Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BANC OF CALIFORNIA, INC. | d888397d8k.htm |

Sandler

O’Neill West Coast Financial Services Conference

Investor Presentation

March 11, 2015

Exhibit 99.1 |

| 1

1

Forward-looking Statements

When used in this presentation and in documents filed with or furnished to the Securities and

Exchange Commission (the “SEC”), or other public shareholder communications,

or in oral statements made with the approval of an authorized executive officer, the words or phrases “believe,” “will,” “should,” “will likely result,”

“are expected to,” “will continue,” “is anticipated,”

“estimate,” “project,” “plans,” or similar expressions are intended to identify “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of 1995. You are cautioned not to

place undue reliance on any forward-looking statements, which speak only as of the

date made. These statements may relate to future financial performance, strategic plans or objectives, revenue, expense or earnings projections, or other

financial items of Banc of California Inc. and its affiliates (“BANC,” the

“Company,” “we,” “us” or “our”). By their nature, these statements are subject to numerous

uncertainties that could cause actual results to differ materially from those anticipated in

the statements.

Factors that could cause actual results to differ materially from the results anticipated or

projected include, but are not limited to, the following: (i) risks that the

Company’s recently completed acquisitions, including the acquisitions of branches from

Banco Popular, The Private Bank of California, CS Financial, Inc., and The Palisades

Group, may disrupt current plans and operations, the potential difficulties in customer and employee retention as a result of those transactions and the

amount of the costs, fees, expenses and charges related to those transactions; (ii) the credit

risks of lending activities, which may be affected by further deterioration in real

estate markets and the financial condition of borrowers, may lead to increased loan and lease delinquencies, losses and nonperforming assets in our loan portfolio,

and may result in our allowance for loan and lease losses not being adequate to cover actual

losses and require us to materially increase our loan and lease loss reserves; (iii)

the quality and composition of our securities and loan portfolios; (iv) changes in general economic conditions, either nationally or in our market areas; (v)

continuation of the historically low short-term interest rate environment, changes in the

levels of general interest rates, and the relative differences between short- and

long-term interest rates, deposit interest rates, our net interest margin and funding sources; (vi) fluctuations in the demand for loans and leases, the number of

unsold homes and other properties and fluctuations in commercial and residential real estate

values in our market area; (vii) results of examinations of us by regulatory

authorities and the possibility that any such regulatory authority may, among other things,

require us to increase our allowance for loan and lease losses, write-down asset

values, increase our capital levels, or affect our ability to borrow funds or maintain or increase deposits, which could adversely affect our liquidity and earnings;

(viii) legislative or regulatory changes that adversely affect our business, including changes

in regulatory capital or other rules; (ix) our ability to control operating costs and

expenses; (x) staffing fluctuations in response to product demand or the implementation of corporate strategies that affect our work force and potential associated

charges; (xi) errors in our estimates in determining fair value of certain of our assets,

which may result in significant declines in valuation; (xii) the network and computer

systems on which we depend could fail or experience a security breach; (xiii) our ability to attract and retain key members of our senior management team;

(xiv) costs and effects of litigation, including settlements and judgments; (xv) increased

competitive pressures among financial services companies; (xvi) changes in consumer

spending, borrowing and saving habits; (xvii) adverse changes in the securities markets; (xviii) earthquake, fire or other natural disasters affecting the

condition of real estate collateral; (xix) the availability of resources to address changes in

laws, rules or regulations or to respond to regulatory actions; (xx) inability of key

third-party providers to perform their obligations to us; (xxi) changes in accounting policies and practices, as may be adopted by the financial institution regulatory

agencies or the Financial Accounting Standards Board or their application to our business or

final audit adjustments, including additional guidance and interpretation on accounting

issues and details of the implementation of new accounting methods; (xxii) war or terrorist activities; and (xxiii) other economic, competitive,

governmental, regulatory, and technological factors affecting our operations, pricing,

products and services and the other risks described in this report and from time to

time in other documents that we file with or furnish to the SEC. You should not place undue reliance on forward-looking statements, and we undertake no obligation

to update any such statements to reflect circumstances or events that occur after the date on

which the forward-looking statement is made. |

2

2

Company Overview

Largest bank based in Orange County, CA

Common Stock: BANC (NYSE)

