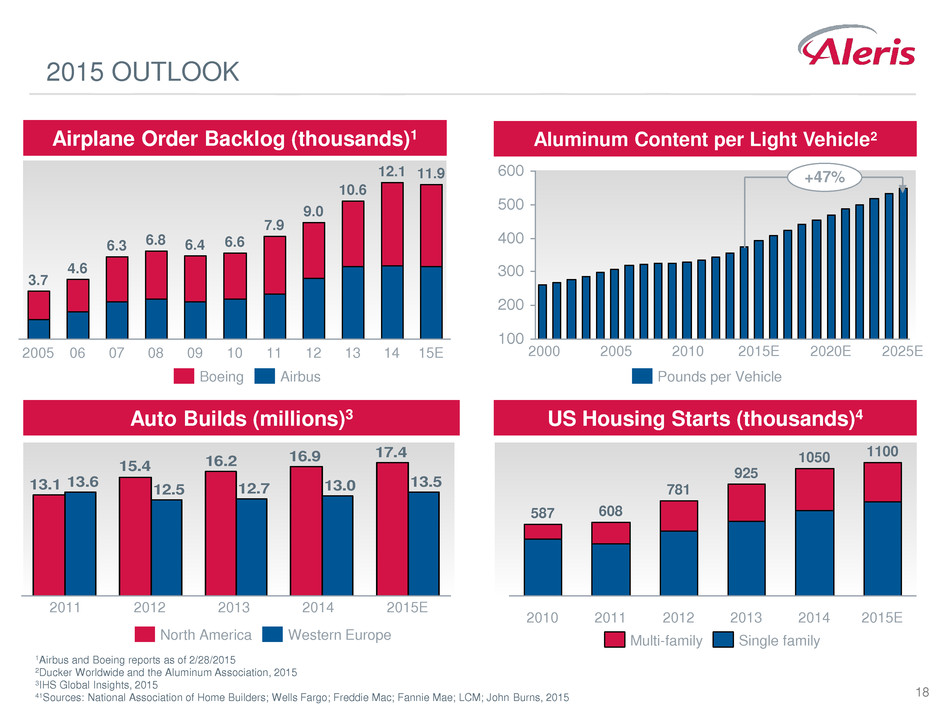

18 2015 OUTLOOK 15E 11.9 14 12.1 13 10.6 12 9.0 11 7.9 10 6.6 09 6.4 08 6.8 07 6.3 06 4.6 2005 3.7 Airbus Boeing 2010 587 2015E 1100 2014 1050 2013 925 2012 781 2011 608 Single family Multi-family 100 200 300 400 500 600 +47% 2025E 2020E 2015E 2010 2005 2000 Pounds per Vehicle 13.1 15.4 16.2 16.9 17.4 13.6 12.5 12.7 13.0 13.5 2014 2013 2012 2011 2015E Western Europe North America Aluminum Content per Light Vehicle2 Airplane Order Backlog (thousands)1 US Housing Starts (thousands)4 Auto Builds (millions)3 1Airbus and Boeing reports as of 2/28/2015 2Ducker Worldwide and the Aluminum Association, 2015 3IHS Global Insights, 2015 41Sources: National Association of Home Builders; Wells Fargo; Freddie Mac; Fannie Mae; LCM; John Burns, 2015

