Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Bristow Group Inc | d897216d8k.htm |

Scotia Howard Weil 43

Annual Energy Conference

Bristow Group Inc.

March 22 –

26, 2015

Exhibit 99.1

rd |

2

Forward-looking statements

This presentation may contain “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. Forward-looking statements include

statements about our future business, operations, capital expenditures, fleet composition, capabilities and

results; modeling information, earnings and adjusted earnings growth guidance, expected operating

margins, cash flow stability and other financial projections; future dividends, share

repurchases and other uses of excess cash; plans, strategies and objectives of our management,

including our plans and strategies to grow earnings and our business, our general strategy going

forward, our business model and our operational excellence initiative; expected actions by us

and by third parties, including our customers, competitors and regulators; impact of grounding

and the effects thereof; the valuation of our company and its valuation relative to relevant financial indices; assumptions underlying

or relating to any of the foregoing, including assumptions regarding factors impacting our business,

financial results and industry; aircraft delivery dates and other matters. Our

forward-looking statements reflect our views and assumptions on the date of this presentation regarding

future events and operating performance. They involve known and unknown risks, uncertainties and other

factors, many of which may be beyond our control, that may cause actual results to differ

materially from any future results, performance or achievements expressed or implied by the

forward-looking statements. These risks, uncertainties and other factors include fluctuations in the demand for our services;

fluctuations in worldwide prices of and demand for natural gas and oil; fluctuations in levels of

natural gas and oil exploration, development and production activities; the impact of

competition; actions by customers; the risk of reductions in spending on aircraft services by

governmental agencies; changes in tax and other laws and regulations; changes in foreign exchange

rates and controls; risks associated with international operations; operating risks inherent in

our business, including the possibility of declining safety performance; general economic

conditions including the capital and credit markets; our ability to obtain financing; the possibility

that we may lack sufficient liquidity to continue to repurchase shares or pay a quarterly

dividend; the risk of grounding of segments of our fleet for extended periods of time or indefinitely; our

ability to re-deploy our aircraft to regions with greater demand; our ability to acquire

additional aircraft and dispose of older aircraft through sales into the aftermarket; the

possibility that we or our suppliers will be unable to deliver new aircraft on time or on budget; the possibility that

we do not achieve the anticipated benefit of our fleet investment program; availability of employees;

political instability, war or acts of terrorism in any of the countries where we operate; and

those discussed under the captions “Risk Factors” and “Management’s Discussion and Analysis

of Financial Condition and Results of Operations” in our Annual Report on Form

10-K for the fiscal year ended March 31, 2014 and our Quarterly Report on Form 10-Q for

the quarter ended December 31, 2014. We do not undertake any obligation, other than as required by law,

to update or revise any forward-looking statements, whether as a result of new information, future

events or otherwise. |

Who

we are: Bristow is a differentiated investment in oilfield services

•

Ticker:

BRS;

stock

price

of

$58.74/share with a market cap ~$2.0

billion

•

369 aircraft in ~20 countries with

~4,800 employees

•

Rated “Investment Grade”

by

Standard & Poor’s

•

Quarterly dividend of $0.32/share

(historic growth ~30% annually)

•

Bristow recently increased our fixed

wing presence with Australia’s

Airnorth regional airline

1)

Based on stock price as of March 13, 2015.

2)

As of December 31, 2014.

3)

Standard

&

Poor’s

secured

rating

is

BBB-

with

an

unsecured

rating

of

BB-

as

of

December

31,

2014.

Bristow transports crews for oil

and gas companies and provides

search and rescue (SAR) services

for them and governments alike

3

1

2

3 |

Who

we are: Bristow’s Target Zero safety culture

BRISTOW AIR ACCIDENT RATE*

PER 100,000 FLIGHT HOURS

*includes commercial operations only

0

YTD FY15

4

•

Industry-leading Target Zero safety

program since 2006

•

Our current safety programs have

been enhanced through:

Internal focus, transitioning from

lagging safety indicators to

leading indicators

Formation of HeliOffshore,

beginning an industry-wide

collaborative program to improve

safety that is having immediate

positive impacts

0.54

0.53

0.53

0.96

0.00

FY10

FY11

FY12

FY13

FY14 |

5

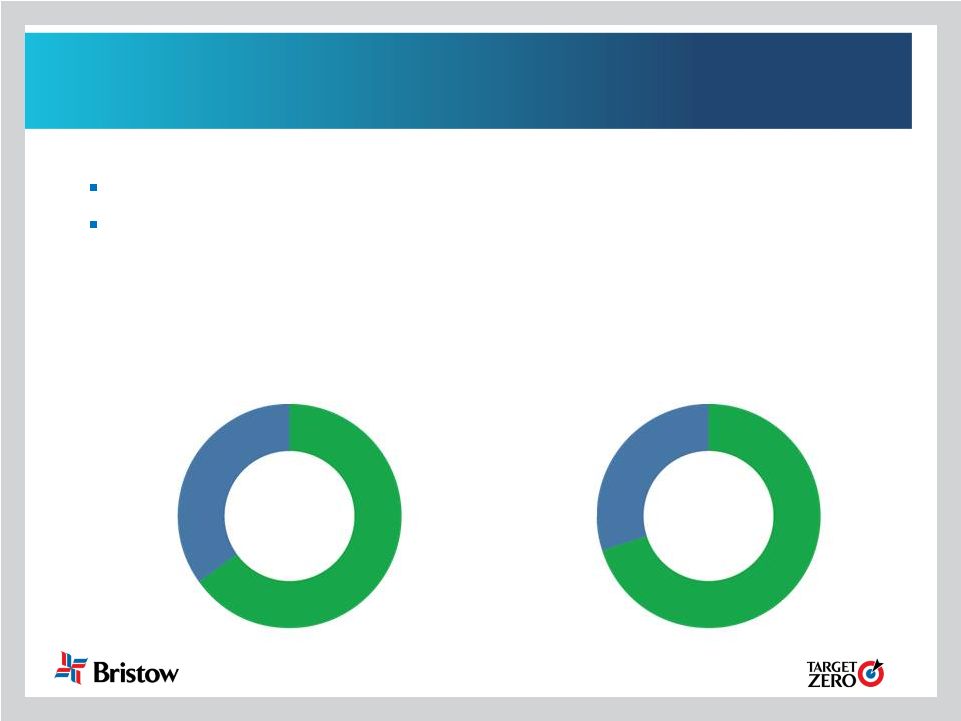

Who we are:

Service to the entire energy value chain, especially production

Typical revenues by segment

Other

10%

Production

60%

Development

10%

Exploration

20%

•

Largest share of revenues (>60%) relates to

oil

and

gas

production

and growth opportunities

•

There

are

~8,000

offshore

production

installations worldwide —

compared with >600

exploratory drilling rigs

•

~1,700 helicopters are servicing the worldwide

oil

and

gas

industry,

of

which

,

providing stability

Bristow’s fleet

•

Bristow revenues are primarily driven by our

clients’

operating expenses

is approximately one-third

|

Who

we are: Bristow’s contract structure generates predictable cash

flow •

Two-tiered contract structure includes both:

Fixed monthly standing charge

Variable fees based on hours flown with

•

Bristow oil and gas contracts earn on average 65% of revenue not

dependent on utilization

•

UK SAR contract earns 85% of revenue not dependent on utilization

Revenue sources

Operating income

6

Variable hourly

30%

Variable hourly

35%

Fixed monthly

70%

Fixed monthly

65%

to reserve helicopter capacity

fuel pass-through |

What

we are doing now: Bristow market perspectives and plans

•

Clients are continuing a three-phase response in this

downturn: retrenching, recalibration and (eventually) renewal

•

The strength of the U.S. dollar continues to impact Bristow’s financial

results more than the decline in oil prices

•

Although production-oriented services (like aviation) are doing better than

many in energy services, available aircraft capacity is increasing

•

Experiencing some reduction in flight hours with minimal idle aircraft in

FY15. In FY16, we are expecting some reduced aircraft per contract

with a few project cancellations, leading to reduced activity and an

increase in supply of available aircraft. •

Bristow

is

executing

on

specific

plans

during

this

downturn

to

reduce

costs

Finalize internal restructurings put in place in Q2 FY15

Proactively work with clients to find efficiencies and ways to reduce costs,

without compromising safety

Partner

with

original

equipment

manufacturers

(OEMs)

and

lessors

during

this

downturn to find cost and capital efficiencies

7 |

16-point efficiency program that responds to our

clients’

demands for cost reductions

Our global footprint incentivizes better aircraft utilization for

our clients

Value Chain

Workshop

Targeted working sessions with clients generate ideas

that lead to efficiency and cost reductions

Other Services: Fixed

Wing, Logistics, End

to End

Examples

Transportation between airports and our bases is a logical

service extension –

many clients are requesting this as

they refocus on their core business

Aircraft

optionality

to

optimize

our

clients’

passenger

capacity needs and accelerate our fleet rationalization

Alternative

Helicopter Types

What we are doing now:

Specific initiatives to help our clients

8

Volume

Incentives |

What

we are doing now: Cost management execution to weather this downturn

$10-$20M

cost

reductions in

FY16

Capex

efficiency

and

deferment

We have already executed several initiatives including:

•

Other International Business Unit elimination to better align

our commercial operations and reduce G & A costs

•

Global heavy maintenance and supply chain restructuring to

enhance asset utilization and inventory management

Additional

cost

reductions in

FY16

We are achieving more cost reductions:

•

Labor and maintenance cost with focus on productivity

•

G & A and discretionary spend freezes

•

Supplier and OEM partner efficiencies

Our balance sheet strength provides us with Capex flexibility:

•

Capex deferral of 25% –

40% year-over-year

•

Supplier and OEM partners are being helpful

•

Inventory reduction with a mostly owned fleet

9 |

10

56

Building long term value:

199 qualified aircraft opportunities over the next three years

30

56

7

Global aircraft

opportunities

North America

South America

and Caribbean

Europe

Gulf of Guinea

E. Africa, M. East

and Central Asia

Australia and

Southeast Asia

Russia

Data as of February 28, 2015

9

19

6

5

8

8

4

36

7

27

27

33

10

118

81

Medium

Large |

199 qualified aircraft opportunities

104 realistic aircraft

opportunities

Data as of February 28, 2015

26 orders*

39 options

*Oil and gas orders and options as of December 31, 2014

Building long term value:

Order book management from our qualified opportunities

31 high probability opportunities

for new contracts

11

•

Bristow uses specific opportunities

to create our order book

with total

opportunities condensed to 104

realistic bids

•

31 high probability opportunities

for new contracts are derived from a

view that we have a ~33% new bid

success rate

•

Our confidence in future growth is

matched by the high percentage of

orders (26) vs. high probability

opportunities (31)

•

The current order book has been

reduced

with recent deliveries,

although Bristow will look to increase

our order book with a large airline-

like order |

Building long term value:

UK SAR provides stable, diversified cash flows

UK SAR

Q1

Q2

Q3

Q4

FY16

GAP SAR

Total FY16

Cumulative LACE

4

8

10

14

14

4

18

Quarterly EBITDAR ($M)

$7 -

$9

$14 -

$17

$20 -

$23

$29 -

$31

$70 -

$80

$15 -

$25

$85 -

$105

UK SAR -

FY16

12

•

Long-term, stable cash flow provides diversification with energy

franchise •

Four

LACE

operating

under

GAP

SAR

contract

expected

to

provide

~

$15

-

$25M

in EBITDAR in FY16

•

UK SAR contract expected to commence April 1, 2015 with four aircraft beginning

revenue service; 14 aircraft expected to be on revenue service by the end of

FY16 |

Building long term value:

Bristow’s H175 order includes innovative lifecycle support

13

•

The H175 range, cruise speed and cost per passenger-mile are highly

desirable for our customers operating with certain capacity requirements

•

Airbus Helicopters is providing a comprehensive airline-style support

agreement, through which availability risk is shared for the entire lifecycle

•

The H175 aircraft deliveries are spread over a number of years, with cash

outflows largely deferred for several years |

14

Building long term value:

Fixed wing creates point-to-point logistics solutions

•

Through acquisitions of Eastern Airways and Airnorth, Bristow has continued

to increase its ability to offer clients point-to-point logistics

solutions •

Point-to-point logistics provide our clients with a more complete and

efficient level of service than when contracting rotary and fixed wing

separately •

Both Eastern Airways and Airnorth operate both charter and scheduled

services that serve energy clients in key cities with limited alternative fixed

wing presence |

Building long term value:

AW609 is the next step in point-to-point logistics solutions

•

The AW609 creates point-to-point logistics solutions for clients in one

airframe •

The aircraft is being developed based on existing military tilt rotor technology,

but with additional capabilities such as a pressurized cabin

•

Bristow will collaborate with AgustaWestland to develop AW609 configurations

and capabilities, as it is a natural fit for air medevac, pilot and engineer

15

vertical lift training, and crew change in hostile environments

|

Building long term value:

A strong balance sheet is critical during this downturn

Bristow’s strong balance sheet and diversified cash flows

provide flexibility to weather downturn and emerge stronger

•

Preference for mostly owned fleet makes cost management and

growth easier during a downturn

•

Opportunistically pursue accretive M&A as well as other growth

investments in advantageous environment

Bristow is committed to returning capital to shareholders

through this downturn

•

Maintain commitment to the dividend and future dividend growth

•

Careful execution of share repurchases in light of the opportunity

set and needed support for our clients

16 |

We

are Bristow 17 |

Bristow Group Inc. (NYSE: BRS)

2103 City West Blvd., 4

Floor

Houston, Texas 77042

t

713.267.7600

f

713.267.7620

bristowgroup.com

Contact us

18

th |