Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CENTERPOINT ENERGY INC | d897564d8k.htm |

Focused on

Energy Delivery, Positioned to Execute

Introduction to CenterPoint Energy

March 2015

A Fortune 500 company included in the:

S&P 500 Index

S&P 500 Utility Index

Dow Jones Utility Average Index

PHLX Utility Sector Index

Russell 1000 Index

Exhibit 99.1 |

investors.centerpointenergy.com

March 2015

Cautionary Statement

2

This presentation contains statements concerning our expectations, beliefs, plans, objectives,

goals, strategies, future events or performance and underlying assumptions and other

statements that are not historical facts. These statements are “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You should not place undue

reliance on forward-looking statements. Actual results may differ materially from those

expressed or implied by these statements. You can generally identify our forward-looking statements by the

words “anticipate,” “believe,” “continue,” “could,”

“estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “objective,” “plan,” “potential,” “predict,” “projection,”

“should,” “will,” or other similar words. The absence of

these words, however, does not mean that the statements are not forward-looking.

We have based our forward-looking statements on our management's beliefs and assumptions

based on information currently available to our management at the time the statements

are made. We caution you that assumptions, beliefs, expectations, intentions, and

projections about future events may and often do vary materially from actual results. Therefore, we cannot

assure you that actual results will not differ materially from those expressed or implied by

our forward-looking statements. Some of the factors that could cause actual results

to differ from those expressed or implied by our forward-looking statements include but are not limited to the timing and impact of

future regulatory, legislative and IRS decisions, financial market conditions, future market

conditions, and other factors described in CenterPoint Energy, Inc.’s Form 10-K for the period ended

December 31, 2014 under “cautionary statement regarding forward-looking

information,” “Risk Factors” and “ – Liquidity and Capital Resources – Other Matters – Other Factors That Could Affect

Cash Requirements” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations - Certain Factors Affecting Future Earnings,” and in other filings with the SEC by

CenterPoint Energy, which can be found at

www.centerpointenergy.com on the Investor Relations page or on the SEC’s website at www.sec.gov .

Slides 20 and 21 are extracted from Enable Midstream Partners, LP’s (“Enable

Midstream”) investor presentation as presented at the Barclays Investment Grade Energy and Pipeline

conference dated March 4, 2015. These slides are included for informational purposes

only. The content has not been verified by CenterPoint Energy and CenterPoint Energy assumes no liability

for the same. You should consider Enable Midstream’s investor materials in the

context of their SEC filings and their entire investor presentation, which is available on their website at

http://investors.enablemidstream.com/.

This presentation contains time sensitive information that is accurate as of the date

hereof. Some of the information in this presentation in unaudited and may be subject to change. We

undertake no obligation to update the information presented herein except as required by law.

Investors and others should note that we may announce material information using SEC

filings, press releases, public conference calls, webcasts and the Investors page of our website. In

the future, we will continue to use these channels to distribute material information about

the Company and to communicate important information about the Company, key personnel, corporate

initiatives, regulatory updates and other matters. Information that we post on our

website could be deemed material; therefore, we encourage investors, the media, our customers, business

partners and others interested in our Company to review the information we post on our

website. Use of Non-GAAP Financial Measures In addition to

presenting its financial results in accordance with generally accepted accounting principles (“GAAP”), CenterPoint Energy also provides guidance based on adjusted diluted

earnings per share, which is a non-GAAP financial measure. Generally, a non-GAAP

financial measure is a numerical measure of a company’s historical or future financial performance that excludes

or includes amounts that are not normally excluded or included in the most directly comparable

GAAP financial measure. A reconciliation of diluted earnings per share to the adjusted basis used in

providing guidance is provided in this presentation on slide 7.

