Attached files

| file | filename |

|---|---|

| EX-23 - EXHIBIT 23 CONSENT OF EY - HARDINGE INC | exhibit23consentofey.htm |

| EX-21 - EXHIBIT 21 SUBSIDIARIES OF THE COMPANY - HARDINGE INC | exhibit21-subsidiariesofth.htm |

| EX-10.15 - EXHIBIT 10.15 MASTER CREDIT AGREEMENT - HARDINGE INC | exhibit1015mastercreditagr.htm |

| EX-3.1 - EXHIBIT 3.1 RESTATED CERTIFICATE OF INCORPORATION OF HARDINGE INC. - HARDINGE INC | exhibit31restatedcertifica.htm |

| EX-32 - EXHIBIT 32 CERTIFICATION - HARDINGE INC | hdng-12312014x10kxex32.htm |

| EX-31.2 - EXHIBIT 31.2 MALONE CERTIFICATION - HARDINGE INC | hdng-12312014x10kxex312.htm |

| EX-31.1 - EXHIBIT 31.1 SIMONS CERTIFICATION - HARDINGE INC | hdng-12312014x10kxex311.htm |

| EXCEL - IDEA: XBRL DOCUMENT - HARDINGE INC | Financial_Report.xls |

| EX-10.34 - EXHIBIT 10.34 SEPANIK EMPLOYMENT AGREEMENT - HARDINGE INC | exhibit1034sepanikemployme.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

or

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-15760

Hardinge Inc.

(Exact name of registrant as specified in its charter)

New York | 16-0470200 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

One Hardinge Drive Elmira, NY | 14902 | |

(Address of principal executive offices) | (Zip Code) | |

(607) 734-2281

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: NONE

Securities registered pursuant to Section 12(g) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Stock, $0.01 par value per share | NASDAQ Global Select Market | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. oYes ýNo

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. oYes ýNo

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ýYes oNo

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ýYes oNo

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Accelerated filer x | |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). oYes ýNo

The aggregate market value of the voting stock held by non-affiliates of the registrant as of June 30, 2014 was $157.1 million, based on the closing price of common stock on the NASDAQ Global Select Market on June 30, 2014.

As of March 6, 2015 there were 12,847,716 shares of common stock of the registrant outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of Hardinge Inc.'s Proxy Statement for its 2015 Annual Meeting of Shareholders to be filed with the Commission on or about March 26, 2015 are incorporated by reference to Part III of this Form 10-K.

HARDINGE INC. AND SUBSIDIARIES

TABLE OF CONTENTS

PAGE | ||

Certifications | ||

2

PART I

Item 1. Business.

General

Hardinge Inc.'s principal executive office is located within Chemung County at One Hardinge Drive, Elmira, New York 14902-1507. Unless otherwise mentioned or unless the context requires otherwise, all references to "Hardinge," "we," "us," "our," "the Company" or similar references mean Hardinge Inc. and its subsidiaries.

Our website, www.hardinge.com, provides links to all of the Company's filings with the Securities and Exchange Commission. A copy of this annual report on Form 10-K and our other annual, quarterly, current reports, and amendments thereto filed with SEC are available on the website or can be obtained free of charge by contacting the Investor Relations Department at our principal executive office. Alternatively, such reports may be accessed at the Internet address of the SEC, which is www.sec.gov, or at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549. Information about the operation of the SEC's Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330.

We are a global designer, manufacturer and distributor of machine tools, specializing in precision computer numerically controlled metalcutting machines and workholding technology solutions. The Company has the following direct and indirect wholly owned subsidiaries:

North America: | ||

Canadian Hardinge Machine Tools, Ltd. | Toronto, Canada | |

Forkardt Inc. | Traverse City, Michigan | |

Hardinge Technology Systems, Inc. | Elmira, New York | |

Usach Technologies Inc. | Elgin, Illinois | |

Europe: | ||

Forkardt Deutschland GmbH | Ekrath, Germany | |

Forkardt SAS | Noisy le Sec, France | |

Hardinge GmbH | Krefeld, Germany | |

Hardinge Holdings GmbH | St. Gallen, Switzerland | |

Hardinge Holdings B.V. | Amsterdam, Netherlands | |

Hardinge Machine Tools B.V. | Raamsdonksveer, Netherlands | |

Jones & Shipman Hardinge Limited | Leicester, England | |

Jones & Shipman SARL | Bron, France | |

L. Kellenberger & Co., AG | St. Gallen, Switzerland | |

Asia and Other: | ||

Forkardt India LLP | Hyderabad, India | |

Hardinge China Limited | Hong Kong, People's Republic of China | |

Hardinge Machine (Shanghai) Co., Ltd. | Shanghai, People's Republic of China | |

Hardinge Machine Tools B.V., Taiwan Branch | Nan Tou City, Taiwan, Republic of China | |

Hardinge Precision Machinery (Jiaxing) Company, Limited | Jiaxing, People's Republic of China | |

Hardinge Taiwan Precision Machinery Limited | Nan Tou City, Taiwan, Republic of China | |

We have manufacturing facilities located in China, Switzerland, Taiwan, Germany, France, India, the United Kingdom ("U.K.") and the United States ("U.S."). We manufacture the majority of the products we sell.

3

Products

We supply high precision computer controlled metalcutting turning machines, grinding machines, machining centers, and repair parts related to those machines. The Company also engineers and supplies high precision, standard and specialty workholding devices, and other machine tool accessories. We believe our products are known for accuracy, reliability, durability and value.

Segments

The Company has two unique business segments: Metalcutting Machine Solutions ("MMS") and Aftermarket Tooling and Accessories ("ATA").

Metalcutting Machine Solutions (MMS)

This segment includes operations related to grinding, turning, and milling, as discussed below, and related repair parts. The products are considered to be capital goods with sales prices ranging from approximately forty thousand dollars for some high volume products to around two million dollars for some lower volume grinding machines or other specialty built turnkey systems of multiple machines. Sales are subject to economic cycles and, because they are most often purchased to add manufacturing capacity, the cycles can be severe with customers delaying purchases during down cycles and then aggressively requiring machine deliveries during up cycles. Machines are purchased to a lesser extent during down cycles as our customers are looking for productivity improvements or they have new products that require new machining capabilities.

We have been a manufacturer of industrial-use high precision and general precision turning machine tools since 1890. Turning machines, or lathes, are power-driven machines used to remove material from either bar stock or a rough-formed part by moving multiple cutting tools against the surface of a part rotating at very high speeds in a spindle mechanism. The multi-directional movement of the cutting tools allows the part to be shaped to the desired dimensions. On parts produced by our machines, those dimensions are often measured in millionths of an inch. We consider Hardinge to be a leader in the field of producing machines capable of consistently and cost-effectively producing parts to very close dimensions.

Grinding is a machining process in which a part's surface is shaped to closer tolerances with a rotating abrasive wheel or tool when compared with other available metalcutting technologies. Grinding machines can be used to finish parts of various shapes and sizes. The grinding machines of our Kellenberger subsidiary are used to grind the inside and outside diameters of cylindrical parts. Such grinding machines are typically used to provide a more exact finish on a part that has been partially completed on a lathe. The Kellenberger grinding machines are generally purchased by the same type of customers as other Hardinge equipment and further our ability to be a primary source for our customers.

