Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Cell Source, Inc. | Financial_Report.xls |

| EX-21 - EXHIBIT 21 - Cell Source, Inc. | v401669_ex21.htm |

| EX-31.1 - EXHIBIT 31.1 - Cell Source, Inc. | v401669_ex31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - Cell Source, Inc. | v401669_ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D. C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the year ended December 31, 2014

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from

Commission file number 333-187049

Cell Source, Inc.

(Exact name of registrant as specified in its charter)

| Nevada | 32-0379665 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

65 Yigal Alon Street

Tel Aviv Israel 67433

(Address of principal executive offices)

011 972 3 562-1755

(Issuer's telephone number)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. o Yes þ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. þ Yes o No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. o Yes þ No

Explanatory Note

Cell Source, Inc. is not subject to the filing requirements of section 13 or 15(d) of the Securities Exchange Act of 1934 (the "Exchange Act"), and files reports with the SEC voluntarily. Cell Source, Inc. has filed all Exchange Act reports for the preceding 12 months.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). þ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K . o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer”, and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o |

| Non-accelerated filer o | Smaller reporting company þ |

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act) ¨ Yes þ No

As of June 30, 2014, the aggregate market value of the issued and outstanding common stock held by non-affiliates of the registrant was $25,600,967, based on the closing sale price as reported on the OTC Markets.

As of March 11, 2015, there were 23,579,256 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE – None.

CELL SOURCE, INC.

FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014

INDEX

Overview

TTSI Corporate History

Cell Source, Inc. (the "Company") is a Nevada corporation formed on June 6, 2012 under the name Ticket to See, Inc. ("TTSI"). Prior to the Share Exchange (as defined below), we did not have any significant assets or operations. Cell Source, Inc. is the parent company of Cell Source Ltd. ("Cell Source Israel"). Cell Source Israel was founded in Israel in 2011 in order to commercialize a suite of inventions relating to certain cancer treatments.

Share Exchange

On June 30, 2014 (the “Closing Date”), TTSI entered into and closed a Share Exchange Agreement (the “Share Exchange Agreement”) with Cell Source Israel and 100% of the shareholders of Cell Source Israel (the “CSL Shareholders”) whereby Cell Source Israel became the wholly-owned subsidiary of TTSI and TTSI changed its name to Cell Source, Inc. (the "Share Exchange"), and whereby certain CSL Shareholders, holding 18,245,923 of the outstanding shares of Cell Source Israel, transferred to the Company an aggregate of 18,245,923 shares of Cell Source Israel’s ordinary shares, each of nominal value of NIS 0.01 (“CSL Ordinary Shares”) in exchange for an aggregate of 18,245,923 newly issued shares of the Company's Common Stock, par value $0.001 per share (the “Company Common Stock” or the "Common Stock"). The aggregate of 18,245,923 shares of newly issued Company Common Stock represents 78.5% of the outstanding shares of Company Common Stock following the Closing Date. In addition, outstanding five (5) year warrants to acquire 4,859,324 CSL Ordinary Shares at an exercise price of $0.75 per share (the "CSL Warrants") were exchanged for newly issued warrants to purchase shares of Company Common Stock (the “Company Warrants”), which Company Warrants contain substantially similar terms as the CSL Warrants. In addition, outstanding warrants to acquire 2,043,835 CSL Ordinary Shares held by Dr. Reisner and Yeda were exchanged for warrants to purchase shares of Company Common Stock (the “Researcher Company Warrants”), which Researcher Company Warrants contain substantially similar terms as their warrants to acquire CSL Ordinary Shares. The aggregate of 6,903,159 Company Warrants and Researcher Company Warrants represents 77.5% of the outstanding warrants to purchase Common Stock of the Company following the Closing Date.

Cell Source Israel's Private Placement

Beginning in November 2013, Cell Source Israel collected and entered into a series of subscription agreements (the “Subscription Agreement”) with certain accredited investors (the “Investors”) in a private placement offering (the “Private Placement”). Cell Source Israel held closings of the Private Placement between December 9, 2013 through April 7, 2014, pursuant to which Cell Source Israel sold an aggregate of 4,759,324 Units (the "Units"), at a purchase price of $0.75 per Unit, for gross proceeds of $3,569,475. Each Unit consists of one (1) share of CSL Ordinary Shares and one (1) CSL Warrant. Each CSL Warrant entitled the holder to purchase one (1) share of CSL Ordinary Shares for a five (5) year period at an exercise price of $0.75 per share. In connection with the Private Placement, Cell Source Israel relied upon the exemption from securities registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”) and Rule 506 as promulgated under the Securities Act for transactions not involving a public offering.

Under the Subscription Agreement, the Investors were granted the following rights for a period of five (5) years commencing on the closing of the Private Offering: (i) in the event any shares of CSL Ordinary Shares or securities convertible, exchangeable or exercisable for CSL Ordinary Shares are issued at a price less than $0.75 per share (“Adjustment Event”), subject to certain adjustments, then additional CSL Ordinary Shares, or equivalents, will be issued to the Investors such that the aggregate holdings of the Investors is equal to the aggregate holding had such Investors initially purchased at the applicable lower price by which securities were issued in the Adjustment Event (except that certain issuances set forth in the Subscription Agreement would not be an Adjustment Event); and (ii) upon any financing by Cell Source whereby CSL Ordinary Shares or securities convertible into CSL Ordinary Shares are issued or sold (a “Subsequent Financing”), Investors have the right to participate in such Subsequent Financing (subject to customary exemptions). The Investors were also granted the right to elect up to two (2) independent board members. On May 29, 2014, the majority of the Investors granted certain groups of shareholders the right to elect, subject to the closing of the Share Exchange Agreement, Yoram Drucker, Itamar Shimrat, David Zolty, Ben Friedman and Dennis Brown to the Board of Directors of the Company. Furthermore, pursuant to the Subscription Agreement, in the event that the Registration Statement is declared effective, the Company is obligated to issue to certain founders of Cell Source Israel (Isaac Braun, Saar Dickman, Itamar Shimrat and Yoram Drucker) warrants to purchase an aggregate of 3,000,000 shares of Company Common Stock at an exercise price of $0.75 per share, subject to the same adjustments and terms as the Company Warrants.

In connection with the Private Placement, Cell Source Israel also entered into a Registration Rights Agreement (the “Registration Rights Agreement”) with the Investors, pursuant to which Cell Source Israel agreed to file a registration statement (the “Registration Statement”), registering for resale (i) all CSL Ordinary Shares, or securities into which they were exchanged, that were included in the Units; and (ii) all CSL Ordinary Shares, or equivalent securities, issuable upon exercise of the Investor Warrants or upon exercise of warrants into which the Investor Warrants were exchanged. The Company filed the Registration Statement on August 8, 2014 and it was declared effective by the Securities and Exchange Commission on November 10, 2014.

| 1 |

As a result of the Share Exchange, the Company assumed the obligations of Cell Source Israel under the Subscription Agreement and Registration Rights Agreement.

In July and August 2014, the Company, Cell Source Israel and the majority of the Investors entered into Amendment No. 1 (the “RRA Amendment”) to the Registration Rights Agreement in order to amend a definition in the Registration Rights Agreement to more accurately reflect the understanding of the parties. Pursuant to the RRA Amendment, the definition relating to the deadline to file the Registration Statement was corrected such that the Company became obligated to file the Registration Statement on or prior to the 60th day after the closing of the Share Exchange Agreement (the “Registration Filing Date”). The RRA Amendment did not change any other term of the Registration Rights Agreement, including the obligation of the Company to get the Registration Statement declared effective within 120 days of the Registration Filing Date.

The foregoing descriptions of the Private Placement and related agreements and transactions do not purport to be complete and are qualified in their entirety by reference to the complete text of such agreements.

