Attached files

| file | filename |

|---|---|

| 8-K - 8-K - 180 DEGREE CAPITAL CORP. /NY/ | v404626_8k.htm |

| EX-99.2 - EX-99.2 - 180 DEGREE CAPITAL CORP. /NY/ | v404626_ex99-2.htm |

2015 Annual Letter to Shareholders

Fellow Shareholders:

Building transformative companies from disruptive science is a “home-run” game. To be successful, Harris & Harris Group has to nurture many disruptive ideas coming from breakthrough scientific research. Yet, only a small subset, over a span of five to fifteen years will find the right market, at the right time and execute heroically to become companies that transform their respective markets. These “home-runs” are the companies that generate the majority of all returns in a venture capital portfolio.

Our business is unlike most businesses that people usually invest in whose performance can be more easily measured on a quarter-by-quarter or even a year-by-year basis. A publicly traded venture capital company, such as Harris & Harris Group, is much less predictable in terms of when growth may occur, if such growth occurs at all. The mathematical/economic language used to describe the behavior of our returns versus those of standard operating companies is that we operate on a power law distribution, not a normal distribution. This means that a small handful of investments - or even a single investment - can radically outperform all the others. This outperformance generates growth that may take time to realize but that can cause rapid growth in metrics such as net asset value per share (“NAV”) and stock price. This concept is well described in chapter seven of Peter Thiel’s recent book Zero to One. It is worth reading, especially pages 84-89, if you would like to familiar yourself with power laws in venture capital.

“The biggest secret in venture capital is that the best investment in a successful fund equals or outperforms the entire rest of the fund combined.” - Peter Thiel, Zero to One, Pg. 86.

We realize this characteristic of Harris & Harris Group makes it a difficult stock to hold. We acknowledge that by the two important metrics, it looks like our company and our portfolio is not progressing. Our stock price has decreased significantly, and our NAV has not yet begun to increase, ending 2014 at $3.51. We also realize that until such time as we realize this power law effect resulting from a “home-run” return, we can believe it will occur, even if that belief is ultimately unfounded. That is the dilemma our shareholders face and why it is a difficult stock to hold. But it is also the reason why it can be very rewarding to hold if and when a “home-run” is developing.

We continue to remain positive on our business because of the following three reasons. First, our team has shown itself capable of identifying and building companies that yielded positive returns. BioVex Group, Inc., Molecular Imprints, Inc., Solazyme, Inc., and Xradia, Inc., are all recent examples. We have not yet experienced a “home-run” return over the past ten years, but we have seen a few returns that yielded multiple times our original investment.

Second, we believe we have the opportunity to realize multiple “home-runs” in our existing maturing portfolio. We believe these returns, if they occur, will meaningfully impact NAV and stock growth, albeit perhaps suddenly, rather than incrementally over time. For example, although it is too early to tell definitively, D-Wave Systems, the company that sold the world’s first commercial quantum computer, is taking a leadership position in a market that could transform computing over the coming decades. If successful, this is clearly a company that could be worth billions, not millions. That said, there remains a substantial amount of risk associated with that investment and it may not generate a return to us at all.

| 1 |

Third, we believe our portfolio and the areas we are now investing in are positioned well for the critical high growth areas of the next decade. Probably the most challenging part of building early stage companies is to anticipate the main technological and market trends five to ten years into the future. Even if a start-up 1) is founded by an extraordinary team, 2) has strong intellectual property, 3) is run by proven, successful management, and 4) can execute flawlessly on time and on budget, it can still fail to generate an outsized investment return. If a company is too far ahead of the market, it may fail owing to slow adoption of its products or technology. If a company is too short-sighted, it will be fighting hordes of competitors and will have likely missed the rapid expansion phase for its industry. The timing for a new product introduction must be just right in order to generate outsized financial returns.

Historically, Harris & Harris Group’s investment team has demonstrated its ability to identify and pursue industry domains positioned for rapid future growth. In some cases, such as printable electronics for the Internet of Things (IoT) (Kovio) and laser-based light sources for the digital cinema market (Laser Light Engines), we were too early for the market. In other areas such as rechargeable batteries (Contour Energy) or optical components (NeoPhotonics and NanoOpto), we were too slow to recognize the future winners and invest ahead of the curve. Yet even in cases where we did not deliver expected returns, our team has been right about the fundamental assumptions of emerging market trends and next generation technologies. We believe we have just been off target on timing.

