Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Endo International plc | d891986d8k.htm |

| Exhibit 99.1

|

Exhibit 99.1

Endo International plc

Barclays Healthcare Conference

March 12, 2015

©2015 Endo Pharmaceuticals Inc. All rights reserved.

|

|

Forward Looking Statements; Non-GAAP Financial Measures

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and

Canadian securities legislation. Statements including words such as “believes,” “expects,” “anticipates,” “intends,” “estimates,” “plan,” “will,” “may,” “look forward,” “intend,” “guidance,” “future” or similar expressions are forward-looking statements. Because these statements reflect our current views, expectations and beliefs concerning future events, these forward-looking statements involve risks and uncertainties. Although Endo believes that these forward-looking statements and information are based upon reasonable assumptions and expectations, readers should not place undue reliance on them, or any other forward looking statements or information in this news release. Investors should note that many factors, as more fully described in the documents filed by Endo with securities regulators in the

United States and Canada including under the caption “Risk Factors” in Endo’s and EHSI’s Form 10-K, Form 10-Q and Form 8-K filings, as applicable, with the Securities and Exchange Commission and with securities regulators in Canada on System for Electronic Document

Analysis and Retrieval (“SEDAR”) and as otherwise enumerated herein or therein, could affect Endo’s future financial results and could cause Endo’s actual results to differ materially from those expressed in forward-looking statements contained in EHSI’s Annual Report on

Form 10-K. The forward-looking statements in this presentation are qualified by these risk factors. These are factors that, individually or in the aggregate, could cause our actual results to differ materially from expected and historical results. Endo assumes no obligation to publicly update any forward-looking statements, whether as a result of new information, future developments or otherwise, except as may be required under applicable securities law.

This presentation may refer to non-GAAP financial measures, including adjusted diluted EPS, that are not prepared in accordance with accounting principles generally accepted in the United States and that may be different from non-GAAP financial measures used by other companies. Investors are encouraged to review Endo’s current report on Form 8-K filed with the SEC for Endo’s reasons for including those non-GAAP financial measures in this presentation. Reconciliation of non-GAAP financial measures to the nearest comparable GAAP amounts have been provided within the appendix at the end of this presentation.

Additional Information

This presentation is provided for informational purposes only and is neither an offer to purchase nor a solicitation of an offer to sell shares of Endo or Salix. Subject to future developments and an agreement between Endo and Salix, Endo may file a registration statement and/or tender offer documents with the U.S. Securities and Exchange Commission (the “SEC”) in connection with the proposed combination. Endo and Salix shareholders should read those filings, and any other filings made by Endo with the SEC in connection with the proposed combination, as they will contain important information. Those documents, if and when filed, as well as Endo’s other public filings with the

SEC, may be obtained without charge at the SEC’s website at www.sec.gov and at Endo’s website at endo.com.

| 1 |

|

©2015 Endo Pharmaceuticals Inc. All rights reserved.

|

|

Discussion Topics

Endo’s Strategy and Operating Model

Update on Endo’s Proposed Acquisition of Salix

Recent Accomplishments

R&D Pipeline Update

2015 Objectives and Financial Guidance

Q&A

| 2 |

|

©2015 Endo Pharmaceuticals Inc. All rights reserved.

|

|

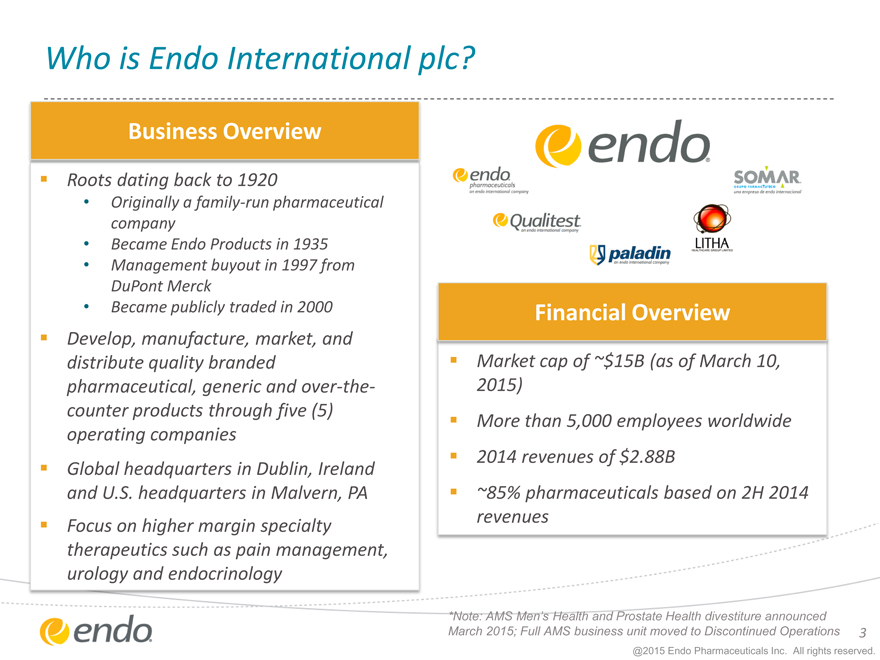

Who is Endo International plc

Business Overview

Roots dating back to 1920

Originally a family-run pharmaceutical company

Became Endo Products in 1935

Management buyout in 1997 from DuPont Merck

Became publicly traded in 2000

Develop, manufacture, market, and distribute quality branded pharmaceutical, generic and over-the-counter products through five (5) operating companies

Global headquarters in Dublin, Ireland and U.S. headquarters in Malvern, PA Focus on higher margin specialty therapeutics such as pain management, urology and endocrinology

Financial Overview

Market cap of ~$15B (as of March 10, 2015)

More than 5,000 employees worldwide

2014 revenues of $2.88B

~85% pharmaceuticals based on 2H 2014 revenues

*Note: AMS Men’s Health and Prostate Health divestiture announced

March 2015; Full AMS business unit moved to Discontinued Operations

@2015 Endo Pharmaceuticals Inc. All rights reserved.

| 3 |

|

|

|

Endo’s Strategic Direction

Build a leading global specialty pharmaceutical company

Focus on maximizing the value of each of our core businesses

Participate in specialty areas offering above average growth and favorable margins

Transform operating model to maximize growth potential and cash flow generation

Continue our commitment to serving our patients & customers

Improving lives while creating value

| 4 |

|

@2015 Endo Pharmaceuticals Inc. All rights reserved.

