Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Manitex International, Inc. | d884858d8k.htm |

| EX-99.1 - EX-99.1 - Manitex International, Inc. | d884858dex991.htm |

“Focused manufacturer

of engineered lifting

equipment”

Manitex International, Inc.

(NASDAQ:MNTX)

Conference Call

Fourth Quarter and Full Year 2014

March 5th, 2015

Exhibit 99.2 |

2

Forward Looking Statements &

Non GAAP Measures

“Focused manufacturer

of engineered lifting

equipment”

Safe Harbor Statement under the U.S. Private Securities Litigation Reform Act of

1995: This presentation contains statements that are forward-looking in

nature which express the beliefs and expectations of management including

statements regarding the Company’s expected results of operations or liquidity;

statements concerning projections, predictions, expectations, estimates or forecasts

as to our business, financial and operational results and future economic

performance; and statements of management’s goals and objectives and

other similar expressions concerning matters that are not historical facts. In some

cases,

you

can

identify

forward-looking

statements

by

terminology

such

as

“anticipate,”

“estimate,”

“plan,”

“project,”

“continuing,”

“ongoing,”

“expect,”

“we

believe,”

“we

intend,”

“may,”

“will,”

“should,”

“could,”

and similar expressions. Such statements are based on current plans, estimates and

expectations and involve a number of known and unknown risks, uncertainties

and other factors that could cause the Company's future results, performance

or achievements to differ significantly from the results, performance or

achievements expressed or implied by such forward-looking statements. These factors and additional

information are discussed in the Company's filings with the Securities and Exchange

Commission and statements in this presentation should be evaluated in light of

these important factors. Although we believe that these statements are based

upon reasonable assumptions, we cannot guarantee future results.

Forward-looking statements speak only as of the date on which they are made, and

the Company undertakes no obligation to update publicly or revise any

forward-looking statement, whether as a result of new information, future

developments or otherwise. Non-GAAP

Measures:

Manitex

International

from

time

to

time

refers

to

various

non-GAAP

(generally

accepted accounting principles) financial measures in this presentation.

Manitex believes that this information is useful to understanding its

operating results without the impact of special items. See Manitex’s Full

Year and Fourth Quarter 2014 Earnings Release on the Investor Relations section of our

website

www.manitexinternational.com

for

a

description

and/or

reconciliation

of

these

measures. |

3

“Focused manufacturer

of engineered lifting

equipment”

Overview

2014 operationally was a year of many positives in an uncertain market

environment

Record sales of $264 million

Increased backlog (excluding ASV transaction) by 27%

Additional military contracts secured to provide total $75-125

million value over 5 years

Generated $1.2 million cash from operations in Q4-2014*

ASV transaction in December of 2014 and PM Group acquisition in January

of 2015 are transformative for the Company

Pro-forma 2014 revenues including PM and ASV ~$500 million

Enhanced product, end-market and geographic diversification

Market challenges from oil and gas sector demand and from euro currency

weakness (impacting translation of profit to USD)

2015 focus is integration and distribution leverage of acquisitions,

cost reduction and cash flow generation to repay debt

*Excluding ASV and transaction and other expenses |

4

“Focused manufacturer

of engineered lifting

equipment”

Commercial Overview

2014

market

conditions

did

not

meet

original

growth

expectations

and

in

our

principal

market,

boom

trucks,

demand

was

down

almost

8%

year

over

year:

Oil and gas demand did not strengthen during the year as expected and

in Q4 there was considerable uncertainty affecting demand.

N. American general construction demand for our equipment

continued to grow at an incremental rate.

European markets continued to be adversely impacted from economic

conditions and lack of credit. CVS

however

were

able

to

exploit

certain

opportunities

in

Europe

and

internationally.

Product revenue profile changed during the year

More specialized, higher tonnage units or industry specific product

(e.g. energy) demand slowed and was replaced by lower capacity

cranes and more construction related product such as material

handling equipment. CVS container handling equipment and

distribution consistently stronger during the year. 12/31/14

Backlog of $107.3 million (12/31/13, $77.3 million): Growth of

39% over 2013 Broad based order book although boom trucks

continue to be heavily represented. 12/31/14 includes ~9% of ASV

product |

5

Key Figures -

Annual

“Focused manufacturer

of engineered lifting

equipment”

USD thousands

2014*

2013

2012

Net sales

$264,081

$245,072

$205,249

% change in 2014 to prior period

7.8%

28.7%

Gross profit

48,287

46,476

40,464

Gross margin %

18.3%

19.0%

19.7%

Operating expenses

31,995

28,938

26,005

Adjusted Net Income

8,816

10,178

8,077

Adjusted Earnings per share

$0.63

$0.80

$0.68

Adjusted Ebitda

20,864

21,483

17,957

Adjusted Ebitda % of Sales

7.9%

8.8%

8.7%

Working capital

89,470

73,868

61,426

Current ratio

2.1

2.5

2.4

Backlog

107,327

77,281

130,352

% change in 2014 to prior period

38.9%

(40.7%)

2014 as adjusted. See reconciliation to US GAAP on appendix

|

6

Key Figures -

Quarterly

“Focused manufacturer

of engineered lifting

equipment”

USD thousands

Q4-2014*

Q4-2013

Q3-2014

Net sales

$66,909

$65,431

66,197

% change in Q4-2014 to prior period

2.3%

1.1%

Gross profit

12,623

12,779

10,915

Gross margin %

18.9%

19.5%

16.5%

Operating expenses

8,531

7,759

7,504

Adjusted Net Income

2,185

2,991

1,768

Adjusted Earnings Per Share

$0.16

$0.22

$0.13

Adjusted Ebitda

5,330

6,225

4,519

Adjusted Ebitda % of Sales

8.0%

9.5%

6.8%

*Q4-2014 as adjusted. See reconciliation to US GAAP on appendix

|

7

“Focused manufacturer

of engineered lifting

equipment”

2014

Adjusted Operating Performance

Full Year

Quarter ended

December 31

$m

$m

$m

$m

2013 Net income

10.2

3.0

Gross profit impact of increased sales

(2014 sales for the period less 2013 sales at 2013 gross profit

% ).

