Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - GeneSYS ID, Inc. | Financial_Report.xls |

| EX-31.1 - CERTIFICATION - GeneSYS ID, Inc. | f10k2014ex31i_rxsafesinc.htm |

| EX-32.1 - CERTIFICATION - GeneSYS ID, Inc. | f10k2014ex32i_rxsafesinc.htm |

| EX-31.2 - CERTIFICATION - GeneSYS ID, Inc. | f10k2014ex31ii_rxsafesinc.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

☐ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to ________

Commission file number: 333-193800

| RX Safes, Inc. | ||

| (Exact name of registrant as specified in its charter) |

| Nevada | 27-2928918 | |

(State

or other jurisdiction of |

(I.R.S.

Employer Identification No.) | |

170 Green Valley Parkway, Suite 300 Henderson, NV |

89012 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number: 516-983-9144

Securities registered under Section 12(b) of the Exchange Act:

| Title of each class | Name of each exchange on which registered |

| none | not applicable |

Securities registered under Section 12(g) of the Exchange Act:

| Title of each class |

| Common Stock, par value of $0.001 |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 232.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes ☐ No ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| ☐ Large accelerated filer | ☐ Accelerated filer |

| ☐ Non-accelerated filer | ☒ Smaller reporting company |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. Not Available

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. 115,591,472 common shares as of February 24, 2015

TABLE OF CONTENTS

Business Overview

Rx Safes, Inc. designs, develops, engineers and markets fingerprint medical security storage solutions for consumers and healthcare professionals. We are led by our CEO and director, Lorraine Yarde, who has been a pioneer in the embedded biometric marketplace. Ms. Yarde successfully launched the first nationwide mass market distribution of consumer biometric products, selling through market leaders such as the Home Depot, Sears and Costco. Ms. Yarde has a proven ability to establish strategic product development and marketing relationships with brand name Original Equipment Manufacturers (OEMs) and has been responsible for selling tens of thousands of fingerprint-enabled products into the US market.

Founded in 2010, Rx Safes, Inc. is an emerging leading provider of standalone, biometric medical security solutions in the new targeted sector of Prescription (Rx) and over-the-counter (OTC) drug security, providing real solutions to address Rx and OTC drug diversion and abuse. The Rx DrugSAFE™ product line of medical safes and drug security products offer consumers and healthcare professionals proprietary, patented fingerprint solutions specifically designed to safely and securely store medications within the home, in healthcare facilities as well as out in the field. These secure storage products help control access to medications, addressing both loss prevention and safety concerns within a variety of healthcare settings. We believe Rx DrugSAFE™ products are easy to set up and operate, convenient and competitively priced.

In an ongoing effort to keep up with ever changing technology, after recently completing a redesign of the core electronics technology and mechanical locking mechanisms of our products to provide further security and convenience for our customers, we are once again looking to redesign our fingerprint interface to introduce enhanced features such as audit tracking capabilities, enterprise system integration, reporting and interoperability with IOS and Android devices. We have taken our experience in safe and security product design and fingerprint technology and our understanding of consumer’s wants and needs and developed a product line that we believe can help save thousands of lives.

Our strategy over the next twenty-four months will be to penetrate the consumer and healthcare medicine storage markets through comprehensive, multi-tiered marketing, distribution and educational efforts that leverage both traditional and online retail pharmacies, medical supply distributors, government funded initiatives and strategic partnerships. We plan to engage the support of credible professional and celebrity endorsements to position and market our products directly to consumers. We further plan to leverage relationships we have established with complementary businesses and organizations to provide education and raise awareness on the issue of Rx and OTC drug abuse and the increase in occurrences of accidental poisonings caused by infants, toddlers, adolescents and others accessing unsecured medications in the home.

The Problem and Challenge

A study by the National Drug Abuse Warning Network (DAWN) found the overall, medical emergencies related to nonmedical use of pharmaceuticals increased 132 percent in the period from 2004 to 2011, with opiate/opioid involvement rising 183 percent. DAWN also estimates that over 1.2 million ER (Emergency Room) visits involved nonmedical use of prescription medicines, over-the-counter drugs, or other types of pharmaceuticals in 2011.

The US population consumes more prescription medication than any other country in the world and the vast majority do not lock up these potentially dangerous drugs. According to the Partnership Attitude Tracking Study (PATS), one in five teens has admitted to abusing prescription medications. Moreover, according to ______________, 70% of these drugs are stolen from the homes of unsuspecting family and friends.

In addition, drug theft and diversion is a major problem facing the healthcare community resulting in businesses losing billions of dollars each year. Every American is affected by this epidemic due to sky-rocketing insurance costs as a result of the extra burden on the healthcare system caused by prescription drug abuse.

| 1 |

With prescription drugs overdoses causing more than 100 deaths each day in the US according to the National Institute of Drug Abuse, parents and providers alike must remain vigilant about keeping medications secured and out of the hands of unauthorized users. Children and toddlers present special concerns, because they often don't yet understand the risks or threats posed by drugs in their surroundings. They are curious about their environment so parents and caregivers must ensure that the environment they explore is always a safe one. Younger toddlers are inclined to put things into their mouths, and preschoolers are curious about items found in drawers and cabinets.

The reality is that all medicines are dangerous and potentially deadly for young children. Even common household medications such as Tylenol and vitamin supplements may appear harmless, but can actually cause harm when accidentally consumed by children.

These problems are also uncovered when physicians and pharmacists either write, or fulfill prescriptions. The traditional protocol to “lock up your medications at home to keep kids away from accessing drugs” has been the advice of these professionals for many years, yet there haven’t been any products patients could turn to that effectively, and conveniently, did the job. We believe our Rx DrugSAFE products provide real security against unauthorized persons, yet convenient access to prescribed users. We also believe families will make use of these products to keep medications locked up and their homes Rx and OTC abuse free.

We plan to offer various sizes of safes for consumer use, professional office use, and professional mobile use.

Principal Products and Potential Markets

According to the National Survey on Drug Use and Health, in 2012, an estimated 23.9 million Americans aged 12 or older were current (past month) illicit drug users, meaning they had used an illicit drug during the month prior to the survey interview. This estimate represents 9.2 percent of the population aged 12 or older. Illicit drugs include marijuana/hashish, cocaine (including crack), heroin, hallucinogens, inhalants, or prescription-type psychotherapeutics used non-medically. Of that number, there were 2.6 percent of persons aged 12 or older who used prescription-type psychotherapeutic drugs non-medically in the past month. These estimates were similar to estimates in 2009 (7.0 million or 2.8 percent) and to estimates in 2002 (6.3 million or 2.7 percent).

An estimated 52 million people (20% aged 12 and older) have used prescription drugs for nonmedical reasons in their lifetimes.

According to a report on Prescription Drug Trends by the Kaiser Family Foundation, the number of prescriptions dispensed in the US in 2009 increased 2.1% (from 3.8 billion to 3.9 billion), a larger growth rate than the 1.0% increase in 2008 over 2007. From 1999 to 2009, the number of prescriptions increased 39% (from 2.8 billion to 3.9 billion), compared to a US population growth of 9 %. Because of the new prevalence of these drugs in US households along with the fact that these medications are typically not locked up and easily accessible, such availability is thought to be one of the main factors contributing to the growing issue of abuse among young adults.