|

|

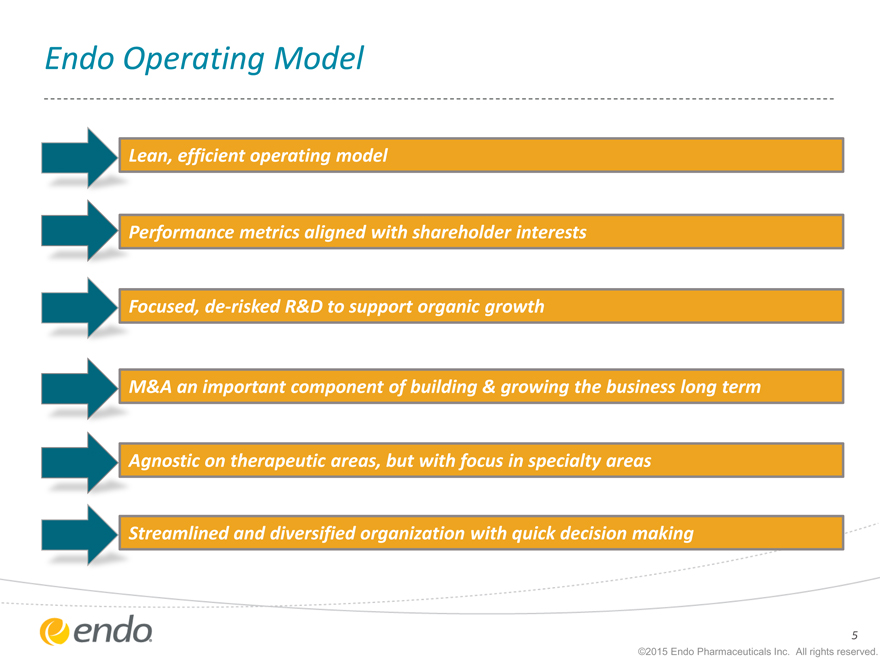

Endo Operating Model

Lean, efficient operating model

Performance metrics aligned with shareholder interests

Focused, de-risked R&D to support organic growth

M&A an important component of building & growing the business long term Agnostic on therapeutic areas, but with focus in specialty areas Streamlined and diversified organization with quick decision making

| 5 |

|

©2015 Endo Pharmaceuticals Inc. All rights reserved.

|

|

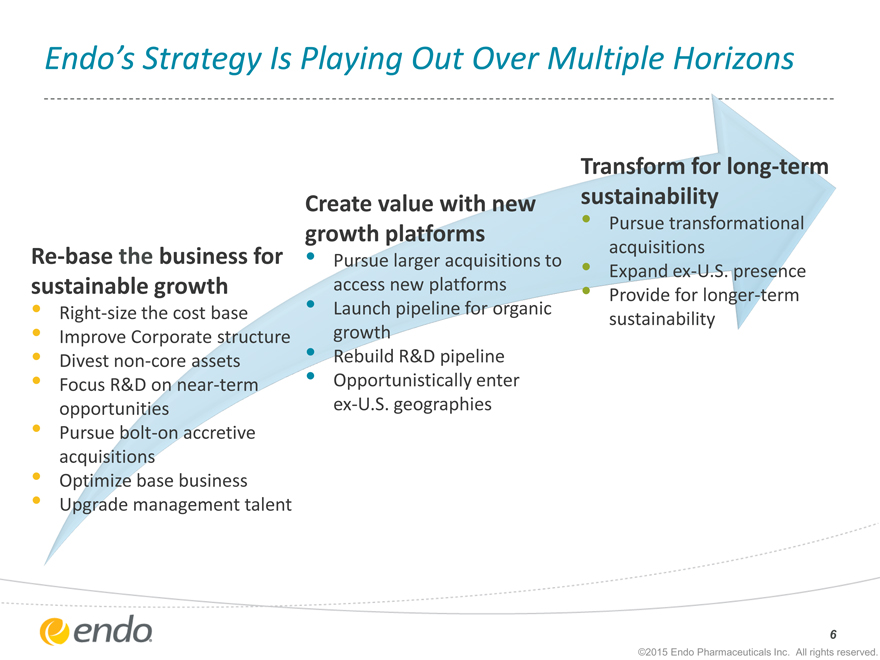

Endo’s Strategy Is Playing Out Over Multiple Horizons

Re-base the business for sustainable growth

Right-size the cost base

Improve Corporate structure

Divest non-core assets

Focus R&D on near-term opportunities

Pursue bolt-on accretive acquisitions

Optimize base business

Upgrade management talent

Create value with new growth platforms

Pursue larger acquisitions to access new platforms

Launch pipeline for organic growth

Rebuild R&D pipeline

Opportunistically enter ex-U.S. geographies

Transform for long-term sustainability

Pursue transformational acquisitions

Expand ex-U.S. presence

Provide for longer-term sustainability

| 6 |

|

©2015 Endo Pharmaceuticals Inc. All rights reserved.

|

|

Salix Acquisition

Proposal

©2015 Endo Pharmaceuticals Inc. All rights reserved.

| 7 |

|

|

|

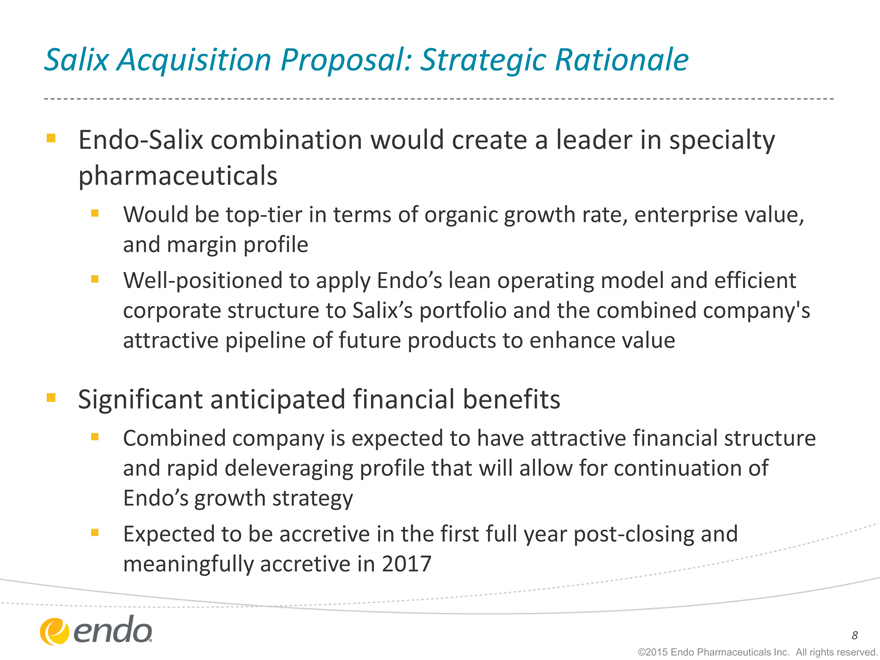

Salix Acquisition Proposal: Strategic Rationale

Endo-Salix combination would create a leader in specialty pharmaceuticals

Would be top-tier in terms of organic growth rate, enterprise value, and margin profile

Well-positioned to apply Endo’s lean operating model and efficient corporate structure to Salix’s portfolio and the combined company’s attractive pipeline of future products to enhance value

Significant anticipated financial benefits

Combined company is expected to have attractive financial structure and rapid deleveraging profile that will allow for continuation of Endo’s growth strategy Expected to be accretive in the first full year post-closing and meaningfully accretive in 2017

| 8 |

|

©2015 Endo Pharmaceuticals Inc. All rights reserved.

