Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION - ZION OIL & GAS INC | f10k2014ex31i_zionoil.htm |

| EX-10.11 - MEMORANDUM OF UNDERSTANDING - ZION OIL & GAS INC | f10k2014ex10xi_zionoil.htm |

| EXCEL - IDEA: XBRL DOCUMENT - ZION OIL & GAS INC | Financial_Report.xls |

| EX-32.1 - CERTIFICATION - ZION OIL & GAS INC | f10k2014ex32i_zionoil.htm |

| EX-31.2 - CERTIFICATION - ZION OIL & GAS INC | f10k2014ex31ii_zionoil.htm |

| EX-32.2 - CERTIFICATION - ZION OIL & GAS INC | f10k2014ex32ii_zionoil.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________

FORM 10-K

__________________________________

MARK ONE:

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year ended December 31, 2014

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 001-33228

__________________________________

ZION OIL & GAS,

INC.

(Exact name of registrant

as specified in its charter)

__________________________________

|

Delaware |

20-0065053 |

|

(State or other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

|

|

|

|

6510 Abrams Rd., Suite 300 Dallas, TX |

75231 |

|

(Address of Principal Executive Offices) |

(Zip Code) |

(214)

221-4610

(Registrant’s

telephone number, including area code)

__________________________________

Securities registered under Section 12 (b) of the Exchange Act:

|

Common Stock, par value $0.01 per share |

NASDAQ Global Market |

|

(Title of Class) |

(Name of each exchange on which registered) |

Securities registered under Section 12 (g) of the Exchange Act: None

__________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨ |

Accelerated filer ¨ |

Non-accelerated filer ¨ |

Smaller Reporting Company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant as of June 30, 2014 was approximately $69.8 million. This amount is based on the registrant’s common stock on the NASDAQ Global Market on that date.

The registrant had 35,859,482 shares of common stock, par value $0.01, outstanding as of February 24, 2015.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its 2015 Annual Meeting of Stockholders to be held in Dallas, Texas on June 10, 2015, are incorporated by reference herein in Items 10, 11, 12, 13 and 14 of Part III of this report.

2014 ANNUAL REPORT (SEC FORM 10-K)

INDEX

Securities and Exchange Commission

Item Number and Description

|

PART I |

||

|

Item 1 |

Business |

3 |

|

Item1A |

Risk Factors |

15 |

|

Item 1B |

Unresolved Staff Comments |

24 |

|

Item 2 |

Properties |

24 |

|

Item 3 |

Legal Proceedings |

25 |

|

Item 4 |

Mine Safety Disclosures |

26 |

|

|

|

|

|

PART II |

||

|

Item 5 |

Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

26 |

|

Item 6 |

Selected Financial Data |

26 |

|

Item 7 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

27 |

|

Item 7A |

Quantitative and Qualitative Disclosures about Market Risk |

34 |

|

Item 8 |

Financial Statements and Supplementary Data |

34 |

|

Item 9 |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

34 |

|

Item 9A |

Controls and Procedures |

34 |

|

Item 9B |

Other Information |

35 |

|

|

|

|

|

PART III |

||

|

Item 10 |

Directors, Executives Officers and Corporate Governance |

35 |

|

Item 11 |

Executive Compensation |

35 |

|

Item 12 |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

36 |

|

Item 13 |

Certain Relationship and Related Transactions and Director Independence |

36 |

|

Item 14 |

Principal Accountant Fees and Services |

36 |

|

|

|

|

|

PART IV |

||

|

Item 15 |

Exhibits, Financial Statement Schedules |

36 |

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K (herein, “Annual Report”) and the documents included or incorporated by reference in this Annual Report contain statements concerning our expectations, beliefs, plans, objectives, goals, strategies, future events or performance and underlying assumptions and other statements that are not historical facts. These statements are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. You generally can identify our forward-looking statements by the words “anticipate,” “believe,” “budgeted,” “continue,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “objective,” “plan,” “potential,” “predict,” “projection,” “scheduled,” “should,” “will” or other similar words. These forward-looking statements include, among others, statements regarding:

• our ability to explore for and develop natural gas and oil resources successfully and economically within our license areas;

• our ability to obtain the exploration license rights to continue our petroleum exploration program;

• the availability of equipment, such as seismic trucks, drilling rigs, and transportation pipelines;

• the impact of governmental regulations, permitting and other legal requirements in Israel relating to onshore exploratory drilling;

• our estimates of the timing and number of wells we expect to drill and other exploration activities and planned expenditures and the time frame within which they will be undertaken;

• changes in our drilling plans and related budgets;

• the quality of existing and future license areas with regard to, among other things, the existence of reserves in economic quantities;

• anticipated trends in our business;

• our future results of operations;

• our liquidity and our ability to raise capital to finance our exploration and development activities;

• our capital expenditure program;

• future market conditions in the oil and gas industry; and

• the demand for oil and natural gas, both locally in Israel and globally.

More specifically, our forward-looking statements include, among others, statements relating to our schedule, business plan, targets, estimates or results of our applications for new exploration rights and future drilling, including the number, timing and results of wells, the timing and risk involved in drilling follow-up wells, planned expenditures, prospects budgeted and other future capital expenditures, risk profile of oil and gas exploration, acquisition of seismic data (including number, timing and size of projects), planned evaluation of prospects, probability of prospects having oil and natural gas, expected production or reserves, acreage, working capital requirements, hedging activities, the ability of expected sources of liquidity to implement our business strategy, future hiring, future exploration activity, production rates, all and any other statements regarding future operations, financial results, business plans and cash needs and other statements that are not historical fact.

Such statements involve risks and uncertainties, including, but not limited to, those relating to the uncertainties inherent in exploratory drilling activities, the volatility of oil and natural gas prices, operating risks of oil and natural gas operations, our dependence on our key personnel, factors that affect our ability to manage our growth and achieve our business strategy, risks relating to our limited operating history, technological changes, our significant capital requirements, the potential impact of government regulations, adverse regulatory determinations, litigation, competition, the uncertainty of reserve information and future net revenue estimates, property acquisition risks, industry partner issues, availability of equipment, weather and other factors detailed herein and in our other filings with the Securities and Exchange Commission (the “SEC”).

1

We have based our forward-looking statements on our management’s beliefs and assumptions based on information available to our management at the time the statements are made. We caution you that assumptions, beliefs, expectations, intentions and projections about future events may and often do vary materially from actual results. Therefore, we cannot assure you that actual results will not differ materially from those expressed or implied by our forward-looking statements.

Some of the factors that could cause actual results to differ from those expressed or implied in forward-looking statements are described under “Risk Factors” in this Annual Report and in our other periodic reports filed with the SEC. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes may vary materially from those indicated. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by reference to these risks and uncertainties. You should not place undue reliance on our forward-looking statements. Each forward-looking statement speaks only as of the date of the particular statement, and we undertake no duty to update any forward-looking statement.

2

PART I

ITEM 1. BUSINESS

Overview

Zion Oil and Gas, Inc., a Delaware corporation (referred to herein as “we”, “our”, “us”, “Zion”, “Zion Oil”, or the “Company”) is an oil and gas exploration company with a history of over 14 years of oil and gas exploration in Israel. We were incorporated in Florida on April 6, 2000 and reincorporated in Delaware on July 9, 2003. We completed our initial public offering in January 2007. Our common stock currently trades on the NASDAQ Global Market under the symbol “ZN” and our common stock warrant under the symbol “ZNWAA.”