Preferred Stock: BANC PRC (NYSE)

Senior Debt: BOCA (NYSE)

Franchise

$6 billion in assets and over $5 billion in

annual loan originations

100+ banking locations

(1)

, including 40

branches in Los Angeles, Orange and San

Diego counties

9th largest public independent California

bank; largest Orange County based bank

15

largest

deposit

franchise

in

Los

Angeles

MSA

(2)

Investment Advisor subsidiary with $4.6

billion in AUA

(3)

managing over 22,000

individual loans

1)

Including locations in California, Oregon, Arizona, Virginia, Indiana, Maryland, Colorado,

Idaho, and Nevada 2)

FDIC SOD Report. Data as of 6/30/14 (combined BANC and Banco Popular CA

branches). 3) Assets under advisement as measured by total UPB

(Data as of 12/31/14 unless noted)

Branches

Loan Offices

th |

3

3

Banc of California has been successful in growing its asset base

both organically as

well as through opportunistic acquisitions since its recap in November 2010

Gateway Bancorp and Beach Business Bank, 2012

The Private Bank of California, CS Financial, and The Palisades Group, 2013

Renovation Ready and Popular Community Bank branches, 2014

All acquisitions successfully integrated into single technology platform

Consistent and disciplined asset growth since 2010

averaging approximately $1 billion annually

with

strong credit metrics

Building California’s Bank

Total Assets

($ in millions)

2010

2011

2012

2013

2014

$900

$900

$900

$800

$900

$900

$1,000

$1,100 $1,100

$1,700

$1,700

$2,100

$2,500

$3,700

$3,600

$4,000

$4,400

$4,500

$6,000

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4 |

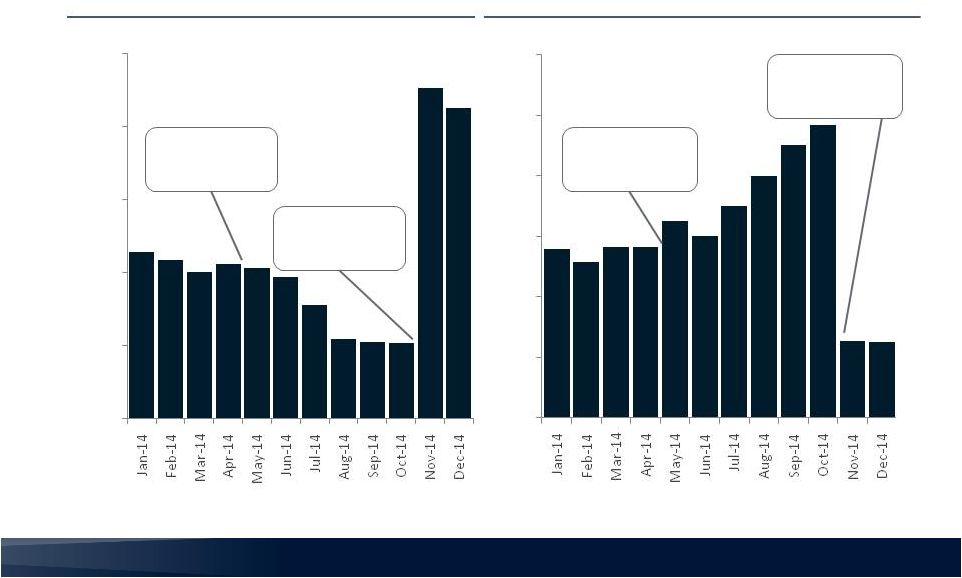

4

4

Operating Platform Built To Scale

FY 2014 All in Productivity

Annualized Salary Cost per Account

BPOP

Acquisition

Announced

BPOP

Acquisition

Closed

BPOP

Acquisition

Announced

BPOP

Acquisition

Closed

0

250

500

750

1,000

1,250

0

50

100

150

200

250

300 |

5

5

i.

building the top full-service bank

serving California’s diverse private

businesses, entrepreneurs, and

homeowners,

and

ii.

investing in and growing

complementary businesses that

enhance shareholder value and serve

as a source of strength to the bank.

Banc of California

is committed to

Our Mission

5 |

6

Private Business

C&I Lending, Lines of Credit, ABL Facilities,

Owner Occupied CRE, SBA Lending, Equipment Finance,

Specialties, Acquisition Financing,

ESOP Financing

Entrepreneurs and Family Offices

Lines of Credit, Investor CRE, Multi-Family, Acquisition

Financing, C&I Lending, SBLOC and IBLOC

Homeowners

Mortgages, Rehabilitation / Construction Lending,

HELOCs

Full-Service Lending Platform

6 |

7

7

Loans Portfolio

* C&I includes C&I, SBA and Leasing; CRE includes CRE and Construction.

$5.1 billion

Average Loan Yield: 4.60%

Total Loans

Total Loans (HFS / HFI)

$480

$497

$54

$23

BPOP

4.60%

4.62%

4.75%

5.12%

5.18%

Average

Loan Yield:

$1,054

$347

$374

$455

$464

$613

$555

$586

$567

$548

$1,042

$142

$155

$234

$367

$956

$1,287

$1,159

$1,213

$1,191

$1,172

$717

$1,000

$1,096

$1,127

$1,187

$116

$123

$134

$142

$167

$3,163

$3,397

$3,698

$3,839

$5,136

4Q 2013

1Q 2014

2Q 2014

3Q 2014

4Q 2014

C&I/SBA/Leasing

CRE

MF

SFR

HFS

Other Consumer

SFR

23%

CRE

20%

MF

19%

C&I

12%

Other

3%

HFS

23%

($ in millions) |

8

8

BPOP

Deposits Franchise

$2.9

$3.1

$3.3

$3.6

$4.7

Total Deposits

($ in billions)

0.60%

0.70%

0.74%

0.77%

0.77%

Cost of

Deposits:

Total Deposits

$.9

$.15

$4.7 billion

Cost of Deposits: 0.60%

$1.05

DDA/NOW

37%

Savings

21%

Money

Market

23%

Time

Deposits

19%

$0.43

$0.43

$0.41

$0.46

$0.66

$2.49

$2.68

$2.94

$3.17

$4.01

4Q 2013

1Q 2014

2Q 2014

3Q 2014

4Q 2014

Noninterest-bearing Deposits

Interest-bearing Deposits |

9

9

Net Interest Income

Net Interest Income

($ in millions)

Cost of Deposits

Loan Yields

Consolidated Net Interest Margin*

* Includes debt interest expense at Holding Company

$33.3

$35.2

$35.6

$38.2

$46.3

4Q 2013

1Q 2014

2Q 2014

3Q 2014

4Q 2014

5.18%

5.12%

4.75%

4.62%

4.60%

4Q 2013

1Q 2014

2Q 2014

3Q 2014

4Q 2014

3.90%

4.00%

3.70%

3.58%

3.65%

4Q 2013

1Q 2014

2Q 2014

3Q 2014

4Q 2014

0.77%

0.77%

0.74%

0.70%

0.60%

4Q 2013

1Q 2014

2Q 2014

3Q 2014

4Q 2014 |

10

10

Noninterest Income and Expenses

Noninterest Income

($ in millions)

Noninterest Expense

($ in millions)