|

|

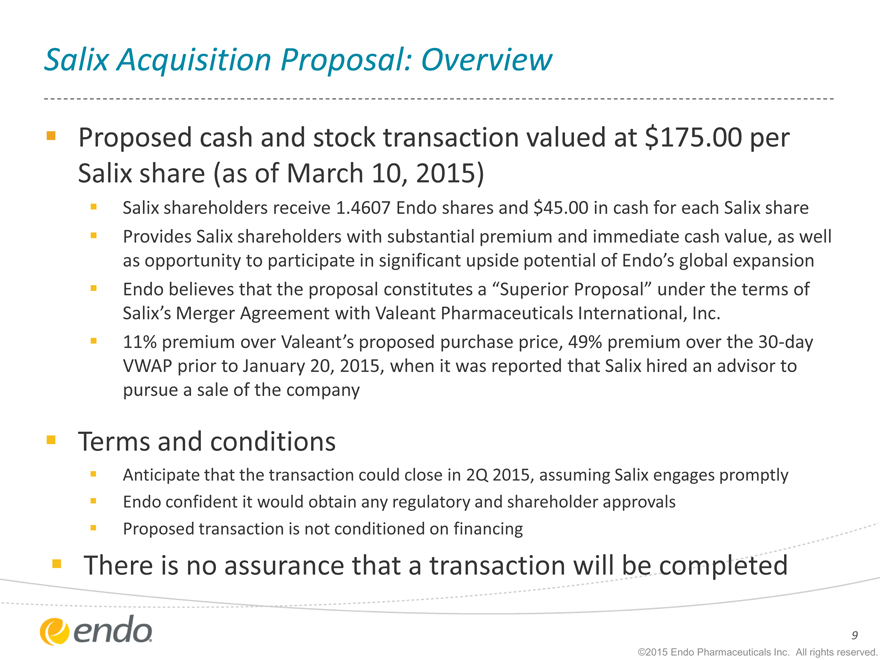

Salix Acquisition Proposal: Overview

Proposed cash and stock transaction valued at $175.00 per

Salix share (as of March 10, 2015)

Salix shareholders receive 1.4607 Endo shares and $45.00 in cash for each Salix share Provides Salix shareholders with substantial premium and immediate cash value, as well as opportunity to participate in significant upside potential of Endo’s global expansion

Endo believes that the proposal constitutes a “Superior Proposal” under the terms of

Salix’s Merger Agreement with Valeant Pharmaceuticals International, Inc.

11% premium over Valeant’s proposed purchase price, 49% premium over the 30-day VWAP prior to January 20, 2015, when it was reported that Salix hired an advisor to pursue a sale of the company

Terms and conditions

Anticipate that the transaction could close in 2Q 2015, assuming Salix engages promptly Endo confident it would obtain any regulatory and shareholder approvals Proposed transaction is not conditioned on financing

There is no assurance that a transaction will be completed

9

©2015 Endo Pharmaceuticals Inc. All rights reserved.

|

|

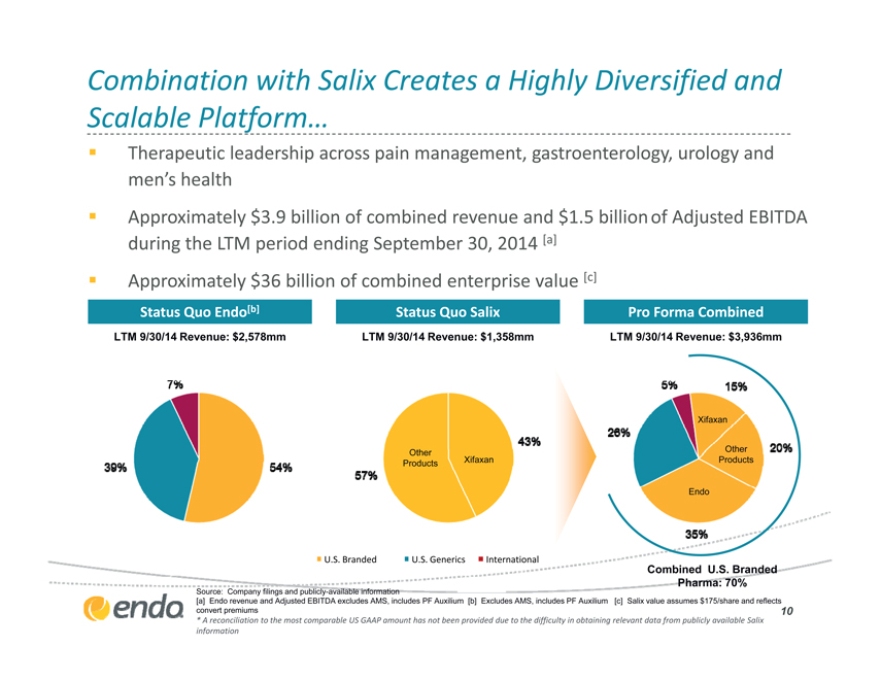

Combination with Salix Creates a Highly Diversified and

Scalable Platform…

Therapeutic leadership across pain management, gastroenterology, urology and men’s health

Approximately $3.9 billion of combined revenue and $1.5 billion of Adjusted EBITDA during the LTM period ending September 30, 2014 [a] Approximately $36 billion of combined enterprise value [c]

Status Quo Endo[b] Status Quo Salix Pro Forma Combined

LTM 9/30/14 Revenue: $2,578mm LTM 9/30/14 Revenue: $1,358mm LTM 9/30/14 Revenue: $3,936mm

Xifaxan

Other Other

Products Xifaxan Products

Endo

U.S. Branded U.S. Generics International

Combined U.S. Branded

Pharma: 70%

Source: Company filings and publicly-available information

[a] Endo revenue and Adjusted EBITDA excludes AMS [b] Excludes AMS [c] Salix value assumes $175/share and reflects convert premiums

* A reconciliation to the most comparable US GAAP amount has not been provided due to the difficulty in obtaining relevant data from publicly available Salix information