According to the National Institute on Drug Abuse, drug abuse and addiction have extreme negative consequences for individuals and for society as a whole. Estimates of the total overall costs of substance abuse in the United States, including productivity and health and crime-related costs, exceed $600 billion annually. As indicated above, the prevalence of prescription drugs in our society continues to grow and is a leading factor in the overall abuse cycle. The US government has committed $25.4 billion in 2015 to address the country’s drug abuse issue,, the largest percentage of which is being spent on prevention and treatment.

We believe that by preventing access we can prevent abuse. Our current product, the RxDrugSAFE stores up to 8 regular size pill bottles, as well as cough syrups. In addition our future planned launch of the RxDrugSAFE PRO will increase that capacity to over 30 regular size pill bottles. These products offer a real solution to potentially100% of the addressable market where there is a need to keep medications on hand and easily accessible but secured when not being used.

| 2 |

The Solution to the Problem

At the forefront of the educational information disseminated by pharmaceutical companies and drug abuse awareness organizations is the promotion of the responsible, secure storage of all potentially dangerous medications in the home. Current child resistant packaging, while helpful, is not alone sufficient to prevent children’s access to medications and does not prevent teens from accessing drugs. Pin code safes or combination lock boxes are easy for a child to thwart and not a viable solution for some prescribed users such as the elderly. A safe uses a key and keys can easily be misplaced or found by a determined teen. The keys can be stolen and copied and further, many elderly patients suffer from arthritis and find it difficult to turn a key. Because of the many deficiencies and problems inherent with other storage methods, it is not easy for most families to lock up their medications today.

Until now, there has not been a medicine security lock box product available to families and healthcare professionals that offers the level of security required, coupled with convenient, quick and reliable access by the authorized user(s) when needed. Rx Safes, Inc. plans to fill the void in the market with its Rx DrugSAFE line of fingerprint activated drug security solutions that can be used to secure medications and prevent unauthorized access in the home and within healthcare facilities.

Consumer Biometrics Market and Applications

Biometrics (or biometric authentication) refers generally to the identification of humans by their characteristics or traits. Biometric identifiers are the distinctive, measurable characteristics used to label and describe individuals. Biometric identifiers are often categorized as physiological versus behavioral characteristics. A physiological biometric would identify by one's voice, DNA, hand print or finger print. Behavioral biometrics are related to the behavior of a person, including but not limited to, typing rhythm, gait, and voice. Automated fingerprint identification system and live-scan biometric fingerprint identification systems, which automatically match one or many unknown fingerprints against a database of known prints and are primarily used for governmental and criminal justice applications. Historically, the adoption of biometrics technology has been concentrated in the government sector. However, there has been a shift in the dynamics of the market, with an increased number of biometric products being developed for other applications. The main use of biometrics in the consumer sector to date has been in the wireless and PC/network security markets, with a range of select high-end models of biometrically-enabled wireless handsets, PCs and laptops appearing on the market.

At present, consumer biometrics products are in the early adoption phase but with companies such as Apple and Samsung incorporating fingerprint readers on smart phones that people use on a daily basis, consumer familiarity and acceptance of fingerprint technology is increasing. These companies are paving the way for other fingerprint-activated products to make their way into every day usage. Rx Safes, Inc. offers biometric security products for securing prescription drugs and other controlled substances in the home and within a variety of healthcare settings. We believe that there is a unique opportunity in the marketplace today for us to establish a trusted brand of fingerprint-enabled drug/healthcare security solutions.

Rx DrugSAFE Products

Our products were originally launched in 2010 and are marketed under the trademark Rx DrugSAFE (“Rx DrugSAFE”). They provide consumers and healthcare professionals with professional grade, secure, yet convenient medicine safes, all using state of the art fingerprint recognition technology. Rx DrugSAFE is a metal safe, not a flimsy plastic container with a cheap digital PIN or tumbler briefcase style lock. Rx DrugSAFE is not designed as a deterrent. It is designed to securely store prescription medications to prevent access.

All Rx DrugSAFE products share these features in common:

| ● | Use secure fingerprint recognition technology to prevent unauthorized access yet provide convenient access to responsible adults, parents, caregivers and healthcare professionals. The authorized user’s fingerprint is their unique key which can never be lost, stolen or forgotten. | |

| ● | Our products are embedded and battery operated and do not require a computer or external power source. | |

| ● | No pin codes or combinations needed – making Rx DrugSAFE products simple and convenient for everyone to use but impossible for kids to thwart. | |

| ● | A key is not required to access the safe, although available as a back-up – eliminates the risk of the keys being stolen or misplaced and prevents the difficulties associated with turning a key for arthritis sufferers. |

| 3 |

| ● | Each safe can store up to 120 unique users making it possible to enroll other responsible family members in the event medications need to be accessed in an emergency, thereby making the products ideal for use within healthcare settings where multiple users may require access to the safe contents. | |

| ● | Durable 17 gauge steel construction – a real safe, not just a deterrent. | |

| ● | Uses a reinforced steel lock and hinges for extra security. | |

| ● | Permanent mounting capabilities so the safe can be secured horizontally in a drawer or other horizontal surface or vertically on a wall, maybe inside a closet or in the bathroom. Future Rx DrugSAFE solutions will mount within an existing medicine cabinet providing a secure compartment within the cabinet to place medicines and other controlled or dangerous items. |

At the end of 2011, we sent the Rx DrugSAFE to a professional security expert who identified a number of deficiencies with the mechanical/industrial design of the earlier version of the product. Because security is the key attribute of the product, the company chose to undergo a redesign, not changing the basic look and feel of the product but improving the locking mechanism as well as other design features that had been identified as potential vulnerabilities. In addition, we further enhanced the fingerprint technology utilized in the product making it easier to program and operate. We did this by shortening the number of steps required for consumers to enroll in the product and also lessened the matching sensitivity of the device to reduce single use failure. We also added additional features to make the product more consumer friendly including a hinge to hold the cover open when the patient is accessing the contents of the safe, serialized keys so that if the keys are lost or misplaced, we are able to replace them and finally a back-up battery pack, so if the user ignores the warning signs (intermittent red and green flashing led) and does not have the keys to hand, they are still able to gain access to the safe to get their medications and then change the batteries. As a result of this re-design, we now feel strongly that the Rx DrugSAFE product is now ready to re-enter the marketplace. We received a sample order of 100 of the newly designed safes in mid-2013 and have spent the last several months testing them internally as well as providing a number as marketing units to prospective business partners and selling a small number of safes to consumers for further feedback. From the immediate feedback, we believe that the modifications that were made addressed the security and user concerns.

Technology

We plan to offer several products under the trademark Rx DrugSAFE, designed to securely store prescription medications, pharmaceutical samples and other controlled substances. The products are designed around identity based technology allowing only authorized users to access the products.

Our Rx DrugSAFE products will all incorporate an embedded high performance micro-processor, flash memory, which stores the encrypted

fingerprint data, and a radio frequency (“RF’) based silicon fingerprint chip to develop superior performance in a

stand-alone device. Based on our many years of experience with this technology, we believe that we offer the industry’s

most efficient technology to deliver accurate fingerprint imaging, secure matching, low power consumption to conserve battery

life and reduced processor load for fast image capture and matching. In addition, other prescription drug safe products use older

mechanical key locks and/or pincodes that are inherently less secure and easier to bypass.