Zion currently holds one active petroleum exploration license onshore Israel, the Megiddo-Jezreel License (approximately 99,000 acres). For a variety of reasons, including the results of the newly reprocessed and recently acquired seismic data, the Company has now fully focused its exploration strategy on the Megiddo-Jezreel License as merged with the southern portion of the former Jordan Valley License area. We have now selected the specific location of our next drilling prospect well location.

At present, we have no revenues or operating income. Our ability to generate future revenues and operating cash flow will depend on the successful exploration and exploitation of our current and any future petroleum rights or the acquisition of oil and/or gas producing properties, and the volume and timing of such production. In addition, even if we are successful in producing oil and gas in commercial quantities, our results will depend upon commodity prices for oil and gas, as well as operating expenses including taxes and royalties.

Our executive offices are located at 6510 Abrams Road, Suite 300, Dallas, Texas 75231, and our telephone number is (214) 221-4610. Our field office’s new address in Israel is at 9 Halamish Street, North Industrial Park, Caesarea 3088900, and the telephone number is +972-4-623-8500. Our website address is: www.zionoil.com.

Company Background

In 1983, during a visit to Israel, John M. Brown (our Founder, Chairman, and Chief Executive Officer) became inspired and dedicated to finding oil and gas in Israel. During the next 17 years he made several trips each year to Israel, hired oil and gas consultants in Israel and Texas, met with Israeli government officials, made direct investments with local exploration companies, and assisted Israeli exploration companies in raising money for oil and gas exploration in Israel. This activity led Mr. Brown to form Zion Oil & Gas, Inc. in April 2000, in order to receive the award of a small onshore petroleum license from the Israeli government.

Zion’s vision, as exemplified by John Brown, of finding oil and/or natural gas in Israel, is biblically inspired. The vision is based, in part, on biblical references alluding to the presence of oil and/or natural gas in territories within the State of Israel that were formerly within certain ancient biblical tribal areas. While John Brown provides the broad vision and goals for our company, the actions taken by the Zion Board of Directors and management team as it actively explores for oil and gas in Israel, are based on modern science and good business practice. Zion’s oil and gas exploration activities are supported by appropriate geological, geophysical and other science-based studies and surveys typically carried out by companies engaged in oil and gas exploration activities.

Upon the award of our first petroleum right (License No. 298/“Ma’anit” or the “Ma’anit License”) in May 2000, the Israeli government gave us access to most of its data with respect to previous exploration in the area, including geologic reports, seismic records and profiles, drilling reports, well files, gravity surveys, geochemical surveys and regional maps. We also gathered information concerning prior and ongoing geological, geophysical and drilling activity relevant to our planned activities from a variety of publicly accessible sources.

To date, the Company has drilled four exploratory wells. While the presence of hydrocarbons was indicated while drilling certain of these wells, none of the exploratory wells that we have drilled to date have been deemed capable of producing oil or gas in commercial quantities.

3

ZION’S CURRENT EXPLORATION LICENSE AREA

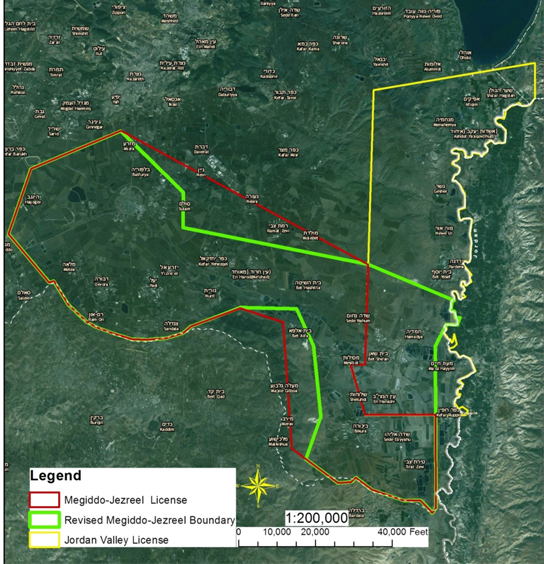

Zion currently holds one active petroleum exploration license onshore Israel, the Megiddo-Jezreel License (covering an area of approximately 99,000 acres – See Map #1). Under Israeli law, Zion has an exclusive right to oil and gas exploration in our license area in that no other company may drill there. In the event we drill an oil or gas discovery in our license areas, current Israeli law entitles us to convert the relevant portions of our license to a 30-year production lease, extendable to 50 years, subject to compliance with a field development work program and production.

Map

#1

Zion’s Megiddo-Jezreel Petroleum Exploration License as of

February, 2015.

Summary of Current and Former Company License Areas

Megiddo-Jezreel Petroleum License

The Megiddo-Jezreel License (No. 401) was awarded on December 3, 2013 for a three-year primary term through December 2, 2016 with the possibility of additional one-year extensions up to a maximum of seven years. The Megiddo-Jezreel License is onshore, south and west of the Sea of Galilee.

Under the terms of this License, the Company has until July 1, 2015 to identify and submit a drilling prospect, enter into a drilling contract by October 1, 2015, and begin drilling or “spud” a well by December 1, 2015.

In September 2014, Israel’s Petroleum Commissioner notified Zion that the Petroleum Council, a 10-member board that he chairs, had recommended approval of our application to merge the southernmost portion of our Jordan Valley License into our Megiddo-Jezreel License. We currently await final approval of the merged license from Israel’s Energy Minister. Unfortunately, it is unlikely that we will receive the final approval signature until after newly called-for Israeli national elections in March 2015 since it is quite likely a new Energy Minister will be named and the current minister may be reluctant to sign any new authorizations.

Zion’s Former Jordan Valley License

On April 10, 2014, Zion filed an application to merge the southernmost portion of the Jordan Valley License into the Megiddo-Jezreel License (see Map #2). The Jordan Valley License (~ 55,845 acres) expired in April 2014 as Zion did not seek an extension beyond its three-year primary term. We contend that there is significant exploration potential in this geologically linked petroleum system that overlaps the boundaries between the present

4

Megiddo-Jezreel and former Jordan Valley Licenses. For a variety of reasons, including the results of the newly reprocessed and recently acquired seismic data, the Company has now fully focused its exploration strategy on the Megiddo-Jezreel License as merged with the southern portion of the former Jordan Valley License area.

Map

#2

Proposed Merger of Part of Former Jordan Valley License into our

Megiddo-Jezreel License

Zion’s Former Asher-Menashe License and Former Joseph License

On May 9, 2014 the Company submitted its Final Completion and Plugging Report for the Elijah #3 well, in the Asher-Menashe License. The Asher-Menashe License expired on June 9, 2014 as its full seven year term ended. The Joseph License expired on October 10, 2013, after our final extension. On November 18, 2013, Zion submitted our Final Plugging Report for the Ma’anit Rehoboth #2 and Ma’anit Joseph #3 wells, in the Joseph License. With this, Zion has plugged all of its wells but it acknowledges its obligation to complete the abandonment of these well sites in accordance with guidance from the Environmental Ministry and local officials.