10

|

|

…With A Broadly Diversified Product Portfolio…

Urology / Men’s Health Pain / Orthopedics Other Specialty Gastroenterology

Source: Company filings

11

|

|

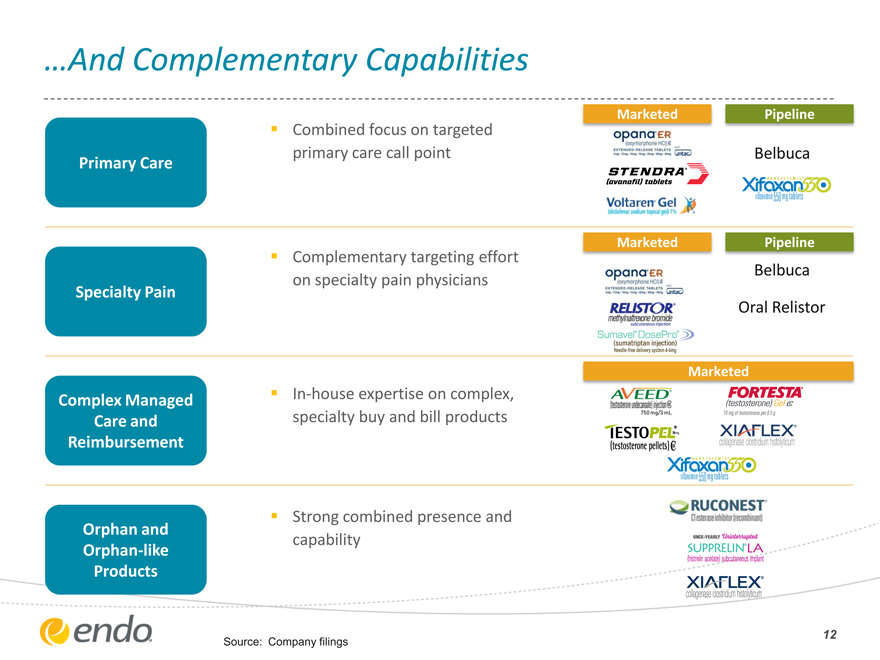

…And Complementary Capabilities

Combined focus on targeted

primary care call point

Primary Care

Complementary targeting effort

on specialty pain physicians

Specialty Pain

Complex Managed In-house expertise on complex,

Care and specialty buy and bill products

Reimbursement

Strong combined presence and

Orphan and

capability

Orphan-like

Products

Source: Company filings

Marketed Pipeline

Belbuca

Marketed Pipeline

Belbuca

Oral Relistor

Marketed

12

|

|

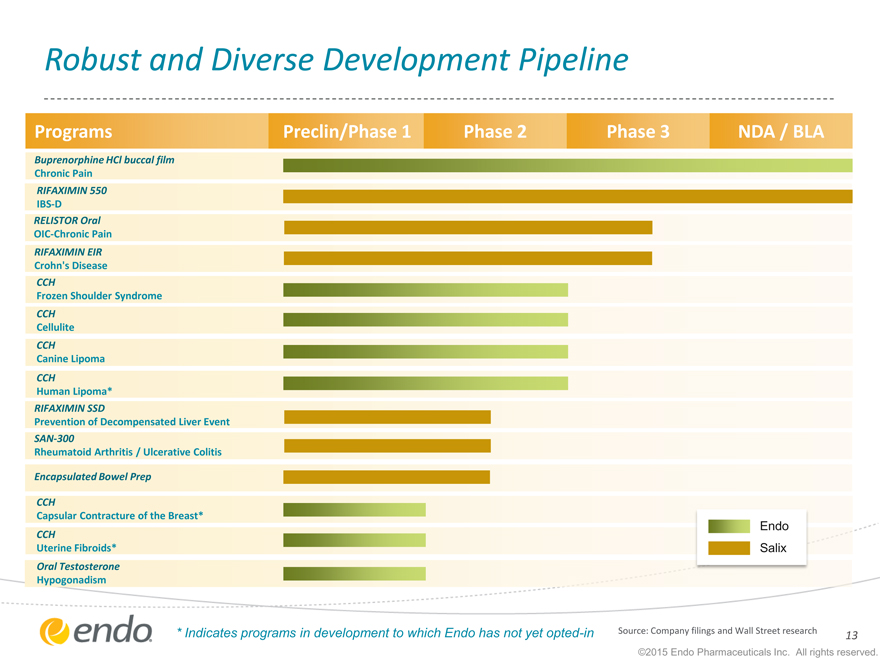

Robust and Diverse Development Pipeline

Programs Preclin/Phase 1 Phase 2 Phase 3 NDA / BLA

Buprenorphine HCl buccal film

Chronic Pain

RIFAXIMIN 550

IBS-D

RELISTOR Oral

OIC-Chronic Pain

RIFAXIMIN EIR

Crohn’s Disease

CCH

Frozen Shoulder Syndrome

CCH

Cellulite

CCH

Canine Lipoma

CCH

Human Lipoma*

RIFAXIMIN SSD

Prevention of Decompensated Liver Event

SAN-300

Rheumatoid Arthritis / Ulcerative Colitis

Encapsulated Bowel Prep

CCH

Capsular Contracture of the Breast*

Endo

CCH

Uterine Fibroids* Salix

Oral Testosterone

Hypogonadism

| * |

|

Indicates programs in development to which Endo has not yet opted-in |

Source: Company filings and Wall Street research 13

©2015 Endo Pharmaceuticals Inc. All rights reserved.

|

|

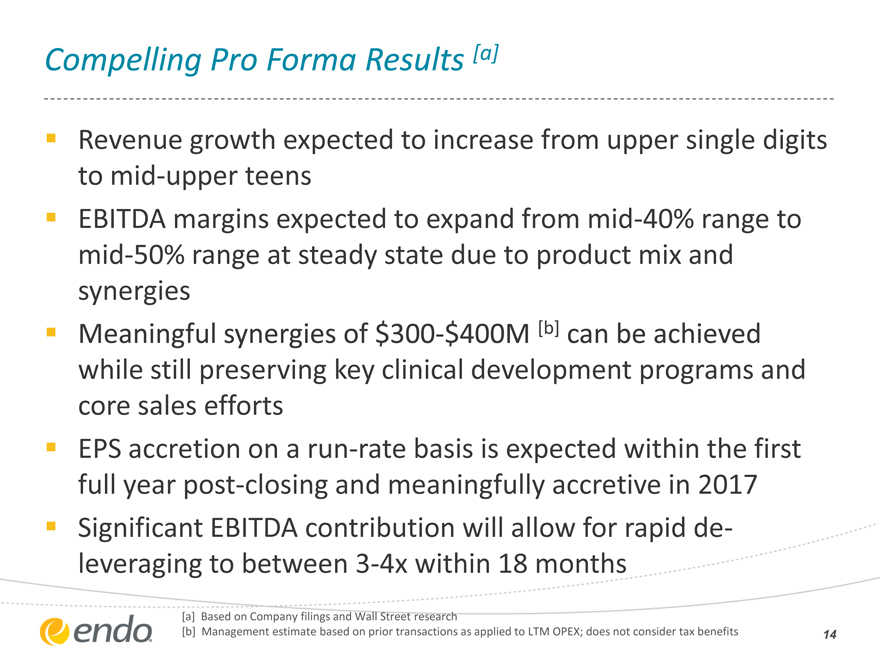

Compelling Pro Forma Results [a]

Revenue growth expected to increase from upper single digits to mid-upper teens EBITDA margins expected to expand from mid-40% range to mid-50% range at steady state due to product mix and synergies

Meaningful synergies of $300-$400M [b] can be achieved while still preserving key clinical development programs and core sales efforts EPS accretion on a run-rate basis is expected within the first full year post-closing and meaningfully accretive in 2017 Significant EBITDA contribution will allow for rapid de-leveraging to between 3-4x within 18 months

Based on Company filings and Wall Street research

Management estimate based on prior transactions as applied to LTM OPEX; does not consider tax benefits