Implications of being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or JOBS Act, enacted in April 2012. An “emerging growth company” may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| · | being permitted to present only two years of audited financial statements and only two years of related Management’s Discussion & Analysis of Financial Condition and Results of Operations in this report on Form 10-K; |

| · | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended, or the Sarbanes-Oxley Act; |

| · | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and |

| · | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

We may take advantage of these provisions until the last day of our fiscal year following the fifth anniversary of the date of the first sale of our common equity securities pursuant to an effective registration statement under the Securities Act of 1933, as amended, or the Securities Act, which such fifth anniversary will occur in 2018. However, if certain events occur prior to the end of such five-year period, including if we become a “large accelerated filer,” our annual gross revenues exceed $1.0 billion or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to the end of such five-year period.

We have elected to take advantage of certain of the reduced disclosure obligations and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our stockholders may be different than you might receive from other public reporting companies in which you hold equity interests.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, we are choosing to “opt out” of such extended transition period, and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that this decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

Notwithstanding the above, we are also currently a “smaller reporting company”, meaning that we are not an investment company, an asset-backed issuer, nor a majority-owned subsidiary of a parent company that is not a smaller reporting company, and has a public float of less than $75 million and annual revenues of less than $50 million during the most recently completed fiscal year. Some of the reduced disclosure and other requirements available to us as a result of the JOBS Act may continue to be available to us after we are no longer considered an “emerging growth company”. Specifically, similar to “emerging growth companies”, “smaller reporting companies” are able to provide simplified executive compensation disclosures in their filings; are exempt from the provisions of Section 404(b) of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the effectiveness of internal control over financial reporting; and have certain other decreased disclosure obligations in their SEC filings, including, among other things, only being required to provide two years of audited financial statements in annual reports. Decreased disclosures in our SEC filings due to our status as an “emerging growth company” or “smaller reporting company” may make it harder for investors to analyze our results of operations and financial prospects.

| 2 |

Cell Source Israel Corporate History

Prior to the Share Exchange, Cell Source Israel was a privately held company located in Tel Aviv, Israel. Cell Source Israel was founded in 2011 in order to commercialize a suite of inventions that were the result of over ten (10) years of research at the Weizmann Institute of Science in Rehovot, Israel (“Weizmann Institute”). Pursuant to a Research and License Agreement by and between Cell Source Israel and Yeda Research and Development Company Limited ("Yeda"), dated October 3, 2011, as amended on April 1, 2014 (the “Yeda License Agreement”), Yeda, the commercial arm of the Weizmann Institute, granted Cell Source Israel an exclusive license to certain patents, discoveries, inventions, and other intellectual property generated (together with others) by Yair Reisner, Ph.D. (“Dr. Reisner”), head of the Immunology Department at the Weizmann Institute.

Our Business

We are a cell therapy company focused on immunotherapy and regenerative medicine. Our technology seeks to address one of the most fundamental challenges within human immunology: how to tune the immune response such that it tolerates selected desirable foreign cells, but continues to attack all other (undesirable) targets. In simpler terms, many potentially life-saving treatments have limited effectiveness today because the patient’s immune system rejects them. Today rejection is partially overcome using aggressive immune suppression treatments that leave the patient exposed to many dangers by compromising their immune system. The ability to overcome rejections without having to compromise the rest of the immune system may open the door to effective treatment of a number of severe medical conditions are characterized by this need. These include:

| · | Haematological malignancies (leukemias, lymphomas, etc.). One of the most effective treatments for these conditions is bone marrow transplantation. However, this is a risky and difficult procedure primarily because of potential conflicts between host and donor immune systems. |

| · | Non-malignant haematological conditions (such as sickle cell anemia) which could also be largely treated by bone marrow transplantation if the procedure did not pose such threatening conflicts between host and donor immune systems. |

| · | Organ failure and transplantation. A variety of conditions can be treated by the transplantation of vital organs. However, transplantation is limited both by the problem of rejection and an insufficient supply of available donor organs. |

Discussion

Haematological Malignancies

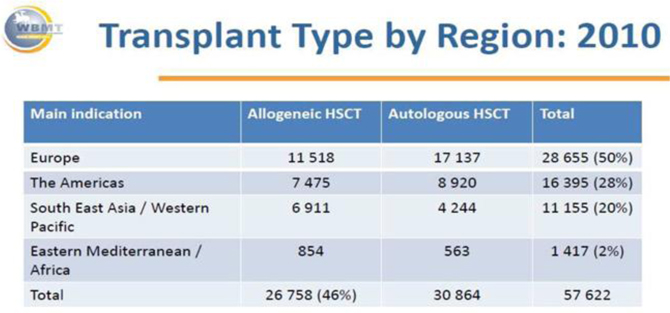

Haematological malignancies (blood cancers) comprise a variety of lymphomas and leukemias. A very important treatment protocol for these malignancies involves the use of hematopoietic stem cell transplantation (“HSCT”). To the best of our knowledge, approximately 50,000 bone marrow transplantations are performed annually worldwide (table below). Our technology will be immediately applicable to, at a minimum, the 47% of worldwide bone marrow transplants that are allogeneic (using cells taken from another individual).

Source: Worldwide Network for Blood and Marrow Transplantations

| 3 |

HSCT has a curative effect when successful. However, it is very risky. HSCT involves destroying the patient’s native immune system with radiation or chemotherapy (myeloablation) before the transplantation, and then suppressing immune response (immunosuppression) with drugs to manage the conflicts between host and donor cells, often for the rest of the patient’s life. Approximately 50% of all transplant patients die within two (2) years of transplantation due to either aggressive pre-transplant immune suppression or post-transplant complications such as infections.

Myeloablation and immunosuppression are dangerous and difficult to tolerate, especially in patients over age 50. Therefore HSCT has been largely off-limits to the older patient population and has traditionally been used only when said older patient is clearly terminal.

This means that:

| a) | Many blood cancer patients are not candidates for the primary treatment (HSCT) that represents a potential cure; |

| b) | there is high mortality among those patients who are candidates for HSCT and do undergo the procedure; and |

| c) | those patients who successfully undergo and survive HSCT take dangerous, expensive, and quality-of-life reducing immunosuppression medications, typically for a prolonged period of time. |

There is widespread awareness of the need for improved immune-system management technologies for HSCT – both to improve outcomes of transplantations that have already taken place and to make transplantation safe enough to become appropriate for older patients and those with earlier-stage diseases.

We aspire to use Veto-Cell technology to dramatically improve the outcomes of the allogeneic transplantations already being performed, and thereby to rapidly penetrate the current market. However, our target population greatly exceeds those patients who currently undergo HSCT, as the firm’s tolerizing technology could potentially make allogeneic transplantation an option for a much larger proportion of the diseased population. The following table shows the prevalence of the specific haematological malignancies on which we will focus:

| Initial Malignancy Indications (note estimates for North America and EU only (1)) | Prevalence (Number patients) | Annual Bone Marrow Transplantations | ||||||

| Non-Hodgkins Lymphoma | 823,000 | 8,700 | ||||||

| Multiple Myeloma | 134,000 | 13,500 | ||||||

| Chronic Lymphocytic Leukemia | 117,000 | 1,500 | ||||||

| Total | 1,074,000 | 23,700 | ||||||

(1) assumes European Union prevalence is approximately same as US

Source: Medtrack, Centers for Disease Control, Journal of Clinical Oncology.

For the purposes of this document, it is assumed that the immediate candidates for Cell Source-enabled HSCT will be the subset of cancer patients that today receive transplantations as part of their cancer treatment (rightmost column in table above). We believe that these patients will benefit from Veto-Cell adjunct therapy, as such therapy aspires to improve the success and reduce the risk and mortality of a procedure that they are having anyway. With time, as Veto-Cell treatment becomes more widespread and data is accumulated, we believe that the percentage of patients that will be referred for Veto-Cell enabled HSCT will increase significantly.

It is also important to note that incidence of these diseases is increasing, with up to a 77 percent increase in the number of newly diagnosed hematologic malignancies among the older population expected to occur over the next 20 years. See Mohamed L. Sorror et al., Long-term Outcomes Among Older Patients Following Nonmyeloablative Conditioning and Allogeneic Hematopoietic Cell Transplantation for Advanced Hematologic Malignancies, J. Am. Med. Ass'n, Nov. 2, 2011, at 1874.