19 APPENDIX

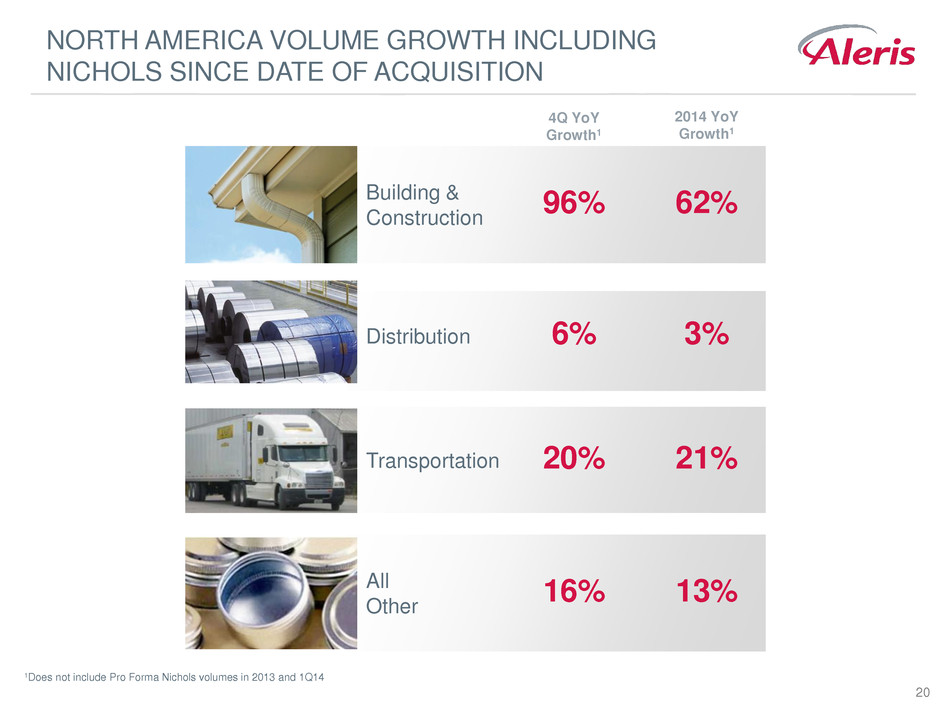

20 4Q YoY Growth1 2014 YoY Growth1 NORTH AMERICA VOLUME GROWTH INCLUDING NICHOLS SINCE DATE OF ACQUISITION 1Does not include Pro Forma Nichols volumes in 2013 and 1Q14 Building & Construction 96% 62% Distribution 6% 3% Transportation 20% 21% All Other 16% 13%