14

|

|

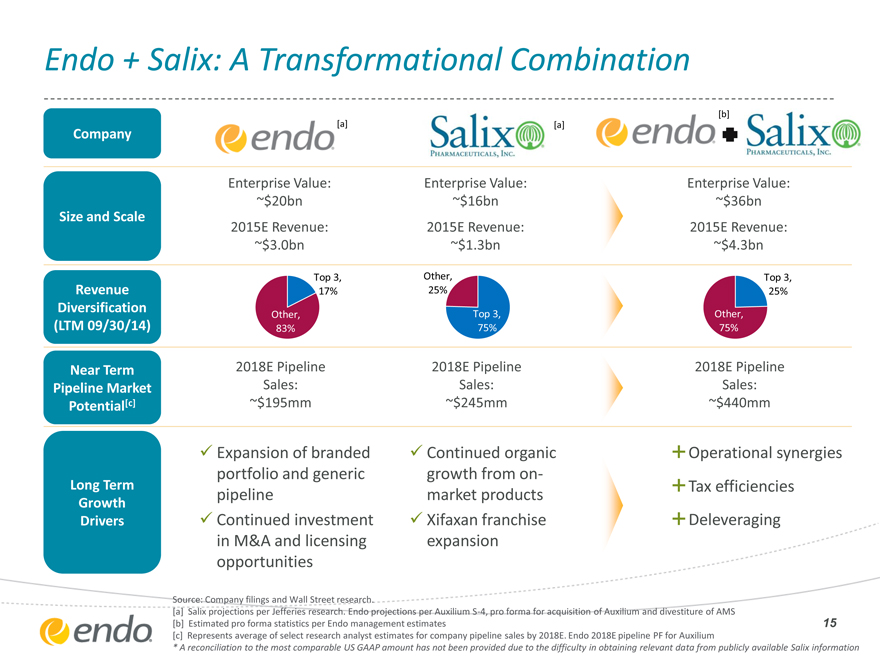

Endo + Salix: A Transformational Combination

[b]

[a] [a]

Company

Enterprise Value: Enterprise Value: Enterprise Value:

~$20bn ~$16bn ~$36bn

Size and Scale

2015E Revenue: 2015E Revenue: 2015E Revenue:

| ~$3.0bn |

|

~$1.3bn ~$4.3bn |

Top 3, Other, Top 3,

Revenue 17% 25% 25%

Diversification Other, Top 3, Other,

(LTM 09/30/14) 83% 75% 75%

Near Term 2018E Pipeline 2018E Pipeline 2018E Pipeline

Pipeline Market Sales: Sales: Sales:

Potential[c] ~$195mm ~$245mm ~$440mm

Expansion of branded Continued organic Operational synergies

portfolio and generic growth from on-

Long Term Tax efficiencies

Growth pipeline market products

Drivers Continued investment Xifaxan franchise Deleveraging

in M&A and licensing expansion

opportunities

Source: Company filings and Wall Street research.

[a] Salix projections per Jefferies research. Endo projections per Auxilium S-4, pro forma for acquisition of Auxilium and divestiture of AMS

[b] Estimated pro forma statistics per Endo management estimates

[c] Represents average of select research analyst estimates for company pipeline sales by 2018E. Endo 2018E pipeline PF for Auxilium

* A reconciliation to the most comparable US GAAP amount has not been provided due to the difficulty in obtaining relevant data from publicly available Salix information

15

|

|

Recent Accomplishments

©2015 Endo Pharmaceuticals Inc. All rights reserved.

16

|

|

Progress on Near-Term Strategic Priorities

Deploying capital to accretive, value-creating opportunities

In-licensed NatestoTM Testosterone Nasal Gel; launch targeted for March 16, 2015 Completed acquisition of Auxilium Pharmaceuticals on January 29, 2015 Announced divestiture of AMS – provides greater financial flexibility and stronger position to take advantage of value-creating M&A opportunities for pharmaceuticals businesses

Enhancing operational focus to drive organic growth

Delivered double-digit organic growth in U.S. Generics for full-year 2014

Completed integration of Auxilium commercial team into U.S. Branded Pharmaceuticals New Pain, Urology and Specialty Pharmaceuticals marketing and sales teams formed by selecting top-performers from both companies

Sharpening R&D focus on near-term opportunities

Delivering strong and sustainable financial performance

Exceeded full-year 2014 adjusted EPS financial guidance Reported 2014 revenues at top-end of guidance range Provided robust 2015 financial guidance

17

©2015 Endo Pharmaceuticals Inc. All rights reserved.

|

|

AMS Divestiture—Transaction Summary

Announced divestiture of American Medical Systems’ (AMS)

Men’s and Prostate Health Businesses to Boston Scientific on March 2, 2015

Sale reflects company belief that AMS would be of greater strategic value to a leading global device company Total consideration of $1.65 billion

$1.6 billion in cash payable at closing

Potential milestone payment of $50 million in cash based on business performance and product revenue milestones in 2016 Transaction expected to close in Q3 2015

Endo is currently evaluating strategic options for the AMS

Women’s Health business

18

©2015 Endo Pharmaceuticals Inc. All rights reserved.

|

|

AMS Divestiture—Strategic Rationale

Continues to focus Endo on its core objective: building on position as a leading global specialty pharmaceutical company Creates balance sheet flexibility

Enables heightened focus on value-creating M&A

Double-digit EBITDA multiple for sale of AMS supports value-creation from opportunities in core businesses

Continuing operations profile

Increased revenue growth rate

Improved operating margin profile Decreased effective tax rate

19

©2015 Endo Pharmaceuticals Inc. All rights reserved.

|

|

Branded R&D Pipeline Update

©2015 Endo Pharmaceuticals Inc. All rights reserved.

20

|

|

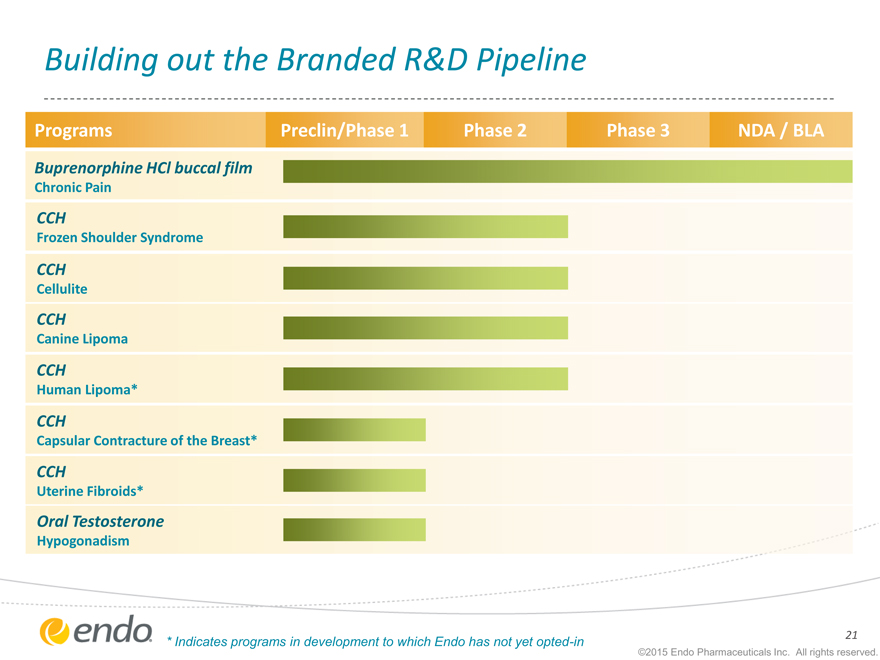

Building out the Branded R&D Pipeline

Programs Preclin/Phase 1 Phase 2 Phase 3 NDA / BLA

Buprenorphine HCl buccal film

Chronic Pain

CCH

Frozen Shoulder Syndrome

CCH

Cellulite

CCH

Canine Lipoma

CCH

Human Lipoma*

CCH

Capsular Contracture of the Breast*

CCH

Uterine Fibroids*

Oral Testosterone

Hypogonadism

| * |

|

Indicates programs in development to which Endo has not yet opted-in |

21

©2015 Endo Pharmaceuticals Inc. All rights reserved.

