Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Ascent Capital Group, Inc. | a8-kacgmarchinvestorpres.htm |

A S C E N T CAPITAL GROUP INC ASCENT CAPITAL GROUP INC Investor Presentation March 2015 Exhibit 99.1

A S C E N T CAPITAL GROUP INC This presentation contains or may contain certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements about our consolidated performance after giving effect to the integrations of Security Networks, LLC and LiveWatch Security, LLC, market potential in the DIY alarm space, consumer demand for home automation systems, lead generation for Monitronics' dealers, business strategies, our ability to perform well in a challenging competitive environment, future financial performance, the growth and development of our core business, growth expectations regarding our HomeTouch® offering, the predictability of our pool attrition curve, our acquisition opportunities and prospects and other matters that are not historical facts. These forward-looking statements involve many risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements, including, without limitation, the operating performance and actual growth potential of the Monitronics and LiveWatch businesses, continued productivity of Monitronics’ dealer network and LiveWatch's internal sales force, Monitronics’ ability to realize estimated synergies from the acquisition of Security Networks, LLC, competitive issues, subscriber preferences, continued access to capital on terms acceptable to Ascent and Monitronics, our ability to capitalize on acquisition opportunities, general market conditions and regulatory issues. These forward looking statements speak only as of the date hereof, and Ascent expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in Ascent's or Monitronics' expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. This presentation will discuss certain non-GAAP financial measures, including Adjusted EBITDA. As companies often define non- GAAP financial measures differently, Adjusted EBITDA as calculated by us may not be comparable to similarly titled measures reported by other companies. Please see Monitronics’ and Ascent Capital's Annual Reports on Form 10-K for the twelve months ended December 31, 2014 filed with the Securities and Exchange Commission (“SEC”) on March 6, 2015 and February 27, 2015, respectively. For applicable definitions and reconciliations, see the Appendix at the end of this presentation together with Ascent's Current Report on Form 8-K filed with the SEC on October 14, 2011 (as amended on March 6, 2012). March 2015 2 Forward Looking Statements

A S C E N T CAPITAL GROUP INC March 2015 3 Ascent Capital Group: Capitalizing on Home Automation Growth • Expanding presence in life safety and security monitoring • Monitronics: #2 residential security monitoring provider with 1.1 million subscribers • National network of ~600 exclusive independent dealers • Extensive suite of new technologies and services to meet customers’ evolving demands • Strong, experienced management team with a track record of profitable growth • Efficient and flexible capitalization with capacity for growth Ascent Capital Group (Nasdaq: ASCMA): Owner of Monitronics – A leading home automation and security monitoring provider

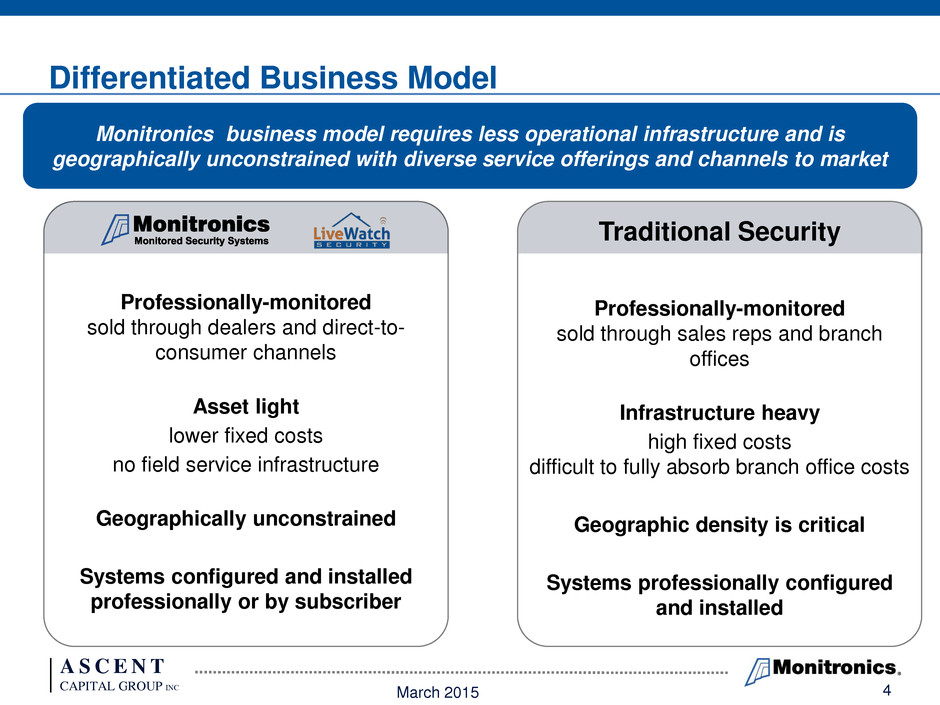

A S C E N T CAPITAL GROUP INC Traditional Security Professionally-monitored sold through sales reps and branch offices Infrastructure heavy high fixed costs difficult to fully absorb branch office costs Geographic density is critical Systems professionally configured and installed Professionally-monitored sold through dealers and direct-to- consumer channels Asset light lower fixed costs no field service infrastructure Geographically unconstrained Systems configured and installed professionally or by subscriber Differentiated Business Model March 2015 4 Monitronics business model requires less operational infrastructure and is geographically unconstrained with diverse service offerings and channels to market

A S C E N T CAPITAL GROUP INC March 2015 5 Monitronics: Strong Growth Profile • Robust historical growth ‒ Revenue CAGR of 17.7% from 2010 to 2014 ‒ Adjusted EBITDA CAGR of 16.9% from 2010 to 2014 • High margin, predictable, stable earnings and cash flow ‒ 67% Adj. EBITDA margin in 2014 • High quality customer base with attractive attrition dynamics ‒ 720 average credit score ‒ 12.6% TTM RMR attrition at 12/31/2014 • Scalable platform for future growth and service expansion ‒ Positioned to grow through discretionary acquisition of high quality account purchases ‒ Increased awareness and uptake of home automation services driving higher ARPU and lower churn ‒ Diversification of account generation channels such as direct-to-consumer DIY • Attractive industry dynamics ‒ Low 20% residential penetration Attractive industry and company financial characteristics: Growing, predictable earnings and cash flow from scalable platform

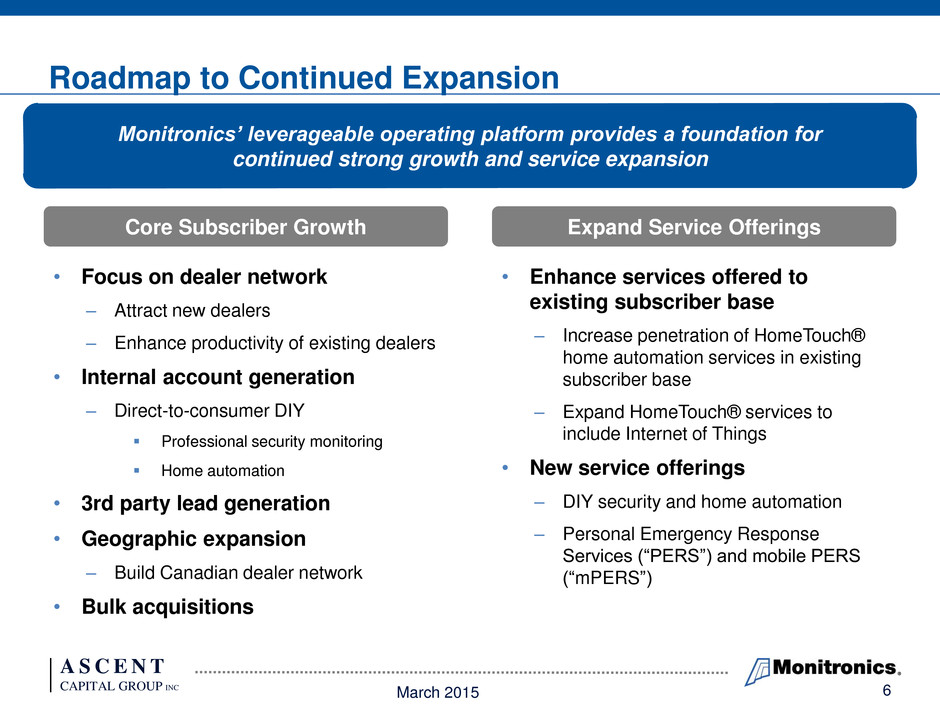

A S C E N T CAPITAL GROUP INC • Focus on dealer network ‒ Attract new dealers ‒ Enhance productivity of existing dealers • Internal account generation ‒ Direct-to-consumer DIY Professional security monitoring Home automation • 3rd party lead generation • Geographic expansion ‒ Build Canadian dealer network • Bulk acquisitions Roadmap to Continued Expansion • Enhance services offered to existing subscriber base ‒ Increase penetration of HomeTouch® home automation services in existing subscriber base ‒ Expand HomeTouch® services to include Internet of Things • New service offerings ‒ DIY security and home automation ‒ Personal Emergency Response Services (“PERS”) and mobile PERS (“mPERS”) Core Subscriber Growth Expand Service Offerings March 2015 6 Monitronics’ leverageable operating platform provides a foundation for continued strong growth and service expansion

A S C E N T CAPITAL GROUP INC Focus on Strategic Acquisitions March 2015 7 Ascent’s record of success is attributable to its strong operating platform and effective capitalization structure, enabling strategic acquisitions Strong Platform: Monitronics • #2 residential security alarm monitoring provider • Asset light model • Large dealer network/ direct-to-consumer DIY • Stable, high quality account base • Leverageable operating platform • Consistent and predictable cash flow Strategic Acquisitions • Security Networks ‒ 200K subscribers ‒ $8.8M of RMR ‒ 200 selling dealers • Pinnacle Security ‒ 115K subscribers ‒ $4.4M of RMR • LiveWatch ‒ 32K subscribers ‒ $905K of RMR ‒ Direct-to-consumer marketing platform Effective Capitalization • Revolving credit facility • Bank debt • High yield bonds • Convertible notes • Ascent cash • Real estate assets • ASCMA equity

A S C E N T CAPITAL GROUP INC Dec-10 Dec-14 Change CAGR Customers (k) 670 1,059 + 58.0% + 12.1% ARPU $36.24 $41.64 + 14.9% + 3.5% RMR $24.3 $44.1 + 81.5% + 16.1% Revenue $281 $539 + 91.8% + 17.7% Adj. EBITDA $194 $362 + 86.7% + 16.9% Net Debt/LQA Adj. EBITDA 4.2x 4.2x - - Avg. Purch. Multiple 33.4x 36.4x + 9.0% + 2.2% Dealers Purchased from TTM 400+ 600+ + 50.0% + 10.7% % HomeTouch® Penetration 3.5% 35%+ + 900.0% + 77.8% $194 $214 $236 $305 $362 $- $50 $100 $150 $200 $250 $300 $350 $400 2010 2011 2012 2013 2014 Adj. EBITDA ($M) $281 $312 $345 $451 $539 $- $100 $200 $300 $400 $500 $600 2010 2011 2012 2013 2014 Revenue ($M) Strong Financial Performance Ascent’s primary operating business, Monitronics, has generated robust growth from its large dealer network, bulk purchases and accretive acquisitions March 2015 8

A S C E N T CAPITAL GROUP INC Leading Edge Product and Service Offerings HomeTouch® by SECURITY LIFESTYLE SAVINGS • Protect your family • Protect your life • Protect your property • Peace of mind • Home automation • Notifications • Video surveillance • Automated lighting control • Smart thermostats • Water sensors March 2015 9 Monitronics offers a broad suite of products and services through HomeTouch® 35% penetrated across the Monitronics subscriber base Mid 60’s % sell-in rate to new subscribers

A S C E N T CAPITAL GROUP INC • Acquired LiveWatch Security for $67 million ‒ Bulk account acquisition of $905K of RMR from 32K accounts ‒ Leading Do-It-Yourself (“DIY”) home security provider ‒ Differentiated growth engine/direct-to-consumer sales platform Rapid growth historically, despite capital constraints Based on analysts estimates of DIY market growth, upwards of 40-50K expected annual account production in 5-6 years ‒ Asset-light business model and professionally monitored security service ‒ Complementary to Monitronics dealer program • Signed large Canadian dealer ‒ Adds scale and geographic diversity • Signed national lead generation provider ‒ Expands customer acquisition channels Diversifying Channels March 2015 10 Monitronics has expanded and diversified its account generation channels

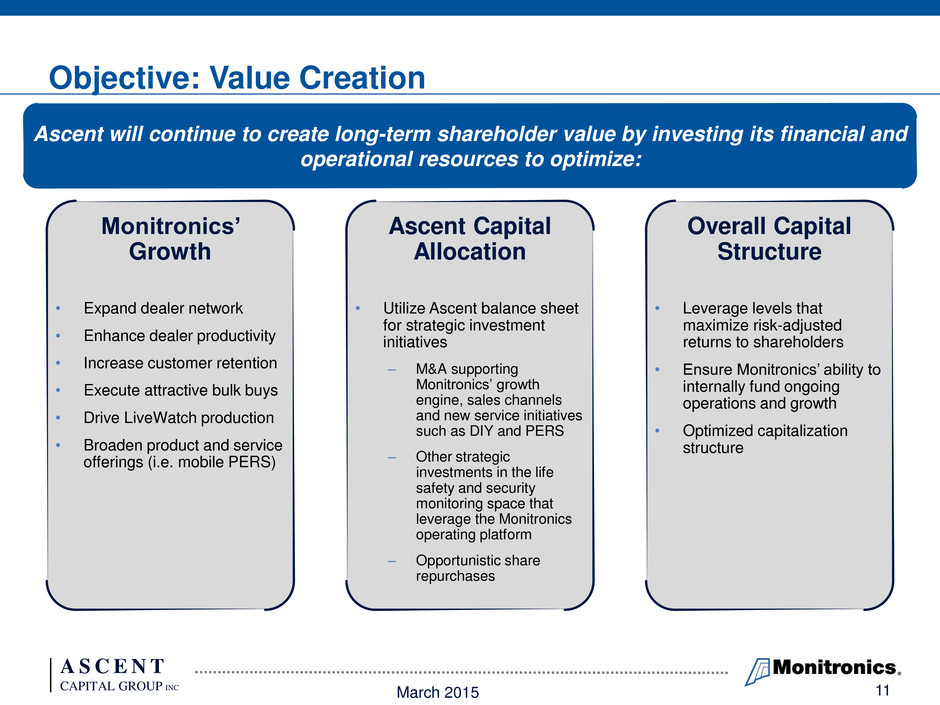

A S C E N T CAPITAL GROUP INC Ascent Capital Allocation • Utilize Ascent balance sheet for strategic investment initiatives ‒ M&A supporting Monitronics’ growth engine, sales channels and new service initiatives such as DIY and PERS ‒ Other strategic investments in the life safety and security monitoring space that leverage the Monitronics operating platform ‒ Opportunistic share repurchases Monitronics’ Growth • Expand dealer network • Enhance dealer productivity • Increase customer retention • Execute attractive bulk buys • Drive LiveWatch production • Broaden product and service offerings (i.e. mobile PERS) Overall Capital Structure • Leverage levels that maximize risk-adjusted returns to shareholders • Ensure Monitronics’ ability to internally fund ongoing operations and growth • Optimized capitalization structure March 2015 11 Objective: Value Creation Ascent will continue to create long-term shareholder value by investing its financial and operational resources to optimize:

A S C E N T CAPITAL GROUP INC • Large, dynamic industry poised for penetration growth • Fragmented landscape with significant consolidation opportunity • Strong and predictable operating business with attractive core growth opportunities • Highly scalable platform for future growth and service expansion • Asset-light model with highly productive, tax efficient, cash flow characteristics • Strong, stable balance sheet with sufficient liquidity and access to capital markets • Capitalization structure to drive highly attractive equity returns March 2015 12 Summary Highlights

A S C E N T CAPITAL GROUP INC Appendix March 2015 13

A S C E N T CAPITAL GROUP INC ($ in Thousands) For the Quarter Ended December 31, For the Twelve Months Ended December 31, 2014 2013 2014 2013 2012 2011 Actual Actual Actual Actual Actual Actual Net Income (Loss) ($5,009) ($14,141) ($29,717) ($16,687) ($16,776) ($6,759) Amortization of subscriber accounts, dealer network and other intangible assets 64,021 62,701 253,403 208,760 163,468 159,619 Depreciation 2,192 2,208 9,019 7,327 5,286 4,704 Stock-based compensation expense 661 654 2,068 1,779 1,384 393 Restructuring charges (17) 709 952 1,111 - - Radio Conversion Program costs (a) 312 - 1,113 - - - Security Networks acquisition related costs - - - 2,470 - - Security Networks integration related costs - 729 2,182 1,264 - - Realized/unrealized loss on derivative instruments - - - - 2,044 10,601 Refinancing costs - - - - 6,245 - Interest expense 30,203 29,820 119,607 96,145 71,405 42,698 Income tax expense (1,611) 5,098 3,600 3,081 2,619 2,564 Adjusted EBITDA $90,752 $87,778 $362,227 $305,250 $235,675 $213,820 Source: Company filings (a) Monitronics Adjusted EBITDA reported for the twelve months ended December 31, 2014 has been adjusted to exclude Radio Conversion Program costs of $441,000 and $360,000 for the three months ended June 30, 2014 and September 30, 2014, respectively. These adjustments will be reflected in future filings. No costs associated with the Radio Conversion Program were incurred prior to 2014. Monitronics generally defines Adjusted EBITDA as net income (loss) before interest, taxes, depreciation and amortization (including the amortization of subscriber accounts, dealer network and other intangible assets) and other non-cash or non-recurring charges such as acquisition related professional fees, restructuring charges and stock-based compensation. Adjusted EBITDA does not represent cash flow from operations as defined by generally accepted accounting principles, should not be construed as an alternative to net income or loss and is indicative neither of Monitronics’ results of operations nor of cash flows available to fund all of its cash needs. It is, however, a measurement Monitronics believes is useful to investors to evaluate its operating performance. Adjusted EBITDA is also a measure that Monitronics believes is customarily used by financial analysts to evaluate the financial performance of companies in the security alarm monitoring industry and is one of the financial measures, subject to adjustments, by which Monitronics’ covenants are calculated under the agreements governing its debt obligations. Monitronics Non-GAAP Measures and Reconciliations March 2015 14