HSCT Market Trends

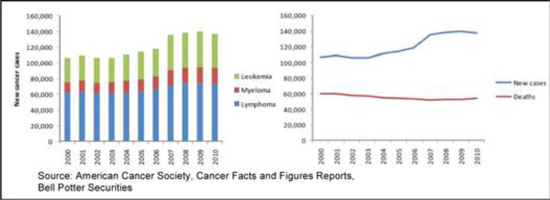

There are four important market trends affecting the haematological malignancies market:

| (1) | As noted above, increasing incidence of these disorders in the West, largely driven by the aging population. |

| (2) | Improvement and proliferation of HSCT treatments. |

| (3) | A “virtuous circle” of lowered death rate due to better transplantations leading to more aggressive focus on HSCT. |

| (4) | The growing use of “reduced intensity conditioning,” i.e., lower myoablative dosing, which makes the procedure more survivable for older patients. |

| 4 |

The trends are highlighted on the above charts. The incidence (above left) of leukemias and other blood cancers has been rising. At the same time (above right) death rate from these conditions has been falling. The improving death rate is largely due to the proliferation of better HSCT techniques. (Source: Bell Potter Securities.)

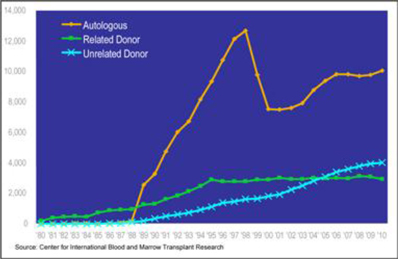

These trends have led to, and been driven by, the increasing number of transplantations as shown in the graphic below. Note that the most significant growth since 2000 is in the area of allogeneic transplantations, including transplantations from unrelated donors (light-blue line).

However, despite the above trends, the use of HSCT, especially allogeneic, remains generally limited to younger, healthier patients because of the risks associated with the myeloablative treatments required to reduce the host immune response and Graft versus Host Disease (“GVHD”). This means that the “gold-standard” of treatment is largely unavailable to the age cohort that makes up the majority of sufferers of these diseases.

The Company aspires to addresses this issue in a distinctive manner by significantly reducing the need for myeloablative treatment and avoiding the risk of GVHD, thereby improving the outlook for allogeneic transplantations and enabling their use in a much larger population set.

Relevant Non-Malignant Diseases

While Hematological malignancies represent the Company's initial focus, the Company's selective immune response blocking technology may also be effective in treating certain non-malignant blood and immune system disorders. This would represent an additional growth opportunity for the Company.

The target non-malignant diseases are widespread. The Company's first non-malignant disorder target is expected to be sickle cell anemia. This is a serious and relatively common disease.

Sickle cell anemia can be treated by HSCT which replaces the defective bone marrow cells. However, because of HSCT’s riskiness, the procedure is currently used only in extreme cases. If successful in enabling safer HSCT, the Company will make this treatment available to a broader set of sickle cell anemia sufferers. As the therapy would be introduced in the form of bone marrow transplantation, we assume that only patients with relatively severe forms of the disease will initially be candidates. As such, only a minority of sickle cell anemia patients will be treatment candidates.

| 5 |

A second target within non-malignant disorders is support of organ transplantations (kidney, liver, etc.). Approximately 60,000 such procedures are conducted in North America and the EU each year. As with bone marrow transplantations, organ transplantations require substantial immunosuppression to prevent rejection. This ongoing treatment is dangerous, quality-of-life reducing, and costly. The Company's Veto-Cell technology can potentially be used to selectively reduce immune response to the transplanted organ, thus reducing the need for aggressive immunosuppression post transplantation.

Market Access and Channels

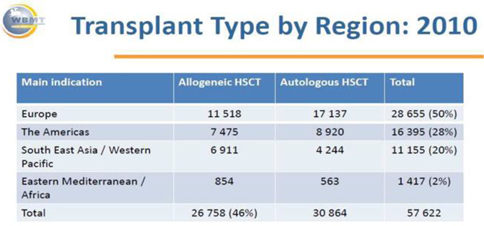

The market for transplantation therapies is relatively concentrated. There are approximately 1,400 transplantation centers worldwide, with the vast majority of them concentrated in the Americas (primarily North America) and Europe as indicated in the chart below.

Source: Worldwide Network for Blood and Marrow Transplantations

A relatively small subset of the above centers (often termed “Centers of Excellence”) tends to set the practice standards for the entire transplantation community. Therefore, as discussed in the Strategy section, the Company plans to focus its initial penetration strategy on a relatively small group of influential centers.

Reimbursement issues for our therapies are expected to be relatively straightforward. Once clinical effectiveness and regulatory approval are established, the value-proposition for payors and providers is expected to be clear and compelling. Issues connected with immunosuppression and rejection constitute a major component of bone marrow transplantation costs, and significant improvement in this area is expected to bring substantive cost-savings for payors.

Sector Focus

We are in the general space of cell therapies. This is an emerging field, described by industry analysts as having “Blockbuster potential for regenerative treatments in indications with high level of unmet need.” (Datamonitor.)

Within the cell therapy field, our initial focus is on allogeneic therapies (treatments using donor derived—as opposed to patient derived—cells), with a focus on haploidentical transplantations (transplantations that use cells from partially matched—as opposed to fully matched—donors and recipients). While potentially valuable, allogeneic therapies are relatively complex, risky, and expensive. A key driver of this complexity and associated costs is the conflict between host and donor immune systems, as discussed above.

Our technology, which in preclinical studies has shown the ability to enable tolerance of donor cells without affecting other immune processes, is fundamentally enabling. We expect it to significantly increase the safety, reduce the cost, and therefore broaden the scope of indications for such procedures.

Over time, we aspire to apply these technologies to autologous therapies (the processing and re-transplantation of an individual’s own cells) for example for the treatment of B cell malignancies. All of these treatments would take the form of non-invasive cell suspension treatments administered intravenously. The currently planned treatment modality of fully personalized medicine (i.e., using the patient’s own cells or those of a donor provided expressly by that patient) could, in some cases, eventually be supplanted by a more generic “off the shelf” modality offering which would be marketed as a pre-packaged suspension of cells and medium, taken and stored in advance for each cell “type” and then shipped to patients with the same “type” who have never met the donor. This delivery model is a longer term aspiration for us and is beyond the scope of our current market share projections.

| 6 |

Our Value Drivers

Our current positioning in the cell-therapy and cancer therapy value chain is typical of an early clinical stage company: developing, validating and attaining regulatory approvals for the various applications of our technology platforms. Going forward, once the products are commercialized, physician and patient interest in these treatments is expected to drive insurer reimbursement for patients – a key demand lever. The generic value chain for biotechnology development commences with an invention which is formulated, patented and successful in pre-clinical animal trials. We have already passed this stage with our core platforms (Veto-Cell and Organsource) for which we have an exclusive license to use (or exclusive option to license) from Yeda, the owner of these patents. The next steps in development include human trials (testing first safety and then efficacy). Finally, the offering earns regulatory approval and patient treatment, along with the ensuing revenues, can commence. This can be a particularly lengthy process in the United States and therefore some medical treatments are approved in Europe or Asia and generate revenues there prior to commencing U.S. sales. Recently passed “fast track” regulation in the U.S. is aimed at getting critical treatments for life threatening conditions to patients more quickly.

Our successful preclinical validation of the Megadose Drug Combination treatment and the Veto-Cell treatment involved basic laboratory research including both in-vivo (live) animal trials and in-vitro (in a glass dish) human cell trials. This validates the protocol prior to commencing human clinical trials. Human clinical trials fine-tune the treatment protocol and confirm both safety and efficacy in treating patents. In parallel, the patents on the core technology go into the national phase in various countries and are emended with claims associated with exact treatment protocols, bolstering the protection afforded by already issued patents on the base technology.