However, over the past decade, our thesis-driven investments in other areas have played out. BioVex, an oncolytic virus company with a systemic response, was an early investment in the area of immuno-oncology. We continue to believe this area still presents opportunities for us going forward. Solazyme was an investment in applying high throughput genetic tools to microorganisms, with applications in non-animal based protein sources as well as green chemicals. Molecular Imprints and Xradia were investments in the next generation semiconductor equipment area.

Looking to the present, other thesis-driven investments now appear to be playing out. D-Wave is an investment in the area of quantum computing, an area we have broadened into machine learning, deep learning and computational statistics, more recently. Additionally, Adesto and HZO are investments focused in the emerging growth area of IoT, and our timing currently appears very fortuitous for both companies, unlike Kovio, where we were too early. Finally, Enumeral Biomedical was able to raise capital and list publicly based largely on current and sustained interest in immuno-oncology companies.

So what are we excited about now, and how do we envision the world in 2025? Our overarching technological theme remains BIOLOGY+, investments in interdisciplinary life science companies where biology innovation is intersecting with innovations in areas such as electronics, physics, materials science, chemistry, information technology, engineering and mathematics. Within this broad thesis, there are several technological and market trends that we believe should be conducive for outsized investment returns in the mid and long term.

| 2 |

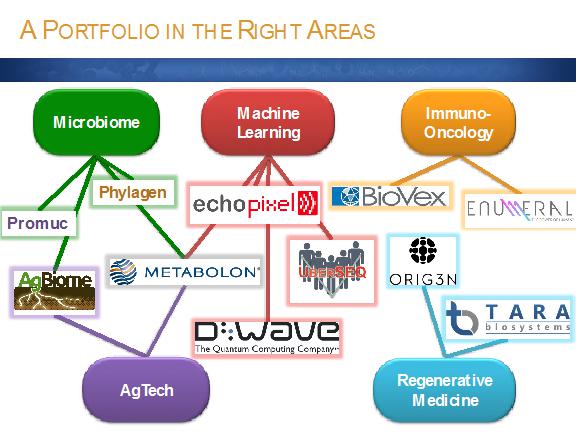

The slide above identifies five fields within BIOLOGY+ that we are actively involved with and where we are continuing to look for future investment opportunities. You will note that a defining feature of our interdisciplinary team and our BIOLOGY+ focus is that many of these companies may intersect other areas of our interest as well.

The first field is machine learning. Machine learning is a scientific discipline that explores the construction and study of algorithms that can learn from data. Such algorithms operate by building a model from example inputs and using that to make predictions or decisions, rather than following strictly static program instructions. It is closely related to computational statistics and includes deep learning. We are living in a transitionary period from database reporting, which utilizes structured data cleaned and entered by humans, to correlation engines that enable computers to “see and hear” information from bit streams. Historically, many promising solutions to pattern recognition were not pursued owing to their difficult computing requirements. Today, powerful machine learning algorithms are being simplified, leading to groundbreaking insights.

We believe machine learning is beginning to penetrate data-driven businesses in the life sciences. As the life sciences continues to adopt insights that will come from the application of computational statistics to the field, this new knowledge will lead to better healthcare outcomes, more personalized medicine, and more sensitive and specific diagnostic decision making. Additionally, even more powerful algorithms can be processed with D-Wave’s quantum computing system, a “natural” tool for statistical sampling and advanced processing of deep learning problems.

| 3 |

The second field is the microbiome. The microbiome is defined as the totality of the microorganisms in a particular environment. Rapidly developing sequencing methods and analytical techniques are enhancing our ability to understand the microbiome - human, plant or the built environment microbiome. By understanding the environment of these systems and how the microorganisms within them interact with the host, we can impact human health, plant vitality and the environments we reside in daily.

The third area is AgTech. It is predicated that the world population will be over 9 billion by 2050 and that 60 percent more food will be required. In order to meet these food demands, the agriculture industry will need to become much more efficient and productive. Advances in agriculture technology such as crop protection, precision agriculture, plant-based protein sources, soil sensing, synthetic biology, farm robotics, and hydroponics will help achieve these goals.