Exploration Plans Going Forward

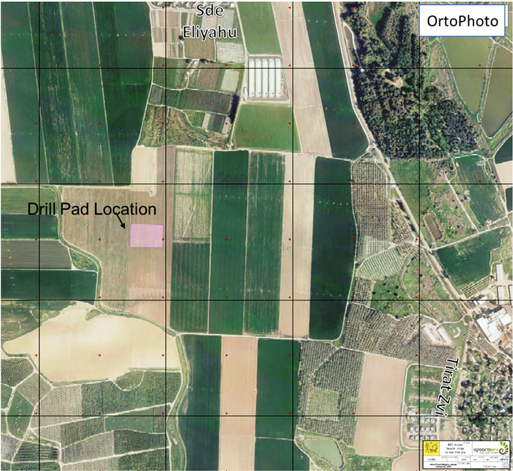

We continue our exploration focus on our Megiddo-Jezreel License area as that area appears to possess the key geologic ingredients of an active petroleum system. This past summer, the Geophysical Institute of Israel (GII) acquired 42 kilometers of new vibroseis seismic data in the area of our existing prospects. Both Eskaton (U.S.-based seismic company) and GII have now both completed computer data processing for us. Based on our interpretations of the newly acquired seismic data, we have now selected the precise drill pad location from which to drill our next well(s) (see Map #3). Assuming all legal and regulatory permits and requirements are obtained, the Company plans to drill our next well in the second half of 2015.

5

Map

#3

Proposed Drill Pad Location Near Sde Eliyahu and Tirat Zvi

Kibbutzim

Geo-Prospect (Israeli geological, environmental, and planning company) and Ya’ad Architects & Planners were hired to assist with the legally required environmental impact assessment (“EIA”) and document — a detailed and extensive document representing months of advance work. Study topics included ecology, hydrology/water, archeology, acoustics, air quality, hazardous materials, pollution, land reclamation, drilling methods, risk mitigation, etc. Zion’s EIA document was delivered in January 2015 to both Israel’s Ministry of National Infrastructures, Energy and Water Resources (“Energy Ministry”) and Israel’s Environmental Ministry. We await feedback from the Environmental Ministry and will revise our document accordingly.

Under Israel’s regulatory system, this environmental document is a prerequisite for a drilling permit. We anticipate that the newly promulgated regulations will considerably increase the time needed to obtain all of the needed permits and authorizations from regulatory and local bodies in Israel, and there is no assurance that the Company will ultimately be granted such permission to drill. See the discussion under “Energy Related Regulations — The Onshore Petroleum Exploration Permitting Process in Israel” below.

Finally, prior to actually drilling our next exploratory well, we will need to enter into a contract with a drilling rig operator with the appropriate rig, equipment, and experienced drilling crew. We have not yet entered into any legally binding agreements for the use of a rig although we are currently in active discussions with an international drilling services company. In the event that we decide to import a drilling rig into Israel, we will need to obtain the appropriate regulatory consents and approvals for the importation of the rig. We will also need to obtain appropriate permits, regulatory consents and approvals with respect to the actual drilling site that we have selected. In addition, we will need to obtain the necessary approvals from the surface owners.

We estimate that, in order to be commercially productive, any of the wells we eventually drill would need to be capable of producing at least 300 barrels of oil equivalent per day. Such production levels will not likely pay out the cost of drilling the well, but only the costs of operating the well on a current basis. In order to justify the costs of drilling additional wells, there would need to be the expectation that each additional well would have initial production rates of at least 500 barrels of oil equivalent per day, based upon minimum oil prices of about $50.00 per barrel.

6

Exploration Expenditures

The following table summarizes the amounts we expended on our exploration efforts during 2014 and 2013:

|

|

|

2014 |

|

|

2013 |

|

||

|

|

|

US$ |

|

|

US$ |

|

||

|

|

|

|

|

|

|

|

||

|

Megiddo-Jezreel Valley License |

|

|

|

|

|

|

|

|

|

|

|

1,430 |

|

|

|

342 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Asher-Menashe License (expired on June 9, 2014) |

|

|

|

|

|

|

|

|

|

|

|

935 |

|

|

|

546 |

|

|

|

|

|

172 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

Jordan Valley License (allowed to expire on April 12, 2014) |

|

|

|

|

|

|

|

|

|

|

|

17 |

|

|

|

98 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Joseph License (expired on October 10, 2013) |

|

|

|

|

|

|

|

|

|

|

|

169 |

|

|

|

371 |

|

|

|

|

|

— |

|

|

|

65 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

2,723 |

|

|

|

1,422 |

|

Employees

As of December 31, 2014, we had 19 employees of whom all but one are on a full time basis. Of these employees, 10 work out of our Dallas office and 9 work out of the Caesarea office. None of our current employees is subject to any collective bargaining agreements, and there have been no strikes. We regularly utilize independent consultants and contractors to perform various professional services, particularly for services connected to drilling operations, such as specialized engineering, logging, cementing and well-testing.

Competition and Markets

The oil and gas exploration industry in Israel currently consists of a number of exploration companies. These include relatively small local or foreign companies with limited financial resources and consortia of local Israeli and foreign participants with substantial financial resources. Most groups are engaged primarily in off-shore activities, which is not an area in which we are currently active. So long as we hold our current license, Israeli law conveys an exclusive exploration right to Zion such that no additional companies may compete in our license area.

Historically, primarily for geopolitical reasons, Israel (particularly onshore) has not been an area of interest for international integrated or large or mid-size independent oil and gas exploration companies. Since the announcement of the Tamar and Leviathan discoveries, this situation has changed somewhat. However, given the current limited availability in Israel of oil field service companies, equipment and personnel, in periods of increased exploration interest and activity, there is competition for available equipment and services. In this market Zion has no particular advantage. We attempt to enhance our position by developing and maintaining good professional relations with oil field service providers and a high level of credibility in making and meeting commercial commitments.

The oil and gas industry is cyclical, and from time to time there is a shortage of drilling rigs, equipment, supplies and qualified personnel. During these periods, the costs and delivery times of rigs, equipment and supplies are substantially greater. If the unavailability or high cost of drilling rigs, equipment, supplies or qualified personnel were particularly severe in the areas where we operate, we could be materially and adversely affected. We believe that there are potential alternative providers of drilling services and that it may be necessary to establish relationships with new contractors as our activity level and capital program grows. However, there can be no assurance that we can establish such relationships or that those relationships will result in increased availability of drilling rigs.

If any of our exploratory wells are commercially productive, we would install the appropriate production equipment which includes among other items oil and gas separation facilities and storage tanks. Under the terms of

7

the Petroleum Law, we may be required by the Minister of Energy and Water Resources to offer first refusal for any oil and gas discovered to Israeli domestic purchasers at market prices.

Since Israel imports almost all of its crude oil needs and the market for crude oil in Israel is limited to two local oil refineries, no special marketing strategy need be adopted initially with regard to any oil that we may ultimately discover. We believe that we would have a ready local market for our oil at market prices and would have the option of exporting to the international market, if any of our future exploratory wells are commercially productive.

Israel’s Petroleum Law

Our business in Israel is subject to regulation by the State of Israel under the Petroleum Law. The administration and implementation of the Petroleum Law is vested in the Minister of Energy and Water Resources, the Petroleum Commissioner and an advisory council. The following discussion includes a brief summary review of certain provisions of the Petroleum Law as currently in effect. This review is not complete and it should not be relied on as a definitive restatement of the law related to petroleum exploration and production activities in Israel.

Petroleum resources are owned by the State of Israel, regardless of whether they are located on state lands or the offshore continental shelf. No person is allowed to explore for or produce petroleum without being granted a specific right under the Petroleum Law.