Management evaluates financial performance in part based on adjusted diluted earnings per

share and believes that presenting this non-GAAP financial measure enhances an investor’s

understanding of CenterPoint Energy’s overall financial performance by providing them

with an additional meaningful and relevant comparison of current and anticipated future results across

periods by excluding items that Management does not believe most accurately reflect its

fundamental business performance, which items include the items reflected in the reconciliation table on

page 7 of this presentation. This non-GAAP financial measure should be considered as

a supplement and complement to, and not as a substitute for, or superior to, the most directly comparable

GAAP financial measure and may be different than non-GAAP financial measures used by other

companies. |

investors.centerpointenergy.com

March 2015

CenterPoint Energy, Inc. (NYSE: CNP)

Regulated Electric and Natural Gas Utility Serving more than 5.5

Million Customers

3

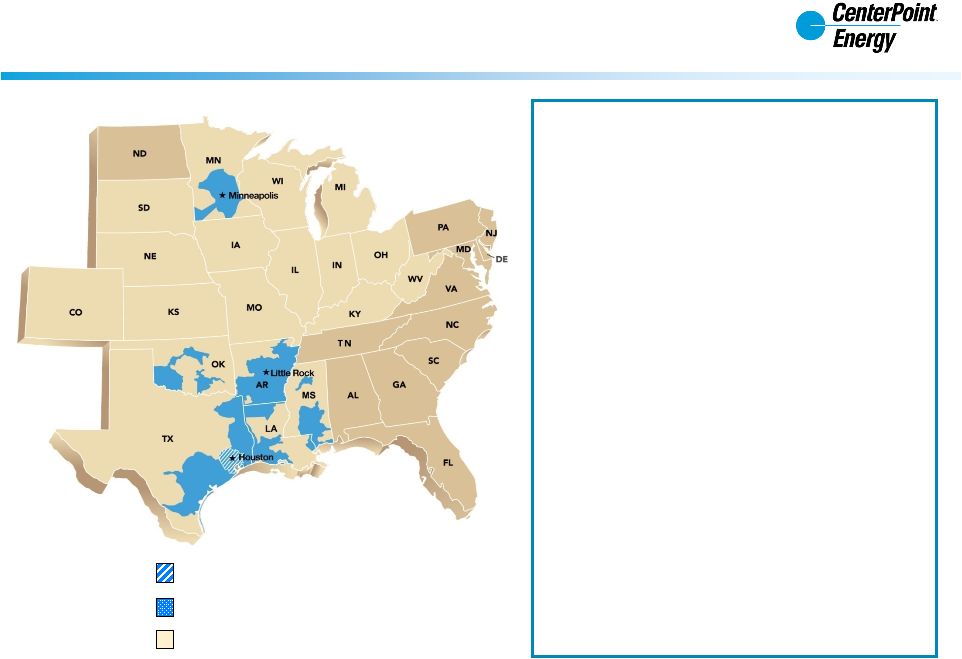

Electric Transmission & Distribution

Natural Gas Distribution

Energy Services

Electric Transmission & Distribution:

•

Electric utility operation with ~2.3 million

metered customers

•

~12,900 km²

service territory in and around

Houston

•

18 largest U.S. investor-owned electric

utility by customer base¹

•

81,839,060 MWh delivered in 2014

Gas Operations

•

10 gas distribution jurisdictions in six states

with ~3.4 million customers

•

5 largest U.S. gas distribution company by

customer base¹

•

Recently ranked 1 among the largest Midwest

Region natural gas utilities in the U.S. for

operational satisfaction in a 2014 Cogent

energy study

•

Gas distribution company and Energy Services

company delivered ~1.1 Tcf of natural gas in

2014

1.

As of Dec. 31, 2013 per AGA and EEI

th

th

st |

investors.centerpointenergy.com

March 2015

Operating Energy Delivery Businesses that Provide

Superior Performance for our Key Stakeholders

4

Our Vision: Lead

the nation in delivering energy, service and value We are a premier U.S.

energy delivery company Delivering energy is CenterPoint Energy’s core

business Delivering service and value applies to all stakeholders

Our Strategy:

Operate, Serve, Grow

Ensure safe, reliable, efficient and

environmentally responsible

energy delivery businesses

Utilize new and innovative

technology to enhance

performance

Add value to energy delivery

through superior customer service,

new technology and innovation

Provide leadership in the

communities we serve

Develop a diverse and capable employee base

Invest in core energy delivery businesses

Actively govern Enable Midstream investment |

investors.centerpointenergy.com

March 2015

CenterPoint Energy’s Value Proposition

Growth, Market Structure and Leadership

5

Strong dividend yield (4.75% as of March 19, 2015)

Competitive dividend growth rate projected to be

supported by regulated utilities with potential for

additional growth from Midstream investment

Lack of generation assets reduces the environmental

risks generally associated with a fully integrated

utility

Future capital investment in transmission and

distribution assets is expected to sustain earnings

momentum

Capital recovery mechanisms at both utilities help

reduce regulatory lag

Utilities’

earnings at or near authorized ROEs of 10%

at electric utility and an aggregated 10% at the gas

utilities

Focus on customer satisfaction improves regulatory

relationships allowing for constructive dialog to

optimize our business model |

investors.centerpointenergy.com

March 2015

2014 Year Highlights

6

Electric transmission and distribution utility operating income for 2014 was $477 million as

compared to $474 million in 2013

Natural gas utility operating income for 2014 was $287 million as compared to $263 million in

2013 o

Rate changes and cost management efforts resulted in record operating income

Sustained strong economic activity with the addition of nearly 55,000 new meters for Houston

Electric and nearly 36,000 new Gas Utility customers

Invested

over

$1.4

billion

in

our

utility

operations,

addressing

demands

associated

with

system

safety,

reliability, growth and ongoing maintenance

Continued

industrial

and

economic

growth

led

to

ongoing

interest

in

our

transmission

rights-of-way

at

our

electric utility; 2014 Rights of Way revenue: $21 MM

Contributed equity income of $308 million in 2014

Enable Midstream Partners completed its initial public offering in 04/2014 under ticker

ENBL Increased 4.2% in January 2015, following a 14.5% increase in January 2014

10th consecutive year of dividend increases; 10 year CAGR of 9.5% off of a 2005 base of

$0.40 Utility Operations: Strong financial and operational performances

Midstream Investments:

Dividend: |

investors.centerpointenergy.com

March 2015

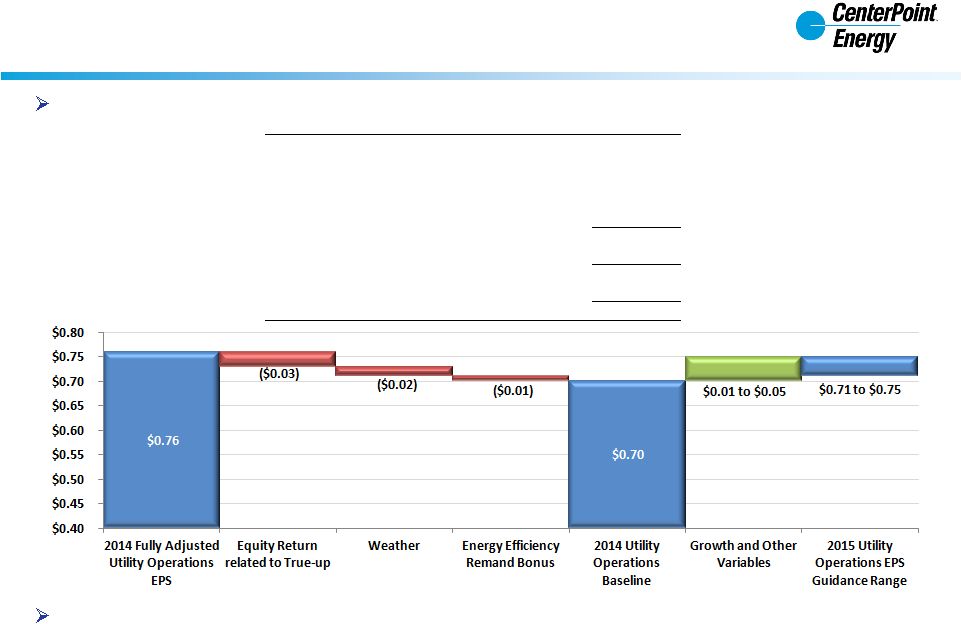

2015 Guidance as Provided on February 26, 2015

Consolidated EPS Guidance of $1.00 to $1.10 per Diluted Share

7

Utility Operations EPS guidance: $0.71 to $0.75 per diluted share from a 2014 Baseline of

