Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TOYOTA MOTOR CREDIT CORP | dp54623_8k.htm |

Exhibit 99.1

|

[GRAPHIC OMITTED]

Toyota Business Highlights 3Q FY2015

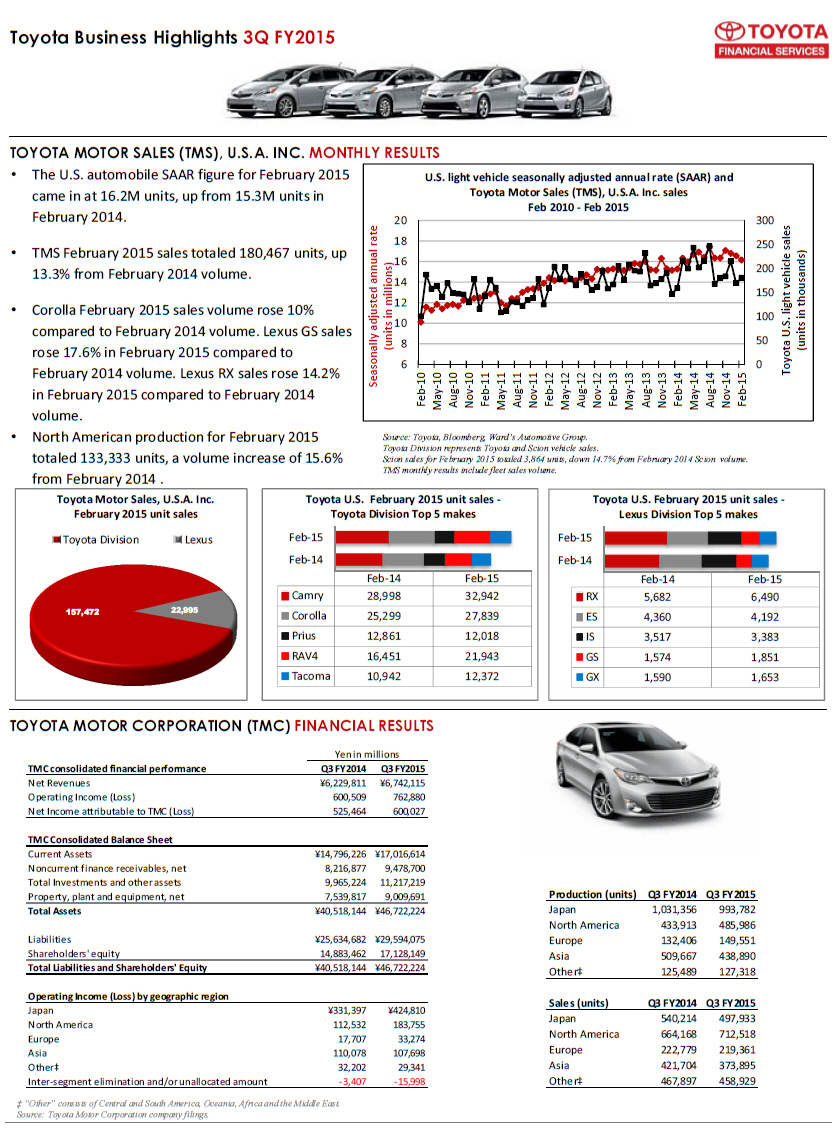

TOYOTA MOTOR SALES (TMS), U.S.A. INC. MONTHLY RESULTS

[] The U.S. automobile SAAR figure for February 2015 came in at 16.2M units,

up from 15.3M units in February 2014.

[] TMS February 2015 sales totaled 180,467 units, up 13.3% from February 2014

volume.

[] Corolla February 2015 sales volume rose 10% compared to February 2014

volume. Lexus GS sales rose 17.6% in February 2015 compared to February

2014 volume. Lexus RX sales rose 14.2% in February 2015 compared to

February 2014 volume.

[] North American production for February 2015 totaled 133,333 units, a

volume increase of 15.6% from February 2014 .

U. S. light vehicle seasonally adjusted annual rate (SAAR) and Toyota Motor

Sales (TMS), U.S.A. Inc. sales Feb 2010 - Feb 2015

[GRAPHIC OMITTED]

Source: Toyota, Bloomberg, Ward's Automotive Group. Toyota Division represents

Toyota and Scion vehicle sales.

Scion sales for February 2015 totaled 3,864 units, down 14.7% from February 2014

Scion volume.

TMS monthly results include fleet sales volume.

Toyota Motor Sales, U.S.A. Inc.

February 2015 unit sales

[GRAPHIC OMITTED]

Toyota U. S. February 2015 unit sales -Toyota Division Top 5 makes

[GRAPHIC OMITTED]

Feb-14 Feb-15

Camry 28,998 32,942

Corolla 25,299 27,839

Prius 12,861 12,018

RAV4 16,451 21,943

Tacoma 10,942 12,372

Toyota U. S. February 2015 unit sales -Lexus Division Top 5 makes

[GRAPHIC OMITTED]