In some cases, successful biotech companies have been able to capitalize on positive human clinical results (even prior to full approval for patient treatment) by either signing lucrative non-dilutive distribution option deals or by being partially or fully acquired by larger market participants. There is no indication or assurance that we are currently under consideration for any option or acquisition deal.

We are poised to commence human trials for the Megadose Drug Combination treatment and concurrently finalize human treatment protocols and seek approval for the Veto-Cell based treatments.

We have had positive preclinical results for three of our cell therapy treatments and for our organ generation and regeneration treatments. Yeda, the proprietary owners of the patents underlying our technologies from whom we license our patents, has been granted patents for its original Veto-Cell and for organ generation. The revised versions of the veto cell, additional organs for “Organsource,” and the combination of the Megadose treatment with a currently FDA approved drug (as a combined treatment) are the subject of a pending patent that leverages the priority of the already granted parents for organ generation, Veto-Cell and Megadose, respectively. We plan to conduct human clinical trials with terminal patients in remission. If these trials are successful, they will demonstrate both safety (the patients survived and were not harmed) and initial indications of efficacy (there are signs of prolonging the progression free period).

Science and Technology Overview

Our Technology Portfolio is comprised of two proprietary platforms. All the patents are owned by Yeda, and we license them exclusively on a worldwide basis. The two platforms are: Anti Third Party Veto-Cell and Organsource. Each platform already has been granted patents and has further patents pending. The total relevant patent portfolio consists of 6 inventions, 17 patent families, 11 granted patents, one allowed patent, and a further 78 pending patents. The patents for the Veto Cell and Megadose Drug Combination and T-regulatory cells are already licensed. Those for the organ platform are covered under an exclusive option agreement whereby Cell Source has until December 31st, 2015 to decide whether it wants to license those patents. We currently license all of the patents related to our Anti Third Party Veto-Cell technology from Yeda. The key terms of the agreement pursuant to which we license all of Yeda’s patents related to our technology is set forth in the section entitled “Intellectual Property” herein. The license period (per product, per country) is for the full life of the patents, and expires at the later of the patent expiration date in that country or 15 years after the date that the FDA or local equivalent regulatory authority in each country approves that particular product for sale in that country. As long as Cell Source pays either a nominal license fee of $50,000 per year (total for use of all the products) or pays royalties on product sales on at least one product as per the license agreement, the license will remain in effect continuously and expire only with the expiration of the patent or 15 years after regulatory approval (later of the two) per product per country as described above. Cell Source voluntarily sponsors Research at the Weizmann Institute for the sake of developing its products and treatments from initial invention through to finalization of human treatment protocols. Cell Source has recently extended the initial research period, which terminated in October of 2014, for a further four years through October 2018.

Although Yeda has applied for and been granted various patents related to our technology, a granted patent only provides Yeda, and the Company by virtue of its exclusive license, the right to use the underlying invention. However, in order for our cell-therapy and cancer therapy to be legally sold and administered to patients, the FDA or similar regulatory agencies must approve its use. In other words, having a patent provides legal “freedom to operate” for a certain technology, and may provide the ability to prevent others from using the same technology without the patent holder’s permission. However, in order to legally manufacture and distribute products, a company must go through all of the typical approval steps delineated in the Overview section above.

| 7 |

The following sections provide an overview of each platform. Further information on the underlying science is available upon written request and the execution of an appropriate nondisclosure agreement.

Our primary focus is the Veto-Cell platform. When we licensed the Veto-Cell platform at our inception, we also were granted an exclusive option to license from Yeda the Organsource platform.

Our licensed technology portfolio consists of 6 inventions, 17 patent families, 11 granted patents 1 allowed patent and a further 86 pending patents. The patents for the organ regeneration platform are supported by Cell Source, but we have until the end of 2015 to determine whether we wish to license them. The following table lists the patents and patent applications that Yeda holds and which we have a license to use or an exclusive option to license for use in each of the below-referenced countries:

Cell Source currently licenses the following patents held by Yeda:

| Name: VETO CELLS EFFECTIVE IN PREVENTING GRAFT REJECTION AND DEVOID OF GRAFT VERSUS HOST POTENTIAL | ||||||||||

| Country | Patent Number | Filed | Expires | Status | Assignee | |||||

| USA (Basic) | 6,544,506 | 05-Jan-2000 | 05-Jan-2020 | Granted | Yeda Research and Development Co. Ltd. | |||||

| USA (National Phase) | 7,270,810 | 28-Dec-2000 | 1-Dec-2021 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Europe | 1244803 | 28-Dec-2000 | 28-Dec-2020 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Israel | 150440 | 28-Dec-2000 | 28-Dec-2020 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Name: USE OF ANTI THIRD PARTY CENTRAL MEMORY T CELLS FOR ANTI-LEUKEMIA/LYMPHOMA TREATMENT | ||||||||||

| Country | Patent Number | Filed | Expires | Status | Assignee | |||||

| USA | 13/821,255 | 08-Sep-2011 | 08-Sep-2031 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Japan | 2013-527738 | 08-Sep-2011 | 08-Sep-2031 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Canada | 2,810,632 | 08-Sep-2011 | 08-Sep-2031 | Pending | Yeda Research and Development Co. Ltd. | |||||

| China | 201180053858.9 | 08-Sep-2011 | 08-Sep-2031 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Republic of Korea | 2013-7008892 | 08-Sep-2011 | 08-Sep-2031 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Israel | 225102 | 08-Sep-2011 | 08-Sep-2031 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Brazil | BR 11 2013 005756 4 | 08-Sep-2011 | 08-Sep-2031 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Mexico | MX/a/2013/002668 | 08-Sep-2011 | 08-Sep-2031 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Singapore | 201301743-9 | 08-Sep-2011 | 08-Sep-2031 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Europe | 11773325.3 | 08-Sep-2011 | 08-Sep-2031 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Hong Kong | 14100513.2 | 08-Sep-2011 | 08-Sep-2031 | Pending | Yeda Research and Development Co. Ltd. | |||||

| 8 |

| Name: ANTI THIRD PARTY CENTRAL MEMORY T CELLS, METHODS OF PRODUCING SAME AND USE OF SAME IN TRANSPLANTATION AND DISEASE TREATMENT | ||||||||||

| Country | Patent Number | Filed | Expires | Status | Assignee | |||||

| USA | 14/343,053 | 06-Sep-2012 | 06-Sep-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Europe | 12769743.1 | 06-Sep-2012 | 06-Sep-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Japan | 2014-529143 | 06-Sep-2012 | 06-Sep-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Canada | 2,848,121 | 06-Sep-2012 | 06-Sep-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| China | 201280054739.X | 06-Sep-2012 | 06-Sep-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Australia | 2012305931 | 06-Sep-2012 | 06-Sep-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Republic of Korea | 10-2014-7009267 | 06-Sep-2012 | 06-Sep-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| New Zealand | 622749 | 06-Sep-2012 | 06-Sep-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| South Africa | 2014/01993 | 06-Sep-2012 | 06-Sep-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| India | 577/MUMNP/2014 | 06-Sep-2012 | 06-Sep-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Israel | 231397 | 06-Sep-2012 | 06-Sep-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Russian Federation | 2014110897 | 06-Sep-2012 | 06-Sep-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Brazil | BR 11 2014 005355 3 | 06-Sep-2012 | 06-Sep-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Mexico | MX/a/2014/002771 | 06-Sep-2012 | 06-Sep-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Singapore | 11201400513P | 06-Sep-2012 | 06-Sep-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Name: ANTI THIRD PARTY CENTRAL MEMORY T CELLS, METHODS OF PRODUCING SAME AND USE OF SAME IN TRANSPLANTATION AND DISEASE TREATMENT | ||||||||||

| Country | Patent Number | Filed | Expires | Status | Assignee | |||||

| USA | 13/126,472 | 29-Oct-2009 | 29-Oct-2029 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Europe | 09764302.7 | 29-Oct-2009 | 29-Oct-2029 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Israel | 212587 | 29-Oct-2009 | 29-Oct-2029 | Pending | Yeda Research and Development Co. Ltd. | |||||