License. The “license” is a petroleum exploration right, bestowing an exclusive right for further exploration work and requiring the drilling of one or more test wells. The initial term of a license is up to three years and it may be extended for up to an additional four years (in one year increments). A license area may not exceed 400,000 dunams (approximately 98,842 acres). One dunam is equal to 1,000 square meters (approximately 0.24711 of an acre). No one entity may hold more than 12 licenses or hold more than a total of four million dunam in aggregate license area.

Production lease. Upon discovery of petroleum in commercial quantities, a licensee has a statutory “right” to receive a production “lease.” The initial lease term is 30 years, extendable for an additional 20 years (up to a maximum period of 50 years). A lease confers upon the lessee the exclusive right to explore for and produce petroleum in the lease area and requires the lessee to produce petroleum in commercial quantities (or pursue test or development drilling). The lessee is entitled to transport and market the petroleum produced, subject, however, to the right of the government to require the lessee to supply local needs first, at market price.

Petroleum rights fees. The holders of licenses and leases are required to pay fees to the government of Israel to maintain the rights. The fees vary according to the nature of the right, the size and location (onshore or offshore) of the right, acreage subject to the right and, in the case of a license, the period during which the license has been maintained. For a license, the two initial years fees are approximately New Israeli Shekels (NIS) 110 (approximately US $28.3 at the Bank of Israel representative rate published on December 31, 2014) per thousand dunams (approx. 247.11 acres) per year. Every subsequent year, the license fee increases incrementally.

Requirements and entitlements of holders of petroleum rights. The holder of a petroleum right (license or lease) is required to conduct its operations in accordance with a work program set as part of the petroleum right, with due diligence and in accordance with the accepted practice in the petroleum industry. The holder is required to submit progress and final reports; provided, however, the information disclosed in such reports remains confidential for as long as the holder owns a petroleum right on the area concerned.

If the holder of a petroleum right does not comply with the work program provided by the terms of the right, the Petroleum Commissioner may issue a notice requiring that the holder cure the default within 60 days of the giving of the notice, together with a warning that failure to comply within the 60-day cure period may entail cancellation of the right. If the petroleum right is cancelled following such notice, the holder of the right may, within 30 days of the date of notice of the Commissioner’s decision, appeal such cancellation to the Minister of Energy and Water Resources. No petroleum right shall be cancelled until the Minister of Energy and Water Resources has ruled on the appeal.

We are obligated, according to the Petroleum Law, to pay royalties to the Government of Israel on the gross production of oil and gas from the oil and gas properties of Zion located in Israel (excluding those reserves serving to operate the wells and related equipment and facilities). The royalty rate stated in the Petroleum Law is 12.5%

8

of the produced reserves. At December 31, 2014 and 2013, the Company did not have any outstanding obligation with respect to royalty payments, since it is in the development stage and, to this date, no proved reserves have been found.

In March 2011, the Israeli parliament enacted the Petroleum Profits Taxation Law, 2011, which imposes a new levy on oil and gas production. Under the new tax regime, the Israeli Government repealed the percentage depletion deduction and imposed a levy at an initial rate of 20% on profits from oil and gas which will gradually rise to 44.56%, depending on the levy coefficient (the R-Factor). The R-Factor refers to the percentage of the amount invested in the exploration, the development and the establishment of the project, so that the 20% rate will be imposed only after a recovery of 150% of the amount invested (R-Factor of 1.5) and will range linearly up to 44.56% after a recovery of 230% of the amount invested (R-Factor of 2.3). For purposes of the levy rate calculation, the minimal gas sale price that will be accepted by the State is the bi-annual average local price. The present 12.5% royalty imposed on oil revenues remains unchanged.

The grant of a petroleum right does not automatically entitle its holder to enter upon the land to which the right applies or to carry out exploration and production work thereon. Entry requires the consent of the private or public holders of the surface rights and of other public regulatory bodies (e.g. planning and building authorities, Nature Reserves Authority, municipal and security authorities, etc.). The holder of a petroleum right may request the government to acquire, on its behalf, land needed for petroleum purposes. The petroleum right holder is required to obtain all other necessary approvals.

Petroleum Taxation. Our activities in Israel will be subject to taxation both in Israel and in the United States. Under the U.S. Internal Revenue Code, we will be entitled to claim either a deduction or a foreign tax credit with respect to Israeli income taxes paid or incurred on our Israeli source oil and gas income. As a general rule, we anticipate that it will be more advantageous for us to claim a credit rather than a deduction for applicable Israeli income taxes on our U.S tax return. A tax treaty exists between the U.S. and Israel that would provide opportunity to use the tax credit.

Exploration and development expenses. Under current US and Israeli tax laws, exploration and development expenses incurred by a holder of a petroleum right can, at the option of such holder, either be expensed in the year incurred or capitalized and expensed (or amortized) over a period of years. Most of our expenses to date have been expensed for both U.S. and Israeli income tax purposes.

Depletion allowances. Until 2011, the holder of an interest in a petroleum license or lease was allowed a deduction for income tax purposes on account of the depletion of the petroleum reserve relating to such interest. This may have been by way of percentage depletion or cost depletion, whichever is greater. In 2010, the Finance Minister of Israel established an advisory committee to study the country’s fiscal policy as it relates to the upstream oil and natural gas sector, as well as various options, including an increase in royalties or cancellation of tax incentives. In January 2011, the Finance Ministry advisory committee issued its final recommendations which included cancellation of currently existing tax incentives, including the depletion allowance. In 2011, the depletion allowance was abolished.

Corporate tax. Under current Israeli tax laws, whether a company is registered in Israel or is a foreign company operating in Israel through a branch, it is subject to Israeli Companies Tax on its taxable income (including capital gains) from Israeli sources at a flat rate of 25%, effective January 1, 2012 and 26.5% effective January 1, 2014.

Import duties. Insofar as similar items are not available in Israel, the Petroleum Law provides that the owner of a petroleum right may import into Israel, free of most customs, purchase taxes and other import duties, all machinery, equipment, installations, fuel, structures, transport facilities, etc. (apart from consumer goods and private cars and similar vehicles) that are required for the petroleum exploration and production purposes, subject to the requirement that security be provided to ensure that the equipment is exported out of Israel within the agreed upon time frame.

Israeli Energy Related Regulations

Our operations are subject to legal and regulatory oversight by energy-related ministries or other agencies of Israel, each having jurisdiction over certain relevant energy or hydrocarbons laws.

9

The Onshore Petroleum Exploration Permitting Process in Israel

The permitting process in Israel with respect to petroleum exploration continues to undergo significant modification, the result of which is to considerably increase the complexity, time period, and expenditures needed to obtain the necessary permits to undertake exploratory drilling once a drilling prospect has been identified. Applications for new exploration licenses need to comply with more demanding requirements relating to a license applicant’s financial capability, experience and access to experienced personnel.

In June 2012, the Ministry of National Infrastructures, Energy and Water Resources (“Energy Ministry”) issued initial guidelines relating to onshore exploratory licensing. Under the now adopted guidelines, an application must meet certain specified conditions and provide detailed information with respect to the requested license area. A condition to the issuance of any license is the submission by the licensee of a performance bank guarantee in an amount equal to 10% of the cost of the proposed work program. The performance bank guarantee is required at or prior to the award of the exploration rights.