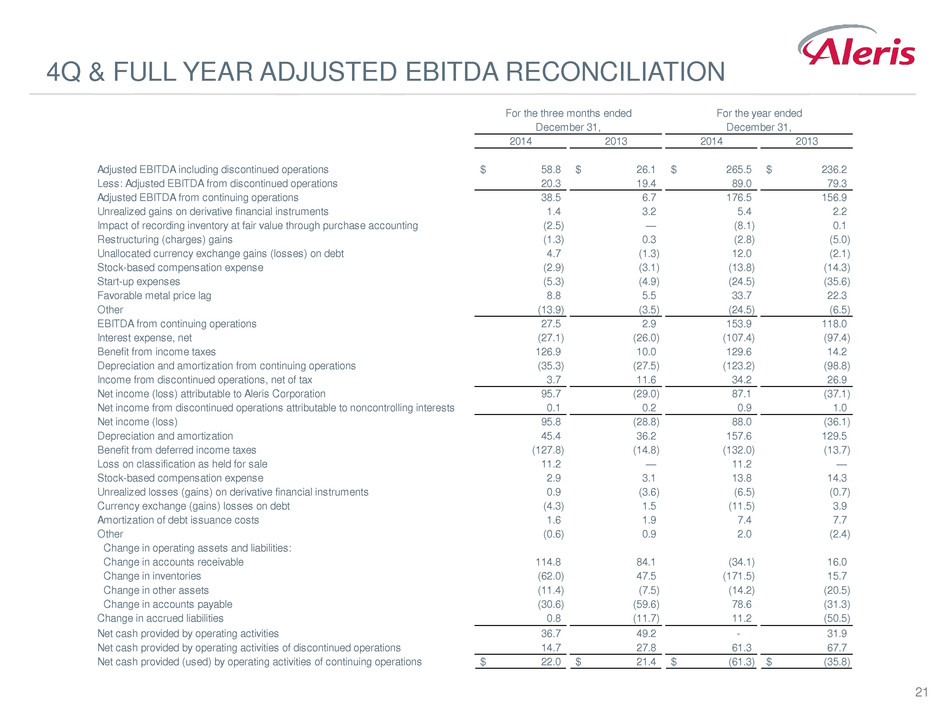

21 4Q & FULL YEAR ADJUSTED EBITDA RECONCILIATION 2014 2013 2014 2013 Adjusted EBITDA including discontinued operations 58.8$ 26.1$ 265.5$ 236.2$ Less: Adjusted EBITDA from discontinued operations 20.3 19.4 89.0 79.3 Adjusted EBITDA from continuing operations 38.5 6.7 176.5 156.9 Unrealized gains on derivative financial instruments 1.4 3.2 5.4 2.2 Impact of recording inventory at fair value through purchase accounting (2.5) — (8.1) 0.1 Restructuring (charges) gains (1.3) 0.3 (2.8) (5.0) Unallocated currency exchange gains (losses) on debt 4.7 (1.3) 12.0 (2.1) Stock-based compensation expense (2.9) (3.1) (13.8) (14.3) Start-up expenses (5.3) (4.9) (24.5) (35.6) Favorable metal price lag 8.8 5.5 33.7 22.3 Other (13.9) (3.5) (24.5) (6.5) EBITDA from continuing operations 27.5 2.9 153.9 118.0 Interest expense, net (27.1) (26.0) (107.4) (97.4) Benefit from income taxes 126.9 10.0 129.6 14.2 Depreciation and amortization from continuing operations (35.3) (27.5) (123.2) (98.8) Income from discontinued operations, net of tax 3.7 11.6 34.2 26.9 Net income (loss) attributable to Aleris Corporation 95.7 (29.0) 87.1 (37.1) Net income from discontinued operations attributable to noncontrolling interests 0.1 0.2 0.9 1.0 Net income (loss) 95.8 (28.8) 88.0 (36.1) Depreciation and amortization 45.4 36.2 157.6 129.5 Benefit from deferred income taxes (127.8) (14.8) (132.0) (13.7) Loss on classification as held for sale 11.2 — 11.2 — Stock-based compensation expense 2.9 3.1 13.8 14.3 Unrealized losses (gains) on derivative financial instruments 0.9 (3.6) (6.5) (0.7) Currency exchange (gains) losses on debt (4.3) 1.5 (11.5) 3.9 Amortization of debt issuance costs 1.6 1.9 7.4 7.7 Other (0.6) 0.9 2.0 (2.4) Change in operating assets and liabilities: Change in accounts receivable 114.8 84.1 (34.1) 16.0 Change in inventories (62.0) 47.5 (171.5) 15.7 Change in other assets (11.4) (7.5) (14.2) (20.5) Change in accounts payable (30.6) (59.6) 78.6 (31.3) Change in accrued liabilities 0.8 (11.7) 11.2 (50.5) Net cash provided by operating activities 36.7 49.2 - 31.9 Net cash provided by operating activities of discontinued operations 14.7 27.8 61.3 67.7 Net cash provided (used) by operating activities of continuing operations 22.0$ 21.4$ (61.3)$ (35.8)$ For the year endedFor the three months ended December 31, December 31,