| India | 905/MUMNP/2011 | 29-Oct-2009 | 29-Oct-2029 | Pending | Yeda Research and Development Co. Ltd. | |||||

| China | 200980153053.4 | 29-Oct-2009 | 29-Oct-2029 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Russian Federation | 2011121630 | 29-Oct-2009 | 29-Oct-2029 | Granted | Yeda Research and Development Co. Ltd. | |||||

| 9 |

| Name: UNIVERSAL DONOR-DERIVED TOLEROGENIC CELLS FOR INDUCING NON-SYNGENEIC TRANSPLANTATION TOLERANCE | ||||||||||

| Country | Patent Number | Filed | Expires | Status | Assignee | |||||

| US | 11/990,628 | 21-Aug-2006 | 21-Aug-2026 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Europe | 06796063.3 | 21-Aug-2006 | 21-Aug-2026 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Europe (Divisional) | 12161171.9 | 21-Aug-2006 | 21-Aug-2026 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Israel | 189688 | 21-Aug-2006 | 21-Aug-2026 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Name: A COMBINATION THERAPY FOR A STABLE AND LONG TERM ENGRAFTMENT | ||||||||||

| Country | Patent Number | Filed | Expires | Status | Assignee | |||||

| Singapore | 11201403459X | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Mexico | MX/a/2014/007647 | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Brazil | BR 11 2014 015960 2 | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Russian Federation | 2014128479 | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Israel | 233303 | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| India | 61/578,917 | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| South Africa | 2014/05071 | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| New Zealand | 627272 | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Republic of Korea | 61/578,917 | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Australia | 2012355990 | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| China | 61/578,917 | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Canada | 61/578,917 | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Japan | 61/578,917 | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Europe | 12859036.1 | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| USA | 14/367,917 | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Name: A COMBINATION THERAPY FOR A STABLE AND LONG TERM ENGRAFTMENT USING SPECIFIC PROTOCOLS FOR T/B CELL DEPLETION | ||||||||||

| Country | Patent Number | Filed | Expires | Status | Assignee | |||||

| Singapore | 11201403456U | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Mexico | MX/a/2014/007648 | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Brazil | BR 11 2014 015959 9 | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Russian Federation | 61/578,917 | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Israel | 233302 | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| India | 61/578,917 | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| South Africa | 61/578,917 | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| New Zealand | 627549 | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Republic of Korea | 61/578,917 | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Australia | 2012355989 | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| China | 61/578,917 | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Canada | 61/578,917 | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Japan | 61/578,917 | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Europe | 61/578,917 | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| USA | 14/367,923 | 20-Dec-2012 | 20-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| 10 |

Cell Source currently has an option to license, and in the interim is fully funding the following patents:

| Name: METHODS OF TREATING DISEASE BY TRANSPLANTATION OF DEVELOPING ALLOGENEIC OR XENOGENEIC ORGANS OR TISSUES | ||||||||||

| Country | Patent Number | Filed | Expires | Status | Assignee | |||||

| Mexico | 319957 | 04-Mar-2004 | 04-Mar-2024 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Mexico (Divisional) | MX/a/2014/001950 | 04-Mar-2004 | 04-Mar-2024 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Europe | 2216033 | 04-Mar-2004 | 04-Mar-2024 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Name: METHODS OF TREATING DISEASE BY TRANSPLANTATION OF ALLOGENEIC OR XENOGENEIC ORGANS OR TISSUES | ||||||||||

| Country | Patent Number | Filed | Expires | Status | Assignee | |||||

| Europe | 11179593.6 | 04-Mar-2004 | 04-Mar-2024 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Name: THE USE OF DEVELOPING ALLOGENEIC OR XENOGENEIC ORGANS OR TISSUES FOR DISEASE TREATMENT | ||||||||||

| Country | Patent Number | Filed | Expires | Status | Assignee | |||||

| Israel | 170622 | 04-Mar-2004 | 04-Mar-2024 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Name: METHODS OF KIDNEY TRANSPLANTATION UTILIZING DEVELOPING NEPHRIC TISSUE | ||||||||||

| Country | Patent Number | Filed | Expires | Status | Assignee | |||||

| Israel | 218961 | 01-Sep-2002 | 01-Sep-2022 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Name: THERAPEUTIC TRANSPLANTATION USING DEVELOPING, HUMAN OR PORCINE, RENAL OR HEPATIC, GRAFTS | ||||||||||

| Country | Patent Number | Filed | Expires | Status | Assignee | |||||

| USA | 7,780,993 | 19-Jan-2005 | 23-Apr-2023 | Granted | Yeda Research and Development Co. Ltd. | |||||

| USA (Divisional) | 12/777,292 | 19-Jan-2005 | 19-Jan-2025 | Pending | Yeda Research and Development Co. Ltd. | |||||

| 11 |

| Name: DISEASE TREATMENT VIA DEVELOPING NON-SYNGENEIC GRAFT TRANSPLANTATION | ||||||||||

| Country | Patent Number | Filed | Expires | Status | Assignee | |||||

| USA | 11/664,530 | 02-Oct-2005 | 02-Oct-2023 | Allowed | Yeda Research and Development Co. Ltd. | |||||

| Europe | 1809734 | 02-Oct-2005 | 02-Oct-2025 | Granted | Yeda Research and Development Co. Ltd. | |||||

| Europe (Divisional) | 11193959.1 | 02-Oct-2005 | 02-Oct-2025 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Israel | 182363 | 02-Oct-2005 | 02-Oct-2025 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Name: MAMMALIAN FETAL PULMONARY CELLS AND THERAPEUTIC USE OF SAME | ||||||||||

| Country | Patent Number | Filed | Expires | Status | Assignee | |||||

| USA | 14/363,814 | 06-Dec-2012 | 06-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Europe | 12813990.4 | 06-Dec-2012 | 06-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Japan | 61/568,240 | 06-Dec-2012 | 06-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Canada | 61/568,240 | 06-Dec-2012 | 06-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| China | 61/568,240 | 06-Dec-2012 | 06-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Australia | 2012348574 | 06-Dec-2012 | 06-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Republic of Korea | 10-2014-7018702 | 06-Dec-2012 | 06-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| New Zealand | 627071 | 06-Dec-2012 | 06-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| South Africa | 02014/04958 | 06-Dec-2012 | 06-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| India | 1366/MUMNP/2014 | 06-Dec-2012 | 06-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Israel | 233022 | 06-Dec-2012 | 06-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Russian Federation | 2014127338 | 06-Dec-2012 | 06-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Brazil | 61/568,240 | 06-Dec-2012 | 06-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Mexico | MX/a/2014/006756 | 06-Dec-2012 | 06-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Singapore | 11201402902V | 06-Dec-2012 | 06-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| Philippines | 1-2014-501309 | 06-Dec-2012 | 06-Dec-2032 | Pending | Yeda Research and Development Co. Ltd. | |||||

| 12 |

Platform I – Veto-Cell

Background

Our Veto-Cell technology is a next generation cell-therapy technology that enables the selective attenuation of the immune system. In other words, pre-clinical studies suggest that the treatment has the ability to reduce the immune response to selective “threats,” with low risk for adverse side effects.

What makes the Veto-Cell approach unique is the degree to which it leverages the inherent specificity of the human immune system. The immune system defends the body by creating a specific stream of T-cell clones for each of millions of individual threats. A given T-cell will attack only its specific target, ignoring all other threats. Our technology might enable the physician to selectively attenuate immune response, thus effectively “switching-off” an individual stream of T-cell clones without affecting any other such streams of T-cell clones dispatched by the immune system to attack unwanted incursions.

The technology is based on the discovery that certain T-cells have the property of attracting and proactively neutralizing immune attacks on them.