Our current design incorporates a fingerprint sensor from Authentec, with its patented TruePrint technology, which utilizes low power radio frequency signals to read beneath the skin’s surface to the living skin layer, which means that unlike any other fingerprint technologies, the solution we use is capable of reading virtually every fingerprint every time, regardless of skin conditions. Authentec was recently acquired by Apple and the sensors have been rebranded and are being manufactured and sold under license, through a company called Digital Persona. We have signed an NDA Agreement with Digital Persona, and are able to continue purchasing sensors from them or through a third party source via our manufacturing partner. Each sensor sold comes with its own license as part of the sale. Because the direction and further development of the Digital Persona product line is unknown, we are presently evaluating other options including a touch sensor from a company called Next Biometrics. Because the fingerprint reader from Next Biometrics requires the user to place their finger on the fingerprint sensor instead of swiping, we believe this will improve the overall user experience. We have written a design document and are presently speaking with a number of familiar engineering resources with specific experience working with fingerprint biometrics, with a view to re-engineer a new fingerprint interface incorporating the Next Biometrics product. This new interface will then be integrated into our existing and future products and will also incorporate new features to address the needs of commercial healthcare customers including audit tracking and reporting capabilities as well as the ability to interface with applications on external smart devices so that data can then be integrated with a healthcare facilities enterprise systems.

| 4 |

RxDrugSAFE at Home

The original RxDrugSAFE product, featured below, offers a real solution to families looking to not just send a message to their kids, but to take serious measures to protect them within their home environment. Rx DrugSAFE works by recognizing an authorized user’s finger before it unlocks. It is specifically designed for use in home environments and can be permanently mounted in a bathroom/bedroom drawer or closet. It also provides families with additional flexibility in that it can be easily transported if medications are needed while traveling. The safe comes with a twisted steel security cable, allowing it to be secured to a fixed item in a room or vehicle, such as a car seat. Our Rx DrugSAFE Home Medicine Security Safe can hold up to 8 regular size prescription bottles. It can also secure other controlled or potentially dangerous substances such as cough syrups containing dextromethorphan, morphine vials, insulin and syringes. For less than the cost of a video game console, parents can now protect their children from the dangers of prescription medicine.

RxDrugSAFE™

|

|

We have begun preliminary design on and intend to introduce to market the Rx DrugSAFE IC (In Cabinet), featured below, a version of the safe which mounts directly into an existing medicine cabinet and can hold up to 18 pill bottles. The “IC” version is designed to be securely mounted on the bottom shelf of an existing medicine cabinet, and will be screwed into the back of the cabinet (and into the wall). We expect to have physical prototypes of the IC product by the end of 2015.

|

R x DrugSAFE IC ™ |

| 5 |

RxDrugSAFE in the Facility

We recognize that the Rx DrugSAFE products and technology can also provide a viable drug security solution for certain areas of the healthcare marketplace, as well as other facilities where medications may be present, such as schools and early learning centers. The Rx DrugSAFE is ideal for use in medical offices as well as by home healthcare providers to store and transport controlled substances. Medical practices can also utilize the product to securely store their prescription pads, an item which is commonly stolen from doctor’s offices. Rx DrugSAFE has also been purchased by hospice facilities and nursing homes, environments where many potentially dangerous drugs are dispensed to individual patients and need to be secured. We have also previously sold units to ambulance services to secure medicines transported in the back of the ambulances. RxDrugSAFE’s sleek, compact design makes its suitable for use by mobile healthcare providers. We also offer an optional carry handle enhancing the product’s portability.

In addition, based on feedback received from the healthcare community, Rx Safes, Inc. has designed and prototyped a larger version of the product called Rx DrugSAFE PRO. This version is designed specifically for use within a variety of healthcare environments. It is much larger than the RxDrugSAFE product, comes with adaptable foam inserts to secure pill bottles of various sizes in the upright position and can store between 16 to 30 pill bottles, and other controlled items and equipment, depending on the configuration used.

| RxDrugSAFE PRO™ | |

|

|

|

|

| 6 |

We had originally anticipated that the PRO would be available for sale at the end of 2014. However, due to delays in obtaining the necessary funding to move this project forward, we now expect the PRO will be available for order in the fall of 2015.

Rx DrugSAFE in the Field

The Affordable Care Act of 2010, Section 2703, created an optional Medicaid State Plan benefit for states to establish Health Homes to coordinate care for people with Medicaid within their home environment. States receive a 90% enhanced Federal Medical Assistance Percentage (FMAP) for the specific health home services. With a goal to provide the ability for mobile healthcare workers to securely and safely transport medications and provide HIPAA compliant care in the field, Rx Safes, Inc, has prototyped the Mobile Medical Station (MMS). The MMS is a waterproof, shockproof and secure rolling case with telescopic handle that is secured with Rx Safes’ patented fingerprint technology. The case incorporates state of the art vital statistics monitoring equipment, a rugged field tablet containing patient H&P data which can be securely uploaded to the primary healthcare enterprise system and one of our Rx DrugSAFE fingerprint lockboxes for the safe and secure transportation of medications.

|

|

We also plan to incorporate mobile printing capabilities, which are often required in a remote healthcare setting. The prototype was developed by Rx Safes as a proof of concept using non-standardized equipment. However, it is our intention to develop strategic relationships with OEM suppliers for each of the required devices and offer a standard MMS along with customizable options, depending upon the specific needs of the healthcare provider group. We anticipate that the MMS will be available for initial order in the fall of 2015.

Rx DrugSAFE in the Future

Our mission is as simple as it is powerful – to become the leading provider of standalone biometric medical security solutions for consumer and healthcare markets. To this end, we intend to consider adding products that complement our current and developing productline including, for instance, biometrically controlled dosing devices, portable HIPAA compliant biometric EMR devices, biometric tele-medicine solutions, products to biometrically secure physical and electronic medical health records and secure, remote healthcare monitoring products.

Initially we are looking to offer a comprehensive approach to drug security and diversion. In 2015/16, we plan to introduce additional products and solutions for home and professional use to safeguard medicines and other types of medical equipment and data. As noted above, we intend to introduce a fingerprint activated lockbox called Rx DrugSAFE-IC, which will provide consumers with the ability to convert a portion of an existing medicine cabinet into a secure lockbox to store their medicines and other controlled substances. This product is expected to be ready for purchase at the end of 2015. Rx DrugSAFE PRO is estimated to reach the market in the fall of 2015.

| 7 |

We envision a three tiered product catalogue and product roadmap. Our first products are based on the need to secure controlled substances in the home and in certain institutional and healthcare environments where a smaller storage solution is needed. This includes the two current RxDrugSAFE products, as well as two additional products for future release. The two new products will use the same technology, but the actual safe sizes will be different. We plan on offering a new intermediate size called Rx DrugSAFE II that is between the sizes of the RxDRUGSAFE and RxDURGSAFE PRO, as well as a fourth size, as mentioned before, that will be designed to fit inside a home medicine cabinet.

The second line of products will utilize the same technology but will focus on larger storage products, such as lateral and vertical file cabinets and vertical storage cabinets. These storage cabinets would be used primarily in professional healthcare offices and facilities to store physical medical files and sample pharmaceutical products.