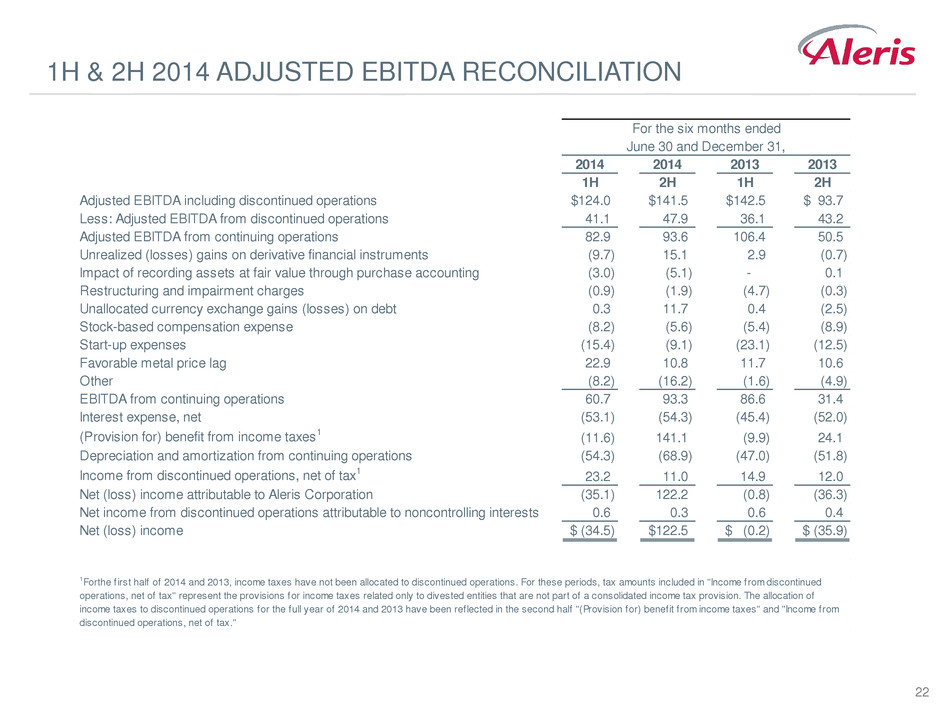

22 1H & 2H 2014 ADJUSTED EBITDA RECONCILIATION 2014 2014 2013 2013 1H 2H 1H 2H Adjusted EBITDA including discontinued operations 124.0$ 141.5$ 142.5$ 93.7$ Less: Adjusted EBITDA from discontinued operations 41.1 47.9 36.1 43.2 Adjusted EBITDA from continuing operations 82.9 93.6 106.4 50.5 Unrealized (losses) gains on derivative financial instruments (9.7) 15.1 2.9 (0.7) Impact of recording assets at fair value through purchase accounting (3.0) (5.1) - 0.1 Restructuring and impairment charges (0.9) (1.9) (4.7) (0.3) Unallocated currency exchange gains (losses) on debt 0.3 11.7 0.4 (2.5) Stock-based compensation expense (8.2) (5.6) (5.4) (8.9) Start-up expenses (15.4) (9.1) (23.1) (12.5) Favorable metal price lag 22.9 10.8 11.7 10.6 Other (8.2) (16.2) (1.6) (4.9) EBITDA from continuing operations 60.7 93.3 86.6 31.4 Interest expense, net (53.1) (54.3) (45.4) (52.0) (Provision for) benefit from income taxes1 (11.6) 141.1 (9.9) 24.1 Depreciation and amortization from continuing operations (54.3) (68.9) (47.0) (51.8) Income from discontinued operations, net of tax1 23.2 11.0 14.9 12.0 Net (loss) income attributable to Aleris Corporation (35.1) 122.2 (0.8) (36.3) Net income from discontinued operations attributable to noncontrolling interests 0.6 0.3 0.6 0.4 Net (loss) income (34.5)$ 122.5$ (0.2)$ (35.9)$ 1Forthe f irst half of 2014 and 2013, income taxes have not been allocated to discontinued operations. For these periods, tax amounts included in "Income from discontinued operations, net of tax" represent the provisions for income taxes related only to divested entities that are not part of a consolidated income tax provision. The allocation of income taxes to discontinued operations for the full year of 2014 and 2013 have been reflected in the second half "(Provision for) benefit from income taxes" and "Income from discontinued operations, net of tax." For the six months ended June 30 and December 31,