Our Kellenberger precision grinding technology is complemented by our Hauser, Tschudin, Jones & Shipman, Usach, and Voumard grinding brands. Hauser machines are jig grinders used to make demanding contour components, primarily for tool and mold-making applications. Tschudin product technology is focused on the specialized grinding of cylindrical parts when the customer requires high volume production. Our Tschudin machines are generally equipped with automatic loading and unloading mechanisms for the part being machined. These loading and unloading mechanisms significantly reduce the level of involvement a machine operator has to perform in the production process. Our Jones & Shipman brand represents a line of high-quality grinding (surface, creep feed, and cylindrical) machines. These super-abrasive machines and machining systems are used by a diverse range of industries. Usach and Voumard machines are high quality internal diameter cylindrical grinding systems used in production and job shop environments.

Machining centers are designed to remove material from stationary, prismatic or box-like parts of various shapes with rotating tools that are capable of milling, drilling, tapping, reaming and routing. Machining centers have mechanisms that automatically change tools based on commands from a built-in computer control without the assistance of an operator. Machining centers are generally purchased by the same customers who purchase other Hardinge equipment. We supply a broad line of machining centers under our Bridgeport brand name addressing a range of sizes, speeds, and powers.

Our machines are generally computer controlled and use commands from an integrated computer to control the movement of cutting tools, grinding wheels, part positioning, and in the case of turning and grinding machines, the rotation speeds of the part being shaped. The computer control enables the operator to program operations such as part rotation, tooling selection, and tooling movement for a specific part and then stores that program in memory for future use. The machines are able to produce parts while left unattended when connected to automatic bar-feeding, robotics equipment, or other material handling devices designed to supply raw materials and remove machined parts from the machine.

4

New products are critical to our growth plans. We gain access to new products through internal product development, acquisitions, joint ventures, license agreements, and partnerships. Products are introduced each year to both broaden our product offering, to take advantage of new technologies available to us, and to replace older models nearing the end of their respective product life cycles. These technologies generally allow our machines to run at higher speeds and with more power, thus increasing their efficiency. Customers routinely replace old machines with newer machines that can produce parts faster and with less time to set up the machine when converting from one type of part to another. Generally, our machines can be used to produce parts from all of the standard ferrous and non-ferrous metals, as well as plastics, composites, and exotic materials.

We focus on products and solutions for companies making parts from hard-to-machine materials with hard to sustain close tolerances and hard to achieve surface finishes that may be hard to hold in the machine. We believe that with our high precision and super precision lathes, our grinding machines, and our rugged machining centers, combined with our accessory products and our technical expertise, we are uniquely qualified to be the supplier of choice for customers manufacturing to demanding specifications.

Multiple options are available on many of our machines, which allows customers to customize their machines to their specific operating performance and cost objectives. We produce machines for stock with popular option combinations for immediate delivery, as well as design and produce machines to specific customer requirements. In addition to our machines, we provide the necessary tooling, accessories, and support services to assist customers in maximizing their return on investment.

The sale of repair parts is important to our business. Certain parts on machines wear out, fail, or need to be replaced due to misuse over time. Customers will buy parts from us throughout the life of the machine, which typically extends over many years. There are thousands of machines in operation in the world for which we provide those repair parts and in many cases the parts are available exclusively from us.

We offer various warranties on our equipment and consider post-sale support to be a critical element of our business. Warranties on machines typically extend for twelve months after purchase. Services provided include operation and maintenance training, in-field maintenance, and in-field repair. We offer these post sales support services on a paid basis throughout the life of the machine. In territories covered by distributors, this support and service is offered through the distributor.

Aftermarket Tooling and Accessories (ATA)

This segment includes products that are purchased by manufacturers throughout the lives of their machines. The selling prices of these units are relatively low per piece with prices ranging from fifty dollars on high volume collets to twenty thousand dollars or more for specialty chucks. While considered to be consumable, these products are more durable in nature, with replacement due to wear over time. Our products are used on all types and brands of machine tools, not limited to our own. Sales levels are affected by manufacturing cycles, but not to the severity of the capital goods lines. While customers may not purchase large dollar machines during a down cycle, their factories are operating with their existing equipment and therefore accessories are still needed as they wear out or they are needed for a change in production requirements.

The two primary product groups in ATA are collets and chucks. Collets are cone-shaped metal sleeves used for holding circular or rod like pieces in a lathe or other machine that provide effective part holding and accurate part location during machining operations. Chucks are a specialized clamping device used to hold an object with radial symmetry, especially a cylindrical object. It is most commonly used to hold a rotating tool or a rotating work piece. Some of our specialty chucks can also hold irregularly shaped objects that lack radial symmetry. While our products are known for accuracy and durability, they are consumable in nature.

In May of 2013, the Company acquired Forkardt, a global provider of specialty chucks. Forkardt is based in Traverse City, Michigan with operations in the United States, Europe, and Asia that provide unique solutions for demanding workholding applications. This acquisition positions Hardinge as one of the largest manufacturers of rotating workholding solutions in the world. In December of 2013, we divested the Forkardt Swiss operations due to potential customer conflicts.

We offer an extensive line of workholding and toolholding solutions that are available in tens of thousands of shapes and sizes to meet unique customer application needs. These solutions can be used on virtually all types and brands of metalcutting machines, as well as non-traditional uses in many industrial applications. The Company continues to explore opportunities to expand this business organically and through acquisitions.

5

Sales, Markets and Distribution

We sell our products in most of the industrialized countries of the world through a combination of distributors, agents, and manufacturers' representatives. In certain areas of China, France, Germany, North America, and the United Kingdom, we have also used a direct sales force for portions of our product lines. Generally, our distributors have an exclusive right to sell our products in a defined geographic area. Our distributors operate as independent businesses and purchase products from us at discounted prices for their customers, while agents and representatives sell products on our behalf and receive commissions on sales. Our discount schedule is adjusted to reflect the level of pre and post sales support offered by our distributors. Our direct sales personnel earn a fixed salary plus commission. Sales through distributors are made only on standard commercial open account terms or through letters of credit. Distributors generally take title to products upon shipment from our facilities and do not have any special return privileges.

Our standard ATA products are sold through direct telephone orders and via our web site at www.shophardinge.com. Custom or special solutions are sold through direct sales and agents. In most cases, we are able to package and ship in-stock tooling, accessories, and repair parts within 24 hours of receiving orders. We can package and ship items with heavy demand within a few hours. In other parts of the world, these products are sold on either a direct sales basis or through distributor arrangements.

We promote recognition of our products in the marketplace through advertising in trade publications, web presences, email newsletters, and participation in industry trade shows. In addition, we market our non-machine products and capabilities through publication of general catalogs and other targeted catalogs, which we distribute to existing and prospective customers. We have a considerable presence on the internet at www.hardinge.com and www.forkardt.com, where customers can obtain information about our products and place orders for accessories, tooling, knee mill products and repair parts.

A substantial portion of our end use customers are small and medium-sized independent job shops, which in turn sell machined parts to their industrial customers. Industries directly and indirectly served by us include aerospace, automotive, computer, communications, consumer-electronics, construction equipment, defense, energy, farm equipment, medical equipment, recreational equipment, and transportation.

No single customer or related group of customers accounted for more than 6% of our consolidated sales in 2014 or 2013. While valuing our relationship with each customer, we do not believe that the loss of any single customer, or any few customers, would have an adverse material effect on our business.

Competitive Conditions

In our industry, the barriers to entry for competition vary based on the level of product performance required. For the products with the highest performance in terms of accuracy and productivity, the barriers are generally technical in nature. For basic products, often the barriers are not technical; they are tied to product availability, competitive price position, and an effective distribution model that offers the pre and post sales support required by customers. Another significant barrier in the global machine tool industry is the high level of working capital that is required to operate the business.