The third line of storage products will be rolling medicine carts and other storage cabinets that can be used by healthcare facilities to store controlled substances in between patient rooms, as well as fixed medicine storage products for the same facilities. Once again, these products will incorporate the same secure and convenient fingerprint technology embedded in current storage units, but may also be tied into an enterprise where data relating to the patient, the type, dose and time of medication dispensed, and by whom can be wirelessly communicated to the main system.

If we are able to build brand recognition and establish market acceptance of our technology, we will then look to introduce the other healthcare security products we have identified above, to offer a comprehensive suite of healthcare related security solutions.

Product Specifications

The RxDrugSAFE™ products are made from hardened 17 gauge steel with steel pin reinforced hinges. They have an advanced steel lock, which is controlled using state of the art fingerprint technology. They are finished in bright white powder coat with the RxDrugSAFE logo and our own personalized medical cross symbol, to distinguish brand identity. The safes come with two sets of back up keys, (most customers seem to require a back-up), and a security cable that is used to temporarily affix the safe to an immovable object. Standard features include:

| ● | Programmable for use by up to 120 individuals |

| ● | Uses unique fingerprint technology to prevent unauthorized access |

| ● | Simplified programming – user is enrolled in less than 10 seconds |

| ● | User recognition takes less than 1 second |

| ● | Convenient and portable - runs on 4 AA Batteries |

| ● | Battery failsafe - enrollment data is not lost due to battery failure or removal |

| ● | Back-up battery pack if the batteries die |

| ● | Can hold up to 8/30 standard size pill bottles |

| ● | Tubular pick resistant back up keylock |

| ● | Serialized keys |

| ● | Stainless steel hinge to hold cover in the open position |

| ● | The portable Rx DrugSAFE weighs less than 3 lbs |

| 8 |

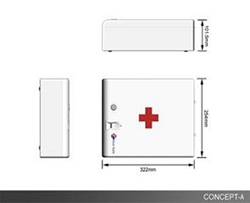

Dimensions of existing product offerings:

Rx DrugSAFE and RX DrugSAFE PRO

|

|

Optional accessories include:

| ● | Carry handle – the detachable handle simply screws on to the RxDrugSAFE, and now you have a portable travel drug safe. |

| ● | Mounting bracket – allows a user to mount the Rx DrugSAFE and PRO horizontally in a drawer or on a counter top, or vertically on a wall inside a closet. This is a more permanent solution than using the security cable and provides additional security. |

Trademark, Copyright and Patent Protection

We believe that we have begun to establish a recognizable brand behind the Rx DrugSAFE product name in the market. To protect the Rx DrugSAFE brand name and mark, we filed an application with the US Patent and Trademark Office for the Rx DrugSAFE mark, as a standard character mark. This mark was published on March 1, 2011 and registered on May 17, 2011. The serial number for the trademark is 85141627. We established “first use” of the mark in May 2010 and due to aggressive sales and business development efforts were able to justify a claim to the mark based on first use and customer familiarity with the name as it relates to our product and market.

We have secured an exclusive license to use patent number 6,766,040, which covers the system and method for capturing, enrolling and verifying a fingerprint and covers the technology used in the Rx DrugSAFE products. The patent was acquired by us in the asset purchase agreement we entered with Axius Consulting Group, Inc. The patent was originally licensed to Axius by bioMETRX.

The patent license is exclusive to Rx Safes, Inc. as it relates to any embedded, battery operated product sold into the healthcare industry, or for related consumer or commercial healthcare applications such as narcotic and prescription pill and gun safes. The patent covers various aspects of the technology used in our products including independent claims on the size of the fingerprint template, the peak power consumption used to process and match a fingerprint image, as well as the fact that it is powered using one or more batteries. The relevant claims of the patent as they relate to the design of the fingerprint user interface used in our products are as follows:

| ● | A biometric verification device for providing secure access to a unit connected to the device, the device comprising: a. a biometric sensor capable of sensing a biometric trait of a user that is unique to said user and providing a first signal containing information representing said biometric trait; and b. a processing unit connected to said biometric sensor so as to receive said first signal, said processing unit being adapted to compare said information with biometric data stored in said processing unit representing a biometric trait of an enrolled person, and provide a verification signal indicating whether or not said information corresponds sufficiently with said biometric data to verify said user is said enrolled person, wherein said processing unit completes said comparison and generates said verification signal within 20 seconds of when said biometric sensor senses said biometric trait, said biometric sensor and processing unit, together being configured to use no more than 1W of peak power. |

| 9 |

| ● | wherein said biometric trait is a fingerprint | |

| ● | wherein said processing unit completes said comparison and generates said verification signal using no more than 400 mW of peak power. | |

| ● | wherein said processing unit completes said comparison and generates said verification signal within 7 seconds of when said biometric sensor senses said biometric trait. | |

| ● | wherein said processing unit stores said biometric data representing a biometric trait of an enrolled person using no more than 1 K bytes of data. | |

| ● | further including one or more batteries that comprise the sole source of power for the device. | |

| ● | further including a wired interface for connecting the device with the unit |

We believe that any practical application used for a similar purpose within our market will likely infringe upon this patent, meaning that Rx Safes, Inc. has the ability to protect its market, prevent illegal competition and offer the only practical, effective fingerprint based solutions to store pills, medicine bottles and other controlled substances.

We intend to file design patents for our products and will continue to pursue all available protection for our current and future product offerings. In order to do this, however, we will need additional capital.

Marketing and Distribution Plan

As previously discussed, we originally launched the Rx DrugSAFE product in 2010 but took it off the market at the end of 2011 to address some vulnerability issues. The core technology and mechanical locking mechanism have been redesigned to address these issues. We also added some additional features to include a hinge for the cover, serialized keys and a back-up battery system. As part of the redesign, we also focused on pricing and have been able to reduce the overall cost of the Rx DrugSAFE product while improving its overall functionality and usability and adding the new features mentioned.

During the initial launch in 2010, we took steps to validate the demand and need for the product by consumers, the health care segment and professionals alike. We conducted beta testing and initial market testing to ensure we were positioning and pricing the product correctly for our initial launch. To facilitate this market testing, we produced physical prototypes and tested these in typical usage situations, initially with friends and family and then a more expansive group of testers and initial customers. We also conducted informal focus groups with the test groups, at trade shows and during grass roots community health and wellness events and events targeting child safety. We received overwhelming positive acceptance from all groups we spoke with. The main areas we focused on were: product features, functionality, pricing, operation and construction. An important, but not the only goal of the plan, was to increase awareness of our products and fingerprint technology in the market.

With the completion of the redesign, we intend to ramp up our business development efforts. Our plan is to have independent sales and marketing teams focusing on each market segment to include consumer, as well as the health care and B2B professional segment, such as schools, early learning centers, government facilities and corporations, among other entities.