$0.70 Regular quarterly cash dividend of $0.2475 declared in January 2015; if

annualized, would equate to $0.99 per share

2014 Fully Diluted EPS

$ 1.42

On an adjusted guidance basis:

ZENS-related mark to market gains

(0.12)

CES MTM gain

(0.04)

Pension Curtailment loss

0.01

2014 Consolidated EPS on a guidance basis

$ 1.27

Deferred Tax Benefit

(0.07)

2014 Fully Adjusted EPS

$ 1.20

Midstream Investments

(0.44)

2014 Fully Adjusted Utility Operations EPS

$ 0.76 |

investors.centerpointenergy.com

March 2015

CenterPoint Summary Financials at a Glance

as of Dec. 31, 2014

8

1.

Excludes revenue from Transition and system restoration bond companies of $566 MM

2.

Excludes Transition and Restoration Bonds

3.

Excludes operating income from Transition and Restoration Bond companies of $118 MM

4.

Securitized regulatory assets of $2,738 MM excluded from total regulatory assets of $3,527 MM

|

investors.centerpointenergy.com

March 2015

Houston Electric:

Transmission & Distribution (T&D) Utility

9 |

investors.centerpointenergy.com

March 2015

Houston Electric: Overview

10

Electric T&D operating income for 2014 was $477 million as compared to $474 million in

2013 ~2.3

million

metered

customers;

~5,000

miles²

(12,900

km²)

in

and

around

Houston,

Texas

Dec. 2014 average residential electric price in TX:

$0.118/kwh¹ Usage per customer ~30% higher than the U.S.

average² Has consistently earned at or near its 10%

authorized ROE Low Business Risk

Poles and wires assets; No generation assets which reduces

business,

environmental, and regulatory risks

Direct customers are ~70 Retail Electric Providers (REPs)

Capital Recovery Mechanisms in Place

~95% of capital plan eligible for recovery through mechanisms

Reduces recovery lag and frequency of general rate cases

No rate case planned during next 5 years as long as current

capital

recovery mechanisms remain

in place

1.

U.S. Energy Information Administration; average price for all sectors was $0.0886

2.