|

|

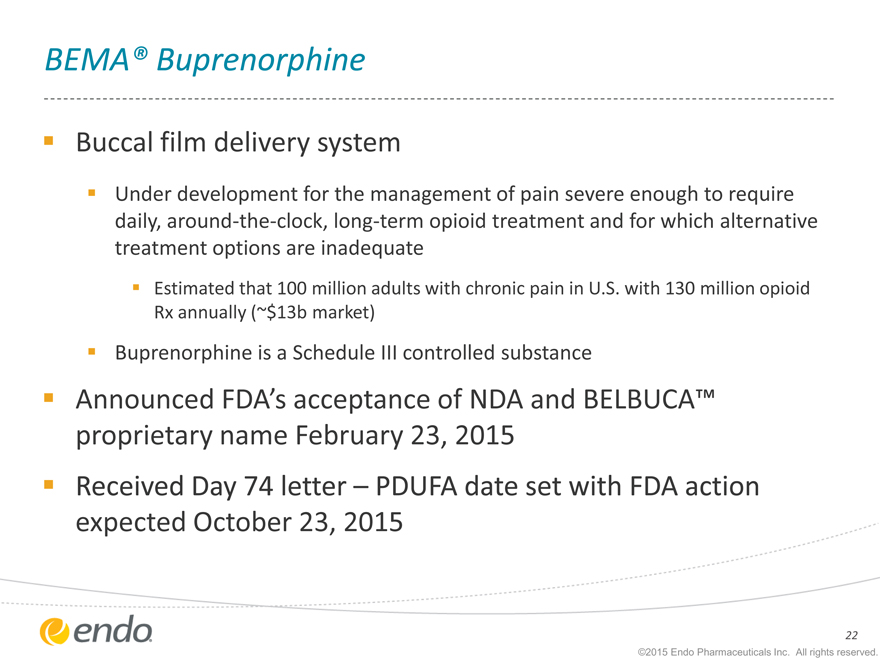

BEMA® Buprenorphine

Buccal film delivery system

Under development for the management of pain severe enough to require daily, around-the-clock, long-term opioid treatment and for which alternative treatment options are inadequate

Estimated that 100 million adults with chronic pain in U.S. with 130 million opioid Rx annually (~$13b market)

Buprenorphine is a Schedule III controlled substance

Announced FDA’s acceptance of NDA and BELBUCA™ proprietary name February 23, 2015

Received Day 74 letter – PDUFA date set with FDA action expected October 23, 2015

22

©2015 Endo Pharmaceuticals Inc. All rights reserved.

|

|

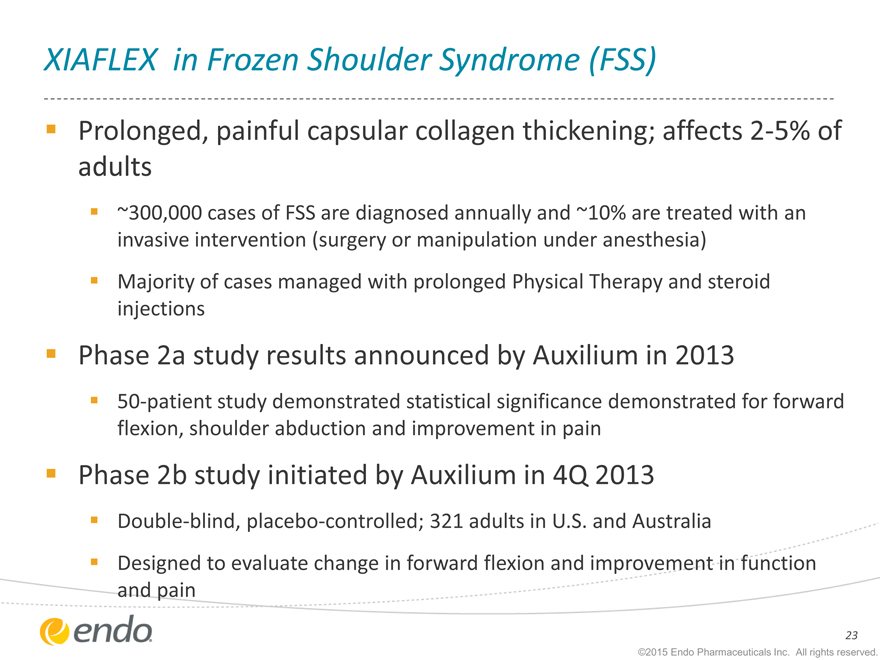

XIAFLEX in Frozen Shoulder Syndrome (FSS)

Prolonged, painful capsular collagen thickening; affects 2-5% of adults

~300,000 cases of FSS are diagnosed annually and ~10% are treated with an invasive intervention (surgery or manipulation under anesthesia)

Majority of cases managed with prolonged Physical Therapy and steroid injections

Phase 2a study results announced by Auxilium in 2013

50-patient study demonstrated statistical significance demonstrated for forward flexion, shoulder abduction and improvement in pain

Phase 2b study initiated by Auxilium in 4Q 2013

Double-blind, placebo-controlled; 321 adults in U.S. and Australia

Designed to evaluate change in forward flexion and improvement in function and pain

23

©2015 Endo Pharmaceuticals Inc. All rights reserved.