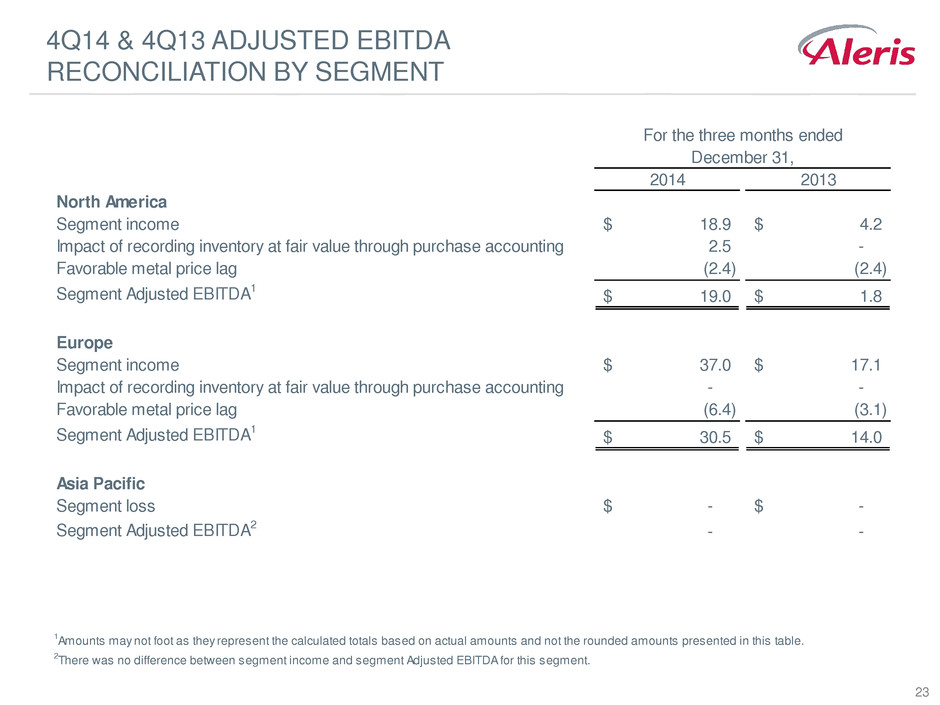

23 4Q14 & 4Q13 ADJUSTED EBITDA RECONCILIATION BY SEGMENT 2014 2013 North America Segment income 18.9$ 4.2$ Impact of recording inventory at fair value through purchase accounting 2.5 - Favorable metal price lag (2.4) (2.4) Segment Adjusted EBITDA1 19.0$ 1.8$ Europe Segment income 37.0$ 17.1$ Impact of recording inventory at fair value through purchase accounting - - Favorable metal price lag (6.4) (3.1) Segment Adjusted EBITDA1 30.5$ 14.0$ Asia Pacific Segment loss -$ -$ Segment Adjusted EBITDA2 - - For the three months ended December 31, 1 Amounts may not foot as they represent the calculated totals based on actual amounts and not the rounded amounts presented in this table. 2 There was no difference betwe n segment income and segment Adjusted EBITDA for this segment.