In October 2012, the Energy Ministry published proposed guidelines relating to the submission of performance guarantees for new and existing onshore and offshore exploration licenses. Under the proposed guidelines, an applicant for a new onshore exploration license must submit a performance bank guarantee for 10% of the cost of the proposed work program upon the award by the Petroleum Commissioner (the “Commissioner”) of the requested license. An existing onshore exploration license owner will be required to submit a performance bank guarantee equal to 10% of the cost of the balance of the planned work program by the earlier of (a) the application for a license extension, (b) the application for transfer of license rights, or (c) the application for changes to the work program. The face amount of the performance bank guarantee for existing licenses will be based on an estimated budget for the balance of the planned work program that an existing license owner is to submit to the Commissioner, which budget is subject to approval by the Commissioner. In the event that the licensee violates (whether intentionally or not) any of the license terms, then the Commissioner is entitled to demand payment of the bank guarantee, after giving the licensee notice and an opportunity to cure.

In November 2012, the Association of Oil and Gas Exploration Industries in Israel (of which we are a member) submitted a response to the Ministry’s proposed guidelines, objecting to the guidelines.

In December 2012 the Ministry published additional proposed guidelines relating to the submission of bank guarantees for potential drilling-related environmental damages. The guidelines will apply to all petroleum exploration licenses to be granted on or after June 30, 2013. Under the proposed guidelines, prior to receiving the approval of the Commissioner to a proposed drilling program, the licensee must submit a bank guarantee in the amount of $100,000 with respect to a drilling depth of up to (and including) 1,000 meters and, if the drilling depth is more than 1,000 meters, the bank guarantee amount increases to $250,000. The Commissioner is entitled to demand a bank guarantee in excess of $250,000 in the event that the Commissioner determines that there is a substantial risk of environmental damage. In the event that the licensee causes environmental damage, the Commissioner is entitled to demand payment of the bank guarantee, after giving the licensee notice and an opportunity to respond to the allegation of damages. In January 2013, the Association of Oil and Gas Exploration Industries in Israel (of which we are a member) submitted a response to the Ministry’s proposed guidelines, objecting to the guidelines.

In July 2013, the Environmental Ministry published: “Environmental Guidelines for the preparation of an environmental document supplementary to a license for searching – experimental drilling and land extraction tests.” This document extensively details the requirements for a supplemental environmental document to an oil and gas exploration plan.

On December 3, 2013, the State of Israel’s Petroleum Commissioner awarded the Company the Megiddo-Jezreel Petroleum Exploration License No. 401. Subsequently, the Company secured a US $930,000 bank guarantee in accordance with the performance guarantee guidelines. Consequently, Zion believes it has met the requirements of the June 2012 onshore exploratory licensing guidelines and the October 2012 performance guarantee guidelines.

On February 6, 2014, the Ministry of Energy and Water Resources issued proposed guidelines for bank guarantees and insurance requirements with respect to oil and gas rights. Under these guidelines, applicants for and existing holders of exploration rights will be required to submit certain bank guarantees and insurance policies that were not previously required.

10

On September 17, 2014, the proposed guidelines became effective and the Ministry of Energy issued a guidance document entitled Instructions for the Giving of Guarantees with respect to Oil Rights. As it relates to existing onshore license holders like Zion, the Instructions call for the Company to obtain a new Base Bank Guarantee in the amount of $500,000, per each existing license area, split into two deposit dates as follows: (1) $250,000 by November 30, 2014 and (2) $250,000 by March 31, 2015.

Furthermore, prior to the start of drilling, an additional bank guarantee of $250,000 will be required at least 14 days before the spud date. This is a partial adoption of the guidelines proposed in December 2012. In summary, this is a potential cumulative total of $750,000 that is separate and apart from the Company’s existing Bank Guarantees.

As of December 31, 2014, the Company has not yet provided any of the additional bank guarantees called for in the new guidelines and has not received a specific request seeking payment.

The Petroleum Commissioner has discretion to raise or lower those amounts or may also forfeit a Company’s existing guarantee and/or cancel a petroleum right under certain circumstances. In addition, new and extended insurance policy guidelines were added. The Petroleum Commissioner may also view insurance requirement non-compliance as breaching the work plan and the rights granted and act accordingly.

The Company believes that these new regulations will significantly increase the expenditures associated with obtaining new exploration rights and drilling new wells, coupled with the heavy financial burden of “locking away” significant amounts of cash that could otherwise be used for operational purposes. Finally, this will also considerably increase the time needed to obtain all of the necessary authorizations and approvals prior to drilling.

Environmental/Safety

Oil and gas drilling operations could potentially harm the environment if there are polluting spills caused by the loss of well control. The Petroleum Law and regulations provide that the conduct of petroleum exploration and drilling operations be pursued in compliance with “good oil field practices” and that measures of due care be taken to avoid seepage of oil, gas and well fluids into the ground and from one geologic formation to another. The Petroleum Law and regulations also require that, upon the abandonment of a well, it be adequately plugged and marked. Recently, as a condition for issuing the required permit for the construction of a drilling site, the planning commissions have required the submission of a site remediation plan, subject to approval of the environmental authorities. The costs of future restoration and remediation can be estimated as the restoration and remediation are typical for the industry and part of “oil field best practices”. At this time, we anticipate that the future cost of the environmental requirements, site remediation and plugging will not be greater than approximately $220,000 per well drilled on our existing license areas. Our operations are also subject to claims for personal injury and property damage caused by the release of chemicals or petroleum substances by us or others in connection with the conduct of petroleum operations on our behalf.

In March 2011, the Ministry of Environmental Protection issued initial guidelines relating to oil and gas drilling. This is the first time that the Ministry published specific environmental guidelines for oil and gas drilling operations, relating to onshore and offshore Israel.

The guidelines are detailed and provide environmental guidelines for all aspects of drilling operations, commencing from the date an application for a preliminary permit is filed, and continuing through license, drilling exploration, production lease, petroleum production and abandonment of the well. The guidelines address details that must be submitted regarding the drill site, surrounding area, the actual drilling operations, the storage and removal of waste and the closing or abandoning of a well. Following meetings between the Ministry and industry representatives in 2011, the Ministry indicated that certain of their initial published guidelines will be revised.

In August 2011, the Government of Israel proposed a draft law entitled “Prevention of Land Contamination and Remediation of Contaminated Land”. For the draft law to become law, the Israeli Parliament must approve it after a second and third hearing. If ultimately adopted, this proposed law would require persons engaged in activities involving “polluted materials” (defined to include petroleum crude oil or any other materials defined as such by the commissioner) including their production, treatment, handling, storage and transportation, that may affect land or water resources to prepare environmental impact statements and remediation plans either prior to commencing activities or following the occurrence of an event that may cause pollution to land or water resources or endanger

11

public health. Under the proposal, persons responsible for violation of the law, directly or indirectly, will be liable for the clean-up costs and such violation may result in criminal sanctions. The draft law has now been re-introduced to the public in a substantially modified form with newly revised guidelines, including provisions concerning the establishment of a historical survey prior to restoration and/or reclamation of land. The proposal is now set for a final public hearing on February 28, 2015.

In April 2012, the “Environmental Protection Law (Emissions and Transfers to the Environment) Reporting Requirements and Register 2012” became effective. This statute imposes reporting obligations on entities engaged in oil and gas exploration activities (amongst others) in Israel relating to quantities of pollutants emitted into the air, water, land and sea (on an annual basis) and the off-site transfer of waste generated in the facility for treatment. The annual report that is to be furnished does not apply to the Company’s operations until we establish oil and/or gas production.

In July 2013, the Environmental Ministry published: “Environmental Guidelines for the preparation of an environmental document supplementary to a license for searching – experimental drilling and land extraction tests.” This document extensively details the requirements for a supplemental environmental document to an oil and gas exploration plan.

In January 2015, new guidelines were published regarding the abandonment of onshore (land-based) wells, as stated in Article 21 of Israel’s Petroleum Regulations 5713 -1521. The guidelines are at least partially based on certain U.S. regulations, including Texas Railroad Commission regulations required in Texas. The guidelines include, among other matters, standards for plugging wells, temporary and permanent abandonment, reclamation, restoration, etc.

We do not know and cannot predict whether any new legislation in this area will be enacted and, if so, in what form and which of its provisions, if any, will relate to and affect our activities, how and to what extent or what impact, if any, it might have on our financial statements. There are no known proceedings instituted by governmental authorities, pending or known to be contemplated against us under any environmental laws. We are not aware of any events of noncompliance in our operations in connection with any environmental laws or regulations. However, we cannot predict whether any new or amended environmental laws or regulations introduced in the future will have a material adverse effect on our future business.

The Company believes that these new and/or revised regulations will significantly increase the complexity, time, and expenditures associated with obtaining new exploration rights, drilling, and plugging/abandoning new wells, coupled with the heavy financial burden of “locking away” significant amounts of cash that could otherwise be used for operational purposes.

Proposed Fuel Market Law Legislation

In March 2012, the Energy Ministry presented a draft law entitled “Fuel Market Law.” Under the proposal as currently drafted, the following activities among others as they relate to crude oil and its products would require licenses by the Director of the Fuel Authority in the Ministry of Energy and Water Resources: import, export, refining, storage, dispensing and loading, transport, marketing and sale. Further under the proposal a condition for the receipt of a license is that the licensee be a corporation incorporated under the Israeli Companies Law. As currently drafted, the proposal does not provide for exceptions for entities holding petroleum rights under the Petroleum Law; however, it is not certain that, even if enacted as currently proposed, the provisions of the proposed law would supersede the provisions of the Petroleum Law. We submitted comments to the Ministry with the aim of clarifying that any law to be presented for enactment clarify that the rights of holders of licenses and leases granted under the Petroleum Law will not be compromised. In July 2012 the Israeli Parliament approved at the first hearing the draft Fuel Market Law.

We do not know and cannot predict the results of any attempt to enact the proposed Fuel Market Law, as currently drafted or as may be amended or, if enacted, the effect of such law on our rights under the Petroleum Law or the results of any legal challenge to the law by a holder of a license or lease issued under the Petroleum Law.

Planning & Building

On April 24, 2012, new regulations entitled “The Petroleum Regulations (Authorization to Deviate from the Provisions of the Planning and Building Law) 5772-2012” were adopted and detail a new permitting process.

12

Among other things, the new regulations require the submission, to the local regulatory and permitting authorities, of a detailed environmental report relating to the proposed drilling site and surroundings. The report is to address, in detail, the environmental implications of the drilling, including hydrological analysis, surface water management, risk assessment, environmental impact, and abandonment and remediation of the drill site, among others.

The drilling application must be published and there are specified time frames (approximately 100 days) for any person (including environmental and other interested bodies) to comment on the drilling application. As a result, we believe that the time periods to obtain the necessary permits (prior to spudding a well) have been considerably increased. Currently, we are unable to accurately assess the time period that we would require to obtain the necessary permits to allow us to spud our next exploratory well.

Transfer of Petroleum Related Rights

In May 2011, the Ministry of National Infrastructure published draft regulations, entitled “Petroleum Regulations (Transferring Petroleum Rights).” The draft regulations apply to the transfer of petroleum and related rights, including rights to a preliminary permit, license and production lease as well as rights to profit, royalties or information. The right to transfer these rights pursuant to the draft regulations, in many circumstances, will be much more limited than under the present regime. To date, these draft regulations have not yet been formally adopted.

Political Climate

We are directly influenced by the political, economic and military conditions affecting Israel. Specifically, we could be adversely affected by:

• any major hostilities involving Israel;

• the interruption or curtailment of trade between Israel and its present trading partners;

• a full or partial mobilization of the reserve forces of the Israeli army; and

• a significant downturn in the economic or financial condition of Israel.

Since the establishment of the State of Israel in 1948, a number of armed conflicts have taken place between Israel and its Arab neighbors, and a state of hostility, varying from time to time in intensity and degree, has led to security and economic problems for Israel. Recently, for about two months from early July to August 2014, Israel launched a military operation named Operation Protective Edge in the Hamas-ruled Gaza Strip. Over the course of the two months there were several thousand Palestinian rocket attacks for which the Israel Defence Forces responded with military action aimed primarily in the Gaza Strip. Military operations resulted in over 30 tunnels that extended from the Gaza Strip into Israel being destroyed. While a ceasefire is currently in effect, some level of conflict should be anticipated in the future. These developments have further strained relations between Israel and the Palestinians. Any ongoing or future violence between Israel and the Palestinians, armed conflicts, terrorist activities, tension along Israel’s northern borders, or political instability in the region would likely disrupt international trading activities in Israel and may materially and negatively affect our business conditions and could harm our prospects and business.

In addition, civil unrest, often accompanied by violence associated with the so-called “Arab Spring” has spread throughout the region over the last several years in areas such as Egypt, Syria, Jordan, and Lebanon. Protestors have demanded economic and political reforms, and to date, there have been several regime changes. Civil unrest could continue to spread throughout the region or grow in intensity, leading to more regime changes resulting in governments that are hostile to the United States and Israel, civil wars, or regional conflict. International tensions over Iran continue to exist regarding their possible development of nuclear weapons. Certain countries have considered actions ranging from economic sanctions to pre-emptive strikes on suspected nuclear sites, and Iranian officials have threatened retaliation by, among other actions, closing the Strait of Hormuz, through which a significant portion of the global crude oil supply is transported. There is also concern in Israel that the internal conflict in Syria and Lebanon, with which Israel shares borders, may spill over into Israel, coupled with the new ISIS terror organization that operates from Syria.

We cannot predict the effect, if any, on our business of renewed hostilities between Israel and its neighbors or any other changes in the political climate in the area.

13

Foundations

If we are successful in finding commercial quantities of hydrocarbons in Israel, 6% of our gross revenues from production will go to fund two charitable foundations that we established with the purpose of donating to charities in Israel, the U.S. and elsewhere in the world.

For charitable activities concerning Israel, the Bnei Joseph Foundation (R.A.) was established. On November 11, 2008, both the Articles of Association and Incorporation Certificate were certified by the Registrar of Amutot (i.e. Charitable Foundations) in Israel.

For the U.S. and worldwide charitable activities, the Abraham Foundation - in Geneva, Switzerland was established. On June 20, 2008, the Articles of Incorporation were executed and filed by the Swiss Notary in the Commercial Registrar in Geneva. On June 23, 2008, the initial organizational meeting of the founding members was convened in Israel. Regulations for the Organization of the Abraham Foundation, signed by the founding members, were then filed with the Registrar. On November 19, 2008, the Swiss Confederation approved the Foundation as an international foundation under the supervision of the federal government. On December 8, 2008, the Republic of Geneva and the Federal government of Switzerland issued a tax ruling providing complete tax exemption for the Foundation.

Our shareholders, in a resolution passed at the 2002 Annual Meeting, gave authority to the Zion Board of Directors to transfer a 3% overriding royalty interest to each of the two foundations with regard to the Joseph and Asher-Menashe licenses. In accordance with that resolution, we took steps to legally donate a 3% overriding royalty interest to the Bnei Joseph Foundation (in Israel) and a 3% overriding royalty interest to the Abraham Foundation (in Switzerland).

On June 22, 2009, we received an official letter from the Commissioner informing us that the 3% overriding royalty interest to each of the Bnei Joseph Foundation and the Abraham Foundation had been registered in the Israeli Oil Register with regard to the Joseph and Asher-Menashe licenses. On November 9, 2011, we received an official letter from the Commissioner informing us that the 3% overriding royalty interest to each of the Bnei Joseph Foundation and the Abraham Foundation had been registered in the Israeli Oil Register with regard to the Jordan Valley License.

On February 5, 2014, the Company submitted applications to the Petroleum Commissioner, requesting royalty interest transfers from the Megiddo-Jezreel License of 3% overriding royalties to the Bnei Joseph Amutot and the Abraham Foundation, respectively. On April 8, 2014, the transfers were approved by the Petroleum Commissioner and duly registered.

Available Information

Zion’s internet website address is “www.zionoil.com”. We make available, free of charge, on our website, and on our Zion Oil mobile application, under “SEC Reports”, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, Forms 3, 4 and 5 filed on behalf of directors and executive officers and amendments to those reports, as soon as reasonably practicable after providing the SEC such reports.

Our Corporate Governance Policy, the charters of the Audit Committee, the Compensation Committee and the Nominating and Governance Committee, and the Code of Ethics for directors, officers, employees and financial officers are also available on our website under “Corporate Governance” and in print to any stockholder who provides a written request to the Corporate Secretary at Zion Oil & Gas, Inc., 6510 Abrams Rd., Suite 300, Dallas, TX 75231, Attn: Corporate Secretary.

We file annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and other documents with the SEC under the Securities Exchange Act of 1934, as amended. The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 450 Fifth Street, N.W., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Also, the SEC maintains an internet website that contains reports, proxy and information statements, and other information regarding issuers, including Zion Oil & Gas, Inc., that file electronically with the SEC. The public can obtain any document we file with the SEC at www.sec.gov. Information contained on or connected to our website is not incorporated by reference into this Form 10-K and should not be considered part of this report or any other filing that we make with the SEC.

14

ITEM 1A. RISK FACTORS

In evaluating our company, the risk factors described below should be considered carefully. The occurrence of one or more of these events could significantly and adversely affect our business, prospects, financial condition and results of operations.

Risks Associated with our Company

We are a company with no current source of revenue. Our ability to continue in business depends upon our continued ability to obtain significant financing from external sources and the ultimate success of our petroleum exploration efforts in onshore Israel, none of which can be assured.

We were incorporated in April 2000 and we have incurred negative cash flows from our operations, and presently all exploration activities and overhead expenses are financed solely by way of the issue and sale of equity securities. The recoverability of the costs we have incurred to date is uncertain and is dependent upon achieving commercial production or sale, none of which can be assured. Our operations are subject to all of the risks inherent in exploration companies with no revenues or operating income. Our potential for success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered in connection with a new business, especially the oil and gas exploration business, and in particular the deep, wildcat exploratory wells in which we are engaged in Israel. We cannot warrant or provide any assurance that our business objectives will be accomplished.

Our ability to continue in business depends upon our continued ability to obtain the necessary financing from external sources to undertake further exploration and development activities and generate profitable operations from oil and natural gas interests in the future. We incurred net losses of $6,756,000 for the year ended December 31, 2014 and $9,077,000 for the year ended December 31, 2013. The audited financial statements have contained a statement by the auditors that raises substantial doubt about us being able to continue as a “going concern” unless we are able to raise additional capital.

We expect to incur substantial expenditures in our exploration and development programs. Our existing cash balances will not be sufficient to satisfy our exploration and development plans going forward. We are considering various alternatives to remedy any future shortfall in capital. We may deem it necessary to raise capital through equity markets, debt markets or other financing arrangements, including participation arrangements that may be available. Because of the current absence of any oil and natural gas reserves and revenues in our license areas, there can be no assurance this capital will be available on commercially acceptable terms (or at all) and if it is not, we may be forced to substantially curtail or cease exploration expenditures which could lead to our inability to meet all of our commitments.

Our financial statements do not reflect the adjustments or reclassifications of assets and liabilities that would be necessary if we are unable to continue as a going concern.

The spudding of our next exploratory well is subject to many contingencies outside of our control, and any considerable delay in obtaining all of the needed licenses, approvals and authorizations prior to actual drilling may severely impair our business.

Even though we have now chosen a drill site within the Megiddo-Jezreel License from where we plan to drill our next well, there remain a number of risks and contingencies prior to actually spudding that well.

In January 2015, the Company completed and delivered our environmental impact assessment (“EIA”) to both Israel’s Ministry of National Infrastructures, Energy and Water Resources (“Energy Ministry”) and Israel’s Environmental Ministry. We await feedback from the Environmental Ministry and will revise our document accordingly. Under Israel’s regulatory system, this environmental document is a prerequisite for a drilling permit. We anticipate that the newly promulgated regulations will considerably increase the time needed to obtain all of the needed permits and authorizations from regulatory and local bodies in Israel, and there is no assurance that the Company will ultimately be granted such permission to drill. See the discussion under “Energy Related Regulation — The Onshore Exploration Permitting Process in Israel;” “New Onshore Licensing Guidelines;” and “Israeli Governmental Regulations.”

15

For the reasons above, while we cannot predict the precise date when we will be able to drill our next exploratory well, we are planning to spud that next well in the second half of 2015. Additionally, prior to actually commencing drilling, we will need to contract with a drilling rig operator with the appropriate drilling rig and crew to carry out the drilling. See “We have not yet signed an agreement with a drilling contractor….”

We require significant capital to realize our business plan.

Our planned work program is expensive. We believe that our current cash resources are sufficient to allow us to undertake non-drilling exploratory activities in our current license areas and in the additional areas of interest that we have identified which are currently outside of our exploration license areas and otherwise meet our plans through November 30, 2015. We estimate that, when we are not actively drilling a well, our monthly expenditure is approximately $472,000 per month. However, when we are engaged in active operations, we estimate that there is an additional cost of approximately $2,500,000 per month. Additionally, the newly enacted onshore licensing and environmental and safety related regulations promulgated by the various energy related ministries in Israel during 2013-2014 are likely to render obtaining new explorations licenses increasingly expensive. For example, at the time of the award of any new exploration license, we will be required to submit performance bank guarantees for 10% of the cost of the planned drilling program as well as other amounts to cover potential environmental damages. See “Israel Energy Related Governmental Regulations”.

We have no commitments for any financing and no assurance can be provided that we will be able to raise funds when needed. Further, we cannot assure you that our actual cash requirements will not exceed our estimates. Even if we were to discover hydrocarbons in commercial quantities, we will require additional financing to bring our interests into commercial operation and pay for operating expenses until we achieve a positive cash flow. Additional capital also may be required in the event we incur any significant unanticipated expenses.