Based on 2013 residential sales data from EIA and CenterPoint Energy

Source: eflon on Flickr [CC-BY-2.0] via Wikimedia Commons

|

investors.centerpointenergy.com

March 2015

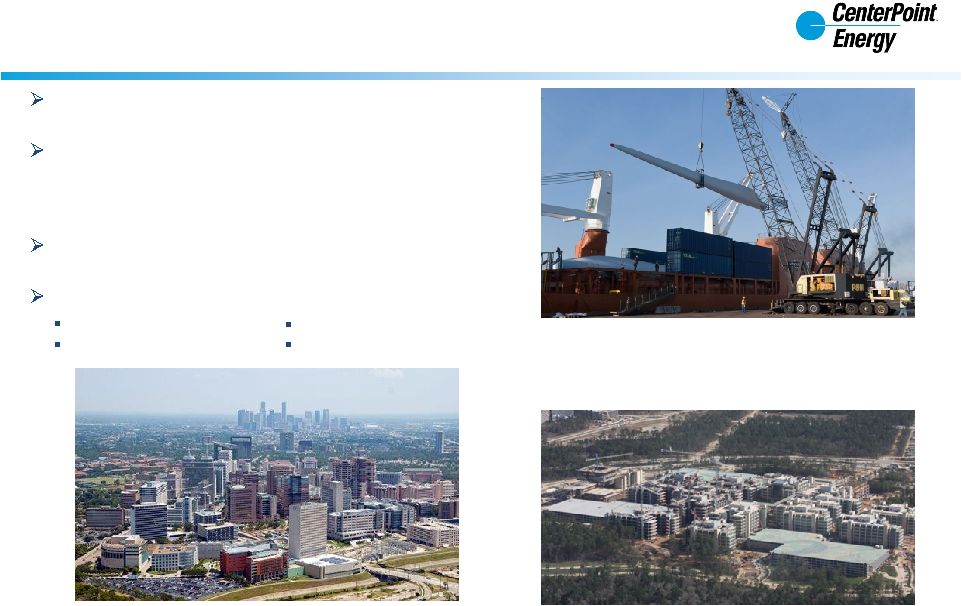

3 highest concentration of Fortune 500 company

headquarters in US (26)

Over the past 10 years and compared to the 10 largest

U.S. cities, Houston

created the most jobs (645,000+),

had the highest job growth CAGR, and made up 8% of

all U.S. jobs created

$30.5 billion in construction contracts awarded in the

Houston metro area in 2014

Diversified Economy

Oil/Gas, Petrochemical

Health Care

Houston Economy: Diverse and Growing

11

Texas Medical Center -

Largest medical center in the

world

Source: Wikipedia

Port of Houston –

Ranked first in the U. S. in foreign

waterborne tonnage, U.S. imports, U.S. export

tonnage, and second in the U.S. in total tonnage

Source: Port of Houston Authority

Exxon Mobil’s 385 acre campus is designed to

accommodate 10,000 employees by the end of 2015

Source: Houston Chronicle

Aerospace

Distribution/Logistics

rd |

investors.centerpointenergy.com

March 2015

39 largest metropolitan economy in the

world² Largest absolute population growth of US cities

from July 2012 –

July 2013³

In the next 25 years, population forecasted to

grow to 9.5-11 million from a base of 6.3 million

in 2013

4

Industrial growth, such as the Freeport

LNG terminal above, and population

growth is driving higher capital

investment at Houston Electric

Source: Freeportlng.com

Houston Economy: Outpacing the Nation

Economy Drives Continued 2% Customer Growth

12

th

1.

IHS Global InSight Mar. 2015 Forecast

4. Greater Houston Partnership

2.

Brookings Institution

5. U.S. Bureau of Labor Statistics

3.

U.S. Census Bureau |

investors.centerpointenergy.com

March 2015

Houston Electric’s Capital Investment Continues to Grow

13

$4.4 Billion 2015 –

2019 Capital Plan

Brazos

Valley

Connection

–

High

voltage

transmission

line¹

Reliability/Resiliency

–

Intelligent

grid

Technology

–

Advanced

Metering

System,

Customer

Service

Platform

Customer

Growth

–

customer

meter

additions

Infrastructure

Improvements

–

grid

hardening

Capital Plan Includes:

1

CenterPoint’s

portion

of

the

Houston

Import

Transmission

Project

expected

to

be

in

service

by

summer

of

2018

and

be

an

investment

of

approximately

$300

MM |

investors.centerpointenergy.com

March 2015

Gas Operations

14 |

investors.centerpointenergy.com

March 2015

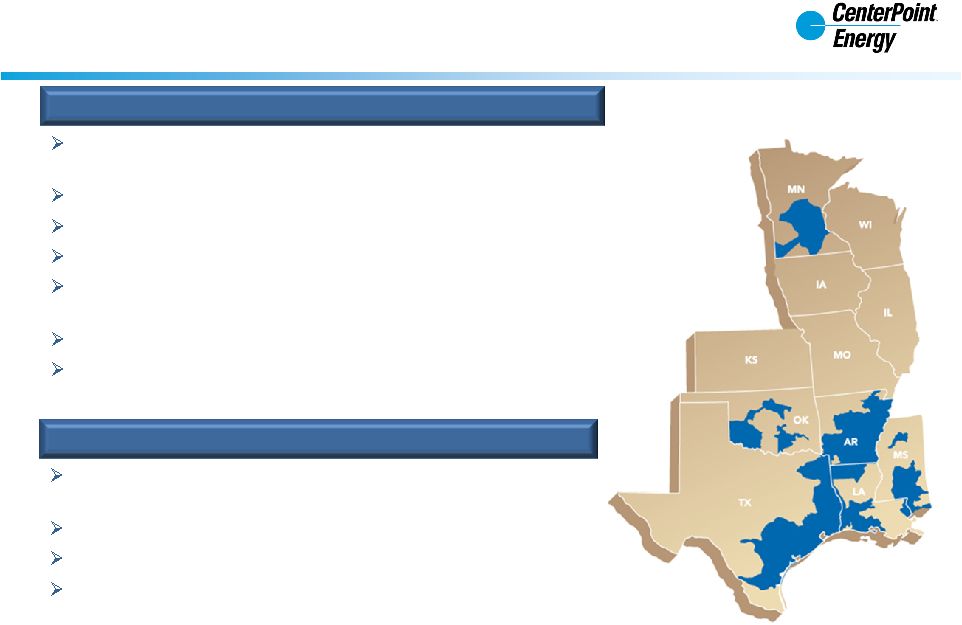

Gas Operations: Overview

15

NATURAL

GAS

UTILITIES

Six state footprint with vibrant metropolitan areas of Houston and

Minneapolis

Nearly 3.4 million customers; 5

largest gas utility in the U.S.

Earning at or near allowed returns; aggregated authorized ROE: 10%

Average Rate Base in 2014 of $2.1 billion

Customer growth of nearly 36,000 in 2014; overall, ~1% annual

customer growth since 2010

Rate base capital structure: 50% debt / 50% equity

Operating income for 2014 was $287 million compared to $263

million in 2013

Competitive natural gas supply and related energy services serving

~18,000 customers across 19 states

Complementary to natural gas utilities

Low VaR business model

Operating income, after adjusting for mark to market accounting,

would have been $23 million in 2014 compared to $15 million in

2013

ENERGY

SERVICES

(NON-REGULATED)

th |

investors.centerpointenergy.com

March 2015

Natural Gas Utilities

16

Gas utilities are regulated at state and/or local

level

Most gas utilities collect a fixed monthly

customer charge and a volumetric variable

charge for delivering gas to customers

Conservation improvement programs offered

in Arkansas, Oklahoma, and Minnesota

Recorded more than $12 MM in conservation

improvement program incentives in 2014

Weather normalization adjustment and/or

Decoupling mechanisms in place for five of six

states

Capital recovery mechanisms in place in five

of six states reducing regulatory lag

Low natural gas price environment in the U.S. reduces

the potential that increased capital investment will

cause customer rate shock

Typical cost of natural gas to CNP residential customer |

investors.centerpointenergy.com

March 2015

Natural Gas Utilities’

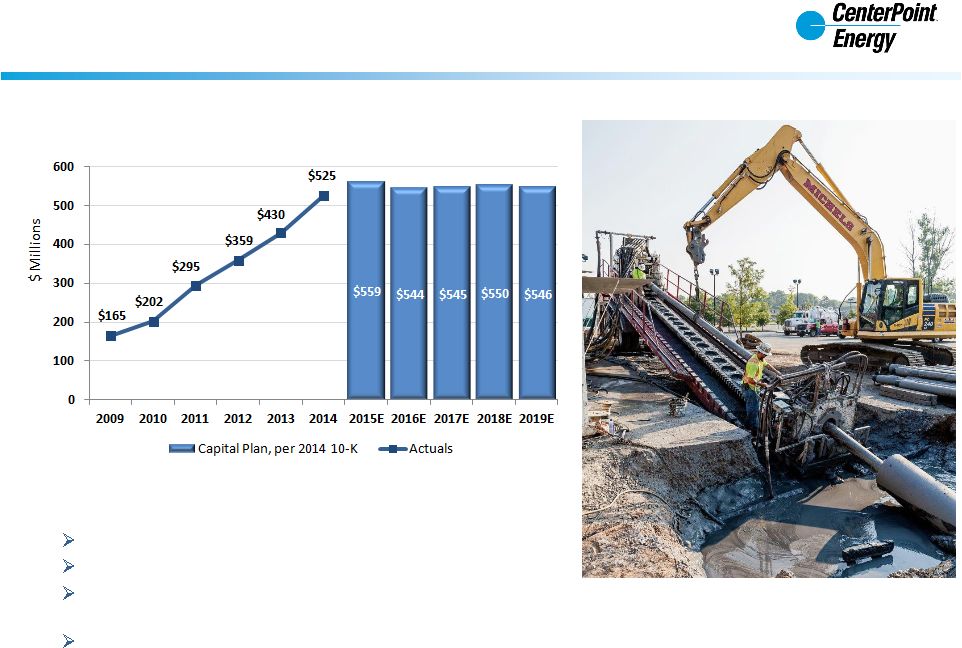

Capital Investment Continues to Grow

17

$2.7 Billion 2015 –

2019 Capital Plan

Replacing

aging

infrastructure

–

cast

iron,

plastic

Customer

growth

investment

–

customer

additions

System-wide Automated Meter Reading; 3.4 million meters

by Q4 2015

Minnesota Belt Line Project; $400 million over 12 years

Capital Plan Includes:

Using horizontal directional drilling to

construct and install a new pipeline under the

bed of the Arkansas River |

investors.centerpointenergy.com

March 2015

Midstream Investments

18 |

investors.centerpointenergy.com

March 2015

Committed to Midstream Excellence

19

CenterPoint owns 55.4% of the limited partner units of Enable Midstream Partners (NYSE:

ENBL) CenterPoint holds a 40% interest in the Incentive Distribution Rights held by the

General Partner 2014

Equity

Income

from

Enable:

$303

million;

2014

distributions

received

from

Enable:

$298

million

Investment in Enable provides expected long-term earnings and cash flow growth as the

U.S. natural gas and oil infrastructure build-out continues

Benefits of the Partnership:

Geographic diversification, with operations in major natural gas

and liquids-rich producing areas of Oklahoma, Texas,

Arkansas and Louisiana

Significant asset positions in a broad range of basins, including the Granite Wash, Tonkawa,

Mississippi Lime, Cana Woodford, Haynesville, Fayetteville, Barnett and Woodford plays

Enhanced supply and market access

Meaningful operating and commercial synergies

Stable and predictable cash flows from a balanced and diversified portfolio of assets

Independent access to capital at the Enable level

Enable Midstream Partners is a joint venture formed in

May 2013 that includes CenterPoint Energy, Inc.’s legacy

interstate pipelines and field services businesses and the

midstream business of Enogex LLC, a previous subsidiary

of OGE Energy Corp. It is managed by a general partner

whose governance is shared by CenterPoint Energy and

OGE on a 50/50 basis |

Extract from Enable Midstream Partners’

March 4, 2015 Investor Presentation

Enable Midstream Highlights

Integrated suite of gathering, processing, transportation and storage assets with a

high degree of interconnectivity between assets and end markets

Significant fee-based and demand-fee margin

Long-term relationships with large-cap producers and utilities, many of

whom are investment grade

Investment grade ratings, lower leverage than many peers and significant

liquidity 20

Source:

http://investors.enablemidstream.com/ |

Extract from Enable Midstream Partners’

March 4, 2015 investor presentation

Well-Positioned for Today’s Environment

21

Significant

fee-based

margin

with

approximately 79% of 2015 gross margin

forecasted to be fee-based and 54%

forecasted to be firm or MVC-based

Hedging program

provides downside

protection

with 88% of 2015 gross

margin projected to be either fee-based

or hedged

Integrated

assets

allow

Enable

to

adjust

volume flows and optimize our system in

response to changing prices and supply

dynamics

Seasoned

management

team

and

significant experience throughout the

organization

Investment grade ratings, low leverage and substantial liquidity

with a 2.9x

debt-to-Adjusted

EBITDA

ratio¹

and

$1.1

billion

in

revolver

capacity²

as

of

December 31, 2014

1.