Consumer Market

The overall goal when attempting to create a footprint in the consumer market is to use the Rx DrugSAFE as a tool to educate parents on the prescription abuse issue because raised awareness translates to increased demand. Sensitivities as to need and price have to be considered but it is clear that to be effective, broad market penetration through a variety of channels is a necessity. We have identified a number of key channels that we must sell through in order to successfully reach the consumer in a meaningful way.

| 10 |

Government Funded Initiatives

Prescription drug abuse has become one of the greatest challenges facing our society and more people overdose from prescription drugs than marijuana and cocaine combined. Many government organizations have begun to gather and study data and have established programs to educate and inform people about the issues of prescription drug abuse. These include the National Institute on Drug Abuse, the CDC and SAMHSA. There are many grants available through SAMSHA, NIDA, Bureau of Justice and other federal programs. In addition, many states have established their own task forces and funds to tackle the prescription drug abuse epidemic. As part of the National Drug Control Budget, President Obama has requested $25.4 billion in 2015 alone, to reduce drug abuse and its consequences and the largest portion of this budget is to be spent on prevention and treatment. The Rx DrugSAFE product can offer a significant positive impact on the prevention element of the government’s efforts. By preventing access to prescription drugs in the home and other healthcare settings, we can reduce the number of teenagers becoming addicted to these drugs, prevent accidental ingestion by toddlers and deter theft by addicts or dealers.

The primary goal is to get our product into the hands of at risk families through the multitude of state and federal programs. To this end, we have begun to make contact with all National Association of Drug Diversion Groups (NADDI) throughout the US, offering the Rx DrugSAFE as a product they can purchase and donate, using one of the many grants available. Recently, we successfully shipped 500 Rx DrugSAFE units to the Oklahoma Bureau of Narcotics and Drug Diversion. The Oklahoma project was supported by a grant awarded by the Bureau of Justice Assistance, which is a component of the Office of Justice Programs. Now that we have proven our product can be recognized as an integral part of one of these such programs and at least one appropriate funding source has been identified, we intend to take this program countrywide as step one in our efforts to benefit from the many government funded prescription drug abuse initiatives.

Retail Pharmacies

In focusing on consumers, we have determined the various potential entry points to consumers in the market, which are primarily “bricks and mortar” retail pharmacies, national chains and community retail pharmacists. These are obvious first points of market penetration, considering that these are the places where the majority of potentially dangerous drugs are dispensed to consumers. Patients often look to their pharmacist for advice and they are often a trusted part of a patient’s care regime.

The national chains operate approximately 39,000 pharmacies and fill nearly 2.6 billion prescriptions annually, which is estimated to be more than 72 percent of annual prescriptions in the United States. Storing medications securely is an initiative that has become more important to these pharmacies due to the increased number of prescriptions being written and the concern that these medications are getting into the wrong hands.

During our initial launch, chain drug stores, Rite Aid and Walgreens and online pharmacy, drugstore.com, piloted the product online. In addition, we established a relationship with OCI, a tier one distributor to Walmart and have also sold a small amount of product at walmart.com. Clearly, we did not want to sell an inferior product through these channels and consequently pulled the product from these sites during the redesign. We are not presently selling product to any of these online retailers. Now that we have completed our redesigned product we plan to reengage with these partners and resume selling on these sites. In addition, we have reached out to the major bricks and mortar retail pharmacy chains proposing a program to use the Rx DrugSAFE as a patient acquisition and retention tool as well as to place Rx DrugSAFE product displays at the pharmacy counter point of sale, making it accessible to patients and available for the pharmacists to point to when dispensing potentially dangerous medication as they advise the patients about the importance to lock up their medications. We plan to work on a coupon program with the stores whereby the customer can obtain a significant discount if they fill a certain amount of prescriptions within a specified period of time. These programs are at the preliminary stages of development and we anticipate closing on one or more such deals within the next 6 months.

In order to successfully penetrate the retail pharmacy market, it is essential to establish Rx DrugSAFE as an item that can be purchased through one of the 3 largest US based health care distribution companies, McKesson, Cardinal Health and Amerisource Bergen. These three companies service approximately 98% of all US based retail pharmacies, national chains and community retail pharmacies.

| 11 |

McKesson is the second largest medical products and health care services distributor in the world next to Cardinal Health. We established a vendor relationship with McKesson and the Rx DrugSAFE product was added as the first product we are able to sell through McKesson Pharmaceuticals Consumer Products Group to their various customers. McKesson serves more than 25,000 pharmacies nationwide and these customers include many of the top retail pharmacy chains, including Walgreens and Rite Aid. McKesson is also the main distributor to Walmart Pharmacies and has its own franchised chain of over 2,600 community pharmacies that are branded under the “Health Mart” umbrella. Health Mart Pharmacy ranked “Highest in Customer Satisfaction with Chain Drug Pharmacies” in JD Power and Associates 2009 National Pharmacy Study. Health Mart Pharmacies are independently owned and fall under the category of community retail pharmacies. They are usually owner operated and are well established within their communities. These pharmacies struggle on a daily basis to compete with larger chains, which frequently have the ability to offer more competitive pricing and more comprehensive services. These pharmacies typically focus their efforts on offering a higher quality of service to customers and are constantly looking for ways to distinguish themselves from the national chains.

We exhibited the Rx DrugSAFE at the 2010 McKesson Pharmacy Strategies Conference, where we were given an opportunity to present our product to hundreds of McKesson community pharmacy owners, many Health Mart franchise owners and independent pharmacy owners and pharmacists. The feedback regarding the product was overwhelmingly positive and we secured a number of orders through the conference. Once again, due to the redesign effort, we subsequently stopped shipping product under the McKesson agreement. We have made initial contact with the new buyer for our category with a goal to re-launch the new improved product through its channels in the coming months.

Prior to our pulling the original Rx DrugSAFE products, we were establishing a vendor relationship with Cardinal Health, the nation’s largest distributor of healthcare products and actually entered into a formal vendor agreement with the company. The plan was that Cardinal Health would offer Rx DrugSAFE products through its various channels, including its retail pharmacy customers, the largest of which is Walgreens, and through its own franchise group of independent pharmacies, The Medicine Shoppe, which has over 850 pharmacy locations across the US and another 400 international pharmacy locations in Canada, China, Japan, Indonesia and the Middle East. To date, we have not sold any product through Cardinal Health but have recently reengaged with them with a view to launch the redesigned product through its various channels.

We were also working on establishing a similar relationship with Amerisource Bergen Drug Corporation, which provides a comprehensive line of consumer products to pharmacy customers, including over the counter (OTC), health and beauty care (HBC), home healthcare (HHC), private label (PL), and general merchandise (GM) customers. They also operate Good Neighbor Pharmacy, a distribution, marketing and purchasing group that provides over 3,000 independently owned pharmacies with branded medical supplies and services. We plan to resume discussions with Amerisource Bergen in the coming months.

We are not a supplier to Amerisource Bergen Drug Corporation, but we hope to work with Amerisource Bergen to reach hospitals, alternate care facilities and other health care businesses throughout the United States, Canada and selected global markets. Amerisource Bergen’s Specialty Group brings specialty pharmaceutical and medical related products from the manufacturer to such entities, as well as primary care physicians, group purchasing organizations, physician practice management companies and large group practices.

Finally, we will seek to establish distribution relationships with pharmacy cooperative buying groups, and have established such a relationship with Epic Pharmacies, under our standard reseller agreement, so that the product may be offered directly to members of such groups. Epic has over 1,200 independent pharmacy members who purchase products for their pharmacies through Epic. We have already established a reseller relationship with Epic, where its members will enjoy the benefit of special discounted pricing for the Rx DrugSAFE product.