Under the current capital and credit market conditions, we may not be able to obtain additional equity or debt financing on acceptable terms. Even if financing is available, it may not be available on terms that are favorable to us or in sufficient amounts to satisfy our requirements.

If we are unable to obtain additional financing, we may be unable to implement our business plan and our growth strategies, respond to changing business or economic conditions and withstand adverse operating results. If we are unable to raise further financing when required, our planned exploration activities may have to be scaled down or even ceased, and our ability to generate revenues in the future would be negatively affected.

Additional financing could cause your relative interest in our assets and potential earnings to be significantly diluted. Even if we have exploration success, we may not be able to generate sufficient revenues to offset the cost of dry holes and general and administrative expenses.

We have not yet signed an agreement with a drilling contractor and thus, we may be unable to affect any future drilling operations within the contemplated time-frame.

Following the completion of the Ma’anit-Joseph #3 well, the drilling rig that we used to drill our last three exploratory wells was exported by the owner from Israel in 2012. Until such time as we sign a legally binding agreement, there can be no assurance that we will be able to come to an agreement with the drilling contractor to drill any future exploratory well(s) on commercially reasonable terms, or at all. Any delay in locating and contracting with an appropriate drilling rig owner/operator can have a material adverse effect on the expanded and new exploration rights that we are seeking and on the implementation of our business plan. On February 25, 2015, the Company entered into a Memorandum of Understanding (“MOU”) with Viking Services BV, an international rig and oilfield services provider, to obtain the right to contract a land-based rig and certain oilfield services and crew with which to drill our next well. The MOU contemplates a two-year agreement to drill two wells with an option to drill a third well.

We rely on independent experts and technical or operational service providers over whom we may have limited control.

The success of our oil and gas exploration efforts is dependent upon the efforts of various third parties that we do not control. These third parties provide critical engineering, geological, geophysical and other scientific analytical services, including 2-D seismic imaging technology to explore for and develop oil and gas prospects. Given our small size and limited resources, we do not have all the required expertise on staff. As a result, we rely upon various companies and other third persons to assist us in identifying desirable hydrocarbon prospects to acquire and to

16

provide us with technical assistance and services. In addition, we rely upon the owners and operators of drilling rigs and related equipment.

If any of these relationships with third-party service providers are terminated or are unavailable on commercially acceptable terms, we may not be able to execute our business plan. Our limited control over the activities and business practices of these third parties, any inability on our part to maintain satisfactory commercial relationships with them, their limited availability or their failure to provide quality services could materially and adversely affect our business, results of operations and financial condition.

We typically commence exploration drilling operations without undertaking extensive analytical testing such as 3-D seismic surveys thereby potentially increasing the risk (and associated costs) of drilling a non-producing well.

Larger oil and gas exploration companies typically conduct extensive analytical pre-drilling testing such as 3-D seismic imaging, the drilling of an expendable “pilot” well or “stratigraphic test” to collect data (logs, cores, fluid samples, pressure data) to determine if drilling a well capable of producing oil or gas (full completion with casing and well testing) is justified. The use of pilot or stratigraphic tests is often used in areas where there is little or no offset well data, like Israel, where our exploration license area is located. While 3-D seismic imaging data is more useful than 2-D data in identifying potential new drilling prospects, its acquisition and processing costs are many multiples greater than that for 2-D data, and GII, our primary provider of geophysical data, has limited ability to acquire and process onshore 3-D data in Israel. In addition to using 2-D seismic technology prior to drilling, we have historically also utilized gravity and magnetic data, built cross section maps from offset wells and utilized geophysical analysis from similar geologic targets. We believe that the additional months, delays and costs associated with more extensive pre-drilling testing typically undertaken by larger oil and gas exploration companies is not necessarily justified when drilling vertical or near-vertical exploration wells (as we have historically been doing). Nonetheless, the absence of more extensive pre-drilling testing may potentially increase the risk of drilling a non-producing well, which would in turn result in increased costs and expenses. Additionally, we are typically engaged in drilling very deep onshore wildcat wells in Israel where only approximately 500 total wells have ever been drilled, the vast majority of which are relatively shallower. As such, exploration risks are inherently very substantial.

Exploratory well drilling locations that we decide to drill may not yield oil or natural gas in commercially viable quantities.

There is no way to predict in advance of drilling and testing whether any particular location will yield oil or natural gas in sufficient quantities to recover drilling or completion costs or to be economically viable. The use of technologies and the study of producing fields in the same area will not enable us to know conclusively prior to drilling whether oil, natural gas liquids (NGLs) or natural gas will be present or, if present, whether oil or natural gas will be present in sufficient quantities to be economically viable. Even if sufficient amounts of oil, NGLs or natural gas exist, we may damage the potentially productive hydrocarbon bearing formation or experience mechanical difficulties while drilling or completing a well, resulting in a reduction in production from the well or abandonment of the well. If we drill exploratory wells that we identify as dry holes in our future drilling locations, our business may be materially harmed. We cannot assure you that the analogies we draw from available data from other wells, more fully explored locations or producing fields will be applicable to our drilling locations. Ultimately, the cost of drilling, completing and operating any well is often uncertain, and new wells may not be productive.

Deterioration of political, economic and security conditions in Israel may adversely affect our operations.

Any major hostilities involving Israel, a substantial decline in the prevailing regional security situation or the interruption or curtailment of trade between Israel and its present trading partners could have a material adverse effect on our operations. See the prior discussion on Political Climate.

Prolonged and/or widespread regional conflict in the Middle East could have the following results, among others:

• capital market reassessment of risk and subsequent redeployment of capital to more stable areas making it more difficult for us to obtain financing for potential development projects;

17

• security concerns in Israel, making it more difficult for our personnel or supplies to enter or exit the country;

• security concerns leading to evacuation of our personnel;

• damage to or destruction of our wells, production facilities, receiving terminals or other operating assets;

• inability of our service and equipment providers to deliver items necessary for us to conduct our operations in Israel, resulting in delays; and

• the lack of availability of drilling rig and experienced crew, oilfield equipment or services if third party providers decide to exit the region.

Loss of property and/or interruption of our business plans resulting from hostile acts could have a significant negative impact on our earnings and cash flow. In addition, we may not have enough insurance to cover any loss of property or other claims resulting from these risks.

We have a history of losses and we cannot assure you that we will ever be profitable.

We incurred net losses of $6,756,000 for the year ended December 31, 2014, and $9,077,000 for the year ended December 31, 2013. We cannot provide any assurance that we will ever be profitable.

Earnings, if any, will be diluted due to charitable contributions and key employee incentive plans.

We are legally bound to fund in the form of a royalty interest or equivalent net operating profits interest, 6% of our gross sales revenues, if any, to two charitable foundations. In addition, we may allocate 1.5% royalty interest or equivalent net operating profits interest to a key employee incentive plan designed as bonus compensation over and above our executive compensation payments. This means that the total royalty burden on our property (including the government royalty of 12.5%) may be up to 20% of gross revenue. As our expenses increase with respect to the amount of sales, these donations and allocation could significantly dilute future earnings and, thus, depress the price of the common stock.

Risks Associated with our Business

We are subject to increasing Israeli governmental regulations and environmental requirements that may cause us to incur substantial incremental costs and/or delays in our drilling program.