Calculated by dividing $2,544 million of debt (including commercial paper and

promissory notes payable to sponsor) by $868 million of Adjusted EBITDA

2.

Calculated by reducing $1.4 billion revolver by $2 million of outstanding letters of

credit and $253 million of outstanding commercial paper Source: http://investors.enablemidstream.com/ |

investors.centerpointenergy.com

March 2015

Improving Customer Satisfaction while Reducing Carbon Emissions

22 |

investors.centerpointenergy.com

March 2015

Electric T&D Utility Technology:

Improving Customer Satisfaction while Reducing Carbon Emissions

23

Absence of generation assets significantly reduces

CenterPoint’s carbon footprint compared to

integrated utilities

One of the first large scale

Smart Meter deployments in the

U.S.

Eliminated need for over 8

million truck rolls since 2009

Intelligent Grid initiative enhances

reliability

28% Reliability improvement in 2014

These efforts strengthen the tie between the

customer and the utility

1

Since 2011

1 |

investors.centerpointenergy.com

March 2015

Electric T&D Utility

Improving Customer Satisfaction while Reducing Carbon Emissions

24

Source: Philips, Roadstar GPLS

LED streetlight project: 173,000 street

lights over 5 years

Initiatives in place to protect wildlife

Awarded the Tree Line USA

designation for 10 consecutive year

Hike and Bike

trails along our

transmission

corridors within

Houston

th |

investors.centerpointenergy.com

March 2015

Natural Gas Utilities:

Improving Customer Satisfaction while Reducing Carbon Emissions

25

Pipeline replacement programs,

especially cast-iron and bare steel,

accelerate the replacement of aging

gas pipelines increasing the efficiency

and safety of our gas distribution

system

CNP is a first-mover in new gas leak

detection technology which will be

begin to be deployed across our entire

footprint in 2015 and will improve our

ability to quickly identify and repair

gas leaks

Drive-by Advanced Meter

Technology eliminates the

need to enter homeowners’

property during monthly

meter reads and reduces

our carbon footprint |

investors.centerpointenergy.com

March 2015

Committed to Community Service

26

Walking and Riding for Good Causes:

Money raised by employees in company-sponsored events

Year

United Negro

College Fund

March of Dimes

Juvenile

Diabetes

Research

Foundation

MS-150

Junior

Achievement

TOTAL

2013

$35,029

$299,934

$67,780

$60,863

$39,952

$502,543

2012

$28,261

$160,767

$74,454

$89,900

$40,100

$393,482

2011

$28,000

$192,000

$76,759

$109,958

$48,000

$454,717

2010

$27,000

$143,000

$76,000

$115,000

$41,000

$402,000

223,005 volunteer hours from employees, retirees, family and friends (Valued at more than $5.1

million.) $5.6 million in total corporate charitable contributions

$2.8 million in corporate/employee contributions to United Way in more than 94 United Way

offices across the nation

5,079 units of blood donated to Gulf Coast Regional Blood Center

|

investors.centerpointenergy.com

March 2015

Additional Reference Materials

27

Category

Reference Material

Link

Financial Information

Quarterly Financial Tables

http://investors.centerpointenergy.com/highlights.cfm

Debt & Maturity Schedules

Equity Return Amortization Schedules

Supplemental Year End Materials

Regulatory Information

State Commission Website Access Points

http://investors.centerpointenergy.com/highlights.cfm

Houston Electric

Natural Gas Utilities

Industry Associations

Edison Electric Institute (EEI)

www.eei.org

American Gas Association (AGA)

www.aga.org

Investor Relations Contact Information –

011-713-207-6500

Carla

Kneipp

-

Vice

President

and

Treasurer

;

carla.kneipp@centerpointenergy.com

Dave

Mordy

–

Director;

david.mordy@centerpointenergy.com

Robert

Mcrae

–

Manager;

robert.mcrae@centerpointenergy.com

Brandi

Summersill

–

IR

Coordinator;

brandi.summersill@centerpointenergy.com |