|

|

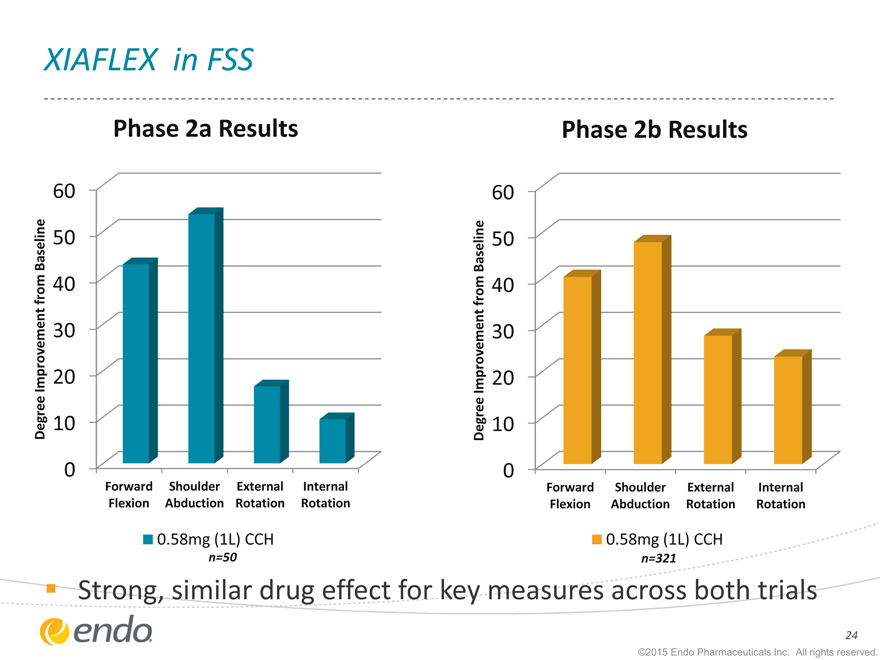

XIAFLEX in FSS

Phase 2a Results

| 60 |

|

Baseline 50

from 40

| 30 |

|

Improvement 20

Degree 10

0

Forward Shoulder External Internal

Flexion Abduction Rotation Rotation

| 0.58mg |

|

(1L) CCH |

n=50

Phase 2b Results

| 60 |

|

Baseline 50

from 40

| 30 |

|

Improvement 20

Degree 10

0

Forward Shoulder External Internal

Flexion Abduction Rotation Rotation

| 0.58mg |

|

(1L) CCH |

n=321

Strong, similar drug effect for key measures across both trials

24

©2015 Endo Pharmaceuticals Inc. All rights reserved.

|

|

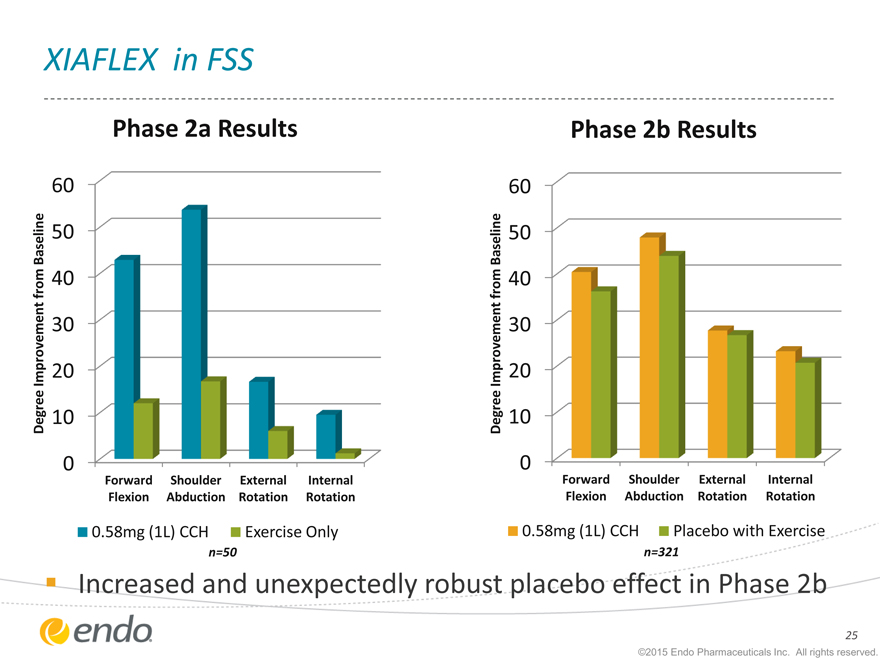

XIAFLEX in FSS

Phase 2a Results

| 60 |

|

Baseline 50

from 40

| 30 |

|

Improvement 20

Degree 10

0

Forward Shoulder External Internal

Flexion Abduction Rotation Rotation

| 0.58mg |

|

(1L) CCH Exercise Only |

n=50

Phase 2b Results

| 60 |

|

Baseline 50

from 40

| 30 |

|

Improvement 20

Degree 10

0

Forward Shoulder External Internal

Flexion Abduction Rotation Rotation

| 0.58mg |

|

(1L) CCH Placebo with Exercise |

n=321

Increased and unexpectedly robust placebo effect in Phase 2b

25

©2015 Endo Pharmaceuticals Inc. All rights reserved.

|

|

XIAFLEX in FSS

Strong drug effect and similar CCH patient improvements in flexion, abduction and rotation seen across trials

Similar CCH patient improvement in pain seen across trials

Full-scale analysis of Phase 2b trial ongoing, with focus on:

Exploration of placebo effect variance and optimal trial design moving forward

Discussions with Key Opinion Leaders

Strong effect seen in recalcitrant patients

Anticipate being ready to move into next trial by year end

26

©2015 Endo Pharmaceuticals Inc. All rights reserved.

|

|

XIAFLEX in Cellulite

Endo has fully transitioned all FDA interactions, post the Auxilium transaction close

Endo has met directly with the Agency to discuss protocols, endpoints and timelines

Expect start of Phase 2b clinical trial by year end 2015

27

©2015 Endo Pharmaceuticals Inc. All rights reserved.

|

|

2015 Objectives and

Financial Guidance

©2015 Endo Pharmaceuticals Inc. All rights reserved.

28

|

|

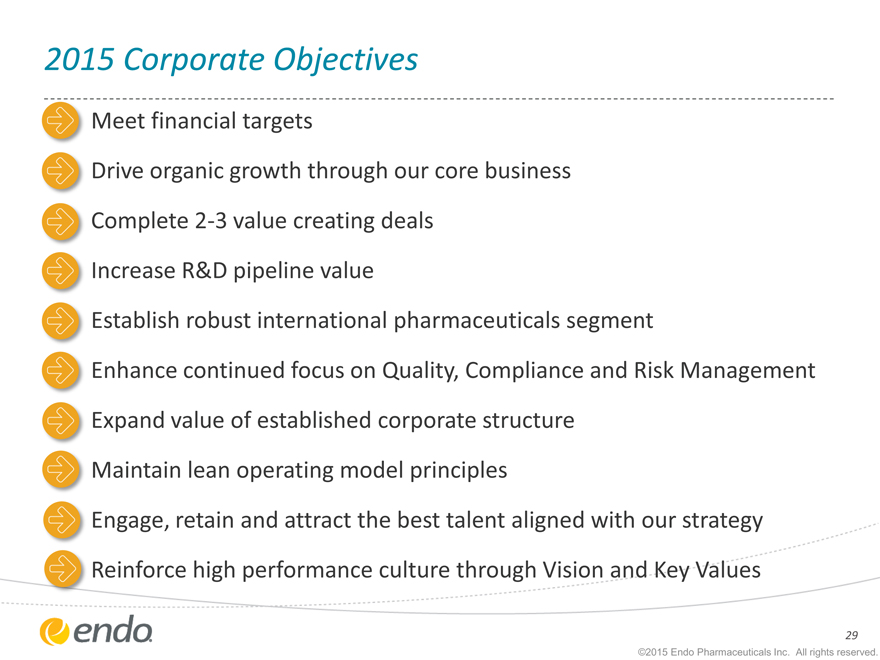

2015 Corporate Objectives

Meet financial targets

Drive organic growth through our core business Complete 2-3 value creating deals Increase R&D pipeline value Establish robust international pharmaceuticals segment