Feb-14 Feb-15

RX 5,682 6,490

ES 4,360 4,192

IS 3,517 3,383

GS 1,574 1,851

GX 1,590 1,653

TOYOTA MOTOR CORPORATION (TMC) FINANCIAL RESULTS

Yen in millions

TMC consolidated financial performance Q3 FY2014 Q3 FY2015

Net Revenues Yen 6,229,811 Yen 6,742,115

Operating Income (Loss) 600,509 762,880

Net Income attributable to TMC (Loss) 525,464 600,027

TMC Consolidated Balance Sheet

Current Assets Yen 14,796,226 Yen 17,016,614

Noncurrent finance receivables, net 8,216,877 9,478,700

Total Investments and other assets 9,965,224 11,217,219

Property, plant and equipment, net 7,539,817 9,009,691

Total Assets Yen 40,518,144 Yen 46,722,224

Liabilities Yen 25,634,682 Yen 29,594,075

Shareholders' equity 14,883,462 17,128,149

Total Liabilities and Shareholders' Equity Yen 40,518,144 Yen 46,722,224

Operating Income (Loss) by geographic region

Japan Yen 331,397 Yen 424,810

North America 112,532 183,755

Europe 17,707 33,274

Asia 110,078 107,698

Other[] 32,202 29,341

Inter-segment elimination and/or unallocated amount -3,407 -15,998

Production (units) Q3 FY2014 Q3 FY2015

Japan 1,031,356 993,782

North America 433,913 485,986

Europe 132,406 149,551

Asia 509,667 438,890

Other[++] 125,489 127,318

Sales (units) Q3 FY2014 Q3 FY2015

Japan 540,214 497,933

North America 664,168 712,518

Europe 222,779 219,361

Asia 421,704 373,895

Other[++] 467,897 458,929

[++] "Other" consists of Central and South America, Oceania, Africa and the

Middle East. Source: Toyota Motor Corporation company filings.

|

|

TOYOTA MOTOR CREDIT CORPORATION (TMCC) FINANCIAL RESULTS

U.S. dollars

in millions

TMCC financial performance 3Q 2014 3Q 2015

Total financing revenues $1,876 $2,112

Income before income taxes 306 492

Net Income 193 307

Debt-to-Equity Ratio 11.2x 10.6x

[GRAPHIC OMITTED]

[GRAPHIC OMITTED]

[GRAPHIC OMITTED]

[GRAPHIC OMITTED]

[] Our consolidated net income was $307 million in Q3 FY2015, compared to

$193 million in Q3 FY2014. The increase in net income for the third

quarter of FY2015 was primarily due to an increase in total financing

revenue of $236 million. In addition, interest expense decreased by $225

million driven by gains on derivatives, which was offset by an increase of

$215 million in depreciation on operating leases and an increase of $72

million in the provision for income taxes.

[] Total financing revenues increased 12.6 percent during the third quarter

of FY2015, as compared to the same period in FY2014 .

[] Net charge-offs as a percentage of average gross earning assets increased

by 0.05% in Q3 FY2015 compared to Q3 FY2014.

[] Aggregate balances for accounts 60 or more days past due as a percentage

of gross earning assets increased by 0.02% in Q3 FY2015 compared to Q3

FY2014.

1 TFS market share represents the percentage of total domestic TMS sales of

new Toyota, Lexus and Scion vehicles financed by us, excluding

non-Toyota/Lexus/Scion sales, sales under dealer rental car and commercial

fleet programs and sales of a private Toyota distributor.

* TMCC consumer portfolio includes TMCC and its consolidated subsidiaries

NORTH AMERICAN SHORT-TERM FUNDING PROGRAMS

[] Toyota Motor Credit Corporation (TMCC), Toyota Credit de Puerto Rico Corp.

(TCPR), and Toyota Credit Canada Inc. (TCCI)[+] maintain direct

relationships with institutional commercial paper investors through its

Sales and Trading team , providing each access to a variety of domestic

and global markets through three, distinct 3(a)(3) programs.

[] As of 12/31/2014, TMCC and TCPR commercial paper programs had an

outstanding balance of $27.5 billion. As of 12/31/2014, TMCC and TCPR

commercial paper programs had a weighted average remaining maturity of 80

days.

[] TCCI and TMCC are subsidiaries of Toyota Financial Services Corporation, a

wholly-owned subsidiary of Toyota Motor Corporation.

[] TMCC consolidated financial liabilities include TMCC and its consolidated

subsidiaries, which includes TCPR.

TMCC consolidated financial liabilities comparison

[GRAPHIC OMITTED]

* Figures above do not incorporate the Carrying Value Adjustments.

LET'S GO PLACES

[] In 2017, Toyota Financial Services plans to relocate its headquarters to

Plano, Texas in order to join Toyota Motor Sales, U.S.A., Inc.; Toyota

Motor Engineering and Manufacturing North America, Inc.; and Toyota Motor

North America as the Toyota affiliates unify their respective headquarters

there to create a single, state-of-the-art Toyota headquarters and pursue

the One Toyota vision in North America.

[] Continue to reference the Investor Relations section of

www.toyotafinancial.com , for important information and filings. Forward

looking statements are subject to risks and uncertainties that could cause

actual results to fall short of current expectations. Toyota and its

affiliates discuss these risks and uncertainties in filings they make with

the Securities and Exchange Commission. This presentation does not

constitute an offer to purchase any securities. Any offer or sale of

securities will be made only by means of a prospectus and related

documentation.

The Toyota Financial Services Sales and Trading team engages in direct dialogue

with institutional investors delivering a variety of fixed income products to

meet our clients' investment objectives and risk tolerances. We focus on

providing simple, personal, and proactive service in the execution of all

trades.

Sales and Trading Contacts

Nicholas Ro Darren Marco Jason Katzen

Sales and Trading Manager Region Manager Region Manager

(310) 468-7758 (310) 468-5330 (310) 468-3509

nicholas_ro@toyota. com darren_marco@toyota. com jason_katzen@toyota.com

Jeffrey DeSilva Alec Small Siva Vadlamannati

Funding and Liquidity Analyst Funding and Liquidity Analyst Funding and Liquidity Analyst

(310) 468-1366 (310) 468-7431 (310) 468-3509

jeffrey_DeSilva@toyota. com alec_small@toyota. com siva_Vadlamannati@Toyota.com

|