$57.8

$60.5

$57.2

1

$67.6

$78.4

* Excludes $12.1 million in non-interest income from non-recurring branch sale

$15.0

$17.3

$26.1

$26.9

$25.0

$4.2

$2.6

$3.0

$10.3

$3.9

$0.4

$1.1

$1.8

$3.3

$6.7

$2.8

$4.2

$4.4

$3.6

$5.2

22.4*

$25.3

$35.4

$44.1

$40.9

4Q 2013

1Q 2014

2Q 2014

3Q 2014

4Q 2014

Mortgage Banking

Gain on Sale of Loans

Advisory Service Fees

All Other

Branch Sale*

$46.0

$49.1

$48.2

$52.0

$59.0

$11.3

$8.7

$12.3

$13.2

$13.5

$2.4

$5.9

4Q 2013

1Q 2014

2Q 2014

3Q 2014

4Q 2014

Base

Volume-Related

Acquisition/Non-core |

11

11

Financial Performance

1 Net Interest Margin shown for Banc of California, N.A. subsidiary. Excludes Holding Company

debt interest expense. Net Interest Margin

1

ROATCE

Efficiency Ratio

ROAA

YE 2015 Run Rate Targets

70 –

75%

3.75 –

4.00%

1.0%

15%

4.05%

4.19%

3.88%

3.78%

3.82%

4Q 2013

1Q 2014

2Q 2014

3Q 2014

4Q 2014

84%

96%

85%

82%

90%

4Q 2013

1Q 2014

2Q 2014

3Q 2014

4Q 2014

6.0%

0.9%

12.0%

13.2%

11.2%

4Q 2013

1Q 2014

2Q 2014

3Q 2014

4Q 2014

0.4%

0.1%

0.8%

1.0%

0.8%

4Q 2013

1Q 2014

2Q 2014

3Q 2014

4Q 2014 |

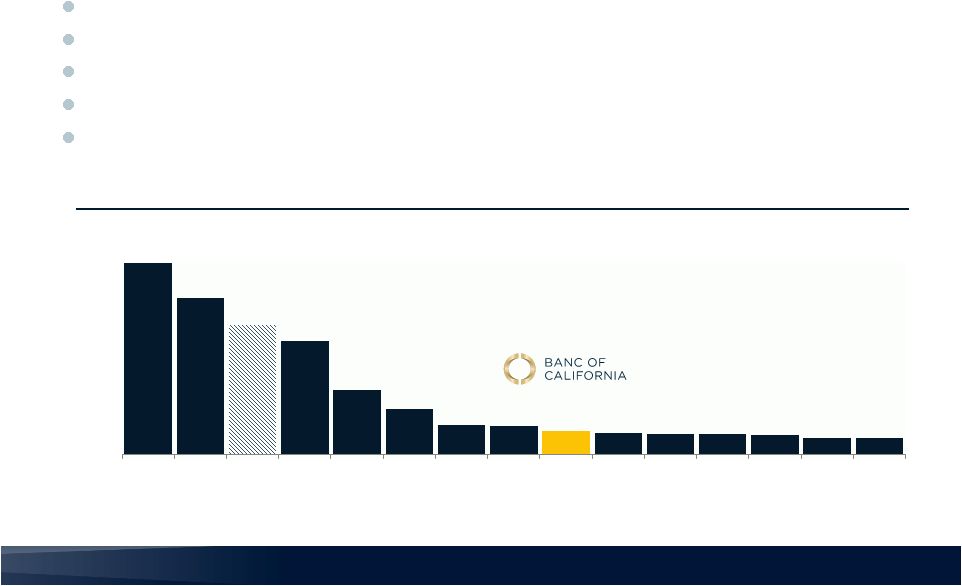

12

12

12

Top Public Independent Banks Headquartered in California by Assets

($ in billions)

BANC is the 9th largest public independent California bank

Proven ability to attract and grow low cost retail deposits

Proven ability to build a scalable and diverse commercial lending platform

Proven M&A capabilities

Compelling economic model with scalable platform

Source: SNL Financial. Financial data as 12/31/14.

A Top California Bank at an Attractive Entry Point

$48

$39

$33

$29

$16

$12

$7

$7

$6

$6

$5

$5

$5

$4

$4

$-

$10

$20

$30

$40

$50

FRC

SIVB

CYN

EWBC

PACW

CATY

CVBF

BBCN

BANC

FMBL

BOFI

OPB

WABC

HAFC

WIBC |