The technology has achieved distinctive results in animal live trial models. See, e.g., Thorsten Zenz, Exhausting T cells in CLL, Blood, Feb. 28, 2013, at 1485. If it succeeds in human clinical trials, we believe that it may have meaningful and potentially broad impact on the field of bone marrow transplantation:

| 1. | Significantly improve outcomes of transplantations by reducing host rejection rate of T-cell depleted bone marrow, markedly reducing both the risk of graft-versus-host-disease and the need for using aggressive amounts of immunosuppression medications. This would significantly reduce the bone marrow transplant mortality rate (currently 50%) and therefore lead to broader use of this treatment. |

| 2. | Substantively increase the number of transplantations by enabling lower myeloablative conditioning and therefore making the therapy accessible to older and sicker patients (who today may not survive ablation). |

| 3. | Further increase the number of transplantations by making transplantation appropriate for other indications (for which today transplantation would be considered an inappropriately risky treatment). |

In addition, our Veto-Cell technology may possibly play a role in the treatment of a number of serious and currently poorly treated non-malignant diseases. Furthermore, initial animal trials have shown potential anti-lymphoma activity.

Mechanism

Our Veto-Cell is a CD8 central memory anti-3rd party T-cell that has five critical properties:

| 1. | It has an outer surface coating that triggers attack by specific host T-cells (and only those specific T-cells). |

| 2. | It can annihilate an attacking T-cell without itself being damaged (specifically, it exposes or releases a death-signaling molecule when an attacking T-cell binds to it). |

| 3. | It has been oriented to attack cells of a simulated third party (i.e., neither host nor donor) and thus exhibits markedly reduced risk of GVHD or graft rejection. |

| 4. | It is long-lived and endures in the body for extended periods. |

| 5. | It migrates to the thymus and lymph nodes. |

The outcome is that when a large number of these cells are introduced into the body, they effectively eliminate the T-cell clones that the immune system dispatches to attack the desirable, transplanted bone marrow cells.

Thus, for example, if a population of Veto-Cells is derived from a donor, they will express the same peptide as do the donor’s cells. Therefore, the specific stream of host T-cells that would ordinarily attack the donor stem-cells, are instead directed to “decoy” Veto-Cells and disabled before they reach the transplantation.

Described in a Blood editorial as a “substantial advance in Cell Therapy," a notable characteristic of our Veto-Cell is that this mechanism is quite specific. Only those specific T-cell clones that were generated to attack cells from this specific donor are disabled. The rest of the immune system essentially remains intact.

This is in marked contrast with conventional immunosuppression which degrades the entire immune system and is therefore associated with severe risk of infection and, in the case of bone marrow transplantations, high mortality.

| 13 |

This effect is long-lived. Firstly, the Veto-Cells themselves are long-lived memory cells. Secondly, when infused with bone marrow cells the latter migrate to the thymus where, over time, they create a new “identity” in the host and initiate “chimerism,” where the host and donor cells peacefully co-exist. This chimerism has the effect of "educating" new T-cells being generated by the thymus to tolerate donor cells. This tolerance can become permanent.

Target Indications

Our Veto-Cell technology, an intravenously administered cell suspension, if successful, could initially be used in bone marrow and other transplantations associated with malignant disorders (i.e., cancers). At a later stage, Veto-Cell technology may be applied to selected non-malignant conditions. The following sections provide a brief overview of the use of the Veto-Cell technology in both of these scenarios.

| i. | Bone Marrow Transplantation |

In order to describe the effect of Veto-Cells in transplantation, it is helpful to first briefly review the state of the art:

In a conventional bone marrow transplant, the recipient first receives myeloablative conditioning – powerful chemotherapy and/or radiation therapy intended to destroy his/her own bone marrow cells. This has a threefold purpose:

| 1. | It destroys the host T-cells so they will not attack (reject) the donor bone marrow cells. |

| 2. | It makes space in the host bone marrow for the new donor cells. |

| 3. | It destroys diseased host blood cells so that they do not proliferate and cause relapse following the procedure. |

In practice however, there are two major problems:

| · | Host rejection – the myeloablative conditioning does not destroy all the host T-cells. Those that remain may aggressively attack the donor bone marrow cells before they can engraft. |

| · | “Graft versus Host Disease” (GVHD) –the transplanted cells include donor T-cells which recognize the host's body as foreign and attack it. |

Both rejection and GVHD are potentially life-threatening complications in and of themselves and also lead to the use of dangerous and costly immunosuppression medications. The Megadose technology addresses the foregoing two problems by introducing an extremely large population of selected donor cells into the host. This overwhelms the remaining host immune system, and therefore, reduces the risk of rejection. It also reduces the risk of GVHD, as the donor cells are selected so as to minimize the number of accompanying T-cells.

Megadose is a well-developed technology and is now used in clinical treatments where a “mismatched” bone marrow blood cancer transplantation is in order.

| ii. | Veto-Cell in Transplantation |

The Veto-Cell technology is a next generation of the Megadose concept. In a transplantation scenario, a population of donor Veto-Cells is created to "escort" the bone marrow cells when they are transplanted. This population is created by identifying donor cells with Veto-Cell properties, exposing them to simulated 3rd party cells (i.e., selecting only those that react to a third person and therefore by definition will not react to either host or donor), and expanding their population in the lab.

The Veto-Cells are then introduced into the host along with the transplanted stem-cells. The host mounts its normal immune response to the donor cells by generating a population of T-cell clones that will bind to any cells expressing markers from this specific donor. In a conventional transplantation, these T-cells would bind to and destroy donor stem-cells thus causing rejection of the transplant.

However, when the transplantation is accompanied by large numbers of Veto-Cells, this rejection mechanism is “ambushed." Since the Veto-Cells express the same donor markers as the stem-cells, the host T-cell clones will attempt to bind to the donor-derived Veto-Cells as noted above, which act as decoys by attracting and then counterattacking and killing the clones before they ever reach the bone barrow transplantation.

| iii. | Direct Anti-Cancer Effect |

A further effect of Veto-Cells has been noted in mouse and in-vitro studies: donor Veto-Cells selectively attack host lymphoma malignant cells. This effect has been robust in animals, in fact completely eradicating lymphoma in mouse models (see Development Status section below).

The direct anti-cancer effect has been documented for several human B cell malignant lines, however, preliminary experiments with human anti-3rd party veto cells prepared in a slightly different protocol than that used for the mouse studies, indicate that further optimization and verification are required before killing fresh human B-CLL or myeloma tumor cells could become a feasible option.

| 14 |

If this effect transfers to human patients, it may have significant therapeutic value for the above disorders, which as noted hereafter in the Marketing Strategy section, are among the largest blood cancer markets.

| iv. | In Non-Malignant Diseases |

As discussed above, there are two major categories of non-malignant disorders that the Veto-Cell technology aspires to address: non-malignant hematological disorders and organ transplantations.

In the case of organ transplantations and congenital non-malignant hematological disorders, the goal of the veto cells is to enable transplantation (bone marrow or organ) by reducing host/donor immune system conflicts.

For example, in the case of congenital non-malignant diseases such as sickle cell anemia, the body’s bone marrow produces “flawed” cells. An effective treatment is HSCT which replaces the flawed host bone marrow with healthy donor cells. These cells then produce healthy blood cells, basically curing the anemia. As noted elsewhere however, today HSCT is a risky procedure because of the graft/host immune conflicts. It is therefore used infrequently to treat sickle cell disease. The Veto-Cell tolerizing technology would increase the target population for this treatment by significantly reducing these conflicts and by extension the procedure’s risk. Likewise, if permanent tolerance to donor hematopoietic cells is induced under safe conditions, the new immune status could permit acceptance of a kidney from the same donor, without further requirement for a toxic immune suppression currently used in organ transplantation. This means that patients who today are required to take expensive and sometimes debilitating anti-rejection medication daily for the rest of their lives would no longer have to do so.