3.6

0.3

Impact from lower margin

(2014 gross profit % for the period less 2013 gross profit %

multiplied by 2014 sales for the period)

(1.8)

(0.4)

Increase / (decrease) in gross profit

1.8

(0.1)

Decrease in R&D expense

Increase in SG&A expenses

SG&A expense from acquired business

0.4

(0.5)

(2.9)

0.2

(0.4)

(0.6)

Tax

(0.2)

0.1

2014 Adjusted Net income

$8.8

$2.2 |

8

Working Capital

“Focused manufacturer

of engineered lifting

equipment”

$000

2014

2013

2012

Working Capital

$89,470

$73,868

$61,426

Days sales outstanding (DSO)

95

53

58

Days payable outstanding (DPO)

60

45

51

Inventory turns

2.3

2.9

3.0

Current ratio

2.1

2.5

2.4

Operating working capital

129,112

85,136

74,300

Operating working capital % of

annualized LQS

48.2%

32.5%

32.9%

Working capital ratios skewed by annualized quarters sales and cost of

goods sold only include 12 days for ASV from acquisition.

Excluding impact of ASV transaction, DSO, DPO and inventory turns were

71 days, 43 days, and 3.1 days respectively

|

9

“Focused manufacturer

of engineered lifting

equipment”

$000

2014

2013

2012

Total Cash

4,370

6,091

1,889

Total Debt

112,294

54,201

49,138

Total Equity

130,006

84,991

59,533

Net capitalization

237,930

133,101

106,782

Net debt / capitalization

45.4%

36.2%

44.2%

Adjusted EBITDA

20,864

21,483

17,957

Adjusted EBITDA % of sales

7.9%

8.8%

8.7%

Debt at 12/31/14 includes:

Non recourse debt at ASV $43.6 million (term and revolving credit

facilities) Fair value of convertible debt for ASV transaction

$6.6 million and $1.6 million note for transaction fees paid by

Terex Manitex revolving credit facilities and Italian working

capital facilities ($53.7 million) Average Debt Cost approximates

6% Full

year

of

ASV

contribution

would

have

resulted

in

a

Debt/Adjusted

EBITDA

ratio

of

approximately

3.2x

for

the

year

Debt & Liquidity

•

Net capitalization is the sum of debt plus equity minus cash

•

Net debt is total debt less cash |

10

Summary

“Focused manufacturer

of engineered lifting

equipment”

We

enter

2015

a

much

larger

and

more

diversified

Company

than

we

were

in 2014

Markets remain difficult to predict and uncertain, with oil and gas in

particular showing slowdown

Weaker Euro adversely impacts translation of overseas profit, but

does provide sales and margin opportunity

No. American housing starts provide opportunity for ASV

Focus for 2015:

Integration of acquisitions

Accelerate No. American production of knuckle boom product to take

advantage of growth

Leverage distribution opportunities for PM in No. America and

Manitex in PM distribution

Cost reduction and cash flow generation to repay debt

|

11

APPENDIX

“Focused manufacturer

of engineered lifting

equipment”

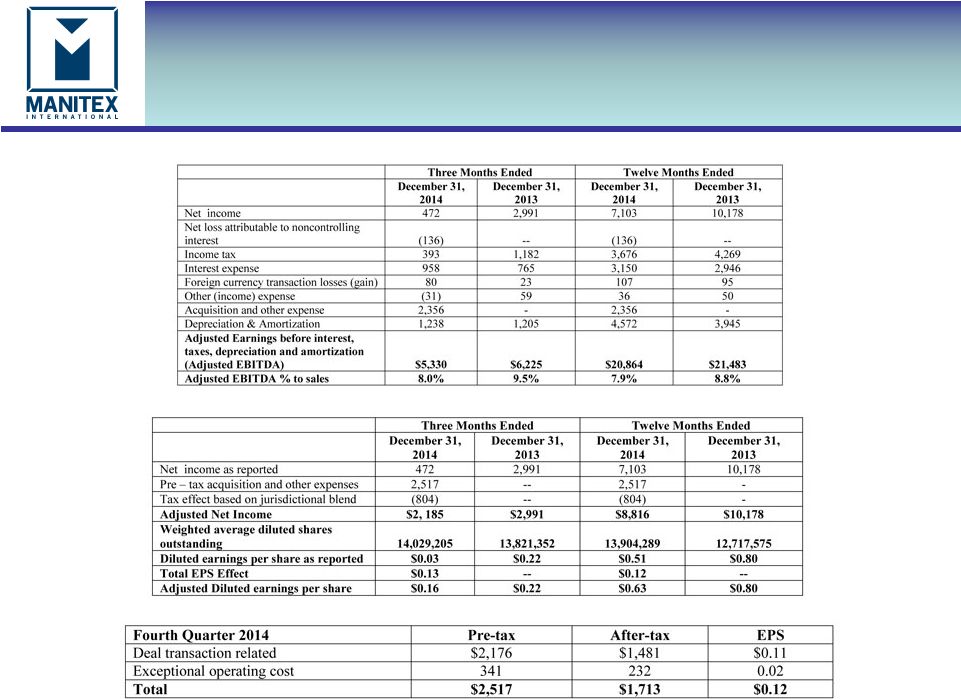

Reconciliation of Adjusted net income and adjusted EPS

Reconciliation of Adjusted EBITDA to GAAP net income

Acquisition and other expense |