The fourth area is regenerative medicine. Regenerative medicine is the process of replacing, engineering or regenerating human cells, tissues or organs to restore normal function. Regenerative medicine aims to harness tissue engineering, molecular biology and stem cell science to replace or regenerate human tissues or organs. The promise of regenerative medicine is to be able to fully heal the tissue and organs of patients that cannot otherwise be treated or recover from disease.

The fifth area is immuno-oncology. There are a number of therapies available to treat a variety of types of cancers. Many of these therapies operate independent of probably the best source of a cure, the human immune system. Recent advances in the understanding of the human immune system allow for development of personalized and targeted combination therapies that partner with and/or control our innate ability to fight such diseases. This field is referred to as immuno-oncology, and it is producing some of the most efficacious therapies for cancer with either no or with dramatically fewer side effects. Additionally, the ability to control one’s immune system is leading to completely new treatments that are personalized for that individual’s tumor type and other physiologic attributes.

There are other fields we believe will hold the promise of “home-run” investment opportunities as well. As we make investments in these areas over the coming years, we will begin to identify and define these areas for our shareholders. Thus far in 2014, we have made two new investments. The first, Phylagen, is a seed stage investment in a company focusing on the microbiome of the built environment. It brings together the founder of Solazyme, Harrison Dillon, with a leading researcher in the field. The second investment is a founding investment in ORIG3N. ORIG3N is a regenerative medicine company using Nobel Prize-winning technology in the stem cell area to develop breakthrough treatments for rare genetically inherited diseases in the fields of heart, liver and neurodegenerative disease.

We will continue to make follow-on investments in existing companies and in new companies that we believe have the potential to succeed at vast scale. These are the investments that have the potential to outperform the rest of our investments combined.

Our strengths as a firm are our multi-disciplinary team, our long relationships with entrepreneurs and universities, the start-up investing ecosystem we have built, and our ability to correctly identify the right areas to be investing in for the future. Our weakness is that we are not investing at the scale that is required to be competitive as a public company in deep science. We recognize that. We are usually the smallest investor in many of our most promising investments, even though we are often the first investor in these companies. When our most promising companies begin to scale and raise rounds of $30 million to $60 million, as D-Wave, Mersana and Nantero recently raised, and as BioVex and Solazyme historically raised, we are tiny contributors in those financings and are diluted rapidly.

| 4 |

Until we realize exits, which we have stated we believe are coming over the next few years, and, likely, until we recognize a “home-run” investment from our current portfolio, we are not going to be at the ideal scale for our deep science investing model. Thus until we have access to more capital, we are focused on working with our best companies to get them to scale and to get them to exit. We are also focused on positioning ourselves to have access to capital as these events occur. We continue to believe this will happen over the next few years.

We are excited about the potential to realize home-runs in our current and future portfolio companies and the potential value that we believe will be created for our shareholders from such returns.

Thank you for your support.

|

|

| Douglas W. Jamison | Daniel B. Wolfe |

| Chairman, Chief Executive Officer | President, Chief Operating Officer, |

| and Managing Director |

and Managing Director |

|

|

| Misti Ushio | Alexei A. Andreev |

| Chief Strategy Officer and Managing Director | Executive Vice President and Managing Director |

March 16, 2015

This letter may contain statements of a forward-looking nature relating to future events. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. These statements reflect the Company's current beliefs, and a number of important factors could cause actual results to differ materially from those expressed in this letter. Please see the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2014, as well as subsequent filings, filed with the Securities and Exchange Commission for a more detailed discussion of the risks and uncertainties associated with the Company's business, including but not limited to, the risks and uncertainties associated with venture capital investing and other significant factors that could affect the Company's actual results. Except as otherwise required by Federal securities laws, the Company undertakes no obligation to update or revise these forward-looking statements to reflect new events or uncertainties. The references to the websites www.HHVC.com, www.newscientist.com and www.youtube.com have been provided as a convenience, and the information contained on such websites is not incorporated by reference into this letter. Harris & Harris Group is not responsible for the contents of third party websites.

| 5 |