Development Status

The Veto-Cell platform has been extensively tested by in vitro studies (on both human and mouse disease) and confirmed in animal trials. The results appear to be consistently effective.

| 1. | Immune-system management: |

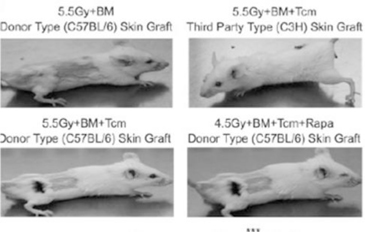

The following images show some example data from the Veto-Cell animal studies. Skin of black mice has been grafted onto the backs of white mice. The data show that T-cells from host and donor mice are fully coexisting in the treatment group using the Megadose treatment (“chimerism”). This is done using high levels of immune suppression that are associated with high mortality. Our Megadose drug combination aspires to produce the same results with lower, safer levels of immune suppression.

| 2. | Anti-lymphoma tumor cells action: |

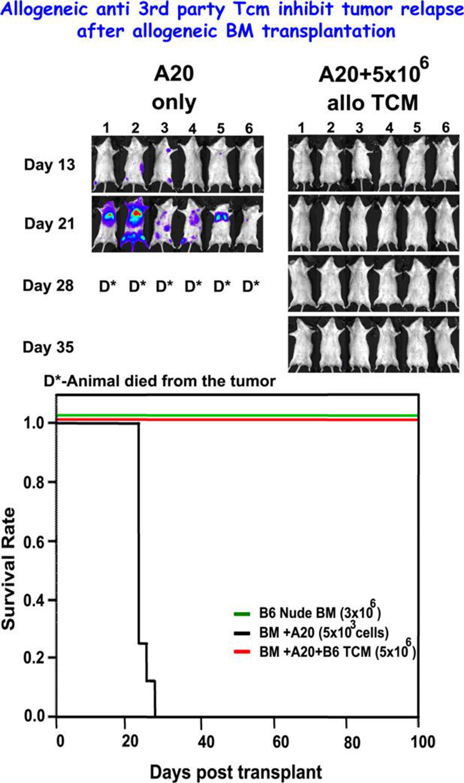

The anti- lymphoma tumor effect also appears to be consistently effective. The data below shows mice with non-Hodgkins lymphoma treated with Veto-Cell therapy.

The control group mice (A) have pronounced tumors by day 21, and have all died by day 28. By contrast, the Veto-Cell treatment group (B) show no tumor and all are still healthy by day 100.

| 15 |

We are less confident about the status of anti-human B-CLL as initial experiments in-vitro were not satisfactory as outlined in our progress report: “While marked progress has been made in developing a protocol for the generation of human Tcm either from normal donors or from B-CLL patients, the Tcm fail to kill autologous B-CLL tumor cells in-vitro. This problem might arise from the secretion of protective cytokines which can accumulate during the culture. This problem which is currently addressed as outlined below, can adversely affect our plans to start a clinical trial with autologous Tcm in patients with B-CLL.”

Administration

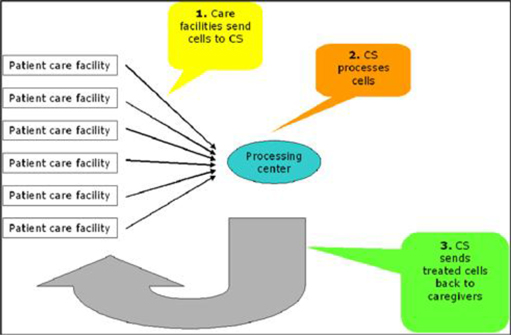

We envision that Veto-Cell therapy will be administered in an in-patient setting, typically as part of the existing preparation procedures for bone marrow transplantations. Blood will be taken from the donor. The frozen blood will be sent to a regional Company center where the Veto-Cells will be developed and expanded – a process that lasts up to two weeks. The Veto-Cells will then be sent to the transplantation center where they will be infused to the patient intravenously along with the transplantation.

| 16 |

Patent Status

The original Veto-Cell is protected by five granted patents and multiple additional pending patents in various countries. The patent for the current central memory or Tcm Veto-Cell, which is slated for human clinical trials, is still pending; however, the patent benefits from the priority of the previous Veto-Cell patents because these earlier versions act as “prior art” thereby bolstering the current patent application. The patents provide coverage on the Veto-Cell technology as discussed in the IP section below.

Development Roadmap

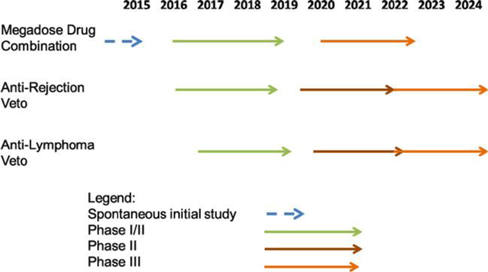

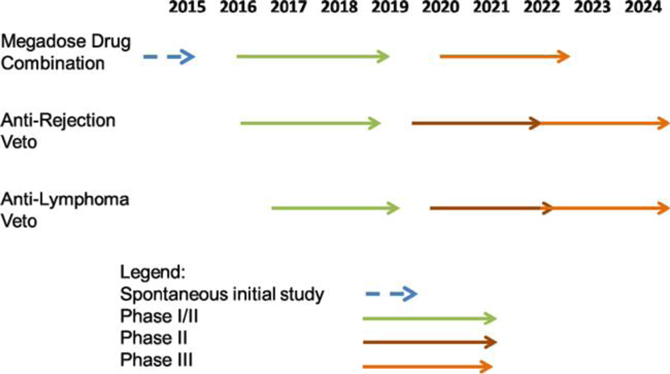

The Veto-Cell platform roadmap comprises three main programs as outlined in the table below. The specific clinical trials planned for each are detailed in the Clinical Trials section of this document.

| Offering | Objective | Major Activities | Estimated start date | |||

| Megadose drug combination (a distinct treatment from the Veto platform) | Validate and introduce new commercial treatment to increase engraftment of allogeneic bone marrow transplantations |

1. Regulatory approval and treatment protocols 2. Conduct human clinical trials 3. Develop plan for commercial exploitation |

• Commence a formal company-sponsored Phase I/II clinical trial by the end of 2015 • Interim analysis within 18 months thereafter

| |||

| Anti-lymphoma veto cell | Validate the possibility of introducing commercial Veto-cell treatment for lymphoma, multiple myeloma and B-cell chronic lymphocytic leukemia (BCLL) based on autologous transplantation |

4. Define feasibility of using human veto cells for killing fresh CLL tumor cells ex-vivo or in experimental mouse models 5. Develop large scale production protocol (GMP process) 6. Conduct human clinical trials to validate safety and efficacy |

• Protocol validation and production process development already underway • If preclinical studies are successful , human trials would be the next step

| |||

| Anti-rejection veto cell | Validate and introduce commercial Veto-cell therapy for reducing rejection in allogeneic bone marrow transplantation for blood-cancers |

7. Develop large scale production protocol (GMP process) 8. Conduct human clinical trials to validate safety and efficacy |

• Production process development already underway • Production process for this Investigational New Drug (IND) may be approved in 18-24 months, Human trials may be approved in 24-30 months depending on regulatory approval cycle |

Platform II – Organsource

Overview

Organsource is Yeda's patented technology, as referenced above. Yeda has been granted patents in the United States and Europe. Organsource addresses the growing shortage of organs for human transplantation. Cell Source has an exclusive option to license this technology, which option has been extended until December 31st, 2015.

The key discovery has two elements:

| · | Embryonic tissue (taken from an animal or human fetus during gestation), which can be identified as organ precursors that will grow into specific organs (e.g., kidney, liver, pancreas), can be harvested at a very specific moment in the gestation period where they have just then become “committed” organ precursors and thus have not yet begun to generate the acute levels of rejection otherwise typical for xenotransplant (i.e., between species) which have been problematic in other earlier studies transplanting porcine tissue into humans. |

| · | These pre-organs can be successfully transplanted into a host, even of another species, and grow into functional organs in the host with only the level of organ rejection associated with an allogeneic organ donor, which can currently be managed through medication. Incidentally, this post transplantation rejection could potentially be further reduced by using Veto-Cells. |

| 17 |

This means that porcine embryonic tissue can potentially become a source for human organ replacement. We intend to exercise our option to license this technology and intellectual property.

Background

The main focus of the Organsource work to date has been demonstrating that organ precursor tissue can be successfully transplanted into both rodents and primates from pigs.