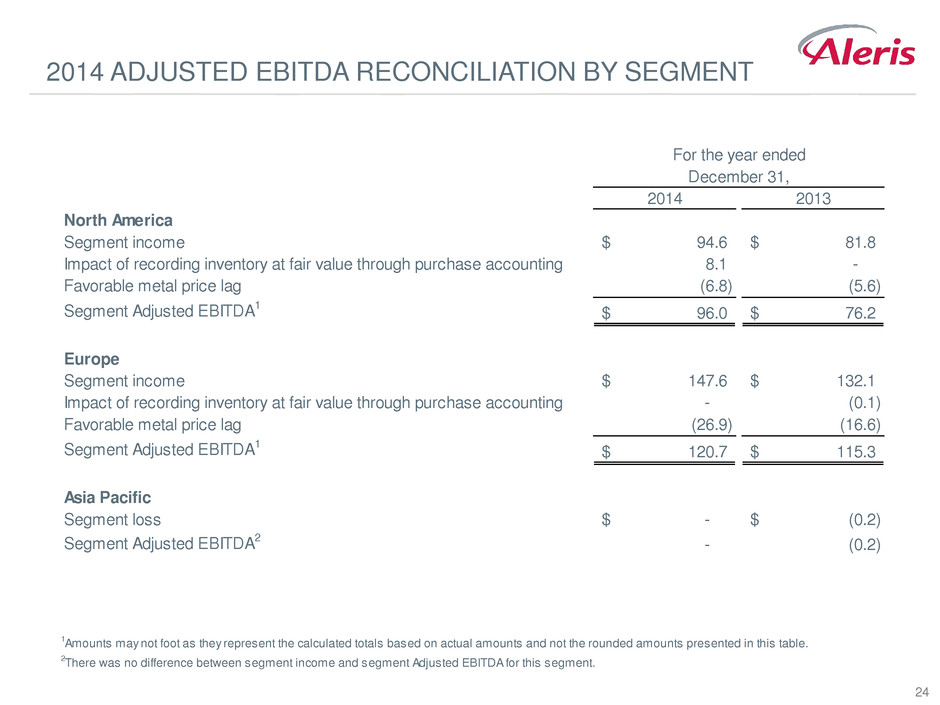

24 2014 ADJUSTED EBITDA RECONCILIATION BY SEGMENT 2014 2013 North America Segment income 94.6$ 81.8$ Impact of recording inventory at fair value through purchase accounting 8.1 - Favorable metal price lag (6.8) (5.6) Segment Adjusted EBITDA1 96.0$ 76.2$ Europe Segment income 147.6$ 132.1$ Impact of recording inventory at fair value through purchase accounting - (0.1) Favorable metal price lag (26.9) (16.6) Segment Adjusted EBITDA1 120.7$ 115.3$ Asia Pacific Segment loss -$ (0.2)$ Segment Adjusted EBITDA2 - (0.2) For the year ended December 31, 1 Amounts may not foot as they represent the calculated totals based on actual amounts and not the rounded amounts presented in this table. 2 There was no difference betwe n segment income and segment Adjusted EBITDA for this segment.

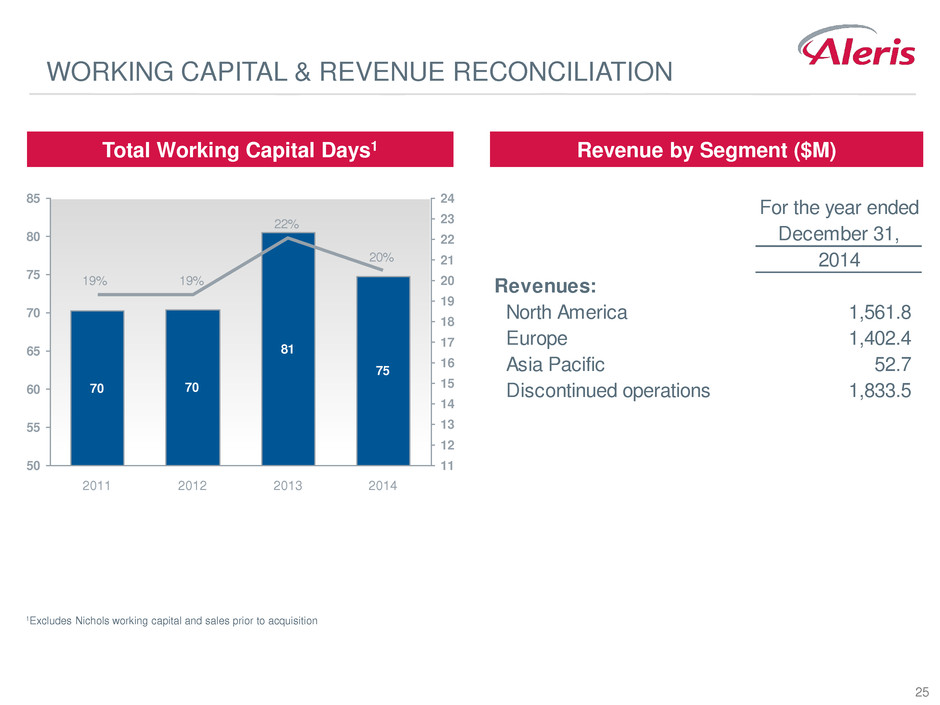

25 WORKING CAPITAL & REVENUE RECONCILIATION For the year ended December 31, 2014 Revenues: North America 1,561.8 Europe 1,402.4 Asia Pacific 52.7 Discontinued operations 1,833.5 70 70 81 75 20% 22% 19%19% 50 55 60 65 70 75 80 85 11 12 13 14 15 16 17 18 19 20 21 22 23 24 2014 2013 2012 2011 Total Working Capital Days1 Revenue by Segment ($M) 1Excludes Nichols working capital and sales prior to acquisition