We compete in various sectors of the machine tool market within the products of turning, milling, grinding, tooling and accessories. We compete with numerous vendors in each market sector we serve. The primary competitive factors in the marketplace for our machine tools are reliability, price, delivery time, service, and technological characteristics. Our management considers our segment of the industry to be extremely competitive. There are many manufacturers of machine tools in the world. They can be categorized by the size of material their products can machine and the precision level their products can achieve. For our high precision, multi-tasking turning and milling equipment, competition comes primarily from companies such as DMG Mori Seiki, Mazak, and Okuma. Competition in our more standard turning and milling equipment comes, in part, from those companies as well as Doosan, which is based in South Korea, and Haas which is based in the U.S., as well as many Taiwanese companies. Our internal and outer diameter (ID/OD) cylindrical grinding machines compete primarily with Studer, a Swiss company as well as Toyoda and Shigiya, which are based in Japan. Our Hauser jig grinding machines compete primarily with Moore Tool, which is based in the U.S., and some Japanese suppliers. Our surface grinding machines compete with Okamoto in Japan and Chevalier in Taiwan. Our ATA products compete with many smaller companies.

6

The overall number of our competitors providing product solutions serving our target markets may increase. Also, the overall composition of companies with which we compete may change as we broaden our product offerings and the geographic markets we serve. As we expand into new market areas, we will face competition not only from our existing competitors but from other competitors as well, including existing companies with strong technological, marketing and sales positions in those markets. In addition, several of our competitors may have greater resources, including financial, technical, and engineering resources, than we do.

Sources and Availability of Components

Our machines within the MMS segment are produced around the world. We produce certain of our lathes, knee mills, and related products at our Elmira, New York plant. The Kellenberger and Voumard grinding machines and related products are manufactured at our St. Gallen, Switzerland plant and Hauser and Tschudin products are produced at our Biel, Switzerland facility. The Jones & Shipman grinding machines are manufactured at our Leicester, England plant. The Usach grinding machines are manufactured at our Elgin, Illinois plant. We produce machining centers and lathes at our Hardinge Taiwan facility in Nan Tou, Taiwan and our Hardinge Precision Machinery (Jiaxing) Company, Ltd. facility in Jiaxing, China. The Company's Forkardt and Hardinge branded ATA segment products and solutions are engineered and produced in our plants located in Traverse City, Michigan, Elmira, New York, Kirchentellinsfurt, Germany, Noisy le Sec, France, and Hyderabad, India. We manufacture products from various raw materials, including cast iron, sheet metal, and bar steel. We purchase a number of components, sub-assemblies and assemblies from outside suppliers, including the computer and electronic components for our computer controlled lathes, grinding machines, and machining centers. There are multiple suppliers for virtually all of our raw material, components, sub-assemblies and assemblies and historically, we have not experienced a serious supply interruption. However, in 2011, because of the increase in demand driven by early 2011 worldwide order activity, producers of bearings, ball screws, and linear guides had difficulty meeting the rise in demand. Similar demand increase in the future could impact our production schedules.

A major component of our computer controlled machines is the computer and related electronics package. We purchase these components from Fanuc Limited, a Japanese electronics company, Heidenhain, a German control supplier, Mitsubishi Electric, a Japanese electronics company, or from Siemens, another German control manufacturer. While we believe that design changes could be made to our machines to allow sourcing from several other existing suppliers, and we occasionally do so for special orders, a disruption in the supply of the computer controls from one of our suppliers could cause us to experience a substantial disruption of our operations, depending on the circumstances at the time. We purchase parts from these suppliers under normal trade terms. There are no agreements with these suppliers to purchase minimum volumes per year.

Research and Development

Our ongoing research and development program involves creating new products, modifying existing products to meet market demands, and redesigning existing products, both to add new functionality and to reduce the cost of manufacturing. The research and development departments throughout the world are staffed with experienced design engineers with varying levels of education, ranging from technical to doctoral degrees.

The worldwide cost of research and development, all of which has been charged to cost of goods sold, amounted to $13.9 million, $12.5 million and $12.3 million, in 2014, 2013 and 2012, respectively.

Patents

Although we hold several patents with respect to certain of our products, we do not believe that our business is dependent to any material extent upon any single patent or group of patents.

Seasonal Trends and Working Capital Requirements

Hardinge's business and that of the machine tool industry in general, is cyclical. It is not subject to significant seasonal trends. However, our quarterly results are subject to fluctuation based on the timing of our shipments of machine tools, which are largely dependent upon customer delivery requirements. Given that a large percentage of our sales are from Asia, the impact of plant shutdowns in that region by us and our customers due to the celebration of the Lunar New Year holiday may impact the first quarter sales, income from operations, and net income, and result in the first quarter being the lowest quarter of the year.

7

The ability to deliver products within a short period of time is an important competitive criterion. We must have inventory on hand to meet customers' delivery expectations, which for standard machines typically range from immediate to eight weeks delivery. Meeting this requirement is especially difficult with some of our products, where delivery is extended due to time associated with shipping on ocean-going vessels, depending on the location of the customer. This creates a need to have inventory of finished machines available in our major markets to serve our customers in a timely manner.

We deliver many of our machine products within one to two months after the order. Some orders, especially multiple machine orders, are delivered on a turnkey basis with the machine or group of machines configured to make certain parts for the customer. This type of order often includes the addition of material handling equipment, tooling and specific programming. In those cases, the customer usually observes and inspects the parts being made on the machine at our facility before it is shipped and the timing of the sale is dependent upon the customer's schedule and acceptance. Therefore, sales from quarter-to-quarter can vary depending upon the timing of those customers' acceptances and the significance of those orders.

We feel it is important, where practical, to provide readily available accessories and replacement parts for the machines we sell and we carry inventory at levels sufficient to meet these customer requirements.

Governmental Regulations

We believe that our current operations and our current uses of property, plant and equipment conform in all material respects to applicable laws and regulations in the various countries in which we conduct business.

Governmental Contracts

No material portion of our business is subject to government contracts.

Environmental Matters

Our operations are subject to extensive federal, state, local and foreign laws and regulations relating to environmental matters. Certain environmental laws can impose joint and several liability for releases or threatened releases of hazardous substances upon certain statutorily defined parties regardless of fault or the lawfulness of the original activity or disposal. Hazardous substances and adverse environmental effects have been identified with respect to real property we own and on adjacent parcels of real property.

In particular, our Elmira, NY manufacturing facility is located within the Kentucky Avenue Wellfield on the National Priorities List of hazardous waste sites designated for cleanup by the United States Environmental Protection Agency ("EPA") because of groundwater contamination. The Kentucky Avenue Wellfield Site (the "Site") encompasses an area which includes sections of the Town of Horseheads and the Village of Elmira Heights in Chemung County, NY. In February 2006, the Company received a Special Notice Concerning a Remedial Investigation/Feasibility Study ("RI/FS") for the Koppers Pond (the "Pond") portion of the Site. The EPA documented the release and threatened release of hazardous substances into the environment at the Site, including releases into and in the vicinity of the Pond. The hazardous substances, including metals and polychlorinated biphenyls, have been detected in sediments in the Pond.

Until receipt of this Special Notice in February 2006, the Company had never been named as a potentially responsible party ("PRP") at the Site nor had the Company received any requests for information from the EPA concerning the Site. Environmental sampling on our property within this Site under supervision of regulatory authorities had identified off-site sources for such groundwater contamination and sediment contamination in the Pond, and found no evidence that our operations or property have contributed or are contributing to the contamination. We have notified all appropriate insurance carriers and are actively cooperating with them, but whether coverage will be available has not yet been determined and possible insurance recovery cannot now be estimated with any degree of certainty.

A substantial portion of the Pond is located on our property. The Company, along with Beazer East, Inc., the Village of Horseheads, the Town of Horseheads, the County of Chemung, CBS Corporation and Toshiba America, Inc., (collectively, the "PRPs"), have agreed to voluntarily participate in the RI/FS by signing an Administrative Settlement Agreement and Order of Consent on September 29, 2006. On September 29, 2006, the Director of Emergency and Remedial Response Division of the EPA, Region II, approved and executed the Agreement on behalf of the EPA. The PRPs also signed a PRP Member Agreement, agreeing to share the cost of the RI/FS study on a per capita basis.

8

The EPA approved the RI/FS Work Plan in May of 2008. On September 7, 2011, the PRPs submitted the draft Remedial Investigation Report to the EPA and on January 10, 2013, the draft Feasibility Study was submitted to the EPA. The PRPs are preparing a revised draft feasibility study to update site information and to address issues raised by the EPA.

The draft Feasibility Study identified alternative remedial actions with estimated life-cycle costs ranging from $0.7 million to $3.4 million. The proposed revised draft feasibility study is identifying an estimated life-cycle range from $0.9 million to $3.7 million. We estimate that our portion of the potential costs, based upon the proposed revised feasibility study, are estimated to range from $0.1 million to $0.5 million. Based on the current estimated costs of the various remedial alternatives now under consideration by the EPA, we have recorded a reserve of $0.2 million for the Company's share of remediation expenses at the Pond as of December 31, 2014. This reserve is included in "Accrued expenses" in the Consolidated Balance Sheets.

We believe, based upon information currently available that, except as described in the preceding paragraphs, we will not have material liabilities for environmental remediation. Though the foregoing reflects the Company's current assessment as it relates to environmental remediation obligations, it is possible that future remedial requirements or changes in the enforcement of existing laws and regulations, which are subject to extensive regulatory discretion, will result in material liabilities to the Company.

Employees

As of December 31, 2014, Hardinge Inc. employed 1,478 persons, 493 of whom were located in the United States. Management believes that relations with our employees are good.

Foreign Operations and Export Sales

Information related to foreign and domestic operations and sales is included in Note 17. "Segment Information" to the Consolidated Financial Statements contained in this Annual Report. Our strategy has been to diversify our sales and operations geographically so that the impact of economic trends in different regions can be balanced.

The risks associated with conducting business on an international basis are discussed further in Item 1A. "Risk Factors".

Item 1A. Risk Factors.

The various risks related to the Company's business include the risks described below. The business, financial condition or results of operations of Hardinge could be materially adversely affected by any of these risks. The risks and uncertainties described below or elsewhere in this Form 10-K are not the only ones to which we are exposed. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also adversely affect our business and operations. If any of the matters included in the following risks were to occur, our business, financial condition, results of operations, cash flows or prospects could be materially adversely affected.

Our customers' activity levels and spending for our products and services have been impacted by global economic conditions, especially deterioration in the credit markets.

For many of our customers, the purchase of our machines represents a significant capital expenditure. For others, the purchase of our machines is a part of a larger improvement or expansion of manufacturing capability. For all, the purchase represents a long term commitment of capital raised by incurrence of debt, issuance of equity or use of cash flow from operations. Global economic and financial difficulties across the world in recent years have been well documented. Governments in Europe, Asia and the U.S. subsequently intervened in an effort to improve economic conditions. These interventions may have reduced the overall impact of the crisis, but also created instability, uncertainty and doubt. During this period, many of our customers experienced uncertain cash flows and reduced access to credit and equity markets, all of which made commitment to larger long term capital projects difficult. While global conditions appear to have improved, similar conditions in the future could negatively impact our operating results.

9

Changes in general economic conditions and the cyclical nature of our business could harm our operating results.

Our business is cyclical in nature, following the strength and weakness of the manufacturing economies in the geographic markets we serve. As a result of this cyclicality, we have experienced, and in the future we can be expected to experience, significant fluctuations in sales and operating income, which may affect our business, operating results, financial condition and the market price of our common shares.

The following factors, among others, significantly influence demand for our products:

▪ | Fluctuations in capacity at both OEMs and job shops; |

▪ | The availability of skilled machinists; |

▪ | The need to replace machines that have reached the end of their useful life; |

▪ | The need to replace older machines with new technology that increases productivity, reduces general manufacturing costs, and machines parts in a new way; |

▪ | The evolution of end-use products requiring machining to more specific tolerances; |

▪ | Our customers' use of new materials requiring machining by different processes; |

▪ | General economic and manufacturing industry expansions and contractions; and |

▪ | Changes in manufacturing capabilities in developing regions. |

Our competitive position and prospects for growth may be diminished if we are unable to develop and introduce new and enhanced products on a timely basis that are accepted in the market.

The machine tool industry is subject to technological change, rapidly evolving industry standards, changing customer requirements, and improvements in and expansion of product offerings, especially with respect to computer-controlled products. Our ability to anticipate changes in technology, industry standards, customer requirements and product offerings by competitors, and to develop and introduce new and enhanced products on a timely basis that are accepted in the market, will be significant factors in our ability to compete and grow. Moreover, if technologies or standards used in our products become obsolete or fail to gain widespread commercial acceptance, our business would be materially adversely affected. Developments by our competitors or others may render our products or technologies obsolete or noncompetitive. Failure to effectively introduce new products or product enhancements on a timely basis could materially adversely affect our business, operating results, and financial condition.

We rely on a limited number of suppliers to obtain certain components, sub-assemblies, assemblies and products. Delays in deliveries from or the loss of any of these suppliers may cause us to incur additional costs, result in delays in manufacturing and delivering our products or cause us to carry excess or obsolete inventory.

Some components, sub-assemblies, or assemblies we use in the manufacturing of our products are purchased from a limited number of suppliers. Our purchases from these suppliers are generally not made pursuant to long-term contracts and are subject to additional risks associated with purchasing products internationally, including risks associated with potential import restrictions and exchange rate fluctuations, as well as changes in tax laws, tariffs, and freight rates. Although we believe that our relationships with these suppliers are good, there can be no assurance that we will be able to obtain these products from these suppliers on satisfactory terms indefinitely. The present economic environment could also pose the risk of one of these key suppliers going out of business, or cause delays in delivery times of critical components as business conditions rebound and demand increases.

We believe that design changes could be made to our machines to allow sourcing of components, sub-assemblies, assemblies or products from several other suppliers; however, a disruption in the supply from any of our suppliers could cause us to experience a material adverse effect on our operations.

10

Our business, financial condition, and results of operations could be adversely affected by the political and economic conditions of the countries in which we conduct business and other factors related to our international operations.

We manufacture a substantial portion of our products overseas and sell our products throughout the world. In 2014, approximately 68% of our products were sold in countries outside of North America. In addition, a majority of our employees are located outside of the United States. Multiple factors relating to our international operations and to particular countries in which we operate could have a material adverse effect on our business, financial condition, results of operations, and cash flows. These factors include:

▪ | A prolonged world-wide economic downturn or economic uncertainty in our principal international markets including Asia and Europe; |

▪ | Changes in political, regulatory, legal, or economic conditions; |

▪ | Restrictive governmental actions, such as restrictions on the transfer or repatriation of funds and foreign investments and trade protection measures, including export duties and quotas, customs duties and tariffs, or trade barriers erected by either the United States or other countries where we do business; |

▪ | Disruptions of capital and trading markets; |

▪ | Changes in import or export licensing requirements; |

▪ | Transportation delays; |

▪ | Civil disturbances or political instability; |

▪ | Geopolitical turmoil, including terrorism or war; |

▪ | Currency restrictions and exchange rate fluctuations; |

▪ | Changes in labor standards; |

▪ | Limitations on our ability under local laws to protect our intellectual property; |

▪ | Nationalization and expropriation; |

▪ | Changes in domestic and foreign tax laws; |

▪ | Difficulty in obtaining distribution and support; and |

▪ | Health epidemics and other localized health risks. |

Additionally, we must comply with complex foreign and U.S. laws and regulations, such as the U.S. Foreign Corrupt Practices Act, the U.K. Bribery Act and other local laws prohibiting corrupt payments to government officials, and anti-corruption regulations. Violations of these laws and regulations could result in fines and penalties, criminal sanctions, restrictions on our business conduct and on our ability to offer products in one or more countries, and could adversely affect our reputation, our ability to attract and retain employees, our international operations, our business and our operating results. Although we have implemented policies and procedures designed to ensure compliance with these laws and regulations, there can be no assurance that our employees, contractors or agents, as well as those companies to which we outsource certain of our business operations, will not violate these policies.

Our business is highly competitive, and increased competition could reduce our sales, earnings and profitability.

The markets in which our machines and other products are sold are extremely competitive and highly fragmented. In marketing our products, we compete primarily with other businesses on quality, reliability, price, value, delivery time, service, and technological characteristics. We compete with a number of U.S., European, and Asian competitors, many of which are larger, have greater financial and other resources, and are supported by governmental or financial institution subsidies. Increased competition could force us to lower our prices or to offer additional product features or services at a higher cost to us, which could reduce our earnings.

The greater financial resources or the lower amount of debt of certain of our competitors may enable them to commit larger amounts of capital in response to changing market conditions. Certain competitors may also have the ability to develop product innovations that could put us at a disadvantage. If we are unable to compete successfully against other manufacturers in our marketplace, we could lose customers, and our sales may decline. There can also be no assurance that customers will continue to regard our products favorably, that we will be able to develop new products that appeal to customers, that we will be able to improve or maintain our profit margins on sales to our customers, or that we will be able to continue to compete successfully in our core markets. While we believe our product lines compete effectively in their markets, we may not continue to do so.

11

Acquisitions could disrupt our operations and harm our operating results.

We may elect to increase our product offerings and the markets we serve through acquisitions of other companies, product lines, technologies and personnel. Acquisitions involve numerous risks, including the following:

▪ | Difficulties in integrating the operations, technologies, products and personnel of the acquired companies; |

▪ | Diversion of management's attention from normal daily operations of the business; |

▪ | Potential difficulties in completing projects associated with in-process research and development; |

▪ | Difficulties in entering markets in which we have no or limited direct prior experience and where competitors in such markets have stronger market positions; |

▪ | Initial dependence on unfamiliar supply chains or relatively small supply partners; |

▪ | Difficulties in predicting market demand for acquired products and technologies and the resultant risk of acquiring excess or obsolete inventory; |

▪ | Insufficient revenues to offset increased expenses associated with acquisitions; and |

▪ | The potential loss of key employees of the acquired companies. |

Acquisitions may also cause us to:

▪ | Issue common stock that would dilute our current shareholders' percentage ownership; |

▪ | Increase our level of indebtedness; |

▪ | Assume liabilities; |

▪ | Record goodwill and non-amortizable intangible assets that will be subject to impairment testing on a regular basis and potential periodic impairment charges; |

▪ | Incur amortization expenses related to certain intangible assets; |

▪ | Incur large and immediate write-offs and restructuring and other related expenses; and |

▪ | Become subject to litigation. |

Acquisitions are inherently risky, and no assurance can be given that our recent or future acquisitions, if any, will be successful and will not have material adverse effect on our business, operating results or financial condition. Failure to manage and successfully integrate acquisitions we make could harm our business and operating results in a material way. Additionally, we may incur significant expenses related to potential acquisitions that are not completed. Prior acquisitions have resulted in a wide range of outcomes, from successful introduction of new products, technologies, facilities, and personnel to an inability to do so. Even when an acquired business has already developed and marketed products, there can be no assurance that product enhancements will be made in a timely fashion or that pre-acquisition due diligence will have identified all possible issues that might arise with respect to such products.

If we are unable to access additional capital on favorable terms, our liquidity, business, and results of operations could be adversely affected.

The ability to raise financial capital, either in public or private markets or through commercial banks, is critical to our current business and future growth. Our business is generally working capital intensive requiring a long cash-out to cash-in cycle. In addition, we will rely on the availability of longer-term debt financing or equity financing to make investments in new opportunities. Our access to the financial markets could be adversely impacted by various factors including the following:

▪ | Changes in credit markets that reduce available credit or the ability to renew existing facilities on acceptable terms; |

▪ | A deterioration in our financial condition that would violate current loan agreement covenants or prohibit us from obtaining additional capital from banks, financial institutions, or investors; |

▪ | Extreme volatility in credit markets that increase margin or credit requirements; and |

▪ | Volatility in our results that would substantially increase the cost of our capital. |

We are subject to significant foreign exchange and currency risks that could adversely affect our operations and our ability to reinvest earnings from operations.

Our international operations generate sales in a number of foreign currencies including British Pound Sterling ("GBP"), Chinese Renminbi ("CNY"), Euros ("EUR"), Indian Rupee ("INR"), New Taiwanese Dollars ("TWD"), and Swiss Francs ("CHF"). Therefore, our results of operations and financial condition are affected by fluctuations in exchange rates between these currencies and the U.S. dollar ("USD"). In addition, our purchases of components in CNY, EUR, TWD, CHF, and Japanese Yen ("JPY") are affected by inter-currency fluctuations in exchange rates.

12

We prepare our financial statements in USD in accordance with accounting principles generally accepted in the United States of America ("US GAAP"), but a sizable portion of our revenue and operating expenses are in foreign currencies. As a result, we are subject to significant risks, including:

▪ | Foreign exchange risks resulting from changes in foreign exchange rates and the implementation or termination of exchange controls; and |

▪ | Limitations on our ability to reinvest earnings from operations in one country to fund the capital needs of our operations in other countries. |

Changes in exchange rates will result in increases or decreases in our revenues, costs, and earnings, and may also affect the book value of our assets located outside of the United States and the amount of our invested equity. Although we may seek to decrease our currency exposure by engaging in hedges against significant transactions and balance sheet currency exposures where we deem it appropriate, we do not hedge against translation risks. Though we monitor and manage our exposures to changes in currency exchange rates, and utilize currency exchange forward contracts and swaps to mitigate the impact of changes in currency values, changes in exchange rates nonetheless cannot always be predicted or hedged. Consequently, we cannot assure that any efforts to minimize our risk to currency movements will be successful. To the extent we sell our products in markets other than the market in which they are manufactured, currency fluctuations may result in our products becoming too expensive for customers in those markets.

Prices of some raw materials, especially steel and iron, fluctuate, which can adversely affect our sales, costs, and profitability.

We manufacture products with a relatively high iron casting or steel content, commodities for which worldwide prices fluctuate. The availability of and prices for these and other raw materials are subject to volatility due to worldwide supply and demand forces, speculative actions, inventory levels, exchange rates, production costs, and anticipated or perceived shortages. In some cases, raw material cost increases can be passed on to customers in the form of price increases; in other cases, they cannot. If raw material prices increase and we are not able to charge our customers higher prices to compensate, it would adversely affect our business, results of operations and financial condition.

Our expenditures for post-retirement pension obligations could be materially higher than we have predicted if our underlying assumptions prove to be incorrect or we are required to use different assumptions.

We provide defined benefit pension plans to eligible employees. Our pension expense, the funding status of our plans and related charges in other comprehensive income (loss), and required contributions to our pension plans are directly affected by the value of plan assets, the projected rate of return on plan assets, the actual rate of return on plan assets and the actuarial assumptions we use to measure our defined benefit pension plan obligations, including the rate at which future obligations are discounted to a present value, or the discount rate. Should the assets earn a return less than the assumed rate of return over time, it is likely that future pension expenses and funding requirements would increase. Investment earnings in excess of the assumed rate of return may reduce future pension expenses and funding requirements. A change in the discount rate would impact the funded status of our plans. An increase to the discount rate would generally reduce the pension liability and future pension expense and, conversely, a lower discount rate would generally increase the pension liability and the future pension expense.

The market-related value of assets for our U.S. qualified defined benefit pension plan recognizes asset losses and gains over a five-year period, which we believe is consistent with the long-term nature of our pension obligations. As a result, the effect of changes in the market value of assets on our pension expense may be experienced in future years rather than fully reflected in the expense for the year immediately following the year in which the fluctuations actually occurred.

In addition, we cannot predict whether changing market or economic conditions, regulatory changes or other factors will increase our pension expenses or our funding obligations, diverting funds we would otherwise apply to other uses. Contribution levels are largely contingent on asset returns and corporate bond yields. If the performance of the assets in our U.S. qualified defined benefit pension plan does not meet our expectations and/or corporate bond yields decrease, our future contributions to the plan could increase.

13

If we are unable to attract and retain skilled employees to work at our manufacturing facilities, our operations and growth prospects would be adversely impacted.

We conduct substantially all of our manufacturing operations in less densely populated urban areas, which, in many cases, may represent a relatively small market for skilled labor force. Our continued success depends on our ability to attract and retain a skilled labor force at these locations. If we are not able to attract and retain the personnel we require, we may be unable to develop, manufacture, and market our products, or to expand our operations in a manner that best exploits market opportunities and capitalizes on our investment in our business. This would materially adversely affect our business, operating results and financial condition.

Due to future technological changes, changes in market demand, or changes in market expectations, portions of our inventory may become obsolete or excessive.

The technologies incorporated in our products change and generally new versions of machines are brought to market in three to five year cycles. The phasing out of an old product involves both estimating the amount of inventory to hold to satisfy the final demand for those machines as well as to satisfy future repair part needs. Based on changing customer demand and expectations of delivery times for repair parts, we may find that we have either obsolete or excess inventory on hand. Because of unforeseen changes in technology, market demand, or competition, we may have to write off unusable inventory at some time in the future, which may adversely affect our results of operations and financial condition.

Major changes in the economic situation of our customer base could require us to write off significant portion of our receivables from customers.

In difficult economic periods, our customers lose work and find it difficult if not impossible to pay for products purchased from us. Although appropriate credit reviews are done at the time of sale, rapidly changing economic conditions can have sudden impacts on our customers' ability to pay. We run the risk of bad debt on existing time payment contracts and open accounts. If we write off significant parts of our customer accounts or notes receivable because of unforeseen changes in their business condition, it would adversely affect our results of operations, financial condition, and cash flows.

If we suffer damage to our factories, facilities or distribution system due to catastrophe, our operations could be seriously harmed.

Our factories, facilities, and distribution system are subject to the risk of catastrophic loss due to fire, flood, terrorism, or other natural or man-made disasters. In particular, several of our facilities could be subject to a catastrophic loss caused by earthquake due to their locations. Our facilities in Southeast Asia are located in areas with above average seismic activity. If any of our facilities were to experience a catastrophic loss, it could disrupt our operations, delay production, shipments and revenue, and result in large expenses to repair or replace the facility.

Our business operations may be adversely affected by interruptions or failures of our technology information systems.

We are dependent on multiple information technology systems throughout our company to operate our business. An interruption or failure of our information technology systems, or a cybersecurity attack, such as unauthorized access, malicious software or other intrusion, may result in a significant disruption of our business operations and materially increase our costs of operations.

We rely in part on independent distributors and the loss of these distributors could adversely affect our business.

In addition to our direct sales force, we depend on the services of independent distributors and agents to sell our products and provide service and aftermarket support to our customers. We support an extensive distributor and agent network worldwide. In 2014, approximately 66% of our sales were through distributors and agents. No distributor accounted for more than 5% of our consolidated sales in 2014. Rather than serving as passive conduits for delivery of product, many of our distributors are active participants in the sale and support of our products. Many of the distributors with whom we transact business offer competitive products and services to our customers. In addition, the distribution agreements we have are typically cancelable by the distributor after a relatively short notice period. The loss of a substantial number of our distributors or an increase in the distributors' sales of our competitors' products to our customers could reduce our sales and profits.

14

We rely on estimated forecasts of our customers' needs, and inaccuracies in such forecasts could adversely affect our business.

We generally sell our products pursuant to individual purchase orders instead of long-term purchase commitments. Therefore, we rely on estimated demand forecasts, based upon input from our customers and the general economic environment, to determine how much material to purchase and product to manufacture. Because our sales are based on purchase orders, our customers may cancel, delay, or otherwise modify their purchase commitments with little or no consequence to them and with little or no notice to us. For these reasons, we generally have limited visibility regarding our customers' actual product needs. The quantities or timing required by our customers for our products could vary significantly. Whether in response to changes affecting the industry or a customer's specific business pressures, any cancellation, delay, or other modification in our customers' orders could significantly reduce our revenue, cause our operating results to fluctuate from period to period and make it more difficult for us to predict our revenue. In the event of a cancellation or reduction of a customer order, we may not have enough time to reduce inventory purchases or our workforce to minimize the effect of the lost revenue on our business. Order cancellations typically average approximately 2% of sales. Cancellations could vary significantly during times of global economic uncertainty.

We could face potential product liability claims relating to products we manufacture, which could result in us having to expend significant time and expense to defend these claims and to pay material amounts in damages or settlement.

We face a business risk of exposure to product liability claims in the event that the use of our products is alleged to have resulted in injury or other adverse effects. We currently maintain product liability insurance coverage; however, such insurance does not cover all types of damages that could be assessed against us in a product liability claim and the coverage amounts are subject to certain limitations under the applicable policies. We may not be able to obtain product liability insurance on acceptable terms in the future. Product liability claims can be expensive to defend and can divert the attention of management and other personnel for long periods of time, regardless of the ultimate outcome. An unsuccessful product liability defense could have a material adverse effect on our business, financial condition, results of operations or prospects. In addition, we believe our business depends on the strong brand reputation we have developed. In the event that our reputation is damaged, we may face difficulty in maintaining our pricing positions with respect to some of our products, which would reduce our sales and profitability.

Current employment laws or changes in employment laws could increase our costs and may adversely affect our business.

Various federal, state and foreign labor laws govern the relationship with our employees and affect operating costs. These laws include minimum wage requirements, overtime, unemployment tax rates, workers' compensation rates, citizenship requirements, and costs to terminate or layoff employees. Significant additional government-imposed increases in the following areas could materially affect our business, financial condition, operating results, or cash flow:

▪ | minimum wages; |

▪ | mandated health benefits; |

▪ | paid leaves of absence; |

▪ | mandatory severance payments; and |

▪ | employment taxes. |

We are subject to environmental laws that could impose significant costs on us and the failure to comply with such laws could subject us to sanctions and material fines and expenses.

Our operations are subject to extensive federal, state, local and foreign laws and regulations relating to environmental matters. Certain environmental laws can impose joint and several liability for releases or threatened releases of hazardous substances upon certain statutorily defined parties regardless of fault or the lawfulness of the original activity or disposal. Hazardous substances and adverse environmental effects have been identified with respect to real property we own and on adjacent parcels of real property.

We believe, based upon information currently available that, except with respect to the environmental matter concerning the Kentucky Avenue Wellfield Site as described in Part I Item 1. "Business - Environmental Matters", we will not have material liabilities for environmental remediation. Though the foregoing reflects the Company's current assessment as it relates to environmental remediation obligations, it is possible that future remedial requirements or changes in the enforcement of existing laws and regulations, which are subject to extensive regulatory discretion, will result in material liabilities to the Company.

15

The loss of current members of our senior management team and other key personnel may adversely affect our operating results.

The loss of senior management and other key personnel could impair our ability to carry out our business plan. We believe our future success will depend in part on our ability to attract and retain highly skilled and qualified personnel. The loss of senior management and other key personnel may adversely affect our operating results as we incur costs to replace the departing personnel and potentially lose opportunities in the transition of important job functions.

If we fail to maintain an effective system of internal controls, we may not be able to report our financial results accurately or prevent fraud.

Effective internal controls are necessary for us to provide reliable financial reports, to prevent fraud and to operate successfully as a publicly traded company. Our efforts to maintain an effective system of internal controls may not be successful, and we may be unable to maintain adequate controls over our financial processes and reporting in the future. Ineffective internal controls subject us to regulatory scrutiny and a loss of confidence in our reported financial information, which could have an adverse effect on our business and would likely have a negative effect on the trading price of our common stock.

We are required, pursuant to Section 404 of the Sarbanes-Oxley Act, to periodically furnish a report by our management regarding, among other things, the effectiveness of our internal control over financial reporting. Our management has concluded that, as of December 31, 2014, the Company's internal control over financial reporting was effective.

Anti-takeover provisions in our charter documents and under New York law may discourage a third party from acquiring us.

Certain provisions of our certificate of incorporation and bylaws may have the effect of discouraging a third party from making a proposal to acquire us and, as a result, may inhibit a change in control of the Company under circumstances that could give the shareholders the opportunity to realize a premium over the then-prevailing market price of our common shares. These include:

Staggered Board of Directors. Our certificate of incorporation and bylaws provide that our Board of Directors, currently consisting of seven members, is divided into three classes of directors, with each class consisting of two or three directors, and with the classes serving staggered three-year terms. This classification of the directors has the effect of making it more difficult for shareholders, including those holding a majority of our outstanding shares, to force an immediate change in the composition of our Board of Directors.

Removal of Directors and Filling of Vacancies. Our certificate of incorporation provides that a member of our Board of Directors may be removed only for cause and upon the affirmative vote of the holders of 75% of the securities entitled to vote at an election of directors. Newly created directorships and Board of Director vacancies resulting from retirement, death, removal or other causes may be filled only by a majority vote of the then remaining directors. Accordingly, it is more difficult for shareholders, including those holding a majority of our outstanding shares, to force an immediate change in the composition of our Board of Directors.

Supermajority Voting Provisions for Certain Business Combinations. Our certificate of incorporation requires the affirmative vote of at least 75% of all of the securities entitled to vote and at least 75% of shareholders who are not Major Shareholders (defined as 10% beneficial holders) in order to effect certain mergers, sales of assets or other business combinations involving the Company. These provisions could have the effect of delaying, deferring or preventing a change of control of the Company.

In addition, as a New York corporation we are subject to provisions of the New York Business Corporation Law which may make it more difficult for a third party to acquire and exercise control over us pursuant to a tender offer or request or invitation for tenders. These provisions could have the effect of deterring or delaying changes in incumbent management, proxy contests or changes in control.

16

Our shareholders may experience further dilution as a result of future equity offerings or issuances.

In order to raise additional capital or pursue strategic transactions, we may in the future offer, issue or sell additional shares of our common stock or other equity securities. Our shareholders may experience significant dilution as a result of future equity offerings or issuances. Investors purchasing shares or other securities in the future could have rights superior to existing shareholders.

In addition, we have filed a registration statement with the Securities and Exchange Commission, allowing us to offer, from time to time and at any time, up to $100.0 million of equity securities (including common or preferred shares), subject to market conditions and other factors. The shares sold under the controlled equity offerings are the only equity securities sold pursuant to such registration statement thus far. Accordingly, we may, from time to time and at any time, seek to offer and sell our equity securities, including sales of shares of common stock, based upon market conditions and other factors.

Under a Controlled Equity Offering Sales Agreement entered into with Cantor Fitzgerald & Co. on August 9, 2013, we have sold approximately $14.6 million of shares of our common stock, as of December 31, 2014, through "at-the-market" offerings, and may offer and sell, from time to time through such offerings an additional amount of up to an aggregate offering price of $25.0 million of shares of our common stock.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

Pertinent information concerning the principal properties of the Company and its subsidiaries is as follows:

Owned Properties:

Location | Type of Facility | Acreage (Land) Square Footage (Building) | ||

Horseheads, New York | Manufacturing, Engineering, Turnkey Systems, Marketing, Sales, Demonstration, Service, and Administration | 80 acres 515,000 sq. ft. | ||

Jiaxing, China | Manufacturing, Engineering, Demonstration, and Administration (Buildings and improvements are owned by the Company; land is under 50-year lease expiring in November 2060) | 7 acres 223,179 sq. ft | ||

St. Gallen, Switzerland | Manufacturing, Engineering, Turnkey Systems, Marketing, Sales, Demonstration, Service, and Administration | 8 acres 162,924 sq. ft. | ||

Nan Tou City, Taiwan | Manufacturing, Engineering, Marketing, Sales, Demonstration, Service, and Administration | 3 acres 123,204 sq. ft. | ||

Romanshorn, Switzerland | Manufacturing | 2 acres 42,324 sq. ft. | ||

Biel, Switzerland | Manufacturing, Engineering, Service, and Turnkey Systems | 4 acres 41,500 sq. ft. | ||

Traverse City, Michigan | Manufacturing, Engineering, Marketing, Sales, Service, and Administration | 2.4 acres 38,800 sq. ft. | ||

17

Leased Properties:

Location | Type of Facility | Square Footage | Lease Expiration Date | |||

Leicester, England | Manufacturing, Sales, Marketing, Engineering, Turnkey Systems, Demonstration, Service, and Administration | 55,000 sq. ft. | 3/31/19 | |||

Ekrath, Germany | Sales, Service, Administration, Engineering, and Marketing | 45,025 sq. ft. | 4/30/2016 | |||

Reutlingen, Germany | Manufacturing and Engineering | 39,547 sq. ft. | 8/31/19 | |||

Shanghai, China | Marketing, Engineering, Turnkey Systems, Sales, Service, Demonstration, and Administration | 38,820 sq. ft. | 5/31/18 | |||

Elgin, Illinois | Manufacturing, Sales, Marketing, Engineering, Turnkey Systems, Demonstration, Service, and Administration | 34,000 sq. ft. | 12/31/17 | |||

Krefeld, Germany | Sales, Turnkey Systems, Service, Demonstration, and Administration | 14,402 sq. ft. | 3/31/20 | |||

Hyderabad, India | Manufacturing, Engineering, Marketing, Sales, Service, and Administration | 10,000 sq. ft. | 9/30/16 | |||

Biel, Switzerland | Manufacturing, Sales, Engineering, Turnkey Systems, Service, and Administration | 7,995 sq. ft. | 6/30/15 | |||

Noisy le Sec, France | Manufacturing, Engineering, Marketing, Sales, Administration, and Service | 7,320 sq. ft. | 12/31/19 | |||

St. Gallen, Switzerland | Manufacturing | 7,136 sq. ft. | 12/31/19 | |||

Bron, France | Marketing, Sales, Administration, and Service | 2,680 sq. ft. | 4/1/23 | |||

Item 3. Legal Proceedings.

The Company is from time to time involved in routine litigation incidental to its operations. None of the litigation in which we are currently involved, individually or in the aggregate, is anticipated to be material to our financial condition, results of operations, or cash flows.

Item 4. Mine Safety Disclosures.

Not Applicable.

18

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

The following table reflects the highest and lowest values at which our common stock traded in each quarter of the last two years. Our common stock trades on the NASDAQ Global Select Market under the symbol "HDNG". The table also includes dividends per share, by quarter:

2014 | 2013 | ||||||||||||||||||||||

Values | Values | ||||||||||||||||||||||

High | Low | Dividends | High | Low | Dividends | ||||||||||||||||||

Quarter Ended | |||||||||||||||||||||||

March 31, | $ | 14.86 | $ | 12.86 | $ | 0.02 | $ | 13.95 | $ | 10.00 | $ | 0.02 | |||||||||||

June 30, | 14.66 | 11.40 | 0.02 | 14.97 | 11.91 | 0.02 | |||||||||||||||||

September 30, | 13.00 | 10.75 | 0.02 | 16.88 | 13.63 | 0.02 | |||||||||||||||||

December 31, | 12.59 | 9.77 | 0.02 | 15.68 | 13.79 | 0.02 | |||||||||||||||||

At March 6, 2015, there were 228 shareholders of record of our common stock.

Issuer Purchases of Equity Securities

None.

Performance Graph

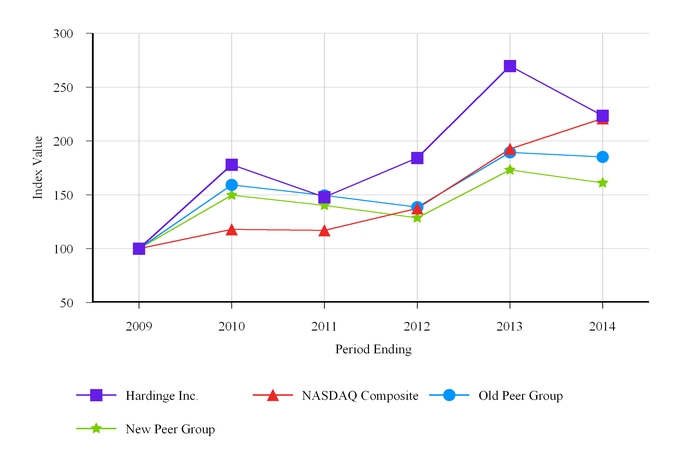

The graph below compares the five-year cumulative total return for Hardinge Inc. common stock with the comparable returns for the NASDAQ Stock Market (U.S.) Index and a group of 16 peer issuers, and our old peer group of 15 peer issuers. The companies included in our new peer group were selected based on comparability to Hardinge with respect to market capitalization, sales, manufactured products and international presence. Our new peer group includes Altra Holding, Inc., Cohu, Inc., Columbus McKinnon Corporation, Dynamic Materials Corporation, Electro Scientific Industries Inc., Global Power Equipment Group Inc., Hurco Companies Inc., Kadant Inc., Nanometrics Inc., Newport Corporation, NN, Inc., PMFG, Inc., Rudolph Technologies, Inc., Sifco Industries Inc., Transcat Inc., and Twin Disc Inc. Our old peer group included Flow International Corporation and Zygo Corporation, both of which were acquired during 2014 and were no longer publicly traded. We replaced these two companies with Dynamic Materials Corporation, PMFG, Inc., and Rudolph Technologies. Cumulative total return represents the change in stock price and the amount of dividends received during the indicated period, assuming reinvestment of dividends. The graph assumes an investment of $100 on December 31, 2009. The stock performance shown in the graph is included in response to SEC requirements and is not intended to forecast or to be indicative of future performance.

19

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Hardinge Inc., the NASDAQ Composite Index,

Old Peer Group and New Peer Group

____________________

*$100 invested on 12/31/09 in stock or index, including reinvestment of dividends.

Fiscal year ended December 31, | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | |||||||||||||||||

Hardinge Inc. | $ | 100.00 | $ | 177.92 | $ | 147.94 | $ | 184.21 | $ | 269.72 | $ | 223.60 | |||||||||||

NASDAQ Composite | 100.00 | 118.02 | 117.04 | 137.47 | 192.62 | 221.02 | |||||||||||||||||

Old Peer Group | 100.00 | 159.20 | 149.42 | 138.66 | 189.30 | 185.28 | |||||||||||||||||

New Peer Group | 100.00 | 149.81 | 140.26 | 128.68 | 173.15 | 161.12 | |||||||||||||||||

20

Item 6. Selected Financial Data.

The following selected financial data is derived from the audited consolidated financial statements of the Company. The data should be read in conjunction with the audited consolidated financial statements, related notes and other information included herein (amounts in thousands except per share data):

2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||||

STATEMENT OF OPERATIONS DATA: | |||||||||||||||||||

Sales | $ | 311,633 | $ | 329,459 | $ | 334,413 | $ | 341,573 | $ | 257,007 | |||||||||

Cost of sales | 224,755 | 236,220 | 237,576 | 250,545 | 195,717 | ||||||||||||||

Gross profit | 86,878 | 93,239 | 96,837 | 91,028 | 61,290 | ||||||||||||||

Selling, general and administrative expenses | 81,045 | 79,533 | 76,196 | 73,599 | 65,650 | ||||||||||||||

Impairment charges(1) | 5,766 | 6,239 | — | — | (25 | ) | |||||||||||||

Other expense (income), net | 514 | 471 | 559 | 832 | (1,605 | ) | |||||||||||||

Operating (loss) income | (447 | ) | 6,996 | 20,082 | 16,597 | (2,730 | ) | ||||||||||||

Interest expense, net | 678 | 1,064 | 741 | 238 | 336 | ||||||||||||||

(Loss) income from continuing operations before income taxes | (1,125 | ) | 5,932 | 19,341 | 16,359 | (3,066 | ) | ||||||||||||

Income taxes | 1,233 | 1,537 | 1,486 | 4,373 | 2,168 | ||||||||||||||

(Loss) income from continuing operations | (2,358 | ) | 4,395 | 17,855 | 11,986 | (5,234 | ) | ||||||||||||

Gain from disposal of discontinued operation, and income from discontinued operations, net of tax(2) | 218 | 5,532 | — | — | — | ||||||||||||||

Net (loss) income | $ | (2,140 | ) | $ | 9,927 | $ | 17,855 | $ | 11,986 | $ | (5,234 | ) | |||||||

PER SHARE DATA: | |||||||||||||||||||

Basic (loss) earnings per share: | |||||||||||||||||||

Continuing operations | $ | (0.19 | ) | $ | 0.37 | $ | 1.53 | $ | 1.03 | $ | (0.46 | ) | |||||||