Online pharmacies are also a growing segment in the US pharmacy market and the largest of these is DrugStore.com. DrugStore.com sells more consumer-based medical supplies than all of the other online pharmacies combined and has over 3,000,000 worldwide purchasers annually. DrugStore.com is also the online service provider for Riteaid.com. We solicited DrugStore.com by phone, and we sent the company a product sample which they reviewed and determined that it would complement their product offerings and they established an agreement with us. We are an approved vendor to DrugStore.com and have successfully shipped product to their customers in the past through a drop ship relationship, which is facilitated by a company called CommerceHub, a third party fee based service which processes all of the DrugStore.com orders. We have re-established communications with DrugStore.com and plan on re-engaging with CommerceHub so that the Rx DrugSAFE product will once again be available for purchase at Drugstore.com.

| 12 |

Online Resellers

To expand our online presence beyond our own website (www.rxdrugsafe.com), we have created a reseller program to attract a variety of online resellers who have established customers and have already expended resources to position their respective sites at the top of the page on major search engines. Our Reseller Agreement offers qualified resellers the ability to purchase our products at a discount to the MSRP for the Rx DrugSAFE. The greater volume of business a reseller conducts with Rx Safes, Inc. the greater the discount the reseller will enjoy. We presently have 5 Reseller discount levels. To maintain status, a Reseller must agree to abide by our Minimum Advertised Pricing (MAP) policy for the Rx DrugSAFE. To date, we have signed up over 20 online resellers who range from home health and medical supply companies to companies that sell all types of products for the home.

We plan to continue to build upon this reseller network and plan to provide monthly incentives and special offers to encourage the resellers to give the Rx DrugSAFE product high profile placement on each of their respective web sites.

Medical Professionals

We have received endorsements from physicians in various specialties. For instance, Dr. Mary Ellen Renna (pediatrician) appears on Fox and Friends as well as WPIX Channel 11 with our products, covering prescription drug abuse and endorses use of our safe as a way families can safeguard their medicines. Although Dr. Renna’s agreement has expired, she still continues to endorse our products during the course of her business by recommending the safe storage of drugs to her patients and suggesting the Rx DrugSAFE as the best option. They will not receive any additional compensation for this. Doctors are called upon to prescribe medications to their patients for various reasons. Just like pharmacists, doctors typically have a trusted relationship with their patients, so it makes perfect sense that we should look at doctors as a channel through which our product could be marketed to consumers. For example, pediatricians support parents from pregnancy, through birth and often up to 18 years of age. They readily dispense advice to parents on what they can do to prepare their homes for their new babies and children in general and a major part of that is ensuring the home environment is safe. Other physicians also dispense medications that people can potentially abuse and that in the wrong hands can be deadly. In addition, pain management clinics primarily take a pharmacologic approach to treating long term pain and various medical practitioners, clinical psychologists, physiotherapists, occupational therapists and nurse practitioners frequently prescribe various narcotic drugs such as opioids and antidepressants to help manage pain over time. These channels as well as drug rehabilitation centers, recovery centers and sober living facilities also provide a conduit through which the Rx DrugSAFE can be introduced to the general public.

Physicians are typically well respected by patients and their advice is taken seriously. Having such respected professionals recommend our product to patients in effect extends our sales force to qualified medical and related professionals, a team we would not be able to engage in any other manner.

To help further develop these channels, Rx Safes, Inc. intends to set up a program where medical professionals will be able to display literature on the Rx DrugSAFE product in their waiting rooms and exam rooms. Making this literature available to patients at a physician’s office will provide the Rx DrugSAFE product some credibility in the eyes of the patient. The medical practices would then be able to choose to take a passive or active role in selling the Rx DrugSAFE product, but either way will be incentivized to a degree to sell the product as they automatically receive a percentage of the sales generated from their practice. This program has not been established as yet and is a proposed program that we are discussing internally and with medical practices. As such, we have not established any details on percentages that participating medical practices would receive. Each physician’s office would be assigned a unique code which would be indicated on the back of the literature available to patients to take away with them. The patient will be required to enter that code when they go to our site to order an Rx DrugSAFE in order to receive a small discount on their purchase and this code would tie back specifically to the physician’s office where the literature was displayed. At the end of every month, the physician’s office would receive a check from Rx Safes, Inc. to cover their commission on sales the office generated.

| 13 |

Health Care Systems

Our hospital marketing program is designed to provide health care systems with an effective outreach program within their local communities, with the visibility to attract patients to their healthcare services. ER doctors often take an active role in advising patients to secure their medications in their homes upon discharge. To facilitate this effort, we plan to supply the hospital system with pre-printed custom Rx DrugSAFE prescription pads that will allow a patient to acquire an Rx DrugSAFE product through our professional referral program at a significant discount to the Management’s Suggested Retail Price (MSRP). In addition, we also plan to provide an informational flyer sponsored by Rx Safes, Inc. offering valuable information on steps discharged patients can take at home to secure their medications. The hospitals/health systems may distribute the pads and flyers throughout their facilities. Physicians and other discharging medical professionals would provide patients with a prescription for an Rx DrugSAFE whenever they issue pain, stimulant or anti-depressant medication. Each safe sold will provide the health system with a 10% commission to further support outreach efforts dealing with prescription drug abuse in their catchment area. This program offers the health systems a tremendous community service opportunity as well as creating increased, credible awareness for the Rx DrugSAFE product. The program is designed to be compliant with regulations specifically pertaining to healthcare advertising and marketing and will likely launch as a pilot by Q3 2015. We intend to begin a recruiting campaign in the coming months to identify qualified regionally based personnel to target healthcare facilities/systems to sign up for the program.

Fundraising/Community Collaboration

Good corporate citizenship is a major part of our business philosophy. We believe in “Doing Well By Doing Good” and feel strongly about our mission to arm families, educators and other community organizations with the information necessary to keep our kids safe. To support this effort, we have developed various fundraising partnership initiatives which tie the Rx DrugSAFE product in with educational material on drug safety which can be disseminated by schools, church groups, youth and community organizations, PTA groups and other non-profit groups. We will support these groups in their educational programs by providing product materials for them to use or make available to their membership. In exchange, we plan to ask these nonprofit groups to include the Rx DrugSAFE product in their marketing materials for various events. We also plan to offer discounts for nonprofit groups and other organizations who want to advertise the Rx DrugSAFE products directly on their websites or at fundraising events for their groups. In establishing these relationships, we are hoping to reach a broader audience than we would be capable of independently utilizing the resources of already established organizations to reach target demographics.

We have already informal relationships with drug awareness outreach programs embedded in communities around the United States, such as D.A.R.E., Partnership at DrugFree.org and NOT MY KID, as well as various PTA and other community based drug free and child safety advocacy groups. These organizations deliver and lead community education programs and create public awareness campaigns relating to the issues of drug and alcohol abuse.

Strategic Corporate Partnerships

We hope to develop relationships to promote our products and the benefits of the products with one or more of the large pharmaceutical companies that are responsible for manufacturing some of the medications that people can potentially abuse. Some of the pharmaceutical companies we have contacted to date are Purdue, Pfizer and Abbott. Each of these companies manufactures a least one heavily abused prescription drug and each has received a great deal of negative media coverage about the addictive effects of the drugs and the level of abuse that has been seen. To date, pharmaceutical companies have primarily attempted to curb such abuse by providing educational materials when medications are dispensed, in the hope that the users of the medications would pay attention and read the literature. Unfortunately, in most cases this information goes unread and, as a result, efforts to date to curb abuse in this manner have been ineffective, as the levels of prescription drug abuse has more than doubled in the last 5 years.

| 14 |

We have proposed a variety of initiatives to pharmaceutical companies to address this abuse, such as sponsoring a donation of Rx DrugSAFE products to at-risk families and a coupon drive, which would be offered through national print and online publications to pharmacies, doctor’s offices and others where the coupon would be given in the name of the pharmaceutical company for a patient to purchase an Rx DrugSAFE product at a significant discount to the MSRP. We would then redeem the coupon value back from the pharmaceutical company to cover the cost of the discount provided. These programs were not established due to the redesign of the Rx DrugSAFE product but we plan to resume discussions with the various pharmaceutical companies to move these relationships forward in the coming months.

Prior to our taking the product off the market to engage in the redesign, Purdue Pharmaceuticals had already taken various steps to implement an alliance with us, featuring our product in the “Safeguard My Meds” campaign, an initiative used by the National Community Pharmacists Association (NCPA) and sponsored by Purdue. For example, Purdue has used a short vignette which appears on the “Safeguard My Meds” home page, showing the Rx DrugSAFE as a recommended mechanism to secure medications in the home. The product was also on display at a special “Safeguard My Meds” booth at the NCPA annual convention, which took place October 23rd – 27th, 2011. We intend to reengage in discussions regarding future initiatives with Purdue Pharmaceuticals and hope to work together more significantly on joint efforts to educate families about the importance of locking up medications at home.

By aligning with a product such as the Rx DrugSAFE, the pharmaceutical companies can demonstrate to their customers that they are taking an active role in addressing drug abuse and offer real solutions for families who use and store medications safely. In turn, Rx Safes, Inc. will benefit from the association with such companies and their extensive global outreach capabilities. As part of each relationship, the pharmaceutical company would not only assist us in reaching potential customers directly but would also become a customer of ours, purchasing Rx DrugSAFE units to give away as part of positive public relation campaign and purchasing the coupons that we could use to make the product affordable for more people.

Health insurers are another group that could become strategically and financially vested in our efforts to prevent unauthorized access to prescription drugs in the home. It is the private health insurers, HMOs, Medicaid and Medicare that feel the financial burden when their members end up in the ER, in treatment or rehabilitation and have to be prescribed medications to treat addiction. The cycle of addiction is perpetuating and we believe costs insurers millions of dollars annually. If insurers provide Rx DrugSAFE units to their members, this could have a positive impact on the number of people, particularly toddlers and teenagers, ending up in the ER and in subsequent in/outpatient treatment, reducing the overall costs to the insurers and demonstrating a real ROI if used as designed by plan members. We have begun initial outreach to some of the larger health insurers and plan to move these discussions forward over the coming months.

Trade Shows and Community Events

Trade shows and grass roots community events are an excellent way to educate the buying public, whether direct consumers, industry buyers or others, about a company’s products and/or services. We plan to look for every opportunity to exhibit our products and talk to trade show attendees. Some of the industry and community sponsored events we have targeted in the past include The McKesson Pharmacy Strategies Conference, The University of Southern Nevada Drug Abuse Awareness Team’s Annual “We Pledge” event, Nevada Youth Alliance’s Back to School Health Fair, The University of Southern Nevada Annual Health Festival and Boulder City Annual Health Festival and University Medical Center’s Annual Pediatric Trauma Conference, among others. With proper resources at our disposal, there are a number of large industry conferences that we would like to target for 2014, including the National Community Pharmacists Association (NCPA) Convention and Trade Expo, Senior Care Pharmacy Annual Meeting and Exhibition, Community Anti-Drug Coalitions of America’s (CADCA) National Leadership Forum and the National Association of Chain Drug Stores (NACDS) Market Place Conference. We have already registered to exhibit at the Mid-America Healthcare Venture Forum in Chicago on March 9-11th and the International Cannabis Expo in NYC, scheduled for June 17-19, 2015 and hope to have the opportunity to attend/exhibit at some of the other conferences referenced.

| 15 |

Medical Marijuana Market

To date, 23 states and DC have enacted laws to legalize medical marijuana and four states have legalized recreational use. As yet another drug available to patients to treat various ailments, medical marijuana and cannabis infused products need to be securely locked up in the home, primarily to prevent access by children. With cannabis infused candy, chocolate, cookies and brownies available for purchase it is not surprising that there were an increased number of ER visits due to children ingesting these drugs. We plan on positioning the Rx DrugSAFE as the go to product for patients who use medical marijuana and have already developed new branding to target this emerging market. We have exhibited at a handful of local medical marijuana events and, as referenced above, we will be participating at the upcoming ICA event in NYC where our CEO, Lorraine Yarde, will be a guest speaker.

In addition to the channels focused on consumers that were discussed above, there are other avenues available to increase our sales to consumers that we would like to pursue once the resources are available to do so. These include targeting corporate health and wellness programs of companies by offering the Rx DrugSAFE product as an incentive for company employees to participate in such programs or offering the product at a discounted price so the company employees can lock medications.

Health Care Organizations and Providers

As discussed above, the Rx DrugSAFE products also provide a viable drug security solution to certain areas of the healthcare marketplace including medical offices, hospitals, home health care providers, nursing homes, rehab and sober living centers, assisted living facilities, hospice facilities and ambulance services. This list will become broader as we begin to expand our product line into larger storage solutions. There are three main established channels through which we will market our products into the health care arena: health care and medical distributors; independent manufacturer’s representatives; and online medical supply stores.

Health Care Distributors

There are many smaller distributors in the health care field, some of whom are more industry category focused or support certain geographic regions. However, if we are to make any significant impact selling our products into the health care and medical arena, we believe that we will have to sell through one or more of the global distribution leaders discussed above.

As previously noted, we are already a vendor for McKesson and we plan to sell our products through the McKesson home healthcare group to the consumer market. However, McKesson Pharmaceutical distribution also supplies branded, generic and over-the-counter pharmaceuticals and medical products to more than 40,000 customers spanning institutional providers such as hospitals, health systems, integrated delivery networks and long-term care providers. Through our already established relationship with McKesson, we hope to also service other McKesson distribution groups including McKesson Medical-Surgical. This McKesson group delivers a comprehensive offering of medical-surgical supplies, medical equipment and health care technology-related services to the alternate site market, including physician offices, surgery centers, long-term care facilities and home care businesses across the country and distributes more than 150,000 medical-surgical products to more than 300,000 customers. Finally, McKesson also owns Moore Medical, an internet-enabled, multichannel, specialty direct marketer and distributor of medical, surgical and pharmaceutical products to nearly 100,000 healthcare practices and facilities in non-hospital settings nationwide, including: physicians, emergency medical technicians, schools, correctional institutions, municipalities, occupational healthcare professionals and other specialty practice communities.

Independent Manufacturer’s Representatives

Independent Sales Representatives play an important role within the health care industry and form a unique bridge between manufacturers and health care facilities, allowing companies like us to effectively get a new product to market and utilize a national sales force, which is purely performance driven, without the burden of the monthly overhead to hire inside sales personnel. By forming relationships with independent sales representatives, we hope to take immediate advantage of their already established relationships in various areas of health care, including hospitals, ambulatory centers, home health care providers, doctor’s offices, dental practices, assisted living and nursing facilities and hospice care centers.

| 16 |

Through membership with the Healthcare Independent Representative Association (HIRA), we intend to expand our network of independent sales representatives. HIRA is a national organization that focuses on furthering the function and professionalism of independent sales agents in the health care marketplace and works to match manufacturer’s products with the right sales agencies and markets.

The advantages to us of establishing a network of independent sales agents is that they will provide us with immediate entry into various territories, permit regular calls to be made on existing customers of the representatives and prospective customers, provide quality salesmanship and help control expenses.

Online Medical Supply Stores

With the newfound dependence on everything electronic, many small to mid-size health care providers and even purchasing departments of hospitals and other medical facilities are turning to reputable sites on the internet to procure a variety of medical products. There are many sites that are recognized as leaders in the online medical supply space. Allegro Medical was one of the first companies to sell medical supplies online back in 1997. Their B2B program serves schools, government agencies, hospital, doctors, nursing homes, rehab facilities, durable medical equipment stores and more. Upon receipt of the new product shipment, we plan to launch the Rx DrugSAFE product on the Allegro site. In addition, we were already selling the Rx DrugSAFE product through a number of online medical supply companies such as Medical Supplies and Equipment Company, Mednetdirect, Universal Medical and Devon Medical Products and we plan to reengage with these groups as well as work with other online medical supply companies to get them to carry their products.

B2B Professional Sales

We are also attempting to market our products to a variety of other organizations and businesses such as educational facilities, day care centers, rehabilitation facilities, government agencies, the military and corporations in general. We have spent a limited amount of time targeting these particular businesses, but plan to increase our efforts in this area and establish a team of independent representatives who will focus on B2B channels on our behalf.

In 2014, we plan to target the largest health care supplier to school nurses nationwide, School Nurses Supply, Inc., to add our products to their catalog. We will also reestablish discussions with Phoenix House, a non-profit residential and outpatient drug and alcohol rehabilitation organization with 120 programs in 10 states, and Hazelden Treatment Centers, one of the world’s largest and most respected private not for profit alcohol and drug addiction treatment centers, to share the benefits of using the Rx DrugSAFE product with its patients. In addition, we also plan on targeting Kinder Care Learning Centers, a Knowledge Learning Corporation Company and Tutor Time, two of the nation’s leading providers of early childhood learning and school age education and care, which are required to lock up medications by law.

Hospice Leasing Program

In any business, it is generally desirable to have some form of recurring revenue model, where the business can expect to receive payment on products or services on a monthly or other regular basis, such as through a leasing arrangement. Although Rx DrugSAFE products may be difficult to market on a recurring revenue basis, we have identified hospice facilities as a segment of the market that could benefit from leasing as opposed to purchasing Rx DrugSAFE and Rx DrugSAFE PRO units.

Medications used by hospice patients are often stored and dispensed at the point of care in the patient’s hospice room. The family and friends of a hospice patient may be concerned the security of these medications. When family members and friends visit the patient, these visits are often unsupervised and it is easy for an inquisitive teen, other family members or friends with the wrong motivation to steal a patient’s pain medications without the knowledge of the patient, the family or the hospice staff.

| 17 |

To eliminate this concern, we plan to develop a leasing program for hospice facilities. For the family of a hospice patient, it may not make practical sense for them to purchase the Rx DrugSAFE. However, leasing the product from the hospice may make more sense. The hospice facilities we have spoken with believe such a program could be effective and some appear interested in offering the product as part of the services available patients. For each Rx DrugSAFE product leased, the facility would receive a percentage of the monthly lease cost. The benefit for Rx Safes, Inc. is that each unit is easily reprogrammable back to factory default once a patient has passed and the family no longer needs the unit. One single Rx DrugSAFE unit can be used over and over within the same facility and continue generating revenue for us and the hospice.

Shipping

Orders for our products are either placed on line at our website or certain customers will call and place a telephone or fax order which we enter into our online ecommerce store. Presently with minimal inventory, orders are shipped directly by the company from our offices but if a larger order comes in, we plan to ship to our warehousing and distribution partner Exxtra Express and products will be shipped from there. Exxtra Express, is located at 8640 Slauson Avenue, Pico Rivera, CA 90660. Orders are expected to be sent to the warehouse on a daily basis, either by fax, email or my providing access to our online order system.

Government Regulation and Legislative Developments

Food and Drug Administration Registration

Our ultimate goal is to facilitate accessibility to our products for the entire patient population. In order to accomplish this, we will need to obtain Food and Drug Administration (FDA) recognition and approval of the Rx DrugSAFE as a medical device to enable us to offer the product through health plans and have the majority of the acquisition costs reimbursable by Medicaid, Medicare and/or other health insurance providers.

The FDA regulates medical devices through the Center for Devices and Radiological Health (CDRH). The Food, Drug and Cosmetic Act and implementing regulations regulate the certification of medical devices. Medical devices must comply with the standards enforced by the CDRH to pass certification. Once a device has been registered with the FDA, the device will appear on a list of FDA registered devices which is accessible through a searchable database by the general buying public. It is also a requirement of many insurance providers that such devices must be registered with the FDA and comply with applicable regulations and controls in order to be covered under insurance plans.

In 2011, we began the process of establishing our business as a “device establishment” to be entered into the FDA Registration and Device Listing Database. We were assigned an Owner Operator Number 10036866, a Listing Number D124488 and requested a new Product Code for our products so that they could be recognized as medical devices. Due to the lack of capital at the time, we did not complete the registration process, which incidentally has to be renewed on an annual basis. With our newly designed product, it is our intention to once again pursue device registration in order to move to the next step of making our product accessible and reimbursable through Medicaid, Medicare and other insurance providers.

Commonwealth of Massachusetts

On August 9, 2010, Massachusetts Governor Deval Patrick signed a bill into law requiring every pharmacy located in the Commonwealth of Massachusetts to make available lock boxes for sale at each location commencing January 1, 2011. The new law, Chapter 283 of the Acts of 2010, added Safeguards to the Prescription Monitoring Program and to Substance Abuse Education and Prevention.

This new legislation mandates that pharmacies offer for sale, and stock, a secure prescription medication safe in all stores located within the Commonwealth. This is the first such law in the United States and similar legislation may be introduced in the near future. This may be a very significant event for our company and products if other states and local governmental units take the initiative to require pharmacies to carry locking prescription safes and there is compulsory enforcement by the government.

| 18 |

Manufacturing/R&D

We have an established relationship with a contract manufacturer/sourcing company called Good Promotion, LTD., located in Shenzen, China. We have been working with this company for over 4 years from the manufacturing of our original safe product through the redesign and cost reduction effort we completed in 2013. Good Promotion acts as our representative in China and sources materials, components and contracts with a specialist electronics manufacturer for the production of the fingerprint module that is used in our products. Good Promotion then manufactures the body of the safe and assembles the mechanical and electronic components, delivering us a finished, packaged product. Good Promotion also offers custom design and development services and was also responsible for the re-design of the mechanical locking mechanism and other hardware features of our current product.

We have no written agreement with Good Promotions to manufacture our products. Our arrangement with our manufacturer to acquire inventory is strictly through purchase orders.