Enhance continued focus on Quality, Compliance and Risk Management Expand value of established corporate structure Maintain lean operating model principles Engage, retain and attract the best talent aligned with our strategy Reinforce high performance culture through Vision and Key Values

29

©2015 Endo Pharmaceuticals Inc. All rights reserved.

|

|

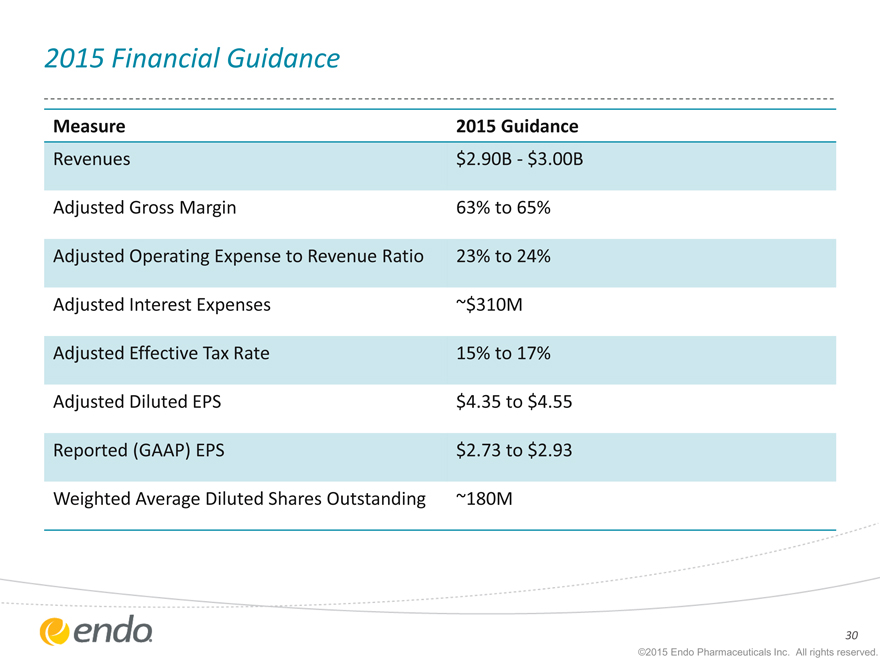

2015 Financial Guidance

Measure 2015 Guidance

Revenues $2.90B—$3.00B

Adjusted Gross Margin 63% to 65%

Adjusted Operating Expense to Revenue Ratio 23% to 24%

Adjusted Interest Expenses ~$310M

Adjusted Effective Tax Rate 15% to 17%

Adjusted Diluted EPS $4.35 to $4.55

Reported (GAAP) EPS $2.73 to $2.93

Weighted Average Diluted Shares Outstanding ~180M

30

©2015 Endo Pharmaceuticals Inc. All rights reserved.

|

|

Executing Our Strategy

Strengthened talent and organization

Implemented a lean operating model to achieve $325 million in savings

Completed multiple accretive, value-creating transactions

Acquisitions and in-licensing deals: Auxilium Pharmaceuticals, Paladin Labs, Boca Pharmacal, DAVA Pharmaceuticals, Grupo Farmaceutico Somar, Sumavel® DosePro® and NatestoTM

Increased strategic focus

Announced plan to divest American Medical Systems (AMS)

Completed the divestiture of HealthTronics and discovery assets

Master Settlement Agreements in place settling substantially all of AMS’ U.S. mesh claims

Sharpened focus on near-term organic growth priorities

Enhanced capital structure flexibility

Delivering on our financial targets

31

©2015 Endo Pharmaceuticals Inc. All rights reserved.

|

|

Appendix

©2015 Endo Pharmaceuticals Inc. All rights reserved.

32

|

|

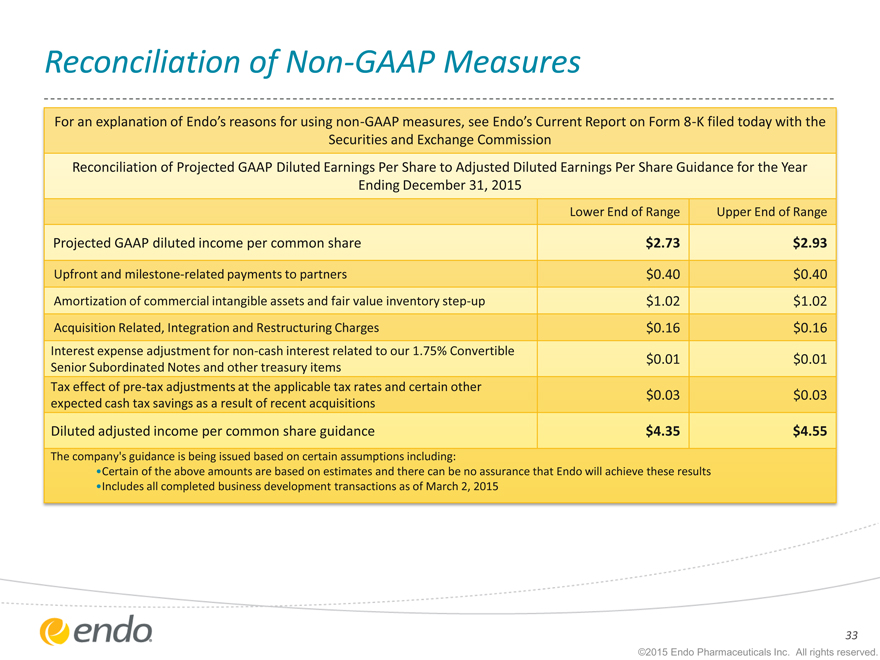

Reconciliation of Non-GAAP Measures

For an explanation of Endo’s reasons for using non-GAAP measures, see Endo’s Current Report on Form 8-K filed today with the

Securities and Exchange Commission

Reconciliation of Projected GAAP Diluted Earnings Per Share to Adjusted Diluted Earnings Per Share Guidance for the Year

Ending December 31, 2015

Lower End of Range Upper End of Range

Projected GAAP diluted income per common share $ 2.73 $ 2.93

Upfront and milestone-related payments to partners $0.40 $0.40

Amortization of commercial intangible assets and fair value inventory step-up $1.02 $1.02

Acquisition Related, Integration and Restructuring Charges $0.16 $0.16

Interest expense adjustment for non-cash interest related to our 1.75% Convertible

| $0.01 |

|

$0.01 |

Senior Subordinated Notes and other treasury items

Tax effect of pre-tax adjustments at the applicable tax rates and certain other

| $0.03 |

|

$0.03 |

expected cash tax savings as a result of recent acquisitions

Diluted adjusted income per common share guidance $ 4.35 $ 4.55

The company’s guidance is being issued based on certain assumptions including:

Certain of the above amounts are based on estimates and there can be no assurance that Endo will achieve these results

Includes all completed business development transactions as of March 2, 2015

33

©2015 Endo Pharmaceuticals Inc. All rights reserved.

|

|

Endo International plc

Barclays Healthcare Conference

March 12, 2015

©2015 Endo Pharmaceuticals Inc. All rights reserved.

34