Pigs have long been considered the ideal source of organs for human transplantation for two reasons:

| · | Their organs are similarly sized to humans, and |

| · | They have large litters so can provide extensive supply (unlike for example monkeys). |

However, others’ previous experimental efforts to transplant porcine organs into primates have shown only limited success because a certain marker on pig blood vessels causes a hyper-immune response in primates (which, for example, have immediately killed organ recipients in trials with monkeys).

Mechanism

The Organsource technology avoids the hyper rejection problem by extracting embryonic pig tissue in a highly specific development window. Cells within this momentary window can grow inside the host using blood vessels of the host, not donor, origin. Therefore, they do not trigger the host hyper-immune response. However these embryonic organ precursors have developed sufficient organ differentiation to act as pre-organs in the host, and they grow into functional developed organs, in the case of primates, within a few months.

Specifically, a mouse with Type 1 diabetes received a transplanted porcine pre-pancreas, which grew into a full sized pancreatic organ largely composed of beta cells which secrete insulin, thus effectively treating diabetes in the mouse. Similar results have also been achieved in monkeys.

Target Indications

Organsource could theoretically provide a significant new source of transplantation organs for major human organ needs.

Work so far indicates positive results for growing a pancreas to replace one in which beta cells have been chemically disabled leading to a disease similar to that found in Type 1 Diabetes.

Development Status

Organsource is at an early stage of development relative to the Veto-Cell platform. However, in-vitro results and animal trials have shown positive progress. For example:

| · | Porcine spleen tissue was successfully implanted into a mouse, effectively treating hemophilia. |

| · | Embryonic lung cells have shown effectiveness in repairing injured mouse lungs and are currently being tested on cystic-fibrosis mice. In principal, these could potentially be used to effectively treat several major lung diseases. |

| · | Porcine pancreatic cells were successfully infused into monkeys where they effectively corrected chemically induced diabetes. The chart below shows exogenous insulin requirements of the subject animal (vertical axis) as a function of the number of days following the transplantation (horizontal axis). |

Note that within days of the transplantation, the insulin requirements drop sharply, indicating that the porcine cells are now producing insulin in the monkey, and 10 months after transplantation the monkey is diabetes free. Considering that in these experiments the recipient body weight is small, and a large dose of tissue was used for transplantation, it could be argued that our approach might not be feasible for treating large human adults. In other words, the number of porcine pancreases required for the dosage for treating a large human being may prove to be prohibitive.

Administration

Administration of Organsource is may be less invasive than a typical organ transplantation procedure. In the case of smaller organs such as the pancreas, Organsource transplantation requires only a relatively minor procedure. This is because precursor cells rather than full grown organs are being introduced.

| 18 |

Since the embryonic implants can promptly attract blood vessels they therefore can be placed in sites in the body nearer to the surface of the skin instead of deeper internal sites such as the pancreatic cavity.

Patent status

U.S. patents have been granted for both porcine and human liver and another U.S. patent has been allowed for porcine pancreas generation. A Mexican porcine tissue and European patents for porcine pancreas and lung generation have also been granted. Patents for heart generation are also pending. There is also a patent pending for repairing existing lung tissue using human embryonic cells.

Development Roadmap

Our Organsource roadmap is to continue animal testing in vivo, with an eventual aspiration to human trials. Current animal tests attempt to regenerate healthy lungs in mice that with diseased lungs. Cell Source also aspires to refine the process of and specific tissue doses required for regenerating pancreases in monkeys and to address organ rejection in such pancreatic procedures. Preliminary human trials, which are most likely at least 2-3 years away, will probably be focused on using human embryonic cells to regenerate healthy lung tissue, as a proof of concept to eventually effectively treating diseased lungs.

Products and Services

Currently, we do not have any products, and there is no assurance that we will be able to develop any products.

Our initial products will likely be based on the Veto-Cell platform. We are also about to commence human trials for a new product that combines Dr. Reisner’s existing Megadose technology with an existing generic FDA approved drug. This combination of products has a potential to be an early source of revenues. We expect that spontaneous trials on compassionate grounds by a University using technology which we license from Yeda will commence in 2015 and Company sponsored trials will commence in 2016. Additionally, the Organsource platform may potentially generate products and revenues in the longer term.

The following products are currently planned and represent most of the projected revenues presented in the financial section:

| 1. | “Anti-rejection” veto-cell tolerance therapy for both matched and mismatched allogeneic bone marrow transplantations. This is our flagship (as an initial platform for increasing transplantation success) and is focused on allogeneic bone marrow transplantations. |

Treatment will comprise a course of infusions of Veto-Cells derived from the donor and processed in a Company facility that will be accessible to the transplantation center at the time of transplantation.

| 2. | “Anti-cancer” veto-cell therapy for lymphoma, multiple myeloma and BCLL. This is an intravenous cell-suspension-based cell-therapy focused on lymphocyte cancers. |

This therapy will comprise a course of infusions derived from the patient’s own blood and prepared for autologous transplantation. (In cases of allogeneic transplantation, donor cells will be used.) This treatment exploits the observed effect that Veto-Cells tend to selectively attack lymphoma cells that is described in the Technology section.

| 3. | Veto-Cell tolerance therapy for non-malignant disorders. This is the application of Veto-Cell technology to treatment of non-malignant (i.e., non-cancerous) diseases. As discussed in the Technology section, a custom treatment would be developed for each selected disorder. |

Target indications for Veto-Cell therapy for nonmalignant disorders are likely to be: tolerizing therapy for allogeneic transplantations for sickle cell anemia and aplastic anemia (by using bone marrow transplantations as referenced in no. 2 above) and tolerizing therapy for conventional organ transplantations.

Our Overall Development Status and Future Development Program

Prior to commercializing its products, the Company must conduct human clinical trials and obtain FDA approval and/or approvals from comparable foreign regulatory authorities.

Generally speaking, as a preclinical biotechnology firm, Cell Source needs to go through several necessary steps in order to commercialize its products and commence revenue generation. These steps are per product, but can run in parallel for multiple products, which are each in different stages of the development “pipeline”, so that, for example, when a certain product is already in a human clinical trial, another product may still be in preclinical development and a third may be awaiting regulatory approval to commence human trials. These can also take place in parallel, and varied stages, for the same product in different geographic jurisdictions. The typical steps per product (and range of time frame for each) are:

| 1. | Complete development of human treatment protocol (2-5 years) |

| 19 |

| 2. | Apply for and receive approval to commence human trials (9-18 months) | |

| 3. | Recruit patients (1-6 months) | |

| 4. | Conduct Phase I trials showing safety of product (1-2 years) | |

| 5. | Apply for and receive approval to conduct trials showing product efficacy (6-12 months) | |

| 6. | Data collecting and analysis (6-12 months) | |

| 7. | Conduct Phase II efficacy trials (2-3 years) | |

| 8. | Data collecting and analysis (6-12 months) | |

| 9. | Apply for and receive approval to conduct trials showing efficacy in larger numbers of patients (6-12 months) | |

| 10. | Conduct Phase III efficacy trials with larger numbers of patients (2-4 years) | |

| 11. | Data collecting and analysis (6-12 months) | |

| 12. | Apply for and receive approval for production scale manufacturing facilities (6-12 months) | |

| 13. | Contract third party or establish own production facilities (6-30 months) | |

| 14. | Contract third party or establish own distribution platform (6-18 months) | |

| 15. | Commence manufacturing and distribution (6-12 months) |

Notably, steps 12-15 can be conducted in parallel with some of the steps above. In the case of Cell Source and other firms that treat terminal patients with either rare diseases or those for which there is currently no effective treatment, or where preclinical studies indicate a reasonable expectation to increase life expectancy and survival rates by a substantive margin, several of these steps can be combined and or shortened, subject to regulatory discretion. For example, Phase I and II (safety and efficacy) can be combined in a single concurrent step; approvals for subsequent steps can be accelerated; in some countries patients can already be treated commercially after the end of Phase II, foregoing the requirement for Phase III data.

The specific detailed next steps the company must take to get the treatments or products to market include the following: